The Dynamic Impact of Agricultural Fiscal Expenditures and Gross Agricultural Output on Poverty Reduction: A VAR Model Analysis

Abstract

1. Introduction

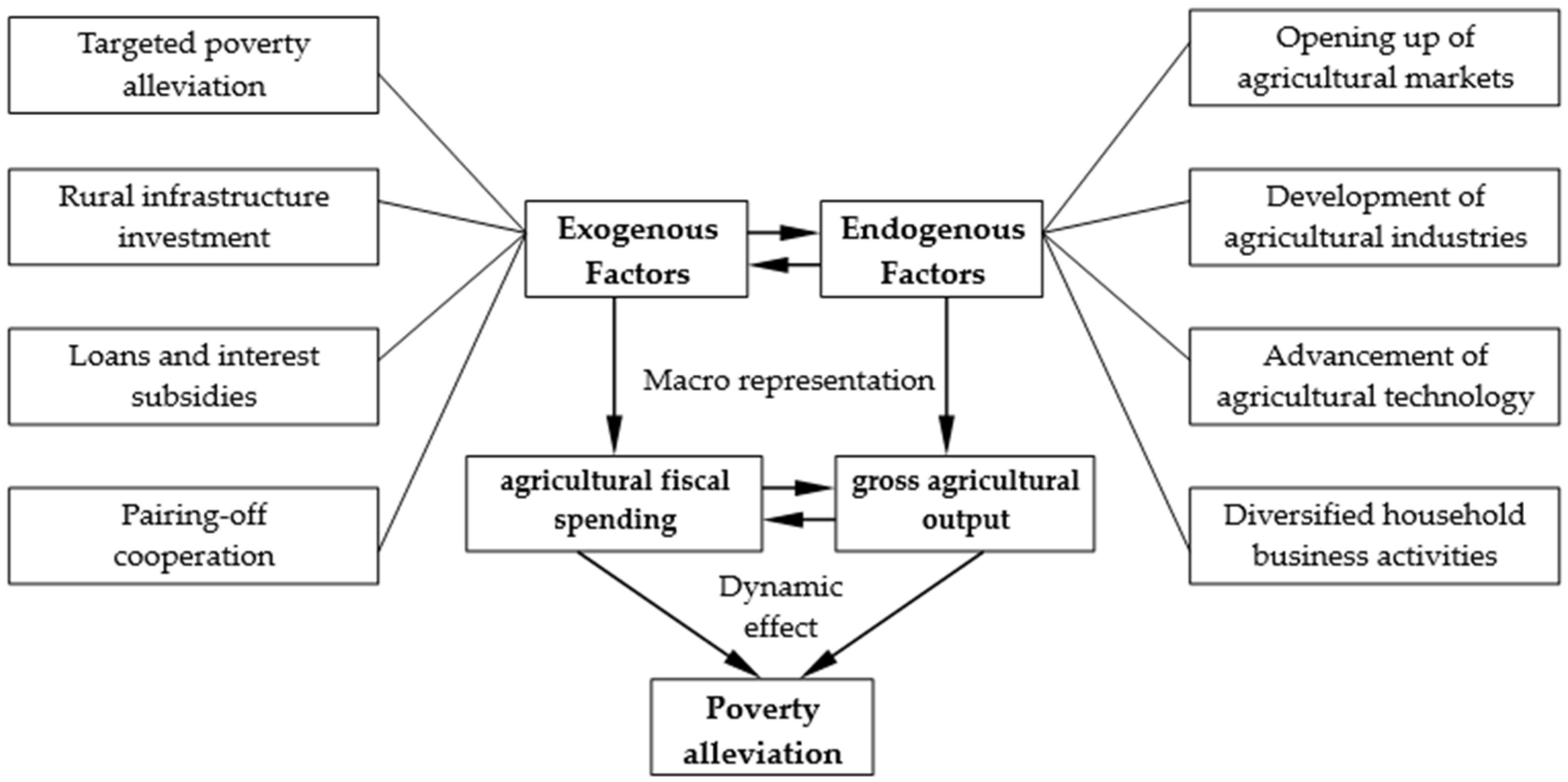

2. Literature and Hypothesis Development

- (1)

