Outflow FDI and Domestic Investment: Aggregated and Disaggregated Analysis

Abstract

:1. Introduction

2. Literature Review

3. Research Methodology, Variable Description and Dataset

3.1. Data Description and Source (Data will Be Provided Based on the Request)

3.2. Cross-Sectional Dependency and Panel Unit Root Tests

3.3. Empirical Model and Method

4. Result Estimations, Analysis and Discussion

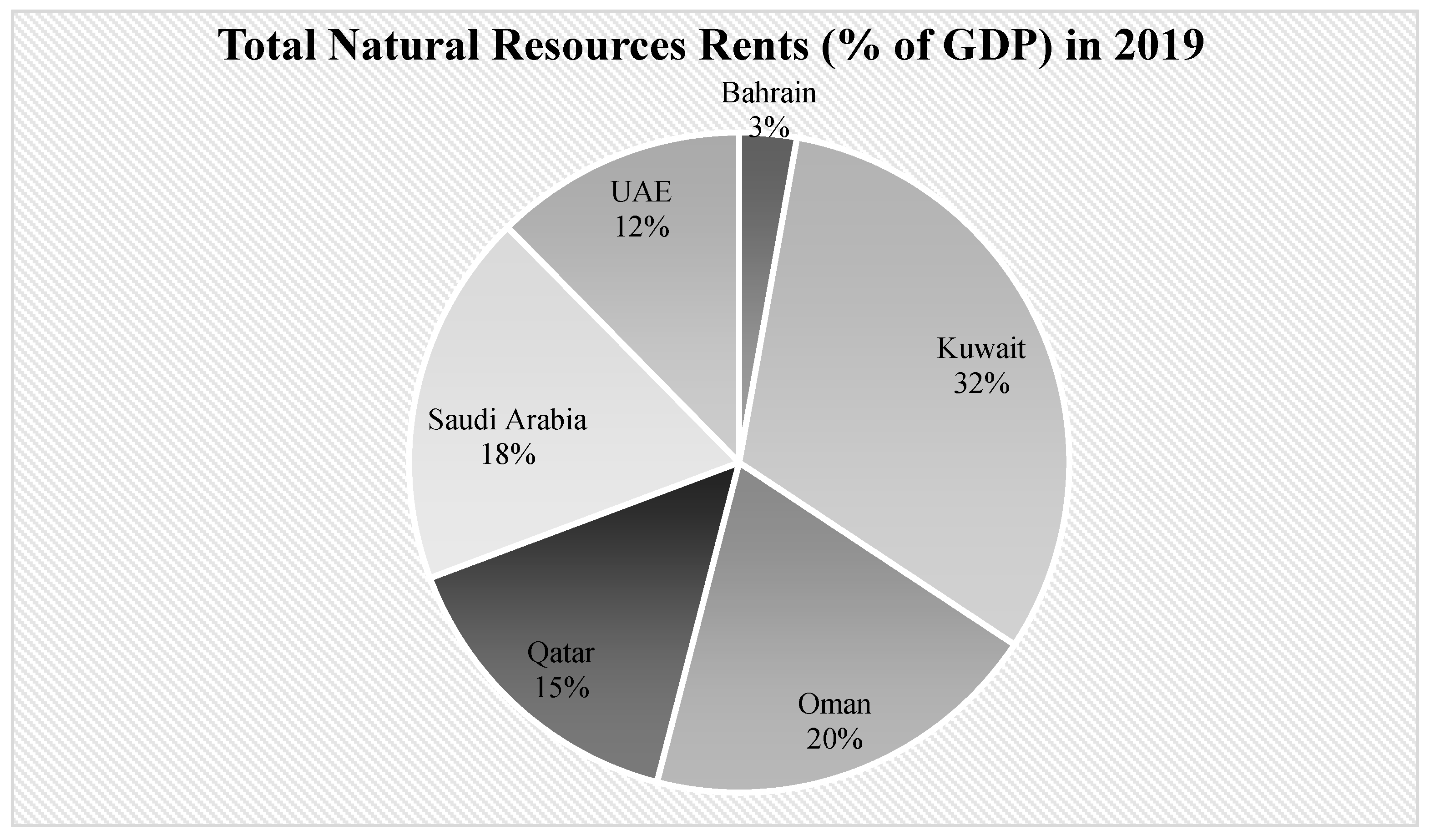

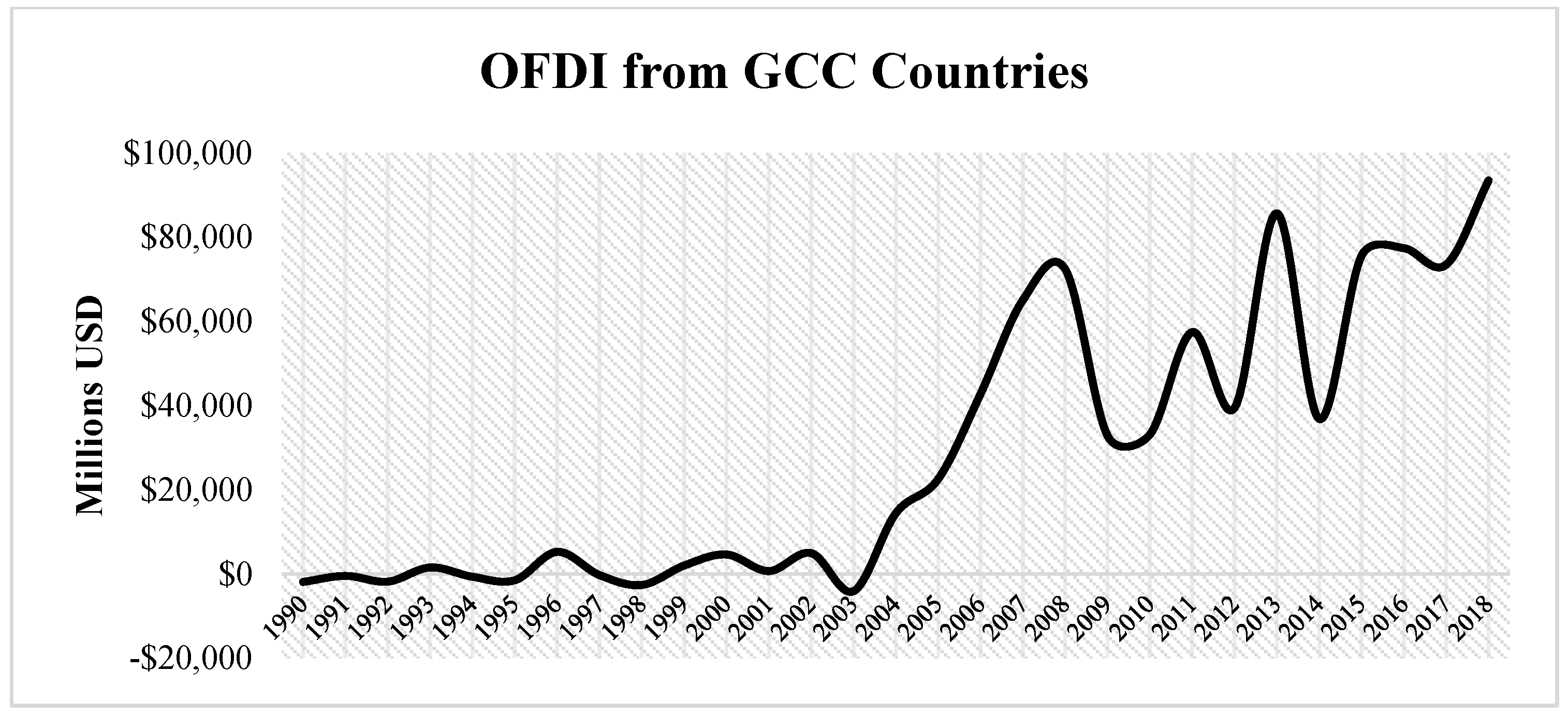

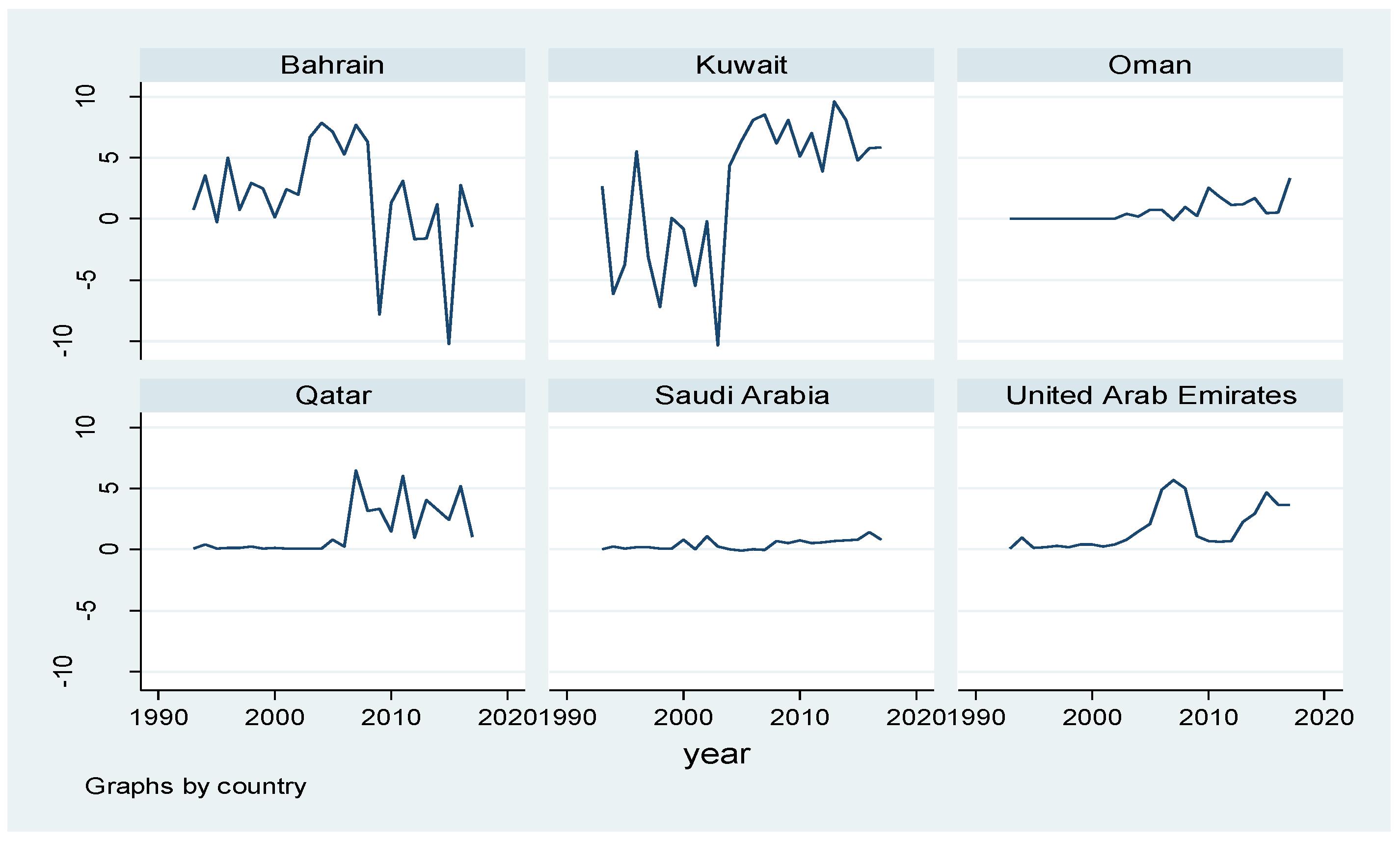

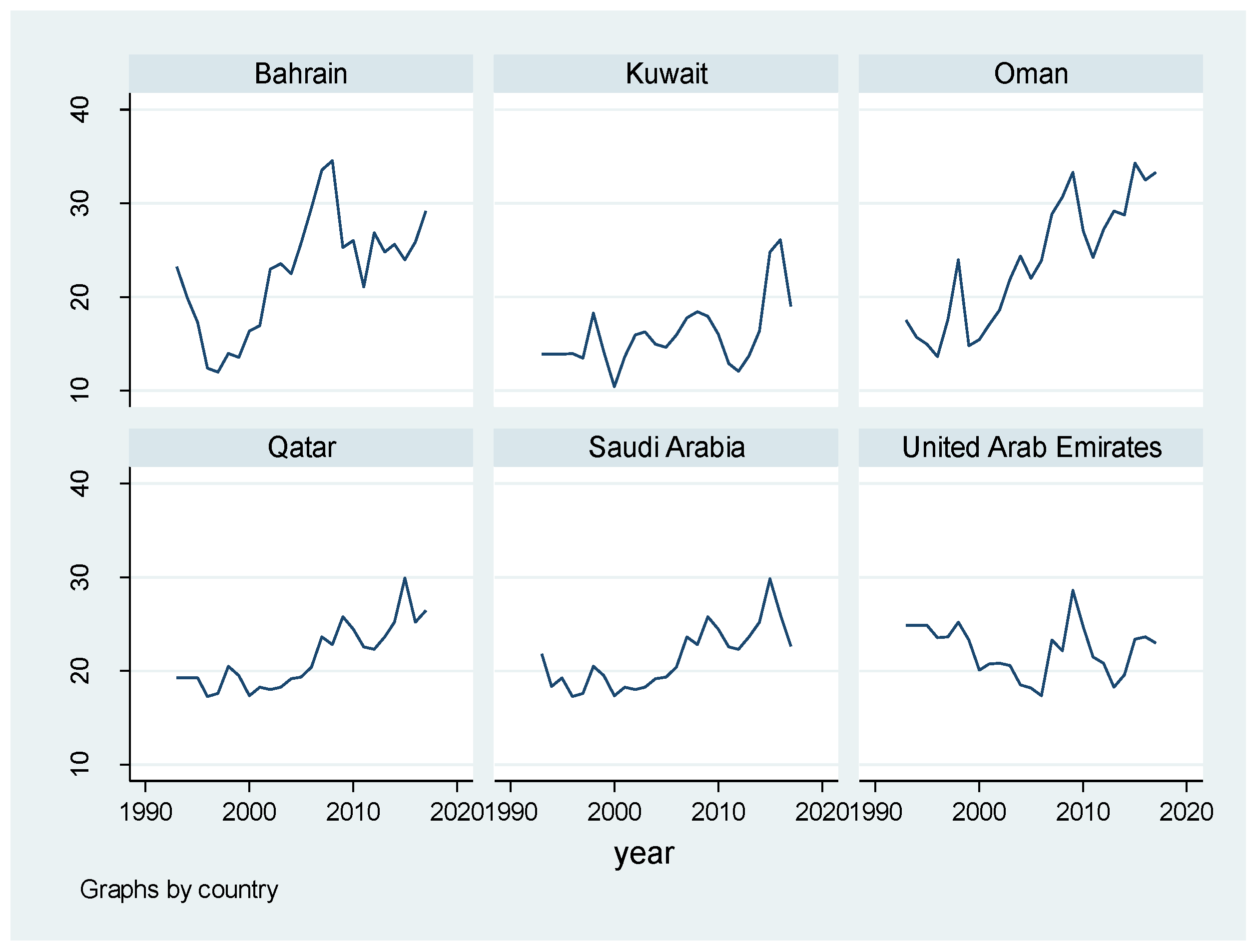

4.1. Descriptive Data and Figures

4.2. Cross-Sectional Dependence and Panel Unit Root Testing

4.3. Main Findings and Estimations

4.3.1. Analyzing Effects of Inbound Investment and Outbound Investment on Aggregate Domestic Formation (DCF) in the Gulf Economies

