Effects of Dual Credit Policy and Consumer Preferences on Production Decisions in Automobile Supply Chain

Abstract

1. Introduction

2. Literature Review

2.1. Production Decisions of Auto Supply Chain under Dual Credit Policy

2.2. Operational Decisions Considering Consumer Preferences of Demand

2.3. Literature Review Summary

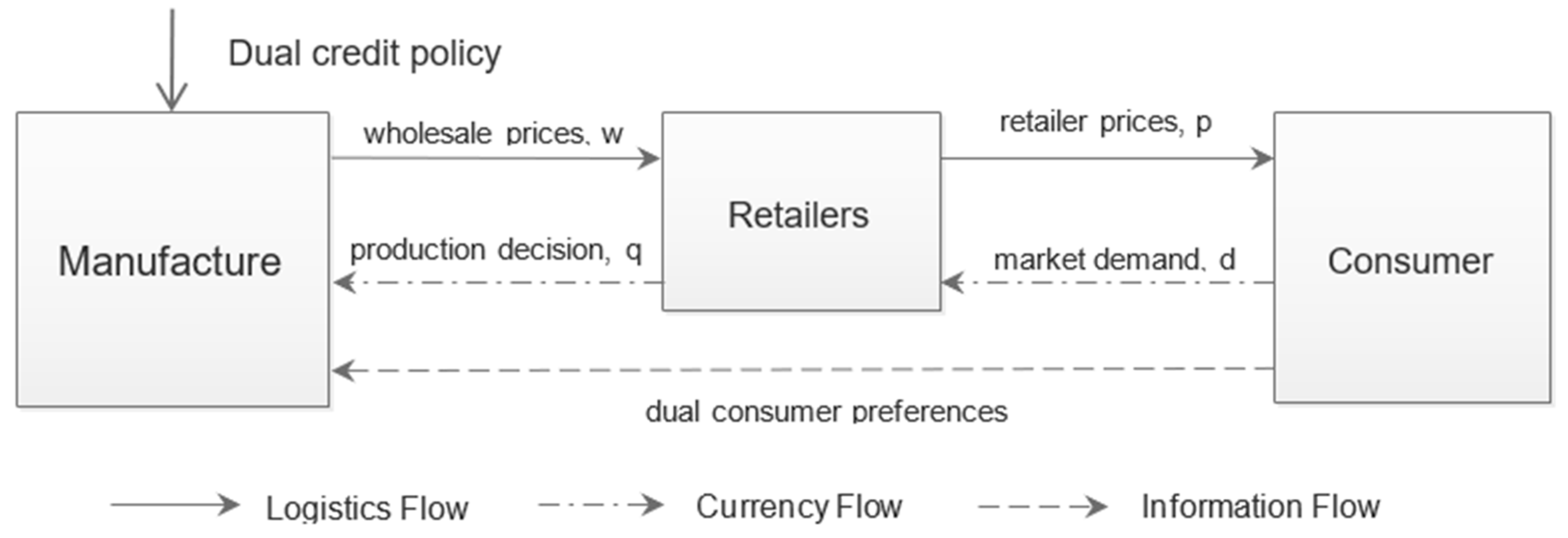

3. Assumptions, Notations and Models

3.1. Assumptions

3.2. The Basic Model

