Business Risk Evaluation of Electricity Retail Company in China Using a Hybrid MCDM Method

Abstract

1. Introduction

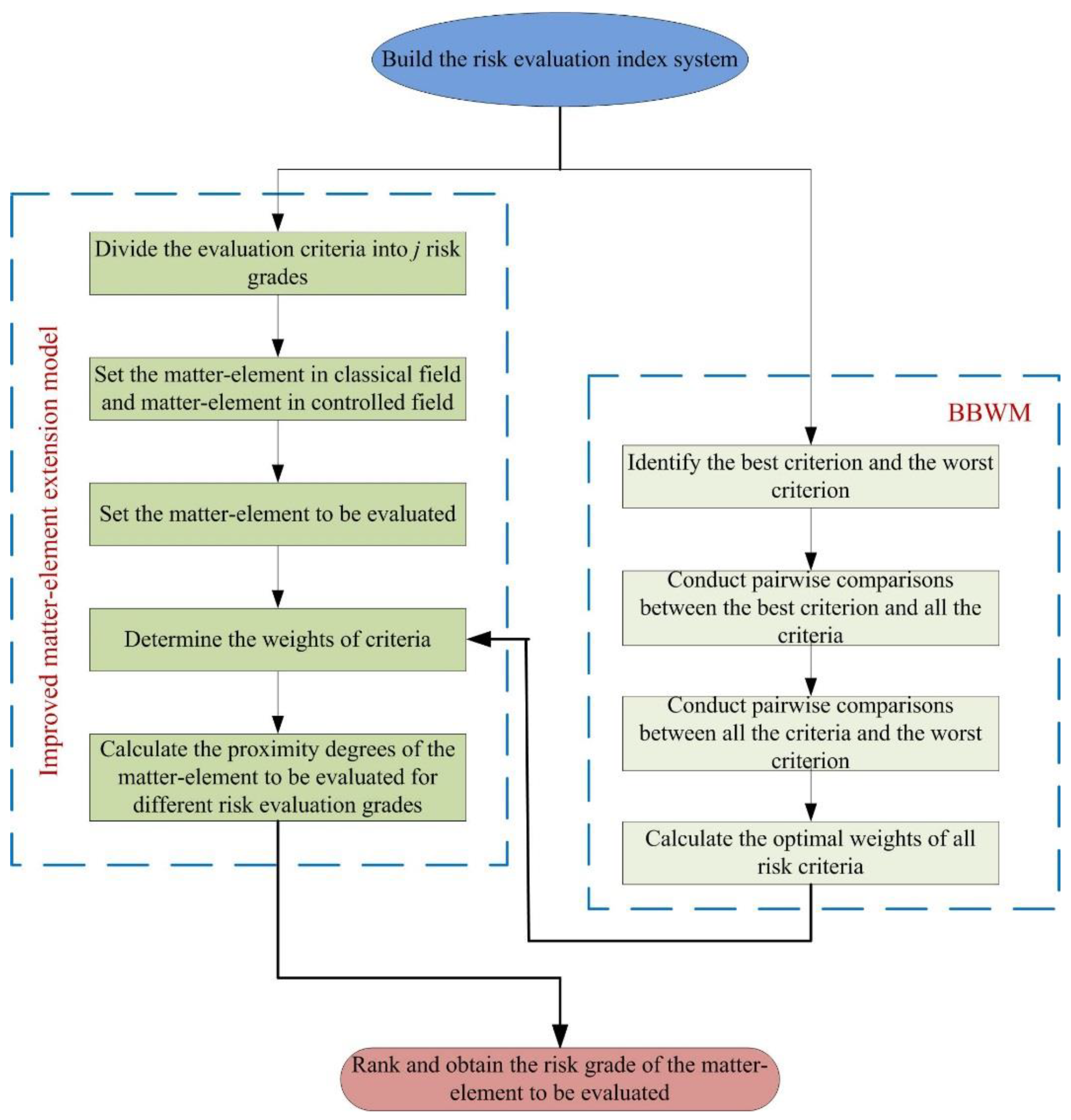

2. Basic Theory of the Proposed MCDM Method for Business Risk Evaluation of Electricity Retail Company

2.1. The BBWM for Weight Determination of Evaluation Criteria

2.2. Improved Matter-Element Extension Model for Business Risk Ranking

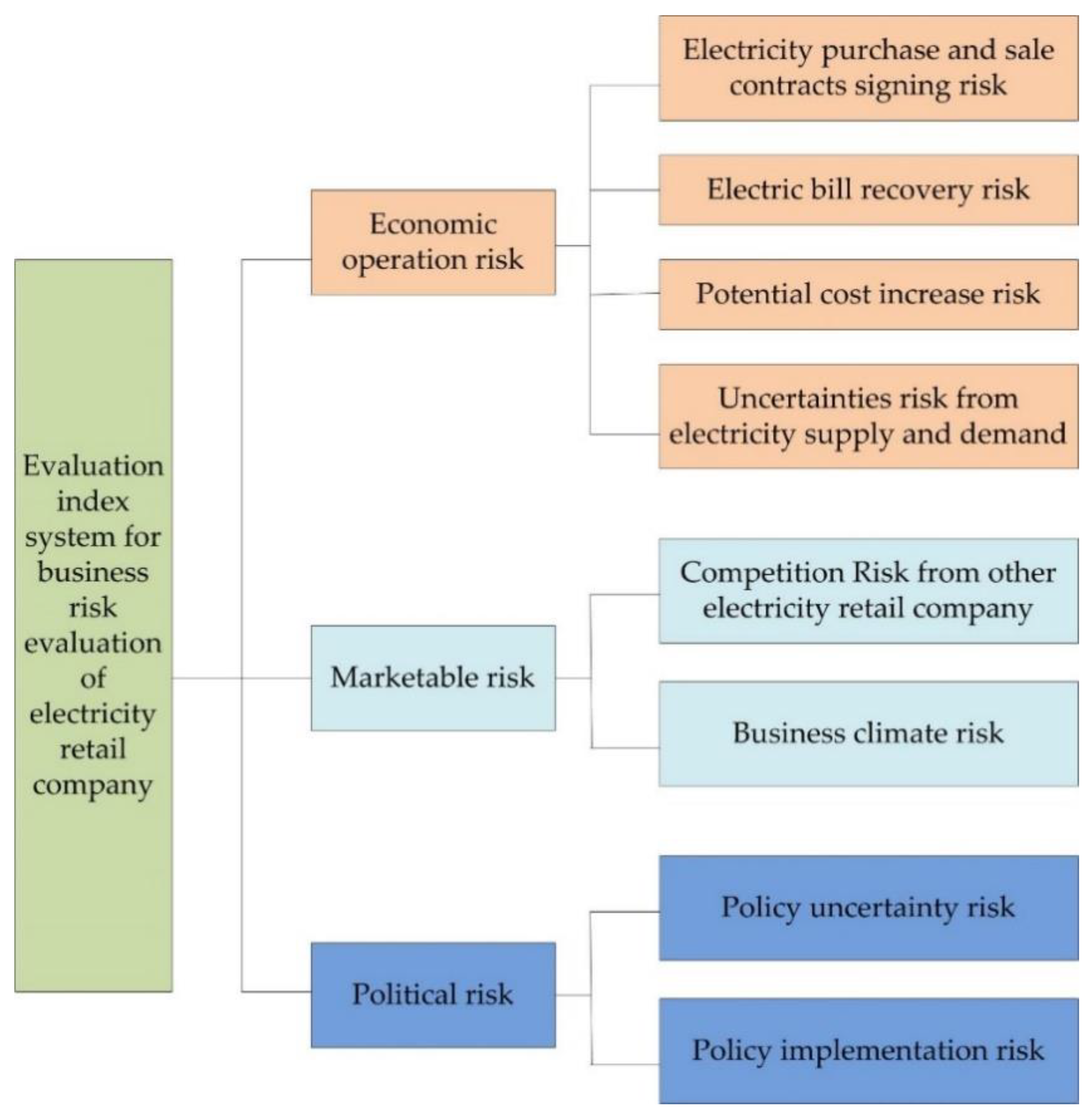

3. Evaluation Index System for Business Risk Evaluation of Electricity Retail Company

4. Empirical Analysis

4.1. Set the Matter-Element in Classical Field and Matter-Element in Controlled Field

4.2. Set the Matter-Element to Be Evaluated

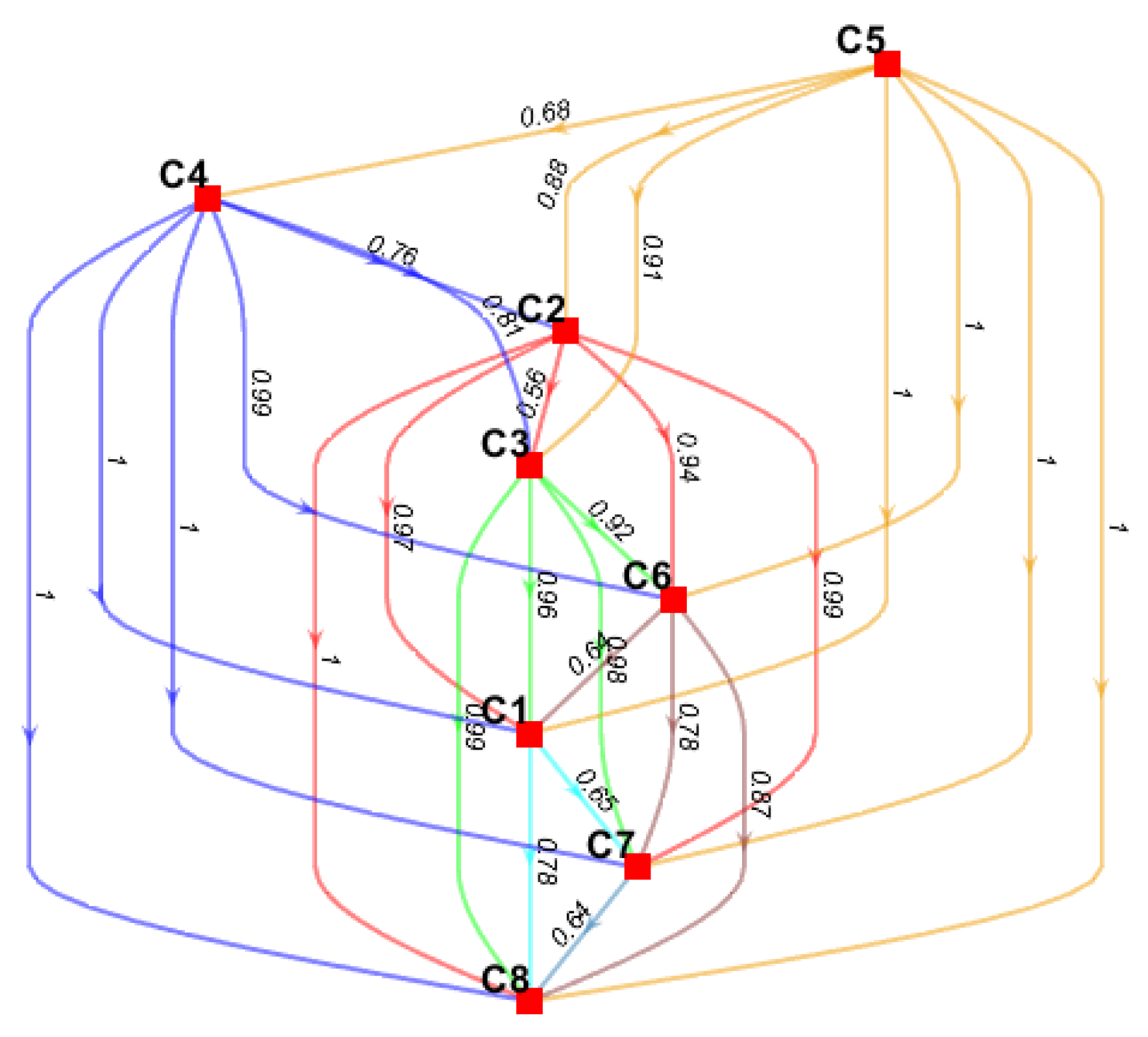

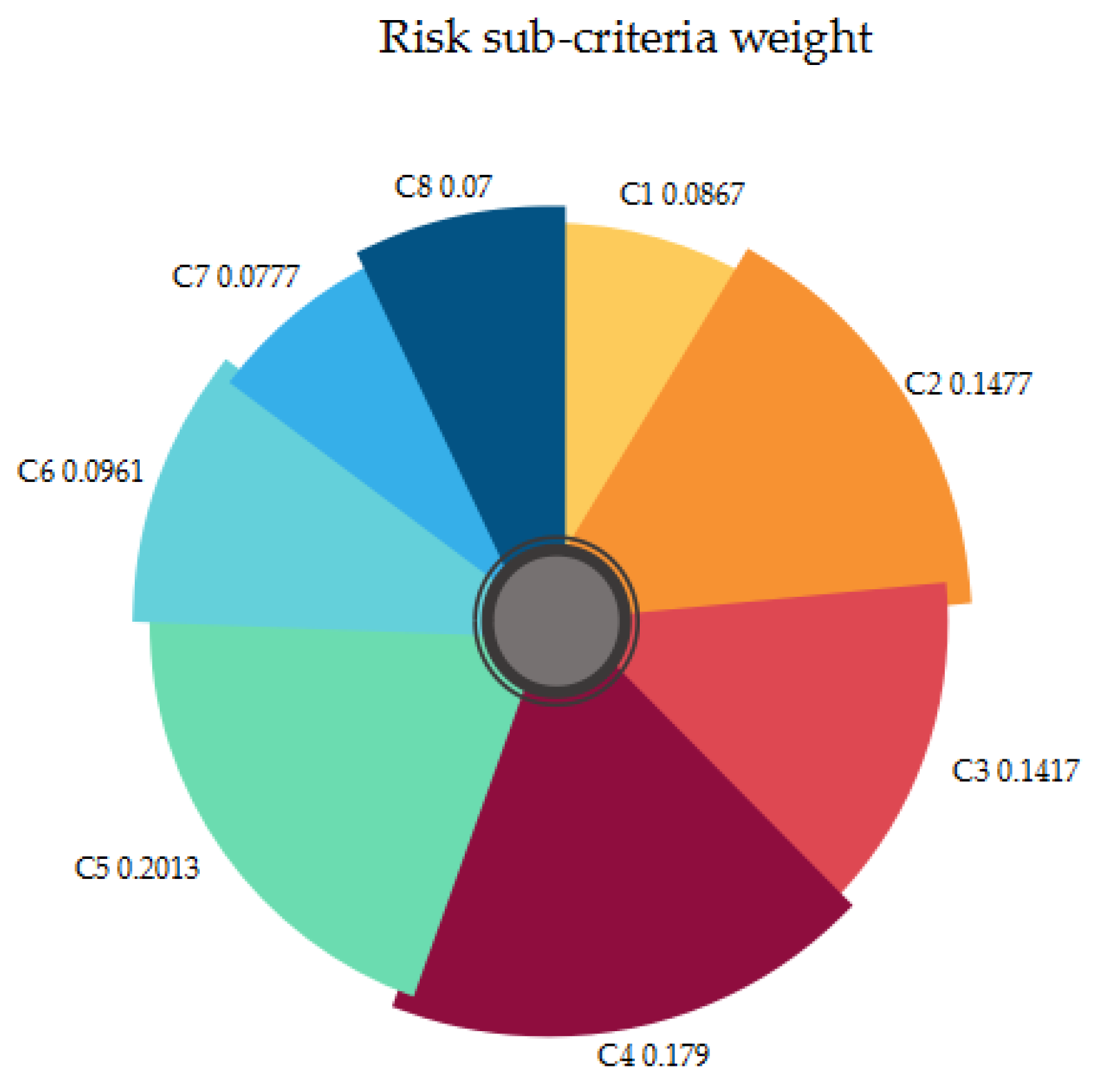

4.3. Determine the Weights of Risk Sub-Criteria

