Abstract

This paper attempts to develop the concept of sustainable management of enterprise capital presented, e.g., in Economies at the beginning of the year 2020. After an introduction and presentation of the theoretical grounds for the construction of the model, the authors attempt at describing its characteristics in a few points, determining the relationship between the objectives of an enterprise and the capitals that constitute the elements of that enterprise. The main assumption in the model is that the management of an enterprise is a constant process of striving to achieve a goal or goals, and balancing the level of the capitals within the enterprise. The point of balance between six capitals of an enterprise entails, at the same time, the maximum effectiveness of this enterprise. The more effective an enterprise, the quicker the managers will reach the point of balance between the capitals, and the longer the managers will maintain the values of the capitals near the balance point. As a measure of effectiveness, the authors propose a coefficient of a mean percentage-rated difference between the capitals, which reflects the mean non-adjustment of the capitals, and the weighed capital differences coefficient, which reflects the effectiveness of an enterprise as a whole. In the second part, the authors prove that, simultaneously, both management based on the presented model, which is based on the effectiveness of achieving objectives, as well as the effectiveness of the capitals of the enterprise, with the use of the new economic ratios as indicated, may be an alternative to globally prevalent revenue as an economic measurement.

1. Introduction

What constitutes the ultimate objective of an enterprise and of the managers of an enterprise remains a disputable issue in literary works. The problem has been much debated, among both economists and researchers of economy and management for more than a hundred years, up to modern times [1,2,3]. In economic practice, for some, the objective would be to increase sales, to increase the share on the market, or to increase the market value of the assets. For others, the objective would be to provide work for the owner and his/her family or simply, striving to survive on the market.

In the neo-classical model of a private company, it was assumed that, in both the short and long term, the objective of an enterprise is to maximize revenue. The neo-classical theory assumes that a person, when making decisions concerning economic issues, will always be guided by maximizing utility, which is why every entrepreneur aims to maximize profits. The neo-classical model of an enterprise, with its assumption of maximizing profit in the short and long term, was dominant in economy until the second half of the 20th century. However, despite there being many advantages of revenue, its disadvantages as a measurement have been common. Within recent years, opinions questioning the maximization of profit as the objective of the functioning of modern corporations have become particularly noticeable [4,5,6]. Currently, researchers dealing with the issue highlight the fact that, although profit, the increase in the value of assets, or the share of sales in the market cannot be the only goal of an enterprise, the principle of maximizing profit or the value of a share in the market as goals of the enterprises is still of big importance. The problem is well-characterized by the conclusions from studies carried out in Great Britain. The authors of these studies claimed that managers act “as if” they were perfectly informed agents of neoclassical economic theory, who aim for profit maximization as their overriding business objective, even though—in real life or ex post—their objectives may not necessarily turn this ambition into reality [7].

Of much importance in searching for the objectives of enterprises were the attempts to explain the functioning of an enterprise, which is not managed by owners directly. The considerations over the meaning of the split between the ownership function and the management function in modern corporations began in 1932 by A.A. Berle and G.C. Means. The authors pointed out the fact that, as a result of disconnecting the function of ownership of an enterprise from the function of managing the enterprise, there is the problem of a conflict of interest between owners and the managers [8]. This led to the development of managerial theories of an enterprise in the 1950s and 1960s. Taking the assumption of the division between the management function and the ownership function leads to a conclusion, common for all managerial concepts of a firm, that the managers maximize their own and variously defined function of the goal; they do this, however, simultaneously meeting the requirement of the minimal level of profit acceptable by the owners. The authors of these concepts assume that, in modern enterprises, there is a conflict of economic interests between managers and the owners of corporate capital. In that regard, the following three concepts are widely known.

The theory of growth as the main goal for the enterprise, and the model of maximizing the growth rate proposed by E.T. Penrose and R. Marris [9,10,11,12,13,14]. It has been indicated the there are two limitations in that respect. The first limitation is the available human resources and the second is the managers’ willingness to ensure the biggest possible financial safety with regard to employment. Penrose points out the fact that the quick rate of an enterprise’s development may be the reason for the lowered effectiveness of enterprise management and, therefore, it is a factor that limits the company’s growth rate, while Koutsoyiannis points to the fact that the revenues of a company maximizing the growth rate are lower than those of an enterprise optimizing revenues, which is, e.g., because of the fact that, in the former case, the selected production factors are more highly remunerated by the company than indicated by their end productivity rate [15] (s. 367–368).

The model of maximizing sales revenue by W.J. Baumol [16,17,18]. Bigger sales gives managers higher satisfaction and prestige from managing an enterprise with a significant share on the market. The salary of the higher-ranked managers and other non-cash benefits (cars, medical care, out-of-pocket expenses) are often dependent on the level of increase in sales. The model is an alternative to the growth rate, but, similarly to the previous model, and to the next model indicated in this study, maximizing sales requires, at the same time, the realization of a minimum level of profit acceptable by the company owners [19].

The mechanisms of making discretionary management decisions in corporations—model by O.E. Williamson [20,21,22]. Williamson assumed that the highest-ranked managers within the enterprises maximize, to the greatest extent, their own utility function and, to a lesser extent, the utility function of the owners of these enterprises. The managers’ utility function involves, among other things, the following: high salary, prestige related to controlling a number of personnel, sense of security of employment, high level of discretionary authority, and social reception of the importance of the work they do. What gives satisfaction to managers are also luxury company cars, new and luxurious offices, different categories of representation expenses, and discretionary investment expenses. However, as indicated above, this function of a goal is achieved with a limitation concerning the minimal required level of profit, which is perceived by the managers themselves as a personal achievement, and as an indicator of managers’ success in running the enterprise [20,23].

