Optimal Channel Strategy for a Fresh Produce E-Commerce Supply Chain

Abstract

1. Introduction

- What are the optimal decisions of the supplier and retailer when adopting the dual-channel model and DFS model? When can supply chain members benefit from these models?

- How does consumer sensitivity to freshness and offline hassle cost affect the optimal performance of supply chain members?

- Is the cooperative implementation of the DFS model beneficial to both parties, and under what situations can a win–win situation be achieved?

2. Literature Review

2.1. Omnichannel Retailing

2.2. Fresh Produce Supply Chain Management

3. Model and Assumption

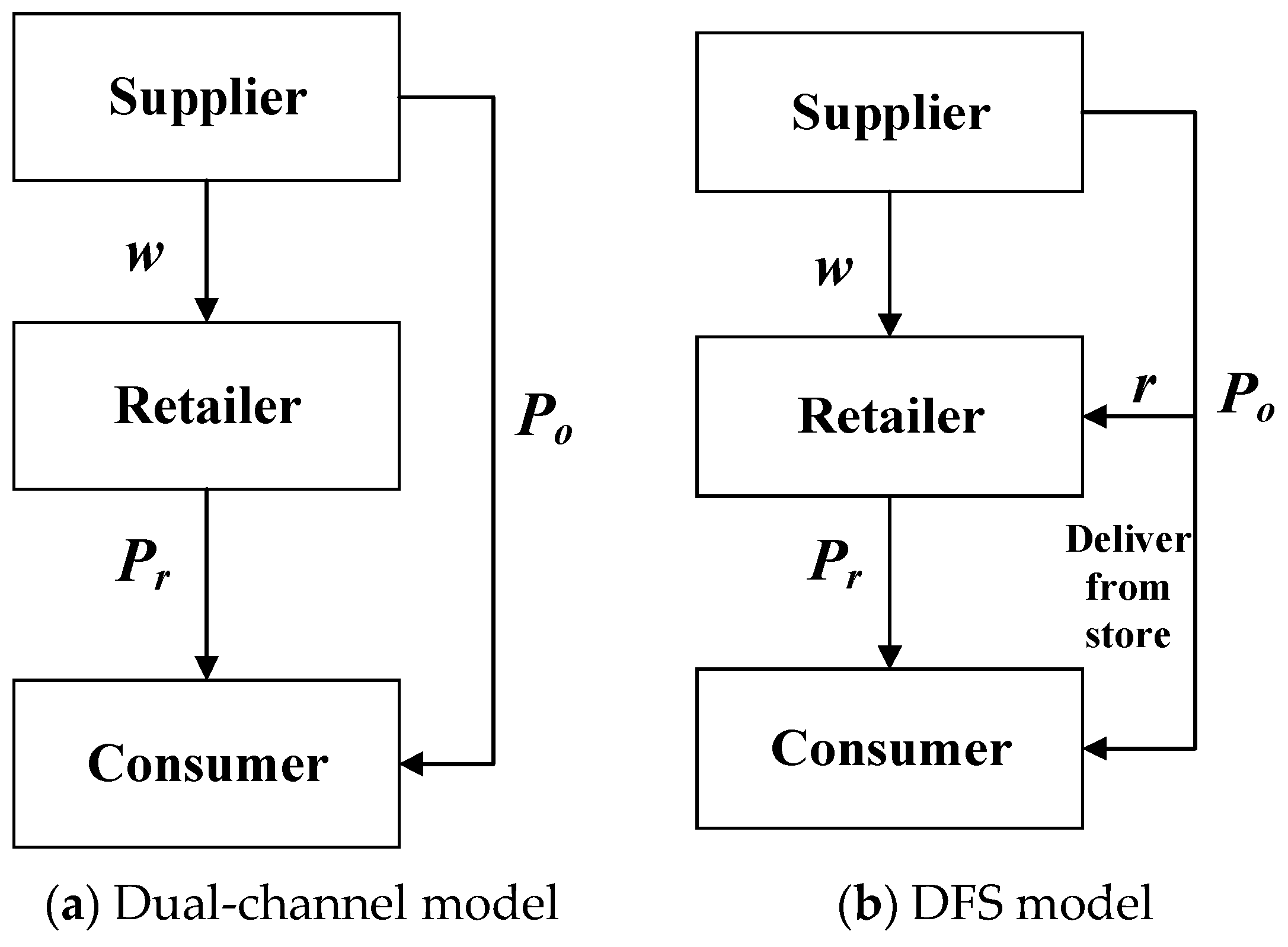

4. Model and Analysis

4.1. Centralized Model

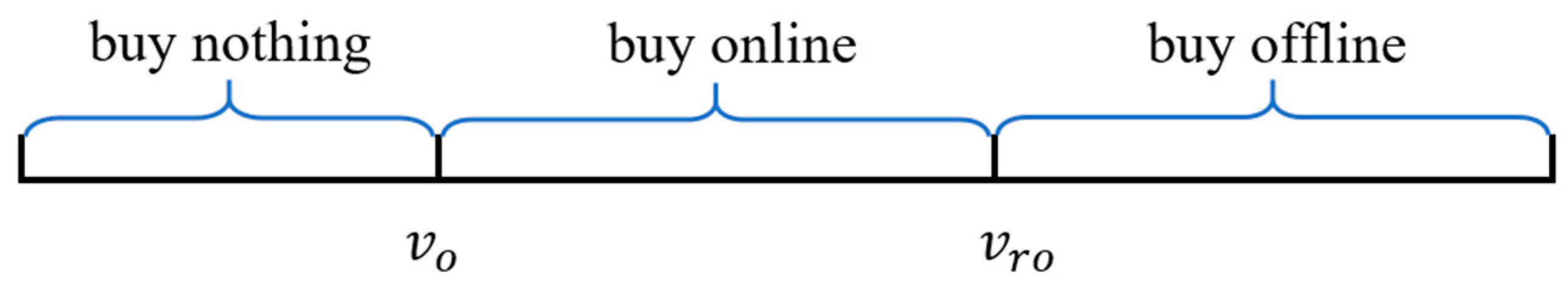

4.1.1. Dual-Channel Model

4.1.2. Omnichannel Model

4.2. Decentralized Model

4.2.1. Dual-Channel Model

4.2.2. Omnichannel Model

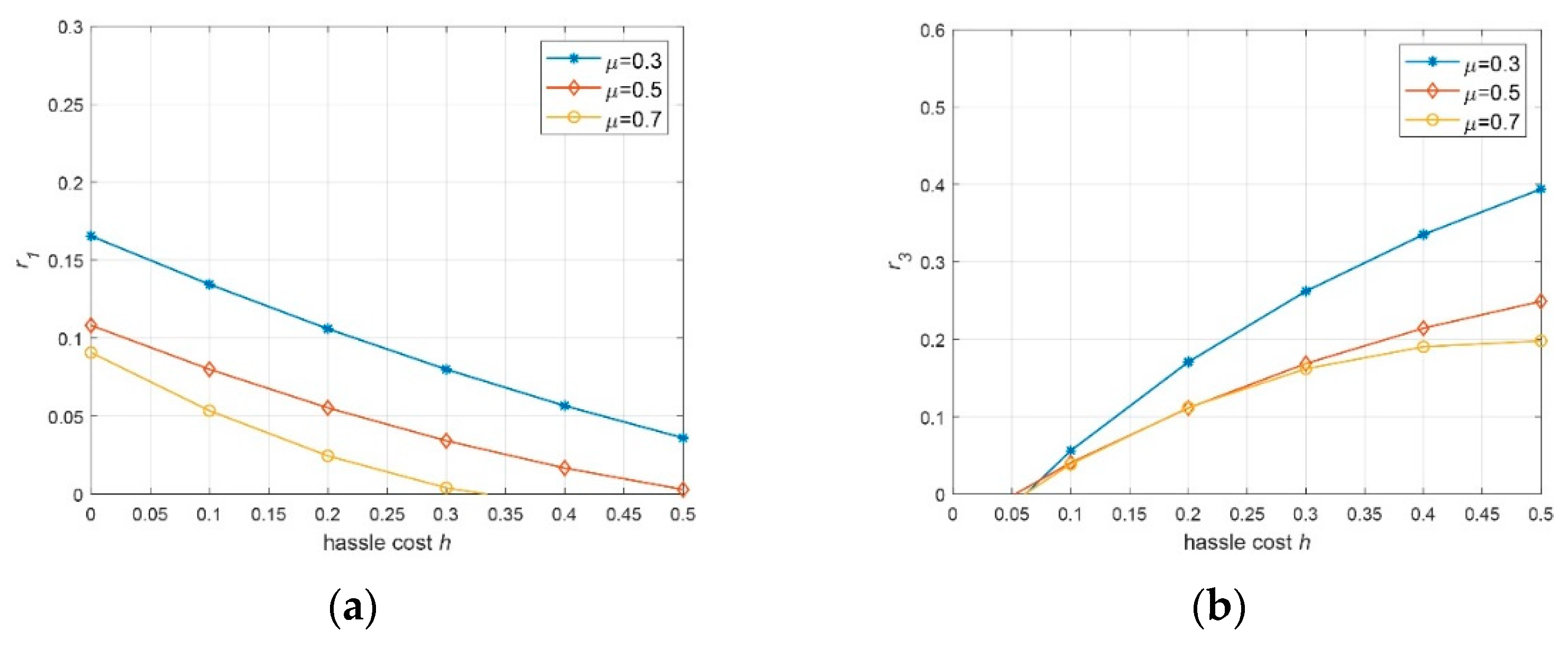

5. Equilibrium Analysis

5.1. Centralized Model

5.2. Decentralized Model

- (1)

- for the retailer, if,; otherwise,.

- (2)

- for the supplier, if,; otherwise,.

- (3)

- if, two firms can achieve a win–win situation.

