Recycling Technology Innovation as a Source of Competitive Advantage: The Sustainable and Circular Business Model of a Bicentennial Company

Abstract

:1. Introduction

- 1.

- Analyse the sustainability of the company, from economic, social, environmental and good governance points of view;

- 2.

- Calculate the value generated by the company and its distribution among factors of production;

- 3.

- Examine the circularity features of the company’s business model;

- 4.

- Classify the circular business model of La Farga according to the typology of Lüdeke-Freund, Gold and Bocken [5];

- 5.

- Analyse the type of circular business model innovation in the company;

- 6.

- Explore the factors that have hindered or driven the adoption of the circular business model in La Farga.

2. Literature Review

3. Materials and Methods

3.1. Data Sources

3.2. Data Analysis

4. Results: Case Study of La Farga

4.1. Copper: An Infinitely Recyclable Mineral

4.2. History of La Farga

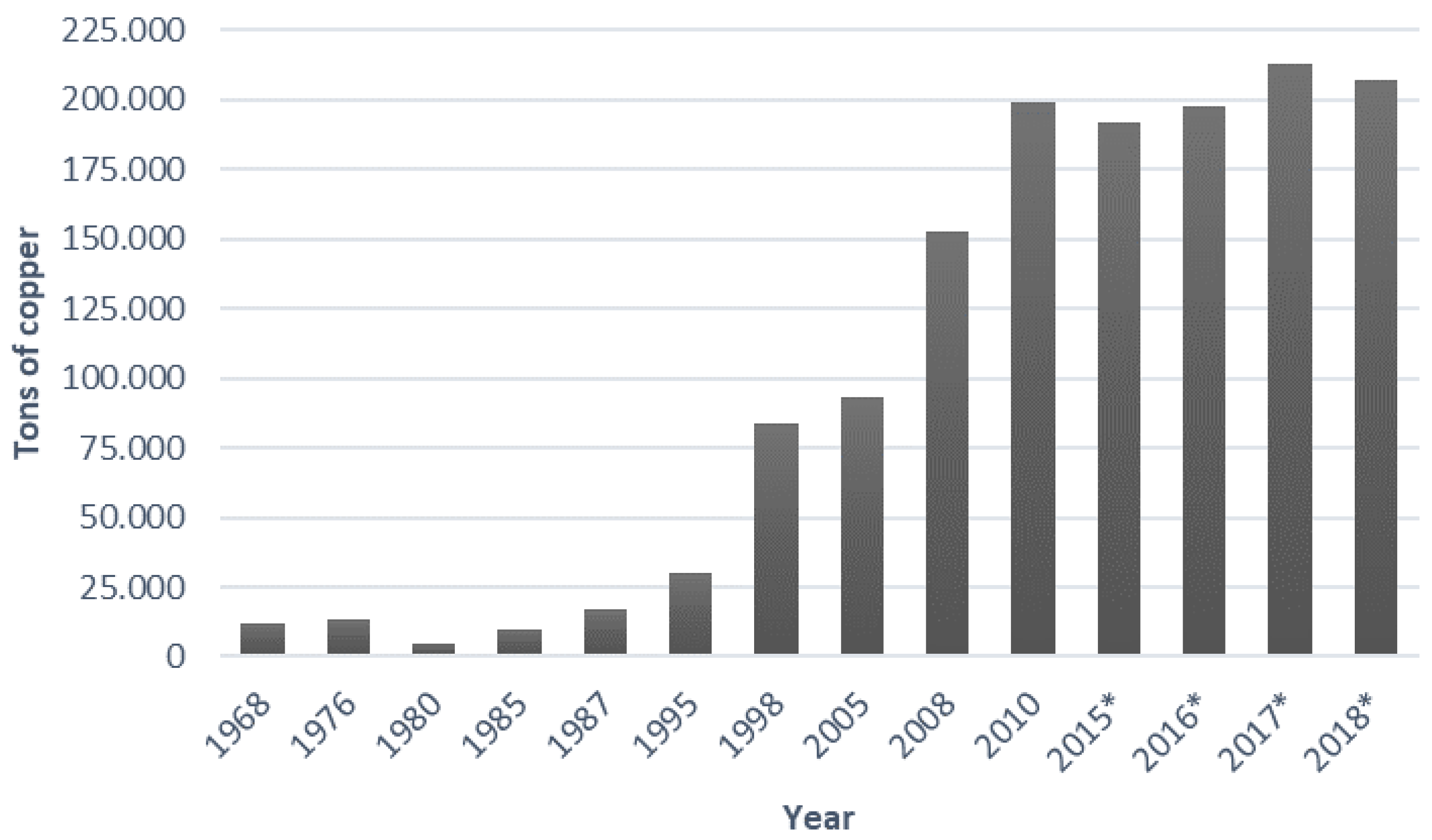

4.3. Sustainability of La Farga

4.4. The Circular Business Model of La Farga: Value Proposition

4.4.1. Products

4.4.2. Services

4.5. The Circular Business Model of La Farga: Value Delivery

4.5.1. Customer Segments

4.5.2. Value Delivery Processes

4.6. The Circular Business Model of La Farga: Value Creation

4.6.1. Key Partnerships

4.6.2. Value Creation Processes

- Melting down and refining the scrap using the classical oxidation-reduction process.

- Pouring the refined copper into a mould that continuously transforms it into solid bars at rolling temperature.

- Hot-rolling the bars in a mill that, through successive steps, transforms it into a wire rod of an indefinite length.

- Cleaning up or descaling, eliminating the superficial oxide and continuous cooling of the wire rod.

- Coiling it onto spools of the desirable weight.

