Modeling and Estimating Host Country Values in International Projects to Facilitate In-Country Value Creation

Abstract

1. Introduction: From the Concept of Local Content to That of In-Country Value

- What are the multiple dimensions of ICV, and how can they be modeled?

- What are the different steps of the project ICV creation process, and how can it be modeled in a way that integrates multiple dimensions, as identified in Question 1?

- To what extent can such a model be practically implemented for industrial applications?

2. Literature Review

2.1. Understanding Project ICV

2.1.1. Defining Project Sustainable Value

2.1.2. Characteristics of Project ICV and Implications

2.2. Using a Systems Approach to Model ICV

2.2.1. Complex Systems Modeling

- 1.

- Teleological dimension: The model should integrate/study the objectives underlying the phenomenon/system, these objectives being driven by the relationships between the phenomenon/system and its environment (including stakeholders).

- 2.

- Functional dimension: The model should integrate/study the activities carried out by the system or attached to the phenomenon and associate them with their impacts on the elements of the teleological dimension.

- 3.

- Ontological dimension: The model should integrate/study the constituting elements of the phenomenon/system that permit to carry out the activities of the elements of the functional dimension.

- 4.

- Genetic dimension: The model (and therefore its elements) should be able to evolve over time because the phenomenon/system is meant to evolve over time.

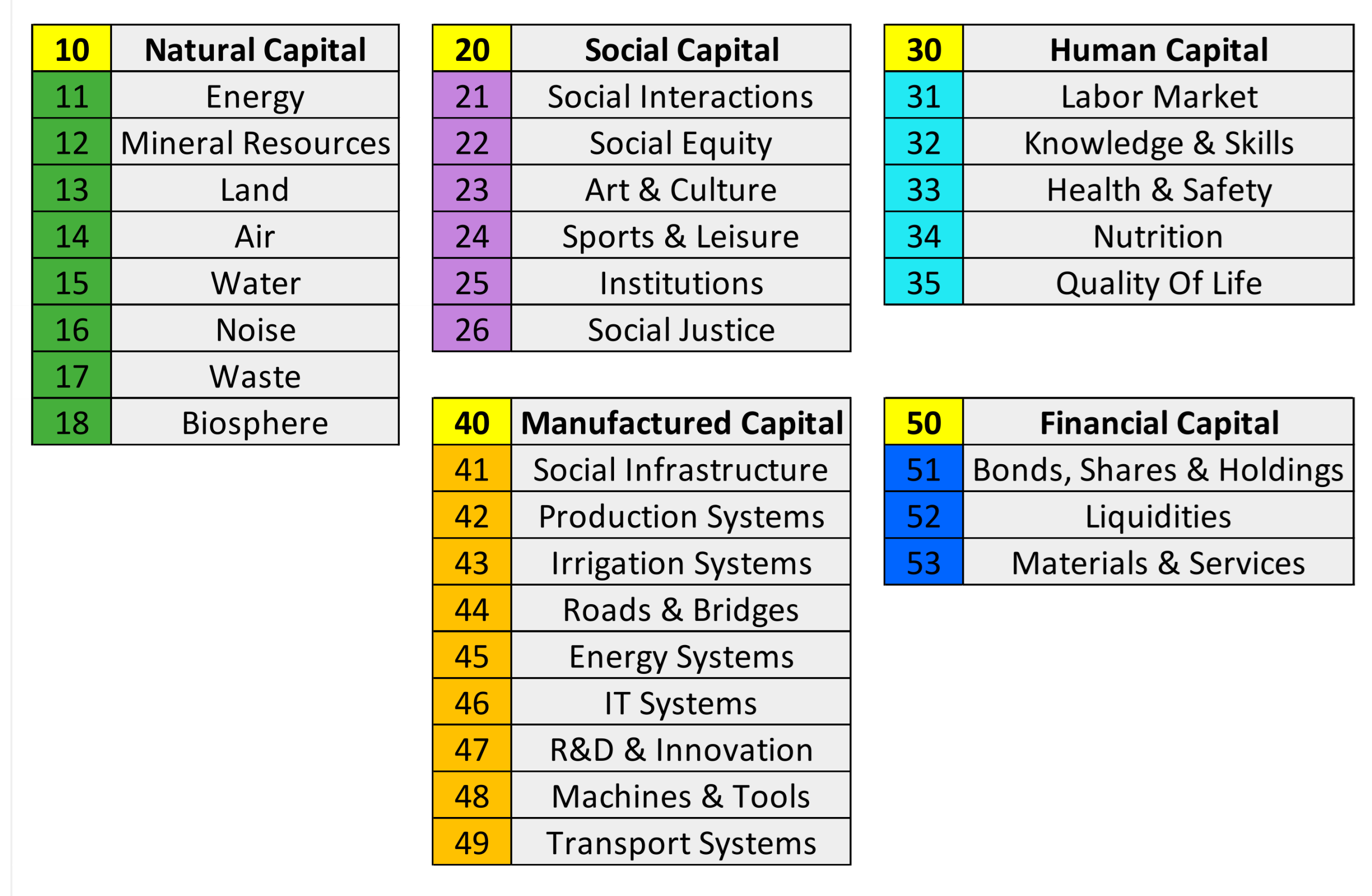

2.2.2. Describing ICV Dimensions with a Capital Stocks and Flows Model

- 1.

- 2.

- 3.

- 4.

- 5.

- Financial capital: The stock of economic and financial resources which can be mobilized by a country/region/area. [100].

2.3. Using Domain Mapping Matrices to Model the Projet ICV Creation Process

2.3.1. Value Creation Estimation

2.3.2. Dependency Structure Matrices (DSMs) and Domain Mapping Matrices (DMMs)

3. Methodology

3.1. First Phase

- The first phase of the research process was designed to validate the hypothesis that a capital stocks and flows model should be built up to represent the dimensions of ICV. The first phase, therefore, focused on Research Question 1 with the identification of the dimensions of ICV and their integration into a description model of ICV. To construct this model in the end, the following methodology steps were followed:

- Sustainable value indicators possibly related to ICV were identified in the literature using the state of the art of Section 2.1.2. as well as institutional studies and reports over the same period of 2000–2020. In particular, several studies were issued by the UNIDO (United Nations Industrial Development Organization, [122,123,124,125,126]) and the World Bank [10]. References focusing on sustainability indicators, value modeling, and estimation, even in other contexts than project management, were also included in this step as long as they could permit to identify indicators that could be directly used, transposed, or easily adapted to the context of the project ICV [100,103,104,127,128,129]. With a total of 1763 articles, 8130 indicators were directly identified. They were included in the list of indicators as long as they were directly or indirectly related to one of the three dimensions of the project ICV creation process: teleological, functional, or ontological (to make sure that all the dimensions of the complex phenomenon were addressed).

- Each of these indicators was then categorized in terms of nature, either as being part of a potential capital stock or being a flow between potential capital stocks, using the five categories of capitals presented in Section 2.2.2. Such a capital stocks and flows model could easily be adjusted with the deletion of some (sub-)capitals and/or integration of new ones, which permitted to validate the genetic dimension of such a model. Some of the indicators, which were close to one another, were gathered under the same common denomination. Other ones (494 indicators, i.e., 6.08%) were rejected at this stage because they could not be considered to be SMART (specific, measurable, assignable, realistic, time-related) [130,131]. These steps allowed to reduce the list to 6940 indicators.

- The analysis of the resulting list of indicators permitted to create sub-capital stocks for each category of capital stocks by categorizing an indicator as a part of a (sub-)capital stock or as a flow between two (sub-)capitals. Based on the analysis of 1000 randomly chosen indicators, a first version of a capital stocks and flows model of project ICV was built up, using the corresponding breakdown of each of the five capitals into relevant sub-capitals.

