Applying Responsible Ownership to Advance SDGs and the ESG Framework, Resulting in the Issuance of Green Bonds

Abstract

:1. Introduction

2. Literature Review

2.1. Ownership Strategy and the Governance Model

2.2. SDGs and Linkages to Environmental, Society and Governance (ESG)

2.3. Linkages to Green Bond Financing

3. Research Design, Materials and Methods

3.1. Methodological Approach

3.2. Institutional Context and Case Selection

3.3. Data Collection and Analysis

- All researchers were involved in in gathering archival data: primary data from in-house sources and secondary data from the Internet and publicly available databases. Prior to commencing the interviews, we made notes on key case questions and requested specific documents. We collected and reviewed articles in the mainstream and business press in both English and Icelandic and accessed company documents including the ownership strategy, annual reports, sustainability reports, and financial data. Primary data included in-house data such as reports on the compliance to ownership strategy, data from SDG workshops held by the case company, information on green bonds, and quality handbook data that pertain to ownership strategy and its implementation. Secondary data were accessible via the Internet or publicly available databases such as Factiva.

- Moving from archival data, which all researchers were involved in analyzing, a semi-structured, open-ended interview guide was developed and agreed upon by all researchers. The information from the archival data was reviewed and analyzed prior to the interviews and fed into the interview guide to focus questions for specific interviewees and minimize redundant questions on the ownership strategy. The formulation of interview questions was based on Becker’s methodology [79], which advises asking how things happened, not why they happened. The questions were meant to probe and thereby gain a deeper understanding of the interviewees’ answers, as per Eisendhardt and Graebner [76] as well as Yin [67]. The interviews were open-ended, although a central theme was given as a topic of discussion (e.g., company context, ownership strategy, SDGs, ESG, and green bonds), giving the respondents leeway in responding and the researchers a chance to probe interviewees’ answers.

- Together, the researchers chose a sample of interviewees. The sample of interviewees was chosen in a deliberate manner, namely a purposeful sample [67]. Interviewees were carefully selected with regard to their knowledge and first-hand experience with the subject. We were interested in interviewees’ words and ideas, seeking a rich empirical description of the instances of the phenomena in question [67]. Interviewees were carefully selected based on consideration of their role and expected contribution to illuminating the subject.

- Two researchers were involved in conducting interviews using the semi-structured, open-ended questionnaire from Step 2. Each interview lasted for about an hour, with majority of interviews directed by two researchers.

- (a)

- The first round of interviews was conducted in October 2019 to gain a fuller understanding of the subject matter. Interviews were conducted at the Reykjavík Energy headquarters in Iceland. There were nine main respondents (see Table 1), holding either board, executive, or specialist positions within the company.

- (b)

- The second round of interviews in October 2020 and November 2020 were conducted specifically to address owners and different stakeholders’ view on the ownership strategy, SDGs, ESG, and green bonds. The respondents included one Reykjavik Energy executive (interviewed in the first round), the mayor of the City of Reykjavik (majority owner), and its former CFO, as well as seven Icelandic business leaders (see Table 1) from the stock exchange, banks, securities firm, and pension fund. The second round of interviews was conducted via video conferencing.

- Interviews were transcribed onsite and within the day. Both researchers conducting the interviews transcribed onsite separately in order to ensure validity and reliability of the transcribed data.

- Interview transcriptions were analyzed and manually coded by a third researcher.

