A Cross-Channel Return Policy in a Green Dual-Channel Supply Chain Considering Spillover Effect

Abstract

1. Introduction

- In what circumstance does a retailer decide to provide a cross-channel return service with no subsidy when the spillover effect is taken into consideration?

- How does the cross-channel return policy affect a manufacturer and a retailer’s decisions?

- How is the green supply chain influenced by consumers’ sensitivity to green products and the degree of spillover effect?

- How should the dual-channel green supply chain be managed?

2. Literature Review

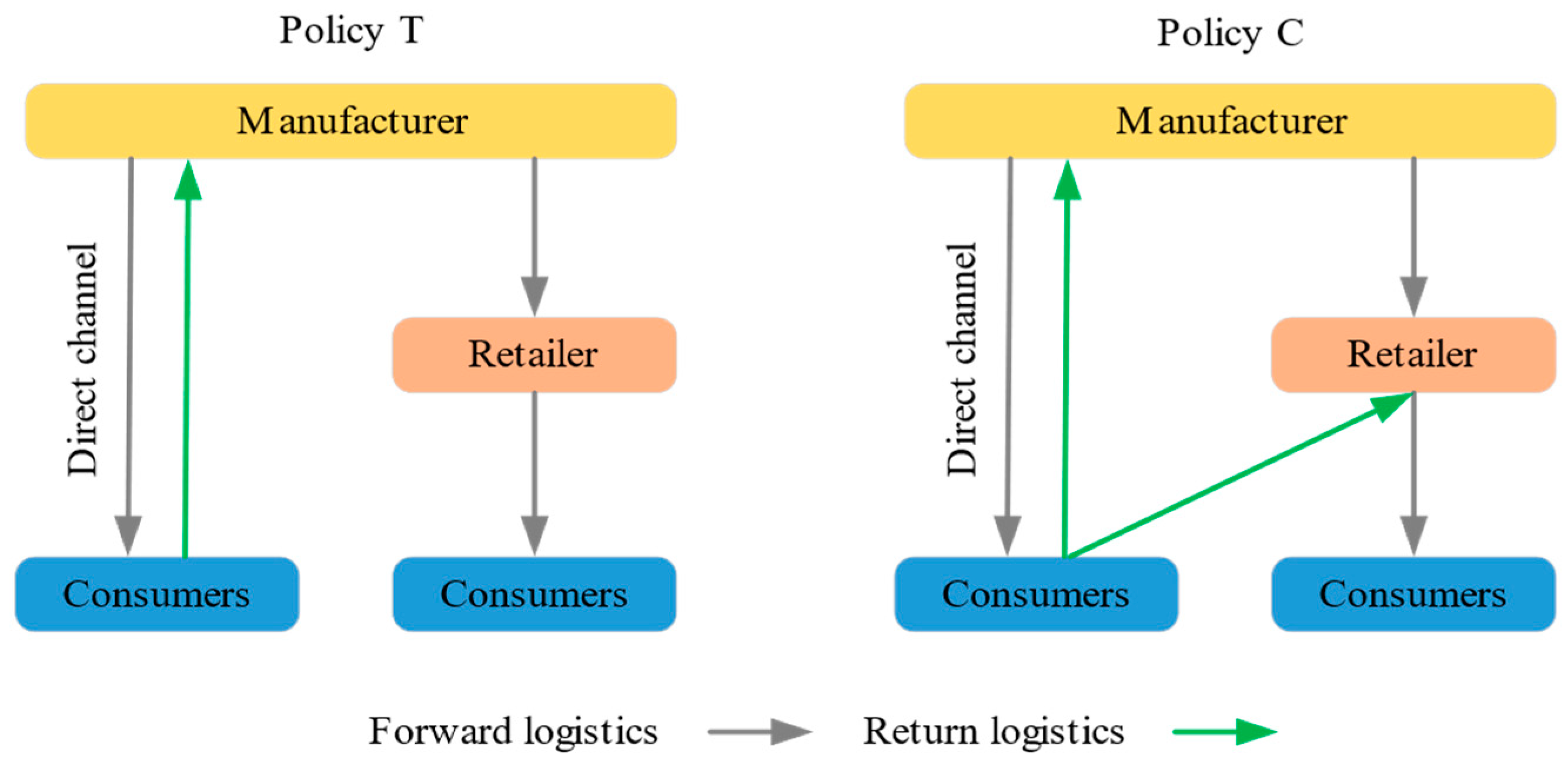

3. Model Formulation

- The potential market demand is sufficiently large and is greater than the other parameters in the article, which is affected by non-price factors such as corporate image, brand influence, and customers’ intrinsic preference. For simplicity, we assumed the basic market demands of the two channels were equal. This similar assumption can be found in Mukhopadhyay et al. [25].

- The return rate of the retail channel is zero, given that the return caused by poor quality will not occur in consumers’ first-hand experience in the store. Our study concentrated on the cooperation of the direct and retail channel based on the cross-channel return policy rather than on two channels’ return activity;

- We only considered the green manufacturing practice to increase product greenness with increasing production costs, which is a common assumption [26,27]. It is different from the scenario of taking lean production and remanufacturing into the supply chain, and the production costs are decreased [28]. The relationship between price and greenness is different in different situations, which can be seen in [5,29];

- We suppose that returned products can be resold in the same selling season with simple adjustments, such as repacking.

