Revisiting Energy Demand Relationship: Theory and Empirical Application

Abstract

1. Introduction

2. Revisiting the Theory of the Energy Demand Equations

Cost Minimization Approach

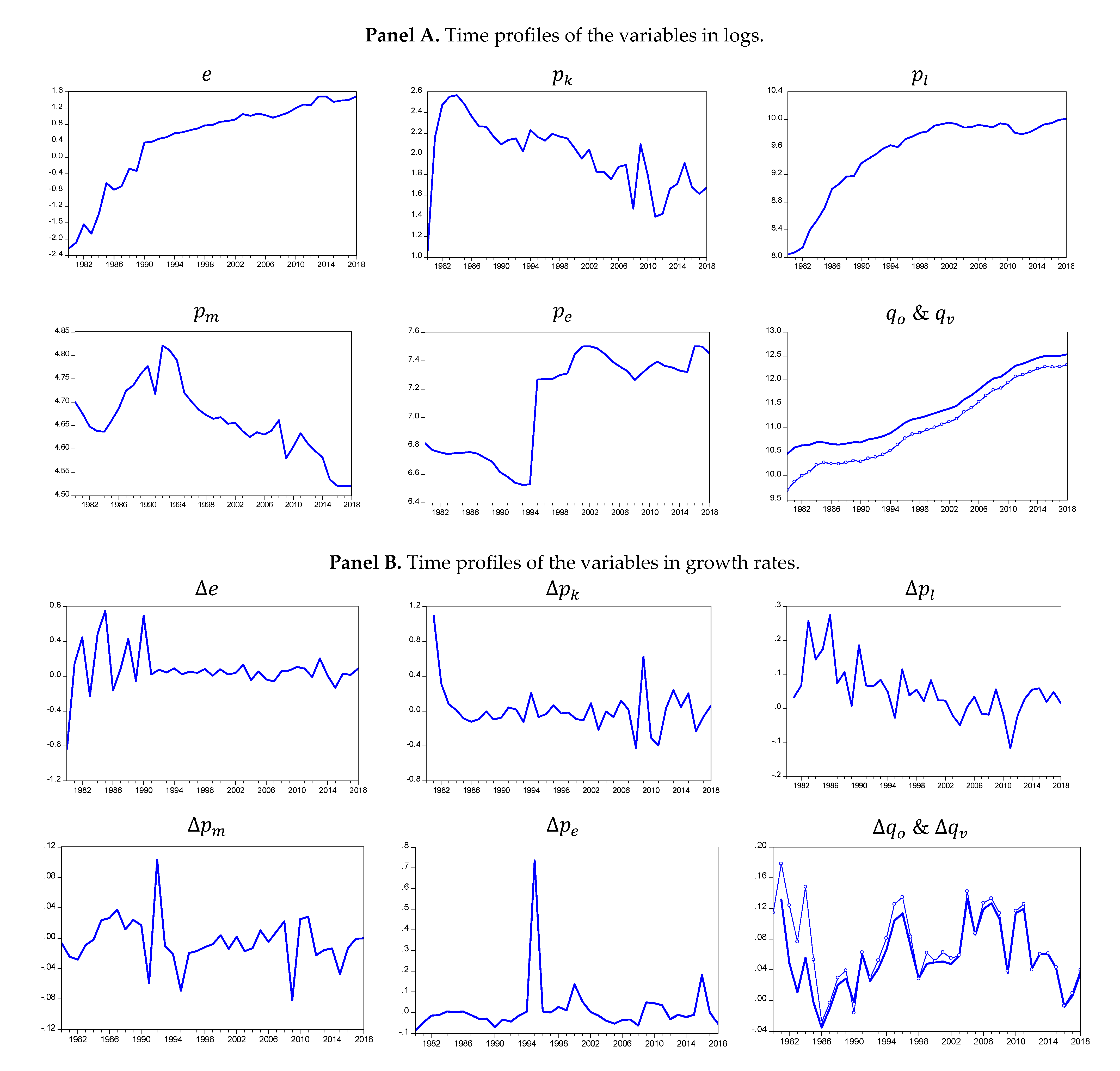

3. The Energy Demand Equations in Empirical Analysis

- Panels A and D report the results of estimations for Equations (2) and (7), respectively. All the explanatory variables have theoretically expected signs. Apparently, the cost of capital is highly statistically insignificant in both estimations. These are the results from option (i): that is, we impose the theory of energy demand on the data and ignore information coming from data, i.e., the insignificance of the capital cost. Our results are theory-driven only, and, hence, we position ourselves at the upper part of Pagan’s curve [7,11].

