A Dynamic Credit Index System for TSMEs in China Using the Delphi and Analytic Hierarchy Process (AHP) Methods

Abstract

1. Introduction

2. Preliminaries and previous literature

2.1. Analytic Hierarchy Process (AHP)

2.2. Previous Research on Credit Evaluation of Enterprises

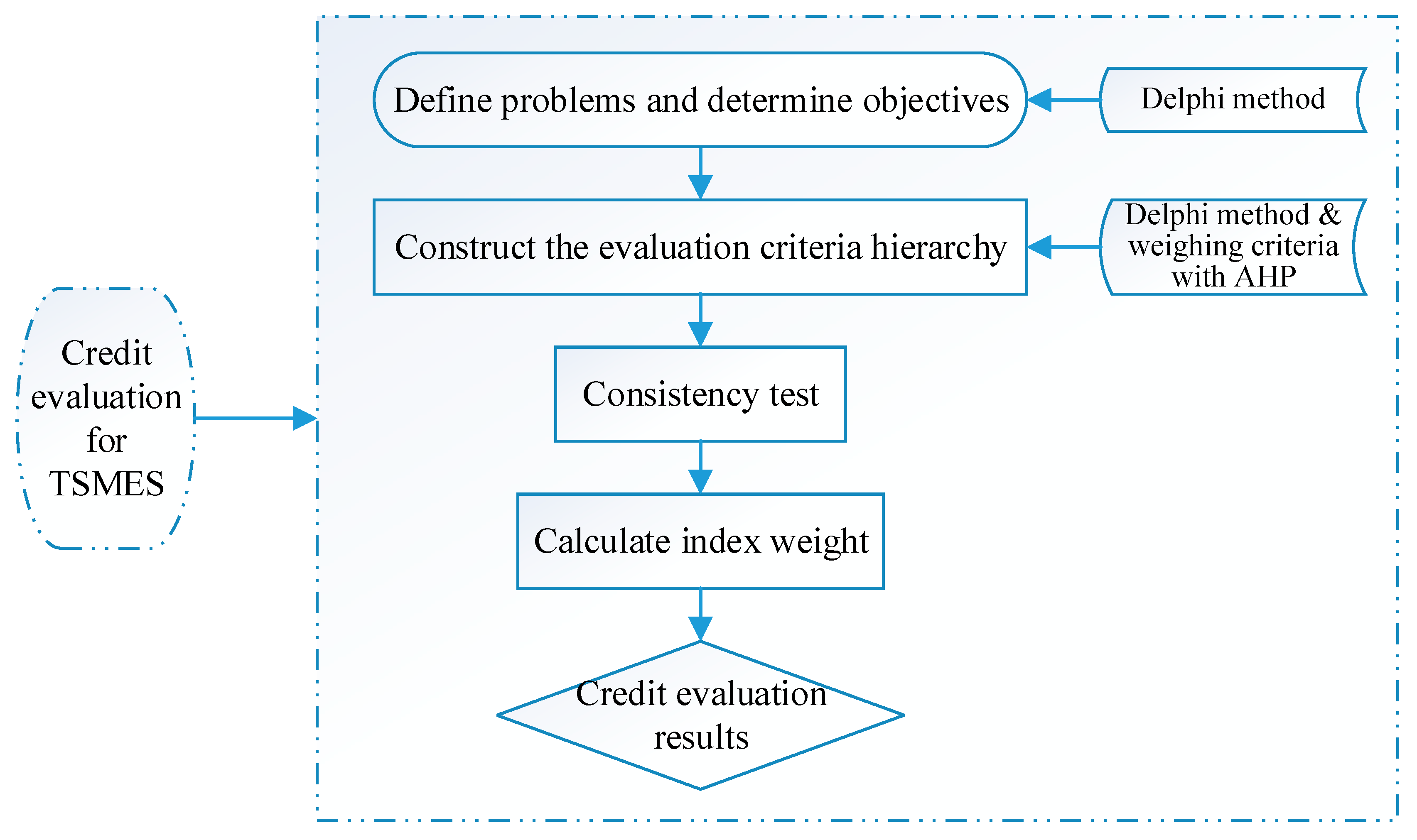

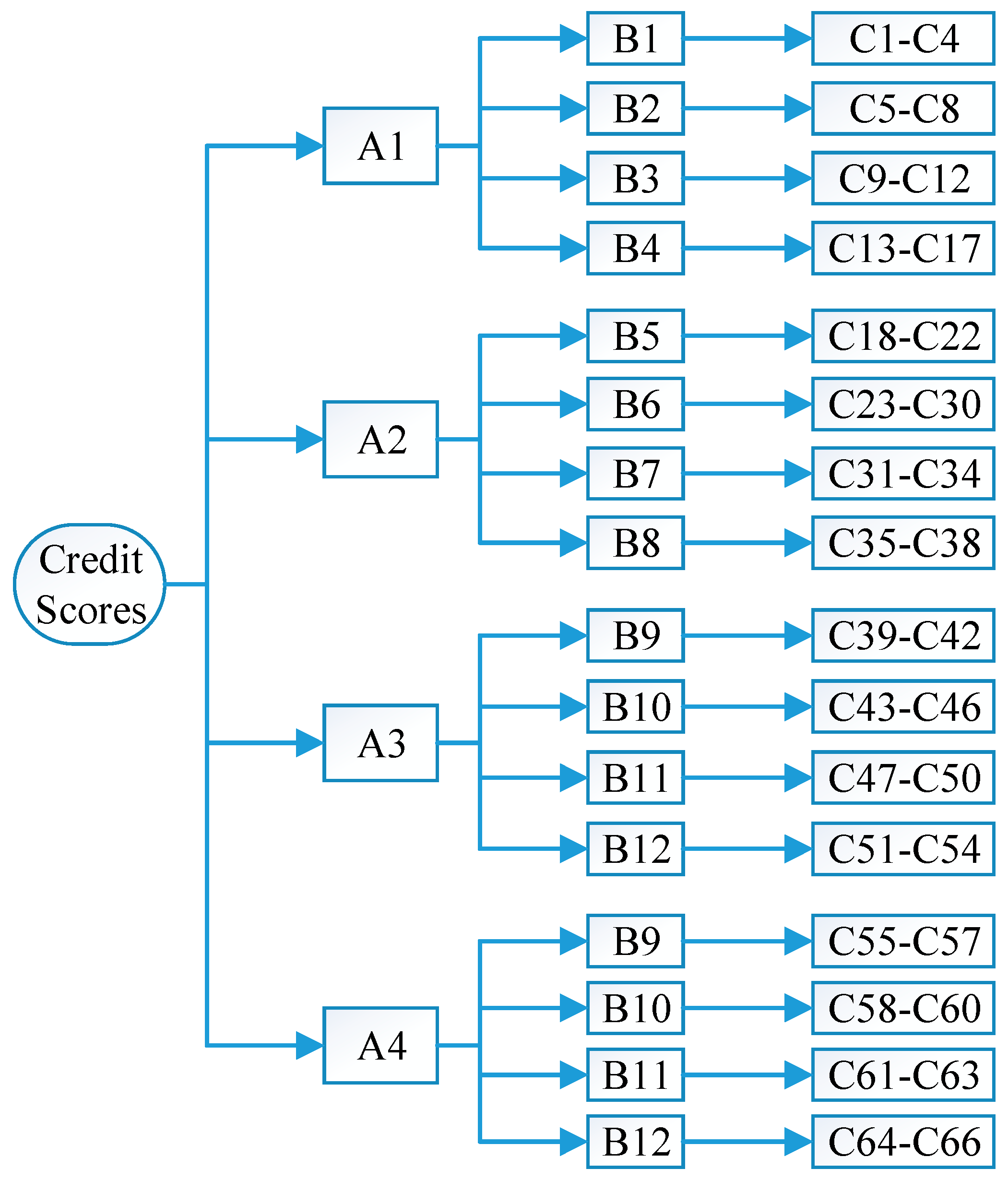

3. The Proposal of the Credit Index System for TSMEs

3.1. Indicator Selection

3.2. Data Collection using the Delphi Method

3.3. Reliability and Validity Test of the Questionnaire

3.4. Calculate the Weight of Indicators using the AHP Method

4. Case of Study on the Credit Index System for TSMEs in China

4.1. Case Description

4.2. Empirical Analysis

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

| First-Level Indicator | a value | Second-Level Indicator | a value | Third-Level Indicator | a value |

|---|---|---|---|---|---|

| Controllers’ ability A1 | 0.940 | Basic information B1 | 0.942 | Education background C1 | 0.943 |

| Work experience C2 | 0.942 | ||||

| Marital status C3 | 0.942 | ||||

| Number of children C4 | 0.942 | ||||

| Personal assets B2 | 0.942 | Real estate and vehicles C5 | 0.942 | ||

| Bank deposit C6 | 0.942 | ||||

| Financial assets C7 | 0.942 | ||||

| Investment assets C8 | 0.941 | ||||

| Credit conditions B3 | 0.942 | Liabilities C9 | 0.942 | ||

| Records of violation of laws and regulations C10 | 0.942 | ||||

| Litigation situation C11 | 0.941 | ||||

| Guarantee situation C12 | 0.941 | ||||

| Status title B4 | 0.943 | Top talents at home and abroad C13 | 0.942 | ||

| National leading talents C14 | 0.942 | ||||

| Local-level leading talents C15 | 0.942 | ||||

| NPC members or CPPCC members C16 | 0.942 | ||||

| Professional title C17 | 0.942 | ||||

| Operation & management ability A2 | 0.942 | Basic information B5 | 0.942 | Historical evolution C18 | 0.941 |

