The Effects of Market Competition, Capital Structure, and CEO Duality on Firm Performance: A Mediation Analysis by Incorporating the GMM Model Technique

Abstract

1. Introduction

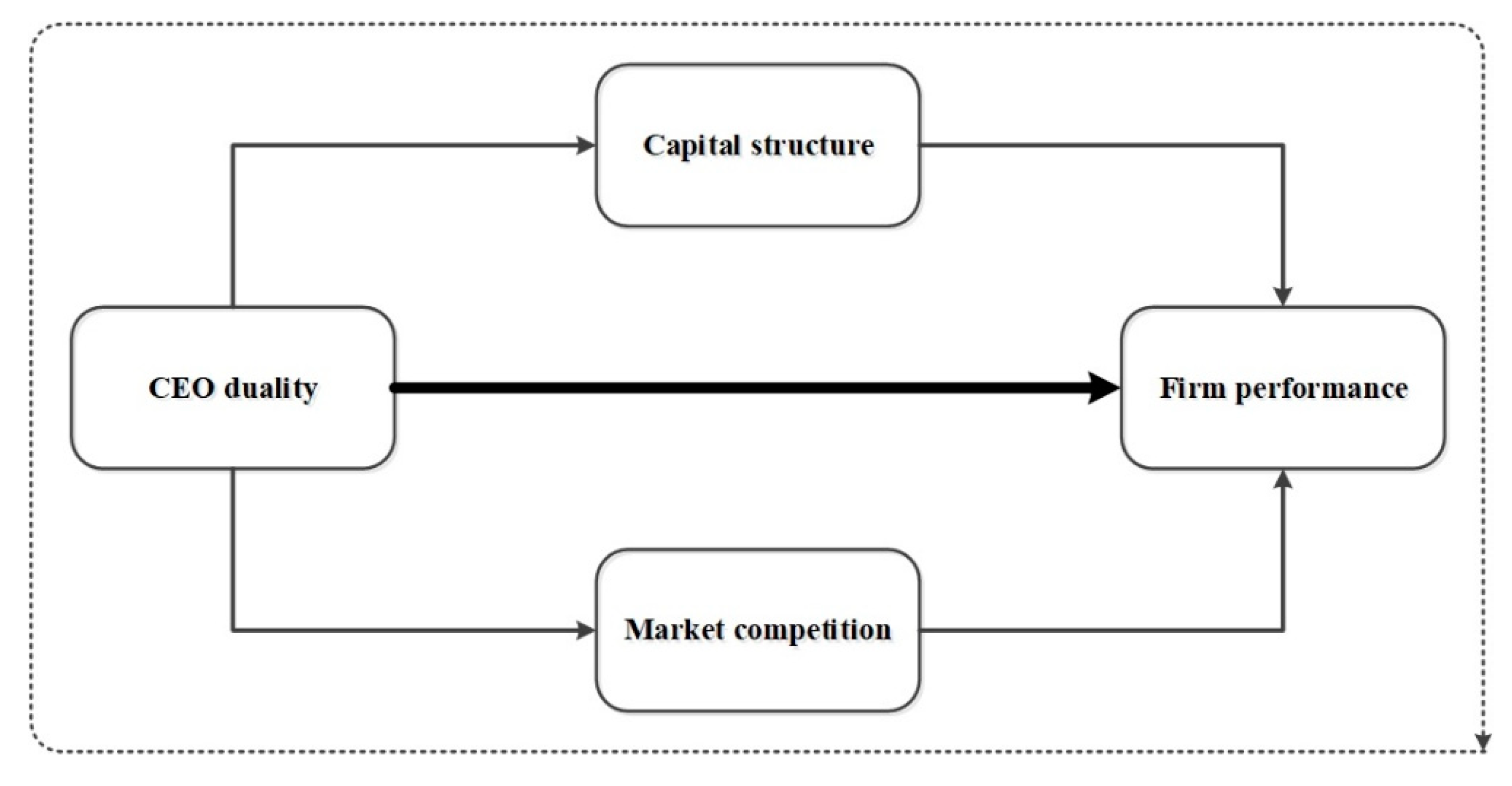

2. Literature Review and Hypotheses

2.1. CEO Duality and Firm Performance

2.2. The Relationship between CEO Duality and Firm Performance with the Mediating Effect of Capital Structure

2.3. The Relationship between CEO Duality and Firm Performance with the Mediating Effect of Market Competition

3. Research Methods

3.1. Sample and Data Collection

3.2. Variable Measurements

3.2.1. Dependent Variable Measurement

3.2.2. Independent and Control Variables

3.2.3. Mediating Variables

3.3. Models

3.4. Empirical Approach

4. Results

4.1. Empirical Analysis

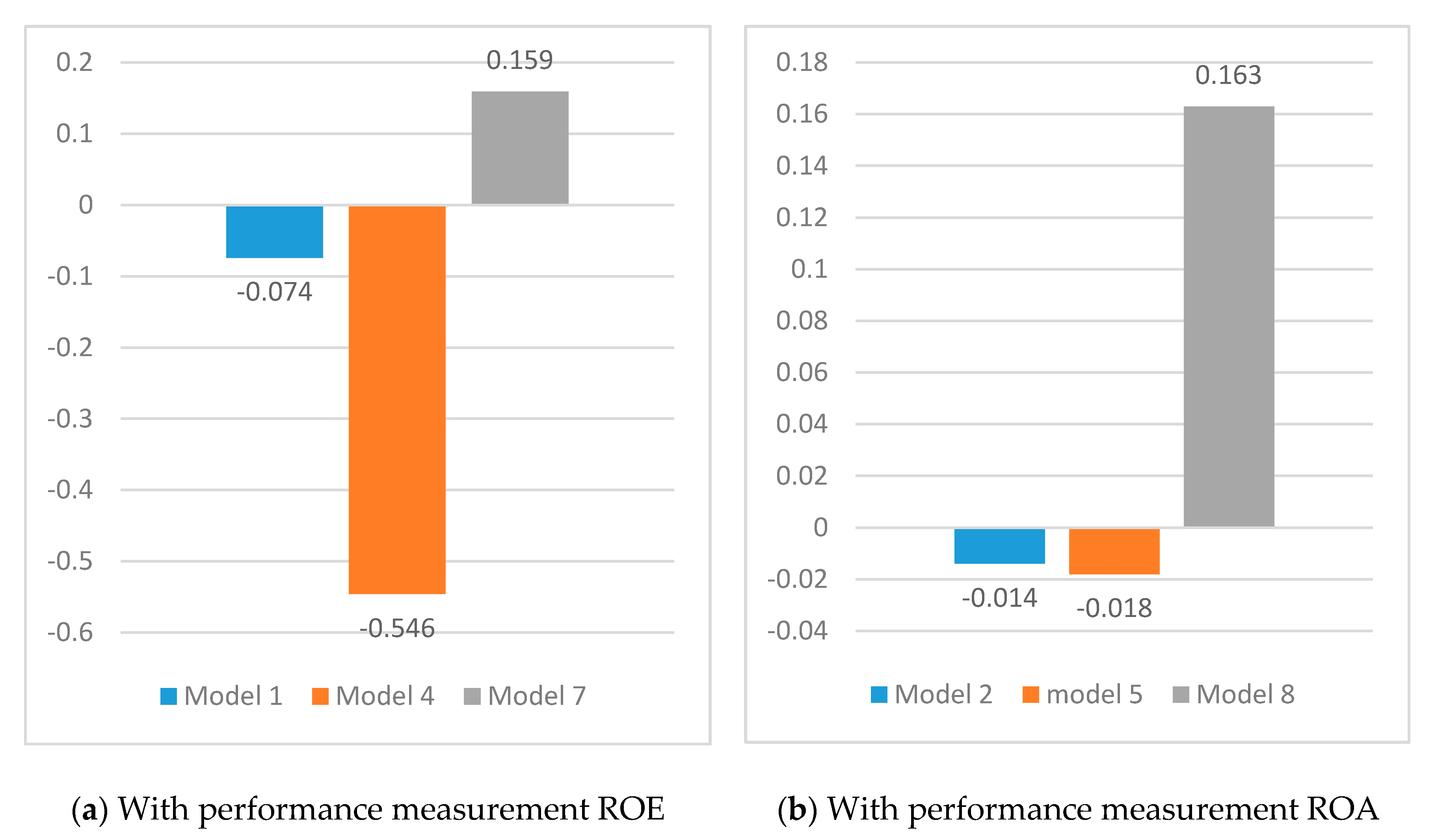

4.2. Analysis of Hypothesis 1

4.3. Analysis of Hypothesis 2

4.4. Analysis of Hypothesis 3

4.5. Robustness Analysis

5. Conclusions and Future Direction

Author Contributions

Funding

Conflicts of Interest

References

- Oak, S.; Iyengar, R.J. Investigating the differences in corporate governance between hospitality and nonhospitality firms. In Advances in Hospitality and Leisure; Emerald Group Publishing Limited: Bingley, UK, 2009; pp. 125–140. [Google Scholar]

- Finkelstein, S.; Cannella SF, B.; Hambrick, D.C.; Cannella, A.A. Strategic Leadership: Theory and Research on Executives, Top Management Teams, and Boards; Oxford University Press: Oxford, MS, USA, 2009. [Google Scholar]

- Wang, G.; DeGhetto, K.; Ellen, B.P.; Lamont, B.T. Board Antecedents of CEO Duality and the Moderating Role of Country-level Managerial Discretion: A Meta-analytic Investigation. J. Manag. Stud. 2019, 56, 172–202. [Google Scholar] [CrossRef]

- Faleye, O. Does one hat fit all? The case of corporate leadership structure. J. Manag. Gov. 2007, 11, 239–259. [Google Scholar] [CrossRef]

