Does Trade Related Sectoral Infrastructure Make Chinese Exports More Sophisticated and Diversified?

Abstract

1. Introduction

2. Sophistication and Diversification of Export in China: A Literature Review

3. Theoretical Background

4. Data Collection and Construction of Export Sophistication and Diversification

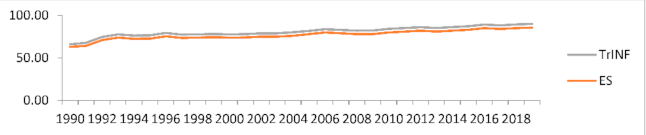

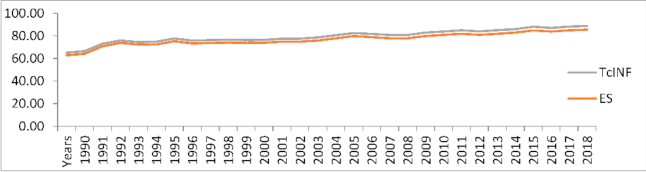

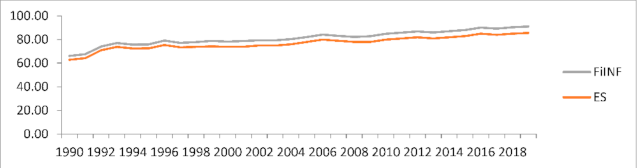

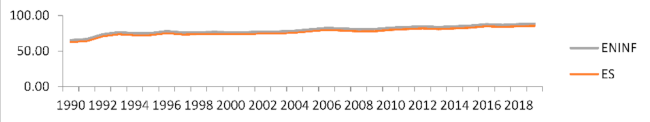

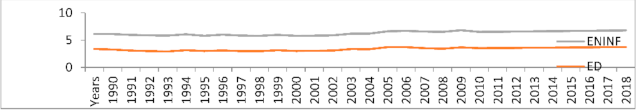

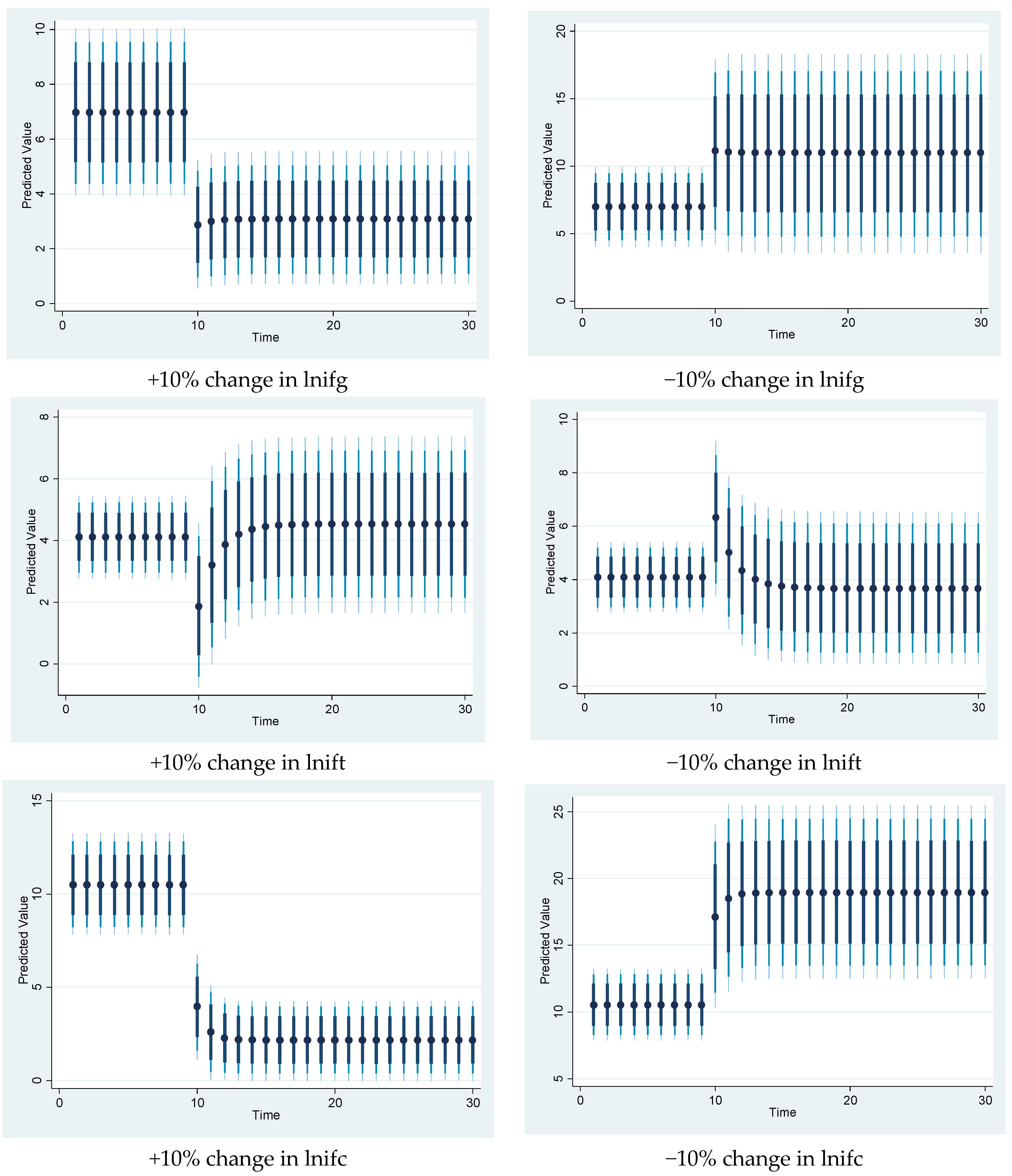

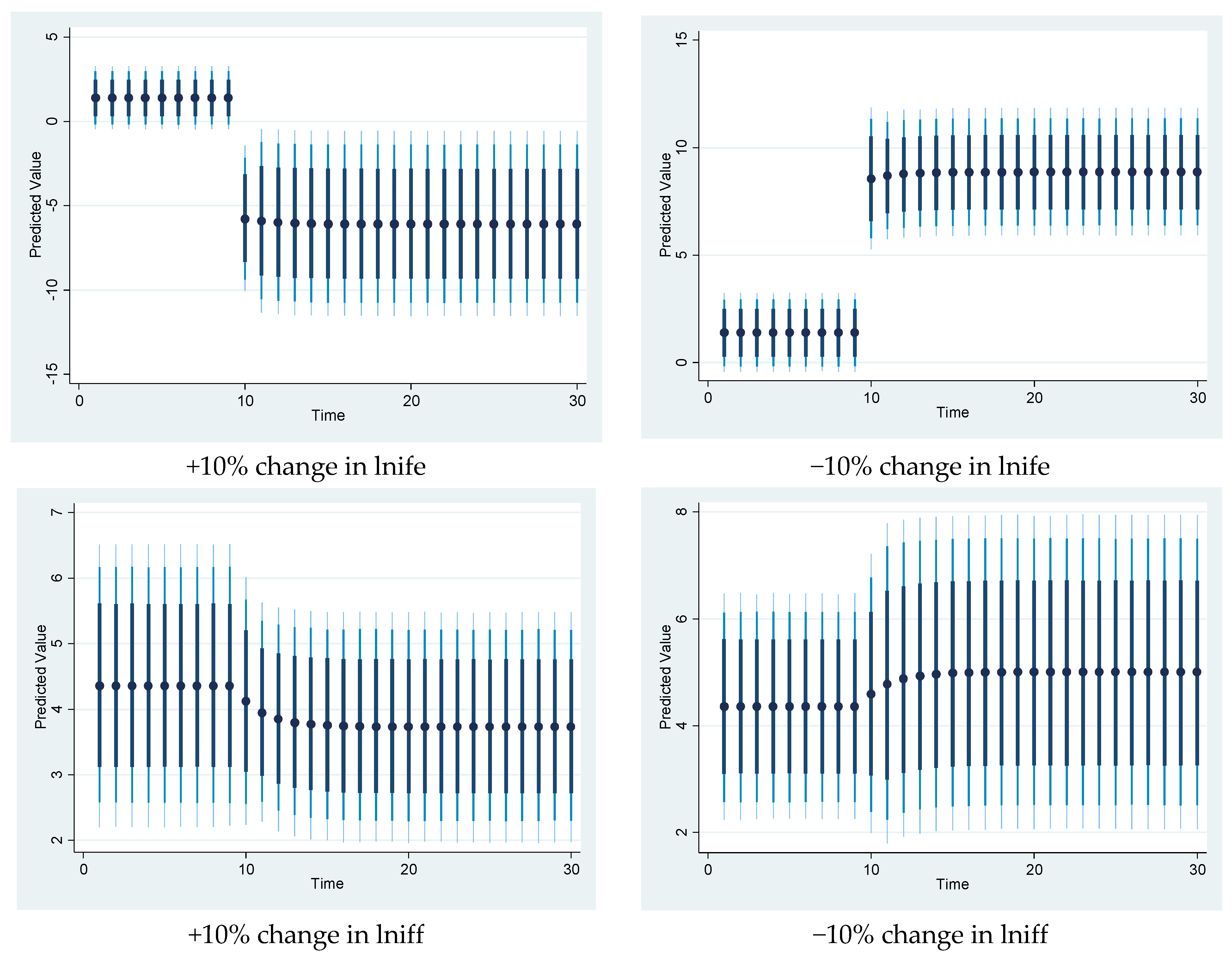

4.1. Construction of Export Sophistication

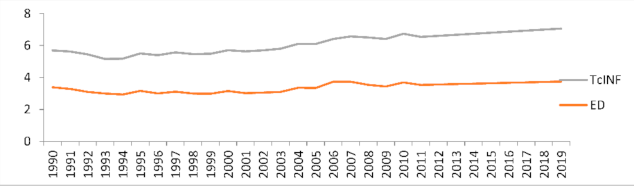

4.2. Export Diversification

5. Econometric Methodology

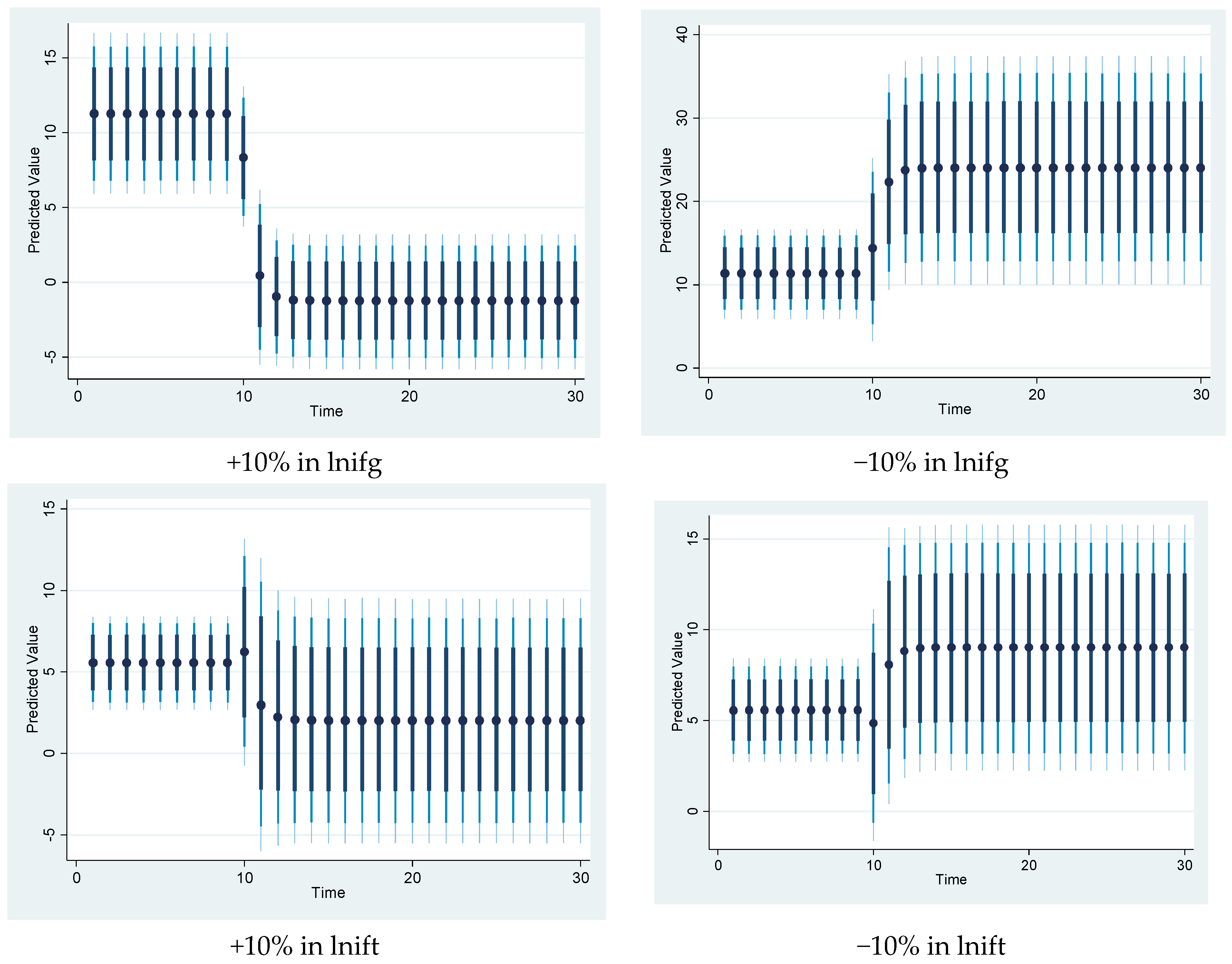

