Environmental Corporate Social Responsibility (ECSR) on the Example of Polish Champion Oil, Gas and Mining Companies

Abstract

1. Introduction

2. Concept of the CSR and ECSR

3. Scope and Methods of the Analysis

4. Empirical Evidence

4.1. Description of the Companies and Their ECSR Strategies

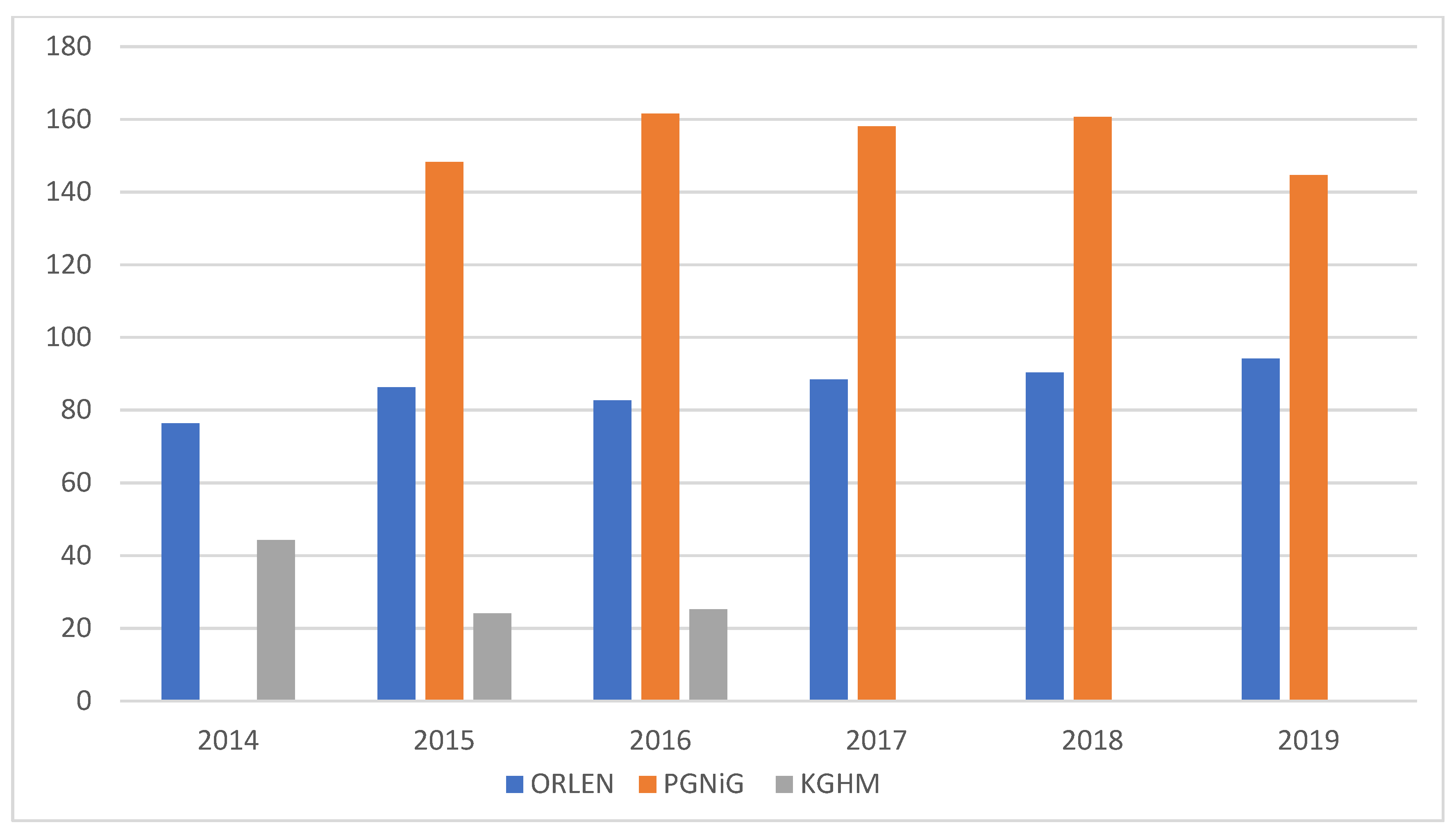

4.2. Water and Wastewater Management

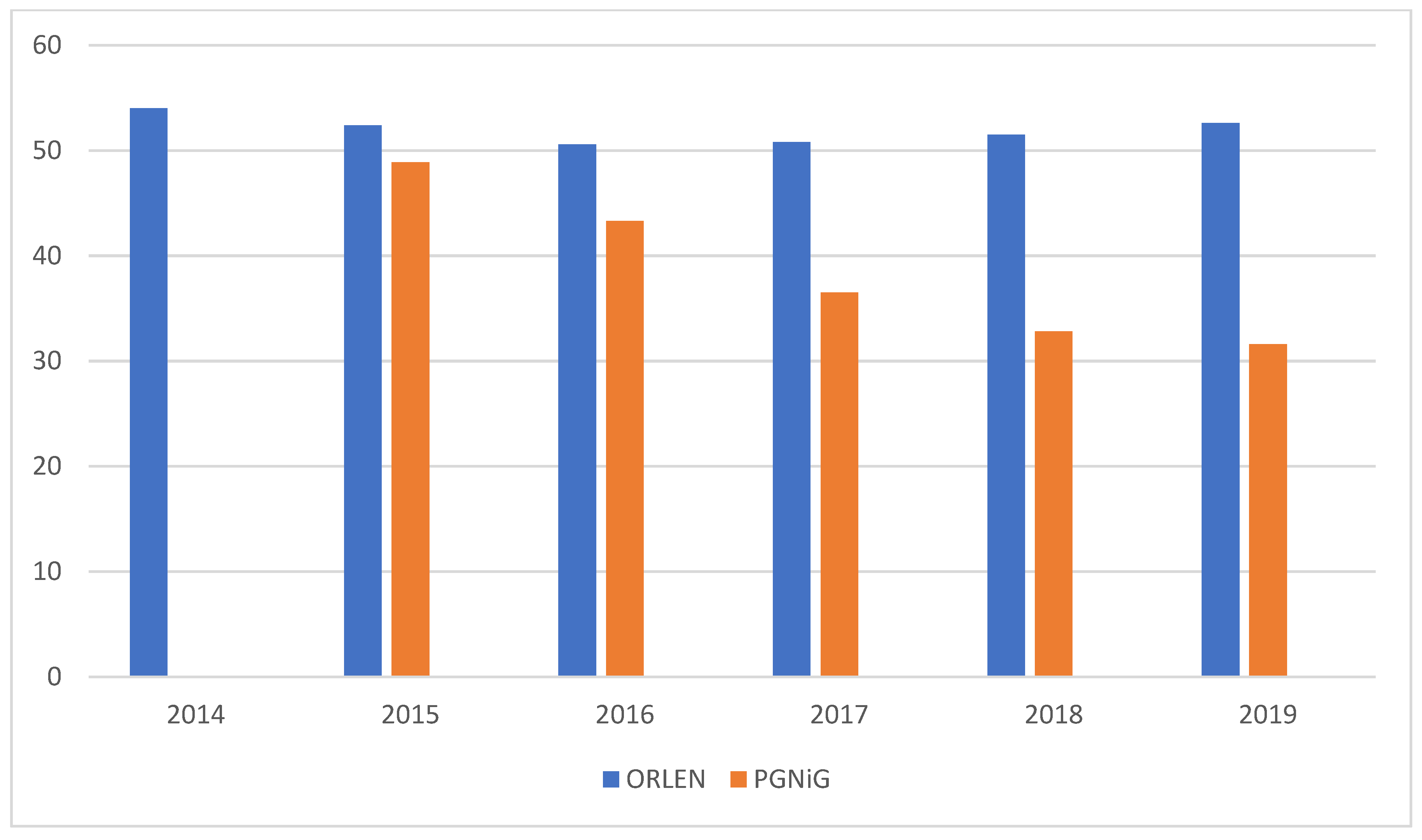

4.3. Air Emissions