- Aktas, N.; Andreou, P.; Karasamani, I.; Philip, D. CEO Duality, Agency Costs, and Internal Capital Allocation Efficiency. Br. J. Manag. 2019, 30, 473–493. [Google Scholar] [CrossRef]

- Iyengar, R.J.; Zampelli, E.M. Self-selection, endogeneity, and the relationship between CEO duality and firm performance. Strat. Manag. J. 2009, 30, 1092–1112. [Google Scholar] [CrossRef]

- Guillet, B.D.; Seo, K.; Kucukusta, D.; Lee, S. CEO duality and firm performance in the U.S. restaurant industry: Moderating role of restaurant type. Int. J. Hosp. Manag. 2013, 33, 339–346. [Google Scholar] [CrossRef]

- Core, J.E.; Holthausen, R.W.; Larcker, D.F. Corporate governance, chief executive officer compensation, and firm performance. J. Financ. Econ. 1999, 51, 371–406. [Google Scholar] [CrossRef]

- Fama, E.F.; Jensen, M.C. Separation of Ownership and Control. J. Law Econ. 1983, 26, 301–325. [Google Scholar] [CrossRef]

- Jensen, M.C.; Meckling, W.H. Theory of the firm: Managerial behavior, agency costs and ownership structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Finkelstein, S.; D’Aveni, R.A. CEO Duality as a Double-Edged Sword: How Boards of Directors Balance Entrenchment Avoidance and Unity of Command. Acad. Manag. J. 1994, 37, 1079–1108. [Google Scholar]

- Dahya, J.; Lonie, A.A.; Power, D. The case for separating the roles of chairman and CEO: An analysis of stock market and accounting data. Corp. Gov. Int. Rev. 1996, 4, 71–77. [Google Scholar] [CrossRef]

- Yang, T.; Zhao, S.; Yang, T.; Zhao, S. CEO duality and firm performance: Evidence from an exogenous shock to the competitive environment. J. Bank. Financ. 2014, 49, 534–552. [Google Scholar] [CrossRef]

- Tang, J. CEO duality and firm performance: The moderating roles of other executives and blockholding outside directors. Eur. Manag. J. 2017, 35, 362–372. [Google Scholar] [CrossRef]

- Frank, M.; Goyal, V. Testing the pecking order theory of capital structure. J. Financ. Econ. 2003, 67, 217–248. [Google Scholar] [CrossRef]

- Naseem, M.A.; Lin, J.; Rehman, R.U.; Ahmed, M.I.; Ali, R. Does capital structure mediate the link between CEO characteristics and firm performance? Manag. Decis. 2020, 58, 164–181. [Google Scholar] [CrossRef]

- Giroud, X.; Mueller, H.M. Corporate Governance, Product Market Competition, and Equity Prices. J. Financ. 2011, 66, 563–600. [Google Scholar] [CrossRef]

- Liu, Q. Corporate Governance in China: Current Practices, Economic Effects and Institutional Determinants. Cesifo Econ. Stud. 2006, 52, 415–453. [Google Scholar] [CrossRef]

- Walsh, J.P.; Seward, J.K. On the efficiency of internal and external corporate control mechanisms. Acad. Manag. Rev. 1990, 15, 421–458. [Google Scholar] [CrossRef]

- Duru, A.; Iyengar, R.J.; Zampelli, E.M. The dynamic relationship between CEO duality and firm performance: The moderating role of board independence. J. Bus. Res. 2016, 69, 4269–4277. [Google Scholar] [CrossRef]

- Lew, Y.K.; Yu, J.; Park, J.-Y. The impacts of independent director and CEO duality on performance in the Chinese post-institutional-transition era. Can. J. Adm. Sci. Rev. Can. Sci. l’Administration 2018, 35, 620–634. [Google Scholar] [CrossRef]

- Saeed, A.; Athreye, S. Internal capital markets and outward foreign investment from India and China. In International Business and Institutions after the Financial Crisis; Springer: Berlin/Heidelberg, Germany, 2014; pp. 93–108. [Google Scholar]

- Peng, M.W.; Li, Y.; Xie, E.; Su, Z. CEO duality, organizational slack, and firm performance in China. Asia Pac. J. Manag. 2010, 27, 611–624. [Google Scholar] [CrossRef]

- Li, H.; Chen, P. Board gender diversity and firm performance: The moderating role of firm size. Bus. Ethic- A Eur. Rev. 2018, 27, 294–308. [Google Scholar] [CrossRef]

- Conyon, M.J.; He, L. Executive compensation and corporate governance in China. J. Corp. Financ. 2011, 17, 1158–1175. [Google Scholar] [CrossRef]

- Su, Z.; Peng, J.; Shen, H.; Xiao, T. Technological Capability, Marketing Capability, and Firm Performance in Turbulent Conditions. Manag. Organ. Rev. 2013, 9, 115–137. [Google Scholar] [CrossRef]

- Krause, R.; Semadeni, M.; Cannella, A.A., Jr. CEO duality: A review and research agenda. J. Manag. 2014, 40, 256–286. [Google Scholar] [CrossRef]

