Impact of a Balanced Scorecard as a Strategic Management System Tool to Improve Sustainable Development: Measuring the Mediation of Organizational Performance through PLS-Smart

Abstract

1. Introduction

2. Literature

2.1. Linking the Strategic Management System with the Balanced Scorecard

2.2. Balanced Scorecard and Organizational Performance

2.3. Balanced Scorecard and Sustainable Development

2.4. Organizational Performance and Sustainable Development

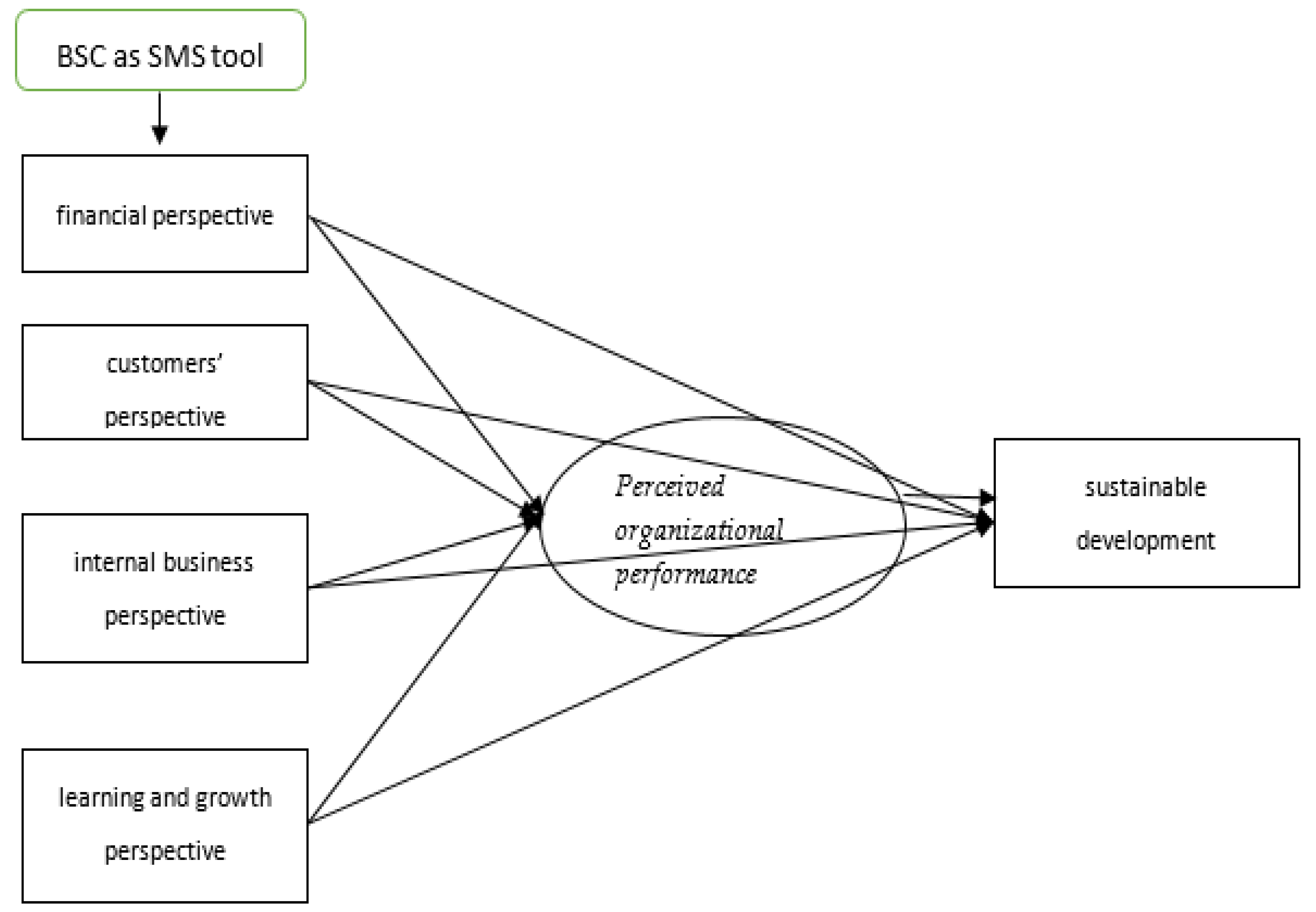

2.5. Research Framework

3. Research Methodology

3.1. The Instrument

3.2. Sampling

4. Analysis

4.1. Demographics

4.2. Discriminant Reliability

5. Implications

6. Conclusions

7. Research Limitation and Future Research

Author Contributions

Funding

Conflicts of Interest

Ethical Statement

References

- Singh, R.K.; Arora, S.S. The adoption of balanced scorecard: An exploration of its antecedents and consequences. Benchmarking Int. J. 2018, 25, 874–892. [Google Scholar] [CrossRef]

- Punniyamoorthy, M.; Murali, R. Balanced score for the balanced scorecard: A benchmarking tool. Benchmarking Int. J. 2008, 15, 420–443. [Google Scholar] [CrossRef]

- Kaplan, R.S.; Norton, D.P. The Balanced Scorecard: Measures That Drive Performance. Harv. Bus. Rev. 1992, 70, 71–79. [Google Scholar]

- Kaplan, R.S.; Norton, D.P. Transforming the Balanced Scorecard from Performance Measurement to Strategic Management: Part I. Account. Horiz. 2001, 15, 1. [Google Scholar]

- Ardito, L.; Dangelico, R.M. Firm environmental performance under scrutiny: The role of strategic and organizational orientations. Corp. Soc. Responsib. Environ. Manag. 2018, 25, 426–440. [Google Scholar] [CrossRef]

- Walls, J.L.; Berrone, P.; Phan, P.H. Corporate governance and environmental performance: Is there really a link? Strateg. Manag. J. 2012, 33, 885–913. [Google Scholar] [CrossRef]

- Alani, F.S.; Khan, M.F.R.; Manuel, D.F. University performance evaluation and strategic mapping using balanced scorecard (BSC) case study–Sohar University, Oman. Int. J. Educ. Manag. 2018, 32, 689–700. [Google Scholar] [CrossRef]