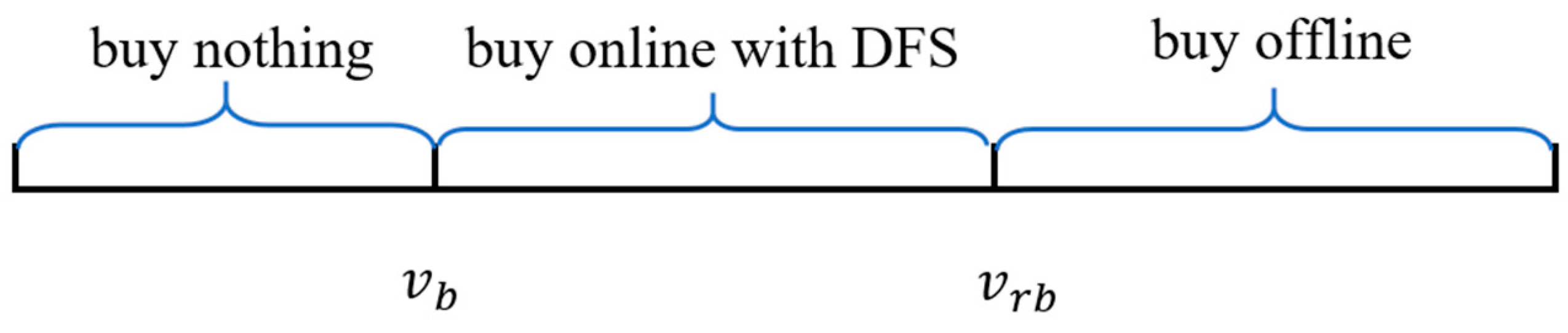

6. Numerical Analysis

6.1. Sensitivity Analysis

6.2. Managerial Implications

7. Conclusions

7.1. Findings and Insights

7.2. Limitations and Future Directions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

References

- Ministry of Commerce of the People’s Republic of China (Mofcom). Available online: http://www.mofcom.gov.cn/article/i/jyjl/j/202101/20210103033716.shtml (accessed on 25 January 2021).

- IResearch. Available online: https://www.iresearch.com.cn/report.shtml (accessed on 13 July 2020).

