Combining Business Model Innovation and Model-Based Analysis to Tackle the Deep Uncertainty of Societal Transitions—A Case Study on Industrial Electrification and Power Grid Management

Abstract

:1. Introduction

- Which circumstances favor or hinder the success of the time-based business model and the diffusion of flexible electrification technologies?

- Which are the main leverage points for the different actors to ensure the success of the business model?

2. Literature Review

2.1. Business Model Innovation in the Energy Transition

2.2. System Dynamics and Exploratory Modeling

2.3. Transition Theory and Business Models

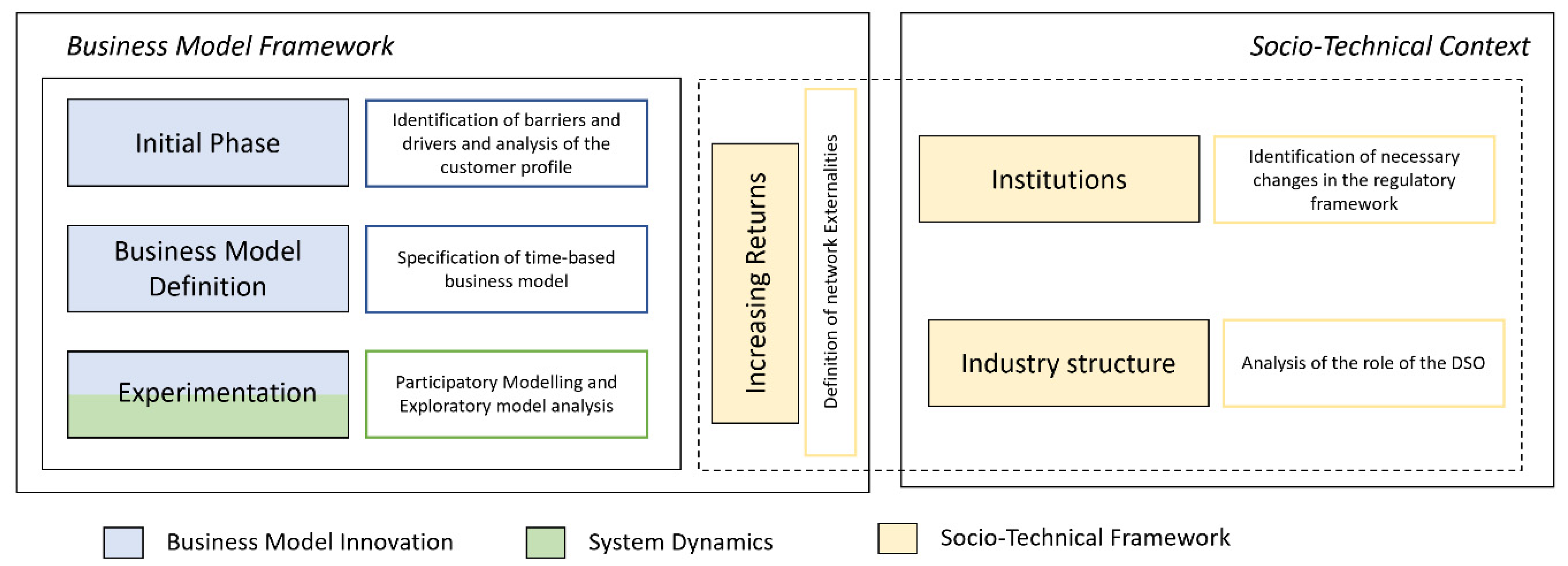

3. Materials and Methods

3.1. Business Model Innovation

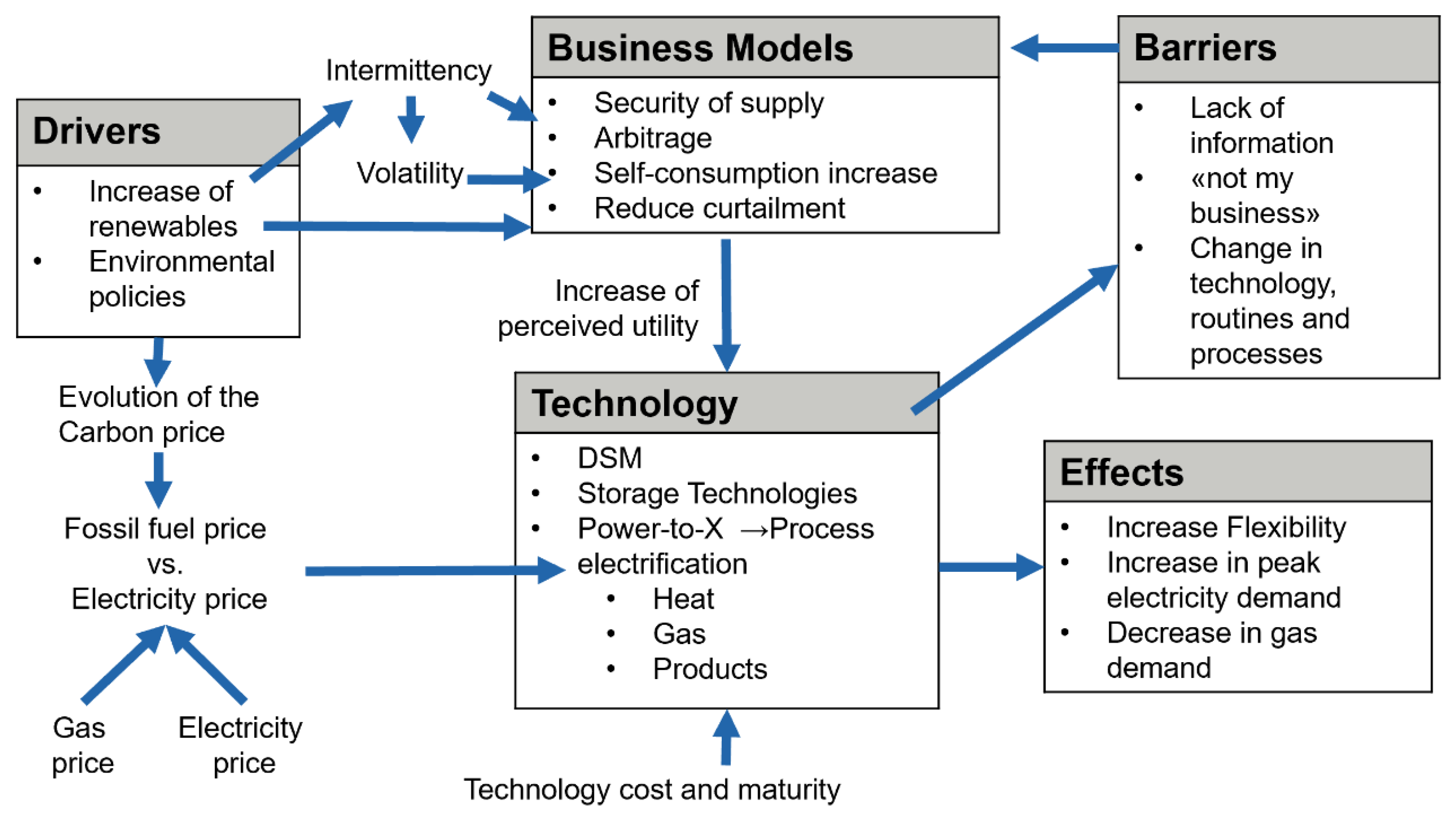

3.1.1. Socio-Technical Drivers and Barriers

3.1.2. Analyzing Customer’s Profile

3.1.3. Design of the Power Alliance Business Model

3.1.4. Exploration Phase

3.1.5. Use Cases for Flexible Electrification Technologies

3.2. System Dynamics Simulation

3.2.1. Model Structure