- Bontis, N.; Bart, C.K.; Bose, S.; Thomas, K. Applying the balanced scorecard for better performance of intellectual capital. J. Intellect. Cap. 2007, 8, 652–665. [Google Scholar]

- Wang, M. Issues of Balanced Scorecard and Its Implication for Chinese Companies; Auckland University of Technology: Auckland, New Zealand, 2016. [Google Scholar]

- Williams, S. Drive your business forward with the Balanced Scorecard. Manag. Serv. 2001, 45, 28–30. [Google Scholar]

- Soderberg, M.; Kalagnanam, S.; Sheehan, N.T.; Vaidyanathan, G. When is a balanced scorecard a balanced scorecard? Int. J. Product. Perform. Manag. 2011, 60, 688–708. [Google Scholar] [CrossRef]

- Davis, S.; Albright, T. An investigation of the effect of balanced scorecard implementation on financial performance. Manag. Account. Res. 2004, 15, 135–153. [Google Scholar] [CrossRef]

- Baumgartner, R.J.; Rauter, R. Strategic perspectives of corporate sustainability management to develop a sustainable organization. J. Clean. Prod. 2017, 140, 81–92. [Google Scholar] [CrossRef]

- Kaplan, R.S.; Norton, D.P. Having trouble with your strategy? Then map it. Harv. Bus. Rev. 2000, 78, 167–176. [Google Scholar] [PubMed]

- Tariq, M.; Ahmed, A.; Ahmed, S.; Rafi, S.K. Investigating the Impact of Balanced Scorecard on Performance of Business: A study based on the Banking Sector of Pakistan. IBT J. Bus. Stud. (JBS) 2013, 9, 1. [Google Scholar]

- Rabbani, F.; Lalji, S.N.; Abbas, F.; Jafri, S.W.; Razzak, J.A.; Nabi, N.; Jahan, F.; Ajmal, A.; Petzold, M.; Brommels, M. Understanding the context of balanced scorecard implementation: A hospital-based case study in Pakistan. Implement. Sci. 2011, 6, 31. [Google Scholar] [CrossRef]

- Al-Najjar, S.M.; Kalaf, K.H. Designing a balanced scorecard to measure a bank’s performance: A case study. Int. J. Bus. Adm. 2012, 3, 44. [Google Scholar] [CrossRef]

- Ahmad, S.T.; Hasnu, S.A.F. Balanced Scorecard Implementation: Case Study of COMSATS Abbottabad. Researcher 2013, 5, 88–109. [Google Scholar]

- CPEC. Energy companies in Pakistan. Available online: https://obortunity.org/cpec-news/energy-projects/ (accessed on 15 October 2019).