4.4. Calculate the Proximity Degrees of the Matter-Element to be Evaluated for Different Evaluation Grades

4.5. Rank Business Risk Evaluation Grade of Electricity Retail Company

5. Discussion

5.1. Result Analysis

5.2. Comparative Analysis

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Wang, Q.; Chen, X. China’s electricity market-oriented reform: From an absolute to a relative monopoly. Energy Policy 2012, 51, 143–148. [Google Scholar] [CrossRef]

- Zeng, M.; Yang, Y.; Wang, L.; Sun, J. The power industry reform in China 2015: Policies, evaluations and solutions. Renew. Sustain. Energy Rev. 2016, 57, 94–110. [Google Scholar] [CrossRef]

- You, P.; Guo, S.; Zhao, H.; Zhao, H. Operation performance evaluation of power grid enterprise using a hybrid BWM-TOPSIS method. Sustainability 2017, 9, 2329. [Google Scholar] [CrossRef]

- He, Y.; Jiao, J.; Chen, R.; Shu, H. The optimization of Chinese power grid investment based on transmission and distribution tariff policy: A system dynamics approach. Energy Policy 2018, 113, 112–122. [Google Scholar] [CrossRef]

- Peng, X.; Tao, X. Cooperative game of electricity retailers in China’s spot electricity market. Energy 2018, 145, 152–170. [Google Scholar] [CrossRef]

- Su, X. Have customers benefited from electricity retail competition? J. Regul. Econ. 2015, 47, 146–182. [Google Scholar] [CrossRef]

- Luo, F.; Ranzi, G.; Wang, X.; Dong, Z.Y. Social information filtering-based electricity retail plan recommender system for smart grid end users. IEEE Trans. Smart Grid 2017, 10, 95–104. [Google Scholar] [CrossRef]

