1. Introduction

Urban infrastructure construction projects (UICPs) have been widely recognized as a crucial driver of economic development [

1,

2]. However, lack of budget and lack of access to novel technologies has led many governments in developing countries to invite the private sector to participate in the financing of infrastructural projects, previously monopolized by the government [

3]. Indeed, accelerating the economic growth process of developing countries requires the reduction of the level of government participation in non-governmental activities, which can be defined under the topic of “privatization” [

4,

5,

6]. A means often used to attract private entities to sustain public projects, without losing government control, is the public–private partnership (PPP) [

7]: a long-term contract between public and private organizations with the goal of financing, designing, implementing, and commissioning infrastructure and service projects [

8]. PPPs allow a public body to retain governance duties and legal responsibilities while also accepting and minimizing part of the risk of the project—done in order to attract the participation of the private sector in the development of infrastructures.

From what has been reported, there is need and interest in discovering and analyzing the success factors and drivers of failure for PPPs in urban infrastructure construction projects (UICPs) in developing countries, as witnessed by the vast amount of literature produced [

9,

10,

11,

12]. However, despite these numerous studies investigating these elements [

13,

14] in developing countries [

15,

16], none has identified and ranked—in a comprehensive manner— the barriers and risks of PPPs undertaking UICPs in developing countries, especially in the Middle East. Taking interest in the Middle East specifically is necessary due to its increasing role in worldwide economics, as well as for its peculiarities that differentiate it from the rest of the world [

17]. Indeed, private sector investment in the Middle East has been a foundation of development projects since the Islamic revolution and subsequent governmental changes, and the use of the capacities of the private sector in the acquisition of capital assets for projects using the PPP model has been prioritized in the Iranian national budget over the March 2018–March 2019 period [

18]. With that in mind, this work tries to answer to these interrelated research questions:

RQ1a: What are the barriers and risks of applying the PPP model in UICPs in developing countries in the Middle East?

RQ1b: What is the distinctive importance of the barriers and risks of applying the PPP model in UICPs in developing countries in the Middle East?