- Pearce, J.A.; Robbins, K. Toward improved theory and research on business turnaround. J. Manag. 1993, 19, 613–636. [Google Scholar] [CrossRef]

- Pearce II, J.A.; Robbins, D.K. Strategic transformation as the essential last step in the process of business turnaround. Bus. Horiz. 2008, 51, 121–130. [Google Scholar] [CrossRef]

- Boulton, W.R. Business Policy: The Art of Strategic Management; Macmillan: New York, NY, USA, 1984. [Google Scholar]

- Krasniqi, B.A.; Tullumi, M. What Perceived Success Factors Are Important for Smalll Business Owners in A Transition Economy? Int. J. Bus. Manag. Stud. 2013, 5, 21–32. [Google Scholar]

- Ronda-Pupo, G.A.; Díaz-Contreras, C.; Ronda-Velázquez, G.; Ronda-Pupo, J.C. The role of academic collaboration in the impact of Latin-American research on management. Scientometrics 2015, 102, 1435–1454. [Google Scholar] [CrossRef]

- Ronda-Pupo, G.A. Growth and consolidation of strategic management research: Insights for the future development of strategic management. Acad. Strateg. Manag. J. 2015, 14, 155. [Google Scholar]

- Wright, M.; Stigliani, I. Entrepreneurship and growth. Int. Small Bus. J. 2013, 31, 3–22. [Google Scholar] [CrossRef]

- Mintzberg, H. The structuring of Organizations; Pearson: London, UK, 1979. [Google Scholar]

- Furrer, O.; Thomas, H.; Goussevskaia, A. The structure and evolution of the strategic management field: A content analysis of 26 years of strategic management research. Int. J. Manag. Rev. 2008, 10, 1–23. [Google Scholar] [CrossRef]

- Guerras-Martin, L.Á.; Madhok, A.; Montoro-Sánchez, Á. The evolution of strategic management research: Recent trends and current directions. BRQ Bus. Res. Q. 2014, 17, 69–76. [Google Scholar] [CrossRef]

- Grant, R.M. Contemporary Strategy Analysis: Text and Cases Edition; John Wiley & Sons: Hoboken, NJ, USA, 2016. [Google Scholar]

- Molina-Azorín, J.F. Microfoundations of strategic management: Toward micro–macro research in the resource-based theory. BRQ Bus. Res. Q. 2014, 17, 102–114. [Google Scholar] [CrossRef]

- Kenworthy, T.P.; Verbeke, A. The future of strategic management research: Assessing the quality of theory borrowing. Eur. Manag. J. 2015, 33, 179–190. [Google Scholar] [CrossRef]

- Ronda-Pupo, G.; Guerras-Martín, L. Dynamics of the scientific community network within the strategic management field through the Strategic Management Journal 1980–2009: The role of cooperation. Scientometrics 2010, 85, 821–848. [Google Scholar] [CrossRef]

- Hoskisson, R.E.; Shi, W.; Yi, X.; Jin, J. The evolution and strategic positioning of private equity firms. Acad. Manag. Perspect. 2013, 27, 22–38. [Google Scholar] [CrossRef]

- Pettigrew, A.; Thomas, H.; Whittington, R. Strategic management: The strengths and limitations of a field. Handb. Strategy Manag. 2002, 544. [Google Scholar] [CrossRef]

- Banker, R.D.; Hu, N.; Pavlou, P.A.; Luftman, J. CIO reporting structure, strategic positioning, and firm performance. MIS Q. 2011, 35, 487–504. [Google Scholar] [CrossRef]

- Jensen, J.A.; Cobbs, J.B.; Turner, B.A. Evaluating sponsorship through the lens of the resource-based view: The potential for sustained competitive advantage. Bus. Horiz. 2016, 59, 163–173. [Google Scholar] [CrossRef]