- Niu, D.; Li, S.; Dai, S. Comprehensive evaluation for operating efficiency of electricity retail companies based on the improved TOPSIS method and LSSVM optimized by modified ant colony algorithm from the view of sustainable development. Sustainability 2018, 10, 860. [Google Scholar] [CrossRef]

- de Bragança, G.G.F.; Daglish, T. Investing in vertical integration: Electricity retail market participation. Energy Econ. 2017, 67, 355–365. [Google Scholar] [CrossRef]

- Wang, C.; Zhou, K.; Yang, S. A review of residential tiered electricity pricing in China. Renew. Sustain. Energy Rev. 2017, 79, 533–543. [Google Scholar] [CrossRef]

- Bae, M.; Kim, H.; Kim, E.; Chung, A.Y.; Kim, H.; Roh, J.H. Toward electricity retail competition: Survey and case study on technical infrastructure for advanced electricity market system. Appl. Energy 2014, 133, 252–273. [Google Scholar] [CrossRef]

- Boroumand, R.H.; Zachmann, G. Retailers’ risk management and vertical arrangements in electricity markets. Energy Policy 2012, 40, 465–472. [Google Scholar] [CrossRef]

- Conejo, A.; Carrion, M. Risk-constrained electricity procurement for a large consumer. IEE Proc.-Gener. Transm. Distrib. 2006, 153, 407–413. [Google Scholar] [CrossRef]

- Ahmadi, A.; Charwand, M.; Aghaei, J. Risk-constrained optimal strategy for retailer forward contract portfolio. Int. J. Electr. Power Energy Syst. 2013, 53, 704–713. [Google Scholar] [CrossRef]

- Zare, K.; Moghaddam, M.P.; Sheikh-El-Eslami, M.K. Risk-based electricity procurement for large consumers. IEEE Trans. Power Syst. 2011, 26, 1826–1835. [Google Scholar] [CrossRef]

