1. Introduction

Since reforming and “opening up” the economy in the late 1970s, China’s industrial development has made remarkable achievements. However, its development model of “pollution first, treatment later” has created environmental concerns (Xiong et al., 2018 [

1]). In particular, large amounts of smoke, dust, sulfur oxides, nitrogen oxides, and other harmful gas emissions have adversely affected the health of many people in society. According to the State of 2019 Global Air, up to 1.2 million people in China suffer from various diseases due to long-term exposure to indoor and outdoor air pollution in 2017. In addition, air pollution has shortened the average life expectancy of people in China by approximately 23 months (Health Effects Institute, 2019 [

2]), of which outdoor air pollution is responsible for 15 months.

Currently, China is in a period of industrial green transformation; therefore, solving severe ecological environment problems is crucial. Technology is a fundamental driving force for alleviating air pollution. Air pollution control technology not only comes from domestic research and development but also relies on importation of advanced clean production technology. Spillovers from foreign direct investment (FDI) technology and international trade technology have become the main means of technology transfer and diffusion across the globe (Keller, 2010 [

3]; Hoekman et al., 2006 [

4]). In contrast, limited by factors such as intellectual property protection, external environment, capital conditions, and technology costs, it is undoubtedly a more direct way to use import trade to introduce and absorb advanced foreign technology (Qu, et al., 2013 [

5]).

The scale of import trade to China has increased significantly in recent decades. According to China Customs statistics, the total value of China’s import trade from 1998 to 2019 increased from 1.16 trillion and 14.31 trillion yuan, an increase of 1134%. Based upon the structure of imported goods, according to the 2017 China Green Trade Development Report, however, China’s capacities for environmental protection and technological innovation are relatively weak. Some environmentally friendly and energy-saving production process equipment and environmental-monitoring equipment, such as air-, water-, and soil-monitoring equipment and core technologies, basically rely on imports. Some intermediate products with high technological content, such as solar-grade polysilicon, automobile engines, and computer chips, also need to be imported in large quantities. Undeniably, the spillovers of environmental protection technology brought about by import trade can have a profound impact on the improvement of China’s atmospheric environmental quality. Therefore, in this critical period of industrial green development transition and import trade expansion stage for China, the relationships between import trade technology spillovers and industrial air pollution emissions are worthy of further research.

2. Literature Review

In the context of international trade, research on the relationship between technology spillovers and air pollution is reflected mainly in two aspects: (1) the perspective of the environmental effects of trade liberalization, that is, scale, structural, and technical effects, and (2) the perspective of the direct effect of foreign trade technology spillovers.

Theoretical research on the environmental impact of international trade was conducted initially by Grossman and Krueger (1991) [

6], who proposed that international trade affects the environmental quality by exerting scale, structural, and technological effects on economic activities. These three environmental effects of trade liberalization have become important theoretical cornerstones for subsequent studies. Some studies have primarily focused on the impact of technological effects of international trade on global air pollution in both developed and developing countries (Managi et al., 2008 [

7]; Kukla-Gryz, 2009 [

8]). These studies can be categorized into two groups. First, the scale effect surpasses technological and structural effects, causing trade liberalization to aggravate air pollution (Copeland and Taylor, 1994 [

9]; Grossman and Krueger, 1995 [

10]). Second, technological and structural effects dominate, causing trade to alleviate air pollution (Antweilier et al., 2001 [

11]; Cole and Elliott, 2003 [

12]; Di Maria and Smulders, 2005 [

13]). In studies belonging to the latter category, some scholars focused on microlevels such as the internal regions and industries of individual countries. Based on three major environmental effects noted above, Benarroch and Werder (2006) [

14] developed a two-country model, wherein there is final and intermediate goods production to verify whether the technological effect can reduce pollution in the intra-industry trade of intermediate products. For China, Jayanthakumaran and Liu (2012) [

15] adopted a simultaneous equations system model to explore the relationships between provincial-level trade, growth, and SO

2 emissions. Their result showed that the China’s scale effect from 1990 to 2007 surpassed the technological effect and occupied a dominant position among the three effects. Xu et al., (2020) [

16] used a spatial lag model to confirm that the trade liberalization of 279 prefecture-level cities in China has reduced PM

2.5 concentration. The main reason is that the impact of technical effects on haze pollution exceeds those of scale and structural effects.

Some scholars have explored the relationship between technology spillovers and environmental pollution based on the direct impacts of foreign trade technology spillovers. Three viewpoints exist regarding the direction of influence. The first viewpoint is that technology spillovers in foreign trade have reduced pollution emissions. Grubb et al., (2002) [

17] and Prakash et al., (2007) [

18] demonstrated that import and export market prices and the quality of foreign commodities put competitive pressure on domestic companies of importing countries. The competitive effect led companies to upgrade their environmental protection technology to reduce the intensity of pollutant emissions. Youssef (2009) [

19] used game theory to prove that, in most cases, the opening of the international trade market increased research and development (R&D) spillovers, thereby reducing the pollutant emission rate of the host country. Liu et al., (2017) [

20] performed the spatial index decomposition analysis to suggest that China should adopt an active import policy and incorporate advanced production and emission technologies from developed countries to reduce air pollution. Uddin and Khan (2013) [

21] used panel econometric methods, selected 72 countries, and verified that imported environmental goods and services technology spillovers reduce air pollution.