- Lin, Y.; Wu, L.-Y. Exploring the role of dynamic capabilities in firm performance under the resource-based view framework. J. Bus. Res. 2014, 67, 407–413. [Google Scholar] [CrossRef]

- Babafemi, I.D. Corporate strategy, planning and performance evaluation: A survey of literature. J. Manag. Policies Pract. 2015, 3, 43–49. [Google Scholar] [CrossRef]

- Mavondo, F.T.; Tsarenko, Y. Organisational learning profiles: Implications for innovation and performance. In Marketing, Technology and Customer Commitment in the New Economy; Springer: Berlin/Heidelberg, Germany, 2015; pp. 98–103. [Google Scholar]

- Beyene, K.T.; Shi, C.S.; Wei, W.W. Linking national culture and product innovation performance: What really influences the interplay, strategy formulation or implementation effectiveness? Int. J. Bus. Manag. 2016, 11, 184. [Google Scholar] [CrossRef]

- Bisbe, J.; Malagueño, R. Using strategic performance measurement systems for strategy formulation: Does it work in dynamic environments? Manag. Account. Res. 2012, 23, 296–311. [Google Scholar] [CrossRef]

- Maia, J.L.; Serio, L.; Alves Filho, A.G. Almost two decades after: A bibliometric effort to map research on strategy as practice using two data sources. Eur. J. Econ. Financ. Adm. Sci. 2015, 73, 7–31. [Google Scholar]

- Smith, M.; Bititci, U.S. Interplay between performance measurement and management, employee engagement and performance. Int. J. Oper. Prod. Manag. 2017, 37, 1207–1228. [Google Scholar] [CrossRef]

- Jarzabkowski, P.; Kaplan, S.; Seidl, D.; Whittington, R. On the Risk of Studying Practices in Isolation: Linking What, Who and How in Strategy Research. Strateg. Organ. Forthcom. 2015. [Google Scholar] [CrossRef]

- Jarzabkowski, P.; Kaplan, S.; Seidl, D.; Whittington, R. On the risk of studying practices in isolation: Linking what, who, and how in strategy research. Strateg. Organ. 2016, 14, 248–259. [Google Scholar] [CrossRef]

- Bromiley, P.; Rau, D. Missing the point of the practice-based view. Strateg. Organ. 2016, 14, 260–269. [Google Scholar] [CrossRef]

- Bromiley, P.; Rau, D. Towards a practice-based view of strategy. Strateg. Manag. J. 2014, 35, 1249–1256. [Google Scholar] [CrossRef]

- Okumus, F.; Köseoglu, M.A.; Morvillo, A.; Altin, M. Scientific progress on strategic management in hospitality and tourism: A state-of-the-art. Tour. Rev. 2017, 72, 261–273. [Google Scholar] [CrossRef]

- Kaplan, R.S.; Davenport, T.H.; Robert, N.P.D.K.S.; Kaplan, R.S.; Norton, D.P. The Strategy-Focused Organization: How Balanced Scorecard Companies Thrive in the New Business Environment; Harvard Business Press: Brighton, Ma, USA, 2001. [Google Scholar]

- Lucianetti, L. The impact of the strategy maps on balanced scorecard performance. Int. J. Bus. Perform. Manag. 2010, 12, 21–36. [Google Scholar] [CrossRef]

- Figge, F.; Hahn, T.; Schaltegger, S.; Wagner, M. The sustainability balanced scorecard–linking sustainability management to business strategy. Bus. Strategy Environ. 2002, 11, 269–284. [Google Scholar] [CrossRef]

- Nathan, M.L. ‘Lighting tomorrow with today’: Towards a (strategic) sustainability revolution. Int. J. Sustain. Strateg. Manag. 2010, 2, 29–40. [Google Scholar] [CrossRef]

- Farid, D.; Mirfakhredini, H. Balanced scorecard application in universities and higher education institutes: Implementation guide in an Iranian context. Univ. Bucur. An. Ser. Stiinte Econ. Si Adm. 2008, 2, 29. [Google Scholar]

