How Knowledge Assets Affect the Learning-by-Exporting Effect: Evidence Using Panel Data for Manufacturing Firms

Abstract

1. Introduction

2. Model Specification and Data Measurement

3. Data Sources and Descriptive Statistics

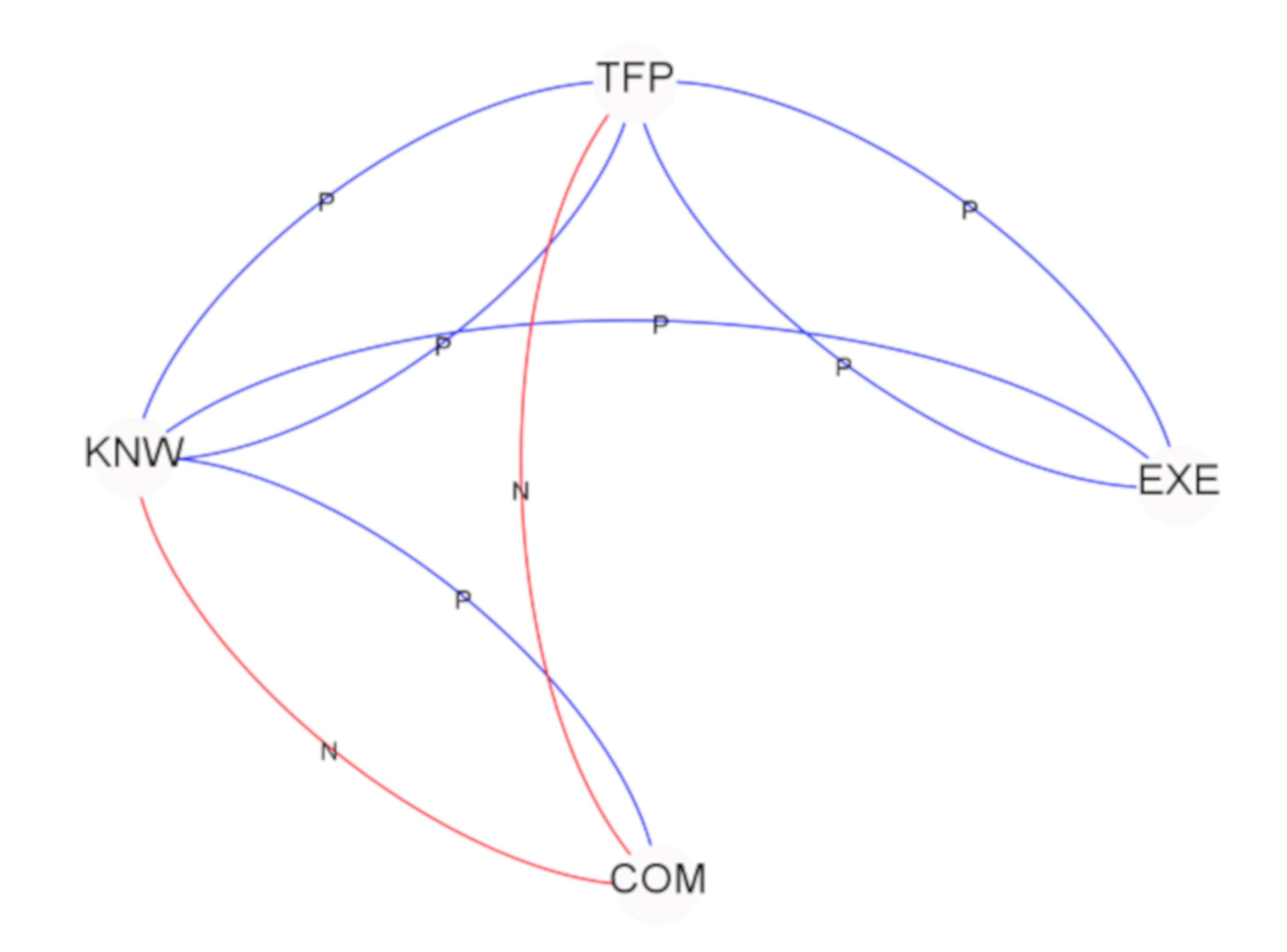

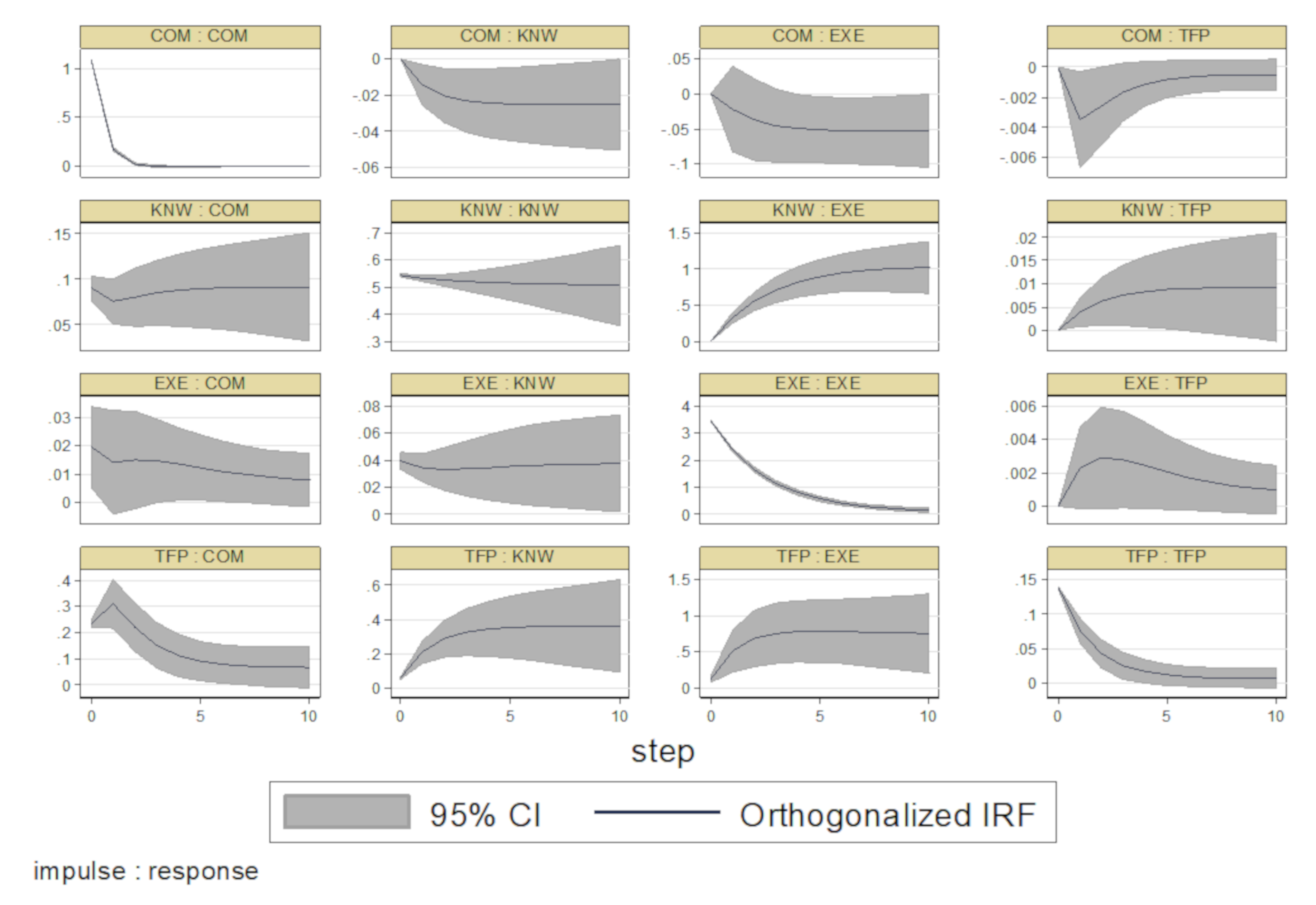

4. Empirical Analysis

5. Discussion

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Bernard, A.B.; Jensen, J.B. Exporters, jobs, and wages in U.S. manufacturing: 1976–1987. In Brookings Papers on Economic Activity. Microeconomics; Brookings Institution Press: Washington, DC, USA, 1995; pp. 67–119. [Google Scholar] [CrossRef]

- Bernard, A.B.; Wagner, J. Exports and successes in German manufacturing. Rev. World Econ. 1997, 133, 134–157. [Google Scholar]