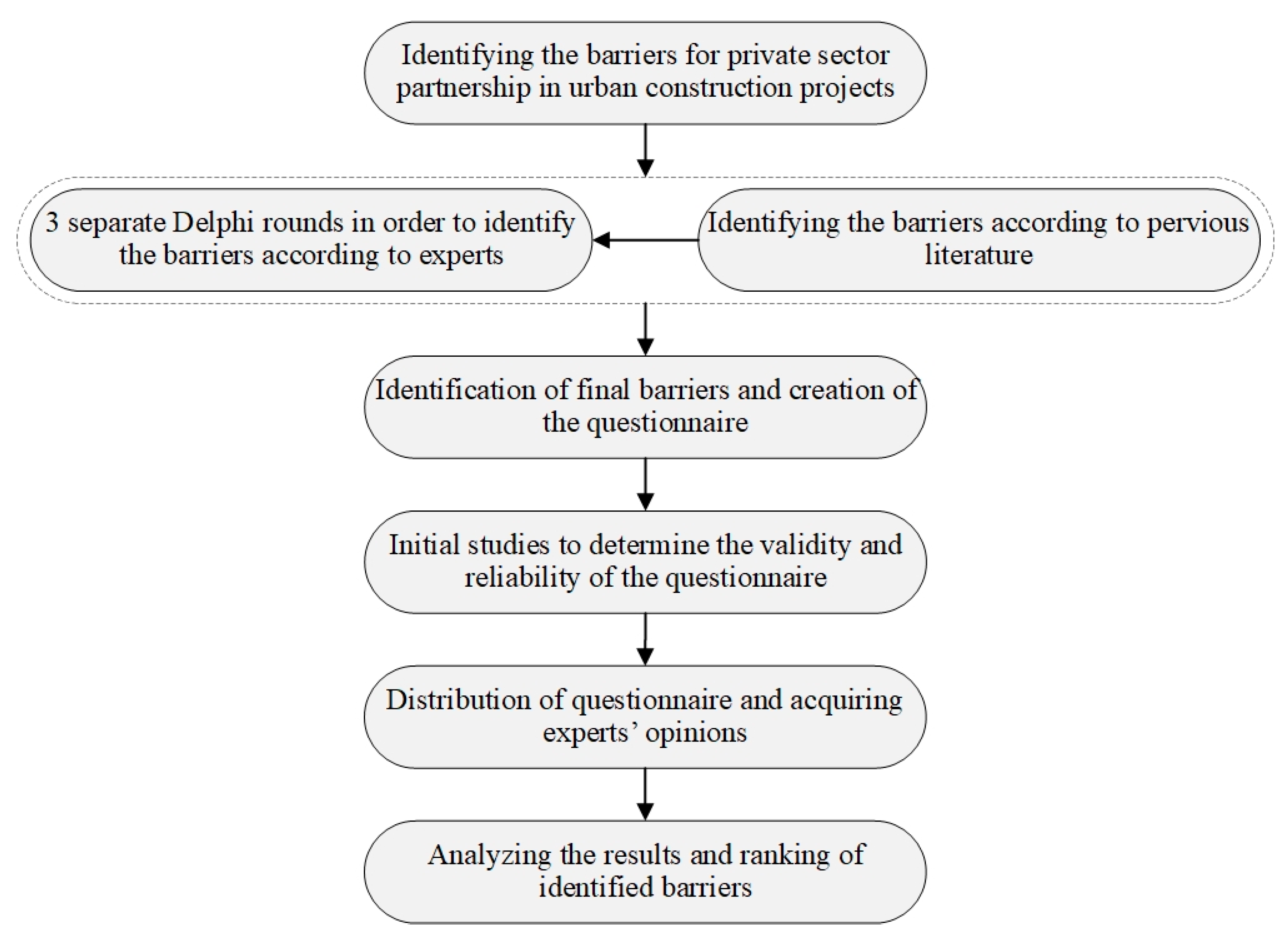

In order to identify and rank the barriers and risks of applying the PPP model to UICPs in Middle Eastern developing counties, a questionnaire was distributed among 60 Iranian experts who had experience as an employer or as part of a contractor team involved in a PPP in a UICP. After analyzing the identified barriers and risks, the effect of these barriers and risks and their prioritizations were determined through the use of the Friedman test. Results show that technical and organizational barriers and risks were perceived as the most important to private sector participation, followed by economic and financial, and then political and legal, barriers and risks. The results of the current study can help both the public and private sectors in better decision-making and implementation of PPPs for the development of UICPs. However, due to the limited experience in Iran regarding PPPs in UICPs, it is necessary to investigate the successes and failures of other countries and use these experiences to forge a path for the success of PPPs in UICPs.

The roadmap of this study is as follows. Within the second section we offer an updated literature framework concerning the use of PPPs in UICPs, highlighting barriers and risks and success factors. Then, the methodology is presented in the third section. Within the fourth section we revealed the results of the quantitative and qualitative analysis, and in the fifth section these are discussed in the light of prior literature. Implications, limitations, and future research suggestions conclude the contribution.

2. Barriers, Risks, and Success Factors of Construction Projects

The construction sector is a significant part of the economy in many countries [

19]. According to a study by the Organization for Economic Co-operation and Development (OECD), the construction sector generates up to 10% of gross domestic product (GDP) in OECD and other developing countries. An efficiently functioning construction sector is also one of the most critical investment sources. Barriers and risks should be assessed to encourage private sector participation in construction projects and make related processes more effective [

20,

21].

