An Australian Perspective on Local Government Investment in Electric Vehicle Charging Infrastructure

Abstract

:1. Introduction

1.1. Global EV Context

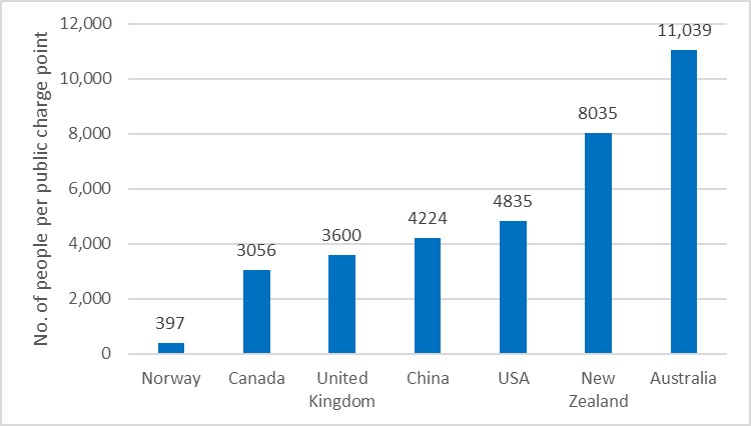

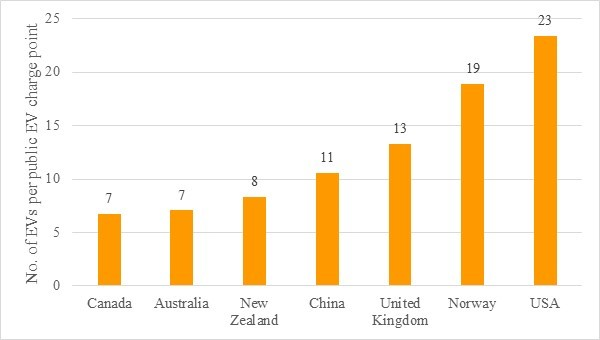

1.2. The Australian Context

1.3. Australia and Electric Vehicles

1.4. The Role of Local Government in Australia

1.5. The Challenge

2. Literature Review

2.1. The Australian Case

2.2. The Role of Government

2.3. Business Models

2.4. The Case Study

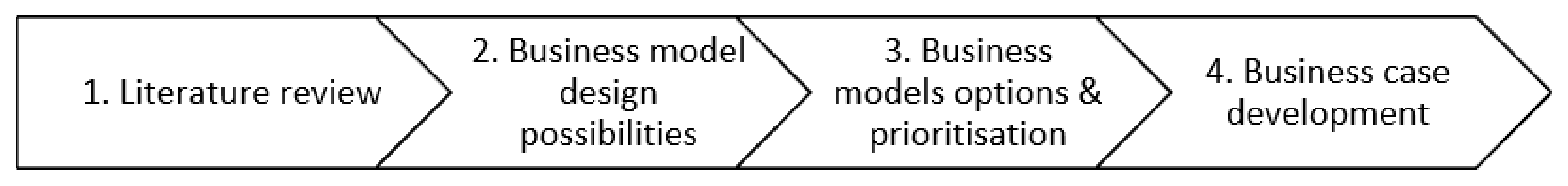

3. Methodology

3.1. Overall Methodology

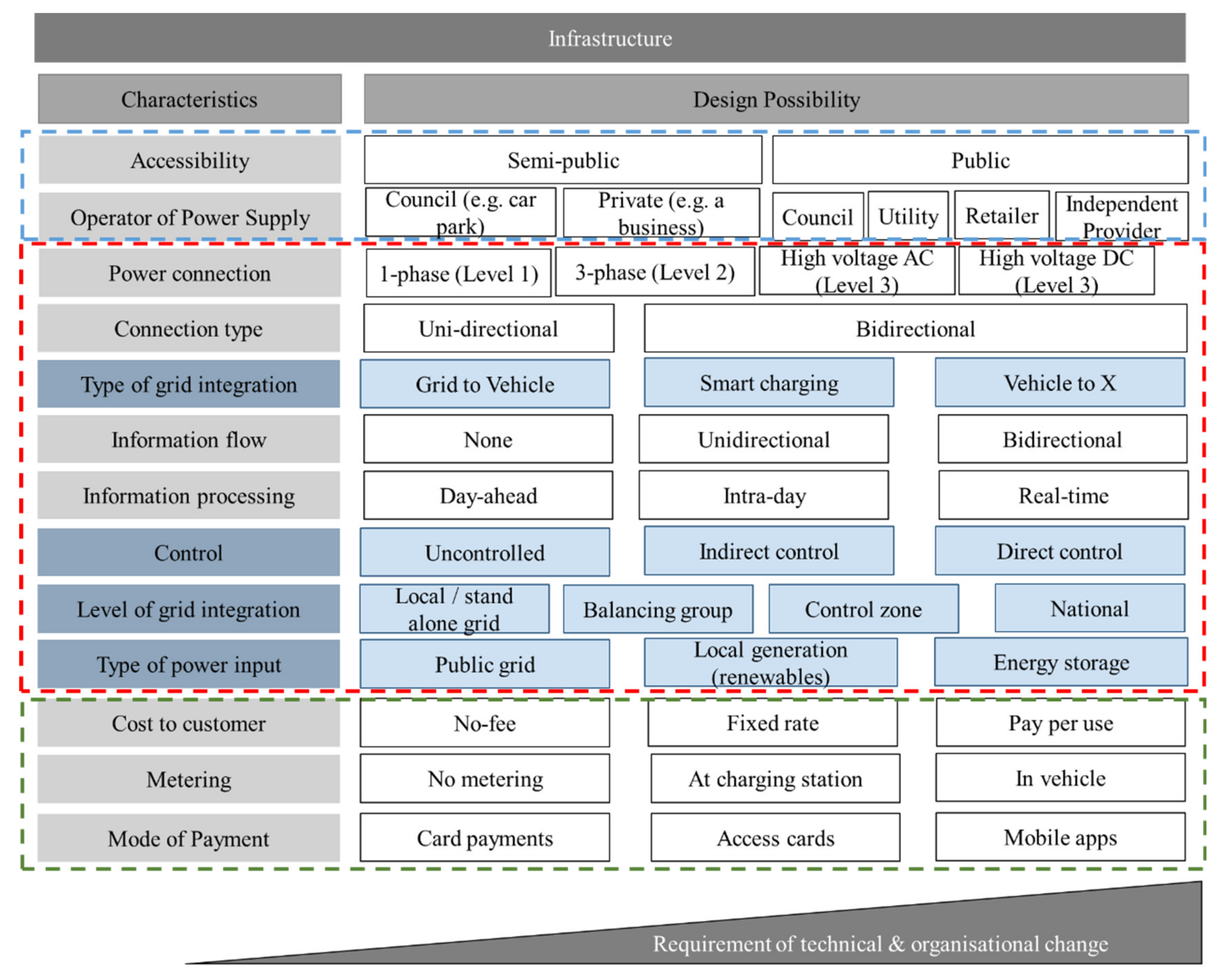

3.2. Business Model Characteristics and Design Possibilities

- Business model decisions from the morphological boxes on infrastructure and system services were combined into a single box.