4.3.2. Analyzing Effects of Inbound Investment and Outbound Investment on Private Capital Formation in the Gulf Economies

4.3.3. Analyzing Effects of Inbound Investment and Outbound Investment on Public Capital Formation in the Gulf Economies

4.3.4. Robustness Check

5. Conclusions and Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Sadik, A.T.; Bolbol, A.A. Capital flows, FDI, and technology spillovers: Evidence from Arab countries. World Dev. 2001, 29, 2111–2125. [Google Scholar] [CrossRef]

- Al-Iriani, M. Foreign direct investment and economic growth in the GCC countries: A causality investigation using heterogeneous panel analysis. Top. Middle East. N. Afr. Econ. 2007, 9, 1–31. [Google Scholar]

- Ghassan, H.B.; Alhajhoj, H.R. Long run relationship between IFDI and Domestic Investment in GCC Countries. J. Econ. Econom. 2016, 59, 16–43. [Google Scholar]

- Lim, E.G. Determinants of, and the Relation between, Foreign Direct Investment and Economic Growth: A Summary of the Recent Literature; International Monetary Fund: Washington, DC, USA, 2001. [Google Scholar]

- Hansen, H.; Rand, J. On the causal links between FDI and growth in the developing countries. World Econ. 2006, 29, 21–41. [Google Scholar] [CrossRef] [Green Version]

- Khalifah, A. Macroeconomic competitiveness of the GCC economies. In The GCC Economies; Ramady, M.A., Ed.; Springer: New York, NY, USA, 2012; pp. 1–324. [Google Scholar]

- Al-Sadig, A.J. Outward Foreign Direct Investment and Domestic Investment: The Case of Developing Countries; International Monetary Fund: Washington, DC, USA, 2013; pp. 1–27. [Google Scholar]

- Desai, M.A.; Foley, C.F.; Hines, J.R. Foreign direct investment and the domestic capital stock. Am. Econ. Rev. 2005, 95, 33–38. [Google Scholar] [CrossRef] [Green Version]

- Stevens, G.V.; Lipsey, R.E. Interactions between domestic and foreign investment. J. Int. Money Finance 1992, 11, 40–62. [Google Scholar] [CrossRef] [Green Version]

- Agnihotri, A.; Arora, S.H. Study of linkages between outward foreign direct investment and domestic economic growth: An Indian Perspective. Financ. Mark. Inst. Risks 2019, 3, 43–49. [Google Scholar] [CrossRef]

- Arndt, C.; Buch, C.M.; Schnitzer, M.E. FDI and domestic investment: An industry-level view. BE J. Econ. Anal. Policy 2010, 10, 1–22. [Google Scholar] [CrossRef] [Green Version]

- Hejazi, W.; Pauly, P.H. Motivations for FDI and domestic capital formation. J. Int. Bus. Stud. 2003, 34, 282–289. [Google Scholar] [CrossRef]

- Andersen, P.; Hainaut, P. Foreign direct investment and employment in the industrial countries. Bank Int. Settl. BIS Work. Pap. 1998, 61, 1–49. [Google Scholar] [CrossRef] [Green Version]

- Feldstein, M.S. The effects of outbound foreign direct investment on the domestic capital stock. In The Effects of Taxation on Multinational Corporations; Lipsey, R.E., Ed.; University of Chicago Press: Chicago, IL, USA, 1995; pp. 43–66. [Google Scholar]

- Ayyagari, M.; Kosová, R. Does FDI facilitate domestic entry? Evidence from the Czech Republic. Rev. Int. Econ. 2010, 18, 14–29. [Google Scholar] [CrossRef]

- Farla, K.; De Crombrugghe, D.; Verspagen, B. Institutions, foreign direct investment, and domestic investment: Crowding out or crowding in? World Dev. 2016, 88, 1–9. [Google Scholar] [CrossRef] [Green Version]

- Narayan, P.K. Do public investments crowd out private investments? Fresh evidence from Fiji. J. Policy Model. 2004, 26, 747–753. [Google Scholar] [CrossRef]

- Shah, S.H.; Hasnat, H.; Cottrell, S.; Ahmad, M.H. Sectoral FDI inflows and domestic investments in Pakistan. J. Policy Model. 2020, 42, 96–111. [Google Scholar] [CrossRef]

- Elheddad, M. Foreign direct investment and domestic investment: Do oil sectors matter? Evidence from oil-exporting gulf cooperation council economies. J. Econ. Bus. 2019, 103, 1–12. [Google Scholar] [CrossRef]

- Fisher, W.H.; Turnovsky, S.J. Public investment, congestion, and private capital accumulation. Econ. J. 1998, 108, 399–413. [Google Scholar] [CrossRef]

