Capital Return Rate and Carbon Storage on Forest Estates of Three Boreal Tree Species

Abstract

1. Introduction

2. Materials and Methods

2.1. Growth Model

2.2. Assortment Yield Model

2.3. Financial Treatment

2.4. Computational Procedures

3. Results

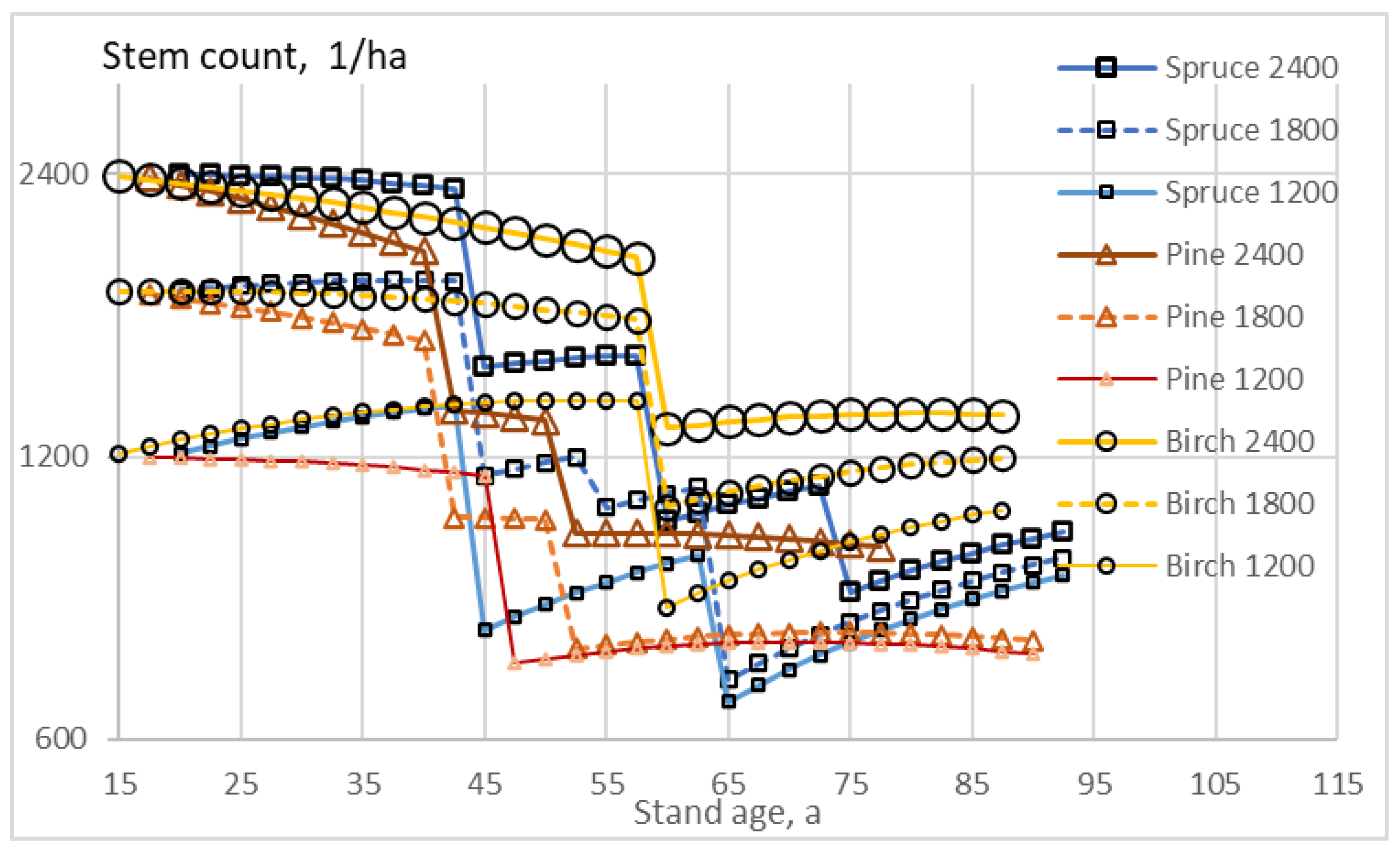

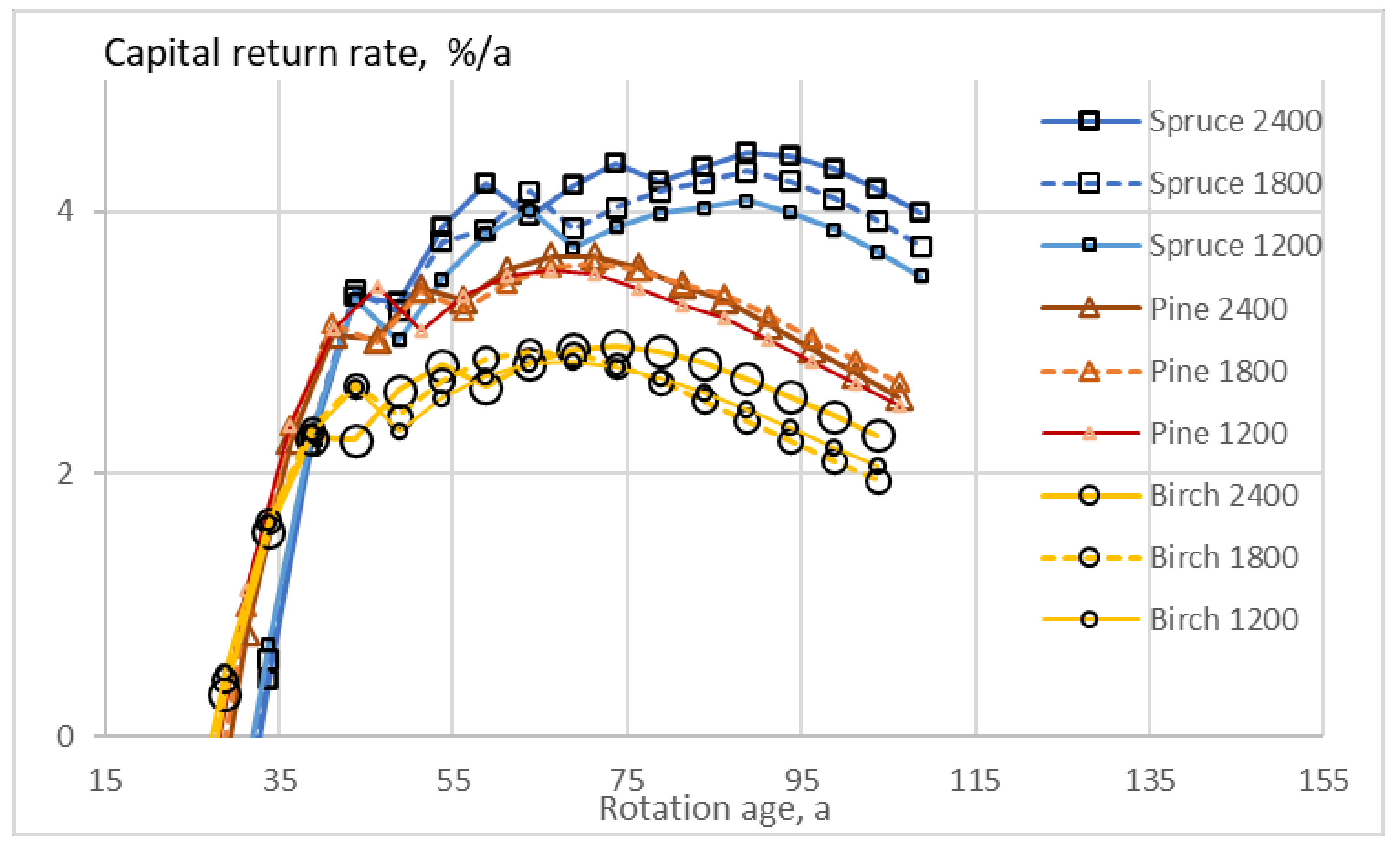

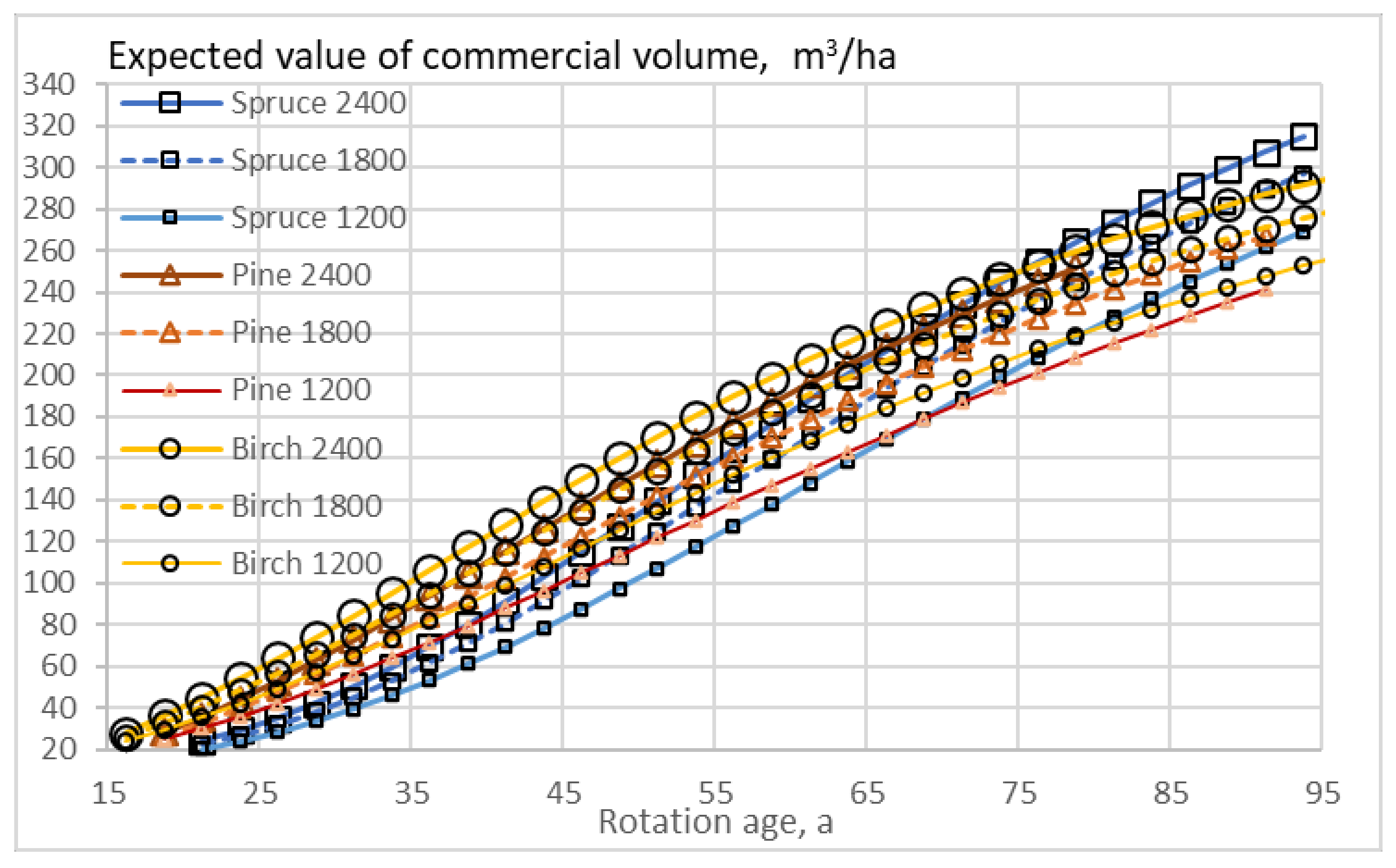

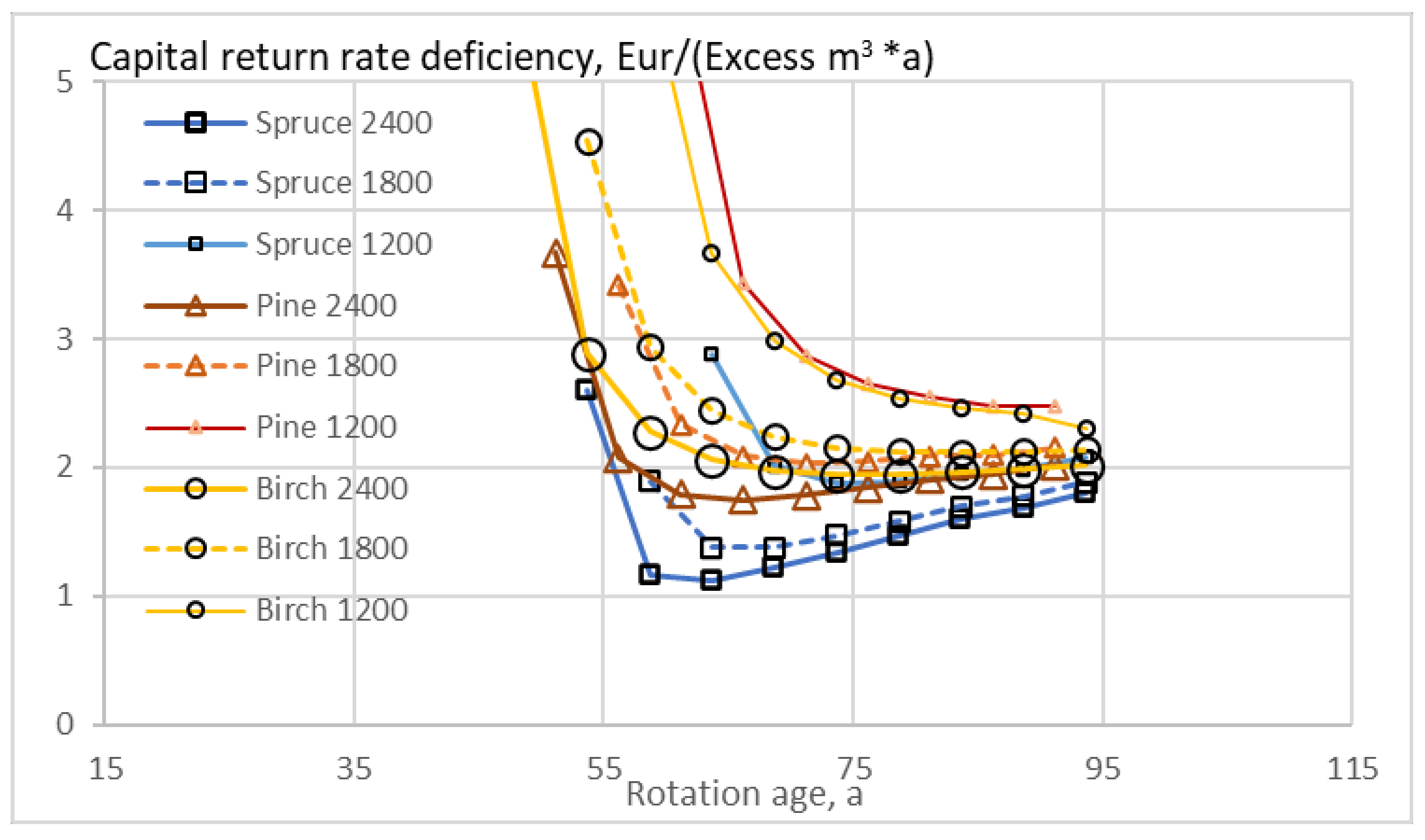

