3.1. Basic Model Settings

In this model, the consumer demand is positively affected by the greenness of products produced by the manufacturer which we define as a quantifiable, measurable attribute. Swami and Shah (2012) refer to this phenomenon as the demand expansion effect of greening efforts. Consumers are more inclined to buy appliances with lower energy consumption levels and vehicles with higher fuel efficiency, which are examples of product greening improvements that have contributed to increased demand.

This paper considers the single choice decision-making process of product greenness, assuming that

is the total market demand faced by enterprises, and

is the price of green products. Further,

is defined as the greening level of the product and is assumed to be continuous; both positive and negative values of

are acceptable. In addition,

and

are consumers’ green-sensitivity and price sensitivity coefficients, respectively. We assume that market demand is linearly decreasing in price and increasing in the ‘greening level of products’. Linear demand models are often used in research because of their processability, and can draw interesting conclusions about model parameters. Therefore, market demand for products is as follows:

where

and

.

The above expression reflects the phenomenon of increasing consumer demand caused by product greenness. The cost per unit of products produced by an enterprise is , in which constant is the production cost per unit of a product when the level of greening is 0 and is the greening cost per unit, showing that the unit cost to the enterprise increases with the greenness of products. Product costs decrease if is less than 0, and product costs increase otherwise.

Enterprises must decide the level of greening for their own products. We next analyze decision-making under the influence of consumer demand expansion with and without government carbon emission policies in existence. We also explore the amount of tax or subsidies that should be set by the government alongside carbon emission policies. In this way, we are able to measure the effect of demand expansion and the influence of government policies on business’ decision-making. Based on this, we explore the optimal level of government decision-making.

3.3. Demand Expansion Effect and Carbon Emission Policy Exist Together

We model government policy in a similar way to CAFE standards. In order to further study the existence of government carbon emission policies, we consider penalty and subsidy policies within the scope of government regulations in this model. Therefore, in addition to the previous parameters,

denotes the penalty or subsidy levied per unit in greening standards for products produced by the enterprise. From a practical point of view, we assume

. For simplicity and generality, it is assumed that the environmental standards set by the government is 0 (unless otherwise stated). Thus, the objective function of the firm is:

The index denotes the tax or subsidy. The expression above articulates an interesting phenomenon. The government levies a linear tax for every unit of greening that the enterprise falls short of, which is multiplied by total production quantity . On the contrary, when the greening level of products is higher than normal, the government subsidizes a proportion of the greening difference .

The goal of firms is to determine the greening level of products according to carbon emission policies and production costs so as to maximize the objective function (6). Therefore, decision-making follows this sequence: firstly, the firm determines the level of greening improvement of their products and then realizes demand by setting greening level. By solving this problem, we draw the following conclusions (refer to the

Appendix A for proof):

Proposition 1. The optimal level of greening achieved by the firm is:where . It can be inferred from the above proposition that when the greening cost is higher than the limit denoted by , the greening level of products does not meet the standard set by the government. Note that is increasing in , indicating that with the increase of government taxes, firms struggle to achieve a higher level of greening (). Obviously, in the process of determining the best greening level of products, costs and taxes remain the most prominent challenges faced by firms.

Under the given assumptions, substituting

for Equations (1) and (6) can express market demand and the profit of the firm as follows

Lemma 1. (i) The optimal greening level

and the optimal total output of the firm decreases in greening cost and increases in demand sensitivity to greening ; (ii) the optimal profit of the firm decreases first when then increases in and .