| Management structure C19 | 0.943 | ||||

| Shareholder change C20 | 0.940 | ||||

| Corporate institutions C21 | 0.942 | ||||

| Registered capital C22 | 0.942 | ||||

| Business information B6 | 0.941 | Current account detailed history list from banks C23 | 0.942 | ||

| Goodwill of cooperative enterprises C24 | 0.942 | ||||

| Quality certification C25 | 0.941 | ||||

| Obtained external capital C26 | 0.941 | ||||

| Social security payment C27 | 0.938 | ||||

| Tax situation C28 | 0.939 | ||||

| Payment for water, electricity and gas C29 | 0.942 | ||||

| Liability situation C30 | 0.942 | ||||

| Negative information B7 | 0.941 | Litigation situation C31 | 0.942 | ||

| Abnormal operation C32 | 0.942 | ||||

| Administrative penalty C33 | 0.941 | ||||

| Bad loan and repayment records C34 | 0.942 | ||||

| Competitive strength B8 | 0.941 | Industry situation C35 | 0.942 | ||

| Market share C36 | 0.941 | ||||

| Policy support C37 | 0.941 | ||||

| Technical barriers C38 | 0.941 | ||||

| Financial capacity A3 | 0.941 | Debt paying ability B9 | 0.941 | Asset-liability ratio C39 | 0.942 |

| Cash to current liabilities ratio C40 | 0.942 | ||||

| Current ratio C41 | 0.941 | ||||

| Quick ratio C42 | 0.941 | ||||

| Operating capacity B10 | 0.941 | Total asset turnover C43 | 0.941 | ||

| Inventory turnover ratio C44 | 0.944 | ||||

| Operating expense ratio C45 | 0.941 | ||||

| Receivable turnover ratio C46 | 0.941 | ||||

| Earning capacity B11 | 0.942 | Sales net profit ratio C47 | 0.942 | ||

| Gross profit margin C48 | 0.942 | ||||

| Return on assets (ROA) C49 | 0.941 | ||||

| Ratio of profits to cost C50 | 0.944 | ||||

| Growth ability B12 | 0.941 | Total asset growth rate C51 | 0.941 | ||

| Main business profit growth rate C52 | 0.942 | ||||

| Main business income growth rate C53 | 0.941 | ||||

| Net profit growth rate C54 | 0.942 | ||||

| Innovation capacity A4 | 0.944 | Innovation inputs B13 | 0.942 | Proportion of R&D expenditure in the main business C55 | 0.942 |

| Proportion of R&D personnel C56 | 0.942 | ||||

| New product development ability C57 | 0.941 | ||||

| Intellectual property B14 | 0.941 | Intellectual property creation C58 | 0.942 | ||

| Intellectual property operation C59 | 0.941 | ||||

| Intellectual property management and protection C60 | 0.941 | ||||

| Innovation team B15 | 0.942 | Education background of members C61 | 0.942 | ||

| Work experience of members C62 | 0.944 | ||||

| Members’ influence power C63 | 0.942 | ||||

| Innovation evaluation B16 | 0.941 | National-level award C64 | 0.941 | ||

| Provincial-level award C65 | 0.942 | ||||

| Municipal-level award C66 | 0.942 |

| Start-up Stage | Growth Stage | Mature Stage | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| A1 | A2 | A3 | A4 | A1 | A2 | A3 | A4 | A1 | A2 | A3 | A4 | |

| A1 | 1.00 | 1.21 | 1.39 | 1.03 | 1.00 | 1.02 | 1.09 | 1.03 | 1.00 | 0.91 | 0.93 | 0.93 |

| A2 | 0.83 | 1.00 | 1.15 | 0.85 | 0.98 | 1.00 | 1.08 | 1.01 | 1.095 | 1.00 | 1.02 | 1.01 |

| A3 | 0.72 | 0.87 | 1.00 | 0.74 | 0.91 | 0.93 | 1.00 | 0.94 | 1.075 | 0.98 | 1.00 | 1.00 |

| A4 | 0.97 | 1.18 | 1.35 | 1.00 | 0.98 | 0.99 | 1.07 | 1.00 | 1.079 | 0.99 | 1.00 | 1.00 |

| W(%) | 28.40 | 23.49 | 20.46 | 27.65 | 25.82 | 25.40 | 23.60 | 25.18 | 23.53 | 25.76 | 25.31 | 25.40 |

| CI | 0.0000 | 0.0001 | 0.0053 | |||||||||

| CR | 0.0000 | 0.0000 | 0.006 | |||||||||

| Category | First-Level Indicator Weight (%) | Second-Level Indicator Weight (%) | Third-Level Indicator | Weight (%) Add Score | TSME A Score | TSME B Score | TSME C Score |