4. Results

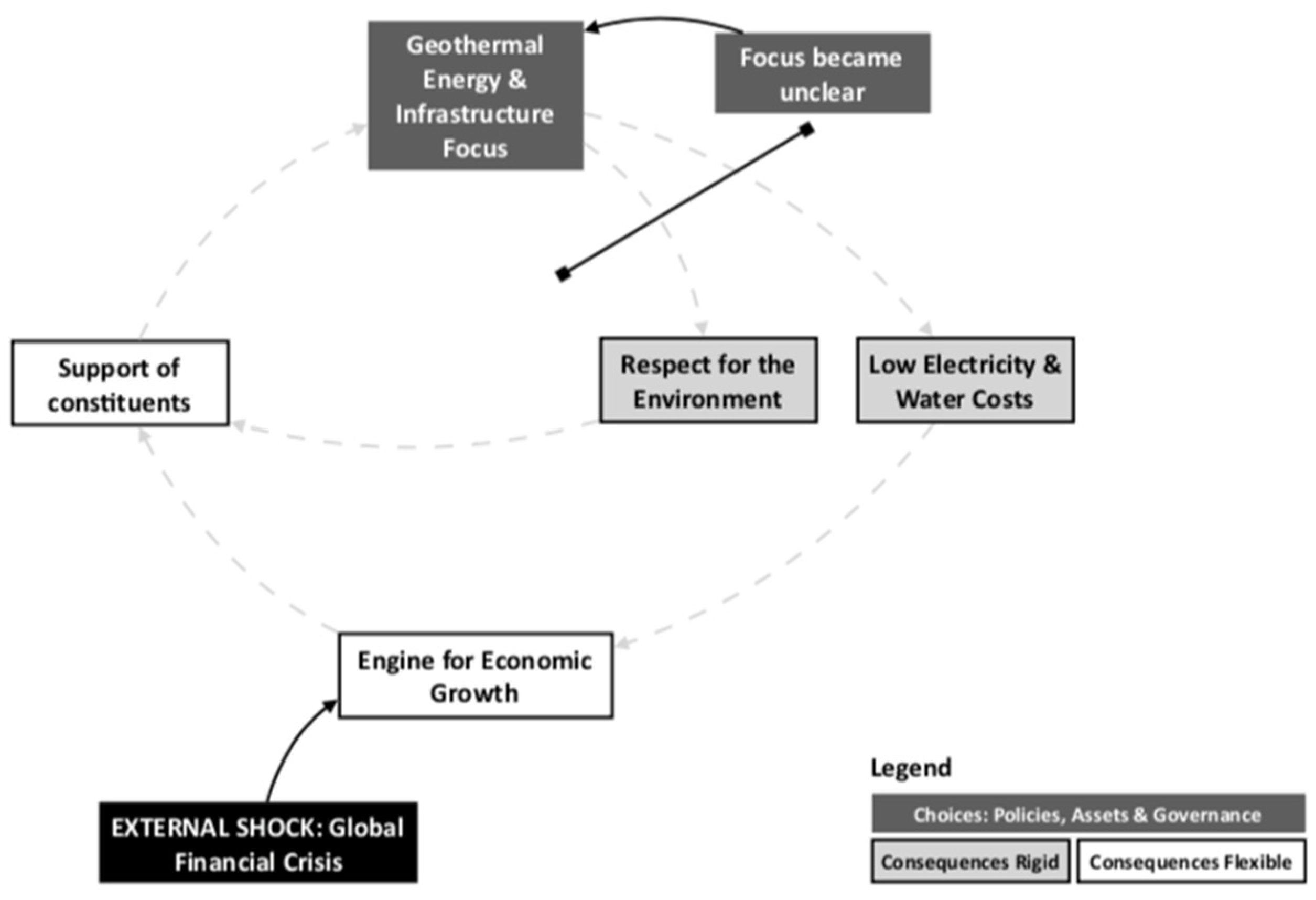

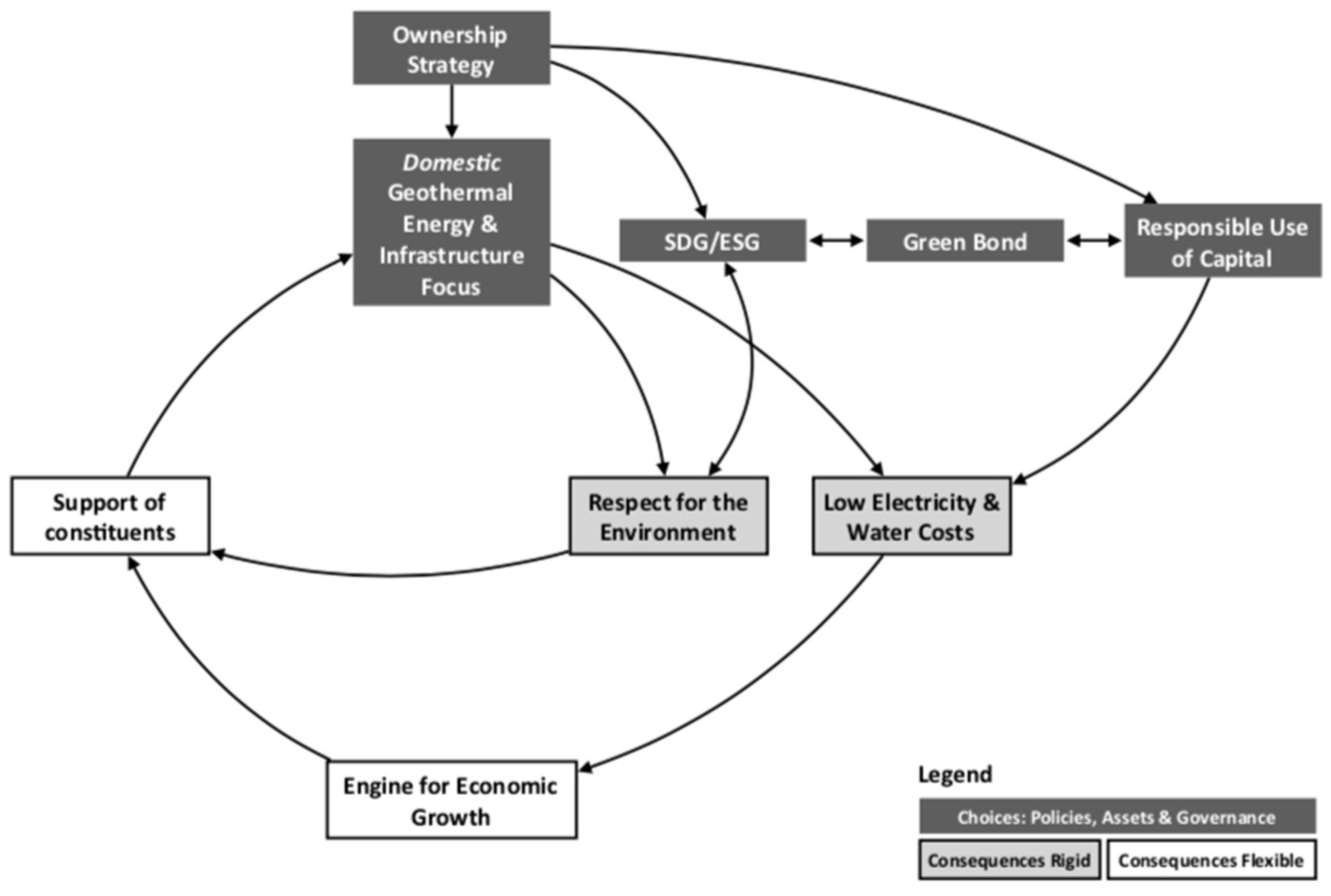

4.1. From Responsible Ownership to the SDGs

When I started there were six values and they had one thing in common—no one knew what they were! We changed this to three main values—foresight, efficiency, and integrity—that actually meant something. Everything we do must align to those values.

We use it to guide all our decision-making and it is a cornerstone of this company’s governance.

Operating an environmentally and socially sustainable business constitute the basis of OR’s [RE] long-term strategy. Sustainable financing is a key part of the strategy and offers means to mobilize debt for environmental efforts.

