Industrial Clusters as Drivers of Sustainable Regional Economic Development? An Analysis of an Automotive Cluster from the Perspective of Firms’ Role

Abstract

1. Introduction

2. Literature Review and Analytical Framework

3. Methodology

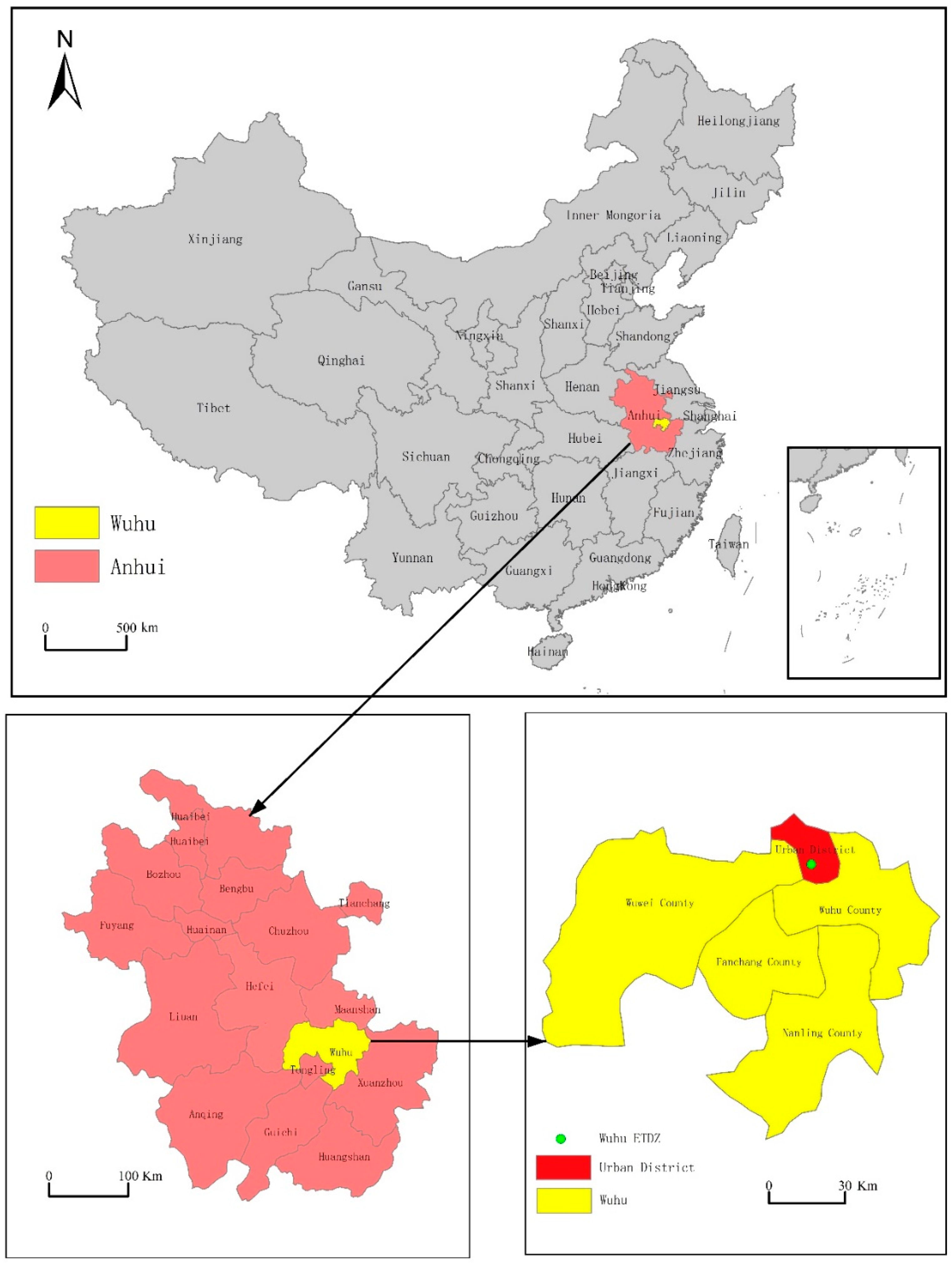

3.1. Data Sources

3.2. Research Design

4. Findings and Discussions

4.1. Industrial Clusters as Drivers of Sustainable Regional Economic Growth

4.2. Firms’ Role within the Chery Auto Cluster