- Kharrati, S.; Kazemi, M.; Ehsan, M. Equilibria in the competitive retail electricity market considering uncertainty and risk management. Energy 2016, 106, 315–328. [Google Scholar] [CrossRef]

- Deng, T.; Yan, W.; Nojavan, S.; Jermsittiparsert, K. Risk evaluation and retail electricity pricing using downside risk constraints method. Energy 2020, 192, 116672. [Google Scholar] [CrossRef]

- Bartelj, L.; Gubina, A.; Paravan, D.; Golob, R. Risk management in the retail electricity market: The retailer’s perspective. In Proceedings of the IEEE PES General Meeting, Providence, RI, USA, 25–29 July 2010; pp. 1–6. [Google Scholar]

- Hatami, A.; Seifi, H.; Sheikh-El-Eslami, M. Optimal selling price and energy procurement strategies for a retailer in an electricity market. Electr. Power Syst. Res. 2009, 79, 246–254. [Google Scholar] [CrossRef]

- Hosseini Imani, M.; Zalzar, S.; Mosavi, A.; Shamshirband, S. Strategic behavior of retailers for risk reduction and profit increment via distributed generators and demand response programs. Energies 2018, 11, 1602. [Google Scholar] [CrossRef]

- Rezaei, J. Best-worst multi-criteria decision-making method. Omega 2015, 53, 49–57. [Google Scholar] [CrossRef]

- Rezaei, J. Best-worst multi-criteria decision-making method: Some properties and a linear model. Omega 2016, 64, 126–130. [Google Scholar] [CrossRef]

- Mohammadi, M.; Rezaei, J. Bayesian best-worst method: A probabilistic group decision making model. Omega 2019. [Google Scholar] [CrossRef]

- Cai, W. Extension theory and its application. Chin. Sci. Bull. 1999, 44, 1538–1548. [Google Scholar] [CrossRef]

- He, Y.-X.; Dai, A.-Y.; Zhu, J.; He, H.-Y.; Li, F. Risk assessment of urban network planning in china based on the matter-element model and extension analysis. Int. J. Electr. Power Energy Syst. 2011, 33, 775–782. [Google Scholar] [CrossRef]

- Li, H.; Guo, S.; Tang, H.; Li, C. Comprehensive evaluation on power quality based on improved matter-element extension model with variable weight. Power Syst. Technol. 2013, 37, 653–659. [Google Scholar]

- Guo, S.; Zhao, H. Fuzzy best-worst multi-criteria decision-making method and its applications. Knowl.-Based Syst. 2017, 121, 23–31. [Google Scholar] [CrossRef]

- Zhao, H.; Guo, S.; Zhao, H. Comprehensive benefit evaluation of eco-industrial parks by employing the best-worst method based on circular economy and sustainability. Environ. Dev. Sustain. 2018, 20, 1229–1253. [Google Scholar] [CrossRef]

- Zhao, H.; Zhao, H.; Guo, S. Comprehensive Performance Evaluation of Electricity Grid Corporations Employing a Novel MCDM Model. Sustainability 2018, 10, 2130. [Google Scholar] [CrossRef]

- Zhao, H.; Guo, S.; Zhao, H. Comprehensive performance assessment on various battery energy storage systems. Energies 2018, 11, 2841. [Google Scholar] [CrossRef]

- Li, H.-Z.; Guo, S. External economies evaluation of wind power engineering project based on analytic hierarchy process and matter-element extension model. Math. Probl. Eng. 2013. [Google Scholar] [CrossRef]

- Cai, W. The extension set and incompatibility problem. J. Sci. Explor. 1983, 1, 81–93. [Google Scholar]

- Wang, Q.; Li, S.; He, G.; Li, R.; Wang, X. Evaluating sustainability of water-energy-food (WEF) nexus using an improved matter-element extension model: A case study of China. J. Clean. Prod. 2018, 202, 1097–1106. [Google Scholar] [CrossRef]