4. Analysis of the Automobile Supply Chain

4.1. Analysis of the Decentralized Automobile Supply Chain

4.2. Analysis of the Centralized Automobile Supply Chain

5. The Influence of Dual Consumer Preferences on Supply Chain and Difference Analysis

6. Numerical Simulation

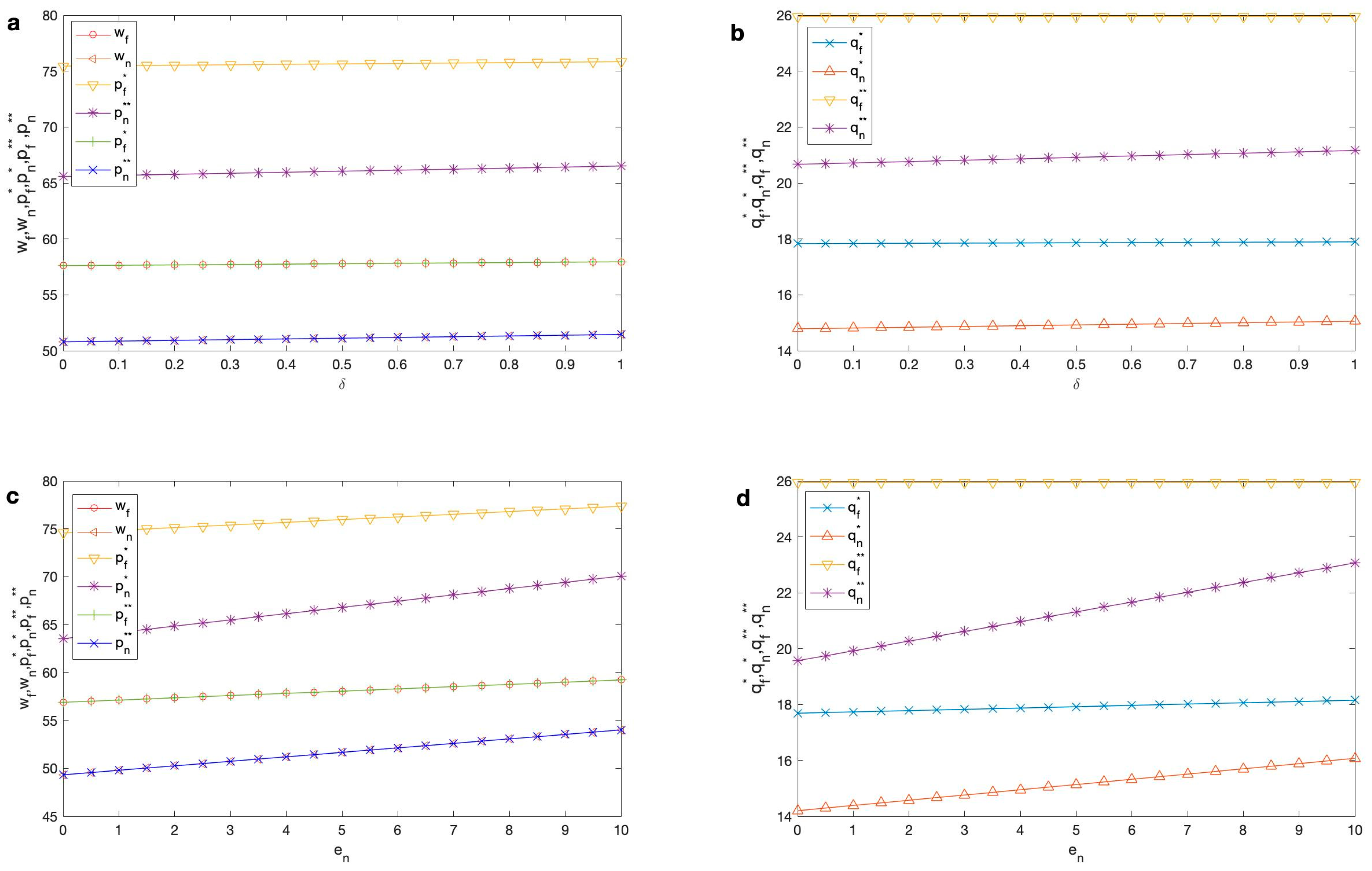

6.1. Analysis of the Impact of Environmental Friendliness and Recognition for Cruising Capability on Supply Chain Prices and Demand

