Trust, Control, and Value Creation in Strategic Networks of SMEs

Abstract

1. Introduction

2. Literature Review

2.1. SME Networks and Sustainable Competitiveness

2.2. The Role of Trust in Inter-Firm Strategic Networks

2.3. The Role of Control in Inter-Firm Strategic Networks

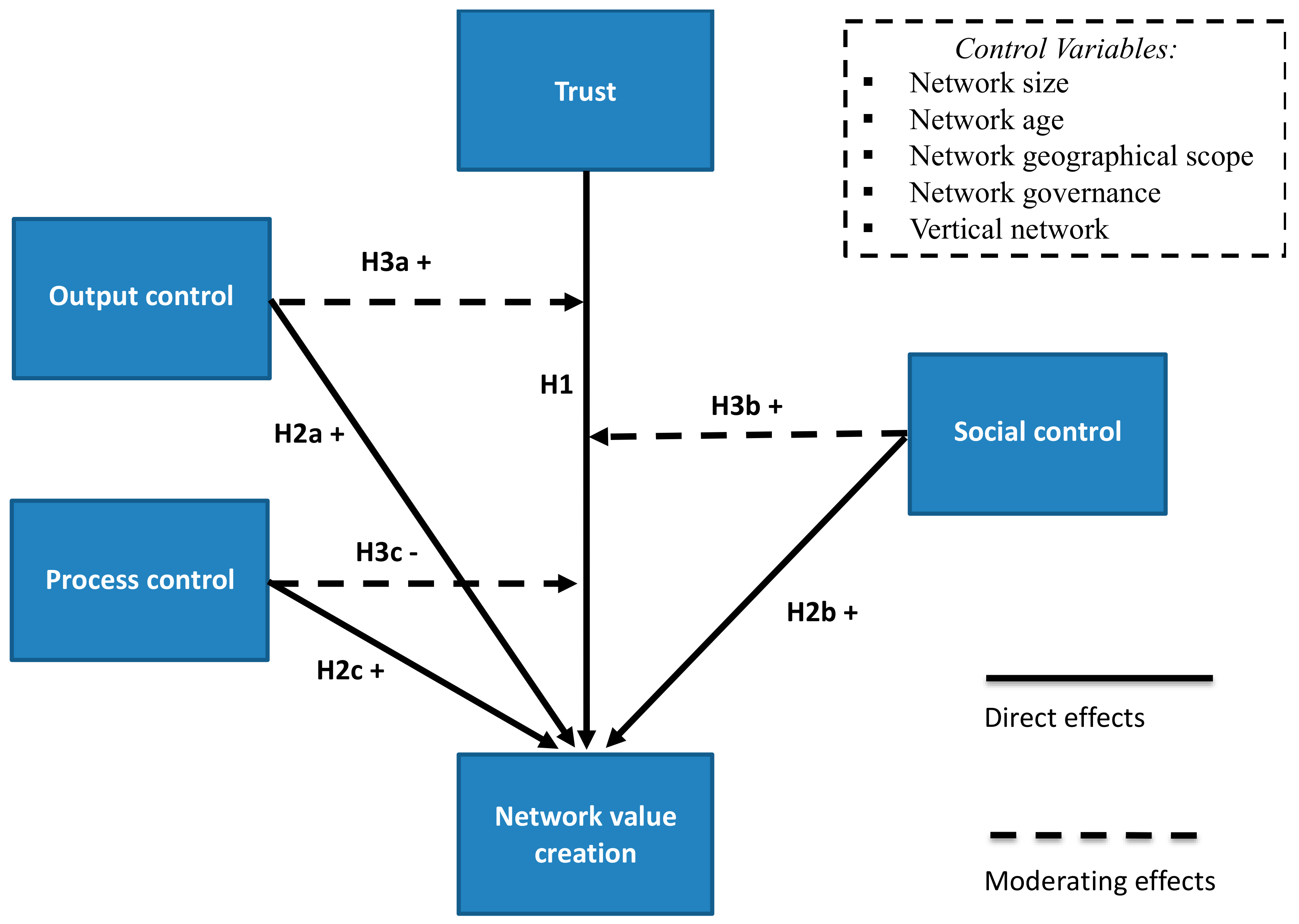

3. Theoretical Framework and Hypotheses

3.1. The Effects of Trust on Network Value Creation

3.2. The Effect of Control on Network Value Creation

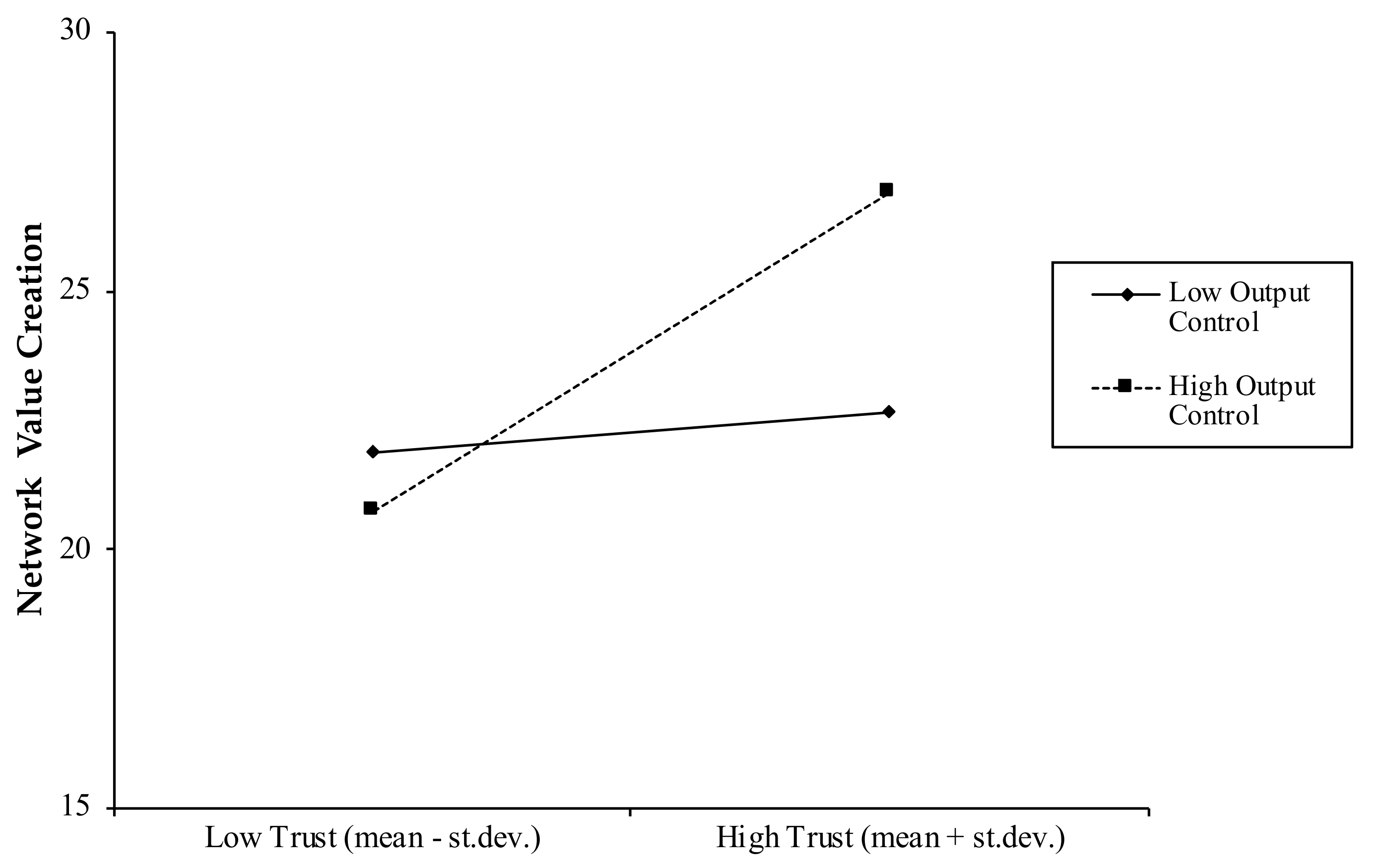

3.3. The Interaction Effect of Trust and Control on Network Value Creation

4. Methodology

4.1. Sample and Data Collection

4.2. Variables and Measures

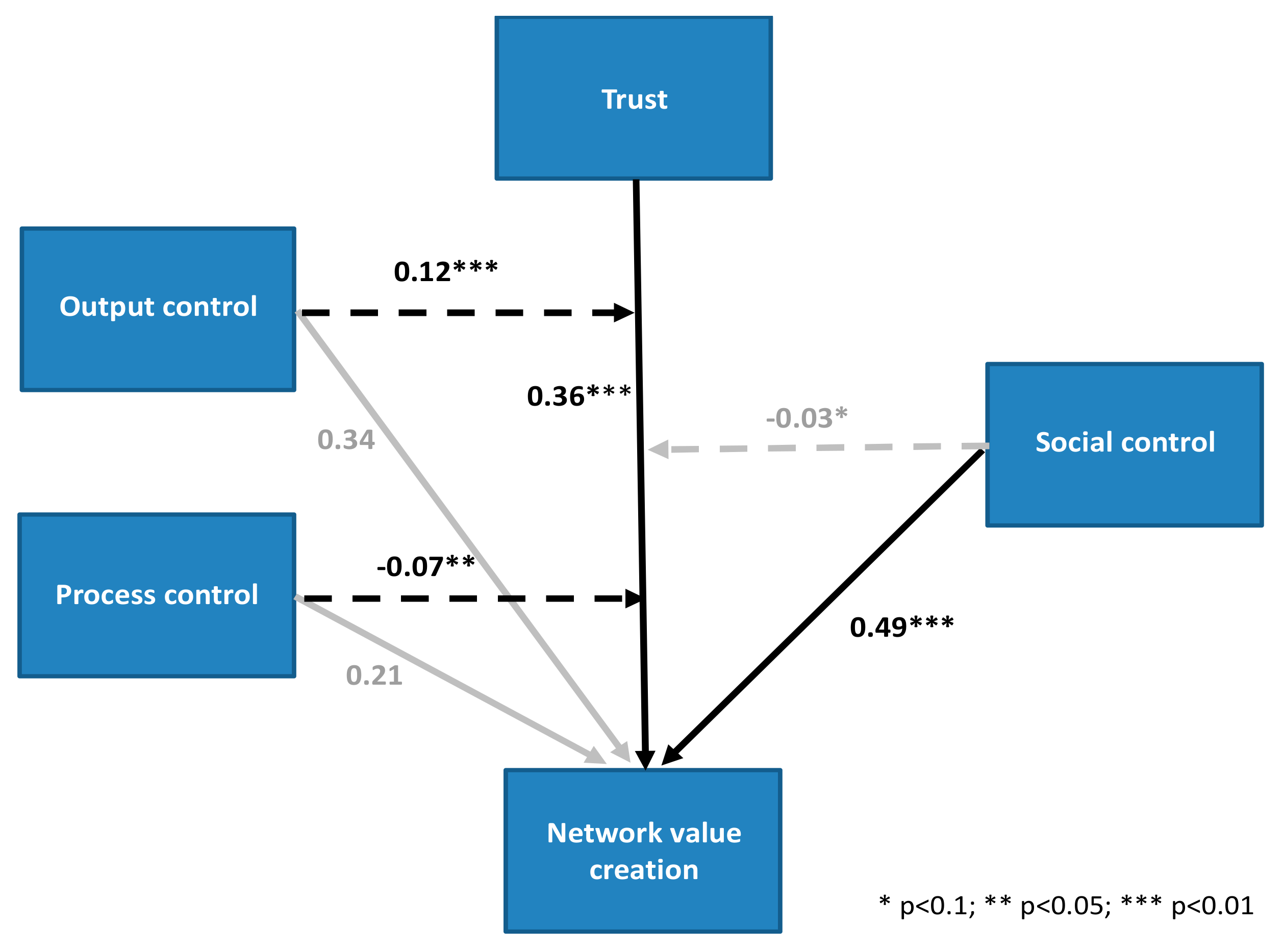

5. Results

6. Discussion

7. Conclusions, Limitations, and Directions for Future Research

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Measures and Items | Source (Adapted From) |

|---|---|

| Network performance (alpha = 0.89) | |

| In our network, all partners are satisfied with the relationships they have with other network members. | Das and Teng [60]. |

| In our network, all partners work prolifically. | Geringer and Hebert [58]. |

| Our network has enabled partners to increase their revenues. | Human and Provan [75]. |

| Our network has improved each partner’s profit. | Moeller [76]. |

| Our network has enabled partners to increase their competitiveness on the markets. | Zollo et al. [64]. |

| Our network has enabled partners to develop and broaden their skills and knowledge, thus starting a continuous learning process. | |

| Trust among firms (alpha = 0.85) | |

| In our network, when a decision has to be made, all partners understand each other well and quickly. | Dhanaraj et al. [65]. |

| In our network, all partners are certain that the other partners would not cheat on them, even if the opportunity arose and there was no chance that they would get caught. | Rempel et al. [83]. |

| In the partners’ relationship, everyone is certain that the other partners will never do anything they are afraid of or anything that will damage them. | Rempel and Holmes [77]. |

| In our network, formal agreements are as significant as informal ones. | Zaheer et al. [16]. |

