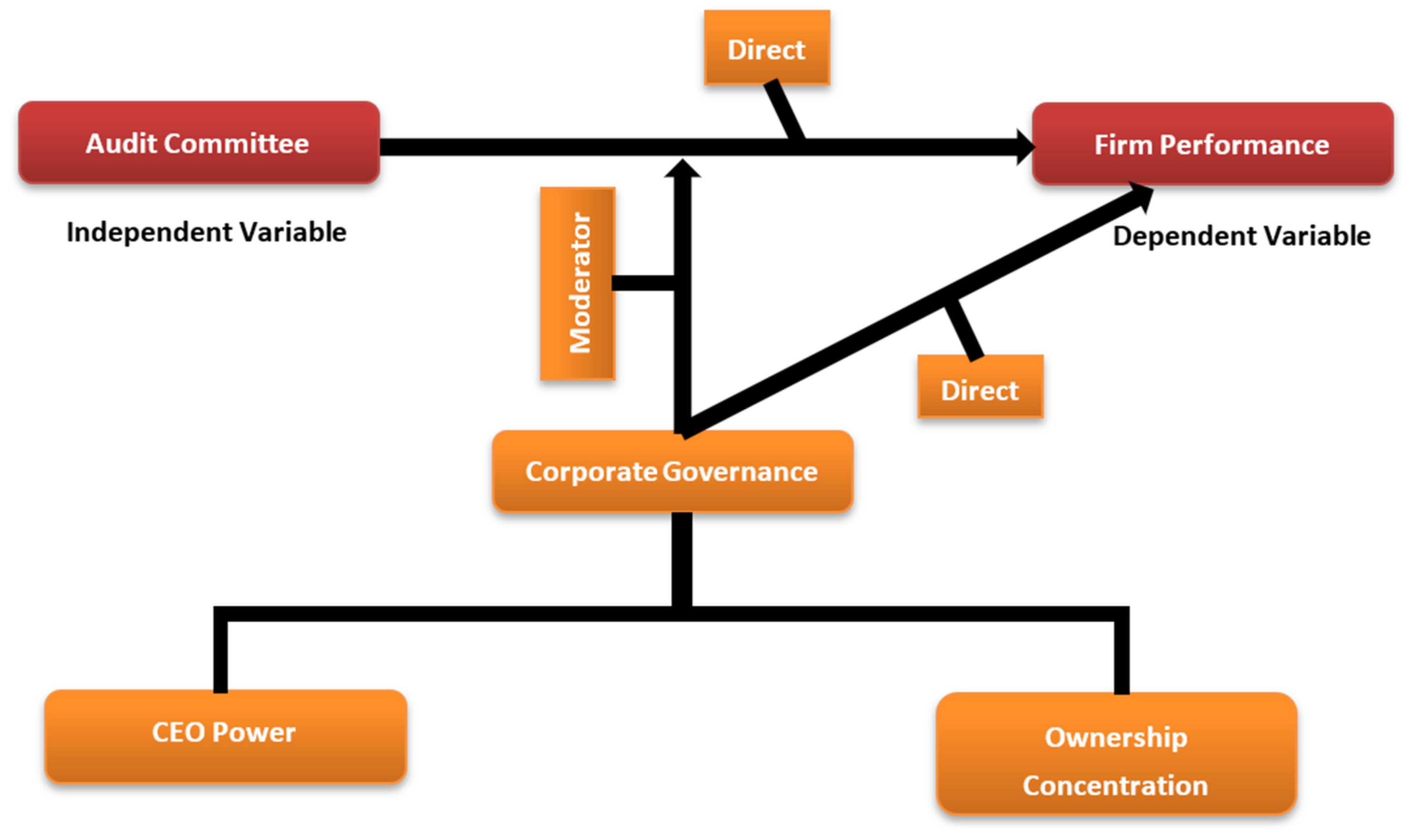

Conceptualizing the Moderating Role of CEO Power and Ownership Concentration in the Relationship between Audit Committee and Firm Performance: Empirical Evidence from Pakistan

Abstract

1. Introduction

2. Auditing Practices in Pakistan

3. Theoretical Background and Review of the Literature

3.1. Audit Committee and Firm Performance

3.2. CEO Power and Firm Performance

3.3. Ownership Concentration and Firm Performance

3.4. The Moderating Role of CEO Power

3.5. The Moderating Role of Ownership Concentration

4. Sample and Empirical Approaches

4.1. Sample Size

4.2. Variables Measurement

4.2.1. Firm Performance

4.2.2. Audit Committee

4.2.3. Chief Executive Officer (CEO) Power

4.2.4. Ownership Concentration

4.2.5. Control Variables

4.3. Estimation Procedure

4.4. Model Construction

5. Results and Discussion

5.1. Descriptive Statistics and Correlations

5.2. Endogeneity Analysis

5.3. Testing of Hypothesis 1

5.4. Testing of Hypothesis 2

5.5. Testing of Hypothesis 3

5.6. Testing of Hypotheses 4 and 5

5.7. Robustness Test

5.8. Discussion

6. Conclusions

6.1. Policy Implications

6.2. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Waweru, N. Determinants of quality corporate governance in Sub-Saharan Africa. Manag. Audit. J. 2014, 29, 455–485. [Google Scholar] [CrossRef]

- Khan, A.; Mihret, D.G.; Muttakin, M.; Management, I. Corporate political connections, agency costs and audit quality. Int. J. Account. Inf. Manag. 2016, 24, 357–374. [Google Scholar] [CrossRef]

- Iyer, V.M.; Bamber, E.M.; Griffin, J. Characteristics of audit committee financial experts: An empirical study. Manag. Audit. J. 2013, 28, 65–78. [Google Scholar] [CrossRef]

- Krishnan, J. Audit committee quality and internal control: An empirical analysis. Account. Rev. 2005, 80, 649–675. [Google Scholar] [CrossRef]

- Hoitash, U.; Hoitash, R.; Bedard, J. Corporate governance and internal control over financial reporting: A comparison of regulatory regimes. Account. Rev. 2009, 84, 839–867. [Google Scholar] [CrossRef]

- Aldamen, H.; Duncan, K.; Kelly, S.; McNamara, R.; Nagel, S. Audit committee characteristics and firm performance during the global financial crisis. Account. Financ. 2011, 52, 971–1000. [Google Scholar] [CrossRef]

- Sattar, U.; Javeed, S.A.; Latief, R. How audit quality affects the firm performance with the moderating role of the product market competition: Empirical evidence from Pakistani manufacturing firms. Sustainability 2020, 12, 4153. [Google Scholar] [CrossRef]

- Mohammed, B.H.; Flayyih, H.H.; Mohammed, Y.N.; Abbood, H.; Science, A. The effect of audit committee characteristics and firm financial performance: An empirical study of listed companies in Iraq stock exchange. J. Eng. Appl. Sci. 2019, 14, 4919–4926. [Google Scholar] [CrossRef][Green Version]