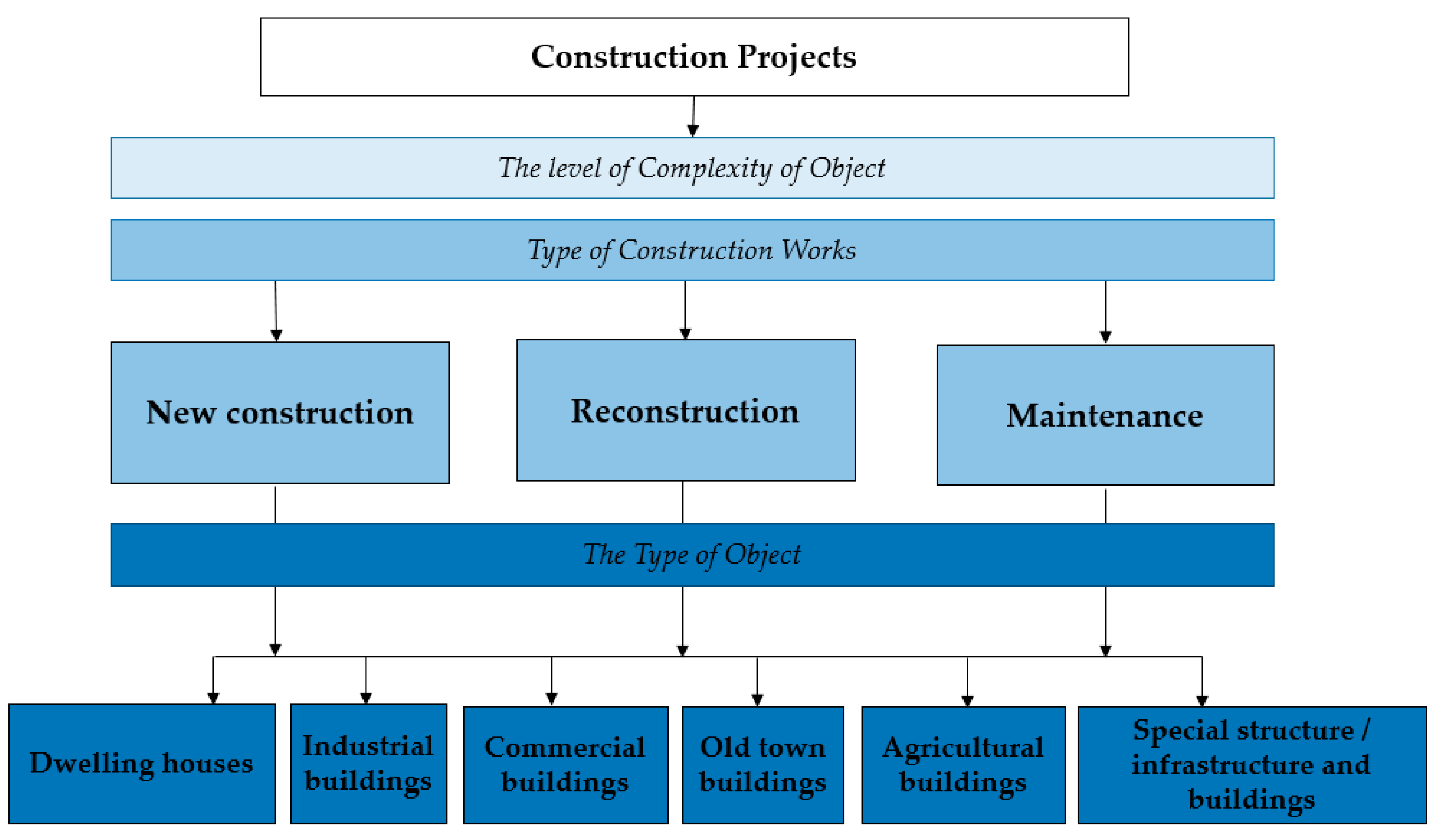

Generally, construction projects are assessed considering emerging barriers, risks, and the complexity of the structures. Projects can be classed by the type of a building, i.e., special, non-special, and simple; construction works, i.e., new construction, reconstruction, renovation or repair; or the purpose of the building under construction, i.e., residential or non-residential, industrial, commercial, historic, and special structures (

Figure 1).

Infrastructure projects are among the most extensive construction tasks. Apart from being large-scale, infrastructure projects also require substantial capital investment. Often, an upswing in the national economy results in a higher demand for roads, electricity, water-supply, and sewerage networks, and other types of infrastructure. Countries have found it difficult to keep up with the latest economic developments and demands for infrastructure. The pressure of infrastructure construction projects is compounded by public pressure to complete them quickly and within budget. As a result, the time allocated for the completion of an intensive project-risk analysis, especially during construction, is not always sufficient.

The construction of large-scale infrastructure projects must start from a thorough construction risk assessment. The Construction Industry Research and Information Association recommended that the awarding of a construction risk allocation contract for a specific project should be based on [

20]: (1) a description of the nature, likely frequency, and extent of the risk; (2) identification of where it may occur; and (3) enforcement measures if the risks nevertheless materialize.

The most important criteria for identifying risks and barriers should be the magnitude of the potential consequences and their assessment.