It provides a framework for strategic decision-making. It is a part of strategic corporate governance, so that the owners do not have to engage in some kind of a detailed management. Our will as owners is clear. If the board of directors assesses it such that the long-term vision is wrong or they wish to take the company in a different direction, then they need to ask for that mandate.

…[they] must be inclined to act and respond based on the Ownership Strategy and be true to it, otherwise trust might be diminished… Trust will not be built by statements but by actions.

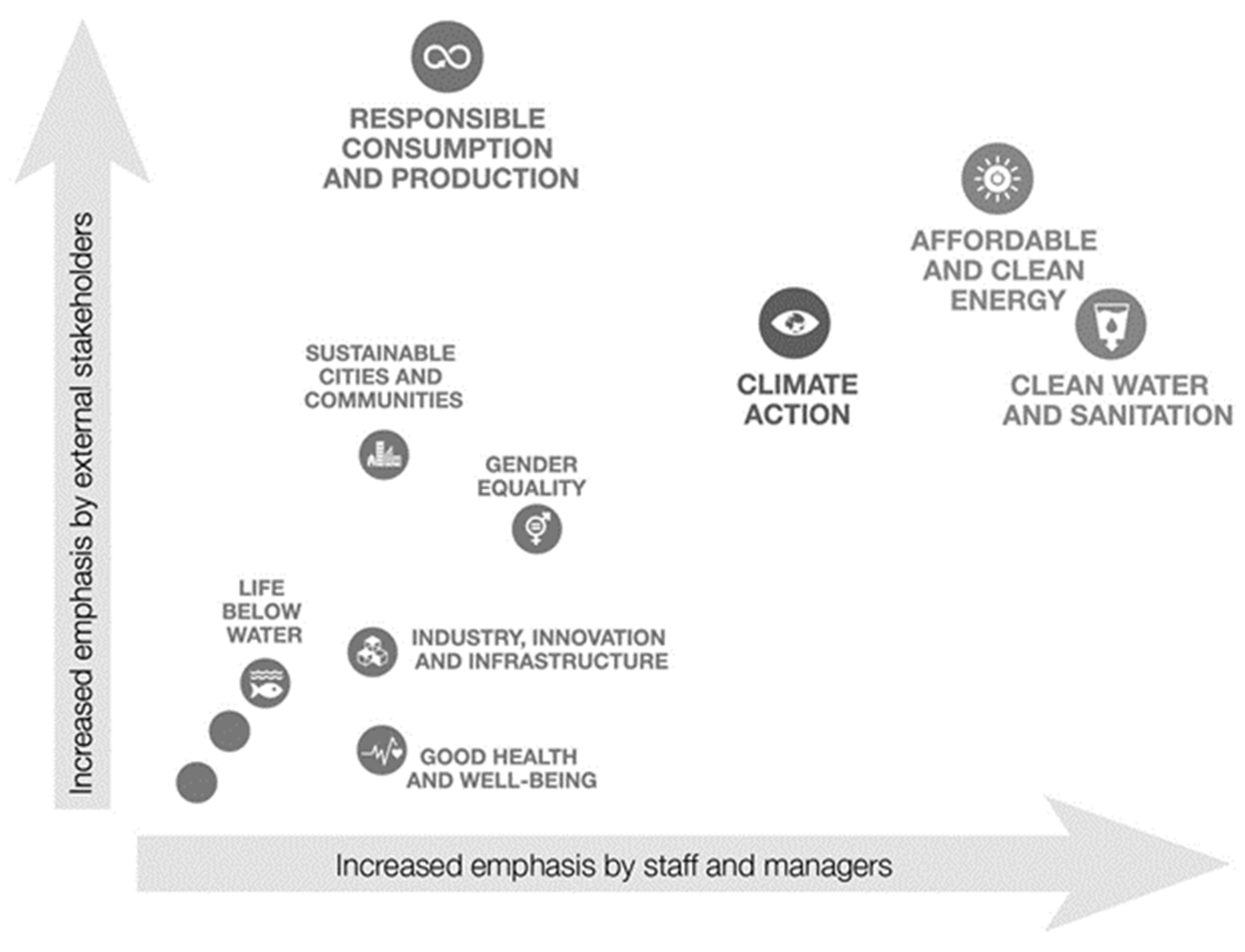

The GRI became a monster. We wanted to really allow a set of measures to answer a question: ‘Are we socially responsible?’ That’s a big question and while we cannot answer it quickly, we wanted to open up the debate by showing accurate measurements along the dimensions of ESG.