In particular, much attention was drawn to the objectives of an enterprise by the representatives of the behavioral theory. Behavioral theories started to develop as early as in the 1950s, although, even in the 1920s and 1930s, there were certain publications criticizing the neo-classic theory of the functioning of enterprises. In 1955, there was an article published by H.A. Simon on reasonable choice [24]. Simon has made a great contribution to the change in the understanding of the concept of the reasonableness of human behavior, and to a transformation for the concept of a man having unlimited calculation capacities, encompassing all available variants to choose from, and maximizing all utility for the idea of the decision-making process to make “sufficiently good” decisions on the basis of imperfect rules. In the case of enterprises, Simon postulated taking an assumption that they aim at reaching solutions that are satisfactory, and not “maximizing”—in other words, sufficiently good, but not the best. The theory of reasonable choice was developed by Simon himself [25,26,27] and by other behaviorists, i.e., R.M. Cyert and J.G. March [28], although it seems that Simon’s theory, as well as his papers, had been widely noticed only in 1978, after he was awarded the Nobel Prize. In behavioral theories, there have also been new concepts with regard to the objectives of enterprises. The behaviorists focused primarily on the circumstances determining the formation of goals. They noticed that managers in an organization have different ranges of goals, depending on the scope of his/her duties and their rank in the corporate hierarchy. Objectives set by a production director, with regard to supplies would differ from those set by a financial director. On the other hand, the employees pay much more attention to the amount of their salaries, and the clients to the prices and quality of purchased goods. The differences in the range of goals were noticeable in history as well, when the owner was separated from corporate capital. Professional managers may, therefore, have other goals than the owner. However, there should finally be a reconciliation of those goals via certain reconciliation tools. These may involve the following: tender, coalitions, and manipulating information. The researchers also point to the “set of goals”, which is the effect of a compromise between different groups of beneficiaries within the company [29,30,31,32,33,34,35].

Currently, a stronger conflict with regard to corporate goals is concentrated on the share in commercial goals, which are dominant in practice, and social goals [36]. The conflict has been present almost as far as we can remember, although it has intensified within the last dozen years. The neo-classical theory assumes that a person, when making decisions concerning economic issues, will always be guided by maximizing utility, which is why every entrepreneur aims to maximize profits. The problem of the adequate proportion between commercial goals and the public benefit goals occurs when the enterprises are publicly owned (e.g., municipal companies).

2. Sources and Methods

The problems in determining the goals as indicated above were the reason the researchers started their studies, in particular those oriented towards a search of an alternative way of measuring the effects of the company’s activity (other than the profit), in connection with the goals of the enterprise. This was the primary objective of the studies, and one of the stages of these studies was developing the model for sustainable management of enterprise capitals, as presented in the paper above.

Before the model of management was developed, in the first stage, the authors created a methodology of measuring social capital and, in 2018, they made successful attempts to measure the least measurable capital in four medium-sized enterprises within the food, beauty, construction material, and water supply industries. This seemed necessary as sustainable management of capitals requires knowledge about the value of all capitals within the enterprise. Although there were no problems in measuring other capitals, measuring, in financial terms, the social capital was a significant methodological challenge. The methodology of measurement and the study results with regard to one of the studied enterprises were described in 2018. As the results applied to an enterprise operating within the food industry, they were published in Economic Sciences for Agribusiness and Rural Economy [37].

In the second stage, in 2019, initial assumptions were made for the concept of sustainable management of capitals in enterprises and, just like in the previous example, there were studies whose aim was to verify whether the concept could be applied in practice. As for the measurement of social capital, the methodology and the results of the studies in one of the enterprises being the subject of study were described in 2019 and published at the beginning of 2020 in Economies [38].

The result of the third stage was the development of a model of sustainable development, whose basic assumptions have been included in this publication. Apart from empirical experience from stages one and two, the model was based, above all, on an analysis of the achievements of several sciences and scientific theories, e.g., intellectual capital, human resources, and social capital. The studies allowed for determining and describing six capitals within the proposed model of sustainable management of capitals. However, of most importance for the development of the model were two theories: the theory of organizational balance and the theory of resources.

The theory of balance is nowadays applied mostly in the analysis of aggregate macro-economic models; it also lays a solid foundation for introducing key microeconomic theories. The idea of general balance was understood by earlier economists, such as Smith or Ricardo, but the grounds for the modern understanding of the balance were laid by, e.g., A. Marshall [39] and, above all, by Walras, L. who, at the turn of the 19th and 20th century, formulated a formal model of general balance, where, above all, he demonstrated the necessary requirements for the occurrence of balance. In 1954, there was a groundbreaking—or so it seems—paper by K. Arrow and G. Debreu. The model presented by them is one of the most general models of competitive economy, and constitutes a key part of the theory of general balance, as it may be used in order to prove the existence of general balance (or Walras balance) in an economy. In the theory of balance, apart from the very fact of there being a possibility of balance in economic systems such as an enterprise, it is important that (according to Arrow and Debreu) there may be numerous points of balance [40].