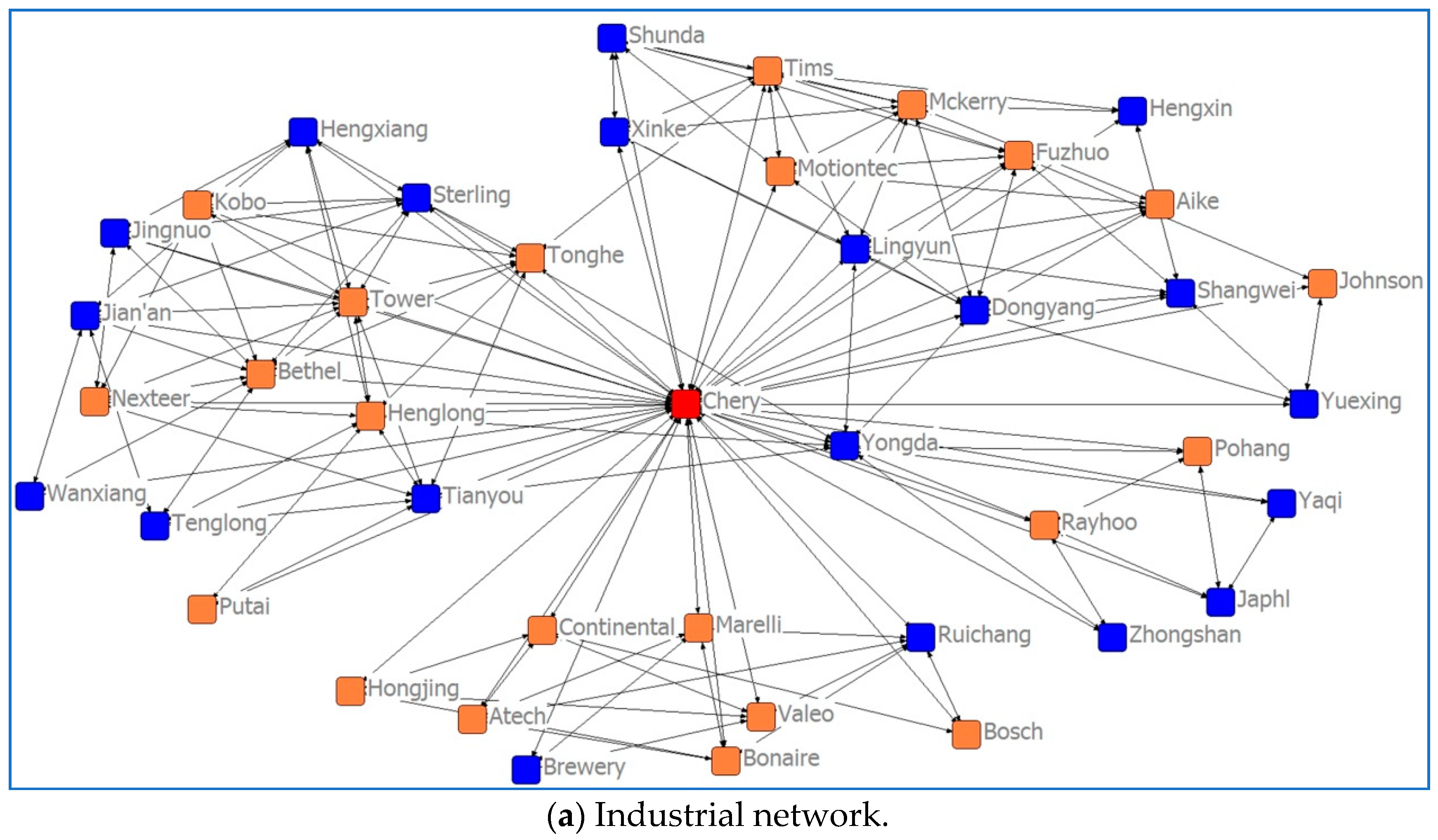

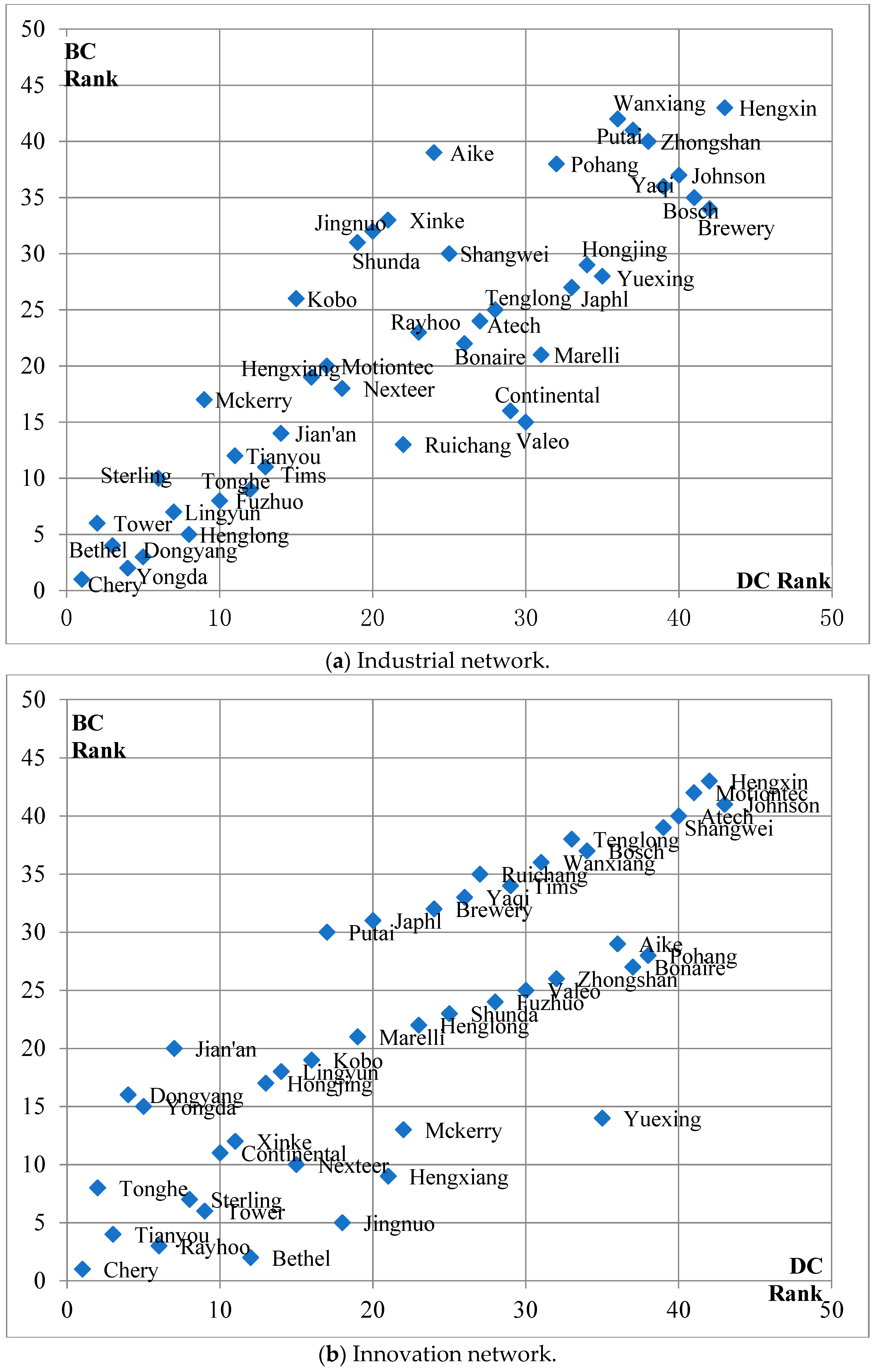

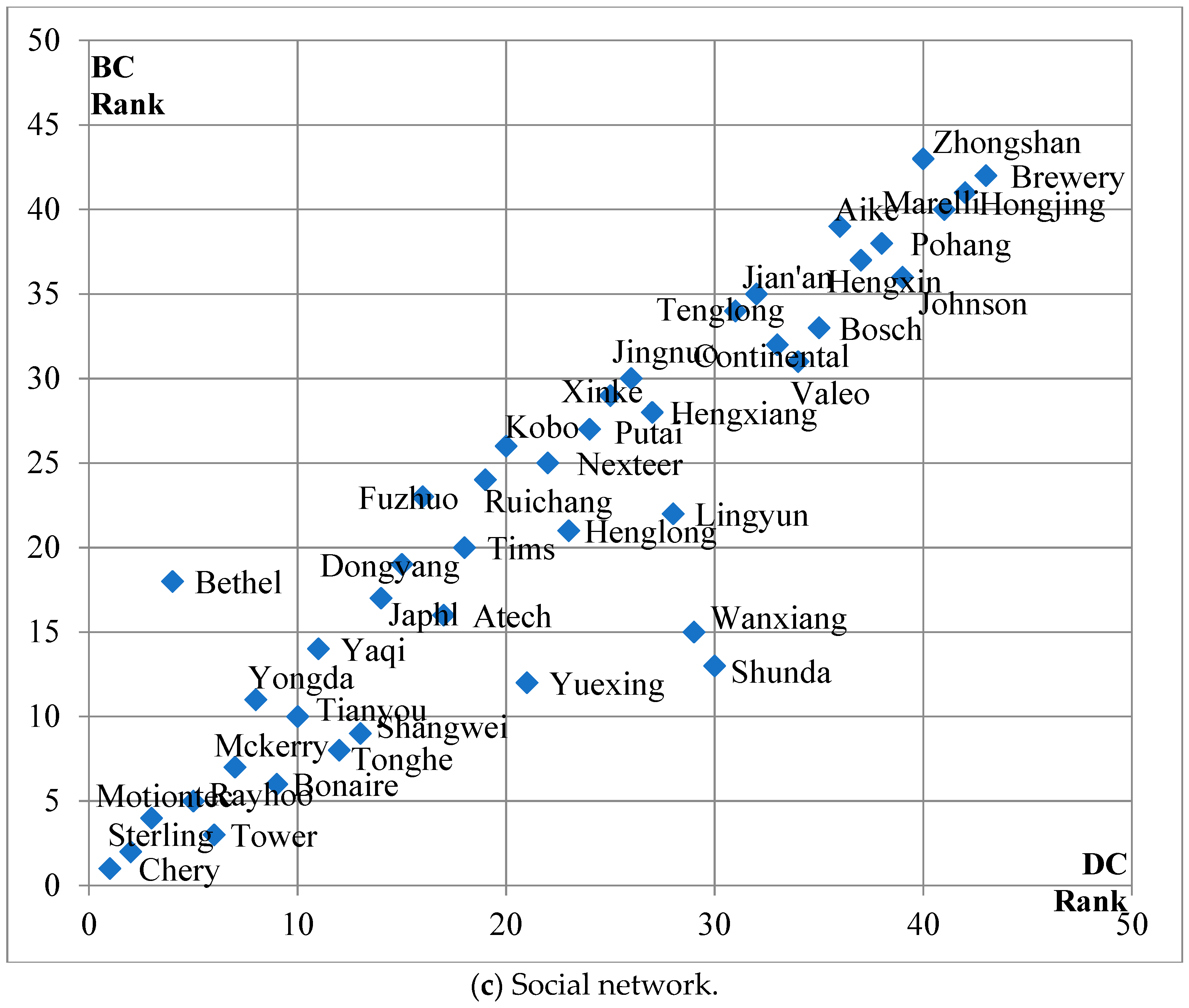

4.2.1. Firms’ Role by Domain

“Our company is a strong competitor in the automotive mold field. We supply about 70% of the powertrain systems and components for Chery. Our company has extensive relationships with firms outside the region. We have a large variety of suppliers. For various reasons, these suppliers do not sell directly to Chery. In other words, they supply Chery with parts and components only through our company.”(Transcribed from an interview conducted on 29 October 2015)

“We opened the factory in Wuhu in 2002. After more than ten years, we have built technological relationships with many foreign and domestic firms within the Wuhu ETDZ. Chassis companies from outside the region often seek assistance from us in order to get involved in the Chery auto cluster.”—Tower company official (Transcribed from an interview conducted on 24 September 2015)