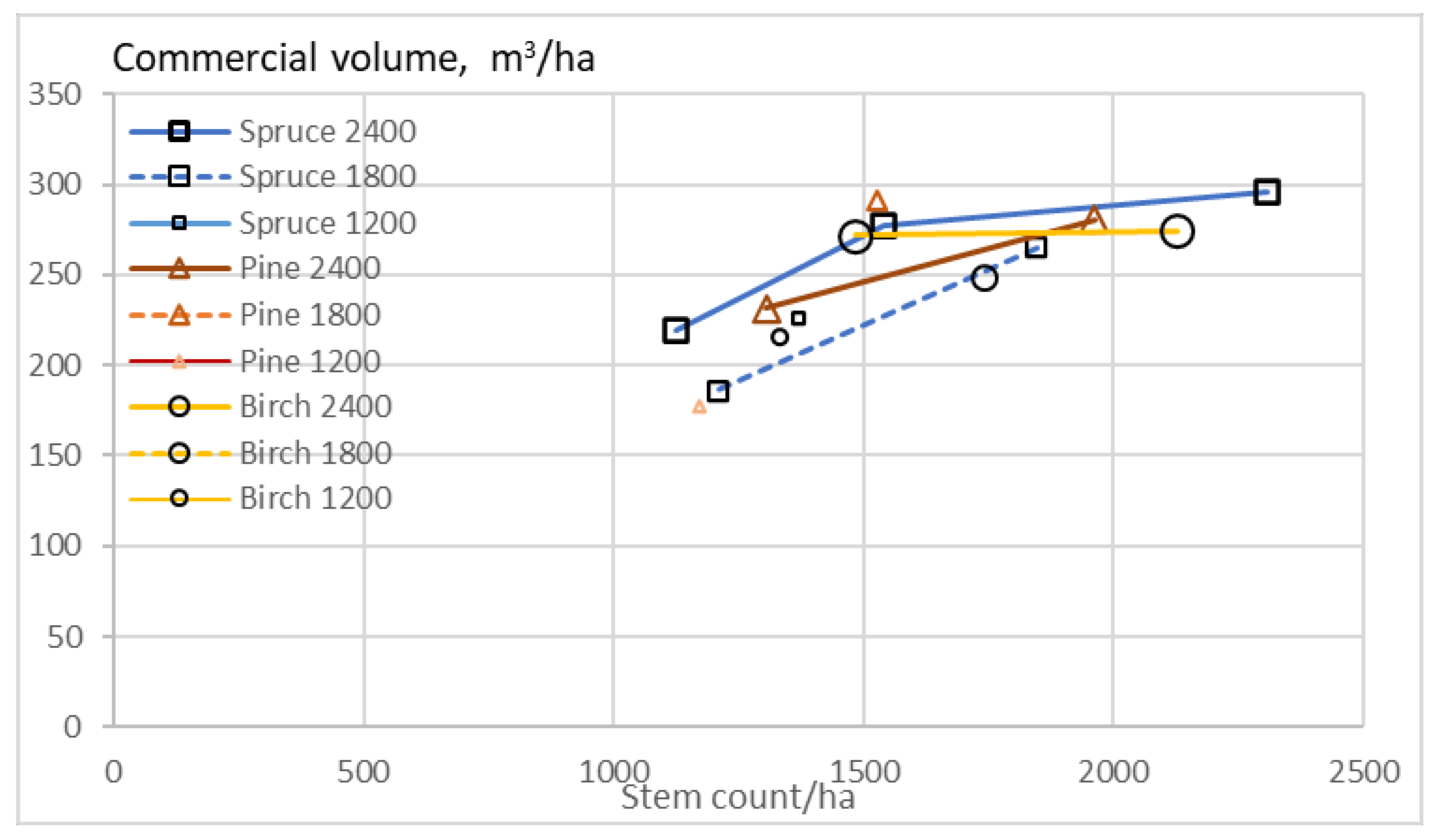

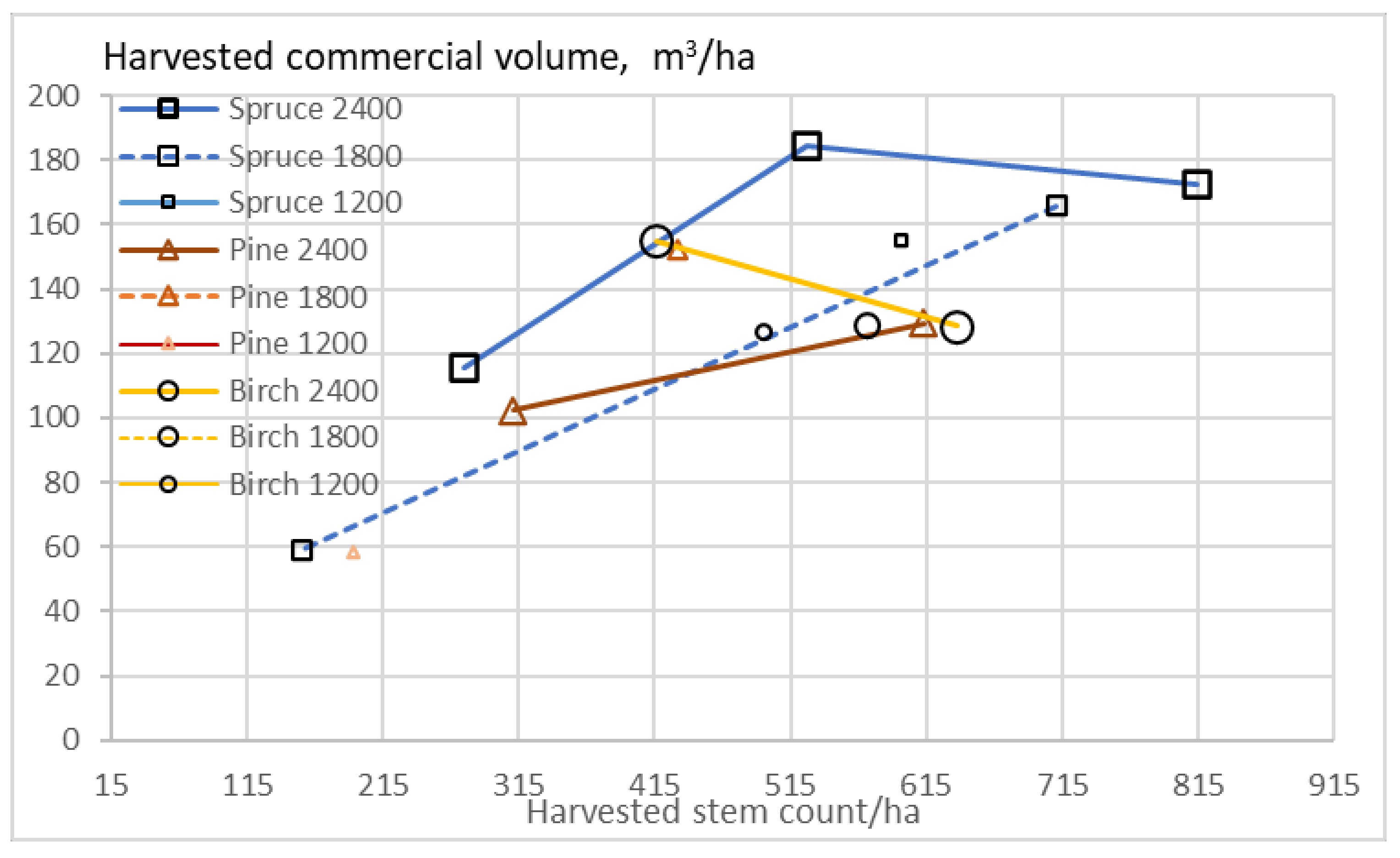

3.1. Original Boundary Conditions

3.2. Sensitivity Analysis

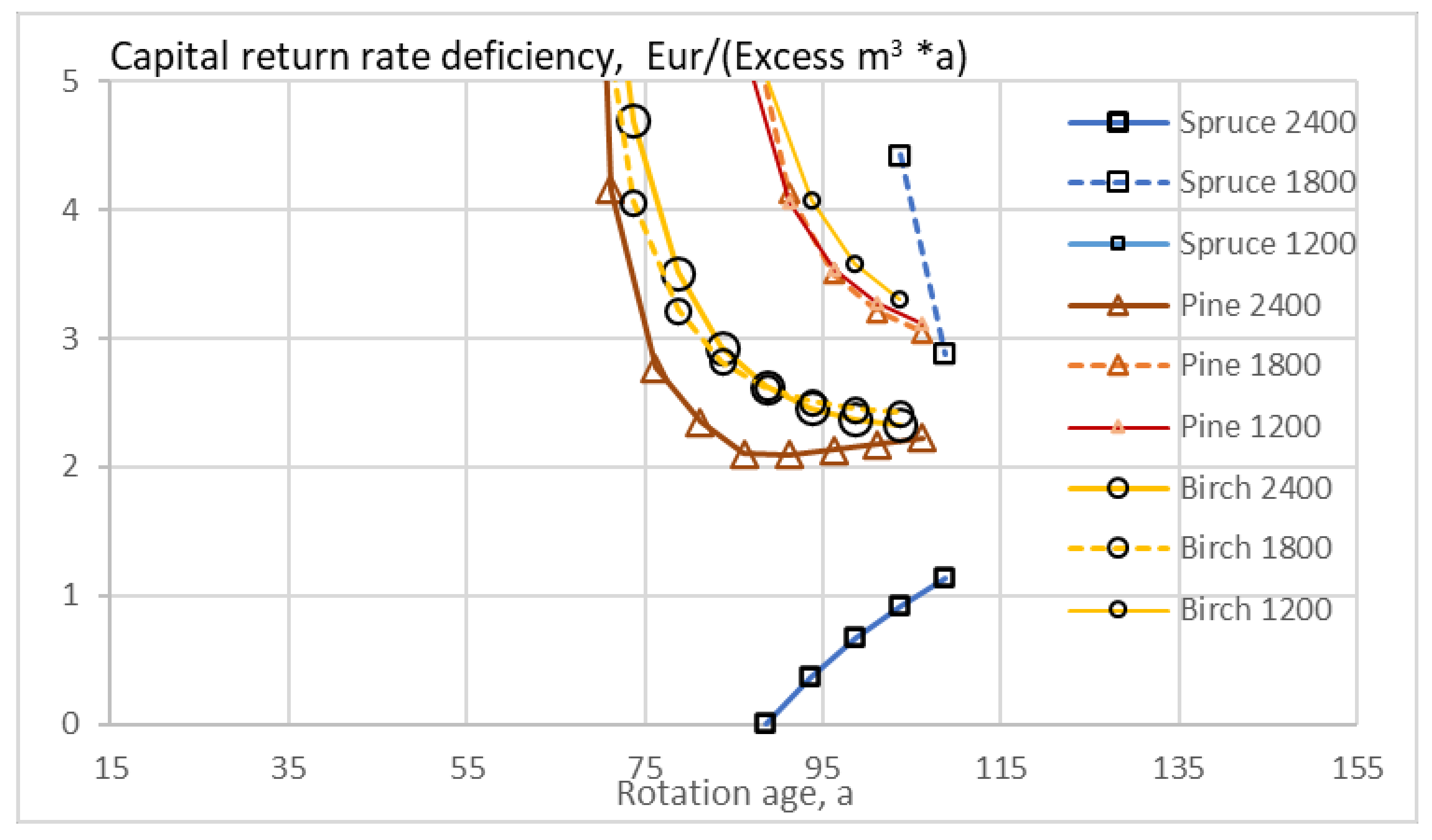

3.3. Carbon Storage Finances

3.4. Operative Outcome in the Absence of Carbon Storage Compensation

4. Discussion

5. Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Gustavsson, L.; Haus, S.; Lundblad, M.; Lundström, A.; Ortiz, C.A.; Sathre, R.; Truong, N.; Wikberg, P.-E. Climate change effects of forestry and substitution of carbon-intensive materials and fossil fuels. Renew. Sustain. Energy Rev. 2017, 67, 612–624. [Google Scholar] [CrossRef]

- Van Kooten, G.C.; Johnston, C.M.T. The economics of forest carbon offsets. Annu. Rev. Resour. Econ. 2016, 8, 227–246. [Google Scholar] [CrossRef]