Resources as a source of the development of an enterprise have been noted in economic sciences since the second half of the last century. The works of E. Penrose in that period outlined, e.g., the general theory of the development of an enterprise, and entrepreneurship based on the individual capacity of an enterprise based on the balance between internal processes, the core of the diversification of the resources within an enterprise, and the potential of growth through mergers and acquisitions. The author listed, e.g., the factors having an impact on slowing the speed of the growth of an enterprise. She connected these factors with the possibilities of managing an enterprise [9,10,12]. The most important thing in the theory of resources for the proposed model is the fact that an enterprise has been considered as a set of resources and human competences distinguishing that enterprise from competing companies, which is a source of advantage over the competitors. The theory of resources states that the enterprises are formed when we see a chance for winning a competitive advantage on the market as a result of combining tangible resources and human resources. Within this theory, the developed resources and competences contribute to the occurrence of next, better resources and more competences. Barney, J., analyzing the relationship between the resources of an enterprise and stable competitive advantage, indicated four empirical indicators of the potential of the resources within an enterprise to generate a stable competitive advantage—value, rareness, imitability, and substitutability [41]. B. Wernerfelt explores the usefulness of analyzing firms from the resource side rather than from the product side, and considers processes with which a company is able to achieve resources. He claimed that its current stock of resources create asymmetries in competition for new resources [42,43] (considers the processes through which a firm can acquire resources and argues that its current stock of resources create asymmetries in competition for new resources).

It is to be pointed out that the search for an alternative for profit is nothing new; it has lasted for several dozen years [44,45,46,47]. In the second half of the last century, despite the fact that topics such as intellectual and human capital or corporate social responsibility had already emerged in social and scientific discussion, they went in the same direction as profit, i.e., maximizing or possibly optimizing it. A little later, as measures of the company’s achievements, alternative to the traditional accounting profit, there were also attempts to popularize the so-called economic value added (EVA), where the basis is the rate of return on investment (ROI) and the subject of measurement is the corrected enterprise value and a measure in the form of free cash flows (FCF), in which the basis is pure cash flow, and the subject of measurement—the value of the enterprise [48]. These methods have been criticized as well [49]. The critics stated, for example, that the technique of economic added value has advantages in comparison with traditional measurements of the accounting results, but it does not ensure a universal cure [5].

The basic difference adopted by the authors of this paper with regard to the attempts made so far is the willingness to include commercial and social goals in a single model, and to connect effectiveness in realizing goals with the effectiveness in using resources, which must be increasingly respected on our planet. The sustainable management of the capitals of an enterprise is a new concept in economic sciences, assuming the managers’ aim is not to achieve profit, but instead, to achieve balance between all capitals within the enterprise in order to achieve and maintain a point of balance between those capitals. Sustainable management, associated in common knowledge with considering the need to protect the environment, is an economic concept taking into account various resources forming an enterprise, including, of course, those related to the natural environment. According to these principles, the purpose of management is to reach the highest possible level of effectiveness, understood as the maximum effect, from certain resources. In practice, the goal is to reach a capital balance between the six capitals within an enterprise: tangibles, structural capital, financial capital, market capital, human resources, and social capital. The balance between the capitals of an enterprise means, at the same time, the maximum effectiveness of the company, although, because the level of individual capitals is subject to constant change, the balance—a certain point reached—is temporary. For this reason, sustainable capital management is an ongoing process. At the same time, it has been highlighted that, apart from effectiveness, there is another important factor—efficiency in achieving goals.

In the fourth stage, we shall study the relationships between the capitals and the balance between capitals, i.e., the mutual interaction of capitals with one another within the process of balance forming, and the impact of individual capitals on the effectiveness of a company (understood as reaching the point of balance between the capitals). Computer software will also be developed for the purposes of sustainable management of capitals within an enterprise.

3. Results—Model for Sustainable Management of Capitals Based on the Efficiency and Effectiveness of Capitals

The basic principles of the model for sustainable management of capitals may be listed in about a dozen points:

- The basic task for an enterprise is to realize strategic and operational goals with the highest possible effectiveness, understood as striving to achieve a point of balance. In other words, an enterprise realizes a goal or goals, and thus should be effective and, at the same time, strive to achieve balance between the capitals, i.e., strive to be as effective as possible. The two ideas—efficiency (in realizing goals) and effectiveness (balance between the capitals)—are the basic principles that shall guide every manager. These principles, realized simultaneously, lead to success and happiness and prove the development of the enterprise. In practice, this means that the actions undertaken by the managers and the economic condition of the enterprise will be assessed based on efficiency (in realizing goal(s)) and effectiveness (the level of balance between the capitals within the enterprise).

- The management of an enterprise is an ongoing process of striving to realize a goal or goals and balancing the level of the capitals within the enterprise. The managers must realize that the efficiency in reaching goals and effectiveness (balance between capitals) often contradict one another. The more efficient the enterprise, the greater the extent to which we succeed in reaching the planned goal or goals. The more effective an enterprise, the quicker the managers will reach the point of balance between the capitals, and the longer the managers will maintain the values of capitals near the balance point. The balance between the company’s capitals should in no case be equated with equal monetary value; balance usually occurs between the capital of different monetary value.

- The monetary values of capitals are subject to constant change. Hence, in practice, management consists of increasing or decreasing the level of a given capital by adjusting its level to the level of other capital, or by adjusting the level of other capital to changes that occurred in one of them. There may also be a situation when the increase in capital(s) does not make it necessary to react with other capital(s), as their level was already higher before. The balance point between the company’s capitals is, at the same time, the maximum efficiency of the company, but because the level of individual capitals is constantly changing, the balance point reached is temporary. For this reason, sustainable capital management is an ongoing process.

