1. Introduction

The EU Commission has introduced the instrument of National Energy and Climate Plans (NECP) to improve the planning and monitoring of the development of the energy transition within and between the EU member states. This is based on the EU Regulation on the Governance of the Energy Union and Climate Action, which focuses on the five dimensions of the Energy Union: (I) energy security, (II) internal energy market, (III) energy efficiency, (IV) decarbonation, and (V) research, innovation, and competitiveness [

1]. The aim of the NECP is to implement the Energy Union strategy in all dimensions. For this, all member states have to report their national efforts to achieve the common EU target in the NECPs. For the first time, NECPs had to be submitted for the period from 2021 to 2030, followed by biannual progress reports [

2].

For Germany, the NECP was passed by the Federal Cabinet on 10 June 2020 [

2,

3]. It builds on the targets and measures of the Energy Concept [

4], the Energy Efficiency Strategy 2050 [

5], and the Climate Action Program 2030 [

6] adopted in 2019. The latter complies Germany’s commitments to climate protection at the international level (Paris Climate Agreement), as well as at the EU level, thus implementing the Climate Action Plan 2050 [

7] at the national level.

The German government has commissioned a study to develop target scenarios for the NECP process [

8]. Detailed bottom-up models were used, as well as socioeconomic and environmental impact assessments. The following summarizes the emission pathways and their sectoral allocation in bottom-up models and details the results of the socioeconomic impact assessment (IA). With the scenarios, the current national GHG reduction targets (55% against 1990 for 2030, 80–95% in 2050) are (almost) achieved. The IA examines macroeconomic and sectoral effects. Therefore, employment effects play an important role. At the same time, the development of final consumer expenditures on energy is considered as another social indicator. Thus, in addition to the emission pathways, both economic and social indicators are reported for all scenarios, so that the effects of the scenarios are captured in all three dimensions of sustainability.

The underlying research question is whether the chosen energy and climate plans of the EU states are not only technically feasible, but whether the achievement of GHG reduction targets can also be sustainable in terms of socioeconomic indicators. In other words: Is a just transition that does not reduce economic output possible, using Germany as an example? Where are synergies and where are possible trade-offs of climate policies? Will GDP be constrained, or will climate policy even have positive macroeconomic effects? GDP, prices, and employment are important parameters in this context. Another question is: Which sectors are particularly affected by climate protection? With regard to social impacts, labour market effects are of great interest. In addition, there is also the question of whether spending on energy consumption will increase significantly. Since the share of energy expenditure in income declines with income, this is an important point for the effects for low-income households.

In addition to many analyses at the international [

9,

10,

11,

12] and European level [

13,

14,

15], the socioeconomic effects of climate policy have been considered for Germany. While negative macroeconomic effects of the energy transition have been reported on various occasions [

16,

17,

18], a more positive picture has emerged over the past 10 years. Positive employment effects have been reported for the expansion of renewable energies in Germany [

19,

20], and positive macroeconomic effects have also been shown for the energy efficiency sector [

21].

A comprehensive overview of studies that consider a complete switch to renewable energies by 2050 is provided in [

22]. These are predominantly techno-economic analyses. The study itself also mainly presents the technical feasibility of the implementation. The negative regional economic effects of the coal phase-out in Germany are addressed in [

23]. The effectiveness of carbon pricing and the promotion of renewable energies is compared in [

24]. According to this, pricing instruments work much better.

A comprehensive analysis of the macroeconomic effects of the energy transition in Germany and their distribution across sectors and regions can be found in [

25]. Our method for determining the effects is similar but builds on a different type of model. While a system dynamics model is used in [

25], we use a macroeconometric model. A key innovation is that the target scenarios capture in detail the current status of policy instruments that are planned and, in some cases, already implemented. In addition, we consider effects on the price level, various components of GDP, and important indicators of the labour market, thus showing different indicators for the macroeconomic effects. In addition, we report the energy costs of final consumers as an important indicator of social effects. There has not yet been a corresponding comprehensive examination of the socioeconomic effects of the currently implemented energy transition in Germany. The paper is structured as follows.

Section 2 describes the model system used. It also presents the scenarios and the main differences for the socioeconomic analysis. The results are presented in

Section 3.

Section 4 discusses the results in the context of other publications. Finally,

Section 5 draws the conclusions and describes future research needs.

2. Materials and Methods

To assess ex-ante the impacts of such energy development and climate change mitigation plans on economy and society, scenario analysis can be applied. For this purpose, various scenarios have been developed, each of them representing a possible future. A comparison of scenarios with a baseline development then allows an assessment of the effect of the modified assumptions, e.g., regarding different energy consumption or prices.

2.1. Coupling of Sectoral Energy System Models and Macroeconomic Models

For the development of scenarios and the evaluation of macroeconomic effects, there are several types of models. First, technology-oriented bottom-up models must be distinguished from economic top-down models. From a technical point of view, the bottom-up models depict options for the development of energy consumption in individual sectors and processes. Top-down models describe the macroeconomic effects resulting from the implementation of corresponding technology pathways.

Top-down macroeconomic models can be grouped into two main categories [

26]: optimisation models, which focus on the supply side and for which computable general equilibrium (CGE) models are well-known representatives, and simulation models, which emphasise the demand side, and for which macroeconometric models (also referred to as macroeconometric input–output models) are examples, such as PANTA RHEI used here. The data requirements are similar for all top-down model types. They are based on the national accounts of the official statistics, which annually record the activities of the government, enterprises, private households, and the rest of the world, and their linkages at the national level. In addition, the interdependencies of different economic sectors are reported in input–output tables. These are a necessary component of all macroeconomic models that capture effects of measures and instruments that have an impact beyond the directly affected sector or impact channel. Furthermore, energy data are needed to address the energy transition.

According to [

26,

27], the two types of models can be differentiated from each other as follows: CGE models are based on neoclassical theory, whereby households and firms are represented by an agent with rational expectations, maximizing the utility or profit. Prices adjust so that supply and demand are in equilibrium and resources are fully used, such that markets are generally cleared. Higher demand (e.g., for the energy transition) leads to higher prices and an (optimal) reallocation of resources. Macroeconometric models follow a post-Keynesian theory and, although they focus more on the demand side, both sides of the market play an important role, in contrast to simple input–output approaches. Behavioural parameters are not determined by optimisation, but by econometric estimation of time series data, so empirical evidence is highly important. Markets are usually not cleared. Imbalances between supply and demand are compensated by quantity effects rather than price effects.

Sectoral energy system models are used to calculate the development of energy consumption and energy supply in the scenarios. These are bottom-up models that can depict technologies and their application in detail. The energy system models for the four demand sectors industry, commerce, wholesale and retail and services (“GHD”, tertiary sector), transport, and residential are simulation models. Electricity generation is calculated with a European electricity market model. The model system is completed by modules for district heating, refineries, and the generation of electricity-based fuels. The models cover the entire energy system and account for interactions between the sectors [

8].

The so-called quantity components of the models (e.g., reference area, transport capacity or vehicle fleet, industrial production quantities, and labour force) are influenced by exogenous variables, such as economic structure and growth, population, standard of living, spatial and transport organisation, etc.

The specific energy consumption values are based on technical information about processes, electrical devices, heating systems, vehicle fleets, etc. The change in specific consumption over time reflects technical developments; this is influenced by policy instruments such as regulations, target agreements or subsidy programmes, energy prices, as well as values and social priorities. Modelling by cohorts allows the inclusion of the age structure of the plants, cars, or appliances in the respective consumption sectors. GHG emissions are calculated by linking energy consumption by energy source to energy-source-specific emission factors.

