Social Media Influence on Consumer Behavior: The Case of Mobile Telephony Manufacturers

Abstract

1. Introduction

2. Theoretical Framework

2.1. Advertising on Social Networks

2.2. Consumer Behaviour and Enterprise in Social Networks

2.3. Symbolic Consumption as One of the Main Driver in Telephony Purchase Behaviour

3. Methodology

4. Results and Discussion

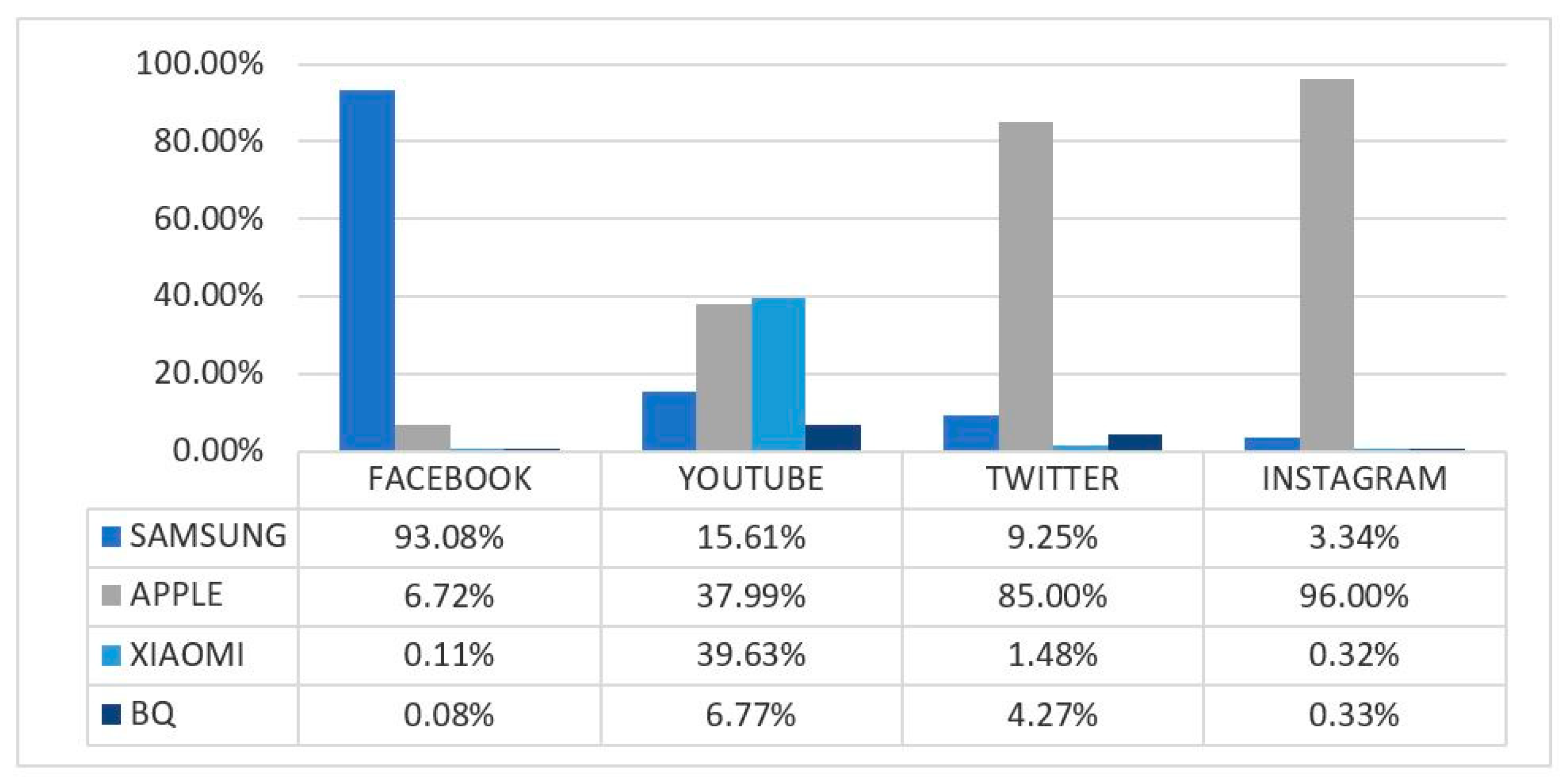

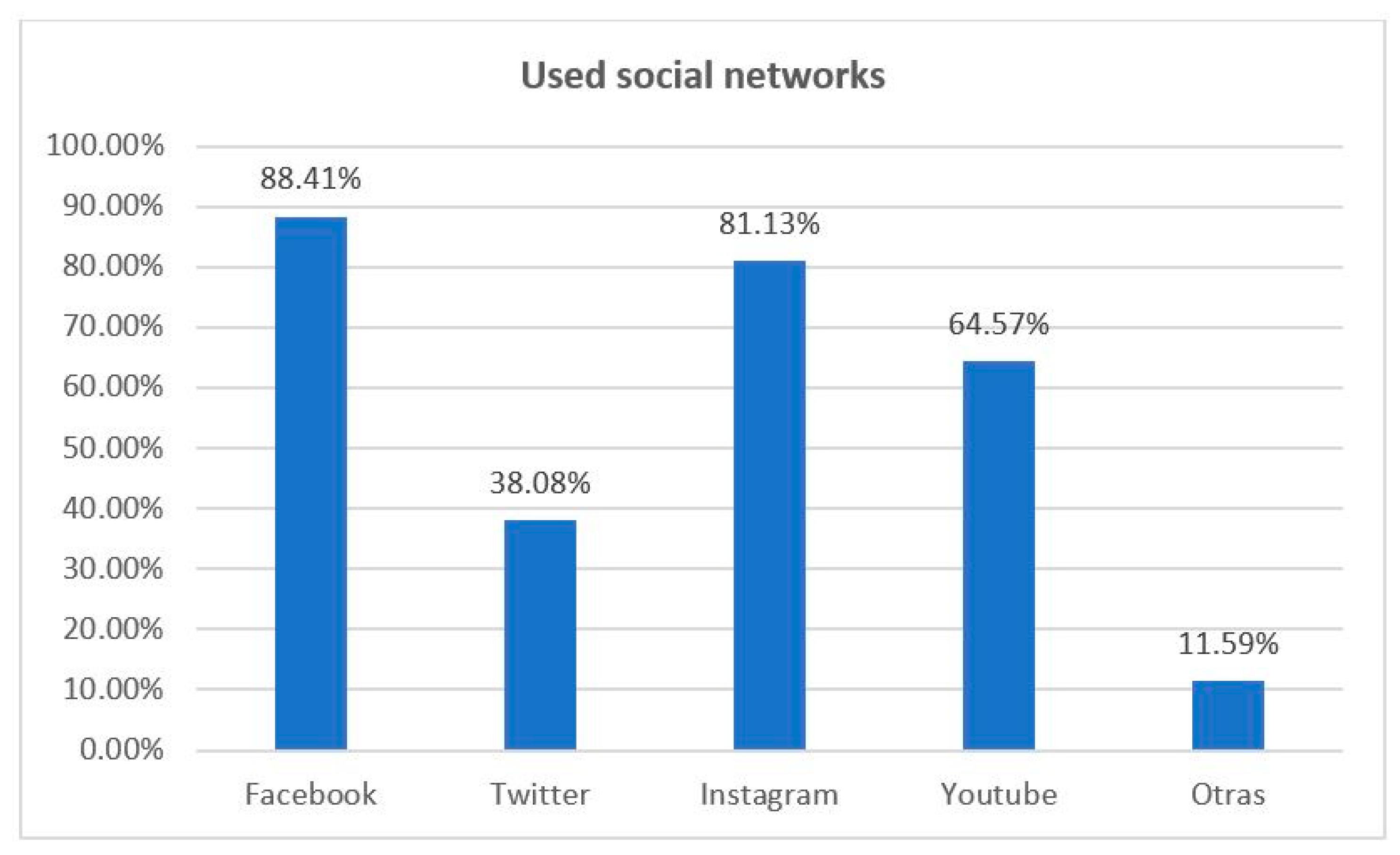

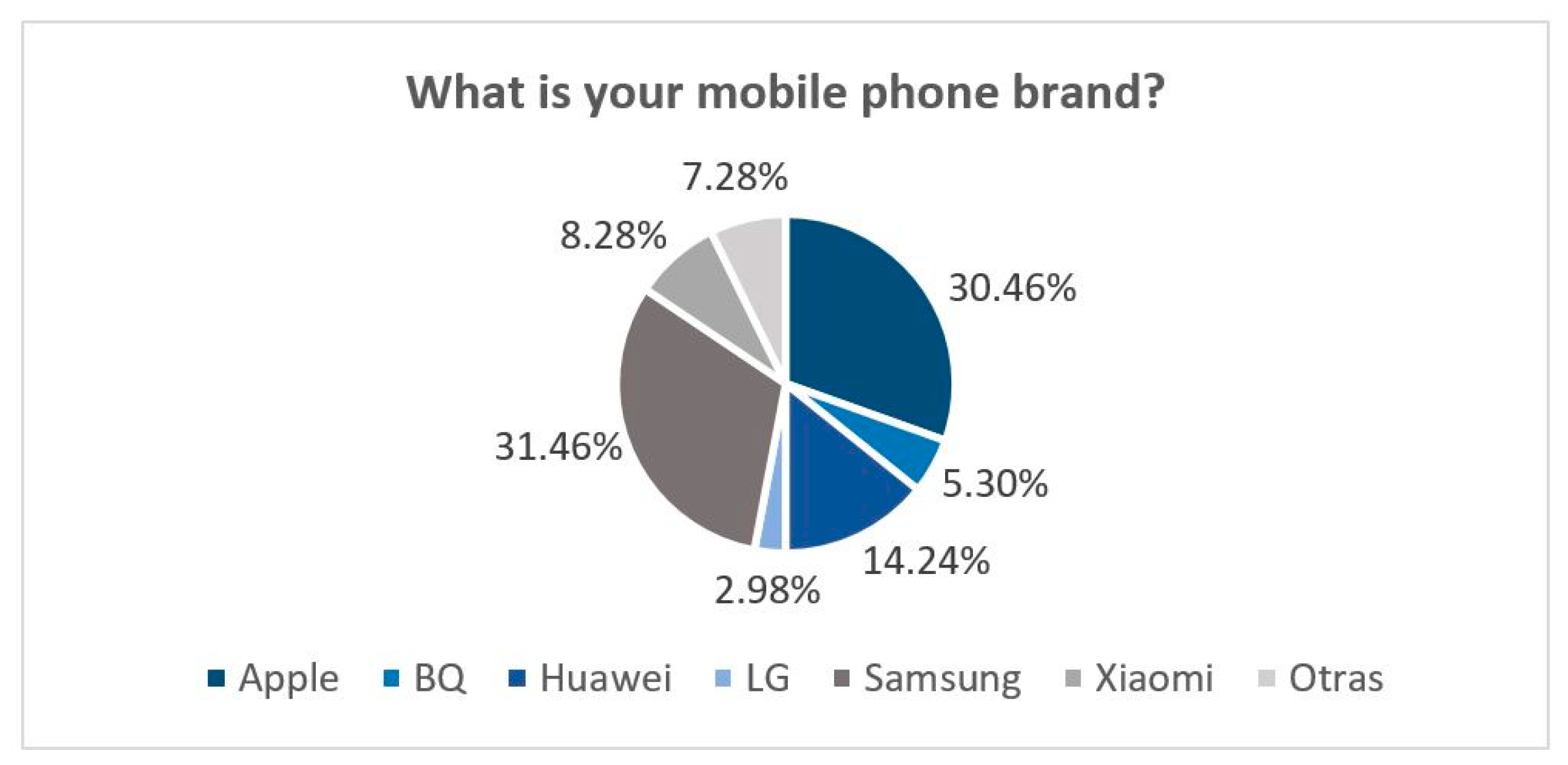

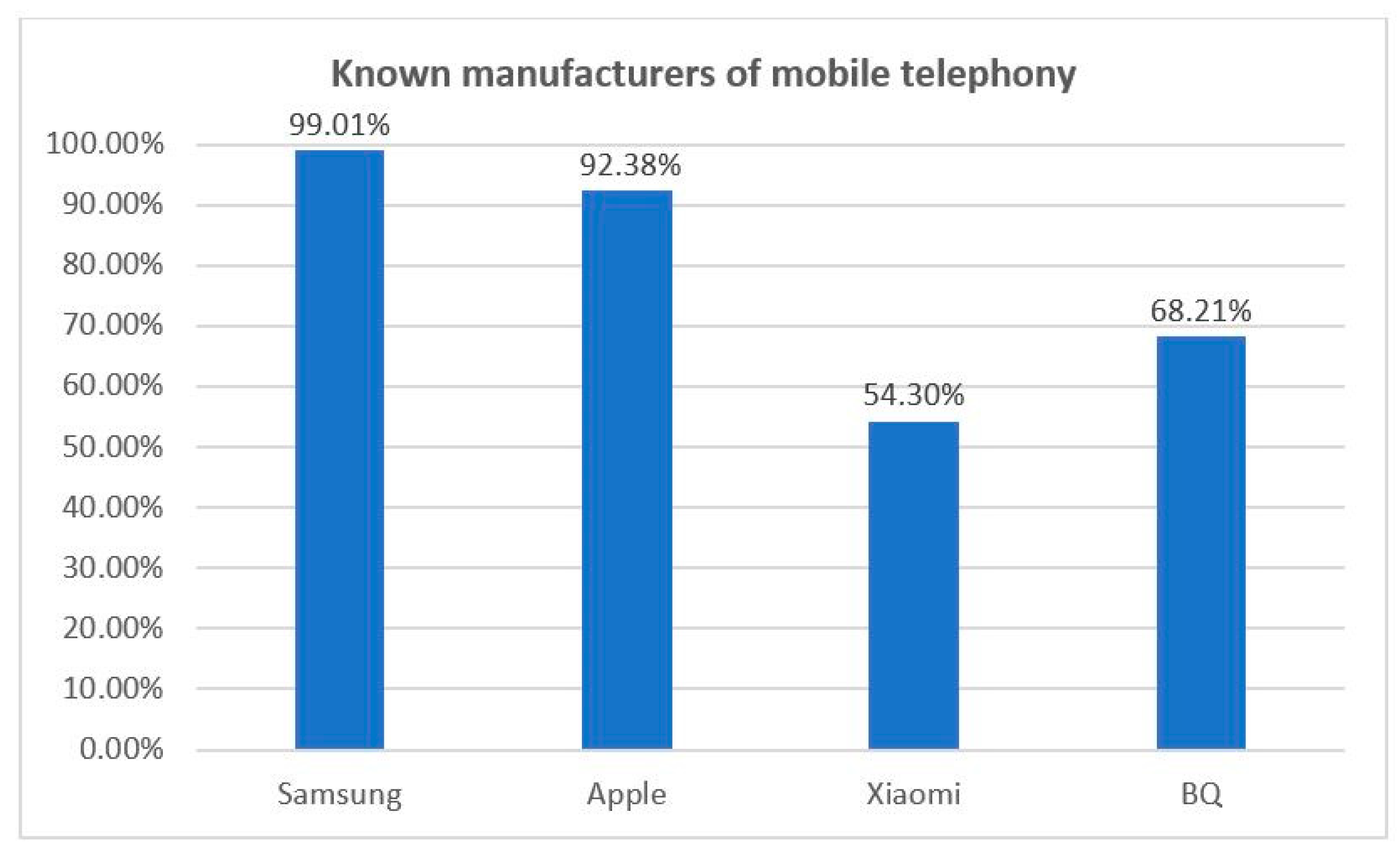

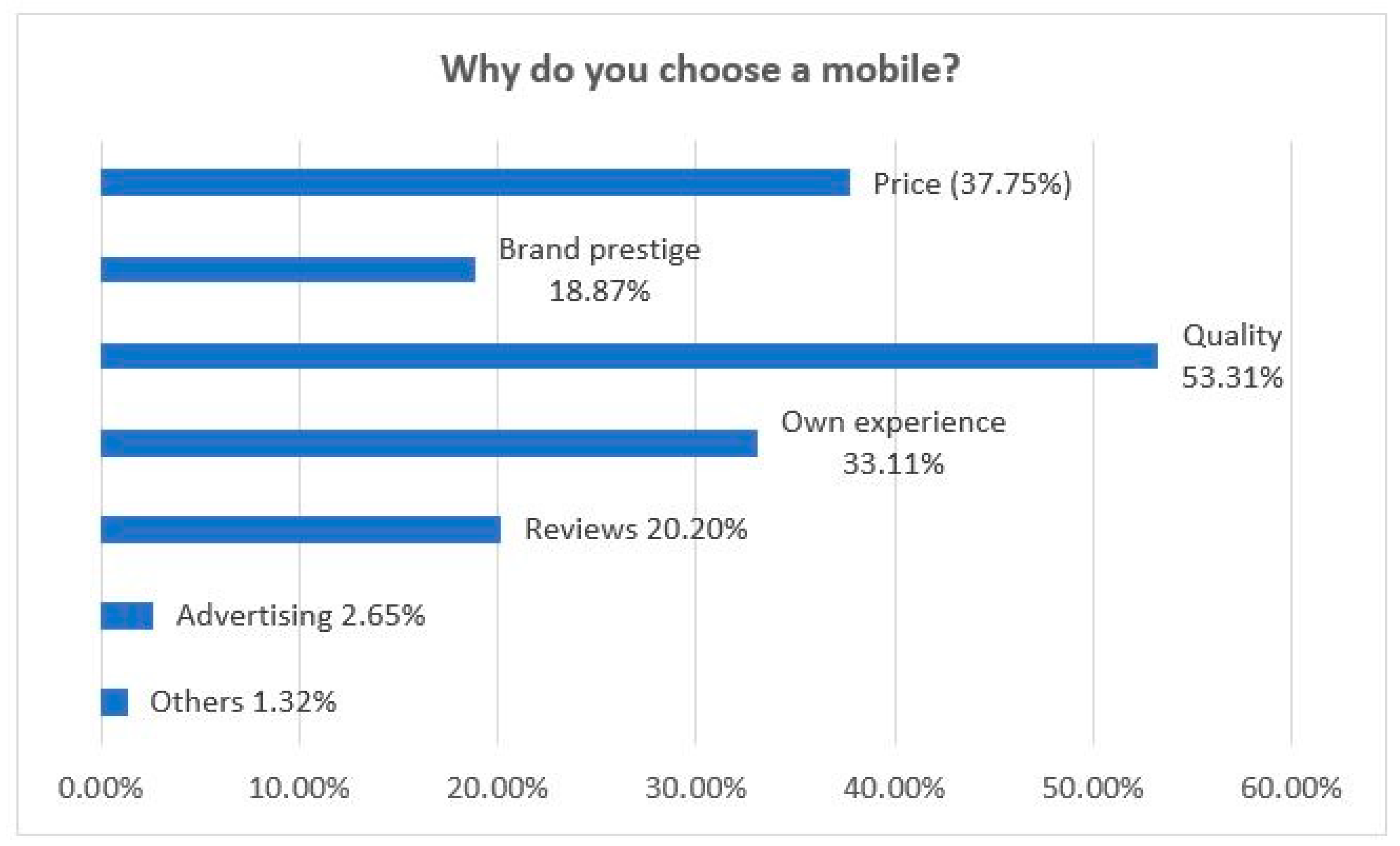

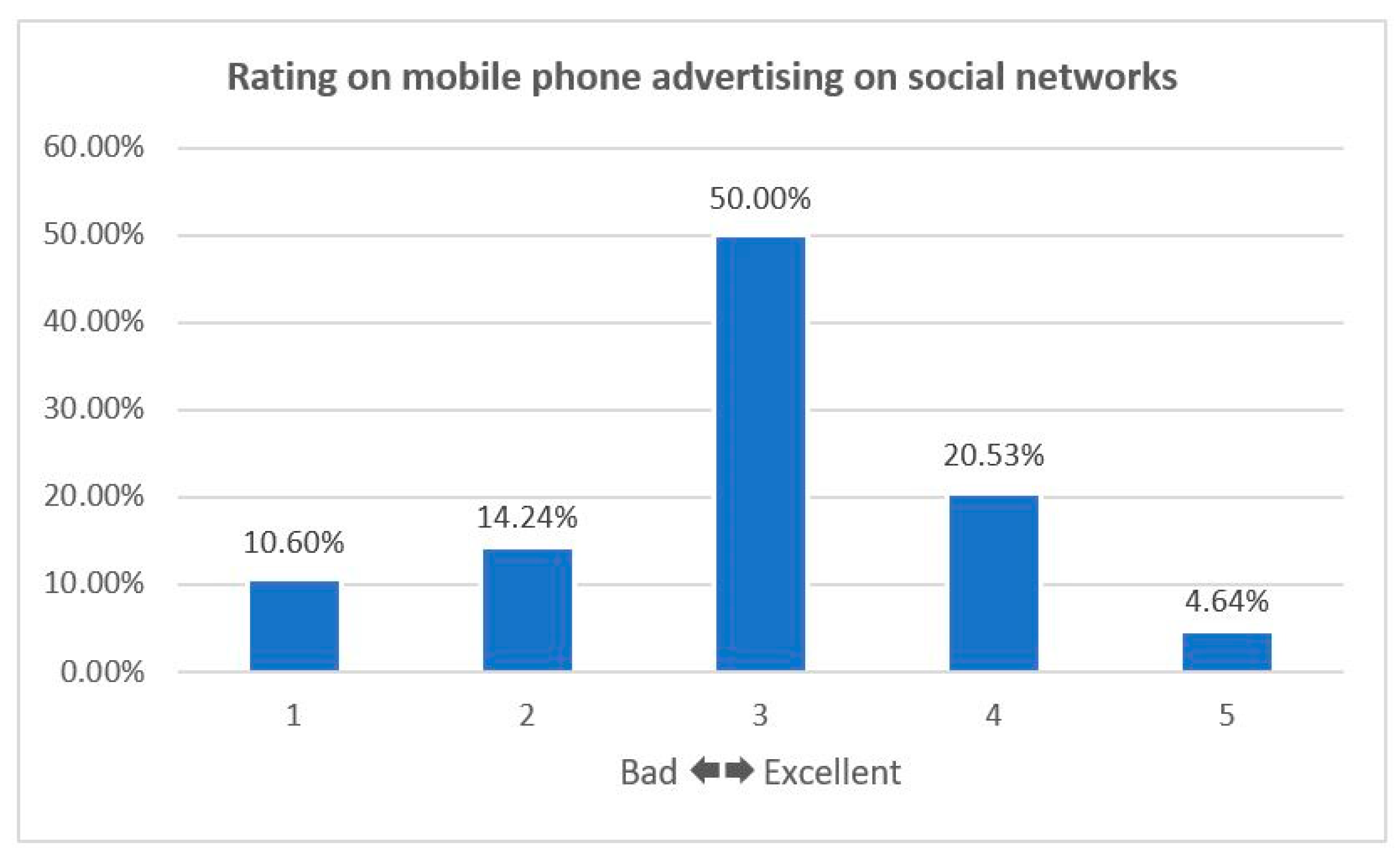

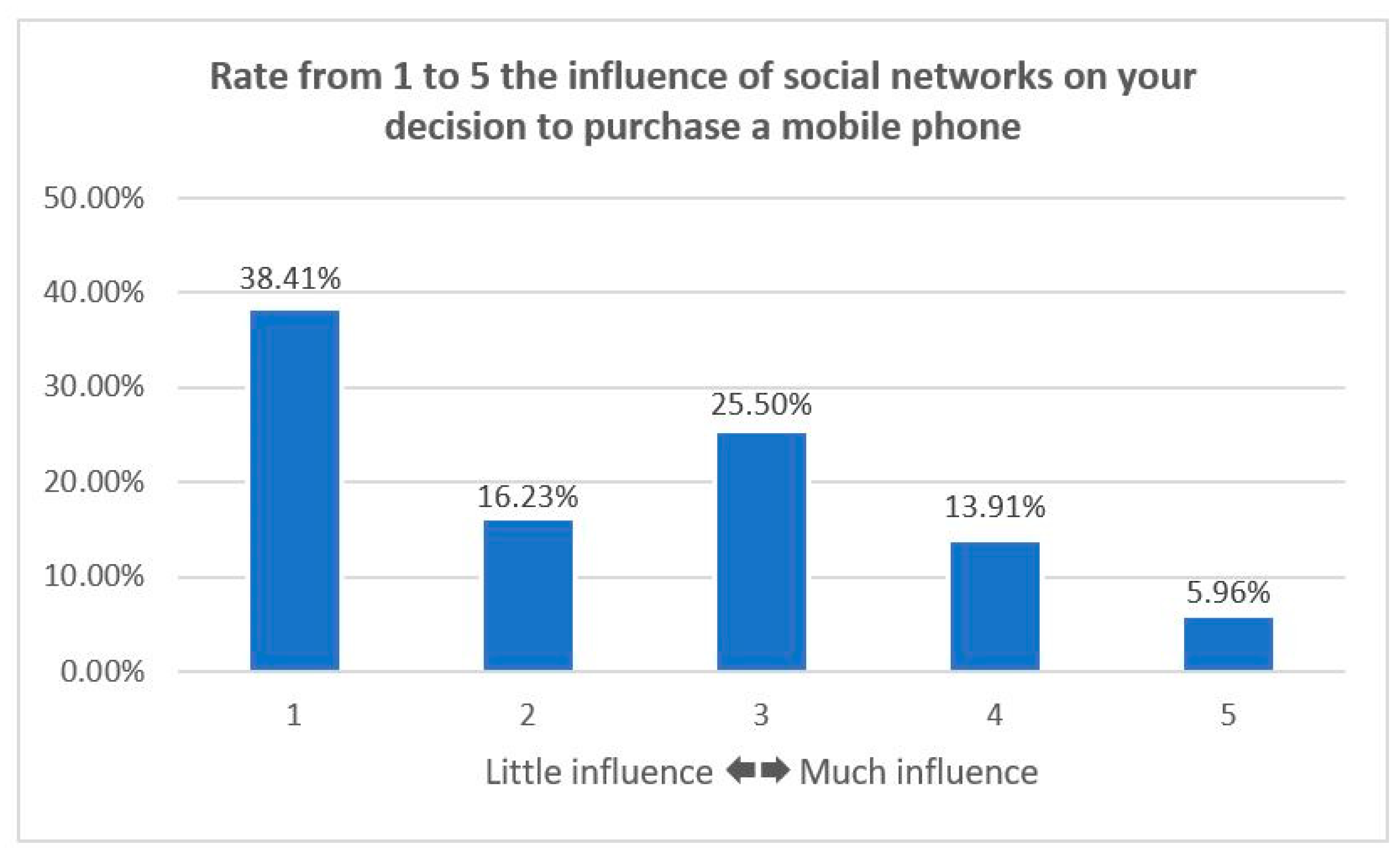

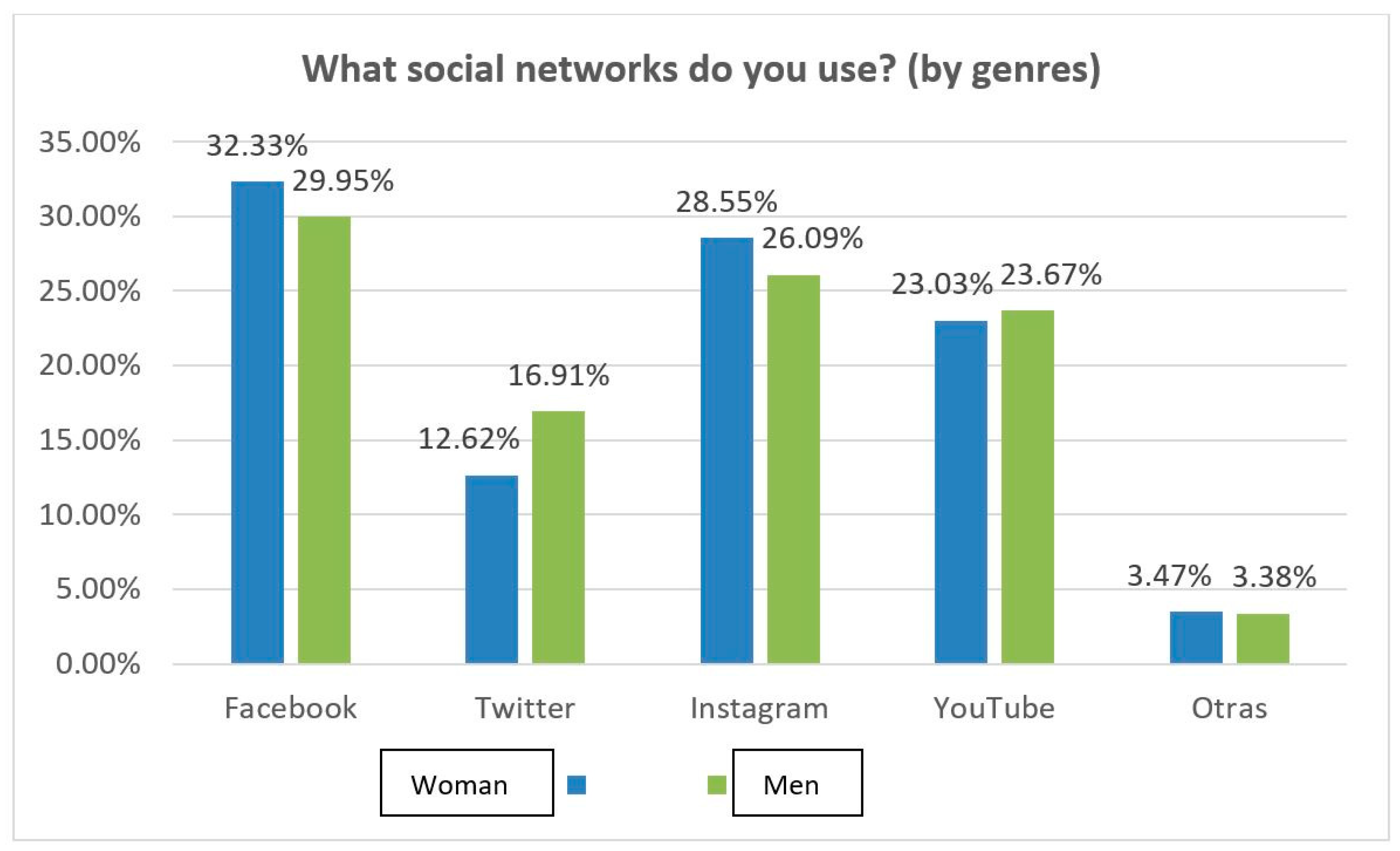

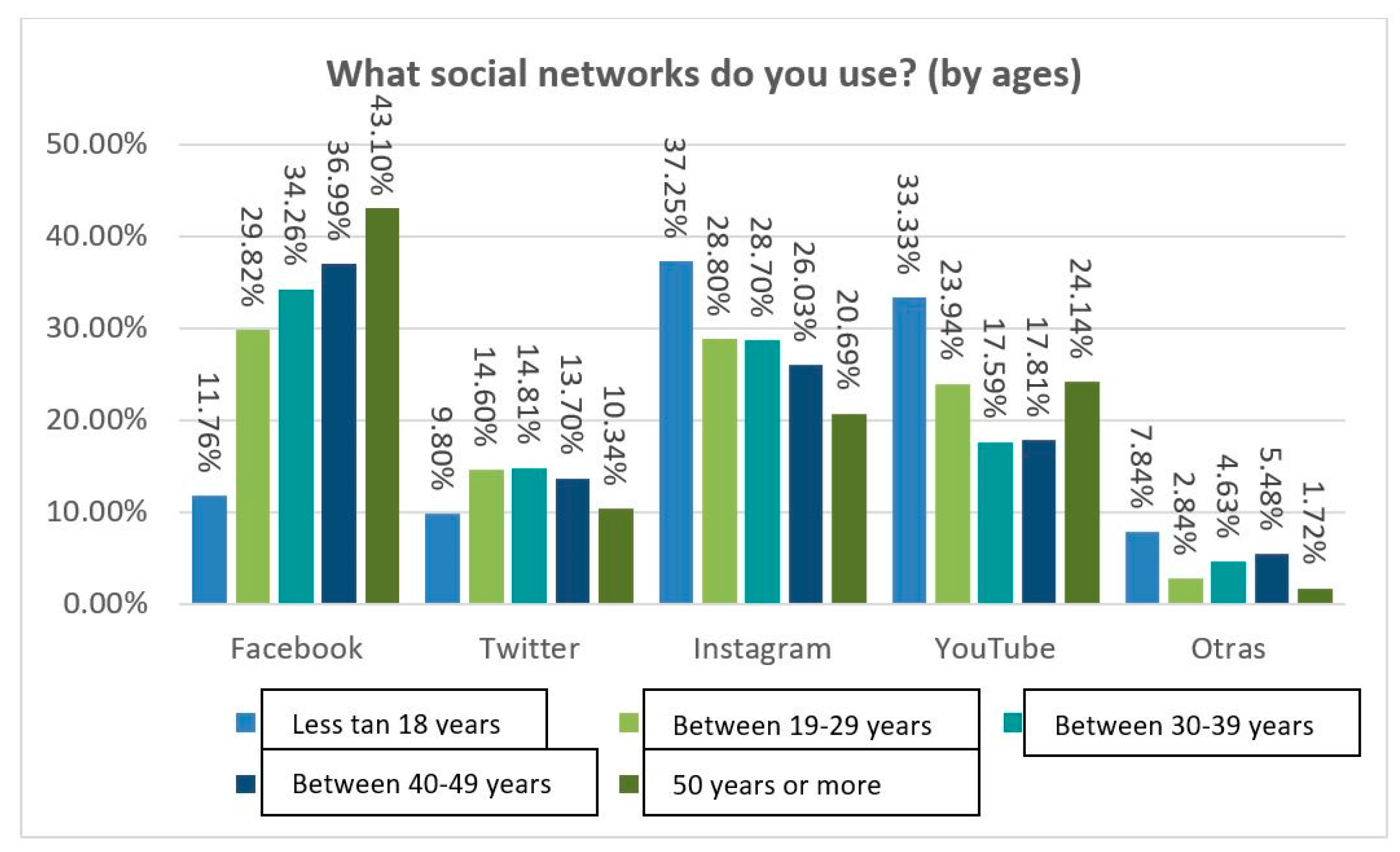

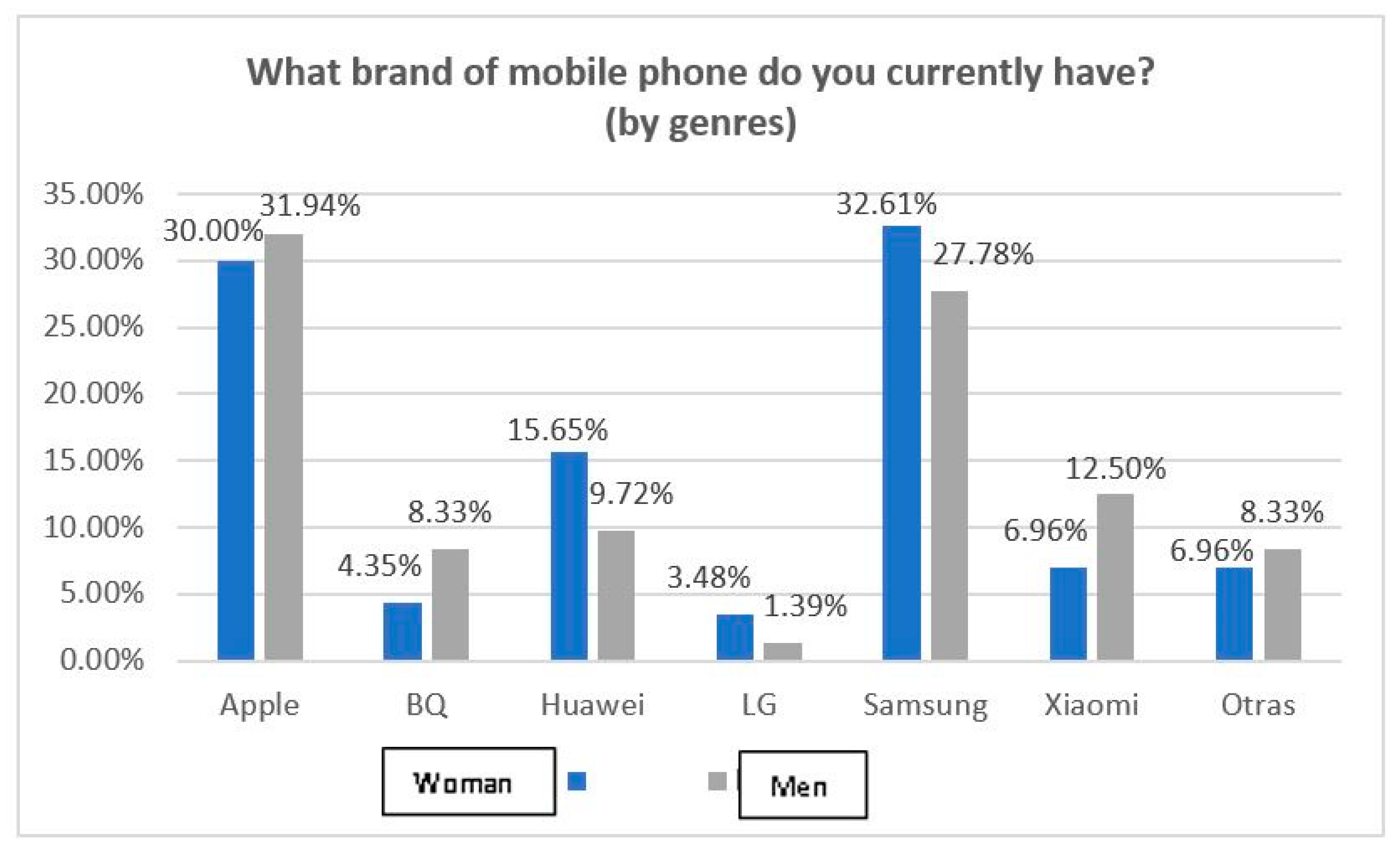

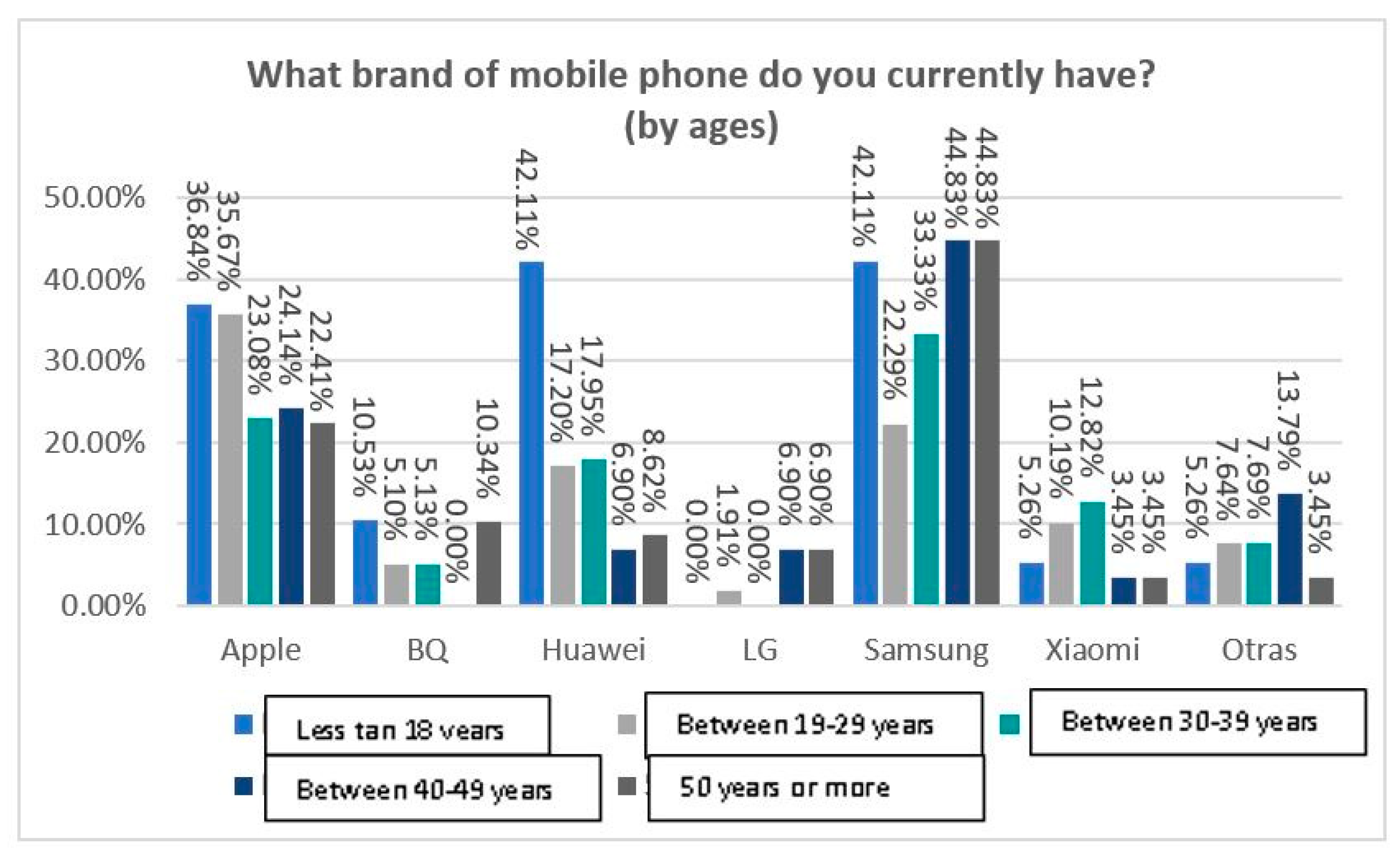

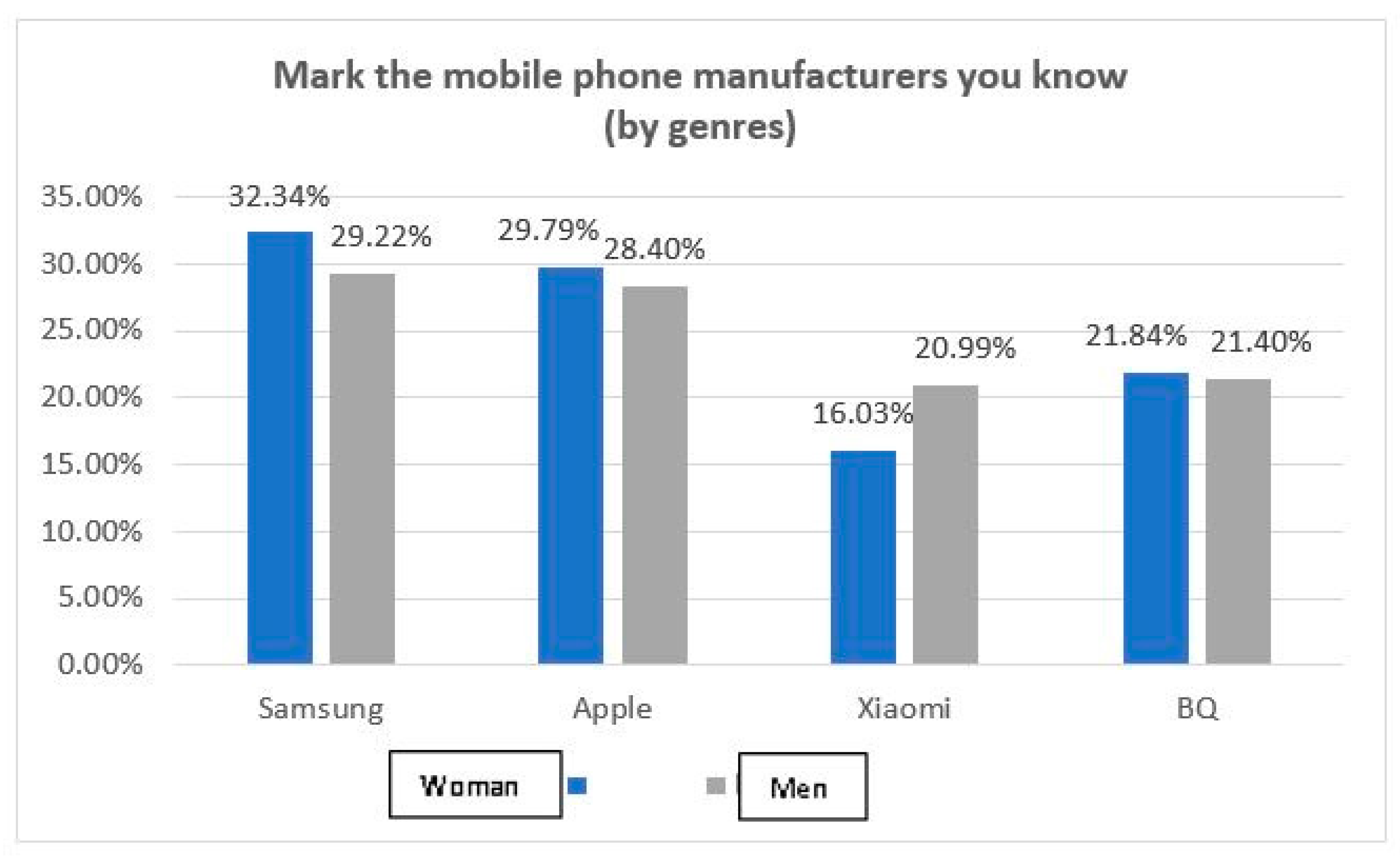

4.1. Statistical Descriptive Results

4.2. Inferential Statistical Results

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Gershon, R.A. Media, Telecommunications, and Business Strategy; Francis & Taylor Group: London, UK; New York, NY, USA, 2013. [Google Scholar]

