1. Introduction

Global warming has resulted in more importance being placed on environmental protection [

1,

2], and businesses are shifting their goals from merely optimizing economic performance toward sustainable development—that is, balancing the needs of the present and future generations [

3]. In order to eliminate serious consequences such as the deterioration of the environment and to reduce greenhouse gas emissions, many countries are encouraging enterprises to apply green supply chain management and achieve a sustainable economy. Meanwhile, as consumer awareness of environmental issues has grown, so has the requirement for sustainable development and a green economy. In recent years, many companies have tried to refine their production methods and produce green products to meet consumer demand [

4,

5].

However, it is actually somewhat difficult for enterprises to apply sustainable supply chain management. For example, as the voice of environmental protection grows louder, many enterprises are beginning to develop green products to satisfy consumers and promote the reduction of carbon emissions [

6,

7], but ahead of them are challenges. For example, customers may sacrifice short-term satisfaction and wait for future price drops. Indeed, an enterprise’s markdown strategy creates the circumstances in which this phenomenon might occur, where a seller may reduce prices to attract customers [

8]. However, the existence of strategic customers may render a markdown pricing strategy ineffective. Such customers anticipate the timing of price reductions and postpone their purchases until the best time, which may harm not only the sellers but also the customers. Therefore, sellers must consider strategic customer behavior when making pricing decisions.

Today, in an environment of fierce market competition and more rational customer behavior, strategic customer behavior is becoming more frequent. We noticed that customers have become more strategic: they may wait for a low price instead of buying immediately, which indicates that strategic customer behavior is becoming more complex, and it turns out that ignoring strategic customer behavior results in a 20% reduction in profits [

9]. A strategy of sacrificing price for volume is a gamble in any industry, and a markdown strategy is not always the best. Several researchers have begun to find a feasible way of mitigating the adverse effects of strategic customers. Du and Zhang (2015) [

10] pointed out that the strategic customer’s behavior adversely influences the profitability of the whole supply chain, which leads to price reductions and smaller inventories. Fortunately, this problem has solutions, and two feasible methods are proposed by Su (2008) [

11]: quantity commitment (to limit volume) and price commitment (to keep the price high).

To summarize, it is necessary to research the impact of strategic customers on sustainable supply chain management. Furthermore, we propose the following questions about customer behavior.

What are the optimal strategies for combating heterogeneous strategic customers in sustainable supply chain?

What is the difference between the two types of customers, and how does strategic customer behavior affect the solutions?

To achieve environmental sustainability, what effective measures can governments and manufacturers take to promote the development of green products and persuade customers to buy early?

To answer these questions, we introduce the concept of heterogeneous strategic customers, according to Guo (2012) [

12], and study the optimal pricing decisions and greenness management of new products. Then, we define three types of strategic customers according to their preferences, analyze the optimal decisions in myopic and strategic scenarios, and explore the impacts of the three purchase thresholds on potential strategic customers’ behavior. The contributions are summarized as follows. First, we distinguish strategic customers from homogeneous customers and analyze optimal pricing and greenness strategies in the sustainable supply chain in strategic customer scenarios. Unlike the current literature, we propose a new model to measure consumer demand, which includes two aspects: a traditional demand function to describe myopic customer behavior, and a potential threshold demand function to model strategic customer behavior. Next, we define three types of strategic customers according to their preferences. Recent literature has mainly assumed that strategic customers might wait for a low price. In fact, customers not only consider price but also prefer the greenness of a new product. Sellers have been over-focused on price competition, disregarding the negative consequences of markdown, which has the effect of making customers even more strategic and patient while they wait for bargains. Therefore, we want to compensate for these disadvantages by introducing other factors such as greenness and the value of the new product.

In this paper, we can offer some novel conclusions. First, strategic customers’ individual preferences can affect the optimal equilibrium and increase the profitability of the low-carbon supply chain. In the price threshold scenario, there is a higher purchase price threshold, which means willingness to pay for green products is increasing and can stimulate the manufacturer to improve greenness and set a higher price; whereas in the greenness threshold scenario, strategic customers pay more attention to the greenness of products, and a higher greenness purchase threshold will force manufacturers to set lower prices to offset the need for greenness. Second, we noticed that strategic customers can increase both the demand and profit of the seller: with the number of strategic customers increasing, the selling price and greenness will experience downward trends in price threshold scenario, but upward trends in the greenness threshold and value threshold scenarios. This proves the Pareto optimum, as 80% of profits come from 20% of customers or 80% of sales from 20% of products, which also emphasizes the importance of strategic consumers in production decision-making. These results provide references for manufacturers and governments, as the firm can implement measures to eliminate the adverse effects of strategic customers by adjusting price and greenness dynamically according to price and greenness sensitivities. Furthermore, governments need to implement subsidy policies to support the development of a sustainable supply chain and play a leading role in actively influencing strategic customer behavior.