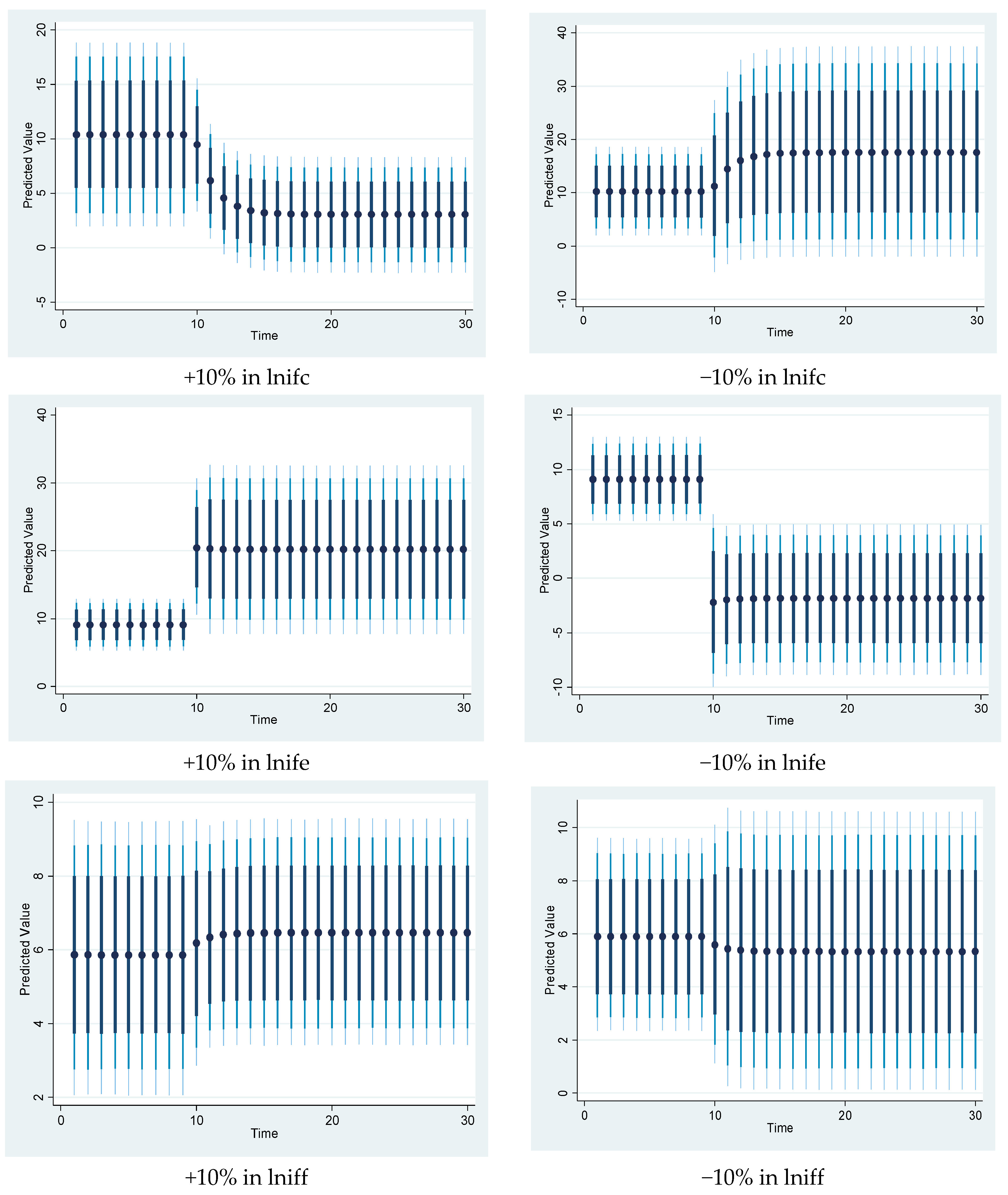

6. Results and Discussion

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Lectard, P.; Rougier, E. Can Developing Countries Gain from Defying Comparative Advantage? Distance to Comparative Advantage, Export Diversification and Sophistication, and the Dynamics of Specialization. World Dev. 2018, 102, 90–110. [Google Scholar] [CrossRef]