| I can rely on my partners to react in a positive way even when I expose my weaknesses to them. | |

| In our network, all partners are very predictable. They can always be counted on to act as we expect. | |

| Output control (alpha = 0.81) | |

| Our network has adopted formal strategic planning that clearly defines the goals to be achieved. | Chen et al. [26]. |

| Our network has strictly defined with what indicators and how often the achievement of the strategic goals must be checked. | |

| Our network has strictly defined the potential causes of partner expulsion if they adopt opportunistic or non-coherent behavior with respect to the objectives of the common strategy. | |

| Process control (alpha = 0.80) | |

| Our network has strictly defined what resources and skills individual partners must bring to it. | Chen et al. [26]. |

| Our network has defined its organizational structure (organization chart and responsibilities). | |

| Our network has strictly defined the operational tasks that each partner must carry out to ensure the best functioning of the alliance. | |

| In our network, there is a sufficient level of mutual exchange of information among the partners regarding the activities and performance carried out by each enterprise. | |

| In our network, we issue periodic detailed reports to tell the partners about the activities carried out, the resources used, and the results achieved. | |

| Social control (alpha = 0.72) | |

| In our network, we regularly organize formal, strategic or operational meetings among our partners. | Chen et al. [26]. |

| In our network, we also periodically organize informal social occasions among our partners. | |

| In our network the entrepreneurs themselves are usually involved in these meetings. | |

| In our network, partners’ staff are often involved in teamwork with colleagues of the other partner firms. | |

| In our network, we often organize training courses and seminars for the partner entrepreneurs. | |

| In our network, we often organize joint training courses and seminars for the employees of all partners. |

References

- Rosenfeld, S.A. Does cooperation enhance competitiveness? Assessing the impacts of interfirm collaboration. Res. Policy 1996, 25, 247–263. [Google Scholar] [CrossRef]

- Mesquita, L.F.; Lazzarini, S.G. Horizontal and vertical relationships in developing economies: Implications for SMEs’ access to global markets. Acad. Manag. J. 2008, 51, 359–380. [Google Scholar] [CrossRef]

- Antoldi, F.; Cerrato, D.; Depperu, D. Export Consortia in Developing Countries: Successful Management of Cooperation among SMEs; Springer: Berlin, Germany, 2011. [Google Scholar]

- Trapczynski, P.; Puslecki, L.; Staszkow, M. Determinants of Innovation Cooperation Performance: What Do We Know. Sustainability 2018, 10, 4517. [Google Scholar] [CrossRef]

- Lavie, D. The Competitive Advantage of Interconnected Firms: An Extension of the Resource-Based View. Acad. Manag. Rev. 2006, 31, 638–658. [Google Scholar] [CrossRef]

- Ze, R.; Kun, Z.; Boadu, F.; Yu, L. The Effects of Boundary-Spanning Search, Network Ties, and Absorptive Capacity for Innovation: A Moderated Mediation Examination. Sustainability 2018, 10, 3980. [Google Scholar] [CrossRef]

- Jarillo, J.C. On strategic networks. Strateg. Manag. J. 1988, 9, 31–41. [Google Scholar] [CrossRef]

- Nahapiet, J.; Ghoshal, S. Social capital, intellectual capital and the organizational advantage. Acad. Manag. Rev. 1998, 23, 242–266. [Google Scholar] [CrossRef]

- Inkpen, A.C.; Tsang, E.W.K. Social capital, networks and knowledge transfer. Acad. Manag. Rev. 2005, 30, 46–165. [Google Scholar] [CrossRef]

- Antoldi, F.; Cerrato, D.; Depperu, D. SMEs export consortia and the development of intangible resources. J. Small Bus. Enterp. Dev. 2013, 20, 567–583. [Google Scholar] [CrossRef]

- Collins, E.; Lawrence, S.; Pavlovich, K.; Ryan, C. Business networks and the uptake of sustainability practices: The case of New Zealand. J. Clean. Prod. 2007, 15, 729–740. [Google Scholar] [CrossRef]

- Moore, S.B.; Manring, S.L. Strategy development in small and medium sized enterprises for sustainability and increased value creation. J. Clean. Prod. 2009, 17, 276–282. [Google Scholar] [CrossRef]

- Gulati, R. Alliances and Networks. Strateg. Manag. J. 1998, 19, 293–317. [Google Scholar] [CrossRef]

- Cao, Z.; Lumineau, F. Revisiting the interplay between contractual and relational governance: A qualitative and meta-analytic investigation. J. Oper. Manag. 2015, 33–34, 15–42. [Google Scholar] [CrossRef]