The second viewpoint is that foreign trade technology spillovers increase pollution emissions. Albornoz et al., (2009) [

22] alleged that competitive pressure is not conducive to technology spillovers in foreign trade. The effect of competition may reduce the profits of importing countries’ enterprises, which can reduce energy efficiency and technological transformation expenditures. This scenario results in higher emissions of greenhouse gas.

The third viewpoint is that the impact of foreign trade technology spillovers on environmental pollutant emissions is uncertain because of other restricting factors. Lovely and Popp (2011) [

23] reported that in constructing a general equilibrium model of free trade, the uncertain relationship between foreign trade technology spillovers and pollutant emissions is affected by environmental regulations. Perkins and Neumayer (2012) [

24] noted that whether the energy-saving and emission reduction effects of foreign trade technology spillovers can be effectively used depends on the absorptive capacity of the importing country, such as the level of education. Hao et al., (2021) [

25] constructed the China’s intellectual property protection system. Restricted by China’s regional heterogeneity, the interaction between trade technology spillovers and IPP restrains carbon emissions in the western region but increases environmental pollution in the eastern and central regions.

Additionally, less attention has been paid to the relationship between import trade technology spillovers and air pollution, and most studies have explored the effect of import trade technology spillovers on the total factor production efficiency (TFP). In other words, these studies have explored the technology spillover effect of import trade. Coe and Helpman (1995) [

26] pioneered the calculation of foreign R&D capital by computing the foreign R&D stocks based on a country’s import share from trading partner countries. Additionally, regression models have been used to empirically analyze whether foreign R&D investment increases the total factor productivity of importing countries. Furthermore, Coe et al., (1997) [

27] verified the effect of technology spillovers in 22 industrialized countries from 1971 to 1990 on the total factor productivity of 77 developing countries; on an average, for every 1% increase in the R&D capital stock of industrialized countries, the TFP of developing countries increases by 0.06%. Since then, many other factors have been regularly introduced to modify the research results of Coe and Helpman (1995) [

26]. For example, Lichtenberg and Potterie (1998) [

28] changed the weightage of the R&D input density, which greatly reduced the total deviation in the original model. Falvey et al., (2002) [

29] introduced the concept of private goods and public goods. They proposed that the spillover effects of import trade can only play a role in technology-receiving countries if the technical knowledge is pertaining to public goods. Madsen (2007) [

30] weighed foreign R&D with per capita imports and empirically tested that imported trade technology spillovers can double TFP growth. Moreover, other studies have used imported capital goods and intermediate goods to replace the total import trade in the model to measure international technology spillovers (Xu and Wang, 1999 [

31]; Kasahara and Rodrigue, 2008 [

32]; Cuadros and Alguacil, 2014 [

33]). All these studies confirmed that the import trade technology spillovers from developed countries have a positive effect on the TFP, economic growth, and technological innovation of developing countries.

The aforementioned studies suggest that technology spillovers of import trade have an important effect on the economic development and technological innovation of a country. In addition, based on the perspective of the environmental effects of international trade or foreign trade technology spillovers, technology spillovers brought about by international trade channels affect the environmental pollution levels of importing countries. Nevertheless, the existing literature has at least three shortcomings. First, studies have mainly focused on independent research of air pollution caused by trade liberalization. Most of the scholars have rarely studied the relationship between import trade technology spillovers and air pollution from the perspective of R&D spillovers. Second, the environmental effects of technology spillovers of imported trade have not been studied. Existing literature focuses more on the environmental effects of international trade and the technology spillover effects of imported trade. However, the technology spillover, as a transfer of foreign technology, also directly or indirectly affects the air pollution of importing countries via environmental factors. Third, the effect of foreign trade technology spillovers has been studied based on greenhouse gas emissions rather than industrial air pollutant emissions in most of these studies.