- Rehman, F.U.; Khan, M.A.; Khan, M.A.; Pervaiz, K.; Liaqat, I. The causal, linear and nonlinear nexus between sectoral FDI and infrastructure in Pakistan: Using a new global infrastructure index. Res. Int. Bus. Financ. 2019, 52, 101129. [Google Scholar] [CrossRef]

- Santos-Paulino, A.U. Trade specialization, export productivity and growth in Brazil, China, India, South Africa, and a cross section of countries. Econ. Chang. Restruct. 2011, 44, 75–97. [Google Scholar] [CrossRef]

- Rehman Faheem, U.; Ding, Y.; Noman Abul, A.; Khan Muhammad, A. China’s outward foreign direct investment and exports diversification: An asymmetric analysis. J. Chin. Econ. Foreign Trade Stud. 2020, 13, 45–69. [Google Scholar] [CrossRef]

- Islam, M.A.; Khan, M.A.; Popp, J.; Sroka, W.; Oláh, J. Financial Development and Foreign Direct Investment—The Moderating Role of Quality Institutions. Sustainability 2020, 12, 3556. [Google Scholar] [CrossRef]

- Rehman, F.U.; Noman, A.A. Does infrastructure promote exports and foreign direct investment in selected Southeast Asian economies? An application of global infrastructure index. J. Econ. Stud. 2020. [Google Scholar] [CrossRef]

- Rehman, F.U.; Noman, A.A.; Ding, Y. Does infrastructure increase exports and reduce trade deficit? Evidence from selected South Asian countries using a new Global Infrastructure Index. J. Econ. Struct. 2020, 9, 10. [Google Scholar] [CrossRef]

- Ismail, N.W.; Mahyideen, J.M. The Impact of infrastructure on trade and economic growth in selected economies in Asia. SSRN Electron. J. 2015. [Google Scholar] [CrossRef]

- Rehman, F.U.; Noman, A.A. Trade related sectorial infrastructure and exports of belt and road countries: Does belt and road initiatives make this relation structurally instable? China Econ. J. 2020, 1–25. [Google Scholar] [CrossRef]

- Rehman, F.U.; Ding, Y.; Noman, A.A.; Khan, M.A. The Nexus Between Infrastructure and Export: An Empirical Evidence from Pakistan. Glob. J. Emerg. Mark. Econ. 2020, 12, 141–157. [Google Scholar] [CrossRef]

- Amiti, M.; Freund, C. China’s export boom. Financ. Dev. 2007, 44, 38–41. [Google Scholar]

- Assche, A.V.; Gangnes, B. Electronics production upgrading: Is China exceptional? Appl. Econ. Lett. 2010, 17, 477–482. [Google Scholar] [CrossRef]

- Shahzad, U.; Ferraz, D.; Doğan, B.; Aparecida do Nascimento Rebelatto, D. Export product diversification and CO2 emissions: Contextual evidences from developing and developed economies. J. Clean. Prod. 2020, 276, 124146. [Google Scholar] [CrossRef]

- Majeed, A.; Jiang, P.; Ahmad, M.; Khan, M.A.; Olah, J. The Impact of Foreign Direct Investment on Financial Development: New Evidence from Panel Cointegration and Causality Analysis. J. Compet. 2021, 13, 95–112. [Google Scholar] [CrossRef]

- Li, C.; Pervaiz, K.; Khan, M.A.; Rehman, F.U.; Oláh, J. On the Asymmetries of Sovereign Credit Rating Announcements and Financial Market Development in the European Region. Sustainability 2019, 11, 6636. [Google Scholar] [CrossRef]

- Xu, B.; Lu, J. Foreign direct investment, processing trade, and the sophistication of China’s exports. China Econ. Rev. 2009, 20, 425–439. [Google Scholar] [CrossRef]

- Fang, Y.; Gu, G.; Li, H. The impact of financial development on the upgrading of China’s export technical sophistication. Int. Econ. Econ. Policy 2015, 12, 257–280. [Google Scholar] [CrossRef]

- Hausmann, R.; Hwang, J.; Rodrik, D. What you export matters. J. Econ. Growth 2007, 12, 1–25. [Google Scholar] [CrossRef]

- Spatafora, M.N.; Anand, R.; Mishra, M.S. Structural Transformation and the Sophistication of Production; International Monetary Fund: Washington, DC, USA, 2012. [Google Scholar]

- Fan, Z.; Anwar, S.; Huang, S. Cultural diversity and export sophistication. Int. Rev. Econ. Financ. 2018, 58, 508–522. [Google Scholar] [CrossRef]

- Wang, Z.; Wei, S.-J. What accounts for the rising sophistication of China’s exports? In China’s Growing Role in World Trade; University of Chicago Press: Chicago, IL, USA, 2010; pp. 63–104. [Google Scholar]

- Amiti, M.; Smarzynska Javorcik, B. Trade costs and location of foreign firms in China. J. Dev. Econ. 2008, 85, 129–149. [Google Scholar] [CrossRef]

- Donaubauer, J.; Meyer, B.E.; Nunnenkamp, P. A New Global Index of Infrastructure: Construction, Rankings and Applications. World Econ. 2016, 39, 236–259. [Google Scholar] [CrossRef]