- Balboni, B.; Marchi, G.; Vignola, M. The Moderating Effect of Trust on Formal Control Mechanisms in International Alliances. Eur. Manag. Rev. 2018, 15, 541–558. [Google Scholar] [CrossRef]

- Zaheer, A.; McEvily, B.; Perrone, V. Does Trust matter? Exploring the Effects of Interorganizational and Interpersonal Trust on Performance. Organ. Sci. 1998, 9, 141–159. [Google Scholar] [CrossRef]

- Leifer, R.; Milis, P. An Information Processing Approach for Deciding upon Control Strategies and Reducing Control Loss in Emerging Organizations. J. Manag. 1996, 22, 113–137. [Google Scholar] [CrossRef]

- Friedberg, E. Going Beyond the Either/or. J. Manag. Gov. 2000, 4, 35–52. [Google Scholar] [CrossRef]

- Patzelt, H.; Shepherd, D.A. The Decision to Persist with Underperforming Alliances: The role of Trust and Control. J. Manag. Stud. 2008, 45, 1217–1243. [Google Scholar] [CrossRef]

- Yang, Z.; Zhour, C.; Jiang, L. When Do Formal Control and Trust Matter? A Context-based Analysis of the Effects on Marketing Channel Relationship in China. Ind. Mark. Manag. 2011, 40, 80–96. [Google Scholar] [CrossRef]

- Das, T.K.; Teng, B. Between Trust and Control: Developing Confidence in Partners Cooperation in Alliances. Acad. Manag. Rev. 1998, 23, 491–512. [Google Scholar] [CrossRef]

- Poppo, L.; Zenger, T. Do Formal Contracts and Relational Governance Function as Substitutes or Complements? Strateg. Manag. J. 2002, 23, 707–725. [Google Scholar] [CrossRef]

- Gulati, R.; Nickerson, J.A. Interorganizational Trust, Governance, Choice, and Exchange Performance. Organ. Sci. 2008, 19, 688–708. [Google Scholar] [CrossRef]

- Senguün, A.E.; Wasti, S. Revisiting trust and control: Effect on perceived relationship performance. Int. Small Bus. J. 2009, 27, 39–69. [Google Scholar]

- Das, T.K.; Teng, B. A risk perception model of alliance structuring. J. Int. Manag. 2001, 71, 1–29. [Google Scholar] [CrossRef]

- Chen, D.; Park, S.H.; Newburry, W. Parent Contribution and Organizational Control in International Joint Ventures. Strateg. Manag. J. 2009, 30, 1133–1156. [Google Scholar] [CrossRef]

- Starr, J.A.; MacMillan, I.C. Resource cooptation via social contracting: Resource acquisition strategies for new ventures. Strateg. Manag. J. 1990, 11, 79–92. [Google Scholar]

- Jørgensen, F.; Ulhøi, J.P. Enhancing Innovation Capacity in SMEs through Early Network Relationships. Creat. Innov. Manag. 2010, 19, 397–404. [Google Scholar]

- Konsti-Laakso, S.; Pihkala, T.; Kraus, S. Facilitating SME Innovation Capability through Business Networking. Creat. Innov. Manag. 2012, 21, 93–105. [Google Scholar] [CrossRef]

- Johanson, J.; Vahlne, J.E. Business relationship learning and commitment in the internationalization process. J. Int. Entrep. 2003, 1, 83–101. [Google Scholar] [CrossRef]

- Elango, B.; Pattnaik, C. Building capabilities for international operations through networks: A study of Indian firms. J. Int. Bus. Stud. 2007, 38, 541–555. [Google Scholar] [CrossRef]

- Allee, V. Reconfiguring the Value Network. J. Bus. Strateg. 2000, 21, 36–39. [Google Scholar] [CrossRef]

- Porter, M.E.; Kramer, M.R. Creating shared value. Harv. Bus. Rev. 2011, 89, 62–77. [Google Scholar]

- Jämsä, P.; Tähtinen, J.; Ryan, A.; Pallari, M. Sustainable SMEs network utilization: The case of food enterprises. J. Small Bus. Enterp. Dev. 2011, 18, 141–156. [Google Scholar]

- Revell, A.; Rutherfoord, R. UK environmental policy and the small firm: Broadening the focus. Bus. Strateg. Env. 2003, 12, 26–35. [Google Scholar] [CrossRef]

- Simpson, M.; Taylor, N.; Barker, K. Environmental responsibility in SMEs: Does it deliver competitive advantage? Bus. Strateg. Env. 2004, 13, 156–171. [Google Scholar] [CrossRef]