- To validate this first version of the model and the list of sub-capitals, a frequency analysis was then conducted on the remaining 5940 indicators to study the extent to which the first version of the model permitted to include them. The number of times that each sub-capital and each flow between sub-capitals could be connected to an indicator was calculated to draw conclusions on the possible validation and refinement of the model.

3.2. Second Phase

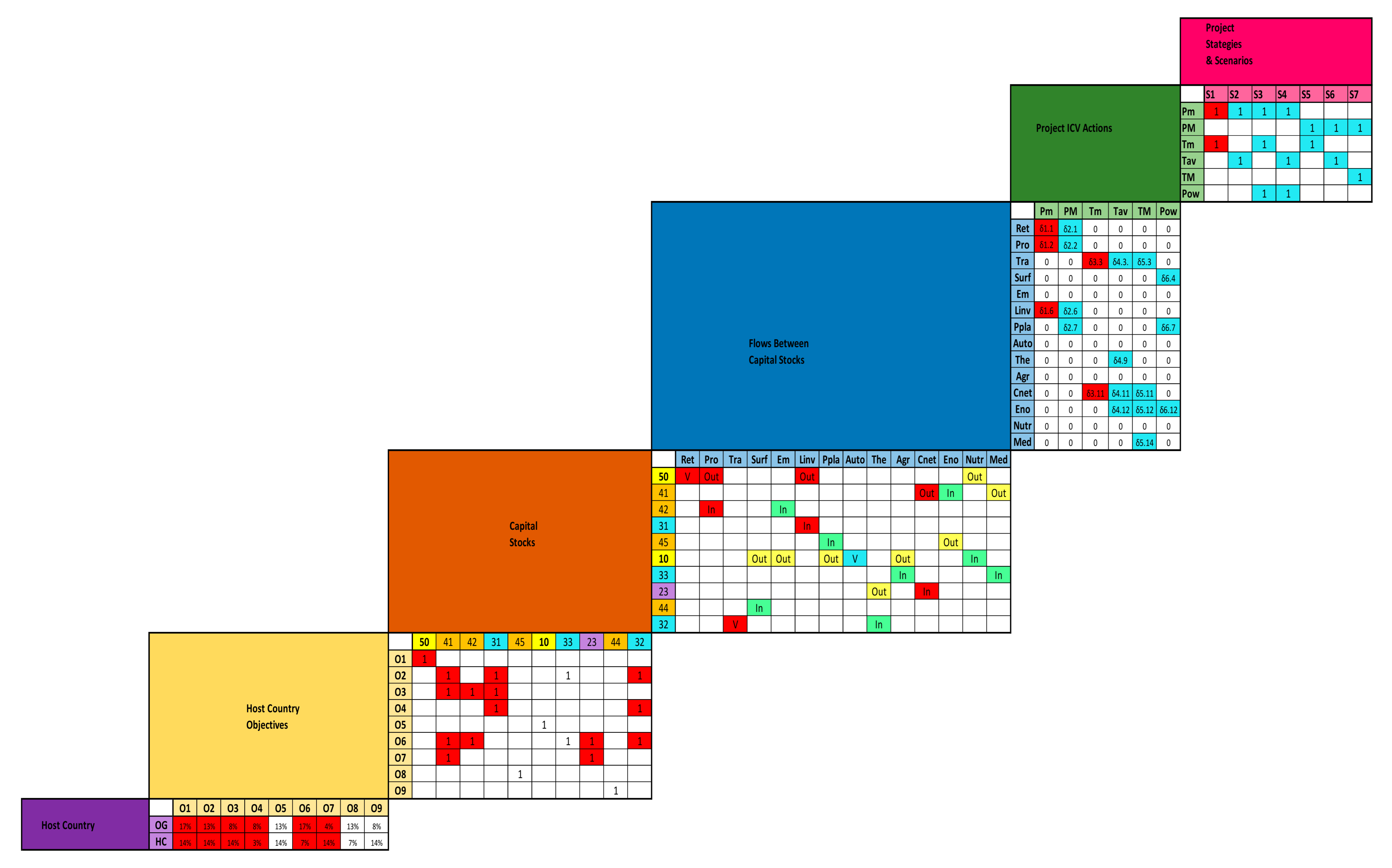

- Using the capital stocks and flows model developed to model the dimensions of ICV, six domains were identified to describe the project ICV creation process with a DMM model.

- The different matrices of the DMM model were then modeled to describe and assess the successive steps of the project ICV creation process.

- The model was then tested and validated through its application to an industrial hybrid case study built up using the data of two projects in the oil and gas industry context.

