The Diversity of Organic Box Schemes in Europe—An Exploratory Study in Four Countries

Abstract

1. Introduction

2. What Do We Know about Organic Box Schemes? A Review of the Literature

2.1. Defining Box Schemes

2.2. Development and History

2.3. Consumer and Farmer Benefit

2.4. Environmental and Social Implications of Organic Box Schemes

2.5. Use of Online Tools for Shopping and Direct Exchange

2.6. Scalability Issues

3. Methods

3.1. Sampling

3.2. Online Survey

3.3. Data Collection and Analysis

3.4. Wording and Concepts

4. Results

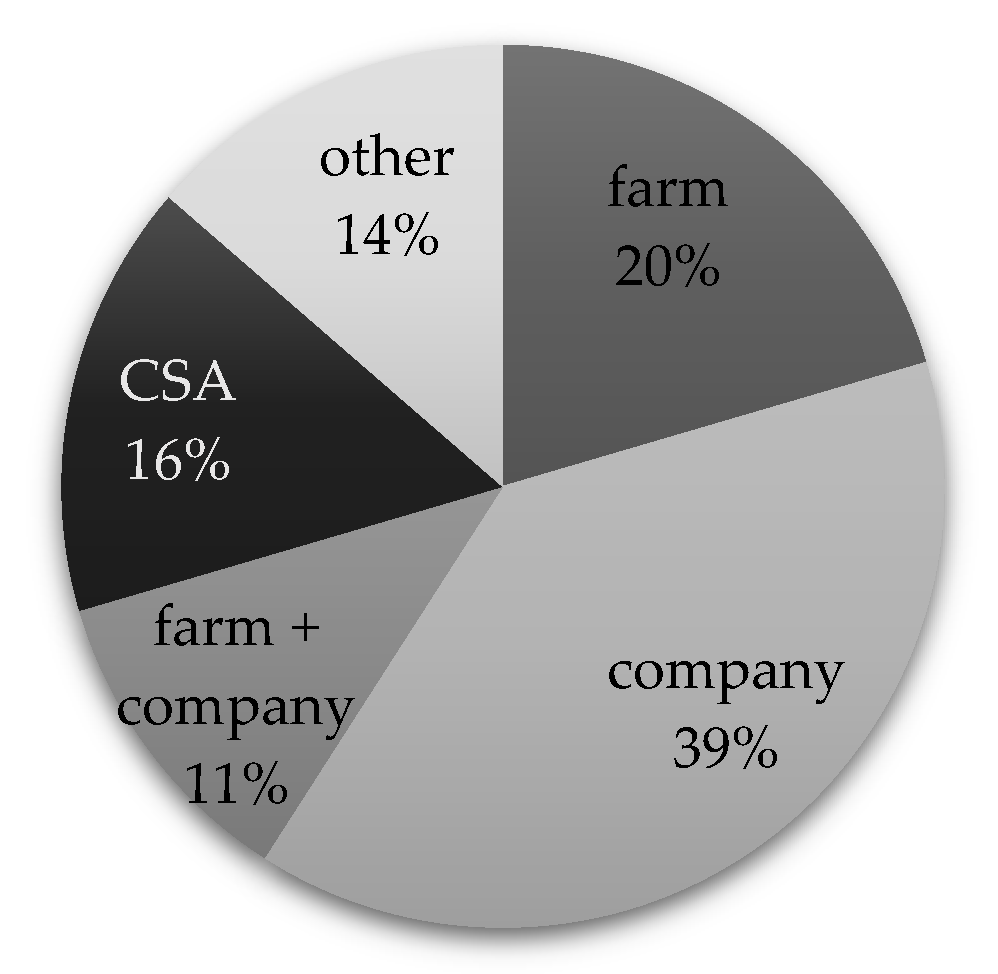

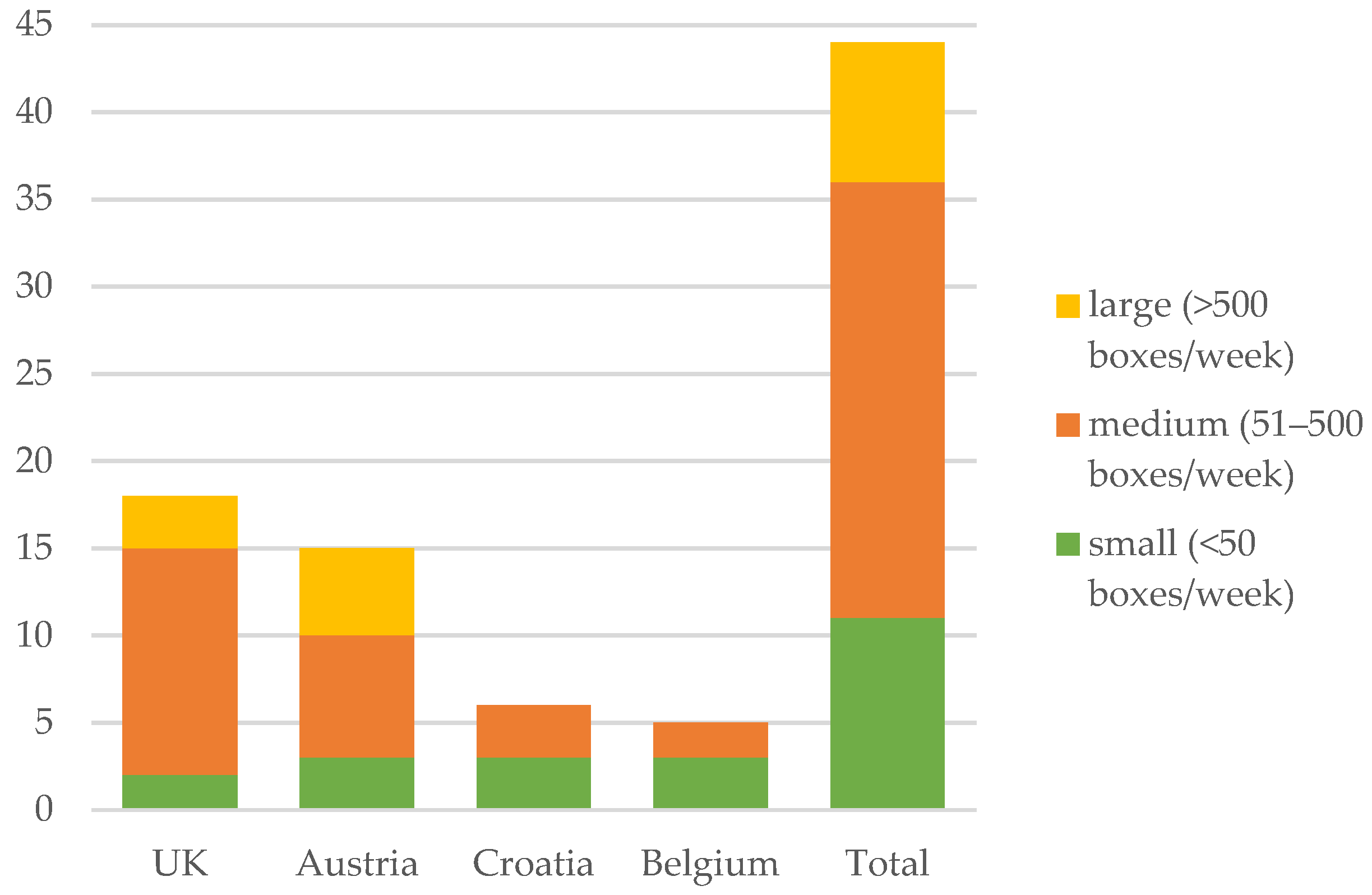

4.1. Organisation, Size, and Growth of the Box Schemes

“Personnel costs are planned for 1000 boxes per week, and now we are at 700.” (AT_13)“Greater turnover would decrease fixed labour costs.” (UK_04)

“(…) we want to offer many people excellent organic food.” (AT_03)“We would like to increase the number of boxes sold because we believe that the best sale is directly to the consumer, without other intermediaries.” (HR_03)

“To offer more support and business to the local farmers we work with, create more jobs and enable more people to eat great food.” (UK_15)

“To reach 150 baskets, number which offers on our scale the best adequacy between our surface and capacity of production and the demand of households in short circuit.” (BE_02)“We can increase to about 60 full shares at which point we will be running at full capacity for the land we have. Which we are now close to.” (UK_10)

“We have no plans to increase the amount of land we are working and we believe we are growing as much as we can on the land so there is no scope to increase the number of boxes sold.” (UK_18)“We are happy with the level of business we do. We feel it is important to do what we do well, and not to spread ourselves too thin.” (UK_16)

