Abstract

The purpose of this study is to examine the effect of the rural household’s head and household characteristics on credit accessibility. This study also seeks to investigate how credit constraint affects rural household welfare in the Mezam division of the North-West region of Cameroon. Using data from a household survey questionnaire, we found that 36.88% of the households were credit-constrained, while 63.13% were unconstrained. A probit regression model was used to examine the determinants of households’ credit access, while an endogenous switching regression model was used to analyze the impact of credit constraint on household welfare. The results from the probit regression model indicate the importance of the farmer’s or trader’s organization membership, occupation, and savings to the household’s likelihood of being credit-constrained. On the other hand, a prediction from the endogenous switching regression model confirms that households with access to credit have a better standard of welfare than a constrained household. From the results, it is necessary for the government to subsidize microfinance institutions, so that they can take on the risk of offering credit to rural households.

1. Introduction

Eradicating poverty and hunger in developing countries in 2015 was one of the main priorities of the Millennium Development Goals (MDGs). According to a rural development report [1], approximately 75% of those living in poverty reside in rural areas, and depend primarily on agriculture for their livelihood. Agriculture is seen as the only potent generator of employment for the rural household [1]. Therefore, the most appropriate approach to improve the well-being of the rural poor is to boost agricultural activity through access to finance, technological knowledge and a market [2]. Von Pischke et al. (1983) acknowledged that lack of the finance needed to undertake productive investments will trap a resource-poor household in poverty [3]. According to the rural development report [1], rural households with access to financial credit are more likely to see an increase in agricultural productivity, wages, consumption expenditure and welfare. The provision of credit to impoverished households has been widely recognized as an effective method to help alleviate poverty [4]. The increased access to financial services, especially credit, can relax liquidity constraints, improve households’ risk-bearing ability and productivity, equip them with new skills, and encourage activities that generate dynamic economic growth [5]. Credit provision also helps households to cope with the ex-post risks of negative income shocks and helps to smooth income and consumption flow [6,7,8]. Access to credit has therefore been enthusiastically canvassed in the development community for its ability and potential to generate sustainable economic growth that favors the poor [9,10]. In addition to maintaining the consumption of basic necessities, access to credit can increase the indigent farmers’ risk-coping ability, and help them alter their risk-coping strategies so that farmers may be more willing to adopt new and riskier strategies with a higher potential return in their production, instead of risk-reducing strategies [10,11]. Hermes and Lensink [12] further agreed that access to credit may contribute to a long-lasting increase in income, through a rise in investment in income-generating activities, and to a possible diversification of income for low-income groups, particularly rural households. However, with limited credit, rural farmers cannot purchase needed items and, as such, their production and consumption choices are limited [13]. According to Coleman [10] and Li et al. [11], the inability of farmers to access credit has often been a crucial constraint upon expanding production, prohibiting farmers from improving their living conditions and welfare. Sawada [14] defined credit constraint as the inability of certain households to borrow, perhaps because lenders believe they are unlikely to repay their loans. In this regard, credit constraint has a wide range of negative consequences for production and consumption in the short run, and asset accumulation, poverty reduction and the evolution of wellbeing in the long run [15]. Thorsten and Demirguc-Kunt [16] pointed out that collateral security and a high interest rate are the two main constraints that hinder rural households’ access to credit. Therefore, credit is a powerful instrument to help impoverished people invest and break out of poverty. This is because credit availability has the potential to improve users’ incomes and savings, and consequently, enhance investment and reinforce high incomes [17].

Cameroon, like many other African countries, has a huge percentage of its population living in rural areas. According to the World Bank [18], 45% of the total population in Cameroon lives in rural areas and depends on agricultural and non-agricultural activities for their livelihood. The poverty rate in the rural areas was estimated to be around 58% in 2014 [18]. As such, the poverty rate in rural areas is high when compared to urban areas. In this regard, [19,20] established a positive relationship between credit access and rural household welfare in Cameroon. Similarly, [21] established a positive link between microcredit and poverty reduction for rural women in Cameroon. The provision of credit has widely been acknowledged as a promising strategy for poverty reduction, and most especially for rural development [22]. Therefore, rural household accessibility to credit is considered an important resource toward improving rural household production and welfare [23]. Access to credit such as an agricultural loan has been found to increase productivity, per capita income, and the standard of living of the rural population [20,21,24,25]. Many rural households that are vulnerable to covariate shocks (that is, extreme weather, disease epidemics, etc.) have relatively few assets for collateral (mostly their land) and have low returns due to high interest rates from a rural loan [26]. As such, most rural households in Cameroon rely on the informal credit market to meet their credit needs [27].

According to Yuan and Xu, and Shoji et al. [28,29], poor rural households in Cameroon are more likely to be credit-constrained from both formal and informal credit sources due to lack of collateral security. Lack of collateral security has resulted in credit constraints from formal credit sources, which restricts their involvement in additional income-generating activities. Owing to this, rural households are deprived of the opportunity to invest in social capital and expand their social network. The social network is an important factor that facilitates rural farmers’ access to informal credit among friends and relatives [28,30]. As such, credit has the potential to improve the users’ incomes and savings, and consequently, enhance investment and reinforce the standard of living [31].

To relax credit constraints on the rural household market, an appropriate strategy is needed to direct both the informal and formal credit sectors to work toward the rural development goal, since both sectors coexist and interact. A better connection would enable one sector to overcome its weaknesses by gaining support from the other [32]. In an effort to tackle credit constraint, the governments of Cameroon opened up rural financial institutions (Crédit Agricole of Cameroon, the Cameroon Development Bank (CDB), the National Funds for Rural Development (FONADER), and microfinance development support projects (PADMIR)), with the aim of providing financial support to the rural population. However, these institutions are bankrupt and are no longer operational. As such, the rural household is left with no choice but to seek financial assistance from private and informal credit institutions that charge a high interest rate on loans [26]. Therefore, this study seeks to identify the possible effect of household characteristics on credit access. Beyond assessing the influence of rural household characteristics on accessing credit, we will also examine the impact of credit constraint on rural household welfare in the Mezam division of the North-West region of Cameroon. Results from the empirical analysis may give insight into the formation of rural credit policies and efforts aimed at enhancing rural production in Cameroon.

While it is evident and widely agreed upon that access to credit has a positive impact on household welfare, there are few studies that have evaluated the impact of credit constraint on rural household welfare in Cameroon [19,20,21,31,33]. Paramount among the limitations of the existing studies is the difference in econometric model and study area, which would make empirical findings more robust and valid for policy purposes. Differences in research methodology and study area seem to account for differences in the research findings. For example, to account for selection bias in the above studies, [19,31] used a 2-stage least square (2SLS) model, while [20] used a switching regression model. The use of a 2SLS model requires the availability of at least one appropriate instrumental variable, which was questioned by [34], while the study by [20] failed to state the method used in collecting the sample data. In addition, [20] used a different study area from the current study. In a study carried out within the rural areas of Cameroon, [21] failed to take into consideration endogeneity and sample selection in their study, while [33] carried out their study in a different study area (southwest region) of Cameroon.