To calculate the effects on macroeconomic variables, such as GDP, employment, production, prices, and other variables in the scenarios, the results of the energy system model (bottom-up) are entered as input into a macroeconomic model (top-down), thus soft linking the two types of models. In contrast to the bottom-up models, in which the sectors are considered separately, the focus of a top-down model is on the interlinkage of all economic sectors and their feedback effects on the overall economic development (see

Figure S1 in the supplement for an overview of the procedure).

The geographical level of the model has been chosen depending on the research question. International models account for international feedback effects that cannot be covered in national models or can only be captured by simple assumptions. National models, on the other hand, depict domestic developments in a detailed and timely manner, while international datasets usually have a longer time lag and a lower level of detail, and the complexity of the model inter-relationships is higher.

As the focus is on measures on the national level, the macroeconometric model PANTA RHEI for Germany is used for the analysis presented here [

28]. It is the environmentally extended version of the simulation and forecasting model INFORGE [

29]. In addition to comprehensive economic modelling, energy, and emissions, as well as transport and housing are covered in detail. All model sections are consistently linked with each other. The entire model is solved simultaneously, i.e., the mutual impact of model variables is considered simultaneously.

The model contains a large number of macroeconomic variables from national accounts and input-output tables and provides sectoral information according to 63 economic branches. The energy balances [

30] are fully integrated into the model.

In contrast to CGE models, which assume that firms and households optimise their behaviour, the behavioural parameters are estimated econometrically using time series data, mainly from 2000 onwards. This basically assumes that behavioural patterns or reactions to price or quantity changes in the past will also prevail in the future. Adjustments can be implemented through exogenous specifications.

In addition to the harmonised framework data, the (changes in) input data from the energy system model characterising the different scenarios are used as inputs in PANTA RHEI. In particular, information from the bottom-up models is taken for energy consumption, investment differences, electricity, and CO

2 prices, as well as Power-to-X (PtX) imports (see

Section 2.3). The comparison of the scenario results provides an assessment of the macroeconomic effects; the differences in the model variables can be interpreted as the effect of the scenario-specific measures. Feedbacks from the macroeconomic model into the energy system model, i.e., of the changed economic data on energy consumption, are not applied.

2.2. Scenarios

To analyse different pathways to achieve the emission reduction targets, the following scenarios are developed (see [

8]):

A baseline scenario, which is based on policies implemented by 2017 and extrapolates historical trends;

Two target scenarios (scenario 1 and 2), which examine different sets of policy measures and different strategies for long-term development leading to GHG reductions between 85 and 90% in 2050 relative to 1990;

A further scenario (scenario 3), which represents the measures adopted in the Climate Action Program 2030. As in scenarios 1 and 2, further measures are introduced in scenario 3 after 2030 that lead to a GHG reduction of about 85% in 2050 relative to 1990.

In scenario 1, the central macroeconomic measure is a carbon tax (see

Table 1) levied in proportion to the CO

2 content of fossil fuels, covering those energy sources that are not included in the European emissions trading system (EU ETS). It is effective in all consumption sectors; in the transport sector, for example, rising fuel prices due to the carbon tax will lead to traffic reduction, a shift to other modes of transport, and a switch to vehicles with lower specific CO

2 emissions. In the building sector, the carbon tax is mainly paid by owner-occupiers and tenants. The latter can only react to the measure by adjusting their heating behaviour but cannot reduce their consumption of fossil fuels by investing in a new heating system.

Scenario 2 assumes the introduction of a separate national emissions trading system for the heating and transport sector. In contrast to the carbon tax in scenario 1, it is applied at the beginning of the value chain, i.e., to primary energy sources (upstream ETS). The maximum emission level is fixed and reduced annually, so that the resulting CO2 price increases from year to year. The higher prices for fossil fuels create incentives for mitigation measures. The introduction of the emissions trading system is supplemented by flanking measures in the final consumption sectors to overcome barriers to the implementation of the energy transition and to avoid distributional inequities that arise, for example, due to a lack of information or capital availability. Thus, in scenario 2, a reduction in the electricity tax and the EEG (Renewable Energy Sources Act (German: Erneuerbare-Energien-Gesetz)) surcharge is introduced as an additional overall measure that is financed from public budget funds. The reduction of certain administrative electricity price components will also benefit sector coupling.

Scenario 3 implements a CO

2 pricing for the non-EU ETS sectors under a national emissions trading system adopted in the Climate Action Program [

6]. As in scenario 2, this is an upstream ETS. In the beginning, emissions are priced at a fixed rate, which offers private households and industries the advantage of being able to adjust their behaviour according to a reliable price path in the first years. However, the risk of exceeding the maximum emission level is thereby accepted. From 2025/26, the price will be determined by emissions allowance trading, for which the German government is setting up a platform. In addition to the emissions trading system, scenario 3 assumes a reduction in the EEG surcharge, which is partly financed from emissions trading revenues.

Additional measures at the sectoral level (industry, transport, buildings, transformation/energy industry), such as regulation, funding programs, or reduced loans, assumed in scenarios 1 to 3, are described in [

8].

Assumptions about important framework data, such as population development and international energy prices (see

Table S1 in the supplement), are not varied between the scenarios. As calculations have been finalized in spring 2020, effects of the COVID-19 pandemic are not included. Variables such as population or import prices have a major influence on the development of energy consumption and emissions. The framework data were specified early in the project and could not be adjusted in the further process, as all calculations are based on them. Thus, the population development deviates slightly from the more recent national projections. The population projection depends on various factors, such as fertility or net immigration. Depending on the assumptions for these factors, there are wide ranges of projections, within which the development assumed here still lies. To assess the effect of energy and climate policies separately by comparing the scenarios, identical framework data are therefore used as a basis. Only the energy prices for end consumers are changed, as they depend on the assumed measures, especially carbon pricing and reduction of the EEG surcharge. For the scenarios, except the baseline scenario, it is assumed that ambitious GHG reduction targets are also pursued and implemented in other countries, especially in Europe, so that similar competitive conditions exist globaly and the risk of carbon leakage is low.

2.3. Central Differences of the Scenarios with Regard to Socioeconomic Effects

Regarding the socioeconomic impact assessment, the most important differences in the input data between the scenarios result from differences in investments, in electricity prices, in prices for CO2 emissions in the non-EU ETS sector, and in imports of power-to-X (PtX) energy sources. The following figures are in real terms (2016 prices).

The investments (see

Figure S2 in the supplement) in the scenarios that are exogenously set as inputs in PANTA RHEI do not represent the total investments, but only those that are additionally made or omitted compared to the baseline scenario. These are the investments in efficiency measures and the expansion of the energy system that are necessary to achieve the climate targets. Negative investments, e.g., in the conventional power sector, that are also considered, mean that less is invested than in the baseline scenario. Over the projection period from 2020 to 2050, the net additional investments in scenario 2 are highest, averaging EUR 49.8 billion per year, followed by scenario 3 (EUR 45.3 billion per year on average) and scenario 1 (annual average: EUR 38.4 billion). The lower investment activity in scenario 1 is compensated by significantly higher imports of PtX fuels (see below), while scenarios 2 and 3 focus more on the development of domestic PtX structures.

Electricity prices (see

Figure S3 in the supplement) are differentiated according to the final consumer groups: private households, commerce, wholesale and retail, and services (“GHD”), industry, and energy-intensive industry. They are the result of a European electricity market model.

Wholesale prices are the main driver of the electricity price for energy-intensive industry. Rising fuel and EU-ETS prices have an increasing effect on the wholesale price, while the expansion of renewable energies leads to a reduction. However, the increasing effect is stronger than the decreasing one, so that the electricity price increases over the projection period and ranges between 7.25 cents/kWh (scenario 2) and 8.9 cents/kWh (scenario 1) in 2050.