“There is a Corporate Social Responsibility Council jointly founded by the Wuhu ETDZ Management Committee and Chery. Our company has been elected as an executive council member. The election was recognition of our social contributions. It also raised expectations for our social responsibilities. As you may also know, Chery has a large number and variety of suppliers. It is often very difficult for small firms to organize some social activities. Under this circumstance, these small firms may propose some social events and apply (for approval) through an executive council member like our company, and we take on the role of a ‘coordinator’. We have done this for more than ten years, and accumulated a wealth of experience. As a result, our company has good social reputation.”—Rayhoo company official (Transcribed from an interview conducted on 28 October 2015)

4.2.2. Firms’ Role in the Chery Auto Cluster: A Comprehensive Identification

4.2.3. Firm’s Role in the Industrial Cluster: Influencing Factors

“The reason we chose to invest in Wuhu ETDZ was to be close to and work with Chery to make profit. But Chery makes strategic adjustments, we have to adjust our own development strategies too in order to upgrade and diversify our products, expand our market, and achieve brand success. Therefore, our role (in the industrial cluster) has evolved over time, from a supplier to intermediary and then to a lead firm (in the network). We even control some supply chains that connect Chery with firms outside the region.”(Transcribed from an interview conducted on 28 October 2015)

“Our company experienced difficulties in 2011 due to Chery’s transformation and increased requirements for product quality. Even though we had the technological capabilities, there were problems in production and post-production services. We made efforts to address them and have seen significant improvement in management.”—Sterling company official (Transcribed from an interview conducted on 27 October 2015)

“My company has not adapted itself to the local environment. The challenges exist in several areas. First, there are some differences in corporate management culture. For example, the popular performance method used in China is not supported in our company. Secondly, we did not do a good job in recruiting and retaining talent. Thirdly, our company is a joint venture, and sometimes we cannot make a decision on some issues because stakeholders cannot reach an agreement.”—Mckerry company official (Transcribed from an interview conducted on 27 October 2015)

5. Summary and Concluding Remarks

Author Contributions

Funding

Conflicts of Interest

Appendix A

| Product Category | Full Name | Abbreviation | Origin |

|---|---|---|---|

| Chery Automobile Co., Ltd. | Chery | Wuhu, Anhui | |

| Powertrain System | Yongda Technology Co., Ltd. | Yongda | Zhejiang |

| Yaqi Automotive Parts Co., Ltd. | Yaqi | Jiangsu | |

| Japhl Powertrain System Co,.Ltd | Japhl | Anhui | |

| RayhooHaobo Mold Technology Co., Ltd. | Rayhoo | Taiwan | |

| Zhongshan Equipment Engineering Co., Ltd. | Zhongshan | Anhui | |

| Pohang Automotive Parts Manufacturing Co., Ltd. | Pohang | Korea | |

| Body System | Motiontec Automotive Technology Co., Ltd. | Bethel | Taiwan |

| Shangwei Automobile Accessories Co., Ltd. | Shangwei | Shanghai | |

| Xinke Automotive Parts Co., Ltd. | Xinke | Shanghai | |

| Fuzhuo Automobile Interior Co., Ltd. | Fuzhuo | Australia | |

| Mckerry Automotive Exterior Co., Ltd. | Mckerry | Canada | |

| Tims Automotive Technology Co., Ltd. | Tims | Japan | |

| Yuexing Automobile Ornaments Co., Ltd. | Yuexing | Liaoning | |

| Shunda Automotive Accessories Co., Ltd. | Shunda | Jilin | |

| Hengxin Automotive Interior Manufacturing Co., Ltd. | Hengxin | Zhejiang | |

| Johnson Controls Automotive Trim Co., Ltd. | Johnson | U.S. | |

| Aike Automobile Technology Co., Ltd | Aike | U.S. | |

| Dongyang Automotive Plastic Parts Co., Ltd. | Dongyang | Taiwan | |

| Lingyun Industrial Co., Ltd. | Lingyun | Hebei | |

| Chassis System | Tianyou Automotive Engineering Co., Ltd. | Tianyou | Zhejiang |

| Tonghe Automotive Pipeline System Co., Ltd. | Tonghe | Hong Kong | |

| Sterling Steering System Co., Ltd. | Sterling | Zhejiang | |

| Henglong Automobile Steering System Co., Ltd. | Henglong | Hong Kong | |

| Tower Automotive Products Co., Ltd. | Tower | U.S. | |

| Bethel Automotive Safety Systems Co., Ltd. | Bethel | Canada | |

| Putai Automotive Technology Co., Ltd. | Putai | U.S. | |

| Jingnuo Automotive Electric Co., Ltd. | Jingnuo | Jiangsu | |

| Nexteer Driveline System Co., Ltd. | Nexteer | U.S. | |

| Jian’an Chassis System Co., Ltd. | Jian’an | Sichuan | |

| Wanxiang System Co., Ltd. | Wanxiang | Zhejiang | |

| Hengxiang Industrial Co., Ltd. | Hengxiang | Zhejiang | |

| Tenglong Automotive Parts Manufacturing Co., Ltd. | Tenglong | Jiangsu | |

| Kobo Auto Parts Co., Ltd. | Kobo | U.S. | |

| Electronics System | Continental Automotive Interior Co., Ltd. | Continental | Germany |

| Bonaire Automotive Electrical Systems Co., Ltd. | Bonaire | U.S. | |

| Atech-Automotive Co., LTD | Atech | U.S. | |

| Ruichang Automotive Electric System Co., Ltd. | Ruichang | Guangdong | |

| Brewery Automotive Parts Co., Ltd. | Brewery | Guangxi | |

| Marelli Automotive Parts Co., Ltd. | Marelli | Italy | |

| Valeo Automotive Lighting Systems Co., Ltd. | Valeo | France | |

| Bosch Automotive Multimedia Co., Ltd. | Bosch | Germany | |

| Hongjing Electronics Co., Ltd. | Hongjing | Taiwan |

References

- Porter, M.E. Clusters and new economics of competition. Harv. Bus. Rev. 1998, 6, 77–90. [Google Scholar]