The European Standard (EN) 1990 [

22] also stipulates that only the most impactful structures should be subjected to extended third-party design supervision and inspections. For all other structures, normal maintenance is sufficient, which in the case of low-risk structures can be performed by the participants of the construction process. In the case of medium-risk structures, in accordance with the organizational procedures, persons other than those who were originally responsible for the preparation of the project or the execution of the construction work should undertake the role. Countries with construction control which is considered as an example of good practice have long used the private sector for such help. Depending on the country, inspections can be carried out by the participants of the construction process or by independent private sector experts, i.e., in the case of high-risk buildings. Currently, only the expertise of buildings and their projects is delegated to the private sector in Europe. Often, the entirety of the remaining process is still managed by public authorities [

19,

23,

24].

Some important aspects to be mentioned for the risk and barrier assessment of construction projects are presented below.

2.1. Contractual Relations

Infrastructure construction projects vary by type of project organization and contracting. Possible options include fixed price, unit price, supply of an equipped object, or “plus cost” contracts. Unit price-type contracts are predominant among infrastructure construction projects in Asian countries.

Contracts of this type require detailed information on the party of ownership, as well as specific information on the legal systems, site conditions, local subcontractors and suppliers, and labor, etc.

Unit price contracts follow a strict sequence of planning and design, supply, and construction. Builders or contractors cannot influence the language or terms of the contract.

In practice, due to bureaucratic systems and government regulations, most project owners, who are government agencies, are reluctant to provide important information about previous projects for risk assessment purposes. This can affect the execution of the project and the relationship with the owner [

20]. Contractual and organizational relationships within large-scale construction infrastructure projects are usually complex.

A contract for an international project usually involves several parties, and the governance model is divided into three levels. These levels reflect the direct relationship between:

The project owner or their representatives, and contractors (general and designated);

Contractors (general and designated) and subcontractors and suppliers (domestic and foreign). To avoid uncertainties surrounding costs, East Asian countries have a practice of transferring construction risk to general and nominated contractors. According to established traditions and culture, fairness is considered paramount in government-funded projects, as local contractors need to maintain good relations for the sake of future projects. Claims and disputes are usually resolved at the site or at the project level. In such cases, government organizations have the overriding right to decide what to do with claims;

Subcontractors (domestic and foreign) and suppliers (domestic and foreign).

These categories may overlap.

2.2. Construction Project Characteristics

In the case of construction projects the technical characteristics of the structure, such as area or height, should be considered in determining the likelihood of defects, not in isolation but rather in conjunction with the magnitude of the effects of the structure. Often, many structures can be classified as high-risk only because of the area parameters. Particular attention must be paid to infrastructure projects.

Infrastructure projects focus on the development and maintenance of services, facilities, and systems. These can be funded by private companies, public funds, or a combination of both, i.e., public–private partnerships (a form of collaboration between a government and private sector companies). Private investments can help in the management of the economic development of a city, state, or entire country.

Infrastructure projects can be grouped according to content, complexity, and size into:

Aviation infrastructure projects, which develop and maintain airplanes and airports;

Bridge infrastructure projects, which oversee the costs of building and maintaining bridges throughout the country. This includes heavily trafficked highway bridges that are accessed daily;

Communications infrastructure projects, which focus on the connection between government agencies, businesses, and the nation through wireless, cable, satellite, and other technologies. Private and government sectors work together, ensuring that outages are fixed, and updates keep wireless networks streamlined;

Power and energy infrastructure projects that deal with power, including electrical lines, power grids, and alternative energy innovations;

Railroad infrastructure projects, which are responsible for innovating and safeguarding trains, subways, and light rail systems. This includes track layout, steel supplies, bridges, and tunnels;

Road infrastructure projects, which focus on building new streets and fixing the existing network of streets, roads, and highways for mass transit. It also oversees the developing transportation projects that grant greater transportation access to communities.

Difficulties in implementing infrastructure construction projects are compounded by public pressure to complete them quickly and within a pre-defined budget. As a result, the time allocated for the completion of an intensive project-risk analysis, especially during construction, is often insufficient. Therefore, prior to the construction of large-scale infrastructure projects, a thorough construction risk assessment must be performed. It is recommended that the awarding of a construction risk allocation contract for a specific project should be based on:

A description of the nature, likely frequency, and extent of the risk;

Identification of where it may occur; and

Enforcement measures should risk materialize.