- Williamson, O.E. The Economic Institutions of Capitalism. Firms, Markets, Relational Contracting; The Free Press: New York, NY, USA, 1985. [Google Scholar]

- Gulati, R.; Nohria, N.; Zaheer, A. Strategic Networks. Strategi. Manag. J. 2000, 21, 293–309. [Google Scholar] [CrossRef]

- McEvily, B.; Zaheer, A. Does trust still matter? Research on the role of trust in interorganizational exchange. In Handbook of Trust Research; Bachmann, R., Zaheer., A., Eds.; Edward Elgar: Cheltenham, UK, 2006; pp. 280–300. [Google Scholar]

- Gambetta, D. Trust. Making and Breaking Cooperative Relations; Basil Blackwell: Oxford, UK, 1989. [Google Scholar]

- Barney, J.B.; Hansen, M.H. Trustworthiness as a source of competitive advantage. Strateg. Manag. J. 1994, 15, 175–190. [Google Scholar] [CrossRef]

- Sroka, W.; Hittmar, S. Management of Alliance Networks. Formation, Functionality and Post Operational Strategies; Springer: Heiderlberg, Germany; New York, NY, USA, 2013. [Google Scholar]

- Lee, Y.; Cavusgil, S.T. Enhancing alliance performance: The effects of contractual-based versus relational-based governance. J. Bus. Res. 2006, 59, 896–905. [Google Scholar] [CrossRef]

- Katsikeas, C.S.; Skarmeas, D.; Bello, D.C. Developing successful trust-based international exchange relationships. J. Int. Bus. Stud. 2009, 40, 32–155. [Google Scholar] [CrossRef]

- Krishnan, R.; Martin, X.; Noorderhaven, N.G. When does trust matter to alliance performance? Acad. Manag. J. 2006, 49, 894–917. [Google Scholar] [CrossRef]

- Sohn, J.D. Social knowledge as a control system: A proposition and evidence from the Japanese FDI behavior. J. Int. Bus. Stud. 1994, 25, 295–324. [Google Scholar] [CrossRef]

- Gençtuürk, E.F.; Aulakh, P.S. Norms- and Control-Based Governance of International Manufacturer-Distributor Relational Exchanges. J. Int. Mark. 2007, 15, 92–126. [Google Scholar]

- Brandenburger, A.M.; Nalebuff, B.J. Co-opetition; Currency/Doubleday: New York, NY, USA, 1996. [Google Scholar]

- Dagnino, G.B.; Rocco, E. (Eds.) Coopetition Strategy: Theory Experiments and Cases; Routledge: London, UK, 2009. [Google Scholar]

- Cygler, J.; Sroka, W.; Solesvik, M.; Debkowska, K. Benefits and Drawbacks of Coopetition: The Roles of Scope and Durability in Coopetitive Relationships. Sustainability 2018, 10, 2688. [Google Scholar] [CrossRef]

- Chenhall, R. Management Control System Design within Its Organizational Context: Finding from Contingency Based Research and Direction from the Future. Acc. Organ. Soc. 2003, 28, 127–168. [Google Scholar] [CrossRef]

- Merchant, K. Control in Business Organization; Pitman Publishing: Marshfield, MA, USA, 1984. [Google Scholar]

- Huemer, L.; Bostrom, G.; Felzensztein, C. Control-trust interplays and the influence paradox: A comparative study of MNC-subsidiary relationship. Ind. Mark. Manag. 2009, 38, 520–528. [Google Scholar] [CrossRef]

- Hamel, G. Competition for competence and inter-partner learning within international strategic alliances. Strateg. Manag. J. 1991, 12, 83–103. [Google Scholar] [CrossRef]

- Inkpen, A.C.; Curral, S.C. The coevolution of trust, control, and learning in joint ventures. Organ. Sci. 2004, 15, 586–599. [Google Scholar] [CrossRef]

- Ouchi, W.G. The transmission of control through organizational hierarchy. Acad. Manag. J. 1978, 21, 173–192. [Google Scholar] [CrossRef]

- Dyer, J.H.; Singh, H. The relational view: Cooperative strategies and sources of inter-organizational competitive advantage. Acad. Manag. Rev. 1998, 23, 660–679. [Google Scholar] [CrossRef]

- Geringer, J.M.; Hebert, L. Measuring Performance of International Joint Ventures. J. Int. Bus. Stud. 1991, 9, 249–263. [Google Scholar] [CrossRef]