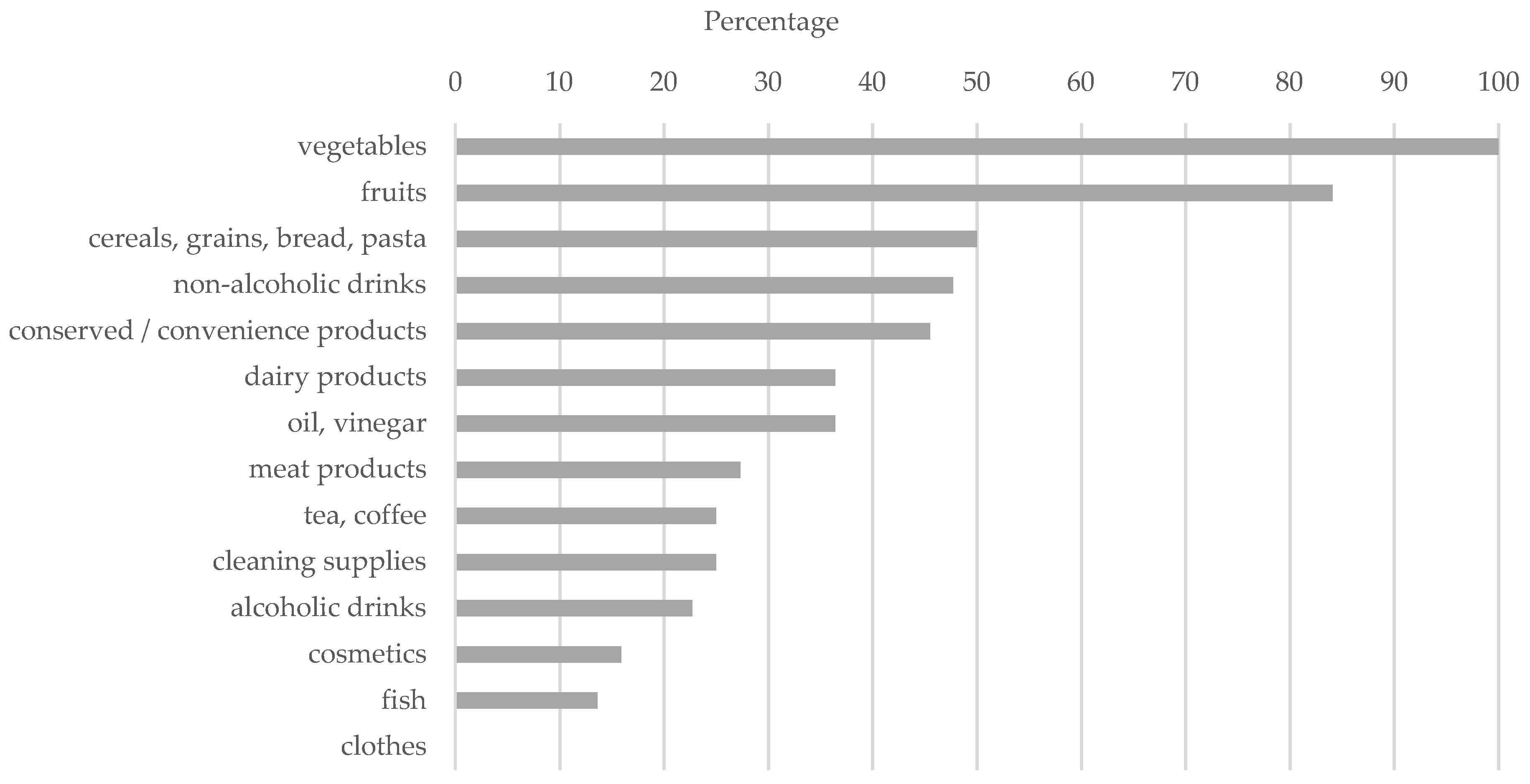

4.2. Product Range, Production Mode, and Provenance of Products Offered in the Boxes

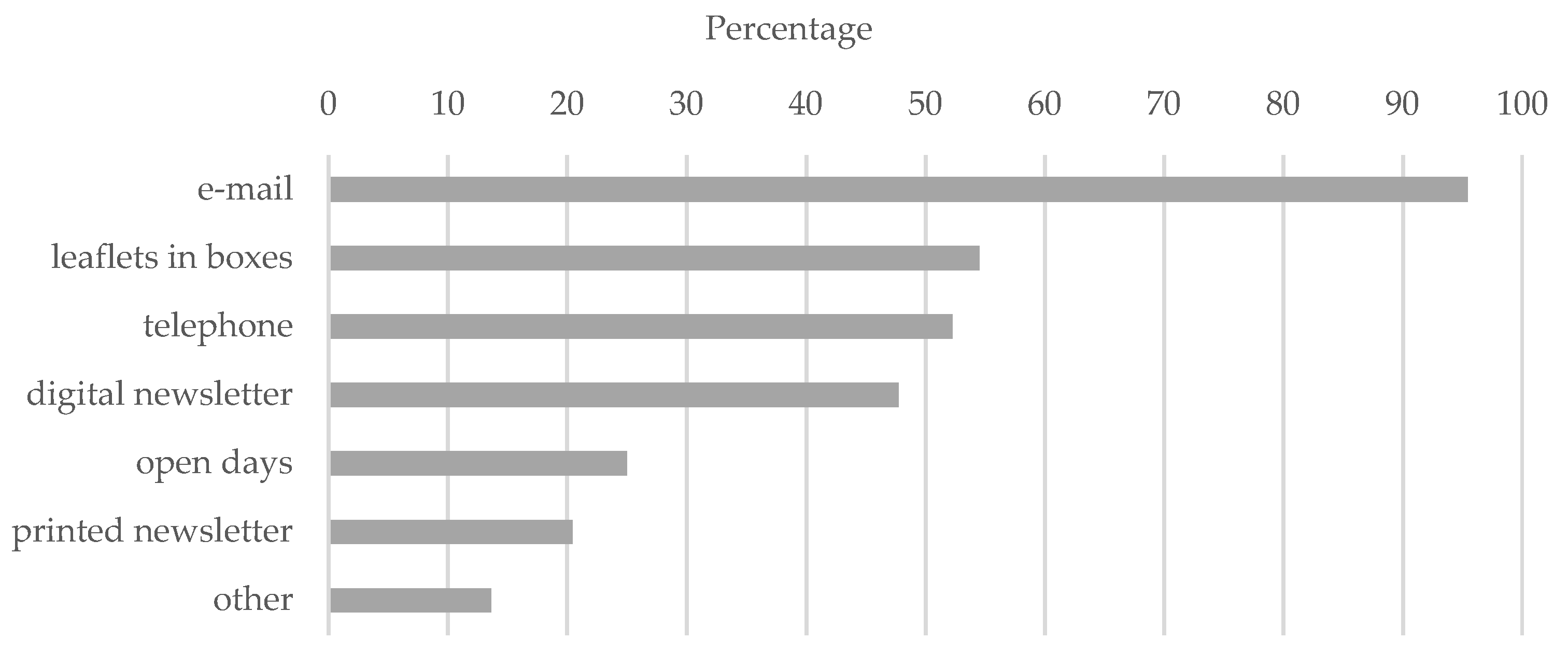

4.3. Communication and Values

4.4. Differences in Box Schemes Characteristics Between Countries

4.5. Tendencies Related to Size (Categories) of the Investigated Box Schemes

5. Discussion

5.1. Growth, Direct Exchange, Communication, and Values

5.2. Organic Box Schemes as an Analytical Category

6. Conclusions

Supplementary Materials

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Additional notes

References

- von Oelreich, J.; Milestad, R. Sustainability Transformations in the Balance: Exploring Swedish Initiatives Challenging the Corporate Food Regime. Eur. Plan. Stud. 2017, 25, 1129–1146. [Google Scholar] [CrossRef]

- Blay-Palmer, A.; Landman, K.; Knezevic, I.; Hayhurst, R. Constructing Resilient, Transformative Communities through Sustainable “Food Hubs”. Local Environ. 2013, 18, 521–528. [Google Scholar] [CrossRef]

- Mount, P. Growing Local Food: Scale and Local Food Systems Governance. Agric. Hum. Values 2012, 29, 107–121. [Google Scholar] [CrossRef]

- Meenar, M.R.; Hoover, B.M. Community Food Security Via Urban Agriculture: Understanding People, Place, Economy, and Accessibility from a Food Justice Perspective. J. Agric. Food Syst. Community Dev. 2012, 3, 143–160. [Google Scholar] [CrossRef]

- Lutz, J.; Schachinger, J. Do Local Food Networks Foster Socio-Ecological Transitions Towards Food Sovereignty? Learning from Real Place Experiences. Sustainability 2013, 5, 4778–4796. [Google Scholar] [CrossRef]

- Milestad, R.; Westberg, L.; Geber, U.; Björklund, J. Enhancing Adaptive Capacity in Food Systems: Learning at Farmers’ Markets in Sweden. Ecol. Soc. 2010, 15, 29. [Google Scholar] [CrossRef]

