Intelligent Predictive Analytics for Sustainable Business Investment in Renewable Energy Sources

Abstract

1. Introduction

1.1. Willingness to Invest in Renewable Energy Sources (RES) Infrastructure

1.2. Inference Modeling Intelligence Analytics and Machine Learning

2. Materials and Methods

2.1. Area of Study

2.2. Intelligent Predictive Analytics Inference Model

2.3. Evaluation Method and Metrics

2.3.1. 10-Fold Cross Validation

2.3.2. Prediction Accuracy

2.3.3. Confusion Matrix

| Class 0 | Class 1 | Classified as |

|---|---|---|

| A | B | class 0 (invest in renewable energy sources (RES)) |

| C | D | class 1 (not invest in renewable energy sources (RES)) |

3. Results

3.1. Experimental Setup

3.1.1. Experimental Setup Dataset Structure

3.1.2. Adopted Classifiers

3.1.3. Experimental Setup Parameters

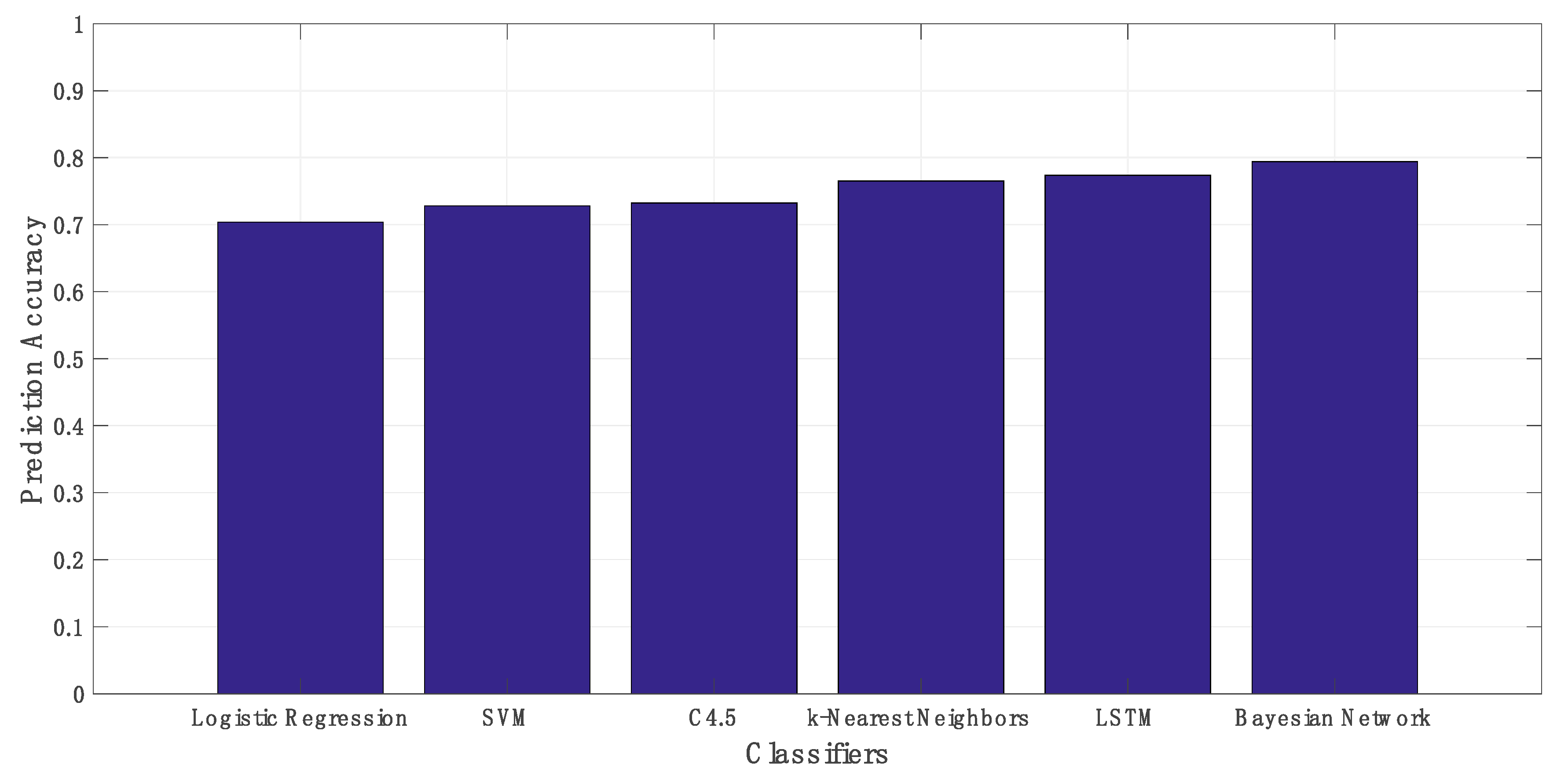

3.2. Experimented Classifiers Prediction Accuracy

3.3. Experimented Classifiers Confusion Matrix

4. Discussion and Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Coburn, T.C.; Farhar, B. Public Reaction to Renewable Energy Sources and Systems. In Encyclopedia of Energy; Cleveland, C.J., Ed.; Elsevier: New York, NY, USA, 2004; pp. 207–222. [Google Scholar]

- Vasseur, V.; Kemp, R. The adoption of PV in the Netherlands: A statistical analysis of adoption factors. Renew. Sustain. Energy Rev. 2015, 41, 483–494. [Google Scholar] [CrossRef]

- Tsekouropoulos, G. Green Marketing and Entrepreneurship: The Strong Environmental Value for Sustainable Development. Book Econ. Gov. Sustain. Tour. New Media 2016, 378, 37–45. [Google Scholar]