- China’s poverty eradication efforts over the past 30 years have not seen a major shift in mechanism or intensity, but have on the whole been steady, with intensity and results commensurate with each other, and even when it has reached the most difficult populations, it has still achieved stable poverty reduction outcomes through administrative accountability and precision poverty alleviation;

- (2)

- As the time required for the success of the agricultural industry is much longer than the allocation and assessment cycle of financial support for agriculture, the higher the incidence of poverty and the greater the pressure to eradicate poverty, the more funds to support rural development and production, and the more poverty alleviation projects become an anchor of accountability. Coupled with the fact that these areas are often poorly endowed, local governments’ consideration of industrial cycles and input-output analysis has given way to formalism, homogeneity, and even complicity, and the endogenous impetus for agricultural development remains insufficient. Overall, fiscal spending has played a much greater role in reducing poverty rates than agricultural development.

3. Materials and Methods

3.1. Data

3.2. Variables

3.3. Methods

4. Results

4.1. Unit Root Test

4.2. Cointegration Test

4.3. Granger Causality Test

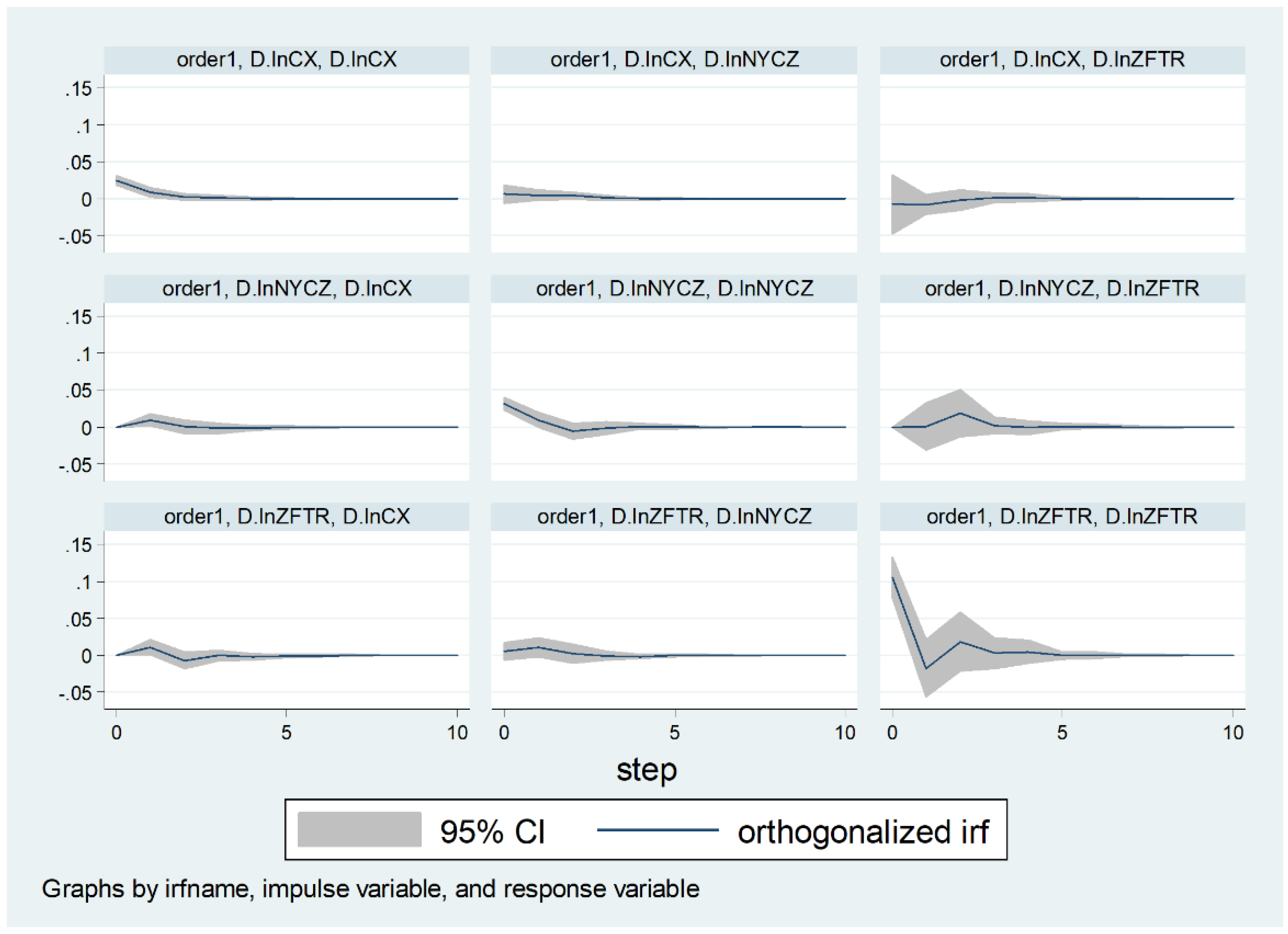

4.4. Impulse Response Analysis

4.5. Variance Decomposition

5. Discussion

- (1)

- The constructed VAR model is stable, and the lag order is consistent with the empirical experiences. This suggests that China’s poverty eradication efforts over the past 30 years have not seen a major shift in mechanism or intensity, but have on the whole been steady, with intensity and results commensurate with each other, and even when it has reached the most difficult populations, it has still achieved stable poverty reduction outcomes through administrative accountability and precision poverty alleviation;

- (2)