- Bernard, A.B.; Jensen, J.B.; Redding, S.J.; Schott, P.K. Firms in international trade. J. Econ. Perspect. 2007, 21, 105–130. [Google Scholar] [CrossRef]

- Wagner, J. Exports and productivity: A survey of the evidence from firm-level data. World Econ. 2007, 30, 60–80. [Google Scholar] [CrossRef]

- Bernard, A.B.; Jensen, J.B.; Redding, S.J.; Schott, P.K. The empirics of firm heterogeneity and international trade. Annu. Rev. Econ. 2012, 4, 283–313. [Google Scholar] [CrossRef]

- Araújo, B.C.; Salerno, M.S. Technological strategies and learning-by-exporting: The case of Brazilian manufacturing firms, 2006–2008. Int. Bus. Rev. 2015, 24, 725–738. [Google Scholar] [CrossRef]

- Aw, B.Y.; Robert, M.J.; Xu, D.Y. R&D investments, exporting, and the evolution of firm productivity. Am. Econ. Rev. 2008, 98, 451–456. [Google Scholar]

- Lindstrand, A.; Eriksson, K.; Sharma, D.D. The perceived usefulness of knowledge supplied by foreign client networks. Int. Bus. Rev. 2009, 18, 26–37. [Google Scholar] [CrossRef]

- Castellani, D. Export behavior and productivity growth: Evidence from Italian manufacturing firms. Rev. World Econ. 2002, 138, 605–628. [Google Scholar] [CrossRef]

- Damijan, J.; Kostevc, C. Learning by exporting: Continuous productivity improvements or capacity utilization effects? Evidence from Slovenian firms. Rev. World Econ. 2006, 142, 599–614. [Google Scholar] [CrossRef]

- Ciuriak, D.; Lapham, B.; Wolfe, R.; Collins-Williams, T.; Curtis, J. Firms in international trade: Trade policy implications of the new trade theory. Glob. Policy 2015, 6, 130–140. [Google Scholar] [CrossRef]

- Wang, W.; Ma, H. Export strategy, export intensity and learning: Integrating the resource perspective and institutional perspective. J. World Bus. 2018, 53, 581–592. [Google Scholar] [CrossRef]

- Silva, A.; Afonso, O.; Africano, A.P. Learning-by-exporting: What we know and what we would like to know. Int. Trade J. 2012, 26, 255–288. [Google Scholar] [CrossRef]

- Crespi, G.; Coouolo, C.; Haskel, J. Productivity, exporting and the learning by exporting hypothesis: Direct evidence from UK firms. Can. J. Econ. 2008, 41, 619–638. [Google Scholar] [CrossRef]

- Haidar, J.I. Trade and productivity: Self-selection or learning-by-exporting in India. Econ. Model. 2012, 29, 1766–1773. [Google Scholar] [CrossRef]

- Sharma, C.; Mishra, R.K. International trade and performance of firms: Unraveling export, import and production puzzle. Q. Rev. Econ. Financ. 2015, 57, 61–74. [Google Scholar] [CrossRef]

- Chen, T.; Chen, X.; Wang, C.; Xiang, X. Export behavior and firm innovation: New method and evidence. Econ. Lett. 2018, 170, 76–78. [Google Scholar] [CrossRef]

- McDowell, W.C.; Peake, W.O.; Coder, L.; Harris, M.L. Building small firm performance through intellectual capital development: Exploring innovation as the “black box”. J. Bus. Res. 2018, 88, 321–327. [Google Scholar] [CrossRef]

- Agostini, L.; Nosella, A.; Filippini, R. Does intellectual capital allow improving innovation performance? A quantitative analysis in the SME context. J. Intellect. Cap. 2017, 18, 400–418. [Google Scholar] [CrossRef]

- Chen, F.-C.; Liu, Z.J.; Kewh, Q.L. Intellectual capital and productivity of Malaysian general insurers. Econ. Model. 2014, 36, 413–420. [Google Scholar] [CrossRef]

- Oppong, G.; Pattanayak, J.; Irfan, M. Impact of intellectual capital on productivity of insurance companies in Ghana: A panel data analysis with system GMM estimation. J. Intellect. Cap. 2019, 20, 763–783. [Google Scholar] [CrossRef]