4. Results and Discussion

4.1. Research Question 1: Building up an ICV Model

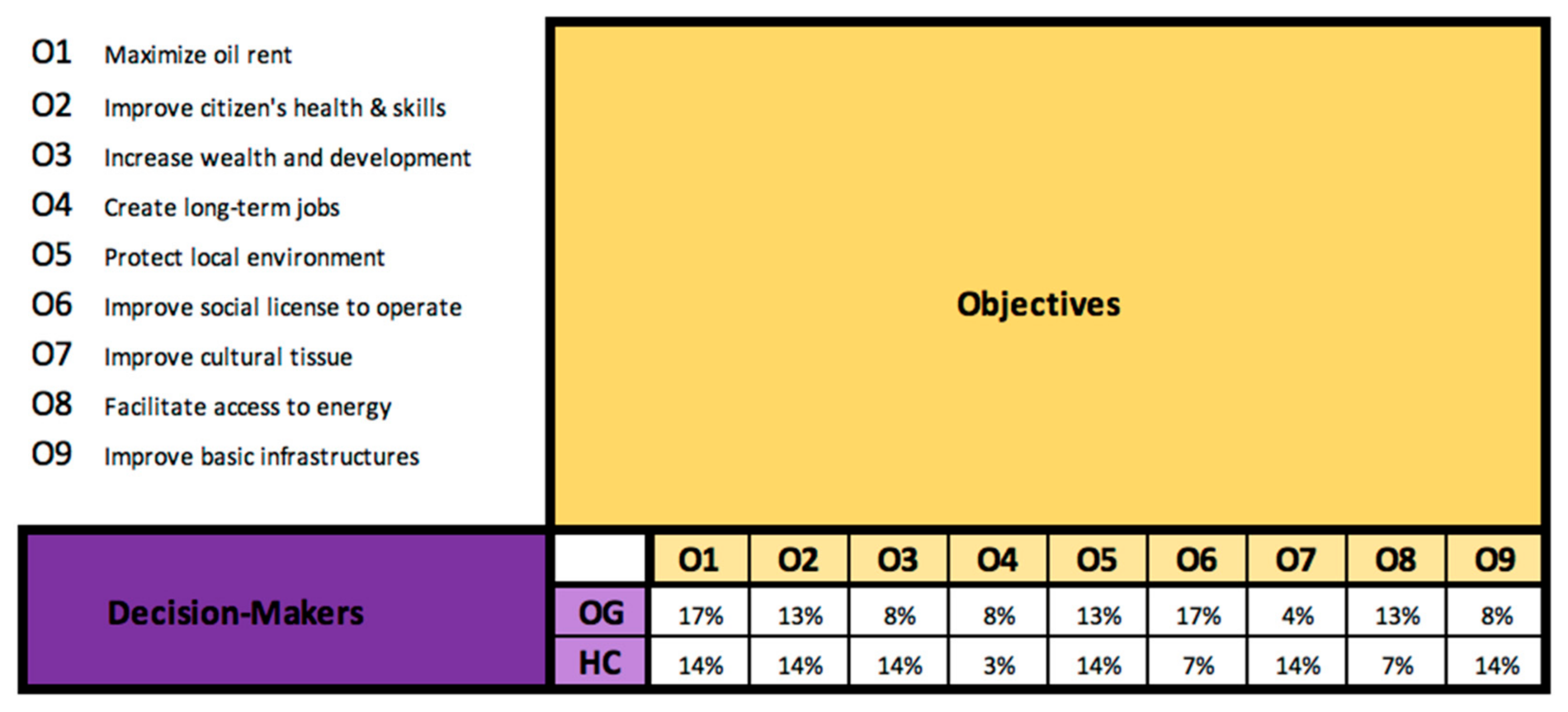

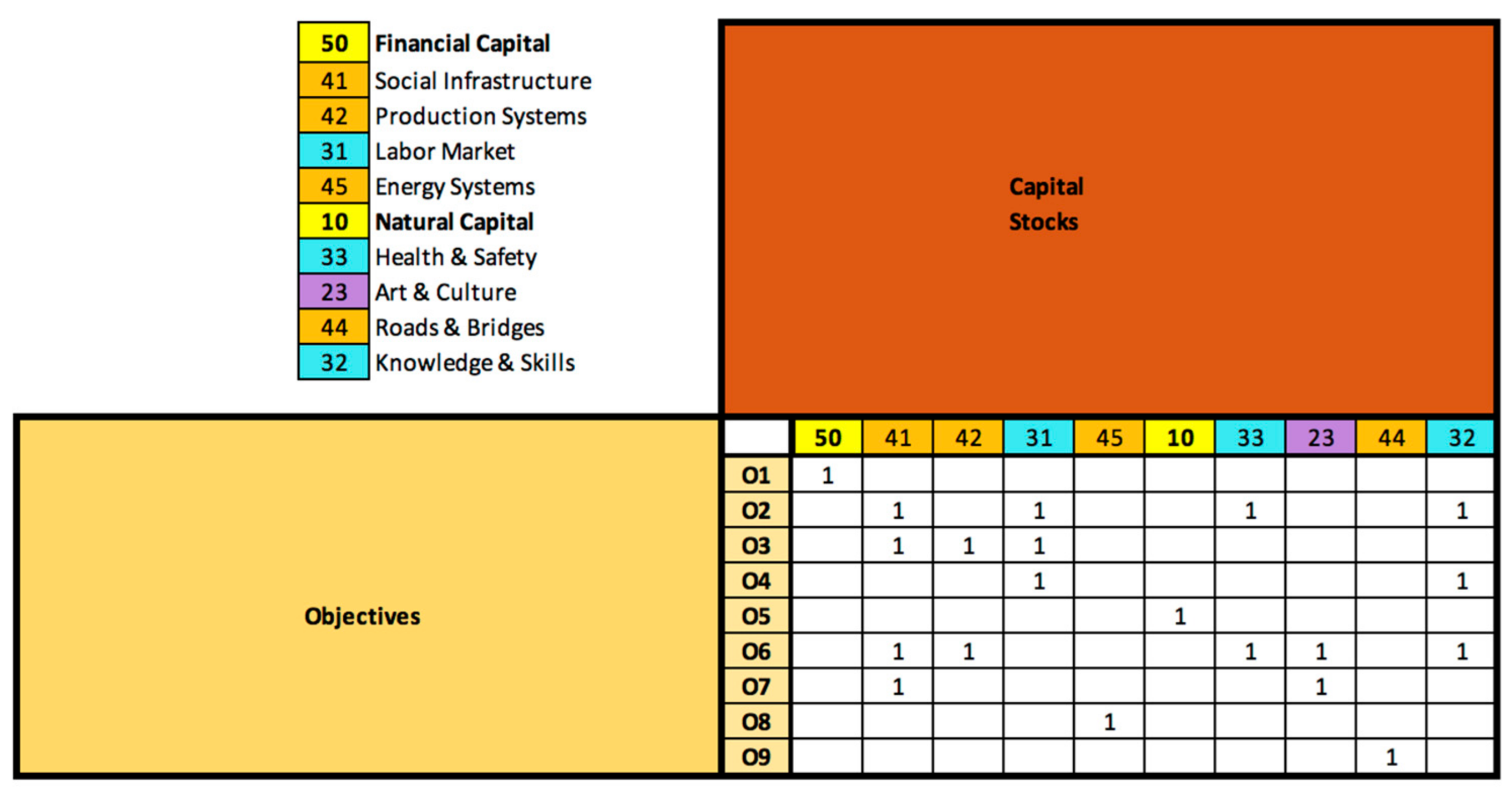

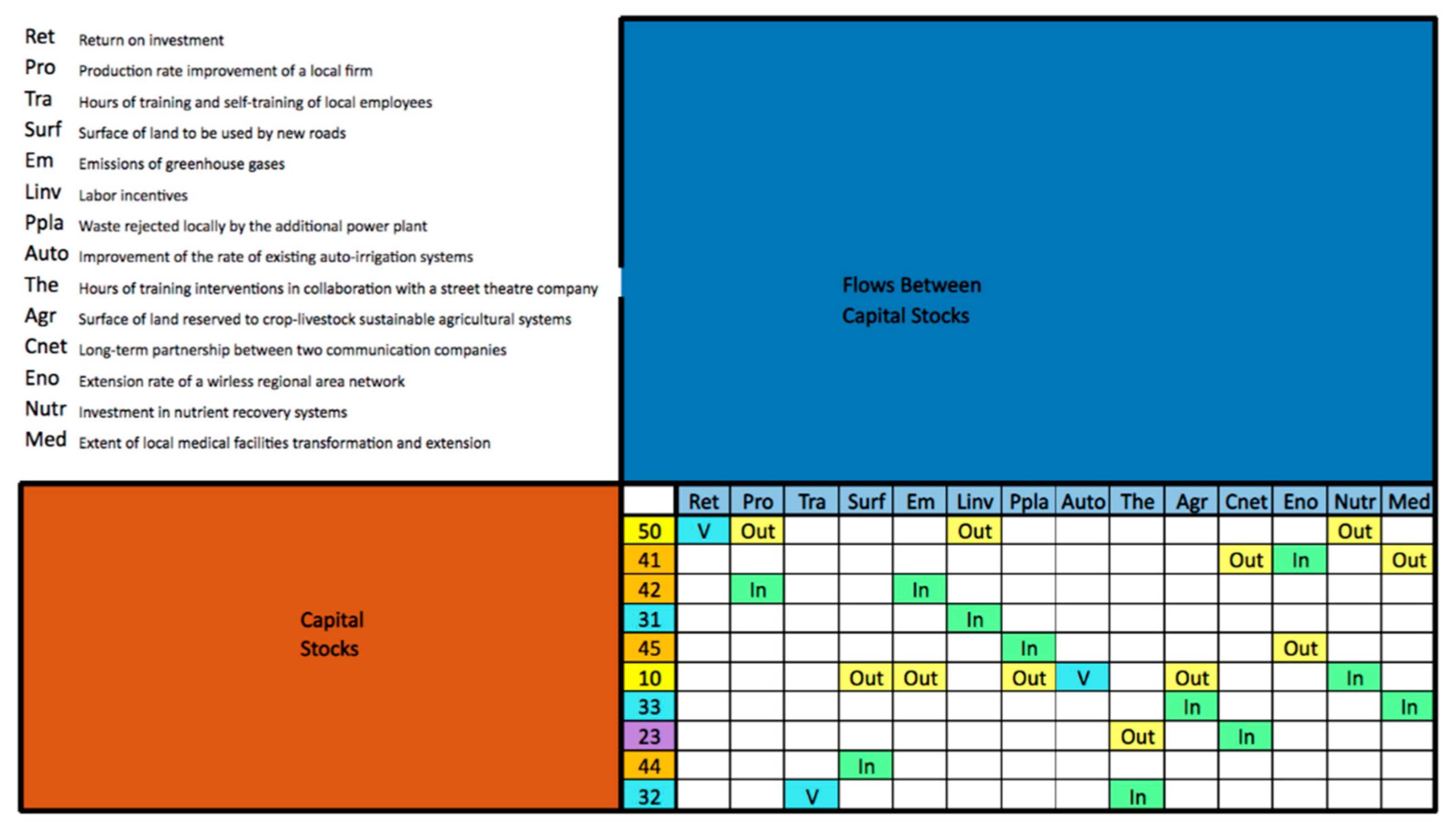

4.2. Research Question 2: Building Up a Project ICV Creation Process Model

- The Decision-Makers Domain (DM)—It represented the different decision-makers (at least two) involved in the decision. Even within the company or within the host country, there might be multiple decision-makers, which might, of course, complexify the capacity to converge and, thus, required to be considered.

