Corporate Social Responsibility Disclosure, Media Reports, and Enterprise Innovation: Evidence from Chinese Listed Companies

Abstract

:1. Introduction

2. Literature Review

2.1. CSR Disclosure and Corporate Innovation

2.2. CSR Disclosure and Media Reports

2.3. Media Reports and Corporate Innovation

3. Model and Method

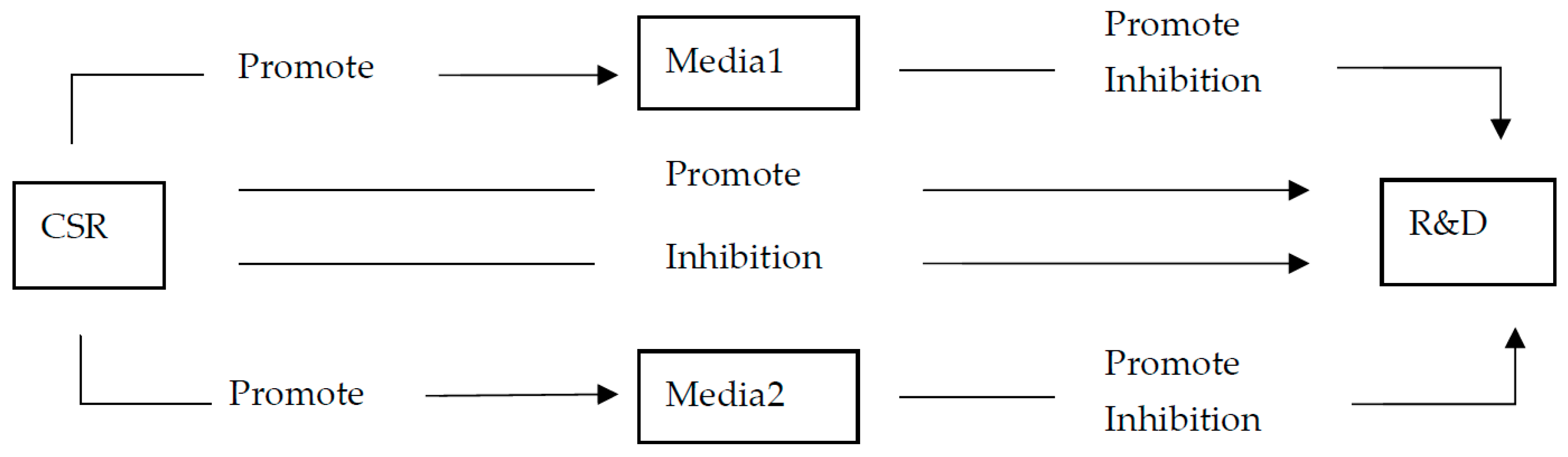

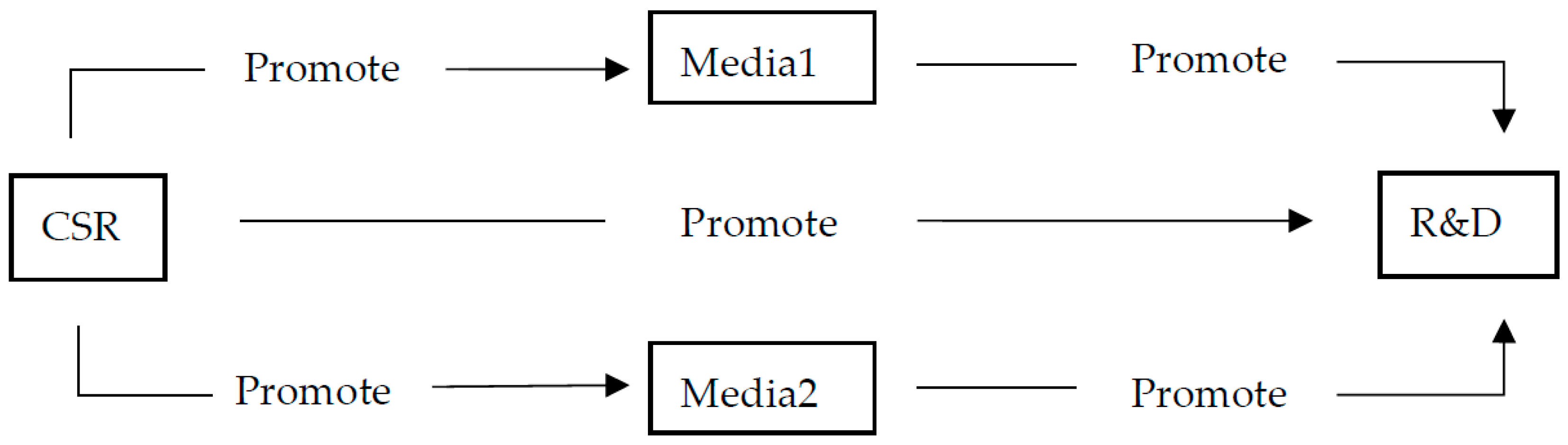

3.1. Test Process and Hypothesis

3.2. Sample Selection and Processing

3.3. Index Selection and Data Source

3.4. Model Design

3.5. Test Results

3.5.1. Statistical Description Results

3.5.2. Analysis of Benchmark Return Results

4. Endogenous Test

5. Robustness Test and Extended Analysis

5.1. Robustness Test

5.2. Extended Analysis

5.2.1. Subdivision of CSR

5.2.2. Subdivision of Online Newspaper Media Report of Different Natures

5.2.3. Subdivision of Online Media Report of Different Natures

6. Conclusions and Policy Implications

- It is confirmed that CSR disclosure can promote corporate innovation significantly;

- Both newspaper and online media reports can positively influence corporate innovation;

- CSR disclosure activities can increase the frequency of newspaper and online media reports;

- Newspaper and online media reports exert a mediating effect in promoting corporate innovation by CSR disclosure.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Halkos, G.; Skouloudis, A. Corporate social responsibility and innovative capacity: Intersection in a macro-level perspective. J. Clean. Prod. 2018, 182, 291–300. [Google Scholar] [CrossRef] [Green Version]

