Inward Foreign Direct Investment-Induced Technological Innovation in Sri Lanka? Empirical Evidence Using ARDL Approach

Abstract

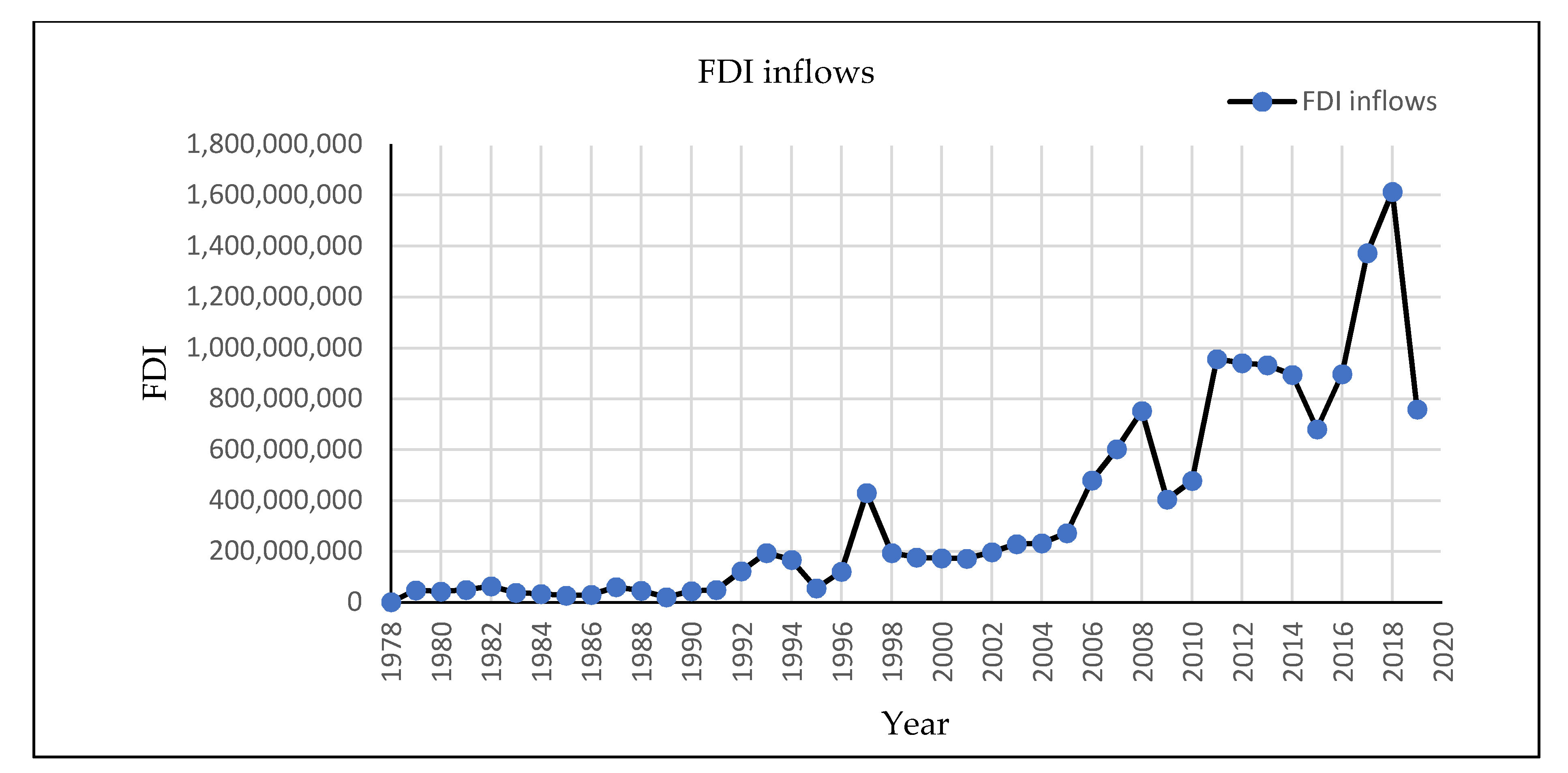

:1. Introduction

2. Theoretical Foundation and Literature Review

3. Materials and Methods

4. Estimating and Analyzing Results

4.1. Unit Root Analysis

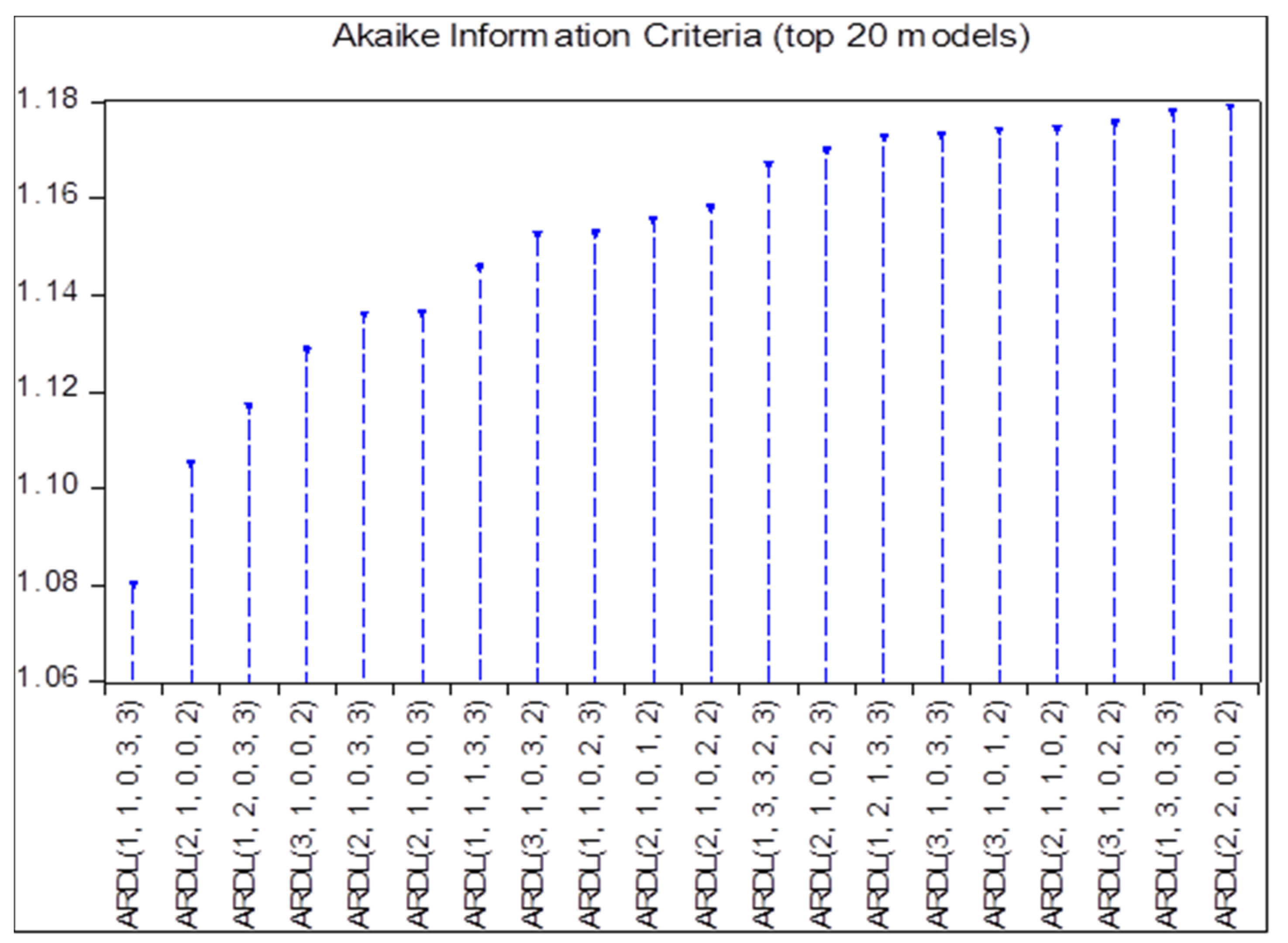

4.2. Lag Length Criteria

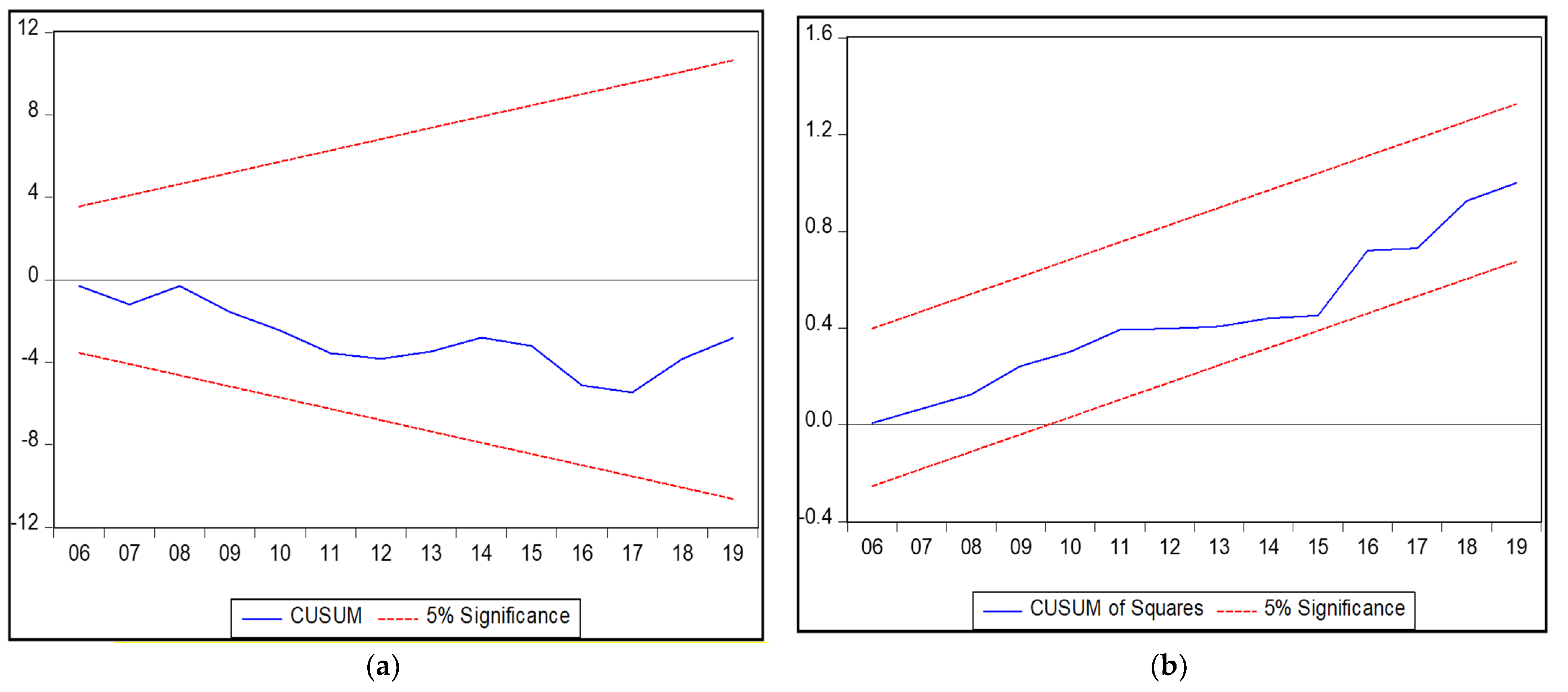

4.3. Diagnostic Tests

4.4. ARDL Bounds Test

4.5. Long-Run Equilibrium Relationship

4.6. Short-Run Equilibrium Relationship

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Bodman, P.; Le, T. Assessing the roles that absorptive capacity and economic distance play in the foreign direct investment-productivity growth nexus. Appl. Econ. 2013, 45, 1027–1039. [Google Scholar] [CrossRef]

- Park, J. International student flows and R&D spillovers. Econ. Lett. 2004, 82, 315–320. [Google Scholar] [CrossRef]

- Le, T. ‘Brain drain’ or ‘brain circulation’: Evidence from oecd’s international migration and r&d spillovers. Scott. J. Political Econ. 2008, 55, 618–636. [Google Scholar] [CrossRef]

- Le, T.; Bodman, P.M. Remittances or technological diffusion: Which drives domestic gains from brain drain? Appl. Econ. 2011, 43, 2277–2285. [Google Scholar] [CrossRef]

- Adediran, A. Nigerian Institute of Advanced Legal Studies Foreign Direct Investment and Sustainable Development in Nigerian Aviation. Australas. Rev. Afr. Stud. 2019, 40, 119. [Google Scholar] [CrossRef]