- Sulong, Z.; Gardner, J.C.; Hussin, A.H.; Mohd Sanusi, Z.; McGowan, C.B. Managerial ownership, leverage and audit quality impact on firm performance: Evidence from the Malaysian Ace Market. Account. Tax. 2013, 5, 59–70. [Google Scholar]

- Zhou, H.; Owusu-Ansah, S.; Maggina, A. Board of directors, audit committee, and firm performance: Evidence from Greece. Int. Account. Audit. Tax. 2018, 31, 20–36. [Google Scholar] [CrossRef]

- Beasley, M.S.; Carcello, J.V.; Hermanson, D.R.; Neal, T. The audit committee oversight process. Account. Res. 2009, 26, 65–122. [Google Scholar] [CrossRef]

- Cohen, J.; Krishnamoorthy, G.; Wright, A.J. Corporate governance in the post-Sarbanes-Oxley era: Auditors’ experiences. Account. Res. 2010, 27, 751–786. [Google Scholar] [CrossRef]

- Carcello, J.V.; Neal, T.L.; Palmrose, Z.V.; Scholz, S. CEO involvement in selecting board members, audit committee effectiveness, and restatements. Contemp. Account. Res. 2011, 28, 396–430. [Google Scholar] [CrossRef]

- Bruynseels, L.; Cardinaels, E. The audit committee: Management watchdog or personal friend of the CEO? Account. Rev. 2014, 89, 113–145. [Google Scholar] [CrossRef]

- Busenbark, J.R.; Krause, R.; Boivie, S.; Graffin, S. Toward a configurational perspective on the CEO: A review and synthesis of the management literature. J. Manag. 2016, 42, 234–268. [Google Scholar] [CrossRef]

- Liu, X.; Lu, J.; Chizema, A. Top executive compensation, regional institutions and Chinese OFDI. J. World Bus. 2014, 49, 143–155. [Google Scholar] [CrossRef]

- Shleifer, A.; Vishny, R.W. Survey of Corporate Governance. J. Financ. 1997, 2, 737–783. [Google Scholar] [CrossRef]

- Hill, C.W.; Jones, T.M. Stakeholder-agency theory. J. Manag. Stud. 1992, 29, 131–154. [Google Scholar] [CrossRef]

- Wiseman, R.M.; Cuevas-Rodríguez, G.; Gomez-Mejia, L.R. Towards a social theory of agency. J. Manag. Stud. 2011, 49, 202–222. [Google Scholar] [CrossRef]

- Jensen, M.C.; Meckling, W.H. Theory of the firm: Managerial behavior, agency costs and ownership structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Sah, R.; Stiglitz, J. The Architecture of Economic Systems: Hierarchies and Polyarchies. Am. Econ. Rev. 1984, 76, 716–727. [Google Scholar] [CrossRef]

- Bebchuk, L.A.; Fried, J.M.; Walker, D.I. Managerial Power and Rent Extraction in The Design Of Executive Compensation; National Bureau of Economic Research: Cambridge, MA, USA, 2002; Volume 69, pp. 751–846. [Google Scholar]

- Sheikh, S. CEO inside debt, market competition and corporate risk taking. Int. J. Manag. Financ. 2019, 15, 636–657. [Google Scholar] [CrossRef]

- Waweru, N.M.; Kamau, R.G.; Uliana, E. Audit committees and corporate governance in a developing country. Int. J. Account. Audit. Perform. Eval. 2011, 7, 337–358. [Google Scholar] [CrossRef]

- Tsamenyi, M.; Enninful-Adu, E.; Onumah, J. Disclosure and corporate governance in developing countries: Evidence from Ghana. Manag. Audit. J. 2007, 22, 319–334. [Google Scholar] [CrossRef]

- Hussain, S. Ownership structure of family business groups of Pakistan. In Proceedings of the Economics and Finance Conferences, Rome, Italy, 10–13 September 2018; pp. 75–89. [Google Scholar] [CrossRef]

- Dam, L.; Scholtens, B. Ownership concentration and CSR policy of European multinational enterprises. J. Bus. Ethics 2013, 118, 117–126. [Google Scholar] [CrossRef]

- Castellaneta, F.; Gottschalg, O. Does ownership matter in private equity? The sources of variance in buyouts’ performance. Strat. Manag. J. 2014, 37, 330–348. [Google Scholar] [CrossRef]

- Siddiqui, J. Development of corporate governance regulations: The case of an emerging economy. J. Bus. Ethics 2010, 91, 253–274. [Google Scholar] [CrossRef]

- Easterly, W. The Political Economy of Growth without Development: A Case Study of Pakistan; Kennedy School of Government, Harvard University: Cambridge, MA, USA, 2001; pp. 1–53. [Google Scholar]

- Iqbal, J. Stock market in Pakistan: An overview. J. Emerg. Mark. Financ. 2012, 11, 61–91. [Google Scholar] [CrossRef]

- Ibrahim, A. Corporate governance in Pakistan: Analysis of current challenges and recommendations for future reforms. Wash. Univ. Glob. Stud. Law Rev. 2006, 5, 323. [Google Scholar]

- Shah, S.Z.A.; Butt, S.A. The impact of corporate governance on the cost of equity: Empirical evidence from Pakistani listed companies. Lahore J. Econ. 2009, 14, 139–171. [Google Scholar] [CrossRef]

- Ashraf, J.; Ghani, W. Accounting development in Pakistan. Int. J. Account. 2005, 40, 175–201. [Google Scholar] [CrossRef]

- Waheed, A. Securities & Exchange Commission of Pakistan and United Nations Development Program; United Nations: San Francisco, CA, USA, 2005. [Google Scholar]

- Rustam, S.; Rashid, K.; Zaman, K. Retracted: The relationship between audit committees, compensation incentives and corporate audit fees in Pakistan. Econ. Model. 2013, 31, 697–716. [Google Scholar] [CrossRef]

- La Porta, R.; Lopez-de-Silanes, F.; Shleifer, A.; Vishny, R. Legal determinants of external finance. J. Financ. 1997, 52, 1131–1150. [Google Scholar] [CrossRef]

- Morck, R.; Shleifer, A.; Vishny, R. Management ownership and market valuation: An empirical analysis. J. Financ. Econ. 1988, 20, 293–315. [Google Scholar] [CrossRef]

- Yusuf, F.; Yousaf, A.; Saeed, A. Rethinking agency theory in developing countries: A case study of Pakistan. Account. Forum 2018, 42, 281–292. [Google Scholar] [CrossRef]

- Bonazzi, L.; Islam, S. Agency theory and corporate governance: A study of the effectiveness of board in their monitoring of the CEO. J. Model. Manag. 2007, 2, 7–23. [Google Scholar] [CrossRef]

