Impact of Political Connection Strength on the Internationalization Outcome of Chinese Firms: Perspectives from Market Exploration and Technology Acquisition

Abstract

1. Introduction

2. Theory and Hypotheses

2.1. Political Connection and International Market Exploration

2.2. Political Connection and Technology Acquisition

3. Data and Method

3.1. Data

3.2. Dependent Variables

3.3. Independent Variables

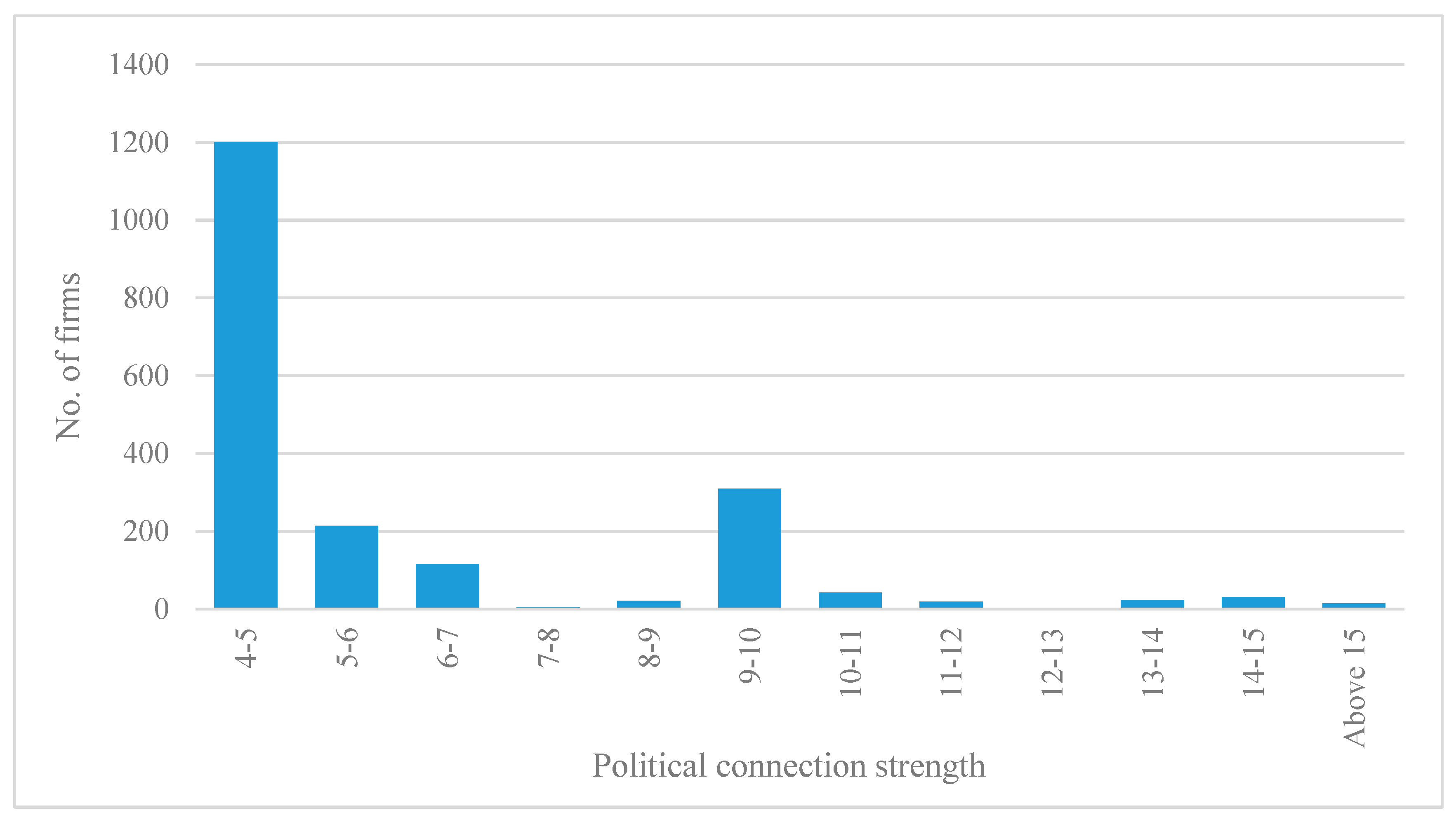