- Adams, S. Foreign Direct investment, domestic investment, and economic growth in Sub-Saharan Africa. J. Policy Model. 2009, 31, 939–949. [Google Scholar] [CrossRef]

- Kobrin, S. The determinants of liberalization of FDI policy in developing countries: A cross-sectional analysis. Transnatl. Corp. 2007, 14, 67–103. [Google Scholar]

- Lipsey, R.; Sjöholm, F.; Sun, J. Foreign Ownership and Employment Growth in Indonesian Manufacturing. Natl. Bur. Econ. Res. 2010, 21, 23. [Google Scholar] [CrossRef]

- United Nations Conference on Trade and Development. World Investment Report; United Nations Conference on Trade and Development: New York, NY, USA, 2019. [Google Scholar]

- United Nations Conference on Trade and Development. World Investment Report; United Nations Conference on Trade and Development: New York, NY, USA, 1994. [Google Scholar]

- Berger, M.; Diez, J.R. Can Host Innovation Systems in Late Industrializing Countries Benefit from the Presence of Transnational Corporations? Insights from Thailand’s Manufacturing Industry. Eur. Plan. Stud. 2008, 16, 1047–1074. [Google Scholar] [CrossRef]

- Zeng, S.; Zhou, Y. Foreign Direct Investment’s Impact on China’s Economic Growth, Technological Innovation and Pollution. Int. J. Environ. Res. Public Health 2021, 18, 2839. [Google Scholar] [CrossRef] [PubMed]