- Xataka Móvil. Ranking de Fabricantes de Telefonía Móvil; Xataka Móvil: Madrid, Spain, 2018. [Google Scholar]

- Hoffman, D.L.; Fodor, M. Can You Measure the ROI of Your Social Media Marketing? MIT Sloan Manag. Rev. 2010, 52, 41–49. [Google Scholar]

- Fondevila-Gascón, J.F.; Mir-Bernal, P.; Rom-Rodríguez, J.; Santana-López, E.; Botey-López, J. Tendencias en métricas en medios sociales. Impacto en la publicidad. In Tendencias Publicitarias en Iberoamérica. Diálogo de Saberes y Experiencias; Zacipa-Infante, I., Tur-Viñes, V., Segarra-Saavedra, J., Eds.; Colección Mundo Digital. Alicante, Universidad de Alicante: Alicante, Spain, 2016; pp. 155–170. [Google Scholar]

- Fondevila-Gascón, J.F.; Botey-López, J.; Rom-Rodríguez, J.; Muñoz-González, M. Posibilidades comunicativas del HbbTV: Un nuevo escenario para la publicidad interactiva. In Publicidad y Convergencia Mediática. Nuevas Estrategias de Comunicación Persuasive; Castelló-Martínez, A., del Pino-Romero, C., Eds.; Egregius Ediciones: Sevilla, Spain, 2017; pp. 11–28. ISBN 978-84-946978-6-9. [Google Scholar]