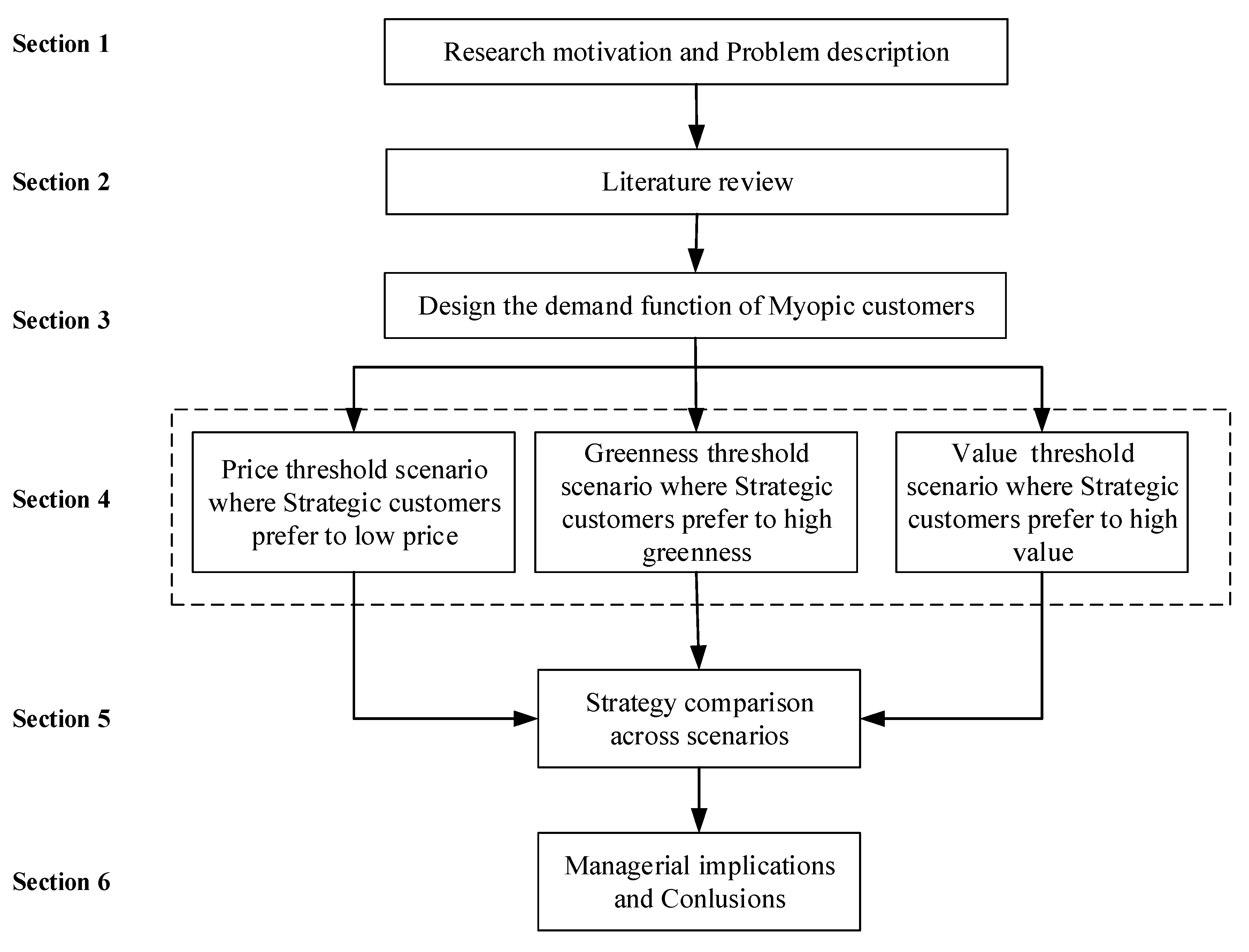

The remainder of this paper is structured as follows (shown in

Figure 1). In

Section 2, we review the related literature on customer behavior.

Section 3 introduces our basic model of myopic customers and analyzes the optimal equilibrium.

Section 4 introduces three heterogeneous strategic customer scenarios (the price threshold scenario, the greenness threshold scenario, and the value threshold scenario).

Section 5 considers strategic customer threshold effects on new products in terms of their price and greenness, and on the firms in terms of their profit.

Section 6 offers conclusions.

3. Pricing Decisions in Myopic Customers (M)

Let us assume a scenario in which a new green product is launched and every customer chooses to either buy or wait. The market consists of a continuum of customers, each of whom can buy only one unit of the product. To begin with, we study optimal pricing decisions when the market includes myopic customers only. In this paper, myopic customers are influenced by the price and greenness in the low-carbon supply chain. According to Young (2009) [

26] and Krass (2013) [

27], we have the myopic customers’ demand function, which is given as

where

α > 0 and represents potential demand, which frees from price and greenness,

β > 0 and represents the influencing coefficient of price on market demand, indicating the crowding-out effect of price on demand, and

γ > 0 indicates the influencing coefficient of greenness on market demand, which brings an expansion effect to the demand of myopic customers. At the same time, in order to ensure the accuracy of the model, Zaccour (2008) [

28] and Martín-Herrán (2015) [

29] pointed out that the model needs to satisfy the condition

α >

βc, which will guarantee a positive demand even if the price is reduced to cost, and the greenness is zero. With the increasing awareness of environmental protection in particular, it is not only the price that affects consumers’ purchase decisions but also the greenness of products. Hence, customers take the initiative and express their demand for greener products, and manufacturers must follow and produce green products [

30,

31]. The key to the problem is to coordinate the balance of supply and demand, which requires optimal production decisions considering both price and greenness [

32,

33].

In order to cater to customers’ demand for green products, manufacturers have increased investment in the research and development of green products. Lópezetal (2007) [

34] and Xie (2012) [

35] pointed out that green innovation improves the greenness of products, which further increases customer demand. For example, manufacturers need to increase green investment and improve the level of greenness according to customers’ preferences. Meanwhile, green innovation requires enterprises to invest large amounts of capital and resources, which leads to high costs, especially in terms of reducing carbon emissions. Therefore, we have a green investment cost function like Lobel’s (2013) [

36].

where

k > 0 and represents the influencing coefficient of green investment on cost. Ahmadi (2017) [

37] and Yoon (2016) [

38] pointed out that the quadratic function reflected the diminishing marginal efficiency of green investment, which resulted in yet further cost.