- Iammarino, S.; McCann, P. The structure and evolution of industrial clusters: Transactions, technology and knowledge spillovers. Res. Policy 2006, 35, 1018–1036. [Google Scholar] [CrossRef]

- Papalia, R.B.; Bertarelli, S. The role of local agglomeration economies and regional characteristics in attracting FDI: Italian evidence. Int. J. Econ. Bus. 2009, 16, 161–188. [Google Scholar] [CrossRef]

- Perri, A. Innovation and the Multinational Firm: Perspectives on Foreign Subsidiaries and Host Locations; Palgrave Macmillan: New York, NY, USA, 2014. [Google Scholar]

- Lambert, T.E.; Mattson, G.A.; Dorriere, K. The impact of growth and innovation clusters on unemployment in US metro regions. Reg. Sci. Polict. Pract. 2017, 9, 25–37. [Google Scholar] [CrossRef]

- Boschma, R. New industries and windows of locational opportunity: A long-term analysis of Belgium. Erdkunde. 1997, 51, 1–19. [Google Scholar] [CrossRef]

- Gereffi, G. The organization of buyer-driven commodity chains: How US retailers shape overseas production networks. In Commodity Chains and Global Capitalism; Gereffi, G., Korzeniewicz, M., Eds.; Greenwood Press: Westport, CT, USA, 1994; pp. 95–122. [Google Scholar]

- Gereffi, G. International trade and industrial upgrading in the apparel commodity chain. J. Int. Econ. 1999, 48, 37–70. [Google Scholar] [CrossRef]

- Gereffi, G. Global Value Chains and Development: Redefining the Contours of 21st Century Capitalism; Cambridge University Press: New York, NY, USA, 2018. [Google Scholar]

- Gereffi, G.; Humphrey, J.; Sturgeon, T. The governance of global value chains. Rev. Int. Polit. Econ. 2005, 12, 78–104. [Google Scholar] [CrossRef]

- Kaplinsky, R. Competitions Policy and the Global Coffee and Cocoa Value Chains; UNCTAD: Geneva, Switzerland, 2004. [Google Scholar]

- Navas-Alemán, L. The impact of operating in multiple value chains for upgrading: The case of the Brazilian furniture and footwear industries. World Dev. 2011, 39, 1386–1397. [Google Scholar] [CrossRef]

- Coe, N.M.; Yeung, H.W.C. Global production networks: Theorizing economic development in an interconnected world. OUP Catalogue 2015, 16, 539–540. [Google Scholar]

- Wang, J.H.; Lee, C.K. Global production networks and local institution building: The development of the information-technology industry in Suzhou, China. Environ. Plann A 2007, 39, 1873–1888. [Google Scholar] [CrossRef]

- Yang, Y.R.; Hsia, C.J. Spatial clustering and organizational dynamics of transborder production networks: A case study of Taiwanese information-technology companies in the Greater Suzhou Area, China. Environ. Plann A 2007, 39, 1346–1363. [Google Scholar] [CrossRef]

- Yeung, H.W.C. Industrial clusters and production networks in Southeast Asia: A global production networks approach. In Production Networks and Industrial Clusters: Integrating Economies in Southeast Asia; Kuroiwa, I., Heng, T.M., Eds.; Institute of Southeast Asian Studies: Singapore, 2008; pp. 83–120. [Google Scholar]

- Christopherson, S.; Clark, J. Power in firm networks: What it means for regional innovation systems. Reg. Stud. 2007, 41, 1223–1236. [Google Scholar] [CrossRef]

- Rutherford, T.; Holmes, J. ‘The flea on the tail of the dog’: Power in global production networks and the restructuring of Canadian automotive clusters. J. Econ. Geogr. 2008, 8, 519–544. [Google Scholar] [CrossRef]

- Granovetter, M. Economic action and social structure: The problem of embeddedness. Am. J. Sciol. 1985, 91, 481–510. [Google Scholar] [CrossRef]

- Gnyawali, D.R.; Madhavan, R. Cooperative networks and competitive dynamics: a structural embeddedness perspective. Acad. Manag. Rev. 2001, 26, 431–445. [Google Scholar] [CrossRef]

- Audretsch, D.B.; Lehmann, E.E. Does the knowledge spillover theory of entrepreneurship hold for regions? Res. Policy 2005, 34, 1191–1202. [Google Scholar] [CrossRef]

- Fu, W. Industrial clusters as hothouses for nascent entrepreneurs? the case of Tianhe Software Park in Guangzhou, China. Ann. Reg. Sci. 2016, 57, 253–270. [Google Scholar] [CrossRef]

- Belussi, F.; Hervas-Oliver, J.L. Cluster advantage and firm performance: A concluding remark. In Agglomeration and Firm Performance; Belussi, F., Hervas-Oliver, J.L., Eds.; Springer: Berlin, Germany, 2018; pp. 309–324. [Google Scholar]