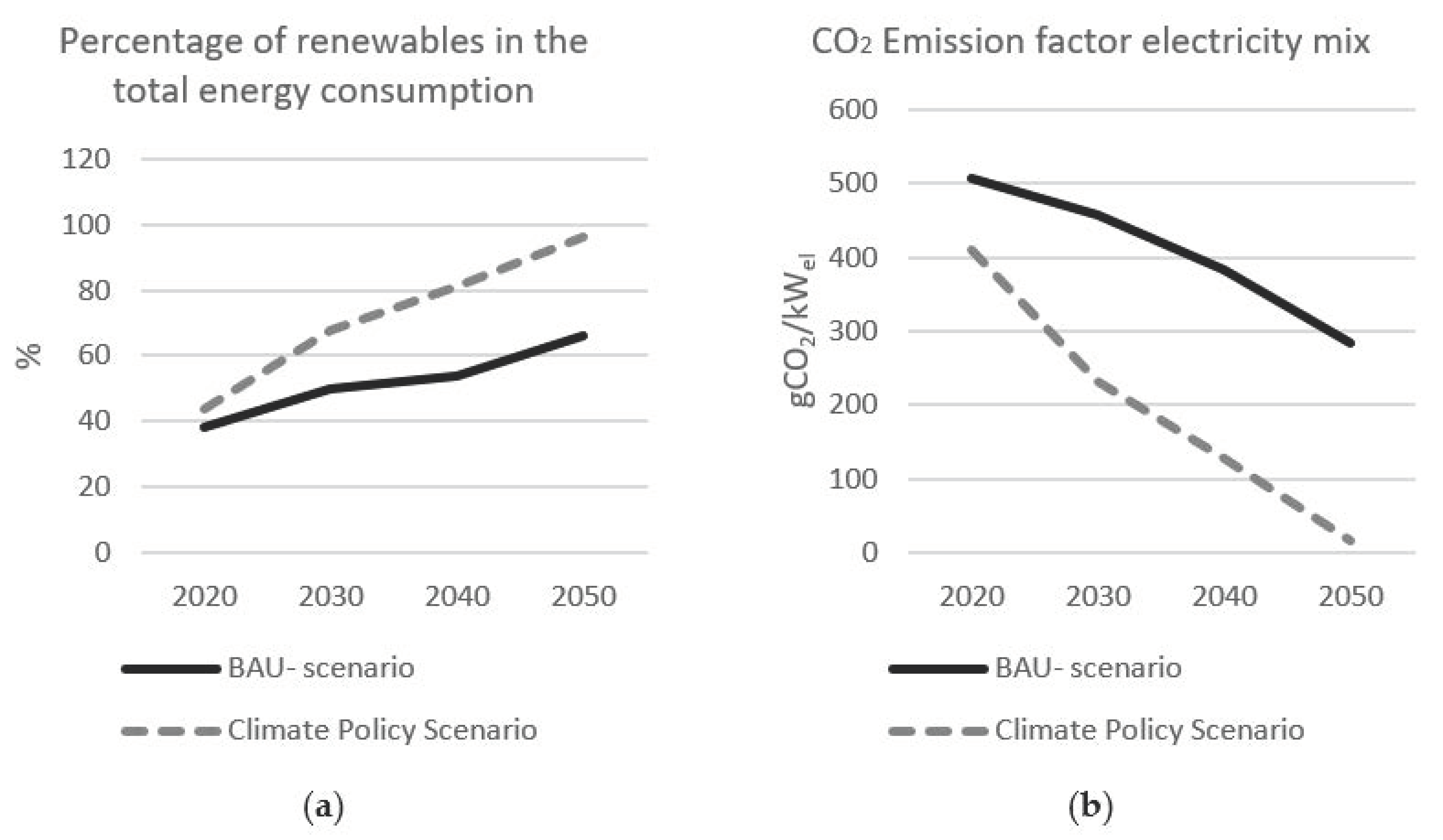

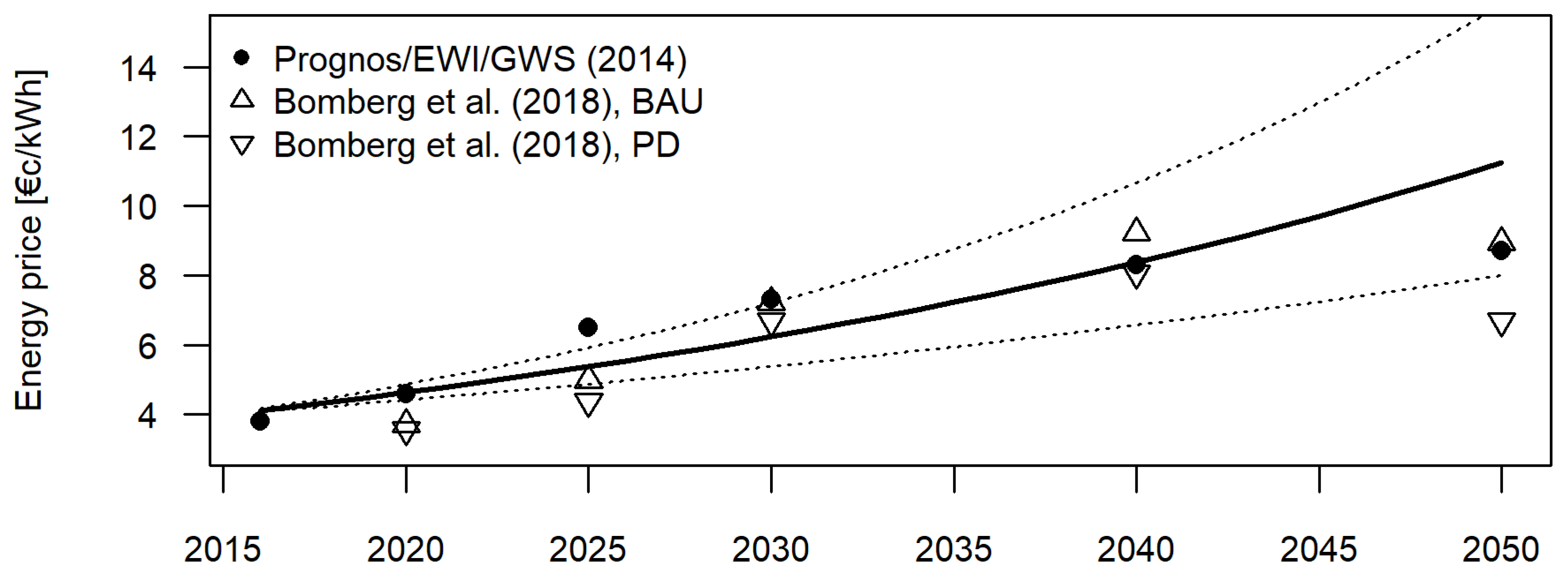

3.2.2. Scenarios

3.2.3. Sensitivity Analysis

3.2.4. Model Validation

4. Results

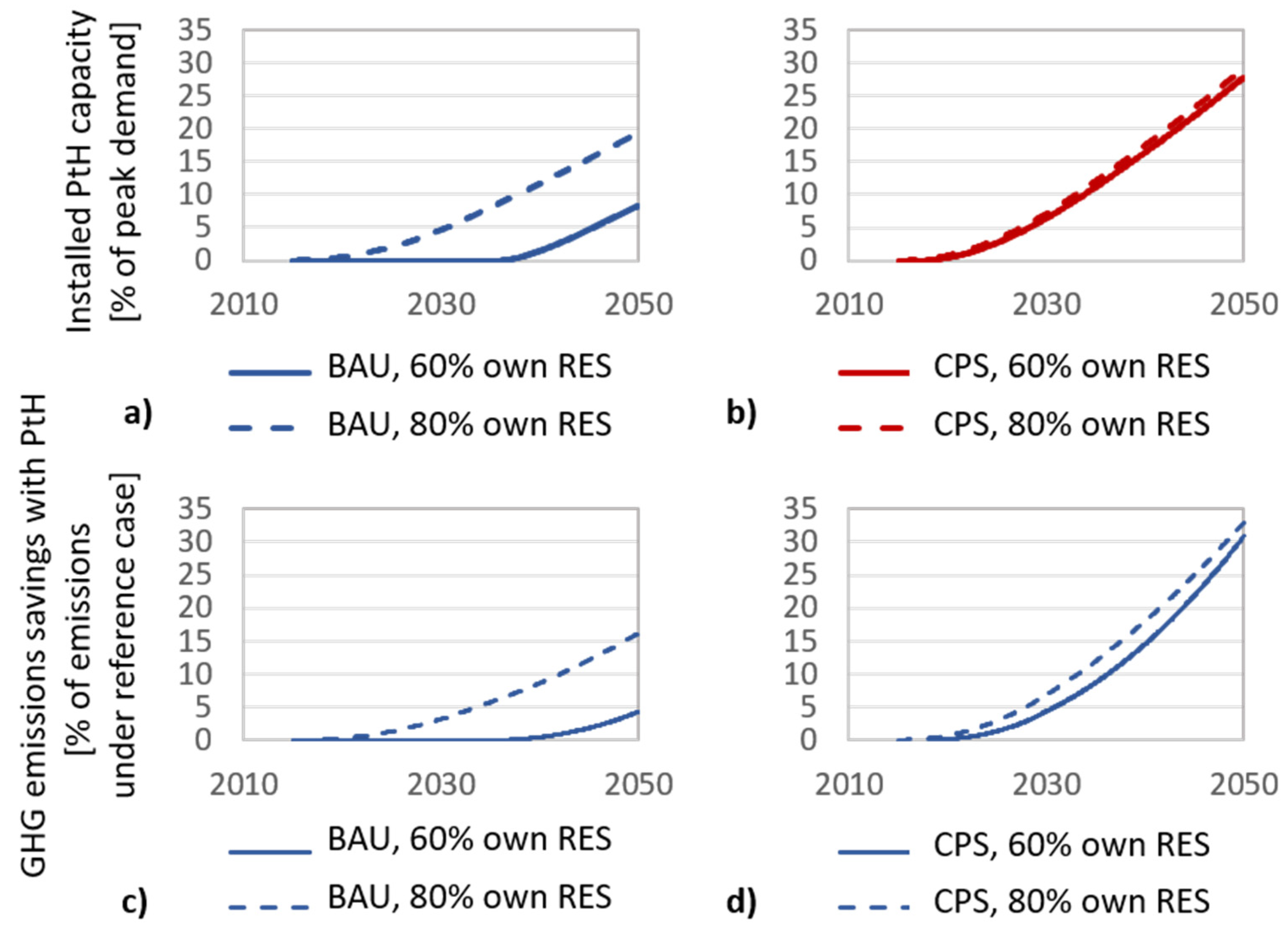

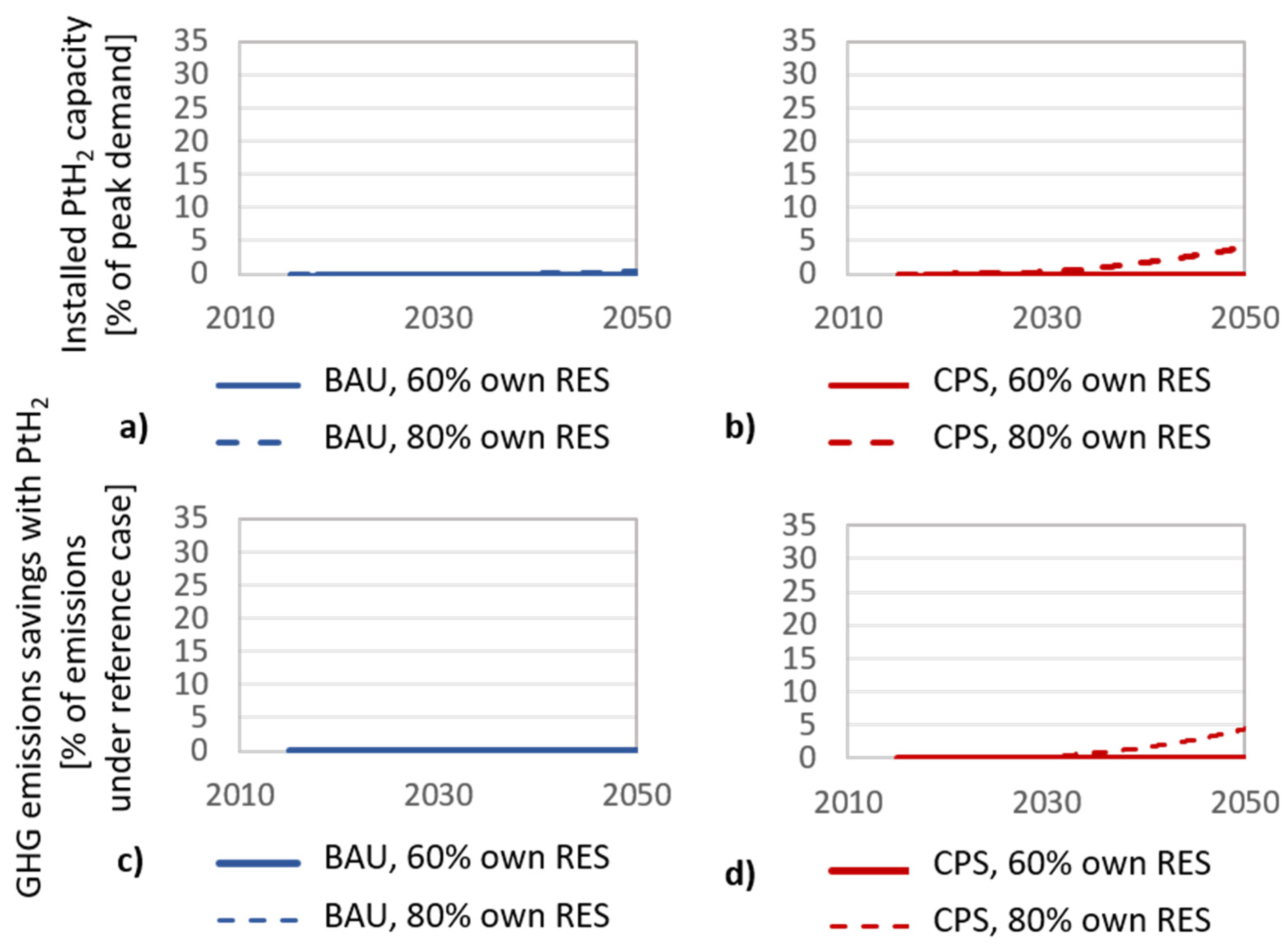

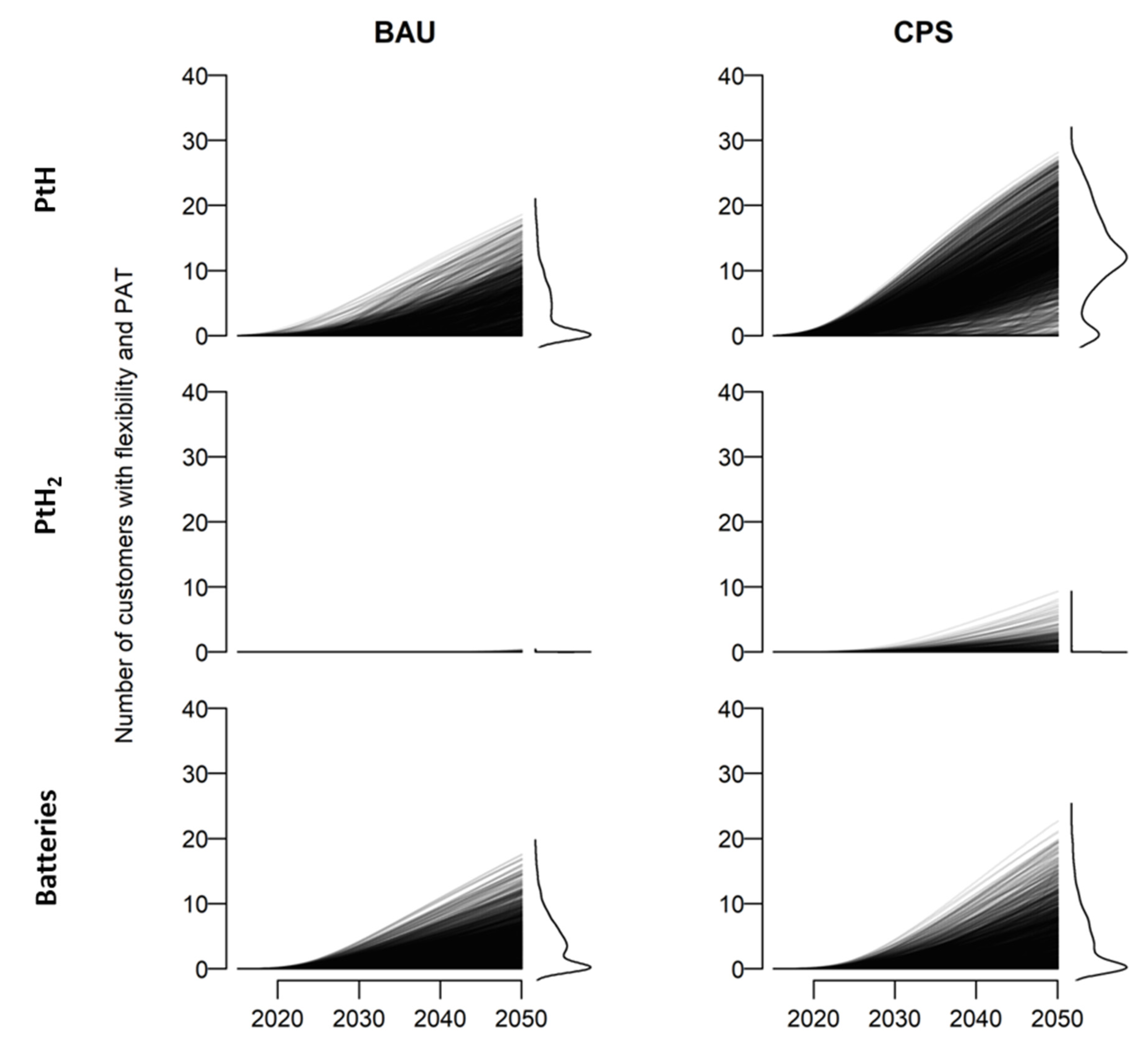

4.1. Simulation Results

4.2. Sensitivity Analysis

5. Discussion

5.1. Prospective Transition Analysis

5.1.1. Institutions

5.1.2. Industry Structure

5.1.3. Increasing Returns

5.2. Methodical Approach

5.3. Limitations of This Study

6. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Rogelj, J.; Luderer, G.; Pietzcker, R.C.; Kriegler, E.; Schaeffer, M.; Krey, V.; Riahi, K. Energy system transformations for limiting end-of-century warming to below 1.5 °C. Nat. Clim. Chang. 2015, 5, 519–527. [Google Scholar] [CrossRef]

- Federal Ministry for Economic Affairs and Energy Bundesministerium für Wirtschaft und Energie “Erneuerbare Energien”. 2019. Available online: https://www.bmwi.de/Redaktion/DE/Dossier/erneuerbare-energien.html (accessed on 1 June 2021).