- Wiradanti, B.; Pettit, S.; Potter, A.; Abouarghoub, W. Willingness to invest in peripheral ports: Perceptions of Indonesian port and maritime industry stakeholders. Marit. Econ. Logist. 2020, 1–16. [Google Scholar] [CrossRef]

- Oyewole, M.O.; Ojutalayo, A.A.; Araloyin, F.M. Developers’ willingness to invest in green features in Abuja, Nigeria. Smart Sustain. Built Environ. 2019, 8, 206–219. [Google Scholar] [CrossRef]

- Breffle, W.S.; Morey, E.R.; Lodder, T.S. Using Contingent Valuation to Estimate a Neighborhood’s Willingness to Pay to Preserve Undeveloped Urban Land. Urban Stud. 1998, 35, 715–727. [Google Scholar] [CrossRef]

- Ntanos, S.; Ntanos, A.; Salmon, I.; Ziatas, T. Public Awareness on Renewable Energy Sources: A Case Study for the Piraeus University of Applied Sciences. In Proceedings of the 5th International Symposium and 27th National Conference on Operational Research (EEEE2016), Athens, Greece, 9–11 June 2016; pp. 18–23, ISBN 978-618-80361-6-1. [Google Scholar]

- Kyriakopoulos, G.L.; Arabatzis, G. Electrical energy storage systems in electricity generation: Energy policies, innovative technologies, and regulatory regimes. Renew. Sustain. Energy Rev. 2016, 56, 1044–1067. [Google Scholar] [CrossRef]

- Chalikias, M.; Ntanos, S. Countries Clustering with Respect to Carbon Dioxide Emissions by Using the IEA Database. In Proceedings of the 7th International Conference on Information and Communication Technologies in Agriculture, Food and Environment, CEUR Workshop Proceedings, Kavala, Greece, 17–20 September 2015; Volume 1498, pp. 347–351, ISSN 1613-0073. [Google Scholar]