- Wills, B.; Arundel, A. Internet-Enabled Access to Alternative Food Networks: A Comparison of Online and Offline Food Shoppers and Their Differing Interpretations of Quality. Agric. Hum. Values 2017, 34, 701–712. [Google Scholar] [CrossRef]

- Berti, G.; Mulligan, C. Competitiveness of Small Farms and Innovative Food Supply Chains: The Role of Food Hubs in Creating Sustainable Regional and Local Food Systems. Sustainability 2016, 8, 616. [Google Scholar] [CrossRef]

- Laforge, J.M.; Anderson, C.R.; McLachlan, S.M. Governments, Grassroots, and the Struggle for Local Food Systems: Containing, Coopting, Contesting and Collaborating. Agric. Hum. Values 2017, 34, 663–681. [Google Scholar] [CrossRef]

- Brown, E.; Dury, S.; Holdsworth, M. Motivations of Consumers That Use Local, Organic Fruit and Vegetable Box Schemes in Central England and Southern France. Appetite 2009, 53, 183–188. [Google Scholar] [CrossRef]

- Thom, A.; Conradie, B. Urban Agriculture’s Enterprise Potential: Exploring Vegetable Box Schemes in Cape Town. Agrekon 2013, 52, 64–86. [Google Scholar] [CrossRef]

- Holt, G. Local Foods and Local Markets: Strategies to Grow the Local Sector in the UK. Anthropol. Food 2005, 4. [Google Scholar] [CrossRef]

- Ostrom, M.; Kjeldsen, C.; Kummer, S.; Milestad, R.; Schermer, M. What’s Going into the Box? An Inquiry into the Social and Ecological Embeddedness of Large-Scale EU and US Box Schemes. Int. J. Sociol. Agric. Food 2017, 24, 113–134. [Google Scholar]

- Haldy, H.-M. Organic Food Subscription Schemes in Germany, Denmark, the Netherlands and the United Kingdom. Definitions and Patterns of Development in an International Context. Master’s Thesis, Aston Business School, Birmingham, UK, 2004. [Google Scholar]

- Schermer, M. From “Food from Nowhere” to “Food from Here”: Changing Producer–Consumer Relations in Austria. Agric. Hum. Values 2014, 32, 121–132. [Google Scholar] [CrossRef]

- Kneafsey, M.; Venn, L.; Schmutz, U.; Balázs, B.; Trenchard, L.; Eyden-Wood, T.; Bos, E.; Sutton, G.; Blackett, M. Short Food Supply Chains and Local Food Systems in the Eu. A State of Play of Their Socio-Economic Characteristics; European Commission: Luxembourg, 2013. [Google Scholar]

- Nost, E. Scaling-up Local Foods: Commodity Practice in Community Supported Agriculture (CSA). J. Rural Stud. 2014, 34, 152–160. [Google Scholar] [CrossRef]

- Migliore, G.; Caracciolo, F.; Lombardi, A.; Schifani, G.; Cembalo, L. Farmers’ Participation in Civic Agriculture: The Effect of Social Embeddedness. Cult. Agric. Food Environ. 2014, 36, 105–117. [Google Scholar] [CrossRef]

- Milestad, R.; Kummer, S.; Hirner, P. Does Scale Matter? Investigating the Growth of a Local Organic Box Scheme in Austria. J. Rural Stud. 2017, 54, 304–313. [Google Scholar] [CrossRef]

- Ilbery, B.; Maye, D. Retailing Local Food in the Scottish-English Borders: A Supply Chain Perspective. Geoforum 2006, 37, 352–367. [Google Scholar] [CrossRef]

- Volpentesta, A.P.; Ammirato, S.; Della Gala, M. Classifying Short Agrifood Supply Chains under a Knowledge and Social Learning Perspective. Rural Soc. 2013, 22, 217–229. [Google Scholar] [CrossRef]

- Smaje, C. Kings and Commoners: Agroecology Meets Consumer Culture. J. Consum. Cult. 2013, 14, 365–383. [Google Scholar] [CrossRef]

- Bos, E.; Owen, L. Virtual Reconnection: The Online Spaces of Alternative Food Networks in England. J. Rural Stud. 2016, 45, 1–14. [Google Scholar] [CrossRef]

- Zepeda, L.; Reznickova, A.; Russell, W.S. Csa Membership and Psychological Needs Fulfillment: An Application of Self-Determination Theory. Agric. Hum. Values 2013, 30, 605–614. [Google Scholar] [CrossRef]

- Hvitsand, C. Community Supported Agriculture (CSA) as a Transformational Act—Distinct Values and Multiple Motivations among Farmers and Consumers. Agroecol. Sustain. Food Syst. 2016, 40, 333–351. [Google Scholar] [CrossRef]

- Lang, K.B. Expanding Our Understanding of Community Supported Agriculture (CSA): An Examination of Member Satisfaction. J. Sustain. Agric. 2005, 26, 61–79. [Google Scholar] [CrossRef]

- Lagane, J. Introduction to the Symposium: Towards Cross-Cultural Views on Community Supported Agriculture. Agric. Hum. Values 2015, 32, 119–120. [Google Scholar] [CrossRef]

- Dubuisson-Quellier, S.; Lamine, C.; Le Velly, R. Citizenship and Consumption: Mobilisation in Alternative Food Systems in France. Sociol. Ruralis 2011, 51, 304–323. [Google Scholar] [CrossRef]

- Cicia, G.; Cembalo, L.; Giudice, T.D. Consumer Preferences and Customer Satisfaction Analysis: A New Method Proposal. J. Food Prod. Mark. 2010, 17, 79–90. [Google Scholar] [CrossRef]

- Pearson, D.; Henryks, J.; Trott, A.; Jones, P.; Parker, G.; Dumaresq, D.; Dyball, R. Local Food: Understanding Consumer Motivations in Innovative Retail Formats. Br. Food J. 2011, 113, 886–899. [Google Scholar] [CrossRef]