- Power, M. Evaluating the audit explosion. Law Policy 2003, 25, 185–202. [Google Scholar] [CrossRef]

- Ghafran, C.; O’Sullivan, N. The governance role of audit committees: Reviewing a decade of evidence. Int. J. Manag. Rev. 2013, 15, 381–407. [Google Scholar] [CrossRef]

- Chan, K.C.; Li, J. Audit committee and firm value: Evidence on outside top executives as expert-independent directors. Corp. Gov. Int. Rev. 2008, 16, 16–31. [Google Scholar] [CrossRef]

- Arshad, M.A.; Satar, R.A.; Hussain, M.; Naseem, M.A. Effect of audit on profitability: A study of cement listed firms, Pakistan. Glob. J. Manag. Bus. Res. 2011, 11, 1–5. [Google Scholar]

- Kallamu, B.S.; Saat, N. Audit committee attributes and firm performance: Evidence from Malaysian finance companies. Asian Rev. Account. 2015, 23, 206–231. [Google Scholar] [CrossRef]

- Bansal, N.; Sharma, A.K. Audit committee, corporate governance and firm performance: Empirical evidence from India. Int. J. Econ. Financ. 2016, 8, 103. [Google Scholar] [CrossRef]

- Hutchinson, M.R.; Zain, M. Internal audit quality, audit committee independence, growth opportunities and firm performance. Corp. Ownersh. Control 2009, 7, 50–63. [Google Scholar] [CrossRef]

- Lin, J.W.; Hwang, M.I. Audit quality, corporate governance, and earnings management: A meta-analysis. Int. J. Audit. 2010, 14, 57–77. [Google Scholar] [CrossRef]

- Chiu, J.; Chen, C.-H.; Cheng, C.-C.; Hung, S.-C. Knowledge capital, CEO power, and firm value: Evidence from the IT industry. N. Am. J. Econ. Financ. 2019, 101012. [Google Scholar] [CrossRef]

- Bebchuk, L.A.; Fried, J.M. Executive compensation as an agency problem. J. Econ. Perspect. 2003, 17, 71–92. [Google Scholar] [CrossRef]

- Faulkender, M.; Yang, J. Inside the black box: The role and composition of compensation peer groups. J. Financ. Econ. 2010, 96, 257–270. [Google Scholar] [CrossRef]

- Bebchuk, L.A.; Cremers, K.M.; Peyer, U.C. The CEO pay slice. J. Financ. Econ. 2011, 102, 199–221. [Google Scholar] [CrossRef]

- Morse, A.; Nanda, V.; Seru, A. Are incentive contracts rigged by powerful CEOs? J. Financ. 2011, 66, 1779–1821. [Google Scholar] [CrossRef]

- Landier, A.; Sauvagnat, J.; Sraer, D.; Thesmar, D. Bottom-up corporate governance. Rev. Financ. 2013, 17, 161–201. [Google Scholar] [CrossRef]

- Brickley, J.A.; Coles, J.L.; Jarrell, G. Leadership structure: Separating the CEO and chairman of the board. J. Corp. Financ. 1997, 3, 189–220. [Google Scholar] [CrossRef]

- Yang, T.; Zhao, S. CEO duality and firm performance: Evidence from an exogenous shock to the competitive environment. J. Bank. Financ. 2014, 49, 534–552. [Google Scholar] [CrossRef]

- Berger, R.; Dutta, S.; Raffel, T.; Samuels, G. Innovating at the Top: How Global CEOs Drive Innovation for Growth and Profit; Palgrave Macmillan: London, UK, 2008. [Google Scholar]

- Papadakis, V.M. Do CEOs shape the process of making strategic decisions? Evidence from Greece. Manag. Decis. 2006, 44, 367–394. [Google Scholar] [CrossRef]

- Coles, J.L.; Li, Z.; Wang, A.Y. Industry tournament incentives. Rev. Financ. Stud. 2017, 31, 1418–1459. [Google Scholar] [CrossRef]

- Javid, A.Y.; Iqbal, R. Ownership concentration, corporate governance and firm performance: Evidence from Pakistan. Pak. Dev. Rev. 2008, 47, 643–659. [Google Scholar] [CrossRef]

- Kamran, K.; Shah, A. The impact of corporate governance and ownership structure on earnings management practices: Evidence from listed companies in Pakistan. Lahore J. Econ. 2014, 19, 27–70. [Google Scholar]

- Bayless, M. The myth of executive compensation: Do shareholders get what they pay for? Appl. Financ. Econ. 2009, 19, 795–808. [Google Scholar] [CrossRef]

- Buck, T.; Liu, X.; Skovoroda, R. Top executive pay and firm performance in China. J. Int. Bus. Stud. 2008, 39, 833–850. [Google Scholar] [CrossRef]

- Setia-Atmaja, L.Y. Governance mechanisms and firm value: The impact of ownership concentration and dividends. Corp. Gov. Int. Rev. 2009, 17, 694–709. [Google Scholar] [CrossRef]

- Baysinger, B.D.; Kosnik, R.D.; Turk, T.A. Effects of board and ownership structure on corporate R&D strategy. Acad. Manag. J. 1991, 34, 205–214. [Google Scholar]

- Berle, A.; Means, G.C. The Modern Corporation and Private Property; Transaction Publishers: Piscatawa, NJ, USA, 1932. [Google Scholar]

- Butt, S.A.; Hasan, A. Impact of ownership structure and corporate governance on capital structure of Pakistani listed companies. Int. J. Bus. Manag. 2009, 4, 50–57. [Google Scholar]

- Abbas, A.; Naqvi, H.A.; Mirza, H.H. Impact of large ownership on firm performance: A case of non financial listed companies of Pakistan. World Appl. Sci. J. 2013, 21, 1141–1152. [Google Scholar]

- Peng, C.-W.; Yang, M.-L. The effect of corporate social performance on financial performance: The moderating effect of ownership concentration. J. Bus. Ethics 2014, 123, 171–182. [Google Scholar] [CrossRef]

- Claessens, S.; Djankov, S.; Pohl, G. Ownership and corporate governance: Evidence from the Czech Republic; World Bank Publications: Washington, DC, USA, 1997. [Google Scholar]

- Hanousek, J.; Kočenda, E.; Svejnar, J. Origin and concentration: Corporate ownership, control and performance in firms after privatization. Econ. Transit. 2007, 15, 1–31. [Google Scholar] [CrossRef]

- Omran, M. Post-privatization corporate governance and firm performance: The role of private ownership concentration, identity and board composition. J. Comp. Econ. 2009, 37, 658–673. [Google Scholar] [CrossRef]