4.7. The Circular Business Model of La Farga: Value Capture

4.7.1. Revenues

4.7.2. Costs

5. Discussion

5.1. Sustainability and Value Creation

5.2. Circular Business Model

5.3. Enablers and Barriers

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A. Timeline of the Company

References

- European Commission; Secretariat-General. The European Green Deal; COM(2019) 640 Final; European Commission: Brussels, Belgium, 2019; Available online: https://eur-lex.europa.eu/resource.html?uri=cellar:b828d165-1c22-11ea-8c1f-01aa75ed71a1.0002.02/DOC_1&format=PDF (accessed on 1 May 2021).

- Sciarelli, M.; Cosimato, S.; Landi, G.; Iandolo, F. Socially responsible investment strategies for the transition towards sustainable development: The importance of integrating and communicating ESG. TQM J. 2021, 33, 39–56. [Google Scholar] [CrossRef]

- Ruan, L.; Liu, H. Environmental, Social, Governance Activities and Firm Performance: Evidence from China. Sustainability 2021, 13, 767. [Google Scholar] [CrossRef]

- Nassos, G.P.; Avlonas, N. Practical Sustainability Strategies: How to Gain a Competitive Advantage, 2nd ed.; John Wiley & Sons: Hoboken, NJ, USA, 2020; ISBN 978-1118250440. [Google Scholar]

- Lüdeke-Freund, F.; Gold, S.; Bocken, N.M.P. A Review and Typology of Circular Economy Business Model Patterns. J. Ind. Ecol. 2018, 23, 36–61. [Google Scholar] [CrossRef] [Green Version]

- Kravchenko, M.; Pigosso, D.C.A.; McAloone, T.C. Towards the ex-ante sustainability screening of circular economy initiatives in manufacturing companies: Consolidation of leading sustainability-related performance indicators. J. Clean. Prod. 2019, 241, 118318. [Google Scholar] [CrossRef]

- Pieroni, M.P.P.; McAloone, T.C.; Pigosso, D.C.A. Business model innovation for circular economy and sustainability: A review of approaches. J. Clean. Prod. 2019, 215, 198–216. [Google Scholar] [CrossRef]

- Sönnichsen, S.D.; Clement, J. Review of green and sustainable public procurement: Towards circular public procurement. J. Clean. Prod. 2020, 245, 118901. [Google Scholar] [CrossRef]

- Lahane, S.; Kant, R.; Shankar, R. Circular supply chain management: A state-of-art review and future opportunities. J. Clean. Prod. 2020, 258, 120859. [Google Scholar] [CrossRef]

- Geissdoerfer, M.; Pieroni, M.P.; Pigosso, D.C.; Soufani, K. Circular business models: A review. J. Clean. Prod. 2020, 277, 123741. [Google Scholar] [CrossRef]

- Da Costa Fernandes, S.; Pigosso, D.C.; McAloone, T.C.; Rozenfeld, H. Towards product-service system oriented to circular economy: A systematic review of value proposition design approaches. J. Clean. Prod. 2020, 257, 120507. [Google Scholar] [CrossRef]

- Benachio, G.L.F.; Freitas, M.D.C.D.; Tavares, S.F. Circular economy in the construction industry: A systematic literature review. J. Clean. Prod. 2020, 260, 121046. [Google Scholar] [CrossRef]

- Munaro, M.R.; Tavares, S.F.; Bragança, L. Towards circular and more sustainable buildings: A systematic literature review on the circular economy in the built environment. J. Clean. Prod. 2020, 260, 121134. [Google Scholar] [CrossRef]

- López, L.A.; Roca, X.; Gassó-Domingo, S. Economía circular en el sector de los residuos de construcción y demolición: Análisis de iniciativas en España. In Proceedings of the 24th International Congress on Project Management and Engineering, Alcoi, Spain, 7–9 July 2020; pp. 1320–1334. Available online: http://dspace.aeipro.com/xmlui/handle/123456789/2514 (accessed on 1 May 2021).

- Jia, F.; Yin, S.; Chen, L.; Chen, X. The circular economy in the textile and apparel industry: A systematic literature review. J. Clean. Prod. 2020, 259, 120728. [Google Scholar] [CrossRef]

- Ang, K.L.; Saw, E.T.; He, W.; Dong, X.; Ramakrishna, S. Sustainability framework for pharmaceutical manufacturing (PM): A review of research landscape and implementation barriers for circular economy transition. J. Clean. Prod. 2021, 280, 124264. [Google Scholar] [CrossRef]

- Acerbi, F.; Taisch, M. A literature review on circular economy adoption in the manufacturing sector. J. Clean. Prod. 2020, 273, 123086. [Google Scholar] [CrossRef]

- Schroeder, P.; Anggraeni, K.; Weber, U. The Relevance of Circular Economy Practices to the Sustainable Development Goals. J. Ind. Ecol. 2019, 23, 77–95. [Google Scholar] [CrossRef] [Green Version]

- Geissdoerfer, M.; Savaget, P.; Bocken, N.M.P.; Hultink, E.J. The Circular Economy—A new sustainability paradigm? J. Clean. Prod. 2017, 143, 757–768. [Google Scholar] [CrossRef] [Green Version]

- Marco-Fondevila, M.; Llena-Macarulla, F.; Callao-Gastón, S.; Jarne-Jarne, J. Are circular economy policies actually reaching organizations? Evidence from the largest Spanish companies. J. Clean. Prod. 2021, 285, 124858. [Google Scholar] [CrossRef]

- Sassanelli, C.; Rosa, P.; Rocca, R.; Terzi, S. Circular economy performance assessment methods: A systematic literature review. J. Clean. Prod. 2019, 229, 440–453. [Google Scholar] [CrossRef]

- Elia, V.; Gnoni, M.G.; Tornese, F. Measuring circular economy strategies through index methods: A critical analysis. J. Clean. Prod. 2017, 142, 2741–2751. [Google Scholar] [CrossRef]

- Saidani, M.; Yannou, B.; Leroy, Y.; Cluzel, F.; Kendall, A. A taxonomy of circular economy indicators. J. Clean. Prod. 2019, 207, 542–559. [Google Scholar] [CrossRef] [Green Version]

- Kristensen, H.S.; Mosgaard, M.A. A review of micro level indicators for a circular economy—Moving away from the three dimensions of sustainability? J. Clean. Prod. 2020, 243, 118531. [Google Scholar] [CrossRef]

- European Commission. Recovery Plan for Europe. Available online: https://ec.europa.eu/info/strategy/recovery-plan-europe_en (accessed on 28 June 2021).