- Castilla-Polo, F.; Sánchez-Hernández, M.I.; Gallardo-Vázquez, D. Assessing the influence of social responsibility on reputation: An empirical Case-Study in agricultural cooperatives in Spain. J. Agric. Environ. Ethics 2017, 30, 99–120. [Google Scholar] [CrossRef]

- Lončar, D.; Paunković, J.; Jovanović, V.; Krstić, V. Environmental and social responsibility of companies cross EU countries–Panel data analysis. Sci. Total Environ. 2019, 657, 287–296. [Google Scholar] [CrossRef]

- Xu, H. Corporate social responsibility, product innovation, and product line. Nankai Bus. Rev. Int. 2020, 11, 171–190. [Google Scholar] [CrossRef]

- Grover, P.; Kar, A.K.; Ilavarasan, P.V. Impact of corporate social responsibility on reputation—Insights from tweets on sustainable development goals by CEOs. Int. J. Inf. Manag. 2019, 48, 39–52. [Google Scholar] [CrossRef]

- Li, G.; Yan, K.; Wei, Z.; Cheng, T. Can Servitization Enhance Customer Loyalty? The Roles of Organizational IT, Social Media, and Service-Oriented Corporate Culture. IEEE Trans. Eng. Manag. 2021, 1–15. [Google Scholar] [CrossRef]

- Camilleri, M.A.; Rui, A.C. The Small Businesses’ Responsible Entrepreneurship and their Stakeholder Engagement through Digital Media. In Proceedings of the 13th European Conference on Innovation and Entrepreneurship (ECIE), Aveiro, Portugal, 20–21 September 2018. [Google Scholar]