- Wignaraja, G. Innovation, learning, and exporting in China: Does R&D or a technology index matter? J. Asian Econ. 2012, 23, 224–233. [Google Scholar]

- Coad, A.; Segarra, A.; Teruel, M. Innovation and firm growth: Does firm age play a role? Res. Policy 2016, 45, 387–400. [Google Scholar] [CrossRef]

- Kolb, D.A. Experiential Learning: Experience as the Source of Learning and Development; Prentice-Hall: Englewood Cliffs, NJ, USA, 1984. [Google Scholar]

- Kim, D.H. The link between individual and organizational learning. MIT Sloan Manag. Rev. 1993, 35, 37–50. [Google Scholar]

- Eriksson, K.; Johanson, J.; Majkgard, A.; Sharma, D.D. Effect of variation on knowledge accumulation in the internationalization process. Int. Stud. Manag. Organ. 2000, 30, 26–44. [Google Scholar] [CrossRef]

- Pellegrino, J.M.; McNaughton, R.B. Beyond learning by experience: The case of alternative learning process by incrementally and rapidly internationalizing SMEs. Int. Bus. Rev. 2017, 26, 614–627. [Google Scholar] [CrossRef]

- Johanson, J.; Vahlne, J.E. The internationalization process of the firm—A model of knowledge development and increasing foreign market commitment. J. Int. Bus. Stud. 1977, 8, 23–32. [Google Scholar] [CrossRef]

- Casillas, J.C.; Acedoa, F.J.; Barberob, J.L. Learning, unlearning and internationalisation: Evidence from the pre-export phase. Int. J. Inf. Manag. 2010, 30, 162–173. [Google Scholar] [CrossRef]

- Cohen, W.M.; Levinthal, D.A. Absorptive capacity: A new perspective on learning and innovation. Adm. Sci. Q. 1990, 35, 128–152. [Google Scholar] [CrossRef]

- Kianto, A.; Sáenz, J.; Aramburu, N. Knowledge-based human resource management practices, intellectual capital and innovation. J. Bus. Res. 2017, 18, 11–20. [Google Scholar] [CrossRef]

- Zambon, S.; Marzo, G. Visualising Intangibles: Reporting in the Knowledge Economy; Ashgate Publishing: Aldershot, UK, 2007. [Google Scholar]

- Pulic, A. Intellectual capital–Does it create or destroy value? Meas. Bus. Excell. 2004, 8, 62–68. [Google Scholar] [CrossRef]

- Costa, R. Assessing intellectual capital efficiency and productivity: An application to the Italian yacht manufacturing sector. Expert Syst. Appl. 2012, 39, 7255–7261. [Google Scholar] [CrossRef]

- Marrocu, E.; Paci, R.; Pontis, M. Intangible capital and firms’ productivity. Ind. Corp. Chang. 2011, 21, 377–402. [Google Scholar] [CrossRef]

- Bontis, N.; Keow, W.C.C.; Richardson, S. Intellectual capital and business performance in Malaysian industries. J. Intellect. Cap. 2000, 1, 85–100. [Google Scholar] [CrossRef]

- Bakhsha, A.; Afrazeh, A.; Esfahanipour, A. Identifying the variables of intellectual capital and its dimensions with the approach of structural equations in the educational technology of Iran. EURASIS J. Math. Sci. Technol. Educ. 2017, 14, 1663–1682. [Google Scholar]

- Ryu, T.-G.; Lim, S.-J.; Kim, H.-J. Studies on Intellectual Property and Economic Development: Estimation of Economic Value of Korean Intellectual Capital and Patents; Korea Institute of Intellectual Property: Seoul, Korea, 2012. [Google Scholar]

- Hsu, Y.-H.; Fang, W. Intellectual capital and new product development performance: The mediating role of organizational learning capability. Technol. Forecast. Soc. Chang. 2009, 76, 664–677. [Google Scholar] [CrossRef]

- Roos, J.; Roos, G.; Edvinsson, L.; Dragonetti, N.C. Intellectual Capital: Navigating in the New Business Landscape; Macmillan: New York, NY, USA, 1997. [Google Scholar]

- Chen, F.-C.; Shu, Z.; Xie, H. Measuring intellectual capital: A new model and empirical study. J. Intellect. Cap. 2004, l5, 195–212. [Google Scholar] [CrossRef]