In the case of private households, the tertiary sector, and non-energy-intensive industry, the government components of the electricity price are decisive for the price development, in addition to the wholesale price; in scenario 2, the electricity tax and EEG surcharge are reduced, and in scenario 3, only the EEG surcharge is reduced, resulting in lower electricity prices in these two scenarios than in scenario 1 and the baseline scenario. In 2050, prices are, thus, lowest in scenario 2; private households would pay 28.6 cents/kWh, the tertiary sector 20.07 cents/kWh, and non-energy-intensive industry 15.7 cents/kWh. The highest prices result—slightly above the baseline development—in scenario 1, with 33 cents/kWh (private households), 23.58 cents/kWh (tertiary sector), and 17.89 cents/kWh (non-energy-intensive industry).

CO

2 prices (see

Figure S4 in the supplement) for sectors not covered by the EU ETS are also varied in the scenarios, while they do not exist in the baseline scenario. In scenario 1, a uniform CO

2 price in the form of a carbon tax is assumed, starting at EUR 30/t in 2020 and increasing to EUR 250/t by 2050. In the scope of sectoral emissions trading systems, the price in scenario 2 is differentiated by the heating and transport sectors, which result from certain CO

2 quantity restrictions in these two sectors. Compared to scenario 1, the CO

2 prices in scenario 2 start significantly higher in 2020 (EUR 115/t CO

2 in the heating sector and EUR 150/t CO

2 in the transport sector). In 2050, the CO

2 price in both sectors reaches EUR 220/t. The CO

2 price in scenario 3 is introduced in 2021. In 2030, it is EUR 140/t, which is below the developments in the other two scenarios. By 2037, it rises to EUR 220/t and then remains constant, so that the CO

2 prices in scenarios 2 and 3 converge by 2050.

Power-to-X (PtX) imports (see

Figure S5 in the supplement) are required in the scenarios to cover the high domestic demand for these energy sources. A supply exclusively by domestic production is not assumed in any of the scenarios because of limited capacities of renewable energies in Germany and lower generation costs in other countries with more favourable renewable energy conditions. It is assumed that only hydrogen (H

2) production is possible domestically, so that power-to-gas (PtG) and power-to-liquid (PtL) products (fuel oil, kerosene, diesel, gasoline) can only be sourced via imports.

In the baseline scenario, there are no PtX imports. In scenario 1, the demand for H2 is relatively low, so that it can be completely covered by domestic production capacities. For the other PtX products, the import volume increases significantly, especially from 2035 onwards, so that imports in 2050 are EUR 76.6 billion. In scenario 2, PtX imports increase until 2040 and then remain almost constant until 2050, amounting to EUR 20.5 billion in 2050. This includes hydrogen imports, as the demand for hydrogen in scenario 2 is significantly higher than in scenario 1 and, thus, around a quarter of the demand in 2050 will have to be imported. Scenario 3 assumes a moderate development of PtX imports until 2030, exclusively in the form of hydrogen for use in mineral oil refineries. They then increase and amount to EUR 43.6 billion in 2050.

3. Results

Differences between the scenario results are reported for GHG emissions and energy consumption, macroeconomic and sectoral economic variables, employment, and final consumer expenditures on energy, so that all three pillars of sustainability are considered.

3.1. Energy Consumption and GHG Emissions

In the baseline scenario, primary energy supply (PES, see

Figure S6 in the supplement) decreases by an average of 1.2% p.a. to 11,418 petajoules (PJ) between 2015 and 2030 (see

Figure 1). At the same time, final energy consumption decreases by a total of 8% to 8370 PJ. Drivers for the decrease are the increasing efficiency of appliances, equipment, and vehicles, as well as demographic trends. By 2050, primary energy supply is reduced to around 9000 PJ (−30% compared to 2008).

In scenarios 1 and 2, PES falls to below 10,200 PJ by 2030. Through the measures of the climate action program in scenario 3, PES is reduced to 10,372 PJ by 2030, and the final energy consumption is reduced by an additional 606 PJ compared to the baseline scenario. The additional reduction is distributed almost equally among the sectors of transport, industry, and buildings. Important causes for the additional reduction are the increased diffusion of electric mobility and heat pumps, as well as more efficient cross-sectional technologies in the industry and tertiary sectors. By 2050, PES is reduced to below 7000 PJ in scenarios 1, 2, and 3. The long-term target of a 50% reduction by 2050 (compared to 2008) is met in all scenarios (except in the baseline).

The goal of the current German Climate Action Plan is to reduce GHG emissions by at least 55% by 2030 compared to 1990 [

7]. In the baseline scenario, the reduction in the period 2015 to 2030 is small. The emissions target of a maximum of 562 Mt CO

2eq in 2030 set out in the Climate Action Plan is exceeded by 169 Mt CO

2eq. There are large gaps in the targets for the energy and transport sectors. By 2050, GHG emissions are reduced to 475 Mt CO

2eq in the baseline (−62% compared to 1990, see

Figure S7 in the supplement). In scenarios 1 and 2, the sector targets of the Climate Action Plan for 2030 are achieved (however, the somewhat more ambitious sector targets of the Climate Change Act (German:

Klimaschutzgesetz) from 2019 will be missed). By 2050, GHG emissions are reduced to 186 Mt CO

2eq (−85% compared to 1990) in scenario 1, and to 179 Mt CO

2eq (−86% compared to 1990) in scenario 2. The specified reduction of at least 85% compared to 1990 is, therefore, achieved in both scenarios. In scenario 2, a more even distribution of GHG reductions among the sectors is implemented. Emission-intensive industrial processes are converted, including the iron and steel, chemical, and cement industries. In iron and steel, conventional coke blast furnaces are increasingly replaced by direct reduction with hydrogen. This increases the demand for renewable hydrogen, leading to an increased renewable electricity generation compared to scenario 1 (for electricity generation in the scenarios see

Figure S8 in the supplement). The industrial sector’s share of the emissions remaining in 2050 decrease to 28% in scenario 2 (scenario 1: around 50%). In addition, due to the increased reduction of process emissions, less electricity-based fuels must be imported in scenario 2 than in scenario 1.

In scenario 3, GHG emissions are reduced to 598 Mt CO

2eq by 2030 (see

Figure S9 in the supplement). Compared to the base year 1990, this corresponds to a reduction of 52.2%. Thus, the overall reduction target of 55% compared to 1990 is not yet fully achieved. By 2050, GHG emissions in scenario 3 are reduced to 167 Mt CO

2eq, which corresponds to a reduction of 87% compared to 1990. As in scenario 2, GHG-intensive industrial sectors are profoundly restructured towards low-carbon processes in scenario 3, to distribute residual emissions evenly among the sectors. For a significantly further reduction of GHG emissions, CCS or negative emission technologies would have to be used.

In summary, energy consumption and, thus, CO2 emissions decrease in all scenarios. In the baseline, however, the reduction is not sufficient, so that the emissions exceed the reduction targets by far. In scenarios 1, 2, and 3, the minimum target of an 85% reduction by 2050 can be achieved, but the interim target of 55% by 2030 is slightly missed in scenario 3.

3.2. Macroeconomic Effects

For the sustainability assessment of energy and climate mitigation scenarios, it is important to consider economic development. A sustainable and prosperous economy with a long-term perspective secures the future investment capability of economic actors, provides jobs, and passes on a working economic system to future generations.