|---|---|---|---|---|---|---|---|

| Basic items | Controllers’ ability Start-up stage (28.40) Growth stage (25.82) Mature stage (23.53) | Basic information (33.00) | Education background | 24.67 | 100 | 100 | 60 |

| Work experience | 28.85 | 80 | 80 | 100 | |||

| Marital status | 23.64 | 100 | 100 | 100 | |||

| Number of children | 22.84 | 100 | 100 | 100 | |||

| Personal assets (32.48) | Real estate and vehicles | 24.86 | 80 | 80 | 80 | ||

| Bank deposit | 24.09 | 60 | 60 | 80 | |||

| Financial assets | 25.06 | 60 | 60 | 80 | |||

| Investment assets | 25.99 | 60 | 60 | 60 | |||

| Credit conditions (34.52) | Liabilities | 26.56 | 80 | 80 | 0 | ||

| Records of violation of laws and regulations | 22.65 | 100 | 100 | 100 | |||

| Litigation situation | 26.10 | 100 | 100 | 100 | |||

| Guarantee situation | 24.69 | 100 | 100 | 100 | |||

| Operation & management ability Start-up stage (23.49) Growth stage (25.40) Mature stage (25.76) | Basic information (25.27) | Historical evolution | 20.92 | 60 | 60 | 100 | |

| Management structure | 25.78 | 80 | 80 | 90 | |||

| Shareholder change | 19.10 | 100 | 100 | 100 | |||

| Corporate institutions | 14.52 | 60 | 100 | 100 | |||

| Registered capital | 19.69 | 100 | 100 | 100 | |||

| Business information (25.49) | Current account detailed history list from banks | 13.53 | 100 | 100 | 0 | ||

| Goodwill of cooperative enterprises | 13.21 | 100 | 100 | 80 | |||

| Quality certification | 12.43 | 60 | 100 | 80 | |||

| Obtained external capital | 12.93 | 100 | 100 | 100 | |||

| Social security payment | 11.81 | 100 | 100 | 100 | |||

| Tax situation | 11.85 | 80 | 80 | 80 | |||

| Payment for water, electricity and gas | 12.02 | 100 | 100 | 100 | |||

| Liability situation | 12.23 | 100 | 60 | 60 | |||

| Negative information (25.65) | Litigation situation | 25.71 | 100 | 100 | 100 | ||

| Abnormal operation | 24.18 | 100 | 100 | 100 | |||

| Administrative penalty | 23.58 | 100 | 100 | -100 | |||

| Bad loan and repayment records | 26.53 | 100 | 100 | 100 | |||

| Competitive strength (23.59) | Industry situation | 25.82 | 100 | 100 | 60 | ||

| Market share | 24.68 | 60 | 60 | 60 | |||

| Policy support | 24.03 | 80 | 100 | 100 | |||

| Technical barriers | 25.47 | 100 | 100 | 60 | |||

| Financial capacity Start-up stage (20.46) Growth stage (23.60) Mature stage (25.31) | Debt paying ability (26.58) | Asset-liability ratio | 25.22 | 80 | 80 | 80 | |

| Cash to current liabilities ratio | 24.35 | 60 | 80 | 80 | |||

| Current ratio | 25.54 | 60 | 80 | 80 | |||

| Quick ratio | 24.89 | 60 | 80 | 80 | |||

| Operating capacity (25.23) | Total asset turnover | 26.61 | 80 | 80 | 0 | ||

| Inventory turnover ratio | 22.27 | 80 | 80 | 0 | |||

| Operating expense ratio | 22.81 | 80 | 80 | 80 | |||

| Receivable turnover ratio | 28.31 | 80 | 80 | 60 | |||

| Earning capacity (24.15) | Sales net profit ratio | 26.19 | 60 | 60 | 80 | ||

| Gross profit margin | 24.45 | 80 | 80 | 80 | |||

| Return on assets (ROA) | 24.17 | 60 | 60 | 60 | |||

| Ratio of profits to cost | 25.19 | 60 | 60 | 60 | |||

| Growth ability (24.04) | Total asset growth rate | 26.44 | 80 | 80 | 60 | ||

| Main business profit growth rate | 24.12 | 80 | 80 | 80 | |||

| Main business income growth rate | 24.85 | 100 | 80 | 100 | |||

| Net profit growth rate | 24.58 | 80 | 80 | 60 | |||

| Innovation capacity Start-up stage (27.65) Growth stage (25.18) Mature stage (25.40) | Innovation inputs (34.36) | Proportion of R&D expenditure in main business | 33.72 | 100 | 100 | 80 | |

| Proportion of R&D personnel | 32.49 | 100 | 100 | 100 | |||

| New product development ability | 33.79 | 80 | 80 | 60 | |||

| Intellectual property (32.27) | Intellectual property creation | 34.21 | 80 | 80 | 60 | ||