We have taken the time to ensure that we’re accurately reflecting the UN measures in our reporting and how they connect to the ESG, which along with the Ownership Strategy, help to guide the environmental goals of what we want to achieve.

We must think 100 years ahead because we are providing underlying infrastructure for society. We must be very sure about where we are going.

4.2. Funding and Green Bond Issuance

Our financing primarily comes through bonds and banks. We had started to talk with the Nordic Investment Bank (NIB) as well as other partners in Sweden and realized they were ahead of us in thinking about sustainable investment. Within the finance area, we were quite inspired by our own Environmental VP and Reykjavik Energy’s mindset and culture to balance financial and environmental factors in decision making. We knew the company was doing so many positive projects for the environment and we thought, ‘why don’t we be a part of it?

One of the other main drivers is the pricing of the green bonds. Pricing is important and this year we have put major efforts into reducing the premium Reykjavik Energy has to pay on benchmark bonds in the market, i.e., government bonds with similar maturity.

[We] postponed an auction in December 2018 to build up demand for the green bond. By doing this we believe we helped demand in the first green bond auction as investors had been “deprived” of the company’s bonds for a few months. [We believe] this [was] crucial in the pricing of the bond and gave us the ability to be aggressive and strategic when it comes to deciding how much we wanted to issue and at what levels.

4.3. Viewpoints from Owners and Business Leaders

Ownership Strategy includes a strategy on dividend’s policy, which includes information important to creditors. This has assisted us when issuing green bonds. It has created trust between the company and buyers of the bonds. I feel that the clear framework of Ownership Strategy has assisted us in establishing necessary trust with the financial market.

We favor a governance mechanism like an Ownership Strategy, as Reykjavik Energy has implemented, where we want a clear ownership structure and social responsibility at the highest levels … Taking profit above purpose would not be following a sustainability strategy. We know that this crisis will be over soon, and if anything, it will divide those who truly follow purpose and those who do not, and we favor the prior.

We believe its partially because of a very clear Ownership Strategy that impacts the governance structure positively, but as well because the companies seem to stick to its sustainability strategy.

Sustainability and Ownership Strategy of Reykjavik Energy are linked together. Our analysis shows that during just the last 5–10 years, investors have more and more searched investment opportunities within sustainability. It has become part of a required investment portfolio to include green investments. The initial idea of issuing a Green Bond was resting on getting a good financing plus increase our own investors’ portfolio. Now we know that we have a solid group of investors who look towards green investment opportunities. We have a strong focus on sustainability, it is part of our corporate strategy and the Ownership Strategy reflects that. We believe that sustainability is a responsible strategy and a part of our Ownership Strategy which will only make ourselves more sought after as investment opportunity.

5. Conclusions and Discussion

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- United Nations. Transforming Our World: The 2030 Agenda for Sustainable Development. UN Report. 2015. Available online: https://sustainabledevelopment.un.org/content/documents/21252030%20Agenda%20for%20Sustainable%20Development%20web.pdf (accessed on 13 April 2020).

- Biermann, F.; Kanie, N.; Kim, R.E. Global Governance by Goal-Setting: The Novel Approach of the UN Sustainable Development Goals. Curr. Opin. Environ. Sustain. 2017, 26–27, 26–31. [Google Scholar] [CrossRef]

- Bowen, K.J.; Cradock-Henry, N.A.; Koch, F.; Patterson, J.; Häyhä, T.; Vogt, J.; Barbi, F. Implementing the “Sustainable Development Goals”: Towards addressing three key governance challenges-collective action, trade-offs, and accountability. Curr. Opin. Environ. Sustain. 2017, 26–27, 90–96. [Google Scholar] [CrossRef]

- Van Zanten, J.A.; Van Tulder, R. Multinational Enterprises and the Sustainable Development Goals: An Institutional Approach to Corporate Engagement. J. Int. Bus. Policy 2018, 1, 208–233. [Google Scholar] [CrossRef]

- Bacon, N.; Wright, M.; Ball, R.; Meuleman, M. Private Equity, HRM, and employment. Acad. Manag. Perspect. 2013, 27, 7–21. [Google Scholar] [CrossRef]

- Bushee, B. Identifying and attracting the ‘right’ investors: Evidence on the behaviour of institutional investors. J. Appl. Corp. Financ. 2004, 26, 28–35. [Google Scholar] [CrossRef]

- Hoskisson, R.E.; Hitt, M.A.; Johnson, R.A.; Grossman, W. Conflicting voices: The effects of institutional ownership heterogeneity and internal governance on corporate innovation strategies. Acad. Manag. J. 2017, 45, 697–716. [Google Scholar] [CrossRef]

- Miller, D.; Wright, M.; Le Breton-Miller, I.; Scholes, L. Resources and innovation in family businesses: The Janus-face of socioemotional preferences. Calif. Manag. Rev. 2015, 58, 20–40. [Google Scholar] [CrossRef] [Green Version]