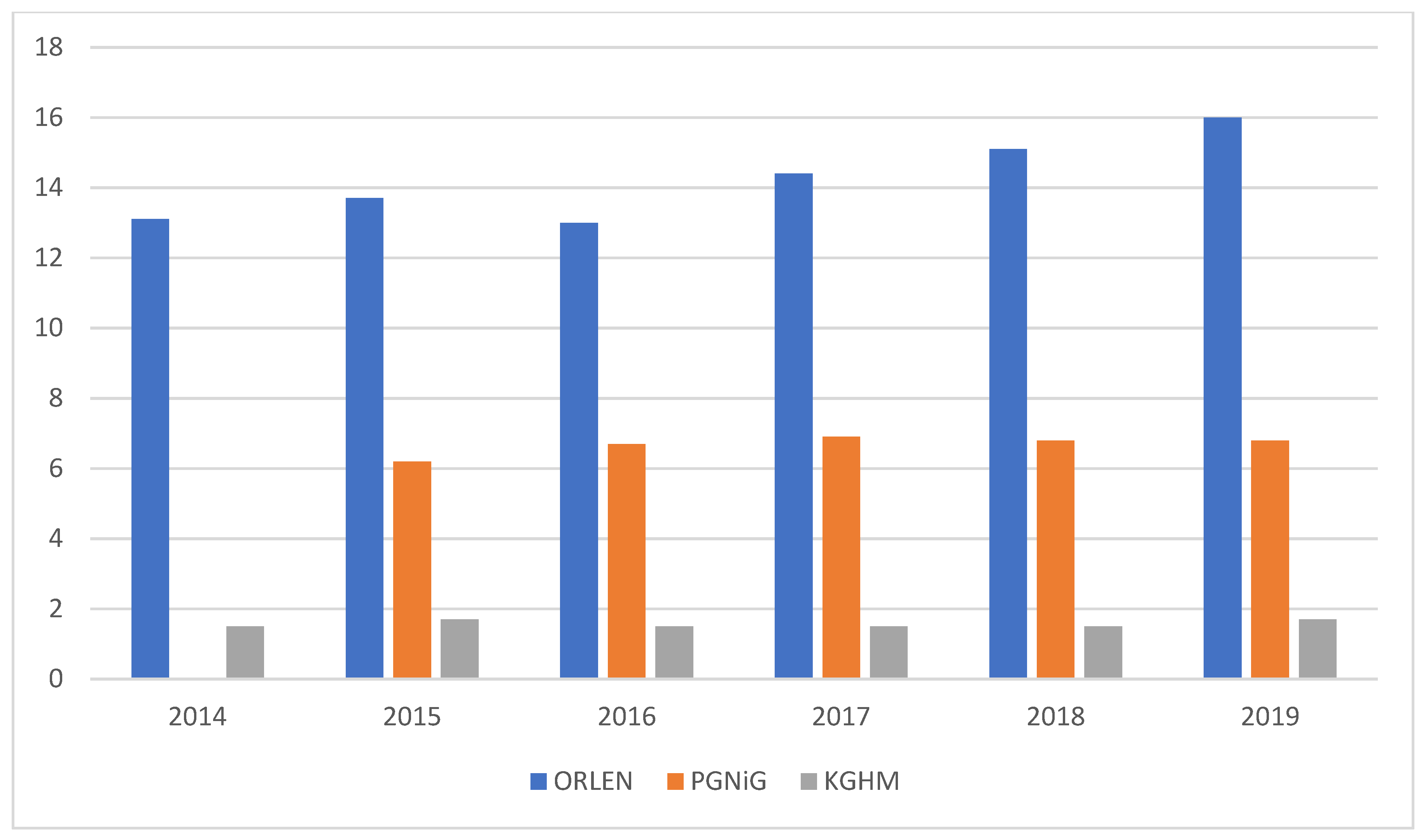

4.4. Waste Management and Circular Economy

4.5. Energy Management

5. Discussion

6. Conclusions

- -

- identification, supervision and monitoring of environmental issues;