- Fan, J.P.; Wong, T.; Zhang, T. Politically connected CEOs, corporate governance, and Post-IPO performance of China’s newly partially privatized firms. J. Financ. Econ. 2007, 84, 330–357. [Google Scholar] [CrossRef]

- Faleye, O. Classified boards, firm value, and managerial entrenchment. J. Financ. Econ. 2007, 83, 501–529. [Google Scholar] [CrossRef]

- Mallette, P.; Fowler, K.L. Effects of Board Composition and Stock Ownership on the Adoption of “Poison Pills”. Acad. Manag. J. 1992, 35, 1010–1035. [Google Scholar]

- Krause, R. Being the CEO’s boss: An examination of board chair orientations. Strat. Manag. J. 2017, 38, 697–713. [Google Scholar] [CrossRef]

- Nahar Abdullah, S. Board composition, CEO duality and performance among Malaysian listed companies. Corp. Gov. Int. J. Bus. Soc. 2004, 4, 47–61. [Google Scholar] [CrossRef]

- Mutlu, C.C.; Van Essen, M.; Peng, M.W.; Saleh, S.F.; Duran, P. Corporate Governance in China: A Meta-Analysis. J. Manag. Stud. 2018, 55, 943–979. [Google Scholar] [CrossRef]

- Pollock, T.G.; Fischer, H.M.; Wade, J.B. The role of power and politics in the repricing of executive options. Acad. Manag. J. 2002, 45, 1172–1182. [Google Scholar]

- Boyd, B.K. CEO duality and firm performance: A contingency model. Strateg. Manag. J. 1995, 16, 301–312. [Google Scholar] [CrossRef]

- Beasley, M.S. An empirical analysis of the relation between the board of director composition and financial statement fraud. Account. Rev. 1996, 443–465. [Google Scholar]

- Eisenhardt, K.M. Making Fast Strategic Decisions In High-Velocity Environments. Acad. Manag. J. 1989, 32, 543–576. [Google Scholar]

- Chahine, S.; Tohmé, N.S. Is CEO Duality Always Negative? An Exploration of CEO Duality and Ownership Structure in the Arab IPO Context. Corp. Governance Int. Rev. 2009, 17, 123–141. [Google Scholar] [CrossRef]

- Ramdani, D.; Van Witteloostuijn, A. The Impact of Board Independence and CEO Duality on Firm Performance: A Quantile Regression Analysis for Indonesia, Malaysia, South Korea and Thailand. Br. J. Manag. 2010, 21, 607–627. [Google Scholar] [CrossRef]

- Donaldson, L.; Davis, J.H. Stewardship Theory or Agency Theory: CEO Governance and Shareholder Returns. Aust. J. Manag. 1991, 16, 49–64. [Google Scholar] [CrossRef]

- Davis, J.H.; Schoorman, F.D.; Donaldson, L. Toward a stewardship theory of management. Acad. Manag. Rev. 1997, 22, 20–47. [Google Scholar] [CrossRef]

- Brickley, J.A.; Coles, J.L.; Jarrell, G. Leadership structure: Separating the CEO and Chairman of the Board. J. Corp. Financ. 1997, 3, 189–220. [Google Scholar] [CrossRef]

- Desai, A.; Kroll, M.; Wright, P. CEO duality, board monitoring, and acquisition performance: A test of competing theories. J. Bus. Strateg. 2003, 20, 137. [Google Scholar]

- Stoeberl, P.; Sherony, B. Board efficiency and effectiveness. In Handbook for Corporate Directors; McGraw-Hill: New York, NY, USA, 1985; pp. 12.1–12.10. [Google Scholar]

- Larcker, D.; Tayan, B. Corporate Governance Matters: A Closer Look at Organizational Choices and Their Consequences; Pearson Education: London, UK, 2015. [Google Scholar]

- Jensen, M.C.; Heckling, W.H. Specific and general knowledge, and organizational structure. J. Appl. Corp. Financ. 1995, 8, 4–18. [Google Scholar] [CrossRef]

- Bhagat, S.; Black, B.S. The Non-Correlation Between Board Independence and Long-Term Firm Performance. SSRN Electron. J. 1998, 27, 231. [Google Scholar] [CrossRef]

- Dalton, D.R.; Daily, C.M.; Ellstrand, A.E.; Johnson, J.L. Meta-analytic reviews of board composition, leadership structure, and financial performance. Strateg. Manag. J. 1998, 19, 269–290. [Google Scholar] [CrossRef]

- Gohar, R.; Batool, A. Effect of Corporate Governance on Performance of Microfinance Institutions: A Case from Pakistan. Emerg. Mark. Financ. Trade 2015, 51, S94–S106. [Google Scholar] [CrossRef]

- Singh, S.; Tabassum, N.; Darwish, T.K.; Batsakis, G. Corporate Governance and Tobin’sQas a Measure of Organizational Performance. Br. J. Manag. 2018, 29, 171–190. [Google Scholar] [CrossRef]