- Asonitis, S.; Kostagiolas, P.A. An analytic hierarchy approach for intellectual capital: Evidence for the Greek central public libraries. Libr. Manag. 2010, 31, 145–161. [Google Scholar] [CrossRef]

- Sivadas, E.; Dwyer, R.F. An examination of organizational factors influencing new product success in internal and alliance-based processes. J. Mark. 2000, 64, 31–49. [Google Scholar] [CrossRef]

- Glynn, M.S. Primer in B2B brand-building strategies with a reader practicum. J. Bus. Res. 2012, 65, 666–675. [Google Scholar] [CrossRef]

- Nadeau, M.-C.; Kar, A.; Roth, R.; Kirchain, R. A dynamic process-based cost modeling approach to understand learning effects in manufacturing. Int. J. Prod. Econ. 2010, 128, 223–234. [Google Scholar] [CrossRef]

- An, G.; Iyigun, M.F. The export technology content, learning by doing and specialization in foreign trade. J. Int. Econ. 2004, 64, 465–483. [Google Scholar] [CrossRef]

- Casillas, J.C.; Moreno, A.M.; Acedo, F.J. Path dependence view of export behavior: A relationship between static patterns and dynamic configurations. Int. Bus. Rev. 2012, 21, 465–479. [Google Scholar] [CrossRef]

- Bernard, A.B.; Jensen, J.B. Exceptional exporter performance: Cause, effect, or both? J. Int. Econ. 1999, 47, 1–25. [Google Scholar] [CrossRef]

- Monreal-Pérez, J.; Aragón-Sánchez, A.; Sánchez-Marín, G.A. A longitudinal study of the relationship between export activity and innovation in the Spanish firm: The moderating role of productivity. Int. Bus. Rev. 2012, 21, 862–877. [Google Scholar] [CrossRef]

- Levinsohn, J.; Petrin, A. Estimating production functions using inputs to control for unobservables. Rev. Econ. Stud. 2003, 70, 317–342. [Google Scholar] [CrossRef]

- Grossman, G.M.; Helpman, E. Innovation and Growth in the Global Economy; MIT Press: Cambridge, MA, USA, 1991. [Google Scholar]

- Salomon, R.; Jin, B. Do leading or lagging firms learn more from exporting? Strateg. Manag. J. 2010, 31, 1088–1113. [Google Scholar] [CrossRef]

- Lerner, A.P. The concept of monopoly and the measurement of monopoly power. Rev. Econ. Stud. 1934, 1, 157–175. [Google Scholar] [CrossRef]

- Sung, B.; Park, S.-D.; Song, W.-Y. How foreign direct investment affects CO2 emission levels in the Chinese manufacturing industry: Evidence from panel data. Econ. Syst. 2018, 43, 320–331. [Google Scholar] [CrossRef]

- Del Gatto, M.; Mion, G.; Ottaviano, G.I.P. Trade integration, firm selection and the costs of non-Europe. In CEPR Discussion Paper; No. 5730; National Bureau of Economic Research: Cambridge, MA, USA, 2006. [Google Scholar]

- Melitz, M.; Ottaviano, G.I.P. Market size, trade and productivity. In NBER Working Paper; No. 11393; National Bureau of Economic Research: Cambridge, MA, USA, 2005. [Google Scholar]

- Wooldridge, J.M. Econometric Analysis of Cross Section and Panel Data; MIT Press: Cambridge, MA, USA, 2002. [Google Scholar]

- Pesaran, M.H. Testing weak cross-sectional dependence in large panels. J. Econ. Rev. 2015, 34, 1089–1117. [Google Scholar] [CrossRef]

- Maddala, G.S.; Wu, S.A. A comparative study of unit root tests with panel data and a new simple test. Oxf. Bull. Econ. Stat. 1999, 61, 631–652. [Google Scholar] [CrossRef]

- Raponi, V.; Robotti, C.; Zaffaroni, P. Testing beta-pricing models using large cross-sections. Rev. Financ. Stud. 2019. [Google Scholar] [CrossRef]

- Sarafidis, V.; Yamagata, T.; Robertson, D. A test for cross section dependence for a linear dynamic panel model with regressors. J. Econom. 2009, 148, 149–161. [Google Scholar] [CrossRef]