- Panels B and E report the results of estimations for Equations (2) and (7) without the cost of capital, respectively. In other words, we follow option (ii), such that we first apply general energy demand specifications to the data and also account for the statistical insignificance of the cost of capital and exclude it from the analysis in the GtSM framework. All the remaining variables have theoretically expected signs and are statistically significant at different levels. In other words, the estimation results are from nesting the theory of energy demand with the data in the GtSM framework, i.e., they are both theory driven and data driven, and, thus, we position ourselves at the middle part of Pagan’s curve [7,11].

- Panels C and F report the results of estimations of Equation (8), where the explanatory variables are only energy price and output/income. In other words, the estimation results are from option (iii). On data, we impose the parsimonious energy demand specification, which omits the theoretically predicted variables of prices of capital, labor, and intermediate consumption based on some assumptions made by default, as discussed in Section 2, without testing the statistical significance of the variables omitted to see whether they can contribute to the explanation of the energy demand pattern. Obviously, we miss some important information, which could come from the prices of labor and intermediate consumption, as the omitted variable tests indicate in Table 2 and Table 3. Apparently, the electricity price has an incorrect sign and is statistically insignificant, most likely due to omitting the important variables (see, e.g., the discussions in [34,35,36,37]). Obviously, if we could follow GtSM and consider both the theoretical coherence and the statistical coherence, we would not end up with such a poor specification of energy demand.

- Sometimes a variable articulated by the theory cannot be exactly measured in practice due to data inaccuracy and unavailability issues, and proxies can provide poor estimates and thus do not help us to approximate the Data Generation Process (DGP) of the variable under interest. This is exactly what we face in our analysis here. The theory in Section 2 articulates the cost of capital as an explanatory variable of energy demand. However, we cannot find the exact cost of capital data for non-oil manufacturing. It can be argued that this is not the case solely for Saudi Arabia, and, even for many developing and developed countries, the cost of capita data is not available for the different branches of industry. Following earlier studies, we proxy it, but it appears that the selected proxy does not contribute to the DGP of industrial energy demand, and it was statistically insignificant.

- Often, theories are vague about variables when it comes to considering the variables in the empirical analysis, and the selected variables may not contribute to the DGP. For example, money demand theories consider income as a scale variable in explaining the behavior of money balance. However, it is not quite clear which income measure should be considered in the empirical analysis. Therefore, GDP, retail turnover, consumption, government expenditure, and industrial production index have all been considered in the empirical analyses of money demand [38].

- All theories are based on certain assumptions, and these assumptions may not be held for the country of interest or for the time period considered (see, [2]).

- Theories do not tell us anything about structural breaks and location shifts, which can play a considerable role in explaining a given process.

4. Concluding Remarks

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

Derivation of Energy Demand Equation

References

- Suganthi, L.; Samuel, A.A. Energy models for demand forecasting—A review. Renew. Sustain. Energy Rev. 2012, 16, 1223–1240. [Google Scholar] [CrossRef]

- Bhattacharyya, S.; Timilsina, G.R. Energy Demand Models for Policy Formulation: A Comparative Study of Energy Demand Models; The World Bank: Washington, DC, USA, 2009. [Google Scholar]

- Greening, L.A.; Boyd, G.; Roop, J.M. Modeling of industrial energy consumption: An introduction and context. Energy Econ. 2007, 29, 599–608. [Google Scholar] [CrossRef]

- Jebaraj, S.; Iniyan, S. A review of energy models. Renew. Sustain. Energy Rev. 2006, 10, 281–311. [Google Scholar] [CrossRef]

- Bhattacharyya, S.; Timilsina, G.R. A review of energy system models. Int. J. Energy Sect. Manag. 2010, 4, 494–518. [Google Scholar] [CrossRef]

- Campos, J.; Ericsson, N.R.; Hendry, D.F. General-to-Specific Modeling: An Overview and Selected Bibliography. FRB Int. Financ. Discuss. Pap. 2005, 838. Available online: https://www.federalreserve.gov/pubs/ifdp/2005/838/ifdp838.pdf (accessed on 18 March 2020).