2.3. Risks in Construction Projects

Many researchers have tried to address risk allocation issues in construction projects [

24]. It is rational to take the position that the risk should be attributed to the party best able to control it, and if both parties fail to do so, the risk should be attributed to the owner. Traditionally, the owner, as a government agency, tries to transfer almost all risk to contractors who, in turn, try to transfer part of it to subcontractors or suppliers [

20].

In general, construction risk is divided into six groups:

- (1)

physical,

- (2)

competency-related,

- (3)

economic,

- (4)

political and social,

- (5)

construction-related, and

- (6)

contractual and legal.

Such grouping is considered narrow and schematic for complex construction projects. Each risk category can be assigned to a specific type of construction work to be performed by a specified party. Risk is distributed naturally, according to the work being done and the parties responsible for that work. Prior to the start of construction, the integration of the works, the types of risks, their connections, and the responsible parties must be carefully examined.

The breakdown of organization, work, and risk can be more detailed to demonstrate the potential for more accurate risk reduction. Contractors are responsible for key risks, such as underground conditions, natural disasters, and complications related to the construction site access. Risk identification is paramount when estimating works. General contractors or subcontractors may add significant contingencies to their bids in order to cover the costs of identified risks. If risks and responsibilities are not properly allocated, claims and disputes can arise during construction.

Complex construction projects often involve interdisciplinary activities and the construction of various types of structural elements, of which underground works (especially underground conditions and construction safety) are at most risk. Infrastructure projects are financially intensive and long-lasting, which poses significant financial risks.

Often, costs are exceeded due to unexpected geological findings, which is one of the problems faced by infrastructure construction projects. Due to increasing pressure from Non-Governmental Organizations (NGOs) regarding environmental issues, political and public interference is becoming yet another serious problem that can lead to the suspension or cancellation of a project even during construction. Up to a certain point, in each case, specific and adverse events can be identified in the construction of large-scale as well as infrastructure projects.

Well-prepared contract terms should set out possible events and seek to assign risks and responsibilities to those who are best placed to control such events. Otherwise, risk-related losses result in cost overruns and a prolonged work schedule.

Four factors in this category were considered significant, namely, delays in construction works; changes in works; labor, materials and equipment resources; and delayed access to the site. The most significant risks are associated with construction delays and changes in works. The results confirm the general concern about construction risks in large infrastructure projects.

Physical risk: Risk of geological conditions, including groundwater, safety on the construction site, etc.

Contractual and legal risks: Negotiations on a modified order and delayed dispute resolution are significant project risks. Prolonged negotiations arising from disputes or changes in the value of construction works are an undesirable factor for many contractors.

Risks related to the quality of works: Poor performance and productivity are the most important risk factors in this category. Low-quality work is considered a significant risk factor as it not only leads to construction delays and additional costs, but also to disputes over liability for defects. As for productivity risk, factors related to equipment are considered more important than factors relating to labor. Compared to other types of projects, progress in hydropower construction is usually determined by equipment performance.

Financial and economic risk: Inflation and financing are significant risk factors, which can be expected given the current economic situation. Labor shortages, and rapidly rising wages and material prices pose certain risks to contractors. Changes in the market also negatively impact on the financing of construction infrastructure projects.

Political and social risks: This category focuses on environmental risk assessment.

2.4. Comparison of Contract Conditions

One of the most important elements of a construction project contract is the conditions governing the legal aspects of the construction works; meanwhile, engineering documents, such as plans and specifications, must detail the technical side of the construction works as fully as possible.

In many infrastructure projects, uncertainties about liability usually stem from the inability to define the scope of the risk, the frequency of occurrence, and the limits of liability between the parties in the terms of the contract. This uncertainty can be reduced through clearly defined contractual terms.

Two preconditions are necessary for the successful and appropriate allocation of construction risk:

In this case, the terms of the contract can specify the definition of success, which would also distribute the construction risk factors, such as construction delays, different construction site conditions, changes in work, etc. The agreements further define the relationship and obligations of the parties. Particular attention must be paid when describing the general terms and conditions of the contract, which is the most important and often the most controversial part of all contractual documents. If written without considering the contractor’s perspective, the terms of the contract can become biased and too focused on the owner’s interests. Potential sources of claims and disputes (barriers) arise when the terms of the contract attribute risks which cannot be controlled to the contractor, such as access to the construction site, owner-initiated changes, and unpredictable or undisclosed terms, etc.