- Elsayed, K. Does CEO Duality Really Affect Corporate Performance? Corp. Gov. Int. Rev. 2007, 15, 1203–1214. [Google Scholar] [CrossRef]

- Jiraporn, P.; Chintrakarn, P.; Liu, Y. Capital structure, CEO dominance, and corporate performance. J. Financ. Serv. Res. 2012, 42, 139–158. [Google Scholar] [CrossRef]

- Stulz, R. Managerial control of voting rights. J. Financ. Econ. 1988, 20, 25–54. [Google Scholar] [CrossRef]

- Fosberg, R.H. Agency problems and debt financing: Leadership structure effects. Corp. Gov. Int. J. Bus. Soc. 2004, 4, 31–38. [Google Scholar] [CrossRef]

- Abor, J. Debt policy and performance of SMEs. J. Risk Financ. 2007, 8, 364–379. [Google Scholar] [CrossRef]

- Bokpin, G.A.; Arko, A.C. Ownership structure, corporate governance and capital structure decisions of firms. Stud. Econ. Financ. 2009, 26, 246–256. [Google Scholar] [CrossRef]

- Margaritis, D.; Psillaki, M. Capital structure, equity ownership and firm performance. J. Bank. Financ. 2010, 34, 621–632. [Google Scholar] [CrossRef]

- Chintrakarn, P.; Jiraporn, P.; Singh, M. Powerful CEOs and capital structure decisions: Evidence from the CEO pay slice (CPS). Appl. Econ. Lett. 2014, 21, 564–568. [Google Scholar] [CrossRef]

- Hitt, M.A.; Hoskisson, R.E.; Johnson, R.A.; Moesel, D.D. The market for corporate control and firm innovation. Acad. Manag. J. 1996, 39, 1084–1119. [Google Scholar]

- Franko, L.G. Global corporate competition: Who’s winning, who’s losing, and the R&D factor as one reason why. Strat. Manag. J. 1989, 10, 449–474. [Google Scholar]

- Ko, H.-C.A.; Tong, Y.; Zhang, F.; Zheng, G. Corporate governance, product market competition and managerial incentives: Evidence from four Pacific Basin countries. Pac.-Basin Financ. J. 2016, 40, 491–502. [Google Scholar] [CrossRef]

- Giroud, X.; Mueller, H.M. Does corporate governance matter in competitive industries? J. Financ. Econ. 2010, 95, 312–331. [Google Scholar] [CrossRef]

- Tian, G.Y.; Twite, G. Corporate governance, external market discipline and firm productivity. J. Corp. Financ. 2011, 17, 403–417. [Google Scholar] [CrossRef]

- Karunananthan, C. Industry product market competition and managerial incentives. J. Account. Econ. 2007, 43, 275–297. [Google Scholar]

- Bloom, N.; Sadun, R.; van Reenen, J. Does product market competition lead firms to decentralize? Am. Econ. Rev. 2010, 100, 434–438. [Google Scholar] [CrossRef]

- Schmidt, K.M. Managerial Incentives and Product Market Competition. Rev. Econ. Stud. 1997, 64, 191–213. [Google Scholar] [CrossRef]

- Dhaliwal, D.; Huang, S.; Khurana, I.K.; Pereira, R. Product market competition and conditional conservatism. Rev. Account. Stud. 2014, 19, 1309–1345. [Google Scholar] [CrossRef]

- Gunasekarage, A.; Luong, H.; Truong, T.T. Growth and market share matrix, CEO power, and firm performance. Pac. Basin Financ. J. 2020, 59, 101257. [Google Scholar] [CrossRef]

- Raith, M. Competition, Risk, and Managerial Incentives. Am. Econ. Rev. 2003, 93, 1425–1436. [Google Scholar] [CrossRef]

- Grosfeld, I.; Tressel, T. Competition and ownership structure: Substitutes or complements? Evidence from the Warsaw Stock Exchange1. Econ. Transit. 2002, 10, 525–551. [Google Scholar] [CrossRef]

- Pant, M.; Pattanayak, M. Corporate Governance, Competition and Firm Performance. J. Emerg. Mark. Financ. 2010, 9, 347–381. [Google Scholar] [CrossRef]

- Sheikh, S. The impact of market competition on the relation between CEO power and firm innovation. J. Multinatl. Financ. Manag. 2018, 44, 36–50. [Google Scholar] [CrossRef]

- Javeed, S.A.; Latief, R.; Lefen, L. An analysis of relationship between environmental regulations and firm performance with moderating effects of product market competition: Empirical evidence from Pakistan. J. Clean. Prod. 2020, 254, 120197. [Google Scholar] [CrossRef]

- Li, M.; Lu, Y.; Phillips, G.M. CEOs and the Product Market: When Are Powerful CEOs Beneficial? J. Financ. Quant. Anal. 2018, 54, 2295–2326. [Google Scholar] [CrossRef]