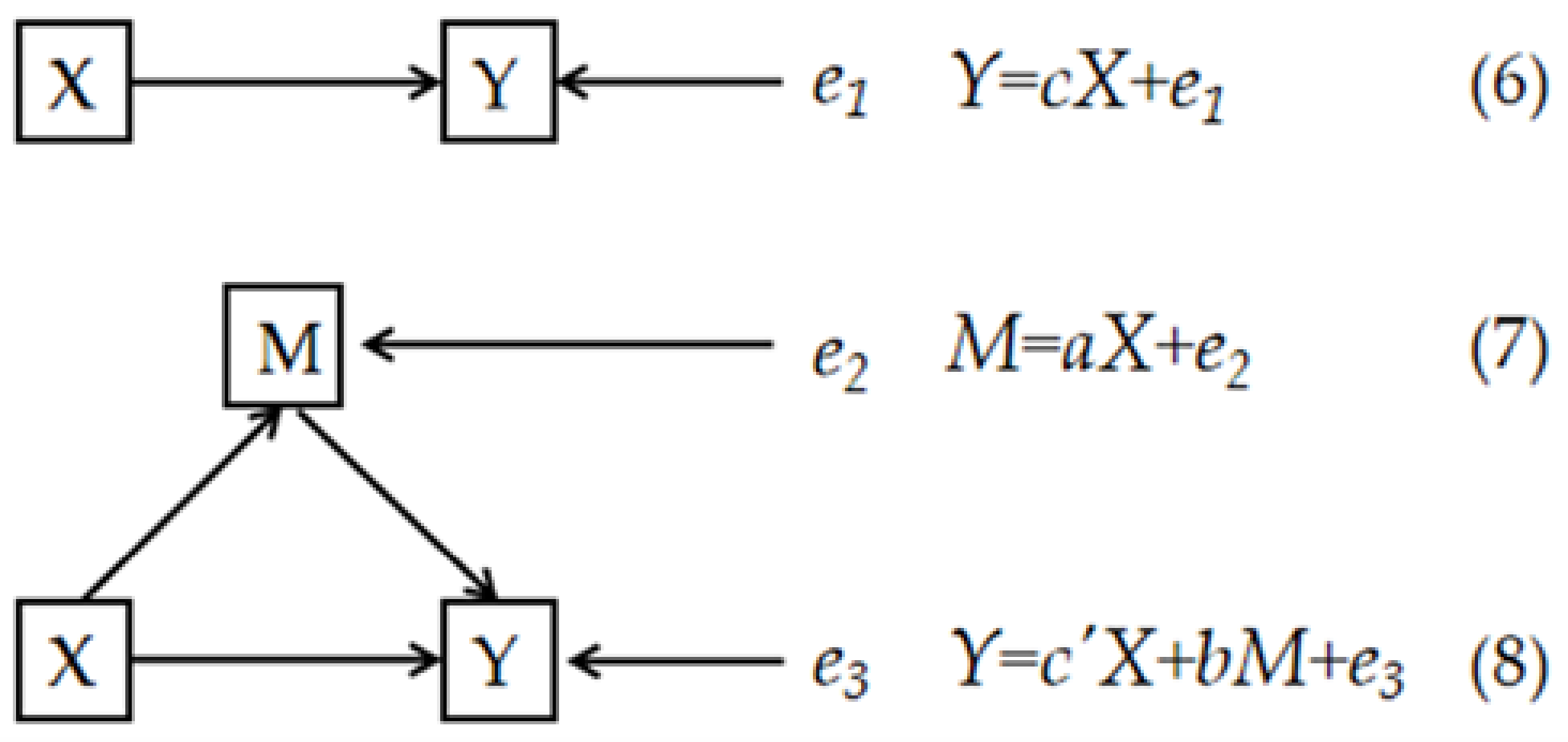

Hence, to address the deficiencies of existing research, we contribute to the literature in following three aspects. First, in terms of research content, this paper not only considers the direct effect of the import trade technology spillovers on the intensities of industrial air pollution emission. but also uses mediating effect models to analyze how import trade technology spillovers affect the intensities of industrial air pollution emission through mediating variables of economic scale, industrial structure, and technological innovation. Second, we use the generalized spatial two-stage least squares method (GS2SLS) method for empirical analysis. Compared with other spatial econometric models (i.e., spatial auto regression model, spatial Durbin model, and spatial error model), this method provides more robust research hypothesis testing because even with heteroscedasticity and non-normal distributions, the empirical results still maintain a consistent estimate. Thirdly, in terms of variable construction for estimating China’s imported capital goods and intermediate goods, we innovatively construct the technology spillovers of capital goods and intermediate goods per capita.

3. Research Hypotheses

The literature review section shows that the import trade channel has a certain external effect on a country’s economic growth and technological progress through materialization in commodities. Moreover, international trade affects air pollution by generating scale, structural, and technological effects on economic activities. To sort out these effects of import technology spillovers on air pollution in China along with the channels through which these effects take place, this paper puts forward three research hypotheses.