- Bataille, C.; Åhman, M.; Neuhoff, K.; Nilsson, L.J.; Fischedick, M.; Lechtenböhmer, S.; Solano-Rodriquez, B.; Denis-Ryan, A.; Stiebert, S.; Waisman, H.; et al. A review of technology and policy deep decarbonization pathway options for making energy-intensive industry production consistent with the Paris Agreement. J. Clean. Prod. 2018, 187, 960–973. [Google Scholar] [CrossRef] [Green Version]

- Napp, T.A.; Gambhir, A.; Hills, T.P.; Florin, N.; Fennell, P.S. A review of the technologies, economics and policy instruments for decarbonising energy-intensive manufacturing industries. Renew. Sustain. Energy Rev. 2014, 30, 616–640. [Google Scholar] [CrossRef]

- Panos, E.; Kober, T.; Wokaun, A. Long term evaluation of electric storage technologies vs alternative flexibility options for the Swiss energy system. Appl. Energy 2019, 252, 113470. [Google Scholar] [CrossRef]

- Baruah, P.J.; Eyre, N.; Qadrdan, M.; Chaudry, M.; Blainey, S.; Hall, J.W.; Jenkins, N.; Tran, M. Energy system impacts from heat and transport electrification. Proc. Inst. Civ. Eng. Energy 2014, 167, 139–151. [Google Scholar] [CrossRef]

- Ecofys. Flex-Efficiency. Ein Konzept zur Integration von Effizienz und Flexibilität bei Industriellen Verbrauchern. 2016. Available online: https://www.agora-energiewende.de/en/topics/-agothem-/Produkt/produkt/286/Flex-Efficiency/ (accessed on 1 May 2021).

- Richter, M. Business model innovation for sustainable energy: German utilities and renewable energy. Energy Policy 2013, 62, 1226–1237. [Google Scholar] [CrossRef] [Green Version]

- Helms, T.; Loock, M.; Bohnsack, R. Timing-Based business models for flexibility creation in the electric power sector. Energy Policy 2016, 92, 348–358. [Google Scholar] [CrossRef]

- Wainstein, M.E.; Bumpus, A.G. Business models as drivers of the low carbon power system transition: A multi-level perspective. J. Clean. Prod. 2016, 126, 572–585. [Google Scholar] [CrossRef]

- Bidmon, C.M.; Knab, S.F. The three roles of business models in societal transitions: New linkages between business model and transition research. J. Clean. Prod. 2018, 178, 903–916. [Google Scholar] [CrossRef]

- Richter, M. German utilities and distributed PV: How to overcome barriers to business model innovation. Renew. Energy 2013, 55, 456–466. [Google Scholar] [CrossRef] [Green Version]

- Frankenberger, K.; Weiblen, T.; Csik, M.; Gassmann, O. The 4I-framework of business model innovation: A structured view on process phases and challenges. Int. J. Prod. Dev. 2013, 18, 249. [Google Scholar] [CrossRef]

- Thompson, J.D.; Macmillan, I.C. Business models: Creating new markets and societal wealth. Long Range Plann. 2010, 43, 291–307. [Google Scholar] [CrossRef]

- Sosna, M.; Trevinyo, R.N.; Velamuri, S.R. Business model innovation through trial-and-error learning: The naturhouse case. Long Range Plann. 2010, 43, 383–407. [Google Scholar] [CrossRef]

- Lempert, R.; Popper, S.; Bankes, S. Shaping the Next One Hundred Years: New Methods for Quantitative, Long-Term Policy Analysis; RAND Corporation: Santa Monica, CA, USA, 2003. [Google Scholar]

- Geissdoerfer, M.; Vladimirova, D.; Evans, S. Sustainable business model innovation: A review. J. Clean. Prod. 2018, 198, 401–416. [Google Scholar] [CrossRef]

- Bolton, R.; Hannon, M. Governing sustainability transitions through business model innovation: Towards a systems understanding. Res. Policy 2016, 45, 1731–1742. [Google Scholar] [CrossRef] [Green Version]

- Moallemi, E.A.; de Haan, F.; Kwakkel, J.; Aye, L. Narrative-Informed exploratory analysis of energy transition pathways: A case study of India’s electricity sector. Energy Policy 2017, 110, 271–287. [Google Scholar] [CrossRef]

- Helms, T. Cleaner and Less Energy—Investment and Business Model Dynamics in the Energy Transition Context. Ph.D. Dissertation, University of St. Gallen, St. Gallen, Switzerland, 2015. [Google Scholar]

- Hannon, M. Co-Evolution of Innovative Business Models and Sustainability Transitions: The Case of the Energy Service Company (ESCo) Model and the UK Energy System. Ph.D. Thesis, University of Leeds, Leeds, UK, October 2012; pp. 1–348.

- Cosenz, F. Supporting start-up business model design through system dynamics modelling. Manag. Decis. 2017, 55, 57–80. [Google Scholar] [CrossRef]

- Sterman, J. Business Dynamics; McGraw-Hill: New York, NY, USA, 2000. [Google Scholar]

- Moellers, T.; von der Burg, L.; Bansemir, B.; Pretzl, M.; Gassmann, O. System dynamics for corporate business model innovation. Electron. Mark. 2019, 29, 387–406. [Google Scholar] [CrossRef] [Green Version]

- Geum, Y.; Lee, S.; Park, Y. Combining technology roadmap and system dynamics simulation to support scenario-planning: A case of car-sharing service. Comput. Ind. Eng. 2014, 71, 37–49. [Google Scholar] [CrossRef]

- Kwakkel, J.H.; Pruyt, E. Exploratory modeling and analysis, an approach for model-based foresight under deep uncertainty. Technol. Forecast. Soc. Chang. 2013, 80, 419–431. [Google Scholar] [CrossRef]

- Sovacool, B.K.; Hess, D.J.; Amir, S.; Geels, F.W.; Hirsh, R.; Medina, L.R.; Miller, C.; Palavicino, C.A.; Phadke, R.; Ryghaug, M.; et al. Sociotechnical agendas: Reviewing future directions for energy and climate research. Energy Res. Soc. Sci. 2020, 70, 101617. [Google Scholar] [CrossRef]

- van Waes, A.; Farla, J.; Frenken, K.; de Jong, J.P.J.; Raven, R. Business model innovation and socio-technical transitions. A new prospective framework with an application to bike sharing. J. Clean. Prod. 2018, 195, 1300–1312. [Google Scholar] [CrossRef]

- Amit, R.; Zott, C. Value creation in E-business. Strateg. Manag. J. 2001, 22, 493–520. [Google Scholar] [CrossRef]

- Hacklin, F.; Björkdahl, J.; Wallin, M.W. Strategies for business model innovation: How firms reel in migrating value. Long Range Plann. 2018, 51, 82–110. [Google Scholar] [CrossRef]

- Chesbrough, H. Business model innovation: Opportunities and barriers. Long Range Plann. 2010, 43, 354–363. [Google Scholar] [CrossRef]