Therefore, this lack of empirical rigor reduces the relevance of their findings for policy purposes. To fill this gap, our study is geared at using an endogenous switching regression model (ESR) to examine credit constraints on rural households in the Mezam division of the North-West region of Cameroon. The use of an ESR model takes into consideration endogeneity and selection bias.

The remainder of the study is organized as follows. Section 2 will contain literature about the rural credit market. Section 3 comprises the research methodology, while Section 4 presents result from the empirical findings. Section 5 concludes with the major findings, proposed implications, and recommendations.

2. Literature Review

Credit sources in most countries are generally classified into two categories: formal, and informal credit. Formal credit is the sourcing of credit mostly from commercial banks, and government banks, while informal credit is from relatives, individual lenders and associations. In the case of Cameroon, formal credit institutions consist of government banks, commercial banks and credit unions, while the informal credit institutions comprise relatives, individual money lenders and Njangi groups or associations.

Factors that influence access to credit are considered under two main actors: borrowers—rural households, and lenders—credit suppliers [35]. The supply factors present the amount that the borrowers can gain from a given source of credit, taking into consideration the information provided by the rural household. Credit constraint arises when there is a mismatch between the household’s credit demand and their access to credit. A household is considered to be credit-constrained if their loan demand is rejected due to certain reasons (lack of collateral security, high interest rate or other factors) best known to the lender [30], or if they have been discouraged from petitioning by their perceiving no chance of gaining credit. The first case is referred to as credit rationing, due to information asymmetry between lenders and borrowers, whilst the latter case represents self-imposed risk rationing by borrowers [36,37].

The literature suggests that determinants of credit access can be divided into two groups, namely, the head of the household’s characteristics and the general household’s characteristics. The head’s characteristics consist of gender, education, age and marital status, while the household characteristics consist of land title, income earners, household experience, farmers’ organization membership, savings, remittance and occupation.

2.1. Household Head Characteristics

Adhering to Sawada (2005) [14], credit constraint refers to the inability of certain households to borrow, perhaps because lenders believe they are unlikely to repay their loans. This happens when their loan demands are rejected by the credit provider [30]. Given the negative impact of credit constraint, it is important to identify factors affecting households’ credit constraint, specifically in rural areas of the Mezam division. Most characteristics of the head of the household, as used when accessing credit, are gender, education, age and marital status [38,39,40,41]. The gender of the household head is expected to have an ambiguous effect on the household’s access to credit. Studies on household head characteristics have shown that a male household head has more chance of obtaining credit than a female household head [42,43,44,45]. According to Hazel and Malapit [43], women are more likely to be credit-constrained than men, partly because of their creditworthiness rather than their wealth. In line with the above reasoning, researchers [31] acknowledged that access to rural credit is influenced by having a male household head in the North-West region of Cameroon. Similarly, [41,42] found that the return of capital for male-owned off-farm activities is more likely to generate the return on investment necessary to repay micro-loans. In most situations, lenders perceive women as having less control over their household finances, as they are less likely to participate in economic activities [46]. According to [1], women have less access to formal financial services, and globally, only 47% have an account at a formal financial institution.

In addition, household heads with educational qualifications are more likely to have access to credit. The educational qualifications of the household head refer to their intellectual resources or relevant experience. In line with the above definition, it is expected that an educated household head will have access to financial credit. This is due to the fact that a household head with a high level of educational qualifications is able to accumulate and have better knowledge about access to credit. Educational achievement augments human capital in the form of cleverness, which is connected to the effective utilization of credit and minimization of default risk [31]. Educated farmers are also expected to utilize their knowledge to become more informed about credit availability, and allocate credit more efficiently. Hence, educated household heads are likely to have access to credit [31,39,40,47]. In line with this, Briggerman et al. [48] and Yusuf et al. [47] showed that uneducated farmers stand the risk of being credit-constrained. However, in a study carried out in Eastern Cape Town, Baiyegunhi et al. [5] found that education did not significantly influence the rural farmer’s access to credit.

In terms of age, the hypothesized sign is ambivalent. It is expected that older farmers will have access to credit because they are more experienced and more responsible in carrying out investments [40]. However, it is believed that as the household head gets older, their capability to access credit or their demand for credit decreases, as they are interested in their immediate consumption and are less concerned with risk-taking and long-term investment [31,43]. On the other hand, younger farmers are more adventurous and will diversify their investment to make more profits [5,49]. Related studies found no significant relationship between age and household access to credit [41,49]. In a study carried out by Freedman et al. [50], age had a negative relationship with credit access. Such an effect was confirmed by Barslund and Tarp [51] in the case of Vietnam.

Though not often used in research, marital household heads are seen as being responsible and rational in their investment decisions. Therefore, the marital household is hypothesized to have a positive relationship with credit access. The marital household displays greater repayment potential, and as such is more likely to have access to credit [45,52]. It is expected that a household head who is married would have more credit demand than an unmarried one, due to their family size and consumption. In addition, taking into consideration their social respect and stability, lenders are comfortable with supplying credit to a marital household [41,48].

2.2. Household Characteristics

Recognizing the fact that credit plays a key role in improving the productivity and livelihood of rural households in developing countries, it is therefore paramount to review studies relating to household characteristics and credit access.

In rural areas, land is considered the most valuable and available capital for the rural household. A household with a land title is expected to have access to credit because that can be used as collateral security in obtaining credit. A land title also serves as evidence of the household’s production capacity. In most studies, households having land titles are more likely to have access to credit [53,54]. However, in his study, Migheli [55] argued that households that owned and cultivated a large parcel of land need less credit because they have an asset (land title) and income. Daniel and Raymond [56] suggested that land status cannot be the only basis for enhancing credit to the rural household, and that the government’s efforts in facilitating the development of efficient financial systems for risk management is vital in credit access.

Income earners play a vital role within the rural community. A household with one or more participants who earn an income is less likely to be credit-constrained. The more income earners a household has, the more chances that household has to access credit. It is expected that a household with income earners will easily access credit, because they earn income from their jobs and can assist in repaying the household loan. Studies carried out by Wen and Simin [57] and by Sekyi [52] found a positive relationship between household income earners and access to credit. In line with these findings, Kofarmata [47] confirmed that more members in a household means more connections; therefore, households with more members will benefit from a larger social network and their loan applications are more likely to succeed.

Moreover, household experience, savings, remittance and occupation are expected to have a significant influence on credit access. A household with farming experience is hypothesized to have a positive relationship with credit access. It is important to note that the experienced household head will use efficient farming methods to optimize his/her output. In this regard, Sadiq and Kolo [58] examined the factors determining subsistence farmers’ access to agricultural credit in Pakistan, and found that farmers’ experience is positive and significantly related to agricultural credit.