- OJD Interactiva. Datos de Marzo de 2018; OJD Interactiva: Madrid, Spain, 2018. [Google Scholar]

- Tuten, T.L.; Solomon, M.R. Social Media Marketing; Sage: London, UK, 2017. [Google Scholar]

- Senders, A.; Govers, R.; Neuts, B. Social Media Affecting Tour Operators’ Customer Loyalty. J. Travel Tour. Mark. 2013, 30, 41–57. [Google Scholar] [CrossRef]

- Fondevila-Gascón, J.F.; Botey-López, J.; Rom-Rodríguez, J. Formats emergents en televisió: Anàlisi comparativa d’aplicacions publicitàries interactives en HBBTV. Comun. Rev. De Recer. i d’Anàlisi (Soc. Catalana Comun.) 2017, 34, 67–81. [Google Scholar]

- Fondevila-Gascón, J.F. El papel decisivo de la banda ancha en el Espacio Iberoamericano del Conocimiento. Rev. Iberoam. Cienc. Tecnol. y Soc.–CTS 2009, 2, 1–15. [Google Scholar]

- Fondevila-Gascón, J.F.; Del Olmo, J.L. La interactividad y el multimedia en la prensa digital internacional: los casos de España y el Reino Unido. Bilbao: III Congreso Internacional de Ciberperiodismo y Web 2.0. 2011. [Google Scholar]