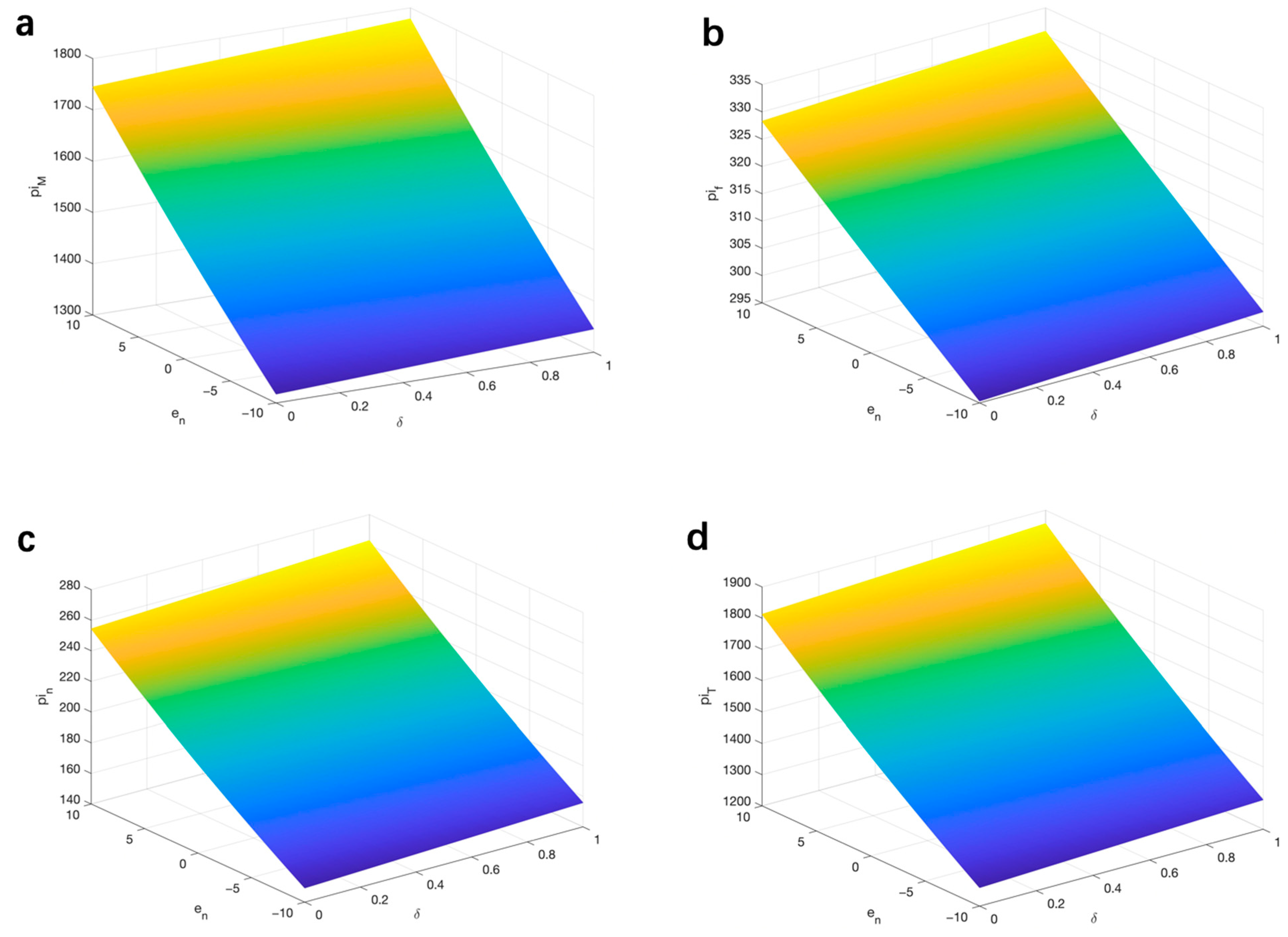

6.2. Analysis of the Impact of Dual Consumer Preferences on Supply Chain Differences

6.2.1. Analysis of the Impact of Dual Consumer Preferences on Supply Chain Pricing and Market Demand Differences

6.2.2. The Impact of Dual Consumer Preferences on the Supply Chain Profits Difference

7. Conclusions

7.1. Contributions and Implications

7.2. Limitations and Future Research Directions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

- (1)

- Under extreme market conditions, there is no demand for new energy vehicles in the market. That is , we get , ;

- (2)

- There is demand for new energy vehicles and fuel vehicles in the market. That is , According to , we get , from , we get , because of , there is . , the proposition is proved. □

References

- Foley, B.; Degirmenci, K.; Tan, Y. Factors Affecting Electric Vehicle Uptake: Insights from a Descriptive Analysis in Australia. Urban Sci. 2020, 4, 57. [Google Scholar] [CrossRef]

- Wu, J.; Liao, H.; Wang, J.W.; Chen, T. The role of environmental concern in the public acceptance of autonomous electric vehicles: A survey. from China. Transp. Res. 2019, 60, 37–46. [Google Scholar] [CrossRef]

- Li, J.; Ku, Y.; Liu, C.; Zhou, Y. Dual credit policy: Promoting new energy vehicles with battery recycling in a competitive environment. J. Clean. Prod. 2020, 243, 118456.1–118456.14. [Google Scholar] [CrossRef]

- Shao, L.; Yang, J.; Min, Z. Subsidy scheme or price discount scheme? Mass adoption of electric vehicles under different market structures. Eur. J. Oper. Res. 2017, 262, 1187–1195. [Google Scholar] [CrossRef]