3.3.1. Measuring the Political Connection Strength

3.3.2. Representation of Firms’ Internationalization Activity

3.4. Control Variables

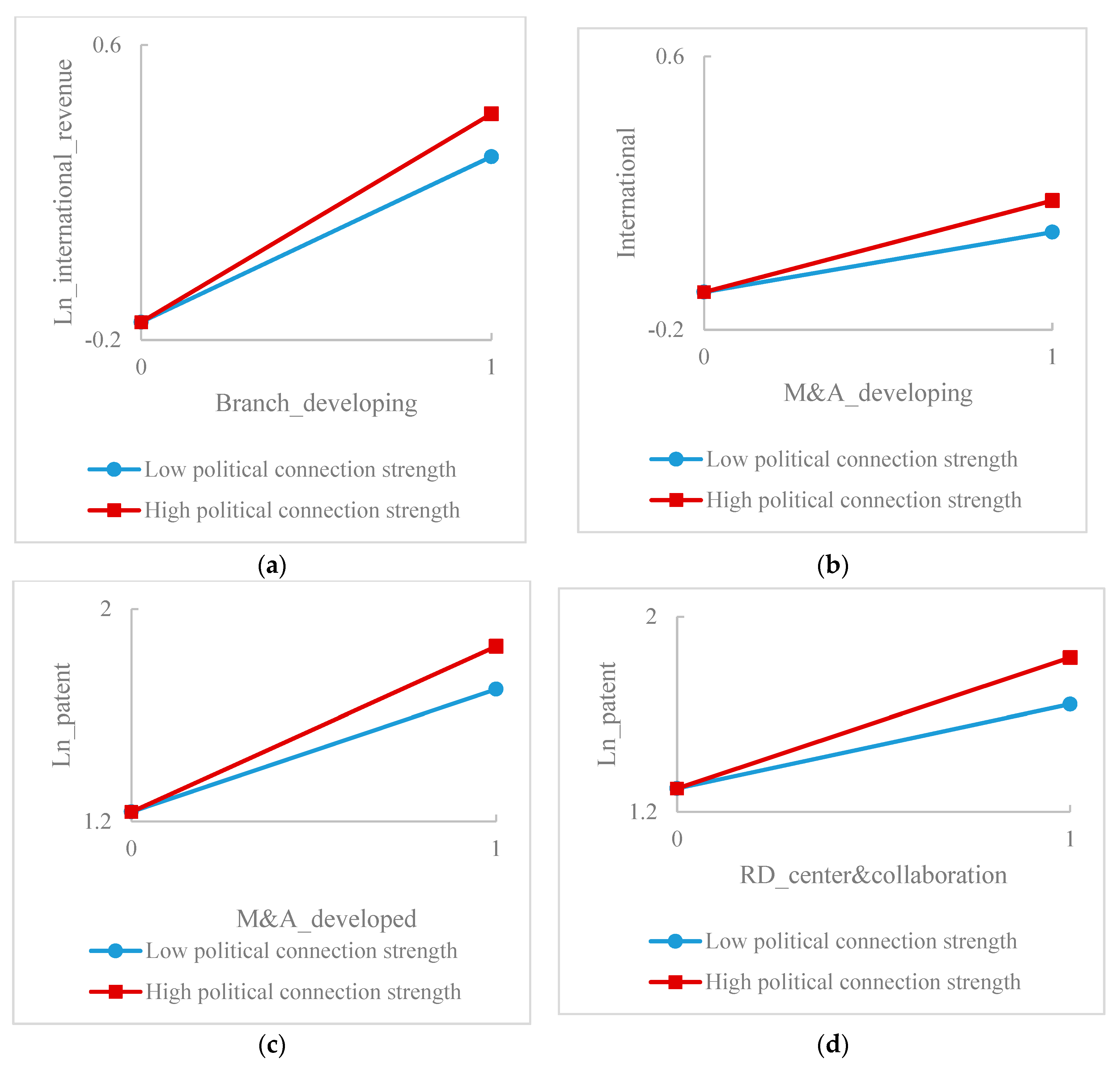

4. Empirical Results

5. Discussion

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Luo, Y.D.; Tung, R.L. International expansion of emerging market enterprises: A springboard perspective. J. Int. Bus. Stud. 2007, 38, 481–498. [Google Scholar] [CrossRef]