- Wang, Q.; Li, S.; Li, R. Evaluating water resource sustainability in Beijing, China: Combining PSR model and matter-element extension method. J. Clean. Prod. 2019, 206, 171–179. [Google Scholar] [CrossRef]

- Chen, Y.-H.; Sun, C.-Y. Further study of validity for the maximum subordination principle. J.-Chongqing Norm. Univ. Nat. Sci. Ed. 2002, 19, 47–49. [Google Scholar]

- Xiaoping, Z. The definition of product about fuzzy comprehensive evaluation methods based on closeness. J. Shandong Univ. Nat. Sci. 2004, 39, 25–29. [Google Scholar]

- Willems, B.; De Corte, E. Market power mitigation by regulating contract portfolio risk. Energy Policy 2008, 36, 3787–3796. [Google Scholar] [CrossRef]

- Wiser, R.; Bachrach, D.; Bolinger, M.; Golove, W. Comparing the risk profiles of renewable and natural gas-fired electricity contracts. Renew. Sustain. Energy Rev. 2004, 8, 335–363. [Google Scholar] [CrossRef]

- Wang, P.; Zhang, A.-Q.; Lv, Z.-X. Risk Analysis and Countermeasures of Electric Bill Retrieving. Sci. Technol. Ind. 2013, 13, 98–100. [Google Scholar]

- Qi, Y.; Xie, Y.; Jia, Q.; Huang, B.; Fu, W. The research and implementation of electricity bill retrieving risk evaluation model for low-voltage users. In Proceedings of the 2017 IEEE Conference on Energy Internet and Energy System Integration (EI2), Beijing, China, 26–28 November 2017; pp. 1–4. [Google Scholar]

- Peixoto, J.; Tereso, A.; Fernandes, G.; Almeida, R. Project risk management methodology: A case study of an electric energy organization. Procedia Technol. 2014, 16, 1096–1105. [Google Scholar] [CrossRef][Green Version]

- Douglas, A.P.; Breipohl, A.M.; Lee, F.N.; Adapa, R. Risk due to load forecast uncertainty in short term power system planning. IEEE Trans. Power Syst. 1998, 13, 1493–1499. [Google Scholar] [CrossRef]

- Weber, C. Uncertainty in the Electric Power Industry: Methods and Models for Decision Support; Springer Science & Business Media: Berlin/Heidelberg, Germany, 2006; Volume 77. [Google Scholar]

- Defeuilley, C. Retail competition in electricity markets. Energy Policy 2009, 37, 377–386. [Google Scholar] [CrossRef]

- Bohi, D.R.; Palmer, K.L. The efficiency of wholesale vs. retail competition in electricity. Electr. J. 1996, 9, 12–20. [Google Scholar] [CrossRef]

- Prokopczuk, M.; Rachev, S.T.; Schindlmayr, G.; Trück, S. Quantifying risk in the electricity business: A RAROC-based approach. Energy Econ. 2007, 29, 1033–1049. [Google Scholar] [CrossRef]

- Tierney, S.; Schatzki, T. Competitive procurement of retail electricity supply: Recent trends in state policies and utility practices. Electr. J. 2009, 22, 50–62. [Google Scholar] [CrossRef]

- Brunekreeft, G.; McDaniel, T. Policy uncertainty and supply adequacy in electric power markets. Oxf. Rev. Econ. Policy 2005, 21, 111–127. [Google Scholar] [CrossRef]

- Larsen, E.R.; Bunn, D.W. Deregulation in electricity: Understanding strategic and regulatory risk. J. Oper. Res. Soc. 1999, 50, 337–344. [Google Scholar] [CrossRef]

- Hyman, L.S. Restructuring electricity policy and financial models. Energy Econ. 2010, 32, 751–757. [Google Scholar] [CrossRef]

- Zhao, X.; Lyon, T.P.; Song, C. Lurching towards markets for power: China’s electricity policy 1985–2007. Appl. Energy 2012, 94, 148–155. [Google Scholar] [CrossRef]

- Ngan, H. Electricity regulation and electricity market reforms in China. Energy Policy 2010, 38, 2142–2148. [Google Scholar] [CrossRef]