- Bom, P.; Ligthart, J. What have we learned from three decades of research on the productivity of public capital? J. Econ. Surveys 2014, 28, 889–916. [Google Scholar] [CrossRef]

- Dunning, J.H. Multinational enterprises and the global economy. In Wokingham, England and Reading, Mass; Addison Wesley: Boston, MA, USA, 1993. [Google Scholar]

- De Mello, L.R., Jr. Foreign direct investment in developing countries and growth: A selective survey. J. Dev. Stud. 1997, 34, 1–34. [Google Scholar] [CrossRef]

- Xu, G.; Wang, R. The Effect of foreign direct investment on domestic capital formation, trade and economic growth in a transition economy: Evidence from China. Glob. Econ. J. 2007, 7, 1–21. [Google Scholar] [CrossRef]

- Kumar, N.; Pradhan, J.P. FDI, externalities, and economic growth in developing countries: Some empirical explorations and implications for WTO negotiations on investment. In RIS Discussion Paper No. 27/2002; India Habitat Centre: New Delhi, India, 2002. [Google Scholar]

- Braunstein, E.; Epstein, G. Bargaining power and foreign direct investment in China: Can 1.3 billion consumers tame the multinationals? In CEPA Working Paper 2002/13; Centre for Economic Policy Analysis: New York, NY, USA, 2002. [Google Scholar]

- You, K.; Solomon, O.H. China’s outward foreign direct investment and domestic investment: An industrial level analysis. China Econ. Rev. 2015, 34, 1–39. [Google Scholar] [CrossRef]

- Ameer, W.; Xu, H.; Alotaish, M.S. Outward foreign direct investment and domestic investment: Evidence from China. Econ. Res. Ekon. Istraž. 2017, 1, 777–788. [Google Scholar] [CrossRef] [Green Version]

- Sauramo, P. Does outward Foreign Direct Investment Reduce Domestic Investment (Discussion Paper 239). Labor Institute for Economic Research. Available online: http://www.labour.fi/tutkimusjulkaisut/tyopaperit/sel239.pdf (accessed on 5 March 2010).

- Morrissey, O.; Udomkerdmongkol, M. Governance, private investment and foreign direct investment in developing countries. World Dev. 2012, 40, 437–445. [Google Scholar] [CrossRef]

- Shah, S.H.; Ameer, W.; Delpachitra, S. OFDI impact on private investment in the gulf economies. Sustainability 2020, 12, 4492. [Google Scholar] [CrossRef]

- Ameer, W.; Sohag, K.; Xu, H.; Halwan, M.M. The Impact of OFDI and institutional quality on domestic capital formation at the disaggregated level: Evidence for developed and emerging countries. Sustainability 2020, 12, 3661. [Google Scholar] [CrossRef]

- Durani, F.; Ameer, W.; Meo, M.S.; Husin, M.M. Relationship between outward foreign direct investment and domestic investment: Evidence from GCC countries. Asian Econ. Financ. Rev. 2021, 11, 278–291. [Google Scholar] [CrossRef]

- Herzer, D.; Schrooten, M. Outward FDI and domestic investment in two industrialized countries. Econ. Lett. 2008, 99, 139–143. [Google Scholar] [CrossRef]

- UNCTAD. World Investment Report; United Nations Conference on Trade and Development: Geneva, Switzerland, 2004. [Google Scholar]

- Shah, S.H.; Ahmad, M.H.; Ahmed, Q.M. The nexus between sectoral FDI and institutional quality: Empirical evidence from Pakistan. Appl. Econ. 2016, 48, 1591–1601. [Google Scholar] [CrossRef]

- Khan, M.S.; Reinhart, C. Private Investment and Economic Growth in the Developing Countries; World Bank: Washington, DC, USA, 1990; pp. 19–27. [Google Scholar]

- Erenburg, S.J.; Wohar, M.E. Public and private investment: Are there causal linkages. J. Macro Econ. 1995, 17, 1–30. [Google Scholar] [CrossRef]

- Dollar, D.; Kraay, A. Growth is good for the poor. In World Bank Policy Research Department Working Paper 2001, No. 2587; The World Bank: Washington, DC, USA, 2001. [Google Scholar]

- Chang, H.J. Institutions and economic development: Theory, policy and history. J. Inst. Econ. 2011, 7, 473–498. [Google Scholar] [CrossRef] [Green Version]

- Pesaran, M.H.; Tosetti, E. Large panels with common factors and spatial correlation. J. Econom. 2011, 161, 182–202. [Google Scholar] [CrossRef] [Green Version]

- Pesaran, M.H. General diagnostic tests for cross section dependence in panels. Empir. Econ. 2004, 60, 13–50. [Google Scholar] [CrossRef]

- Pesaran, M.H. A simple panel unit root test in the presence of cross-section dependence. J. Appl. Econom. 2007, 22, 265–312. [Google Scholar] [CrossRef] [Green Version]

- Im, K.S.; Pesaran, M.H.; Shin, Y. Testing for unit roots in heterogeneous panels. J. Econom. 2003, 115, 53–74. [Google Scholar] [CrossRef]