- Fondevila-Gascón, J.F. “La prensa digital en España: ¿un negocio viable para emprendedores?”. In El periodismo digital analizado desde la investigación procedente del ámbito académico; Sabés, F., Verón, J.J., Eds.; Asociación de la Prensa de Aragón: Huesca, Spain, 2012; pp. 231–243. [Google Scholar]

- Fondevila-Gascón, J.F.; Carreras-Alcalde, M.; Del Olmo, J.L. Fuentes de información y elección de universidad: el caso catalán. Didáctica Innovación y Multimed. 2012, 8, 24. [Google Scholar]

- Campos-Freire, F. Las redes sociales trastocan los modelos de los medios de comunicación tradicionales. Rev. Lat. Comun. Soc. 2008, 63, 277–286. [Google Scholar]

- De Salas Nestares, M.I. La publicidad en las redes sociales: De lo invasivo a lo consentido. Icono 2010, 8, 5. [Google Scholar] [CrossRef]

- Castelló, A.; Del Pino, C. La comunicación publicitaria con influencers. Rev. Académica Mark. Apl. 2015, 14, 21–50. [Google Scholar]

- Geirinhas, G.G.A. Social Media: The New Tool in Firms’ Marketing Strategies; NOVA—School of Business and Economics: Lisboa, Portugal, 2014. [Google Scholar]

- Findlay, R. The short, passionate, and close-knit history of personal style blogs. Fash. Theory 2015, 19, 157–178. [Google Scholar] [CrossRef]