- The design possibilities were re-arranged in a different order to structure this around three key questions the Council had regarding their business models.

- Some design possibilities were added or amended to be more relevant for a local council and the business model design decisions they were contemplating.

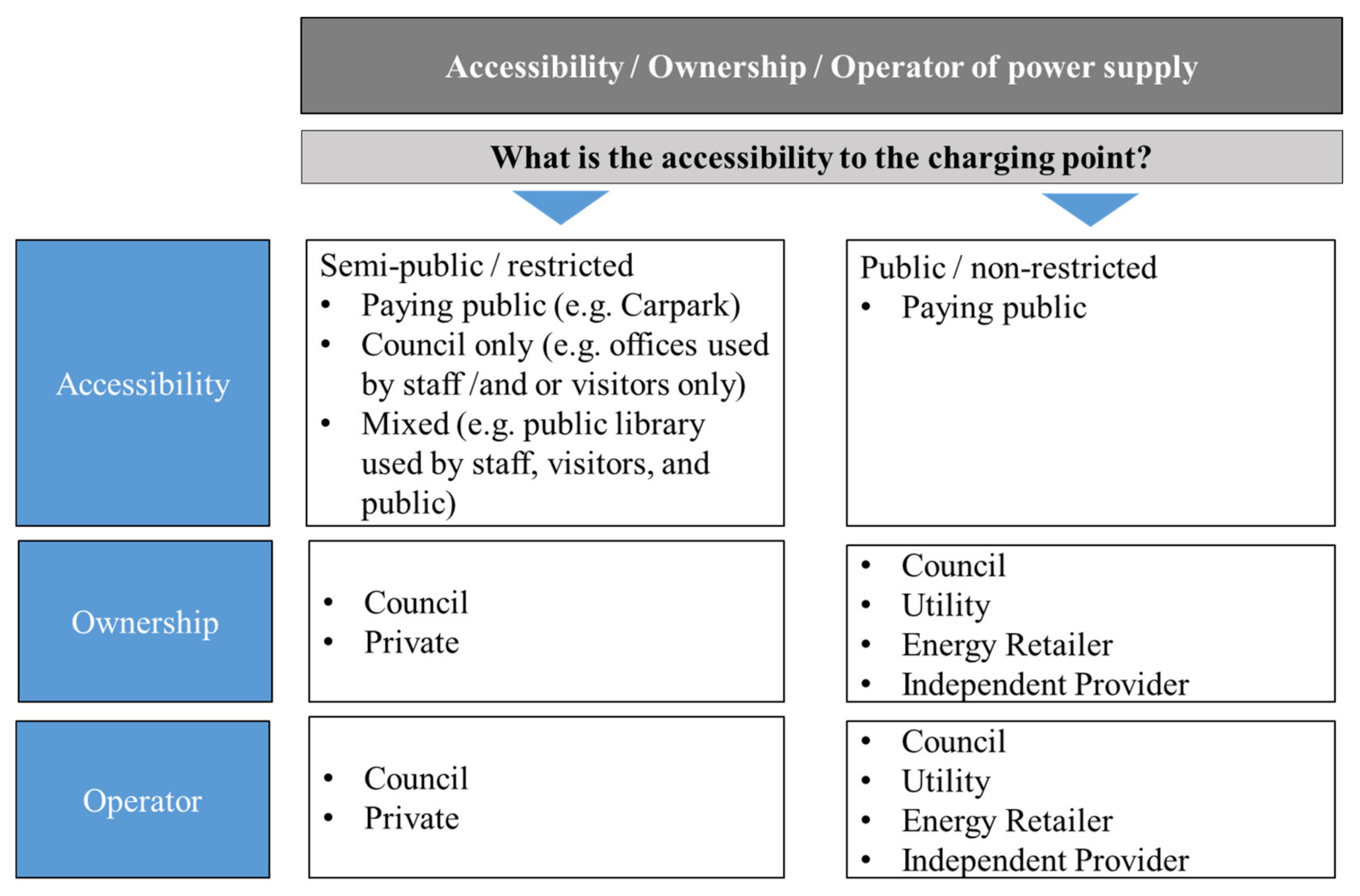

- Accessibility, ownership, and operation (blue box).