- Kim, K.A.; Kitsabunnarat, P.; Nofsinger, J.R. Ownership and operating performance in an emerging market: Evidence from Thai IPO firms. J. Corp. Financ. 2004, 10, 355–381. [Google Scholar] [CrossRef]

- Yasser, Q.R.; Mamun, A.A. The impact of ownership concentration on firm performance: Evidence from an emerging market. Emerg. Econ. Stud. 2017, 3, 34–53. [Google Scholar] [CrossRef]

- Cohen, J.; Krishnamoorthy, G.; Wright, A.M. Corporate governance and the audit process. Contemp. Account. Res. 2002, 19, 573–594. [Google Scholar] [CrossRef]

- Abbott, L.J.; Parker, S. Auditor selection and audit committee characteristics. Audit. J. Pract. Theory 2000, 19, 47–66. [Google Scholar] [CrossRef]

- Boyd, B.K.; Haynes, K.T.; Zona, F. Dimensions of CEO–board relations. J. Manag. Stud. 2011, 48, 1892–1923. [Google Scholar] [CrossRef]

- Ghosh, A.A.; Tang, C.Y. Assessing financial reporting quality of family firms: The auditors’ perspective. J. Account. Econ. 2015, 60, 95–116. [Google Scholar] [CrossRef]

- Srinidhi, B.N.; He, S.; Firth, M. The effect of governance on specialist auditor choice and audit fees in US family firms. Account. Rev. 2014, 89, 2297–2329. [Google Scholar] [CrossRef]

- Chen, Y.; Gul, F.A.; Veeraraghavan, M.; Zolotoy, L. Executive equity risk-taking incentives and audit pricing. Account. Rev. 2015, 90, 2205–2234. [Google Scholar] [CrossRef]

- Turley, S.; Zaman, M. Audit committee effectiveness: Informal processes and behavioural effects. Account. Audit. Account. J. 2007, 20, 765–788. [Google Scholar] [CrossRef]

- Lubatkin, M.H.; Schulze, W.S.; Ling, Y.; Dino, R.N. The effects of parental altruism on the governance of family-managed firms. J. Organ. Behav. Int. J. Ind. Occup. Organ. Psychol. Behav. 2005, 26, 313–330. [Google Scholar]

- Jizi, M.; Nehme, R. Board monitoring and audit fees: The moderating role of CEO/chair dual roles. Manag. Audit. J. 2018, 33, 217–243. [Google Scholar]

- Karim, A.W.; van Zijl, T.; Mollah, S. Impact of board ownership, CEO-Chair duality and foreign equity participation on auditor quality choice of IPO companies. Int. J. Account. Inf. Manag. 2013, 21, 148–169. [Google Scholar] [CrossRef]

- Lisic, L.L.; Neal, T.L.; Zhang, I.X.; Zhang, Y. CEO power, internal control quality, and audit committee effectiveness in substance versus in form. Contemp. Account. Res. 2016, 33, 1199–1237. [Google Scholar] [CrossRef]

- Kim, H.; Kwak, B.; Lim, Y.; Yu, J. Audit committee accounting expertise, CEO power, and audit pricing. Asia-Pac. J. Account. Econ. 2017, 24, 421–439. [Google Scholar]

- Alzeban, A. The impact of audit committee, CEO, and external auditor quality on the quality of financial reporting. Corp. Gov. Int. J. Bus. Soc. 2019, 20, 263–279. [Google Scholar] [CrossRef]

- Tee, C.M. CEO power and audit fees: Evidence from Malaysia. Int. J. Audit. 2019, 23, 365–386. [Google Scholar] [CrossRef]

- Imhoff, E.A. Accounting quality, auditing and corporate governance. Account. Horiz. 2003, 17, 117–128. [Google Scholar] [CrossRef]

- Watts, R.L.; Zimmerman, J.L. Agency problems, auditing, and the theory of the firm: Some evidence. J. Law Econ. 1983, 26, 613–633. [Google Scholar] [CrossRef]

- Mitra, S.; Hossain, M.; Deis, D.R. The empirical relationship between ownership characteristics and audit fees. Rev. Quant. Financ. Account. 2007, 28, 257–285. [Google Scholar] [CrossRef]

- Lin, Z.J.; Liu, M. The impact of corporate governance on auditor choice: Evidence from China. J. Int. Account. Audit. Tax. 2009, 18, 44–59. [Google Scholar] [CrossRef]

- Fan, J.P.; Wong, T.J. Do external auditors perform a corporate governance role in emerging markets? Evidence from East Asia. J. Account. Res. 2005, 43, 35–72. [Google Scholar] [CrossRef]

- Wahab, E.A.A.; Zain, M.M.; James, K. Political connections, corporate governance and audit fees in Malaysia. Manag. Audit. J. 2011, 26, 393–418. [Google Scholar] [CrossRef]

- Mustapha, M.; Che Ahmad, A. Blockholders and corporate monitoring costs: Evidence from Malaysia. Int. J. Econ. Manag. 2013, 7, 28–44. [Google Scholar]

- SECP. Rules and Regulations for Firms; SECP: Islamabad, Pakistan, 2013. [Google Scholar]

- Javid, A.Y.; Iqbal, R.; Reports, R. Corporate Governance in Pakistan: Corporate Valuation, Ownership and Financing; PIDE Working Papers; Pakistan Institute of Development Economics: Islamabad, Pakistan, 2010; p. 57. [Google Scholar]

- Javeed, S.A.; Lefen, L. An analysis of corporate social responsibility and firm performance with moderating effects of CEO power and ownership structure: A case study of the manufacturing sector of Pakistan. Sustainability 2019, 11, 248. [Google Scholar] [CrossRef]

- SECP. Rules and Regulations for Firms; SECP: Islamabad, Pakistan, 2017. [Google Scholar]

- World Bank. World Development Indicators; World Bank: Washington, DC, USA, 2016. [Google Scholar]

- Ehsan, S.; Nazir, M.; Nurunnabi, M.; Raza Khan, Q.; Tahir, S.; Ahmed, I. A Multimethod Approach to Assess and Measure Corporate Social Responsibility Disclosure and Practices in a Developing Economy. Sustainability 2018, 10, 2955. [Google Scholar] [CrossRef]

- Wang, Y.; Chui, A.C. Product market competition and audit fees. Audit. J. Pract. Theory 2014, 34, 139–156. [Google Scholar] [CrossRef]

- Bhatti, M.I.; Awan, H.M. The role of quality auditing in the continuous improvement of quality: Lessons from Pakistani experience. Int. J. Audit. 2004, 8, 21–32. [Google Scholar] [CrossRef]

- Awan, U.; Kraslawski, A.; Huiskonen, J. Understanding the relationship between stakeholder pressure and sustainability performance in manufacturing firms in Pakistan. Procedia Manuf. 2017, 11, 768–777. [Google Scholar] [CrossRef]