- Capitals of an enterprise interact with each other regardless of any actions taken by managers. An increase or a decrease in one capital causes an increase or a decrease of the other capitals, but this is not a general rule. One can imagine a reverse situation, where an increase or a decrease in the level of one capital causes an increase or a decrease in another capital or capitals. The number of capitals and qualifying individual components to it is a matter for the managers. It is important that the number and allocation of components to individual capitals be maintained in the long run, because of the possibility and purposefulness of comparing effects over time. Of much importance in that respect are well-functioning computer programs, leaving the managers, however, with a certain level of flexibility, subject to the requirement indicated in the sentence above, concerning the stability within a certain period of time.

- Lack of balance between capitals is constant. The reasons that cause the lack of balance between capitals may be very different. It would be difficult to classify them into one of the following groups:

- -

- lack of balance resulting from the realization of the goals of an enterprise;

- -

- lack of balance as a result of changes in the environment (change in laws, activity of the competing companies, change in customer preferences, new technologies, change of the percentage rate, etc.);

- -

- lack of balance resulting from the changes within an enterprise.

- We can calculate the progress of reaching the equilibrium point in many ways. It can be expressed, e.g., by the quotient of the sum of differences between the current values of individual capitals and the optimal values of those capitals, ensuring the equilibrium of capitals by the number of capitals included in the calculations. For management purposes, of much importance would be the ratios of the mean percentage difference between capitals and weighted capital differences.

The ratio of the average percentage difference in capital may be expressed through the following formula:

Source: [38].

This ratio informs us about average capital mismatch; it is very sensitive to large deviations of even one of the capitals. If it is close to 1, it means that the capitals are close to the optimal level. If it is close to 0, it means that the level of capital is significantly different from the optimal (expected) value. It should be remembered that average maladjustment means that not all, but only some of the capitals may deviate from the optimal level.

- 1.

- The weighted capital difference ratio has only a slightly more complicated structure:Source: [38].

The value of this coefficient informs us about the effectiveness of an enterprise as a whole. The differences in each of the constituent capitals are measured by the share of the capital in the total value of the enterprise. If it is close to 0, it means that the most significant capitals for a given entity (i.e., those that currently had the highest values) are at a very poor level. If it is close to 1, it means that changes to target values should be insignificant.

- 2.

- Only these two factors together inform us about the condition of the enterprise because, while the second one is good for characterizing its overall efficiency, the first one detects large errors on individual capitals, even those with the lowest value at the moment. Such measurements can even be made every day, however, such a high frequency is not needed for the day-to-day management of the enterprise. It can be expected that, in practice, the measurements would be carried out on a monthly, quarterly, and annual basis. Throughout the study, it was possible to develop a mathematical approach towards the discussed concept in the form of two coefficients: the average percentage difference of capitals and weighted capital differences.

- 3.

- The definition of an enterprise is extended. In sustainable management, an enterprise is defined as a set of capitals designated for the efficient realization of goal(s) in striving to achieve effectiveness, or—in broader terms—an enterprise is defined as a set of capitals: tangibles, financial capital, structural capital, market capital, human capital, and social capital, designated for the efficient realization of goal(s) in striving to achieve effectiveness.

- 4.

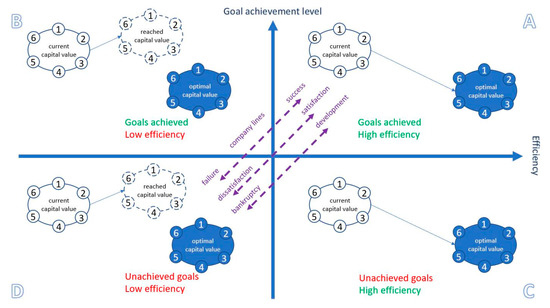

- Graphically, in a simplified way, we may present the process of enterprise management as moving along two lines indicating the level of the realization of goal(s) and reaching the point of balance (accumulation of capitals) between capitals within an ABCD matrix (Figure 1).

Figure 1. Goals and effects matrix.

Figure 1. Goals and effects matrix. - 5.

- The best effects in management are achieved when the enterprise is in box A, when it realizes a goal (e), with the largest possible concentration of capitals (tangibles, structural capital, financial capital, market capital, human resources, and social capital). Such a situation ensures success and happiness.

- 6.

- Box B presents a situation where the enterprise realizes goals, but its effectiveness is at a low level of balance between capitals. Not adjusting the level of the capitals may involve not using them (waste) and incurring unnecessary costs. We should point out the fact that, although the failure to use or improper use of tangibles and structural capital is clearly noticeable, the failure to use or improper use of market and financial capitals is noticeable as well, but in practice, we usually pay less attention to it, while the worst situation occurs in the cases of human and social capital. These are the so-called hidden capitals, and they are rarely measured; usually, managers get partial or incidental information in that respect.

- 7.

- Box C seems a little worse (although this depends on the strategy and the priorities of the owners) than box B, because, although the enterprise remains effective (is able to balance capitals), it does not realize goals. This hinders the development of the enterprise, not to mention the legal, financial, or personnel consequences related to the failure in realizing goal(s).

- 8.

- The worst situation occurs in box D. This means both the failure to realize goal(s) and low effectiveness of capitals. In consequence, this means not only a failure, but it may be the reason of a crisis, or even a bankruptcy. Surely enough, if an enterprise lands in that situation, it is a sign that it is in need of radical changes.