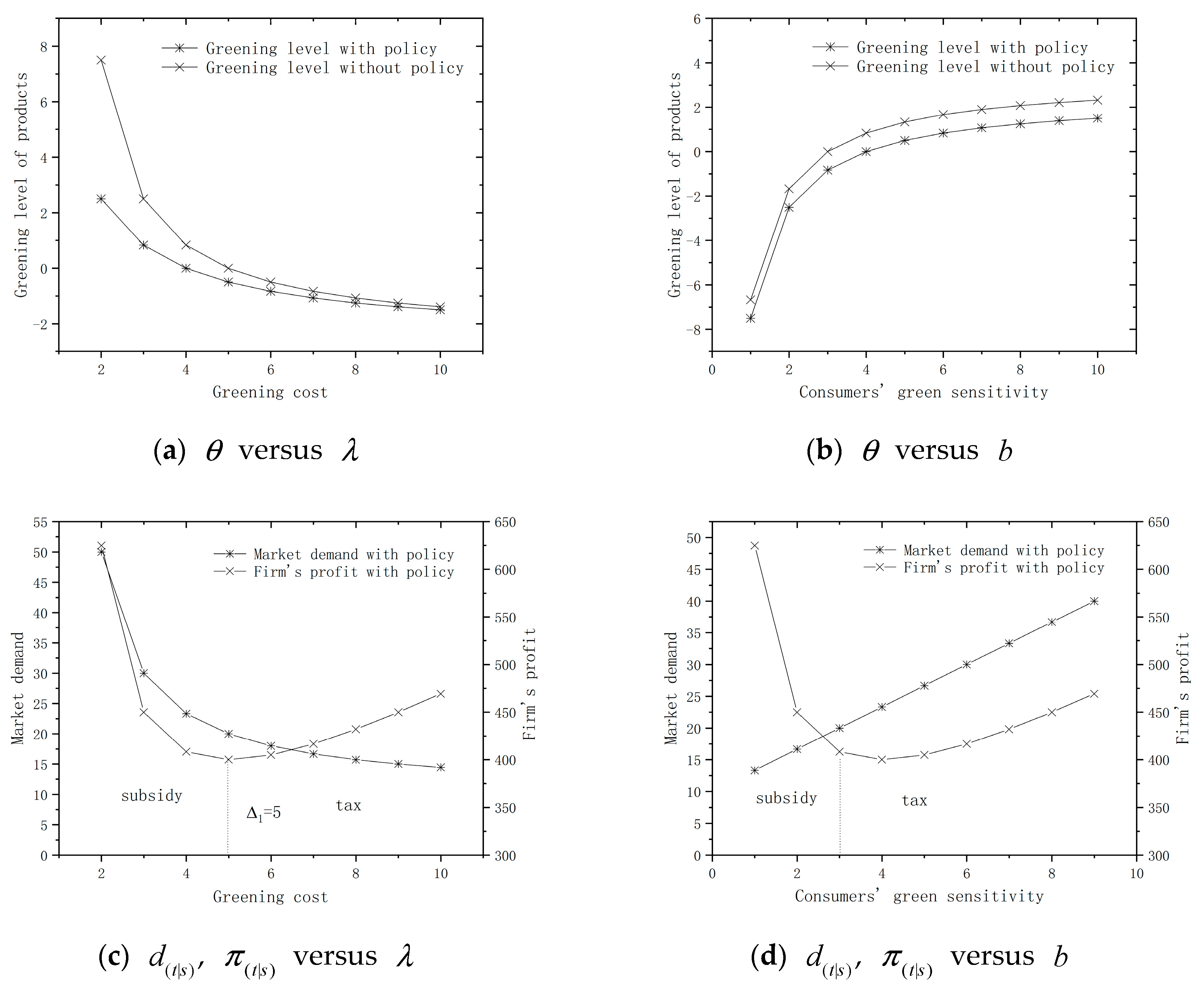

When the cost of greening rises, the firm will take the initiative to reduce the greening level of their products to reduce costs (see

Figure 1a). At the same time, due to the existence of government-guided price, greening level of the product declines, resulting in lower product demand, so the production of the firm is also reduced (see

Figure 1c). When

, that is, when the greening level of the firm’s product is higher than the standard set by the government, the government must subsidize the firm. In this case, with the increase of

, the decrease of revenue and subsidies caused by the decrease of product output is greater than the reduction of cost caused by the decrease of greening level. Therefore, when

, the profit of the firm is decreasing in greening cost; when

, that is, the greening level of the firm’s products is lower than the standard set by the government, the firm must pay tax for their choice. In this case, when

increases, both demand and the greening level of the product will decrease, resulting in a reduction in tax greater than the reduction in profit. Therefore, when

, the profit of the firm increases with the greening cost (see

Figure 1c).