- Kerr, G.F.; Mortimer, K.; Dickinson, S.; Waller, D. Buy, Boycott Or Blog Exploring Online Consumer Power to Share, Discuss and Distribute Controversial Advertising Messages. Eur. J. Mark. 2012, 46, 387–405. [Google Scholar] [CrossRef]

- Bowman, S.; Willis, C. Nosotros, el Medio; The Media Center at the American Press Institute: Reston, VA, USA, 2005. [Google Scholar]

- Gangadharbatla, H. Facebook me: Collective self-esteem, need to belong, and Internet self-efficacy as predictors of the iGeneration’s attitudes toward social networking sites. J. Interact. Advert. 2008, 8, 5–15. [Google Scholar] [CrossRef]

- Ramos, M. Publicidad e Internet: Una Oportunidad Para Conversar con el Usuario; Los libros de la Frontera Comunicación: Madrid, Spain, 2011. [Google Scholar]

- Cerezo, J.M. Hacia un nuevo paradigm: La era de la información fragmentada. Telos 2008, 76, 91–98. [Google Scholar]

- Fondevila-Gascón, J.F. Las redes de telecomunicaciones de cable histórico: Realidad y tendencias. Rev. De Comun. De La SEECI (Soc. Española Estud. Comun. Iberoam.) 2004, 11, 67–89. [Google Scholar]