- European Commission. Europe’s Moment: Repair and Prepare for the Next Generation; COM(2020) 456 final; European Commission: Brussels, Belgium, 2020; Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52020DC0456&qid=1624914952249 (accessed on 28 June 2021).

- Parchomenko, A.; Nelen, D.; Gillabel, J.; Rechberger, H. Measuring the circular economy—A Multiple Correspondence Analysis of 63 metrics. J. Clean. Prod. 2019, 210, 200–216. [Google Scholar] [CrossRef]

- Rizos, V.; Tuokko, K.; Behrens, A. The Circular Economy: A Review of Definitions, Processes and Impacts. CEPS Research Report No 2017/8. Available online: https://www.ceps.eu/ceps-publications/circular-economy-review-definitions-processes-and-impacts (accessed on 1 May 2021).

- Rosa, F.; Lunkes, R.; Brizzolla, M. Data on the environmental sustainability index of large Brazilian companies. Data Brief 2019, 24, 103819. [Google Scholar] [CrossRef] [PubMed]

- Centobelli, P.; Cerchione, R.; Chiaroni, D.; Del Vecchio, P.; Urbinati, A. Designing business models in circular economy: A systematic literature review and research agenda. Bus. Strat. Environ. 2020, 29, 1734–1749. [Google Scholar] [CrossRef]

- Kirchherr, J.; Piscicelli, L. Towards an Education for the Circular Economy (ECE): Five Teaching Principles and a Case Study. Resour. Conserv. Recycl. 2019, 150, 104406. [Google Scholar] [CrossRef]

- Fraccascia, L.; Giannoccaro, I.; Agarwal, A.; Hansen, E.G. Business models for the circular economy: Opportunities and challenges. Bus. Strat. Environ. 2019, 28, 430–432. [Google Scholar] [CrossRef] [Green Version]

- Mackey, P.J.; Cardona, V.N.; Reemeyer, L. The Role of Scrap Recycling in the USA for the Circular Economy: A Case Study of Copper Scrap Recycling. In REWAS 2019. The Minerals, Metals & Materials Series; Gaustad, G., Cardona, V.N., Reemeyer, L., Eds.; Springer: Cham, Switzerland, 2019; pp. 319–320. [Google Scholar] [CrossRef]

- Hong, J.; Chen, Y.; Liu, J.; Ma, X.; Qi, C.; Ye, L. Life cycle assessment of copper production: A case study in China. Int. J. Life Cycle Assess. 2017, 23, 1814–1824. [Google Scholar] [CrossRef]

- Poveda, R. Estudio Comparativo de los Modos de Gobernanza del Cobre en Chile, el Ecuador y el Perú. In La Gobernanza del Litio y el Cobre en los Países Andinos, Documentos de Proyectos (LC/TS.2020/124); León, M., Muñoz, C., Sánchez, J., Eds.; Comisión Económica para América Latina y el Caribe (CEPAL): Santiago, Chile, 2020; pp. 87–162. Available online: https://www.cepal.org/sites/default/files/publication/files/46479/S2000535_es.pdf (accessed on 1 May 2021).

- Helander, H.; Petit-Boix, A.; Leipold, S.; Bringezu, S. How to monitor environmental pressures of a circular economy: An assessment of indicators. J. Ind. Ecol. 2019, 23, 1278–1291. [Google Scholar] [CrossRef]

- Sauvé, S.; Bernard, S.; Sloan, P. Environmental sciences, sustainable development and circular economy: Alternative concepts for trans-disciplinary research. Environ. Dev. 2016, 17, 48–56. [Google Scholar] [CrossRef] [Green Version]

- Moreau, V.; Sahakian, M.; Van Griethuysen, P.; Vuille, F. Coming Full Circle: Why Social and Institutional Dimensions Matter for the Circular Economy. J. Ind. Ecol. 2017, 21, 497–506. [Google Scholar] [CrossRef]

- Gonzalo, J.A.; Pérez, J. Una propuesta de normalización relativa al valor añadido como medida alternativa de rendimiento empresarial. Rev. AECA 2017, 119, 35–39. Available online: https://aeca.es/wp-content/uploads/2014/05/119.pdf (accessed on 2 May 2021).

- Riahi-Belkaoui, A.; Picur, R.D. The substitution of net value added for earnings in equity valuation. Manag. Finance 1999, 25, 66–78. [Google Scholar] [CrossRef]

- Nandi, K.C. Performance measures: An application of value added statement. IUP J. Oper. Manag. 2011, 10, 39–61. [Google Scholar]

- Arangies, G.; Mlambo, C.; Hamman, W.D.; Steyn-Bruwer, B.W. The value-added statement: An appeal for standarisation. Manag. Dyn. 2008, 17, 31–43. Available online: https://mpra.ub.uni-muenchen.de/25970/1/MPRA_paper_25970.pdf (accessed on 2 May 2021).