In this section we assume a scenario where there are myopic customers only. Ignoring strategic customers, the myopic equilibrium means that firms set prices based on myopic customers’ preferences only and can set the optimal price according to the market demand function. Hence, we assume the manufacturers’ profit function is as in formula (3)

Proposition 1. In the myopic customer scenario, the optimal sales price and greenness are Substituting

p and

e into (1) and (3), we get the optimal myopic customer demand and the maximum profit of the firm in the following form:

Corollary 1. For the comparative statics ofp,

e,

q, andπwith respect to key parametersβandγ, we have Note that the price and greenness of the firm decrease with β, which also reduces the optimal quantity and the maximum profit as γ increases. This implies that if myopic customers are more price-sensitive, meaning a large β, the best decision for an enterprise is to set a lower price and greenness. However, if myopic customers are more green-sensitive, meaning a large γ, the best decision for an enterprise is to set a high price and greenness. Therefore, enterprises need to consider both the price sensitivity and greenness sensitivity coefficients, which reflects myopic customers’ preferences for price and greenness.

4. Pricing Decisions with Heterogeneous Strategic Customers

In the previous section, we studied the optimal pricing decision of myopic customers. Retailers usually adopt a price reduction strategy to lure more customers into their stores. However, reducing prices is not always a good strategy, especially when customers are strategic and patient enough, as they may predict the time of a price reduction and wait for a lower price before purchasing [

39]. Hence, we introduce heterogeneous strategic customers to this section, who will compare the available possibilities with their purchase thresholds. Then, we analyze the optimal pricing decisions when customers are heterogeneous, meaning strategic and myopic.

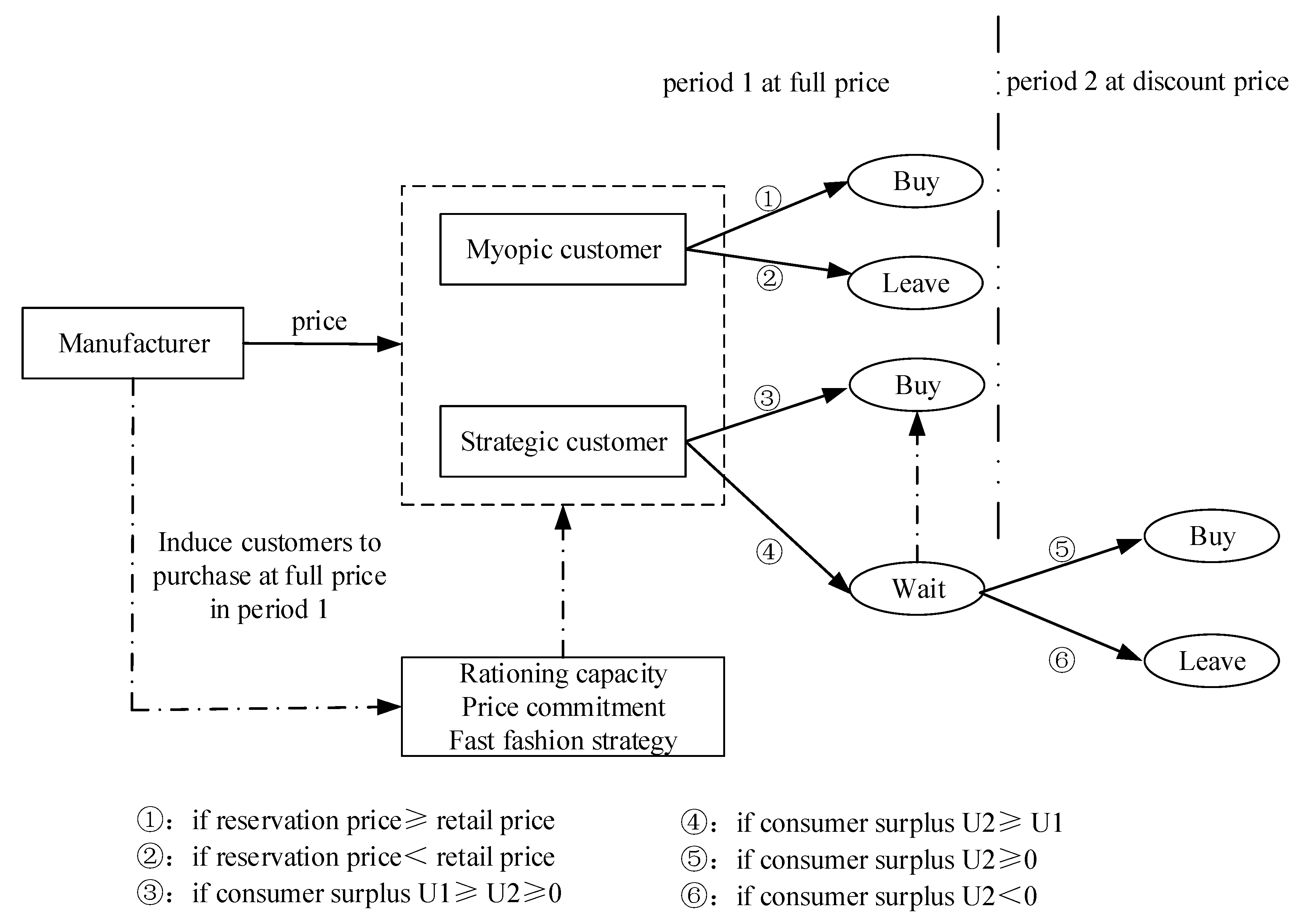

Unlike classic models, we define customers as strategic and myopic. Let us now model the purchase decisions of strategic customers. Suppose there is a situation when a group of people are shopping in the mall and they see a product display. Some customers will choose to buy immediately, whereas others will choose whether to buy or not based on the feelings of the customers who have already bought. Based on the Granovetter and Standing Ovation models, we assume there are large numbers of heterogeneous customers who are strategic or myopic. According to their type, they may choose to delay their purchasing decisions. So, what is the exact reason for strategic customers’ purchasing decisions?