- Saunders, M.; Mann, R.; Smith, R. Implementing Strategic initiatives: A framework of leading practices. Int. J. Oper. Prod. Manag. 2008, 28, 1095–1123. [Google Scholar] [CrossRef]

- Free, C.; Qu, S.Q. The use of graphics in promoting management ideas: An analysis of the Balanced Scorecard, 1992–2010. J. Account. Organ. Chang. 2011, 7, 158–189. [Google Scholar] [CrossRef]

- Stede, W.A.V.d.; Chow, C.W.; Lin, T.W. Strategy, choice of performance measures, and performance. Behav. Res. Account. 2006, 18, 185–205. [Google Scholar] [CrossRef]

- Tung, A.; Baird, K.; Schoch, H.P. Factors influencing the effectiveness of performance measurement systems. Int. J. Oper. Prod. Manag. 2011, 31, 1287–1310. [Google Scholar] [CrossRef]

- Ferreira, A.; Otley, D. The design and use of performance management systems: An extended framework for analysis. Manag. Account. Res. 2009, 20, 263–282. [Google Scholar] [CrossRef]

- Ittner, C.D.; Larcker, D.F.; Rajan, M.V. The choice of performance measures in annual bonus contracts. Account. Rev. 1997, 231–255. [Google Scholar]

- Ittner, C.D.; Larcker, D.F. Innovations in performance measurement: Trends and research implications. J. Manag. Account. Res. 1998, 10, 205. [Google Scholar]

- Banker, R.D.; Potter, G.; Srinivasan, D. An empirical investigation of an incentive plan that includes nonfinancial performance measures. Account. Rev. 2000, 75, 65–92. [Google Scholar] [CrossRef]

- Hoque, Z.; James, W. Linking balanced scorecard measures to size and market factors: Impact on organizational performance. J. Manag. Account. Res. 2000, 12, 1–17. [Google Scholar] [CrossRef]

- Hoque, Z. 20 years of studies on the balanced scorecard: Trends, accomplishments, gaps and opportunities for future research. Br. Account. Rev. 2014, 46, 33–59. [Google Scholar] [CrossRef]

- Baird, K.; Su, S. The association between controls, performance measures and performance. Int. J. Product. Perform. Manag. 2018, 67, 967–984. [Google Scholar] [CrossRef]

- De Geuser, F.; Mooraj, S.; Oyon, D. Does the balanced scorecard add value? Empirical evidence on its effect on performance. Eur. Account. Rev. 2009, 18, 93–122. [Google Scholar] [CrossRef]

- Radomska, J. The concept of sustainable strategy implementation. Sustainability 2015, 7, 15847–15856. [Google Scholar] [CrossRef]

- Cierna, H.; Sujova, E. Parallels between corporate social responsibility and the EFQM excellence model. MM Sci. J. 2015, 10, 670–676. [Google Scholar] [CrossRef]

- Chalmeta, R.; Palomero, S. Methodological proposal for business sustainability management by means of the Balanced Scorecard. J. Oper. Res. Soc. 2011, 62, 1344–1356. [Google Scholar] [CrossRef]

- Hristov, I.; Chirico, A.; Appolloni, A. Sustainability Value Creation, Survival, and Growth of the Company: A Critical Perspective in the Sustainability Balanced Scorecard (SBSC). Sustainability 2019, 11, 2119. [Google Scholar] [CrossRef]

- Stead, J.G.; Stead, W.E. The coevolution of sustainable strategic management in the global marketplace. Organ. Environ. 2013, 26, 162–183. [Google Scholar] [CrossRef]

- Rafiq1a, M.; Zhang, X.; Yuan, J.; Naz, S. A Meta-synthesis Study on the Political and Regulatory RisNs of Chinese Power Companies Investing in PaNistan. Int. J. Comput. Eng. 2018, 3, 151. [Google Scholar]

- Hansen, E.G.; Schaltegger, S. The sustainability balanced scorecard: A systematic review of architectures. J. Bus. Ethics 2016, 133, 193–221. [Google Scholar] [CrossRef]

- Duman, G.M.; Taskaynatan, M.; Kongar, E.; Rosentrater, K.A. Integrating environmental and social sustainability into performance evaluation: A Balanced Scorecard-based Grey-DANP approach for the food industry. Front. Nutr. 2018, 5, 65. [Google Scholar] [CrossRef]