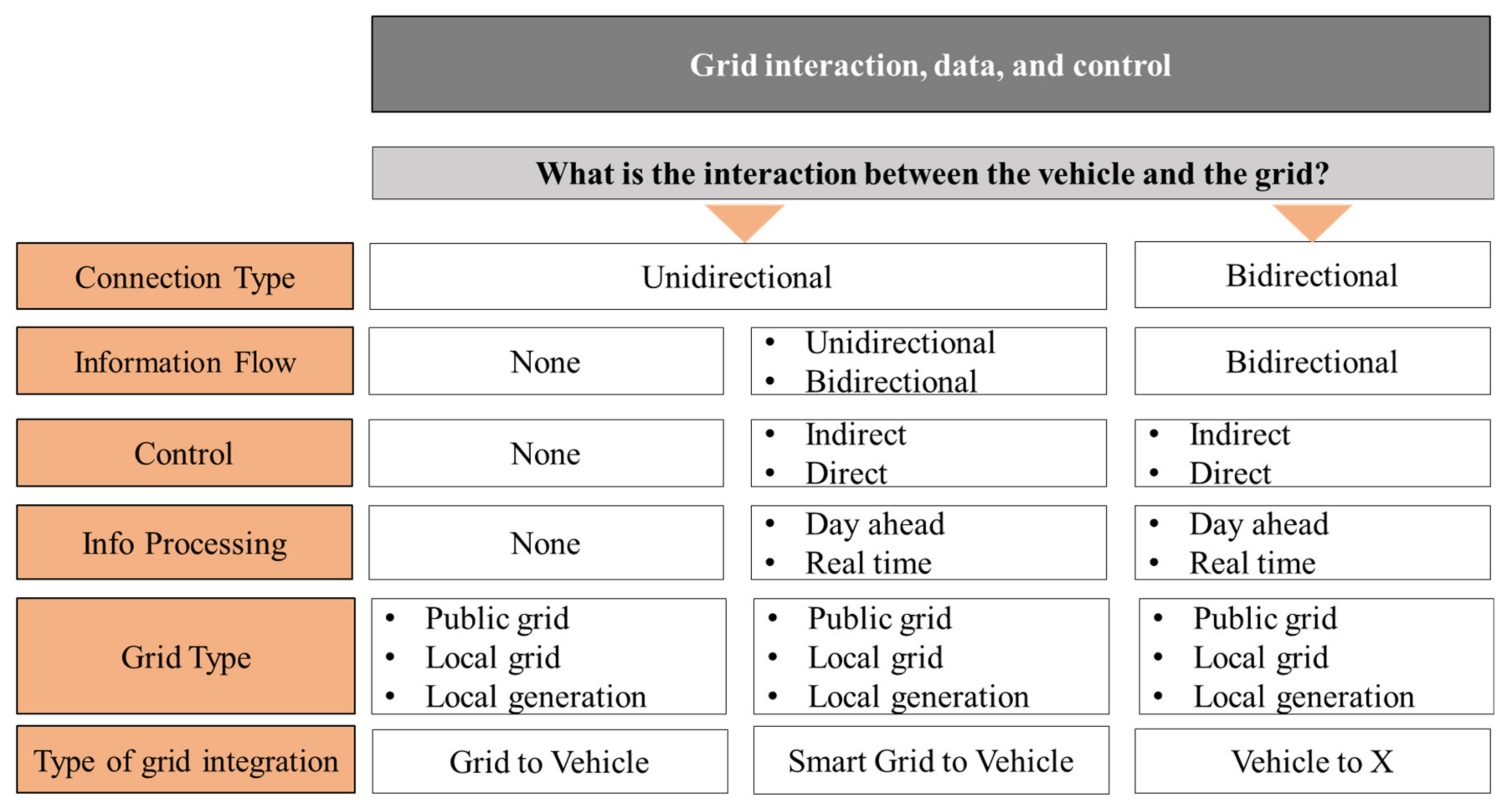

- Grid interaction, data, and control (red box).

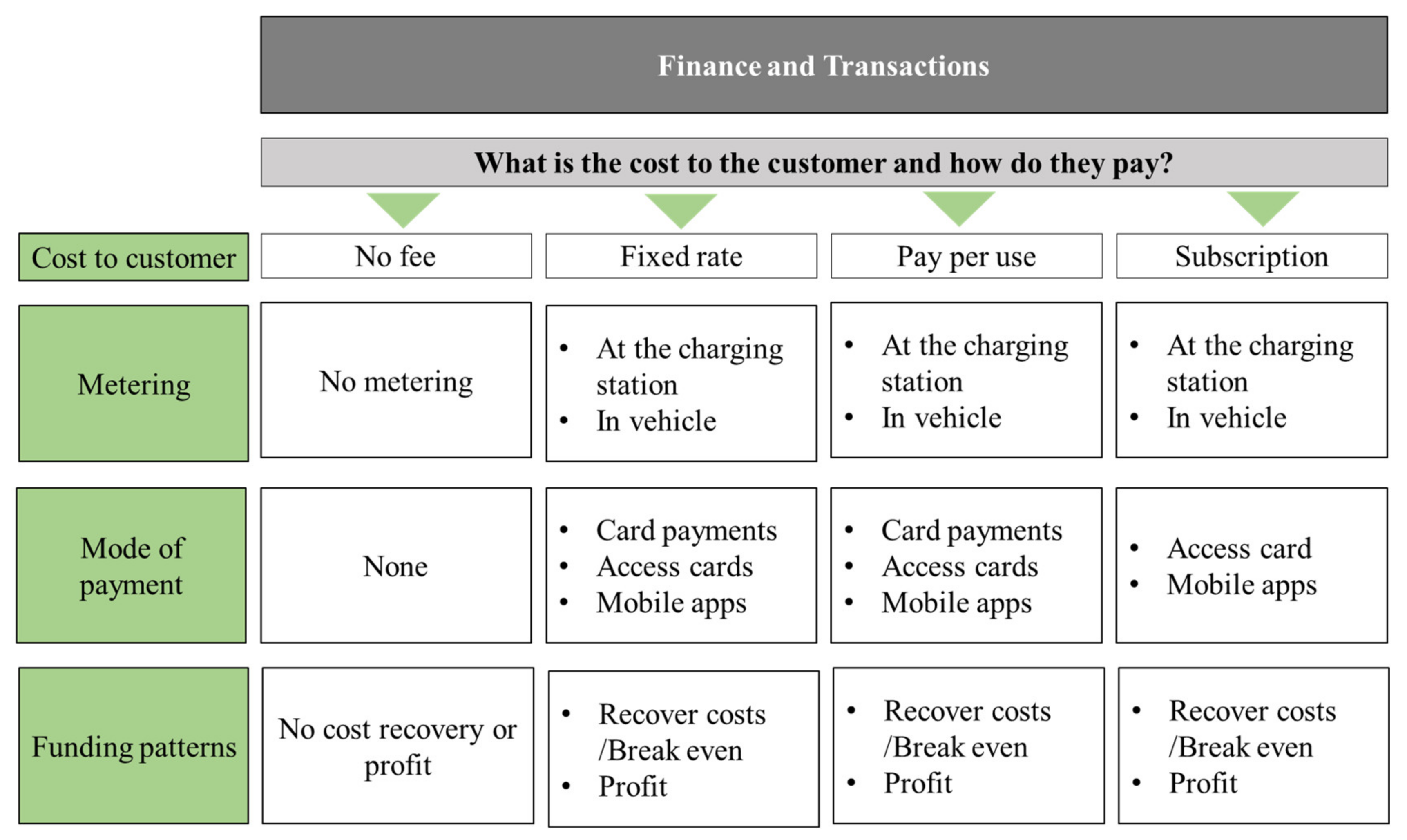

- Finance and transactions (green box).

3.2.1. Accessibility, Ownership, and Operation

3.2.2. Grid Interaction, Data, and Control

- The type of connection can be “unidirectional” (delivers power in one direction) or “bidirectional” (transmits electricity in both directions), necessary to access services such as load-shifting or back-feeding electricity into the grid.

- The information and communication could be unidirectional, where control is based on grid or vehicle data, or bidirectional, which allows both grid and vehicle to be integrated into controlling the charging process.