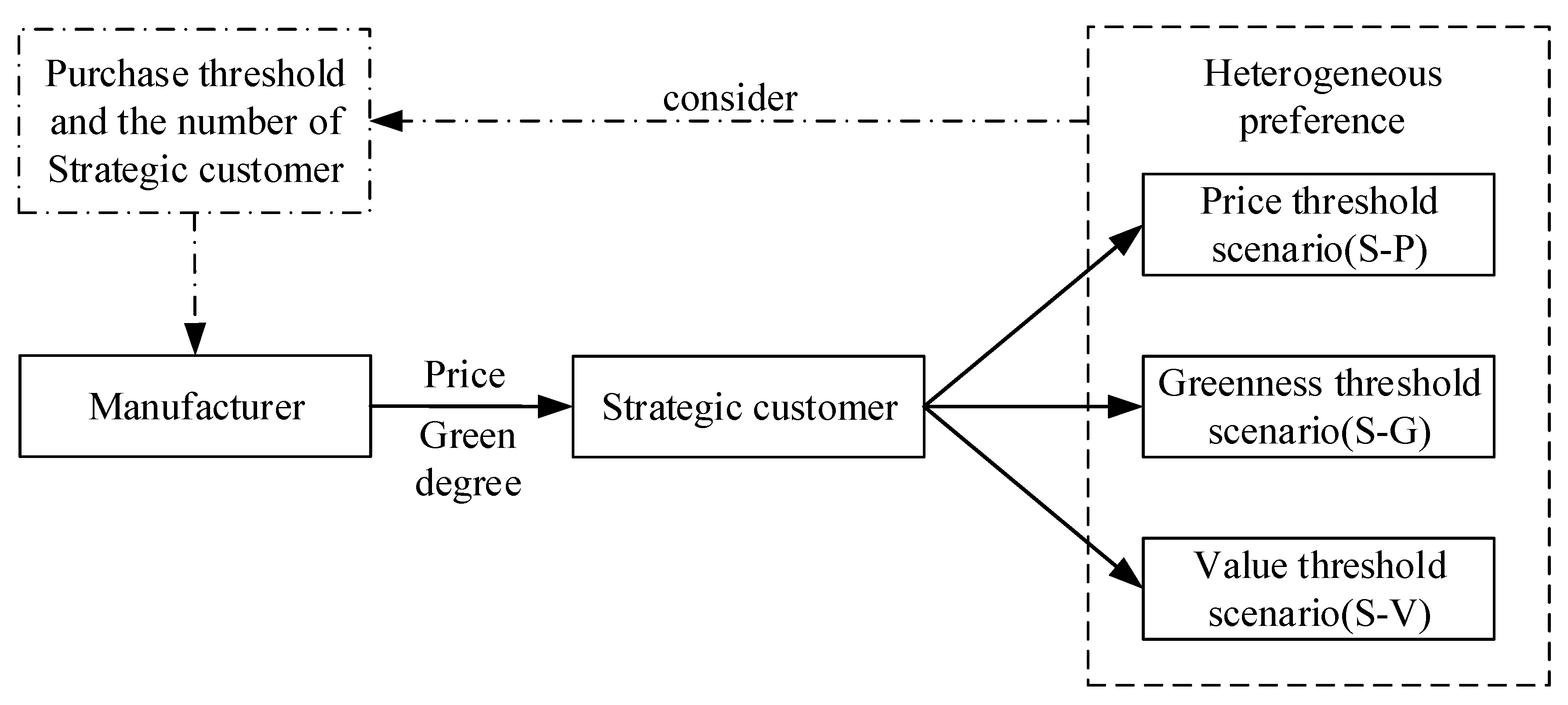

In order to distinguish strategic customers from myopic customers, we initially propose the concept of strategic customer purchase threshold (shown in

Figure 3). Specifically, strategic customers have their own perception of the product before they buy it. First, according to their preferences, we define three types of strategic customer: price threshold, greenness threshold, and value threshold. Second, we assume that the market consists of

Q customers whose individual valuations of the product are uniformly distributed. For example, in the price threshold scenario, we define the threshold of purchase price as

P and the price of the new product as

p. Strategic customers are heterogeneous, and their individual valuations

P for the product are uniformly distributed over [

P1,

P2]; customers buy the product only if

p ≤

P. Last, in order to maximize profits, manufacturers will redefine pricing strategies considering strategic customers to improve sales.

4.1. The Price Threshold Scenario (S-P)

In the price threshold scenario, strategic customers will compare the price of the product with their purchase threshold price before buying. For example, if there is a possibility of a price reduction, and the markdown information is available to strategic customers, they will delay their purchase. Let

P denote customers’ purchase threshold, which refers to their willingness to pay, and let

p be the price of the new product. Clearly, we know that strategic customers buy the product if

p ≤

P. Then, we assume that the market consists of

Q customers whose individual purchase price thresholds,

P, are uniformly distributed over [

P1,

P2]. Thus, customers will be willing to buy the new product when the purchase willingness valuation belongs to [

P1,

p]. So, we can obtain the positive probability that customers would buy the product at the price

pConsider the first type of strategic customers, not only focusing on short-term profit but also potential profits and greenness. In the price threshold scenario, supply chain members should consider that all customers, including both myopic and strategic customers, opt for instantaneous and potential profits. Hence, we can obtain the firm’s profit function as follows

Proposition 2. In the price threshold scenario, the optimal sales price and greenness are 4.2. The Greenness Threshold Scenario (S-G)

In the greenness threshold scenario, strategic customers will compare the greenness of the new product with their purchase threshold greenness before buying. If the regular greenness is too low, strategic customers who prefer a high greenness may choose to wait until the greenness is higher, even if the price is very low. For a variety of reasons, depreciation strategy is often used to speed up sales. We suspect that a price war is not good for the healthy development of the profession, and this markdown strategy has little impact on strategic customers. To describe the model, let