- Hendry, D.F. Deciding between alternative approaches in macroeconomics. Int. J. Forecast. 2018, 34, 119–135. [Google Scholar] [CrossRef]

- Hendry, D.F.; Johansen, S. Model discovery and Trygve Haavelmo’s legacy. Econ. Theory 2014, 31, 93–114. [Google Scholar] [CrossRef]

- Juselius, K. The Cointegrated VAR Model: Methodology and Applications; Oxford University Press: Oxford, UK, 2006. [Google Scholar]

- Hoover, K.D.; Johansen, S.; Juselius, K. Allowing the Data to Speak Freely: The Macroeconometrics of the Cointegrated Vector Autoregression. Am. Econ. Rev. 2008, 98, 251–255. [Google Scholar] [CrossRef]

- Pagan, A. Report on modelling and forecasting at the Bank of England/Bank’s response to the Pagan report. Bank Engl. Q. Bull. 2003, 1, 60. [Google Scholar]

- Hasanov, F. Theoretical Framework for Industrial Electricity Consumption Revisited; Discussion Papers ks—2019-dp66; King Abdullah Petroleum Studies and Research Center: Riyadh, Saudi Arabia, 2018. [Google Scholar]

- Fiscal Balance Program; version 2030; Kingdom of Saudi Arabia: Riyadh, Saudi Arabia, 2017. Available online: https://vision2030.gov.sa/en/programs/FBP (accessed on 18 March 2020).

- Gonand, F.; Hasanov, F.J.; Hunt, L.C. Estimating the Impact of Energy Price Reform on Saudi Arabian Intergenerational Welfare using the MEGIR-SA Model. Energy J. 2019, 40, 23. [Google Scholar] [CrossRef]

- Beenstock, M.; Dalziel, A. The demand for energy in the UK: A general equilibrium analysis. Energy Econ. 1986, 8, 90–98. [Google Scholar] [CrossRef]

- Cobb, C.W.; Douglas, P.H. A Theory of Production. Am. Econ. Rev. 1928, 18, 139–165. [Google Scholar]

- Nordhaus William, D. International Studies of the Demand for Energy. In The Demand for Energy: An International Perspective; William, N., Ed.; Chapter 13; North-Holland Publishing Company: Amsterdam, The Netherlands; USA and Canada, American Elsevier Pub. Co.: New York, NY, USA, 1977. [Google Scholar]

- International Energy Agency. 2019. Available online: https://www.iea.org/data-and-statistics?country=WORLD&fuel=Energy%20supply&indicator=Total%20primary%20energy%20supply%20(TPES)%20by%20source (accessed on 18 March 2020).

- General Authority for Statistics (GaStat). 2019. Available online: https://www.stats.gov.sa/en/ (accessed on 18 March 2020).

- Oxford Economics. “Global Economic Model”. 2018. Available online: https://www.oxfordeconomics.com/global-economic-model (accessed on 18 March 2020).

- Saudi Arabian Monetary Authority (SAMA). 2019. Available online: http://www.sama.gov.sa/en-US/Pages/default.aspx (accessed on 18 March 2020).

- El-Mallakh, R. The Saudi Arabia Rush to Development; Croom Helm Ltd.: London, UK, 1982. [Google Scholar]

- Chatah, M. A Monetary Framework for Saudi Arabia. Ph.D. Thesis, University of Texas, Austin, TX, USA, 1983. (Unpublished). [Google Scholar]

- Darrat, A.F. The Money Demand Relationship in Saudi Arabia: An Empirical Investigation. J. Econ. Stud. 1984, 11, 43–50. [Google Scholar] [CrossRef]

- Darrat, A.F. The demand for money in some major OPEC members: Regression estimates and stability results. Appl. Econ. 1986, 18, 127–142. [Google Scholar] [CrossRef]

- Al-Bassam, K.A. Money Demand and Supply in Saudi Arabia: An Empirical Analysis. Ph.D. Thesis, University of Leicester, Leicester, UK, 1990. [Google Scholar]