| Intellectual property operation | 33.70 | 60 | 60 | 60 | |||

| Intellectual property management and protection | 32.09 | 80 | 100 | 60 | |||

| Innovation team (33.37) | Education background of members | 32.36 | 100 | 100 | 80 | ||

| Work experience of members | 35.55 | 100 | 100 | 80 | |||

| The influence power of members | 32.09 | 100 | 100 | 60 | |||

| Bonus-point items | Controllers’ ability | Status & title | Top talents at home and abroad | 30 | 0 | 0 | 0 |

| National leading talents | 20 | 0 | 0 | 0 | |||

| Local-level leading talents | 10 | 0 | 10 | 0 | |||

| NPC members or CPPCC members | 15/10/8/3 | 0 | 0 | 0 | |||

| Professional title | 5/3/1 | 3 | 0 | 0 | |||

| Innovation capacity | Innovation evaluation | National-level award | 30/20/15 | 0 | 0 | 0 | |

| Provincial-level award | 10 | 0 | 0 | 0 | |||

| Municipal-level award | 5 | 0 | 0 | 0 | |||

| The comprehensive credit score | 87.87 | 96.63 | 73.80 | ||||

References

- Wang, Z.; Shou, M.; Wang, S.; Dai, R.N.; Wang, K.Q. An empirical study on the key factors of intelligent upgrade of small and medium-sized enterprises in China. Sustainability 2019, 11, 619. [Google Scholar] [CrossRef]

- Tian, X.L.; Xu, Z.S.; Wang, X.X.; Gu, J. Decision models to find a promising start-up firm with QUALIFLEX under probabilistic linguistic circumstance. Int. J. Inf. Technol. Decis. Mak. 2019, 18, 1379–1402. [Google Scholar] [CrossRef]

- Tian, X.L.; Xu, Z.S.; Gu, J. Group decision-making models for venture capitalists: The PROMETHEE with hesitant fuzzy linguistic information. Technol. Econ. Dev. Econ. 2019, 25, 743–773. [Google Scholar] [CrossRef]

- Tian, X.L.; Xu, Z.S.; Gu, J.; Herrera-Viedma, E. How to select a promising enterprise for venture capitalists with prospect theory under intuitionistic fuzzy circumstance? Appl. Soft. Comput. 2018, 67, 756–763. [Google Scholar] [CrossRef]

- Sang, B.H.; Kwon, S.; Yun, J. The effects of policy funds on the financing constraints of small and medium-sized enterprises in South Korea. Appl. Econ. Lett. 2017, 24, 1–4. [Google Scholar]

- Bao, S.X.; Yin, Y.F. Credit evaluation and empirical analysis of technological small and medium-sized enterprises. Sci. Technol. Prog. Policy 2009, 10, 143–147. [Google Scholar]

- Giudici, P. Financial data science. Stat. Probab. Lett. 2018, 136, 160–164. [Google Scholar] [CrossRef]

- Liu, C.; Wu, P.; Hao, F.J. Research on credit rating of technological small and medium-sized enterprises based on fuzzy set theory. Sci. Technol. Prog. Policy 2013, 9, 170–175. [Google Scholar]

- Kou, G.; Yang, P.; Peng, Y.; Xiao, F.; Chen, Y.; Alsaadi, F.E. Evaluation of feature selection methods for text classification with small datasets using multiple criteria decision-making methods. Appl. Soft. Comput. 2019, 86, 105836. [Google Scholar] [CrossRef]

- Zhang, H.H.; Kou, G.; Yang, P. Soft consensus cost models for group decision making and economic interpretations. Eur. J. Oper. Res. 2019, 277, 964–980. [Google Scholar] [CrossRef]

- Kou, G.; Ergu, D.; Lin, C.S.; Chen, Y. Pairwise comparison matrix in multiple criteria decision making. Technol. Econ. Dev. Econ. 2016, 22, 738–765. [Google Scholar] [CrossRef]

- Kou, G.; Lu, Y.Q.; Peng, Y.; Shi, Y. Evaluation of classification algorithms using MCDM and rank correlation. Int. J. Inf. Technol. Decis. Mak. 2012, 11, 197–225. [Google Scholar] [CrossRef]

- Kou, G.; Peng, Y.; Wang, G.X. Evaluation of clustering algorithms for financial risk analysis using MCDM methods. Inf. Sci. 2014, 27, 1–12. [Google Scholar] [CrossRef]

- Zhang, W.K.; Du, J.; Tian, X.L. Finding a promising venture capital project with TODIM under probabilistic hesitant fuzzy circumstance. Technol. Econ. Dev. Econ. 2018, 24, 2026–2044. [Google Scholar] [CrossRef]