- Velnampy, T.; Achchuthan, S.; Kajananthan, R. Foreign Direct Investment and Economic Growth: Evidence from Sri Lanka. 10 Years of ASARC International Conference, The Australian National University. Int. J. Bus. Manag. 2013, 9, 140. [Google Scholar] [CrossRef] [Green Version]

- Athukorala, P.; Jayasuriya, S.K. Complementarity of Trade and FDI Liberalization in Industrial Growth: Lessons from Sri Lanka. In Proceedings of the 10 Years of ASARC International Conference, Canberra, Australia, 27–28 April 2004; Available online: https://ideas.repec.org/p/pas/asarcc/2004-10.html (accessed on 11 June 2021).

- Coe, D.T.; Helpman, E.; Hoffmaister, A.W. North-South R & D Spillovers. Econ. J. 1997, 107, 134–149. [Google Scholar] [CrossRef] [Green Version]

- Potterie, B.V.P.D.L.; Lichtenberg, F. Does Foreign Direct Investment Transfer Technology Across Borders? Rev. Econ. Stat. 2001, 83, 490–497. [Google Scholar] [CrossRef]

- Aghion, P.; Harris, C.; Vickers, J. Competition and growth with step-by-step innovation: An example. Eur. Econ. Rev. 1997, 41, 771–782. [Google Scholar] [CrossRef]

- Romer, P. Endogenous Technological Change. Endog. Technol. Chang. 1989, 98, S71–S102. [Google Scholar] [CrossRef]

- Chunlai, C. Provincial Characteristics and Foreign Direct Investment Location Decision within China, Chinese Economies Research Centre (CERC) Working Papers; University of Adelaide, Australia. Available online: https://econpapers.repec.org/scripts/showcites.pf?h=repec:isa:wpaper:27 (accessed on 11 June 2021).