- Rais, R.B.; Saeed, A. CMER Working Paper. In Regulatory Impact Assessment of SECP’s Corporate Governance Code in Pakistan; Lahore University of Management Sciences: Lahore, Pakistan, 2005. [Google Scholar]

- Moradi, M.; Velashani, M.A.B.; Omidfar, M. Corporate governance, product market competition and firm performance: Evidence from Iran. Humanomics 2017, 33, 38–55. [Google Scholar] [CrossRef]

- Chiang, M.H.; Lin, J.H. The Relationship between Corporate Governance and Firm Productivity: Evidence from Taiwan’s manufacturing firms. Corp. Gov. Int. Rev. 2007, 15, 768–779. [Google Scholar] [CrossRef]

- Gill, A.S.; Biger, N.J. The impact of corporate governance on working capital management efficiency of American manufacturing firms. Manag. Financ. 2013, 39, 116–132. [Google Scholar] [CrossRef]

- Florax, R.; Mulatu, A.; Withagen, C. Environmental regulation and competitiveness: A meta-analysis of international trade studies. In Empirical Modelling of the Economy and the Environment; Physica: Berlin/Heidelberg, Germany, 2003; Volume 20, pp. 53–73. [Google Scholar]

- Kim, P.K.; Rasiah, D. Relationship between corporate governance and bank performance in Malaysia during the pre and post Asian financial crisis. Eur. J. Econ. Financ. Adm. Sci. 2010, 21, 39–63. [Google Scholar]

- Shen, C.-H.; Wu, M.-W.; Chen, T.-H.; Fang, H. To engage or not to engage in corporate social responsibility: Empirical evidence from global banking sector. Econ. Model. 2016, 55, 207–225. [Google Scholar] [CrossRef]

- Hutchinson, M.; Gul, F.A. Investment opportunity set, corporate governance practices and firm performance. J. Corp. Financ. 2004, 10, 595–614. [Google Scholar] [CrossRef]

- Bhagat, S.; Bolton, B. Corporate governance and firm performance. J. Corp. Financ. 2008, 14, 257–273. [Google Scholar] [CrossRef]

- Kumar, J. Does corporate governance influence firm value? Evidence from Indian firms. J. Entrep. Financ. 2004, 9, 61–91. [Google Scholar]

- King, A.; Lenox, M. Exploring the locus of profitable pollution reduction. Manag. Sci. 2002, 48, 289–299. [Google Scholar] [CrossRef]

- Horváthová, E. The impact of environmental performance on firm performance: Short-term costs and long-term benefits? Ecol. Econ. 2012, 84, 91–97. [Google Scholar] [CrossRef]

- Ciftci, I.; Tatoglu, E.; Wood, G.; Demirbag, M.; Zaim, S. Corporate governance and firm performance in emerging markets: Evidence from Turkey. Int. Bus. Rev. 2019, 28, 90–103. [Google Scholar] [CrossRef]

- Wagner, M. The role of corporate sustainability performance for economic performance: A firm-level analysis of moderation effects. Ecol. Econ. 2010, 69, 1553–1560. [Google Scholar] [CrossRef]

- Nazir, M.S.; Afza, T. Does managerial behavior of managing earnings mitigate the relationship between corporate governance and firm value? Evidence from an emerging market. Future Bus. J. 2018, 4, 139–156. [Google Scholar] [CrossRef]

- Bhagat, S.; Black, B. The non-correlation between board independence and long-term firm performance. J. Corp. Law 2001, 27, 231. [Google Scholar] [CrossRef]

- Arens, A.A.; Elder, R.J.; Mark, B. Auditing and Assurance Services: An Integrated Approach; Prentice Hall: Boston, MA, USA, 2012. [Google Scholar]

- Hamdan, A.M.; Mushtaha, S.; Musleh Al-Sartawi, A. The audit committee characteristics and earnings quality: Evidence from Jordan. Australas. Account. Bus. Financ. J. 2013, 7. [Google Scholar] [CrossRef]

- Finkelstein, S.; D’aveni, R.A. CEO duality as a double-edged sword: How boards of directors balance entrenchment avoidance and unity of command. Acad. Manag. J. 1994, 37, 1079–1108. [Google Scholar]

- Hu, A.; Kumar, P. Managerial entrenchment and payout policy. J. Financ. Quant. Anal. 2004, 759–790. [Google Scholar] [CrossRef]

- Singh, D.A.; Gaur, A.S. Business group affiliation, firm governance, and firm performance: Evidence from China and India. Corp. Gov. Int. Rev. 2009, 17, 411–425. [Google Scholar] [CrossRef]

- Karaca, S.S.; Eksi, I.H. The relationship between ownership structure and firm performance: An empirical analysis over Istanbul Stock Exchange (ISE) listed companies. Int. Bus. Res. 2012, 5, 172. [Google Scholar] [CrossRef]

- Dang, C.; Li, Z.F.; Yang, C.J. Measuring firm size in empirical corporate finance. J. Bank. Financ. 2018, 86, 159–176. [Google Scholar] [CrossRef]

- Becker, T. Potential problems in the statistical control of variables in organizational research: A qualitative analysis with recommendations. Organ. Res. Methods 2005, 8, 274–289. [Google Scholar] [CrossRef]

- Murphy, B.J. Selecting out of control variables with the T2 multivariate quality control procedure. J. R. Stat. Soc. D (Stat.) 1987, 36, 571–581. [Google Scholar]

- Li, F. Endogeneity in CEO power: A survey and experiment. Invest. Anal. J. 2016, 45, 149–162. [Google Scholar] [CrossRef]

- Li, Y.; Gong, M.; Zhang, X.-Y.; Koh, L. The impact of environmental, social, and governance disclosure on firm value: The role of CEO power. Br. Account. Rev. 2018, 50, 60–75. [Google Scholar] [CrossRef]

- Al-Matari, E.M.; Al-Swidi, A.K.; Fadzil, F.H.B. Audit committee characteristics and executive committee characteristics and firm performance in Oman: Empirical study. Asian Soc. Sci. 2014, 10, 98. [Google Scholar]

- Feng, Y.; Chen, H.H.; Tang, J. The Impacts of Social Responsibility and Ownership Structure on Sustainable Financial Development of China’s Energy Industry. Sustainability 2018, 10, 301. [Google Scholar] [CrossRef]

- Ibhagui, O.W.; Olokoyo, F.O. Leverage and firm performance: New evidence on the role of firm size. N. Am. J. Econ. Financ. 2018, 45, 57–82. [Google Scholar] [CrossRef]

- Shah, S.Z.A.; Hussain, Z. Impact of ownership structure on firm performance evidence from non-financial listed companies at Karachi Stock Exchange. Int. Res. J. Financ. Econ. 2012, 84, 6–13. [Google Scholar]