- Information can be processed in different time intervals from day-ahead planning to a real-time connection, allowing an immediate modification of the charging profile.

- Indirect control of charging processes can be via a price signal while direct control allows switching signals to be sent to the battery in the vehicle. In practice, a combination of both could be used.

3.2.3. Finance and Transaction

- Retail operators: This may include shopping centres, hotels, service stations, car manufactures/dealers, etc.

- Energy utilities: In the Australian context, the energy utility can be either energy retailers or distribution network service providers.

- Third parties: These may include independent charging station providers, charging infrastructure manufactures, or other interested parties.

3.3. Defining the Business Model Options

3.3.1. Business Model Type Classification

- Public access—where the charging station is available to all to use. These are typically offered to the general public to use by councils, motoring organisations, and energy utilities. The cost to the customer varies from being free, to pay per use, subscription/membership fees, or a combination of them. Subtypes were classified as:

- a.

- Government-owned.

- b.

- Third party-owned.

- c.

- Energy utility-owned.

- Semi-public access—where the use of the charging station is restricted to a set of users. For example, the service is offered to members of a particular EV charging network, owners of certain brands of vehicles, guests visiting certain hotels, or customers visiting certain businesses. From the end customer perspective, these services may be provided for free or different charge models might be offered. Subtypes were classified as:

- a.

- Membership-based.

- b.

- Guest and visitor servicing.

- c.

- Business self-funded.