- Boschma, R.; Balland, P.A.; Kogler, D. The geography of inter-firm knowledge spillovers in biotech. In The Economics of Knowledge, Innovation and Systemic Technology Policy; Crespi, F., Quatraro, F., Eds.; Routledge: New York, NY, USA, 2015; pp. 147–169. [Google Scholar]

- Broekel, T.; Boschma, R. The cognitive and geographical structure of knowledge links and how they influence firms’ innovation performance. Region. Stat. 2016, 6, 3–26. [Google Scholar] [CrossRef]

- Liu, W.; Dicken, P. Transnational corporations and ‘obligated embeddedness’: Foreign direct investment in China’s automobile industry. Environ. Plann A 2006, 38, 1229–1247. [Google Scholar] [CrossRef]

- Burt, S.; Johansson, U.; Dawson, J. Dissecting embeddedness in international retailing. J. Econ. Geogr. 2017, 17, 685–707. [Google Scholar] [CrossRef]

- Grabher, G. The disembedded regional economy: The transformation of East German industrial complexes into western enclaves. In Globalization, Institutions, and Regional Development in Europe; Amin, A., Thrift, N., Eds.; Oxford University Press: Oxford, UK, 1994; pp. 177–195. [Google Scholar]

- Bell, M.; Albu, M. Knowledge systems and technological dynamism in industrial clusters in developing countries. World Dev. 1999, 27, 1715–1734. [Google Scholar] [CrossRef]

- Pan, F.; Wang, J. From obligated embeddedness to supplier chain park investment: A new mode of FDI? China Soft Sci. Mag. 2010, 3, 95–102. [Google Scholar]

- Chen, X.; Miao, C.; Pan, S.; Ai, S. Characteristics and construction mechanism of enterprise networks in “Hub- and- Spoke” cluster: Empirical evidence from Chery cluster in 2014, China. Geogr Res. 2018, 37, 353–365. [Google Scholar]

- Wasserman, S.; Faust, K. Social Network Analysis: Methods and Applications; Cambridge University Press: New York, NY, USA, 1994. [Google Scholar]

- Batt, P.J.; Purchase, S. Managing collaboration within networks and relationships. Ind. Market. Manag. 2004, 33, 169–174. [Google Scholar] [CrossRef]

- Boschma, R.A.; TerWal, A.L. Knowledge networks and innovative performance in an industrial district: The case of a footwear district in the South of Italy. Ind. Innov. 2007, 14, 177–199. [Google Scholar] [CrossRef]

- Prell, C.; Hubacek, K.; Reed, M. Stakeholder analysis and social network analysis in natural resource management. Soc. Nat. Resour. 2009, 22, 501–518. [Google Scholar] [CrossRef]

- Pauget, B.; Wald, A. Relational competence in complex temporary organizations: The case of a French hospital construction project network. Int. J. Projt. Manag. 2013, 31, 200–211. [Google Scholar] [CrossRef]

- Dolfsma, W.; Van der Eijk, R. Network position and firm performance–the mediating role of innovation. Technol. Anal. Strateg. Manag. 2017, 29, 556–568. [Google Scholar] [CrossRef]

- Chuluun, T.P.; Prevost, A.; Upadhyay, A. Firm network structure and innovation. J. Corp. Financ. 2017, 44, 193–214. [Google Scholar] [CrossRef]

- Pavlínek, P.; Ženka, J. Upgrading in the automotive industry: Firm-level evidence from Central Europe. J. Econ. Geogr. 2010, 11, 559–586. [Google Scholar] [CrossRef]

- Li, Y.; Kong, X.; Zhang, M. Industrial upgrading in global production networks: The case of the Chinese automotive industry. Asia Pac. Bus. Rev. 2016, 22, 21–37. [Google Scholar] [CrossRef]

- Pavlínek, P.; Žížalová, P. Linkages and spillovers in global production networks: Firm-level analysis of the Czech automotive industry. J. Econ. Geogr. 2016, 16, 331–363. [Google Scholar] [CrossRef]

- Sturgeon, T.; Van, B.J.; Gereffi, G. Value chains, networks and clusters: Reframing the global automotive industry. J. Econ. Geogr. 2008, 8, 297–321. [Google Scholar] [CrossRef]

- Pavlínek, P. Global production networks, foreign direct investment, and supplier linkages in the integrated peripheries of the automotive industry. Econ. Geogr. 2018, 94, 141–165. [Google Scholar] [CrossRef]

- Anaya, L.G. Knowledge transfer in the automotive industry: The case of JICA’s project for automotive supply chain development in Mexico. Méx Cuenca Pac. 2019, 23, 93–122. [Google Scholar] [CrossRef]

- Khan, Z.; Shenkar, O.; Lew, Y.K. Knowledge transfer from international joint ventures to local suppliers in a developing economy. J. Int. Bus. Stud. 2015, 46, 656–675. [Google Scholar] [CrossRef]

- Kramer, J.P.; Diez, J.R. Catching the local buzz by embedding? Empirical insights on the regional embeddedness of multinational enterprises in Germany and the UK. Reg. Stud. 2012, 46, 1303–1317. [Google Scholar] [CrossRef]

- Rugraff, E.; Sass, M. How did the automotive component suppliers cope with the economic crisis in Hungary? Eur.-Asia Stud. 2016, 68, 1396–1420. [Google Scholar] [CrossRef]

- Eisingerich, A.B.; Bell, S.J.; Tracey, P. How can clusters sustain performance? The role of network strength, network openness, and environmental uncertainty. Res. Policy 2010, 39, 239–253. [Google Scholar] [CrossRef]

- Plum, O.; Hassink, R. Analysing the knowledge base configuration that drives southwest Saxony’s automotive firms. Eur. Urban Reg Stud. 2013, 20, 206–226. [Google Scholar] [CrossRef]

- Shen, Y.J.; Yu, S.L.; Zhu, D. Rising labor costs, industrial transfer and firm value: A case study on Foxconn’s immigration. J. Account. Econ. 2017, 31, 56–70. [Google Scholar]

- Turkina, E.; Van Assche, A.; Kali, R. Structure and evolution of global cluster networks: Evidence from the aerospace industry. J. Econ. Geogr. 2016, 16, 1211–1234. [Google Scholar]

- SBA (Statistical Bureau of Anhui) Anhui Statistical Yearbook; China Statistics Press: Beijing, China, 2018.