- Gonçalves, T.S.H.; Ferreira, F.A.F.; Jalali, M.S.; Meidutė-Kavaliauskienė, I. An idiosyncratic decision support system for credit risk analysis of small and medium-sized enterprises. Technol. Econ. Dev. Econ. 2016, 22, 598–616. [Google Scholar] [CrossRef]

- Liu, X.; Xu, Y.J.; Ge, Y.; Zhang, W.K.; Herrera, F. A group decision making approach considering self-confidence behaviors and its application in environmental pollution emergency management. Int. J. Environ. Res. Public Health 2019, 16, 385. [Google Scholar] [CrossRef]

- Tian, X.L.; Xu, Z.S.; Fujita, H. Sequential funding the venture project or not? A prospect consensus process with probabilistic hesitant fuzzy preference information. Knowl. Based Syst. 2018, 161, 172–184. [Google Scholar] [CrossRef]

- Tian, X.L.; Xu, Z.S.; Gu, J. An extended TODIM based on cumulative prospect theory and its application in venture capital. Informatica 2019, 30, 413–429. [Google Scholar] [CrossRef]

- Herrera, F.; Herrera, V.E.; Martínez, L.; Mata, F.; Sánchez, P.J. A Multi-granular linguistic decision model for evaluating the quality of network services. In Intelligent Sensory Evaluation; Springer: Berlin/Heidelberg, Germany, 2004. [Google Scholar]

- Martínez, L.; Liu, J.; Yang, J.B.; Herrera, F. A multigranular hierarchical linguistic model for design evaluation based on safety and cost analysis. Int. J. Intell. Syst. 2010, 20, 1161–1194. [Google Scholar] [CrossRef]

- Kou, G.; Ergu, D. AHP/ANP theory and its application in technological and economic development: The 90th anniversary of Thomas L. Saaty. Technol. Econ. Dev. Econ. 2016, 22, 649–650. [Google Scholar] [CrossRef]

- Gunduz, M.; Alfar, M. Integration of innovation through analytical hierarchy process (AHP) in project management and planning. Technol. Econ. Dev. Econ. 2019, 25, 258–276. [Google Scholar] [CrossRef]

- Saaty, T.L. Book review. J. Optim. Theory Appl. 1970, 6, 284. [Google Scholar] [CrossRef]

- Ishizaka, A.; Lusti, M. An expert module to improve the consistency of AHP matrices. Int. Trans. Oper. Res. 2010, 11, 97–105. [Google Scholar] [CrossRef]

- Gu, W.; Basu, M.; Chao, Z.; Wei, L.R. A unified framework for credit evaluation for internet finance companies: Multi-criteria analysis through AHP and DEA. Int. J. Inf. Technol. Decis. Mak. 2017, 16, 597–624. [Google Scholar] [CrossRef]

- Lang, Z.; Hu, H.; Dan, Z. A Credit risk assessment model based on SVM for small and medium enterprises in supply chain finance. Financ. Innov. 2015, 1, 14–35. [Google Scholar]

- Calabrese, R.; Marra, G.; Osmetti, S.A. Bankruptcy prediction of small and medium enterprises using a flexible binary generalized extreme value model. J. Oper. Res. Soc. 2016, 67, 604–615. [Google Scholar] [CrossRef]

- Saaty, T.L. The Analytic Hierarchy Process; McGraw-Hill: New York, NY, USA, 1980. [Google Scholar]

- Eisenbeis, R.A. Problems in applying discriminant analysis in credit scoring models. J. Bank Financ. 1978, 2, 205–219. [Google Scholar] [CrossRef]

- William, P. The Four Big C’s Factor in Extending Credit; Central National Bank of Philadelphia: Philadelphia, PA, USA, 1910. [Google Scholar]

- Altman, E.I. Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. J. Financ. 1968, 23, 589–609. [Google Scholar] [CrossRef]

- Beaver, W.H. Financial ratios as predictors of failure. J. Account. Res. 1966, 4, 71–111. [Google Scholar] [CrossRef]

- Black, F.; Scholes, M. The pricing of options and corporate liabilities. J. Polit. Econ. 1973, 81, 637–654. [Google Scholar] [CrossRef]

- Chatterjee, S.; Barcun, S. A nonparametric approach to credit screening. J. Am. Stat. Assoc. 1970, 65, 150–154. [Google Scholar]

- Kang, L.; Niskanen, J.; Kolehmainen, M.; Niskanen, M. Financial innovation: Credit default hybrid model for SME lending. Expert Syst. Appl. 2016, 61, 343–355. [Google Scholar]

- Grunert, J.; Norden, L.; Weber, M. The role of non-financial factors in internal credit ratings. J. Bank Financ. 2005, 29, 509–531. [Google Scholar] [CrossRef]