3.3.2. Business Model Options and Prioritisation

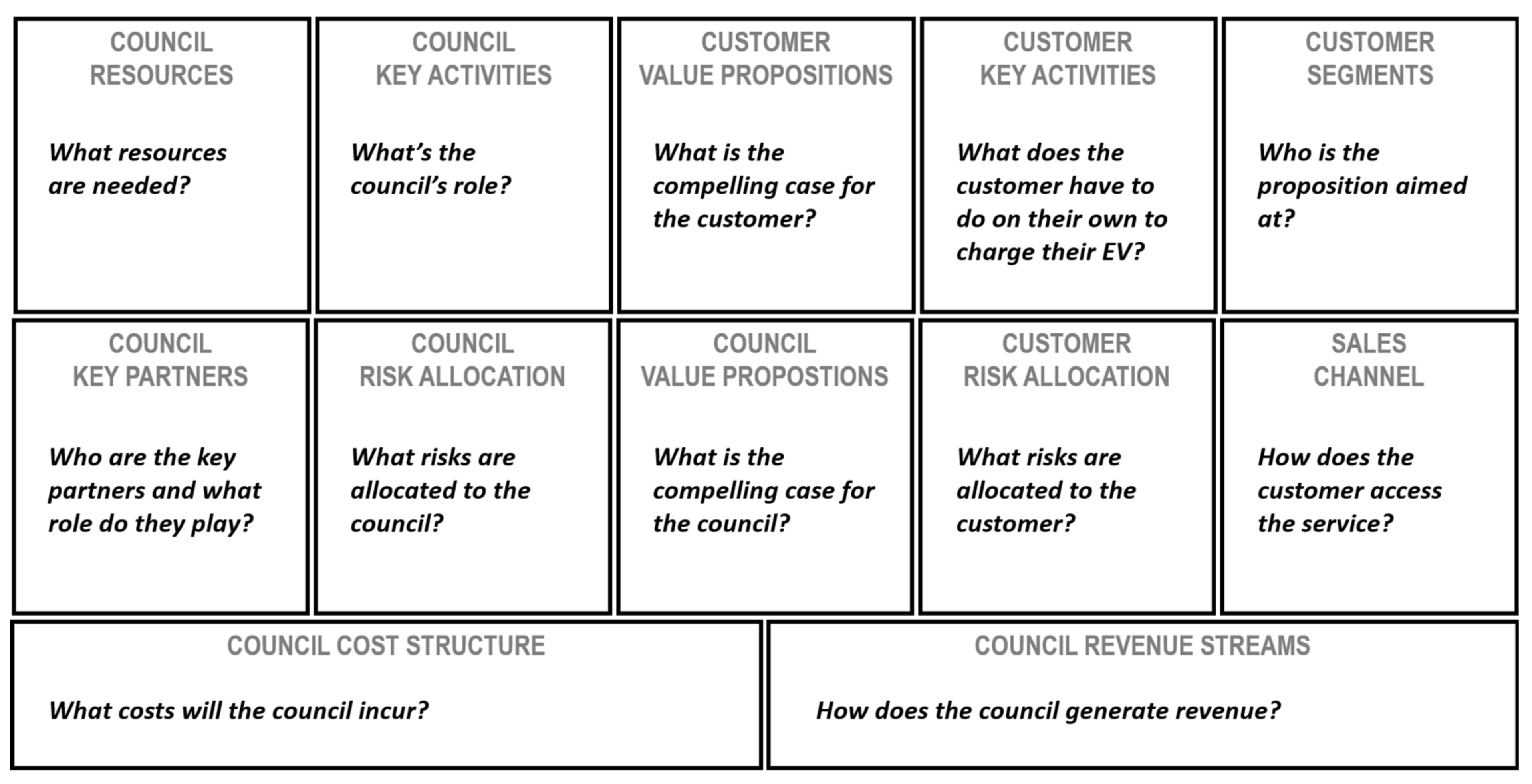

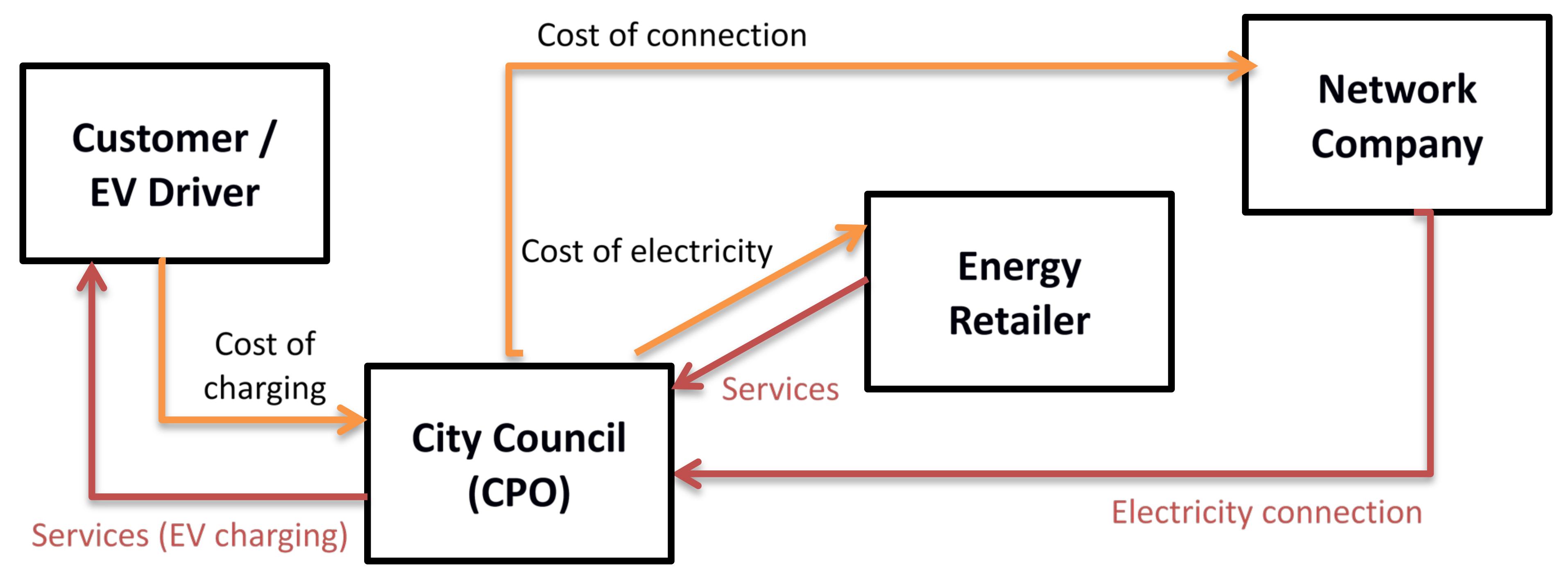

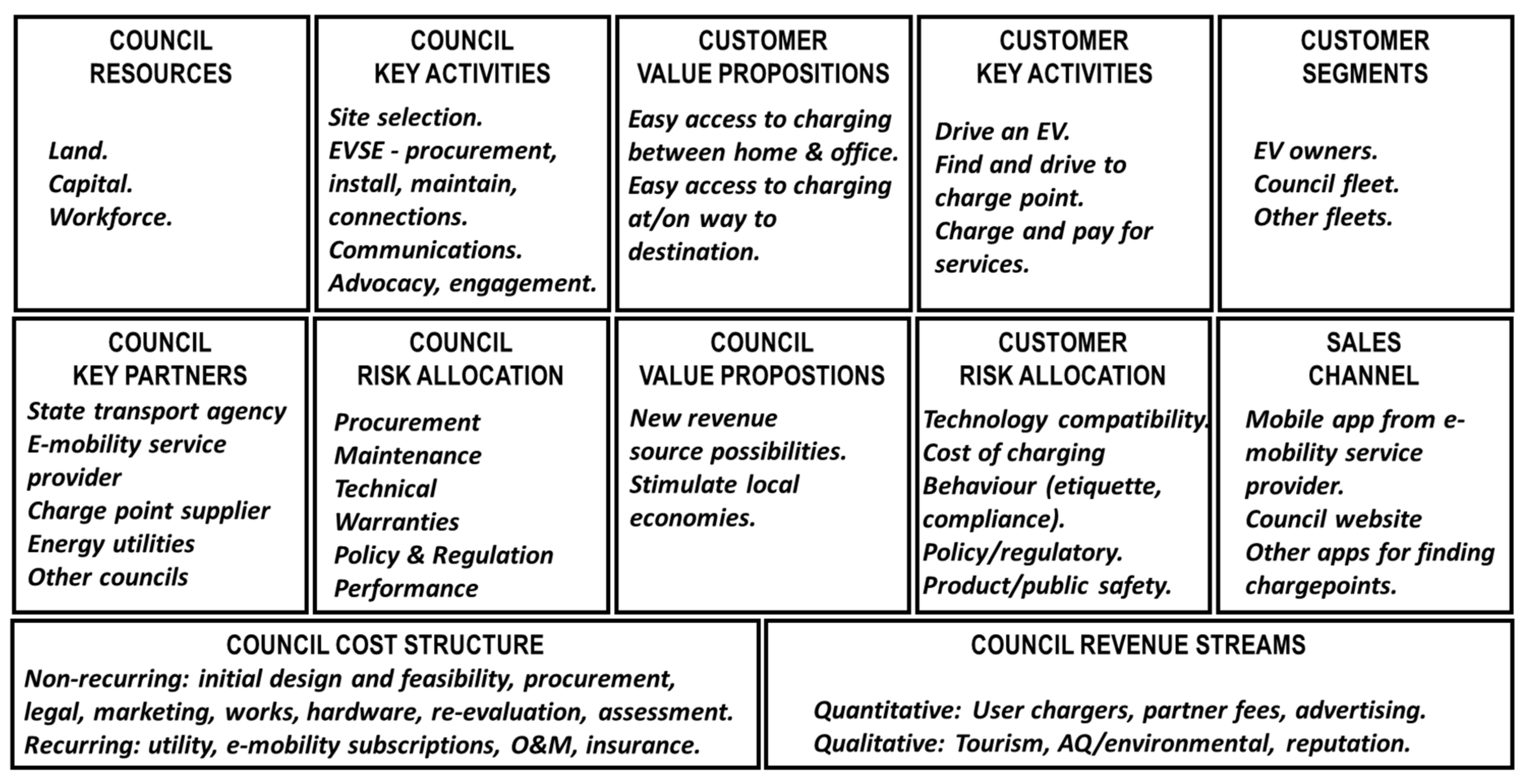

- For the “Customer”: This is the end customer. In the case of this model, it is the person(s) with the EV who is looking to get it charged.

- For the “Council”: In this case (self-managed model), the Council is the charge point operator.

4. Analysis

- The Self-Managed EV Charging Business Model.

- The Third-Party EV Charging Business Model.

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- International Energy Agency. World Energy Outlook 2020; Cozzi, L., Gould, T., Bouckart, S., Crow, D., Kim, T.-Y., McGlade, C., Olejarnik, P., Wanner, B., Wetzel, D., Eds.; OECD Publishing: Paris, France, 2020; ISBN 0872625710. [Google Scholar]

- Australian Government. Quarterly Update of Australia’s National Greenhouse Gas Inventory: December 2020; Australian Government, Department of Industry, Science, Energy and Resources: Canberra, Australia, 2020.

- Australian Government. National Inventory Report 2018; Australian Government: Canberra, Australia, 2020; Volume 1.