- Aulakh, P.S.; Kotabe, M.; Sahay, A. Trust and performance in cross-border marketing partnerships: A behavioral approach. J. Int. Bus. Stud. 1996, 27, 1005–1032. [Google Scholar] [CrossRef]

- Das, T.K.; Teng, B. Partner Analysis and Alliance Performance. Scand. J. Manag. 2003, 19, 279–308. [Google Scholar] [CrossRef]

- Inkpen, A.C.; Curral, S.C. The nature, antecedents and consequences of joint venture trust. J. Int. Manag. 1998, 4, 1–20. [Google Scholar] [CrossRef]

- Fryxell, G.E.; Dooley, R.S.; Vryza, M. After the ink dries: the interaction of trust and control in US-based international joint ventures. J. Manag. Stud. 2002, 39, 865–886. [Google Scholar] [CrossRef]

- Luo, Y. Contract, cooperation, and performance in international joint ventures. Strateg. Manag. J. 2002, 23, 903–919. [Google Scholar] [CrossRef]

- Zollo, M.; Reuer, J.J.; Singh, H. Interorganizational Routines and Performance in Strategic Alliances. Organ. Sci. 2002, 13, 701–713. [Google Scholar] [CrossRef]

- Dhanaraj, C.; Lyles, M.A.; Steensma, H.K.; Tihanyi, L. Managing Tacit and Explicit Knowledge Transfer in IJVs: The Role of Relational Embeddedness and the Impact on Performance. Acad. Manag. J. 2004, 44, 1149–1168. [Google Scholar] [CrossRef]

- Abosag, I.; Lee, J.-W. The formation of trust and commitment in business relationships in the Middle East: Understanding et-Moone relationships. Int. Bus. Rev. 2013, 22, 602–614. [Google Scholar] [CrossRef]

- Wuyts, S.; Geyskens, I. The Formation of Buyer-Supplier Relationship: Detailed Contract Drafting and Close Partner Selection. J. Mark. 2005, 69, 103–117. [Google Scholar] [CrossRef]

- Yan, A.; Gray, B. Bargaining Power, Management Control, and Performance in United States-China Joint Ventures: A Comparative Case Study. Acad. Manag. J. 1994, 37, 1478–1517. [Google Scholar]

- Parkhe, A. Strategic alliance structuring: A game theory and transaction cost examination of inter-firm cooperation. Acad. Manag. J. 1993, 36, 794–829. [Google Scholar]

- Costa, A.C.; Bijlsma-Frankema, K. Trust and Control Interrelations: New Perspectives on the Trust–Control Nexus. Group Organ. Manag. 2007, 32, 392–406. [Google Scholar] [CrossRef]

- Gulati, R. Does Familiarity Breed Trust? The implication of Repeated Ties for Contractual Choice in Alliances. Acad. Manag. J. 1995, 38, 85–112. [Google Scholar]

- Bernheim, B.D.; Whinston, M.D. Incomplete contracts and strategic ambiguity. Am. Econ. Rev. 1998, 88, 902–932. [Google Scholar]

- Dillman, D.A. Mail and Telephone Surveys: The Total Design Method; Wiley: New York, NY, USA, 1978. [Google Scholar]

- Robson, M.J.; Katsikeas, C.S. International strategic alliance relationship within the foreign investment decision process. Int. Mark. Rev. 2005, 22, 399–419. [Google Scholar] [CrossRef]

- Human, S.E.; Provan, K.G. An Emergent Theory of Structure and Outcomes in Small-firm Strategic Manufacturing Networks. Acad. Manag. J. 1997, 40, 368–403. [Google Scholar]

- Moeller, K. Partner Selection, Partner Behavior, and Business Network Performance. J. Acc. Organ. Chang. 2010, 6, 27–51. [Google Scholar] [CrossRef]

- Rempel, J.K.; Holmes, J.G. How Do I Trust Thee? Psychol. Today 1986, 20, 28–34. [Google Scholar]

- Aiken, L.S.; West, S.G.; Reno, R.R. Multiple Regression: Testing and Interpreting Interactions; Sage Publications: Newbury Park, CA, USA, 1991. [Google Scholar]

- Costa e Silva, S.; Bradley, F.; Sousa, C.M. Empirical test of the trust–performance link in an international alliances context. Int. Bus. Rev. 2012, 21, 293–306. [Google Scholar] [CrossRef]

- Elkington, J. Towards the sustainable corporation: Win-win business strategies for sustainable development. Calif. Manag. Rev. 1994, 36, 90–100. [Google Scholar] [CrossRef]

