Impacts of Tourism Demand on Retail Property Prices in a Shopping Destination

Abstract

1. Introduction

2. Literature Review

3. Development of Hypotheses

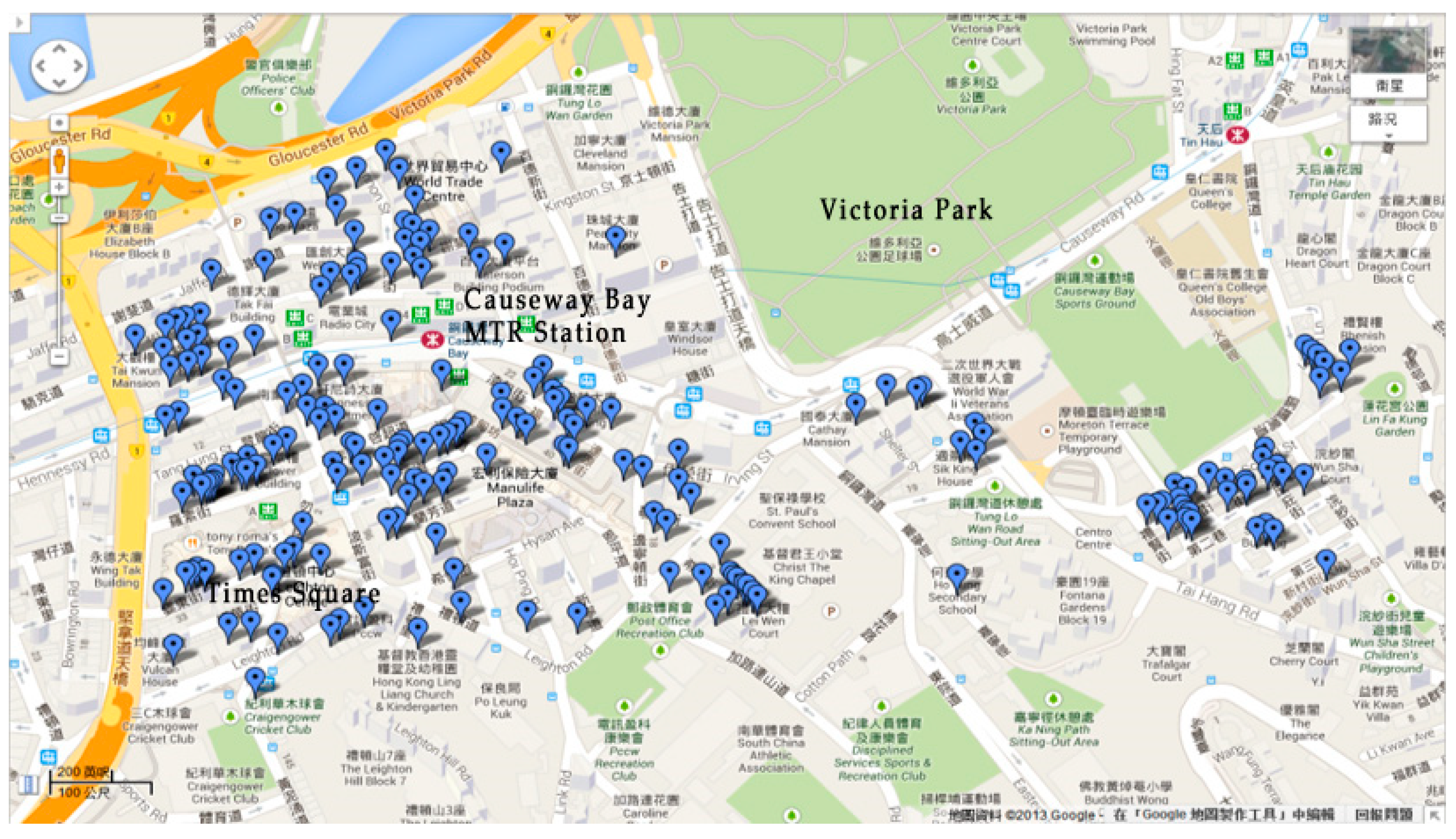

4. Data and Variables

4.1. Data

4.2. Variables

5. Methodology

6. Results

7. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Biagi, B.; Brandano, M.G.; Lambiri, D. Does tourism affect house prices? Evidence from Italy. Growth Chang. 2015, 46, 501–528. [Google Scholar] [CrossRef]