- Al Rasasi, M.; Banafea, W.A. Estimating Money Demand Function in Saudi Arabia: Evidence from Cash in Advance Model; SAMA Working Paper; SAMA Publication: Riyadh, Saudi Arabia, 2018. [Google Scholar]

- Al Rasasi, M.; Qualls, J. Revisiting the Demand for Money in Saudi Arabia; SAMA Working Paper; SAMA Publication: Riyadh, Saudi Arabia, 2019. [Google Scholar]

- Adedeji, O.; Kirti, D.; Kirti, D. How Do Changing U.S. Interest Rates Affect Banks in the Gulf Cooperation Council (GCC) Countries? IMF Work. Pap. 2019, 2019, 18. [Google Scholar] [CrossRef]

- Algahtani, G. Impact of Rising Interest Rate on Saudi Economy. Saudi Arab. Monet. Agency 2015. [Google Scholar] [CrossRef]

- Al-Jasser, M.; Ahmed, B. Monetary policy instruments and procedures in Saudi Arabia. BIS Policy Pap. 1999, 5, 203–217. [Google Scholar]

- Phillips, P.C.B.; Hansen, B.E. Statistical Inference in Instrumental Variables Regression with I (1) Processes. Rev. Econ. Stud. 1990, 57, 99–125. [Google Scholar] [CrossRef]

- Phillips, P.C.B.; Loretan, M. Estimating Long-Run Economic Equilibria. Rev. Econ. Stud. 1991, 58, 407–436. [Google Scholar] [CrossRef]

- Odhiambo, N.M. Electricity consumption and economic growth in South Africa: A trivariate causality test. Energy Econ. 2009, 31, 635–640. [Google Scholar] [CrossRef]

- Triacca, U. Non-causality: The role of the omitted variables. Econ. Lett. 1998, 60, 317–320. [Google Scholar] [CrossRef]

- Caporale, G.M.; Nikitas, P. Causality and forecasting in incomplete systems. J. Forecast. 1997, 16, 425–437. [Google Scholar] [CrossRef]

- Lütkepohl, H. Non-causality due to omitted variables. J. Econ. 1982, 19, 367–378. [Google Scholar] [CrossRef]

- Sriram, S. A survey of recent empirical money demand studies. IMF Staff Pap. 2001, 47, 334–365. [Google Scholar]

- Atalla, T.N.; Hunt, L.C. Modelling residential electricity demand in the GCC countries. Energy Econ. 2016, 59, 149–158. [Google Scholar] [CrossRef]

- Hagihara, J. Saudi Arabia’s domestic energy situation and policy: Focusing on its power sector. Kyoto Bull. Islam. Area Stud. 2013, 6, 107–135. [Google Scholar]

- Christopoulos, D.K. The demand for energy in Greek manufacturing. Energy Econ. 2000, 22, 569–586. [Google Scholar] [CrossRef]

| Variable | Notation | Description/definition | Source |

|---|---|---|---|

| Electricity consumption | The demand for electricity in non-oil industrial sector, mtoe.* | IEA [18] | |

| Output in non-oil manufacturing in real terms | This is the sum of value added and intermediate consumption both in manufacturing (excluding petroleum manufacturing) in million SAR at 2010 prices. | GSTAT [19] and OEGEM [20] | |

| Value added in non-oil manufacturing in real terms | The value added in manufacturing excluding petroleum manufacturing, in million SAR at 2010 prices. | GSTAT [19] | |

| Price of electricity consumed in industry in real terms | is the nominal price of the electricity consumed in industry in SAR/toe. is the deflator of the non-oil manufacturing value added, which is calculated as below: is the nominal value added in non-oil manufacturing, in million SAR. | Own calcula tion using GSTAT [19] data | |

| Cost of capital in real terms | This is the United States Seven-Year Treasury note yield, at constant maturity, adjusted for the US inflation rate, %. | OEGEM [20] | |

| Average annual wage in real terms | is the average annual wage in nominal term, which is calculated as below: is the total earnings in thousand SAR. is total employment in thousand persons. is Consumer Price Index, 2010 = 100. | Own calcula tion using GSTAT [19] data | |