Another key determinant of household credit access is remittance. Remittance is expected to have a positive relationship with credit access, helping to stabilize the flow of resources because they are countercyclical, and therefore reduce the risk of default [59]. Adhering to this, Mesnard [60] acknowledges that remittance can help deal with credit market imperfections and reduce credit demand by relaxing financial constraints.

Like other household characteristics, access to credit is affected by household savings. In the context of this study, savings refers to the household action of putting money aside to consume or invest at a later date. Money can be saved at home, deposited in a savings account or invested in different types of capital/assets. In most African countries, individual or group savings are used as collateral to obtain a loan [61]. The ability of a household to save serves as a sign of commitment and portrays their ability to repay a loan [62].

Household occupation is deemed to have a positive relationship with credit access. It is expected that households whose main occupation is farming are more likely to have access to credit, because most households in rural areas depend on farming as the only economic activity that generates income. Therefore, this study hypothesizes that the household occupation (farming) will have a positive relationship with credit access.

Issues related to farmers and trade organizations have been documented [33,63,64]. In a study carried out in Cameroon, [33] found that the farmers’ association is positively related to borrowing money by the farmer. Similarly, [64] explained that farmers who are members of an association indirectly have a high level of social capital, which is likely to increase their chances of obtaining credit. In a study carried out in Osun State, Nigeria, [64] found that farmers who are members of the Cocoa Farmers’ Association had easy access to credit.

2.3. Credit Constraint and Households’ Welfare

Credit access undoubtedly has a huge socio-economic impact on rural households, such as an increase of output/production, improving household income, and poverty reduction [19,20,21]. The above studies proved that access to credit is instrumental toward poverty reduction and improved household welfare in Cameroon. However, limited access to credit is a major factor that hinders productivity and leads to stagnant economic development [65]. Farmers’ investment and consumption decisions are largely affected by access to rural credit [66,67]. This is due to the fact that credit access enables rural households to satisfy their financial needs, which allows them to spend more on agricultural input and productive investments. Rural households that are credit-constrained are limited in participating in many income-generating activities. Although credit constraint is not necessarily a cause of poverty, it apparently exaggerates it.

Credit constraint has been empirically found to have a negative influence on rural household welfare. Baiyegunhi and Darroch [5] examined the impact of credit constraint on household welfare and found that unconstrained households have a higher consumption expenditure than a constrained household [68]. Similarly, Minh et al. [40] found that households with increased access to credit can improve their consumption pattern and thus improve their welfare. Li and Zhu [69] added that welfare losses are larger if the household’s credit request is rejected. In a study carried out in rural China, [70] found that credit constraint had a negative impact on food consumption per day. This study therefore expects a negative relationship between credit constraint and rural household welfare.

3. Materials and Methods

3.1. Study Site and Data

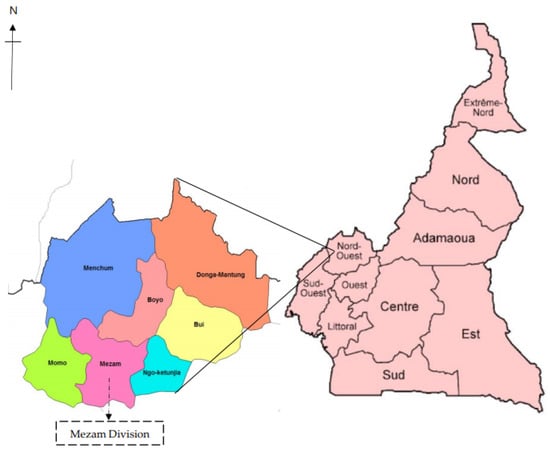

A structural questionnaire was used to carry out a survey at the rural household level. Rural households in the Mezam division of the North-West region of Cameroon (see Figure 1) were selected as a target group for this study. This division was selected because it is one of the largest agricultural divisions in the North-West region. This division is also the headquarters (capital) of the North-West region, which means that it offers a rich opportunity in terms of an available market for the rural farmer to sell their produce. The North-West region comprises seven divisions, namely, Boyo, Bui, Donga-Mantung, Menchum, Mezam, Momo, and Ngo-Ketunjia. A multistage sampling technique was adopted to select representative rural households for the study. The first step involved selecting one division (Mezam division) out of the seven divisions. The second stage involved a simple random selection of four subdivisions (Bali, Bamenda I, Bamenda II and Tubah) out of the seven subdivisions (Bafut, Bali, Bamenda I, Bamenda II, Bamenda III, Santa, and Tubah) in the Mezam division. Finally, from each subdivision, forty simple random selections were carried out, making a total of 160 respondents.

Figure 1.

Map of Cameroon and the Mezam division.

The households of these selected subdivisions are known for practicing agricultural (horticulture) and non-agricultural activities (trade, transport services, vocational trades). Most of the vegetables and fruit that are cultivated are white potatoes, tomatoes, cabbage, carrots, lettuce, green beans, pineapples, pawpaws and pears. The market days of these subdivisions are mostly Saturdays and Sundays of each week. The authors of this paper, along with two data collectors, interviewed farmers and traders at their market sheds. The market area was seen as the perfect place to administer the questionnaires, because farmers and traders had come there to trade. Farmers also mostly stay on their farms during the week, while at weekends, they come to the market to trade their produce. This means that to locate farmers on non-market days would be very difficult, because they would have gone to their farms. Considering such a circumstance, we decided to visit the marketplace to make sure we could meet with the farmers. In addition, most rural households are sparsely distributed, which means that moving from one household to another would be costly and time-consuming. The collection of data took a period of 5 weeks, and a total of 160 households were interviewed.

3.2. Analytical Framework

Based on questionnaire responses, households were categorized into credit-constrained and unconstrained households. As mentioned earlier, credit constraint refers to the inability of certain households to borrow, perhaps because lenders believe they are unlikely to repay their loans. Following Maddala [34], an endogenous switching regression model (ESR) was used in the analysis. The endogenous switching regression model allows for joint estimation of the determinants of households’ credit-constraint conditions, and whether the household welfare was affected by access to credit or not. The analysis of this study was carried out using the STATA software package. The ESR model estimates the effects of credit access on the outcome variable by considering two equations, one for those households that are credit-constrained and the other for those households that are unconstrained. The possibility of self-selection bias arises due to the fact that credits are targeted toward certain households. For example, households who have collateral, like land or other assets, are more likely to have access to credit. In this situation, we supposed that there were some unobservable characteristics of the household that influenced their access to credit. In this regard, self-selection bias is the source of an endogeneity problem, and failure to take such problems into account will overstate the true impact of credit constraint on household welfare. Therefore, an estimation method is needed to correct this bias and obtain an unbiased estimation [71]. The choice of model addresses a self-selection bias and takes into account the observed and unobserved factors when estimating the impact of credit constraint on household welfare.