- He, B.; Gan, X.; Yuan, K. Entry of online presale of fresh produce: A competitive analysis. Eur. J. Oper. Res. 2019, 272, 339–351. [Google Scholar] [CrossRef]

- Liu, L.; Feng, L.; Xu, B.; Deng, W. Operation strategies for an omnichannel supply chain: Who is better off taking on the online channel and offline service? Electron. Commer. Res. Appl. 2020, 39, 100918. [Google Scholar] [CrossRef]

- Blackburn, J.; Scudder, G. Supply chain strategies for perishable products: The case of fresh produce. Prod. Oper. Manag. 2009, 18, 129–137. [Google Scholar] [CrossRef]

- Emarketer. Available online: https://www.emarketer.com/chart/230850/us-internet-users-whose-concern-about-temperature-freshness-of-fresh-frozen-food-items-reason-they-have-not-ordered-them-online-home-delivery-aug-2019-of-respondents-by-age (accessed on 3 September 2019).

- Liu, C.; Chen, W.; Zhou, Q.; Mu, J. Modelling dynamic freshness-keeping effort over a finite time horizon in a two-echelon online fresh product supply chain. Eur. J. Oper. Res. 2021, 293, 511–528. [Google Scholar] [CrossRef]

- Wu, Q.; Mu, Y.; Feng, Y. Coordinating contracts for fresh product outsourcing logistics channels with power structures. Int. J. Prod. Econ. 2015, 160, 94–105. [Google Scholar] [CrossRef]

- Yu, Y.; Xiao, T. Analysis of cold-chain service outsourcing modes in a fresh agri-product supply chain. Transp. Res. Part E Logist. Transp. Rev. 2021, 148, 102264. [Google Scholar] [CrossRef]

- Choudhary, A.; De, A.; Ahmed, K.; Shankar, R. An integrated fuzzy intuitionistic sustainability assessment framework for manufacturing supply chain: A study of UK based firms. Ann. Oper. Res. 2021. [Google Scholar] [CrossRef]

- Bai, H.; Guo, Q. Analysis on the influencing factors of the development of Chinese fresh cold chain logistics under e-commerce background. J. Manag. Strategy 2017, 8, 55–60. [Google Scholar] [CrossRef][Green Version]

- Yan, B.; Chen, X.; Cai, C.; Guan, S. Supply chain coordination of fresh agricultural products based on consumer behavior. Comput. Oper. Res. 2020, 123, 105038. [Google Scholar] [CrossRef]

- Musso, F. Innovation in marketing channels: Relationships, technology, channel structure. Symph. Emerg. Issues Manag. 2010, 1, 23–42. [Google Scholar]

- He, B.; Gupta, V.; Mirchandani, P. Online selling through O2O platform or on your own? Strategic implications for local Brick-and-Mortar stores. Omega 2021, 103, 102424. [Google Scholar] [CrossRef]

- Lin, X.; Zhou, Y.W.; Hou, R. Impact of a “buy-online-and-pickup-in-store” channel on price and quality decisions in a supply chain. Eur. J. Oper. Res. 2020. [Google Scholar] [CrossRef]

- Melero, I.; Sese, F.J.; Verhoef, P.C. Recasting the customer experience in today’s omnichannel environment. Universia Bus. Rev. 2016, 50, 18–37. [Google Scholar]

- He, Y.; Xu, Q.; Shao, Z. “Ship-from-store” strategy in platform retailing. Transp. Res. Part E Logist. Transp. Rev. 2021, 145, 102153. [Google Scholar] [CrossRef]

- Gallino, S.; Moreno, A.; Stamatopoulos, I. Channel integration, sales dispersion, and inventory management. Manag. Sci. 2017, 63, 2813–2831. [Google Scholar] [CrossRef]

- Hossain, T.M.T.; Akter, S.; Kattiyapornpong, U.; Dwivedi, Y. Reconceptualizing Integration Quality Dynamics for Omnichannel Marketing. Ind. Mark. Manag. 2020, 87, 225–241. [Google Scholar] [CrossRef]