| Price of intermediate consumption in real terms | is the deflator of the non-oil value added, which is calculated as below: is the nominal value added in non-oil manufacturing, in million SAR. is the real value added in non-oil manufacturing, in million SAR at 2010 prices. | Own calcula tion using GSTAT [19] data |

| Panel A. Estimation of Equation (2) | Panel B. Estimation of Equation (2) without | Panel C. Estimation of Equation (8), where total output is used | ||||

|---|---|---|---|---|---|---|

| Estimated long-run elasticities | ||||||

| Regressor | Coef. | P-value | Coef. | P-value | Coef. | P-value |

| 0.097 | 0.643 | − | − | − | − | |

| 1.453 | 0.000 | 1.505 | 0.000 | − | − | |

| 1.980 | 0.086 | 1.493 | 0.087 | − | − | |

| −0.224 | 0.200 | −0.285 | 0.075 | 0.630 | 0.392 | |

| 0.608 | 0.001 | 0.532 | 0.000 | 0.892 | 0.021 | |

| 0.171098 | 0.168028 | 0.604501 | ||||

| 0.969779 | 0.970854 | 0.622769 | ||||

| Post-estimation test results | ||||||

| Q | 0.368 | 0.544 | 0.316 | 0.574 | 0.809 | 0.000 |

| 0.369 | 0.832 | 0.849 | 0.654 | 6.330 | 0.042 | |

| for | − | − | 0.200 | 0.658 | 0.567 | 0.456 |

| for | − | − | − | − | 507.355 | 0.000 |

| for | − | − | − | − | 51.613 | 0.000 |

| Cointegration test results | ||||||

| −5.492 | 0.027 | −5.545 | 0.011 | −2.623 | 0.440 | |

| −34.067 | 0.024 | −34.239 | 0.009 | −5.674 | 0.852 | |

| Panel D. Estimation of Equation (7) | Panel E. Estimation of Equation (7) without | Panel F. Estimation of Equation (8), where income is used | ||||

|---|---|---|---|---|---|---|

| Estimated long-run elasticities | ||||||

| Regressor | Coef. | P-value | Coef. | P-value | Coef. | P-value |

| 0.030 | 0.885 | − | − | − | − | |

| 1.368 | 0.000 | 1.439 | 0.000 | − | − | |

| 1.838 | 0.111 | 1.621 | 0.056 | − | − | |

| −0.218 | 0.217 | −0.249 | 0.105 | 0.364 | 0.727 | |

| 0.540 | 0.002 | 0.499 | 0.000 | 1.019 | 0.029 | |

| 0.170074 | 0.169650 | 0.608458 | ||||

| 0.970140 | 0.970289 | 0.672940 | ||||

| Post-estimation test results | ||||||

| Q | 0.594 | 0.441 | 0.669 | 0.413 | 31.490 | 0.000 |

| 0.164 | 0.921 | 0.922 | 0.631 | 0.687 | 0.709 | |

| for | − | − | 0.029 | 0.865 | 0.808 | 0.375 |

| for | − | − | − | − | 399.451 | 0.000 |

| for | − | − | − | − | 67.250 | 0.000 |

| Cointegration test results | ||||||

| −5.351 | 0.035 | −5.378 | 0.015 | −1.853 | 0.795 | |

| −33.126 | 0.031 | −33.258 | 0.013 | −5.137 | 0.881 | |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hasanov, F.J.; Mikayilov, J.I. Revisiting Energy Demand Relationship: Theory and Empirical Application. Sustainability 2020, 12, 2919. https://doi.org/10.3390/su12072919

Hasanov FJ, Mikayilov JI. Revisiting Energy Demand Relationship: Theory and Empirical Application. Sustainability. 2020; 12(7):2919. https://doi.org/10.3390/su12072919

Chicago/Turabian StyleHasanov, Fakhri J., and Jeyhun I. Mikayilov. 2020. "Revisiting Energy Demand Relationship: Theory and Empirical Application" Sustainability 12, no. 7: 2919. https://doi.org/10.3390/su12072919

APA StyleHasanov, F. J., & Mikayilov, J. I. (2020). Revisiting Energy Demand Relationship: Theory and Empirical Application. Sustainability, 12(7), 2919. https://doi.org/10.3390/su12072919