- Levin, A.; Lin, C.F.; Chu, C.S.J. Unit root tests in panel data: Asymptotic and finite-sample properties. J. Econom. 2002, 108, 1–24. [Google Scholar] [CrossRef]

- Maddala, G.S.; Wu, S. A Comparative study of unit root tests with panel data and a new simple test. Oxf. Bull. Econ. Stat. 1999, 61, 631–652. [Google Scholar] [CrossRef]

- Bai, J.; Ng, S. A panic attack on unit roots and cointegration. Econometrica 2004, 72, 1127–1177. [Google Scholar] [CrossRef] [Green Version]

- Choi, I. Combination unit root tests for cross-sectionally correlated panels. In Econometrics Theory and Practice: Frontiers of Analysis and Applied Research; Corbae, D., Durlauf, S.N., Hansen, B.E., Eds.; Cambridge University Press: Cambridge, UK, 2006; Chapter 12; pp. 311–333. [Google Scholar]

- Moon, H.; Perron, B. Testing for unit root in panels with dynamic factors. J. Econom. 2004, 122, 81–126. [Google Scholar] [CrossRef] [Green Version]

- Smith, L.V.; Leybourne, S.; Kim, T.H.; Newbold, P. More powerful panel data unit root tests with an application to mean reversion in real exchange rates. J. Appl. Econom. 2004, 19, 147–170. [Google Scholar] [CrossRef]

- Sadorsky, P. Do urbanization and industrialization affect energy intensity in developing countries? Energy Econ. 2013, 37, 52–59. [Google Scholar] [CrossRef]

- Driffield, N.; Hughes, D. Foreign and domestic investment: Regional development or crowding out? Reg. Stud. 2003, 37, 277–288. [Google Scholar] [CrossRef]

- Mišun, J.; Tomšk, V. Does foreign direct investment crowd in or crowd out domestic investment? Eastern Eur. Econ. 2002, 40, 38–56. [Google Scholar]

- Mamun, M.A.; Sohag, K. Revisiting the dynamic effect of foreign direct investment on economic growth in LDCs. Int. J. Econ. Pol. Emerg. Econ. 2015, 8, 97–118. [Google Scholar] [CrossRef]

- Sohag, K.; Chukavina, K.; Samargandi, N. Renewable energy and total factor productivity in OECD member countries. J. Clean. Prod. 2021, 296, 126499. [Google Scholar] [CrossRef]

- Zeqiraj, V.; Sohag, K.; Soytas, U. Stock market development and low-carbon economy: The role of innovation and renewable energy. Energy Econ. 2020, 91, 104908. [Google Scholar] [CrossRef]

- Dumitrescu, E.I.; Hurlin, C. Testing for Granger non-causality in heterogeneous panels. Econ. Model. 2012, 29, 1450–1460. [Google Scholar] [CrossRef] [Green Version]

| Variable | Description | Theoretical Explanation of the Variables | Source |

|---|---|---|---|

| DCF | Domestic Capital Formation share of GDP | Domestic capital formation increases productivity as well as helps achieve technical development and stimulate economic activities in a country [17]. | WDI |

| OFDI | Foreign Direct Investment Outflows share of GDP | Outbound investment positively stimulates the production of the local industry in the source countries by providing them access to adequate finance, advanced technology, sufficient financial resources, technical skills as well as access to the global chain of production [35]. | WDI |

| IFDI | Incoming Foreign Direct Investment share of GDP | IFDI increases production and stimulates the exports in recipient countries by transporting capital assets, latest technologies as well as access to financial and managerial expertise [36]. | WDI |

| GR | GDP Growth rate of the GCC countries | GDP growth expands socioeconomic activities, enhances productivity, boosts technical skills and stimulatess economic development in a economy [18]. | WDI |

| PRI | Private Capital Formation share of GDP | Private capital formation stimulates as well as enhances output, sharpens technical and professional development as well as encourages economic development in a country [37]. | IMF Fiscal Affairs Department |

| PUBI | Public Capital Formation share of GDP | Classical economists assert that public investment negatively influences economic activities [17] while Keynesians claim that it positively contributes to economic development of the economy [38]. | IMF Fiscal Affairs Department |

| TRD | Trade Openness. Total trade share of GDP | Trade openness diversifies an economy and stimulates economic development in a economy [39]. | WDI |

| IQ | Quality of institutions in the GCC Countries. Index values | Institutional Quality reduces cost of business, safeguards property rights and provides an encouraging environment for business to thrive [40]. | International Country Risk Guide (ICRG) dataset |

| Variable | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| DCF | 150 | 21.212 | 5.112 | 10.480 | 34.520 |