- Lugovskaya, L. Predicting default of Russian SMEs on the basis of financial and non-financial variables. J. Financ. Serv. Mark. 2010, 14, 301–313. [Google Scholar] [CrossRef]

- Blanco, O.A.; Irimia, D.A.; Oliver, A.M.; Wilson, N. Improving bankruptcy prediction in micro-entities by using nonlinear effects and non-financial variables. Financ. A Uver 2015, 65, 144–166. [Google Scholar]

- Mao, Q.; Zhao, X.C. Research on credit evaluation from the perspective of innovation value chain. East China Econ. Manag. 2018, 5, 134–139. [Google Scholar]

- Zhao, C.W.; Chen, C.F.; Tang, Y.K. Science and Technology Financial; Science Press: Beijing, China, 2009. [Google Scholar]

- Zhang, D.F.; Zhou, X.Y.; Leung, S.C.H.; Zhang, J.M. Vertical bagging decision trees model for credit scoring. Expert Syst. Appl. 2010, 37, 7838–7843. [Google Scholar] [CrossRef]

- Ferreira, F.A.F.; Santos, S.P.; Dias, V.M.C. An AHP-based approach to credit risk evaluation of mortgage loans. Int. J. Strateg. Prop. Manag. 2014, 18, 38–55. [Google Scholar] [CrossRef]

- Li, J.; Zhang, Q.; Yan, F.; Zhong, M. A cloud model-based multi-level fuzzy comprehensive evaluation approach for financing credit of scientific & technological small-medium enterprises. J. Differ. Equ. Appl. 2016, 23, 443–456. [Google Scholar]

- Thanassoulis, E.; Dey, P.K.; Petridis, K.; Goniadis, I.; Georgiou, A.C. evaluating higher education teaching performance using combined analytic hierarchy process and data envelopment analysis. J. Oper. Res. Soc. 2017, 68, 431–445. [Google Scholar] [CrossRef]

- Chao, S.L. Integrating multi-stage data envelopment analysis and a fuzzy analytical hierarchical process to evaluate the efficiency of major global liner shipping companies. Marit. Policy Manag. 2018, 44, 1–16. [Google Scholar] [CrossRef]

- Ilce, A.C.; Ozkaya, K. An integrated intelligent system for construction industry: A case study of raised floor material. Technol. Econ. Dev. Econ. 2018, 24, 1866–1884. [Google Scholar] [CrossRef]

- Pamucar, D.; Stevic, Z.; Zavadskas, E.K. Integration of interval rough AHP and interval rough MABAC methods for evaluating university web pages. Appl. Soft. Comput. 2018, 67, 141–163. [Google Scholar] [CrossRef]

- Kim, D.H.; Sohn, S.Y. Fuzzy analytic hierarchy process applied to technology credit scorecard considering entrepreneurs’ psychological and behavioral attributes. J. Intell. Fuzzy Syst. 2016, 30, 2349–2364. [Google Scholar] [CrossRef]

- Mou, W.M.; Wong, W.K.; Mcaleer, M. Financial credit risk evaluation based on core enterprise supply chains. Sustainability 2018, 10, 3699. [Google Scholar] [CrossRef]

- Karan, M.B.; Ulucan, A.; Kaya, M. Credit risk estimation using payment history data: A comparative study of Turkish retail stores. Cent. Eur. J. Oper. Res. 2013, 21, 479–494. [Google Scholar] [CrossRef]

- Ju, Y.H.; Sohn, S.Y. Updating a credit-scoring model based on new attributes without realization of actual data. Eur. J. Oper. Res. 2014, 234, 119–126. [Google Scholar] [CrossRef]

- Ciampi, F. Small enterprise default prediction modeling through artificial neural networks: An empirical analysis of Italian small enterprises. J. Small Bus. Manag. 2012, 51, 23–45. [Google Scholar] [CrossRef]

- Li, Z.J.; Yang, C.R. Establishment of the credit indicator system of micro enterprises based on support vector machine and r-type clustering. Math. Probl. Eng. 2018, 4, 1–12. [Google Scholar] [CrossRef]

- Dalkey, N.; Helmer, O. An experimental application of the Delphi method to the use of experts. Manag. Sci. 1963, 9, 458–467. [Google Scholar] [CrossRef]

- Boomsma, A. The robustness of LISREL against small sample sizes in factor analysis models. In Systems Under Indirect Observation: Causality, Structure, Prediction; Jöreskog, K.G., Wold, H., Eds.; North-Holland: Amsterdam, The Netherlands, 1982. [Google Scholar]

- Nunnally, J.C.; Bernstein, I.H. Psychometric Theory; McGraw-Hill: New York, NY, USA, 1994. [Google Scholar]