- Grossman, G.M.; Helpman, E. Endogenous Innovation in the Theory of Growth. J. Econ. Perspect. 1994, 8, 23–44. [Google Scholar] [CrossRef] [Green Version]

- Barro, R.; Sala-I-Martin, X. Economic Growth; McGraw-Hill: Cambridge, MA, USA, 1995. [Google Scholar]

- Lucas, R.E., Jr. On the mechanics of economic development. J. Monet. Econ. 1988, 1, 3–42. [Google Scholar] [CrossRef]

- De Mello, L.R., Jr. Foreign direct investment in developing countries and growth: A selective survey. J. Dev. Stud. 1997, 34, 1–34. [Google Scholar] [CrossRef]

- Herzer, D.; Schrooten, M. Outward FDI and domestic investment in two industrialized countries. Econ. Lett. 2008, 99, 139–143. [Google Scholar] [CrossRef]

- Goldar, B.; Banga, R. Impact of Trade Liberalization on Foreign Direct Investment in Indian Industries; ARTNeT Working Paper Series, Asia-Pacific Research and Training Network on Trade; Bangkok, Thailand. Available online: https://www.econstor.eu/handle/10419/178394 (accessed on 11 June 2021).

- Solow, R.M. A Contribution to the Theory of Economic Growth. Q. J. Econ. 1956, 70, 65. [Google Scholar] [CrossRef]

- Elboiashi, H.A.T. The Effect of FDI and Other Foreign Capital Inflows on Growth and Investment in Developing Economies. Ph.D. Thesis, Glasgow University, Glasgow, Scotland, 2011. [Google Scholar]

- Śledzik, K. Schumpeter’s View on Innovation and Entrepreneurship. SSRN Electron. J. 2013. [Google Scholar] [CrossRef]

- Aghion, P.; Bloom, N.; Blundell, R.; Griffith, R.; Howitt, P. Competition and Innovation: An Inverted-U Relationship. Q. J. Econ. 2005, 120, 701–728. [Google Scholar] [CrossRef] [Green Version]

- Aghion, P.; Blundell, R.; Griffith, R.; Howitt, P.; Prantl, S. The Effects of Entry on Incumbent Innovation and Productivity. Rev. Econ. Stat. 2009, 91, 20–32. [Google Scholar] [CrossRef] [Green Version]

- Griliches, Z.; Mairesse, J. Productivity and R and D at the Firm Level. In R and D Patents, and Productivity; University of Chicago Press: Chicago, IL, USA, 1984; pp. 339–374. [Google Scholar]

- Chu, A.C. Effects of Patent Policy on Income and Consumption Inequality in a R&D Growth Model. South. Econ. J. 2010, 77, 336–350. [Google Scholar] [CrossRef] [Green Version]

- Hu, A.G.; Png, I.P.L. Patent rights and economic growth: Evidence from cross-country panels of manufacturing industries. Oxf. Econ. Pap. 2013, 65, 675–698. [Google Scholar] [CrossRef] [Green Version]

- Crepon, B.; Duguet, E.; Mairessec, J. Research, Innovation And Productivi [Ty: An Econometric Analysis At The Firm Level. Econ. Innov. New Technol. 1998, 7, 115–158. [Google Scholar] [CrossRef]

- Belze, L.; Gauthier, O. Innovation and economic growth: Role and challenges of SME financing. International SME Review: Economy and Management of Small and Medium Enterprises. Rev. Int. PME Économie et Gest. Petite et Moy. Entrep. 2000, 13, 65–86. [Google Scholar] [CrossRef] [Green Version]

- Salomon, R.M.; Shaver, J.M. Learning by Exporting: New Insights from Examining Firm Innovation. J. Econ. Manag. Strat. 2005, 14, 431–460. [Google Scholar] [CrossRef]

- Cheung, K.-Y.; Lin, P. Spillover effects of FDI on innovation in China: Evidence from the provincial data. China Econ. Rev. 2004, 15, 25–44. [Google Scholar] [CrossRef] [Green Version]

- Liu, X.; Zou, H. The impact of greenfield FDI and mergers and acquisitions on innovation in Chinese high-tech industries. J. World Bus. 2008, 43, 352–364. [Google Scholar] [CrossRef]

- Saggi, K. Trade, Foreign Direct Investment, and International Technology Transfer. World Bank Res. Obs. 2002, 17, 191–235. [Google Scholar] [CrossRef]

- Damanpour, F. An Integration of Research Findings of Effects of Firm Size and Market Competition on Product and Process Innovations. Br. J. Manag. 2010, 21, 996–1010. [Google Scholar] [CrossRef]

- Lin, H.-L.; Lin, E.S. FDI, Trade, and Product Innovation: Theory and Evidence. South. Econ. J. 2010, 77, 434–464. [Google Scholar] [CrossRef]

- Javorcik, B.S. Can Survey Evidence Shed Light on Spillovers from Foreign Direct Investment? World Bank Res. Obs. 2008, 23, 139–159. [Google Scholar] [CrossRef]

- Bučar, M.; Rojec, M.; Stare, M.; Bu, M. Backward FDI linkages as a channel for transferring technology and building innovation capability: The case of Slovenia. Eur. J. Dev. Res. 2009, 21, 137–153. [Google Scholar] [CrossRef]

- Blalock, G.; Gertler, P.J. Welfare gains from Foreign Direct Investment through technology transfer to local suppliers. J. Int. Econ. 2008, 74, 402–421. [Google Scholar] [CrossRef]

- Jabbour, L.; Mucchielli, J.L. Technology Transfer Through Vertical Linkages: The Case of the Spanish Manufacturing Industry. J. Appl. Econ. 2007, 10, 115–136. [Google Scholar] [CrossRef] [Green Version]