- Tan, H.; Mathews, J.A. Accelerated internationalization and resource leverage strategizing: The case of Chinese wind turbine manufacturers. J. World Bus. 2015, 50, 417–427. [Google Scholar] [CrossRef]

- Zhang, J.; Tan, J.; Wong, P.K. When does investment in political ties improve firm performance? The contingent effect of innovation activities. Asia Pac. J. Manag. 2015, 32, 363–387. [Google Scholar] [CrossRef]

- Luo, Y.D.; Xue, Q.Z.; Han, B.J. How emerging market governments promote outward FDI: Experience from China. J. World Bus. 2010, 45, 68–79. [Google Scholar] [CrossRef]

- Luo, Y.; Zhang, H. Emerging market MNEs: Qualitative review and theoretical directions. J. Int. Manag. 2016, 22, 333–350. [Google Scholar] [CrossRef]

- Ramasamy, B.; Yeung, M.; Laforet, S. China’s outward foreign direct investment: Location choice and firm ownership. J. World Bus. 2012, 47, 17–25. [Google Scholar] [CrossRef]

- Alon, I.; Anderson, J.; Munim, Z.H.; Ho, A. A review of the internationalization of Chinese enterprises. Asia Pac. J. Manag. 2018, 35, 573–605. [Google Scholar] [CrossRef]

- Guillén, M.F.; García-Canal, E. The American model of the multinational firm and the new multinationals from emerging economies. Acad. Manag. Perspect. 2009, 23, 23–35. [Google Scholar] [CrossRef]

- Ramamurti, R. Competing with emerging market multinationals. Bus. Horiz. 2012, 55, 241–249. [Google Scholar] [CrossRef]

- Buckley, P.J.; Clegg, L.J.; Cross, A.R.; Liu, X.; Voss, H.; Zheng, P. The determinants of Chinese outward foreign direct investment. J. Int. Bus. Stud. 2007, 38, 499–518. [Google Scholar] [CrossRef]

- Deng, P. Why do Chinese firms tend to acquire strategic assets in international expansion? J. World Bus. 2009, 44, 74–84. [Google Scholar] [CrossRef]

- Petricevic, O.; Teece, D.J. The structural reshaping of globalization: Implications for strategic sectors, profiting from innovation, and the multinational enterprise. J. Int. Bus. Stud. 2019, 50, 1487–1512. [Google Scholar] [CrossRef]

- Deng, P. Outward investment by Chinese MNEs: Motivations and implications. Bus. Horiz. 2004, 47, 8–16. [Google Scholar] [CrossRef]

- Li, F.R.; Ding, D.Z. The effect of institutional isomorphic pressure on the internationalization of firms in an emerging economy: Evidence from China. Asia Pac. Bus. Rev. 2013, 19, 506–525. [Google Scholar] [CrossRef]

- Du, M.; Baoteng, A. State ownership, institutional effects and value creation in cross-border mergers & acquisitions by Chinese firms. Int. Bus. Rev. 2015, 24, 430–442. [Google Scholar]

- Angulo-Ruiz, F.; Pergelova, A.; Wei, W.X. How does home government influence the internationalization of emerging market firms? The mediating role of strategic intents to internationalize. Int. J. Emerg. Mark. 2018, 14, 187–206. [Google Scholar] [CrossRef]

- Minin, A.D.; Zhang, J.Y.; Gammeltoft, P. Chinese foreign direct investment in R&D in Europe: A new model of R&D internationalization? Eur. Manag. J. 2012, 30, 189–203. [Google Scholar]

- Hitt, M.A.; Xu, K. The Transformation of China: Effects of the institutional environment on business actions. Long Range Plan. 2016, 49, 589–593. [Google Scholar] [CrossRef]

- Wu, W.F.; Wu, C.F.; Zhou, C.Y.; Wu, J. Political connections, tax benefits and firm performance: Evidence from China. J. Account. Public Policy 2012, 31, 277–300. [Google Scholar] [CrossRef]