- Dias-Sardinha, I.; Reijnders, L.; Antunes, P. From environmental performance evaluation to eco-efficiency and sustainability balanced scorecards. Environ. Qual. Manag. 2002, 12, 51–64. [Google Scholar] [CrossRef]

- Falle, S.; Rauter, R.; Engert, S.; Baumgartner, R. Sustainability management with the sustainability balanced scorecard in SMEs: Findings from an Austrian case study. Sustainability 2016, 8, 545. [Google Scholar] [CrossRef]

- Kramer, S. Strategic Sustainability: The Case of the New Zealand Energy Sector. Master Thesis, Victoria University of Wellington, Wellington, New Zealand, 2009. [Google Scholar]

- Henrique da Rocha Vencato, C.; Maffini Gomes, C.; Luciane Scherer, F.; Marques Kneipp, J.; Schoproni Bichueti, R. Strategic sustainability management and export performance. Manag. Environ. Qual. Int. J. 2014, 25, 431–445. [Google Scholar] [CrossRef]

- Yilmaz, A.K.; Flouris, T. Managing corporate sustainability: Risk management process based perspective. Afr. J. Bus. Manag. 2010, 4, 162–171. [Google Scholar]

- Epstein, M.J.; Wisner, P. Good neighbours: Implementing social and environmental strategies with the BSC. Balanced Scorec. Rep. 2001, 3, 8–11. [Google Scholar]

- Araújo, M.; Sampaio, P. The path to excellence of the Portuguese organisations recognised by the EFQM model. Total Qual. Manag. Bus. Excell. 2014, 25, 427–438. [Google Scholar] [CrossRef]

- Veress, Z.E.; Gavreliuc, A. Organizational Commitment, Organizational Justice and Work Satisfaction: A Comprehensive Model in a Romanian Organizational Setting. Rom. J. Psychol. 2018, 20. [Google Scholar] [CrossRef]

- Porter, M.E.; Reinhardt, F.L. A strategic approach to climate. Harv. Bus. Rev. 2007, 85, 22. [Google Scholar]

- Adams, R.; Jeanrenaud, S.; Bessant, J.; Denyer, D.; Overy, P. Sustainability-oriented innovation: A systematic review. Int. J. Manag. Rev. 2016, 18, 180–205. [Google Scholar] [CrossRef]

- Bhattacharya, C.; Polman, P. Sustainability lessons from the front lines. MIT Sloan Manag. Rev. 2017, 58, 71. [Google Scholar]

- Hart, S.L. Beyond greening: Strategies for a sustainable world. Harv. Bus. Rev. 1997, 75, 66–77. [Google Scholar]

- Stadtler, L.; Lin, H. Moving to the next strategy stage: Examining firms’ awareness, motivation and capability drivers in environmental alliances. Bus. Strategy Environ. 2017, 26, 709–730. [Google Scholar] [CrossRef]

- Engert, S.; Rauter, R.; Baumgartner, R.J. Exploring the integration of corporate sustainability into strategic management: A literature review. J. Clean. Prod. 2016, 112, 2833–2850. [Google Scholar] [CrossRef]

- Pope, J.; Annandale, D.; Morrison-Saunders, A. Conceptualising sustainability assessment. Environ. Impact Assess. Rev. 2004, 24, 595–616. [Google Scholar] [CrossRef]

- González-Benito, Ó.; González-Benito, J. Implications of market orientation on the environmental transformation of industrial firms. Ecol. Econ. 2008, 64, 752–762. [Google Scholar] [CrossRef]

- Testa, F.; Rizzi, F.; Daddi, T.; Gusmerotti, N.M.; Frey, M.; Iraldo, F. EMAS and ISO 14001: The differences in effectively improving environmental performance. J. Clean. Prod. 2014, 68, 165–173. [Google Scholar] [CrossRef]

- Siva, V.; Gremyr, I.; Bergquist, B.; Garvare, R.; Zobel, T.; Isaksson, R. The support of Quality Management to sustainable development: A literature review. J. Clean. Prod. 2016, 138, 148–157. [Google Scholar] [CrossRef]