- Solberger, M. Demeaning the data in panel-cointegration models to control for cross-sectional dependencies. Econ. Lett. 2011, 110, 252–254. [Google Scholar] [CrossRef]

- Cho, I. Unit root tests for panel data. J. Int. Money Financ. 2001, 20, 249–272. [Google Scholar] [CrossRef]

- Westerlund, J. Testing for error correction in panel data. Oxf. Bull. Econ. Stat. 2007, 34, 63–87. [Google Scholar] [CrossRef]

- Roodman, D. How to do xtabond2: An introduction to difference and system GMM in Stata. Stata J. 2009, 9, 86–136. [Google Scholar] [CrossRef]

- D’Amato, A.; Mazzanti, M.; Nicolli, F. Waste and organized crime in regional environments: How waste tariffs and the Mafia affect waste management and disposal. Resour. Energy Econ. 2015, 41, 185–201. [Google Scholar] [CrossRef]

- Arellano, M.; Bover, O. Another look at the instrumental variable estimation of error-component model. J. Econom. 1995, 68, 29–51. [Google Scholar] [CrossRef]

- Love, I.; Zicchino, L. Financial development and dynamic investment behavior: Evidence from panel VAR. Q. Rev. Econ. Financ. 2006, 46, 190–210. [Google Scholar] [CrossRef]

- Gnimassoun, B.; Mignon, V. How do macroeconomic imbalances interest? Evidence from a panel var analysis. Macroecon. Dyn. 2016, 20, 1717–1741. [Google Scholar] [CrossRef]

- Comunale, M. A Panel VAR Analysis of Macro-Financial Imbalances in the EU; Working Paper Series 2016; European Central Bank: Frankfurt am Main, Germany, 2017. [Google Scholar]

- Adraov, A. Dynamic interactions between financial and macroeconomics imbalances: A panel VAR analysis. In Working Paper 162; The Vienna Institute for International Economic Studies: Vienna, Austria, 2019. [Google Scholar]

- Abrigo, M.R.M.; Love, I. Estimation of panel vector autoregression in Stata. Stata J. 2016, 16, 778–804. [Google Scholar] [CrossRef]

- Hansen, J. Large sample properties of generalized method of moments estimator. Econometrica 1982, 50, 1029–1054. [Google Scholar] [CrossRef]

- Andrews, D.W.K.; Lu, B. Consistent model and moment selection procedures for GMM estimation with application to dynamic panel data models. J. Econom. 2001, 101, 123–164. [Google Scholar] [CrossRef]

- Sims, C.A. Macroeconomics and reality. Econometrica 1980, 48, 1–48. [Google Scholar] [CrossRef]

- Weerawardena, J.; O’Cass, A.; Julian, C. Does industry matter? Examining the role of industry structure and organizational learning in innovation and brand performance. J. Bus. Res. 2006, 59, 37–45. [Google Scholar] [CrossRef]

- Durana, P.; Valaskova, K.; Vagner, L.; Zadnanova, S.; Podhorska, I.; Siekelova, A. Disclosure of strategic managers’ factotum: Behavioral incentives of innovative business. Int. J. Financ. Stud. 2020, 8, 17. [Google Scholar] [CrossRef]

- Swart, J.; Kinnie, N. Organisational learning, knowledge assets and HR practices in professional service firms. Hum. Resour. Manag. J. 2010, 20, 64–79. [Google Scholar] [CrossRef]

- Tripathy, T.; Sahoo, D.; Kesharwani, A.; Mishra, A.K. Competition, intellectual capital efficiency and firms’ performance outcome in India: A structural equation modelling. Int. J. Learn. Intellect. Cap. 2016, 13, 72–95. [Google Scholar] [CrossRef]

- Montresor, S.; Perani, G.; Vezzani, A. How do companies “perceive” their intangible? New statistical evidence from the INNOBAROMETER. In IRIMA Workpackage 2, JRC Scientific and Technological Reports; Joint Research Centre: Brussels, Belgium, 2013. [Google Scholar]

- Pender, M. Entrepreneurial Competition and Industrial Location; Edward Elgar: Cheltenham, UK, 2001. [Google Scholar]