- Ahern, K.R.; Sosyura, D. Rumor has it: Sensationalism in financial media. Rev. Financ. Stud. 2015, 28, 2050–2093. [Google Scholar] [CrossRef] [Green Version]

- Liu, B.; McConnell, J.J. The role of the media in corporate governance: Do the media influence managers’ capital allocation decisions? J. Financ. Econ. 2013, 110, 1–17. [Google Scholar] [CrossRef]

- Lin, Y.-E.; Li, Y.-W.; Cheng, T.Y.; Lam, K. Corporate social responsibility and investment efficiency: Does business strategy matter? Int. Rev. Financ. Anal. 2021, 73, 101585. [Google Scholar] [CrossRef]

- Luo, W.; Guo, X.; Zhong, S.; Wang, J. Environmental information disclosure quality, media attention and debt financing costs: Evidence from Chinese heavy polluting listed companies. J. Clean. Prod. 2019, 231, 268–277. [Google Scholar] [CrossRef]

- Hung, M.; Shi, J.; Wang, Y. The Effect of Mandatory CSR Disclosure on Information Asymmetry: Evidence from a Quasi-Natural Experiment in China. Soc. Sci. Electron. Publ. 2013, 33, 1–17. [Google Scholar] [CrossRef] [Green Version]

- Hu, W.; Du, J.; Zhang, W. Corporate social responsibility information disclosure and innovation sustainability: Evidence from China. Sustainability 2020, 12, 409. [Google Scholar] [CrossRef] [Green Version]

- Costa, C.; Lages, L.F.; Hortinha, P. The bright and dark side of CSR in export markets: Its impact on innovation and performance. Int. Bus. Rev. 2015, 24, 749–757. [Google Scholar] [CrossRef]

- Yu, F.; Shi, Y.; Wang, T. R&D Investment and Chinese Manufacturing SMEs Corporate Social Responsibility: The Moderating Role of Regional Innovative Milieu. J. Clean. Prod. 2020, 258, 120840. [Google Scholar]

- Cheng, B.; Ioannou, I.; Serafeim, G. Corporate social responsibility and access to finance. Strateg. Manag. J. 2014, 35, 1–23. [Google Scholar] [CrossRef]

- Yang, J. Corporate Social Responsibility Disclosure and Innovation Performance: An Empirical Study—Based on Chinese Listed Firms during “the Post-mandatory Period”. Sci. Sci. Manag. S & T 2021, 42, 57–75. [Google Scholar]

- Hutton, A.P.; Marcus, A.J.; Tehranian, H. Opaque financial reports, R2, and crash risk. J. Financ. Econ. 2009, 94, 67–86. [Google Scholar] [CrossRef]

- Zhao, Y.; Qin, Y.; Zhao, X.; Wang, X.; Shi, L. Perception of corporate hypocrisy in China: The roles of corporate social responsibility implementation and communication. Front. Psychol. 2020, 11, 595. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Huang, J.; Chen, L.; Ding, J. Corporate social responsibility, mediacoverage and stock pricecrash risk. Chin. J. Manag. Sci. 2021, 29, 1–12. [Google Scholar]

- Tian, L.; Wang, K. The “masking effect” of social responsibility information disclosure and the risk of listed companies’ collapse: DID-PSM analysis from China’s stock market. Manag. World 2017, 11, 146–157. [Google Scholar]

- Kuo, L.; Kuo, P.-W.; Chen, C.-C. Mandatory CSR Disclosure, CSR Assurance, and the Cost of Debt Capital: Evidence from Taiwan. Sustainability 2021, 13, 1768. [Google Scholar] [CrossRef]

- Dai, L.; Shen, R.; Zhang, B. The dark side of news coverage: Evidence from corporate innovation. Unpubl. wp. 2015. Available online: https://acfr.aut.ac.nz/__data/assets/pdf_file/0005/29723/581119-R-Shen-News-Coverage-and-Corporate-Innovation-20150226.pdf (accessed on 16 June 2021).