- National Transport Commission. Carbon Dioxide Emissions Intensity for New Australian Light Vehicles 2016; National Transport Commission: Melbourne, Australia, 2020.

- The World Bank. Land Area by Country. Available online: https://data.worldbank.org/indicator/AG.LND.TOTL.K2?most_recent_value_desc=true (accessed on 16 November 2020).

- Central Intelligence Agency. The World Factbook. 2020. Available online: https://www.cia.gov/library/publications/resources/the-world-factbook/index.htm (accessed on 28 October 2020).

- The World Bank. Urban Population (% of Total Population)—Australia. Available online: https://data.worldbank.org/indicator/SP.URB.TOTL.IN.ZS?locations=AU (accessed on 29 October 2020).

- Morgan, R. Rising Numbers of Australians Looking at Electric and Hybrid Vehicles for Their Next Set of Wheels. Available online: https://www.roymorgan.com/findings/8089-electric-and-hybrid-vehicle-intenders-june-2019-201908280629 (accessed on 10 October 2019).

- The Electric Vehicle Council. Huge Jump in Aussie EV Sales Underscores Massive Untapped Potential. Available online: https://electricvehiclecouncil.com.au/huge-jump-in-aussie-ev-sales-underscores-massive-untapped-potential/ (accessed on 6 February 2019).

- FCAI. Australia’s New Vehicle Market. Available online: https://www.fcai.com.au/sales (accessed on 6 May 2020).

- The World Bank. GDP (Current US$). Available online: https://data.worldbank.org/indicator/NY.GDP.MKTP.CD (accessed on 28 October 2020).

- ABS. Motor Vehicle Census, Australia. Available online: https://www.abs.gov.au/statistics/industry/tourism-and-transport/motor-vehicle-census-australia/latest-release#:~:text=9309.0-Motor-Vehicle-Census%2C-Australia%2C-31-Jan2020&text=Therewere19.8millionregistered,cent-from-2019-to-2020.&text=Dieselve (accessed on 28 October 2020).

- Electric Vehicle Council. State of Electric Vehicles; Electric Vehicle Council: Sydney, Australia, 2020. [Google Scholar]

- Canada Energy Regulator. Market Snapshot: EVs in Canada—The Hidden Potential of the Electric Truck Market. Available online: https://www.cer-rec.gc.ca/en/data-analysis/energy-markets/market-snapshots/2019/market-snapshot-evs-in-canada-hidden-potential-electric-truck-market.html (accessed on 28 October 2020).

- Statistics Canada. Vehicle Registrations, by Type of Vehicle. Available online: https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=2310006701 (accessed on 28 October 2020).

- Government of Canada. Electric Charging and Alternative Fuelling Stations Locator. Available online: https://www.nrcan.gc.ca/energy-efficiency/energy-efficiency-transportation-and-alternative-fuels/electric-charging-alternative-fuelling-stationslocator-map/20487#/analyze?country=CA&fuel=ELEC&show_map=true (accessed on 28 October 2020).

- Xinhua. China Has 340 mln Vehicles by Mid-2019. Available online: http://www.xinhuanet.com/english/2019-07/04/c_138196389.htm (accessed on 28 October 2020).

- Columbia University. Guide to Chinese Climate Policy. Available online: https://chineseclimatepolicy.energypolicy.columbia.edu/en/electric-vehicles#/_ftn3 (accessed on 28 October 2020).

- NZ Transport Agency. National Vehicle Fleet Status. Available online: https://www.nzta.govt.nz/resources/new-zealand-motor-vehicle-register-statistics/national-vehicle-fleet-status/ (accessed on 28 October 2020).

- NZ Transport Agency. Electric Vehicle Charging Stations. Available online: https://www.journeys.nzta.govt.nz/ev-chargers-list-view/ (accessed on 28 October 2020).

- Norweigen Electric Car Association. Strong Growth in the Number of Lightning Chargers. Available online: https://elbil.no/kraftig-vekst-i-antall-lynladere/#:~:text=Vedårsskiftetvardeti,Lynladere%3A226(%2B804%25) (accessed on 28 October 2020).

- Statistics Norway. Registered Vehicles. Available online: https://www.ssb.no/en/bilreg (accessed on 20 October 2020).

- UK Government. Vehicle Licensing Statistics: 2017. Available online: https://www.gov.uk/government/statistics/vehicle-licensing-statistics-2017#:~:text=In2017%2Ctherewere%3A,theendoftheyear (accessed on 28 October 2020).

- UK Government. Statistical Data Set—Cars (VEH02). Available online: https://www.gov.uk/government/statistical-data-sets/veh02-licensed-cars#registered-for-the-first-time (accessed on 28 October 2020).

- Department for Transport. Electric vehicle charging device statistics. Stat. Release 2020, 2, 1–5. [Google Scholar]

- Bureau of Transportation Statistics. Number of U.S. Aircraft, Vehicles, Vessels, and Other Conveyances. Available online: https://www.bts.gov/content/number-us-aircraft-vehicles-vessels-and-other-conveyances (accessed on 28 October 2020).

- US Department of Energy. Vehicles Technologies Office. Available online: https://www.energy.gov/eere/vehicles/articles/fotw-1089-july-8-2019-there-are-more-68800-electric-vehicle-charging-units#:~:text=FOTW%231089%2CJuly8%2C,UnitedStates%7CDepartmentofEnergy (accessed on 28 October 2020).

- Noel, L.; Zarazua, G.; Rubens, D.; Kester, J.; Sovacool, B.K. Understanding the socio-technical nexus of Nordic electric vehicle (EV) barriers: A qualitative discussion of range, price, charging and knowledge. Energy Policy 2020, 138, 111292. [Google Scholar] [CrossRef]

- Gong, S.; Ardeshiri, A.; Rashidi, T.H. Impact of government incentives on the market penetration of electric vehicles in Australia. Transp. Res. Part D 2020, 83, 102353. [Google Scholar] [CrossRef]

- Naor, M.; Bernardes, E.S.; Druehl, C.T.; Shiftan, Y. Overcoming barriers to adoption of environmentally-friendly innovations through design and strategy: Learning from the failure of an electric vehicle infrastructure firm. Int. J. Oper. Prod. Manag. 2015, 35, 26–59. [Google Scholar] [CrossRef]

- Australian Local Government Association. Roads and Transport Agenda; Australian Local Government Association: Canberra, Australia, 2019.