3.1. Demand Functions

3.2. Cost Structure

3.3. Profit Functions

4. Model Analysis

4.1. Traditional Return Policy

4.2. Cross-Channel Return Policy

4.3. Comparative Analysis

- If , then ;

- If , then .

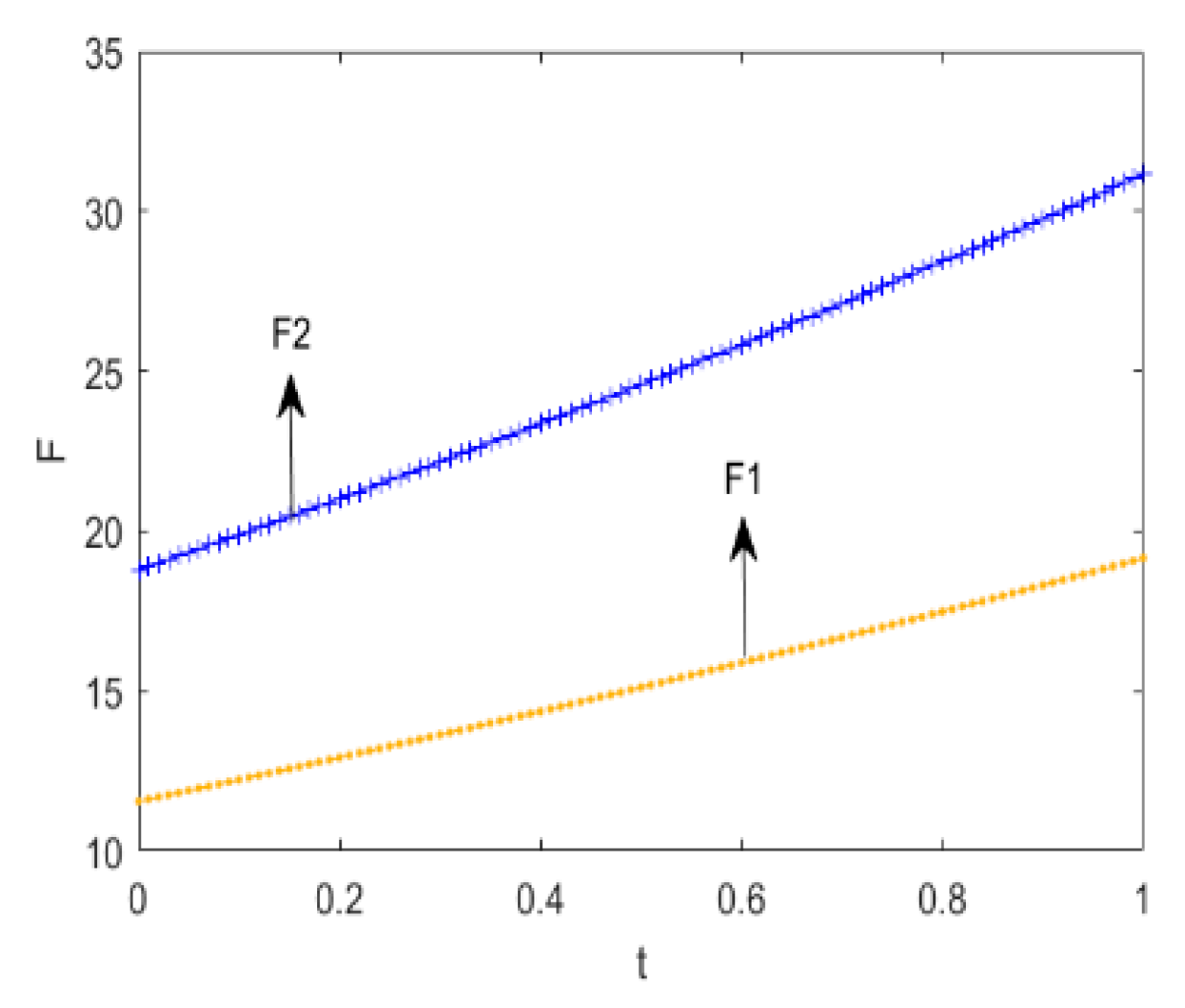

4.4. Coordination Contract

5. Numerical Analysis

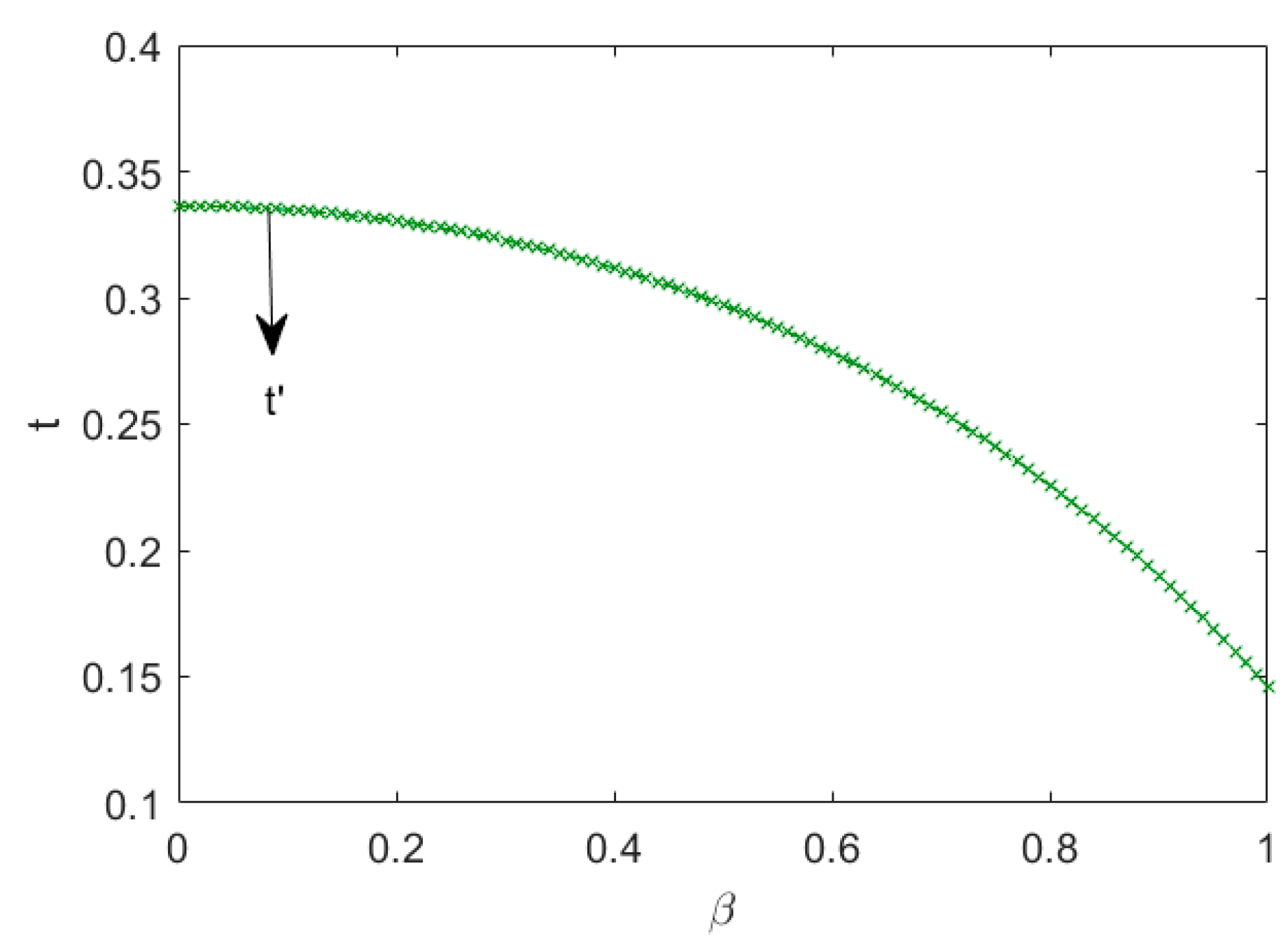

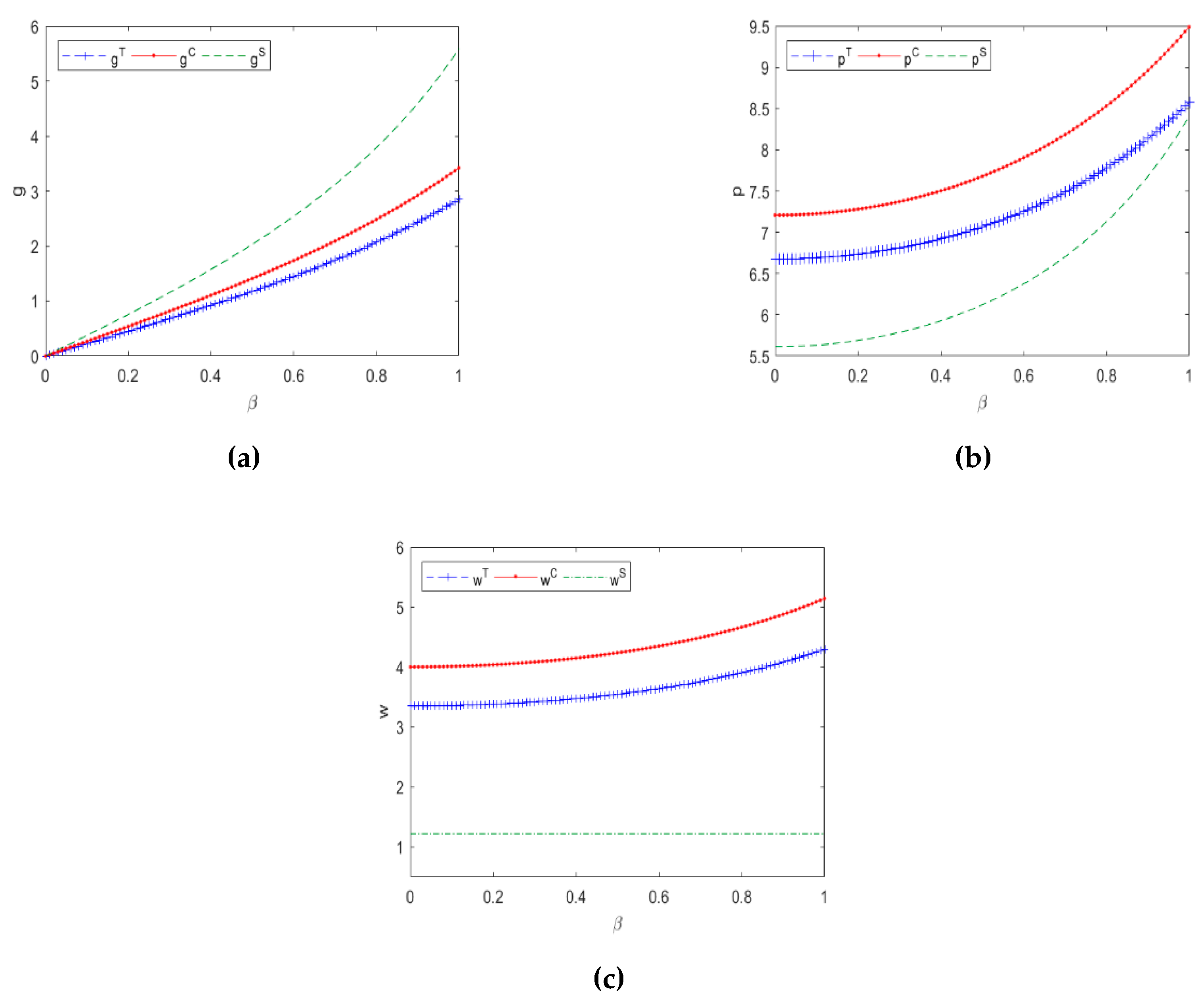

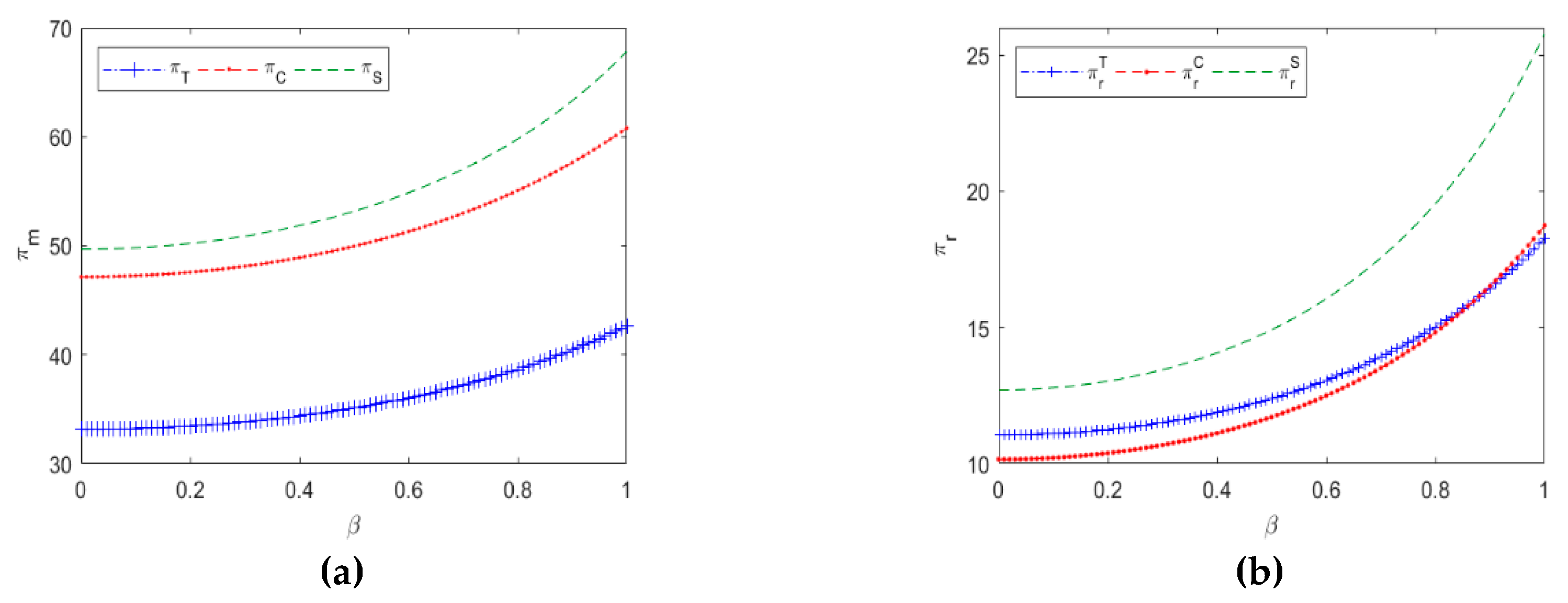

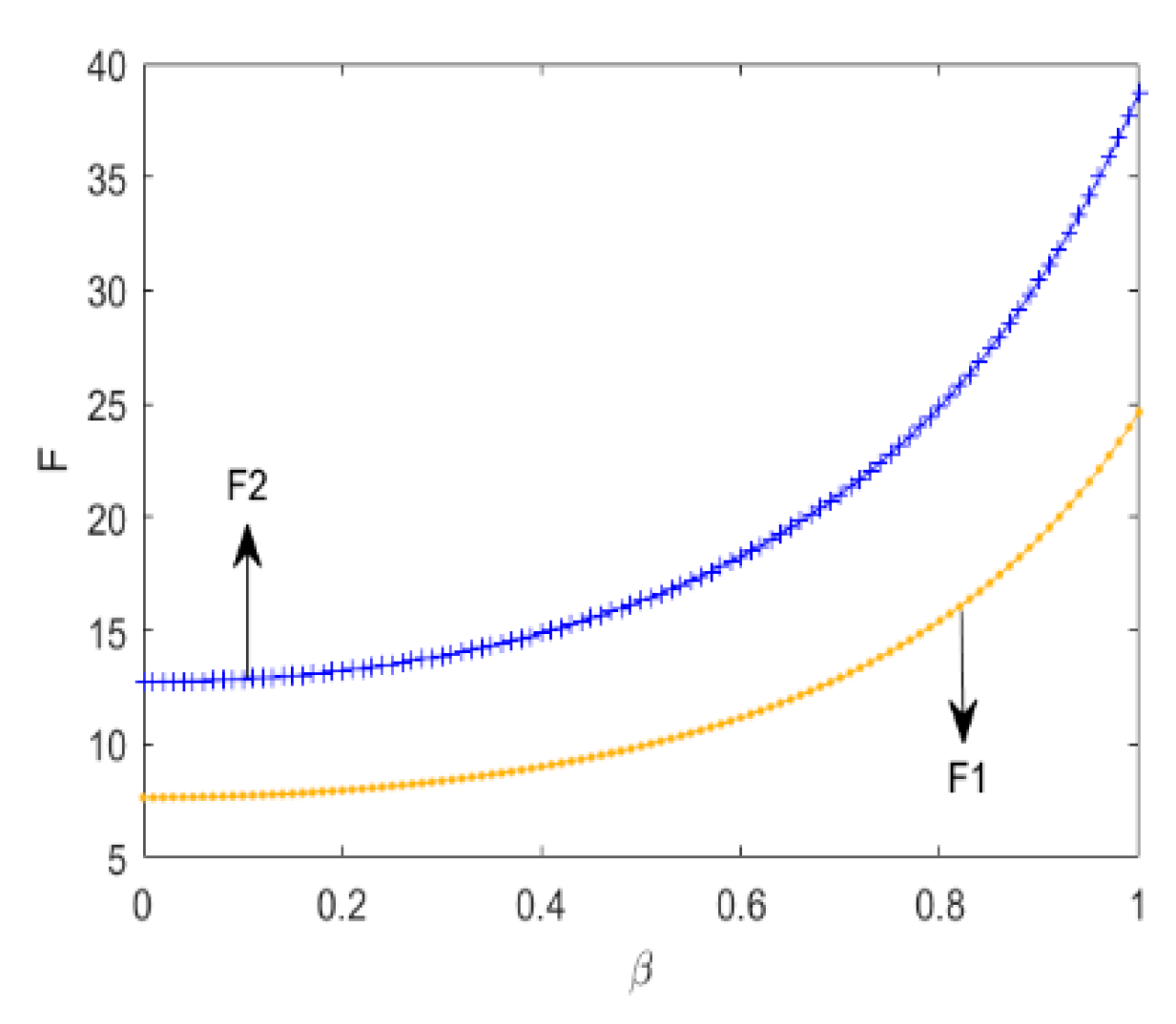

5.1. Impact of the Degree of the Spillover Effect

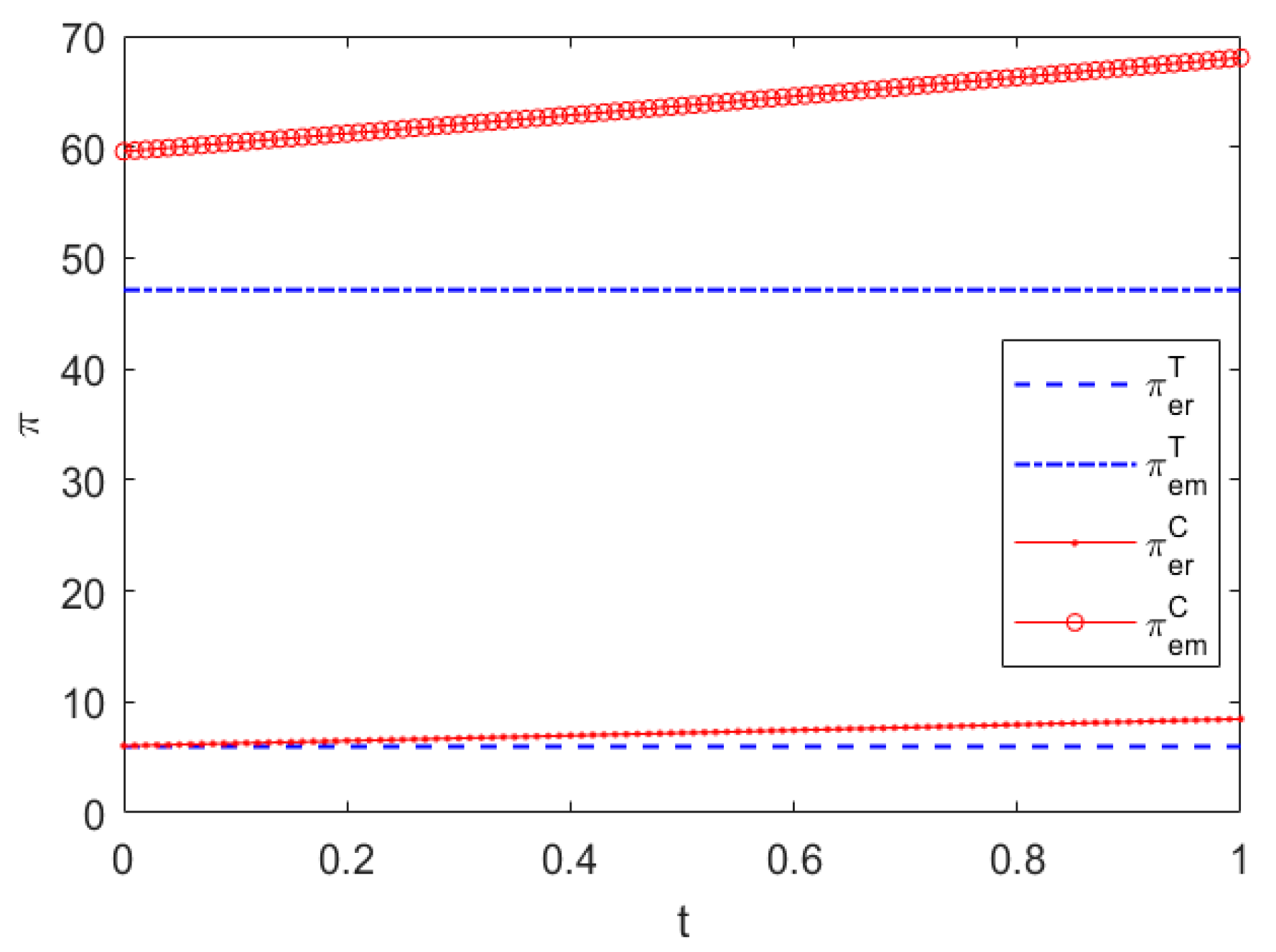

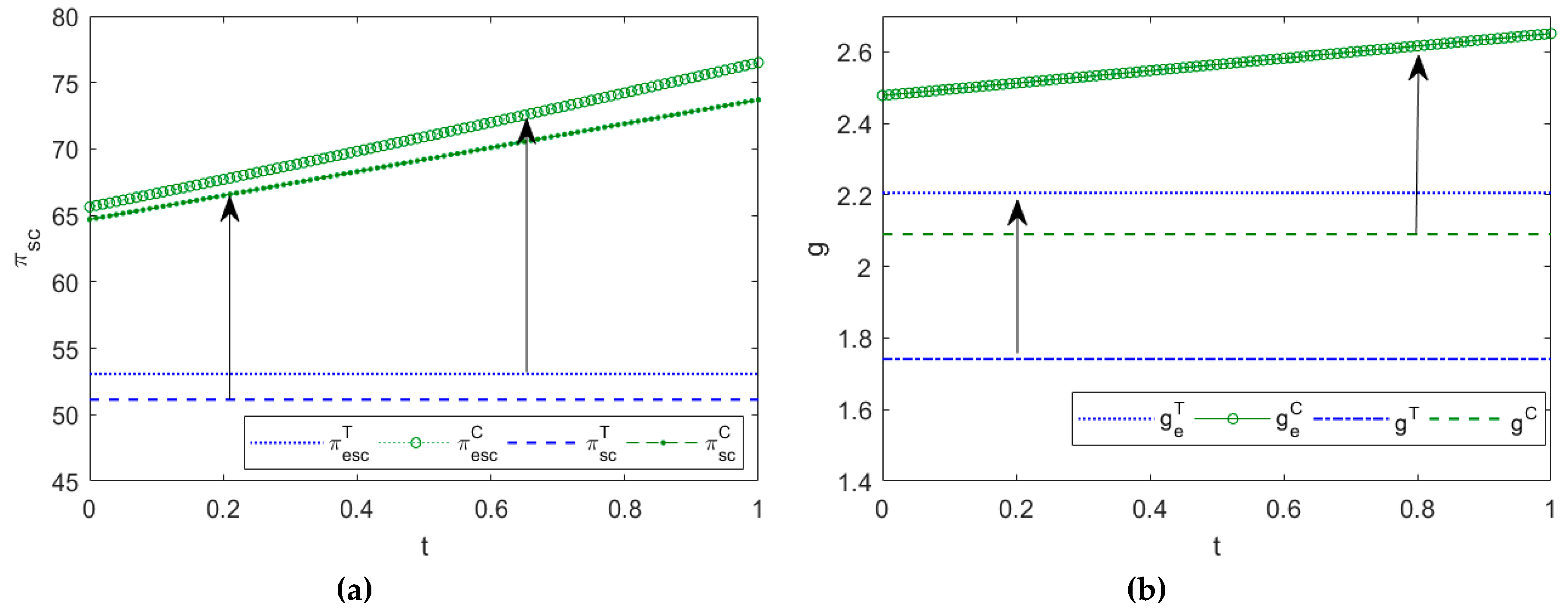

5.2. Impact of the Degree of Consumer Sensitivity to Green Products