- Braam, G.J.; Nijssen, E.J. Performance effects of using the balanced scorecard: A note on the Dutch experience. Long Range Plan. 2004, 37, 335–349. [Google Scholar] [CrossRef]

- Malina, M.A.; Selto, F.H. Communicating and controlling strategy: An empirical study of the effectiveness of the balanced scorecard. J. Manag. Account. Res. 2001, 13, 47–90. [Google Scholar] [CrossRef]

- Becker, B.; Gerhart, B. The impact of human resource management on organizational performance: Progress and prospects. Acad. Manag. J. 1996, 39, 779–801. [Google Scholar]

- Bell, E.; Bryman, A.; Harley, B. Business Research Methods; Oxford university press: Oxford, UK, 2018. [Google Scholar]

- Bell, E.; Bryman, A. The ethics of management research: An exploratory content analysis. Br. J. Manag. 2007, 18, 63–77. [Google Scholar] [CrossRef]

- M’maiti, H.I. Balanced Score Card as A Strategic Management Tool in the Kenyan Commercial State Corporations. Master’s Thesis, University Of Nairobi, Nairobi, Kenya, 2014. [Google Scholar]

- Pallant, J. SPSS survival guide. Crow’s Nest; Allen & Unwin: Crows Nest, Australia, 2005. [Google Scholar]

- Yang, B. Factor analysis methods. In Research in organizations: Foundations and methods of inquiry.; Berrett-Koehler: San Francisco, CA, USA, 2005; pp. 181–199. [Google Scholar]

- Tavakol, M.; Dennick, R. Making sense of Cronbach’s alpha. Int. J. Med Educ. 2011, 2, 53. [Google Scholar] [CrossRef]

- Alarcón, D.; Sánchez, J.A.; De Olavide, U. Assessing convergent and discriminant validity in the ADHD-R IV rating scale: User-written commands for Average Variance Extracted (AVE), Composite Reliability (CR), and Heterotrait-Monotrait ratio of correlations (HTMT). In Proceedings of the Spanish STATA Meeting, Madrid, Spain, 22 October 2015; pp. 1–39. [Google Scholar]

- Henseler, J.; Ringle, C.M.; Sarstedt, M. A new criterion for assessing discriminant validity in variance-based structural equation modeling. J. Acad. Mark. Sci. 2015, 43, 115–135. [Google Scholar] [CrossRef]

- Dodge, Y. The Oxford Dictionary of Statistical Terms; International Statistical Institute: Voorburg, The Netherlands, 2003. [Google Scholar]

- Kaplan, R.S.; Norton, D.P. The strategy map: Guide to aligning intangible assets. Strategy Leadersh. 2004, 32, 10–17. [Google Scholar] [CrossRef]

| Items | Frequency | Percent | |

|---|---|---|---|

| Gender | Male | 222 | 72.8 |

| Female | 68 | 22.3 | |

| Age | 20–25 | 14 | 4.6 |

| 26–30 | 25 | 8.2 | |

| 31–35 | 76 | 24.9 | |

| 36–40 | 70 | 23 | |

| 41–45 | 62 | 20.3 | |

| 46–50 | 32 | 10.5 | |

| Above 50 | 17 | 5.6 | |

| Designation | Upper level | 18 | 5.9 |

| Middle level | 209 | 68.5 | |

| Operational level | 69 | 22.6 | |

| Experience | Less than 2 years | 44 | 14.7 |

| Between 2 and 4 years | 84 | 27.5 | |

| Between 5 and 7 years | 109 | 35.7 | |

| More than seven years | 58 | 19 | |

| Variables | Cronbach’s Alpha | Composite Reliability | Average Variance Extracted (AVE) |

|---|---|---|---|

| Internal business perspective | 0.875 | 0.910 | 0.670 |

| Customers’ perspective | 0.884 | 0.912 | 0.632 |

| Financial perspective | 0.827 | 0.892 | 0.636 |

| Learning and growth perspective | 0.798 | 0.861 | 0.555 |

| Perceived organizational performance | 0.867 | 0.908 | 0.637 |

| Sustainable development | 0.798 | 0.857 | 0.502 |

| Variables | Internal Business Perspective | Customer Perspective | Financial Perspective | Learning and Growth Perspective | Perceived Organizational Performance | Sustainable Development |