- The Capital Stocks Domain (CS)–It represented the five capital stocks (or thirty-one sub-capital stocks) of the model developed in Section 2. The detail level was adapted to each context, meaning that this domain could mix several capitals and several sub-capitals.

- The Flows Domain (F)–It represented the potential impacts of an ICV action, extracted from the 1296 inter-capital flows of the model developed in Section 2. These flows could be between two different (sub-)capital stocks (when there was an exchange from a (sub-)capital to another one) or between a (sub-)capital stock and itself (to model the possible variation of this given (sub-)capital).

- The ICV Actions Domain (ICVA)–It represented the possible project actions that had a potential impact on project ICV.

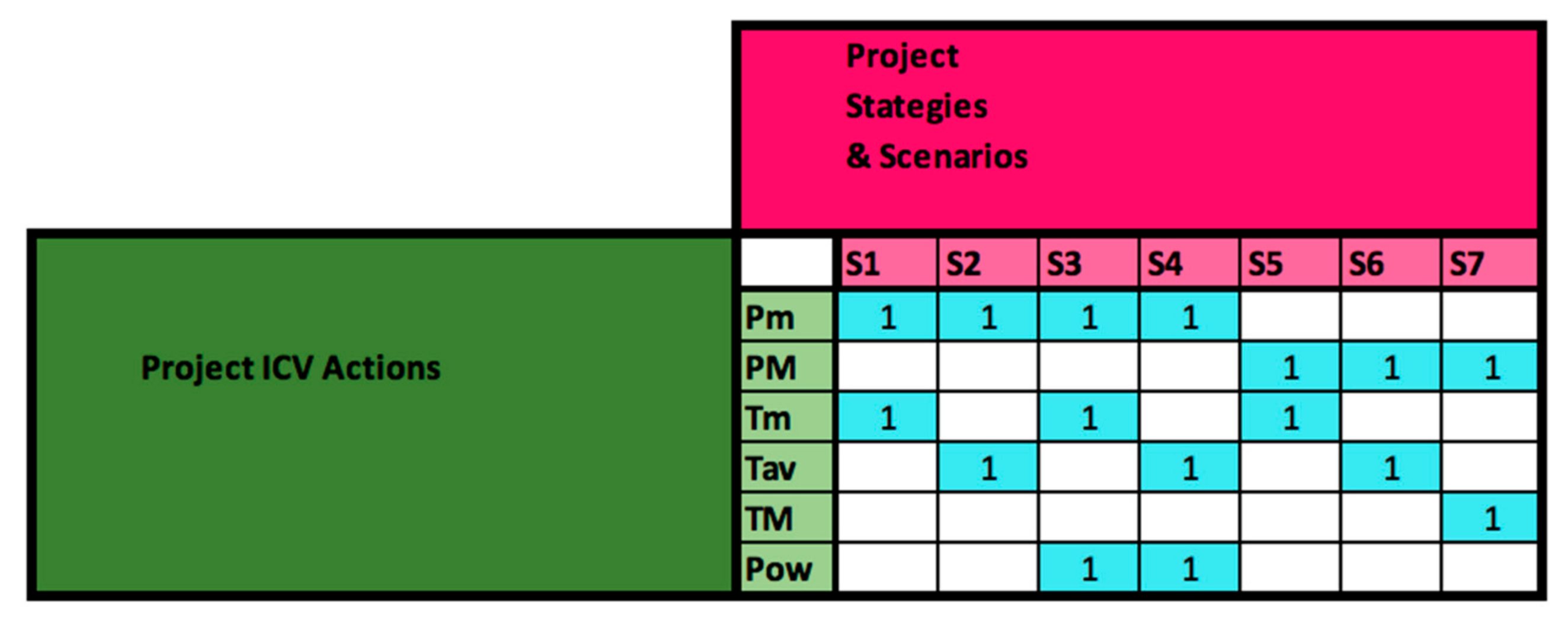

- The Project Strategy and Scenario Domain (PSS)–It represented the possible project strategies or scenarios. Each scenario was described as a set of ICV actions.

4.3. Research Question 3: Implementing the Project ICV Creation Process DMM Model

4.3.1. Building Up a Hybrid Industrial Case Study

- Description of LC actions: A description of the different LC actions was present. This description should include several possible alternatives for local content actions.

- Description of ICV actions: A description of the different ICV actions was present.

- Local capabilities: This information reflected the labor required at a reasonably detailed level of detail as well as the labor available.

- Host country data: Data helped defining the impacts to be considered and the systems to be modeled as a priority. Potential sources included macroeconomic data, stakeholders’ needs assessments, socio-environmental impact studies.

- Host country vision: A clear documentation, reflecting the host country’s development strategy objectives, was present. The vision on local content legislation should also be available.

- Contact within the project: It was crucial to have a well-established local contact within the project to facilitate access to information.

4.3.2. The Decision-Makers/Objectives Matrix

4.3.3. The Objectives/Capital Stocks Matrix

4.3.4. The Capital Stocks/Flows Matrix

4.3.5. The Flows/ICV Actions Matrix

- Local production actions consisted of the realization of project items for the implementation of the infrastructures. Two alternatives were considered: a baseline scenario (production minimum Pm) and a scenario where the local production exceeded local capacity (production maximum PM). These actions were estimated from project data and employment curves for the baseline scenario. Extrapolation from these data was carried out for the second scenario.

- Human capital improvement actions consisted of training to make the local workforce more productive and bring it up to oil industry standards. Three scenarios were envisaged, seeking to train more or less large numbers of people (training minimum Tm, average Tav, and maximum TM in Figure 6). Data collected on the project allowed us to provide estimates.

- A final action consisted of building an infrastructure to produce electricity (Pow). Only one scenario was described here. This one was entirely fictitious.