E denote customers’ greenness purchase threshold, and let the greenness of the new product be

e. Clearly, we know that strategic customers buy the product if

e ≥

E. Then, we assume that the market consists of

Q customers whose individual greenness purchase thresholds,

E, are uniformly distributed over [

E1,

E2]. Thus, customers will be willing to buy the new product when the purchase willingness valuation of greenness belongs to [

e,

E2]. So, we can obtain the positive probability that strategic customers will buy the product at greenness

eConsidering the second type of strategic customer, more and more customers are willing to pay extra for greener products, which means that their willingness to pay is high enough to purchase green products. In the greenness threshold scenario, supply chain members should consider that all customers, including both myopic and strategic customers, opt for instantaneous and potential profits. Hence, we can obtain the firm’s profit function as follows

Proposition 3. In the greenness threshold scenario, the optimal sales price and greenness are 4.3. The Value Threshold Scenario (S-V)

In the value threshold scenario, strategic customers consider price and greenness simultaneously in the pursuit of value. They will compare the price and greenness of the product with their purchase threshold value before buying. Suppose that manufactures have realized that every strategic customer has a reservation value of purchase, strategic customers, who may consider both price and greenness, will compare the product value with their reservation value. Let

V denote customers’ purchase threshold value, and let the value of the new product be

v. Clearly, we know that strategic customers buy the product if

v ≥

V. Then, we assume that the market consists of

Q customers whose individual value thresholds for purchasing,

V, are uniformly distributed over [

V1,

V2]. Thus, customers will be willing to buy the new product when the purchase willingness valuation of value belongs to [

v,

V2]. So, we can obtain the positive probability that customers would buy the product at the value

vThe last type of strategic customer will consider both price and greenness, where we define it as value. So, in the value threshold scenario, supply chain members should consider that all customers, including both myopic and strategic customers, opt for instantaneous and potential profits. Hence, we can obtain the firm’s profit function as follows

Proposition 4. In the value threshold scenario, the optimal sales price and greenness are 5. Comparison of Pricing Decisions across Scenarios

By affecting the equilibrium, heterogeneous strategic customers influence the retailer’s decisions. Thus, this section considers strategic customers’ threshold effects on new products in terms of their price and greenness, as well as on the heterogeneous strategic customers in terms of the potential demand, which is what myopic customers do not have. Now, we compare and analyze the differences between heterogeneous strategic customers with myopic customers based on the aspects of strategic customers’ purchase threshold and quantity.

5.1. Sensitivity Analysis

Table 1 summarizes the impacts of sensitivity of demand to sales price on equilibrium solutions in the myopic and strategic scenarios, respectively. As can be seen from

Table 1, when the sensitivity of demand to sales price

β increases from 0.2 to 0.5, the sales price

p, greenness

e, demand

q, and the firm’s profit

π experience downward trends. As expected, with a consistent increase in the sensitivity of demand to sales price

β, meaning that the market pushes firms to lower the selling price, so the optimal price will be reduced. Then, firms may choose to set a lower greenness to reduce the cost of green investment. Finally, ignoring the reality of the high demand response to price shocks, profit and demand will experience downward trends.

What are the differences between myopic and strategic customers? We compare these three heterogeneous strategic customers with myopic customers. First, in the price threshold scenario, where strategic customers prefer lower prices, the firm is willing to reduce the price, aiming to attract more strategic customers by adopting a low-price strategy. Accordingly, greenness drops, but market demand increases so as to offset losses from price cuts. In particular, we find an interesting phenomenon where the price sensitivity coefficient is small (β = 0.2), profit is lower in the price threshold scenario than the myopic customers scenario, while profit is higher when the price sensitivity coefficient is larger (β = 0.5). So, when the sensitivity to price is weak, a rational enterprise will choose to ignore customers’ price threshold. Second, in the greenness threshold scenario, we know that strategic customers are more concerned about the greenness of products and are willing to pay a higher price. So, we can see that the price and greenness are higher than in the myopic customer case. Third, in the value threshold scenario, the decision-making of enterprises depends on both price and greenness, and that the demand expansion effect of greenness weakens the impact of prices.

Table 2 summarizes the impacts of the sensitivity of demand to greenness on equilibrium solutions in the myopic and strategic scenarios, respectively. As can be seen from

Table 2, when the sensitivity of demand to greenness

γ increases from 0.1 to 0.3 (customers are more sensitive to prices than others factors in real life), the sales price

p, greenness

e, demand

q, and the firm’s profit

π experience upward trends, whereas

Table 1 shows a downward trend. As expected, with a consistent increase in the sensitivity of demand to greenness

γ, meaning that the market pushes firms to improve the level of greenness, so the optimal greenness will increase. Most important of all, customers may choose to spend more to obtain a greener product. Finally, the stronger the desire for green, the more obvious the positive effect of greenness is.

We compare these three heterogeneous strategic customers with myopic customers. First, in the price threshold scenario, a higher greenness cannot attract more strategic customers, but a lower price will. Hence, the optimal strategy of manufactures is to set a low selling price to improve cumulative sales, but this strategy of ensuring economic profits at the expense of greenness is, not surprisingly, denied within the industry. At the same time, this reveals the phenomenon of low-price fake products gaining market share. Second, in the greenness threshold scenario, we find that price and greenness are higher than in the other three cases. Accordingly, greenness increases, which in turn requires more green investment, so manufacturers will increase the price to cover the investment cost. As such, the cost of improved greenness and increasing demand will improve the performance of the supply chain. Third, the value threshold scenario falls between the price threshold scenario and the greenness threshold scenario. We notice that customer awareness of environmental protection promotes the demand for green products.