- Wuhu Economic and Technological Development Zone (ETDZ), Wuhu Economic and Technological Development Zone—Profile. Available online: http://www.weda.gov.cn/UserData/SortHtml/539/59219796547.html (accessed on 10 June 2019).

- Liu, Y. The dynamics of local upgrading in globalizing latecomer regions: A geographical analysis. Reg. Stud. 2017, 51, 880–893. [Google Scholar] [CrossRef]

- Han, F.; Xi, Q.; Ma, T. Building competitive advantage of locations for automobile industry: Changchun as the example. Int. J. Bus. Manag. 2008, 3, 107–112. [Google Scholar] [CrossRef]

- Depner, H.; Bathelt, H. Exporting the German model: The establishment of a new automobile industry cluster in Shanghai. Econ. Geogr. 2005, 81, 53–81. [Google Scholar] [CrossRef]

- Chu, W. How the Chinese government promoted a global automobile industry. Ind. Corp. Chang. 2011, 20, 1235–1276. [Google Scholar] [CrossRef]

- Borgatti, S.P.; Everett, M.G. Models of core/periphery structures. Soc. Netw. 1999, 21, 375–395. [Google Scholar] [CrossRef]

- Yeung, H.W.C. Strategic Coupling: East Asian Industrial Transformation in the New Global Economy; Cornell University Press: Ithaca, NY, USA, 2016. [Google Scholar]

- Lowe, B. Design driven innovation: Changing the rules of competition by radically innovating what things mean. Res. Tech. Manag. 2009, 52, 67–68. [Google Scholar]

- Wang, C. Geography of knowledge sourcing, search breadth and depth patterns, and innovative performance: A firm heterogeneity perspective. Environ. Plann A 2015, 47, 744–761. [Google Scholar] [CrossRef]

- Markusen, A. Sticky places in slippery space: A typology of industrial districts. Econ. Geogr. 1996, 72, 293–313. [Google Scholar] [CrossRef]

- Martin, R.; Sunley, P. Path dependence and regional economic evolution. Papers Evol. Econ. Geogr. 2006, 6, 395–437. [Google Scholar] [CrossRef]

| Role Type | Linkages with Other Firms | Network Position | Power Relations | |||

|---|---|---|---|---|---|---|

| Domestic | Foreign | Industrial | Technological | Social | ||

| Dominant Core | Strongest | Strongest | Core | Strongest | Strongest | Strongest |

| Lead Firms | Stronger | Stronger | Central | Stronger | Stronger | Stronger |

| Gatekeepers | Strong | Strong | Critical | Strong | Strong | Strong |

| Intermediaries | Uncertain | Uncertain | Intermediate | Weak | Weak | Weak |

| Club of Foreigners | Weak | Strong | Peripheral | Strong | Strong | Weak |

| Peripherals | Weak | Weak | Peripheral | Weaker | Weaker | Weaker |

| Loners | Weak | Weak | Isolated | Weakest | Weakest | Weakest |

| Industrial Network | Technological Network | Social Network | ||||||

|---|---|---|---|---|---|---|---|---|

| Firm | Foreign | Domestic | Firm | Foreign | Domestic | Firm | Foreign | Domestic |