- Gong, B. Total-factor spillovers, similarities, and competitions in the petroleum industry. Energy Econ. 2018, 73, 228–238. [Google Scholar] [CrossRef]

| Variable | Mean | Variable | Mean |

|---|---|---|---|

| Total factor productivity () | 2.941 | Export volume () | 3.074 |

| Knowledge assets () | 3.922 | Reciprocal of profit margin () | 1.491 |

| Industry | Observations | Sales | Exports | Value Added | Total Assets | Knowledge Assets | Tangible Assets | Age | Profit Margin |

|---|---|---|---|---|---|---|---|---|---|

| Food products | 1185 | 338.07 | 6.68 | 126.09 | 348.10 | 45.87 | 22.32 | 39.43 | 20.30 |

| Beverages | 271 | 246.09 | 1.92 | 116.26 | 453.61 | 59.05 | 39.39 | 50.58 | 9.92 |

| Tobacco products | 24 | 2250.00 | 353.66 | 1330.00 | 4750.00 | 418.41 | 228.25 | 32.00 | 2.73 |

| Textiles (except apparel) | 364 | 113.79 | 19.00 | 24.03 | 203.87 | 10.66 | 10.50 | 51.42 | 26.18 |

| Apparel, clothing accessories, and fur articles | 533 | 172.88 | 1.76 | 61.40 | 176.20 | 26.72 | 0.54 | 32.44 | 23.36 |

| Leather, luggage, and footwear | 132 | 102.17 | 32.71 | 22.24 | 100.45 | 11.12 | 2.56 | 46.00 | 11.68 |

| Wood and products of wood and cork (except furniture) | 110 | 161.41 | 6.78 | 52.04 | 266.03 | 13.48 | 42.17 | 51.50 | 96.83 |

| Pulp, paper, and paper products | 662 | 142.14 | 11.30 | 38.77 | 187.35 | 13.60 | 42.15 | 46.41 | 29.36 |

| Printing and reproduction of recorded media | 87 | 29.05 | 3.26 | 10.82 | 45.30 | 7.91 | 2.68 | 25.72 | 12.58 |

| Coke, briquettes, and refined petroleum products | 137 | 5040.00 | 2520.00 | 2840.00 | 2600.00 | 116.03 | 341.33 | 47.60 | 8.53 |

| Chemicals and chemical products (except pharmaceuticals and medicinal chemicals) | 2526 | 498.14 | 72.33 | 160.81 | 567.86 | 36.50 | 73.15 | 35.06 | 21.36 |

| Pharmaceuticals, medicinal chemicals, and botanical products | 2416 | 68.69 | 2.41 | 39.03 | 109.94 | 17.72 | 1,440.00 | 38.4 | 13.63 |

| Rubber and plastic products | 981 | 137.03 | 10.42 | 46.61 | 167.16 | 18.21 | 19.50 | 32.43 | 17.25 |

| Other non-metallic mineral products | 932 | 192.16 | 3.29 | 60.66 | 345.47 | 22.15 | 37.83 | 43.19 | 27.92 |

| Basic metals | 1928 | 637.94 | 83.29 | 187.39 | 895.59 | 35.00 | 201.62 | 42.20 | 32.56 |

| Other machinery and equipment | 3278 | 138.88 | 26.37 | 51.32 | 184.01 | 28.56 | 7.84 | 25.62 | 15.84 |

| Electronic components, computers; visual, sound, and communication equipment | 5004 | 698.81 | 279.43 | 282.53 | 748.21 | 34.64 | 130.22 | 25.84 | 17.67 |

| Medical, precision, and optical instruments; watches and clocks | 1085 | 41.69 | 4.66 | 21.70 | 61.37 | 21.58 | 3.31 | 15.89 | 26.70 |

| Electrical equipment | 1405 | 217.54 | 45.70 | 72.84 | 274.85 | 18.95 | 17.97 | 32.13 | 18.78 |

| Other transport equipment | 512 | 1720.00 | 502.94 | 445.82 | 2280.00 | 118.45 | 103.66 | 22.90 | 29.18 |

| Furniture | 165 | 150.76 | 3.63 | 60.24 | 135.08 | 15.85 | 2.45 | 32.40 | 13.93 |

| Other types of manufacturing | 163 | 48.39 | 9.18 | 17.54 | 75.91 | 8.37 | 0.65 | 31.24 | 13.83 |