- 9.

- The lines in the model only show direction, and have a symbolic character. In reality, every enterprise moves along the line from development to bankruptcy, but the line is often a curve, and it loops often. Anyway, in reality, an enterprise does not tend to move from point A to D, or vice versa. We can say that the realization of goals very often spoils the balance between capitals, thus an enterprise is first located in box B (e.g., realizes an investment) and only later starts to care about the balance between the capitals, although it would be ideal if efficiency (realization of goals) could be combined with effectiveness (balance between the capitals).

- 10.

- Sustainable management is not only a balance between the capitals, but also between the capitals and the goals. To put it another way, at the stage of planning goals, it should be taken into account to what extent the realization of the goals will cause a lack of balance between capitals, whether it is possible, in what time frame, and with how much effort and resources should capitals be balanced, as the realization of the goals progresses.

- 11.

- Also of key importance for sustainable management of capitals was the development of principles for the measurement of individual capitals, not only of their level, but also of their financial value. The experience with measurements has indicated that the simplest methods are the most effective, even if as accurate as possible. In the future, it would be necessary to develop special IT software for the effective management of capitals, in particular for capital balancing.

4. Discussion

The proposed model of sustainable management of capitals within an enterprise falls within the trend of an academic search for options to substitute the old-fashioned net revenue measurement, not meeting modern requirements, within the management process [50]. At this point, let us try to indicate those critical aspects and, at the same time, consider whether the combination of efficiency in realizing goals and effectiveness as balance between capitals is the alternative. It seems that the key aspect for the functioning of the model of sustainable management of capitals is the following:

- In the management model presented above, there is a clear distinction between goals and effects. A goal should not involve an economic effect, it is only a result of realizing a goal. A goal may relate to, e.g., market, technology, ecology, or society. In the era of a pandemic, a goal may be, e.g., to ensure the presence of the staff or the timely payment of liabilities. On the other hand, the economic condition of a company should be reflected by capital effectiveness, not related directly to the extent to which the goals are realized.

- Six capitals may be managed so that their optimal value may be shaped, thus striving at reaching the point of balance. For the first time, the managers would be able to see and compare the value of all capitals that contribute to the effects of the company’s activity. In particular, this involves unnoticed and under-appreciated human resources and social capital. Comparing their values and relationships with other capitals will help the managers realize their importance for the effects; it will also show how important it is to keep the balance between the capitals.

- Profit is not a measurement optimizing the use of resources (capitals) within an enterprise. The same level of revenues may be achieved in an enterprise in a number of ways [51]. Striving to achieve revenues at all costs may result in waste of resources, not only of natural resources, but also of human resources, for example. This is the biggest advantage of the described model in comparison with traditional management. One of the basic assumptions within the model is the optimization (mutual adjustment) of the level of six capitals, including human, social, and structural (organizational) capital, and the integration of efficiency in realizing goals with effectiveness. We thus avoid wasting capitals, irrespective of the way in which we would like to reach the point of balance. Problems, such as the social responsibility of a business, treated sometimes as an addition that should be present for goodwill reasons, is becoming an integral part of management.

- Revenues may quite easily be used instrumentally. An example of instrumental use of profit can be an international company within the holding structure, which can easily bring profits to a country with lower taxes, e.g., by maximizing the remuneration of suppliers from another holding company located abroad. On the other hand, municipal enterprises having the characteristics of public utility, in particular when they are owned by the municipalities (in the countries of continental Europe), must shape the profit in such a way that it should not be too big, as managers will be accused of fixing an excessively high level of prices of their services for the dwellers. The revenues cannot be too low either, as this may indicate bad management. Many researchers, in order to name similar phenomena, use the term revenue manipulation [52]. Can you manipulate the extent of realizing a goal or can you manipulate the balance between capitals? The answer is probably yes, which may result, e.g., from the imperfection of capital pricing, but it cannot be used instrumentally for lowering taxes (as this is not why we calculate taxes), and for transferring the profits.

- We do not really know the answer to a question—is the profit gained by the enterprise as a result of the work of the management board and of the employees or of other internal or external circumstances? It may happen that the management board and the employees do a good job, but, because of various circumstances, the enterprise will gain no revenues. Reversely, there are enterprises where, at least within a short period of time, the management board would do nothing or would even make mistakes, and there will be profits. The revenues, as a category, may thus not be a basis for assessing the work of the management board, or at least, it may not be the only indicator. In the case of the model for the sustainable management of capitals, one can quite clearly separate the assessment of the condition of the enterprise, in particular the impact of external factors, beyond the manager’s control, from the assessment of the manager’s work as such.

- The revenues themselves, as a measurement used to assess the company’s condition, may be misleading and decrease awareness. Revenues are not always tantamount to the correct use of capitals, e.g., social capital or human resources. There might be a situation when there is a profit, but the company has no financial liquidity or is excessively indebted, and the repayment of debts exceeds the company’s financial capacity. That is why, in the practice of financial analysis, there is a need to verify at least several or approximately a dozen different indicators, and the calculations must be done many times within certain periods of time in order to get the answer to the question—is the situation getting better or worse? A problematic issue is comparing the profit of an enterprise with other enterprises in the industry—to a group of enterprises or even a single enterprise, potentially being a leader in its industry. Anyway, a large number of ratios are to be calculated at all times, and we should remember that, in practice, there is no such thing as an optimal level of a given indicator. In the proposed model, apart from the extent to which the goals are realized, there are only two more indicators, generally reflecting the company’s economic condition.