- Villalonga, B. Growing, Financing, and Managing Family and Closely Held Firms: Overview of the Course; Harvard Business School: Cambridge, MA, USA, 2009. [Google Scholar]

- Villalonga, B.; Amit, R. How are U.S. family firms controlled? Rev. Financ. Stud. 2009, 22, 3047–3091. [Google Scholar] [CrossRef] [Green Version]

- Villalonga, B. The impact of ownership on building sustainable and responsible businesses. J. Br. Acad. 2018, 6, 375–403. [Google Scholar] [CrossRef]

- Gillan, S.; Hartzell, J.; Koch, A.; Starks, L. Firms’ environmental, social and governance (ESG) choices, performance and managerial motivation. Working Paper. 2010. [Google Scholar]

- Ortas, E.; Álvarez, I.; Garayar, A. The Environmental, Social, Governance, and Financial Performance Effects on Companies that Adopt the United Nations Global Compact. Sustainability 2015, 7, 1932–1956. [Google Scholar] [CrossRef] [Green Version]

- United Nations. Report of the Secretary-General on SDG Progress 2019. UN Report. 2019. Available online: https://sustainabledevelopment.un.org/content/documents/24978Report_of_the_SG_on_SDG_Progress_2019.pdf (accessed on 13 April 2020).

- Schoon, M.; Cox, M.E. Collaboration, Adaptation, and Scaling: Perspectives on Environmental Governance for Sustainability. Sustainability 2018, 10, 679. [Google Scholar] [CrossRef] [Green Version]

- Van Tulder, R. Business & The Sustainable Development Goals: A Framework for Effective Corporate Involvement; Erasmus University: Rotterdam, The Netherlands, 2018. [Google Scholar]

- Jonsdottir, G.E.; Sigurjonsson, T.O.; Poulsen, T. Ownership Strategy: A Governance Mechanism for Collective Action and Responsible Ownership. Corp. Ownersh. Control 2020, 17, 34–45. [Google Scholar] [CrossRef]

- Wahl, M.F. Strategic Audit and Ownership Strategy. Int. J. Bus. Soc. Res. 2015, 5, 93–100. [Google Scholar] [CrossRef]

- Poteete, A.R.; Janssen, M.A.; Ostrom, E. Working Together: Collective Action, the Commons, and Multiple Methods in Practice; Princeton University Press: Princeton, NJ, USA, 2010. [Google Scholar]

- Young, O.R. Beyond Regulation: Innovative Strategies for Governing Large Complex Systems. Sustainability 2017, 9, 938. [Google Scholar] [CrossRef] [Green Version]

- Tang, D.Y.; Zhang, Y. Do shareholders benefit from green bonds? J. Corp. Financ. 2018. [Google Scholar] [CrossRef]

- Valkering, P.; Yücel, G.; Gebetsroither-Geringer, E.; Markvica, K.; Meynaerts, E.; Frantzeskaki, N. Accelerating Transition Dynamics in City Regions: A Qualitative Modeling Perspective. Sustainability 2017, 9, 1254. [Google Scholar] [CrossRef] [Green Version]

- Mintzberg, H.; Waters, J.A. Of Strategies, Deliberate and Emergent. Strateg. Manag. J. 1985, 6, 257–272. [Google Scholar] [CrossRef]

- Mayer, C. Firm Commitment; Oxford University Press: Oxford, UK, 2013. [Google Scholar]

- Mayer, C. Prosperity; Oxford University Press: Oxford, UK, 2018. [Google Scholar]

- Forbes, D.P.; Milliken, F.J. Cognition and Corporate Governance: Understanding Boards of Directors as Strategic Decision-Making Groups. Acad. Manag. Rev. 1999, 24, 489–505. [Google Scholar] [CrossRef] [Green Version]

- Ertimur, Y.; Ferri, F.; Stubben, S.R. Board of directors’ responsiveness to shareholders: Evidence from shareholder proposals. J. Corp. Financ. 2010, 16, 53–72. [Google Scholar] [CrossRef]

- Briscoe, F.; Gupta, A. Social Activism in and around Organizations. Acad. Manag. Ann. 2016, 10, 671–727. [Google Scholar] [CrossRef]

- Stout, L. The Shareholder Value Myth: How Putting Shareholders First Harms Investors, Corporations, and the Public; Berrett Keohler: San Francisco, CA, USA, 2012. [Google Scholar]

- Sikka, P.; Stittle, J. Debunking the myth of shareholder ownership of companies: Some implications for corporate governance and financial reporting. Crit. Perspect. Account. 2019, 63. [Google Scholar] [CrossRef]

- Jonsdottir, G.E. A question of trust: The story of Reykjavík Energy. In The Return of Trust? Institutions and the Public after a Crisis; Sigurjonsson, T.O., Bryant, M., Schwarzkopf, D., Eds.; Emerald Publishing: Bingley, UK, 2018. [Google Scholar]

- García-Sánchez, I.-M.; Raimo, N.; Marrone, A.; Vitolla, F. How Does Integrated Reporting Change in Light of COVID-19? A Revisiting of the Content of the Integrated Reports. Sustainability 2020, 12, 7605. [Google Scholar] [CrossRef]

- Bolton, P.; Samama, F. Loyalty shares: Rewarding long-term investors. J. Appl. Corp. Financ. 2013, 25, 86–97. [Google Scholar] [CrossRef]