- McGrath, R.G. Business models: A discovery driven approach. Long Range Plann. 2010, 43, 247–261. [Google Scholar] [CrossRef]

- Andries, P.; Debackere, K.; Looy, B.V.A.N. Simultaneous experimentation as a learning strategy: Business model development under uncertainty. Strateg. Entrep. J. 2013, 310, 288–310. [Google Scholar] [CrossRef]

- Dobson, K.; Boone, S.; Andries, P.; Daou, A. Successfully creating and scaling a sustainable social enterprise model under uncertainty: The case of ViaVia Travellers Cafés. J. Clean. Prod. 2018, 172, 4555–4564. [Google Scholar] [CrossRef]

- Demil, B.; Lecocq, X. Crafting an innovative business model in an established company: The role of artifacts. Bus. Models Model. 2015, 31–58. [Google Scholar] [CrossRef]

- Sterman, D.J.; Henderson, R.; Beinhocker, D.E.; Newman, I.L. Getting big too fast: Strategic dynamics with increasing returns and bounded rationality. Manag. Sci. 2007, 53, 1–32. [Google Scholar] [CrossRef]

- Warren, K. The dynamics of strategy. Bus. Strateg. Rev. 1999, 10, 1–16. [Google Scholar] [CrossRef]

- Bankes, S. Exploratory modeling for policy analysis. Oper. Res. 1993, 41, 435–449. [Google Scholar] [CrossRef] [Green Version]

- Ghaffarzadegan, N.; Lyneis, J.; Richardson, G.P. How small system dynamics models can help the public policy process. Syst. Dyn. Rev. 2011, 27, 22–44. [Google Scholar] [CrossRef] [Green Version]

- Ding, Z.; Gong, W.; Li, S.; Wu, Z. System dynamics versus agent-based modeling: A review of complexity simulation in construction waste management. Sustainability 2018, 10, 2484. [Google Scholar] [CrossRef] [Green Version]

- Geels, F.W. Technological transitions as evolutionary reconfiguration processes: A multi-level perspective and a case-study. Res. Policy 2002, 31, 1257–1274. [Google Scholar] [CrossRef] [Green Version]

- Hekkert, M.P.; Suurs, R.A.A.; Negro, S.O.; Kuhlmann, S.; Smits, R.E.H.M. Functions of innovation systems: A new approach for analysing technological change. Technol. Forecast. Soc. Chang. 2007, 74, 413–432. [Google Scholar] [CrossRef] [Green Version]

- Wüstenhagen, R.; Boehnke, J. Perspectives on Radical Changes to Sustainable Consumption and Production; Greenleaf Publishing: Sheffield, UK, 2008. [Google Scholar]

- Wirtz, B.W.; Pistoia, A.; Ullrich, S.; Göttel, V. Business models: Origin, development and future research perspectives. Long Range Plann. 2016, 49, 36–54. [Google Scholar] [CrossRef]

- Yin, R.K. Case Study Research: Design and Method, 3rd ed.; SAGE Publications Inc.: London, UK; Thousand Oaks, CA, USA, 2003. [Google Scholar]

- Philibert, C. Direct and indirect electrification of industry and beyond. Oxf. Rev. Econ. Policy 2019, 35, 197–217. [Google Scholar] [CrossRef]

- Estermann, T.; Pichlmaier, S.; Guminski, A.; Pellinger, C. Kurzstudie Power-to-X. 2017. Available online: https://www.ffe.de/attachments/article/761/Kurzstudie Power-to-X.pdf (accessed on 10 November 2020).

- Pleßmann, G.; Blechinger, P. How to meet EU GHG emission reduction targets? A model based decarbonization pathway for Europe’s electricity supply system until 2050. Energy Strateg. Rev. 2017, 15, 19–32. [Google Scholar] [CrossRef]

- Behrangrad, M. A review of demand side management business models in the electricity market. Renew. Sustain. Energy Rev. 2015, 47, 270–283. [Google Scholar] [CrossRef]

- Lechtenböhmer, S.; Nilsson, L.J.; Åhman, M.; Schneider, C. Decarbonising the energy intensive basic materials industry through electrification—Implications for future EU electricity demand. Energy 2016, 115, 1623–1631. [Google Scholar] [CrossRef] [Green Version]

- Agora Energiewende. Eine Neuordnung der Abgaben und Umlagen auf Strom, Wärme, Verkehr. 2018. Available online: https://www.agora-energiewende.de/veroeffentlichungen/eine-neuordnung-der-abgaben-und-umlagen-auf-strom-waerme-verkehr/ (accessed on 1 February 2021).

- Wei, M.; McMillan, C.A.; de la Rue du Can, S. Electrification of industry: Potential, challenges and outlook. Curr. Sustain. Energy Rep. 2019, 6, 140–148. [Google Scholar] [CrossRef]

- Olsthoorn, M.; Schleich, J.; Klobasa, M. Barriers to electricity load shift in companies: A survey-based exploration of the end-user perspective. Energy Policy 2015, 76, 32–42. [Google Scholar] [CrossRef]

- Brolin, M.; Fahnestock, J.; Rootzen, J. Industry’s Electrification and Role in the Future Electricity System—A Strategic Innovation Agenda; Research Institutes of Sweden: Göteborg, Sweden, 2017. [Google Scholar] [CrossRef]

- Malhotra, A.; Battke, B.; Beuse, M.; Stephan, A.; Schmidt, T. Use cases for stationary battery technologies: A review of the literature and existing projects. Renew. Sustain. Energy Rev. 2016, 56, 705–721. [Google Scholar] [CrossRef]

- Fitzgerald, G.; Mandel, J.; Morris, J.; Touati, H. The Economics of Battery Energy Storage: How Multi-Use, Customer-Sited Batteries Deliver the Most Services and Value to Customers and the Grid; Rocky Mountain Institute: Basalt, CO, USA, 2015; Available online: https://rmi.org/wp-content/uploads/2017/03/RMI-TheEconomicsOfBatteryEnergyStorage-FullReport-FINAL.pdf (accessed on 11 November 2020).

- Klobasa, M. Dynamische Simulation eines Lastmanagements und Integration von Windenergie in ein Elektrizitätsnetz auf Landesebene unter Regelungstechnischen und Kostengesichtspunkten. Ph.D. Thesis, ETH Zurich, Zurich, Switzerland, 2007. [Google Scholar]

- Krzikalla, N.; Achner, S.; Brühl, S. Möglichkeiten zum Ausgleich Fluktuierender Einspeisungen aus Erneuerbaren Energien; Bundesverband Erneuerbare Energie e.V.: Bochum, Germany, 2013; Available online: https://www.bee-ev.de/fileadmin/Publikationen/Studien/Plattform/BEE-Plattform-Systemtransformation_Ausgleichsmoeglichkeiten.pdf (accessed on 10 November 2020).