5.2. Strategic Customer Preference

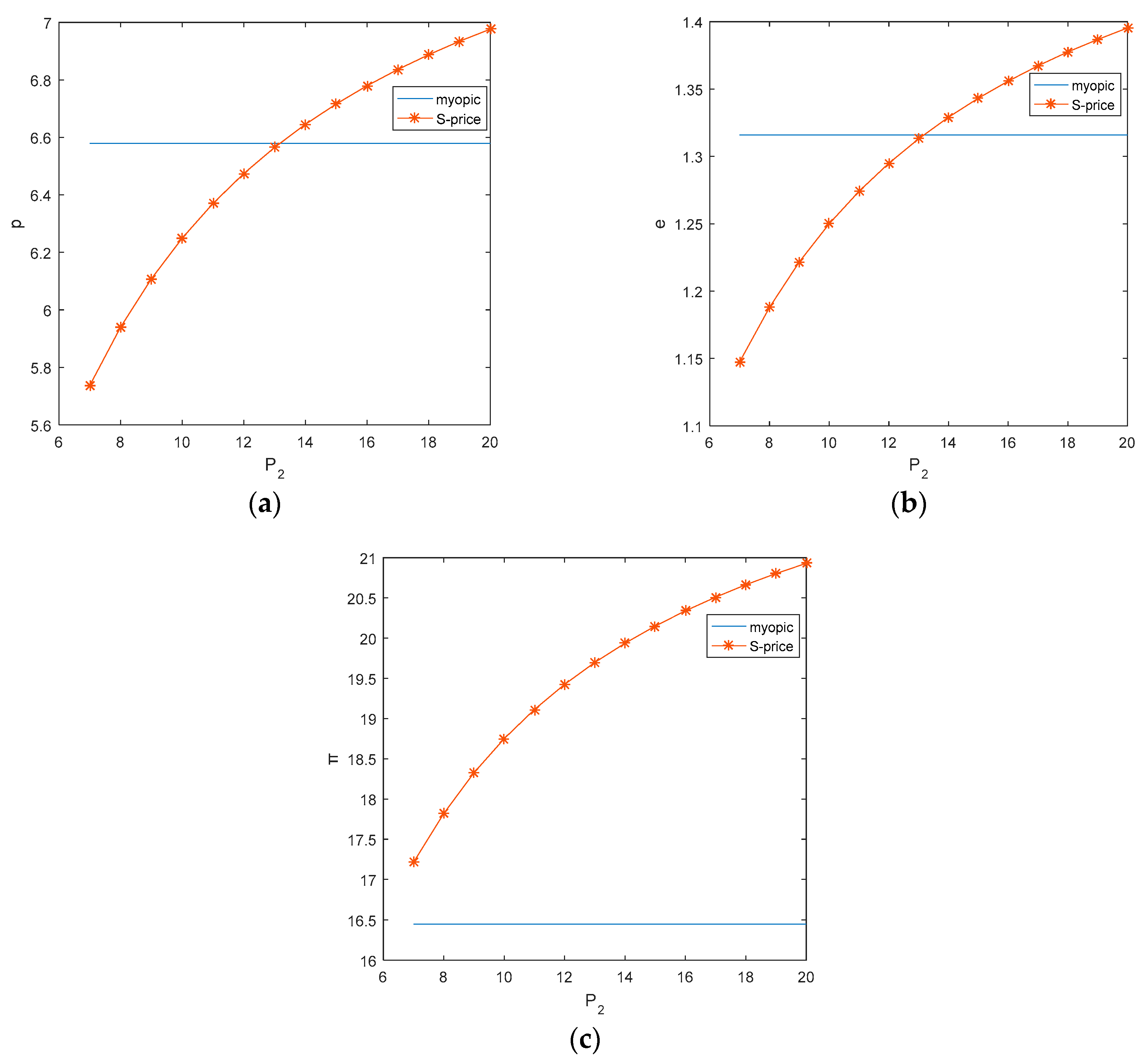

Unlike previous literature on strategic customer behavior, we introduce the concept of heterogeneous strategic customers, and we divide strategic customers into three types according to their heterogeneous preferences. In this section, we want to discover what impact strategic customers’ characteristics have on supply chain decision-making. To depict strategic customers’ characteristics concretely, we select the customers’ purchase price threshold P2 and greenness threshold E2 as reference variables to explore their impact on price, greenness, and profit.

Figure 4 summarizes the impact of customer purchase price threshold

P2 on optimal decisions in the myopic and price threshold scenarios, respectively. We notice that with a consistent increase of the upper threshold value

P2, meaning strategic customers are willing to pay extra for greener products (i.e. the number of customers will increase at the same price), the price, the greenness, and joint profit was increased. Moreover, environmental awareness worldwide has led to greater concerns regarding low-carbon products. As shown in

Figure 1, there is a junction point

P’. Specifically, if

P2 <

P’,

p(S-price) <

p(myopic),

e(S-price) <

e(myopic), but if

P2 >

P’,

p(S-price) >

p(myopic),

e(S-price) >

e(myopic). In other words, when the price threshold

P2 is small (i.e. smaller than

P’), strategic customers are willing to pay more to obtain the product. However, if the price threshold

P2 is relatively large (i.e., higher than

P’), strategic customers accept a slightly higher price. This is in line with the reality that customer preference for a variety of complementary products improves the firm’s bargaining power and promotes the development of a sustainable supply chain.