- Freedman, M.R.; King, J.K. Examining a New “Pay-as-You-Go” Community-Supported Agriculture (CSA) Model: A Case Study. J. Hunger Environ. Nutr. 2016, 11, 122–145. [Google Scholar] [CrossRef]

- Torjusen, H.; Lieblein, G.; Vittersø, G. Learning, Communicating and Eating in Local Food-Systems: The Case of Organic Box Schemes in Denmark and Norway. Local Environ. 2008, 13, 219–234. [Google Scholar] [CrossRef]

- Markussen, M.V.; Kulak, M.; Smith, L.G.; Nemecek, T.; Østergård, H. Evaluating the Sustainability of a Small-Scale Low-Input Organic Vegetable Supply System in the United Kingdom. Sustainability 2014, 6, 1913–1945. [Google Scholar] [CrossRef]

- Chiffoleau, Y. From Politics to Co-Operation: The Dynamics of Embeddedness in Alternative Food Supply Chains. Sociol. Ruralis 2009, 49, 218–235. [Google Scholar] [CrossRef]

- Papaoikonomou, E.; Ginieis, M. Putting the Farmer’s Face on Food: Governance and the Producer–Consumer Relationship in Local Food Systems. Agric. Hum. Values 2017, 34, 53–67. [Google Scholar] [CrossRef]

- Tua, C.; Nessi, S.; Rigamonti, L.; Dolci, G.; Grosso, M. Packaging Waste Prevention in the Distribution of Fruit and Vegetables: An Assessment Based on the Life Cycle Perspective. Waste Manag. Res. 2017, 35, 400–415. [Google Scholar] [CrossRef]

- Coley, D.; Howard, M.; Winter, M. Local Food, Food Miles and Carbon Emissions: A Comparison of Farm Shop and Mass Distribution Approaches. Food Policy 2009, 34, 150–155. [Google Scholar] [CrossRef]

- Lughofer, E. Greenhouse Gas Emissions for Vegetables from Different Marketing Channels—A Case Study Including Shopping Traffic (in German). Master’s Thesis, University of Natural Resources and Life Sciences (BOKU), Vienna, Austria, 2011. [Google Scholar]

- Doernberg, A.; Zasada, I.; Bruszewska, K.; Skoczowski, B.; Piorr, A. Potentials and Limitations of Regional Organic Food Supply: A Qualitative Analysis of Two Food Chain Types in the Berlin Metropolitan Region. Sustainability 2016, 8, 1125. [Google Scholar] [CrossRef]

- Trivette, S.A. Invoices on Scraps of Paper: Trust and Reciprocity in Local Food Systems. Agric. Hum. Values 2017, 34, 529–542. [Google Scholar] [CrossRef]

- Galt, R.E. The Moral Economy Is a Double-Edged Sword: Explaining Farmers’ Earnings and Self-Exploitation in Community-Supported Agriculture. Econ. Geogr. 2013, 89, 341–365. [Google Scholar] [CrossRef]

- Lamine, C. Settling Shared Uncertainties: Local Partnerships between Producers and Consumers. Sociol. Ruralis 2005, 45, 324–345. [Google Scholar] [CrossRef]

- Aggestam, V.; Fleiß, E.; Posch, A. Scaling-up Short Food Supply Chains? A Survey Study on the Drivers Behind the Intention of Food Producers. J. Rural Stud. 2017, 51, 64–72. [Google Scholar] [CrossRef]

- Umweltberatung. Biokistl-Anbieterinnen aus Österreich. Available online: https://www.umweltberatung.at/biokistl-anbieterinnen-aus-oesterreich (accessed on 9 March 2016).

- BIO AUSTRIA. Bio-Kistl Anbieter in Österreich. Available online: https://www.bio-austria.at/download/bio-kistl-anbieter-in-oesterreich/ (accessed on 9 March 2016).

- VegBox Recipes (VegBox-Recipes.co.uk), Find a Box Scheme. Available online: https://web.archive.org/web/20150707173351/http://www.vegbox-recipes.co.uk/veg-boxes/find-a-box-scheme.php (accessed on 9 March 2016).

- Réseau Des GASAP Bruxellois. La Carte Des GASAP. Available online: http://www.gasap.be/ (accessed on 9 March 2016).

- Blankenhorn, B.; Demkina, T.; Franzmayr, S.; Funk, A.; Iwanov, G.; Jelović, D.; Lechthaler, S.; Paris, P.; Perrin, A.; Anna, S.; et al. Organic Box Schemes. Student Report within Lecture “Organic Farming and Regional Development” (Lecture Nr. 933.316), Summer Term 2016; Kummer, S., Ed.; University of Natural Resources and Life Sciences Vienna: Vienna, Austria; 109p, Available online: https://short.boku.ac.at/643epz (accessed on 18 February 2020).

- Bernard, H.R. Research Methods in Anthropology. Qualitative and Quantitative Approaches, 4th ed.; Altamira Press: Oxford, UK, 2006. [Google Scholar]

- Holloway, L.; Kneafsey, M.; Venn, L.; Cox, R.; Dowler, E.; Toumainen, H. Possible Food Economics: A Methodological Framework for Exploring Food Production-Consumption Relationships. Sociol. Ruralis 2007, 47, 1–19. [Google Scholar] [CrossRef]

- Reko-Ringar I Sverige. Available online: https://hushallningssallskapet.se/forskning-utveckling/reko/ (accessed on 30 March 2020).

- La Ruche Qui Dit Oui! Available online: https://laruchequiditoui.fr (accessed on 30 March 2020).