- Ammann, M.; Oesch, D.; Schmid, M.M. Product Market Competition, Corporate Governance, and Firm Value: Evidence from the EU Area. Eur. Financ. Manag. 2013, 19, 452–469. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Personal. Soc. Psychol. 1986, 51, 1173. [Google Scholar] [CrossRef]

- Tien, C.; Chen, C.-N.; Chuang, C.-M. A study of CEO power, pay structure, and firm performance. J. Manag. Organ. 2013, 19, 424–453. [Google Scholar] [CrossRef]

- Tam, O.K.; Tan, M.G.-S. Ownership, Governance and Firm Performance in Malaysia. Corp. Gov. Int. Rev. 2007, 15, 208–222. [Google Scholar] [CrossRef]

- Berg, S.V.; Smith, S.K. CEO and board chairman: A quantitative study of dual vs. unitary board leadership. Dir. Boards 1978, 3, 34–39. [Google Scholar]

- Chen, C.-W.; Lin, J.S.B.; Yi, B. CEO duality and firm performance—An endogenous issue. Corp. Ownersh. Control 2008, 6, 58–65. [Google Scholar] [CrossRef]

- Li, Y.; Gong, M.; Zhang, X.-Y.; Koh, L. The impact of environmental, social, and governance disclosure on firm value: The role of CEO power. Br. Account. Rev. 2018, 50, 60–75. [Google Scholar] [CrossRef]

- Dang, C.; Li, Z.; Yang, C. Measuring firm size in empirical corporate finance. J. Bank. Finance 2018, 86, 159–176. [Google Scholar] [CrossRef]

- Abbas, J.; Mahmood, S.; Ali, H.; Ali Raza, M.; Ali, G.; Aman, J.; Bano, S.; Nurunnabi, M. The Effects of Corporate Social Responsibility Practices and Environmental Factors through a Moderating Role of Social Media Marketing on Sustainable Performance of Business Firms. Sustainability 2019, 11, 3434. [Google Scholar] [CrossRef]

- Abbas, J.; Raza, S.; Nurunnabi, M.; Minai, M.S.; Bano, S. The Impact of Entrepreneurial Business Networks on Firms’ Performance Through a Mediating Role of Dynamic Capabilities. Sustainability 2019, 11, 3006. [Google Scholar] [CrossRef]

- Azhar, A.; Abbas, J.; Wenhong, Z.; Akhtar, T.; Aqeel, M. Linking infidelity stress, anxiety and depression: Evidence from Pakistan married couples and divorced individuals. Int. J. Hum. Rights Healthc. 2018, 11, 214–228. [Google Scholar] [CrossRef]

- Fosu, S. Capital structure, product market competition and firm performance: Evidence from South Africa. Q. Rev. Econ. Financ. 2013, 53, 140–151. [Google Scholar] [CrossRef]

- Zou, H.L.; Zeng, S.X.; Lin, H.; Xie, X.M. Top executives’ compensation, industrial competition, and corporate environmental performance. Manag. Decis. 2015, 53, 2036–2059. [Google Scholar] [CrossRef]

- Michaelides, P.G.; Tsionas, E.G.; Konstantakis, K.N.; Xidonas, P. The impact of market competition on CEO salary in the US energy sector1. Energy Policy 2019, 132, 32–37. [Google Scholar] [CrossRef]

- Jain, B.A.; Li, J.; Shao, Y. Governance, product market competition and cash management in IPO firms. J. Bank. Financ. 2013, 37, 2052–2068. [Google Scholar] [CrossRef]

- Sardana, D.; Gupta, N.; Kumar, V.; Terziovski, M. CSR ‘sustainability’ practices and firm performance in an emerging economy. J. Clean. Prod. 2020, 258, 120766. [Google Scholar] [CrossRef]

- Song, H.J.; Yoon, Y.N.; Kang, K.H. The relationship between board diversity and firm performance in the lodging industry: The moderating role of internationalization. Int. J. Hosp. Manag. 2020, 86, 102461. [Google Scholar] [CrossRef]

- Nekhili, M.; Chakroun, H.; Chtioui, T. Women’s Leadership and Firm Performance: Family Versus Nonfamily Firms. J. Bus. Ethic 2018, 153, 291–316. [Google Scholar] [CrossRef]

- Hermalin, B.E.; Weisbach, M.S. Boards of Directors as an Endogenously Determined Institution: A Survey of the Economic Literature; National Bureau of Economic Research: Cambridge, MA, USA, 2001. [Google Scholar]

- Kang, E.; Zardkoohi, A. Board Leadership Structure and Firm Performance. Corp. Gov. Int. Rev. 2005, 13, 785–799. [Google Scholar] [CrossRef]

- Adams, R.; Hermalin, B.E.; Weisbach, M.S. The Role of Boards of Directors in Corporate Governance: A Conceptual Framework and Survey. J. Econ. Lit. 2010, 48, 58–107. [Google Scholar] [CrossRef]

- Li, F. Endogeneity in CEO power: A survey and experiment. Invest. Anal. J. 2016, 45, 149–162. [Google Scholar] [CrossRef]