- Duranton, G.; Morrow, P.M.; Turner, M.A. Roads and Trade: Evidence from the US. Rev. Econ. Stud. 2014, 81, 681–724. [Google Scholar] [CrossRef]

- Portugal-Perez, A.; Wilson, J.S. Export Performance and Trade Facilitation Reform: Hard and Soft Infrastructure. World Dev. 2012, 40, 1295–1307. [Google Scholar] [CrossRef]

- Wessel, J. Evaluating the transport-mode-specific trade effects of different transport infrastructure types. Transp. Policy 2019, 78, 42–57. [Google Scholar] [CrossRef]

- Francois, J.; Manchin, M. Institutions, Infrastructure, and Trade. World Dev. 2013, 46, 165–175. [Google Scholar] [CrossRef]

- Garsous, G. How Productive Is Infrastructure? A Quantitative Survey; ECARES Working Paper; Universite libre de Bruxelles: Brussels, Belgium, 2012. [Google Scholar]

- Horvat, T.; Bendix, H.; Bobek, V.; Skoko, H. Impacts of investments in infrastructure projects on emerging markets’ growth: The case of East African countries. Econ. Res. Ekon. Istraz. 2020, 1–27. [Google Scholar] [CrossRef]

- Hoffmann, M. Cross-country evidence on the link between the level of infrastructure and capital inflows. Appl. Econ. 2003, 35, 515–526. [Google Scholar] [CrossRef]

- Lemoine, F.; Ünal-Kesenci, D. Assembly Trade and Technology Transfer: The Case of China. World Dev. 2004, 32, 829–850. [Google Scholar] [CrossRef]

- Roller, L.-H.; Waverman, L. Telecommunications infrastructure and economic development: A simultaneous approach. Am. Econ. Rev. 2001, 91, 909–923. [Google Scholar] [CrossRef]

- Yu, C.; Hu, X. Sophistication of China’s Manufactured Exports and Determinants. Transnatl. Corp. Rev. 2015, 7, 169–189. [Google Scholar] [CrossRef]

- Asif, M.; Rehman, F.U.; Zheng, L.; Shah, H.S. Does trade with China can make growth in Pakistan more inclusive? pre and post empirical impact of China-Pakistan economic corridor. Dev. Ctry. Stud. 2019, 9, 57–67. [Google Scholar]

- Donaubauer, J.; Meyer, B.; Nunnenkamp, P. Aid, Infrastructure, and FDI: Assessing the Transmission Channel with a New Index of Infrastructure. World Dev. 2016, 78, 230–245. [Google Scholar] [CrossRef]

- Jordan, S.; Philips, A.Q. Cointegration testing and dynamic simulations of autoregressive distributed lag models. Stata J. 2018, 18, 902–923. [Google Scholar] [CrossRef]

- Ianchovichina, E.; Martin, W. Trade Liberalization in China’s Accession to WTO. J. Econ. Integr. 2001, 16, 421–445. [Google Scholar] [CrossRef]

- Rehman, F.U.; Noman, A.A. China’s outward foreign direct investment and bilateral export sophistication: A cross countries panel data analysis. China Financ. Rev. Int. 2021. [Google Scholar] [CrossRef]

- Babatunde, S.A. Government spending on infrastructure and economic growth in Nigeria. Econ. Res. Ekon. Istraživanja 2018, 31, 997–1014. [Google Scholar] [CrossRef]

- Rodrik, D. What’s So Special about China’s Exports? China World Econ. 2006, 14, 1–19. [Google Scholar] [CrossRef]

- Schott, P.K. The relative sophistication of Chinese exports. Econ. Policy 2008, 23, 6–49. [Google Scholar]

- Gözgör, G.; Can, M. Causal Linkages among the Product Diversification of Exports, Economic Globalization and Economic Growth. Rev. Dev. Econ. 2017, 21, 888–908. [Google Scholar] [CrossRef]

- Mania, E.; Rieber, A. Product export diversification and sustainable economic growth in developing countries. Struct. Chang. Econ. Dyn. 2019, 51, 138–151. [Google Scholar] [CrossRef]

- Osakwe, P.N.; Santos-Paulino, A.U.; Dogan, B. Trade dependence, liberalization, and exports diversification in developing countries. J. Afr. Trade 2018, 5, 19–34. [Google Scholar] [CrossRef]

- Jarreau, J.; Poncet, S. Export sophistication and economic growth: Evidence from China. J. Dev. Econ. 2012, 97, 281–292. [Google Scholar] [CrossRef]

- Kireyev, A. Diversification in the Middle East: From Crude Trends to Refined Policies. Extr. Ind. Soc. 2020. [Google Scholar] [CrossRef]

- Hesse, H. Export Diversification and Economic Growth Paper No. 21. In Commission on Growth and Development; World Bank: Washington, DC, USA, 2008. [Google Scholar]

- Parteka, A. What drives cross-country differences in export variety? A bilateral panel approach. Econ. Model. 2020, 92, 48–56. [Google Scholar] [CrossRef] [PubMed]

- Goya, D. The exchange rate and export variety: A cross-country analysis with long panel estimators. Int. Rev. Econ. Financ. 2020, 70, 649–665. [Google Scholar] [CrossRef]

- Herzer, D.; Nowak-Lehnmann, D.F. What does export diversification do for growth? An econometric analysis. Appl. Econ. 2006, 38, 1825–1838. [Google Scholar] [CrossRef]

- Desmarchelier, B.; Regis, P.J.; Salike, N. Product space and the development of nations: A model of product diversification. J. Econ. Behav. Organ. 2018, 145, 34–51. [Google Scholar] [CrossRef]

- Kito, T.; New, S.; Reed-Tsochas, F. Disentangling the complexity of supply relationship formations: Firm product diversification and product ubiquity in the Japanese car industry. Int. J. Prod. Econ. 2018, 206, 159–168. [Google Scholar] [CrossRef]