- -

- application of environmentally friendly technologies and techniques to reduce the negative environmental footprint;

- -

- reducing the emissions of greenhouse gases (decarbonization);

- -

- regularly monitoring and reporting the outcomes of the environmental activities, including the use of natural resources, the level of emissions and waste;

- -

- aiming at the achievement of the maximal ecological neutrality, including the use of water;

- -

- increasing the involvement in the area of the closed circle economy, the development of distributing infrastructure for alternative fuels (e.g., electrical energy, biofuels and hydrogen);

- -

- conducting and participation in R & D projects in terms of new technologies;

- -

- identification and fulfilment of legal requirements and other regulations, undertaking remediation and reclamation measures.

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Frederick, W. The growing concern over social responsibility. Calif. Manag. Rev. 1960, 2, 54–61. [Google Scholar] [CrossRef]

- McGuire, J. Business and Society; McGraw-Hill: New York, NY, USA, 1963. [Google Scholar]

- Donaldson, T. Corporations and Morality; Prentice Hall: Englewood Cliffs, NJ, USA, 1982. [Google Scholar]

- Langtry, B. Stakeholders and the moral responsibilities of business. Bus. Ethics Q. 1994, 4, 431–443. [Google Scholar] [CrossRef]

- Lulewicz-Sas, A.; Godlewska, J. Assessment of environmental issues of Corporate Social Responsibility by enterprises in Poland—Results of empirical research. Procedia Soc. Behav. Sci. 2015, 213, 533–538. [Google Scholar] [CrossRef]

- Suska, M. Corporate Social Responsibility in Asia: Asian vision vs. American vision. In Azjatyckie Systemy Ochrony Praw Człowieka: Inspiracja Uniwersalna—Uwarunkowania Kulturowe—Bariery Realizacyjne; Jaskiernia, J., Spryszak, K., Eds.; Adam Marszałek: Toruń, Poland, 2016; pp. 220–244. [Google Scholar]

- Suska, M. Corporate social responsibility (CSR)—the human rights regime in Africa. In Ochrona Praw Człowieka w Afryce: Aksjologia—Instytucje—Nowe Wyzwania—Praktyka; Jaskiernia, J., Spryszak, K., Eds.; Adam Marszałek: Toruń, Poland, 2017; pp. 103–121. [Google Scholar]

- Piskalski, G. Społeczna Odpowiedzialność Biznesu w Polskich Realiach. Teoria a Praktyka; Fundacja CentrumCSR.pl: Warszawa, Poland, 2015. [Google Scholar]

- Cameron, P.D.; Stanley, M.C. Oil, Gas and Mining; A Sourcebook for Understanding the Extractive Industries; World Bank: Washington, DC, USA, 2017. [Google Scholar]

- Spector, B. Business responsibilities in a divided world: The Cold War roots of the corporate social responsibility movement. Enterp. Soc. 2008, 9, 314–336. [Google Scholar] [CrossRef]

- Bowen, H. Social Responsibilities of the Businessman; Harper & Row: New York, NY, USA, 1953. [Google Scholar]

- Davis, K. Can business afford to ignore social responsibilities? Calif. Manag. Rev. 1960, 2, 70–76. [Google Scholar] [CrossRef]

- Walton, C. Corporate Social Responsibilities; Wadsworth: Belmont, CA, USA, 1967. [Google Scholar]

- Carroll, A. Corporate social responsibility: Will industry respond to cut-backs in social program funding. Vital Speeches Day 1983, 49, 604–608. [Google Scholar]

- Carroll, A. Corporate social responsibility: Evolution of a definitional construct. Bus. Soc. 1999, 38, 268–295. [Google Scholar] [CrossRef]