- Javorcik, B.S. Does Foreign Direct Investment Increase the Productivity of Domestic Firms? In Search of Spillovers through Backward Linkages. Am. Econ. Rev. 2004, 94, 605–627. [Google Scholar] [CrossRef] [Green Version]

- Caves, R.E. Multinational Firms, Competition, and Productivity in Host-Country Markets. Economica 1974, 41, 176. [Google Scholar] [CrossRef]

- Dunning, J.H. Theory Toward an Eclectic Production: Of International Tests Some Empirical. J. Int. Bus. Stud. 1970, 11, 12–23. [Google Scholar]

- Freeman, C.; Cantwell, J. Technological Innovation and Multinational Corporations. Econ. J. 1990, 100, 621. [Google Scholar] [CrossRef]

- Wang, C.C.; Wu, A. Geographical FDI knowledge spillover and innovation of indigenous firms in China. Int. Bus. Rev. 2016, 25, 895–906. [Google Scholar] [CrossRef]

- Girma, S.; Gong, Y.; Görg, H. What Determines Innovation Activity in Chinese State-owned Enterprises? The Role of Foreign Direct Investment. World Dev. 2009, 37, 866–873. [Google Scholar] [CrossRef]

- Nyeadi, J.D.; Adjasi, C. Foreign direct investment and firm innovation in selected sub-Saharan African Countries. Cogent Bus. Manag. 2020, 7, 7. [Google Scholar] [CrossRef]

- Wang, J.; Liu, X.; Wei, Y.; Wang, C. Cultural Proximity and Local Firms’ catch up with Multinational Enterprises. World Dev. 2014, 60, 1–13. [Google Scholar] [CrossRef] [Green Version]

- Khachoo, Q.; Sharma, R. FDI and Innovation: An Investigation into Intra- and Inter-industry Effects. Glob. Econ. Rev. 2016, 45, 311–330. [Google Scholar] [CrossRef]

- Keller, W.; Yeaple, S.R. Multinational Enterprises, International Trade, and Productivity Growth: Firm-Level Evidence from the United States. Rev. Econ. Stat. 2009, 91, 821–831. [Google Scholar] [CrossRef] [Green Version]

- García, F.; Jin, B.; Salomon, R. Does inward foreign direct investment improve the innovative performance of local firms? Res. Policy 2013, 42, 231–244. [Google Scholar] [CrossRef]

- Osano, H.M.; Koine, P.W. Role of foreign direct investment on technology transfer and economic growth in Kenya: A case of the energy sector. J. Innov. Entrep. 2016, 5, 31. [Google Scholar] [CrossRef] [Green Version]

- Dhrifi, A. Foreign direct investment, technological innovation and economic growth: Empirical evidence using simultaneous equations model. Int. Rev. Econ. 2015, 62, 381–400. [Google Scholar] [CrossRef]

- Erdal, L.; Göçer, I. The Effects of Foreign Direct Investment on R&D and Innovations: Panel Data Analysis for Developing Asian Countries. Procedia Soc. Behav. Sci. 2015, 195, 749–758. [Google Scholar] [CrossRef] [Green Version]

- Zhang, L. The knowledge spillover effects of FDI on the productivity and efficiency of research activities in China. China Econ. Rev. 2017, 42, 1–14. [Google Scholar] [CrossRef]

- Kemeny, T. Does Foreign Direct Investment Drive Technological Upgrading? World Dev. 2010, 38, 1543–1554. [Google Scholar] [CrossRef]

- Sivalogathasan, V.; Wu, X. The Effect of Foreign Direct Investment on Innovation in South Asian Emerging Markets. Glob. Bus. Organ. Excel. 2014, 33, 63–76. [Google Scholar] [CrossRef]

- Chen, Y. Impact of Foreign Direct Investment on Regional Innovation Capability: A Case of China. J. Data Sci. 2007, 5, 577–596. [Google Scholar]

- Mohamed, M.; Liu, P.; Nie, G. Are Technological Innovation and Foreign Direct Investment a Way to Boost Economic Growth? An Egyptian Case Study Using the Autoregressive Distributed Lag (ARDL) Model. Sustainability 2021, 13, 3265. [Google Scholar] [CrossRef]

- Ustalar, S.A.; Şanlisoy, S. Doğrudan Yabancı Yatırımlarının Yenilik Performansı Üzerindeki Etkisi: Doğrusal Olmayan ARDL Yaklaşımı. Izmir İktisat Derg. 2020, 35, 77–89. [Google Scholar] [CrossRef]

- Ismail, N.W. Innovation and high-tech trade in Asian countries. Int. Conf. Recent Dev. Asian Trade Policy Integr. 2013, 1–19. [Google Scholar]

- Shamsub, H. Interrelationships between inward FDI and indigenous innovation in developing economies. Glob. Bus. Econ. Rev. 2014, 16, 296. [Google Scholar] [CrossRef]

- Globerman, S. Foreign Direct Investment and ’Spillover’ Efficiency Benefits in Canadian Manufacturing Industries. Can. J. Econ. /Rev. Can. d’économique 1979, 12, 42. [Google Scholar] [CrossRef]

- Blomström, M.; Persson, H. Foreign investment and spillover efficiency in an underdeveloped economy: Evidence from the Mexican manufacturing industry. World Dev. 1983, 11, 493–501. [Google Scholar] [CrossRef]