- Bettencourt, L.A.; Ulwick, A.W. The customer-centered innovation map. Harv. Bus. Rev. 2008, 86, 109–114. [Google Scholar]

- Bagemihl, J.; Boesner, F.; Riesinger, J.; Künzli, M.; Wilke, G.; Binder, G.; Wache, H.; Laager, D.; Breit, J.; Wurzinger, M.; et al. A market-based smart grid approach to increasing power grid capacity without physical grid expansion. Comput. Sci. Res. Dev. 2018, 33, 177–183. [Google Scholar] [CrossRef]

- Osterwalder, A.; Pigneur, Y. Business Model Generation: A Handbook for Visionaries, Game Changers, and Challengers; John Wiley & Sons: Hoboken, NJ, USA, 2010. [Google Scholar]

- Bagemihl, J.; Breit, J.; Layec, V.; West, M.; Zapata, J. Poweralliance: Von der Lokalen Lastoptimierung zur Regionalen Verteilnetzoptimierung. 2019. Available online: https://www.aramis.admin.ch/Default?DocumentID=65020&Load=true (accessed on 1 May 2021).

- Christen, R.; Layec, V.; Wilke, G.; Wache, H. Technical validation of the RLS smart grid approach to increase power grid capacity without physical grid expansion. In Proceedings of the 8th International Conference on Smart Cities and Green ICT Systems—SMARTGREENS, Heraklion, Greece, 3–5 May 2019; pp. 123–130. [Google Scholar] [CrossRef]

- Viessmann. Oil/Gas Boilers and Low Pressure Hot Water Boilers up to 22 MW. Available online: http://www.viessmann-project.hk/content/dam/vi-corporate/COM/Download/Oil-gas-boilers-and-hot-water-boilers.pdf/_jcr_content/renditions/original.media_file.download_attachment.file/Oil-gas-boilers-and-hot-water-boilers.pdf (accessed on 1 May 2019).

- Tractebel; Engie; Hinicio. Study on Early Business Cases for H2 in Energy Storage and More Broadly Power to H2 Applications; Fuel, Cells and Hydrogen Joint Undertaking: Brussels, Belgium, 2017. [Google Scholar]

- Mulder, M.; Perey, P.; Moraga, J.L. Outlook for a Dutch Hydrogen Market; Pol. No 5; Centre for Energy Economics Research (CEER): Groningen, The Netherlands, 2019. [Google Scholar]

- Kubli, M. Squaring the sunny circle? On balancing distributive justice of power grid costs and incentives for solar prosumers. Energy Policy 2018, 114, 173–188. [Google Scholar] [CrossRef] [Green Version]

- Struben, J.; Sterman, J.D. Transition challenges for alternative fuel vehicle and transportation systems. Environ. Plan. B Plan. Des. 2008, 35, 1070–1097. [Google Scholar] [CrossRef]

- Öko-Institut; Fraunhofer ISI. Klimaschutzszenario 2050. 2015. Available online: https://www.oeko.de/oekodoc/2451/2015-608-de.pdf (accessed on 3 June 2019).

- Prognos; EWI; GWS. Entwicklung der Energiemärkte—Energiereferenzprognose; Prognos: Basel, Switzerland; EWI: Köln, Germany; GWS: Osnabrück, Germany, 2014; Available online: https://www.bmwi.de/Redaktion/DE/Publikationen/Studien/entwicklung-der-energiemaerkte-energiereferenzprognose-endbericht.pdf (accessed on 3 June 2019).

- Liaw, A.; Wiener, M. Classification and regression by randomForest. R News 2002, 2, 18–22. Available online: https://www.r-project.org/doc/Rnews/Rnews_2002-3.pdf (accessed on 2 May 2016).

- Harper, E.B.; Stella, J.C.; Fremier, A.K. Global sensitivity analysis for complex ecological models: A case study of riparian cottonwood population dynamics. Ecol. Appl. 2011, 21, 1225–1240. [Google Scholar] [CrossRef] [PubMed]

- Coutts, S.R.; Yokomizo, H. Meta-Models as a straightforward approach to the sensitivity analysis of complex models. Popul. Ecol. 2014, 56, 7–19. [Google Scholar] [CrossRef]

- Speich, M.J.R.; Zappa, M.; Lischke, H. Sensitivity of forest water balance and physiological drought predictions to soil and vegetation parameters—A model-based study. Environ. Model. Softw. 2018, 102, 213–232. [Google Scholar] [CrossRef]

- Pianosi, F.; Beven, K.; Freer, J.; Hall, J.W.; Rougier, J.; Stephenson, D.B.; Wagener, T. Sensitivity analysis of environmental models: A systematic review with practical workflow. Environ. Model. Softw. 2016, 79, 214–232. [Google Scholar] [CrossRef]

- Bomberg, C.; Grundmann, R.A.; Hönniger, S.; Brauns, P.; Feske, L.; Früh, S.; Schubert, F.; Trott, T.; Zöll, J. Strommarkt 2050—Analyse Möglicher Szenarien der Entwicklung des Deutschen und Mitteleuropäischen Strommarktes bis 2050; Fachhochschule Erfurt: Erfurt, Germany, 2018; Available online: https://get.fh-erfurt.de/fileadmin/GET/Dokumente/Download/Forschung-Lenz/Studie_Strommarkt_2050.pdf (accessed on 3 May 2019).

- BDEW. Diskussionspapier Marktregeln für Eine Erfolgreiche Sektorkopplung; BDEW: Berlin, Germany, 2019; Available online: https://www.bdew.de/media/documents/Stn_20190528_Diskussionspapier-Marktregeln-Sektorkopplung.pdf (accessed on 10 November 2020).

- Golling, C.; Heuke, R.; Seidl, H.; Uhlig, J. Roadmap Power to Gas; DENA: Berlin, Germany, 2017; Available online: https://www.dena.de/fileadmin/dena/Publikationen/PDFs/2019/Roadmap_Power_to_Gas.pdf (accessed on 10 November 2020).

- Schröder, S.T. Parallel Feed-In Grids for Renewable Energy: Contesting the Natural Monopoly? 2009. Available online: https://tu-dresden.de/bu/wirtschaft/bwl/ee2/ressourcen/dateien/dateien/ordner_enerday/ordner_enerday2009/ordner_vortrag/schroeder_paper.pdf?lang=de (accessed on 1 February 2021).