- Fondevila-Gascón, J.F. La televisión IP (IPTV) y la transmisión mediante VDSL: Realidad y perspectivas de negocio. Vivat Acad. 2009, 105, 59–87. [Google Scholar] [CrossRef][Green Version]

- Fondevila-Gascón, J.F. La adaptación regulatoria de los operadores de cable histórico en Spain. La competencia de los grandes operadores Older Cable Operators Adapt to New Regulations in Spain. Competition for Large Cable Operators. Telos. Cuad. Comun. Innovación 2009, 80, 139–146. [Google Scholar]

- Fondevila-Gascón, J.F. El peso de la televisión en el triple play de los operadores de cable en Spain y en Europa. Zerrevista Estud. Comun. (J. Commun. Stud.) 2009, 14, 13–31. [Google Scholar]

- Bronner, F.; de Hoog, R. Social media and consumer choice. Int. J. Mark. Res. 2013, 56, 51–71. [Google Scholar] [CrossRef]

- Blackwell, R.D.; Miniard, P.W.; Engel, J.F. Consumer Behavior, 10th ed.; Thomson South-Western: Boston, MA, USA, 2006. [Google Scholar]

- Firat, A. A critique of the orientations in theory development in consumer behavior: Suggestions for the future. Adv. Consum. Res. 1985, 12, 3–6. [Google Scholar]

- Jacoby, J. ACR presidential address consumer research: Telling it like it is. Adv. Consum. Res. 1976, 3, 1–11. [Google Scholar]

- Belk, R.W. Possessions and the extended self. J. Consum. Res. 1988, 15, 139–168. [Google Scholar] [CrossRef]

- Douglas, M.; Isherwood, B. The World of Goods: Towards an Anthropology of Consumption; Routledge: London, UK, 1979. [Google Scholar]

- Firat, A.F.; Dholakia, N.; Venkatesh, A. Marketing in a postmodern world. Eur. J. Mark. 1995, 29, 40–56. [Google Scholar] [CrossRef]

- Bauman, Z. Vida de Consumo; Fondo de Cultura Económica: Madrid, Spain, 2007. [Google Scholar]

- Chernatony, L.; McDonald, M. Creating Powerful Brands; Elsevier: Oxford, UK, 2003. [Google Scholar]

- Belk, R.W. Extended self in digital world. J. Consum. Res. 2013, 40, 477–500. [Google Scholar] [CrossRef]

- Csikszentmihalyi, M.; Rochberg-Halton, E. The Meaning of Things: Domestic Symbols and the Self; Cambridge University Press: London, UK, 1981. [Google Scholar]

- Muniz, A.; O’Guinn, T. Brand community. J. Consum. Res. 2001, 27, 412–432. [Google Scholar] [CrossRef]

- Schouten, J.W.; McAlexander, J.H. Subcultures of consumption: An etnography of the new bikers. J. Consum. Res. 1995, 22, 43–61. [Google Scholar] [CrossRef]

- Solomon, M.R. Mapping product constellations: A social categorization approach to consumption symbolism. Psychol. Mark. 1988, 5, 233–258. [Google Scholar]

- Firat, A.F.; Shultz, C.J. From segmentation to fragmentation. Market and marketing strategy in the postmodern era. Eur. J. Mark. 1997, 31, 183–207. [Google Scholar] [CrossRef]

- Holt, D. How consumers consume: A typology of consumption practices. J. Consum. Res. 1995, 22, 1–16. [Google Scholar] [CrossRef]

- Ventakesh, A. Postmodernism perspectives for micromarketing. J. Macromarketing 1999, 19, 153–169. [Google Scholar]

- McCracken, G. Culture and consumption: A theorical account of the structure of the cultural meaning of consumer goods. J. Consum. Res. 1986, 13, 71–83. [Google Scholar] [CrossRef]

- Solomon, M.R. The role of products as social stimuli: A symbolic interactionism perspective. J. Consum. Res. 1983, 10, 319–329. [Google Scholar] [CrossRef]

- Solomon, M.R.; Assael, H. The forest or the trees? A Gestalt approach to symbolic consumption. In Marketing and Semiotics: New Directions in the Study of Signs for Sale; Umiker-Sebeok, J., Ed.; Mouton de Gruyter: Berlin, Germany, 1987; pp. 189–217. [Google Scholar]

- Aaker, J.; Benet-Martínez, V.; Garolera, J. Consumption Symbols as Carriers of Culture: A Study of Japanese and Spanish Brand Personality Constructs. J. Personal. Soc. Psychol. 2001, 81, 492–508. [Google Scholar] [CrossRef]

- Holt, D. Poststructuralist lifestyle analysis: Conceptualizing the social of consumption in productivity. J. Consum. Res. 1997, 23, 326–350. [Google Scholar] [CrossRef]

- Muniz, A. Consumers and brand meaning: Brands, the self and others. Adv. Consum. Res. 1997, 24, 308–309. [Google Scholar]

- Comer, J.C.; Wikle, T.A. Worldwide diffusion of the cellular telephone (1995–2005). Prof. Geogr. 2008, 60, 252–269. [Google Scholar] [CrossRef]

- Fondevila-Gascón, J.F. Periodismo ciudadano y cloud journalism: Un flujo necesario en la Sociedad de la Banda Ancha. Comun. y Hombre 2013, 9, 25–41. [Google Scholar] [CrossRef]

| Followers | YouTube | |||

|---|---|---|---|---|

| Samsung | 156,577,540 (Spain) | 57,466 (Spain) | 194,962 (Spain) | 168,995 (Spain) |

| Apple | 11,306,781 (Official) | 139,866 (Spain) | 1,790,586 (Official) | 4,853,287 (Official) |

| Xiaomi | 187,150 (Spain) | 145,894 (Official) | 31,202 (Spain) | 16,387 (Spain) |

| BQ | 139,368 (Official) | 24,915 (Official) | 89,934 (Official) | 16,852 (Official) |

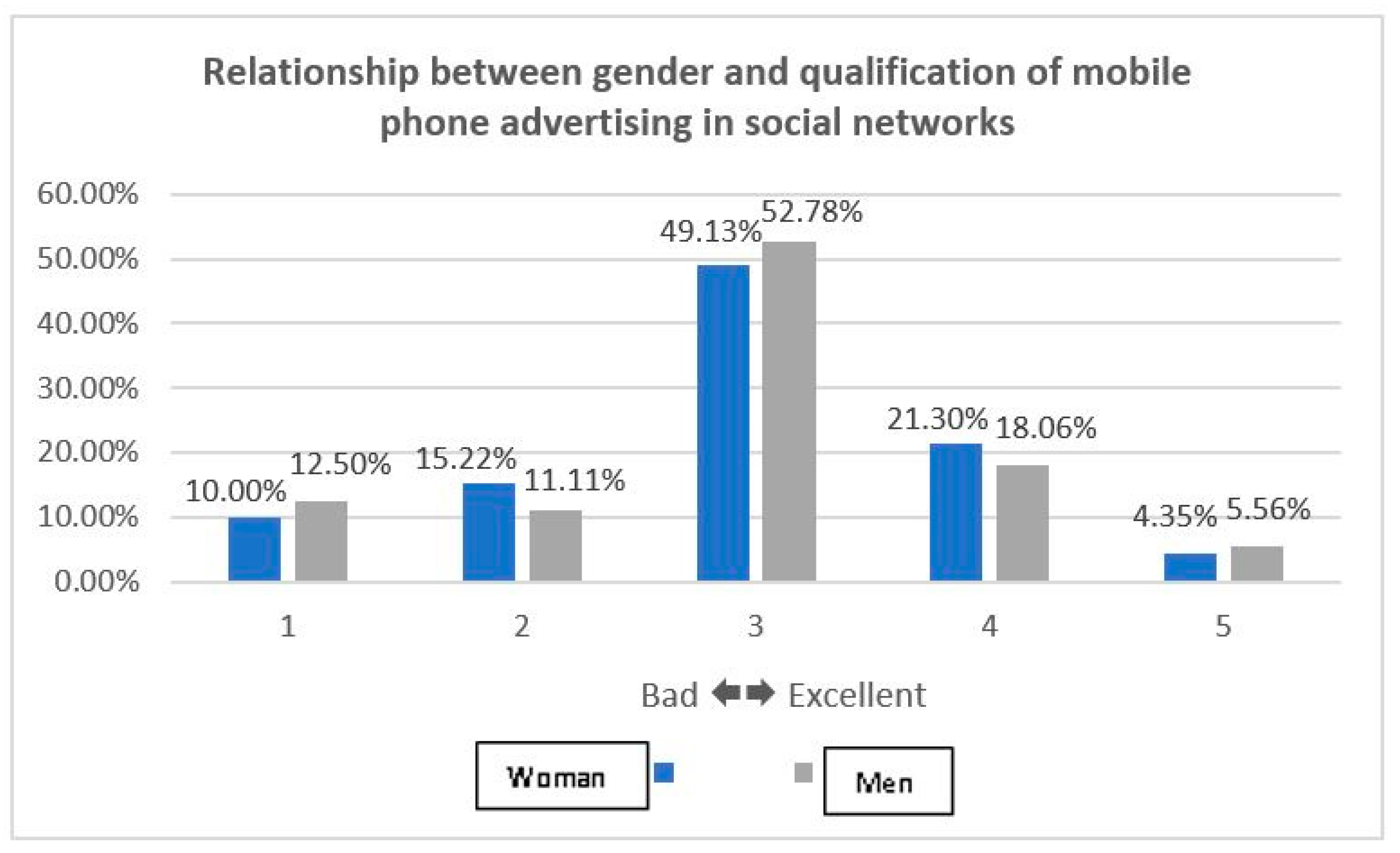

| Gender | n | Mean | Standard Deviation | Means of Standard Error | |

|---|---|---|---|---|---|

| How do you rate mobile phone advertising on social networks? | Women | 230 | 2.95 | 0.970 | 0.064 |

| Men | 72 | 2.93 | 1.012 | 0.119 |

| Gender | Kolmogorov–Smirnov a | Shapiro–Wilk | |||||

|---|---|---|---|---|---|---|---|

| Statistics | gl | Sig. | Statistics | gl | Sig. | ||

| How do you rate mobile phone advertising on social networks? | Women | 0.269 | 230 | 0.000 | 0.882 | 230 | 0.000 |