- Hayes, R.A.; Carr, C.T. Getting called out: Effects of feedback to social media corporate social responsibility statements. Public Relat. Rev. 2021, 47, 101962. [Google Scholar] [CrossRef]

- Lu, W.; Yanxi, L.; Xiaochong, L. Corporate social responsibility disclosure, media coverage and financial performance: An empirical analysis in the chinese context. Singap. Econ. Rev. 2020, 1–18. [Google Scholar] [CrossRef]

- Xiang, X.; Liu, C.; Yang, M.; Zhao, X. Confession or justification: The effects of environmental disclosure on corporate green innovation in China. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 2735–2750. [Google Scholar] [CrossRef]

- Gupta, S.; Nawaz, N.; Tripathi, A.; Muneer, S.; Ahmad, N. Using Social Media as a Medium for CSR Communication, to Induce Consumer–Brand Relationship in the Banking Sector of a Developing Economy. Sustainability 2021, 13, 3700. [Google Scholar] [CrossRef]

- Xu, L.; Xin, Y.; Zhu, J. Media attention and the fulfillment of social responsibilities of listed companies: An empirical study based on donations from the Wenchuan earthquake. Manag. World 2011, 3, 135–143, 188. [Google Scholar]

- He, Y.; Zhao, C. Impact of media reports on innovative behaviours of photovoltaic enterprises: Experience view from China. Light Eng. 2018, 26, 129–138. [Google Scholar] [CrossRef]

- Liu, J.; Li, R. Research on the Influence of Media Attention on the Innovation Behavior of Publishing Enterprises. China Publ. J. 2019, 22, 11–17. [Google Scholar]

- Wang, M.-C. The relationship between environmental information disclosure and firm valuation: The role of corporate governance. Qual. Quant. 2016, 50, 1135–1151. [Google Scholar] [CrossRef]

- Zhang, Y.; Peng, S. Media Attention and Enterprise Innovation Performance. J. Guizhou Univ. Financ. Econ. 2020, 4, 29–39. [Google Scholar]

- Zhao, Y.; Chen, Z.; Li, C. Research of the Influencing Mechanism of External Knowledge Acquisition & Social Media on Firm Innovation Based on Open Innovation Perspective. Forecasting 2020, 39, 1–8. [Google Scholar]

- Jin, X.; Yu, J. Government governance, executive networks and corporate investment efficiency. China Financ. Rev. Int. 2018, 8, 122–139. [Google Scholar] [CrossRef]

- Li, X.; Li, C.; Wang, Z.; Jiao, W.; Pang, Y. The effect of corporate philanthropy on corporate performance of Chinese family firms: The moderating role of religious atmosphere. Emerg. Mark. Rev. 2020, 1, 100757. [Google Scholar] [CrossRef]

- Zhao, L.; Zhang, L. The Impact of Media Coverage on Enterprise Green Technology Innovation: The Moderating role of Marketization Level. Manag. Rev. 2020, 32, 132–141. [Google Scholar]

- Luo, J.; Liu, Q. Corporate social responsibility disclosure in China: Do managerial professional connections and social attention matter? Emerg. Mark. Rev. 2020, 43, 100679. [Google Scholar] [CrossRef]

- Zhou, K.; Ying, Q.; Chang, Z. Can media coverage improve corporate governance? evidence from fraud by listed firms in China. J. Financ. Res. 2016, 6, 193–206. [Google Scholar]

- Li, F.; Geng, X. Research on the Relationship between Environmental Uncertainty Perceived by CEO and Enterprise Choice of Innovation Mode. Sci. Technol. Prog. Policy 2021, 38, 1–10. [Google Scholar]

- Yang, D.; Chen, H.; Liu, Q. Media Pressure and Corporate Innovation. Econ. Res. J. 2017, 52, 125–139. [Google Scholar]