- International Renewable Energy Agency (IRENA). Innovation Landscape Brief: Future Role of Distribution System Operators; International Renewable Energy Agency (IRENA): Abu Dhabi, United Arab Emirates, 2019. [Google Scholar]

- Edens, M.G.; Lavrijssen, S.A.C.M. Balancing public values during the energy transition—How can German and Dutch DSOs safeguard sustainability? Energy Policy 2019, 128, 57–65. [Google Scholar] [CrossRef]

- Ruester, S.; Schwenen, S.; Batlle, C.; Pérez-Arriaga, I. From distribution networks to smart distribution systems: Rethinking the regulation of European electricity DSOs. Util. Policy 2014, 31, 229–237. [Google Scholar] [CrossRef] [Green Version]

- Walker, W.E.; Harremoës, P.; Rotmans, J.; van der Sluijs, J.P.; van Asselt, M.B.A.; Janssen, P.; Krayer von Krauss, M.P. Defining uncertainty: A conceptual basis for uncertainty management in model-based decision support. Integr. Assess. 2003, 4, 5–17. [Google Scholar] [CrossRef] [Green Version]

- Eker, S.; Slinger, J.; van Daalen, E.; Yücel, G. Sensitivity analysis of graphical functions. Syst. Dyn. Rev. 2014, 30, 186–205. [Google Scholar] [CrossRef]

- Refsgaard, J.C.; van der Sluijs, J.P.; Højberg, A.L.; Vanrolleghem, P.A. Uncertainty in the environmental modelling process—A framework and guidance. Environ. Model. Softw. 2007, 22, 1543–1556. [Google Scholar] [CrossRef] [Green Version]

- Taylor, T.R.B.; Ford, D.N.; Ford, A. Improving model understanding using statistical screening. Syst. Dyn. Rev. 2010, 26, 73–87. [Google Scholar] [CrossRef] [Green Version]

- Abdelkafi, N.; Täuscher, K. Business models for sustainability from a system dynamics perspective. Organ. Environ. 2016, 29, 74–96. [Google Scholar] [CrossRef]

- Cosenz, F.; Noto, G. A dynamic business modelling approach to design and experiment new business venture strategies. Long Range Plann. 2018, 51, 127–140. [Google Scholar] [CrossRef]

| PtH | ||

| Installed capacity | 500 kWe | |

| Investment cost | 100 EUR/kW | [47] |

| Life time | 30 years | [47] |

| Efficiency | 98% | [47] |

| Efficiency of the replaced boiler | 98% | [64] |

| PtH2 | ||

| Capacity of the water electrolyzer | 500 kW | |

| Investment cost @2016 | 1500 EUR/kW | [47] |

| Investment cost @2050 | 480 EUR/kW | [47] |

| Life time | 30 years | [47] |

| Electricity consumption per kg H2 | 55 kWh/kg | [65] |

| Gas needed per kg H2 for the replaced SMR | 40 kWh/kg | [66] |

| Batteries | ||

| Installed capacity | 500 kWe | |

| Investment cost @2016 | 1192 EUR/kWh | [48] |

| Investment cost @2050 | 289 EUR/kWh | [48] |

| Life time | 20 years | |

| Charging time | 1 h | |

| BAU Scenario | Climate Policy Scenario | ||||

| 2030 | 2050 | 2030 | 2050 | ||

| CO2 electricity mix emission factor 1 | CO2g/kWel | 506 | 284 | 411 | 17 |

| Percentage of renewables in the total energy consumption 1 | % | 38 | 66 | 44 | 96 |

| CO2 price on gas 2 | EUR/kWh | 0 | 0.01 (45 EUR/TonCO2) | ||

| Electricity tax reduction (tax reform) 2 | EUR/kWh | 0 | up to 0.077 (see Supplementary Materials) | ||

| Symbol | Meaning | Units | Minimum Value | Maximum Value | Default Value | Eq. |

|---|---|---|---|---|---|---|

| Common parameters | ||||||

| Standard network tariff (ST) | EUR/kW | 50 | 100 | 70 | BM | |

| PAT, as a fraction of ST | Dmnl | 0.1 | 1 | 0.1 | BM | |

| Investment cost smart control | EUR | 100 | 500 | 300 | BM | |

| Running hours per year (PtH and PtH2 only) | hours/year | 3000 | 7000 | 6000 | BM | |

| Annual percentual electricity price increase | Dmnl | 0.02 | 0.04 | 0.03 | 8 | |

| Min electricity price difference | EUR/kWh | 0 | 0.04 | 0.04 | BM | |

| Max electricity price difference | EUR/kWh | 0 | 0.1 | 0.07 | BM | |

| ATload | AT flexible loads | years | 5 | 20 | 15 | 1 |

| ATPAT | AT smart control | years | 1 | 5 | 2 | 1 |

| Shape parameter for the function linking utility to preference | Dmnl | 4 | 8 | 6 | 2 | |

| Contact rate | Dmnl | 0.1 | 0.3 | 0.2 | 7 | |

| Effect of customer relationship management by utility on familiarity | Dmnl | 0.05 | 0.15 | 0.1 | 6,7 | |

| PtH parameters | ||||||

| PtH efficiency | Dmnl | 0.97 | 0.99 | 0.97 | BM | |

| Annual percentual gas price increase | Dmnl | 0.02 | 0.03 | 0.02 | 8 | |

| Battery parameters | ||||||

| Feed-in tariff | EUR/kWh | 0.03 | 0.12 | 0.08 | BM | |

| Battery efficiency | Dmnl | 0.7 | 0.9 | 0.7 | BM | |

| PtH2 parameters | ||||||

| Hydrogen price | EUR/kg | 4 | 12 | 8 | BM | |

| Electricity consumption per kg hydrogen | kWh/kg | 50 | 60 | 55 | BM | |

| BAU | CPS | |

|---|---|---|

| PtH | 94.82% | 86.55% |

| PtH2 | 6.07% | 69.18% |

| Batteries | 84.39% | 84.17% |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zapata Riveros, J.; Speich, M.; West, M.; Ulli-Beer, S. Combining Business Model Innovation and Model-Based Analysis to Tackle the Deep Uncertainty of Societal Transitions—A Case Study on Industrial Electrification and Power Grid Management. Sustainability 2021, 13, 7264. https://doi.org/10.3390/su13137264

Zapata Riveros J, Speich M, West M, Ulli-Beer S. Combining Business Model Innovation and Model-Based Analysis to Tackle the Deep Uncertainty of Societal Transitions—A Case Study on Industrial Electrification and Power Grid Management. Sustainability. 2021; 13(13):7264. https://doi.org/10.3390/su13137264

Chicago/Turabian StyleZapata Riveros, Juliana, Matthias Speich, Mirjam West, and Silvia Ulli-Beer. 2021. "Combining Business Model Innovation and Model-Based Analysis to Tackle the Deep Uncertainty of Societal Transitions—A Case Study on Industrial Electrification and Power Grid Management" Sustainability 13, no. 13: 7264. https://doi.org/10.3390/su13137264

APA StyleZapata Riveros, J., Speich, M., West, M., & Ulli-Beer, S. (2021). Combining Business Model Innovation and Model-Based Analysis to Tackle the Deep Uncertainty of Societal Transitions—A Case Study on Industrial Electrification and Power Grid Management. Sustainability, 13(13), 7264. https://doi.org/10.3390/su13137264