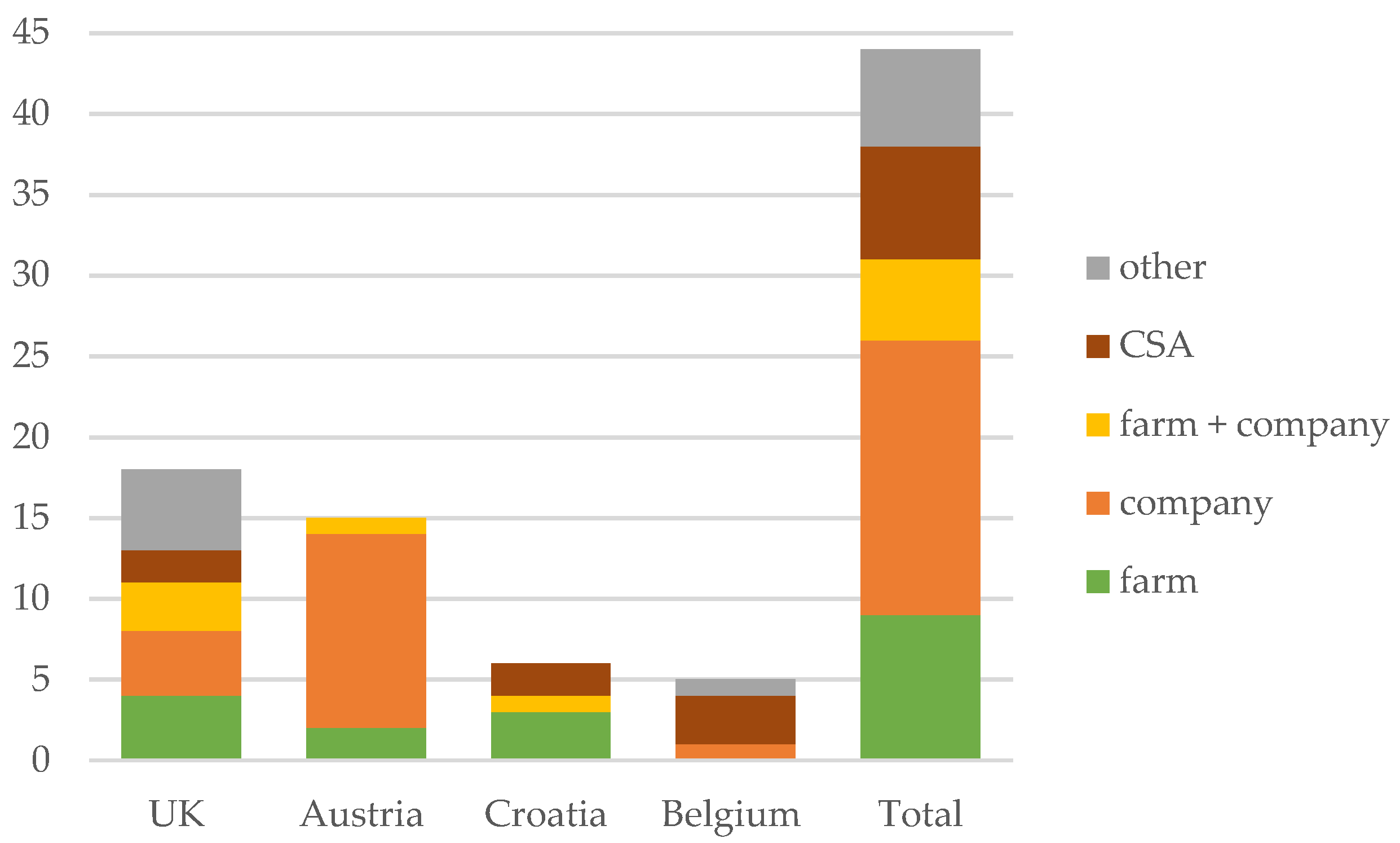

| Country | Sampling Based on | No. of Box Schemes Contacted | No. of Responses (Response Rate) |

|---|---|---|---|

| Austria | Online lists of Umweltberatung [44] and Bio Austria [45] | 43 | 15 (35%) |

| UK | Internet search, online list at vegbox-recipes.co.uk [46] | 147 | 18 (12%) |

| Belgium | Internet search, list of members of GASAP [47] | 21 | 5 (24%) |

| Croatia | Internet search | 17 | 6 (35%) |

| Sum | 228 | 44 (19%) |

| Years of Operation | No. Employees | Boxes/Week First Year | Boxes/Week 2015 | |

|---|---|---|---|---|

| Arit. mean | 11.1 | 10.6 | 68.2 | 567.2 |

| Median | 10.5 | 4.5 | 30.0 | 95.5 |

| Max | 26 | 120 | 900 | 7500 |

| Min | 2 | 0 | 2 | 4 |

| No. of Weekly Boxes in First Year | No. of Weekly Boxes 2015 | Growth Rate in Weekly Boxes per Year 1 | Multipli-Cation 2 | Growth Rate Total 3 | Average Growth Rate over Time 4 | |

|---|---|---|---|---|---|---|

| Arith. mean | 68.2 | 567.2 | 39.2 | 8.3 | 729% | 16% |

| median | 30.0 | 95.5 | 8.2 | 3.4 | 240% | 11% |

| max | 900 | 7500 | 411.1 | 83.3 | 8233% | 88% |

| min | 2 | 4 | −1.3 | 0.5 | −50% | −11% |

| Reason for Wanting to Grow (f = 37) | f | Reason for not Wanting to Grow (f = 7) | f |

|---|---|---|---|

| reach better or optimum use of capacity | 8 | sufficient size/scale | 4 |

| reach more consumers | 4 | reached maximum use of capacity | 2 |

| expand direct marketing | 4 | will quit box scheme (was not profitable) | 1 |

| increase cost recovery | 3 | ||

| hire additional employee(s) | 3 | ||

| increase profitability | 3 | ||

| increase production | 3 | ||

| other reasons | 9 |

| Arit. Mean | Count 100% Cases | % 100% Cases | |

|---|---|---|---|

| % of certified organic products | 90.2 | 28 | 63.6 |

| % of non-certified organic products | 5.8 | 1 | 2.3 |

| % of conventional products | 3.7 | 0 | 0.0 |

| % of other products (e.g., in conversion) | 0.3 | 0 | 0.0 |

| % of organic products in total (=certified + non-certified + in conversion) | 96.1 | 37 | 84.1 |