- Chen, S.; Sun, S.Y.; Wu, D. Client importance, institutional improvements, and audit quality in China: An office and individual auditor level analysis. Account. Rev. 2010, 85, 127–158. [Google Scholar] [CrossRef]

- Kroes, J.R.; Manikas, A.S.; Gattiker, T.F. Operational leanness and retail firm performance since 1980. Int. J. Prod. Econ. 2018, 197, 262–274. [Google Scholar] [CrossRef]

- Pepperberg, I.M. The Alex Studies: Cognitive and Communicative Abilities of Grey Parrots; Harvard University Press: Cambridge, MA, USA, 1999; p. 434. [Google Scholar]

- Dittmar, A.; Mahrt-Smith, J. Corporate governance and the value of cash holdings. J. Financ. Econ. 2007, 83, 599–634. [Google Scholar] [CrossRef]

- Antonakis, J.; Bendahan, S.; Jacquart, P.; Lalive, R. On making causal claims: A review and recommendations. Leadersh. Q. 2010, 21, 1086–1120. [Google Scholar]

- Hamilton, B.H.; Nickerson, J.A. Correcting for endogeneity in strategic management research. Strateg. Organ. 2003, 1, 51–78. [Google Scholar] [CrossRef]

- Beiner, S.; Drobetz, W.; Schmid, M.M.; Zimmermann, H.J. An integrated framework of corporate governance and firm valuation. Eur. Financ. Manag. 2006, 12, 249–283. [Google Scholar] [CrossRef]

- Schultz, E.L.; Tan, D.T.; Walsh, K.D. Endogeneity and the corporate governance-performance relation. Aust. J. Manag. 2010, 35, 145–163. [Google Scholar] [CrossRef]

- Wintoki, M.B.; Linck, J.S.; Netter, J.M. Endogeneity and the dynamics of internal corporate governance. J. Financ. Econ. 2012, 105, 581–606. [Google Scholar] [CrossRef]

- Javeed, S.A.; Latief, R.; Lefen, L. An analysis of relationship between environmental regulations and firm performance with moderating effects of product market competition: Empirical evidence from Pakistan. J. Clean. Prod. 2020, 254, 120197. [Google Scholar] [CrossRef]

- Wooldridge, J.M. Econometric Analysis of Cross Section and Panel Data; MIT Press: Cambridge, UK, 2010. [Google Scholar]

- Semykina, A.; Wooldridge, J. Estimating panel data models in the presence of endogeneity and selection. J. Econom. 2010, 157, 375–380. [Google Scholar] [CrossRef]

- Gujarati, D.N.; Porter, D.C.; Gunasekar, S. Basic Econometrics; Tata McGraw-Hill Education: New York, NY, USA, 2012. [Google Scholar]

- Parket, I.R.; Eilbirt, H.J. The practice of business social responsibility: The underlying factors. Horizons 1975, 18, 5–10. [Google Scholar] [CrossRef]

- Iwata, H.; Okada, K. How does environmental performance affect financial performance? Evidence from Japanese manufacturing firms. Ecol. Econ. 2011, 70, 1691–1700. [Google Scholar] [CrossRef]

- Aitken, A.C. IV.—On least squares and linear combination of observations. Proc. R. Soc. Edinb. 1936, 55, 42–48. [Google Scholar] [CrossRef]

- Wooldridge, J. Inverse probability weighted M-estimators for sample selection, attrition, and stratification. Port. Econ. J. 2002, 1, 117–139. [Google Scholar] [CrossRef]

- Greene, W. Estimating Econometric Models with Fixed Effects; Stern School of Business, New York University: New York, NY, USA, 2001. [Google Scholar]

- Baltagi, B.H. Forecasting with panel data. J. Forecast. 2008, 27, 153–173. [Google Scholar] [CrossRef]

- Chen, H.; Li, X.; Zeng, S.; Ma, H.; Lin, H. Does state capitalism matter in firm internationalization? Pace, rhythm, location choice, and product diversity. Manag. Decis. 2016, 54, 1320–1342. [Google Scholar] [CrossRef]

- Mayur, M.; Saravanan, P. Performance implications of board size, composition and activity: Empirical evidence from the Indian banking sector. Corp. Gov. 2017, 17, 466–489. [Google Scholar] [CrossRef]

- Singh, S.; Guha, M. Experiential learning: Analyzing success and failures in Indian telecom sector. Benchmarking Int. J. 2018, 25, 3702–3719. [Google Scholar] [CrossRef]

- Ahmad, N.B.J.; Rashid, A.; Gow, J. Board independence and corporate social responsibility (CSR) reporting in Malaysia. Australas. Account. Bus. Financ. J. 2017, 11, 61–85. [Google Scholar] [CrossRef]

- Wysocki, P. Corporate compensation policies and audit fees. J. Account. Econ. 2010, 49, 155–160. [Google Scholar] [CrossRef]

| Sr. No. | Sectors | No. of Firms | Dropped Firms | Reasons for Dropping Firms | Final Selection of Firms |

|---|---|---|---|---|---|

| 1 | Textile Weaving | 9 | 4 | Declared Defaulter by PSX | 5 |

| 2 | Textile Composite | 58 | 23 | Declared Defaulter by PSX and Data Missing | 35 |

| 3 | Textile Woolen | 4 | 1 | Declared Defaulter by PSX | 3 |

| 4 | Cement | 25 | 8 | Declared Defaulter by PSX and Data Missing | 17 |

| 5 | Chemical | 29 | 6 | Declared Defaulter by PSX | 23 |

| 6 | Fertilizer | 9 | 6 | Declared Defaulter by PSX | 3 |

| 7 | Transport | 7 | 4 | Declared Defaulter by PSX | 3 |

| 8 | Oil and Gas Marketing | 11 | 5 | Declared Defaulter by PSX and Data Missing | 6 |

| 9 | Pharmaceutical | 12 | 4 | Declared Defaulter by PSX and Data Missing | 8 |

| 10 | Synthetic and Rayon | 13 | 5 | Declared Defaulter by PSX | 8 |

| 11 | Automobile Assembler | 16 | 4 | Declared Defaulter by PSX | 12 |

| 12 | Engineering | 20 | 12 | Declared Defaulter by PSX and Data Missing | 8 |

| 13 | Cable and Electrical Goods | 9 | 4 | Declared Defaulter by PSX | 5 |

| 14 | Automobile Parts and Accessories | 11 | 6 | Declared Defaulter by PSX | 5 |