| OFDI | 150 | 1.450 | 3.172 | −10.350 | 9.550 |

| IFDI | 150 | 2.362 | 3.760 | −5.285 | 33.560 |

| GR | 150 | 5.222 | 5.833 | −7.071 | 33.990 |

| PRI | 150 | 26.155 | 12.833 | 8.233 | 70.221 |

| PUBI | 150 | 14.866 | 9.400 | 3.588 | 50.577 |

| TRD | 150 | 85.266 | 32.100 | 39.078 | 87.877 |

| IQ | 150 | 5.600 | 0.942 | 3.800 | 7.600 |

| Variable | ρˆ | CD | Levels CIPS | First Differences CIPS |

|---|---|---|---|---|

| DCF | 0.533 | 9.831 *** | −0.234 | −2.400 *** |

| OFDI | 0.311 | 4.266 *** | −0.900 | −6.800 *** |

| IFDI | 0.255 | 4.600 *** | 0.444 | −5.200 *** |

| GR | 0.199 | 2.666 *** | −1.044 | −6.172 *** |

| TRD | 0.477 | 8.611 *** | 3.222 | −3.311 *** |

| PRI | 0.644 | 12.412 *** | −0.555 | −5.655 *** |

| PUBI | 0.566 | 10.913 *** | −1.900 ** | −5.300 *** |

| IQ | 0.811 | 15.724 *** | 0.750 | −6.400 *** |

| DV: DCF | M1.1 | M1.2 | M1.3 | M1.4 |

|---|---|---|---|---|

| Error Correction (EC) | −0.173 *** | −0.431 *** | −0.269 *** | −0.538 *** |

| (−3.160) | (−4.455) | (−3.100) | (0.147) | |

| Long-term estimates | ||||

| OFDI | 0.548 | 0.447 | 0.391 | 0.022 |

| (1.451) | (1.36) | (1.64) | (0.224) | |

| IFDI | −0.812 *** | 0.021 | −0.398 ** | 0.010 |

| (−2.67) | (0.110) | (−2.333) | (0.108) | |

| GR | 0.207 | −0.081 | 0.131 | 0.024 |

| (0.531) | (−0.900) | (0.522) | (0.056) | |

| TRD | −0.054 *** | −0.100 *** | −0.050 *** | |

| (−4.355) | (−3.133) | (0.008) | ||

| IQ | 1.039 | 0.752 | ||

| (0.532) | (0.755) | |||

| SB | 5.535 *** | |||

| (0.907) | ||||

| Short-term estimates | ||||

| ∆ OFDI | −0.1976 | −0.2281 | −0.2717 | −0.538 *** |

| (−1.01) | (−1.05) | (−1.27) | (0.147) | |

| ∆ IFDI | 0.006 | −0.0491 | 0.1435 | −0.353 |

| (0.11) | (−0.69) | (1.40) | (0.295) | |

| ∆ GR | 0.0371 | 0.0102 | −0.0214 | 0.155 |

| (0.36) | (0.18) | (−0.34) | (0.127) | |

| ∆ TRD | −0.0451 | −0.0202 | 0.0359 | |

| (−1.30) | (−1.02) | (0.0702) | ||

| ∆ IQ | 3.3089 *** | −0.0153 | ||

| (3.60) | (0.0229) | |||

| 3.085 *** | ||||

| (0.633) | ||||

| Constant | 6.5960 *** | 4.3242 *** | 2.8801 ** | 10.21 *** |

| (2.91) | (5.35) | (2.08) | (2.714) | |

| Observations | 144 | 144 | 144 | 144 |

| Country | 06 | 06 | 06 | 06 |

| DV: PRI | M2.1 | M2.2 | M2.3 | M2.4 | M2.5 |

|---|---|---|---|---|---|

| Long run | |||||

| Error Corr. | −0.144 ** | −0.203 * | −0.291 * | −0.234 ** | −0.374 *** |

| (−2.342) | (−1.688) | (−1.932) | (−1.977) | (0.109) | |

| Long-term estimates | |||||

| OFDI | 4.099 *** | 7.517 *** | 5.274 *** | 6.755 *** | 3.392 *** |

| (3.350) | (4.271) | (6.321) | (5.022) | (0.658) | |

| IFDI | 0.593 | 2.102 ** | 0.970 * | 0.612 | 1.136 ** |

| (0.811) | (2.577) | (1.866) | (1.020) | (0.344) | |

| GR | −0.957* | −0.723 ** | −0.669 *** | −1.030 *** | 0.090 |

| (−1.80) | (−2.31) | (−3.15) | (−2.97) | (0.260) | |

| TRD | 0.100 | 0.122 | 0.060 | −0.090 *** | |

| (0.98) | (1.60) | (0.81) | (0.0315) | ||

| PUBI | −0.5781 ** | −0.81 * | −0.0923 | ||

| (−2.02) | (−1.88) | (0.163) | |||

| IQ | 11.55 * | 1.308 | |||

| (−1.86) | (2.270) | ||||

| SB | 23.41 *** | ||||

| (5.713) | |||||

| Short-term estimates | |||||

| ∆OFDI | 1.5113 ** | 1.9074 ** | 1.6255 ** | 1.7994 ** | 0.862 *** |

| (2.48) | (2.22) | (2.27) | (2.27) | (0.276) | |

| ∆FDI | 0.0138 | 0.1132 | −0.1355 | −0.0291 | 0.373 *** |

| (0.04) | (0.39) | (−0.46) | (−0.11) | (0.115) | |

| ∆GR | 0.1069 | 0.0639 | −0.0868 | −0.0510 | 0.00775 |