4.3.6. The ICV Actions/Strategies Matrix

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Gelb, A.H. Windfall Gains: Blessing or Curse? Oxford University Press: New York, NY, USA, 1988. [Google Scholar]

- Auty, R.M. Resource-Based Industrialization: Sowing the Oil in Eight Developing Countries; Oxford University Press: New York, NY, USA, 1990. [Google Scholar]

- Sachs, J.; Warner, A. Natural Resource Abundance and Economic Growth; National Bureau of Economic Research: Cambridge, MA, USA, 1995. [Google Scholar] [CrossRef]

- Sachs, J.D.; Warner, A.M. The curse of natural resources. Eur. Econ. Rev. 2001, 45, 827–838. [Google Scholar] [CrossRef]

- Gylfason, T. Natural resources, education, and economic development. Eur. Econ. Rev. 2001, 45, 847–859. [Google Scholar] [CrossRef]

- Haddow, K.H. How best can mining be a catalyst for diversifying economies? Miner. Econ. 2014, 27, 149–151. [Google Scholar] [CrossRef]

- Bastida, A.E. From extractive to transformative industries: Paths for linkages and diversification for resource-driven development. Miner. Econ. 2014, 27, 73–87. [Google Scholar] [CrossRef]

- Dietsche, E. Diversifying mineral economies: Conceptualizing the debate on building linkages. Miner. Econ. 2014, 27, 89–102. [Google Scholar] [CrossRef]

- Farooki, M.; Kaplinsky, R. Promoting diversification in resource-rich economies. Miner. Econ. 2014, 27, 103–113. [Google Scholar] [CrossRef]

- Tordo, S.; Warner, M.; Manzano, O.; Anouti, Y. Local Content Policies in the Oil and Gas Sector; The World Bank: Washington, DC, USA, 2013. [Google Scholar]

- Nwapi, C. A survey of the literature on local content policies in the oil and gas industry in East Africa. Sch. Public Policy Univ. Calgary 2016, 9, 16. [Google Scholar]

- De Hemmer Gudme, O.; Poissonnier, H. Valeur(s) et Management: Des Méthodes pour Plus de Valeur(s) Dans le Management; EMS GEODIF: Caen, France, 2013. [Google Scholar]

- IPIECA. Local Content Strategy: A Guidance Document for the Oil and Gas Industry; IPIECA: London, UK, 2011. [Google Scholar]

- Ado, R. Local content policy and the WTO rules of trade-related investment measures (TRIMS): The pros and cons. Int. J. Bus. Manag. Stud. 2013, 2, 137–146. [Google Scholar]

- Hufbauer, G.C.; Schott, J.J.; Cimino, C.; Vieiro, M.; Wada, E. Local Content Requirements: A Global Problem; Peterson Institute Press: Washington, DC, USA, 2013. [Google Scholar]

- Kalyuzhnova, Y.; Nygaard, C.A.; Omarov, Y.; Saparbayev, A. Local Content Policies in Resource-Rich Countries; Palgrave Macmillan: London, UK, 2016. [Google Scholar]

- African Development Bank. Creating Local Content for Human Development in Africa’s New Natural Resource-Rich Countries (Flagship Report Paper Series Paper 6); African Development Bank: Abidjan, Côte d’Ivoire, 2015. [Google Scholar]

- Olawuyi, D.S. Local content requirements in oil and gas contracts: Regional trends in the middle east and north Africa. J. Energy Nat. Resour. Law 2019, 37, 93–117. [Google Scholar] [CrossRef]

- Ablo, A.D. Scale, local content and the challenges of Ghanaians employment in the oil and gas industry. Geoforum 2018, 96, 181–189. [Google Scholar] [CrossRef]

- Ngoasong, M.Z. How international oil and gas companies respond to local content policies in petroleum-producing developing countries: A narrative enquiry. Energy Policy 2014, 73, 471–479. [Google Scholar] [CrossRef]

- Adewuyi, A.O.; Ademola Oyejide, T. Determinants of backward linkages of oil and gas industry in the Nigerian economy. Resour. Policy 2012, 37, 452–460. [Google Scholar] [CrossRef]

- Warner, M. Local Content In Procurement: Creating Local Jobs and Competitive Domestic Industries in Supply Chains; Greenleaf Publishing: Sheffield, UK, 2011. [Google Scholar]

- Hammann, E. Three Years Experience in Engaging Local Content at Project Planning Phase. In Proceedings of the SPE International Conference and Exhibition on Health, Safety, Security, Environment, and Social Responsibility, Stavanger, Norway, 11–13 April 2016. [Google Scholar]

- Ovadia, J.S. The Making of Oil-backed Indigenous Capitalism in Nigeria. New Polit. Econ. 2013, 18, 258–283. [Google Scholar] [CrossRef]

- Dernis, M.; Ouerdane, W.; Vidal, L.-A.; Da Costa, P.; Marle, F. Assessment of Sustainable strategies based on DMM approach and value creation. In Proceedings of the 19th Dependency and Structure Modelling Conference (DSM), Helsinki, Finland, 11–13 September 2017. [Google Scholar]

- Nadorff, N.J.; Van-Dunem, J.O.S. If you build it they will come: Angola’s homegrown approach to post-graduate oil and gas instruction. J. World Energy Law Bus. 2018, 11, 164–181. [Google Scholar] [CrossRef]

- Toledano, P.; Thomashausen, S.; Maennling, N.; Shah, A. A Framework to Approach Shared Use of Mining-Related Infrastructure; Vale Columbia Center on Sustainable International Investment: New York, NY, USA, 2014. [Google Scholar] [CrossRef]

- Dernis, M. Modélisation et Estimation Des Valeurs ApportéES au Pays Hôte Pour Aider à la Décision Dans L’éLaboration Des Stratégies in-Country-Value. Ph.D. Thesis, Université Paris-Saclay (ComUE), Paris, France, 2019. [Google Scholar]

- Obeng-Odoom, F. Oil, Local Content Laws and Paternalism: Is Economic Paternalism Better Old, New or Democratic? Forum Soc. Econ. 2019, 48, 281–306. [Google Scholar] [CrossRef]

- Arvanitis, Y.; Weigert, M. Turning resource curse into development dividends in Guinea-Bissau. Resour. Policy 2017, 53, 226–237. [Google Scholar] [CrossRef]

- PMI—Project Management Institute. A Guide to the Project Management Body Of Knowledge; Project Management Institute: Newtown Square, PA, USA, 2000. [Google Scholar]

- Belassi, W.; Tukel, O.I. A new framework for determining critical success/failure factors in projects. Int. J. Proj. Manag. 1996, 14, 141–151. [Google Scholar] [CrossRef]

- Fleming, Q.W.; Koppelman, J.M. Using earned value management. Cost Eng. 2002, 44, 32–36. [Google Scholar]

- Laursen, M.; Svejvig, P. Taking stock of project value creation: A structured literature review with future directions for research and practice. Int. J. Proj. Manag. 2016, 34, 736–747. [Google Scholar] [CrossRef]

- Vidal, L.-A. Thinking Project Management in the Age of Complexity. Particular Implications on Project Risk Management. Ph.D. Thesis, Ecole Centrale Paris, Paris, France, 2009. [Google Scholar]

- Lauras, M.; Marques, G.; Gourc, D. Towards a multi-dimensional project Performance Measurement System. Decis. Support Syst. 2010, 48, 342–353. [Google Scholar] [CrossRef]

- Marques, G.; Gourc, D.; Lauras, M. Multi-criteria performance analysis for decision making in project management. Int. J. Proj. Manag. 2011, 29, 1057–1069. [Google Scholar] [CrossRef]

- Thomas, J.; Mullaly, M. Understanding the Value of Project Management: First Steps on an International Investigation in Search of Value. Proj. Manag. J. 2007, 38, 74–89. [Google Scholar] [CrossRef]

- Armenia, S.; Dangelico, R.M.; Nonino, F.; Pompei, A. Sustainable Project Management: A Conceptualization-Oriented Review and a Framework Proposal for Future Studies. Sustainability 2019, 11, 2664. [Google Scholar] [CrossRef]

- Hope, A.J.; Moehler, R. Balancing Projects with Society and the Environment: A Project, Programme and Portfolio Approach. Procedia Soc. Behav. Sci. 2014, 119, 358–367. [Google Scholar] [CrossRef]

- Silvius, A.J.G.; Schipper, R.P.J. Sustainability in project management: A literature review and impact analysis. Soc. Bus. 2014, 4, 63–96. [Google Scholar] [CrossRef]