- Arellano, M.; Bond, S. Some Tests of Specification for Panel Data: Monte Carlo Evidence and an Application to Employment Equations. Rev. Econ. Stud. 1991, 58, 277–297. [Google Scholar] [CrossRef]

- Hair, J.F.; Black, W.C.; Babin, B.J.; Anderson, R.E.; Tatham, R.L. Multivariate Data Analysis; Pearson Prentice Hall: Upper Saddle River, NJ, USA, 2006; Volume 6. [Google Scholar]

- Sheikh, S. CEO power, product market competition and firm value. Res. Int. Bus. Financ. 2018, 46, 373–386. [Google Scholar] [CrossRef]

- Pham, N.; Oh, K.; Pech, R. Mergers and acquisitions: CEO duality, operating performance and stock returns in Vietnam. Pac. Basin Financ. J. 2015, 35, 298–316. [Google Scholar] [CrossRef]

- Abbas, J.; Zhang, Q.; Hussain, I.; Akram, S.; Afaq, A.; Shad, M.A. Sustainable Innovation in Small Medium Enterprises: The Impact of Knowledge Management on Organizational Innovation through a Mediation Analysis by Using SEM Approach. Sustainability 2020, 12, 2407. [Google Scholar] [CrossRef]

- Abbas, J.; Zhang, Q.; Hussain, I.; Akram, S.; Afaq, A.; Shad, M.A. The Impact of Knowledge Sharing and Innovation on Sustainable Performance in Islamic Banks: A Mediation Analysis through a SEM Approach. Sustainability 2019, 11, 4049. [Google Scholar] [CrossRef]

- Abbas, J.; Aman, J.; Nurunnabi, M.; Bano, S. The moderating role of social support for marital adjustment, depression, anxiety, and stress: Evidence from Pakistani working and nonworking women. J. Affect. Disord. 2019, 244, 231–238. [Google Scholar] [CrossRef]

- Chintrakarn, P.; Chatjuthamard, P.; Tong, S.; Jiraporn, P. How do powerful CEOs view dividends and stock repurchases? Evidence from the CEO pay slice (CPS). Int. Rev. Econ. Financ. 2018, 58, 49–64. [Google Scholar] [CrossRef]

- Abbas, J.; Aqeel, M.; Jaffar, A.; Nurunnabi, M.; Bano, S. Tinnitus perception mediates the relationship between physiological and psychological problems among patients. J. Exp. Psychopathol. 2019, 10, 2043808719858559. [Google Scholar] [CrossRef]

- Abbas, J.; Aqeel, M.; Wenhong, Z.; Aman, J.; Zahra, F. The moderating role of gender inequality and age among emotional intelligence, homesickness and development of mood swings in universitystudents. Int. J. Hum. Rights Healthc. 2018, 11, 356–367. [Google Scholar] [CrossRef]