- Shao, W.; Yang, K.; Bai, X. Impact of financial subsidies on the R&D intensity of new energy vehicles: A case study of 88 listed enterprises in China. Energy Strategy Rev. 2021, 33, 100580. [Google Scholar]

- Azevedo, A.; Pereira, P.J.; Rodrigues, A. Optimal Timing and Capacity Choice with Taxes and Subsidies Under Uncertainty. Omega 2020, 6, 102312. [Google Scholar] [CrossRef]

- Harrison, G.; Thiel, C. An exploratory policy analysis of electric vehicle sales competition and sensitivity to infrastructure in Europe. Technol. Forecast. Soc. Chang. 2017, 114, 165–178. [Google Scholar] [CrossRef]

- Yang, W.; Artie, W.; Yu, Z.; Huang, J.; Meng, K.; Dong, Z. A review of evolutionary policy incentives for sustainable development of electric. vehicles in China: Strategic implications. Energy Policy 2021, 148, 111983. [Google Scholar]

- Wang, Z.; Zhang, J.; Zhao, H. The Selection of Green Technology Innovations under Dual-Credit Policy. Sustainability 2020, 12, 6343. [Google Scholar] [CrossRef]

- Heutel, G.; Muehlegger, E.J. Consumer learning and hybrid vehicle adoption. Environ. Resour. Econ. 2014, 62, 125–161. [Google Scholar] [CrossRef]

- Adepetu, A.; Keshav, S. The relative importance of price and driving range on electric vehicle adoption: Loss angles case study. Transportation 2015, 44, 1–21. [Google Scholar] [CrossRef]

- Haustein, S.; Jensen, A.F.; Cherchi, E. Battery electric vehicle adoption in Denmark and Sweden: Recent changes, related factors, and policy implications. Energy Policy 2021, 149, 112096. [Google Scholar] [CrossRef]

- Zhang, X.; Wang, K.; Hao, Y.; Fan, J.L.; Wei, Y.M. The impact of government policy on preference for NEVs: The evidence from China. Energy Policy 2013, 61, 382–393. [Google Scholar] [CrossRef]

- Degirmenci, K.; Breitner, M.H. Consumer purchase intentions for electric vehicles: Is green more important than price and range? Transp. Res. Part D Transp. Environ. 2017, 51, 250–260. [Google Scholar] [CrossRef]

- Rezvani, Z.; Jansson, J.; Bodin, J. Advances in consumer electric vehicle adoption research: A review and research agenda. Transp. Res. Part D Transp. Environ. 2015, 34, 122–136. [Google Scholar] [CrossRef]

- Moorthy, K.S. Product and price competition in a monopoly. Mark. Sci. 1988, 7, 141–168. [Google Scholar] [CrossRef]

- Gu, H.; Liu, Z.; Qing, Q. Optimal electric vehicle production strategy under subsidy and battery recycling. Energy Policy 2017, 109, 579–589. [Google Scholar] [CrossRef]

- Zhang, X. Dependent electric vehicle production strategy considering subsidies and consumer trade-offs. Energy Policy 2014, 67, 422–430. [Google Scholar] [CrossRef]

- Huang, J.; Leng, M.; Liang, L.; Liu, J. Promoting electric automobiles: Supply chain analysis under a government’s subsidy incentive scheme. IIE Trans. 2013, 45, 826–844. [Google Scholar] [CrossRef]

- Mohan, T.V.K.; Amit, R.K. Modeling oligopsony market for end-of-life vehicle recycling. Sustain. Prod. Consum. 2021, 25, 325–346. [Google Scholar] [CrossRef]

- Zhou, F.; Lim, M.K.; He, Y.; Lin, Y.; Chen, S. End-of-life vehicle (ELV) recycling management: Improving performance using an ISM approach. J. Clean. Prod. 2019, 228, 231–243. [Google Scholar] [CrossRef]

- Basiri, Z.; Heydari, J. A mathematical model for green supply chain coordination with substitutable products. J. Clean. Prod. 2017, 145, 232–249. [Google Scholar] [CrossRef]

- Madani, S.R.; Rasti-Barzoki, M. Sustainable supply chain management with pricing, greening and governmental tariffs determining strategies: A game-theoretic approach. Comput. Ind. Eng. 2017, 105, 287–298. [Google Scholar] [CrossRef]