| Men | 0.291 | 72 | 0.000 | 0.866 | 72 | 0.000 | |

| Levene Test of Variance Quality | t-Test for Equality of Means | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| F | Sig. | t | gl | Sig. (bilateral) | Difference of Means | Difference of Standard Error | 95% Confidence Interval of the Difference | |||

| Lower | Upper | |||||||||

| How do you rate mobile phone advertising on social networks? | Equal variances are assumed | 0.014 | 0.904 | 0.131 | 300 | 0.896 | 0.017 | 0.132 | –0.243 | 0.278 |

| Equal variances are not assumed | 0.128 | 114.787 | 0.899 | 0.017 | 0.135 | –0.251 | 0.285 | |||

| Gender | Kolmogorov–Smirnov a | Shapiro–Wilk | |||||

|---|---|---|---|---|---|---|---|

| Statistic | gl | Sig. | Statistic | gl | Sig. | ||

| Rate from 1 to 5 the influence of social networks on your decision to purchase a mobile phone | Women | 0.230 | 230 | 0.000 | 0.853 | 230 | 0.000 |

| Men | 0.248 | 72 | 0.000 | 0.842 | 72 | 0.000 | |

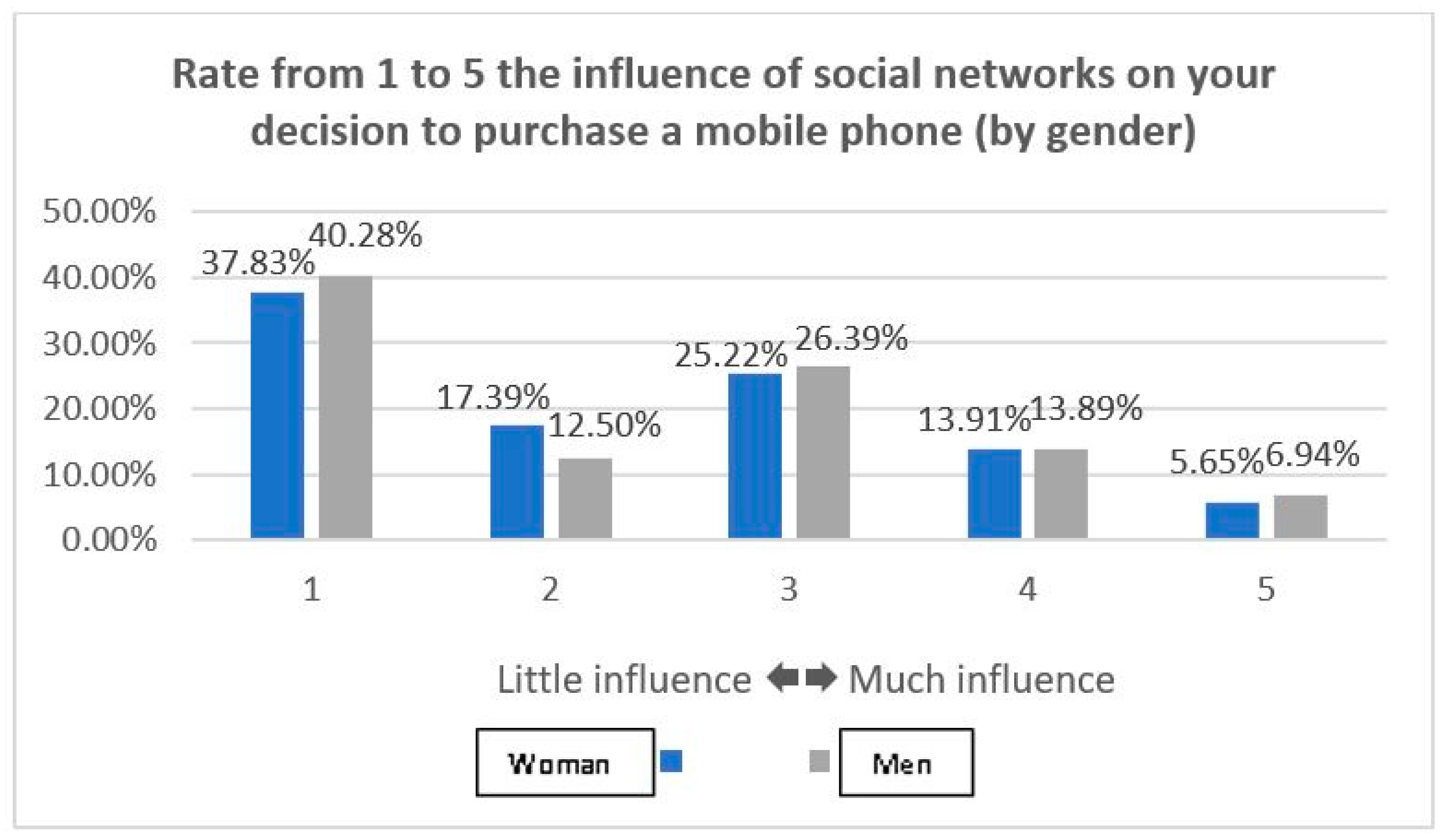

| Genre | n | Means | Standard Deviation | Means of Standard Error | |

|---|---|---|---|---|---|

| Rate from 1 to 5 the influence of social networks on your decision to purchase a mobile phone | Women | 230 | 2.32 | 1.265 | 0.083 |

| Men | 72 | 2.35 | 1.323 | 0.156 |

| Levene Test of Variance Quality | t-Test for Equality of Means | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| F | Sig. | t | gl | Sig. (bilateral) | Difference of Means | Difference of Standard Error | 95% Confidence Interval of the Difference | |||

| Lower | Upper | |||||||||

| How do you rate mobile phone advertising on social networks? | Equal variances are assumed | 0.556 | 0.456 | –0.148 | 300 | 0.883 | –0.025 | 0.173 | –0.365 | 0.314 |

| Equal variances are not assumed | –0.144 | 114.498 | 0.886 | –0.025 | 0.177 | –0.376 | 0.325 | |||

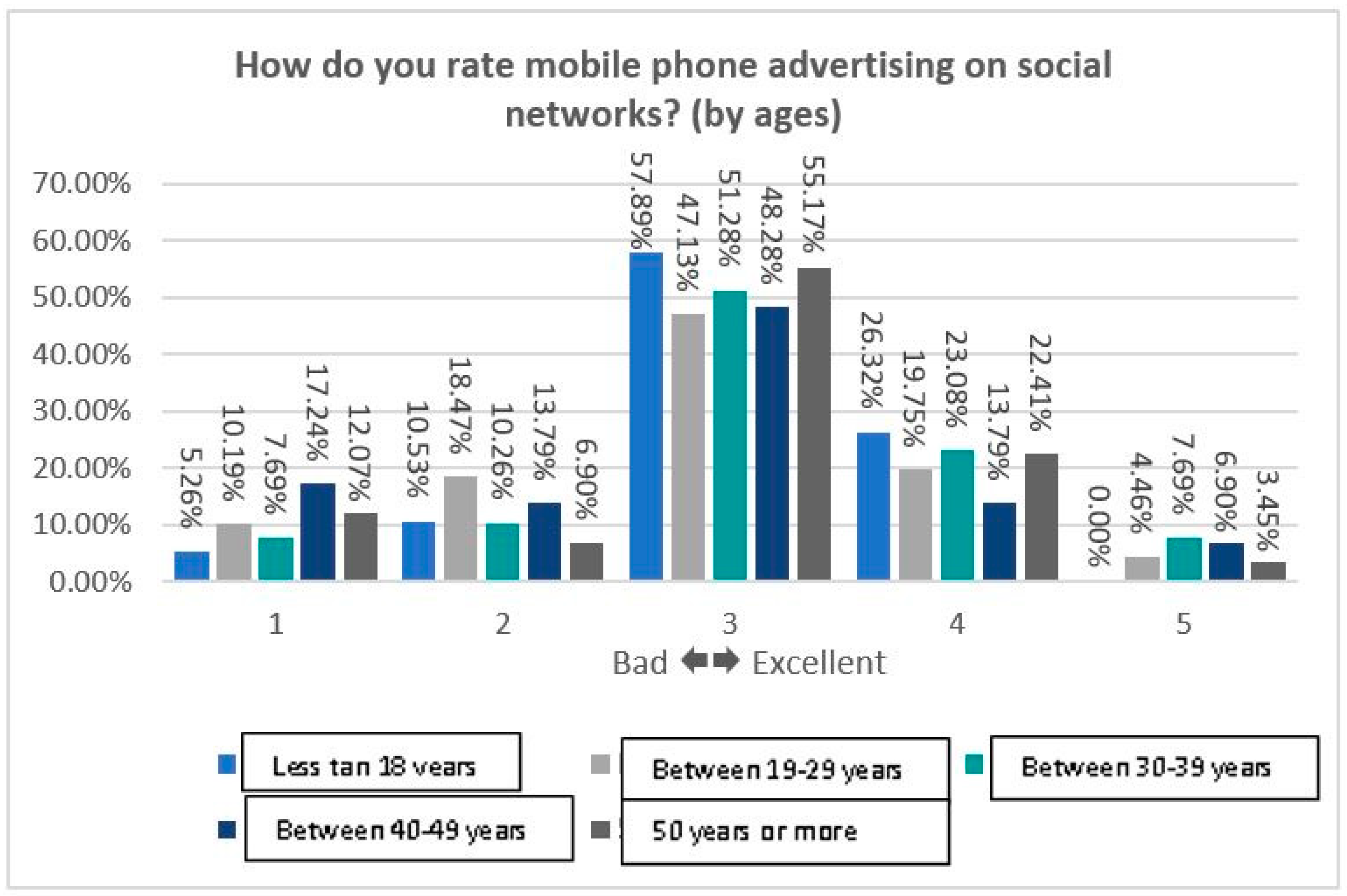

| How Do You Rate Mobile Phone Advertising on Social Networks? | ||||||||

|---|---|---|---|---|---|---|---|---|

| n | Media | StandardDeviation | Standard Error | 95% Confidence Interval for the Mean | Min. | Max. | ||