- Carroll, A. The pyramid of corporate social responsibility: Toward the moral management of organizational stakeholders. Bus. Horiz. 1999, 34, 39–48. [Google Scholar] [CrossRef]

- Carroll, A.; Shabana, K. The business case for corporate social responsibility: A review of concepts, research and practice. Int. J. Manag. Rev. 2010, 12, 85–105. [Google Scholar] [CrossRef]

- Frederick, W. Corporate social responsibility: Deep roots, flourishing growth, promising future. In The Oxford Handbook of Corporate Social Responsibility; Crane, A., Matten, D., McWilliams, A., Moon, J., Siegel, D., Eds.; Oxford University Press: New York, NY, USA, 2008; pp. 522–531. [Google Scholar]

- Waddock, S.A.; Graves, S.B. The corporate social performance-financial performance link. Strateg. Manag. J. 1997, 18, 303–319. [Google Scholar] [CrossRef]

- Margolis, J.D.; Walsh, J.P. People and Profits? The Search for a Link between the Company’s Social and Financial Performance; Lawrence Erlbraum Associates: Mahwah, NJ, USA, 2001. [Google Scholar]

- Orlitzky, M.; Schmidt, F.L.; Rynes, S.L. Corporate social and financial performance: A meta-analysis. Organ. Stud. 2003, 24, 430–441. [Google Scholar] [CrossRef]

- Aguilera, R.V.; Rupp, D.E.; Williams, C.A.; Ganapathi, J. Putting the S back in corporate social responsibility: A multilevel theory of social change in organizations. Acad. Manag. Rev. 2007, 32, 836–863. [Google Scholar] [CrossRef]

- European Commission. Communication from the Commission to the European Parliament, the Council, the European Economic and Social Commitee and the Commitee of the Regions; European Commission: Brussels, Belgium, 2011; p. 681. [Google Scholar]

- Ambec, S.; Lanoie, P. Does it pay to be green? A systematic overview. Acad. Manag. Exec. 2008, 22, 45–56. [Google Scholar]

- Goldman Sachs. 2008 Environmental Report; Goldman Sachs: New York, NY, USA, 2008. [Google Scholar]

- International Civil Aviation Organisation. 2019 Environmental Report; International Civil Aviation Organisation: Montreal, Canada, 2019. [Google Scholar]

- Laroche, M.; Bergeron, J.; Barbaro-Forleo, G. Targeting consumers who are willing to pay more for environmentally friendly products. J. Consum. Mark. 2001, 18, 503–520. [Google Scholar] [CrossRef]

- Jansson, J.; Marell, A.; Annika, N. Green consumer behavior: Determinants of curtailment and eco-innovation adoption. J. Consum. Mark. 2010, 27, 358–370. [Google Scholar] [CrossRef]

- Huong Tran, T.T.; Paparoidamis, N.G. Eco-innovations in global markets: The effect of ecological (in)congruence on consumers’ adoption intentions. J. Int. Market. 2020, 28, 64–83. [Google Scholar] [CrossRef]

- Stronza, A.; Gordillo, J. Community views of ecotourism. Ann. Tour. Res. 2008, 35, 448–468. [Google Scholar] [CrossRef]

- Chiutsi, S.; Mukoroverwa, M.; Karigambe, P.; Mudzengi, B.K. The theory and practice of ecotourism in Southern Africa. J. Hosp. Manag. Tour. 2011, 2, 14–21. [Google Scholar]

- Wells, V.K.; Manika, D.; Gregory-Smith, D.; Taheri, B.; McCowen, C. Heritage tourism, CSR and the role of employee environmental behaviour. Tour. Manag. 2015, 48, 399–413. [Google Scholar] [CrossRef]

- Nik Ramli Nik, R.; Naja, M. Spill over of environmentally friendly behaviour phenomenon: The mediating effect of employee organizational identification. OIDA Int. J. Sustain. Dev. 2011, 2, 29–42. [Google Scholar]

- Islam, T.; Ali, G.; Asad, H. Environmental CSR and pro-environmental behaviors to reduce environmental dilapidation: The moderating role of empathy. Manag. Res. Rev. 2019, 42, 332–351. [Google Scholar] [CrossRef]