| 15 | Oil and Gas Exploration | 5 | 1 | Declared Defaulter by PSX | 4 |

| 16 | Refinery | 4 | 2 | Declared Defaulter by PSX | 2 |

| Total Firms | 242 | 95 | 147 |

| Variable Names | Abbreviations | Measures |

|---|---|---|

| Dependent Variables | ||

| Return on Asset | ROA | Net profits/Total assets [114,116]. |

| Tobin’s Q | TQ | The market value of firm/Firm total assets value [118,119]. |

| Independent Variables | ||

| Audit Committee | AC1 | The ratio of the independent directors in the audit committee [6]. |

| Audit Committee | AC2 | Total number of directors serving in audits committee [122]. |

| Chief Executive Officer Power | CEO Power | CEO annual compensations/ Whole board of directors compensations [138]. |

| Ownership Concentration | OC | The major shareholding portion or Top 5 shareholders [125]. |

| Control Variables | ||

| Firm Size | FS | The natural log of total assets [130]. |

| Audit Committee Expert | ACE | Financial expert members in audit committee [122]. |

| Leverage | LEV | Total liability divided by total assets [133]. |

| Asset Turnover | ATO | The ratio of total sales to the total asset [135]. |

| Property, Plant, and Equipment | PPE | Amount of plant, property, and equipment divided by total sales [130]. |

| Variables | M | SD | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. ROA | 0.164 | 0.208 | 1 | ||||||||||

| 2. TQ | 0.033 | 0.048 | 0.98 *** | 1 | |||||||||

| 3. AC1 | 1.686 | 0.746 | 0.14 *** | 1.17 *** | 1 | ||||||||

| 4. AC2 | 0.030 | 0.136 | 0.26 *** | 0.27 *** | −0.17 *** | 1 | |||||||

| 5. CEO Power | 0.693 | 0.369 | 0.25 *** | 0.30 *** | 0.89 *** | −0.11 *** | 1 | ||||||

| 6. OC | 0.061 | 0.029 | 0.26 *** | 0.26 *** | −0.18 *** | 0.99 *** | −0.13 *** | 1 | |||||

| 7. ATO | 8.26 | 5.79 | 0.11 *** | 0.09 *** | −0.24 *** | 0.04 *** | −0.34 *** | 0.06 *** | 1 | ||||

| 8. LEV | 0.274 | 0.474 | 0.55 *** | 0.57 *** | 0.23 *** | 0.14 *** | 0.31 *** | 0.13 *** | −0.04 *** | 1 | |||

| 9. ACE | 0.535 | 0.516 | −0.13 *** | −0.07 *** | 0.55 *** | −0.06 *** | 0.62 *** | −0.07 *** | −0.39 *** | 0.22 *** | 1 | ||

| 10. FS | 0.097 | 0.101 | 0.08 *** | 0.10 *** | 0.66 *** | −0.08 *** | 0.56 *** | −0.09 *** | −0.17 *** | 0.46 *** | 0.40 *** | 1 | |

| 11. PPE | 0.634 | 0.616 | 0.79 *** | 0.77 *** | 0.12 *** | 0.22 *** | 0.25 *** | 0.22 *** | −0.006 ** | 0.67 *** | 0.12 *** | 0.04 *** | 1 |

| Independent Variables | OLS | |||||||

|---|---|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | ||

| RESID_AC1 | 0.038 *** | |||||||

| RESID_AC2 | 0.094 *** | |||||||

| RESID_CEOPOWER | 0.064 *** | |||||||

| RESID_OC | 0.333 *** | |||||||

| RESID_CEOAC1 | 0.126 *** | |||||||

| RESID_CEOAC2 | 0.123 *** | |||||||

| RESID_OCAC1 | 0.065 *** | |||||||

| RESID_OCAC2 | 0.025 *** | |||||||

| ATO | 0.003 *** | 0.004 *** | 0.003 *** | 0.004 *** | 0.002 *** | 0.003 *** | −0.001 ** | −0.001 *** |

| LEV | 0.007 | 0.012 | 0.007 | 0.008 | 0.008 | −0.180 *** | −0.002 *** | 0.002 |

| ACE | −0.157 *** | −0.149 *** | −0.154 *** | −0.155 *** | −0.167 *** | −0.151 *** | −0.069 *** | −0.024 *** |

| FS | 0.101 *** | 0.026 | 0.083 ** | 0.084 ** | −0.524 *** | −0.121 ** | 0.030 *** | −0.001 |

| PPE | 0.222 *** | 0.221 *** | 0.224 *** | 0.225 *** | 0.210 *** | 0.222 *** | 0.094 *** | 0.055 *** |

| Constant | 0.068 *** | 0.028 * | 0.069 *** | 0.067 *** | −0.043 ** | −0.009 | 0.023 *** | 0.013 *** |

| R2 | 0.8726 | 0.8725 | 0.8702 | 0.8705 | 0.8784 | 0.8784 | 0.9888 | 0.9569 |

| Wald Test F-statistics | 23.14 *** | 28.56 *** | 13.10 *** | 16.60 *** | 6.07 ** | 48.97 *** | 12.32 *** | 42.68 *** |

| Dependent Variables | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Independent Variables | ROA | TQ | ROA | TQ | ROA | TQ | ||||||

| FE | GMM | FE | GMM | FE | GMM | FE | GMM | FE | GMM | FE | GMM | |

| AC1 | 0.037 ** | 0.039 *** | 0.008 *** | 0.009 *** | ||||||||

| AC2 | 0.091 *** | 0.053 *** | 0.022 *** | 0.011 ** | ||||||||

| CEO POWER | 0.063 *** | 0.094 *** | 0.011 *** | 0.023 *** | ||||||||

| OC | 0.325 *** | 0.217 ** | 0.079 *** | 0.041 * | ||||||||

| CEOAC1 | ||||||||||||

| CEOAC2 | ||||||||||||

| OCAC1 | ||||||||||||

| OCAC2 | ||||||||||||

| ATO | 0.004 *** | 0.001 ** | 0.001 *** | 0.001 *** | 0.004 *** | 0.001 * | 0.001 *** | 0.001 *** | 0.004 *** | 0.002 *** | 0.008 *** | 0.001 *** |

| LEV | 0.013 | −0.003 | 0.005 *** | 0.002 | 0.013 | 0.003 ** | 0.005 *** | 0.002 | 0.007 | −0.007 | 0.004 ** | 0.011 |

| ACE | −0.151 *** | −0.187 *** | −0.033 *** | −0.042 *** | −0.149 *** | 0.188 *** | −0.033 *** | −0.042 *** | −0.155 *** | −0.183 *** | −0.034 *** | 0.041 *** |

| FS | 0.026 * | 0.143 ** | 0.002 | 0.024 | 0.025 | 0.137 ** | 0.002 | 0.023 | 0.098 ** | 0.226 *** | 0.017 * | 0.044 *** |

| PPE | 0.219 *** | 0.249 *** | 0.045 *** | 0.052 *** | 0.224 *** | 0.250 *** | 0.046 *** | 0.052 *** | 0.224 *** | 0.249 *** | 0.046 *** | 0.052 *** |