Social welfare, achieved through development processes, is one of the main duties of governments in the current century. Various countries aim to increase the speed of their development efforts in order to not only improve welfare in their society, but also to improve their role and position in international relations [

25,

26]. Achieving these aims requires the creation and development of suitable physical infrastructures. One of the most important economic development infrastructures is the development of transportation networks, especially urban transportation networks. The development of transportation networks is traditionally one of the duties of the government [

27]. The high value of these infrastructures in a countries’ overall development process, through their role in developing other economic sectors and their effect on the improvement of social factors due to the presence of an increased level of public services, means that governments are incentivized to move towards the development and strengthening of these infrastructures [

28]. One of the possible methods to achieve this aim is through direct investment in this sector from governments. However, limitations of financial resources, long decision-making times, and the low productivity levels of government projects usually cause serious barriers and risks for the development of these infrastructures [

12]. One alternative method is to use the financial and executive abilities of the private sector, including credible private companies and foreign investments as well as national and international banks, which results in better financing and higher productivity of these projects in comparison to government projects [

8].

In recent times, attempts have been made to use various methods in order to take advantage of the managerial, financial, and technical capacities of the private sector for the development of economic infrastructures. The use of the private sector in the development of urban infrastructures is often due to limitations of government budgets, limited time, and increased demand for the improvement of these infrastructures [

4]. In today’s world, urbanization is expanding in all its dimensions and due to this increased urbanization and the necessity of achieving safe, environmentally friendly, and clean cities, urban managers attempt to answer citizens’ and organizations’ expectations regarding cities and urban management and make plans for managing a modern and developed urban environment [

15,

29]. In the past, it was possible to manage cities through government intervention and financing methods, such as taxes, due to their limited population. However, the increase of urbanization, increased demands from urban management, the necessity of implementing new programs by urban management, and ensuring the sustainability of urban services has created the need for new financial resources. Nowadays, one of the common methods used in urban management in developing countries to reduce the dependence on government support and move towards sustainable incomes is the use of new financing methods in urban management, above all PPPs [

3,

11,

30]. The success of municipalities in this regard requires new and updated regulations, legal support from relevant organizations, and the trust of investors and citizens. It is obvious that the implementation of this method requires suitable legal and technical frameworks for systematic partnerships between public and private sectors in creating a culture of PPPs in the country [

26,

31]. However, unfortunately, there are currently numerous problems, barriers, and risks working against PPPs.

Table 1 shows the barriers, risks, and problems faced by PPPs working on UCIPs, according to previous studies.

Among these studies, to provide some examples with the aim of identifying the effect of organizational environments on public–private partnerships in Canada, we used expert opinions in order to evaluate PPP projects in Alberta, Canada, between the years 2004 and 2016 [

31]. Their study emphasized the role of financing and accounting in PPPs and evaluated their performance based on the nature and scale of decisions and their effects on long-term financial stability. Their results showed that political environment and organizational capacity are important factors, among others, in the success of partnership projects. In another study, Oppio and Tolrrieri focused on the advantages of the surplus created by public and private developers in urban development interventions [

47]. To this end, they suggested the use of measures to ensure the fair distribution of profits between these two sectors. In this study, they used a case study of urban renovation projects in the city of Milan in order to measure potential risk prevention and uncertainty in these projects.

Regarding the barriers and risks of PPPs undertaking UCIPs in developing countries, Willoughby investigated large-scale PPP projects in several cities in South America and Eastern Asia and showed that, despite delays and mistakes in the development of many PPP projects, the overall results are still positive and promote the use of PPPs: their involvement significantly improves the development of transportation networks [

48]. Yet, Mahalingam assessed—through a combination of archival sources, case studies, and insights from a roundtable discussion on PPPs—key barriers and risks that PPP projects face in the urban Indian context and cited the following five areas: distrust between the public and private sector; a lack of political willingness to develop PPPs; the absence of an enabling institutional environment for PPPs; a lack of project preparation capacity on the part of the public sector; and poorly designed and structured PPP projects [

49]. Lastly, Babatunde and Pereira assessed the barriers and risks to bond financing for public–private partnership (PPP) infrastructure projects in Nigeria using an empirical quantitative analysis [

13]. Results of their study show that, among the 12 identified barriers and risks, governance and institutional capacity issues, higher issuance costs and risks, difficulties in getting approval for changes, the small size of bond markets, and stringent disclosure requirements are considered to be the most harmful for PPPs [

50].