- Revenue in enterprises is calculated by the accountants and financial analysts. Their point of honor is often that the numbers are consistent with each other. However, this accuracy and attention to detail is needed for tax payments, but unnecessary for enterprise management. In financial prognosis in particular, because of an unlimited number of circumstances and significant changeability of the surrounding circumstances, the most important managerial decisions, although based on financial calculations, are taken based on the experience of the managers and even based on intuition. Of much importance is also the managers’ willingness to take risk.

The model presented herein has been, in part or in whole, a subject of pilot studies whose objective was to verify the possibility of its application. The conclusions are promising. What is important is that the current level of knowledge about capitals allows to measure not only their level in non-measurable units, but also in monetary values, and this applies in particular to social capital. It is important to have the possibility and skill in using quite simple pricing methods (cost-based methods). High flexibility of rules regarding the selection of the number and type of capitals, the period, and the methods of measuring the value of individual capitals allows for the adjustment of the modes to various enterprises. Above all, the proposed concept ensures balance between commercial goals and social goals within the enterprise. This is because social (external and internal) as well as market and structural capital must be adapted to the level of other capital. This eliminates the age-old dilemma of managers of public utilities—profit, or the best satisfaction of the needs of the population and entrepreneurs.

In order to efficiently manage the capitals to achieve the balance between the present value and optimal value, the capitals should be properly valued using appropriate methods. The basic principle is to use the simplest and most reliable methods of valuation. At this stage of the research, the authors used two basic methods of valuation. The essence of first method was to compare the structure of the six capitals of the examined enterprise with the capitals of another enterprise of a similar size and industry. This company should be recognized as a leader with good performance. The article published in the Economies journal from 2020 presents the examples of the results of such a capital valuation in one of the listed companies. The results of the valuation were used to find the equilibrium point between capitals. The equilibrium point indicated the best efficiency.

The problem is that it is not always possible to find such a company. We should remember that such a company should provide additional data beyond the standard financial information whose publication is required by law. This information relates, for example, to human or social capital. The authors encountered such a case in two out of four cases studied. One of them is presented below. It concerns a family-owned cosmetics company with approximately 200 employees. Because of the inability to compare the capital structure, the second method of capital valuation was used. It is based on the verification of the market value of individual capitals in order to find their optimal level. Nevertheless, in this case, some changes also had to be made compared with the commonly used valuation methods.

In the case of material capital, the basis for the valuation is the market value of the assets. As it was not about the sale of the property, the value of this capital was based on the usefulness-to-business ratio instead of the marketability ratio. The optimal amount of financial capital is financial liquidity and the lack of unused funds. The value of marketing capital was determined by financial outlays on promotion and advertising as well as the expansion of the commercial network in the last few years. As the company had a recognizable brand, it was valued separately using the license method—estimating license fees in relation to revenues. In the case of human capital, there are many methods of valuation, but the simplest-cost method of valuation was used to determine the optimal capital. It was calculated how much it would cost to replace employment. The most time-consuming and the most difficult was the valuation of social capital, because, in this case, two valuations had to be made. First of all, the current level of this capital had to be established.

It was assumed that the social capital of a company can be characterized by means of three dimensions: (1) A structural dimension (structural capital). This dimension describes social capital from the point of view of the organizational perspective of the company; a kind of an organizational structure favorable for cooperation of employees within units and between units, a kind of a communication system—employee access to information, necessary knowledge, and attitudes of managers towards activities facilitating cooperation. (2) A relational dimension (relation capital). This dimension describes the quality of contacts between employees and the kind of contacts, trust, reliability, as well as eagerness of employees to share knowledge and experience. (3) A cognitive dimension (cognitive capital). This dimension describes coherence between norms and values of employees and of the company, a common understanding of company problems, a usage of vocabulary comprehensive for everybody, and so on.

In order to measure social capital, a multi-dimensional psychometric tool was used—a survey questionnaire consisting of 40 questions, including attributes and indicators adopted in the model. Such a construction of the survey allowed for the creation of aggregated indexes of social capital. The psychometric tool is a deliberately constructed scale that analyses attitudes characterized by good psychometric parameters (accuracy and reliability). While creating the scale, the method of summing up evaluations, created by Likert, was used. This entailed the evaluation of all 40 statements according to a five-level scale, presenting different levels of acceptance and evaluation of a given statement, where 5—‘I completely agree’, 4—‘I partially agree’, 3—‘I have no opinion’, 2—‘I do not completely agree’, and 1—‘I completely disagree’. The definition of the value of social capital was the aim of the second stage of the research. The obtained result of 68.7% indicated a very high and high level of this capital. The value of 100% means, in this case, the social capital at its maximum level. It was assumed that 100% of the level of social capital is the optimal value, which is, in fact, probably impossible to achieve. The question of, what was the monetary value of this capital corresponding to the level of 68.7%, was then addressed. Two convictions were adopted here. The first one is that the value of the company is the sum of the value of five capitals: material, financial, structural (organizational) and market, human, and social. The second conviction is that the value of social capital is the difference between the value of the whole company and five capitals (material, financial, structural, market, and human). The second conviction was necessary because of existing ambiguity while defining capital. In this way, it is possible to avoid potential accusations that some element of social capital was not included in the evaluation. The evaluation of the value of the whole company using the DCF (discounted cash flow) method.