- Kley, F.; Lerch, C.; Dallinger, D. New business models for electric cars—A holistic approach. Energy Policy 2011, 39, 3392–3403. [Google Scholar] [CrossRef] [Green Version]

- Sohaib, R.; Town, G.E. Potential for electric vehicle adoption in Australia. Int. J. Sustain. Transp. 2018, 13, 245–254. [Google Scholar] [CrossRef]

- Stanley, J.; Ellison, R.; Loader, C.; Hensher, D. Reducing Australian motor vehicle greenhouse gas emissions. Transp. Res. Part A Policy Pract. 2018, 109, 76–88. [Google Scholar] [CrossRef]

- Brooker, R.P.; Qin, N. Identification of potential locations of electric vehicle supply equipment. J. Power Sources 2015, 299, 76–84. [Google Scholar] [CrossRef]

- Ustun, T.S.; Zayegh, A.; Ozansoy, C. Electric vehicle potential in Australia: Its impact on smartgrids. IEEE Ind. Electron. Mag. 2013, 7, 15–25. [Google Scholar] [CrossRef]

- Queensland Government. Queensland Electric Vehicle Strategy; Queensland Government: Brisbane, Australia, 2017.

- Australian Government. A National Strategy for Electric Vehicles; Australian Government: Canberra, Australia, 2019.

- Transport for NSW. NSW Electric and Hybrid Vehicle Plan; Transport for NSW: Sydney, Australia, 2019.

- South Australian Government. Targeted Industry Consultation Discussion Paper and Survey; South Australian Government: Adelaide, Australia, 2019.

- Government of the Northern Territory. Preparing the Northern Territory for Electric Vehicles: Discussion Paper 2019; Government of the Northern Territory: Darwin, Australia, 2019.

- Government of the Australian Capital Territory. The ACT’s Tranmsition to Zero Emissions Vehicles; Government of the Australian Capital Territory: Canberra, Australia, 2018.

- Lake Macquarie City Council. Electric Vehicle Charging Strategy 2020–2023; Lake Macquarie City Council: Lake Macquarie, Australia, 2020. [Google Scholar]

- Osterwalder, A.; Pigneur, Y. Business Model Generation; Modderman Drukwerk: Amsterdam, The Netherlands, 2009; pp. 1–44. [Google Scholar]

- Magretta, J. Why business models matter. Harv. Bus. Rev. 2002, 80, 86–92. [Google Scholar] [PubMed]

- Madina, C.; Zamora, I.; Zabala, E. Methodology for assessing electric vehicle charging infrastructure business models. Energy Policy 2016, 89, 284–293. [Google Scholar] [CrossRef] [Green Version]

- Zarazua, G.; Rubens, D.; Noel, L.; Kester, J.; Sovacool, B.K. The market case for electric mobility: Investigating electric vehicle business models for mass adoption. Energy 2020, 194, 116841. [Google Scholar] [CrossRef]

- Gavrilescu, I. Effective business models for electric vehicles. Proc. Int. Conf. Bus. Excell. 2017, 11, 36–44. [Google Scholar] [CrossRef] [Green Version]

- Lake Macquarie City Council. Snapshot of the City. Available online: https://www.lakemac.com.au/city/snapshot (accessed on 6 February 2019).

- Myers, A. How States Can Overcome The Looming Electric Vehicle Charging Infrastructure Gap: California. Available online: https://www.forbes.com/sites/energyinnovation/2019/04/03/how-states-can-overcome-the-looming-electric-vehicle-charging-infrastructure-gap/#2ca76c844ded (accessed on 7 June 2019).

- City of Amsterdam. Plan Amsterdam. Available online: https://issuu.com/gemeenteamsterdam/docs/plan_amsterdam_the_electric_city (accessed on 9 May 2019).

- NRMA. NRMA Electric Vehicle Fast Charging Network. Available online: https://www.mynrma.com.au/community/initiatives/electric-vehicle-fast-charging-network (accessed on 7 June 2019).

- Merchant, E.F. California Regulators Approve Landmark Utility EV-Charging Proposals. Greentech Media. Available online: https://www.greentechmedia.com/articles/read/california-cpuc-approves-landmark-ev-charging-proposals#gs.awcfqs (accessed on 10 May 2019).

- City of Amsterdam. Charging and Parking Electric Vehicles—City of Amsterdam. Available online: https://www.amsterdam.nl/en/parking/electric-charging/ (accessed on 7 June 2019).

- Chargefox. Our Network. Australia’s Largest EV Charging Network. Available online: https://www.chargefox.com/network/ (accessed on 7 June 2019).

- AEMO. AEMO Annual Report 2019; AEMO: Sydney, Australia, 2019. [Google Scholar]

- Clean Energy Council. Clean Energy Australia Report 2020; Clean Energy Council: Melbourne, Australia, 2020. [Google Scholar]

- Naor, M.; Druehl, C.; Bernardes, E.S. Servitized business model innovation for sustainable transportation: Case study of failure to bridge the design-implementation gap. J. Clean. Prod. 2018, 170, 1219–1230. [Google Scholar] [CrossRef]

| Country | Population (Million) a | Landmass (sq. km) a | Population Density (People Per sq. km) | GDP (Millions of US Dollars) a | Vehicle Fleet (Registered Motor Vehicles) (Millions) | EV Vehicle Fleet (Plug-in) | No. of Public Chargers |

|---|---|---|---|---|---|---|---|

| Australia b | 25.4 | 7,692,020 | 3 | 1,392,681 | 19.8 | 16,275 | 2307 |

| Canada e | 37.6 | 9,093,510 | 4 | 1,736,426 | 35.7 | 82,756 | 12,333 |

| China d | 1397.7 | 9,388,210 | 149 | 14,342,903 | 340 | 3,500,000 | 330,000 |

| New Zealand g | 4.9 | 263,310 | 19 | 206,929 | 3.5 | 5108 | 613 |

| Norway f | 5.3 | 365,123 | 15 | 403,336 | 5.9 | 260,692 | 13,786 |

| United Kingdom g | 66.8 | 241,930 | 276 | 2,827,113 | 37.7 | 242,200 | 18,265 |

| USA h | 328.2 | 9,147,420 | 36 | 21,427,700 | 273.6 | 1,608,261 | 68,800 |

| State/Federal | Dedicated EV/ e-Mobility Strategy | Type of EV Support Mechanism | Description |

|---|---|---|---|

| Federal | |||

| Australian Government | Factsheet on strategy (2019). Future Fuels Strategy discussion paper (2021). | None | Consultation on strategy for enabling private sector deployment of low emission road transport technologies. |