- Ntanos, S.; Arabatzis, G.; Milioris, K.; Chalikias, M.; Lalou, P. Energy Consumption and CO2 Emissions on a Global Level. In Proceedings of the 4th International Conference in Quantitative and Qualitative Methodologies in the Economic and Administrative Sciences (I.C.Q.M.E.A.S. 2015), Technological Educational Institute (TEI) of Athens, Athens, Greece, 21–22 May 2015; pp. 251–260, ISBN 978-960-98739-6-3. [Google Scholar]

- Lavin, J.F.; Valle, M.A.; Magner, N.S. Heuristics in Mutual Fund Consumers’ Willingness-to-Invest: An Experimental Approach. J. Consum. Aff. 2019, 53, 1970–2002. [Google Scholar] [CrossRef]

- Moon, J.; Tikoo, S. Determinants of supplier willingness to invest in supporting a manufacturer’s line. J. Mark. Channels 2003, 11, 53–64. [Google Scholar] [CrossRef]

- Mulatu, D.W.; van Oel, P.R.; van der Veen, A. Firms’ willingness to invest in a water fund to improve water-related ecosystem services in the Lake Naivasha basin, Kenya. Water Int. 2015, 40, 463–482. [Google Scholar] [CrossRef]

- Alho, E. Farmers’ willingness to invest in new cooperative instruments: A choice experiment. Ann. Public Coop. Econ. 2019, 90, 161–186. [Google Scholar] [CrossRef]

- Alho, E. Survey evidence of members’ willingness to invest in agricultural hybrid cooperatives. J. Chain Netw. Sci. 2016, 16, 41–58. [Google Scholar] [CrossRef]

- Ming, B.H.; Gan, G.G.G.; Ramasamy, S. The role of concern for the environment and perceived consumer effectiveness on investors’ willingness to invest in environmentally-friendly firms. Kaji. Malays. 2015, 33, 173–190. [Google Scholar]

- Memon, J.A.; Alizai, M.Q.; Hussain, A. Who will think outside the sink? Farmers’ willingness to invest in technologies for groundwater sustainability in Pakistan. Environ. Dev. Sustain. 2019. [Google Scholar] [CrossRef]

- Gahrs, S.; Mehler, K.; Bost, M.; Hirschl, B. Acceptance of ancillary services and willingness to invest in PV-storage-systems. Energy Procedia 2015, 73, 29–36. [Google Scholar] [CrossRef]

- Kyriakopoulos, G.L.; Arabatzis, G.; Tsialis, P.; Ioannou, K. Electricity consumption and RES plants in Greece: Typologies of regional units. Renew. Energy 2018, 127, 134–144. [Google Scholar] [CrossRef]

- Karasmanaki, E.; Galatsidas, S.; Tsantopoulos, G. An investigation of factors affecting the willingness to invest in renewables among environmental students: A logistic regression approach. Sustainability 2019, 11, 5012. [Google Scholar] [CrossRef]

- Asonitou, S.; Tromaridis, H. Bologna Tools to promote skills and competences in Higher Education: The Greek Context. In Business and Economics, Strategic Innovative Marketing; Springer: Cham, Switzerland, 2015; pp. 35–43. [Google Scholar]

- Asonitou, S.; Hassall, T. Which skills and competences to develop in accountants in a country in crisis? Int. J. Manag. Educ. 2019, 17, 100308. [Google Scholar] [CrossRef]

- Arabatzis, G.; Kyriakopoulos, G.; Tsialis, P. Typology of regional units based on RES plants: The case of Greece. Renew. Sustain. Energy Rev. 2017, 78, 1424–1434. [Google Scholar] [CrossRef]

- Ntanos, S.; Kyriakopoulos, G.; Chalikias, M.; Arabatzis, G.; Skordoulis, M. Public perceptions and willingness to pay for renewable energy: A case study from Greece. Sustainability 2018, 10, 687. [Google Scholar] [CrossRef]

- Ntanos, S.; Kyriakopoulos, G.; Chalikias, M.; Arabatzis, G.; Skordoulis, M.; Galatsidas, S.; Drosos, D. A social assessment of the usage of Renewable Energy Sources and its contribution to life quality: The case of an Attica Urban area in Greece. Sustainability 2018, 10, 1414. [Google Scholar] [CrossRef]