- Zhang, H.M.; Li, L.S.; Zhou, D.Q.; Zhou, P. Political connections, government subsidies and firm financial performance: Evidence from renewable energy manufacturing in China. Renew. Energy 2014, 63, 330–336. [Google Scholar] [CrossRef]

- Mathews, J.A. Dragon Multinationals: A New Model of Global Growth; Oxford University Press: New York, NY, USA, 2002. [Google Scholar]

- Mathews, J.A. Dragon multinationals powered by linkage, leverage and learning: A review and development. Asia Pac. J. Manag. 2017, 34, 769–775. [Google Scholar] [CrossRef]

- Aulakh, P.S. Emerging multinationals from developing economies: Motivations, paths and performance. J. Int. Manag. 2007, 13, 235–240. [Google Scholar] [CrossRef]

- Zeng, R.; Zeng, S.; Xie, X.; Tam, C.; Wan, T. What motivates firms from emerging economies to go internationalization? Technol. Econ. Dev. Econ. 2012, 18, 280–298. [Google Scholar] [CrossRef]

- Ramamurti, R. Internationalization and innovation in emerging markets. Strateg. Manag. J. 2016, 37, E74–E83. [Google Scholar] [CrossRef]

- Zhang, X.; Ma, X.; Wang, Y.; Li, X.; Huo, D. What drives the internationalization of Chinese SMEs? The joint effects of international entrepreneurship characteristics, network ties, and firm ownership. Int. Bus. Rev. 2016, 25, 522–534. [Google Scholar] [CrossRef]

- Wu, B.Z. Political connections and entrepreneurial investment: Evidence from China’s transition economy. J. Bus. Ventur. 2013, 28, 299–315. [Google Scholar]

- Lu, J.; Liu, X.; Filatotchev, I.; Wright, M. The impact of domestic diversification and top management teams on the international diversification of Chinese firms. Int. Bus. Rev. 2014, 23, 455–467. [Google Scholar] [CrossRef]

- Ma, X.F.; Ding, Z.J.; Lin, Y. Subnational institutions, political capital, and the internationalization of entrepreneurial firms in emerging economies. J. World Bus. 2016, 51, 843–854. [Google Scholar] [CrossRef]

- Wu, J.; Wang, C.; Hong, J.; Piperopoulos, P.; Zhuo, S. Internationalization and innovation performance of emerging market enterprises: The role of host-country institutional development. J. World Bus. 2016, 51, 251–263. [Google Scholar] [CrossRef]

- Dunning, J. The eclectic paradigm of international production: A statement and some possible extensions. J. Int. Bus. Stud. 1988, 19, 1–31. [Google Scholar] [CrossRef]

- Lin, C.; Klaus, E.M.; Helen, W.H. What drives firms’ intent to seek strategic assets by foreign direct investment? A study of emerging economy firms. J. World Bus. 2014, 49, 488–501. [Google Scholar]

- Faccio, M. Politically connected firms. Am. Econ. Rev. 2006, 96, 369–386. [Google Scholar] [CrossRef]

- Wu, J. Asymmetric roles of business ties and political ties in product innovation. J. Bus. Res. 2011, 64, 1151–1156. [Google Scholar] [CrossRef]

- Hou, Q.; Hu, M.; Yuan, Y. Corporate innovation and political connections in Chinese listed firms. Pac. Basin Financ. J. 2017, 46, 158–176. [Google Scholar] [CrossRef]

- Guo, D.; Guo, Y.; Jiang, K. Government-subsidized R&D and firm innovation: Evidence from China. Res. Policy 2016, 45, 1129–1144. [Google Scholar]

- Song, M.; Ai, H.; Li, X. Political connections, financing constraints, and the optimization of innovation efficiency among China’s private enterprises. Technol. Forecast. Soc. Chang. 2015, 92, 290–299. [Google Scholar] [CrossRef]

- Hong, J.; Wang, C.; Kafouros, M. The role of the state in explaining the internationalization of emerging market enterprises. Br. J. Manag. 2015, 26, 45–62. [Google Scholar] [CrossRef]

- Peng, M.W.; Wang, D.Y.L.; Jiang, Y. An institution-based view of international business strategy: A focus on emerging economies. J. Int. Bus. Stud. 2008, 39, 920–936. [Google Scholar] [CrossRef]