- Lacy, P.; Keeble, J.; McNamara, R.; Rutqvist, J.; Haglund, T.; Cui, M.; Cooper, A.; Pettersson, C.; Kevin, E.; Buddemeier, P.; et al. Circular Advantage: Innovative Business Models and Technologies to Create Value in a World without Limits to Growth; Accenture: Chicago, IL, USA, 2014. [Google Scholar]

- Ellen MacArthur Foundation. Delivering the Circular Economy: A Toolkit for Policymakers; Ellen MacArthur Foundation: Cowes, UK, 2015; Available online: https://www.ellenmacarthurfoundation.org/assets/downloads/publications/EllenMacArthurFoundation_PolicymakerToolkit.pdf (accessed on 26 May 2021).

- Ellen MacArthur Foundation. Towards the Circular Economy: Economic and Business Rationale for an Accelerated Transition. Available online: https://www.ellenmacarthurfoundation.org/assets/downloads/publications/Ellen-MacArthur-Foundation-Towards-the-Circular-Economy-vol.1.pdf (accessed on 21 June 2020).

- Braungart, M.; McDonough, W.; Bollinger, A. Cradle-to-cradle design: Creating healthy emissions—A strategy for eco-effective product and system design. J. Clean. Prod. 2007, 15, 1337–1348. [Google Scholar] [CrossRef]

- Lewandowski, M. Designing the business models for circular economy—Towards the conceptual framework. Sustainability 2016, 8, 43. [Google Scholar] [CrossRef] [Green Version]

- Zott, C.; Amit, R.; Massa, L. The Business Model: Recent Developments and Future Research. J. Manag. 2011, 37, 1019–1042. [Google Scholar] [CrossRef] [Green Version]

- Osterwalder, A.; Pigneur, Y. Business Model Generation: A Handbook for Visionaries, Game Changers, and Challengers; John Wiley & Sons: Hoboken, NJ, USA, 2010; ISBN 9780470876411. [Google Scholar]

- Antikainen, M.; Aminoff, A.; Kettunen, O.; Sundqvist-Andberg, H.; Paloheimo, H. Circular Economy Business Model Inno-vation Process–Case Study. In Proceedings of the International Conference on Sustainable Design and Manufacturing; Springer: Berlin/Heidelberg, Germany, 2017; pp. 546–555. [Google Scholar]

- Bocken, N.; Strupeit, L.; Whalen, K.; Nußholz, J. A Review and Evaluation of Circular Business Model Innovation Tools. Sustainability 2019, 11, 2210. [Google Scholar] [CrossRef] [Green Version]

- Rizos, V.; Behrens, A.; Van Der Gaast, W.; Hofman, E.; Ioannou, A.; Kafyeke, T.; Flamos, A.; Rinaldi, R.; Papadelis, S.; Hirschnitz-Garbers, M.; et al. Implementation of Circular Economy Business Models by Small and Medium-Sized Enterprises (SMEs): Barriers and Enablers. Sustainability 2016, 8, 1212. [Google Scholar] [CrossRef] [Green Version]

- Kirchherr, J.; Piscicelli, L.; Bour, R.; Kostense-Smit, E.; Muller, J.; Huibrechtse-Truijens, A.; Hekkert, M. Barriers to the Circular Economy: Evidence from the European Union (EU). Ecol. Econ. 2018, 150, 264–272. [Google Scholar] [CrossRef] [Green Version]

- Tura, N.; Hanski, J.; Ahola, T.; Ståhle, M.; Piiparinen, S.; Valkokari, P. Unlocking circular business: A framework of barriers and drivers. J. Clean. Prod. 2019, 212, 90–98. [Google Scholar] [CrossRef]

- Guldmann, E.; Huulgaard, R.D. Barriers to circular business model innovation: A multiple-case study. J. Clean. Prod. 2020, 243, 118160. [Google Scholar] [CrossRef]

- Yin, R.K. Case Study Research: Design and Methods, 6th ed.; SAGE Publications Inc.: Thousand Oaks, CA, USA, 2017; ISBN 9781506336169. [Google Scholar]

- Serra, R.; Bayón, E. La Farga Lacambra. Solucions en Coure des de 1808; Angle: Barcelona, Spain, 2008; ISBN 978-84-96970-29-8. [Google Scholar]

- Pascual, P.; Nadal, J. El Coure II. La Farga Lacambra (1808–2007): Un Estudi Socioeconòmic; Eumo, Fundació La Farga, La Farga Group: Vic, Spain, 2008; ISBN 978-84-9766-280-2. [Google Scholar]

- Pascual, P. La industria del cobre en España II. De 1976 a 2005. Hist. Ind. 2008, 38, 115–159. [Google Scholar]

- Tàpies, J.; San Román, E.; Gil, Á. 100 Families that Changed the World. Family Businesses and Industrialization; EUNSA: Pamplona, Spain, 2014; ISBN 978-84-608-5437-1. [Google Scholar]

- Hemeroteca Digital, Buscador de Noticias. MyNews Hemeroteca. Available online: https://www.mynews.es/hemeroteca-digital (accessed on 27 May 2021).

- Sabi. Spanish and Portuguese Company Data. Bureau van Dijk. Available online: https://www.bvdinfo.com/en-gb/our-products/data/national/sabi (accessed on 27 May 2021).

- GRI. Sustainability Disclosure Database; Global Reporting Iniciative (GRI): Amsterdam, The Netherlands, 2013; p. 96. Available online: https://www.globalreporting.org/standards (accessed on 25 July 2019).

- World Intellectual Property Organization. Available online: https://www.wipo.int/patentscope (accessed on 9 April 2021).

- OmniSource, LLC. Available online: https://www.omnisource.com (accessed on 9 April 2021).

- Steel Dynamics, Inc. Available online: https://www.steeldynamics.com (accessed on 9 April 2021).

- SDI LaFarga, LLC. Available online: https://www.sdilafarga.com (accessed on 9 April 2021).

- Continuus-Properzi Spa. Available online: https://properzi.com (accessed on 9 April 2021).