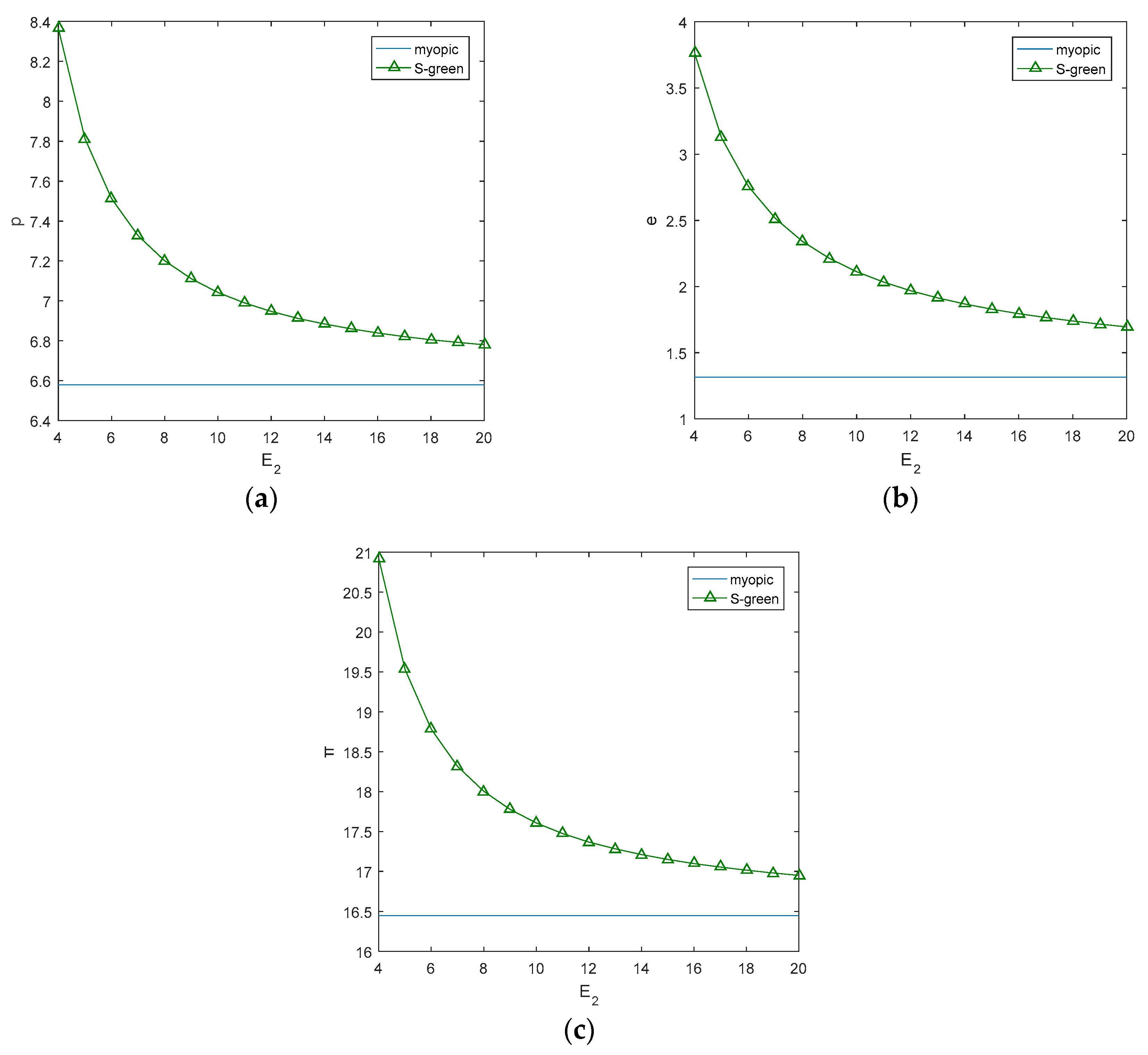

Figure 5 summarizes the impact of customer purchase greenness threshold

E2 on equilibrium solutions in the myopic and greenness threshold scenarios, respectively. With a consistent increase in the upper threshold value

E2, meaning strategic customers are eager to obtain greener products, the price, the greenness, and the joint profit decreases. As shown in

Figure 5,

p(S-green) >

p(myopic),

e(S-green >

e(myopic) and

π(S-green) >

π(myopic). That is, strategic customers’ low-carbon preference can improve the greenness of new products and raise the price because customers are willing to pay extra for greener products. However, we notice that the upper threshold value

E2 may weaken the expansion effect of customer preference for green products.