- Lu, J.; Liu, X.; Wang, H. Motives for outward FDI of Chinese private firms: Firm resources, industry dynamics, and government policies. Manag. Organ. Rev. 2011, 7, 223–248. [Google Scholar] [CrossRef]

- Child, J.; Rodrigues, S.B. The internationalization of Chinese firms: A case for theoretical extension? Manag. Organ. Rev. 2005, 1, 381–410. [Google Scholar] [CrossRef]

- Tung, R.L. Opportunities and challenges ahead of China’s new normal. Long Range Plan. 2016, 49, 632–640. [Google Scholar] [CrossRef]

- Cheng, J.L.C.; Yiu, D. China Business at a Crossroads: Institutions, Innovation, and International Competitiveness. Long Range Plan. 2016, 49, 584–588. [Google Scholar] [CrossRef]

- Rugman, A.M.; Nguyen, Q.T.K.; Wei, Z. Rethinking the literature on the performance of Chinese multinational enterprises. Manag. Organ. Rev. 2016, 12, 269–302. [Google Scholar] [CrossRef]

- O’Connor, S. How Chinese Companies Facilitate Technology Transfer from the United States. Available online: http://www.defense-aerospace.com/articles-view/release/3/202365/report-details-how-chinese-companies-steal-us-technology.html (accessed on 12 October 2019).

- Yu, F.F.; Guo, Y.; Le-Nguyen, K.; Barnes, S.J.; Zhang, W.T. The impact of government subsidies and enterprises’ R&D investment: A panel data study from renewable energy in China. Energy Policy 2016, 89, 106–113. [Google Scholar]

- Li, F.R.; Ding, D.Z.; Oh, C.H. The dual effects of home country institutions on the internationalization of private firms in emerging markets: Evidence from China. Multinatl. Bus. Rev. 2017, 25, 128–149. [Google Scholar] [CrossRef]

- Wang, C.; Hong, J.; Kafouros, M.; Boateng, A. What drives outward FDI of Chinese firms? Testing the explanatory power of three theoretical frameworks. Int. Bus. Rev. 2012, 21, 425–438. [Google Scholar] [CrossRef]

- Wang, Y.B.; Li, J.Z.; Furman, J.L. Firm performance and state innovation funding: Evidence from China’s Innofund program. Res. Policy 2017, 46, 1142–1161. [Google Scholar] [CrossRef]

- Buckley, P.; Cross, A.R.; Tan, H.; Voss, H.; Liu, X. Historic and emergent trends in Chinese outward direct investment. Manag. Int. Rev. 2008, 48, 715–748. [Google Scholar] [CrossRef]

- Errunza, V.R.; Senbet, L.W. The Effects of international operations on the market value of the firm: Theory and evidence. J. Financ. 1984, 36, 401–417. [Google Scholar] [CrossRef]

- Capar, N.; Kotabe, M. The relationship between international diversification and performance in service firms. J. Int. Bus. Stud. 2003, 34, 345–355. [Google Scholar] [CrossRef]

- Jeong, I. A cross-national study of the relationship between international diversification and new product performance. Int. Mark. Rev. 2003, 20, 353–376. [Google Scholar] [CrossRef]

- Griliches, Z. Patent statistics as economic indicators: A survey. J. Econ. Lit. 1990, 28, 1661–1707. [Google Scholar]

- Arnoldi, J.; Villadsen, A.R. Political ties of listed Chinese companies, performance effects, and moderating institutional factors. Manag. Organ. Rev. 2015, 11, 217–236. [Google Scholar] [CrossRef]

- Fisman, R.; Wang, Y. The mortality cost of political connections. Rev. Econ. Stud. 2015, 82, 1346–1382. [Google Scholar] [CrossRef]

- Huang, P. The verticality of policy mixes for sustainability transitions: A case study of solar water heating in China. Res. Policy 2019, 48, 103–758. [Google Scholar] [CrossRef]

- Armstrong, S.J.; Overton, T. Estimating non-response bias in mail surveys. J. Mark. Res. 1977, 14, 396–402. [Google Scholar] [CrossRef]

- Sambharya, R.B. The combined effect of international diversification and product diversification strategies on the performance of U.S.-based multinational corporations. Manag. Int. Rev.