- Marcelino-Sádaba, S.; González-Jaen, L.F.; Pérez-Ezcurdia, A. Using project management as a way to sustainability. from a comprehensive review to a framework definition. J. Clean. Prod. 2015, 99, 1–16. [Google Scholar] [CrossRef]

- Gilbert Silvius, A.J.; Kampinga, M.; Paniagua, S.; Mooi, H. Considering sustainability in project management decision making; An investigation using Q-methodology. Int. J. Proj. Manag. 2017, 35, 1133–1150. [Google Scholar] [CrossRef]

- Borg, R.; Gonzi, R.D.; Borg, S.P. Building sustainably: A pilot study on the project manager’s contribution in delivering sustainable construction projects—a maltese and international perspective. Sustainability 2020, 12, 10162. [Google Scholar] [CrossRef]

- Labuschagne, C.; Brent, A.C. Sustainability assessment criteria for projects and technologies: Judgements of industry managers. South Afr. J. Ind. Eng. 2007, 18. [Google Scholar] [CrossRef]

- Sánchez, M.A. Integrating sustainability issues into project management. J. Clean. Prod. 2015, 96, 319–330. [Google Scholar] [CrossRef]

- Labuschagne, C.; Brent, A.C. Social indicators for sustainable project and technology life cycle management in the process industry. Int. J. Life Cycle Assess. 2006, 11, 3–15. [Google Scholar]

- Oehlmann, I. The Sustainable Footprint Methodology - Including Sustainability in the Project Management of the Bergermeer Gas Storage Project. Master’s Thesis, Delft University of Technology, Delft, The Netherlands, 2010. [Google Scholar]

- Toljaga-Nikolić, D.; Todorović, M.; Dobrota, M.; Obradović, T.; Obradović, V. Project Management and Sustainability: Playing Trick or Treat with the Planet. Sustainability 2020, 12, 8619. [Google Scholar] [CrossRef]

- Doskočil, R.; Lacko, B. Risk Management and Knowledge Management as Critical Success Factors of Sustainability Projects. Sustainability 2018, 10, 1438. [Google Scholar] [CrossRef]

- Talbot, J.; Venkataraman, R. Evaluating sustainability on projects using indicators. In Sustainability Integration for Effective Project Management; IGI Global: Hershey, PA, USA, 2013; pp. 194–211. [Google Scholar]

- Maniak, R.; Midler, C.; Lenfle, S.; Pellec-Dairon, M. Le Value management for exploration projects. Proj. Manag. J. 2014, 45, 55–66. [Google Scholar] [CrossRef]

- Daniel, E.I.; Pasquire, C. Creating social value within the delivery of construction projects: The role of lean approach. Eng. Constr. Arch. Manag. 2019, 26, 1105–1128. [Google Scholar] [CrossRef]

- Sjåfjell, B. Sustainable value creation within planetary boundaries-Reforming corporate purpose and duties of the corporate board. Sustainability 2020, 12, 6245. [Google Scholar] [CrossRef]

- Bae, J.W.; Kim, Y.W. Sustainable value on construction projects and lean construction. J. Green Build. 2008, 3, 155–167. [Google Scholar] [CrossRef]

- Ayentimi, D.T.; Burgess, J.; Brown, K. Developing effective local content regulations in sub-Sahara Africa: The need for more effective policy alignment. Multinatl. Bus. Rev. 2016, 24, 354–374. [Google Scholar] [CrossRef]

- Ettmayr, C.; Lloyd, H. Local content requirements and the impact on the South African renewable energy sector: A survey-based analysis. South Afr. J. Econ. Manag. Sci. 2017, 20. [Google Scholar] [CrossRef]

- Lebdioui, A. Local content in extractive industries: Evidence and lessons from Chile’s copper sector and Malaysia’s petroleum sector. Extr. Ind. Soc. 2020, 7, 341–352. [Google Scholar] [CrossRef]

- Maack, M.; Davidsdottir, B. Five capital impact assessment: Appraisal framework based on theory of sustainable well-being. Renew. Sustain. Energy Rev. 2015, 50, 1338–1351. [Google Scholar] [CrossRef]

- Asiago, B.C. Fact or fiction: Harmonising and unifying legal principles of local content requirements. J. Energy Nat. Resour. Law 2016, 34, 337–360. [Google Scholar] [CrossRef]

- Baldassarre, B.; Calabretta, G.; Bocken, N.M.P.; Jaskiewicz, T. Bridging sustainable business model innovation and user-driven innovation: A process for sustainable value proposition design. J. Clean. Prod. 2017, 147, 175–186. [Google Scholar] [CrossRef]

- Choumert Nkolo, J. Developing a socially inclusive and sustainable natural gas sector in Tanzania. Energy Policy 2018, 118, 356–371. [Google Scholar] [CrossRef]

- Henriques, J.; Catarino, J. Sustainable value and cleaner production—Research and application in 19 Portuguese SME. J. Clean. Prod. 2015, 96, 379–386. [Google Scholar] [CrossRef]

- Koke, B.; Moehler, R.C. Earned Green Value management for project management: A systematic review. J. Clean. Prod. 2019, 230, 180–197. [Google Scholar] [CrossRef]

- Grzeszczyk, T.A.; Waszkiewicz, M. Sustainable investment project evaluation. Entrep. Sustain. Issues 2020, 7. [Google Scholar] [CrossRef]

- Sterman, J. Business Dynamics: Systems Thinking and Modeling for a Complex World; McGraw-Hill Higher Education: Boston, MA, USA, 2000. [Google Scholar]

- Baccarini, D. The concept of project complexity—A review. Int. J. Proj. Manag. 1996, 14, 201–204. [Google Scholar] [CrossRef]

- Bérard, C. Le Processus de Décision Dans Les Systèmes Complexes: Une Analyse D’Une Intervention Systémique. Ph.D. Thesis, Université Paris Dauphine, Paris, France, Université du Québec à Montréal, Montreal, QC, Canada, 2009. [Google Scholar]

- Le Moigne, J.-L. La Théorie du Système Général. Théorie de la Modélisation; Presses Universitaires de France: Paris, France, 1990. [Google Scholar]

- Jackson, M.C. Creative Holism: A Critical Systems Approach to Complex Problem Situations. Syst. Res. Behav. Sci. 2006, 23, 647–657. [Google Scholar] [CrossRef]

- Battistoni, C.; Nohra, C.G.; Barbero, S. A systemic design method to approach future complex scenarios and research towards sustainability: A holistic diagnosis tool. Sustainability 2019, 11, 4458. [Google Scholar] [CrossRef]

- Simon, H.A. The Architecture of Complexity. In Facets of Systems Science; Springer: Berlin/Heidelberg, Germany, 1962; Volume 106. [Google Scholar]

- Boulding, K. General Systems Theory, the Skeleton of Science. Manag. Sci. 1956, 2, 197–208. [Google Scholar] [CrossRef]

- Von Bertalanffy, L. General System Theory Foundations, Development, Applications; George Braziller: New York, NY, USA, 1968. [Google Scholar]

- Churchman, C.W. The Design of Inquiring Systems: Basic Concepts of Systems and Organization; Basic Books: New York, NY, USA, 1971. [Google Scholar]

- Checkland, P. Systems Thinking, Systems Practice: Includes a 30-Year Retrospective; Wiley: Hoboken, NJ, USA, 1999. [Google Scholar]

- Morin, E. La Complexité Humaine; Flammarion: Paris, France, 2008. [Google Scholar]

- Luhmann, N. Introduction to Systems Theory; Wiley: Hoboken, NJ, USA, 2012. [Google Scholar]