- Zheng, H.-H.; Wang, Z.-X. Measurement and comparison of export sophistication of the new energy industry in 30 countries during 2000–2015. Renew. Sustain. Energy Rev. 2019, 108, 140–158. [Google Scholar] [CrossRef]

- Li, C.; Lu, J. R&D, financing constraints and export green-sophistication in China. China Econ. Rev. 2018, 47, 234–244. [Google Scholar] [CrossRef]

- Aditya, A.; Acharyya, R. Trade liberalization and export diversification. Int. Rev. Econ. Financ. 2015, 39, 390–410. [Google Scholar] [CrossRef]

- Koopman, R.; Wang, Z.; Wei, S.-J. How Much of Chinese Exports Is Really Made in China? Assessing Domestic Value-Added When Processing Trade Is Pervasive; National Bureau of Economic Research: Cambridge, MA, USA, 2008. [Google Scholar]

- Guoming, S.B.X. Preference for Sophistication and China’s Export Growth—Based on the Extended Gravity Model. South China J. Econ. 2012, 8. Available online: https://en.cnki.com.cn/Article_en/CJFDTotal-NFJJ201208009.htm (accessed on 6 April 2021).

- Baliamoune-Lutz, M. Trade sophistication in developing countries: Does export destination matter? J. Policy Modeling 2019, 41, 39–51. [Google Scholar] [CrossRef]

- Hu, G.; Can, M.; Paramati, S.R.; Doğan, B.; Fang, J. The effect of import product diversification on carbon emissions: New evidence for sustainable economic policies. Econ. Anal. Policy 2020, 65, 198–210. [Google Scholar] [CrossRef]

- Khan, M.K.; Teng, J.-Z.; Khan, M.I. Effect of energy consumption and economic growth on carbon dioxide emissions in Pakistan with dynamic ARDL simulations approach. Environ. Sci. Pollut. Res. 2019, 26, 23480–23490. [Google Scholar] [CrossRef]

- Khan, M.K.; Teng, J.-Z.; Khan, M.I.; Khan, M.O. Impact of globalization, economic factors and energy consumption on CO2 emissions in Pakistan. Sci. Total Environ. 2019, 688, 424–436. [Google Scholar] [CrossRef]

- Khan, M.A.; Ahmed, M.; Olah, J.; Popp, J. US Policy Uncertainty and Stock Market Nexus revisited through Dynamic ARDL Simulation and Threshold Modelling. Mathematics 2020, 8, 2073. [Google Scholar] [CrossRef]

- Vernon, R. International Investment and International Trade in the Product Cycle. Q. J. Econ. 1966, 80, 190–207. [Google Scholar] [CrossRef]

- Jozsef, T.; Balogh, J.M.; Torok, A. Networking theory of innovation in practice–The Hungarian case. Agric. Econ. 2018, 64, 536–545. [Google Scholar]

- Xing, Y. China’s high-tech exports: The myth and reality. Asian Econ. Pap. 2014, 13, 109–123. [Google Scholar] [CrossRef]

- Xu, B. The sophistication of exports: Is China special? China Econ. Rev. 2010, 21, 482–493. [Google Scholar] [CrossRef]

- Yao, S. Why Are Chinese Exports Not So Special? China World Econ. 2009, 17, 47–65. [Google Scholar] [CrossRef]

- Yang, R.; Yao, Y.; Zhang, Y. Technological structure and its upgrading in China’s exports. China Econ. J. 2009, 2, 55–71. [Google Scholar] [CrossRef]

- Rehman, F.U.; Ding, Y. The nexus between outward foreign direct investment and export sophistication: New evidence from China. Appl. Econ. Lett. 2020, 27, 357–365. [Google Scholar] [CrossRef]

- Rehman, F.U.; Khan, D. The Determinants of Food Price Inflation in Pakistan: An Econometric Analysis. Adv. Econ. Bus. 2015, 3, 571–576. [Google Scholar] [CrossRef]

- Sarkodie, S.A.; Strezov, V.; Weldekidan, H.; Asamoah, E.F.; Owusu, P.A.; Doyi, I.N.Y. Environmental sustainability assessment using dynamic Autoregressive-Distributed Lag simulations—Nexus between greenhouse gas emissions, biomass energy, food and economic growth. Sci. Total Environ. 2019, 668, 318–332. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Shin, Y.; Smith, R.J. Bounds testing approaches to the analysis of level relationships. J. Appl. Econom. 2001, 16, 289–326. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Shin, Y.; Smith, R.P. Pooled Mean Group Estimation of Dynamic Heterogeneous Panels. J. Am. Stat. Assoc. 1999, 94, 621–634. [Google Scholar] [CrossRef]

- Khan, M.A.; Khan, M.A.; Abdulahi, M.E.; Liaqat, I.; Shah, S.S.H. Institutional quality and financial development: The United States perspective. J. Multinatl. Financ. Manag. 2019, 49, 67–80. [Google Scholar] [CrossRef]

- Khan, M.A.; Ilyas, R.M.A.; Hashmi, S.H. Cointegration between Institutional Quality and Stock Market Development. NUML Int. J. Bus. Manag. 2018, 13, 90–103. [Google Scholar]

- Haug, A.A. Temporal Aggregation and the Power of Cointegration Tests: A Monte Carlo Study. Oxf. Bull. Econ. Stat. 2002, 64, 399–412. [Google Scholar] [CrossRef]

- Ahmad, M.; Majeed, A.; Khan, M.A.; Sohaib, M.; Shehzad, K. Digital financial inclusion and economic growth: Provincial data analysis of China. China Econ. J. 2021, 1–20. [Google Scholar] [CrossRef]