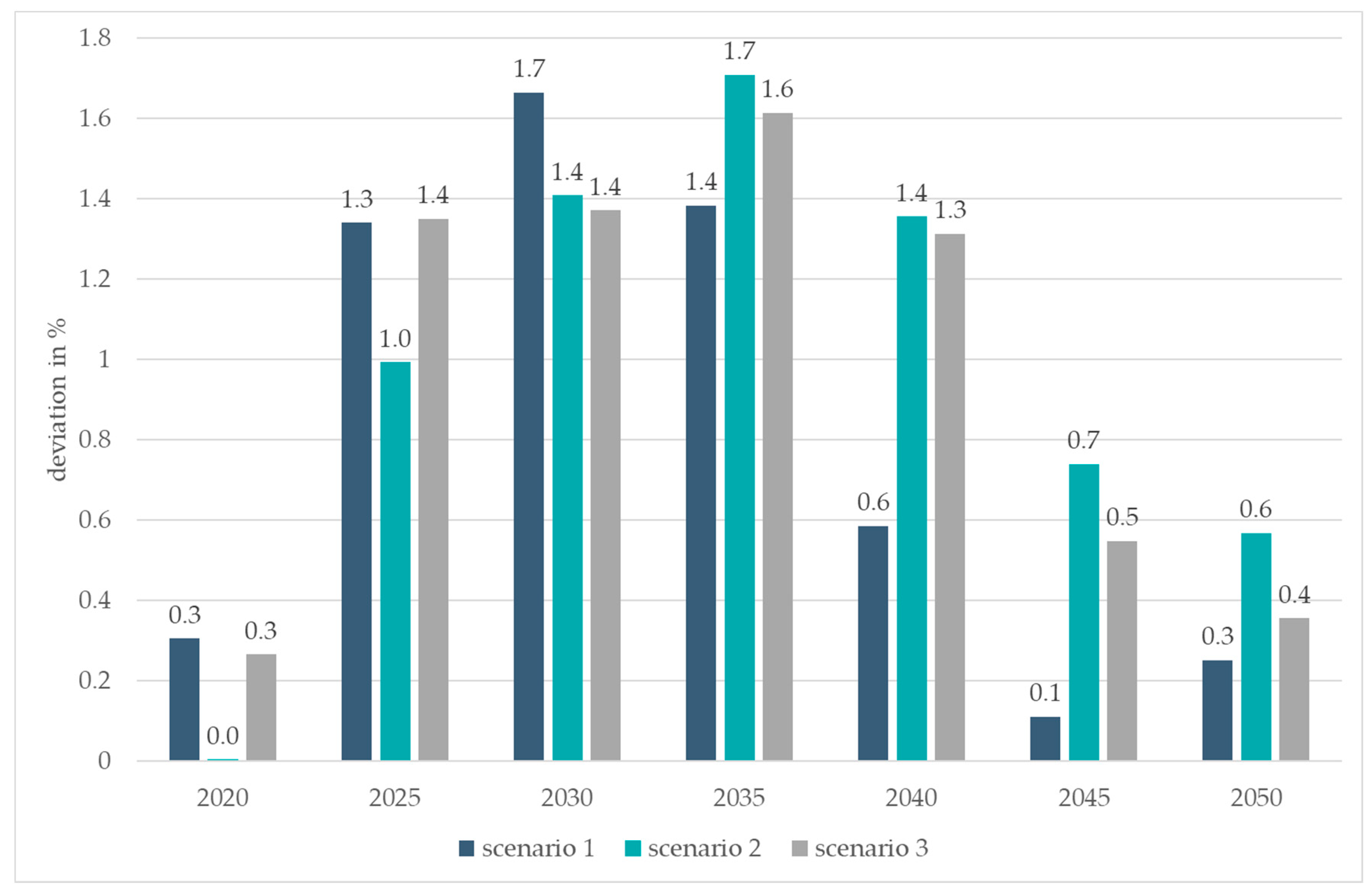

Analysing the scenarios with PANTA RHEI, as described in

Section 2.1, positive macroeconomic effects result for all three scenarios: the price-adjusted gross domestic product (GDP) is higher in the scenarios compared to the baseline development (

Figure 2). These positive deviations increase until 2030 in scenario 1, and until 2035 in scenarios 2 and 3, and decrease thereafter but remain positive. In 2030, GDP is around 1.7% (scenario 1) and 1.4% (scenarios 2 and 3) higher than in the baseline.

The differences in GDP effects between the scenarios result from the assumptions described in

Section 2.3. The main reason for the positive GDP effect is the significantly higher investment, which has an immediate effect on stimulating demand and directly increases GDP. In subsequent years, investments lead to higher depreciation, which is reflected in higher commodity prices and dampens economic growth somewhat. In scenarios 1 and 2, the additional investment in the period up to 2030 is higher than in scenario 3. Between 2030 and 2040, scenario 2 shows the highest additional investment, while from 2040 onwards, the only low additional investment requirement in scenario 1 is particularly noticeable.

At the same time, electricity prices are only slightly higher in scenario 1 than in the baseline development, and even lower in scenarios 2 and 3, with prices slightly lower in scenario 2 than in scenario 3. Higher CO2 prices in transport and heating lead to higher fossil fuel prices but have almost no negative impact on international competitiveness. Revenue recycling from carbon pricing can significantly influence the effect on GDP. CO2 prices are lower in scenario 3 than in the other scenarios until 2030. They are particularly high in the first years in scenario 2. From 2035, the differences between the scenarios are only small. However, since the revenues are partly redistributed, certain structural changes result. For example, in scenario 3, the German renewable energy surcharge (EEG surcharge) is reduced with the additional revenue from the CO2 price.

High PtX imports worsen the trade balance, while lower fossil fuel imports have a positive effect on the trade balance. Although less fossil energy sources are imported, the expensive PtX imports have a negative impact on GDP. For PtX, imports are very high from 2040 onwards in scenario 1. In scenario 3, this value is lower than in scenario 2 until 2040 and increases significantly thereafter.

The respective combinations of assumptions in the three scenarios result in scenarios 2 and 3 showing almost identical positive GDP effects relative to the baseline in 2030, while higher investment slightly favours scenario 1. In 2025, the GDP effects of scenarios 1 and 3 are a bit higher than in scenario 2. After 2030, scenario 1 falls significantly below the other two scenarios in comparison. Reasons are lower additional investment, high PtX imports, and the slightly higher electricity prices. The differences between scenarios 2 and 3 are very small in 2035 and 2040. Thereafter, electricity prices, investment, and PtX imports develop slightly more favourably in scenario 2 than in scenario 3.

Table 2 shows the effects on the components of GDP in 2030 and 2050. The additional investment shown in

Section 2.3 becomes visible in gross fixed capital formation; in 2030, the additional investment in the transformation and final demand sector is highest in scenario 1, and in 2050 in scenario 3. With lower energy costs and higher GDP, private and public consumption increase. Imports also develop in line with economic output, although energy imports are significantly lower than in the baseline development. Exports fall with the slightly higher producer prices because it is assumed that no additional competitive advantages are gained on international markets because of the energy transition.