- Xu, C.; Zhang, X. Research on the Improvement of State-owned Enterprises’ Independent Innovation Ability. Res. Financ. Econ. Issues 2015, 4, 110–116. [Google Scholar]

- Yasuda, T. Firm growth, size, age and behavior in Japanese manufacturing. Small Bus. Econ. 2005, 24, 1–15. [Google Scholar] [CrossRef]

- Wu, C.; Wu, S.; Cheng, J.; Wang, L. The Role of Venture Capital in the Investment and Financing Behavior of Listed Companies: Evidence from China. Econ. Res. J. 2012, 47, 105–119, 160. [Google Scholar]

- Conte, A.; Vivarelli, M. Succeeding in innovation: Key insights on the role of R&D and technological acquisition drawn from company data. Empir. Econ. 2014, 47, 1317–1340. [Google Scholar]

- Duan, J.; Zhuang, X. Research on the Hierarchical Influencing Mechanism of Social Responsibility Performance on Enterprise Innovation Ability: Empirical Evidence Based on Chinese Listed Companies. S. China J. Econ. 2020, 8, 49–64. [Google Scholar]

- Ma, H.; Hou, G. Environmental Protection Investment, Financing Constraints, and Enterprise Technological Innovation: A Research Perspective Based on the Impact of Long- and Short-term Heterogeneity. Secur. Mark. Her. 2018, 8, 12–19. [Google Scholar]

| Variable | Symbol | Definition |

|---|---|---|

| Core variable | ||

| R&D intensity | R&D | Natural logarithm of the total investment amount for R&D projects of enterprise i in the tth year |

| CSR index | CSR | Natural logarithm of the social responsibility index of enterprise i in the tth year released by Hexun |

| Newspaper media reports | Media1 | The number of newspaper media reports about enterprise i in the tth year in the CFND database is plus 1, and then the natural logarithm is taken |

| Online media reports | Media2 | The number of online media reports about enterprise i in the tth year in the CFND database plus 1, and then the natural logarithm is taken |

| Control variable | ||

| Nature of the property right | SOE | The nature of enterprise i in the tth year is assigned 1 for state-owned enterprises; otherwise, 0 |

| Growth | Growth | Market value/asset replacement cost of enterprise i in the tth year |

| Listed years | Age | Duration of enterprise i by the end of the tth year |

| Cash flow | CFO | Net cash flow from operating activities of enterprise i in the tth year/total assets in the tth year |

| Leverage | Lev | Total liabilities of enterprise i in the tth year/total assets in the tth year |

| Executive shareholding ratio | ESI | Enterprise i with executive shareholding in the tth year is assigned 1; otherwise, 0 |

| Return on assets | ROA | The net profit of enterprise i in the tth year/total assets in the tth year |

| Number of employees | Num | Number of employees in enterprise i in the tth year |

| Capital intensity | CI | The fixed assets of enterprise i in the tth year/total assets in the tth year |

| Enterprise size | Size | Natural logarithm of the total assets of enterprise i in the tth year |

| Variable | 1/4 Quartile | 2/4 Quartile | 3/4 Quartile | Mean Value | Standard Deviation | Observed Value |