- DIOPMA—Centre de Disseny i Optimització de Processos i Materials. Available online: http://www.fbg.ub.edu/es/investigadores/grupos-tecnio/diopma-centro-diseno-y-optimizacion-procesos-y-materiales (accessed on 9 April 2021).

- Roig, R.; Quintanilla, T. Caso práctico: La Farga Lacambra, S.A. Harv. Deusto Bus. Rev. 1997, 78, 80–87. [Google Scholar]

- Vilà, J.; Bosch, G. La Farga Lacambra: La Innovació com a Revulsiu de Negoci; Generalitat de Catalunya, CIDEM: Barcelona, Spain, 2003. [Google Scholar]

- The Copper Museum. Available online: https://www.lafarga.es/en/the-group/the-copper-museum/introduction (accessed on 9 April 2021).

- Malhotra, N.K. Essentials of Marketing Research: A Hands-on Orientation; Pearson: Upper Saddle River, NJ, USA, 2015; ISBN 978-0-13-706673-5. [Google Scholar]

- Corral-Marfil, J.A.; Morral, N. (Eds.) Estratègia Competitiva a la Petita i Mitjana Empresa. 10 Casos Pràctics Reals; Cambra de Comerç de Barcelona, Universitat de Vic: Barcelona, Spain, 2010; ISBN 978-84-96998-51-3. [Google Scholar]

- Corral-Marfil, J.A.; Morral, N. (Eds.) Estratègia Competitiva a la Petita i Mitjana Empresa. Notes Pedagògiques; Cambra de Comerç de Barcelona, Universitat de Vic: Barcelona, Spain, 2010; ISBN 978-84-92956-16-6. [Google Scholar]

- Corral-Marfil, J.A.; Sabata-Aliberch, A.; Arimany-Serrat, N. Innovación de embutido tradicional a alimento gourmet: Estudio del caso de Casa Riera Ordeix. Espacios 2018, 39, 23. Available online: http://www.revistaespacios.com/a18v39n33/18393323.html (accessed on 30 April 2021).

- Verd, J.M.; Lozares, C. Introducción a la Investigación Cualitativa. Fases, Métodos y Técnicas; Síntesis: Madrid, Spain, 2016; ISBN 978-84-9077-403-8. [Google Scholar]

- ATLAS.ti Scientific Software Development GmbH. ATLAS.ti 9. (version 9.0.23.0) [computer software]. Berlin, Germany. 2020. Available online: https://atlasti.com (accessed on 30 April 2021).

- European Copper Institute. Available online: https://copperalliance.eu (accessed on 8 April 2021).

- International Copper Association. Available online: https://copperalliance.org (accessed on 8 April 2021).

- Copper Development Association. Available online: https://www.antimicrobialcopper.org (accessed on 8 April 2021).

- Martínez de Rioja, J. Los que Dejan Huella II. 20 Historias de Éxito Empresarial; KPMG: Madrid, Spain, 2016; ISBN 978-84-608-7718-9. [Google Scholar]

- La Farga Yourcoppersolutions. Talent and Innovation, Our Essence; Sustainability report 2018; Lavola: Manlleu, Spain, 2019; Available online: https://lafarga.es/en/responsibility-corporate-responsibility/sustainability-report/item/informe-sostenibilitat-2018 (accessed on 2 May 2021).

- La Farga. Available online: https://lafarga.es/en (accessed on 8 April 2021).

- Galtés, M. El reinventor del cobre. In La Vanguardia; Grupo Godó: Barcelona, Spain, 2008; p. 63. [Google Scholar]

- Kotler, P.; Armstrong, G. Principles of Marketing, 17th ed.; Pearson: Harlow, UK, 2018; ISBN 978-1-292-22017-8. [Google Scholar]

- La Farga Group. Creating Links; Sustainability report 2008; Lavola: Manlleu, Spain, 2009; Available online: https://lafarga.es/en/responsibility-corporate-responsibility/sustainability-report/item/sustainability-report-2008 (accessed on 2 May 2021).

- La Farga Yourcoppersolutions. Global Solutions; Sustainability report 2016; Lavola: Manlleu, Spain, 2017; Available online: https://lafarga.es/en/responsibility-corporate-responsibility/sustainability-report/item/informe-sostenibilidad-2016 (accessed on 2 May 2021).

- La Farga Yourcoppersolutions. Staying on Course; Sustainability report 2012; Lavola: Manlleu, Spain, 2013; Available online: https://lafarga.es/en/responsibility-corporate-responsibility/sustainability-report/item/sustainability-report-2012 (accessed on 2 May 2021).

- La Farga Yourcoppersolutions. We are the Future; Sustainability report 2014; Lavola: Manlleu, Spain, 2015; Available online: https://lafarga.es/en/responsibility-corporate-responsibility/sustainability-report/item/sustainability-report-2014 (accessed on 2 May 2021).

- La Farga Yourcoppersolutions. Connexions That Add Up; Sustainability report 2017; Lavola: Manlleu, Spain, 2018; Available online: https://lafarga.es/en/responsibility-corporate-responsibility/sustainability-report/item/sustainability-report-2017 (accessed on 2 May 2021).

- La Farga Group Yourcoppersolutions. Responses Adapted to a Word in Movement; Sustainability report 2010; Lavola: Manlleu, Spain, 2011; Available online: https://lafarga.es/en/responsibility-corporate-responsibility/sustainability-report/item/sustainability-report-2010 (accessed on 2 May 2021).

- Toto, D. Shining Brightly. Recycling Today. 2 August 2012. Available online: https://www.recyclingtoday.com/article/rt0812-la-farga-copper-recycling (accessed on 28 April 2021).