- Lyons, M.H.; Adjali, I.; Collings, D.; Jensen, K.O. Complex systems models for strategic decision making. BT Technol. J. 2003, 21, 11–27. [Google Scholar] [CrossRef]

- Vidal, L.-A.; Marle, F. Understanding project complexity: Implications on project management. Kybernetes 2008, 37, 1094–1110. [Google Scholar] [CrossRef]

- Schindler, A. Vers la Multi-Performance Des Organisations: Conception et Pilotage Par Les Valeurs du Centre de Recherche Intégré MIRCen du CEA. Ph.D. Thesis, Ecole centrale de Paris, Paris, France, 2010. [Google Scholar]

- Safi, H. Le Management Socio-éConomique et la Mise en œUvre D’Une Démarche de Qualité Intégrale Dans Un éTablissement D’Enseignement Supérieur en Tunisie. Ph.D. Thesis, Conservatoirenational des Arts et Metiers—CNAM, Paris, France, 2012. [Google Scholar]

- Hansen, J.-C. Cindynics Contribution to Crisis/Disasters Strategic Steering. In Proceedings of the WADEM Congress on Disaster and Emergency Medicine, Toronto, ON, Canada, 25–28 April 2017. [Google Scholar]

- Vajna, S. Integrated Design Engineering—Interdisciplinary and Holistic Product Development; Vajna, S., Ed.; Springer: Berlin/Heidelberg, Germany, 2020. [Google Scholar]

- Vidal, L.-A.; Marle, F.; Bocquet, J.-C. Using a Delphi process and the Analytic Hierarchy Process (AHP) to evaluate the complexity of projects. Expert Syst. Appl. 2011, 38, 5388–5405. [Google Scholar] [CrossRef]

- Jones, L.; Norton, L.; Austin, Z.; Browne, A.L.; Donovan, D.; Emmett, B.A.; Grabowski, Z.J.; Howard, D.C.; Jones, J.P.G.; Kenter, J.O.; et al. Stocks and flows of natural and human-derived capital in ecosystem services. Land Use Policy 2016, 52, 151–162. [Google Scholar] [CrossRef]

- Mancini, M.S.; Galli, A.; Niccolucci, V.; Lin, D.; Hanscom, L.; Wackernagel, M.; Bastianoni, S.; Marchettini, N. Stocks and flows of natural capital: Implications for Ecological Footprint. Ecol. Indic. 2017, 77, 123–128. [Google Scholar] [CrossRef]

- Dahiyat, S.E.; Khasawneh, S.M.; Bontis, N.; Al-Dahiyat, M. Intellectual capital stocks and flows: Examining the mediating roles of social capital and knowledge transfer. VINE J. Inf. Knowl. Manag. Syst. 2021. [Google Scholar] [CrossRef]

- Porritt, J. Capitalism as if the World Matters, 1st ed.; Routledge: Milton Park, UK, 2007. [Google Scholar]

- Stahel, W.R.; Clift, R. Stocks and flows in the performance economy. In Taking Stock of Industrial Ecology; Springer: Berlin/Heidelberg, Germany, 2015; pp. 137–158. [Google Scholar]

- Terama, E.; Milligan, B.; Jiménez-Aybar, R.; Mace, G.M.; Ekins, P. Accounting for the environment as an economic asset: Global progress and realizing the 2030 Agenda for Sustainable Development. Sustain. Sci. 2016, 11, 945–950. [Google Scholar] [CrossRef]

- Maseyk, F.J.F.; Mackay, A.D.; Possingham, H.P.; Dominati, E.J.; Buckley, Y.M. Managing Natural Capital Stocks for the Provision of Ecosystem Services. Conserv. Lett. 2017, 10, 211–220. [Google Scholar] [CrossRef]

- Geepu, M.; Tiepoh, N.; Reimer, B. Social Capital, Information Flows, and Income Creation in Rural Canada: A Cross-Community Analysis 1 Social Capital, Information Flows, and Income Creation in Rural Canada: A Cross-Community Analysis. J. Sociol. Econ. 2004, 33, 427–448. [Google Scholar]

- Krishna, A. Moving from the stock of social capital to the flow of benefits: The role of agency. World Dev. 2001, 29, 925–943. [Google Scholar] [CrossRef]

- Hasan, M.M.; Habib, A. Social capital and idiosyncratic return volatility. Aust. J. Manag. 2019, 44, 3–31. [Google Scholar] [CrossRef]

- Ployhart, R.E.; Weekley, J.A.; Ramsey, J. The Consequences of Human Resource Stocks and Flows: A Longitudinal Examination of Unit Service Orientation and Unit Effectiveness. Acad. Manag. J. 2009, 52, 996–1015. [Google Scholar] [CrossRef]

- Park, T.Y.; Park, J. Managing stocks and flows of human capital: Inflow, outflow, and instability. In Proceedings of the 74th Annual Meeting of the Academy of Management, AOM 2014, Philadelphia, PA, USA, 1–5 August 2014; pp. 1100–1105. [Google Scholar]

- Weisz, H.; Suh, S.; Graedel, T.E. Industrial ecology: The role of manufactured capital in sustainability. Proc. Natl. Acad. Sci. USA 2015, 112, 6260–6264. [Google Scholar] [CrossRef] [PubMed]

- Lennox, J.A.; Turner, G.M. Modelling Manufactured Capital Stocks and Material Flows in the Australian Stocks and Flows Framework. In Handbook of Input-Output Economics in Industrial Ecology; Springer: Dordrecht, Germany, 2009; pp. 77–97. [Google Scholar]

- Ekins, P.; Medhurst, J. The European Structural Funds and Sustainable Development: A Methodology and Indicator Framework for Evaluation. Evaluation 2006, 12, 474–495. [Google Scholar] [CrossRef]

- Lowery, B. “Knowing Beyond Measurement”: Integrating Sustainability Indicators and Storytelling in an Alternative Approach to Sustainable Development in Rural Newfoundland and Labrador. Ph.D. Thesis, Memorial University of Newfoundland, St. John’s, NL, Canada, 2020. [Google Scholar]

- Dernis, M.; Vidal, L.-A.; Marle, F.; Ouerdane, W.; da Costa, P. Aide à la sélection de stratégies pour apporter des valeurs durables à des pays hôtes en contexte pétrolier. In Proceedings of the Congrès International de Génie Industriel CIGI, Compiègne, France, 3–5 May 2017. [Google Scholar]

- Kulig, A.; Kolfoort, H.; Hoekstra, R. The case for the hybrid capital approach for the measurement of the welfare and sustainability. Ecol. Indic. 2010, 10, 118–128. [Google Scholar] [CrossRef]

- Roca, L.C.; Searcy, C. An analysis of indicators disclosed in corporate sustainability reports. J. Clean. Prod. 2012, 20, 103–118. [Google Scholar] [CrossRef]

- Sustainable Development Solutions Network (SDSN). Indicators and a Monitoring Framework for the Sustainable Development Goals—Launching a Data Revolution for the SDGs; Sustainable Development Solutions Network (SDSN): Paris, France, 2015. [Google Scholar]

- Keeney, R.L. Applying value-focused thinking. Mil. Oper. Res. 2008, 13, 6–17. [Google Scholar] [CrossRef]

- Steward, D.V. Design Structure System: A method for managing the desing of complex systems. IEEE Trans. Eng. Manag. 1981, EM-28, 71–74. [Google Scholar] [CrossRef]

- Carrascosa, M.; Eppinger, S.D.; Whitney, D.E. Using the design structure matrix to estimate product development time. In Proceedings of the ASME 1998 Design Engineering Technical Conferences, Atlanta, GA, USA, 13–16 September 1998; pp. 1–10. [Google Scholar]