- The Granger causality test finds that agricultural fiscal policy at all levels and agricultural development have strong contributions to the effectiveness of rural poverty alleviation. However, conversely, the feedback of achievements of poverty reduction does affect central and local governments’ decisions on fiscal policy and levels of agricultural development in the short run. This suggests that China’s campaign against poverty is based on a longer-range objective, with the aim of significantly reduce disparities in urban-rural development. This conclusion is consistent with what the data on agricultural fiscal expenditures and the gross output of agriculture, forestry, animal husbandry, and fishery industry in the statistical yearbook show. In reality, the increase in government inputs to support agriculture and the growth in agricultural output will obviously promote the effectiveness of poverty alleviation in poor areas, but the effectiveness of poverty alleviation in poor areas does not necessarily promote or reduce the increase in government inputs or the growth in agricultural output value, the latter two being determined by multiple factors;

- (3)

- Impulse response analysis finds that the effects of fiscal inputs and the level of agricultural development on the effectiveness of rural poverty reduction are stable in the long run, although there are some small fluctuations in the short run. Meanwhile, the level of agricultural development in the short run is influenced by the agricultural fiscal support, and this influence is also stable in the long run. Therefore, it can be said that the increasing government financial support to agriculture and the continuous development of agricultural production are the key factors to promote the effectiveness of rural poverty alleviation;

- (4)

- Variance decomposition finds that the short-term effectiveness of poverty alleviation was continuously improved on the basis of previous effectiveness, but in the long run, fiscal spending has played a significantly larger role. In other words, the effectiveness of rural poverty alleviation relies heavily on the external factor of financial support from governments at all levels, while the endogenous development of agricultural production and rural areas plays a much less significant role. This confirms with the literature that China’s current achievements in poverty eradication have been driven more by exogenous fiscal policies, and the lack of sustainable endogenous development is still prevalent in poor rural areas.