Following Maddala [34], the credit-constrained condition of a household (designated i) is presented using a probit function with the following specification:

Equation (1c) indicates the degree to which a household is credit-constrained, and is given by the index , which is a latent variable as the author cannot directly observe the households’ request for credit [8]. This index is explained by which represents a vector of the explanatory variables; represent the parameter to be estimated, and is the random error term, distributed as a normal function with a null mean. Since > 0 is unobservable, credit status is first estimated using a probit model which estimates the probability of a household being credit-constrained.

The probability of a household having access to credit = 1 is written as:

and the probability of not having access to credit = 0 is written as:

As mentioned earlier, to address the possibility of selection bias, an ESR model is applied. This choice of model is agreed by [34,72]. Previous studies [5,40,73] have used this model in their analysis. Therefore, the household’s welfare is estimated using the following equation, with regime 1 representing a household with access to credit (credit-unconstrained) and regime 0 representing a household with no access to credit (credit-constrained):

where and represent the household welfare with access to credit and no access to credit respectively; and are the vector parameters; X represent the various explanatory variables; and are the error terms. The covariance of the error term is unknown, since and cannot be observed simultaneously. Therefore, , and Equation (1a) are assumed to have a normal distribution, with a mean vector of zero and a covariance matrix:

where , , represent the variance of the error terms , in the welfare functions in Equations (4) and (5). is the covariance of and , while is the covariance of and . and are the correlation terms between household credit access status in Equation (1a) and the impact of welfare in Equations (2) and (3). If and = 0, then it is assumed that there is no problem with selection bias. However, if and ≠ 0, then the model has selection bias. This implies the error term or is not equal to zero, and OLS estimation is no longer consistent. According to Maddala [34], an ESR model can be efficiently estimated using maximum likelihood estimation as follows:

where represents the standard normal probability density function, and is the cumulative density function. The ratio of and in Equations (4) and (5) is the inverse Mills ratio. Therefore, the inverse Mills ratio is written as:

Fitting Equations (6) and (7) in Equations (2) and (3) yields:

where and are the new error term with zero means. Freedman et al. [50] used weighted least square to account for heteroskedastic errors in and .

Based on the estimated covariance and , and the likelihood ratio test obtained from the endogenous switching regression model, we can assess if the ESR model is suitable for this study or not. If or are statistically significant, and the likelihood ratio test accepts the alternative hypothesis of endogenous, then the application of an endogenous switching model is necessary to address the selection bias.

3.3. Robustness Testing

In order to correct for the selection bias, the vce (robust) command in STATA was applied. This therefore suggests that having access to credit was not randomly distributed in our sample and shows an indication of selection bias.

4. Results

4.1. Descriptive Statistics of Surveyed Households

Table 1 present the descriptive statistics of the household respondents used in the study. From the survey of 160 rural households of the Mezam division in Cameroon, the response showed that 101 household participants had access to credit, while 59 were credit-constrained. About 64 percent of the household participants were female. Table 1 reveals that close to 40 percent of the households participated in agricultural activities, while 59 percent participated in non-agricultural activities. Regarding farmer/trader organizations, approximately 43 percent belonged to a farmer/trader organization. Most respondents belonged to the age group 35–65 years (61.25 percent) with a high school certificate as their highest educational achievement (94.25 percent). About 89 percent of the respondents had savings, while 66.25 percent rented land for agricultural activity. Approximately 34 percent of households had remittances, mostly from friends and family members. On average, there were approximately two income earners (51.25 percent) in a household. Similarly, around 6 million CFA (Central African francs) were spent annually on consumption expenditure by rural households. Furthermore, on average, the rural household head had approximately 13 years of experience in farming.

Table 1.

Summary of descriptive statistics.

Table 2 presents descriptive statistics relating to credit access. The average number of times a household could seek credit was approximately twice a year. The minimum and maximum times a household can borrow is once and 12 times, respectively. Most of the credit borrowed was used for non-agricultural activities (75.2 percent), while 24 percent was used for agricultural activities. Most of the respondents (93.1) opted for a short-term loan (monthly).

Table 2.

Descriptive statistics relating to credit access.

Table 3 reveals household borrowing conditions. Out of the 101 that had access to credit, 68 (67.32 percent of households) sought credit from an informal source while 33 (32.67 percent of households) sought credit from a formal source. The majority of the households preferred the informal sector because it was reliable and flexible, while the few who opted for the formal sector said they offered huge loan amounts. The difficulties households face when accessing credit is collateral services. Out of the 50 (49.50%) households that did not have collateral security, 40 (39.60%) accessed credit with the informal sector, while 10 (9.90%) accessed credit with the formal sector. The same trend could be witnessed in households with collateral. Out of the 51 (50.49) households that had access to credit, 28 (27.72%) of them chose informal credit, while 23 (22.77%) chose formal credit. This implies that most of the households in this study preferred an informal credit source. This is because these informal credit providers are mostly family members or friends who are flexible in their borrowing terms and conditions.

Table 3.

Household borrowing conditions.

4.2. Household Determinants of Credit Access

The determinants of credit access are estimated using the maximum likelihood estimates of the probit model. Table 4 presents the VIF test results (mean VIF = 1.18). A threshold value of 5 was chosen to represent multicollinearity in the model [74]. The VIF test result shows 1.18, which is less than 5, indicating that there is no multicollinearity in the model. The Hosmer–Lemeshow’s goodness of fit test (estat gof) (p-value 0.882) and the significant chi-square () proves that the model fits the data.

Table 4.

Test of Multicollinearity (Variance Inflation Factor VIP).

The results obtained indicate that farmer/trader organization membership, occupation, and savings were statistically significant while the other variables (gender, age, level of education, marital status, income earner, land status and income supplement) were not statistically significant (see Table 5). Although [31] confirm that age, gender and level of education of rural households affect credit demand in the North-West region of Cameroon, these differences in results could be explained by the following reasons. First, the sample area (division) used by [31] is different from the current study area. Moreover, the authors of [31] failed to identify the specific technique used in selecting the various subdivisions within the study area. Second, the model used by [31] is different from the current study. In line with the above reasons, the current study presents different results from [31]. From the results, the coefficient of farmer/trader organization membership is significantly positive. This implies that households belonging to farmer/trader organizations are more likely to have access to credit. Farmer/trader organizations act as guarantors on behalf of households who wish to obtain credit from a formal or informal financial institution. With such backing, households can easily have access to credit. Masaood and Maharjan [75] supported this result, arguing that households that belong to farmers’ organizations have easy access to credit. This result is also consistent with the findings of [76].

Table 5.

Household determinant of credit access.

The significantly negative coefficient of occupation implies that households who undertake agricultural activities such as crop-farming and animal-rearing are less likely to have access to credit than households that are engaged in non-agricultural activities (trade, transport services). Farming activities in the study area are carried out once or, at times, twice a year. In such a situation, the rural household can only harvest their product once or twice a year. This means that they will have to wait for a long period of time before marketing their produce. With such a delay in harvesting and selling their produce, lenders will feel uncomfortable about lending money to such households, because they might not pay promptly, whereas non-agricultural activities such as traders have a quick turnover in their business, and as a result they can easily generate income on a daily basis. With such a quick turnover, lenders feel comfortable in lending to such households because they are likely to repay loans on time.