| Motor vehicles, trailers, and semitrailers | 2218 | 807.66 | 219.07 | 269.74 | 872.35 | 97.04 | 70.61 | 37.07 | 28.53 |

| Fabricated metal products (except machinery and furniture) | 990 | 92.63 | 12.35 | 31.76 | 111.51 | 18.13 | 9.11 | 25.63 | 20.81 |

| Statistic | Variable | With Trend | Without Trend | ||

|---|---|---|---|---|---|

| Level | 1st-difference | Level | 1st-difference | ||

| Inverse normal | 0.857 (0.804) | –44.563 (0.000) | –15.086 (0.000) | –60.718 (0.000) | |

| 0.863 (0.805) | –31.655 (0.000) | –2.900 (0.000) | –51.945 (0.000) | ||

| 6.120 (1.000) | –17.711 (0.000) | –11.973 (0.000) | –45.691 (0.000) | ||

| –16.280 (0.000) | –58.374 (0.000) | −27.604 (0.000) | –80.557 (0.000) | ||

| Modified inverse | 11.912 (0.000) | 79.428 (0.000) | 24.448 (0.000) | 109.316 (0.000) | |

| 8.630 (0.000) | 56.730 (0.000) | 10.752 (0.000) | 88.337 (0.000) | ||

| 6.228 (0.762) | 46.302 (0.000) | 22.733 (0.000) | 69.354 (0.000) | ||

| 24.360 (0.000) | 104.605 (0.000) | 34.978 (0.000) | 153.851 (0.000) | ||

| Statistic | With Trend | Without Trend | ||||

|---|---|---|---|---|---|---|

| Value | Z-Value | -Value | Value | Z-Value | -Value | |

| –2.001 | 27.996 | 0.850 | –1.239 | 36.579 | 0.890 | |

| –5.705 | 42.389 | 0.800 | −3.139 | 38.596 | 1.000 | |

| −95.106 | −10.273 | 0.330 | −78.372 | –11.125 | 0.350 | |

| −9.727 | 11.112 | 0.370 | −0.846 | –8.032 | 0.380 | |

| Panel A: GMM Estimation | ||||

|---|---|---|---|---|

| Independent Variables | Dependent Variables | |||

| 0.5496 (0.5978)*** | 2.8456 (0.0206)*** | 1.1219 (0.2450)*** | 1.9124 (0.3160)*** | |

| 0.0006 (0.0003)* | 0.6826 (0.0108)*** | −0.0012 (0.0018) | 0.0019 (0.0026) | |

| 0.0077 (0.0027)*** | 0.6016 (0.0015)*** | 0.9809 (0.0104)*** | 0.1130 (0.0213)*** | |

| −0.0032 (0.0014)** | −0.0201 (0.0286) | −0.0133 (0.0052)*** | 0.1579 (0.0118)*** | |

| Panel B: Statistical Values for Short-Run Causality Tests | ||||

| Independent Variables | Dependent Variable | |||

| - | 7.774*** | 20.961*** | 36.622*** | |

| 2.592* | - | 1.048 | 0.510 | |

| 7.717*** | 66.788*** | - | 27.940*** | |

| 4.703** | 0.495 | 6.404 *** | - | |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kim, H.-J.; Sung, B. How Knowledge Assets Affect the Learning-by-Exporting Effect: Evidence Using Panel Data for Manufacturing Firms. Sustainability 2020, 12, 3105. https://doi.org/10.3390/su12083105

Kim H-J, Sung B. How Knowledge Assets Affect the Learning-by-Exporting Effect: Evidence Using Panel Data for Manufacturing Firms. Sustainability. 2020; 12(8):3105. https://doi.org/10.3390/su12083105

Chicago/Turabian StyleKim, Hyun-Jee, and Bongsuk Sung. 2020. "How Knowledge Assets Affect the Learning-by-Exporting Effect: Evidence Using Panel Data for Manufacturing Firms" Sustainability 12, no. 8: 3105. https://doi.org/10.3390/su12083105

APA StyleKim, H.-J., & Sung, B. (2020). How Knowledge Assets Affect the Learning-by-Exporting Effect: Evidence Using Panel Data for Manufacturing Firms. Sustainability, 12(8), 3105. https://doi.org/10.3390/su12083105