- Lyon, T.P.; Maxwell, J.W. Corporate social responsibilty and the environment: A thereotical perspective. Rev. Environ. Econ. Policy 2008, 2, 240–260. [Google Scholar] [CrossRef]

- Babiak, K.; Trendafilova, S. CSR and environmental responsibility: Motives and pressures to adopt green management practices. Corp. Soc. Responsib. Environ. Manag. 2011, 18, 11–24. [Google Scholar] [CrossRef]

- Rahman, N.; Post, C. Measurement issues in environmental corporate social responsibility (ECSR): Toward a transparent, reliable and construct valid instrument. J. Bus. Ethics 2012, 105, 307–319. [Google Scholar] [CrossRef]

- Khojastehpour, M.; Johns, R. The effect of environmental CSR issues on corporate/brand reputation and corporate profitability. Eur. Bus. Rev. 2014, 26, 330–339. [Google Scholar] [CrossRef]

- Nik Ramli Nik, R.; Nor Irwani, A.R.; Shaiful Annuar, K. Environmental corporate social responsibility (ECSR) as a strategic marketing initiatives. Procedia Soc. Behav. Sci. 2014, 130, 499–508. [Google Scholar]

- Li, J.Y.; Overton, H.; Bhalla, N. Communicative action and supportive behaviors for environmental CSR practices: An attitude-based segmentation approach. Corp. Commun. Int. J. 2020, 25, 171–186. [Google Scholar] [CrossRef]

- Guenther, E.; Hoppe, H.; Poser, C. Environmental corporate social responsibility of firms in the mining and oil and gas industries: Current status quo of reporting following GRI Guidelines. Greener Manag. Int. 2006, 53, 7–25. [Google Scholar]

- Frynas, J.G. Corporate social responsibility in the oil and gas sector. J. World Energy Law Bus. 2009, 2, 178–195. [Google Scholar] [CrossRef]

- Shvarts, E.; Pakhalov, A.; Knizhnikov, A. Assessment of environmental responsibility of oil and gas companies in Russia; the rating method. J. Clean. Prod. 2016, 127, 143–151. [Google Scholar] [CrossRef]

- Koolwal, N.; Khandelwal, S. Corporate social responsibility (CSR) implementation in oil & gas industry: Challenges and solutions. In Proceedings of the International Conference on Sustainable Computing in Science, Technology and Management (SUSCOM), Amity University Rajasthan, Jaipur, India, 26–28 February 2019; Available online: https://ssrn.com/abstract=3358059 (accessed on 20 April 2021).

- Największe Firmy w Polsce, Największe Firmy na Świecie. Available online: https://lepiejnizwbanku.pl/ogolna/najwieksze-firmy-w-polsce-najwieksze-firmy-na-swiecie/ (accessed on 20 April 2021).

- Business Alert. Polskie Społki Paliwowo, Energetyczne i Górnicze w Ranking TOP 500 CEE. 06.09.2019. Available online: https://biznesalert.pl/polskie-spolki-paliwowe-energetyczne-i-gornicze-w-rankingu-top-500-cee/ (accessed on 20 April 2021).

- Forum Odpowiedzialnego Biznesu. Partnerzy Strategiczni FOB Liderami XVI Rankingu Odpowiedzialnych Firm. 04.06.2020. Available online: http://odpowiedzialnybiznes.pl/aktualności/partnerzy-strategiczni-fob-liderami-xiv-rankingu-odpowiedzialnych-firm/ (accessed on 20 April 2021).

- Official Journal of the European Union. Directive 2013/34/EU of the European Parliament and of the Council of 22 October 2014. 2014. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32014L0095&from=FI (accessed on 30 March 2021).

- PKN ORLEN. Napędzamy Przyszłość, Raport Zintegrowany 2014. Available online: https://www.orlen.pl/PL/RelacjeInwestorskie/Raportyroczne/Strony/default.aspx (accessed on 25 March 2021).