- Aitken, B.J.; Harrison, A.E. Do Domestic Firms Benefit from Direct Foreign Investment? Evidence from Venezuela. Am. Econ. Rev. 1999, 89, 605–618. [Google Scholar] [CrossRef] [Green Version]

- Haddad, M.; Harrison, A. Are there positive spillovers from direct foreign investment? J. Dev. Econ. 1993, 42, 51–74. [Google Scholar] [CrossRef]

- Djankov, S.; Hoekman, B. Foreign Investment and Productivity Growth in Czech Enterprises. World Bank Econ. Rev. 2000, 14, 49–64. [Google Scholar] [CrossRef]

- Sasidharan, S. Foreign Direct Investment and Technology Spillovers: Evidence from the Indian Manufacturing Sector. Working Paper Series, United Nations University, Maastricht Economic and Social Research Institute on Innovation and Technology, Netherland. 2006. Available online: https://www.worldscientific.com/doi/10.1142/S0217590812500117 (accessed on 24 June 2021).

- Qu, Y.; Wei, Y. The Role of Domestic Institutions and FDI on Innovation—Evidence from Chinese Firms. Asian Econ. Pap. 2017, 16, 55–76. [Google Scholar] [CrossRef]

- Loukil, K. Foreign direct investment and technological innovation in developing countries. Oradea J. Bus. Econ. 2016, 31–40. [Google Scholar] [CrossRef]

- Gardner, T.A.; Joutz, F.L. Economic Growth, Energy Prices and Technological Innovation. South. Econ. J. 1996, 62, 653. [Google Scholar] [CrossRef]

- Maradana, R.P.; Pradhan, R.P.; Dash, S.; Zaki, D.B.; Gaurav, K.; Jayakumar, M.; Sarangi, A.K. Innovation and economic growth in European Economic Area countries: The Granger causality approach. IIMB Manag. Rev. 2019, 31, 268–282. [Google Scholar] [CrossRef]

- Agénor, P.-R.; Neanidis, K.C. Innovation, public capital, and growth. J. Macroecon. 2015, 44, 252–275. [Google Scholar] [CrossRef] [Green Version]

- Sohag, K.; Begum, R.; Abdullah, S.M.S.; Jaafar, M. Dynamics of energy use, technological innovation, economic growth and trade openness in Malaysia. Energy 2015, 90, 1497–1507. [Google Scholar] [CrossRef]

- Hao, Y.; Wu, Y.; Wu, H.; Ren, S. How do FDI and technical innovation affect environmental quality? Evidence from China. Environ. Sci. Pollut. Res. 2019, 27, 7835–7850. [Google Scholar] [CrossRef]

- Allred, B.B.; Park, W.G. Patent rights and innovative activity: Evidence from national and firm-level data. J. Int. Bus. Stud. 2007, 38, 878–900. [Google Scholar] [CrossRef]

- Dang, J.; Motohashi, K. Patent statistics: A good indicator for innovation in China? Patent subsidy program impacts on patent quality. China Econ. Rev. 2015, 35, 137–155. [Google Scholar] [CrossRef]

- Maradana, R.P.; Pradhan, R.P.; Dash, S.; Gaurav, K.; Jayakumar, M.; Chatterjee, D. Does innovation promote economic growth? Evidence from European countries. J. Innov. Entrep. 2017, 6, 1–23. [Google Scholar] [CrossRef] [Green Version]

- Sun, Y.; Du, D. Determinants of industrial innovation in China: Evidence from its recent economic census. Technovation 2010, 30, 540–550. [Google Scholar] [CrossRef]

- Ang, J. Research, technological change and financial liberalization in South Korea. J. Macroecon. 2010, 32, 457–468. [Google Scholar] [CrossRef]

- Wong, C.-Y.; Goh, K.-L. Modeling the behaviour of science and technology: Self-propagating growth in the diffusion process. Science 2010, 84, 669–686. [Google Scholar] [CrossRef]

- Kim, J.; Lee, S. Patent databases for innovation studies: A comparative analysis of USPTO, EPO, JPO and KIPO. Technol. Forecast. Soc. Chang. 2015, 92, 332–345. [Google Scholar] [CrossRef]

- Coe, D.T.; Helpman, E.; Hoffmaister, A.W. International R&D spillovers and institutions. Eur. Econ. Rev. 2009, 53, 723–741. [Google Scholar]

- Durham, J. Absorptive capacity and the effects of foreign direct investment and equity foreign portfolio investment on economic growth. Eur. Econ. Rev. 2004, 48, 285–306. [Google Scholar] [CrossRef]

- Griffith, R.; Huergo, E.; Mairesse, J.; Peters, B. Innovation and Productivity Across Four European Countries. Oxf. Rev. Econ. Policy 2006, 22, 483–498. [Google Scholar] [CrossRef]

- Conrad, D.A. The Level-Specific Effects of Education on Economic Growth: Evidence from Four Caribbean Countries. J. Dev. Areas 2011, 45, 279–290. [Google Scholar] [CrossRef]

- Yun, W.S.; Yusoff, R. Determinants of public education expenditure: A review. Southeast Asian J. Econ. 2019, 7, 127–142. [Google Scholar]

- Pesaran, M.H.; Shin, Y.; Smithc, R.J. Bounds testing approaches to the analysis of level relationships. J. Appl. Econ. 2001, 16, 289–326. [Google Scholar] [CrossRef]