|---|---|---|---|---|---|---|

| R&D | 17.093 | 17.863 | 18.700 | 17.970 | 1.320 | 8264 |

| CSR | 2.969 | 3.166 | 3.328 | 3.179 | 0.413 | 8264 |

| Media1 | 2.303 | 3.045 | 3.850 | 3.166 | 1.234 | 8264 |

| Media2 | 4.370 | 4.997 | 5.635 | 5.039 | 0.984 | 8264 |

| SOE | 0.000 | 0.000 | 0.000 | 0.090 | 0.286 | 8264 |

| Growth | 1.406 | 1.840 | 2.653 | 2.285 | 1.437 | 8264 |

| Age | 2.000 | 5.000 | 10.000 | 6.768 | 6.362 | 8264 |

| CFO | 0.012 | 0.046 | 0.086 | 0.049 | 0.065 | 8264 |

| Lev | 0.205 | 0.344 | 0.497 | 0.360 | 0.190 | 8264 |

| ESI | 1.000 | 1.000 | 1.000 | 0.824 | 0.381 | 8264 |

| ROA | 17.872 | 18.706 | 19.640 | 18.804 | 1.491 | 8264 |

| Num | 6.791 | 7.494 | 8.352 | 7.636 | 1.206 | 8264 |

| CI | 1.382 | 1.914 | 2.648 | 2.246 | 3.432 | 8264 |

| Size | 21.008 | 21.731 | 22.565 | 21.938 | 1.276 | 8264 |

| Variable | (1) R&D | (2) R&D | (3) R&D | (4) Media1 | (5) R&D | (6) Media2 | (7) R&D |

|---|---|---|---|---|---|---|---|

| CSR | 0.072 *** (0.025) | 0.118 *** (0.032) | 0.070 *** (0.025) | 0.020 (0.024) | 0.071 *** (0.025) | ||

| Media1 | 0.019 ** (0.008) | 0.018 ** (0.008) | |||||

| Media2 | 0.036 *** (0.011) | 0.035 *** (0.011) | |||||

| SOE | −0.006 (0.031) | −0.002 (0.031) | −0.001 (0.031) | −0.070 (0.040) | −0.004 (0.031) | −0.054 (0.030) | −0.004 (0.031) |

| Growth | 0.077 *** (0.007) | 0.075 *** (0.007) | 0.071 *** (0.007) | 0.106 *** (0.009) | 0.075 *** (0.007) | 0.167 *** (0.007) | 0.071 *** (0.007) |

| Age | −0.008 *** (0.002) | −0.008 *** (0.002) | −0.008 *** (0.002) | −0.012 *** (0.002) | −0.008 *** (0.002) | −0.016 *** (0.002) | −0.008 *** (0.002) |

| CFO | 0.105 (0.149) | 0.123 (0.149) | 0.128 (0.149) | 0.169 (0.194) | 0.102 (0.149) | −0.054 (0.145) | 0.107 *** (0.149) |

| Lev | −0.334 *** (0.063) | −0.341 *** (0.063) | −0.347 *** (0.063) | 0.120 (0.082) | −0.336 *** (0.063) | 0.215 *** (0.062) | −0.341 *** (0.063) |

| ESI | 0.054 ** (0.023) | 0.052 ** (0.023) | 0.051 ** (0.023) | 0.077 ** (0.030) | 0.052 ** (0.023) | 0.075 *** (0.023) | 0.051 ** (0.023) |

| ROA | 0.060 *** (0.011) | 0.071 *** (0.010) | 0.070 *** (0.010) | 0.067 *** (0.014) | 0.058 *** (0.011) | 0.074 *** (0.011) | 0.057 *** (0.011) |

| Num | 0.295 *** (0.014) | 0.291 *** (0.014) | 0.293 *** (0.014) | 0.194 *** (0.018) | 0.291 *** (0.014) | 0.025 (0.014) | 0.294 *** (0.014) |

| CI | −0.015 *** (0.003) | −0.015 *** (0.003) | −0.015 *** (0.003) | 0.001 (0.003) | −0.015 *** (0.003) | 0.001 (0.002) | −0.105 *** (0.003) |

| Size | 0.587 *** (0.018) | 0.573 *** (0.018) | 0.567 *** (0.019) | 0.386 *** (0.024) | 0.580 *** (0.019) | 0.376 *** (0.018) | 0.573 *** (0.019) |

| Constant | 1.484 *** (0.257) | 1.771 *** (0.263) | 1.801 *** (0.260) | −8.684 *** (0.333) | 1.636 *** (0.267) | −5.267 *** (0.250) | 1.671 *** (0.264) |