- ORLEN. Raport zintegrowany Grupy ORLEN 2015. Available online: https://www.orlen.pl/PL/RelacjeInwestorskie/Raportyroczne/Strony/default.aspx (accessed on 25 March 2021).

- ORLEN. Raport zintegrowany Grupy ORLEN 2016. Available online: https://www.orlen.pl/PL/RelacjeInwestorskie/Raportyroczne/Strony/default.aspx (accessed on 25 March 2021).

- ORLEN. Raport zintegrowany Grupy ORLEN 2017. Available online: https://www.orlen.pl/PL/RelacjeInwestorskie/Raportyroczne/Strony/default.aspx (accessed on 25 March 2021).

- ORLEN. Raport zintegrowany Grupy ORLEN 2018. Available online: https://www.orlen.pl/PL/RelacjeInwestorskie/Raportyroczne/Strony/default.aspx (accessed on 25 March 2021).

- ORLEN. Raport zintegrowany Grupy ORLEN 2019. Available online: https://www.orlen.pl/PL/RelacjeInwestorskie/Raportyroczne/Strony/default.aspx (accessed on 25 March 2021).

- PGNiG. Raport Zintegrowany 2017. Available online: https://pgnig.pl/relacje-inwestorskie/prezentacje-i-materialy/raporty-roczne (accessed on 27 March 2021).

- PGNiG. Raport Zintegrowany 2018. Available online: https://pgnig.pl/relacje-inwestorskie/prezentacje-i-materialy/raporty-roczne (accessed on 27 March 2021).

- PGNiG. Raport Zintegrowany 2019. Available online: https://pgnig.pl/relacje-inwestorskie/prezentacje-i-materialy/raporty-roczne (accessed on 27 March 2021).

- KGHM. Raport Zintegrowany 2014. Available online: https://kghm.com/pl/inwestorzy/centrum-wynikow/raporty-zintegrowane (accessed on 28 March 2021).

- KGHM. Raport Zintegrowany 2015. Available online: https://kghm.com/pl/inwestorzy/centrum-wynikow/raporty-zintegrowane (accessed on 28 March 2021).

- KGHM. Raport Zintegrowany 2016. Available online: https://kghm.com/pl/inwestorzy/centrum-wynikow/raporty-zintegrowane (accessed on 28 March 2021).

- KGHM. Raport Zintegrowany 2017. Available online: https://kghm.com/pl/inwestorzy/centrum-wynikow/raporty-zintegrowane (accessed on 28 March 2021).

- KGHM. Raport Zintegrowany 2018. Available online: https://kghm.com/pl/inwestorzy/centrum-wynikow/raporty-zintegrowane (accessed on 28 March 2021).

- KGHM. Raport Zintegrowany 2019. Available online: https://kghm.com/pl/inwestorzy/centrum-wynikow/raporty-zintegrowane (accessed on 28 March 2021).

- Ehsan, S.; Nazir, M.S.; Nurunnabi, M.; Raza Khan, Q.; Tahir, S.; Ahmed, I. A multimethod approach to assess and measure Corporate Social Responsibility disclosure and practices in a developing economy. Sustainability 2018, 10, 2955. [Google Scholar] [CrossRef]

- European Commission. Circular Economy Action Plan. For a Cleaner and More Competitive Europe. Available online: https://ec.europa.eu/environment/circular-economy/pdf/new_circular_economy_action_plan.pdf (accessed on 20 April 2021).

- Official Journal of the European Union. Directive (EU) 2018/851 of the European Parliament and the Council of 30 May 2018 Amending Directive 2008/98/EC on Waste L. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32018L0851&rid=5 (accessed on 30 March 2021).