- Sarker, B.; Khan, F. Nexus between foreign direct investment and economic growth in Bangladesh: An augmented autoregressive distributed lag bounds testing approach. Financ. Innov. 2020, 6, 1–18. [Google Scholar] [CrossRef]

- Kim, S. The Effects of Foreign Direct Investment, Economic Growth, Industrial Structure, Renewable and Nuclear Energy, and Urbanization on Korean Greenhouse Gas Emissions. Sustainability 2020, 12, 1625. [Google Scholar] [CrossRef] [Green Version]

- Ridzuan, A.R.; Ismail, N.A.; Hamat, A.F.C. Does Foreign Direct Investment Successfully Lead to Sustainable Development in Singapore? Economies 2017, 5, 29. [Google Scholar] [CrossRef] [Green Version]

- Engele, R.F.; Granger, C.W.R. Co-Integration and Error Correction.pdf. Econometrica 1987, 55, 251–276. [Google Scholar] [CrossRef]

- Johamen, S.; Jtiselius, K. Maximum likelihood estimation and inference on cointegration—with appucations to the demand for money. Oxf. Bull. Econ. Stat. 1990, 52, 169–210. [Google Scholar]

- Narayan, P.K. The saving and investment nexus for China: Evidence from cointegration tests. Appl. Econ. 2005, 37, 1979–1990. [Google Scholar] [CrossRef]

- Sam, C.Y.; McNown, R.; Goh, S.K. An augmented autoregressive distributed lag bounds test for cointegration. Econ. Model. 2019, 80, 130–141. [Google Scholar] [CrossRef]

- Brown, R.L.; Durbin, J.; Evans, J.M. Techniques for Testing the Constancy of Regression Relationships Over Time. J. R. Stat. Soc. Ser. B Stat. Methodol. 1975, 37, 149–163. [Google Scholar] [CrossRef]

- Konara, K.M.P.S.B. Foreign direct investment in Sri Lanka: Determinants and impact. Ph.D. Thesis, York University, Heslington, UK, 2013. [Google Scholar]

- CBSL. Annual Report; Central Bank of Sri Lanka: Colombo, Sri Lanka, 2015. [Google Scholar]

- CBSL. Annual Report; Central Bank of Sri Lanka: Colombo, Sri Lanka, 2019. [Google Scholar]

- NSF. Sri Lanka Science and Technology Statistical Handbook; National Science Foundation: Colombo, Sri Lanka, 2013; pp. 2–5. [Google Scholar]

- NSF. Sri Lanka Science and Technology Statistical Handbook; National Science Foundation: Colombo, Sri Lanka, 2018; pp. 2–18. [Google Scholar]

- United Nations (UN). Transforming Our World. In The 2030 Agenda for Sustainable Development; United Nations General Assembly: New York, NY, USA, 2015; pp. 1–35. [Google Scholar]

| Researcher(s) | Period | Database | Methods |

|---|---|---|---|

| Wang and Wu [50] | 2009 | A firm-level study in China | Five sets of regression analyses |

| Girma et al. [51] | 1999–2005 | A firm-level study in China—20,000 state-owned enterprises | Generalized method of moment (GMM) method |

| Nyeadi and Adjasi [52] | Nigeria 2014 and South Africa 2007: World Bank Enterprise Survey | A firm-level study in Nigeria and South Africa | Instrumental variable two-stage least square (IV2SLS) method, instrumental limited information maximum likelihood (IVLIML) method |

| Wang et al. [53] | 1998–2007 | A firm-level study in China | Regression analysis |

| Khachoo and Sharma [54] | 2000–2013 | A firm-level study in India | Log-likelihood model |

| Keller and Yeaple. [55] | 1987–1996 | A firm-level study in the United States | Ordinary Least Square (OLS) model |

| Garcia et al. [56] | 1990–2002 | A firm-level study in Spanish | Poisson regression |

| Osano and Koine [57] | 2001–2014 | The energy sector in Kenya | Regression analysis |

| Researcher(s) | Period | Database | Methods |

|---|---|---|---|

| Dhrifi [58] | 1990–2012 | A countries level study—83 developed and developing countries | Simultaneous Equations Model (SEM) |

| Erdal and Gocer [59] | 1996–2013 | A countries level studies—10 developing countries | Fully Modified Least Squares (PFMOLS) |

| Zeng and Zhou [12] | 2004–2016 | A country-level study—China | Dynamic panel simultaneous-equation model |

| Zhang [60] | 2004–2012 | A country-level study—China | Generalized method of moment(GMM) |

| Kemeny [61] | 1975–2000 | A countries level study—119 countries in Europe, America, and Asia. | Generalized method of moment(GMM) |

| Sivalogathasan and Wu [62] | 2000–2011 | A countries level study—South Asian country | Ordinary least square (OLS) model |

| Cheung and Lin [37] | 1995–2000 | A country-level study—China | Ordinary Least Square (OLS) model |

| Chen [63] | 2004 | A country-level study—China | Ordinary Least Square (OLS) model |

| Mohamed et al. [64] | 1990–2019 | A country level study—Egypt | ARDL method |

| Ustalar and Sanlisoy [65] | 1984–2017 | A country-level study—Turkey | Non-linear autoregressive distributed lag (NARDL) |

| Loukil 2016 [75] | 1980–2009 | A countries level study—54 developing countries | Panel threshold model |