- Browning, T.R.; Deyst, J.J.; Eppinger, S.D.; Whitney, D.E. Complex System Product Development: Adding Value by Creating Information and Reducing Risk. In Proceedings of the Tenth Annual International Symposium INCOSE 2000, Minneapolis, MN, USA, 16–20 July 2000; Volume 9. [Google Scholar]

- Danilovic, M.; Browning, T.R. Managing complex product development projects with design structure matrices and domain mapping matrices. Int. J. Proj. Manag. 2007, 25, 300–314. [Google Scholar] [CrossRef]

- Sosa, M.E.; Eppinger, S.D.; Rowles, C.M. A Network Approach to Define Modularity of Components in Complex Products. J. Mech. Des. 2007, 129, 1118. [Google Scholar] [CrossRef]

- Marle, F.; Vidal, L.-A.; Bocquet, J.-C. Interactions-based risk clustering methodologies and algorithms for complex project management. Int. J. Prod. Econ. 2013, 142, 225–234. [Google Scholar] [CrossRef]

- Fu, Y.; Li, M.; Chen, F. Impact propagation and risk assessment of requirement changes for software development projects based on design structure matrix. Int. J. Proj. Manag. 2012, 30, 363–373. [Google Scholar] [CrossRef]

- Feng, W.; Crawley, E.F.; De Weck, O.; Keller, R.; Robinson, B. Dependency structure matrix modelling for stakeholder value networks. In Proceedings of the 12th International DSM Conference, Cambridge, UK, 22–23 July 2010. [Google Scholar]

- Hein, A.M.; Jankovic, M.; Farel, R.; Yannou, B. A Data- and Knowledge-Driven Methodology for Generating Eco-Industrial Park Architectures. In Proceedings of the ASME International Design Engineering Technical Conferences and Computers and Information in Engineering Conference IDETC, Charlotte, NC, USA, 21–24 August 2016. [Google Scholar]

- Danilovic, M.; Sandkull, B. The use of dependence structure matrix and domain mapping matrix in managing uncertainty in multiple project situations. Int. J. Proj. Manag. 2005, 23, 193–203. [Google Scholar] [CrossRef]

- Eichinger, M.; Maurer, M.; Lindemann, U. Using Multiple Design Stucture Matrices. In Proceedings of the International Design Conference, Dubrovnik, Croatia, 15–18 May 2006. [Google Scholar]

- Bartolomei, J.E.; Hastings, D.E.; de Neufville, R.; Rhodes, D.H. Engineering Systems Multiple-Domain Matrix: An organizing framework for modeling large-scale complex systems. Syst. Eng. 2012, 15, 41–61. [Google Scholar] [CrossRef]

- Siyam, G.I.; Kirner, K.G.M.; Wynn, D.C.; Lindemann, U.; Clarkson, P.J. Value and waste dependencies and guidelines. In Proceedings of the 14th International Dependency and Structure Modelling Conference, Kyoto, Japan, 13–14 September 2012; pp. 65–78. [Google Scholar]

- Jean, C. Comment Réussir L’Intégration de Systèmes Technologiques Innovants au Sein de Systèmes Complexes Organisationnels? Application à la TéLémedecine en France. Ph.D. Thesis, Ecole Centrale Paris, Paris, France, 2013. [Google Scholar]

- Kamari, A. A Multi-Methodology and Sustainability-Supporting Framework for Implementation and Assessment of a Holistic Building Renovation: Implementation and Assessment of a Holistic Sustainable Building Renovation. Ph.D. Thesis, Aarhus University, Aarhus, Denmark, 2017. [Google Scholar]

- UNIDO. Global Value Chains and Development: Unido’s Support towards Inclusive and Sustainable Industrial Development; UNIDO: Vienna, Austria, 2015. [Google Scholar]

- Weiss, M. The Role of Local Content Policies in Manufacturing and Mining in Low-and Middle-Income Countries; UNIDO: Vienna, Austria, 2016. [Google Scholar]

- Tong, Y.-S.; Kokko, A. Linking Fdi and Local Firms for Global Value Chain Upgrading: Policy Lessons From Samsung Mobile Phone Production in Viet Nam; UNIDO: Vienna, Austria, 2019. [Google Scholar]

- UNIDO. The Unido Approach to Cluster Development—Key Principles and Project Experiences; UNIDO: Vienna, Austria, 2020. [Google Scholar]

- UNIDO. Short Food Supply Chains for Promoting Local Food on Local Markets; UNIDO: Vienna, Austria, 2020. [Google Scholar]

- Stamford, L.; Azapagic, A. Sustainability indicators for the assessment of nuclear power. Energy 2011, 36, 6037–6057. [Google Scholar] [CrossRef]

- Horsley, J.; Prout, S.; Tonts, M.; Ali, S.H. Sustainable livelihoods and indicators for regional development in mining economies. Extr. Ind. Soc. 2015, 2, 368–380. [Google Scholar] [CrossRef]

- Liu, Y.; Huang, C.; Wang, Q.; Luan, J.; Ding, M. Assessment of Sustainable Livelihood and Geographic Detection of Settlement Sites in Ethnically Contiguous Poverty-Stricken Areas in the Aba Prefecture, China. ISPRS Int. J. Geo-Inf. 2018, 7, 16. [Google Scholar] [CrossRef]

- Doran, G.T. There’s a S.M.A.R.T. Way to Write Management’s Goals and Objectives. Manag. Rev. 1981, 70, 35–36. [Google Scholar]

- Steffens, G.; Cadiat, A.-C. Les Objectifs SMART 5 Critères pour des Objectifs Efficaces; 50Minutes.fr Lemaître Publishing: Bruxelles, Belgium, 2015. [Google Scholar]

- Wu, Y.; Dai, R.; Xu, Y.; Han, J.; Li, P. Statistical Assessment of Water Quality Issues in Hongze Lake, China, Related to the Operation of a Water Diversion Project. Sustainability 2018, 10, 1885. [Google Scholar] [CrossRef]

- Raveed, S.R.; Renforth, W. State Enterprise-Multinational Corporation Joint Ventures: How Well Do They Meet Both Partners’ Needs? Manag. Int. Rev. 1983, 1, 47–57. [Google Scholar]

- Oetzel, J.; Doh, J.P. MNEs and development: A review and reconceptualization. J. World Bus. 2009, 44, 108–120. [Google Scholar] [CrossRef]

- The Independent State of Papua New Guinea. Papua New Guinea Vision 2050; National Strategic Plan Taskforce; The Independent State of Papua New Guinea: Port Moresby, Papua New Guinea, 2011. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Vidal, L.-A.; Marle, F.; Dernis, M. Modeling and Estimating Host Country Values in International Projects to Facilitate In-Country Value Creation. Sustainability 2021, 13, 5592. https://doi.org/10.3390/su13105592

Vidal L-A, Marle F, Dernis M. Modeling and Estimating Host Country Values in International Projects to Facilitate In-Country Value Creation. Sustainability. 2021; 13(10):5592. https://doi.org/10.3390/su13105592

Chicago/Turabian StyleVidal, Ludovic-Alexandre, Franck Marle, and Mathieu Dernis. 2021. "Modeling and Estimating Host Country Values in International Projects to Facilitate In-Country Value Creation" Sustainability 13, no. 10: 5592. https://doi.org/10.3390/su13105592

APA StyleVidal, L.-A., Marle, F., & Dernis, M. (2021). Modeling and Estimating Host Country Values in International Projects to Facilitate In-Country Value Creation. Sustainability, 13(10), 5592. https://doi.org/10.3390/su13105592