| Lower Limit | Upper Limit | |||||||

| Less than 18 years | 19 | 3.05 | 0.780 | 0.179 | 2.68 | 3.43 | 1 | 4 |

| Between 19 and 29 years | 157 | 2.90 | 0.982 | 0.078 | 2.74 | 3.05 | 1 | 5 |

| Between 30 and 39 years | 39 | 3.13 | 0.978 | 0.157 | 2.81 | 3.45 | 1 | 5 |

| Between 40 and 49 years | 29 | 2.79 | 1.114 | 0.207 | 2.37 | 3.22 | 1 | 5 |

| 50 years or more | 58 | 2.98 | 0.964 | 0.127 | 2.73 | 3.24 | 1 | 5 |

| Total | 302 | 2.94 | 0.978 | 0.056 | 2.83 | 3.05 | 1 | 5 |

| How Do You Rate Mobile Phone Advertising on Social Networks? | |||

|---|---|---|---|

| Levene Statistic | df1 | df2 | Sig. |

| 0.954 | 4 | 297 | 0.433 |

| How Do You Rate Mobile Phone Advertising on Social Networks? | |||||

|---|---|---|---|---|---|

| Sum of Squares | gl | Quadratic Means | F | Sig. | |

| Between groups | 2.626 | 4 | 0.656 | 0.683 | 0.604 |

| In groups | 285.417 | 297 | 0.961 | ||

| Total | 288.043 | 301 | |||

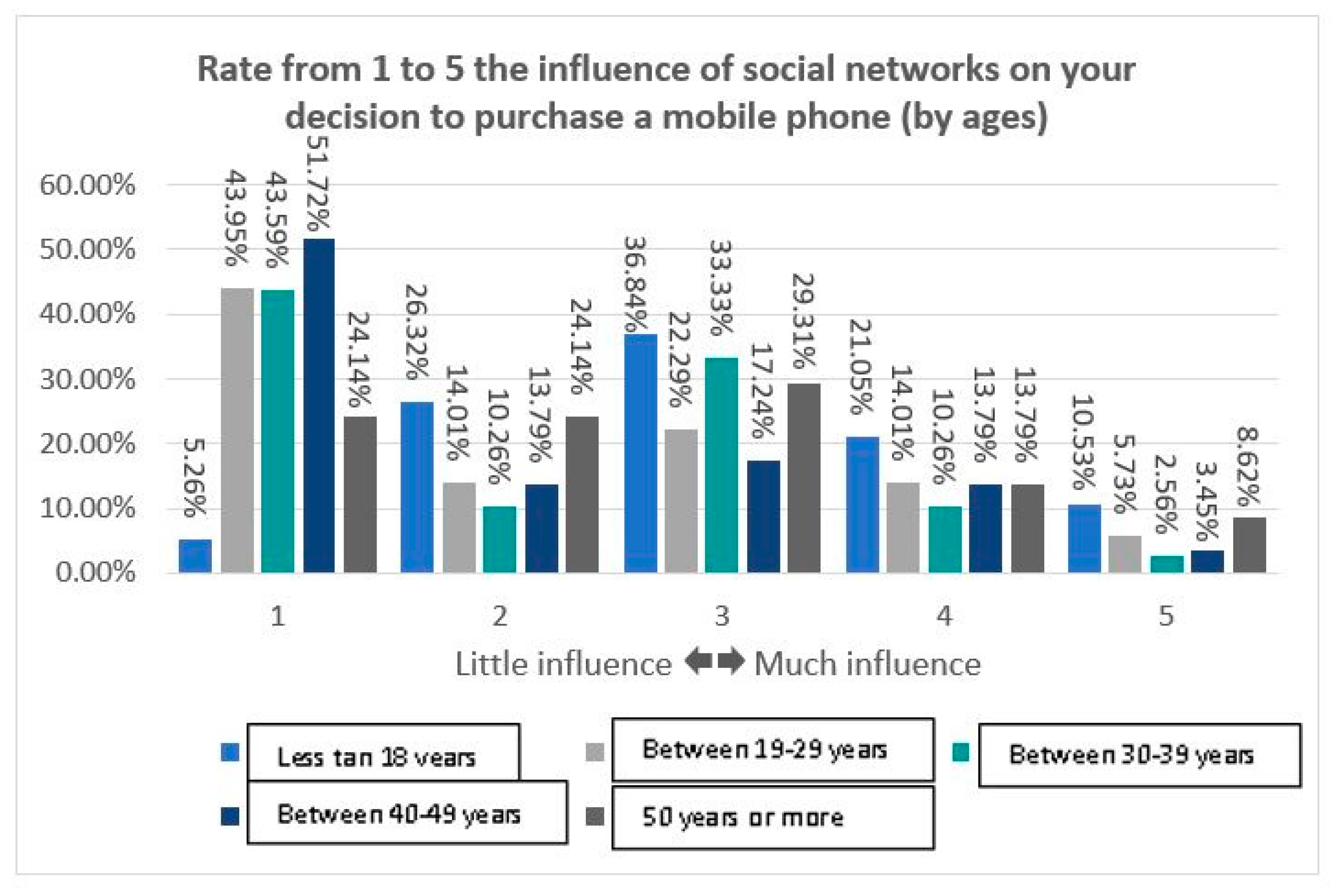

| Rate from 1 to 5 the Influence of Social Networks on Your Decision to Purchase a Mobile Phone | ||||||||

|---|---|---|---|---|---|---|---|---|

| n | Media | Standard Deviation | Standard Error | 95% Confidence Interval of the Difference | Min. | Max. | ||

| Lower Limit | Upper Limit | |||||||

| Less than 18 years | 19 | 3.05 | 1.079 | 0.247 | 2.53 | 3.57 | 1 | 5 |

| Between 19 and 29 years | 157 | 2.24 | 1.302 | 0.104 | 2.03 | 2.44 | 1 | 5 |

| Between 30 and 39 years | 39 | 2.18 | 1.189 | 0.190 | 1.79 | 2.56 | 1 | 5 |

| Between 40 and 49 years | 29 | 2.03 | 1.267 | 0.235 | 1.55 | 2.52 | 1 | 5 |

| 50 years or more | 58 | 2.59 | 1.243 | 0.163 | 2.26 | 2.91 | 1 | 5 |

| Total | 302 | 2.33 | 1.277 | 0.073 | 2.18 | 2.47 | 1 | 5 |

| Rate from 1 to 5 the Influence of Social Networks on Your Decision to Purchase a Mobile Phone | |||

|---|---|---|---|

| Levene Statistic | df1 | df2 | Sig. |

| 1.517 | 4 | 297 | 0.197 |

| Rate from 1 to 5 the Influence of Social Networks on Your Decision to Purchase a Mobile Phone | |||||

|---|---|---|---|---|---|

| Sum of Squares | gl | Quadratic Means | F | Sig. | |

| Between groups | 18.541 | 4 | 4.635 | 2.917 | 0.022 |

| In groups | 472.006 | 297 | 1.589 | ||

| Total | 490.546 | 301 | |||

| Dependent Variable: Rate from 1 to 5 the Influence of Social Networks on Your Decision to Buy a Mobile Phone | ||||||

|---|---|---|---|---|---|---|

| HSD Tukey | ||||||

| (I) Age | (J) Age | Means Difference (I-J) | STANDARD ERROR | Sig. | 95% Confidence Interval of the Difference | |

| Lower Limit | Upper Limit | |||||

| Less than 18 years | Between 19 and 29 years | 0.817 | 0.306 | 0.061 | -0.02 | 1.66 |

| Between 30 and 39 years | 0.873 | 0.353 | 0.099 | -0.09 | 1.84 | |

| Between 40 and 49 years | 1.018 | 0.372 | 0.051 | 0.00 | 2.04 | |

| 50 years or more | 0.466 | 0.333 | 0.628 | –0.45 | 1.38 | |

| Between 19 and 29 years | Less than 18 years | –0.817 | 0.306 | 0.061 | –1.66 | 0.02 |

| Between 30 and 39 years | 0.056 | 0.226 | 0.999 | –0.56 | 0.68 | |

| Between 40 and 49 years | 0.201 | 0.255 | 0.934 | –0.50 | 0.90 | |

| 50 years or more | –0.351 | 0.194 | 0.370 | –0.88 | 0.18 | |

| Between 30 and 39 years | Less than 18 years | –0.873 | 0.353 | 0.099 | –1.84 | 0.09 |

| Between 19 and 29 years | –0.056 | 0.226 | 0.999 | –0.68 | 0.56 | |

| Between 40 and 49 years | 0.145 | 0.309 | 0.990 | –0.70 | 0.99 | |

| 50 years or more | –0.407 | 0.261 | 0.526 | –10.12 | 0.31 | |

| Between 40 and 49 years | Less than 18 years | –1.018 | 0.372 | 0.051 | –2.04 | 0.00 |

| Between 19 and 29 years | –0.201 | 0.255 | 0.934 | –0.90 | 0.50 | |

| Between 30 and 39 years | –0.145 | 0.309 | 0.990 | –0.99 | 0.70 | |

| 50 years or more | –0.552 | 0.287 | 0.307 | –10.34 | 0.24 | |

| 50 years or more | Less than 18 years | –0.466 | 0.333 | 0.628 | –1.38 | 0.45 |

| Between 19 and 29 years | 0.351 | 0.194 | 0.370 | –0.18 | 0.88 | |

| Between 30 and 39 years | 0.407 | 0.261 | 0.526 | –0.31 | 1.12 | |

| Between 40 and 49 years | 0.552 | 0.287 | 0.307 | –0.24 | 1.34 | |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Fondevila-Gascón, J.-F.; Polo-López, M.; Rom-Rodríguez, J.; Mir-Bernal, P. Social Media Influence on Consumer Behavior: The Case of Mobile Telephony Manufacturers. Sustainability 2020, 12, 1506. https://doi.org/10.3390/su12041506

Fondevila-Gascón J-F, Polo-López M, Rom-Rodríguez J, Mir-Bernal P. Social Media Influence on Consumer Behavior: The Case of Mobile Telephony Manufacturers. Sustainability. 2020; 12(4):1506. https://doi.org/10.3390/su12041506

Chicago/Turabian StyleFondevila-Gascón, Joan-Francesc, Marc Polo-López, Josep Rom-Rodríguez, and Pedro Mir-Bernal. 2020. "Social Media Influence on Consumer Behavior: The Case of Mobile Telephony Manufacturers" Sustainability 12, no. 4: 1506. https://doi.org/10.3390/su12041506

APA StyleFondevila-Gascón, J.-F., Polo-López, M., Rom-Rodríguez, J., & Mir-Bernal, P. (2020). Social Media Influence on Consumer Behavior: The Case of Mobile Telephony Manufacturers. Sustainability, 12(4), 1506. https://doi.org/10.3390/su12041506