The Order Selection Strategy of Polluting OEMs under Environmental Regulations

Abstract

1. Introduction

2. Literature Review

3. Optimal Order Selection Model and Strategy Formulation

3.1. Model Strategy Selection within a Single Foundry Cycle

3.1.1. Basic Model Construction

3.1.2. Optimal Order Selection Strategy

3.1.3. Numerical Analysis under Single-Cycle Model

3.2. Order Selection Strategy in Multi-Foundation Cycle

3.2.1. Optimal Order Selection Strategy

3.2.2. Numerical Analysis in Multi-Foundation Cycle

4. Conclusions

- (1)

- When the OEMs formulate the optimal strategy in single foundry cycle, the conditional probability (failure rate) used to describe the appearance of high-profit foundry orders plays an important role in the decision-making process. Specifically, when monotonically increases or remains unchanged in , the optimal strategy of the firm is H or L, and there is no optimal mixed strategy M; when monotonically decreases in , there may be an optimal mixed strategy M so that the OEMs can obtain the maximum expected profit, which indicates that the conditional probability of high-profit orders is the key to the optimal order selection of the OEMs. In addition, regardless of the distribution of high-profit orders, the OEMs need to determine the corresponding optimal order selection strategy based on the optimal waiting time. Therefore, the optimal waiting-time threshold is important for making an order selection.

- (2)

- In a single foundry cycle, the time value of money is reflected by the discount rate, and the discount rate determines the risk factor and time cost of the OEMs when waiting for high-profit orders. Therefore, the discount rate can reflect the patience of the OEMs to the waiting time well and affect the decision of order selection. Based on the distribution of high-profit orders, the OEMs can combine the upper bound of waiting time or the conditional probability of high-profit orders in response to the discount rate to make optimal order selections. When the discount rate is constant, as long as the upper boundary of the waiting time exceeds the corresponding threshold, the OEMs will choose high-profit orders.

- (3)