With such amounts of capital, the ratio of average percentage differences is 0.79, while the weighted capital difference ratio is 0.82 (Table 1 and Table 2).

Table 1.

The value of capitals as at 31 December 2019.

Table 2.

Calculation of differences in the capital structure in PLN.

The model of sustainable management may be of great economic importance not only for the management of an enterprise on a micro scale, but also in economics on a macro scale. In recent years, economic literature has published many studies indicating that certain solutions or phenomena may have a strong impact on the economy of the entire country [53,54].

However, there is no doubt that we need further research, both in order to improve on theoretical assumptions of the model and their empirical verification. All enterprises where the said pilot studies have been carried out were in good economic condition; therefore, there are no studies at this point that could allow for the assessment of the model in enterprises with a less stable economic condition. There is also a lack of wider knowledge about the mutual influence of capitals on each other. It is likely that this impact is conditioned by a number of different factors and it will not be possible to build a uniform and universal rule in this respect for all enterprises for the needs of management, except for general guiding principles. At this stage of the study, many problems with the model were of methodological as well as organizational character, starting with the correct classification of individual costs into correct capitals, and ending with the lack of software that could automatically classify the costs as falling within certain capitals. Problems may also originate from the need to apply the same capital valuation principles in individual years for the purpose of the comparability of results. Views and long-standing habits, as well as the reluctance to try new things, and changes among employees of enterprises and institutions, all affect the role of net profit as a universal measure.

Author Contributions

Conceptualization, methodology, visualization, and writing—original draft—D.K.; Formal analysis, methodology, and writing—original draft—E.J. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data sharing not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Hawley, F.B. Enterprise and Profit. Q. J. Econ. 1900, 15, 75–105. [Google Scholar] [CrossRef]

- Hawley, F.B. The Controversy about the Capital Concept. Q. J. Econ. 1908, 22, 467–475. [Google Scholar] [CrossRef]

- Beckerath, H. MacGregor’s Enterprise Purpose and Profit. Q. J. Econ. 1936, 50, 367–371. [Google Scholar] [CrossRef]

- Coates, J.B.; Davis, E.W.; Stacey, R.J. Performance measurement systems, incentive reward schemes and short—termism in multinational companies: A note. Manag. Account. Res. 1995, 6, 125–135. [Google Scholar] [CrossRef]

- Crowther, D.; Davies, M.; Cooper, S. Evaluating Corporate Performance: A Critique of Economic Value Added. J. Appl. Account. Res. 1998, 4, 3–34. [Google Scholar]

- Coram, B. Marx’s Theory of Profit: A critique. J. Politics 1983, 18, 100–103. [Google Scholar] [CrossRef]

- Crossman, K.; Lange, T. Business as Usual? Ambitions of Profit Maximization and the Theory of the Firm. J. Interdiscip. Econ. 2006, 17, 313–326. [Google Scholar] [CrossRef]

- Berle, A.A.; Means, G.C. The Modern Corporation and Private Property; MacMillan: New York, NY, USA, 1932. [Google Scholar]

- Penrose, E.T. Limits to the growth and size of firms. Am. Econ. Rev. 1955, 45, 531–543. [Google Scholar]

- Penrose, E.T. Foreign investment and the growth of the firm. Econ. J. 1956, 66, 220–235. [Google Scholar] [CrossRef]

- Penrose, E.T. The Theory of the Growth of the Firm; Basil Blackwell: Oxford, UK, 1959. [Google Scholar]

- Penrose, E.T. The growth of the firm: A case study: The Hercules Powder Company. Bus. Hist. Rev. 1960, 34, 1–23. [Google Scholar] [CrossRef]

- Marris, R. A Model of the “Managerial” Enterprise. Q. J. Econ. 1963, 77, 185–209. [Google Scholar] [CrossRef]

- Marris, R. The Economic Theory of Managerial Capitalism; MacMillan: London, UK, 1964. [Google Scholar]

- Koutsoyiannis, A. Modern Microeconomics; MacMillan: London, UK, 1979. [Google Scholar]

- Baumol, W.J. Business Behaviour, Value and Growth; MacMillan: New York, NY, USA, 1959. [Google Scholar]

- Sandmeyer, R.L. Baumol’s Sales-Maximization Model: Comment. Am. Econ. Rev. 1964, 54, 1073–1081. [Google Scholar]

- Haveman, R.; Bartolo, B. The Revenue Maximization Oligopoly Model: Comment. Am. Econ. Rev. 1968, 58, 1355–1358. [Google Scholar]

- Dobson, S.; Maddala, G.S.; Miller, E. Microeconomics; McGraw-Hill Book Company Europe: Berkshire, UK, 1995. [Google Scholar]

- Williamson, O.E. Managerial Discretion and Business Behaviour? Am. Econ. Rev. 1963, 53, 1032–1057. [Google Scholar]

- Williamson, O.E. The Economics of Discretionary Behaviour: Managerial Objectives of the Theory of the Firm; Englewood Cliffs, Prentice-Hall Inc.: New York, NY, USA, 1964. [Google Scholar]

- Williamson, O.E. Corporate Control and Business Behavior: An Inquiry into the Effects of Organization Form on Enterprise Behavior; Prentice Hall: New York, NY, USA, 1970. [Google Scholar]

- Jones, T. Business Economics and Managerial Decision Making; John Wiley and Sons: West Sussex, UK, 2004. [Google Scholar]

- Simon, H.A. A behavioural Model of Rational Choice. Q. J. Econ. 1955, 69, 99–118. [Google Scholar] [CrossRef]