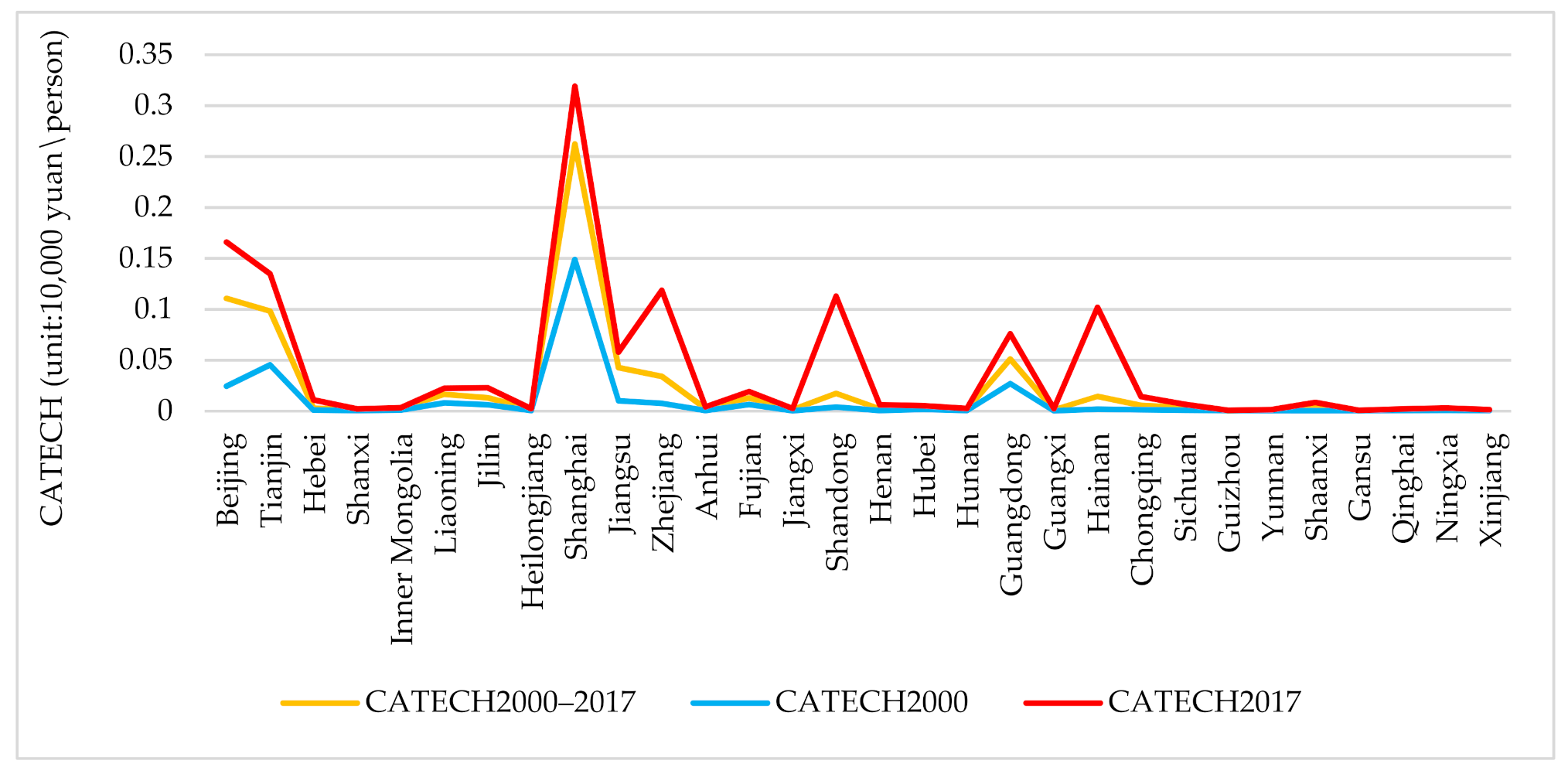

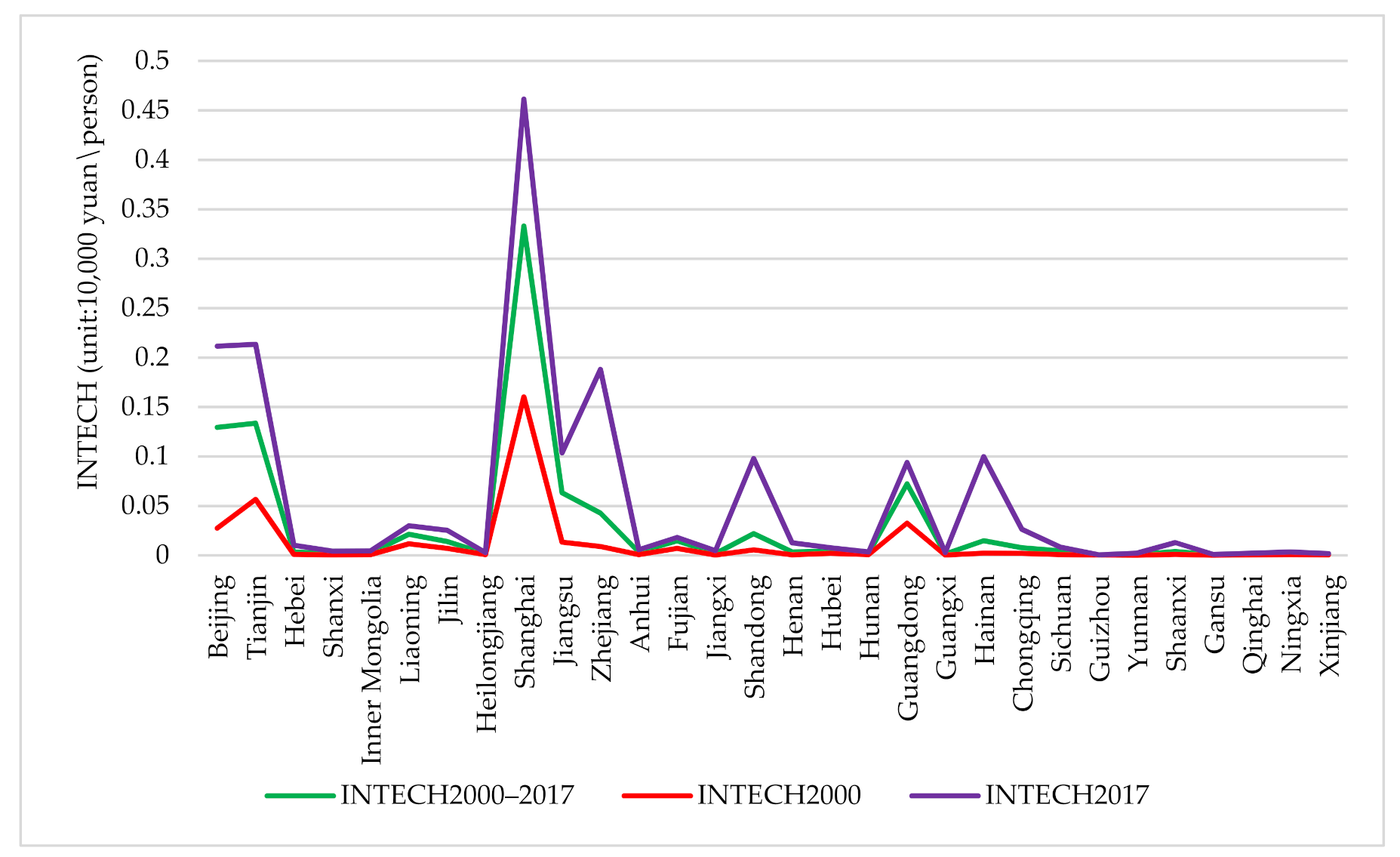

Figure 1 presents the relationships envisioned among technology spillovers of import trade, intermediary variables, and industrial air pollution.

For Hypothesis 1, foreign R&D knowledge indirectly affects the technological progress of importing countries through the import trade channel, thereby promoting economic development. The subsequent expansion of economic scale leads to increasing the intensity of industrial air pollution emissions. If technological progress and government supervision cannot effectively curb the environmental pollution, the scale effect exerted by technology spillover promotes an increase in air pollution.

For much of its development, China’s heavy industry-based industrial structure has been dependent on nonclean energy sources, resulting in a large amount of polluting waste during industrial production and operation (Lam 2005 [

34], Jin et al., 2011 [

35]). However, imported trade technology spillovers, as a form of diffusion of advanced foreign technology, can promote the shift of industrial structure from primary industries such as agriculture and secondary industries to tertiary industries such as science and technology. Specifically, technology spillovers can reduce the intensity of industries with high pollution and high energy consumption in heavy industries. These high value-added and high-tech imported goods help increase the proportion of tertiary industries in the economy along with their low-pollution and low-emission characteristics. These connections lead to Hypothesis 2 occurring with China’s economy.