- Zhu, M.; Liu, Z.; Li, J.; Zhu, S.X. Electric vehicle battery capacity allocation and recycling with the downstream competition. Eur. J. Oper. Res. 2020, 283, 365–379. [Google Scholar] [CrossRef]

- Hao, H.; Qiao, Q.; Liu, Z.; Zhao, F. Impact of recycling on energy consumption and greenhouse gas emissions from electric vehicle production: The China 2025 case Resources. Conserv. Recycl. 2017, 122, 114–125. [Google Scholar] [CrossRef]

- Tang, Y.; Zhang, Q.; Li, Y.; Wang, G.; Li, W. Recycling mechanisms and policy suggestions for spent electric vehicles’ power battery—A case of Beijing. J. Clean. Prod. 2018, 186, 388–406. [Google Scholar] [CrossRef]

- Gu, X.; Zhou, L.; Huang, H.; Shi, X.; Ieromonachou, P. Electric Vehicle Battery Secondary Use Under Government Subsidy: A Closed-loop Supply Chain Perspective. Int. J. Prod. Econ. 2021, 234, 108035. [Google Scholar] [CrossRef]

- Zhang, H.; Xu, X.; Liu, W.; Jia, Z. Green supply chain decision modeling under the financial policy, with or without uniform government emission reduction policy. Manag. Decis. Econ. 2020, 41, 1040–1056. [Google Scholar] [CrossRef]

- Liu, L.; Zhang, T.; Avrin, A.P.; Wang, X. Is China’s industrial policy failing? An empirical study of the new energy vehicles industry. Technol. Soc. 2020, 63, 101356. [Google Scholar] [CrossRef]

- Wang, N.; Tang, L.; Zhang, W.; Guo, J. How to face the challenges caused by the abolishment of subsidies for electric vehicles in China? Energy 2019, 166, 359–372. [Google Scholar] [CrossRef]

- Luo, Q.; Saigal, R.; Chen, Z.; Yin, Y. Accelerating the adoption of automated vehicles by subsidies: A dynamic games approach. Transp. Res. Part B Methodol. 2019, 129, 226–243. [Google Scholar] [CrossRef]

- Li, J.; Ku, Y.; Yu, Y.; Liu, C.; Zhou, Y. Optimizing production of new energy vehicles with across-chain cooperation under China’s dual credit policy. Energy 2020, 194, 116832. [Google Scholar] [CrossRef]

- Yu, Y.; Zhou, D.; Zha, D.; Wang, Q.; Zhu, Q. Optimal production and pricing strategies in auto supply chain when dual credit policy is substituted for subsidy policy. Energy 2021, 120369. [Google Scholar] [CrossRef]

- Cheng, Y.; Fan, T. Production coopetition strategies for an FV automaker and a competitive NEV automaker under the dual-credit policy. Omega 2021, 102391. [Google Scholar] [CrossRef]

- Ou, S.; Lin, Z.; Qi, L.; He, X.; Przesmitzki, S. The dual-credit policy: Quantifying the policy impact on plug-in electric vehicle sales and. industry profits in China. Energy Policy 2018, 121, 597–610. [Google Scholar] [CrossRef]

- Jun, S.; Yoo, H.; Kim, J. A study on the effects of the CAFE standard on consumers. Energy Policy 2016, 91, 148–160. [Google Scholar] [CrossRef]

- Wang, Y.; Benjamin, T.H. Consumer product knowledge and intention to purchase remanufactured products. Int. J. Prod. Econ. 2016, 181, 460–469. [Google Scholar] [CrossRef]

- Ping, H.A.; Zheng, W.A.; Shi, V.; Liao, Y. The direct and cross effects in a supply chain with consumers sensitive to both carbon emissions and delivery time. Eur. J. Oper. Res. 2021, 292, 172–183. [Google Scholar]

- Lim, M.K.; Mak, H.Y.; Rong, Y. Toward Mass Adoption of Electric Vehicles: Impact of the Range and Resale Anxieties. Manuf. Serv. Oper. Manag. 2015, 17, 101–119. [Google Scholar] [CrossRef]

- White, L.V.; Sintov, N.D. You are what you drive: Environmentalist and social innovator symbolism drive electric vehicle adoption intentions. Transp. Res. Part A Policy Pract. 2017, 99, 94–113. [Google Scholar] [CrossRef]

- Hardman, S. Understanding the impact of reoccurring and non-financial incentives on plug-in electric vehicle adoption—A review. Transp. Res. Part A Policy Pract. 2019, 119, 1–14. [Google Scholar] [CrossRef]