- Janik, A.; Ryszko, A.; Szafraniec, M. Greenhouse gases and circular economy issues in sustainability reports from the energy sector in the European Union. Energies 2020, 13, 5993. [Google Scholar] [CrossRef]

- Freiberg, D.; Park, D.G.; Serafeim, G.; Zochowski, T.R. Corporate Environmental Impact: Measurement, Data and Information. Working Paper 20-098; Harvard Business School: Boston, MA, USA, 2021. [Google Scholar]

- ORLEN. ORLEN w Liczbach 2019. Available online: https://www.orlen.pl/PL/RelacjeInwestorskie/InformacjeFinansowe/Strony/OrlenWLiczbach.aspx (accessed on 18 May 2021).

- PGNiG. Polakie Górnictwo Naftowe i Gazownictwo SA, Maj 2019. Available online: https://pgnig.pl/documents/10184/2580770/Company-Overview_PL_May2019.pdf/5da1eb13-8aaf-47ef-93b2-a8a18a6aae5c (accessed on 18 May 2021).

- KGHM. Raporty Zintegrowane. Available online: https://kghm.com/pl/inwestorzy/centrum-wynikow (accessed on 18 May 2021).

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | |

|---|---|---|---|---|---|---|

| ORLEN | - | 76.8 | 22.0 | 24.8 | 124.0 | 40.5 |

| PGNiG | - | 53.2 | 31.6 | 240.6/6.2 * | 309.0 | - |

| KGHM | 140.8 | 148.1 | 230.6 | 88.5 | 33.3 | 53.8 |

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | |

|---|---|---|---|---|---|---|

| ORLEN | 152.6 | 160.4 | 173.0 | 213.0 | 169.1 | 220.5 |

| PGNiG * | 762.6 | 674.4 | 690.8 | 610.2 | 807.4 | |

| KGHM | 31,066.7 | 31,350.9 | 31,653.2 |

| Specification | ORLEN 2015–2019 | PGNiG 2015–2019 | KGHM * 2016–2019 |

|---|---|---|---|

| total revenue (in million PLN) | 72,031 | 37,755 | 20,691 |

| water consumption (in million m3) | 86.3 | 154.6 | 31.2 |

| wastewater (in million m3) | 50.6 | 156.6 | 29.7 |

| CO2 emissions (in million Mg) | 14.4 | 6.7 | 1.6 |

| waste (in thousand Mg) | 187.2 | 709.1 | 31,356.9 |

| water consumption (per billion PLN of total revenue) | 1.20 | 0.41 | 1.51 |

| wastewater (per billion PLN of total revenue) | 0.70 | 0.41 | 1.44 |

| CO2 emissions (per billion PLN of total revenue) | 0.20 | 0.02 | 0.08 |

| waste (per billion PLN of total revenue) | 2.60 | 1.88 | 1515.50 |

| ORLEN 2015–2019 | PGNiG 2015–2019 | KGHM ** 2016–2019 | |

|---|---|---|---|

| dynamics of output * (% change) | 9.2 | −5.7 | 4.5 |

| water consumption (% change) | 9.2 | −2.5 | −43.1 |

| wastewater (% change) | −5.6 | −7.2 | −19.5 |

| CO2 emissions (% change) | 16.8 | 9.7 | 13.3 |

| waste (% change) | 37.5 | 5.9 | 1.9 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Suska, M. Environmental Corporate Social Responsibility (ECSR) on the Example of Polish Champion Oil, Gas and Mining Companies. Sustainability 2021, 13, 6179. https://doi.org/10.3390/su13116179

Suska M. Environmental Corporate Social Responsibility (ECSR) on the Example of Polish Champion Oil, Gas and Mining Companies. Sustainability. 2021; 13(11):6179. https://doi.org/10.3390/su13116179

Chicago/Turabian StyleSuska, Magdalena. 2021. "Environmental Corporate Social Responsibility (ECSR) on the Example of Polish Champion Oil, Gas and Mining Companies" Sustainability 13, no. 11: 6179. https://doi.org/10.3390/su13116179

APA StyleSuska, M. (2021). Environmental Corporate Social Responsibility (ECSR) on the Example of Polish Champion Oil, Gas and Mining Companies. Sustainability, 13(11), 6179. https://doi.org/10.3390/su13116179