Finally, Hypothesis 3 is related to the “increasing intermediate varieties” model (Grossman and Helpman, 1991 [

36]). Increases of intermediate varieties can bring about diversified technological spillovers, allowing final products to be more in line with green requirements. In addition, importing high-quality intermediate products into the production of final products can enhance the technological progress of importing countries. This idea is mainly reflected in the “quality ladder model” (Aghion and Howitt, 1990 [

37]; Grossman and Helpman, 1991 [

38]). Therefore, higher-quality intermediate product inputs lead to more green productivity and environmental protection technology spillovers. Finally, the most direct way of technology spillover is the import of capital goods such as machinery equipment and transportation equipment (Acharya and Keller, 2009 [

39]). Capital goods contain highly technical knowledge, leading to more green technology spillovers.

Hypothesis 1. Technology spillovers from imported trade can bring about economic scale expansion effects. Economic scale expansion has a positive mediating effect on the impact of import trade technology spillover on industrial air pollution emissions. That is, through the effect of economic scale expansion, import trade technology spillovers increase industrial air pollution.

Hypothesis 2. Import trade technology spillovers can bring industrial structural optimization effects. Industrial structure optimization has a negative mediating effect on the impact of import trade technology spillover on industrial air pollution emissions. Thus, through its effect on optimizing industrial structure, import trade technology spillover reduces industrial air pollution.