6. Extended Discussion

6.1. Traditional Return Policy under the Differential Pricing Policy

6.2. Cross-Channel Return Policy under the Differential Pricing Policy

7. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Hybris. Fulfillment in a Multichannel Retailing Environment: Consumer Expectations, Proven Strategies, Organizational Issue and Technology Considerations; Hybris AG: Zurich, Switzerland, 2012; pp. 1–7. [Google Scholar]

- Hu, J.; Liu, Y.-L.; Yuen, T.W.W.; Lim, M.K.; Hu, J. Do green practices really attract customers? The sharing economy from the sustainable supply chain management perspective. Resour. Conserv. Recycl. 2019, 149, 177–187. [Google Scholar] [CrossRef]

- Cao, L.; Li, L. The Impact of Cross-Channel Integration on Retailers’ Sales Growth. J. Retail. 2015, 91, 198–216. [Google Scholar] [CrossRef]

- Tseng, M.-L.; Islam, M.S.; Karia, N.; Fauzi, F.A.; Afrin, S. A literature review on green supply chain management: Trends and future challenges. Resour. Conserv. Recycl. 2019, 141, 145–162. [Google Scholar] [CrossRef]

- Li, B.; Zhu, M.; Jiang, Y.; Li, Z. Pricing policies of a competitive dual-channel green supply chain. J. Clean. Prod. 2016, 112, 2029–2042. [Google Scholar] [CrossRef]