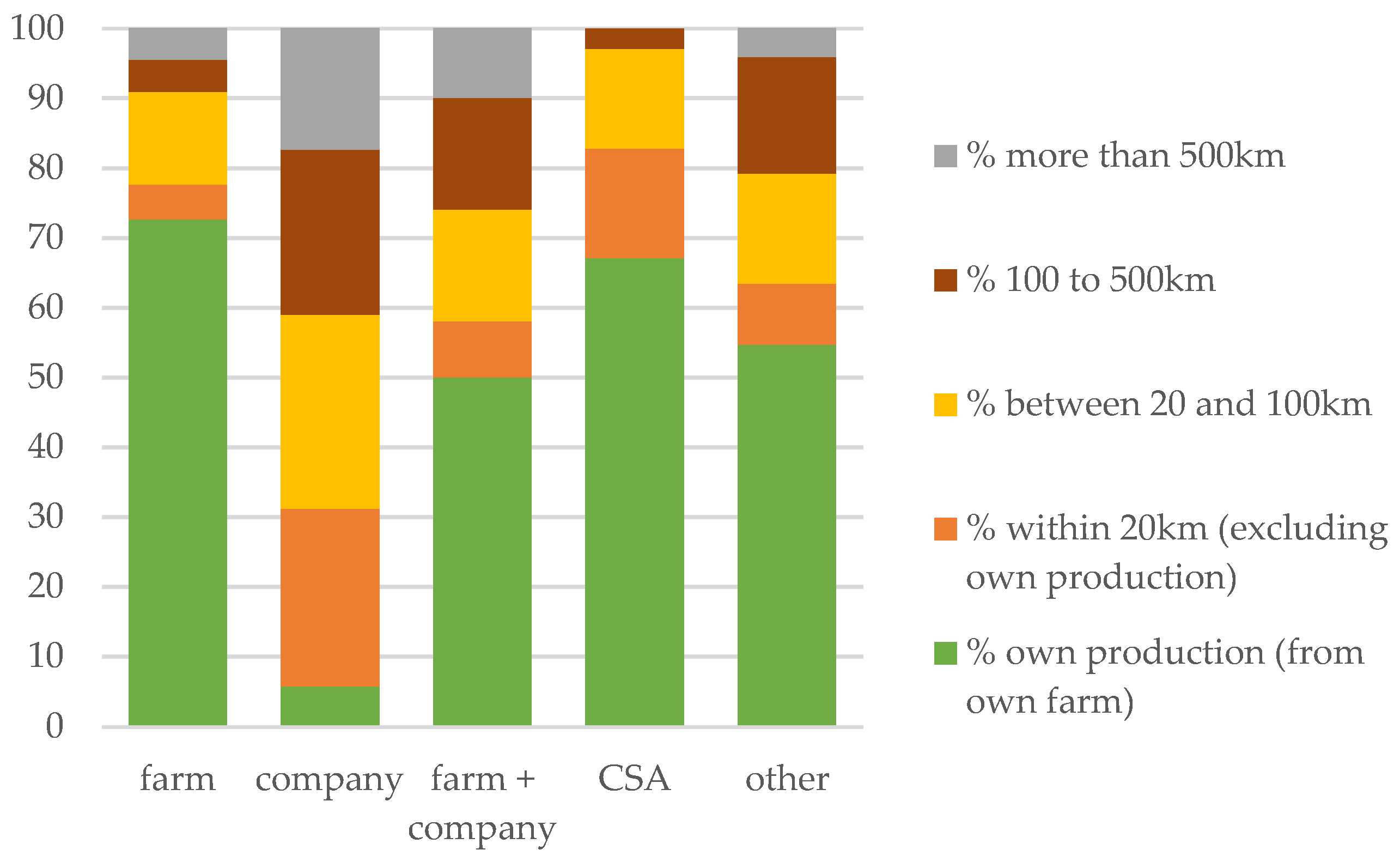

| Arit. Mean | Count 100% Cases | % 100% Cases | Count 0% Cases | % 0% Cases | |

|---|---|---|---|---|---|

| % own production (from own farm) | 40.9 | 7 | 15.9 | 11 | 25.0 |

| % within 20 km (excluding own production) | 15.5 | 1 | 2.3 | 13 | 29.5 |

| % 20 to 100 km | 19.7 | 1 | 2.3 | 12 | 27.3 |

| % 100 to 500 km | 14.6 | 0 | 0 | 15 | 34.1 |

| % more than 500 km | 9.4 | 0 | 0 | 24 | 54.5 |

| Average Delivery Distance in km | Maximum Delivery Distance in km | |

|---|---|---|

| Arit. mean | 29.3 | 73.9 |

| Median | 15.0 | 30.0 |

| Std. Deviation | 51.2 | 109.1 |

| Min | 0.0 | 2.0 |

| Max | 300.0 | 600.0 |

| Arit. Mean | Count 100% | % 100% | Count 0% | % 0% | |

|---|---|---|---|---|---|

| webshop/Internet | 45.2% | 3 | 6.8 | 14 | 31.8 |

| 36.3% | 4 | 9.1 | 5 | 11.4 | |

| telephone | 10.9% | 0 | 0.0 | 11 | 25.0 |

| face-to-face | 7.6% | 1 | 2.3 | 21 | 47.7 |

| How Customers and Farmers Meet | f | % |

|---|---|---|

| at events (occasional) | 12 | 36.4 |

| at pick-up (regularly) | 8 | 24.2 |

| customers can visit farm (not organised) | 7 | 21.2 |

| at farm shop/farmers market | 7 | 21.2 |

| in organised meetings | 4 | 12.1 |

| not specified | 2 | 6.1 |

| during delivery | 1 | 3.0 |

| Pre-defined Values | Arit. Mean | Rated “Very Important” (f) | Rated “Very Important” (%) |