| Industry | yes | yes | yes | yes | yes | yes | yes |

| Time | yes | yes | yes | yes | yes | yes | yes |

| Obs | 8264 | 8264 | 8264 | 8264 | 8264 | 8264 | 8264 |

| R2 | 0.667 | 0.667 | 0.668 | 0.359 | 0.668 | 0.433 | 0.668 |

| DE | — | — | — | — | — | 0.060 *** | |

| IDE | — | — | — | — | — | 0.073 *** | |

| RIT | — | — | — | — | — | 0.453 | |

| Sobel | — | — | — | — | — | 0.000 | |

| Variable | (8) R&D | (9) R&D | (10) R&D | (11) Media1 | (12) R&D | (13) Media2 | (14) R&D |

|---|---|---|---|---|---|---|---|

| CSR | 0.065 *** (0.024) | 0.115 *** (0.032) | 0.066 *** (0.025) | 0.013 (0.024) | 0.067 *** (0.024) | ||

| Media1 | 0.018 ** (0.008) | 0.017 ** (0.008) | |||||

| Media2 | 0.034 *** (0.011) | 0.033 *** (0.011) | |||||

| Constant | 0.022 (0.302) | 0.373 (0.312) | 0.386 *** (0.307) | −8.690 *** (0.400) | 0.247 (0.315) | −5.178 *** (0.300) | 0.263 (0.310) |

| Controls | yes | yes | yes | yes | yes | yes | yes |

| Industry | yes | yes | yes | yes | yes | yes | yes |

| Time | yes | yes | yes | yes | yes | yes | yes |

| Obs | 8440 | 8251 | 8314 | 8251 | 8251 | 8314 | 8314 |

| R2 | 0.671 | 0.670 | 0.670 | 0.358 | 0.670 | 0.435 | 0.671 |

| DE | — | — | — | — | — | 0.060 *** | |

| IDE | — | — | — | — | — | 0.073 *** | |

| RIT | — | — | — | — | — | 0.453 | |

| Sobel | — | — | — | — | — | 0.000 | |

| Variable | (15) R&D | (16) R&D | (17) R&D | (18) R&D | (19) R&D | (20) R&D |

|---|---|---|---|---|---|---|

| CSR | 0.080 *** (0.029) | 0.083 *** (0.029) | ||||

| F.CSR | 0.083 *** (0.029) | 0.087 *** (0.029) | 0.080 *** (0.029) | 0.084 *** (0.029) | ||

| Media1 | 0.028 *** (0.011) | |||||

| F.Media1 | 0.044 *** (0.010) | 0.043 *** (0.010) | ||||

| Media2 | 0.038 *** (0.014) | |||||

| F.Media2 | 0.066 *** (0.014) | 0.065 *** (0.014) | ||||

| Constant | 1.831 *** (0.327) | 1.777 *** (0.321) | 1.662 *** (0.325) | 1.614 *** (0.320) | 1.829 *** (0.327) | 1.777 *** (0.321) |

| Controls | yes | yes | yes | yes | yes | yes |

| Industry | yes | yes | yes | yes | yes | yes |

| Time | yes | yes | yes | yes | yes | yes |

| Obs | 5017 | 5017 | 5017 | 5017 | 5017 | 5017 |

| R2 | 0.695 | 0.695 | 0.694 | 0.694 | 0.695 | 0.695 |

| Variable | (21) R&D | (22) R&D | (23) Patent | (24) Patent |

|---|---|---|---|---|

| CSR | 0.060 ** (0.027) | 0.061 ** (0.031) | 0.154 *** (0.042) | 0.165 *** (0.042) |

| Media1 | 0.023 ** (0.010) | 0.103 *** (0.015) | ||

| Media2 | 0.049 *** (0.013) | 0.080 *** (0.019) | ||

| Constant | −0.416 (0.454) | −0.134 (0.440) | −4.599 *** (0.457) | −5.070 *** (0.452) |