When the green-sensitivity of consumers increases, the firm will strive to improve the greening level of their products to cater to the market (see

Figure 1b). As the greening level of products increases, so too will market demand and product output (see

Figure 1d). When

, that is, the greening level of products is higher than the standard set by the government, the government must subsidize the firm. In this case, with the increase of

b, greater profit and subsidies for higher output outweighs the associated increase in greening costs. Therefore, profit is positively influenced by the increase in consumers’ green-sensitivity. When

, that is, the greening level of the firms’ products is lower than the standard set by the government, the firm is penalized with taxes. In this case, when

increases, both demand and the greening level of the product will increase, resulting in increased costs greater than the sum of increase of income and reduction of taxes. Therefore, profit is negatively influenced by the increase in consumers’ green-sensitivity (see

Figure 1d).

The analysis above shows the effect of greening costs and consumers’ green-sensitivity to the strategic decisions of the firm. Profitability is deeply affected by the cost of greening. Therefore, the government must help consumers build green awareness so that businesses can benefit from the green market. Whether taxes or subsidies are levied, the aim is to publicize green awareness and encourage consumers to focus on more environmentally friendly products.

Although this analysis proves the influence of greening costs and consumers’ green-sensitivity on business decision-making, it is also of great significance to analyze the role of government policies. In the following section, we assess the enterprise’s optimal outcome in the presence of government policies. This helps to distinguish the impact of government policies on the firm’s decision-making and illustrates the role of government policies in influencing product greening.

3.4. The Impact of Government Policy

In this section, we assess and analyze the optimal outcome for the firm in two situations to analyze the role of government policy, that is, how to implement government policy when demand expansion effect exists. By calculating this, we have obtained the conditions for the government to impose taxes or subsidies on the firm. By analyzing the impact of government policy on consumer surplus and social welfare, we study the influence of government policy in detail and then analyze optimal government policy.

Proposition 2. The greenness of products in the presence of government policy is higher than that in the absence of government policy, that is,

.

Comparing and , we can come to the conclusion above. Government policy (taxes or subsidies) plays a necessary role in forcing manufacturers to offer greener products than when government policy does not exist (notice that is increasing in ). The above analysis identifies that with the increase of , the greening level of products increases. This means that only manufacturers will benefit from green-sensitive markets in the absence of government policy, but additional government policy will result in increased greening levels of products, thereby improving the environment. Therefore, from an environmental perspective, the existence of government policies is necessary. Voluntary measures taken by firms to maximize profits and green conscious consumers needs may promote greening measures, but the existence of government policy can further enhance this.

In the past, government policy has been thoroughly analyzed in associated literature. We next analyze the impact of government policy on consumer surplus and social welfare. Consumer surplus is represented by CS [

27]:

where

is the inverse demand function, expressed by

and

denotes the production output.

Proposition 3. Consumer surplus in the presence of government policy is higher than that in the absence of government policy, that is, .

From the analysis above, although manufacturers may not benefit from government policy, consumer surplus increases after the implementation of government policy. Therefore, leaving aside the environmental perspective, from a consumer perspective, government policy is also necessary.