- Guixà, O.; Properzi, G. Continuous copper rod production from 100 percent scrap. Wire J. Int. 1996, 29, 60–67. [Google Scholar]

- Saborit, S. La Farga invierte 15 millones en su nueva línea de cobre. In Expansión; Grupo Expansión: Mexico City, Mexico, 2019; p. 5. [Google Scholar]

- Chesbrough, H.W.; Appleyard, M.M. Open Innovation and Strategy. Calif. Manag. Rev. 2007, 50, 57–76. [Google Scholar] [CrossRef] [Green Version]

- Corral-Marfil, J.A. La implantación del Sistema Español de Calidad Turística en Destinos (SICTED): Un caso práctico de gestión de destinos. TURyDES 2012, 5, 28. Available online: https://www.eumed.net/rev/turydes/13/jacm.html (accessed on 28 April 2021).

- Commodity. Merriam-Webster.com. Available online: https://www.merriam-webster.com/dictionary/commodity (accessed on 28 April 2021).

- Grant, R.M. Contemporary Strategy Analysis. Text and Cases, 9th ed.; John Wiley & Sons: Chichester, UK, 2016; ISBN 9781119120841. [Google Scholar]

- La Farga Group Yourcoppersolutions. Moulding Day by Day with Firmness; Sustainability report 2009; Lavola: Manlleu, Spain, 2010; Available online: https://lafarga.es/en/responsibility-corporate-responsibility/sustainability-report/item/sustainability-report-2009 (accessed on 2 May 2021).

- Ranta, V.; Keränen, J.; Aarikka-Stenroos, L. How B2B suppliers articulate customer value propositions in the circular economy: Four innovation-driven value creation logics. Ind. Mark. Manag. 2020, 87, 291–305. [Google Scholar] [CrossRef]

- Fraccascia, L.; Giannoccaro, I.; Albino, V. Business models for industrial symbiosis: A taxonomy focused on the form of governance. Resour. Conserv. Recycl. 2019, 146, 114–126. [Google Scholar] [CrossRef]

- Schaffer, N.; Drieschner, C.; Krcmar, H. An Analysis of Business Model Component Interrelations. In Proceedings of the PACIS 2020, Dubai, United Arab Emirates, 20–24 June 2020; p. 82, ISBN 9978-1-7336325-3-9. Available online: https://aisel.aisnet.org/pacis2020/82 (accessed on 30 May 2021).

- Fisas, F. Manual de Supervivencia para la Empresa Familiar; Península: Barcelona, Spain, 2013; ISBN 978-84-9942-289-3. [Google Scholar]

- Transmmission, Family Business Advisors. Available online: https://transmmission.com (accessed on 30 May 2021).

| La Farga Lacambra | La Farga Tub | La Farga Rod | La Farga Intec | |||||

|---|---|---|---|---|---|---|---|---|

| 2008 | 2017 | 2008 | 2017 | 2008 | 2017 | 2009 | 2017 | |

| Non-current assets 1 | 25 | 38.9 | 12 | 18 | 16 | 14 | 4.53 | 0.0006 |

| Net equity 1 | 33.7 | 43.2 | 18 | 15 | 16.7 | 16.15 | 1.33 | −0.424 |

| Turnover 1 | 393 | 442 | 88.5 | 101 | 360 | 776 | 0.95 | 0.022 |

| Profit and loss for period 1 | 7.8 | 2.2 | 0.083 | −0.499 | 0.044 | 3.1 | 0.068 | −0.983 |

| Indebtedness | 49% | 69% | 28.44% | 67.35% | 59% | 75% | 73.07% | 451.92% |

| Short-term solvency | 1.42 | 1.15 | 1.82 | 1.01 | 1.29 | 1.06 | 0.27 | 0.22 |

| Financial profitability | 23.39% | 5.23% | 0.45% | −3.82% | 0.27% | 19.59% | 5.16% | −231.49% |

| Economic profitability | 17.61% | 2.37% | 1.55% | −1.43% | 2.26% | 7.35% | 4.01% | −815.47% |