- UNWTO. International Tourism Highlights, 2019 ed.; UNWTO: Madrid, Spain, 2019. [Google Scholar]

- Xu, Y.; McGehee, N.G. Shopping behavior of Chinese tourists visiting the United States: Letting the shoppers do the talking. Tour. Manag. 2012, 33, 427–430. [Google Scholar] [CrossRef]

- Choi, M.; Law, R.; Heo, C.Y. Shopping destinations and trust–tourist attitudes: Scale development and validation. Tour. Manag. 2016, 54, 490–501. [Google Scholar] [CrossRef]

- Pantano, E.; Dennis, C. Store buildings as tourist attractions: Mining retail meaning of store building pictures through a machine learning approach. J. Retail. Consum. Serv. 2019, 51, 304–310. [Google Scholar] [CrossRef]

- Murphy, L.; Moscardo, G.; Benckendorff, P.; Pearce, P. Evaluating tourist satisfaction with the retail experience in a typical tourist shopping village. J. Retail. Consum. Serv. 2011, 18, 302–310. [Google Scholar] [CrossRef]

- Meng, F.; Xu, Y. Tourism shopping behavior: Planned, impulsive, or experiential? Int. J. Cult. Tour. Hosp. Res. 2012, 6, 250–265. [Google Scholar] [CrossRef]

- Zaidan, E.A. Tourism shopping and new urban entertainment: A case study of Dubai. J. Vacat. Mark. 2016, 22, 29–41. [Google Scholar] [CrossRef]

- Bao, Z.; Lu, W.; Chi, B.; Yuan, H.; Hao, J. Procurement innovation for a circular economy of construction and demolition waste: Lessons learnt from Suzhou, China. Waste Manag. 2019, 99, 12–21. [Google Scholar] [CrossRef]

- Yeung, S.; Wong, J.; Ko, E. Preferred shopping destination: Hong Kong versus Singapore. Int. J. Tour. Res. 2004, 6, 85–96. [Google Scholar] [CrossRef]

- Hong Kong Tourism Board. A Statistical Review of Hong Kong Tourism; Hong Kong Tourism Board: Hong Kong, China, 2018.

- Li, L.-H.; Cheung, K.S.; Han, S.Y. The impacts of cross-border tourists on local retail property market: An empirical analysis of Hong Kong. J. Prop. Res. 2018, 35, 252–270. [Google Scholar] [CrossRef]

- Yang, L.; Chau, K.W.; Lu, Y.; Cui, X.; Meng, F.; Wang, X. Locale-varying relationships between tourism development and retail property prices in a shopping destination. Int. J. Strateg. Prop. Manag. 2020, in press. [Google Scholar]

- Jayantha, W.M.; Yung, E.H.K. Effect of Revitalisation of Historic Buildings on Retail Shop Values in Urban Renewal: An Empirical Analysis. Sustainability 2018, 10, 1418. [Google Scholar] [CrossRef]

- Litirell, M.A.; Baizerman, S.; Kean, R.; Gahring, S.; Niemeyer, S.; Reilly, R.; Stout, J. Souvenirs and tourism styles. J. Travel Res. 1994, 33, 3–11. [Google Scholar] [CrossRef]

- Oh, J.Y.-J.; Cheng, C.K.; Lehto, X.Y.; O’Leary, J.T. Predictors of tourists’ shopping behaviour: Examination of socio-demographic characteristics and trip typologies. J. Vacat. Mark. 2004, 10, 308–319. [Google Scholar] [CrossRef]

- Lloyd, A.E.; Yip, L.S.; Luk, S.T. An examination of the differences in retail service evaluation between domestic and tourist shoppers in Hong Kong. Tour. Manag. 2011, 32, 520–533. [Google Scholar] [CrossRef]

- Zeithaml, V.A. Consumer perceptions of price, quality, and value: A means-end model and synthesis of evidence. J. Mark. 1988, 52, 2–22. [Google Scholar] [CrossRef]