- Van Kooten, G.C.; Bogle, T.N.; De Vries, F.P. Forest carbon offsets revisited: Shedding light on darkwoods. For. Sci. 2015, 61, 370–380. [Google Scholar] [CrossRef]

- Pukkala, T. Carbon forestry is surprising. For. Ecosyst. 2018, 5, 5. [Google Scholar] [CrossRef]

- Seppälä, J.; Heinonen, T.; Pukkala, T.; Kilpeläinen, A.; Mattila, T.; Myllyviita, T.; Asikainen, A.; Peltola, H. Effect of increased wood harvesting and utilization on required greenhouse gas displacement factors of wood-based products and fuels. J. Environ. Manag. 2019, 247, 580–587. [Google Scholar] [CrossRef]

- Kilkki, P.; Väisänen, U. Determination of the optimum cutting policy for the forest stand by means of dynamic programming. Acta For. Fenn. 1969, 102, 1–23. [Google Scholar] [CrossRef]

- Kärenlampi, P.P. Harvesting design by capital return. Forests 2019, 10, 283. [Google Scholar] [CrossRef]

- Kärenlampi, P.P. The effect of capitalization on financial return in periodic growth. Heliyon 2019, 5, e02728. [Google Scholar] [CrossRef]

- Kärenlampi, P.P. Estate-Level economics of carbon storage and sequestration. Forests 2020, 11, 643. [Google Scholar] [CrossRef]

- Lintunen, J.; Laturi, J.; Uusivuori, J. How should a forest carbon rent policy be implemented? For. Policy Econ. 2016, 69, 31–39. [Google Scholar] [CrossRef]

- Pukkala, T. At what carbon price forest cutting should stop. J. For. Res. 2020, 31, 713–727. [Google Scholar] [CrossRef]

- Kärenlampi, P.P. Stationary forestry with human interference. Sustainability 2018, 10, 3662. [Google Scholar] [CrossRef]

- Kärenlampi, P.P. The effect of empirical log yield observations on carbon storage economics. Forests 2020, 11, 1312. [Google Scholar] [CrossRef]

- Kärenlampi, P.P. Diversity of carbon storage economics in fertile boreal spruce (Picea Abies) estates. Sustainability 2021, 13, 560. [Google Scholar] [CrossRef]

- Leslie, A.J. A review of the concept of the normal forest. Aust. For. 1966, 30, 139–147. [Google Scholar] [CrossRef]

- Bollandsås, O.M.; Buongiorno, J.; Gobakken, T. Predicting the growth of stands of trees of mixed species and size: A matrix model for Norway. Scand. J. For. Res. 2008, 23, 167–178. [Google Scholar] [CrossRef]

- Vuokila, Y. Männyn kasvusta ja sen vaihteluista harventaen käsitellyissä ja luonnontilaisissa metsiköissä. 38 s., kuv. On growth and its variations in thinned and unthinned Scots pine stands. Comm. Inst. For. Fenn. 1960, 52, 7. [Google Scholar]

- Vuokila, Y.; Väliaho, H. Viljeltyjen havumetsiköiden kasvatusmallit. Growth and yield models for conifer cultures in Finland. Comm. Inst. For. Fenn. 1980, 99, 2. [Google Scholar]

- Vuokila, Y. Etelä-Suomen hoidettujen kuusikoiden kehityksestä. Viljeltyjen havumetsiköiden kasvatusmallit. On the development of managed spruce stands in Southern Finland. Comm. Inst. For. Fenn. 1956, 48, 1. [Google Scholar]

- Raulo, J. Development of dominant trees in Betula pendula Roth and Betula pubescens Ehrh. planta-tions. Seloste: Viljeltyjen raudus- ja hieskoivikoidenvaltapuiden kehitys. Commun. Inst. For. Fenn. 1977, 90, 4. [Google Scholar]

- Oikarinen, M. Etelä-Suomen viljeltyjen raudus-koivikoiden kasvatusmallit. Suumary: Growth andyield models for silver birch (Betula pendula) plantations in southern Finland. Commun. Inst. Fenn. 1983, 113, 75. [Google Scholar]

- Kärenlampi, P.P. Empirical observations of the yield of logs from trees of the boreal region. Balt. For. 2021. submitted 4 February. [Google Scholar]

- Mehtätalo, L. Valtakunnalliset puukohtaiset tukkivähennysmallit männylle, kuuselle, koivuille ja haavalle. Metsätieteen Aikakausk. 2002, 4, 575–591. [Google Scholar] [CrossRef]

- Laasasenaho, J. Taper curve and volume functions for pine, spruce and birch. Comm. Inst. For. Fenn. 1982, 108, 74. [Google Scholar]

- Parkatti, V.-P.; Assmuth, A.; Rämö, J.; Tahvonen, O. Economics of boreal conifer species in continuous cover and rotation forestry. For. Policy Econ. 2019, 100, 55–67. [Google Scholar] [CrossRef]