| (0.73) | (0.50) | (−1.04) | (−0.48) | (0.0696) | |

| ∆TRD | 0.0175 | 0.0440 | 0.0468 | 0.0510 | |

| (0.59) | (1.29) | (1.15) | (0.0466) | ||

| ∆PUBI | 0.0622 | 0.0070 | 0.233 | ||

| (0.23) | (0.03) | (0.268) | |||

| ∆IQ | 1.3299 | 4.291 * | |||

| (0.92) | (2.479) | ||||

| ∆SB | −3.779 | ||||

| (2.526) | |||||

| Constant | 7.5216 ** | 1.4619 | −3.2534 * | 0.57 | 8.617 *** |

| (2.00) | (0.74) | (−1.84) | (0.36) | (2.531) | |

| Observations | 144 | 144 | 144 | 144 | 144 |

| DV: PUBI | M3.1 | M3.2 | M3.3 | M3.4 | M3.5 |

|---|---|---|---|---|---|

| Error Corr. | −0.2555 *** | −0.4597 ** | −0.4473 ** | −0.4406 ** | −0.238 *** |

| (−3.800) | (−2.400) | (−1.500) | (−1.960) | (0.0855) | |

| Long-term estimates | |||||

| OFDI | −1.0443 *** | 0.3320 | −1.475 *** | −1.123 *** | −1.047 ** |

| (−2.710) | (1.440) | (−7.690) | (−6.340) | (0.511) | |

| IFDI | 0.6758 | 0.3190 ** | 1.3290 *** | 0.3764 | 1.890 *** |

| (1.240) | (1.980) | (3.550) | (1.640) | (0.550) | |

| GR | −0.4884 ** | −0.1699 *** | −0.7211 *** | −0.504 *** | −0.207 |

| (−2.200) | (-3.270) | (−6.280) | (−5.150) | (0.128) | |

| Trade | −0.0571 *** | −0.1050 *** | −0.047 *** | −0.0127 | |

| (−5.470) | (−5.830) | (−4.280) | (0.0467) | ||

| PRI | −0.0909 | 0.0924 | −0.0249 | ||

| (−1.030) | (1.330) | (0.0948) | |||

| IQ | 4.440 | 2.607 | |||

| (0.220) | (2.069) | ||||

| SB | 1.677 | ||||

| (3.601) | |||||

| Short-term estimates | |||||

| ∆ OFDI | −0.5135 * | −0.3381 | −0.3532 | −0.1770 | −0.220 |

| (−1.830) | (−1.270) | (0.334) | (−0.920) | (0.177) | |

| ∆ IFDI | 0.0003 | 0.0275 | −0.790 | 0.3074 ** | 0.324 * |

| (0.000) | (0.610) | (0.122) | (2.080) | (0.196) | |

| ∆ GR | −0.1959 | −0.1399 | −0.1661 *** | −0.202 *** | −0.108 *** |

| (−1.63) | (−1.46) | (−4.77) | (−4.21) | (0.0349) | |

| ∆ Trade | 0.0089 | 0.0391 | 0.0376 | 0.0429 | |

| (0.210) | (0.650) | (0.6600) | (0.0669) | ||

| ∆ PRI | −0.0680 | −0.0688 | −0.0927 | ||

| (−0.410) | (−0.430) | (0.145) | |||

| ∆ INST | −0.342 | −1.595 | |||

| (−0.150) | (1.475) | ||||

| ∆ SB | −2.636 | ||||

| (2.390) | |||||

| Constant | −0.5335 | −1.6530 | 5.980 *** | −0.7945 | −3.093 ** |

| (−0.62) | (−0.99) | (3.16) | (−0.83) | (1.401) | |

| Observations | 144 | 144 | 144 | 144 | 144 |

| Country | 6 | 6 | 6 | 6 | 6 |

| Pair | Outcome | Pair | Outcome | ||

|---|---|---|---|---|---|

| 1.2056 | No | 10.8143 *** | Yes | ||

| −0.3614 | No | 0.5071 | No | ||

| −0.7747 | No | −0.8778 | No | ||

| 1.9002 ** | Yes | 4.8475 *** | Yes | ||

| 3.3940 *** | Yes | −0.7973 | No | ||

| 0.7353 | No | 0.7353 | No |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ameer, W.; Xu, H.; Sohag, K.; Shah, S.H. Outflow FDI and Domestic Investment: Aggregated and Disaggregated Analysis. Sustainability 2021, 13, 7240. https://doi.org/10.3390/su13137240

Ameer W, Xu H, Sohag K, Shah SH. Outflow FDI and Domestic Investment: Aggregated and Disaggregated Analysis. Sustainability. 2021; 13(13):7240. https://doi.org/10.3390/su13137240

Chicago/Turabian StyleAmeer, Waqar, Helian Xu, Kazi Sohag, and Syed Hasanat Shah. 2021. "Outflow FDI and Domestic Investment: Aggregated and Disaggregated Analysis" Sustainability 13, no. 13: 7240. https://doi.org/10.3390/su13137240

APA StyleAmeer, W., Xu, H., Sohag, K., & Shah, S. H. (2021). Outflow FDI and Domestic Investment: Aggregated and Disaggregated Analysis. Sustainability, 13(13), 7240. https://doi.org/10.3390/su13137240