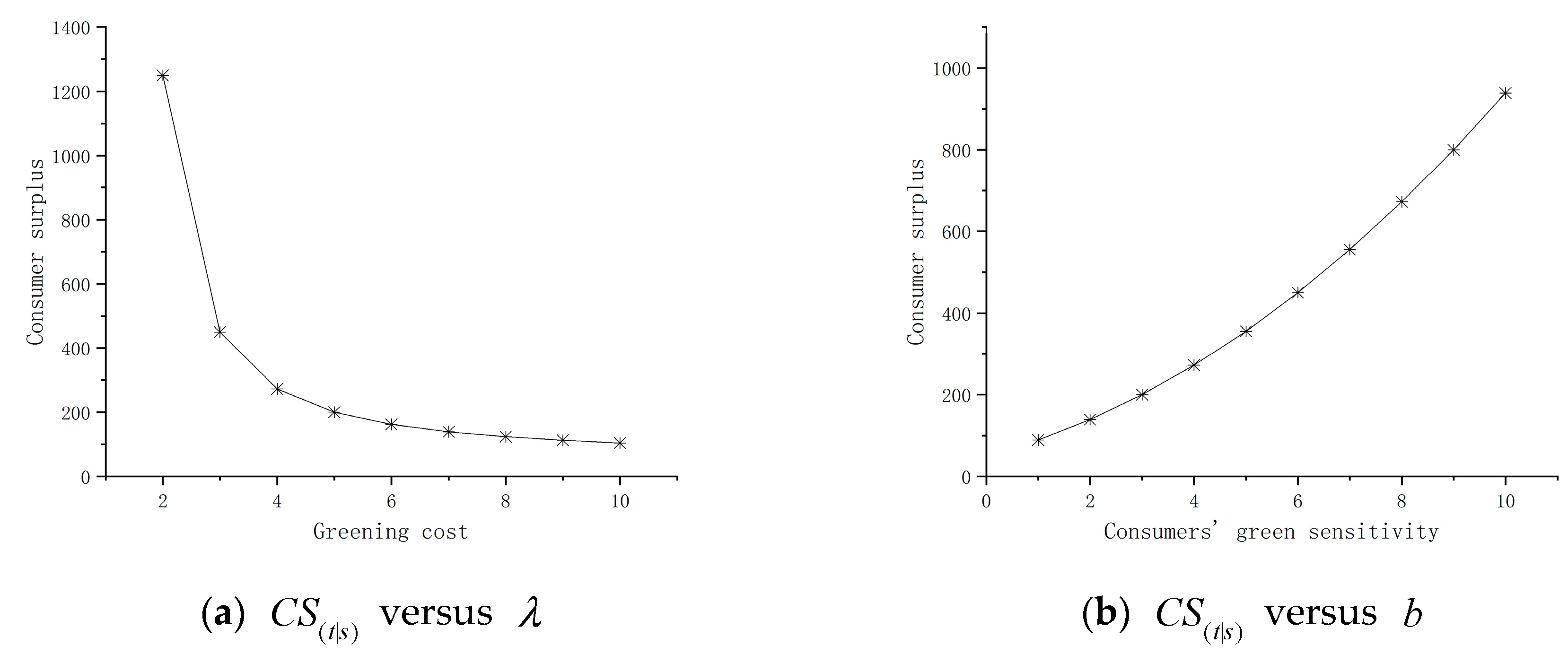

Lemma 2. Consumer surplus

decreases in greening cost and increases in consumers’ green sensitivity .

Figure 2 shows that the increase in greening costs reduces consumer surplus, which poses a major challenge to consumers and the government (see

Figure 2a). However, consumers with higher green-sensitivity can alleviate the impact of cost (see

Figure 2b). Thus, the government is now focusing on fostering consumers’ green awareness. Previous analysis shows that in the green market, the existence of government carbon emission policies enables firms to provide greener products. Although the government can influence strategic decisions by formulating carbon emission policies to improve greening levels, at the same time, the government should also support firms by cultivating green consumer markets.

The government is concerned with the overall maximization of social welfare (SW). Social welfare comes from a comprehensive consideration of profit, consumer surplus, government revenue and environmental externality [

20] expressed as:

where

is environmental damage per unit of greening level for each product produced. It is exogenously determined. We suppose that environmental damage is linear and is a function of the difference in greening levels and production.