The estimated coefficient of household savings is positive and is statistically significant. The positive significance of household savings indicates that households with financial savings are seen to be more creditworthy by formal lenders, and as such, they are likely to have access to credit. Therefore, the result is in compliance with expectations. This finding supports the findings of [65], where households with a savings account find it easy to obtain loans from financial institutions.

4.3. The impact of Credit Constrained on Household Welfare

Table 6 presents results obtained from the endogenous switching regression model. Household consumption expenditure is used as an indicator for a household’s welfare. The choice of this proxy follows the recommendation of [77,78]. The significance of the regression and the constant term is confirmed by the Wald test. The LR test (30.36) is significant at 1%, indicating that the endogenous switching regression model is better than an exogenous model. The estimated correlation coefficient of () is positive and significantly different from zero. This result implies that there is evidence of selection bias, and applying OLS estimation would result in biased estimates. The coefficient () is negative and significantly different from zero. These signs agree with the expectation that unconstrained households in the study sample have a higher consumption expenditure than credit-constrained households.

Table 6.

Impact of credit constraint on household welfare.

Table 6 shows the difference in the significance of income supplement (remittance), savings, gender, land status and occupation variables between credit-constrained and unconstrained households. The coefficient of income supplement (remittance) is positive and significant at 10%. This implies that credit-constrained households that receive income supplements in the form of remittance will experience an increase in their consumption expenditure. The result is in line with the previous study conducted by Richard et al. [79], who found that households will increase their home expenditure when they receive a remittance. The coefficient of savings is positive and significant at 5%. The positive sign of this coefficient implies that credit-constrained households with savings in either formal or informal financial institutions have the chance to increase their consumption expenditure. Since they have savings at formal and informal financial institutions, a rural household can improve their consumption expenditure by using up their savings. This finding supports the findings of [5], where household savings were found to have a positive relationship with household expenditure.

For the credit-unconstrained households, gender, land status and occupation have a statistically significant effect on household consumption expenditure. The positive and significant effects of gender on credit-unconstrained households imply that male-headed households will likely have a greater increase in consumption expenditure than female-headed households. This finding is in compliance with [5], who suggested that male-headed households would contribute to improving the welfare and poverty alleviation in the Eastern Cape Province of South Africa.

Regarding household occupations, the coefficient of agricultural activities (crop-farming and animal-rearing) is negative and statistically significant. This implies that credit-unconstrained households that are involved in agricultural activities will likely experience a decrease in consumption expenditure. This is because most rural households lack the technical ability to produce quality output that can fetch huge profits, and thus influence their consumption expenditure. This result is supported by the findings of [80]. For example, most rural household farmers lack the necessary inputs (capital, fertilizers, herbicides, and quality seeds) to use on their farms. As such, sales from their output are usually very low, prompting low income as well as low consumption expenditure. In addition, most agricultural products are harvested once or twice a year, creating a situation where the farmers will have to wait for a lengthy period before selling their products.

As expected, the coefficient of land status is negative and statistically significant. This implies that an unconstrained household with rented land will have lower consumption expenditure. The reason for the negative relationship is because households who rent land for cultivation cannot use the land as collateral security. Land titles in the study area are mostly used as collateral security to obtain credit. Therefore, a household with rented land will find it difficult to improve their consumption expenditure, because they cannot use the land as collateral security to obtain credit. In addition, some of the rented land may have many conditions. For example, a landowner might restrict the use of pesticides on his land due to their chemical composition and the damage they may cause to the environment.

5. Conclusions and Policy Implications

Credit serves not only as a tool for development but also as an effective means of combating poverty. The limited availability of credit for those that are in need of it poses a threat to their welfare and is a crucial issue to government and credit providers. In this paper, we analyze the determinant of credit-constraint status and evaluate the impact of credit constraint on rural household welfare in the Mezam division of the North-West region of Cameroon.

Our study identifies that household access to credit is significantly determined by household farmer/trader organization membership, occupation, and savings. In this regard, households that belong to a farmer/trader organization have access to credit. This is because, as an organization, they have a collective bargaining power to obtain and repay loans promptly. As expected, rural households that rent land for farming are less likely to have access to credit. The results also indicate that households with savings have easier access to credit. Most financial institutions consider savings as some sort of collateral security, therefore, a household with savings finds it easier to access credit.

Consumption expenditure was used as an indicator to measure household welfare. Our results showed that constrained households with savings accounts have better welfare than those without savings accounts. Rural households could use part of their savings in difficult periods to improve their consumption, and as such improve their welfare. Moreover, credit-constrained households can improve their welfare if they receive financial support in the form of a remittance. Overall, our results confirm that having access to credit has a positive impact on household welfare in the study area (Mezam division).

On the other hand, unconstrained households would have a better standard of welfare if the household were headed by a male. Male heads of the household in rural Cameroon are seen as breadwinners in their families. Our study identifies that agricultural activities will have a negative impact on rural household welfare. This could be explained by the fact that most rural households lack resources (farm inputs like fertilizer, pesticides) and the technical know-how to farm quality products that can fetch huge profits in the market. With such limitations (farm inputs and technical know-how), the rural household is likely to have a low income and a low standard of living. In addition, a rural household with rented land will experience a fall in their standard of living. This is because these households are unable to obtain loans on rented land. In such a situation, the household will find it very difficult to obtain credit to improve their agricultural productivity and subsequently the household welfare.

The results from this study provide important policy implications focusing on enhancing household credit accessibility and welfare in the Mezam division of the North-West region of Cameroon. Following our results, in other to facilitate credit access, a well-functioning and vibrant farmer-based organization is paramount. It is recommended, therefore, that Cameroon’s Ministry of Agriculture and Rural Development should create a separate department tasked with the responsibility of creating, registering, training and building the capacity of farmers’ organizations as well as linking them to critical services, in this case, credit.

The study suggests that having savings accounts at financial institutions gives rural households more chance of accessing credit. Therefore, the government of Cameroon should subsidize microfinance institutions to provide rural households with credit. Moreover, financial institutions should have supportive policies to facilitate the opening of accounts by rural households. This would greatly help rural households to have easy access to credit. Since agriculture stands out to be the activity generating the most income in the study area, it is advisable for the rural population to engage in one or more agricultural activities. The government, through the Ministry of Agriculture and Rural Development, could step in by providing training and educational programs to improve and increase rural household agricultural productivity. For example, through the national agricultural extension and research programs (NAREP), rural farmers can adopt new farming methods and technologies. The adoption of these new farming methods and technologies will help farmers to increase their agricultural output.