- Wong, W.K.; Guo, Z.X. A hybrid intelligent model for medium-term sales forecasting in fashion retail supply chains using extreme learning machine and harmony search algorithm. Int. J. Prod. Econ. 2010, 128, 614–624. [Google Scholar] [CrossRef]

- Domingos, S.D.O.; de Oliveira, J.F.; de Mattos Neto, P.S. An intelligent hybridization of ARIMA with machine learning models for time series forecasting. Knowl.-Based Syst. 2019, 175, 72–86. [Google Scholar] [CrossRef]

- Deng, Z.; Chen, J.; Zhang, T.; Cao, L.; Wang, S. Generalized Hidden-Mapping Minimax Probability Machine for the training and reliability learning of several classical intelligent models. Inf. Sci. 2018, 436–437, 302–319. [Google Scholar] [CrossRef]

- Khan, S.A.; Jabbar, M.A. Prediction of by-diseases in diabetic patients using associative classification with improved classifier accuracy for decision support system. Int. J. Eng. Adv. Technol. 2019, 8, 2625–2628. [Google Scholar] [CrossRef]

- HWEA. Hellenic Wind Energy Association Statistics. Available online: http://eletaen.gr/wp-content/uploads/2020/01/2020-1-30-hwea-statistics-greece.pdf (accessed on 28 February 2020).

- Frank, E.; Hall, M.A.; Witten, I.H. The Weka Workbench. In Online Appendix for “Data Mining: Practical Machine Learning Tools and Techniques”, 4th ed.; Morgan Kaufmann, 2016; Available online: https://www.cs.waikato.ac.nz/ml/weka/Witten_et_al_2016_appendix.pdf (accessed on 1 April 2020).

- Ntanos, S.; Kyriakopoulos, G.; Skordoulis, M.; Chalikias, M.; Arabatzis, G. An Application of the New Environmental Paradigm (NEP) Scale in a Greek Context. Energies 2019, 12, 239. [Google Scholar] [CrossRef]

- Ministry of Interior. Election Departments of the Prefecture of Evia, Parliamentary Elections January 2015, Ministry of Interior and Administrative Reconstruction. Available online: http://www.ypes.gr/UserFiles/f0ff9297-f516-40ff-a70e-eca84e2ec9b9/16.xls (accessed on 28 February 2020). (In Greek)

- Kaldellis, J.; Kapsali, M.; Katsanou, E. Renewable energy applications in Greece—What is the public attitude? Energy Policy 2012, 42, 37–48. [Google Scholar] [CrossRef]

- Zografakis, N.; Sifaki, E.; Pagalou, M.; Nikitaki, G.; Psarakis, V.; Tsagarakis, K. Assessment of public acceptance and willingness to pay for renewable energy sources in Crete. Renew. Sustain. Energy Rev. 2010, 14, 1088–1095. [Google Scholar] [CrossRef]

- Hagos, D.H.; Engelstad, P.E.; Yazidi, A.; Kure, O. General TCP State Inference Model from Passive Measurements Using Machine Learning Techniques. IEEE Access 2018, 6, 28372–28387. [Google Scholar] [CrossRef]

- Aziz, A.A.; Indahwati, I.; Sartono, B. Improving prediction accuracy of classification model using cascading ensemble classifiers. IOP Conf. Ser. Earth Environ. Sci. 2019, 299, 012025. [Google Scholar] [CrossRef]

- Dang, V.-H.; Dieu, T.B.; Tran, X.-L.; Hoang, N.-D. Enhancing the accuracy of rainfall-induced landslide prediction along mountain roads with a GIS-based random forest classifier. Bull. Eng. Geol. Environ. 2019, 78, 2835–2849. [Google Scholar] [CrossRef]

- Lopez, C.-P.; Tenemaza, M.; Loza-Aguirre, E. Alternative Ensemble Classifier Based on Penalty Strategy for Improving Prediction Accuracy. Adv. Intell. Syst. Comput. 2019, 876, 1070–1076. [Google Scholar] [CrossRef]