| Panel A Descriptive Statistics | Panel B VIF | ||||

|---|---|---|---|---|---|

| VARIABLES | OBS. | MEAN | STD. DEV | VIF | 1/VIF |

| ROE | 2502 | 0.0273 | 0.172 | 0.424 | |

| ROA | 2502 | 0.239 | 0.523 | 1.03 | 6.96 |

| CEO Duality | 2502 | 0.176 | 0.381 | 1.01 | 0.989 |

| Market Competition | 2502 | 0.805 | 0.396 | 1.00 | 0.998 |

| Capital Structure | 2502 | 0.069 | 0.089 | 1.03 | 0.973 |

| Growth | 2502 | 15.16 | 531.6 | 1.00 | 0.998 |

| Firm Size | 2502 | 9.45 | 0.732 | 1.44 | 0.967 |

| Asset Tangibility | 2502 | 1.35 | 3.73 | 1.37 | 0.729 |

| VIF Mean | 1.13 | ||||

| MODEL 1 (ROE) | MODEL 2 (ROA) | |

|---|---|---|

| CEO Duality | −0.074 *** (0.037) | −0.014 *** (0.007) |

| Firm Size | 0.197 *** (0.033) | 0.047 *** (0.009) |

| Asset Tangibility | 7.90 (7.62) | −2.63 *** (1.33) |

| Growth | 0.002 *** (2.89) | −5.18 (5.66) |

| Constant | −1.61 *** 0.305 | −0.413 *** (0.089) |

| Wald Test | 204.81 *** | 77.57 *** |

| AR (1) | −2.21 | −1.51 |

| AR (2) | −2.58 | −1.58 |

| Sargan Test | 4.70 | 0.07 |

| Observation | 2502 | 2502 |

| Model 3 (DR) | Model 4 (ROE) | Model 5 (ROA) | |

|---|---|---|---|

| CEO Duality | 0.936 *** (0.307) | −0.546 ** (0.322) | −0.018 *** (0.065) |

| Leverage | −1.745 *** (0.368) | 0.174 *** (0.065) | |

| Firm Size | 0.075 *** (0.026) | 1.03 *** (0.204) | 0.158 *** (0.0511) |

| Asset Tangibility | −7.71 *** (3.38) | −8.60 *** (3.80) | −1.49 *** (0.065) |

| Growth | 8.36 *** (2.02) | −0.0001 *** (4.05) | −9.14 * (6.43) |

| Constant | −7.97 *** (2892) | −9.21 *** (1.90) | −1.43 *** (0.003) |

| Wald Test | 59.90 *** | 376.29 *** | 82.88 *** |

| AR (1) | −2.86 | −3.07 | −1.52 |

| AR (2) | −1.23 | −2.12 | −1.38 |

| Sargan Test | 13.0 | 9.10 | 0.01 |

| Observation | 2502 | 2502 | 2502 |

| MODEL 6 (HHI) | MODEL 7 (ROE) | MODEL 8 (ROA) | |

|---|---|---|---|

| CEO Duality | 2.68 *** (1.20) | 0.159 *** (0.077) | 0.163 ** (0.090) |

| Market Competition | −0.189 *** (0.072) | −0.102 *** (0.051) | |

| Firm Size | −0.566 ** (0.302) | 1.30 *** (0.363) | 1.102 *** (0.373) |

| Asset Tangibility | 6.58 ** (3.93) | −5.09 *** (1.67) | 4.45 *** (1.71) |

| Growth | 0.003 *** (0.0005) | 0.0002 *** (0.0001) | 0.0002 *** (9.49) |

| Constant | 5.60 *** (2.86) | 11.3 *** (3.23) | −9.75 *** (3.33) |

| Wald Test | 0.626 *** | 205.78 *** | 78.47 *** |

| AR (1) | −3.23 (0.001) | 0.66 (0.506) | −0.16 (0.869) |

| AR (2) | −0.05 (0.962) | 0.94 (0.345) | 1.01 (0.314) |

| Sargan Test | 233.63 | 1383.18 | 178.47 |

| Observation | 2502 | 2502 | 2502 |

| Hypotheses | Whether Hypotheses are Supported |

|---|---|

| H1: There is a direct relationship between CEO duality and firm performance. | Supported |

| H2: Capital structure mediates the link between CEO duality and firm performance. H2a: CEO duality is positively linked to firm leverage. H2b: Capital structure negatively mediates the association between CEO duality and firm performance. | Supported |

| H3: Market competition mediates the relationship between CEO duality and firm performance. H3a: CEO duality is positively associated with market competition. H3b: Market competition positively mediates the relationship between CEO duality and firm performance. | Fully supported mediated effect |

| Model 9 | Model 10 | Model 11 | |

|---|---|---|---|

| CEO Duality | −0.0134 *** (0.0073) | −0.015 ** (0.0065) | 0.1212 ** (0.0722) |

| Leverage | −0.153 *** (0.030) | ||

| Market Competition | −0.1126 ** (0.064) | ||

| Firm Size | 0.0313 *** (0.0005) | 0.0399 *** (0.0080) | 1.046 *** (0.442) |

| Asset Tangibility | −1.780 * (1.100) | −2.26 ** (1.33) | −4.60 *** (2.170) |

| Growth | 0.0037 (0.0005) | 8.870 ** (4.970) | −0.00205 *** (0.054) |

| Constant | −0.2683 *** (0.0511) | −0.337 (0.0746) *** | −9.19 (3.905) |

| Wald Test | 57.279 *** | 66.786 *** | 57.280 *** |

| AR (1) | −1.55 | −1.38 | −0.46 |

| AR (2) | −1.71 | −1.67 | 1.07 |

| Sargan Test | 548.82 | 1363.05 | 280.78 |

| Observation | 2502 | 2502 | 2502 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mubeen, R.; Han, D.; Abbas, J.; Hussain, I. The Effects of Market Competition, Capital Structure, and CEO Duality on Firm Performance: A Mediation Analysis by Incorporating the GMM Model Technique. Sustainability 2020, 12, 3480. https://doi.org/10.3390/su12083480

Mubeen R, Han D, Abbas J, Hussain I. The Effects of Market Competition, Capital Structure, and CEO Duality on Firm Performance: A Mediation Analysis by Incorporating the GMM Model Technique. Sustainability. 2020; 12(8):3480. https://doi.org/10.3390/su12083480

Chicago/Turabian StyleMubeen, Riaqa, Dongping Han, Jaffar Abbas, and Iftikhar Hussain. 2020. "The Effects of Market Competition, Capital Structure, and CEO Duality on Firm Performance: A Mediation Analysis by Incorporating the GMM Model Technique" Sustainability 12, no. 8: 3480. https://doi.org/10.3390/su12083480

APA StyleMubeen, R., Han, D., Abbas, J., & Hussain, I. (2020). The Effects of Market Competition, Capital Structure, and CEO Duality on Firm Performance: A Mediation Analysis by Incorporating the GMM Model Technique. Sustainability, 12(8), 3480. https://doi.org/10.3390/su12083480