- Lindquist, J.D. Meaning of image: A survey of empirical and hypothetical evidence. J. Retail. 1974, 50, 29–38. [Google Scholar]

- Christiansen, T.; Snepenger, D.J. Is it the mood or the mall that encourages tourists to shop? J. Shop. Center Res. 2002, 9, 7–26. [Google Scholar]

- Benjamin, J.D.; Boyle, G.W.; Sirmans, C. Retail leasing: The determinants of shopping center rents. Real Estate Econ. 1990, 18, 302–312. [Google Scholar] [CrossRef]

- Iii, W.G.H.; Wolverton, M.L. Neighborhood Center Image and Rents. J. Real Estate Financ. Econ. 2001, 23, 31–46. [Google Scholar]

- Brown, G.R.; Chau, K.W. Excess returns in the Hong Kong commercial real estate market. J. Real Estate Res. 1997, 14, 91–106. [Google Scholar]

- Sirmans, C.F.; Guidry, K.A. The determinants of shopping center rents. J. Real Estate Res. 1993, 8, 107–116. [Google Scholar]

- Chau, K.W.; Pretorius, F.; Yu, C.K. The determinants of street level retail shop prices in Hong Kong. In Proceedings of the Pacific Rim Real Estate Society Conference, Sydney, Australia, 23–27 January 2000. [Google Scholar]

- Li, Y.; Yang, L.; Shen, H.; Wu, Z. Modeling intra-destination travel behavior of tourists through spatio-temporal analysis. J. Dest. Mark. Manag. 2019, 11, 260–269. [Google Scholar] [CrossRef]

- Xu, W.A.; Zhou, J.; Yang, L.; Li, L. The implications of high-speed rail for Chinese cities: Connectivity and accessibility. Transp. Res. Part A Policy Pract. 2018, 116, 308–326. [Google Scholar]

- Xu, W.A.; Yang, L. Evaluating the urban land use plan with transit accessibility. Sustain. Cities Soc. 2019, 45, 474–485. [Google Scholar] [CrossRef]

- Seiders, K.; Berry, L.L.; Gresham, L.G. Attention, retailers! How convenient is your convenience strategy? MIT Sloan Manag. Rev. 2000, 41, 79–89. [Google Scholar]

- Kang, C.-D. Spatial access to pedestrians and retail sales in Seoul, Korea. Habitat Int. 2016, 57, 110–120. [Google Scholar] [CrossRef]

- Transport Department. Travel Characteristics Surveys 2011 Final Report; Hong Kong Transport Department: Hong Kong, China, 2014.

- Simon, D. Inherent complexity: Disability, accessible tourism and accommodation information preferences. Tour. Manag. 2010, 31, 816–826. [Google Scholar]

- Pierce, W.D.; Cheney, C.D. Behavior Analysis and Learning; Psychology Press: London, UK, 2013. [Google Scholar]

- Gollwitzer, P.M.; Heckhausen, H.; Ratajczak, H. From weighing to willing: Approaching a change decision through pre- or postdecisional mentation. Organ. Behav. Hum. Decis. Process. 1990, 45, 41–65. [Google Scholar] [CrossRef]

- Wimmer, G.E.; Shohamy, D. Preference by association: How memory mechanisms in the hippocampus bias decisions. Science 2012, 338, 270–273. [Google Scholar] [CrossRef]

- Yang, L.; Chau, K.W.; Chu, X. Accessibility-based premiums and proximity-induced discounts stemming from bus rapid transit in China: Empirical evidence and policy implications. Sustain. Cities Soc. 2019, 48, 101561. [Google Scholar] [CrossRef]

- Wong, S.K.; Chau, K.W.; Yau, Y.; Cheung, A.K.C. Property price gradients: The vertical dimension. J. Hous. Built Environ. 2011, 26, 33–45. [Google Scholar] [CrossRef]

- Eppli, M.; Benjamin, J. The evolution of shopping center research: A review and analysis. J. Real Estate Res. 1994, 9, 5–32. [Google Scholar]

- Chau, K.W.; Wong, S.K.; Yiu, C.Y.; Leung, H.F. Real estate price indices in Hong Kong. J. Real Estate Lit. 2005, 13, 337–356. [Google Scholar]