- Thakor, A.V.; Quinn, R.E. The economics of higher purpose. ECGI Financ. Work. Paper 2013, 395. [Google Scholar] [CrossRef]

- Thakor, A.V.; Quinn, R.E. Creating a purpose-driven organization. Harv. Bus. Rev. 2018, 96, 78–85. [Google Scholar]

- Hart, O.; Zingales, L. Companies should maximize shareholder welfare not market value. J. Law Financ. Account. 2017, 2, 247–275. [Google Scholar] [CrossRef]

- Asaba, S. Patient investment of family firms in the Japanese electric machinery industry. Asia Pac. J. Manag. 2013, 30, 697–715. [Google Scholar] [CrossRef]

- Thomsen, S.; Poulsen, T.; Børsting, C.; Kuhn, J. Industrial foundations as long-term owners. Corp. Gov. Int. Rev. 2018, 26, 180–196. [Google Scholar] [CrossRef]

- Faigen, B.; Mygind, N.; Sigurjonsson, T.O.; Arnardottir, A.A. Three dimensions of employees acquiring shares in their firms: Personal characteristics, motives and type of ownership. Econ. Ind. Democr. 2018. [Google Scholar] [CrossRef]

- Bolívar, M.P.R.; Sánchez, R.G.; Hernández, A.M.L. Managers as drivers of CSR in state-owned enterprises. J. Environ. Plan. Manag. 2015, 58, 777–801. [Google Scholar] [CrossRef]

- Bruton, G.D.; Peng, M.W.; Ahlstrom, D.; Stan, C.; Xu, K. State-owned enterprises around the world as hybrid organizations. Acad. Manag. Perspect. 2015, 29, 92–114. [Google Scholar] [CrossRef] [Green Version]

- Zhao, M. CSR-Based Political Legitimacy Strategy: Managing the State by Doing Good in China and Russia. J. Bus. Ethics 2012, 111, 439–460. [Google Scholar] [CrossRef]

- Russo, A.; Perrini, F. Investigating Stakeholder Theory and Social Capital; CSR in Large Firms and SMEs. J. Bus. Ethics 2010, 91, 207–221. [Google Scholar] [CrossRef]

- Cunningham, M. State-owned Enterprises: Pursuing Responsibility in Corporate Social Responsibility. Manag. Commun. Q. 2011, 25, 718–724. [Google Scholar] [CrossRef]

- Joshi, D.K.; Hughes, B.B.; Sisk, T.D. Improving governance for the post-2015 Sustainable Development Goals: Scenario forecasting the next 50 years. World Dev. 2015, 70, 286–302. [Google Scholar] [CrossRef]

- Persson, Å.; Weitz, N.; Nilsson, M. Follow-up and Review of the Sustainable Development Goals: Alignment vs. Internalization. Rev. Eur. Comp. Int. Environ. Law (Reciel) 2016, 25, 59–68. [Google Scholar] [CrossRef]

- Kocmanová, A.; Šimberová, I. Determination of Environmental, Social and Corporate Governance Indicators: Framework in the Measurement of Sustainable Performance. J. Bus. Econ. Manag. 2014, 15, 1017–1033. [Google Scholar] [CrossRef] [Green Version]

- Syed, A.M. Environment, social, and governance (ESG) criteria and preference of managers. Cogent Bus. Manag. 2017, 4, 1340820. [Google Scholar] [CrossRef]

- Greenwald, C. ASSET4: ESG and Earnings Performance; Thomson Reuters: New York, NY, USA, 2010; Available online: https://www.thomsonreuters.com/content/dam/openweb/documents/pdf/tr-com-financial/case-study/esg-and-earnings-performance.pdf (accessed on 8 March 2020).

- Friede, G.; Busch, T.; Bassen, A. ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. J. Sustain. Financ. Investig. 2015, 5, 210–233. [Google Scholar] [CrossRef] [Green Version]

- Hanson, D.; Lyons, T.; Bender, J.; Bertocci, B.; Lamy, B. Analysts’ roundtable on Integrating ESG into investment decision-making. J. Appl. Corp. Financ. 2017, 29, 44–55. [Google Scholar] [CrossRef]

- IHS Market. Review of Fixed Income Markets in 2015. Available online: https://ihsmarkit.com/research-analysis/08122015-Credit-Review-of-fixed-income-markets-in-2015.html (accessed on 15 April 2020).

- Polbennikov, S.; Desclée, A.; Dynkin, L.; Maitra, A. ESG ratings and performance of corporate bonds. J. Fixed Income 2016, 26, 21–41. [Google Scholar] [CrossRef]

- Schneider, T. Is Enviromental Performance a Determinant of Bond Pricing? Evidence from US Pulp and Paper and Chemical Industries. Contemp. Account. Res. 2011, 28, 1537–1561. [Google Scholar] [CrossRef]

- Bauer, R.; Hann, D. Corporate Environmental Management and Credit Risk; ECCE Working Paper; Maastricht University: Maastricht, The Netherlands, 2010; Available online: http://ssrn.com/abstract=1660470 (accessed on 8 March 2021).