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Lu, Y. The social system determines the effectiveness of poverty alleviation. Red. Flag. J. 2020, 10, 21–23. [Google Scholar]

- Li, S.; Li, Y.; Li, Q. From absolute poverty to relative poverty: The dynamic evolution of rural poverty in China. J. South. China Norm. Univ. 2020, 6, 30–43. [Google Scholar]

- Ravallion, M.; Chen, S. China’s (uneven) progress against poverty. J. Dev. Econ. 2007, 82, 1–42. [Google Scholar] [CrossRef]

- Lu, C.; Zhuang, T. A study on the competence of village-based cadres and the effect of poverty alleviation from the perspective of exact matching. J. Nanjing Agric. Univ. 2016, 5, 74–86. [Google Scholar]

- Tan, X. A study on the endogenous development of the poor villages: An investigation into the precise poverty alleviation in Xin village in northern Anhui Province. China’s R. Econ. 2018, 11, 48–63. [Google Scholar]

- Li, X.; Bai, H. Dual governmental power operation: The governance logic of rural poverty alleviation scenario—An investigation based on the practice of village poverty reduction in national poverty counties. J. Public Adm. 2019, 4, 48–62. [Google Scholar]

- Wang, Y.; Ding, S. The effects, experiences and challenges of poverty alleviation in ethnic areas: A case study of “three regions and three states”. J. Southwest Univ. Natl. 2020, 11, 8–16. [Google Scholar]

- Li, X. Practice and experience of poverty reduction in China: Effective exertion of government role. Res. Financ. Econ. 2020, 9, 14–17. [Google Scholar]

- Li, Z.; Wu, F. Can increasing fiscal transfers improve the quality of poverty relief: An empirical study based on livelihood resilience and CFPS data. Agric. Econ. 2020, 11, 65–76. [Google Scholar]

- Feng, C.; Li, H. The influencing factors and practice path of poverty alleviation in poverty-stricken counties: A comparative analysis of the quality of 6 cases in southwest China. J. Yunnan Univ. Financ. Econ. 2020, 11, 46–56. [Google Scholar]

- Gao, Q. Coordination of poverty alleviation and rural revitalization: Situation, task and strategic transformation. J. Renmin Univ. China 2020, 6, 29–39. [Google Scholar]

- Poverty Alleviation by DEVELOPING Industries, the Hardest Hit by Formalism. Available online: https://www.sohu.com/a/415659422_732417 (accessed on 1 May 2021).

- Problems and Suggestions for the Development of Rural Revitalization in China. Available online: https://f.qianzhan.com/xiandainongye/detail/191014-0a908f53.html (accessed on 1 May 2021).

- Schneider, H. Participatory governance for poverty reduction. J. Int. Dev. 1999, 11, 521–534. [Google Scholar] [CrossRef]

- Thorbecke, E.; Jung, H.-S. A multiplier decomposition method to analyze poverty alleviation. J. Dev. Econ. 1996, 48, 279–300. [Google Scholar] [CrossRef]

- Gazso, A.; Mcdaniel, S.; Waldron, I. Networks of social support to manage poverty: More changeable than durable. J. Poverty 2016, 20, 441–463. [Google Scholar] [CrossRef]

- Khoo, B.T. Policy Regimes and the Political Economy of Poverty Reduction in Malaysia, 1st ed.; Palgrave Macmillan: Basingstoke, UK; New York, NY, USA, 2012; p. 17. [Google Scholar]

- Zeller, M.; Sharma, M. Rural finance and poverty alleviation. In Food Policy Reports 8; International Food Policy Research Institute (IFPRI): Washington, DC, USA, 1998. [Google Scholar]

- Minten, B.; Vandeplas, A.; Swinnen, J. Regulations, brokers, and interlinkages: The institutional organization of wholesale markets in India. J. Dev. Stud. 2011, 48, 864–886. [Google Scholar] [CrossRef]

- Besley, T.; Burgess, R. Halving global poverty. J. Econ. Perspect. 2003, 17, 3–22. [Google Scholar] [CrossRef]

- Irz, X.; Lin, L.; Thirtle, C.; Wiggins, S. Agricultural productivity growth and poverty alleviation. Dev. Policy Rev. 2001, 19, 449–466. [Google Scholar] [CrossRef]

- Pingali, P. Agricultural growth and economic development: A view through the globalization lens. Agric. Econ. 2007, 37, 1–12. [Google Scholar] [CrossRef]