Hypothesis 3. Import trade technology spillovers can bring about technological innovation effects. Technological innovation has a negative mediating effect on the impact of import trade technology spillover on industrial air pollution emissions. That is, through the effect of enhancing technological innovation, import trade technology spillover reduces industrial air pollution.

6. Conclusions and Policy Implications

6.1. Research Conclusions

This paper analyzes the impact of import trade technology spillovers on industrial air pollution emission intensity in China by examining the channels through which mediation effects take place. We use panel data from 30 provinces and province-level cities between 2000 and 2017 with industrial SO2 and smoke and dust emissions as measures of air pollution. GS2SLS models are used to examine economic scale, industrial structure, and technological innovation as mediating variables. Our research conclusions are listed below.

We find that technology spillovers due to capital and intermediate goods imports have direct and statistically significant reductions in industrial SO2 and smoke and dust emission intensities. These results indicate that technology spillovers of import trade bring about both energy savings and emission reductions. The capital and intermediate goods that China imports from developed countries are of high added value and are made using highly developed technologies. Chinese industrial enterprises have also effectively absorbed green spillovers by improving human resources, R&D investment, and technical exchanges. The characteristics of imported goods and absorption capacity have reduced industrial air pollution emissions.

In addition to direct effects, trade-imported technology spillovers indirectly help improve air quality in China by expanding the economic scale, optimizing the industrial structure, and improving domestic technological innovation. Specifically, technology spillovers have economic scale expansion, industrial structure optimization, and technological innovation effects. Hence, research findings reject Hypothesis 1, while accepting Hypotheses 2 and 3. Further, the technology innovation effect due to technology spillover of capital goods and the structural optimization effect of technology spillover due to intermediate goods have the largest intermediary effects on industrial SO2 emission intensities; that is, a 1% increase reduces emission intensities by 0.0289% and 0.0307%, respectively. However, the scale expansion effect brought by the two technology spillovers has the largest mediating effects on industrial soot and dust emission intensities; that is, a 1% increase reduces emission intensities by 0.0591% and 0.0610%, respectively. In addition to the technological innovation effect, the mediating effect of the technology spillover due to intermediate goods exceeds that of the technology spillover due to capital import.