| Constant | 0.008 * | 0.026 | 0.003 ** | 0.009 * | 0.026 * | 0.026 ** | 0.005 *** | 0.010 * | 0.066 *** | 0.028 * | 0.013 *** | 0.004 |

| R2 | 0.6861 | 0.6431 | 0.6808 | 0.6362 | 0.6815 | 0.6387 | ||||||

| F | 10.66 *** | 13.93 *** | 9.44 *** | 11.79 *** | 12.44 *** | 16.21 *** | ||||||

| N | 1617 | 1320 | 1617 | 1320 | 1617 | 1320 | 1617 | 1320 | 1617 | 1320 | 1617 | 1320 |

| Hausman Test | 14.31 ** | 182.58 *** | 63.47 *** | 81.33 *** | 102.06 *** | 209.30 *** | ||||||

| Wald Chi2 | 2973.10 *** | 2521.15 *** | 2935.13 *** | 2493.31 *** | 2951.75 *** | 2497.05 *** | ||||||

| Dependent Variables | Model 7 | Model 8 | Model 9 | Model 10 | ||||

|---|---|---|---|---|---|---|---|---|

| Independent Variables | ROA | TQ | ROA | TQ | ||||

| FE | GMM | FE | GMM | FE | GMM | FE | GMM | |

| AC1 | 0.012 | −0.030 | 0.011 | −0.004 | 0.045 ** | 0.005 * | −0.003 | 0.001 * |

| AC2 | 0.110 *** | 0.065 *** | 0.026 *** | 0.014 *** | −0.408 *** | −0.425 *** | 0.029 * | 0.019 |

| CEO POWER | 0.163 *** | 0.288 *** | 0.024 | 0.069 *** | ||||

| OC | 2.046 *** | 2.120 *** | 0.128 ** | −0.088 | ||||

| CEOAC1 | 0.129 *** | 0.214 *** | 0.042 *** | 0.062 *** | ||||

| CEOAC2 | 0.121 *** | 0.163 *** | 0.036 *** | 0.048 *** | ||||

| OCAC1 | 0.064 *** | 0.065 *** | 0.012 *** | 0.013 *** | ||||

| OCAC2 | 0.025 *** | 0.027 *** | 0.010 *** | 0.009 *** | ||||

| ATO | 0.002 *** | 0.001 | 0.007 *** | 0.003 ** | 0.001 *** | −0.009 *** | −0.003 | −0.006 |

| LEV | −0.126 *** | −0.230 *** | −0.041 *** | −0.065 *** | 0.002 | −0.002 | 0.001 *** | 0.002 *** |

| ACE | −0.167 *** | −0.196 *** | −0.037 *** | 0.044 *** | 0.031 *** | 0.046 *** | −0.006 *** | −0.009 *** |

| FS | 0.579 *** | 0.641 *** | −0.181 *** | 0.209 *** | 0.004 | 0.018 | 0.004 * | 0.007 *** |

| PPE | 0.219 *** | 0.251 *** | 0.044 *** | 0.052 *** | 0.058 *** | 0.057 *** | 0.008 *** | |

| Constant | 0.051 *** | 0.107 *** | 0.017 *** | 0.033 *** | 0.016 *** | 0.026 *** | 0.036 *** | 0.004 ** |

| R2 | 0.7001 | 0.6683 | 0.9725 | 0.9735 | ||||

| F | 8.71 *** | 11.05 *** | 18.09 *** | 22.86 *** | ||||

| N | 1615 | 1320 | 1615 | 1302 | 1615 | 1320 | 1615 | 1320 |

| Hausman Test | 28.23 *** | 27.80 *** | 91.66 *** | 9.49 * | ||||

| Wald Chi2 | 3270.48 *** | 2948.59 *** | 49,681.24 *** | 47,962.33 *** | ||||

| Dependent Variables | EPS | ||||

|---|---|---|---|---|---|

| Independent Variables | FGLS | ||||

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | |

| AC1 | 0.022 *** | −0.011 | 0.018 *** | ||

| AC2 | 0.066 *** | 0.060 *** | −0.165 *** | ||

| CEO Power | 0.056 *** | 0.063 *** | |||

| OC | 0.225 *** | 0.864 *** | |||

| CEOAC1 | 0.026 * | ||||

| CEOAC2 | 0.017 *** | ||||

| OCAC1 | 0.017 *** | ||||

| OCAC2 | 0.039 *** | ||||

| ATO | 0.001 | 0.001 *** | −0.002 *** | 0.004 *** | −0.001 *** |

| LEV | 0.042 *** | 0.039 *** | 0.017 *** | 0.005 | 0.012 *** |

| ACE | −0.037 *** | −0.041 *** | 0.027 *** | −0.043 *** | 0.002 *** |

| FS | 0.033 *** | −0.018 ** | 0.090 *** | −0.127 *** | −0.024 *** |

| PPE | 0.080 *** | 0.081 *** | 0.097 *** | 0.082 *** | 0.013 *** |

| Constant | 0.021 *** | 0.023 *** | 0.001 * | 0.024 *** | 0.003 *** |

| N | 1615 | 1615 | 1615 | 1615 | 1615 |

| Wald Chi2 | 7481.56 *** | 6863.92 *** | 8747.40 *** | 7066.66 *** | 45,947.83 *** |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Javeed, S.A.; Ong, T.S.; Latief, R.; Muhamad, H.; Soh, W.N. Conceptualizing the Moderating Role of CEO Power and Ownership Concentration in the Relationship between Audit Committee and Firm Performance: Empirical Evidence from Pakistan. Sustainability 2021, 13, 6329. https://doi.org/10.3390/su13116329

Javeed SA, Ong TS, Latief R, Muhamad H, Soh WN. Conceptualizing the Moderating Role of CEO Power and Ownership Concentration in the Relationship between Audit Committee and Firm Performance: Empirical Evidence from Pakistan. Sustainability. 2021; 13(11):6329. https://doi.org/10.3390/su13116329

Chicago/Turabian StyleJaveed, Sohail Ahmad, Tze San Ong, Rashid Latief, Haslinah Muhamad, and Wei Ni Soh. 2021. "Conceptualizing the Moderating Role of CEO Power and Ownership Concentration in the Relationship between Audit Committee and Firm Performance: Empirical Evidence from Pakistan" Sustainability 13, no. 11: 6329. https://doi.org/10.3390/su13116329

APA StyleJaveed, S. A., Ong, T. S., Latief, R., Muhamad, H., & Soh, W. N. (2021). Conceptualizing the Moderating Role of CEO Power and Ownership Concentration in the Relationship between Audit Committee and Firm Performance: Empirical Evidence from Pakistan. Sustainability, 13(11), 6329. https://doi.org/10.3390/su13116329