- Moons, I.; Pelsmacker, D. Emotions as determinants of electric car usage intention. J. Mark. Manag. 2012, 28, 195–237. [Google Scholar] [CrossRef]

- Shahla, A.; Nilashi, M.; Samad, S.; Abdulah, R.; Mahmoud, M.; Alknani, M.H.; Yadegaridehkoridi, E. Factors impacting consumers’ intention toward adoption of electric vehicles in Malaysia. J. Clean. Prod. 2021, 282, 124474. [Google Scholar]

- Zhang, X.; Bai, X.; Shang, J. Is subsidized electric vehicles adoption sustainable: Consumers’ perceptions and motivation toward incentive policies, environmental benefits, and risks. J. Clean. Prod. 2018, 192, 71–79. [Google Scholar] [CrossRef]

- Kumar, R.R.; Alok, K. Adoption of electric vehicle: A literature review and prospects for sustainability. J. Clean. Prod. 2020, 253, 119911. [Google Scholar] [CrossRef]

- Lane, B.; Potter, S. The adoption of cleaner vehicles in the UK: Exploring the consumer attitude–action gap. J. Clean. Prod. 2007, 15, 1085–1092. [Google Scholar] [CrossRef]

- Stephen, M.S. How consumer drivers construe vehicle performance: Implications for electric vehicles. Transp. Res. Part F Traffic Psychol. Behav. 2014, 23, 15–31. [Google Scholar]

- Mccollum, D.L.; Charlie, W.; Michela, B.; Carrara, S.; Edelenbosch, O.Y.; Emmerling, J.; Guivarch, C.; Karkatsoulis, P.; Keppo, I.; Krey, V.; et al. Interaction of consumer. preferences and climate policies in the global transition to low-carbon vehicles. Nat. Energy 2018, 3, 664–673. [Google Scholar] [CrossRef]

- Wang, Y.; Hou, G. A duopoly game with heterogeneous green supply chains in optimal price and market stability with consumer green. preference. J. Clean. Prod. 2020, 255, 120161. [Google Scholar] [CrossRef]

- Xia, L.; Hao, W.; Qin, J.; Ji, F.; Yue, X. Carbon emission reduction and promotion policies considering social preferences and consumers’ low-carbon awareness in the cap-and-trade system. J. Clean. Prod. 2018, 195, 1105–1124. [Google Scholar] [CrossRef]

- Zhang, L.; Zhou, H.; Liu, Y.; Lu, R. Optimal environmental quality and price with consumer environmental awareness and retailer’s fairness concerns in supply chain. J. Clean. Prod. 2018, 213, 1063–1079. [Google Scholar] [CrossRef]

- Gong, B.; Xia, X.; Cheng, J. Supply-Chain Pricing and Coordination for New Energy Vehicles Considering Heterogeneity in Consumers’ Low Carbon Preference. Sustainability 2020, 12, 1306. [Google Scholar] [CrossRef]

- Sarkar, S.; Bhadouriya, A. Manufacturer competition and collusion in a two-echelon green supply chain with production trade-off between non-green and green quality. J. Clean. Prod. 2020, 253, 119904. [Google Scholar] [CrossRef]

- Debabrata, G.; Janat, S. Supply chain analysis under green-sensitive consumer demand and cost-sharing contract. Int. J. Prod. Econ. 2015, 164, 319–329. [Google Scholar]

- Ghosh, S.; Seikh, M.; Chakrabortty, M. Analyzing a stochastic dual-channel supply chain under consumers’ low carbon preferences and cap-and-trade regulation. Comput. Ind. Eng. 2020, 149, 106765. [Google Scholar] [CrossRef]

- Chong, Z.; Ying, L.; Guanghua, H. Two-stage pricing strategies of a dual-channel supply chain considering public green preference. Comput. Ind. Eng. 2020, 151, 10689. [Google Scholar]

- Meng, Q.; Li, M.; Liu, W.; Li, Z.; Zhang, J. 2021. Pricing policies of the dual-channel green supply chain: Considering government subsidies and consumers dual preferences. Sustain. Prod. Consum. 2021, 26, 1021–1030. [Google Scholar] [CrossRef]

- Zhou, D.; Yu, Y.; Wang, Q.; Zha, D. Effects of a generalized dual-credit system on green technology investments and pricing decisions in a supply chain. J. Environ. Manag. 2019, 247, 269–280. [Google Scholar] [CrossRef] [PubMed]