| State | |||

| Australian Capital Territory (ACT) | Yes (2018) | Stamp duty waiver on new vehicles. Discounted vehicle registration. | New vehicle purchases pay nothing for stamp duty for the first 2 years followed by an ongoing 20% discount. They also receive an extra $200 discount on registration. |

| Queensland (QLD) | Yes (2017) | Reduced stamp duty for EVs and hybrids. | Reduced stamp duty ($2 per $100 up to $100,000 and $4 per $100 thereafter). |

| New South Wales (NSW) | Yes (2019) | Reduced motor vehicle tax (all fuel-efficient vehicles). | For all vehicles with CO2 emissions <150 g/km. |

| South Australia (SA) | Yes (2020) | None | Support for smart charging demonstrations. |

| Northern Territory (NT) | In consultation (2019) | None | - |

| Western Australia (WA) | Yes (2020) | None | $20 million in support for an EV charging network. |

| Victoria (VIC) | Yes (2021) | Discounted vehicle registration. Reduced stamp duty rate, Subsidy. | $100 annual discount on vehicle registration. EVs exempt from “luxury vehicle” rate of stamp duty (pay a flat rate of $8.40 per $200 of market value, rather than up to $18 as per non-electric vehicles), Twenty-thousand subsidies of up to $3000 for new EV purchases under $69,000. |

| Tasmania | No | None | - |

| Local Government (a selection) | |||

| City of Adelaide | No | Sustainability incentives for rebates on EV charging stations. | Up to 50% (up to a maximum of $10,000 for advanced systems capable of demand management) for EV charging stations. |

| City of Sydney | No | Discounted parking permits. | For vehicles with emissions less than 112 CO2 g/km, an annual parking permit costs $41, which increases to $159 for CO2 emissions >260 g/km. |

| Lake Macquarie City Council | Yes (2020) | None | - |

| Business Model Subtype | Government-Owned | Third-Party Owned | Utility Owned | |

|---|---|---|---|---|

| Example | City of Amsterdam | City of Adelaide | NRMA | Californian Energy Utilities |

| Type of Organisation | Local council | Local council | Automobile association | Energy utilities (various) |

| Summary | Public-owned, public access charging points provided within a locally governed area for a charge (initially free). | Public-owned, public access charging points provided within a locally governed area for a charge. | Private owned, public access charging points provided for free to all (non-members charged in future) on major highways and popular travel destinations. | Private owned, public access charging points provided by an energy retailer for a charge. |

| Charge Point Operator | City of Amsterdam, Energy companies | Chargefox | NRMA | Varies (third-party operators, utility operated) |

| Value Proposition for Owner/Operator | Increase visits by EV owner market segment, improve local air quality, provide EV infrastructure to residents. | Demonstrate that sustainability is a commercial opportunity for the council, position Adelaide as a hub for EVs, ensure access for visitors, create investment opportunities, support the local economy, and benefit the community. | Reduce motoring costs, increase consumer choice, (eventually) increase membership through the offering of free charging. | Increase electricity sales, gain new customers, bundle with new service offerings, demonstrate social responsibility. |

| Locations |

|

|

|

|

| Access | Open access but requires a pass card. | Open access but you must also pay for the parking. Pay with a credit card. | Open access | Open access |

| Cost to Customer |

| Pay per use model (standard parking charges still apply for both on-street and off-street parking). | Currently, free for all (eventually, non-members will pay per use). | Pay per use model (time of use discounts in some cases to encourage off-peak charging). |

| Revenue Model |

|

|

|

|

| Charger Type |

|

|

|

|

| Information Platform |

|

|

|

|

| Value Add 1 |

|

|

|

|

| Pros |

|

|

|

|

| Cons | Lots of risks reside with the council (finance, own and operation). | Relies on initial funding. | May find it difficult to scale up to the national level to benefit all members. |

|

| Business Model Subtype | Membership-Based Charging Stations | Guest and Visitor Servicing | Business Self-Funded |

|---|---|---|---|

| Example | Tesla | eChargeWork | Go-To-U Charging Network |

| Type of organisation | Automobile manufacturer | Chargepoint Operator | Businesses (various) |

| Summary | Self-funded, privately owned charging points with a mix of semi-public (Destination Charging) and restricted access (Tesla Superchargers for Tesla owners) provided for a charge. | Third-party funded, private owned, restricted (semi-public) access charging points provided for a charge to guests, customers, and visitors. | Self-funded, private owned, restricted access charging points provided for free to guests, customers, and visitors. |

| Charge Point Operator | Tesla | eChargeWork | Business owners |

| Value proposition for owner/operator | The world’s fastest charging network and the most access to charging stations of all EV owners. |

| Early access to the EV owner customer segment. |

| Locations |

|

|

|

| Access |

|

| Access for guests, customers, and visitors. |

| Cost to customer |

| Pay per use (€20 per charging session). | Free |

| Revenue Model |

|

|

|

| Charger Type |

|

|

|

| Information Platform |

|

|

|

| Value Add |

|

|

|

| Pros |

|

|

|

| Cons | Takes on a lot of the risks but slowly transferring these back to hosts and customers. | Revenue for the business may not be enough to compensate if paid parking.Competing with Tesla’s Destination Charging proposition. | Much of the risk resides with the business for own, install, operate. Host business must pay for the additional service for customers and tricky to balance cost vs. reward (increased patronage). |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dwyer, S.; Moutou, C.; Nagrath, K.; Wyndham, J.; McIntosh, L.; Chapman, D. An Australian Perspective on Local Government Investment in Electric Vehicle Charging Infrastructure. Sustainability 2021, 13, 6590. https://doi.org/10.3390/su13126590

Dwyer S, Moutou C, Nagrath K, Wyndham J, McIntosh L, Chapman D. An Australian Perspective on Local Government Investment in Electric Vehicle Charging Infrastructure. Sustainability. 2021; 13(12):6590. https://doi.org/10.3390/su13126590

Chicago/Turabian StyleDwyer, Scott, Claudine Moutou, Kriti Nagrath, Joseph Wyndham, Lawrence McIntosh, and Dean Chapman. 2021. "An Australian Perspective on Local Government Investment in Electric Vehicle Charging Infrastructure" Sustainability 13, no. 12: 6590. https://doi.org/10.3390/su13126590

APA StyleDwyer, S., Moutou, C., Nagrath, K., Wyndham, J., McIntosh, L., & Chapman, D. (2021). An Australian Perspective on Local Government Investment in Electric Vehicle Charging Infrastructure. Sustainability, 13(12), 6590. https://doi.org/10.3390/su13126590