- Gomes, L.; Ramaswamy, K. An empirical examination of the form of the relationship between multinationality and performance. J. Int. Bus. Stud. 1999, 30, 173–188. [Google Scholar] [CrossRef]

- El ghoul, S.; Guedhami, O.; Kim, Y. Country level institutions, firm value, and the role of corporate social responsibility initiatives. J. Int. Bus. Stud. 2017, 48, 360–385. [Google Scholar] [CrossRef]

- Li, J.; Zhang, Y.; Hu, Y.H.; Tao, X.L. Developed market or developing market? A perspective of institutional theory on multinational enterprises’ diversification and sustainable development with environmental protection. Bus. Strategy Environ. 2018, 27, 858–871. [Google Scholar] [CrossRef]

- Beule, F.D.; Elia, S.; Piscitello, L. Entry and access to competencies abroad: Emerging market firms versus advanced market firms. J. Int. Manag. 2014, 20, 137–152. [Google Scholar] [CrossRef]

- Bhanji, Z.; Oxley, J.E. Overcoming the dual liability of foreignness and privateness in international corporate citizenship partnerships. J. Int. Bus. Stud. 2013, 44, 290–311. [Google Scholar] [CrossRef]

- Gruca, T.S.; Rego, L.L. Customer satisfaction, cash flow, and shareholder value. J. Mark. 2005, 69, 115–130. [Google Scholar] [CrossRef]

- Luo, X.; Bhattacharya, C.B. Corporate social responsibility, customer satisfaction, and market value. J. Mark. 2006, 70, 1–18. [Google Scholar] [CrossRef]

- Gaur, A.S.; Kumar, V.; Singh, D. Institutions, resources, and internationalization of emerging economy firms Website address. J. World Bus. 2014, 49, 12–20. [Google Scholar] [CrossRef]

- Peng, M.W. The global strategy of emerging multinationals from China. Glob. Strategy J. 2012, 2, 97–107. [Google Scholar] [CrossRef]

- Li, J.; Oh, C.H. Research on emerging-market multinational enterprises: Extending Alan Rugman’s critical contributions. Int. Bus. Rev. 2016, 25, 776–784. [Google Scholar] [CrossRef]

- Gammeltoft, P.; Filatotchev, I.; Hobdari, B. Emerging multinational companies and strategic fit: A contingency framework and future research agenda. Eur. Manag. J. 2012, 30, 175–188. [Google Scholar] [CrossRef]

- Yu, S.; Qian, X.W.; Liu, T.X. Belt and road initiative and Chinese firms’ outward foreign direct investment. Emerg. Mark. Rev. 2019, 41, 100629. [Google Scholar] [CrossRef]

- Windsor, D. Tightening corporate governance. J. Int. Manag. 2009, 15, 306–316. [Google Scholar] [CrossRef]

- Wu, J.; Chen, X. Home country institutional environments and foreign expansion of emerging market firms. Int. Bus. Rev. 2014, 23, 862–872. [Google Scholar] [CrossRef]

| Items | Mean | Std. Dev. | KMO a and Bartlett’s Test | ||

|---|---|---|---|---|---|

| Congress representative (Board chairperson) | 1. Representative of the National Congress of the Communist Party of China (NCCPC) | 4.61 | 3.65 | 0.96 | KMO = 0.86 457.08 df = 10 Sig. = 0.00 |

| 2. Deputy to the National People’s Congress (NPC) | 4.26 | 3.43 | |||

| 3. Member of the National Committee of the Chinese People’s Political Consultative Conference (CPPCC) | 4.16 | 3.43 | |||

| 4. Deputy to the Provincial People’s Congress | 5.02 | 3.26 | |||

| 5. Member of the Provincial Committee of the Chinese People’s Political Consultative Conference | 4.40 | 3.16 | |||

| Government position (Board chairperson) | 6. Provincial-ministerial level officer | 6.00 | 3.92 | 0.94 | KMO = 0.69 245.01 df = 3 Sig. = 0.00 |

| 7. Bureau-director level officer | 5.16 | 3.87 | |||

| 8.Division-head level officer | 4.47 | 3.51 | |||

| Congress representative (General manager) | 9. Representative of the National Congress of the Communist Party of China (NCCPC) | 4.72 | 3.61 | 0.98 | KMO = 0.80 626.39 df = 10 Sig. = 0.00 |