- Mishra, R.; Singh, R.K.; Koles, B. Consumer decision-making in Omnichannel retailing: Literature review and future research agenda. Int. J. Consum. Stud. 2021, 45, 147–174. [Google Scholar] [CrossRef]

- Gerea, C.; Gonzalez-Lopez, F.; Herskovic, V. Omnichannel customer experience and management: An integrative review and research agenda. Sustainability 2021, 13, 2824. [Google Scholar] [CrossRef]

- Kang, J.; Majer, M.; Kim, H.J. Empirical study of omnichannel purchasing pattern with real customer data from health and lifestyle company. Sustainability 2019, 11, 7185. [Google Scholar] [CrossRef]

- Rodríguez-Torrico, P.; Cabezudo, R.S.J.; San-Martín, S. Tell me what they are like and I will tell you where they buy. An analysis of omnichannel consumer behavior. Comput. Hum. Behav. 2017, 68, 465–471. [Google Scholar] [CrossRef]

- Thaichon, P.; Phau, I.; Weaven, S. Moving from multi-channel to omnichannel retailing: Special issue introduction. J. Retail. Consum. Serv. 2020. [Google Scholar] [CrossRef]

- Cui, T.H.; Ghose, A.; Halaburda, H.; Iyengar, R.; Pauwels, K.; Sriram, S.; Tucker, C.; Venkataraman, S. Informational Challenges in Omnichannel Marketing: Remedies and Future Research. J. Mark. 2021, 85, 103–120. [Google Scholar] [CrossRef]

- Verhoef, P.C.; Kannan, P.K.; Inman, J.J. From multi-channel retailing to omni-channel retailing: Introduction to the special issue on multi-channel retailing. J. Retail. 2015, 91, 174–181. [Google Scholar] [CrossRef]

- Palmatier, R.W.; Stern, L.W.; El-Ansary, A.I. Marketing Channel Strategy: An Omni-Channel Approach; Routledge: London, UK, 2016; pp. 3–13. [Google Scholar]

- Musso, F. Destructuring of Marketing Channels and Growth of Multichannelling. In Search of a New Model for Distribution Systems. In Competitive Business Management. A Global Perspective; Brondini, S.M., Ed.; Routledge: London, UK, 2018; pp. 125–136. [Google Scholar]

- Aubrey, C.; Judge, D. Re-imagine retail: Why store innovation is key to a brand’s growth in the “new normal”, digitally-connected and transparent world. J. Brand Strategy 2012, 1, 31–39. [Google Scholar]

- Gao, F.; Su, X. Omnichannel retail operations with buy-online-and-pick-up-in-store. Manag. Sci. 2017, 63, 2478–2492. [Google Scholar] [CrossRef]

- Jiang, Y.; Liu, L.; Lim, A. Optimal pricing decisions for an omni-channel supply chain with retail service. Int. Trans. Oper. Res. 2020, 27, 2927–2948. [Google Scholar] [CrossRef]

- Kong, R.; Luo, L.; Chen, L.; Keblis, M.F. The effects of BOPS implementation under different pricing strategies in omnichannel retailing. Transp. Res. Part E Logist. Transp. Rev. 2020, 141, 102014. [Google Scholar] [CrossRef]

- Song, Y.; Fan, T.; Tang, Y.; Xu, C. Omnichannel strategies for fresh produce with extra losses in-store. Transp. Res. Part E Logist. Transp. Rev. 2021, 148, 102243. [Google Scholar] [CrossRef]

- Jin, M.; Li, G.; Cheng, T.C.E. Buy online and pick up in-store: Design of the service area. Eur. J. Oper. Res. 2018, 268, 613–623. [Google Scholar] [CrossRef]

- Zhang, P.; He, Y.; Zhao, X. “Preorder-online, pickup-in-store” strategy for a dual-channel retailer. Transp. Res. Part E Logist. Transp. Rev. 2019, 122, 27–47. [Google Scholar] [CrossRef]