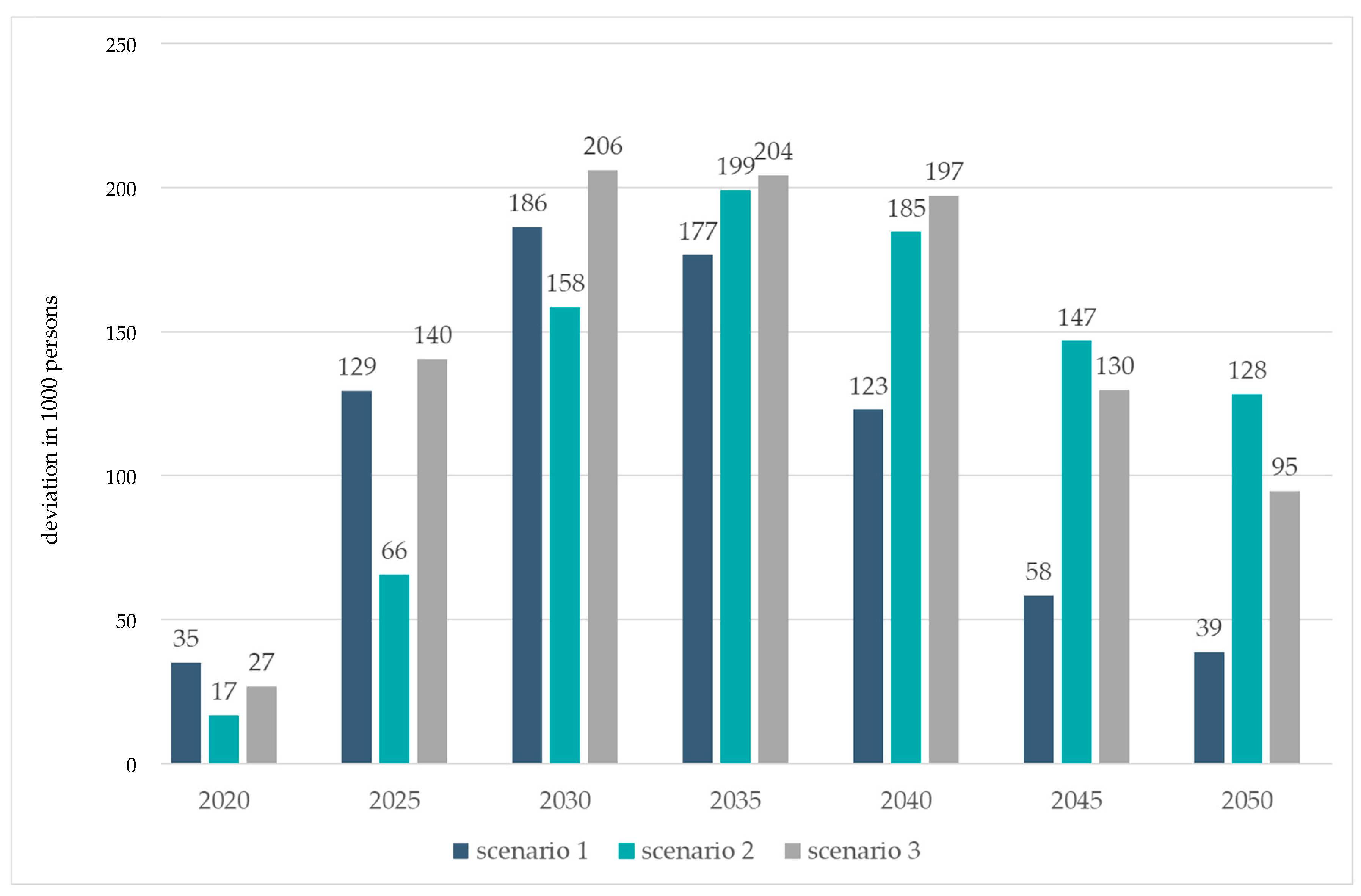

Besides GDP, further socioeconomic variables are important for evaluating the scenarios.

Figure 3 shows the effects on employment, which is—given the higher economic output—also higher compared with the baseline scenario over the entire projection period; in 2030, there are 0.42% (scenario 1), 0.36% (scenario 2), and 0.46% (scenario 3) more persons employed compared to the baseline. In the period from 2025 to 2040, the employment effects are highest in scenario 3. The effect on employment is, thus, generally significantly lower than that on GDP across all scenarios, because part of the higher economic output leads to higher wages and, thus, again, to higher labour productivity.

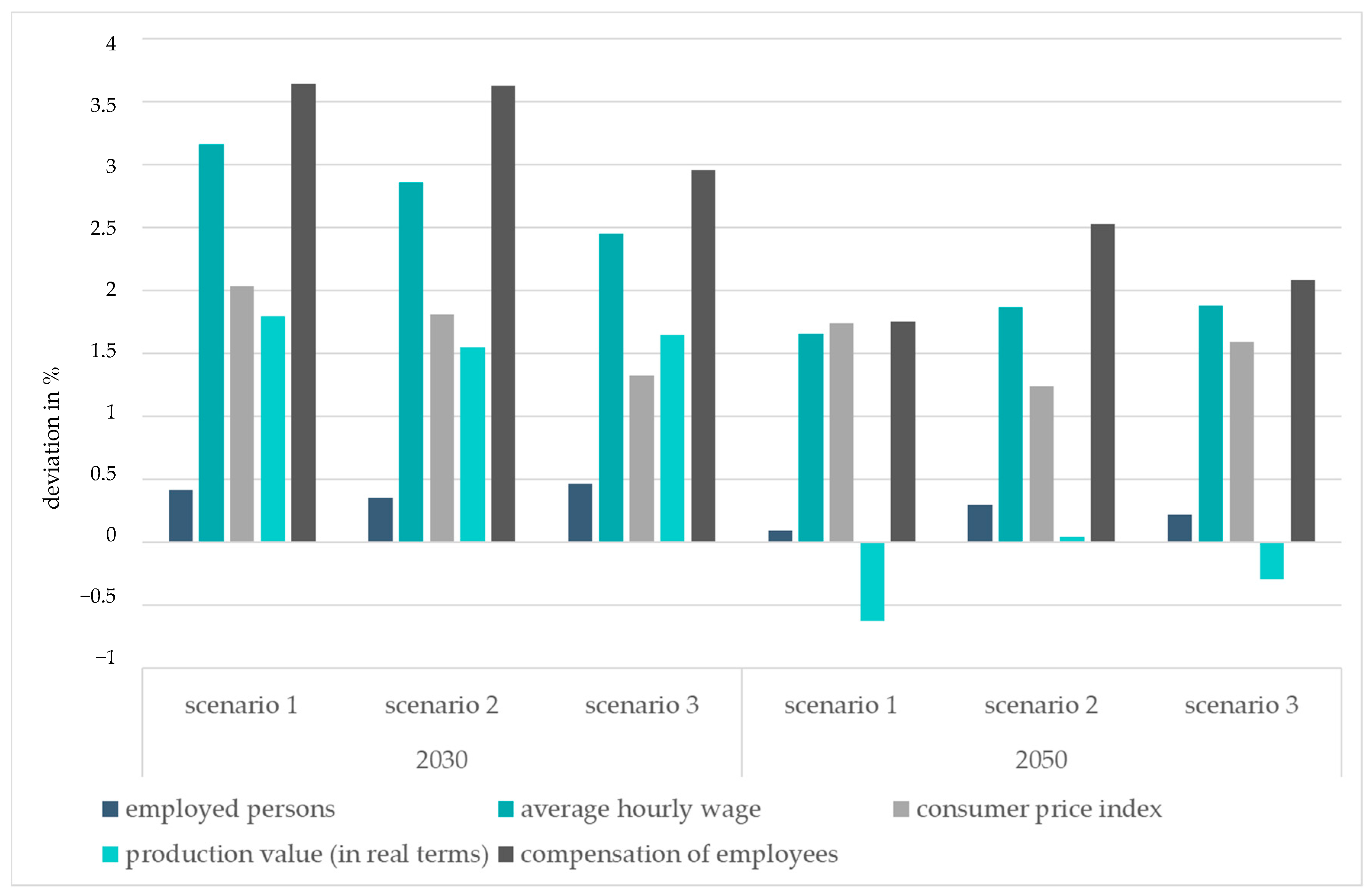

A closer look at the labour market is provided by

Figure 4 for the years 2030 and 2050. The consumer price index (see

Figure S11 in the supplement) is higher in the scenarios than in the baseline; in 2030, the price index exceeds the level of the baseline by about 2.0% (scenario 1), 1.8% (scenario 2), and 1.3% (scenario 3), respectively. The main reasons for this are the carbon prices for non-EU ETS sectors, higher capital costs for the additional investments, and, in scenario 1, slightly higher electricity prices for final consumers in several years. The positive development on the labour market also leads to higher wages; in 2030, the average wage per hour exceeds the baseline by about 3.2% in scenario 1, 2.2% in scenario 2, and 2.5% in scenario 3. In the long term, the effects weaken in all scenarios.