|---|---|---|---|---|---|---|

| Internal business perspective | 0.818 | |||||

| customer perspective | 0.704 | 0.795 | ||||

| financial perspective | 0.710 | 0.821 | 0.797 | |||

| learning and growth perspective | 0.412 | 0.523 | 0.488 | 0.745 | ||

| Perceived organizational performance | 0.563 | 0.650 | 0.723 | 0.561 | 0.798 | |

| Sustainable development | 0.531 | 0.540 | 0.566 | 0.811 | 0.596 | 0.709 |

| Items | Customers’ Perspective |

|---|---|

| cp1 | 0.838 |

| cp2 | 0.804 |

| cp3 | 0.793 |

| cp4 | 0.788 |

| cp5 | 0.789 |

| cp6 | 0.756 |

| Financial perspective | |

| fp2 | 0.902 |

| fp3 | 0.912 |

| fp4 | 0.881 |

| fp5 | 0.856 |

| fp6 | 0.806 |

| internal business perspective | |

| ibp1 | 0.745 |

| ibp2 | 0.856 |

| ibp3 | 0.885 |

| ibp4 | 0.795 |

| ibp5 | 0.802 |

| learning and growth perspective | |

| lgp1 | 0.841 |

| lgp2 | 0.849 |

| lgp3 | 0.764 |

| lgp4 | 0.651 |

| lgp5 | 0.556 |

| Perceived organizational performance | |

| op2 | 0.897 |

| op3 | 0.911 |

| op4 | 0.831 |

| op5 | 0.881 |

| op6 | 0.834 |

| Sustainable development | |

| sd1 | 0.528 |

| sd2 | 0.807 |

| sd3 | 0.802 |

| sd4 | 0.755 |

| sd5 | 0.751 |

| sd6 | 0.549 |

| Hypothesis | Relationship | Standard Deviation | T Statistics | p-Values | Decision |

|---|---|---|---|---|---|

| H1 | FP→POP | 0.167 | 4.381 | 0.000 | Accepted |

| H2 | CP→POP | 0.204 | 3.461 | 0.034 | Accepted |

| H3 | IBP→POP | 0.096 | 3.213 | 0.032 | Accepted |

| H4 | LGP→POP | 0.076 | 4.375 | 0.000 | Accepted |

| H5 | FP→SD | 0.268 | 1.332 | 0.183 | Rejected |

| H6 | CP→SD | 0.237 | 2.046 | 0.041 | Accepted |

| H7 | IBP→SD | 0.124 | 2.365 | 0.018 | Accepted |

| H8 | LGP→SD | 0.112 | 9.021 | 0.000 | Accepted |

| H9 | POP→SD | 0.169 | 0.509 | 0.611 | Rejected |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rafiq, M.; Zhang, X.; Yuan, J.; Naz, S.; Maqbool, S. Impact of a Balanced Scorecard as a Strategic Management System Tool to Improve Sustainable Development: Measuring the Mediation of Organizational Performance through PLS-Smart. Sustainability 2020, 12, 1365. https://doi.org/10.3390/su12041365

Rafiq M, Zhang X, Yuan J, Naz S, Maqbool S. Impact of a Balanced Scorecard as a Strategic Management System Tool to Improve Sustainable Development: Measuring the Mediation of Organizational Performance through PLS-Smart. Sustainability. 2020; 12(4):1365. https://doi.org/10.3390/su12041365

Chicago/Turabian StyleRafiq, Muhammad, XingPing Zhang, Jiahai Yuan, Shumaila Naz, and Saif Maqbool. 2020. "Impact of a Balanced Scorecard as a Strategic Management System Tool to Improve Sustainable Development: Measuring the Mediation of Organizational Performance through PLS-Smart" Sustainability 12, no. 4: 1365. https://doi.org/10.3390/su12041365

APA StyleRafiq, M., Zhang, X., Yuan, J., Naz, S., & Maqbool, S. (2020). Impact of a Balanced Scorecard as a Strategic Management System Tool to Improve Sustainable Development: Measuring the Mediation of Organizational Performance through PLS-Smart. Sustainability, 12(4), 1365. https://doi.org/10.3390/su12041365