- Zhang, J.; Xu, Q.; He, Y. Omnichannel retail operations with consumer returns and order cancellation. Transp. Res. Part E Logist. Transp. Rev. 2018, 118, 308–324. [Google Scholar] [CrossRef]

- Nageswaran, L.; Cho, S.H.; Scheller-Wolf, A. Consumer return policies in omnichannel operations. Manag. Sci. 2020, 66, 5558–5575. [Google Scholar] [CrossRef]

- Jin, D.; Caliskan-Demirag, O.; Chen, F.Y.; Huang, M. Omnichannel retailers’ return policy strategies in the presence of competition. Int. J. Prod. Econ. 2020, 225, 107595. [Google Scholar] [CrossRef]

- Bayram, A.; Cesaret, B. Order fulfillment policies for ship-from-store implementation in omnichannel retailing. Eur. J. Oper. Res. 2020. [Google Scholar] [CrossRef]

- Yang, D.; Zhang, X. Omnichannel operations with ship-from-store. Oper. Res. Lett. 2020, 48, 257–261. [Google Scholar] [CrossRef]

- He, P.; He, Y.; Xu, H. Buy-online-and-deliver-from-store strategy for a dual-channel supply chain considering retailer’s location advantage. Transp. Res. Part E Logist. Transp. Rev. 2020, 144, 102127. [Google Scholar] [CrossRef]

- Li, G.; Li, L.; Sun, J. Pricing and service effort strategy in a dual-channel supply chain with showrooming effect. Transp. Res. Part E Logist. Transp. Rev. 2019, 126, 32–48. [Google Scholar] [CrossRef]

- Du, S.; Wang, L.; Hu, L. Omnichannel management with consumer disappointment aversion. Int. J. Prod. Econ. 2019, 215, 84–101. [Google Scholar] [CrossRef]

- Shen, X.L.; Li, Y.J.; Sun, Y.; Wang, N. Channel integration quality, perceived fluency and omnichannel service usage: The moderating roles of internal and external usage experience. Decis. Support Syst. 2018, 109, 61–73. [Google Scholar] [CrossRef]

- Kim, K.; Han, S.L.; Jang, Y.Y.; Shin, Y.C. The effects of the antecedents of “Buy-Online-Pick-Up-In-Store” service on consumer’s BOPIS choice behaviour. Sustainability 2020, 12, 9989. [Google Scholar] [CrossRef]

- Song, Z.; He, S. Contract coordination of new fresh produce three-layer supply chain. Ind. Manag. Data Syst. 2019, 119, 148–169. [Google Scholar] [CrossRef]

- Zheng, Q.; Zhou, L.; Fan, T.; Ieromonachou, P. Joint procurement and pricing of fresh produce for multiple retailers with a quantity discount contract. Transp. Res. Part E Logist. Transp. Rev. 2019, 130, 16–36. [Google Scholar] [CrossRef]

- Ge, H.; Goetz, S.; Canning, P.; Perez, A. Optimal locations of fresh produce aggregation facilities in the United States with scale economies. Int. J. Prod. Econ. 2018, 197, 143–157. [Google Scholar] [CrossRef]

- Cai, X.; Chen, J.; Xiao, Y.; Xu, X. Optimization and coordination of fresh product supply chains with freshness-keeping effort. Prod. Oper. Manag. 2010, 19, 261–278. [Google Scholar] [CrossRef]

- Liu, M.; Dan, B.; Zhang, S.; Ma, S. Information sharing in an E-tailing supply chain for fresh produce with freshness-keeping effort and value-added service. Eur. J. Oper. Res. 2021, 290, 572–584. [Google Scholar] [CrossRef]

- Zheng, Q.; Ieromonachou, P.; Fan, T.; Zhou, L. Supply chain contracting coordination for fresh products with fresh-keeping effort. Ind. Manag. Data Syst. 2017, 117, 538–559. [Google Scholar] [CrossRef]

- Chernonog, T. Inventory and marketing policy in a supply chain of a perishable product. International. J. Prod. Econ. 2020, 219, 259–274. [Google Scholar] [CrossRef]