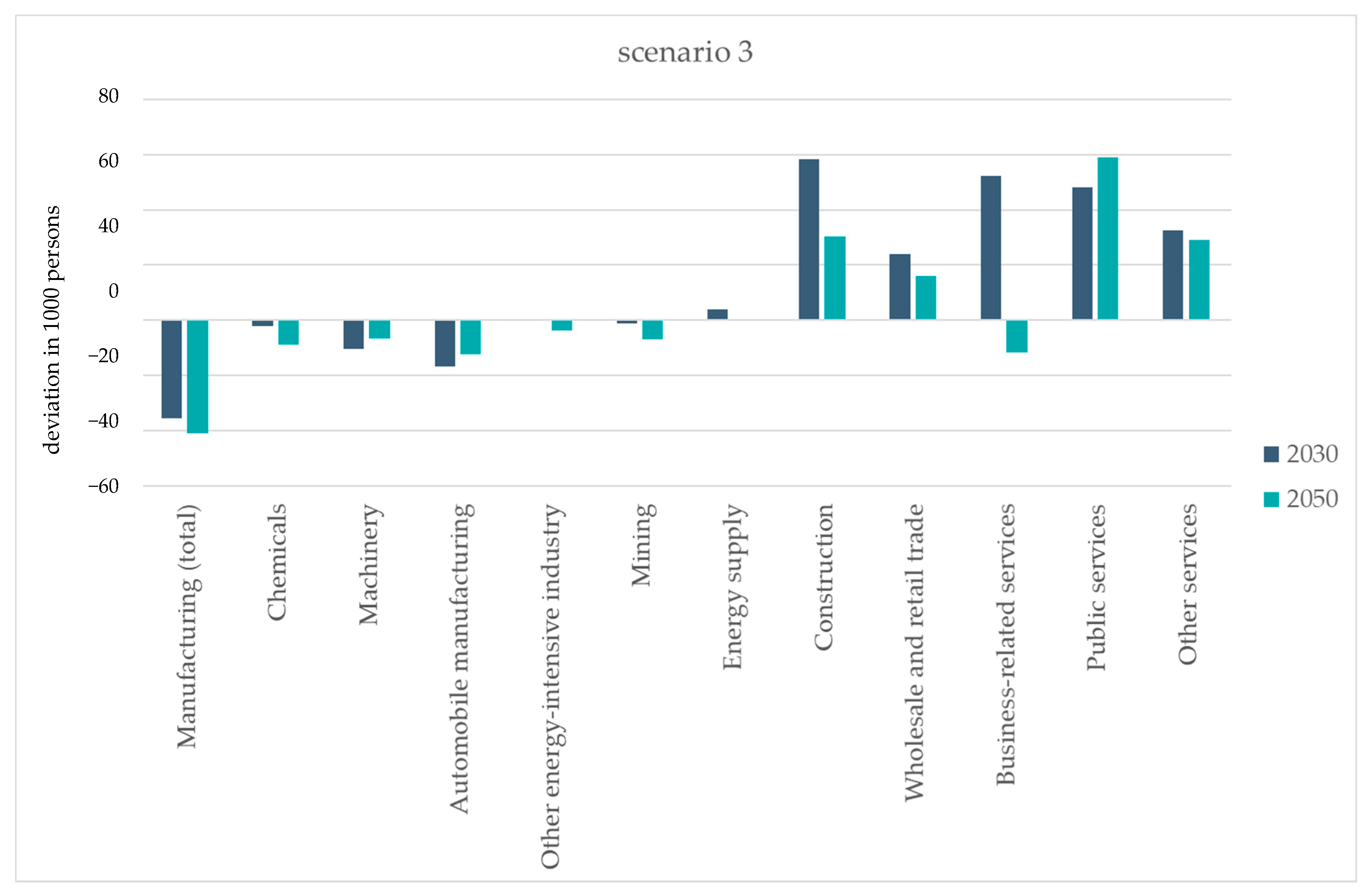

Figure 5 presents the employment effects for selected economic sectors in scenario 3 (see

Figure S12 for deviations of gross production of those sectors in scenario 3). Scenarios 1 and 2 show similar patterns of sectoral deviations from the baseline. The highest negative effects result in the manufacturing industry, which is included in the figure both in total and by major sectors, such as chemical industry and machinery. Although the effect on production in 2030 is positive, the potential for increasing labour productivity is highest in this sector. Moreover, the automobile sector is slightly negatively affected by the transition to electromobility. More inputs (e.g., batteries and electronics) and, among other things, fewer transmission parts are needed, leading to increased imports given the current input structure. However, the assumptions made for this are characterised by high uncertainties regarding the development of the automobile industry.

An increase in employment compared to the baseline can be seen, in particular, in the construction industry due to higher investment, as well as in wholesale and retail trade and services due to the overall higher output in 2030. In 2050, the employment effect in business-related services, which strongly depend on activities in the manufacturing sector, becomes negative. However, the overall employment effects are clearly positive in all scenarios over the entire projection period until 2050, even if the effects weaken after 2030.

In summary, scenarios 1, 2, and 3 show positive effects compared to the baseline, ranging between 1.4 and 1.7% for GDP in 2030. The differences between these three scenarios are, thus, quite small. In the long term, the highest positive effects result in scenario 2, both for GDP and employment.