Our ESR model result recommends that under credit-constrained conditions, remittance and household savings are essential for rural household welfare. Owing to the fact that an unconstrained household has a better welfare outcome than a constrained household, it is important for the government and private financial institutions to relax their policies of obtaining loans regarding impoverished and disadvantaged households. The government, through its national agricultural investment plan (PNIA), should facilitate and improve the access to credit of rural households. The PNIA is one of the government’s national economic strategies to reduce poverty by 10 percent by 2035. In addition, the government could assist rural farmers to obtain loans by subsidizing microfinance institutions (MFI). This will encourage the MFI to take risks when lending to rural household farmers.

6. Recommendation for Future Study

Although the implication of this study adhered to the fact that access to credit plays a vital role in enhancing rural household welfare, its inherent limitations must be stated. In this study, a line of research not covered, but necessary for rural household access to credit vis-à-vis welfare, is the consideration of different forms of credit (formal and informal) on rural household welfare. From the above study, it can be seen that most rural households prefer informal credit to formal credit. Therefore, examining the impact of the different credit types will help governments and other stakeholders find efficient ways of providing credit.

Furthermore, social capital is an important element in the rural areas of developing countries. Social capital can play an important role in household access to credit. Reputation and social status entitlement in the community can help rural households to access credit. Furthermore, the household’s relationship with financial institutions, which is measured by connections with bank officials, length of relationship with banks, or savings accounts in banks, could help ease credit access.

This study has a couple of limitations that can be addressed in future research. The categorization of a household with credit access (unconstrained) and the household sample size used in this study are small; future studies can consider a larger sample size. Moreover, the categorization of a household with credit access (unconstrained) and a household with no credit access (constrained) is based on the households’ response to key questions asked. However, this study fails to use a static household model to examine if rural households are effectively credit-constrained or not. This study uses cross-sectional data to examine credit access and measure its impact on welfare within a short period. Future research can use time-series data to examine the determinants of credit access and its impact on rural household welfare.

Author Contributions

L.A. contributed to the research design, data analysis and formal analysis. S.Y. contributed in writing and supervising the research. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

Data are available on request.

Acknowledgments

We would like to appreciate the help of the two data collectors, Manka Wendy Chi and Fonyuy Bimilar Leonard, who is a Ph.D. candidate in the Department of Law, University of Bamenda, North-West Region, Cameroon.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Rural Development Report. Fostering Inclusive Rural Transformation; IFAD: Rome, Italy, 2016.

- World Development Report. Agriculture for Development; The World Bank: Washington, DC, USA, 2008.

- Von Pischke, J.D.; Adams, D.W.; Donald, G. (Eds.) Rural Financial Markets in Developing Countries: Their Use and Abuse; John Hopkins University Press: Baltimore, MD, USA, 1984. [Google Scholar]

- Diagne, A.; Zeller, M.; Sharma, M. Empirical Measurements of Household’s Access to Credit and Credit Constrained in Developing Countries: Methodological Issues and Evidence; Citeseer: State College, PA, USA, 2000. [Google Scholar]

- Baiyegunhi, L.; Fraser, G.; Darroch, M. Credit constrained and household welfare in the Eastern Cape Province, South Africa. Afr. J. Agric. Res. 2010, 5, 2243–2252. [Google Scholar]

- Khandker, S.; Faruqee, R.R. The Impact of Farm Credit in Pakistan; The World Bank: Washington, DC, USA, 1999. [Google Scholar]

- Rosenzweig, M.R. Savings Behavior in Low-income Countries. Oxf. Rev. Econ. Policy 2001, 17, 40–54. [Google Scholar] [CrossRef]

- Foltz, J.D. Credit Market access and Profitability in Tunisian agriculture. Agric. Econ. 2004, 30, 229–240. [Google Scholar] [CrossRef]

- Murdoch, J.; Haley, B. Analysis of the Effects of Microfinance on Poverty Reduction; New York University (NYU) Wagner Working Paper No. 1014; NYU: New York, NY, USA, 2002; Available online: http://pdf.wri.org/ref/morduch_02_analysis_effects.pdf (accessed on 11 January 2021).

- Coleman, S. Access to capital and terms of credit: A comparison of men- and women-owned small businesses. J. Small Bus. Manag. 2002, 38, 37–52. [Google Scholar]

- Li, X.; Gan, C.; Hu, B. Accessibility to microcredit by Chinese rural households. J. Asian Econ. 2011, 22, 235–246. [Google Scholar] [CrossRef]

- Hermes, N.; Lensink, R. Microfinance: Its impact, Outreach, and Sustainability. World Dev. 2011, 39, 875–881. [Google Scholar] [CrossRef]

- Dong, F.; Lu, J.; Featherstone, A. Effects of Credit constrained on Household Productivity in Rural China. Agric. Financ. Rev. 2012, 72, 402–415. [Google Scholar] [CrossRef]

- Sawada, Y. Credit constrained and Poverty Dynamics: Theory, Evidence, and Field Survey Strategy. In Agricultural Production, Household Behavior, and Child Labor in Andhra Pradesh; Institute of Developing Economies Joint Research Program Series No. 135; IDE: Chiba-shi, Japan, 2006. [Google Scholar]

- Gonzaler-Vega, C. Deepening Rural Financial Markets: Macroeconomic, Policy and Political Dimensions. In Paper for Paving the Way Forward: An International Conference on Best Practices in Rural Finance, Washington, DC, USA, 2–3 June2003; USAID: Washington, DC, USA, 2003. [Google Scholar]

- Thorsten, B.; Demirguc-Kunt, A. Access to Finance: An unfinished Agenda. World Bank Econ. Rev. 2008, 22, 383–396. [Google Scholar]

- Mohamed, K. Access to Formal and Quasi-Formal Credit by Smallholder Farmers and Artisanal Fishermen: A Case of Zanzibar; Research Report No. 03.6; Research on Poverty Alleviation (REPOA): Dar es Salaam, Tanzania, 2003. [Google Scholar]

- The World Bank. The World Bank in Cameroon. Available online: https://www.worldbank.org/en/country/cameroon/overview (accessed on 5 October 2020).

- Sikod, F.; Baye, M. Microfinance access and poverty reduction in Cameroon. In La Microfinance en Afrique Centrale: Le Défi des Exclus; Ayuk, E.T., Ed.; Centre de Recherches pour le Développement International: Ottawa, ON, Canada, 2015; pp. 253–284. [Google Scholar]

- Schrieder, G.; Heidhues, F. Rural financial markets and the food security of the poor: The case of Cameroon. Afr. Rev. Money Financ. Bank. 1995, 1/2, 131–154. [Google Scholar]

- Kimengsi, J.N.; Balgah, R.A.; Buchenrieder, G.; Silberberger, M.; Batosor, H.P. An empirical analysis of credit-financed agribusiness investments and income poverty dynamics of rural women in Cameroon. Community Dev. 2017, 51, 72–89. [Google Scholar] [CrossRef]

- Maryjane, U.; Celestine, U. Analysis of Micro Credit as a Veritable Tool for Poverty Reduction among Rural Farmers in Anambra State, Nigeria. Discourse J. Agric. Food Sci. 2013, 1, 152–159. [Google Scholar]