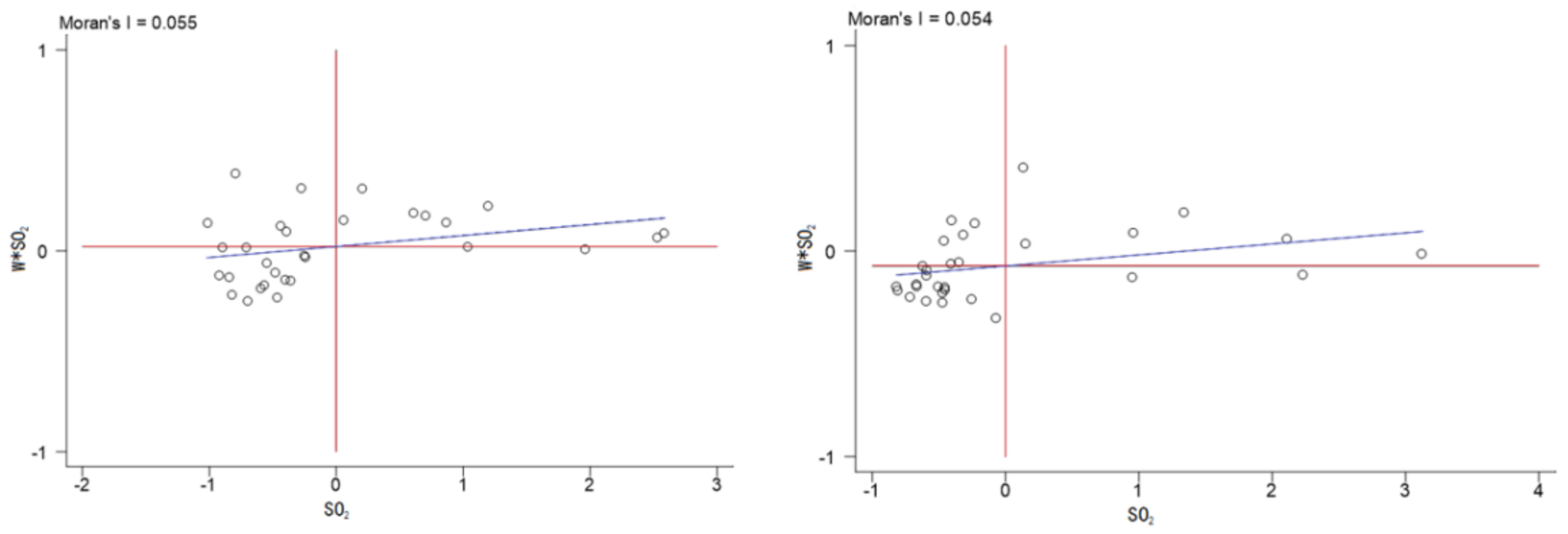

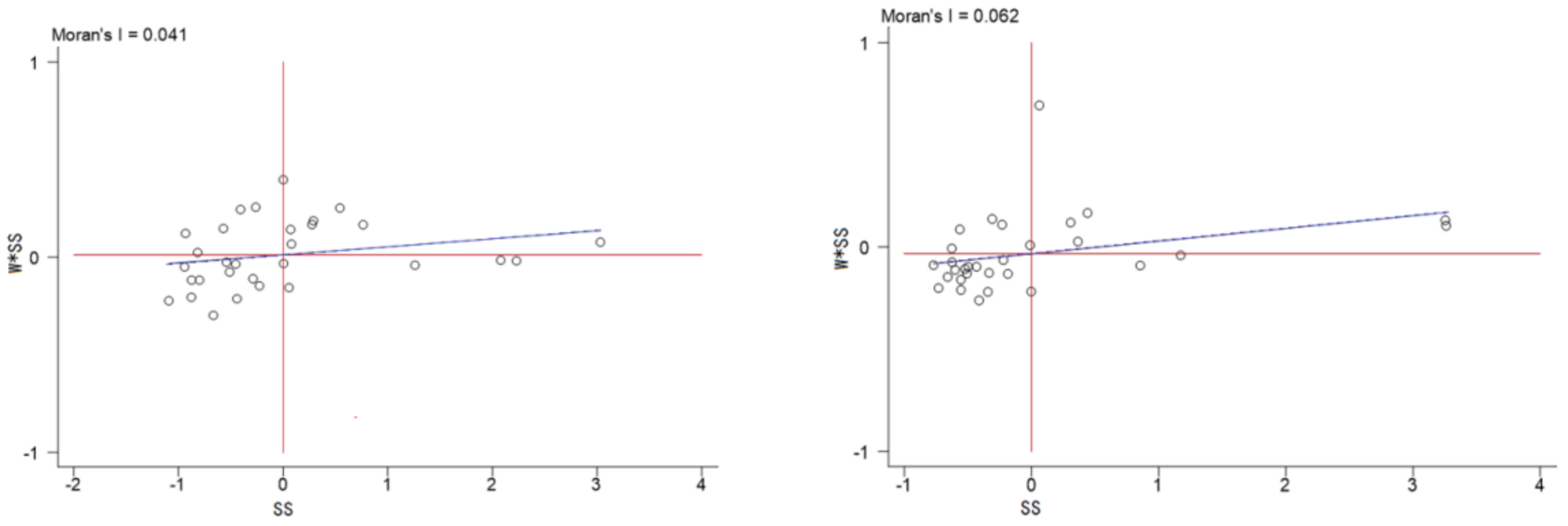

By performing spatial autocorrelation tests and empirical analyses, the emission intensities of industrial SO2, smoke, and dust have obvious spatial spillover effects and time lag effects. From the perspective of spatial agglomeration effects, both the Moran index and GS2SLS models confirm industrial air pollution’s transboundary attributes. Affected by natural factors and the development of regional economic integration, industrial pollutants in a certain area spread to neighboring areas, causing damage to the environment in these neighboring areas. From the perspective of time lag effect, industrial air pollutant emissions in the previous period positively impact air pollutant emissions in the current period, creating a “snowball” effect of compounding air quality deterioration. Furthermore, once the air quality in a certain period deteriorates (improves), the air quality in the subsequent period is likely to be decline (improve).

The regression analysis results showed that energy structure and environmental regulation exacerbated industrial air pollution emissions, whereas the level of urbanization and foreign direct investment reduced environmental pollution emissions. We have four explanations for these results. First, China’s industrial energy consumption is dominated by coal. The burning of coal releases a large amount of harmful gases, aggravating the emission of SO2, smoke, and dust. Second, the lagging effect and inadequacy of investment in industrial environmental governance are important reasons that cause environmental regulations to exacerbate pollution. Third, when urbanization develops to a certain degree, high-quality human resources and green consumption concepts have an inhibitory effect on industrial air pollution. Fourth, FDI’s pollution halo effect is established. FDI causes advanced technology spillovers and enhances industrial air quality.