- Gero, A.A.; Egbendewe, A.Y.G. Macroeconomic effects of semi-subsistence agricultural productivity growth: Evidence from Benin and extension to the WAEMU countries. Sci. Afr. 2020, 7, e00222. [Google Scholar]

- Wang, Y.; Chen, Y.; Liu, Z. Agricultural structure adjustment and rural poverty alleviation in the agro-pastoral transition zone of northern China: A case study of Yulin city. Sustainability 2020, 12, 4187. [Google Scholar] [CrossRef]

- Zhao, W.; Ritchie, J.R.B. Tourism and poverty alleviation: An integrative research framework. Curr. Issues Tour. 2007, 10, 119–143. [Google Scholar] [CrossRef]

- Muganda, M.; Sahli, M.; Smith, K.A. Tourism’s contribution to poverty alleviation: A community perspective from Tanzania. Dev. S. Afr. 2010, 27, 629–646. [Google Scholar] [CrossRef]

- Shahbaz, M.; Solarin, S.A.; Azam, M.; Tiwari, A.K. Tourism-induced income distribution in Malaysia: A practical experience of a truly Asian economy. Curr. Issues Tour. 2020, 23, 2910–2929. [Google Scholar] [CrossRef]

- You, K.; Bianco, S.D.; Amankwah-Amoah, J. Closing technological gaps to alleviate poverty: Evidence from 17 Sub-Saharan African countries. TFSC 2020, 157, 120055. [Google Scholar] [CrossRef]

- Li, S.; Sicular, T.; Tarp, F. Income inequality in China: Development, transition and policy. J. Beijing Technol. Bus. Univ. 2020, 4, 21–31. [Google Scholar]

- Liu, W.; Li, W. Effectiveness utilization and experience transmission of poverty alleviation in rural revitalization process. J. Henan Norm. Univ. 2020, 9, 30–37. [Google Scholar]

- Zhang, Q. Steadily advancing the link between poverty alleviation and rural revitalization. People’s Forum 2019, 10, 84–86. [Google Scholar]

- Yu, H.; Fan, Y. A study on the effect of fiscal policy supporting agriculture on agricultural economic growth. J. Yangzhou Univ. 2012, 6, 23–30. [Google Scholar] [CrossRef]

- Cao, Z.; Li, W.; Chen, Y. A study on the relationship among intellectual property protection, intellectual property trade barriers and Sino-US trade: Based on vector autoregression and Granger causality test. Macroecon. Res. 2020, 2, 92–101. [Google Scholar]

| Variables | (c,t,p) 1 | ADF | 1% Critical Value | 5% Critical Value | 10% Critical Value | Result |

|---|---|---|---|---|---|---|

| lnCX | (c,t,0) | −1.422 | −3.723 | −2.989 | −2.625 | non-stationary |

| DlnCX | (c,t,0) | −10.707 | −3.730 | −2.992 | −2.626 | stationary |

| lnZFTR | (c,t,0) | 0.262 | −3.723 | −2.989 | −2.625 | non-stationary |

| DlnZFTR | (c,t,0) | −5.349 | −3.730 | −2.992 | −2.626 | stationary |

| lnNYCZ | (c,t,0) | −1.026 | −3.723 | −2.989 | −2.625 | non-stationary |

| DlnNYCZ | (c,t,0) | −3.859 | −3.730 | −2.992 | −2.626 | stationary |

| Number of Cointegration Equations | Eigenvalue | Trace | 5% Significance Level | 1% Significance Level | Result |

|---|---|---|---|---|---|

| None | 0.83378 | 76.0708 | 29.68 | 35.65 | Rejected |

| At most 1 | 0.51862 | 27.6211 | 15.41 | 20.04 | Rejected |

| At most 2 | 0.25317 | 7.8817 | 3.76 | 6.65 | Rejected |

| Lagging Explanatory Variables | Coefficient (p-Value) | Lagging Explanatory Variables | Coefficient (p-Value) | Lagging Explanatory Variables | Coefficient (p-Value) |