- Sethi, V.; Carraher, S. Developing measures for assessing the organizational impact of information technology: A comment on Mahmood and Soon’s paper. Decis. Sci. 2010, 24, 867–877. [Google Scholar] [CrossRef]

| Numerical Rate | The Verbal Judgment of Preference |

|---|---|

| l | Equal importance |

| 3 | Weak importance of one over another |

| 5 | Essential or strong importance |

| 7 | Demonstrated importance |

| 9 | Absolute importance |

| 2,4,6,8 | Intermediate values between the two adjacent judgments |

| Reciprocal | If the importance ratio of factor i to factor j is , then the importance ratio of factor j to the factor i is . |

| n | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

|---|---|---|---|---|---|---|---|---|---|---|

| RI | 0 | 0 | 0.52 | 0.89 | 1.12 | 1.24 | 1.36 | 1.41 | 1.46 | 1.49 |

| Studies | Method | Contribution |

|---|---|---|

| Ciampi (2012) [52] | ANN | Evaluate the credit risk of SMEs in Italian. |

| Karan et al. (2013) [50] | LR | Assess the credit risk of retail enterprises and cluster risky customers by ranking their risk levels. |

| Ferreira et al. (2014) [45] | AHP | Propose a methodological framework conceived to adjust trade-offs among evaluation criteria and provide DMs with a more transparent mortgage risk evaluation system. |

| Ju and Sohn (2014) [51] | EFA LR | Construct a new technology credit-scoring model that can contribute to finding the optimal scenario. |

| Lang et al. (2015) [26] | AHP TOPSIS | Evaluate the credit risk analysis of Chinese urban commercial banks. |

| Kim and Sohn (2016) [48] | FAHP | Propose a technology credit scorecard that additionally accommodates an applicant’s intelligence, personality, integrity, verbal communication, and non-verbal behaviors. |

| Kang et al. (2016) [35] | ANN LR | Introduce a novel, more accurate credit risk estimation approach for SMEs. |

| Gonçalves et al. (2016) [15] | TODIM | Create a unique decision support system to identify the multiple criteria of SMEs credit risk. |

| Thanassoulis et al. (2017) [44] | DEA AHP | Propose an integrated approach to higher education teaching evaluation |

| Gu et al. (2017) [25] | DEA AHP | Propose a credit index system for internet finance SMEs, which includes financial indicators and non-financial indicators. |

| Li et al. (2017) [43] | AHP | Construct a new evaluation index system for financing credit of TSMEs in both macro and micro aspects. |

| Li and Yang (2018) [53] | SVM | Provide a screening model for credit indicators of micro-enterprises. |

| Chao et al. (2018) [45] | DEA AHP | Establish a model to evaluate the efficiency of companies. |

| Mou et al. (2018) [49] | FAHP | Construct a supply chain financial credit risk evaluation system for enterprises. |

| Respondents | First-Round | Second-Round | ||||

|---|---|---|---|---|---|---|

| Distribute | Return | Ratio (%) | Distribute | Return | Ratio (%) | |

| Bank | 75 | 59 | 78.67 | 75 | 61 | 81.33 |

| Small loan company | 50 | 35 | 70.00 | 50 | 34 | 68.00 |

| Government | 30 | 17 | 56.67 | 30 | 18 | 60.00 |

| TSMEs | 45 | 34 | 75.56 | 45 | 36 | 80.00 |

| Total | 200 | 145 | 72.50 | 200 | 149 | 74.50 |

| Enterprise | Development Stage | Score | Grade | Loan Amount | Loan Result |

|---|---|---|---|---|---|

| A | Start-up | 87.87 | AA | 800 thousand | Approved |

| B | Start-up | 96.63 | AAA | 1 million | Approved |

| C | Mature | 73.80 | BB | 1 million | Rejected |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yu, A.; Jia, Z.; Zhang, W.; Deng, K.; Herrera, F. A Dynamic Credit Index System for TSMEs in China Using the Delphi and Analytic Hierarchy Process (AHP) Methods. Sustainability 2020, 12, 1715. https://doi.org/10.3390/su12051715

Yu A, Jia Z, Zhang W, Deng K, Herrera F. A Dynamic Credit Index System for TSMEs in China Using the Delphi and Analytic Hierarchy Process (AHP) Methods. Sustainability. 2020; 12(5):1715. https://doi.org/10.3390/su12051715

Chicago/Turabian StyleYu, Ao, Zhuoqiang Jia, Weike Zhang, Ke Deng, and Francisco Herrera. 2020. "A Dynamic Credit Index System for TSMEs in China Using the Delphi and Analytic Hierarchy Process (AHP) Methods" Sustainability 12, no. 5: 1715. https://doi.org/10.3390/su12051715

APA StyleYu, A., Jia, Z., Zhang, W., Deng, K., & Herrera, F. (2020). A Dynamic Credit Index System for TSMEs in China Using the Delphi and Analytic Hierarchy Process (AHP) Methods. Sustainability, 12(5), 1715. https://doi.org/10.3390/su12051715