- Geetha Ramani, R.; Lakshmi, B.; Jacob, S.G. Data Mining Method of Evaluating Classifier Prediction Accuracy in Retinal Data. In Proceedings of the IEEE International Conference on Computational Intelligence and Computing Research, ICCIC 2012, Coimbatore, India, 18–20 December 2012. Article number 6510290. [Google Scholar] [CrossRef]

- Geng, T.; Du, Y. The business model of intelligent manufacturing with Internet of Things and machine learning. Enterp. Inf. Syst. 2020. [Google Scholar] [CrossRef]

- Ardavani, O.; Zerefos, S.; Doulos, L.T. Redesigning the exterior lighting as part of the urban landscape: The role of transgenic bioluminescent plants in mediterranean urban and suburban lighting environments. J. Clean. Prod. 2020, 242, 118477. [Google Scholar] [CrossRef]

- Grigoropoulos, C.J.; Doulos, L.T.; Zerefos, S.C.; Tsangrassoulis, A.; Bhusal, P. Estimating the benefits of increasing the recycling rate of lamps from the domestic sector: Methodology, opportunities and case study. Waste Manag. 2020, 101, 188–199. [Google Scholar] [CrossRef] [PubMed]

- Doulos, L.T.; Sioutis, I.; Kontaxis, P.; Zissis, G.; Faidas, K. A decision support system for assessment of street lighting tenders based on energy performance indicators and environmental criteria: Overview, methodology and case study. Sustain. Cities Soc. 2019, 51, 101759. [Google Scholar] [CrossRef]

- Kolovos, K.G.; Kyriakopoulos, G.; Chalikias, M.S. Co-evaluation of basic woodfuel types used as alternative heating sources to existing energy network. J. Environ. Prot. Ecol. 2011, 12, 733–742. [Google Scholar]

- Lindstrom, T. A fuzzy design of the willingness to invest in Sweden. J. Econ. Behav. Organ. 1998, 36, 1–17. [Google Scholar] [CrossRef]

- Yang, T.; Qian, K.; Lo, D.C.-T.; Xie, Y.; Shi, Y.; Tao, L. Improve the Prediction Accuracy of Naïve Bayes Classifier with Association Rule Mining. In Proceedings of the 2nd IEEE International Conference on Big Data Security on Cloud, IEEE BigDataSecurity 2016, IEEE IDS 2016, New York, NY, USA, 9–10 April 2016; Article number 7502277. pp. 129–133. [Google Scholar] [CrossRef]

- Hasan, A.N.; Twala, B. Improving Single Classifiers Prediction Accuracy for Underground Water Pump Station in a Gold Mine Using Ensemble Techniques. In Proceedings of the IEEE EUROCON 2015—International Conference on Computer as a Tool (EUROCON), Salamanca, Spain, 8–11 September 2015. Article number 7313694. [Google Scholar] [CrossRef]

- Augusty, S.M.; Izudheen, S. Improving the Accuracy of Ensemble Classifier Prediction Model Based on FLAME Clustering with Random Forest Algorithm. In Proceedings of the 3rd International Conference on Advances in Computing and Communications, ICACC 2013, Cochin, India, 29–31 August 2013; Article number 6686386. pp. 269–273. [Google Scholar] [CrossRef]

- Ekbal, A. Improvement of prediction accuracy using discretization and voting classifier. Proc.-Int. Conf. Pattern Recognit. 2006, 2, 695–698. [Google Scholar] [CrossRef]

- Zhai, P.; Williams, E. Analyzing consumer acceptance of photovoltaics (PV) using fuzzy logic model. Renew. Energy 2012, 41, 350–357. [Google Scholar] [CrossRef]

- Swift, K.D. A comparison of the cost and financial returns for solar photovoltaic systems installed by businesses in different locations across the United States. Renew. Energy 2013, 57, 137–143. [Google Scholar] [CrossRef]