- Jia, X.; Heidhues, F.; Zeller, M. Credit Rationing of rural households in China. Agric. Financ. Rev. 2010, 70, 37–54. [Google Scholar] [CrossRef]

- Akotey, O.J.; Adjasi, C.K.D. Does Microcredit increase Household Welfare in the Absence of Micro insurance? World Dev. 2011, 77, 380–394. [Google Scholar] [CrossRef]

- Imai, K.; Azam, S. Does Microfinace Reduce Poverty in Bangladesh? New Evidence from Household Panel Data. J. Dev. Stud. 2012, 48, 633–653. [Google Scholar] [CrossRef]

- George, O.; Shem, A.O. Informal Credit and Factor Productivity in Africa: Does informal Credit Matter. In Proceedings of the International Association of Agricultural Economists Triennial Conference, Foz do Iguaco, Brazil, 18–24 August 2012. [Google Scholar] [CrossRef]

- Liqiong, L.; Weizhuo, W.; Christopher, G.; Quang, T.T.N. Credit constrained on Farm households Welfare in Rural China: Evidence from Fujian Province. Sustainability 2019, 11, 3221. [Google Scholar] [CrossRef]

- Yuan, Y.; Xu, L. Are Poor able to access the informal Credit Market? Evidence from Rural Households in China. China Econ. Rev. 2015, 33, 232–246. [Google Scholar] [CrossRef]

- Shoji, M.; Aoyagi, K.; Kasahara, R.; Sawada, Y.; Ueyama, M. Social capital formation and Credit Access: Evidence from Sri Lanka. World Dev. 2012, 40, 2522–2536. [Google Scholar] [CrossRef]

- Calum, G.T.; Kong, R. Informal lending amongst friends and relatives: Can microcredit compete in rural China? China Econ. Rev. 2020, 21, 544–556. [Google Scholar]

- Bime, M.-J.; Mbanasor, J.A. Analysis of rural credit market performance in north west region, Cameroon. Agris On-Line Pap. Econ. Inform. 2011, 3, 23–28. [Google Scholar]

- Tang, S.; Guo, S. Formal and informal credit markets and rural credit demand in China. In Proceedings of the 2017 4th International Conference on Industrial Economics System and Industrial Security Engineering (IEIS), Kyoto, Japan, 24–27 July 2017; pp. 1–7. [Google Scholar]

- Djoumessi, Y.F.; Kamdem, C.B.; Afari-sefa, V.; Bidogeza, J.-C. Determinants of Smallholder Vegetable Farmers Credit Access and Demand in Southwest region, Cameroon. Econ. Bull. 2018, 38, 1231–1240. [Google Scholar]

- Maddala, G.S. Disequilibrium, self-selection, and Switching Models. Handb. Econom. 1986, 3, 1633–1688. [Google Scholar]

- Zeller, M. Determinants of Credit Rationing: A study of informal lenders and formal credit groups in Madagascar. World Dev. 1994, 22, 1895–1907. [Google Scholar] [CrossRef]

- Muhongayire, W.; Hitayezu, P.; Mbatia, O.; Mukoya-Wangia, S. Determinants of Farmers’ Participation in Formal Credit Markets in Rural Rwanda. J. Agric. Sci. 2013, 4, 87–94. [Google Scholar] [CrossRef]

- Stiglitz, J.E.; Weiss, A. Credit rationing in markets with imperfect information. Am. Econ. Rev. 1981, 71, 393–410. [Google Scholar]

- Malapit, H.J.L. Are women more likely to be credit constrained? Evidence from low-income urban household in the Philippines. Fem. Econ. 2012, 18, 81–108. [Google Scholar] [CrossRef]

- Jegede, S.O. Credit Consraints towards Agricultural Development in Ogun State, Nigeria. Master’s Thesis, Eastern Mediterranean University Gazimağusa, Gazimağusa, North Cyprus, 2015. (Unpublished Thesis Master of Science in Economic). [Google Scholar]

- Minh, C.T.; Christopher, E.C.; Baiding, H. Credit constrained and impact on Farm Household Welfare: Evidence from Vietnam’s North Central Coast Region. Int. J. Soc. Econ. 2016, 43, 782–803. [Google Scholar]

- Kiplimo, J.K.; Ngenoh, E.; Koech, W.; Bett, J.K. Determinants of Access to Credit Financial Services by Smallholder Farmers in Kenya. J. Dev. Agric. Econ. 2015, 7, 303–313. [Google Scholar]

- De Mel, S.; Mckenzie, D.; Woodruff, C. Are women more Credit Constrained? Experimental Evidence on Gender and Microenterprise Returns. Am. Econ. J. Appl. Econ. 2008, 1, 1–32. [Google Scholar] [CrossRef]

- Ongena, S.; Popov, A. Gender Bias and Credit Access; Working Paper Series 1822; European Central Bank: Frankfurt, Germany, 2015. [Google Scholar]

- Duy, V.Q. Determinants of Household Access to Formal Credit in the Rural Areas of the Mekong Delta, Vietnam. MPRA Paper No 38202. Munich Personal RePEc Archieve. 2012. Available online: https://mpra.ub.uni-muenchen.de/38202/ (accessed on 6 April 2020).

- Mpuga, P. Constraints in Access to and Demand for Rural Credit: Evidence from Uganda. In Proceedings of the African Economic Conference (AEC), Tunis, Tunisia, 12–14 November 2008. [Google Scholar]

- Buvinic, M.; Sebstad, J.; Zeidenstein, S. Credit for Rural Women: Some Facts and Lessons; International Center for Research on Women: Washington, DC, USA, 1979. [Google Scholar]

- Kofarmata, Y.I.; Applanaidu, S.D.; Hassan, S. Examination of the Determinants of Credit Constrained in the Rural Agricultural Credit Market of Nigeria. Res. J. Appl. Sci. 2016, 11, 235–239. [Google Scholar] [CrossRef]

- Briggerman, B.C.; Charles, A.T.; Morehart, M.J. Credit constrained: Their Existence, Determinants, and Implications for U.S. Farm and Nonfarm sole proprietorships. Agric. Appl. Econ. Assoc. 2009, 91, 275–289. [Google Scholar]

- Saifullahi, S.I.; Haruna, A. An analysis of farmers access to formal credit in the rural areas of Nigeria. Afr. J. Agric. Res. 2012, 7, 6249–6253. [Google Scholar] [CrossRef]

- Freedman, D.A.; Klien, S.P.; Ostland, M.; Roberts, M.R. Review of a Solution to the Ecological Inference Problem, by G. King. J. Am. Stat. Assoc. 1998, 93, 1518–1522. [Google Scholar] [CrossRef]

- Barslund, M.; Tarp, F. Formal and informal rural credit in four provinces of Vietnam. J. Dev. Stud. 2008, 44, 485–503. [Google Scholar] [CrossRef]

- Sekyi, S. Farm credit access, credit constrained and productivity in Ghana: Empirical evidence from Northern Savanah ecological zone. Agric. Financ. Rev. 2017, 77, 446–462. [Google Scholar] [CrossRef]