| 10. Deputy to the National People’s Congress (NPC) | 4.72 | 3.35 | |||

| 11. Member of the National Committee of the Chinese People’s Political Consultative Conference (CPPCC) | 4.67 | 3.34 | |||

| 12. Deputy to the Provincial People’s Congress | 4.28 | 3.20 | |||

| 13. Member of the Provincial Committee of the Chinese People’s Political Consultative Conference | 4.05 | 3.17 | |||

| Government position (General manager) | 14. Provincial-ministerial level officer | 5.35 | 3.61 | 0.68 | KMO = 0.68 259.12 df = 3 Sig. = 0.00 |

| 15. Bureau-director level officer | 4.93 | 3.53 | |||

| 16. Division-head level officer | 4.75 | 3.38 | |||

| Firm ownership | 17. Central firm | 6.65 | 3.90 | 0.61 | KMO = 0.57 138.99 df = 3 Sig. = 0.00 |

| 18. State-owned firm | 5.14 | 3.55 | |||

| 19. Private firm | 4.88 | 3.09 |

| Variables | Mean | Standard Deviation | Min. | Max. | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. | 18.72 | 2.28 | 7.49 | 25.19 | |||||||||||||||

| 2. | 2.53 | 1.73 | 0 | 9.22 | 0.20 | ||||||||||||||

| 3. | 2008.40 | 6.98 | 1990 | 2018 | −0.28 | −0.01 | |||||||||||||

| 4. | 0.77 | 0.42 | 0 | 1 | 0.03 | −0.02 | 0.22 | ||||||||||||

| 5. | 0.15 | 0.35 | 0 | 1 | 0.00 | 0.03 | −0.16 | −0.77 | |||||||||||

| 6. | 7.61 | 1.22 | 3.00 | 12.59 | 0.56 | 0.33 | −0.46 | −0.11 | 0.08 | ||||||||||

| 7. | 21.73 | 1.36 | 17.88 | 27.96 | 0.52 | 0.27 | −0.56 | −0.14 | 0.09 | 0.83 | |||||||||

| 8. | 5.89 | 1.27 | 1.10 | 12.23 | 0.44 | 0.35 | −0.36 | −0.05 | 0.05 | 0.79 | 0.70 | ||||||||

| 9. | 17.73 | 1.37 | 9.31 | 23.27 | 0.45 | 0.43 | −0.28 | 0.00 | 0.02 | 0.68 | 0.70 | 0.74 | |||||||

| 10. | 1.94 | 5.86 | 0 | 26.23 | 0.19 | 0.03 | −0.07 | 0.02 | −0.02 | 0.15 | 0.21 | 0.14 | 0.15 | ||||||

| 11. | 0.24 | 0.42 | 0 | 1 | 0.18 | 0.04 | −0.02 | 0.08 | −0.07 | 0.06 | 0.09 | 0.10 | 0.13 | 0.14 | |||||

| 12. | 0.08 | 0.28 | 0 | 1 | 0.16 | 0.06 | 0.00 | 0.01 | 0.02 | 0.11 | 0.11 | 0.11 | 0.12 | 0.12 | 0.03 | ||||

| 13. | 0.11 | 0.32 | 0 | 1 | 0.15 | 0.02 | −0.05 | 0.02 | −0.02 | 0.10 | 0.12 | 0.15 | 0.12 | 0.24 | 0.22 | 0.08 | |||

| 14. | 0.02 | 0.13 | 0 | 1 | 0.10 | 0.02 | −0.03 | −0.02 | 0.02 | 0.07 | 0.10 | 0.06 | 0.07 | 0.09 | 0.03 | 0.15 | 0.03 | ||

| 15. | 0.13 | 0.33 | 0 | 1 | 0.10 | 0.10 | −0.03 | 0.00 | 0.00 | 0.12 | 0.13 | 0.15 | 0.17 | 0.12 | 0.12 | 0.10 | 0.20 | 0.04 | |

| 16. | 1.79 | 0.32 | 1.58 | 3.13 | 0.12 | 0.13 | −0.19 | −0.16 | 0.13 | 0.24 | 0.29 | 0.21 | 0.18 | 0.02 | −0.02 | 0.05 | −0.02 | 0.01 | 0.08 |