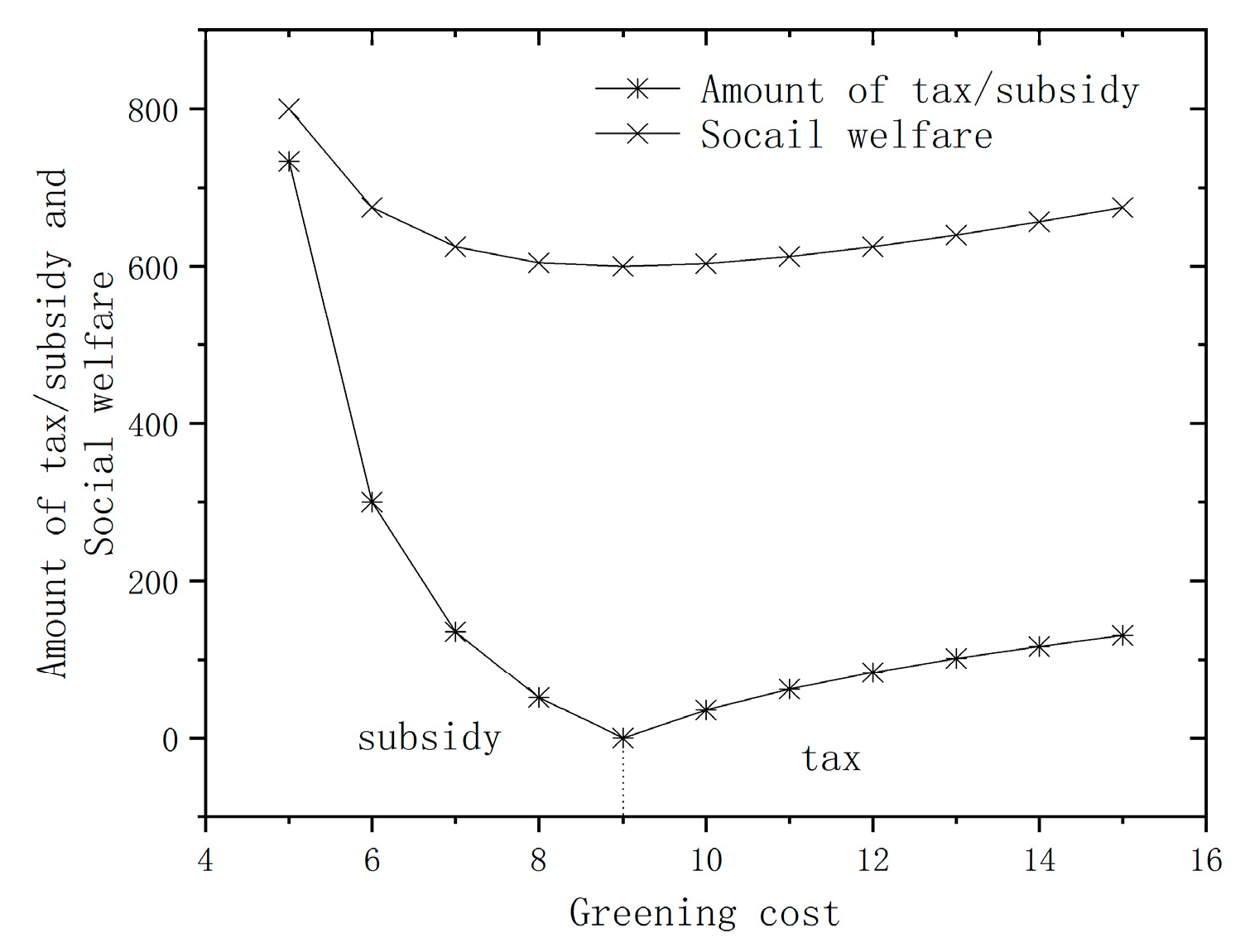

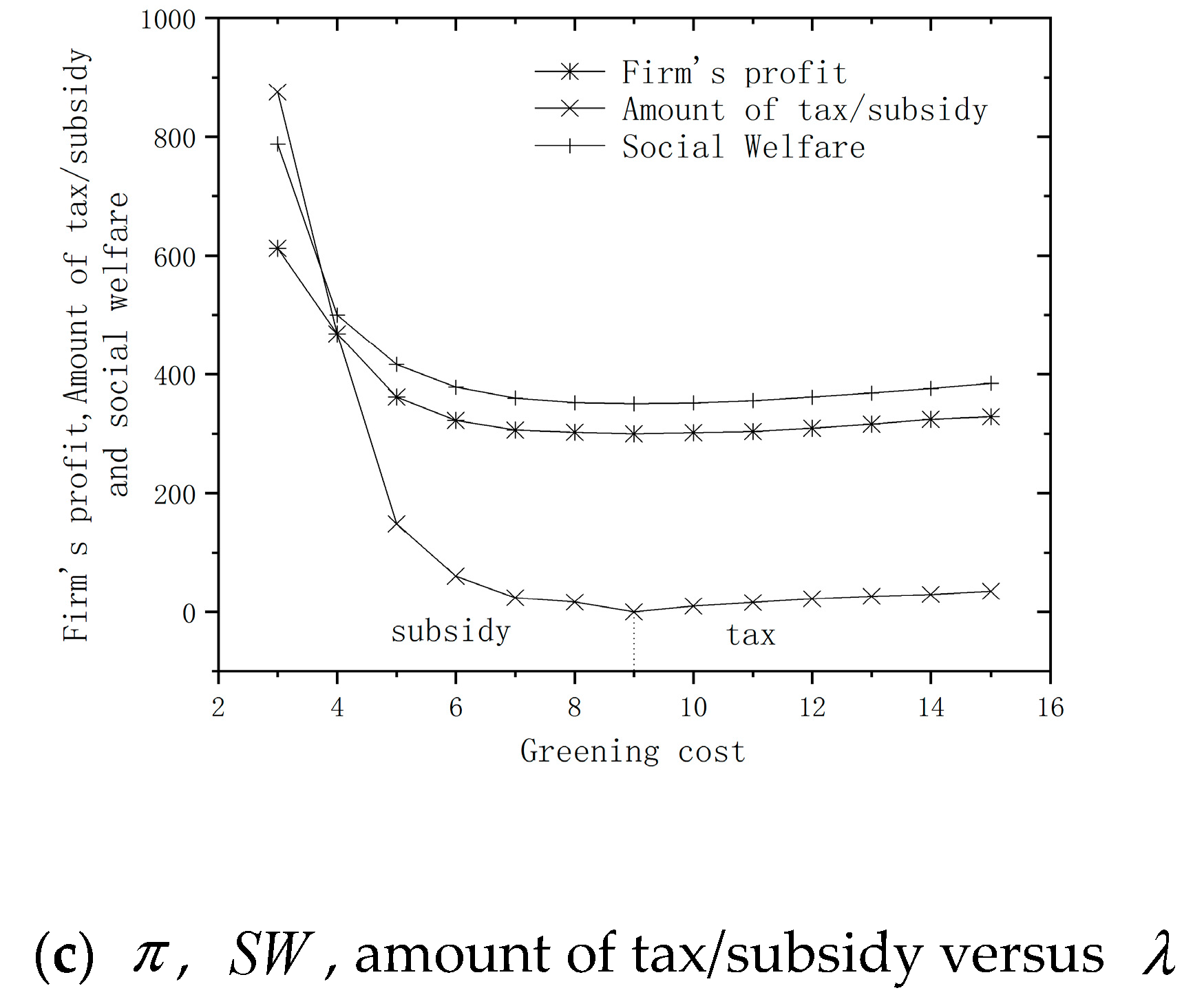

Proposition 4. When , the government adopts a policy of subsidies; when , the government adopts a tax policy.

From Proposition 4, we can see that when the cost of greening

is low, the cost of improving greening levels is also low. The greening level of products is relatively high. The firm has a strong willingness to produce more and higher greening level products. According to Richard Thaler’s nudge theory [

28], the government should subsidize firms that produce green products, and guide and encourage them to meet market demand (see

Figure 3). When the cost of greening

is relatively high, the cost of improving greening levels is also high, so the greening level of products is low and market demand is limited. This creates a problem for the government. Therefore, the government should punish firms by implementing tax policy, warn them and guide them to increase investment in green technology research, carry out technological innovation and strive to reduce greening costs.

Corollary 1. When , the government adopts a subsidy policy; when , the government adopts a tax policy.

This conclusion can be deduced from the condition of Proposition 4. It can be seen from Corollary 1 that when consumers’ green-sensitivity is relatively limited, the greening level of products has little influence on demand, so firms will produce products with lower greening levels, because, as Lemma 1 shows, improving the greening level of products will not increase profits. The government should adopt tax policies to punish firms for adopting low greening levels, make them aware of the importance of improving the greening level of products and guide the firm to produce greener products. When consumers are more sensitive to greening levels, there is a greater impact on demand, so the firm will produce products with higher greening levels to achieve higher profits. In this case, the government should reward firms, subsidize the cost of improving the greening level of products, develop positive models and encourage firms to produce greener products.

Corollary 2. When , the government adopts a subsidy policy; when , the government adopts a tax policy.

This conclusion can also be deduced from the condition of Proposition 4. It can be concluded from Corollary 2 that when environmental sensitivity is low, the difference in greening levels per product will cause less damage to the environment. If the firm produces products with lower greening levels, the impact on the environment will be relatively small. The government should implement tax policies to prevent firms from profiteering by producing products with low greening levels. When environmental sensitivity is relatively large, the difference in greening levels per product will cause greater environmental harm. Therefore, from an environmental protection perspective, the government hopes firms will produce greener products. In this case, the government should implement policies to subsidize investment in greening to encourage firms to produce greener products.