| Workforce 2 | 155 | 226 | 80 | 97 | 22 | 25 | 2 | n/d |

| 2018 | 2019 | |

|---|---|---|

| Non-current assets 1 | 83.2 | 82.9 |

| Net equity 1 | 63.12 | 60.17 |

| Turnover 1 | 1.048 | 1.011 |

| Profit and loss for period 1 | 1.357 | −2.896 |

| Indebtedness | 71.75% | 70.94% |

| Short-term solvency | 1 | 0.94 |

| Financial profitability | 2.15 | −4.81% |

| Economic profitability | 0.99% | −0.87% |

| Workforce 2 | 396 | 349 |

| 2015 | 2016 | 2017 | 2018 | |

|---|---|---|---|---|

| Energy efficiency and emissions | ||||

| Energy consumption (kWh/t) | 1209 | 1301 | 1234 | 1269 |

| Water consumption (m3/t copper processed) | 0.81 | 0.98 | 0.78 | 0.91 |

| Contaminating emissions (t/year) | 75,369 | 84,441 | 80,075 | 82,668 |

| CO2 emissions (kg/t copper processed) | 263.00 | 273.56 | 280.32 | 268.64 |

| Waste management efficiency | ||||

| Waste management (Kg/t copper) | 9.51 | 7.78 | 6.95 | 9.49 |

| Non-hazardous waste managed | 81% | 62% | 72% | 78% |

| Waste reused | 15% | 18.85% | 13.77% | 16.17% |

| Tonnes of copper produced | 218,053 | 231,210 | 248,441 | 206,851 |

| 2015 | 2016 | 2017 | 2018 | |

|---|---|---|---|---|

| Employees | 347 | 406 | 429 | 396 |

| Gender diversity of employees | Men 87% | Men 90% | Men 82% | Men 88% |

| Women 13% | Women 10% | Women 18% | Women 12% | |

| Senior management positions | 16 | 19 | 18 | 16 |

| Gender diversity in senior management | 4 | 4 | 5 | 5 |

| Employee stability | 84% | 80% | 79% | 77% |

| Absenteeism | 3.57% | 5.32% | 5.46% | 5.98% |

| Employee turnover | 8% | 10% | 10% | 18% |

| Net job creation | 27 | 34 | 43 | 13 |

| Labour seniority | 10.71 | 9.64 | 8.89 | 9.05 |

| Employee training (hours) | 9288 | 12,968 | 17,220 | 10,756 |

| Product | Description | Image |

|---|---|---|

| Copper rod | Genius: 100% recycled copper rod: Frod, Cu-FRHC (Fire Refining High Conductivity). Essential: high conductivity and purity electrolytic rod, obtained from grade A cathode, for demanding conductivity situations: Premiumrod, Cu-ETP1 (Electrolytic Tough Pitch); Ofrod, oxygen-free; Tinrod, CuSn, copper–tin alloy; Argentrod, CuAg, copper–silver; Magnesiumrod, CuMg, copper–magnesium |  |

| Copper wire drawing | Semi-finished to produce electrical cables, oxygen-free and tinned: Unifil, rigid copper wire; Plurifil, stranded parallel cooper wire; Rigidcord, rigid strands; Flexicord, flexible strands |  |

| Welding wire | Joinfil, poly micro-alloy copper wire for welding metal packaging for the food-canning industry, aerosols and cosmetic products |  |

| Copper tubes | Wide range for plumbing, gas, heating, solar power, air conditioning, medical gases and industrial uses: Sanitub, Sanicrom, Climatub, Climaplus, Sanistar, Saniheat, Meditub, Indutub and Level Wound Coil |  |

| Railway cables | Range of materials for catenary: Railfil grooved contact wire, contact wire, feeder, hangers and cables: copper, copper–tin, copper–silver and copper–magnesium; for conventional, metro, tram and high-speed lines |  |

| Earthing strands | Earthing cables for buildings to prevent electrocution, accidental contact and surge protection: Earthing Rigidcord, ECCC-I (Earthing Copper Coated Conductor Industrial), ECCC-AT (Anti-Theft), ECCC-AC (Anti Corrosion) |  |

| Specialcables | High content copper alloys, with extensive mechanical and electrical features for the railway, aerospace and automotive sectors: CuOF, oxygen-free copper; CuAg, copper–silver; CuSn, copper–tin; CuMg, copper–magnesium |  |

| Overhead line conductors | CAC (Copper Alloy Conductor), high-temperature micro-alloyed conductor, designed for low-, medium-, high- and very high voltage overhead lines |  |

| Billets | Copper cylinders for the production of copper pipes, bars, profiles and plates: Fbillet |  |

| Customer Segment | Product |

|---|---|

| Electrical cable manufacturers | Thermal wire rod |

| Enamellists, plate manufacturers, cable manufacturers | Electrolytic wire rod |

| Electrical cable manufacturer | Drawn wire |

| Metal packaging manufacturers | Welding wire |

| Plumbing, heating and refrigeration warehouses; industrial applications manufacturers | Tubes |

| Railway infrastructure construction firms | Railway cable |

| Electrical warehouses | Earthing strands |

| Railway, aerospace and automotive sectors | Special cables |

| Transport and electric power distribution sector | Overhead line conductors |

| Copper tube, bar, profile and plate manufacturers | Billets |

| New foundries | Sale of technology |

| Tourists, pensioners, associations, educational centres, groups of students | Copper Museum |

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| La Farga Rod | M EUR | 4.5 | 6.3 | 6.9 | 7.5 | 8.0 | 10.5 | 13.5 | 12.0 | 11.3 | 13.9 | ||

| % Income | 1.2 | 2.3 | 1.3 | 1.2 | 1.3 | 1.9 | 2.4 | 2.1 | 2.1 | 1.8 | |||

| La Farga Tub | M EUR | 12.3 | 6.6 | 8.7 | 12.8 | 6.3 | 11.0 | 11.0 | 9.9 | 1.3 | 11.3 | ||

| % Income | 13.9 | 9.4 | 8.6 | 11.6 | 6.2 | 11.5 | 11.6 | 11.6 | 1.6 | 11.2 | |||

| La Farga Intec | M EUR | - | 0.9 | 1.4 | 1.1 | 1.2 | 1.1 | 1.7 | 1.3 | 0.7 | - | ||

| % Income | - | 90.3 | 97.2 | 99.6 | 100.0 | 99.1 | 100.0 | 99.6 | 100.0 | - | |||

| La Farga Lacambra | M EUR | 33.5 | 5.7 | 38.3 | 30.3 | 33.7 | 40.6 | 34.2 | 36.3 | 21.0 | 41.2 | ||

| % Income | 9.3 | 2.1 | 7.4 | 5.0 | 5.6 | 7.5 | 6.0 | 6.2 | 3.9 | 5.3 | |||

| La Farga Yourcopersolutions | M EUR | 40.3 | 39.8 | ||||||||||

| % Income | 3.8 | 3.9 |

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| La Farga Rod | 1.0 | 1.3 | 1.3 | 1.2 | 1.9 | 2.8 | 3.1 | 3.0 | 1.9 | 0.9 | ||

| La Farga Tub | 0.3 | 1.5 | 2.5 | 2.6 | 2.0 | 3.0 | 2.2 | 4.9 | 2.9 | 3.5 | ||

| La Farga Intec | - | 91.4 | 78.1 | 77.6 | 75.0 | 73.1 | 58.4 | 67.4 | 69.6 | - | ||

| La Farga Lacambra | 0.7 | 1.2 | 1.6 | 3.3 | 4.7 | 6.0 | 5.4 | 5.7 | 5.4 | 4.5 | ||