- Parkatti, V.-P.; Tahvonen, O. Optimizing continuous cover and rotation forestry in mixed-species boreal forests. Can. J. For. Res. 2020, 50, 1138–1151. [Google Scholar] [CrossRef]

- Nurminen, T.; Korpunen, H.; Uusitalo, J. Time consuming analysis of the mechanized cut-to-length harvesting system. Silva Fenn. 2006, 40, 335–363. [Google Scholar] [CrossRef]

- Kärenlampi, P.P. State-space approach to capital return in nonlinear growth processes. Agric. Financ. Rev. 2019, 79, 508–518. [Google Scholar] [CrossRef]

- Kärenlampi, P.P. Wealth accumulation in rotation forestry–Failure of the net present value optimization? PLoS ONE 2019, 14, e0222918. [Google Scholar] [CrossRef]

- Pressler, M.R. Aus der Holzzuwachlehre (zweiter Artikel). Allgemeine Forst und Jagd Zeitung, 1860, 36, 173. Translated by Löwenstein, W. and Wirkner, J.R. as “For the comprehension of net revenue silviculture and the management objectives derived thereof”. J. For. Econ. 1995, 1, 45–87. [Google Scholar]

- Speidel, G. Forstliche Betreibswirtschaftslehre, 2nd ed.; Paul Parey: Hamburg, Germany, 1967; 226p. (In German) [Google Scholar]

- Speidel, G. Planung in Forstbetrieb, 2nd ed.; Paul Parey: Hamburg, Germany, 1972; 270p. (In German) [Google Scholar]

- Woś, B.; Pietrzykowski, M. Simulation of birch and pine litter influence on early stage of reclaimed soil formation process under controlled conditions. J. Environ. Qual. 2015, 44, 1091–1098. [Google Scholar] [CrossRef]

- Augusto, L.; De Schrijver, A.; Vesterdal, L.; Smolander, A.; Prescott, C.; Ranger, J. Influences of evergreen gymnosperm and deciduous angiosperm tree species on the functioning of temperate and boreal forests. Biol. Rev. Camb. Philos. Soc. 2015, 90, 444–466. [Google Scholar] [CrossRef]

- Kohnle, U. Spruce and Climate Change—What Is to Be Done? 2015. Available online: www.waldwissen.net (accessed on 9 June 2021).

- Seidl, R.; Thom, D.; Kautz, M.; Martin-Benito, D.; Peltoniemi, M.; Vacchiano, G.; Wild, J.; Ascoli, D.; Petr, M.; Honkaniemi, J.; et al. Forest disturbances under climate change. Nat. Clim. Chang. 2017, 7, 395–402. [Google Scholar] [CrossRef] [PubMed]

- Felton, A.; Petersson, L.; Nilsson, O.; Witzell, J.; Cleary, M.; Felton, M.; Björkman, C.; Sang, Å.O.; Jonsell, M.; Holmström, E.; et al. The tree species matters: Biodiversity and ecosystem service implications of replacing Scots pine production stands with Norway spruce. Ambio 2020, 49, 1035–1049. [Google Scholar] [CrossRef]

- Tilastopalvelu. Available online: https://www.luke.fi/avoin-tieto/tilastopalvelu/ (accessed on 9 June 2021).

- Bouchaud, J.-P.; Potters, M. Théorie des Risques Financiers; Commissariat à l’Energie Atomique: Paris, France, 1997. [Google Scholar]

- Theory of Financial Risk: From Data Analysis to Risk Management. Available online: http://web.math.ku.dk/~rolf/Klaus/bouchaud-book.ps.pdf (accessed on 9 June 2021).

- Brealey, R.A.; Myers, S.C.; Allen, F. Principles of Corporate Finance, 10th ed.; McGraw-Hill Irwin: New York, NY, USA, 2011. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kärenlampi, P.P. Capital Return Rate and Carbon Storage on Forest Estates of Three Boreal Tree Species. Sustainability 2021, 13, 6675. https://doi.org/10.3390/su13126675

Kärenlampi PP. Capital Return Rate and Carbon Storage on Forest Estates of Three Boreal Tree Species. Sustainability. 2021; 13(12):6675. https://doi.org/10.3390/su13126675

Chicago/Turabian StyleKärenlampi, Petri P. 2021. "Capital Return Rate and Carbon Storage on Forest Estates of Three Boreal Tree Species" Sustainability 13, no. 12: 6675. https://doi.org/10.3390/su13126675

APA StyleKärenlampi, P. P. (2021). Capital Return Rate and Carbon Storage on Forest Estates of Three Boreal Tree Species. Sustainability, 13(12), 6675. https://doi.org/10.3390/su13126675