| Kobo | 1 | 6 | Mckerry | 0 | 3 | Putai | 0 | 3 |

| Aike | 1 | 4 | Henglong | 0 | 3 | Lingyun | 0 | 3 |

| Continental | 1 | 4 | Kobo | 0 | 3 | Kobo | 0 | 3 |

| Atech | 1 | 4 | Fuzhuo | 0 | 2 | Continental | 0 | 1 |

| Johnson | 1 | 2 | Bosch | 0 | 2 | Bosch | 0 | 1 |

| Putai | 1 | 2 | Pohang | 0 | 1 | Pohang | 0 | 0 |

| Bosch | 1 | 2 | Aike | 0 | 1 | Johnson | 0 | 0 |

| Motiontec | 2 | 5 | Motiontec | 0 | 0 | Aike | 0 | 0 |

| Bonaire | 2 | 3 | Johnson | 0 | 0 | Marelli | 0 | 0 |

| Vale | 2 | 3 | Bonaire | 0 | 0 | Vale | 0 | 0 |

| Henglong | 3 | 6 | Atech | 0 | 0 | Hongjing | 0 | 0 |

| Fuzhuo | 3 | 4 | Continental | 1 | 3 | Mckerry | 1 | 8 |

| Marelli | 3 | 2 | Putai | 1 | 2 | Tower | 1 | 8 |

| Pohang | 3 | 1 | Marelli | 1 | 2 | Fuzhuo | 1 | 4 |

| Hongjing | 3 | 1 | Tims | 1 | 1 | Atech | 1 | 3 |

| Tower | 4 | 7 | Vale | 1 | 1 | Henglong | 1 | 2 |

| Behtel | 4 | 6 | Hongjing | 2 | 2 | Tims | 2 | 1 |

| Tims | 4 | 5 | Tower | 3 | 1 | Tonghe | 3 | 4 |

| Mckerry | 4 | 4 | Behtel | 3 | 1 | Behtel | 4 | 7 |

| Tonghe | 4 | 4 | Lingyun | 3 | 1 | Rayhoo | 4 | 6 |

| Rayhoo | 4 | 1 | Rayhoo | 4 | 1 | Bonaire | 4 | 5 |

| Lingyun | 5 | 4 | Tonghe | 5 | 1 | Motiontec | 5 | 6 |

| Firm Type | Industrial Network | Technological Network | Social Network |

|---|---|---|---|

| Lead firms | Tower, Yongda, Dongyang, Bethel, Mckerry, Tims, Lingyun, Sterling, Henglong, Tianyou | Tianyou, Tonghe, Yongda, Rayhoo, Xinke, Lingyun, Sterling, Tower, Bethel, Jian’an | Sterling, Motiontec, Bethel, Rayhoo, Yongda, Mckerry, Tower, Bonaire, Yaqi, Tianyou |

| Intermediaries | Yongda, Dongyang, Bethel, Henglong, Tower, Lingyun, Fuzhuo, Tonghe, Sterling, Tims, Tianyou, Ruichang, Jian’an, Valeo | Bethel, Rayhoo, Tianyou, Jingnuo, Tower, Sterling, Tonghe, Hengxiang, Nexteer, Continental, Xinke, Mckerry, Yuexing, Yongda | Sterling, Tower, Motiontec, Rayhoo, Bonaire, Mckerry, Tonghe, Shangwei, Tianyou, Yongda, Yuexing, Shunda, Yaqi, Wanxiang |

| Club of foreigners | Johson, Aike, Putai, Continental, Atech, Motiontec, Tonghe, Kobo, Bonaire, Valeo | Puhang, Mckerry, Aike, Henglong, Kobo, Marelli, Bosch, Fuzhuo, Tims, Putai, Continental, Valeo | Henglong, Tower, Kobo, Lingyun, Continental, Bosch, Fuzhuo, Mckerry, Putai, Atech |

| Gatekeepers | Tower, Yongda, Bethel, Dongyang | Tonghe, Rayhoo, Tower, Sterling | Sterling, Yongda, Rayhoo, Bonaire |

| Peripherals | Nexteer, Hengxiang, Shangwei, Xinke, Shunda, Rayhoo, Tenglong, Marelli, Japhl, Pohang, Yuexing, Hengxin, Hongjing, Yaqi, Zhongshan, Jingnuo, Wanxiang, Bosch, Brewery | Hongjing, Japhl, Dongyang, Brewery, Yaqi, Zhongshan, Shunda, Hengxin, Wanxiang, Tenglong, Ruichang, Shangwei, Bonaire | Japhl, Dongyang, Hengxin, Xinke, Tims, Nexteer, Ruichang, Jingnuo, Hengxiang, Jian’an, Tenglong |

| Loners | Motiontec, Johnson, Atech | Zhongshan, Pohang, Johnson, Aike, Marelli, Valeo, Hongjing, Brewery |

| Category | Role | Firms |

|---|---|---|

| Core Firms | Dominant core | Chery |

| Lead firms | Tower, Yongda, Sterling, Rayhoo, Bonaire, Bethel, Tianyou | |

| Intermediaries (high DC) | Tower, Bethel, Yongda, Sterling, Tianyou, Bonaire | |

| Gatekeepers | Rayhoo, Sterling, Tower, Yongda, Bonaire | |

| Peripheral Firms | “Club of foreigners” | Fuzhuo, Mckerry, Aike, Henglong, Putai, Kobo, Continental, Atech, Bosch |

| Intermediaries (low DC) | Tonghe, Lingyun, Henglong, Mckerry, Tims, Motiontec | |

| Loners | Johnson, Zhongshan, Brewery, Marelli, Valeo | |

| Other peripherals | Yaqi, Japhl, Shangwei, Xinke, Yuexing, Shunda, Hengxin, Dongyang, Jingnuo, Nexteer, Jian’an, Wanxiang, Hengxiang, Ruichang, Hongjing |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, X.; Wang, E.; Miao, C.; Ji, L.; Pan, S. Industrial Clusters as Drivers of Sustainable Regional Economic Development? An Analysis of an Automotive Cluster from the Perspective of Firms’ Role. Sustainability 2020, 12, 2848. https://doi.org/10.3390/su12072848

Chen X, Wang E, Miao C, Ji L, Pan S. Industrial Clusters as Drivers of Sustainable Regional Economic Development? An Analysis of an Automotive Cluster from the Perspective of Firms’ Role. Sustainability. 2020; 12(7):2848. https://doi.org/10.3390/su12072848

Chicago/Turabian StyleChen, Xiaofei, Enru Wang, Changhong Miao, Lili Ji, and Shaoqi Pan. 2020. "Industrial Clusters as Drivers of Sustainable Regional Economic Development? An Analysis of an Automotive Cluster from the Perspective of Firms’ Role" Sustainability 12, no. 7: 2848. https://doi.org/10.3390/su12072848

APA StyleChen, X., Wang, E., Miao, C., Ji, L., & Pan, S. (2020). Industrial Clusters as Drivers of Sustainable Regional Economic Development? An Analysis of an Automotive Cluster from the Perspective of Firms’ Role. Sustainability, 12(7), 2848. https://doi.org/10.3390/su12072848