|---|---|---|---|---|---|

| L1D. lnCX | 0.321 ** (0.021) | L1D.lnZFTR | 0.162 *** (0.000) | L1D.lnNYCZ | 0.204 (0.133) |

| L2D. lnCX | 0.236 * (0.094) | L2D.lnZFTR | −0.061 * (0.075) | L2D.lnNYCZ | −0.063 (0.634) |

| L3D. lnCX | −0.053 (0.712) | L3D.lnZFTR | 0.070** (0.034) | L3D.lnNYCZ | −0.086 (0.563) |

| L4D. lnCX | −0.041 (0.526) | L4D.lnZFTR | −0.069 ** (0.078) | L4D.lnNYCZ | 0.159 (0.244) |

| L5D. lnCX | −0.081 ** (0.010) | L5D.lnZFTR | −0.119 *** (0.000) | L5D.lnNYCZ | −0.408 *** (0.001) |

| Constant | 0.041 *** (0.004) |

| Null Hypothesis | Lag | 1 | 2 | 3 | 4 | 5 |

|---|---|---|---|---|---|---|

| DlnZFTR is not the Granger reason for DlnCX | Chi-square | 0.311 | 11.687 | 13.448 | 22.003 | 59.594 |

| p-value | 0.577 | 0.003 | 0.004 | 0.000 | 0.000 | |

| Result | Accept | Refuse | Refuse | Refuse | Refuse | |

| DlnNYCZ is not the Granger reason for DlnCX | Chi-square | 0.002 | 6.806 | 4.755 | 8.526 | 29.46 |

| p-value | 0.966 | 0.033 | 0.191 | 0.074 | 0.000 | |

| Result | Accept | Refuse | Accept | Refuse | Refuse | |

| DlnCX and DlnZFTR are not the Granger reasons for DlnNYCZ at the same time | Chi-square | 0.314 | 16.45 | 17.993 | 28.985 | 74.615 |

| p-value | 0.855 | 0.002 | 0.006 | 0.000 | 0.000 | |

| Result | Accept | Refuse | Refuse | Refuse | Refuse |

| Period | lnCX | lnZFTR | lnNYCZ |

|---|---|---|---|

| 1 | 1 | 0 | 0 |

| 2 | 0.760119 | 0.138172 | 0.101708 |

| 3 | 0.720815 | 0.183292 | 0.095893 |

| 4 | 0.718417 | 0.18232 | 0.099262 |

| 5 | 0.713002 | 0.184948 | 0.10205 |

| 6 | 0.712527 | 0.185481 | 0.101993 |

| 7 | 0.712381 | 0.185651 | 0.101969 |

| 8 | 0.712362 | 0.185648 | 0.101991 |

| 9 | 0.712354 | 0.185647 | 0.101999 |

| 10 | 0.712353 | 0.185648 | 0.101999 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zeng, G.; Zhang, C.; Li, S.; Sun, H. The Dynamic Impact of Agricultural Fiscal Expenditures and Gross Agricultural Output on Poverty Reduction: A VAR Model Analysis. Sustainability 2021, 13, 5766. https://doi.org/10.3390/su13115766

Zeng G, Zhang C, Li S, Sun H. The Dynamic Impact of Agricultural Fiscal Expenditures and Gross Agricultural Output on Poverty Reduction: A VAR Model Analysis. Sustainability. 2021; 13(11):5766. https://doi.org/10.3390/su13115766

Chicago/Turabian StyleZeng, Guanglu, Chenggang Zhang, Sanxi Li, and Hailin Sun. 2021. "The Dynamic Impact of Agricultural Fiscal Expenditures and Gross Agricultural Output on Poverty Reduction: A VAR Model Analysis" Sustainability 13, no. 11: 5766. https://doi.org/10.3390/su13115766

APA StyleZeng, G., Zhang, C., Li, S., & Sun, H. (2021). The Dynamic Impact of Agricultural Fiscal Expenditures and Gross Agricultural Output on Poverty Reduction: A VAR Model Analysis. Sustainability, 13(11), 5766. https://doi.org/10.3390/su13115766