| Dependent Variable | |||||||

|---|---|---|---|---|---|---|---|

| Model 1 RE a | Model 2 RE | Model 3 RE | Model 4 RE | Model 5 RE | Model 6 RE | Model 7 RE | |

| 40.14 *** (13.32) | 39.13 *** (13.16) | 35.64 *** (13.30) | −66.20 *** (10.02) | −66.54 *** (10.03) | −66.60 *** (10.06) | −66.67 *** (10.03) | |

| −0.02 *** (0.01) | −0.02 *** (0.01) | −0.01 ** (0.01) | 0.04 *** (0.005) | 0.04 *** (0.005) | 0.04 *** (0.005) | 0.04 *** (0.005) | |

| 0.87 *** (0.16) | 0.81 *** (0.15) | 0.86 *** (0.16) | 0.01 (0.12) | −0.01 (0.12) | −0.004 (0.12) | 0.001 (0.12) | |

| 0.41 ** (0.18) | 0.40 ** (0.18) | 0.40 ** (0.18) | 0.12 (0.13) | 0.12 (0.14) | 0.12 (0.14) | 0.11 (0.14) | |

| 0.66 *** (0.04) | 0.64 *** (0.04) | 0.65 *** (0.04) | |||||

| 0.32 *** (0.03) | 0.33 *** (0.03) | 0.33 *** (0.03) | |||||

| 0.24 *** (0.03) | 0.25 *** (0.03) | 0.24 *** (0.03) | 0.25 *** (0.03) | ||||

| 0.36 *** (0.02) | 0.36 *** (0.02) | 0.36 *** (0.02) | 0.36 *** (0.02) | ||||

| −0.003 (0.01) | 0.01 (0.01) | ||||||

| 0.76 * (0.47) | |||||||

| Reference: No international branch during 2013–2016 | |||||||

| 1.10 ** (0.51) | −0.07 (0.39) | ||||||

| 1.16 (0.77) | −0.32 (0.60) | ||||||

| Reference: No international M&A during 2013–2016 | |||||||

| 1.22 * (0.73) | 0.94 * (0.57) | ||||||

| 0.51 (1.78) | −1.80 (1.35) | ||||||

| 0.01 (0.01) | −0.01 (0.01) | ||||||

| 0.52 * (0.30) | |||||||

| −0.22 (0.28) | 0.03 (0.22) | ||||||

| 0.41 *** (0.11) | 0.21 (0.32) | ||||||

| −0.34 (0.41) | 0.44 ** (0.21) | ||||||

| 0.33 ** (0.15) | 0.95 (0.74) | ||||||

| Number of observations | 6092 | 6092 | 6092 | 6030 | 6030 | 6030 | 6030 |

| Number of groups | 1996 | 1996 | 1996 | 1969 | 1969 | 1969 | 1969 |

| Wald chi-squared | 1587.05 | 1692.93 | 1610.43 | 626.93 | 618.55 | 617.23 | 624.71 |

| Prob > chi-squared | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| R2 | 0.35 | 0.37 | 0.36 | 0.21 | 0.20 | 0.20 | 0.21 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, G.; Zhang, Q.; Huang, D. Impact of Political Connection Strength on the Internationalization Outcome of Chinese Firms: Perspectives from Market Exploration and Technology Acquisition. Sustainability 2020, 12, 1617. https://doi.org/10.3390/su12041617

Zhang G, Zhang Q, Huang D. Impact of Political Connection Strength on the Internationalization Outcome of Chinese Firms: Perspectives from Market Exploration and Technology Acquisition. Sustainability. 2020; 12(4):1617. https://doi.org/10.3390/su12041617

Chicago/Turabian StyleZhang, Gupeng, Qianlong Zhang, and Dujuan Huang. 2020. "Impact of Political Connection Strength on the Internationalization Outcome of Chinese Firms: Perspectives from Market Exploration and Technology Acquisition" Sustainability 12, no. 4: 1617. https://doi.org/10.3390/su12041617

APA StyleZhang, G., Zhang, Q., & Huang, D. (2020). Impact of Political Connection Strength on the Internationalization Outcome of Chinese Firms: Perspectives from Market Exploration and Technology Acquisition. Sustainability, 12(4), 1617. https://doi.org/10.3390/su12041617