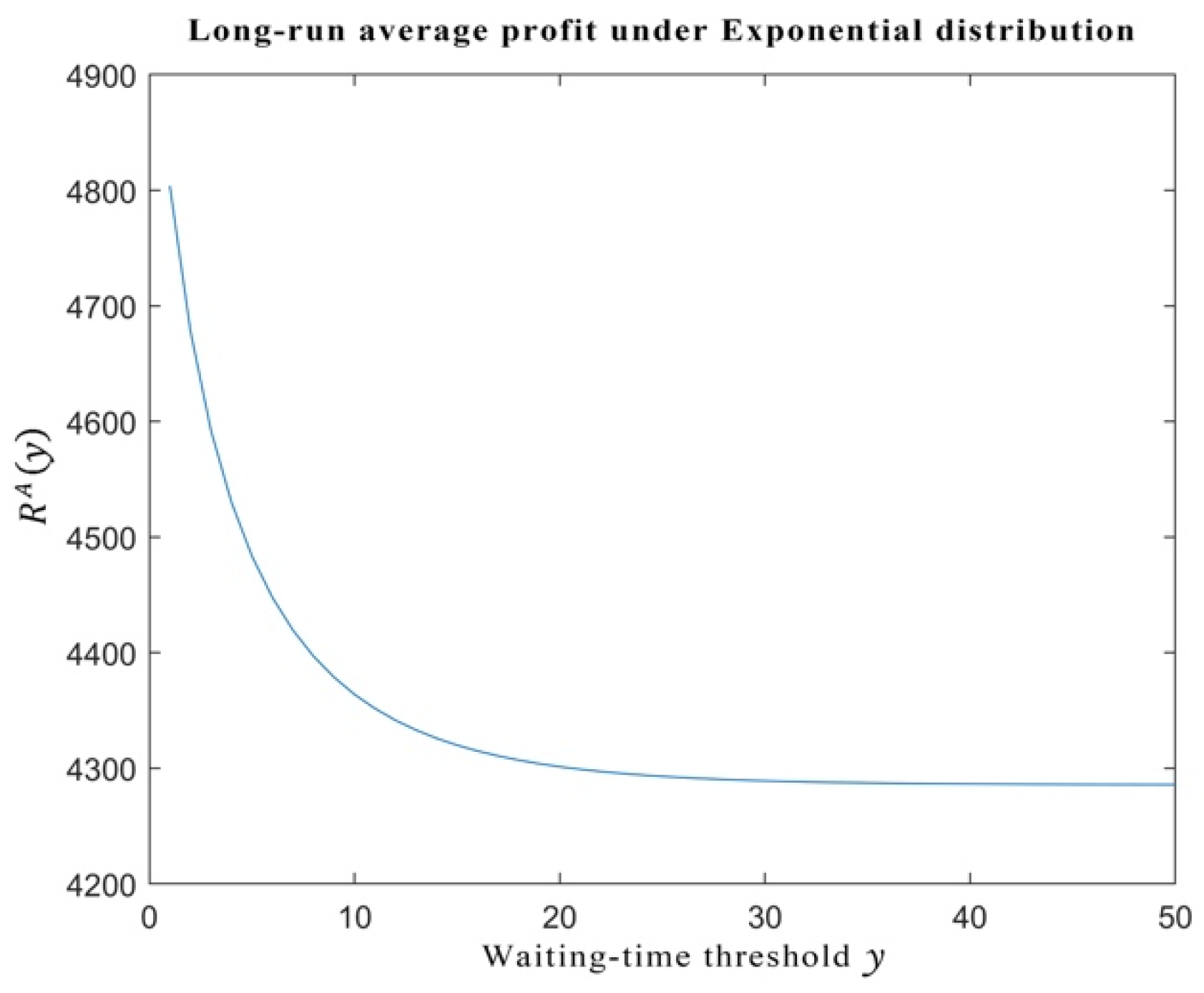

- In a multi-foundation cycle, the OEMs pursue the optimal long-term profit when they make order selection decisions. The conditional probability of the appearance of high-profit orders in multi-foundation cycles still affect the long-term average profits. However, unlike a single-cycle, the specific functional nature of has no effect on the OEMs’ final order selection decision-making. Moreover, the optimal waiting-time threshold , as the main factor of waiting cost, has become the key criterion for the OEMs to make order selection decisions in multi-foundation cycles.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Wu, J. Using Analytic Hierarchy Process to Discuss the Conflict of Transnational Foundry Pollution Transfer. Ecol. Econ. 2014, 30, 86–88. (In Chinese) [Google Scholar]

- Lee, H.L.; So, K.C.; Tang, C.S. The value of information sharing in a two-level supply chain. Manag. Sci. 2000, 46, 626–643. [Google Scholar] [CrossRef]

- Ma, H. and Dong, S. The impact of different types of environmental regulations on carbon emission efficiency. J. Beijing Inst. Technol. (Soc. Sci. Ed.) 2020, 22, 1–10. (In Chinese) [Google Scholar]

- Fan, Q.; Chu, C.; Gao, J. The impact of environmental regulations and industrial structure upgrading on high-quality economic development. China Popul.·Resour. Environ. 2020, 6, 84–94. (In Chinese) [Google Scholar]

- Landi, D.; Capitanelli, A.; Germani, M. Ecodesign and energy labelling: The role of virtual prototyping. Procedia CIRP 2017, 61, 87–92. [Google Scholar] [CrossRef]

- Landi, D.; Consolini, A.; Germani, M.; Favi, C. Comparative life cycle assessment of electric and gas ovens in the italian context: An environmental and technical evaluation. J. Clean. Prod. 2019, 221, 189–201. [Google Scholar] [CrossRef]

- Fan, D.; Sun, X. Environmental Regulation, Green Technology Innovation and Green Economic Growth. China Popul.·Resour. Environ. 2020, 6, 105–115. (In Chinese) [Google Scholar]

- Xu, X.; Zhang, W.; He, P.; Xu, X. Production and pricing problems in make-to-order supply chain with cap-and-trade regulation. Omega 2017, 66, 248–257. [Google Scholar] [CrossRef]

- Guhlich, H.; Fleischmann, M.; Mönch, L.; Stolletz, R. A clearing function based bid-price approach to integrated order acceptance and release decisions. Eur. J. Oper. Res. 2018, 268, 243–254. [Google Scholar] [CrossRef]

- Beemsterboer, B.; Land, M.; Teunter, R. Flexible lot sizing in hybrid make-to-order/make-to-stock production planning. Eur. J. Oper. Res. 2017, 260, 1014–1023. [Google Scholar] [CrossRef]

- Huang, M.; Zhang, Y.; Wang, Y. Optimal decision-making method for merger and packaging of online supermarket split orders. Syst. Eng. Theory Pract. 2021, 41, 286–296. (In Chinese) [Google Scholar]

- Zhang, Y.; Hu, X.; Huang, M.; Sun, L. The Economic Decision Model of Online Supermarket Splitting Order Merging and Packaging Strategy. J. Manag. Sci. 2019, 22, 24–36. Available online: https://kns.cnki.net/kcms/detail/detail.aspx?dbcode=CJFD&dbname=CJFDLAST2020&filename=JCYJ201910003&v=Kw7MO1cZbDY46RdlVcoNzRWfeu7%25mmd2B5I89guG75JB%25mmd2BLyOl4GY%25mmd2BrT18WD7trarytNrK (accessed on 23 April 2021). (In Chinese).