- Li, G.; Shao, S.; Zhang, L. Green supply chain behavior and business performance: Evidence from China. Technol. Forecast. Soc. Change 2019, 144, 445–455. [Google Scholar] [CrossRef]

- Su, X. Consumer Returns Policies and Supply Chain Performance. Manuf. Serv. Oper. Manag. 2009, 11, 595–612. [Google Scholar] [CrossRef]

- Tran, T.; Gurnani, H.; Desiraju, R. Optimal Design of Return Policies. Market. Sci. 2018, 37, 649–667. [Google Scholar] [CrossRef]

- Pei, Z.; Paswan, A.; Yan, R. E-tailer’s return policy, consumer’s perception of return policy fairness and purchase intention. J. Retail. Consum. Serv. 2014, 21, 249–257. [Google Scholar] [CrossRef]

- Li, B.; Jiang, Y. Impacts of returns policy under supplier encroachment with risk-averse retailer. J. Retail. Consum. Serv. 2019, 47, 104–115. [Google Scholar] [CrossRef]

- Li, G.; Li, L.; Sethi, S.P.; Guan, X. Return strategy and pricing in a dual-channel supply chain. Int. J. Prod. Econ. 2019, 215, 153–164. [Google Scholar] [CrossRef]

- Ji, G.; Han, S.; Tan, K.H. False failure returns: Optimal pricing and return policies in a dual-channel supply chain. J. Syst. Sci. Syst. Eng. 2018, 27, 292–321. [Google Scholar] [CrossRef]

- Radhi, M.; Zhang, G. Pricing policies for a dual-channel retailer with cross-channel returns. Computers Ind. Eng. 2018, 119, 63–75. [Google Scholar] [CrossRef]

- Radhi, M.; Zhang, G. Optimal cross-channel return policy in dual-channel retailing systems. Int. J. Prod. Econ. 2019, 210, 184–198. [Google Scholar] [CrossRef]

- Hervani, A.A.; Helms, M.M.; Sarkis, J. Performance measurement for green supply chain management. Benchmarking Int. J. 2005, 12, 330–353. [Google Scholar] [CrossRef]

- Srivastava, S.K. Green supply-chain management: A state-of-the-art literature review. Int. J. Manag. Rev. 2007, 9, 53–80. [Google Scholar] [CrossRef]

- Zhang, L.; Wang, J.; You, J. Consumer environmental awareness and channel coordination with two substitutable products. Eur. J. Oper. Res. 2015, 241, 63–73. [Google Scholar] [CrossRef]