- Yang, L.; Tang, R. Comparisons of sales modes for a fresh product supply chain with freshness-keeping effort. Transp. Res. Part E Logist. Transp. Rev. 2019, 125, 425–448. [Google Scholar] [CrossRef]

- Hu, Q.; Xu, B. Differential game analysis of optimal strategies and cooperation in omni-channel organic agricultural supply chain. Sustainability 2019, 11, 848. [Google Scholar] [CrossRef]

- Chiang, W.Y.K.; Chhajed, D.; Hess, J.D. Direct marketing, indirect profits: A strategic analysis of dual-channel supply-chain design. Manag. Sci. 2003, 49, 1–20. [Google Scholar] [CrossRef]

- Yang, F.; Wang, M.; Ang, S. Optimal remanufacturing decisions in supply chains considering consumers’ anticipated regret and power structures. Transp. Res. Part E Logist. Transp. Rev. 2021, 148, 102267. [Google Scholar] [CrossRef]

- Zhang, P.; He, Y.; Shi, C.V. Retailer’s channel structure choice: Online channel, offline channel, or dual channels? Int. J. Prod. Econ. 2017, 191, 37–50. [Google Scholar] [CrossRef]

- Wang, C.; Leng, M.; Liang, L. Choosing an online retail channel for a manufacturer: Direct sales or consignment? Int. J. Prod. Econ. 2018, 195, 338–358. [Google Scholar] [CrossRef]

- Cai, X.; Chen, J.; Xiao, Y.; Xu, X.; Yu, G. Fresh-product supply chain management with logistics outsourcing. Omega 2013, 41, 752–765. [Google Scholar] [CrossRef]

- Dan, B.; Zhang, H.; Zhang, X.; Guan, Z.; Zhang, S. Should an online manufacturer partner with a competing or noncompeting retailer for physical showrooms? Int. Trans. Oper. Res. 2020, 28, 2691–2714. [Google Scholar] [CrossRef]

- Zhang, J.; Liu, G.; Zhang, Q.; Bai, Z. Coordinating a supply chain for deteriorating items with a revenue sharing and cooperative investment contract. Omega 2015, 56, 37–49. [Google Scholar] [CrossRef]

- Wang, C.; Chen, X. Option pricing and coordination in the fresh produce supply chain with portfolio contracts. Ann. Oper. Res. 2017, 248, 471–491. [Google Scholar] [CrossRef]

- Goswami, M.; Daultani, Y.; De, A. Decision modeling and analysis in new product development considering supply chain uncertainties: A multi-functional expert based approach. Expert Syst. Appl. 2021, 166, 114016. [Google Scholar] [CrossRef]

| Notation | Definition |

|---|---|

| Consumer’s valuation of fresh produce | |

| Consumer’s utility | |

| The matching degree of online produce, | |

| The freshness sensitivity of consumer, | |

| The hassle cost for consumer purchasing from an offline channel (e.g., search cost, travel cost, transaction cost) | |

| Delivery cost of the supplier | |

| Wholesale price of the supplier | |

| Retail price of the offline channel | |

| Retail price of the online channel | |

| The increased freshness level due to the retailer’s effort | |

| The commission rate of supplier sharing to the retailer, |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zheng, Q.; Wang, M.; Yang, F. Optimal Channel Strategy for a Fresh Produce E-Commerce Supply Chain. Sustainability 2021, 13, 6057. https://doi.org/10.3390/su13116057

Zheng Q, Wang M, Yang F. Optimal Channel Strategy for a Fresh Produce E-Commerce Supply Chain. Sustainability. 2021; 13(11):6057. https://doi.org/10.3390/su13116057

Chicago/Turabian StyleZheng, Qian, Manman Wang, and Feng Yang. 2021. "Optimal Channel Strategy for a Fresh Produce E-Commerce Supply Chain" Sustainability 13, no. 11: 6057. https://doi.org/10.3390/su13116057

APA StyleZheng, Q., Wang, M., & Yang, F. (2021). Optimal Channel Strategy for a Fresh Produce E-Commerce Supply Chain. Sustainability, 13(11), 6057. https://doi.org/10.3390/su13116057