- Soto-Acosta, P.; Cismaru, D.-M.; Vatamanescu, E.-M.; Ciochina, R.S. Sustainable Entrepreneurship in SMEs: A Business Performance Perspective. Sustainability 2016, 8, 342. [Google Scholar] [CrossRef]

- Liang, X.; Xianli Zhao, X.; Wang, M.; Zhi Li, Z. Small and Medium-Sized Enterprises Sustainable Supply Chain Financing Decision Based on Triple Bottom Line Theory. Sustainability 2018, 10, 4242. [Google Scholar] [CrossRef]

- Rempel, J.K.; Holmes, J.G.; Zanna, M.P. Trust in Close Relationship. J. Person. Soc. Psychol. 1985, 49, 95–112. [Google Scholar] [CrossRef]

| Mean | St. Dev. | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Network value creation | 21.24 | 5.43 | 1 | ||||||||

| 2 | Trust | 24.71 | 4.76 | 0.54 * | 1 | |||||||

| 3 | Output control | 11.88 | 2.28 | 0.42 * | –0.00 | 1 | ||||||

| 4 | Process control | 19.83 | 3.84 | 0.62 * | 0.24 | 0.72 * | 1 | |||||

| 5 | Social control | 20.41 | 5.37 | 0.68 * | 0.15 | 0.37 * | 0.50 * | 1 | ||||

| 6 | Network size | 9.55 | 8.21 | –0.02 | –0.21 | 0.11 | 0.07 | 0.19 | 1 | |||

| 7 | Network age | 3.26 | 1.39 | –0.02 | –0.04 | 0.03 | –0.06 | 0.15 | –0.08 | 1 | ||

| 8 | Network geographical scope | 1.98 | 1.16 | 0.06 | –0.07 | –0.01 | 0.13 | 0.08 | 0.11 | –0.04 | 1 | |

| 9 | Vertical network | 0.33 | 0.47 | 0.02 | 0.07 | 0.07 | 0.09 | –0.10 | 0.03 | –0.03 | –0.12 | 1 |

| 10 | Network governance | 0.76 | 0.42 | 0.09 | –0.19 | 0.30 * | 0.28 * | 0.18 | 0.11 | 0.11 | –0.12 | 0.20 |

| Dependent Variable: Network Value Creation | |||

|---|---|---|---|

| (1) | (2) | (3) | |

| Network size | 0.04 (0.08) | –0.05 (0.05) | –0.06 (0.05) |

| Network age | –0.06 (0.44) | –0.33 (0.30) | –0.46 (0.29) |

| Network geographical scope | 0.58 (0.56) | 0.18 (0.38) | –0.08 (0.37) |

| Vertical network | –0.65 (1.33) | 0.28 (0.89) | –0.11 (0.83) |

| Network governance | 2.98 * (1.53) | 0.16 (1.08) | 1.16 (1.03) |

| Trust | 0.70 *** (0.13) | 0.46 *** (0.10) | 0.36 *** (0.10) |

| Output control | 0.23 (0.27) | 0.34 (0.25) | |

| Process control | 0.26 (0.18) | 0.21 (0.19) | |

| Social control | 0.52 *** (0.09) | 0.49 *** (0.10) | |

| Trust * Output control | 0.12 *** (0.04) | ||

| Trust * Process control | –0.07 ** (0.03) | ||

| Trust * Social control | –0.03 * (0.01) | ||

| Constant | 17.78 *** (2.37) | 22.19 *** (1.65) | 23.03 *** (1.57) |

| Number of observations (network contracts) | 58 | 58 | 58 |

| F | 4.80 *** | 15.23 *** | 14.87 *** |

| Adj-R2 | 0.29 | 0.69 | 0.74 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Antoldi, F.; Cerrato, D. Trust, Control, and Value Creation in Strategic Networks of SMEs. Sustainability 2020, 12, 1873. https://doi.org/10.3390/su12051873

Antoldi F, Cerrato D. Trust, Control, and Value Creation in Strategic Networks of SMEs. Sustainability. 2020; 12(5):1873. https://doi.org/10.3390/su12051873

Chicago/Turabian StyleAntoldi, Fabio, and Daniele Cerrato. 2020. "Trust, Control, and Value Creation in Strategic Networks of SMEs" Sustainability 12, no. 5: 1873. https://doi.org/10.3390/su12051873

APA StyleAntoldi, F., & Cerrato, D. (2020). Trust, Control, and Value Creation in Strategic Networks of SMEs. Sustainability, 12(5), 1873. https://doi.org/10.3390/su12051873