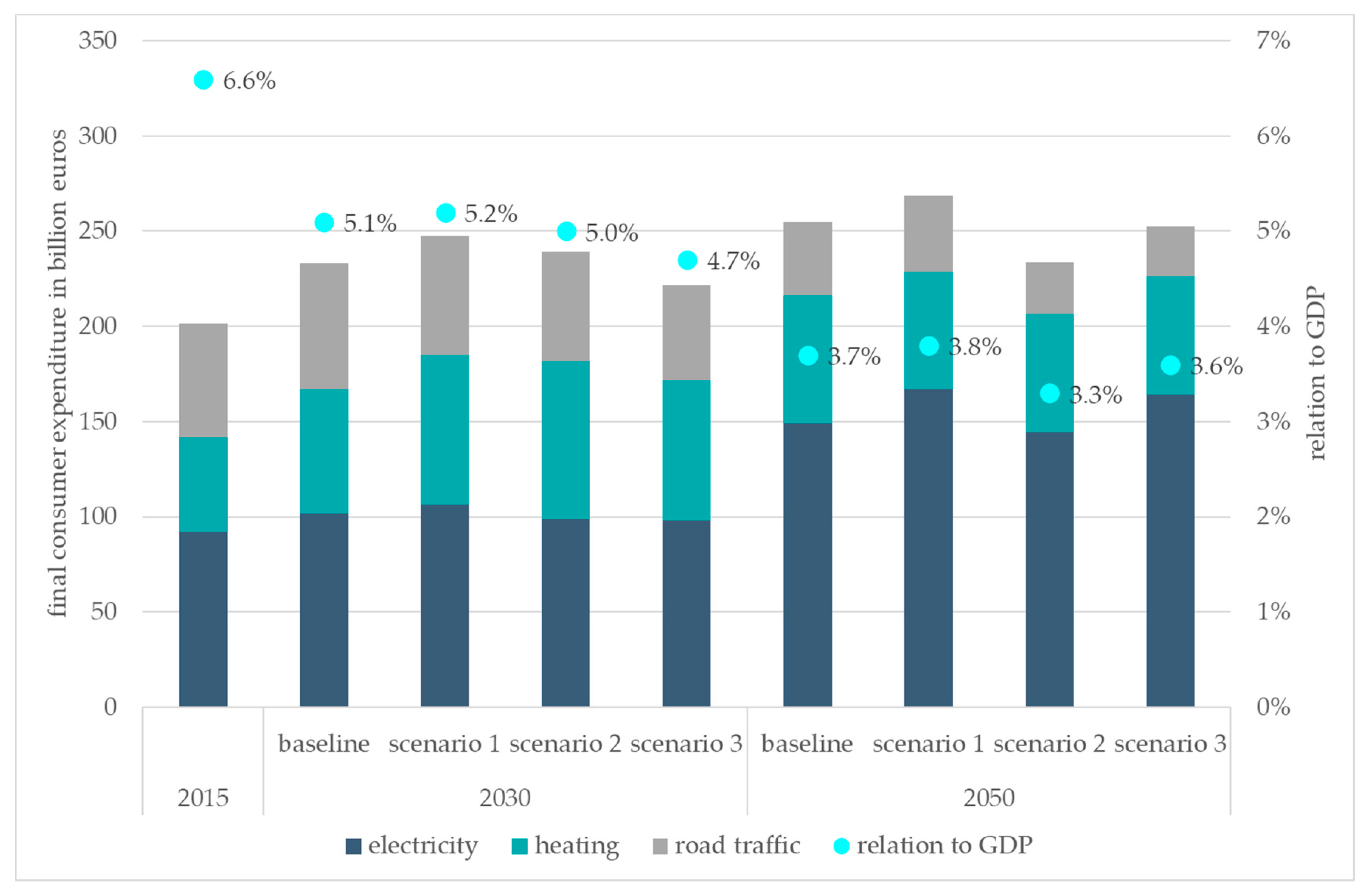

3.3. Impact on Final Consumer Expenditures on Energy

The development of final consumer expenditures on energy in relation to GDP provides an indication of the overall burden of energy expenditures at macro level. This parameter was proposed by the Expert Commission on the “Energy of the Future” Monitoring Process [

31] as a key indicator for the ex-post evaluation of the cost development of the energy transition. First calculations for the electricity, heating, and transport sectors were presented in [

32]. Since then, it is part of the monitoring process, and figures are available in the current monitoring report up to 2019 [

33].

One open question is the handling of investment in the energy transition. The Expert Commission advocates that investment in the heating sector should be included in final consumer expenditures [

32]. However, there is a lack of data in some cases and there are various methodological difficulties, e.g., that some of the investments in the heating sector are not made by private households and, therefore, do not restrict their budgets.

To assess the future development of this indicator, the calculation of final consumer expenditures was projected into the future using the energy quantities and prices from the scenarios. Some methodological details about the indicator are described in [

34].

Figure 6 shows the results for 2030 and 2050 in absolute terms and in relation to GDP. Measured in absolute terms, expenditures in all scenarios rise in the future (in current prices), with the increase in spending on electricity being above average. In relation to GDP, final consumer expenditures decrease in the baseline from 6.6% in 2015 to 5.1% in 2030, and finally to 3.7% in 2050. In the scenario 1 with high imports of expensive PtX, they develop at a level slightly above the baseline. Thus, scenario 1 would at least not turn out worse than the baseline. The most favourable scenario in 2030 is scenario 3, with final consumer expenditures falling from 6.6% in 2015 to 4.7% of GDP in 2030.

Even if final consumer expenditures are interpreted in a broader sense and the additional energy-related investment in final demand is added, as proposed by the Expert Commission [

32], the relation to GDP increases and is, thus, slightly higher than in the baseline; nevertheless, they are lower in the future in all scenarios than in 2015 (see

Figure S13 in the supplement). In 2030, this relation is lowest in scenario 3 at 5.4%. In addition to the methodological difficulties mentioned above, it should be noted when interpreting the results that expenditures in the building sector increase wealth and have a beneficial effect in the long term, while energy expenditures incur annually. Thus, they have a different quality.

In summary, the development of final consumer expenditures during the energy transition is, thus, positive at macro level. Although energy expenditures increase in the projected scenarios compared to today, it is at a similar level or even lower compared to the baseline. Measured in relation to GDP, the share of expenditures for the energy transition and for energy will be lower than today, even if investments in the energy transition in the final demand sector are fully included. In the narrow definition as energy expenditures, their proportion relative to economic output will fall sharply in the course of the energy transition.

4. Discussion

In the following, the results are first placed in the relevant literature. Then, the methods used are reflected upon and, finally, some policy implications are discussed.

The results show that ambitious climate protection in Germany can lead to positive macroeconomic effects, with final consumer expenditures on energy declining further in relation to GDP. Scenario comparison shows between 1.4 and 1.7% higher GDP in 2030 compared to the baseline development. Employment effects are also positive.

The impact assessment of the German Action Plan using the ISI-Macro model [

35] arrives at similar results. The effect of the Climate Action Plan on GDP in 2030 is determined to be between 1.1 and 1.6% higher than the reference development, depending on the target path. Even in the case of a complete crowding out of other investment by the additional climate protection investment, both target paths still result in a slightly higher GDP compared to the reference development (0.3% and 0.5%, respectively). Another study on the impacts of the energy transition, which also analyses the sectoral and regional distribution of these effects [

25], finds a GDP increase of 1.6% and additional employment of 1.1% in 2030. The sectoral effects of ambitious climate mitigation in Germany are mostly positive, except for the conventional energy and mining sector. According to this study, the construction industry, real estate activities, and the electricity sector, in particular, benefit. While results according to

Figure 5 are similar for construction, they are more optimistic for manufacturing and a bit less optimistic for some service sectors.

An ex-post assessment of the employment effects in the renewable energy industry in Germany is provided in [

36] using static input–output modelling; the gross effect of investment in RES technologies and related operation and maintenance, as well as the provision of biofuels is in the range of several hundred thousand jobs, peaking in 2011 at 417,000, declining to 304,000 jobs by 2018. The decrease is due to declining investments, while the importance of operation and maintenance and biogenic fuels is increasing. Further studies show positive net economic effects of expansion of renewable energy in Germany [

20] and positive economic effects from wind energy expansion in a German region [

37].

Impact assessment by the European Commission [

38] analyses the transformation toward a climate-neutral economic system. Here, the macroeconomic effects are examined using three different models: GEM-E3 [

39] is a CGE model, and E3ME [

40] and QUEST [

41] are macroeconometric models. However, QUEST is a macro model without sector detail. The impact on GDP is calculated for four different scenarios. On the one hand, a differentiation is made between the targets of 1.5 °C and 2 °C temperature increase. On the other hand, the policy efforts undertaken outside the EU are varied; in the one case, emissions are reduced as specified in the Nationally Determined Contributions (NDC), in the other case more ambitious emission targets are assumed. According to E3ME, EU GDP in 2050 is between 1.26 and 2.19% higher than the baseline scenario, whereas GEM-E3 projects a negative deviation from the baseline scenario between 0.13 and 1.3%. The results from QUEST lie in between in the slightly positive range.

At the global level, the socioeconomic effects of the energy transition can be estimated using multiregional input–output models, as in [

42]. Here, a 2-degree scenario in which climate change mitigation is implemented globally is compared with a business-as-usual scenario. This results in 0.3% more jobs worldwide for the year 2030. The effect varies between countries and reaches up to 0.9%. These effects are in line with studies from international organisations [

43,

44,

45,

46] that have published studies confirming positive macroeconomic effects of climate protection programs at the international level. For example, the effects on the global labour market between a reference scenario, in which the RE deployment plans currently adopted by national governments are reached, and an energy scenario, in which a greater expansion of renewable energies, as well as more electrification and higher energy efficiency, are pursued, are compared in [

46]. For the energy sector, the energy transition scenario results in 14% more jobs in 2050 compared to the reference development. Other sectors see some job losses. Nevertheless, the number of jobs on macro level is slightly above the level in the reference scenario (+0.2%), i.e., the overall net employment effect is positive.