- PRI (Principles for Responsible Investment). Corporate Bonds: Spotlight on ESG Risks, London. 2013. Available online: http//www.unpri.org/fixed-income/corporate-bonds-spotlight-on-esg-risks/40.article (accessed on 8 March 2020).

- Bhojraj, S.; Sengupta, P. Effect of corporate governance on bond ratings and yields: The role of institutional investors and outside directors. J. Bus. 2003, 76, 455–475. [Google Scholar] [CrossRef]

- Klock, M.; Mansi, S.; Maxwell, W. Does corporate governance matter to bondholders? J. Financ. Quant. Anal. 2005, 40, 693–719. [Google Scholar] [CrossRef]

- Attig, N.; El Ghoul, S.; Guedhami, O.; Suh, J. Corporate social responsibility and credit ratings. J. Bus. Ethics 2013, 117, 679–694. [Google Scholar] [CrossRef]

- Wilkins, M. Climate Risk Increasingly Important for Ratings, Says S&P. Environmental Finance, 24 November 2017. [Google Scholar]

- Baker, M.; Bergstresser, D.; Serafeim, G.; Wurgler, J. Financing the Response to Climate Change: The Pricing and Ownership of U.S. Green Bonds; NBER Working Papers 25194; National Bureau of Economic Research, Inc.: Cambridge, MA, USA, 2018. [Google Scholar]

- Flammer, C. Corporate Green Bonds. J. Financ. Econ. (JFE) 2018. [Google Scholar] [CrossRef]

- Karpf, A.; Mandel, A. Does it Pay to Be Green? A Comparative Study of the Yield Term Structure of Green and Brown Bonds in the US Municipal Bonds Market. Working Paper. 2017. Available online: http://dx.doi.org/10.2139/ssrn.2923484 (accessed on 24 February 2017).

- Zerbib, O.D. The effect of pro-environmental preferences on bond prices: Evidence from green bonds. J. Bank. Financ. 2019, 98, 39–60. [Google Scholar] [CrossRef]

- Flammer, C. Green bonds: Effectiveness and implications for public policy. Environ. Energy Policy Econ. 2020, 1, 95–128. [Google Scholar] [CrossRef]

- Maltais, A.; Nykvist, B. Understanding the role of green bonds in advancing sustainability. J. Sustain. Financ. Investig. 2020, 1–20. [Google Scholar] [CrossRef] [Green Version]

- Yin, R.K. Case Study Research: Design and Methods, 5th ed.; Sage Publications: Thousand Oaks, CA, USA, 2014. [Google Scholar]

- Easterby-Smith, M.; Thorpe, R.; Jackson, P.R. Management & Business Research, 5th ed.; SAGE: Los Angeles, CA, USA, 2015. [Google Scholar]

- Saunders, M.; Lewis, P.; Thornhill, A. Research Methods for Business Students, 7th ed.; Pearson Education Limited: Essex, UK, 2016. [Google Scholar]

- Eisenhardt, K.M. Building Theories from Case Study Research. Acad. Manag. Rev. 1989, 14, 532–550. [Google Scholar] [CrossRef]

- Bezemer, P.-J.; Nicholson, G.; Pugliese, A. The Influence of Board Chairs on Director Engagement: A Case-Based Exploration of Boardroom Decision-Making. Corp. Gov. Int. Rev. 2018, 26, 219–234. [Google Scholar] [CrossRef]

- McNulty, T.; Zattoni, A.; Douglas, T. Developing Corporate Governance Research Through Qualitative Methods: A Review of Previous Studies. Corp. Gov. Int. Rev. 2013, 21, 183–198. [Google Scholar] [CrossRef]

- Fischer, F. Policy inquiry in a post-positivist perspective. Policy Stud. J. 1998, 26, 129–146. [Google Scholar] [CrossRef] [Green Version]

- Brinkmann, S.; Kvale, S. Doing Interviews, 2nd ed.; Sage Publications: London, UK, 2011. [Google Scholar]

- Berg, B.L.; Lune, H. Qualitative Research Methods for the Social Sciences, 8th ed.; Pearson Education: Harlow, UK, 2013. [Google Scholar]

- Eisenhardt, K.M.; Graebner, M.E. Theory Building from Cases: Opportunities and Challenges. Acad. Manag. J. 2007, 50, 25–32. [Google Scholar] [CrossRef]

- Patton, M.Q. Qualitative Research and Evaluation Methods, 3rd ed.; Sage Publications: Thousand Oaks, CA, USA, 2002. [Google Scholar]

- Casadesus-Masanell, R.; Ricart, J.E. How to Design a Winning Business Model. Harvard Business Review. January–February 2011. Available online: https://hbr.org/2011/01/how-to-design-a-winning-business-model (accessed on 15 November 2020).

- Becker, H. Tricks of the Trade: How to Think About Your Research While You’re Doing It; Chicago University Press: Chicago, IL, USA, 1998. [Google Scholar]

- EIA U.S. Energy Information Administration. Geothermal Explained. 2020. Available online: https://www.eia.gov/energyexplained/geothermal/geothermal-energy-and-the-environment.php (accessed on 15 November 2020).