- Simon, H. Models of Man, Social and Rational: Mathematical Essays on Rational Human Behavior in a Social Setting; Wiley: New York, NY, USA, 1957. [Google Scholar]

- Simon, H. Theories of Decision-Making in Economics and Behavioral Science. Am. Econ. Rev. 1959, 49, 253–283. [Google Scholar]

- Simon, H. Rational Decision Making in Business Organizations. Am. Econ. Rev. 1979, 69, 493–513. [Google Scholar]

- Cyert, R.M.; March, J.G. A Behavioural Theory of the Firm, Englewood Cliffs; Prentice-Hall: New York, NY, USA, 1963. [Google Scholar]

- Petit, T.A. A Behavioral Theory of Management. Acad. Manag. J. 1967, 10, 341–350. [Google Scholar]

- Machlup, F. Corporate Management, National Interest, and Behavioral Theory. J. Political Econ. 1967, 75, 772–774. [Google Scholar] [CrossRef]

- Katona, G. On the Function of Behavioral Theory and Behavioral Research in Economics. Am. Econ. Rev. 1968, 58, 146–149. [Google Scholar]

- Argote, L.; Greve, H.R. A Behavioral Theory of the Firm: 40 Years and Counting: Introduction and Impact. Organ. Sci. 2007, 3, 337–349. [Google Scholar] [CrossRef]

- Greve, H.R. A Behavioral Theory of Firm Growth: Sequential Attention to Size and Performance Goals. Acad. Manag. J. 2008, 51, 476–494. [Google Scholar] [CrossRef]

- Powell, T.C.; Lovallo, D.; Fox, C.R. Behavioral Strategy. Strateg. Manag. J. 2011, 32, 1369–1386. [Google Scholar] [CrossRef]

- Barreto, I. A Behavioral Theory of Market Expansion Based on the Opportunity Prospects Rule. Organ. Sci. 2012, 23, 1008–1023. [Google Scholar] [CrossRef]

- Besley, T.; Ghatak, M. Profit with Purpose? A Theory of Social Enterprise. Am. Econ. J. 2017, 9, 19–58. [Google Scholar] [CrossRef]

- Jędrych, E.; Klimek, D. Social Capital in the Company (Meat and Vegetable Processing Industry). Econ. Sci. Agribus. Rural. Econ. 2018, 2, 300–305. [Google Scholar]

- Klimek, D. Sustainable Enterprise Capital Management. Economies 2020, 8, 12. [Google Scholar] [CrossRef]

- Marshall, A. Economics of Industry; Macmillan & Co.: London, UK, 1892. [Google Scholar]

- Arrow, K.J.; Debreu, G. Existence of an equilibrium for a competitive economy. Econom. J. Econom. Soc. 1954, 22, 265–290. [Google Scholar] [CrossRef]

- Barney, J. Firm resources and sustained competitive advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Wernerfelt, B. A resource-based view of the firm. Strateg. Manag. J. 1984, 5, 171–180. [Google Scholar] [CrossRef]

- Wernerfelt, B. The use of resources in resource acquisition. J. Manag. 2011, 37, 1369–1373. [Google Scholar]

- Fisher, F.M.; McGowan, J.I. On the misuse of accounting rates of return to infer monopoly profits. Am. Econ. Rev. 1983, 73, 82–97. [Google Scholar]

- Eccles, R.G. The performance evaluation manifesto. Harv. Bus. Rev. 1991, 69, 131–137. [Google Scholar]

- Crowther, D. Dimensions of corporate performance: Towards a new evaluation paradigm. In Proceedings of the Second Research Colloquium; Henley: Henley-Nisbet; James Nisbet & Co. Ltd.: London, UK, 1995; pp. 57–69. [Google Scholar]

- Crowther, D. Corporate performance operates in three dimensions. Manag. Audit. J. 1996, 11, 4–13. [Google Scholar] [CrossRef]

- Šalaga, J.; Bartosova, V.; Kicova, E. Economic Value Added as a Measurement Tool of Financial Performance. Procedia Econ. Financ. 2015, 26, 484–489. [Google Scholar]

- Shalini, H.S.; Preethi, V.S. A Comparative Study of Financial Dialectics and Economic Value Added vs. Traditional Profit based Measures: A case study at BHEL-Electro Porcelains Division (EPD). J. Bus. Manag. 2012, 6, 37–55. [Google Scholar]

- Itang’ata, M.J. Discussion Paper an Assessment of the Criticisms of the Principle of Profit Maximization. J. Interdiscip. Econ. 2010, 23, 85–107. [Google Scholar]

- Keen, S.; Stanish, R.K. Profit Maximization, Industry Structure, and Competition: A critique of neoclassical theory. Physica A 2006, 370, 81–85. [Google Scholar] [CrossRef]

- Lambert, C.; Sponem, S. Corporate governance and profit manipulation: A French field study. Crit. Perspect. Account. 2005, 16, 717–748. [Google Scholar] [CrossRef]

- Evgenidis, A.; Tsagkanos, A. Asymmetric effects on the international transmission of US financial stress. A Threshold VAR approach. Int. Rev. Financ. Anal. 2017, 51, 69–81. [Google Scholar] [CrossRef]

- Tsagkanos, A.; Siriopoulos, C.; Vartholomatou, K. FDI and Stock Market Development: Evidence from a ‘new’ emerging market. J. Econ. Stud. 2019, 46, 55–70. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).