- Virglerova, Z.; Khan, M.A.; Martinkute-Kauliene, R.; Kovács, S. The internationalization of SMEs in Central Europe and its impact on their methods of risk management. Amfiteatru Econ. 2020, 792–807. [Google Scholar]

| ADF Test | DF-GLS Test | |||

|---|---|---|---|---|

| Variables | I(0) | I(1) | I(0) | I(1) |

| LNGNF | −1.987 | −5.360 *** | −1.542 | −5.49 *** |

| LNTNF | −5.577 *** | −6.381 *** | −5.801 *** | −6.638 *** |

| LNCNF | −2.075 | −5.377 *** | −1.969 | −5.488 *** |

| LNENF | −4.724 *** | −6.102 *** | −4.868 *** | −6.387 *** |

| LNFNF | −1.838 | −4.927 *** | −1.392 | −5.128 *** |

| LNINQ | −1.279 | −4.397 *** | −1.398 | −4.591 *** |

| LNES | −2.852 | −3.362 ** | −2.977 * | −3.542 *** |

| LNOFDI | −5.686 *** | −5.344 *** | −5.892 *** | −5.351 *** |

| LNED | −1.483 | −3.753 ** | −1.581 | −3.935 *** |

| LNTO | −2.554 | −3.224 ** | −2.702 | −3.368 *** |

| LNDI | −2.402 | −6.345 *** | −2.538 | −6.157 *** |

| Variable | Obs | Mean | Std.Dev. | Min | Max |

|---|---|---|---|---|---|

| LNED | 30 | 1.208 | 0.086 | 1.075 | 1.32 |

| LNES | 30 | 4.34 | 0.075 | 4.14 | 4.449 |

| LNGNF | 30 | 1.279 | 0.133 | 0.954 | 1.475 |

| LNINQ | 30 | 3.261 | 0.089 | 3.06 | 3.376 |

| LNTO | 30 | −10.092 | 0.22 | −10.366 | −9.657 |

| LNOFDI | 30 | 9.475 | 1.891 | 6.721 | 12.187 |

| LNDI | 30 | −0.461 | 0.135 | −0.695 | −0.273 |

| Export Sophistication | Export Diversification | ||||

|---|---|---|---|---|---|

| Variables | F-Stat | K | Variables | F-Stat | K |

| ES/GNF | 9.13 *** | 1 | ES/GNF | 3.12 | 1 |

| ES/GNF/FNF | 12.76 *** | 2 | ES/GNF/FNF | 5.76 * | 2 |

| ES/GNF/FNF/CNF | 7.14 *** | 3 | ES/GNF/FNF/CNF | 8.43 *** | 3 |

| ES/GNF/FNF/CNF/ENF | 5.65 *** | 4 | ES/GNF/FNF/CNF/ENF | 6.54 *** | 4 |

| ES/GNF/FNF/CNF/ENF/TNF | 6.76 *** | 5 | ES/GNF/FNF/CNF/ENF/TNF | 5.54 *** | 5 |

| ES/GNF/FNF/CNF/ENF/TNF/INQ | 7.87 *** | 6 | ES/GNF/FNF/CNF/ENF/TNF/QI | 7.18 *** | 6 |

| ES/GNF/FNF/CNF/ENF/TNF/QI/TO | 5.91 *** | 7 | ES/GNF/FNF/CNF/ENF/TNF/QI/TO | 6.32 *** | 7 |

| ES/GNF/FNF/CNF/ENF/TNF/INQ/TO/OFDI | 6.37 *** | 8 | ES/GNF/FNF/CNF/ENF/TNF/INQ/TO/OFDI | 7.19 *** | 8 |

| Econometric Problem | Test | F-Stat | p-Value | Null Hypothesis Accepted/Rejected | Equation No. |

|---|---|---|---|---|---|

| Serial Correlation | Breusch-Godfrey-LM | 0.586 | 0.568 | accepted | Equation (5) |

| Heteroscedasticity | Breusch-Pagan-Godfrey | 0.391 | 0.712 | Accepted | |

| Specification | Ramsey RESET | 3.64 | 0.13 | Accepted | |

| Normality | Jarque-Bera | 4.57 | 0.14 | Accepted | |

| Serial Correlation | Breusch-Godfrey LM | 1.14 | 0.16 | Accepted | Equation (6) |

| Heteroscedasticity | Breusch-Pagan-Godfrey | 3.06 | 0.12 | Accepted | |

| Specification | Ramsey RESET | 0.05 | 0.86 | Accepted | |

| Normality | Jarque-Bera | 0.528 | 0.96 | accepted |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| lned | lned | lned | lned | lned | |