- Sudhir, K. Competitive Pricing Behavior in the Auto Market: A Structural Analysis. Mark. Sci. 2001, 20, 42–60. [Google Scholar] [CrossRef]

- Mcguire, T.W.; Staelin, R. An Industry Equilibrium Analysis of Downstream Vertical Integration. Mark. Sci. 1983, 27, 115–130. [Google Scholar] [CrossRef]

- Steven, T.B. Estimating Discrete-Choice Models of Product Differentiation. RAND J. Econ. 1994, 25, 242–262. [Google Scholar]

- Hua, G.; Wang, S.; Cheng, T. Price, and lead time decisions in dual-channel supply chains. Eur. J. Oper. Res. 2010, 205, 113–126. [Google Scholar] [CrossRef]

- Mohammad, B.J.; Rasti, B.M. A game-theoretic approach to investigate the effects of third-party logistics in a sustainable supply chain by reducing. delivery time and carbon emissions. J. Clean. Prod. 2019, 235, 636–652. [Google Scholar]

- Fan, J.L.; Wang, Q.; Yang, L.; Zhang, H.; Zhang, X. Determinant changes of consumer preference for NEVs in China: A comparison between. 2012 and 2017. Int. J. Hydrogen Energy 2020, 45, 23557–23575. [Google Scholar] [CrossRef]

- Sierzchula, W.; Bakker, S.; Maat, K.; Vee, B. The influence of financial incentives and other socio-economic factors on electric vehicle adoption. Energy Policy 2014, 68, 183–194. [Google Scholar] [CrossRef]

- Wang, R.X.; Ke, C.X.; Cui, S. Product Price, Quality, and Service Decisions Under Consumer Choice. MSOM 2021, 1–18. [Google Scholar] [CrossRef]

- Wang, Z.; Zhao, C.; Yin, J.; Zhang, B. Purchasing intentions of Chinese citizens on new energy vehicles: How should one respond to current. preferential policy? J. Clean. Prod. 2017, 161, 1000–1010. [Google Scholar] [CrossRef]

- Li, J.; Jiao, J.; Tang, Y. Analysis of the impact of policies intervention on electric vehicles adoption considering information transmission—based on consumer network model. Energy Policy 2020, 144, 1–12. [Google Scholar] [CrossRef]

| Parameters Notation | Definition |

|---|---|

| Potential market size | |

| Self-price sensitivity of fuel vehicles | |

| Self-price sensitivity of new energy vehicles | |

| Consumers’ preference for new energy vehicles, | |

| Average fuel consumption of fuel vehicles and new energy vehicles (L/100 km) | |

| The standard value (L/100 km) | |

| The unit cost of fuel vehicles and new energy vehicles | |

| , | Credit coefficient of fuel vehicles and new energy vehicles |

| Requirement for the new energy vehicle credit ratio | |

| The cross-price coefficient of fuel vehicles and new energy vehicles | |

| Consumers’ willingness to pay for green, | |

| The vehicles of cruising capability, | |

| The wholesale price of the traditional vehicle and new energy vehicle | |

| Retail price of the traditional vehicle and new energy vehicle | |

| Profits of the manufacture, traditional vehicle retailer, and new energy vehicle retailer | |

| Market demands for the traditional vehicle and new energy vehicle |

| Parameters Notation | Values |

|---|---|

| Parameters Notation | Values |

|---|---|

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Peng, L.; Li, Y.; Yu, H. Effects of Dual Credit Policy and Consumer Preferences on Production Decisions in Automobile Supply Chain. Sustainability 2021, 13, 5821. https://doi.org/10.3390/su13115821

Peng L, Li Y, Yu H. Effects of Dual Credit Policy and Consumer Preferences on Production Decisions in Automobile Supply Chain. Sustainability. 2021; 13(11):5821. https://doi.org/10.3390/su13115821

Chicago/Turabian StylePeng, Liangui, Ying Li, and Hui Yu. 2021. "Effects of Dual Credit Policy and Consumer Preferences on Production Decisions in Automobile Supply Chain" Sustainability 13, no. 11: 5821. https://doi.org/10.3390/su13115821

APA StylePeng, L., Li, Y., & Yu, H. (2021). Effects of Dual Credit Policy and Consumer Preferences on Production Decisions in Automobile Supply Chain. Sustainability, 13(11), 5821. https://doi.org/10.3390/su13115821