- Li, H.; Yi, H. Multilevel governance and deployment of solar PV panels in U.S. cities. Energy Policy 2014, 69, 19–27. [Google Scholar] [CrossRef]

| Attribute | Type | Value |

|---|---|---|

| PV Degree of Information | Predictive | {0,1,2,3,4,5,6,7} |

| PV Future Development Potential | Predictive | {0,1,2,3,4,5,6,7} |

| SHP Future Development Potential | Predictive | {0,1,2,3,4,5,6,7} |

| RES Environmental Enhancement | Predictive | {0,1,2,3,4,5,6,7} |

| RES Social Acceptance | Predictive | {0,1,2,3,4,5,6,7} |

| PV Environmental Protection Contribution | Predictive | {0,1,2,3,4,5,6,7} |

| PV Sustainable Development Contribution | Predictive | {0,1,2,3,4,5,6,7} |

| PV Landscape Upgrade Contribution | Predictive | {0,1,2,3,4,5,6,7} |

| Wind Turbines Life Quality Upgrade | Predictive | {0,1,2,3,4,5,6,7} |

| Wind Turbines Energy Production | Predictive | {0,1,2,3,4,5,6,7} |

| SHP Sustainable Development Contribution | Predictive | {0,1,2,3,4,5,6,7} |

| Biomass Life Quality Upgrade | Predictive | {0,1,2,3,4,5,6,7} |

| Willingness to Invest in RES | Class | {0,1} |

| Parameter | Value |

|---|---|

| 1st Experimented Classifier | Logistic Regression |

| 2nd Experimented Classifier | SVM |

| 3rd Experimented Classifier | C4.5 |

| 4th Experimented Classifier | k-Nearest Neighbors |

| 5th Experimented Classifier | LSTM |

| 6th Experimented Classifier | Bayesian Network |

| Evaluation Method | 10-Fold Cross Validation |

| Evaluation Metrics | a, Confusion Matrix |

| Classifiers | Class 0 | Class 1 | Classified as |

|---|---|---|---|

| Logistic Regression | 158 | 21 | Class 0 |

| 51 | 13 | Class 1 | |

| C4.5 | 177 | 2 | Class 0 |

| 63 | 1 | Class 1 | |

| LSTM | 161 | 18 | Class 0 |

| 37 | 27 | Class 1 | |

| SVM | 151 | 28 | Class 0 |

| 38 | 26 | Class 1 | |

| k-Nearest Neighbors | 164 | 15 | Class 0 |

| 42 | 22 | Class 1 | |

| Bayesian Network | 164 | 15 | Class 0 |

| 42 | 22 | Class 1 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Anagnostopoulos, T.; Kyriakopoulos, G.L.; Ntanos, S.; Gkika, E.; Asonitou, S. Intelligent Predictive Analytics for Sustainable Business Investment in Renewable Energy Sources. Sustainability 2020, 12, 2817. https://doi.org/10.3390/su12072817

Anagnostopoulos T, Kyriakopoulos GL, Ntanos S, Gkika E, Asonitou S. Intelligent Predictive Analytics for Sustainable Business Investment in Renewable Energy Sources. Sustainability. 2020; 12(7):2817. https://doi.org/10.3390/su12072817

Chicago/Turabian StyleAnagnostopoulos, Theodoros, Grigorios L. Kyriakopoulos, Stamatios Ntanos, Eleni Gkika, and Sofia Asonitou. 2020. "Intelligent Predictive Analytics for Sustainable Business Investment in Renewable Energy Sources" Sustainability 12, no. 7: 2817. https://doi.org/10.3390/su12072817

APA StyleAnagnostopoulos, T., Kyriakopoulos, G. L., Ntanos, S., Gkika, E., & Asonitou, S. (2020). Intelligent Predictive Analytics for Sustainable Business Investment in Renewable Energy Sources. Sustainability, 12(7), 2817. https://doi.org/10.3390/su12072817