| La Farga Yourcopersolutions | 4.1 | 4.1 |

| 2018 | 2019 | |||

|---|---|---|---|---|

| M EUR | % | M EUR | % | |

| Revenues | 1048.6 | 100% | 1011.2 | 100% |

| Costs of bought in goods and services | 1008.3 | 96.2% | 971 | 96.1% |

| Total gross value added | 40.3 | 3.8% | 39.8 | 3.9% |

| Employees (benefits and remuneration) | 18.6 | 46.1% | 17.5 | 43.9% |

| Shareholders (dividends) | 0 | 0 | 0 | 0 |

| Capital providers (financial expenditure) | 3.5 | 8.6% | 2.8 | 7.0% |

| Government (corporate tax) | 0 | 0% | 0 | 0% |

| Retained earnings (depreciation, impairments) | 18.3 | 45.3% | 20 | 49.1% |

| Total value added | 40.3 | 100.0% | 39.8 | 100.0% |

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| La Farga Rod (1) | 360.4 | 276.6 | 516.4 | 604.5 | 596.9 | 540.8 | 572.7 | 582.1 | 539.5 | 776.6 | ||

| La Farga Tub | 88.5 | 70.5 | 101.5 | 110.4 | 101.9 | 95.7 | 94.8 | 84.9 | 76.1 | 101.2 | ||

| La Farga Intec | 1.0 | 1.5 | 1.1 | 1.2 | 1.1 | 1.7 | 1.3 | 0.7 | ||||

| La Farga Lacambra (2) | 393.0 | 257.6 | 425.8 | 556.0 | 555.9 | 504.7 | 515.4 | 479.9 | 396.5 | 442.7 | ||

| La Farga Yourcopersolutions | 1.048.6 | 1.011.2 | ||||||||||

| (1)/(2) | 0.92 | 1.07 | 1.21 | 1.09 | 1.07 | 1.07 | 1.11 | 1.21 | 1.36 | 1.75 |

| BM Dimensions | Lüdeke-Freund et al. [5] Design Options | La Farga Design Options | Comments | |

|---|---|---|---|---|

| Value proposition | Products | Products based on recycled waste|Reusable or recyclable production inputs | Wire rod, drawn wire, welding wire, tube, railway cable, earthing strands, special cables, overhead lines, billets | Portfolio of copper products produced from scrap |

| Services | Take-back management|Waste handling, processing | Recovery service, recycling technology transfer, technical support service, Copper Museum | Take-back management and waste handling only provided for welding wire; scrap dealers perform this task for other products | |

| Value delivery | Target customers | Green customers|B2B customers | Electricity market, cable manufacturers, packaging manufacturers, sanitary water installers, governmental bodies, installers, railway sector, electricity distribution sector, tube manufacturers, new foundries, tourists, schools | B2B customers and cost-conscious customers. Green customers are still a minority |

| Value delivery processes | Connecting suppliers and customers|Providing used products, components, materials or waste|Taking back used products, components, materials or waste | Owned distribution channels: Vicente Torns Distribution, Vicente Torns Distribution France, La Farga Tub France, La Farga Limited and external channels: warehouses. Coordinated structure to dialogue with clients: project “Value for the client” | Partial vertical integration into distribution|Taking back used waste only provided for welding wire | |

| Value creation | Partners and stakeholders | Collectors of products, components, materials, waste | Machinery manufacturers: Continuus Properzi, Danieli. Research centres and universities. Scrap dealers. Cathode suppliers. Joint ventures: Steel Dynamics, Ganzhou Jiangwu | Open innovation |

| Value creation processes | Recycling of products, components, materials, waste|Upgrading or upcycling of products, components, materials, waste|Taking back or recapturing products, components, materials, waste|Winning back base materials | Recycling of scrap. Upcycling of scrap. Taking back some used products (welding wire)|Designing products and materials (R & D) | Intangible key resources: know-how, patents, homologations, certifications | |

| Value capture | Revenues | Additional product revenues | Approximately, half of the revenues come from sales of products produced from scrap. Royalties | Strong pressure from customers on the price of products produced from scrap. Low appreciation by the market. Copper Museum, financially loss-making |

| Costs | Waste handling, processing|Resource inputs|Transportation, logistics | Resource inputs. Transportation, logistics. Waste processing. Labor | Economies in the purchase of materials. Additional cost for scrap refining. Technical efficiency | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Corral-Marfil, J.-A.; Arimany-Serrat, N.; Hitchen, E.L.; Viladecans-Riera, C. Recycling Technology Innovation as a Source of Competitive Advantage: The Sustainable and Circular Business Model of a Bicentennial Company. Sustainability 2021, 13, 7723. https://doi.org/10.3390/su13147723

Corral-Marfil J-A, Arimany-Serrat N, Hitchen EL, Viladecans-Riera C. Recycling Technology Innovation as a Source of Competitive Advantage: The Sustainable and Circular Business Model of a Bicentennial Company. Sustainability. 2021; 13(14):7723. https://doi.org/10.3390/su13147723

Chicago/Turabian StyleCorral-Marfil, José-Antonio, Núria Arimany-Serrat, Emma L. Hitchen, and Carme Viladecans-Riera. 2021. "Recycling Technology Innovation as a Source of Competitive Advantage: The Sustainable and Circular Business Model of a Bicentennial Company" Sustainability 13, no. 14: 7723. https://doi.org/10.3390/su13147723

APA StyleCorral-Marfil, J.-A., Arimany-Serrat, N., Hitchen, E. L., & Viladecans-Riera, C. (2021). Recycling Technology Innovation as a Source of Competitive Advantage: The Sustainable and Circular Business Model of a Bicentennial Company. Sustainability, 13(14), 7723. https://doi.org/10.3390/su13147723