| Statistics | EDU | FDI | RDE | TI | GDP |

|---|---|---|---|---|---|

| Mean | 2.293000 | 1.252912 | 0.103000 | 56.73333 | 5.172965 |

| Median | 2.310000 | 1.157522 | 0.110000 | 54.50000 | 5.226372 |

| Maximum | 3.060000 | 2.849580 | 0.180000 | 220.0000 | 9.144572 |

| Minimum | 1.560000 | 0.429754 | 0.000000 | 11.00000 | −1.545408 |

| Std. Dev. | 0.443584 | 0.489321 | 0.055470 | 37.60130 | 2.065283 |

| Skewness | −0.019560 | 1.048155 | −0.875986 | 2.760139 | −0.808621 |

| Kurtosis | 1.844386 | 5.080466 | 2.682458 | 12.98912 | 5.165784 |

| Jarque-Bera | 1.671218 | 10.90356 | 3.962803 | 162.8200 | 9.132617 |

| Probability | 0.433610 | 0.004289 | 0.137876 | 0.000000 | 0.010396 |

| Variable | ADF Test Statistics (with Trend and Intercept) | PP Test Statistics (with Trend and Intercept) | ||||

|---|---|---|---|---|---|---|

| Level | First Difference | Order of Integration | Level | First Difference | Order of Integration | |

| LnTI | −2.92 | −5.48 * | I (1) | −5.68 * | −18.33 * | I (1) |

| FDI | −4.67 * | −5.19 * | I (0), I (1) | −6.43 * | −9.32 * | I (0), I (1) |

| GDP | −3.94 * | −7.80 * | I (0), I (1) | −3.94 * | −19.18 * | I (0), I (1) |

| EDU | −2.91 | −6.48 * | I (1) | −2.96 | −5.70 * | I (1) |

| RDE | −2.60 | −4.48 * | I (1) | −2.41 | −16.90 * | I (1) |

| Items | Test | Probability Value |

|---|---|---|

| Serial correlation | Breusch-Godfrey Serial Correlation LM Test | 0.3163 |

| Normality | Normality Test (Jarque-Bera) | 0.5126 |

| Heteroscedasticity | Breusch-Pagan-Godfrey | 0.8471 |

| F-Bounds Test | Null Hypothesis: No Levels Relationship | |||

|---|---|---|---|---|

| Test Statistic | Value | Significant Level | I (0) | I (1) |

| F-statistic K = 4 | 17.868 | 10% | 2.525 | 3.560 |

| 5% | 3.058 | 4.223 | ||

| 1% | 4.280 | 5.840 | ||

| Selected Model: ARDL (2,2,1,0,1) Dependent Variable is LnTI | ||||

|---|---|---|---|---|

| Variable | Coefficient | Standard Error | t-Statistic | p-value |

| FDI | −0.576635 | 0.214343 | −2.690246 | 0.0176 * |

| GDP | 0.013455 | 0.023356 | 0.576096 | 0.5737 |

| EDU | 0.260810 | 0.146114 | 1.784985 | 0.0959 ** |

| RDE | 5.700958 | 1.332285 | 4.279082 | 0.0008 * |

| R-squared | 0.759168 | |||

| Adjusted R-squared | 0.552740 | |||

| F-statistic | 3.677646 | |||

| Prob(F-statistic) | 0.011534 | |||

| Selected Model: ARDL (2,2,1,0,1 Dependent Variable is D(LnTI(-1)) | ||||

|---|---|---|---|---|

| Variable | Coefficient | Standard Error | t-Statistic | p-Value |

| D(FDI) | −0.016211 | 0.116883 | −0.138695 | 0.8917 |

| D(EDU) | −0.059020 | 0.286751 | −0.205823 | 0.8399 |

| D(EDU(-1)) | −0.566639 | 0.274799 | −2.062009 | 0.0583 |

| D(EDU(-2)) | 0.476211 | 0.239712 | 1.986591 | 0.0669 |

| D(RDE) | −3.257514 | 1.691467 | −1.925851 | 0.0747 |

| D(RDE(-1)) | −5.740806 | 1.980127 | −2.899211 | 0.0117 |

| D(RDE(-2)) | 3.935395 | 1.492745 | 2.636348 | 0.0195 |

| ECT(-1) | −0.593810 | 0.132132 | −12.06224 | 0.0000 |

| R-squared | 0.905931 | |||

| Adjusted R-squared | 0.871275 | |||

| Sector | 2005 | 2010 | 2015 | 2019 |

|---|---|---|---|---|

| Manufacturing | 135.32 | 159.65 | 257.0 | 319.5 |

| Agriculture | 0.47 | 6.45 | 3.9 | 1.3 |

| Services and infrastructure | 151.41 | 350.20 | 708.8 | 867.9 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Adikari, A.P.; Liu, H.; Marasinghe, M. Inward Foreign Direct Investment-Induced Technological Innovation in Sri Lanka? Empirical Evidence Using ARDL Approach. Sustainability 2021, 13, 7334. https://doi.org/10.3390/su13137334

Adikari AP, Liu H, Marasinghe M. Inward Foreign Direct Investment-Induced Technological Innovation in Sri Lanka? Empirical Evidence Using ARDL Approach. Sustainability. 2021; 13(13):7334. https://doi.org/10.3390/su13137334

Chicago/Turabian StyleAdikari, AM.Priyangani, Haiyun Liu, and MMSA. Marasinghe. 2021. "Inward Foreign Direct Investment-Induced Technological Innovation in Sri Lanka? Empirical Evidence Using ARDL Approach" Sustainability 13, no. 13: 7334. https://doi.org/10.3390/su13137334