| Controls | yes | yes | yes | yes |

| Industry | no | no | yes | yes |

| Time | no | no | yes | yes |

| Obs | 8264 | 8264 | 8264 | 8264 |

| R2 | 0.569 | 0.569 | 0.327 | 0.324 |

| Variable | (25) R&D | (26) R&D | (27) R&D | (28) R&D | (29) R&D |

|---|---|---|---|---|---|

| CSR1 | 0.014 *** (0.003) | ||||

| CSR2 | 0.028 *** (0.003) | ||||

| CSR3 | 0.005 ** (0.002) | ||||

| CSR4 | 0.002 (0.002) | ||||

| CSR5 | −0.019 *** (0.003) | ||||

| Constant | 1. 496 *** (0.254) | 1.961 *** (0.255) | 1. 663 *** (0.254) | 1.646 *** (0.254) | 1.666 *** (0.253) |

| Controls | yes | yes | yes | yes | yes |

| Industry | yes | yes | yes | yes | yes |

| Time | yes | yes | yes | yes | yes |

| Obs | 8264 | 8264 | 8264 | 8264 | 8264 |

| R2 | 0.668 | 0.670 | 0.667 | 0.667 | 0.669 |

| Variable | (30) R&D | (31) R&D | (32) R&D |

|---|---|---|---|

| CSR | 0.069 *** (0.025) | 0.070 *** (0.025) | 0.072 *** (0.025) |

| Media11 | 0.027 *** (0.008) | ||

| Media12 | 0.013 (0.008) | ||

| Media13 | −0.007 (0.009) | ||

| Constant | 1.745 *** (0.269) | 1.592 *** (0.266) | 1.429 *** (0.268) |

| Controls | yes | yes | yes |

| Industry | yes | yes | yes |

| Time | yes | yes | yes |

| Obs | 8264 | 8264 | 8264 |

| R2 | 0.668 | 0.668 | 0.668 |

| Variable | (33) R&D | (34) R&D | (35) R&D |

|---|---|---|---|

| CSR | 0.069 *** (0.025) | 0.070 *** (0.025) | 0.072 *** (0.025) |

| Media21 | 0.074 *** (0.011) | ||

| Media22 | 0.013 (0.010) | ||

| Media23 | −0.001 (0.010) | ||

| Constant | 1.934 *** (0.265) | 1.584 *** (0.268) | 1.478 *** (0.263) |

| Controls | yes | yes | yes |

| Industry | yes | yes | yes |

| Time | yes | yes | yes |

| Obs | 8264 | 8264 | 8264 |

| R2 | 0.669 | 0.668 | 0.667 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wu, S.; Zhang, H.; Wei, T. Corporate Social Responsibility Disclosure, Media Reports, and Enterprise Innovation: Evidence from Chinese Listed Companies. Sustainability 2021, 13, 8466. https://doi.org/10.3390/su13158466

Wu S, Zhang H, Wei T. Corporate Social Responsibility Disclosure, Media Reports, and Enterprise Innovation: Evidence from Chinese Listed Companies. Sustainability. 2021; 13(15):8466. https://doi.org/10.3390/su13158466

Chicago/Turabian StyleWu, Shilei, Hongjie Zhang, and Taoyuan Wei. 2021. "Corporate Social Responsibility Disclosure, Media Reports, and Enterprise Innovation: Evidence from Chinese Listed Companies" Sustainability 13, no. 15: 8466. https://doi.org/10.3390/su13158466

APA StyleWu, S., Zhang, H., & Wei, T. (2021). Corporate Social Responsibility Disclosure, Media Reports, and Enterprise Innovation: Evidence from Chinese Listed Companies. Sustainability, 13(15), 8466. https://doi.org/10.3390/su13158466