| L1_LNED | −0.825 *** | −0.777 *** | −0.515 ** | −0.679 *** | −0.555 ** |

| (0.194) | (0.265) | (0.220) | (0.173) | (0.206) | |

| D_LNGNF | −0.303 | ||||

| (0.331) | |||||

| L1_LNGNF | 1.042 ** | ||||

| (0.442) | |||||

| D_LNTNF | 0.074 | ||||

| (0.309) | |||||

| L1_LNTNF | 0.268 | ||||

| (0.391) | |||||

| D_LNCNF | 0.092 | ||||

| (0.455) | |||||

| L1_LNCNF | 0.371 | ||||

| (0.511) | |||||

| D_LNENF | 1.139 ** | ||||

| (0.417) | |||||

| L1_LNENF | 0.757 | ||||

| (0.476) | |||||

| D_LNFNF | 0.032 | ||||

| (0.077) | |||||

| L1_LNFNF | 0.033 | ||||

| (0.117) | |||||

| D_LNINQ | 0.053 | −0.018 | −0.105 | −0.130 | −0.121 |

| (0.132) | (0.147) | (0.137) | (0.118) | (0.140) | |

| D_LNTO | 0.083 | 0.027 | 0.079 | 0.049 | 0.057 |

| (0.078) | (0.089) | (0.094) | (0.075) | (0.091) | |

| D_LNOFDI | 0.003 | 0.001 | −0.004 | −0.018 | −0.007 |

| (0.014) | (0.017) | (0.017) | (0.015) | (0.016) | |

| D_LNDI | 6.194 * | 6.976 * | 7.181 * | 5.277 | 6.970 * |

| (3.161) | (3.617) | (3.742) | (3.208) | (3.764) | |

| L1_LNINQ | −0.035 | −0.120 | −0.219 | −0.258 * | −0.212 |

| (0.129) | (0.141) | (0.140) | (0.123) | (0.143) | |

| L1_LNTO | −0.087 | −0.006 | −0.002 | 0.036 | 0.021 |

| (0.065) | (0.058) | (0.062) | (0.052) | (0.066) | |

| L1_LNOFDI | 0.001 | 0.010 | 0.000 | −0.023 | 0.004 |

| (0.015) | (0.016) | (0.019) | (0.019) | (0.016) | |

| L1_LNDI | 1.616 *** | 0.579 ** | 0.788 | 0.632 *** | 0.366 |

| (0.526) | (0.229) | (0.582) | (0.186) | (0.306) | |

| _cons | 2.227 ** | 1.714 | 1.950 | 1.656 * | 1.561 |

| (0.909) | (1.095) | (1.182) | (0.844) | (1.018) | |

| Obs. | 29 | 29 | 29 | 29 | 29 |

| R-squared | 0.725 | 0.649 | 0.619 | 0.724 | 0.606 |

| ECT(−1) | −0.49 * | −0.53 ** | −0.51 ** | −0.56 ** | −0.47 * |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| lnes | lnes | lnes | lnes | lnes | |

| L1_LNES | −0.599 *** | −0.500 *** | −0.753 ** | −0.446 *** | −0.448 ** |

| (0.189) | (0.143) | (0.271) | (0.128) | (0.181) | |

| D_LNGNF | −0.413 * | ||||

| (0.215) | |||||

| L1_LNGNF | 0.238 | ||||

| (0.273) | |||||

| D_LNTNF | 0.225 * | ||||

| (0.123) | |||||

| L1_LNTNF | 0.021 | ||||

| (0.130) | |||||

| D_LNCNF | 0.654 *** | ||||

| (0.225) | |||||

| L1_LNCNF | −0.628 | ||||

| (0.366) | |||||

| D_LNENF | 0.714 *** | ||||

| (0.176) | |||||

| L1_LNENF | 0.332 | ||||

| (0.207) | |||||

| D_LNFNF | 0.023 | ||||

| (0.039) | |||||

| L1_LNFNF | −0.029 | ||||

| (0.062) | |||||

| D_LNINQ | 0.089 | 0.054 | 0.132 * | 0.120 ** | 0.130 * |

| (0.073) | (0.063) | (0.064) | (0.053) | (0.075) | |

| D_LNTO | −0.033 | 0.011 | −0.014 | 0.026 | 0.018 |

| (0.043) | (0.036) | (0.039) | (0.033) | (0.046) | |

| D_LNOFDI | 0.009 | 0.012 * | 0.011 * | 0.021 *** | 0.013 * |

| (0.007) | (0.006) | (0.007) | (0.006) | (0.008) | |

| D_LNDI | 0.836 | 1.062 | 1.933 | 2.609 * | 1.518 |

| (1.711) | (1.559) | (1.584) | (1.394) | (1.935) | |

| L1_LNINQ | 0.058 | −0.016 | 0.038 | 0.059 | 0.074 |

| (0.092) | (0.067) | (0.068) | (0.059) | (0.083) | |

| L1_LNTO | −0.052 | −0.017 | −0.053 * | −0.038 | −0.040 |

| (0.039) | (0.025) | (0.027) | (0.022) | (0.034) | |

| L1_LNOFDI | 0.008 | 0.014 ** | 0.005 | 0.029 *** | 0.014 * |

| (0.007) | (0.006) | (0.007) | (0.009) | (0.008) | |

| L1_LNDI | 0.397 | 0.029 | 0.936 * | −0.045 | 0.109 |

| (0.376) | (0.103) | (0.486) | (0.092) | (0.192) | |

| _cons | 2.294 ** | 1.896 *** | 3.609 ** | 1.390 ** | 1.242 |

| (0.880) | (0.638) | (1.519) | (0.548) | (0.759) | |

| Obs. | 29 | 29 | 29 | 29 | 29 |

| R-squared | 0.750 | 0.783 | 0.777 | 0.829 | 0.659 |

| ECT(−1) | −0.56 ** | −0.59 ** | −0.57 ** | −0.53 ** | −0.57 ** |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ur Rehman, F.; Ahmad, E.; Khan, M.A.; Popp, J.; Oláh, J. Does Trade Related Sectoral Infrastructure Make Chinese Exports More Sophisticated and Diversified? Sustainability 2021, 13, 5408. https://doi.org/10.3390/su13105408

Ur Rehman F, Ahmad E, Khan MA, Popp J, Oláh J. Does Trade Related Sectoral Infrastructure Make Chinese Exports More Sophisticated and Diversified? Sustainability. 2021; 13(10):5408. https://doi.org/10.3390/su13105408

Chicago/Turabian StyleUr Rehman, Faheem, Ejaz Ahmad, Muhammad Asif Khan, József Popp, and Judit Oláh. 2021. "Does Trade Related Sectoral Infrastructure Make Chinese Exports More Sophisticated and Diversified?" Sustainability 13, no. 10: 5408. https://doi.org/10.3390/su13105408

APA StyleUr Rehman, F., Ahmad, E., Khan, M. A., Popp, J., & Oláh, J. (2021). Does Trade Related Sectoral Infrastructure Make Chinese Exports More Sophisticated and Diversified? Sustainability, 13(10), 5408. https://doi.org/10.3390/su13105408