- Jorge, G.H.; Maira, D.; Maria, H.M. The Impact of land titling on agricultural production and agricultural investments in Tanzania: A theory-based approach. J. Dev. Eff. 2015, 7, 530–544. [Google Scholar]

- Petracco, C.; Pender, J.L. Evaluating the Impact of Land Tenure and Titling on Access to Credit in Uganda; IFPRI discussion Paper 00853; International Food Policy Research Institute: Washington, DC, USA, 2009. [Google Scholar]

- Migheli, M. Land Ownership and Informal Credit in Rural Vietnam; 2018 Working Paper 183/18; Centre for Economic Research in Pakistan (CERP): Lahore, Pakistan, 2018. [Google Scholar]

- Domeher, D.; Abdulai, R. Access to Credit in the developing World: Does land registration matter? Third World Q. 2012, 33, 161–175. [Google Scholar] [CrossRef]

- Wen, S.; Simin, W. The Relationship between Credit Constrained and Household Risky Assets: The Case of China. Master’s Thesis, Jönköping University, Jönköping, Sweden, 2017. Available online: http://urn.kb.se/resolve?urn=urn:nbn:se:hj:diva-36750 (accessed on 20 September 2020).

- Sadiq, M.S.; Kolo, M.D.; Akerele, F.O. Determinants of Credit constrained of farming Household participating in National Special Programme for Food Security in Niger State, Nigeria. Glob. J. Agric. Econ. Econom. 2015, 3, 114–120. [Google Scholar]

- Yang, D.; Choi, H. Are remittances insurance? Evidence from rainfall shocks in the Philippines. World Bank Econ. Rev. 2007, 21, 219–248. [Google Scholar] [CrossRef]

- Mesnard, A. Temporary migration and capital market imperfections. Oxf. Econ. Pap. 2004, 56, 242–262. [Google Scholar] [CrossRef]

- Bendig, M.; Giesbert, L.; Steiner, S. (Eds.) Transformation in the Process of Globalization—Savings, Credit and Insurance: Household Demand for Formal Financial Services in Rural Ghana; GIGA German Institute of Global and Area Studies: Hamburg, Germany, 2009. [Google Scholar]

- Fletschner, D.; Kenney, L. Rural Women’s Access to Financial Services: Credit, Savings, and Insurance. In Gender in Agriculture; Quisumbing, A., Meinzen-Dick, R., Raney, T., Croppenstedt, A., Behrman, J., Peterman, A., Eds.; Springer: Dordrecht, The Netherlands, 2014. [Google Scholar] [CrossRef]

- Omonona, B.; Jimoh, A.; Awoyinka, Y. Credit constrained condition and welfare among farmers in Egbeda local Government Area of Oyo State, Nigeria. Eur. J. Soc. Sci. 2008, 6, 422–432. [Google Scholar]

- Lawal, J.O.; Omonona, B.T.; Ajani, O.I.Y.; Oni, O.A. Determinants of Constraints to Credit Access among Cocoa Farming Households in Osun State, Nigeria. Pak. J. Soc. Sci. 2009, 6, 159–163. [Google Scholar]

- Cianan, P.; Kolkowski, J.; Kancs, D.A. Access to credit, factor allocation and farm productivity: Evidence from the CEE transition economies. Agric. Financ. Rev. 2012, 72, 22–47. [Google Scholar] [CrossRef]

- Tang, S.; Guan, Z.F.; Jin, S.Q. Formal and informal credit markets and rural credit demand in China. In Proceedings of the Agricultural and Applied Economics Association Joint Annual Meeting, Denver, CO, USA, 25–27 July 2010. [Google Scholar]

- Eswaran, M.; Kotwal, A. Implication of credit constrained for risk behavior in less developed economies. Oxf. Econ. Pap. 1990, 42, 473–482. [Google Scholar] [CrossRef]

- Diagne, A.; Zeller, M. Access to Credit and Its Impact on Welfare in Malawi; Research Report 116; International Food Policy Research Institute (IFPRI): Washington, DC, USA, 2001. [Google Scholar]

- Li, R.; Zhu, X. Economic analysis of credit constrained of Chinese rural households and welfare loss. Appl. Econ. 2010, 42, 1615–1625. [Google Scholar]

- Lin, L.; Wang, W.; Gan, C.; Cohen, D.A.; Nguyen, Q.T. Rural credit constrained and informal rural credit accessibility in China. Sustainability 2019, 11, 1935. [Google Scholar] [CrossRef]

- Lee, L.F. Some approaches to the correction of selectivity bias. Rev. Econ. Stud. 1982, 49, 355–372. [Google Scholar] [CrossRef]

- Kiefer, N. Discrete parameter Variation: Efficiency estimation of a switching Regression Model. Econometricia 1978, 46, 427–434. [Google Scholar] [CrossRef]

- Boucher, S.R.; Guirkinger, C.; Trivelli, C. Direct elicitation of credit constrained: Conceptual and practical issues with an application to peruvian agriculture. Econ. Dev. Cult. Chang. 2009, 57, 609–640. [Google Scholar] [CrossRef]

- Kumar, P.R. Multicollinearity: Causes, Effects and Remedies. Working Paper, Unknown Date. 2006. Available online: https://www.researchgate.net/profile/Ranjit-Paul-2/publication/255640558_MULTICOLLINEARITY_CAUSES_EFFECTS_AND_REMEDIES/links/004635371a7b335d9f000000/MULTICOLLINEARITY-CAUSES-EFFECTS-AND-REMEDIES.pdf (accessed on 8 April 2021).

- Moahid, M.; Maharjan, K.L. Factors affecting farmers Access to formal and informal credit: Evidence from rural Afghanistan. Sustainability 2020, 12, 1269. [Google Scholar] [CrossRef]

- Mbaye, L.M. Remittances and Rural Credit Markets: Evidence from Senegal. Rev. Dev. Econ. 2021, 25, 183–199. [Google Scholar] [CrossRef]

- Ravallion, M. Poverty Comparisons: A Guide to Concepts and Methods; LSMS Working Paper No. 88; The World Bank: Washington DC, USA, 1992; ISSN 0253-4517. [Google Scholar]

- Coudouel, A.; Hentschel, J.S.; Wodon, Q.T. Poverty Measurement and Analysis [A Sourcebook for Poverty Reduction Strategies]. Available online: https://mpra.ub.uni-muenchen.de/10490/1/poverty_fr.pdf (accessed on 15 April 2021).

- Adams, R.H., Jr.; Cuecuecha, A.; Page, J. Remittances, Consumption and Investment in Ghana. Development Prospects Group (DECPG); The World Bank: Washington, DC, USA, 2009. [Google Scholar]

- Amare, M.; Shiferaw, B. Nonfarm employment, agricultural intensification, and productivity change: Empirical findings from Uganda. Agric. Economic. 2017, 48, 59–72. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).