Ultimately, the results shown in

Section 3 are consistent with the literature. Compared to the national studies, our results on GDP and employment are in the same direction and of similar magnitude. The sectoral effects differ to some extent. Such a picture also emerges in comparative studies at the European level. Our results also fit well within the range of studies at the European and global levels.

Assuming that the economy is not already at the optimum (as in CGE models) and that additional investments in the energy transition are possible, a smart energy and climate policy that combines price instruments with further specific measures can lead to positive macroeconomic effects. The assumption of additional investments is central to this. Sensitivity calculations have, therefore, been carried out on various occasions. They show that, assuming a complete crowding out of investments, the effects would be significantly lower, although they would remain positive. The assumption of additional investment is the more valid the weaker the capacity utilization of production and the larger the overall investment gap in the economy. In Germany, both these factors currently suggest that the assumption of investment additionality is plausible.

Even though the positive macroeconomic effects are also found in other studies, this is not uncontroversial, as methods also have an influence on the results. A meta-regression analysis on studies calculating employment effects of renewable energy deployment and energy efficiency improvement [

47] shows that CGE models tend to find more negative effects than input–output based (including macroeconometric) methods. It is also noted that policy reports have a greater tendency for reporting positive employment effects than academic papers.

The German Council of Economic Experts (SVR) refers to studies applying CGE models that examine the economic effects of a nationally uniform carbon price, mainly for the US, and determine predominantly negative consequences for economic development [

48] (p. 102). Accordingly, the average GDP growth rate could decline in the long term because of the introduction of a carbon price. The argumentation assumes that capital and energy would be used complementarily in companies, so that the higher costs for fossil energy sources due to the carbon price would lead to less investment. However, depending on the use of carbon tax revenues, studies with positive effects on GDP are also cited.

These studies assuming a uniform carbon price can only be compared to a limited extent to the scenarios examined here, which, in addition to regulation and support instruments for renewable energy and energy efficiency, introduce a carbon price only for companies (and households) that are not already part of the EU ETS. The assumption of complementarity of energy and capital, as assumed in the studies cited by the SVR, seems too simplistic for less energy-intensive companies. In the scenarios considered above, a substantial part of the climate policy measures leads to the substitution of carbon-intensive by carbon-free energy sources, so that the introduction of a carbon price does not necessarily lead to a reduction in energy use or to a crowding-out of investments due to higher energy costs. The promotion of energy efficiency in companies, as well as the insulation of houses, which are important components of the scenarios analysed here, precisely target the replacement of energy by capital.

The combination of bottom-up models with a top-down macroeconomic model has also been used in other analyses, which combines the respective advantages of both approaches. This works better for already known and marketable technologies than for new technologies, for which it is partly unclear which economic sectors the goods are composed of. It is also advantageous if the technology can be clearly assigned to an economic sector of the statistics. This works well for building renovation and for established renewable energies, such as wind and PV, for which corresponding input vectors and, thus, allocations are available [

36]. It is much more difficult to translate the technology development into the macroeconomic model if, for example, in the case of hydrogen or synthetic fuels, it is unclear where the production will take place, how high the costs will be, and how the still small-scale production can be classified by statistics. In such cases, the uncertainties of translation into economic impulses are much larger. More research is needed in this area to better understand these economic aspects of emerging energy and climate technologies. This especially holds for the area of agriculture and forestry, as well as the possible carbon capture and storage.

There is also some trade-off between national models as applied here, which are built on current and detailed data and concentrate on impacts of national policy, and international models, which focus more on trade effects and climate change mitigation levels relative to international trading partners, which are often expressed as different carbon price levels.

This aspect also plays an important role for policy implications. With respect to international trade, the analysed scenarios lead to lower exports resulting from the slightly higher production prices compared to the baseline and the associated weaker position in international competition. However, more internationally coordinated action, in which the energy transition is implemented on a global level and more countries introduce a carbon tax, could prevent the weakening of exports. In this context, it is important not to underestimate the opportunity that Germany has in the markets for climate mitigation goods by moving as one of the first. German industry is already very well positioned internationally in many climate mitigation goods [

49,

50]. The more countries that pursue ambitious climate policies, the greater the opportunities for additional exports of corresponding technology goods.

In addition to the consideration of the international dimension, the main factors that play a role in practical implementation are possible losers at both the sectoral and regional levels, as well as possible negative personnel distribution effects. The energy transition will only be successful if policy offers new opportunities to particularly affected groups and distributes burdens fairly.

Regarding the social dimension, final consumer expenditures indicate the extent to which the overall economy is burdened with energy expenditures, but no distributional effects between income groups are apparent from this. Even though final consumer expenditures in relation to GDP are lower in scenarios 2 and 3 than in the baseline development, price increases can have a different impact on the financial burden of different income groups.

Low-income households mainly live in rented accommodation, drive older cars, if at all, and cannot afford to invest in renewable energies on their own roofs. They also spend a larger share of their income on energy. Specific measures are needed to make it financially possible for these groups to participate in the energy transition. Future studies should take a closer look at the distributional effects of climate policy. However, determination of distributional effects between households is methodologically difficult. A classification based on socioeconomic characteristics abstracts from the factors that determine personal energy consumption expenditures, which are, regarding heating, e.g., location, size, and insulation of the house or apartment, as well as energy source and age of the heating system. In the case of transport, the distance to the workplace or the available infrastructure play a decisive role for the expenditure level.

Specific funding measures can help to ensure that the energy transition is implemented in a socially just way. Low-income households, which are more burdened with energy expenditures relative to their income, or tenant households, which cannot choose the type of heating themselves and therefore have only limited influence on their heating expenditures, can thus be supported and enabled to benefit from the progress made through the energy transition. A per capita rebate on carbon price revenues and specific subsidy programs for low-income households could be useful supplementary instruments for this purpose.

5. Conclusions

The result show that the German energy and climate plan is not only technically feasible, but can also lead to positive macroeconomic effects, including employment effects, while remaining affordable for consumers. Some sectors are slightly negatively affected. In general, a just transition is possible. There are some minor differences in detail between the three scenarios. The instrument of socioeconomic impact assessments is useful and should be used in future policy making to an even greater extent and, if possible, more integrated with technical analyses. Certain aspects, such as the inclusion of impacts on different social groups, should be considered even more in the future.

What do the results presented mean for further analysis and research? First, the European NECP process is a major step forward towards a comprehensive impact analysis of ambitious energy and climate policies. It should further differentiate sectoral, spatial, and distributional effects so that policies can be designed to achieve a just transition of economies. This also includes specific skills on the labour market.

Individual carbon-intensive industries, such as iron and steel or non-metallic minerals, partly face challenges as a result of the envisioned transition. They need public support to invest in carbon-free technologies. Individual regions, especially those with coal mining and carbon-intensive heavy industry, are equally affected. There, structural change and the creation of carbon-free technologies should be promoted. On the labour market, the transition will lead to new requirements, for which training and continuing education should be provided. Effects on individual occupations and skill levels should be analysed in more detail. Impact assessments should be expanded to include additional indicators, such as more SDG indicators, to draw appropriate conclusions.

Finally, Germany must increase its climate mitigation ambitions if it is to contribute to achieving the 1.5° target. The EU has already agreed on more stringent targets (−55% in 2030 compared to 1990), which still have to be shared among the member states. Against this background, new zero-carbon and negative emission technologies must be included in the analysis. At the same time, technology alone may not be enough to achieve the more ambitious targets. Behavioural changes may also be necessary and have to be considered. To achieve the just transition as soon as possible, effects in sustainable development indicators must be analysed comprehensively, and the results considered in climate and energy policymaking.