|---|---|---|---|

| quality production | 4.75 | 34 | 77.3 |

| organic production | 4.70 | 36 | 81.8 |

| sustainability | 4.70 | 32 | 72.7 |

| supporting small-scale farms | 4.57 | 29 | 65.9 |

| local production | 4.55 | 29 | 65.9 |

| transparency | 4.36 | 22 | 50.0 |

| fair wages | 4.32 | 22 | 50.0 |

| reducing transport | 4.30 | 21 | 47.7 |

| personal interaction farmers & consumers | 4.27 | 23 | 52.3 |

| reducing CO2-emissions | 4.20 | 20 | 45.5 |

| transfer of knowledge | 4.07 | 18 | 40.9 |

| profitability | 3.95 | 15 | 34.1 |

| community building | 3.75 | 10 | 22.7 |

| supporting social projects | 3.73 | 11 | 25.0 |

| traditional agriculture | 3.61 | 12 | 27.3 |

| artisan production | 3.52 | 8 | 18.2 |

| Country | No. Cases | Years of Operation | No. Employees | Boxes/Week First Year | Boxes/Week 2015 | Growth Rate (Multiplication *) |

|---|---|---|---|---|---|---|

| United Kingdom | 18 | 14.3 | 7.2 | 90.8 | 438.4 | 4.8 |

| Austria | 15 | 10.7 | 19.3 | 75.0 | 1078.3 | 14.4 |

| Croatia | 6 | 6.5 | 6.3 | 14.5 | 69.8 | 4.8 |

| Belgium | 5 | 6.4 | 1.6 | 30.8 | 94.6 | 3.1 |

| No. Employees | Years of Operation | |||

|---|---|---|---|---|

| Arith. Mean | Max | Min | Arit. Mean | |

| Small (<50 boxes/week) (n = 11) | 1.5 | 5 | 0 | 5.7 |

| Medium (51–500 boxes/week) (n = 25) | 5.8 | 20 | 0 | 12.8 |

| Large (>500 boxes/week) (n = 8) | 38.0 | 120 | 5 | 13.1 |

| Organisational Type | Total | ||||||

|---|---|---|---|---|---|---|---|

| Size Category | Farm | Company | Farm + Company | CSA | Other | ||

| small (<50 boxes/week); (n = 11) | Count | 3 | 3 | 0 | 5 | 0 | 11 |

| % within row | 27.3 % | 27.3% | 0.0 % | 45.5% | 0.0 % | 100 % | |

| medium (51–500 boxes/week); (n = 25) | Count | 4 | 9 | 4 | 2 | 6 | 25 |

| % within row | 16.0% | 36.0% | 16.0 % | 8.0 % | 24.0% | 100 % | |

| large (>500 boxes/week); (n = 8) | Count | 2 | 5 | 1 | 0 | 0 | 8 |

| % within row | 25.0 % | 62.5 % | 12.5 % | 0.0 % | 0.0 % | 100 % | |

| Total | Count | 9 | 17 | 5 | 7 | 6 | 44 |

| % within row | 20.5 % | 38.6 % | 11.4 % | 15.9 % | 13.6 % | 100 % | |

| Arit. Mean | Median | Max | Min | |

|---|---|---|---|---|

| small (<50 boxes/week) (n = 10) | 88.5 | 63 | 250 | 20 |

| medium (51-500 boxes/week) (n = 21) | 114.0 | 70 | 400 | 20 |

| large (>500 boxes/week) (n = 8) | 121.3 | 100 | 300 | 10 |

| % from Own Farm | % from within 20 km | % from 20 to 100 km | % from 100 to 500 km | % from more than 500 km | |

|---|---|---|---|---|---|

| small (<50 boxes/week) (n = 11) | 41.5 | 18.2 | 20.9 | 12.3 | 7.1 |

| medium (51-500 boxes/week) (n = 25) | 44.3 | 15.0 | 18.8 | 15.7 | 6.2 |

| large (>500 boxes/week) (n = 8) | 29.2 | 13.1 | 20.9 | 14.4 | 22.4 |

| Size Category | ||||||

|---|---|---|---|---|---|---|

| Small (<50 boxes/week) (n = 11) | Medium (51–500 boxes/week) (n = 25) | Large (>500 boxes/week) (n = 8) | ||||

| f | % | f | % | f | % | |

| name of producer | 9 | 81.8% | 13 | 52.0% | 8 | 100.0% |

| origin (region/country) | 7 | 63.6% | 15 | 60.0% | 7 | 87.5% |

| portraits of producers/processors | 4 | 36.4% | 6 | 24.0% | 4 | 50.0% |

| description of products | 8 | 72.7% | 12 | 48.0% | 8 | 100.0% |

| recipes | 6 | 54.5% | 14 | 56.0% | 6 | 75.0% |

| Organisation | Origin Products | Producer–Consumer-Interaction | |

|---|---|---|---|

| Smaller box schemes |

|

|

|

| Larger box schemes |

|

|

|

| Commonalities |

| ||

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kummer, S.; Milestad, R. The Diversity of Organic Box Schemes in Europe—An Exploratory Study in Four Countries. Sustainability 2020, 12, 2734. https://doi.org/10.3390/su12072734

Kummer S, Milestad R. The Diversity of Organic Box Schemes in Europe—An Exploratory Study in Four Countries. Sustainability. 2020; 12(7):2734. https://doi.org/10.3390/su12072734

Chicago/Turabian StyleKummer, Susanne, and Rebecka Milestad. 2020. "The Diversity of Organic Box Schemes in Europe—An Exploratory Study in Four Countries" Sustainability 12, no. 7: 2734. https://doi.org/10.3390/su12072734

APA StyleKummer, S., & Milestad, R. (2020). The Diversity of Organic Box Schemes in Europe—An Exploratory Study in Four Countries. Sustainability, 12(7), 2734. https://doi.org/10.3390/su12072734