- Cheng, B.; Dai, H.; Wang, P.; Xie, Y.; Chen, L.; Zhao, D.; Masui, T. Impacts of low-carbon power policy on carbon mitigation in Guangdong Province, China. Energy Policy 2016, 88, 515–527. [Google Scholar] [CrossRef]

- Zhang, Y.; Wang, R.; Huang, P.; Wang, X.; Wang, S. Risk evaluation of large-scale seawater desalination projects based on an integrated fuzzy comprehensive evaluation and analytic hierarchy process method. Desalination 2020, 478, 114286. [Google Scholar] [CrossRef]

- Cai, T.; Li, X.; Ding, X.; Wang, J.; Zhan, J. Flood risk assessment based on hydrodynamic model and fuzzy comprehensive evaluation with GIS technique. Int. J. Disaster Risk Reduct. 2019, 35. [Google Scholar] [CrossRef]

- Zhang, H.; He, X.; Mitri, H. Fuzzy comprehensive evaluation of virtual reality mine safety training system. Saf. Sci. 2019, 120, 341–351. [Google Scholar] [CrossRef]

- Zhao, H.; Guo, S. Risk evaluation on UHV power transmission construction project based on AHP and FCE method. Math. Probl. Eng. 2014. [Google Scholar] [CrossRef]

| Expert Number | The Best Risk Sub-Criterion | The Worst Risk Sub-Criterion |

|---|---|---|

| 1 | C5 | C8 |

| 2 | C5 | C1 |

| 3 | C4 | C7 |

| 4 | C2 | C6 |

| 5 | C3 | C8 |

| Expert Number | 1 | 2 | 3 | 4 | 5 |

|---|---|---|---|---|---|

| The Best Risk Sub-Criterion | C5 | C5 | C4 | C2 | C3 |

| C1 | 6 | 7 | 5 | 3 | 3 |

| C2 | 4 | 3 | 3 | 1 | 3 |

| C3 | 4 | 4 | 4 | 2 | 1 |

| C4 | 3 | 2 | 1 | 3 | 2 |

| C5 | 1 | 1 | 2 | 2 | 2 |

| C6 | 5 | 3 | 4 | 5 | 4 |

| C7 | 7 | 5 | 6 | 4 | 5 |

| C8 | 7 | 6 | 5 | 5 | 6 |

| Expert Number | 1 | 2 | 3 | 4 | 5 |

|---|---|---|---|---|---|

| The Worst Risk Sub-Criterion | C8 | C1 | C7 | C6 | C8 |

| C1 | 2 | 1 | 3 | 3 | 2 |

| C2 | 4 | 3 | 4 | 5 | 3 |

| C3 | 4 | 3 | 3 | 3 | 6 |

| C4 | 5 | 5 | 6 | 2 | 5 |

| C5 | 7 | 6 | 4 | 3 | 4 |

| C6 | 2 | 3 | 3 | 1 | 3 |

| C7 | 2 | 3 | 1 | 2 | 2 |

| C8 | 1 | 2 | 2 | 2 | 1 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Guo, S.; Zhang, W.; Gao, X. Business Risk Evaluation of Electricity Retail Company in China Using a Hybrid MCDM Method. Sustainability 2020, 12, 2040. https://doi.org/10.3390/su12052040

Guo S, Zhang W, Gao X. Business Risk Evaluation of Electricity Retail Company in China Using a Hybrid MCDM Method. Sustainability. 2020; 12(5):2040. https://doi.org/10.3390/su12052040

Chicago/Turabian StyleGuo, Sen, Wenyue Zhang, and Xiao Gao. 2020. "Business Risk Evaluation of Electricity Retail Company in China Using a Hybrid MCDM Method" Sustainability 12, no. 5: 2040. https://doi.org/10.3390/su12052040

APA StyleGuo, S., Zhang, W., & Gao, X. (2020). Business Risk Evaluation of Electricity Retail Company in China Using a Hybrid MCDM Method. Sustainability, 12(5), 2040. https://doi.org/10.3390/su12052040