- Jamali, M.-B.; Rasti-Barzoki, M. A game theoretic approach for green and non-green product pricing in chain-to-chain competitive sustainable and regular dual-channel supply chains. J. Clean. Prod. 2018, 170, 1029–1043. [Google Scholar] [CrossRef]

- Ghosh, D.; Shah, J. A comparative analysis of greening policies across supply chain structures. Int. J. Prod. Econ. 2012, 135, 568–583. [Google Scholar] [CrossRef]

- Chen, J.; Liang, L.; Yao, D.-Q.; Sun, S. Price and quality decisions in dual-channel supply chains. Eur. J. Oper. Res. 2017, 259, 935–948. [Google Scholar] [CrossRef]

- Ghosh, D.; Shah, J. Supply chain analysis under green sensitive consumer demand and cost sharing contract. Int. J. Prod. Econ. 2015, 164, 319–329. [Google Scholar] [CrossRef]

- Song, H.; Gao, X. Green supply chain game model and analysis under revenue-sharing contract. J. Clean. Prod. 2018, 170, 183–192. [Google Scholar] [CrossRef]

- Li, Y.; Xu, L.; Li, D. Examining relationships between the return policy, product quality, and pricing strategy in online direct selling. Int. J. Prod. Econ. 2013, 144, 451–460. [Google Scholar] [CrossRef]

- Chen, X.; Wang, X.; Zhou, M. Firms’ green R&D cooperation behaviour in a supply chain: Technological spillover, power and coordination. Int. J. Prod. Econ. 2019, 218, 118–134. [Google Scholar] [CrossRef]

- Mukhopadhyay, S.K.; Zhu, X.; Yue, X. Optimal Contract Design for Mixed Channels Under Information Asymmetry. Prod. Oper. Manag. 2008, 17, 641–650. [Google Scholar] [CrossRef]

- Yang, D.; Xiao, T.; Huang, J. Dual-channel structure choice of an environmental responsibility supply chain with green investment. J. Clean. Prod. 2019, 210, 134–145. [Google Scholar] [CrossRef]

- Raza, S.A.; Govindaluri, S.M. Pricing strategies in a dual-channel green supply chain with cannibalization and risk aversion. Oper. Res. Perspect. 2019, 6, 100118. [Google Scholar] [CrossRef]

- Saha, S.; Sarmah, S.P.; Moon, I. Dual channel closed-loop supply chain coordination with a reward-driven remanufacturing policy. Int. J. Prod. Res. 2015, 54, 1503–1517. [Google Scholar] [CrossRef]

- Liu, P.; Yi, S.-p. Pricing policies of green supply chain considering targeted advertising and product green degree in the Big Data environment. J. Clean. Prod. 2017, 164, 1614–1622. [Google Scholar] [CrossRef]

- Rahmani, K.; Yavari, M. Pricing policies for a dual-channel green supply chain under demand disruptions. Computers Ind. Eng. 2019, 127, 493–510. [Google Scholar] [CrossRef]

- Chen, J.; Zhang, H.; Sun, Y. Implementing coordination contracts in a manufacturer Stackelberg dual-channel supply chain. Omega 2012, 40, 571–583. [Google Scholar] [CrossRef]

| Parameters | Definition |

|---|---|

| Market base in direct and retail channels | |

| The return rate of green products from the online channel’s customer, | |

| Green investment parameter | |

| Consumer sensitivity to green level improvement on the demand | |

| Percentage of consumers who prefer to return products to the physical channel, | |

| Spillover rate of cross-channel return policy to the retail channel, | |

| Increased demand due to added return channels | |

| Retailer/manufacturer’s unit return cost | |

| Demand sensitivity to self-price when adopting a differentiated pricing strategy | |

| Demand sensitivity to cross-price when adopting a differentiated pricing strategy | |

| The wholesale price of the manufacturer to the retailer (Decision variable) | |

| The selling price of the retailer in dual channel (Decision variable) | |

| Green level of the products (Decision variable) | |

| Superscript | The decentralized scenario under policy T, policy C |

| Superscript | The centralized scenario under policy C |

| Superscript | The scenario under coordination contract ) and contract () |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, H.; Xu, H.; Pu, X. A Cross-Channel Return Policy in a Green Dual-Channel Supply Chain Considering Spillover Effect. Sustainability 2020, 12, 2171. https://doi.org/10.3390/su12062171

Zhang H, Xu H, Pu X. A Cross-Channel Return Policy in a Green Dual-Channel Supply Chain Considering Spillover Effect. Sustainability. 2020; 12(6):2171. https://doi.org/10.3390/su12062171

Chicago/Turabian StyleZhang, Huanyong, Huiyuan Xu, and Xujin Pu. 2020. "A Cross-Channel Return Policy in a Green Dual-Channel Supply Chain Considering Spillover Effect" Sustainability 12, no. 6: 2171. https://doi.org/10.3390/su12062171

APA StyleZhang, H., Xu, H., & Pu, X. (2020). A Cross-Channel Return Policy in a Green Dual-Channel Supply Chain Considering Spillover Effect. Sustainability, 12(6), 2171. https://doi.org/10.3390/su12062171