With regards to construction risk and liability sharing, the extent and nature of construction risk depends largely on three factors:

5. Discussion and Conclusions

This study attempted to answer the following research questions for the implementation of PPPs in UCIPs in developing countries in the Middle East: What are the barriers and risks of applying the PPP model in UICPs in developing countries in the Middle East? What is the distinctive importance of the barriers and risks of applying the PPP model in UICPs in developing countries in the Middle East? In order to do this, a Delphi study was conducted in Iran involving 60 UICP experts from both the public and private sectors. Data have been analyzed according to inferential statistical techniques as to identify and prioritize barriers and risks.

According to the results of the current study, similar to Cui et al. [

3], Osei-Kyei Chan [

11], and Sinharoy et al. [

30], one of the most important strategies for attracting the partnership of the private sector is the removal of barriers and risks, such as weaknesses in managerial knowledge and control of construction projects in private companies through the training and employment of better managers, in order to improve the level of planning and management knowledge in these projects. Furthermore, the lack of attention to cost reduction methods and the use of traditional and inefficient approaches by contractors, a lack of systematic cooperation between the public and private sectors, and a lack of use of new financing methods are among the most important barriers and risks for participation. However, solving these barriers and risks is now enough to increase partnership in urban construction projects. According to the results of the current study, severe political nepotism in project assignment; a lack of legal and technical infrastructures for partnerships; equipment and technological weaknesses in the private sector; a lack of certainty in the private sector regarding financing costs for maintenance and commissioning periods due to high and volatile inflation rates in Iran; a lack of competent managers in policymaking of public organizations; the implementation of wrong policies due to a lack of knowledge in employees and managers of the public sector; a lack of skill in executive managers for project control; and conflicts among project stakeholders and therefore miscommunication between the private sector and organizations are also among important barriers and risks to private investment in urban projects.

In terms of practical implications, since one of the most important factors in the success of PPPs is the selection of suitable private companies or contractors according to criteria set by government organizations as well as the size and complexity of the projects, success in these projects requires the systemic view of managers as well as the removal of barriers and risks such as severe political nepotism in project assignment. Creating a suitable environment and removing the barriers and risks identified in this study can help facilitate the increased partnership of private companies in urban construction projects.

In terms of theoretical implications, it is clear that the nature of UCIPs is different from other infrastructural projects including roads, water and wastewater, oil, gas, and telecommunication projects. Indeed, infrastructural urban projects, including bridges and urban roads; business and recreational projects; and large economic, social, and environmental projects are different from other infrastructural projects with regard to the type of services, commissioning, and return of investment guarantees [

7,

33,

54]. With that in mind, comparative and cross-sectorial studies are needed to generalize and reinforce provided insights.

Limitations of this study are many, starting from the method adopted, i.e., the Delphi technique, that has inner reliability and validity limits. Indeed, having respondents undertaking three different rounds of interviews, with specific questions aimed at the arrival of a shared vision, can lead to a forced convergence of opinions [

55] which undermines the Delphi’s forecasting ability. To avoid this problem, sampling participants—as done in this study—with knowledge and an interest in the topic ensures the validity of the Delphi technique [

56]. In this vein, stemming from the fact that the quality and characteristics of the experts chosen is pivotal in Delphi studies, their socio-demographic characteristics may have had a role in directing their attention to the identification of what the barriers, risks, and solutions are in implementing PPPs for UICPs in developing countries. In this regard, it would be interesting to investigate, in a quantitative manner and building upon the Upper Echelons Theory literature [

29], whether socio-demographic characteristics and/or other psychological variables are significant in the definition and evaluation of the barriers, risks, and solutions of implementing PPPs for UICPs in developing countries. Last but not least, future research can integrate the findings of the proposed work within already established models for the definition of priority lists in PPP redevelopment initiatives [

57,

58]; this would help in developing stronger management models of public assets within PPPs.