6.2. Policy Implications

Based on the aforementioned conclusions, we derived the following four policy implications:

The first implication is to expand the scale of import trade. Given that technological spillovers of imported capital goods and intermediate goods have actively reduced the intensity of industrial air pollution emissions by expanding economic scale, optimizing industrial structure, and enhancing technological innovation, further expansion of international trade, especially the importation of clean capital goods and intermediate goods, is an important means to continue improving air quality in China. Speeding up the development process through import trade requires government support and guidance, perhaps in the form of lower tariffs. Examples include reducing and/or exempting tariffs on environmental monitoring equipment, environmental protection materials, and pollution control equipment as well as reducing import tax rates of green products. In addition, the government should increase trade liberalization and facilitation. Measures include simplifying the import process of high-tech products, improving public services for imported environment-friendly products, and optimizing custom clearance services. On the other hand, enterprises should seize the opportunity to expand import trade. They should actively participate in international import trade fairs and purchase imported duty-free cleaning equipment and materials.

The second implication is to strengthen interregional coordination to control industrial air pollution emissions due to existence of spatial spillover effects. Controlling industrial air pollution solely within a single province or city no longer solves environmental problems. Strengthening the inter-regional joint prevention and control mechanism involves three approaches. First, a consultation and decision-making mechanism should be established across regions. Neighboring provinces and cities should jointly formulate emission reduction policies and regulations on industrial air pollution emissions through consultation and exchanges of governments that coordinate the common goals, plans, and action plans of regional cooperative governance. Second, information-sharing mechanisms across regions should be improved. Establishing a regional air pollution forecast, early warning, and monitoring center to share pollution control data is necessary. In addition, provinces and cities that have achieved considerable results in the treatment of industrial air pollution should share advanced experience and technology with surrounding areas. Third, an operable inter-regional benefit balance and compensation mechanism should be established across regions. Based on the experiences of developed countries, each region should realize the balance of ecological compensation and interests through a legal system, responsibility definition, and performance appraisal.

The third implication is choosing the right trading partner. Technological spillovers because of imported goods from nine developed countries have reduced industrial air pollution in China. Developed countries have rich experience and advanced technology for pollution control. Chinese enterprises should expand the scope of import countries and choose to become trade partners with more developed countries. Considering the expertise of developed countries in Asia, China should make use of the superior geographical location and infrastructure to strengthen the construction of free trade zones, facilitating the trading of green products. For distantly located developed countries, market access restrictions and environmental regulations of environmentally protected products should be relaxed to attract more high-quality trade partners.

The final implication is that the causes of industrial air pollution emissions must be determined, and the problem must be solved at inception. Industrial air pollution is caused by human factors such as environmental regulation, energy structure, and foreign direct investment. First, the government should optimize the investment structure, improve the investment efficiency of industrial waste gas treatment, and strengthen the supervision to ensure maximum efficiency of the utilization of government funds. Then, each region should adjust the energy structure, that is, reduce coal consumption and increase the proportion of clean energy. Specific programs include research and development of clean coal technology, increasing the proportion of new energy vehicles, and improving the awareness of green consumption among citizens. Second, provinces and cities should focus on promoting ecological urbanization. The government should rationally plan an intensive and green urban layout. Measures include expediting the upgradation of industrial structure, perfecting transportation facilities, cultivating new environmental protection industries, and rationally utilizing land resources. Finally, enterprises should actively introduce foreign investment in the field of energy conservation and environmental protection. Since this research demonstrated that the “pollution haven” hypothesis is invalid, enterprises should introduce high-quality and clean foreign capital technology and environmental protection standards and pay attention to the development of advanced technology and the green production process of foreign enterprises.

6.3. Limitations and Research Prospects

Although this study provided several valuable insights, it has some limitations.

First, the spillover of imported trade technology not only has an inhibitory effect on industrial sulfur dioxide and smoke and dust, but it also has a certain impact on other environmental pollution such as haze pollution, industrial wastewater, and nitrogen oxides. Moreover, other international technology spillovers, such as technology spillovers due to FDI and export, may also affect environmental pollution. Under the condition of ensuring the availability of data, expanding the research scope of technology spillover and environmental pollution variables is also worth exploring in the future.

Second, we verified the existence of direct and intermediary effects from imported trade technology spillovers on industrial air pollution in China only, but we did not demonstrate whether this research formulation is applicable to other countries. Due to different characteristics of economic development, industrial structure, and technological innovation within each country along with differing scenarios of international trade cooperation and environmental pollution, future research in other countries may find interesting conclusions different from those of China.

Third, the import trade process may be associated with uncertain factors, which could affect the relationships between technology spillovers and industrial air pollution. For example, the uncertainty of trade policies and agreements could affect sustainable green spillovers (Imbruno 2019 [

60]), whereas uncertainties over trade regulations may increase the cost of import spillovers (Qu et al., 2021 [

61]). These uncertainties potentially have important impacts on industrial air pollution. While we use spatial econometrics and past data to examine the possibilities of correlation relationships between technology spillovers and industrial air pollution, to adequately account for uncertainty, it is necessary to use advanced algorithms and game theory to predict future outcomes accounting for uncertainties (Wu et al., 2018 [

62]; Qu et al., 2021 [

63]). Therefore, future research regarding the relationship between import trade and environmental pollution incorporating uncertainty analysis is worthy of pursuit.