- Xu, X.; He, P.; Xu, H.; Zhang, Q. Supply Chain Coordination with Green Technology under Cap-and-Trade Regulation. Int. J. Prod. Econ. 2016, 183, 433–442. [Google Scholar] [CrossRef]

- Wang, Z.; Li, T.; Yue, C. Online scheduling based on multiple prediction scenarios for the same-city instant delivery problem. Syst. Eng. Theory Pract. 2018, 38, 3197–3211. (In Chinese) [Google Scholar]

- Gao, H.; Dan, B.; Yan, J. Comprehensive decision-making of MTO enterprise order selection and scheduling considering demand timing correlation. Chin. J. Manag. Eng. 2017, 31, 108–116. (In Chinese) [Google Scholar]

- Zhang, R. Comparative Research on Order Selection Decisions Considering Time Series Correlation. J. Manag. Sci. 2009, 12, 44–55. (In Chinese) [Google Scholar]

- Zhang, Y.; Dan, B.; Gao, H. Research on Random Scheduling Problem of Product Service System Order with Time Assignment. China Manag. Sci. 2019, 27, 93–106. (In Chinese) [Google Scholar]

- Nobil, A.H.; Sedigh, A.; Leopoldo Eduardo Cárdenas-Barrón. A multiproduct single machine economic production quantity (epq) inventory model with discrete delivery order, joint production policy and budget constraints. Ann. Oper. Res. 2017, 286, 1–37. [Google Scholar] [CrossRef]

- Buergin, J.; Hammerschmidt, A.; Hao, H.; Kramer, S.; Tutsch, H.; Lanza, G. Robust order planning with planned orders for multi-variant series production in a production network. Int. J. Prod. Econ. 2019, 210, 107–119. [Google Scholar] [CrossRef]

- Wang, X.; Ma, C. The choice and coordination of multi-tier supply chain outsourcing model. Chin. Manag. Sci. 2019, 27, 151–161. (In Chinese) [Google Scholar]

- Gong, F.; Zeng, A. Functional Upgrade of my country’s Foundry Enterprises: Duality Based on Modularity. Manag. World 2016, 184–185. (In Chinese) [Google Scholar]

- Jayaswal, S.; Jewkes, E.M. Price and lead time differentiation, capacity strategy and market competition. Int. J. Prod. Res. 2016, 54, 2791–2806. [Google Scholar] [CrossRef]

- Boulaksil, Y.; Fransoo, J.C.; Tan, T. Capacity reservation and utilization for a manufacturer with uncertain capacity and demand. OR Spectr. 2017, 39, 689–709. [Google Scholar] [CrossRef]

- Xie, X.; Zhang, B. Determination of committed delivery time and capacity under uncertain demand. Chin. Manag. Sci. 2016, 24, 73–80. (In Chinese) [Google Scholar]

- Choi, T.M.; Li, D.; Yan, H. Optimal single ordering policy with multiple delivery models and Bayesian information updates. Comput. Oper. Res. 2004, 31, 1965–1984. [Google Scholar] [CrossRef]

- Hui, S.K.; Eliashberg, J.; George, E.I. Modeling DVD preorder and sales: An optimal stopping approach. Mark. Sci. 2008, 27, 1097–1110. [Google Scholar] [CrossRef]

| Total production capacity | Discounting factor | ||

| HPOs’ net profit | Waiting-time threshold | ||

| Waiting time to obtain HPOs | Upper bound of | ||

| LPOs’ net profit | failure rate | ||

| Decision-making time | Waiting cost | ||

| HPOs’ total profit | HPOs profit after discounting | ||

| LPOs’ total profit | LPOs profit after discounting | ||

| Random variable of waiting time |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zuo, N.; Qu, S.; Li, C.; Zhan, W. The Order Selection Strategy of Polluting OEMs under Environmental Regulations. Sustainability 2021, 13, 6835. https://doi.org/10.3390/su13126835

Zuo N, Qu S, Li C, Zhan W. The Order Selection Strategy of Polluting OEMs under Environmental Regulations. Sustainability. 2021; 13(12):6835. https://doi.org/10.3390/su13126835

Chicago/Turabian StyleZuo, Naiqian, Shiyou Qu, Chengzhang Li, and Wentao Zhan. 2021. "The Order Selection Strategy of Polluting OEMs under Environmental Regulations" Sustainability 13, no. 12: 6835. https://doi.org/10.3390/su13126835

APA StyleZuo, N., Qu, S., Li, C., & Zhan, W. (2021). The Order Selection Strategy of Polluting OEMs under Environmental Regulations. Sustainability, 13(12), 6835. https://doi.org/10.3390/su13126835