5.3. Number of Strategic Customers

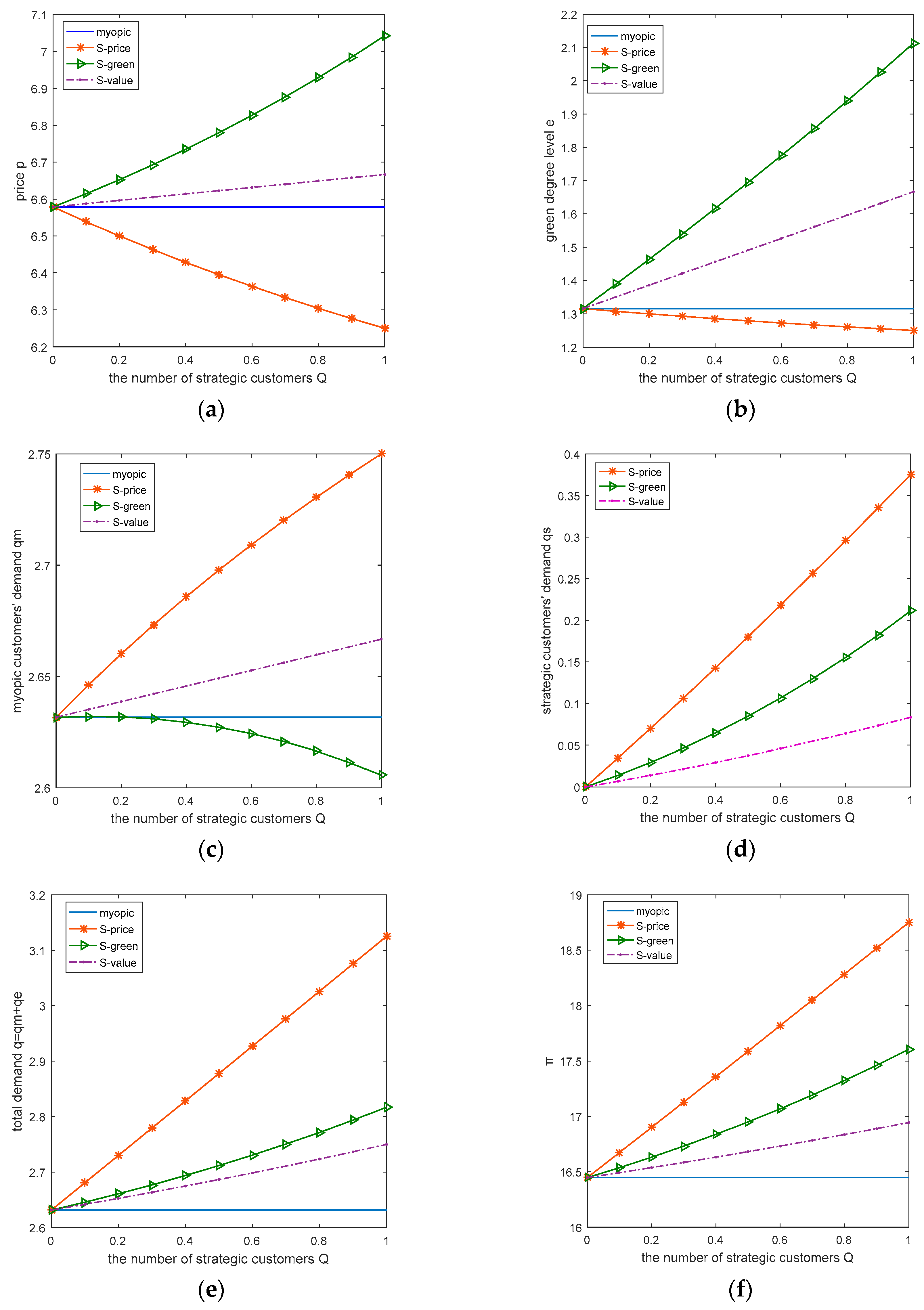

Figure 6 summarizes the impact of the number of strategic customers

Q on optimal decisions in the myopic and heterogeneous strategic customer scenarios, respectively. Specifically, with a consistent increase in the number of strategic customers

Q from 0 to 1, meaning the fraction of strategic customers becomes larger. As shown in

Figure 6a,b, there is a large fraction of strategic customers whose preference is price, which has led to a fall in both prices and greenness. Otherwise, in other cases where strategic customers prefer greenness or the value of the product, the greater the number of strategic customers, the higher the price and greenness. However, we may find an interesting phenomenon in

Figure 6c, where strategic customer preference for greenness will decrease the number of myopic customers. Because strategic customers pursue greener products, they are willing to pay extra, but expensive products decrease the demand from myopic customers. In

Figure 6d–f, we notice that strategic customers can increase demand and the profit of the seller. In this way, customers whose preference is price is optimized for the most strategic cases.

6. Conclusions

Sustainability is an important issue in supply chain management, and many manufacturers introduce green products to meet customer demand and persuade customers to buy early. Before deciding to buy, strategic consumers may choose to delay their purchase decisions, hoping for bargains. In particular, price reductions, which enterprises usually adopt, may results in customers becoming more and more strategic and patient. This paper investigates the decision-making of a manufacturer when customers are strategic and heterogeneous. It is demonstrated that considering strategic customers can improve the profit of the low-carbon supply chain. First, in the price threshold scenario, the firm is willing to set a low selling price to attract more strategic customers, but the greenness is lower than in the myopic scenario. Second, in the greenness threshold scenario, we find that price and greenness are higher than in the other three cases. That is, customers who prefer high greenness are willing to pay extra for greener products and share the extra cost of green products produced by enterprises. The stronger the desire for green, the more obvious the positive effect of greenness is. Third, in the value threshold scenario, enterprises decision making is influenced by both price and greenness. Last but not least, we notice that strategic customer special preference characteristics can affect the optimal equilibrium, and taking into account strategic customers can improve the profit of the low-carbon supply chain. Furthermore, as the number of strategic customers increases, selling price and greenness will experience downward trends in the price threshold scenario but upward trends in the greenness and value threshold scenarios.

In this case, the firm can change its position from being passive to actively influencing customer behavior. Market conditions and customer preferences affect product sales and the firm’s profits. So, it is important to promote selling activities for customer preferences. At the same time, the government should increase subsidies and provide many preferential policies for enterprises, and enhance customer awareness of environmental protection to promote the purchasing of more green products. Enterprises need to fully consider the heterogeneous preferences of strategic customers, take steps to weaken sensitivity to price, and attract more strategic customers. Thus, it is conducive to promoting enterprises to achieve ideal business results and sustainable management, meet the needs of strategic customers, and open up potential customer markets.

This study has some limitations, and there are other directions that require investigation. First, we studied how strategic customer special preference characteristics affect the prices set by manufacturers in the presence of strategic consumers, which is a two-way game played between manufacturers and consumers. In fact, the role of the government in sustainable supply chains cannot be ignored. The government can subsidize either consumers or manufacturers, which will also affect the pricing decisions of enterprises [

40] (Nielsen et al., 2019). Second, we use the consumer purchase threshold as the basis to judge whether consumers buy or not, so as to obtain the demand of consumers. In practice, the possible arrival time of consumers is random, and the cost brought by distance will reduce the utility level of consumers, and this affects their purchase decision making. The phenomenon that distance and time costs affect decision-making is very significant in port transportation problems.

Therefore, this study can be extended in several directions. First, the realization of sustainable development is the joint goal of many parties. In the future we will extend our research into how government subsidy policy affects manufacturers’ pricing decisions, and the mechanism influencing the sustainable supply chain when consumers are heterogeneous. Second, we will extend this study to liner shipping and the port interface to analyze the optimal pricing schemes applied in the port transportation problem [

41] (Wang et al., 2018). On the one hand, we will study the pricing schemes of collaborative port and shipping according to the congestion effect [

42] (Iris et al., 2018). Therefore, how to realize coordination and cooperation between port and shipping becomes a potential future research direction. On the other hand, this is the loading problem under flexible management [

43] (Venturini et al., 2017). From the perspective of the port network, we will study how to make pricing decisions to maximize profits and optimize environmental protection.