- Sigurjonsson, O.; Schwarzkopf, D.L.; Bryant, M. (Eds.) The Return of Trust? Institutions and the Public after the Icelandic Financial Crisis; Emerald Publishing: Bingley, UK, 2018. [Google Scholar] [CrossRef]

- Reykjavik Energy. Ownership Strategy. 2014. Available online: https://www.or.is/en/about-or/organization-and-corporate-governance/owners-policy/ (accessed on 2 November 2019).

- Reykjavik Energy. Green Bond Framework. 2019. Available online: https://www.or.is/en/finance/financing/green-bond-framework/ (accessed on 12 November 2020).

- Reykjavik Energy. Annual Report 2015; Reykjavik Energy: Reykjavik, Iceland, 2015. [Google Scholar]

- Reykjavik Energy. Annual Report 2018; Reykjavik Energy: Reykjavik, Iceland, 2018; Available online: https://annualreport2018.or.is/ (accessed on 2 November 2019).

- United Nations Global Compact. Integrating the SDGs into Corporate Reporting: A Practical Guide. UN Report. 2018. Available online: https://www.unglobalcompact.org/library/5628 (accessed on 13 April 2020).

- International Capital Market Association (IMCA). Green Bond Principles: Voluntary Process Guidelines for Issuing Green Bonds. 2019. Available online: https://www.icmagroup.org/green-social-and-sustainability-bonds/green-bond-principles-gbp/ (accessed on 12 December 2019).

- Bryson, J.M. What To Do When Stakeholders Matter: Stakeholder Identification and Analysis Techniques. Public Manag. Rev. 2004, 6, 21–53. [Google Scholar] [CrossRef]

| 1st Round Interviewees | Type | Gender | Length of Interview |

| CEO | In-Person | Male | 1.5 h |

| CFO | In-Person | Male | 1.5 h |

| Specialist Finance Treasury | Female | 1.5 h (est.) | |

| VP Strategy and Governance | In-Person | Female | 2 h |

| VP Communications | In-Person | Male | 1 h |

| VP Environmental Affairs | In-Person | Female | 1 h |

| VP Legal | In-Person | Female | 0.5 h |

| Company Representative | In-Person | Female | 1 h |

| Vice-Chairman, Board | In-Person | Male | 1 h |

| 2nd Round Interviewees | |||

| VP of Private Equity of a listed bank | In-Person | Female | 1 h |

| CEO of a stock exchange | In-Person | Male | 1 h |

| COO of a pension fund | In-Person | Female | 1.5 h |

| VP of Corporate Finance, securities firm | In-Person | Female | 0.5 h |

| CEO of a software company within sustainability and ESG reporting | In-Person | Male | 1 h |

| VP of Asset Management at a bank | In-Person | Female | 1.5 h |

| Reykjavik Energy CFO | In-Person | Male | 1.5 h |

| Portfolio Manager at a bank | In-Person | Female | 1 h |

| Reykjavik Energy Owner—mayor Reykjavik | In-Person | Male | 1 h |

| Reykjavik Energy Owner—former CFO Reykjavik | In-Person | Male | 1 h |

| Theme | Subtheme | Informing |

|---|---|---|

| Governance | Responsible ownership | Poteete et al. (2010) on how humans work together to resolve collective action dilemmas. |

| Collective action | Van Tulder (2018) on the ability for related stakeholders to collectively work together towards a common vision, thus determining the effectiveness of chosen interactions or interventions. | |

| Sustainability | Collaboration | Schoon and Cox (2018) in highlighting the importance of collaboration in governance for sustainability. |

| Ownership strategy | Young (2017) on new types of governance during periods of transformation, detailing the importance of and the need for collaboration. | |

| Business model | Valkering et al. (2017) on local-level sustainability transition. | |

| Funding | Strategic decision making | Forbes and Milliken (1999) on effective board decision making crucial to good governance. |

| Green bonds | ||

| Challenges | Sustainability | García-Sánchez’s et al. (2020) on ideas on distortion in organization’s business models following global challenges. |

| Tang & Zhang (2018) on how green bonds can improve ESG ratings. | ||

| Maltais and Nykvist’s (2020) on how green bonds influence sustainability at a company. |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jonsdottir, G.E.; Sigurjonsson, T.O.; Alavi, A.R.; Mitchell, J. Applying Responsible Ownership to Advance SDGs and the ESG Framework, Resulting in the Issuance of Green Bonds. Sustainability 2021, 13, 7331. https://doi.org/10.3390/su13137331

Jonsdottir GE, Sigurjonsson TO, Alavi AR, Mitchell J. Applying Responsible Ownership to Advance SDGs and the ESG Framework, Resulting in the Issuance of Green Bonds. Sustainability. 2021; 13(13):7331. https://doi.org/10.3390/su13137331

Chicago/Turabian StyleJonsdottir, Gudrun Erla, Throstur Olaf Sigurjonsson, Ahmad Rahnema Alavi, and Jordan Mitchell. 2021. "Applying Responsible Ownership to Advance SDGs and the ESG Framework, Resulting in the Issuance of Green Bonds" Sustainability 13, no. 13: 7331. https://doi.org/10.3390/su13137331

APA StyleJonsdottir, G. E., Sigurjonsson, T. O., Alavi, A. R., & Mitchell, J. (2021). Applying Responsible Ownership to Advance SDGs and the ESG Framework, Resulting in the Issuance of Green Bonds. Sustainability, 13(13), 7331. https://doi.org/10.3390/su13137331