- Chau, K.W.; Chin, T. A critical review of literature on the hedonic price model. Int. J. Hous. Sci. Appl. 2003, 27, 145–165. [Google Scholar]

- Zhang, D.; Jiao, J. How Does Urban Rail Transit Influence Residential Property Values? Evidence from An Emerging Chinese Megacity. Sustainability 2019, 11, 534. [Google Scholar] [CrossRef]

- Perez-Sanchez, V.R.; Serrano-Estrada, L.; Marti, P.; Mora-Garcia, R.-T. The What, Where, and Why of Airbnb Price Determinants. Sustainability 2018, 10, 4596. [Google Scholar] [CrossRef]

- Ye, Y.; Xie, H.; Fang, J.; Jiang, H.; Wang, D. Daily Accessed Street Greenery and Housing Price: Measuring Economic Performance of Human-Scale Streetscapes via New Urban Data. Sustainability 2019, 11, 1741. [Google Scholar] [CrossRef]

- Xiao, Y.; Lu, Y.; Guo, Y.; Yuan, Y. Estimating the willingness to pay for green space services in Shanghai: Implications for social equity in urban China. Urban For. Urban Green. 2017, 26, 95–103. [Google Scholar] [CrossRef]

- Rosen, S. Hedonic prices and implicit markets: Product differentiation in pure competition. J. Political Econ. 1974, 82, 34–55. [Google Scholar] [CrossRef]

- Anselin, L. Lagrange multiplier test diagnostics for spatial dependence and spatial heterogeneity. Geogr. Anal. 1988, 20, 1–17. [Google Scholar] [CrossRef]

- Wong, S.K.; Yiu, C.Y.; Chau, K.W. Trading volume-induced spatial autocorrelation in real estate prices. J. Real Estate Financ. Econ. 2013, 46, 596–608. [Google Scholar] [CrossRef]

- Li, C.W.; Wong, S.K.; Chau, K.W. An analysis of spatial autocorrelation in Hong Kong’s housing market. Pac. Rim Prop. Res. J. 2011, 17, 443–462. [Google Scholar]

- Cao, X.J.; Hough, J.A. Hedonic value of transit accessibility: An empirical analysis in a small urban area. J. Transp. Res. Forum 2008, 47, 171–183. [Google Scholar] [CrossRef]

- Cao, X.J.; Lou, S. When and how much did the green line LRT increase single-family housing values in St. Paul, Minnesota? J. Plan. Educ. Res. 2018, 38, 427–436. [Google Scholar] [CrossRef]

- Xu, P.; Huang, H. Modeling crash spatial heterogeneity: Random parameter versus geographically weighting. Accid. Anal. Prev. 2015, 75, 16–25. [Google Scholar] [CrossRef]

- Xu, P.; Huang, H.; Dong, N.; Wong, S.C. Revisiting crash spatial heterogeneity: A Bayesian spatially varying coefficients approach. Accid. Anal. Prev. 2017, 98, 330–337. [Google Scholar] [CrossRef]

- Yang, H.; Zhang, Y.; Zhong, L.; Zhang, X.; Ling, Z. Exploring spatial variation of bike sharing trip production and attraction: A study based on Chicago’s Divvy system. Appl. Geogr. 2020, 115, 102130. [Google Scholar] [CrossRef]

- Zhong, H.; Li, W. Rail transit investment and property values: An old tale retold. Transp. Policy 2016, 51, 33–48. [Google Scholar] [CrossRef]

- Lan, H.; Cheng, B.; Gou, Z.; Yu, R. An evaluation of feed-in tariffs for promoting household solar energy adoption in Southeast Queensland, Australia. Sustain. Cities Soc. 2020, 53, 101942. [Google Scholar] [CrossRef]

- Zhou, L.; Tian, L.; Gao, Y.; Ling, Y.; Fan, C.; Hou, D.; Shen, T.; Zhou, W. How did industrial land supply respond to transitions in state strategy? An analysis of prefecture-level cities in China from 2007 to 2016. Land Use Policy 2019, 87, 104009. [Google Scholar] [CrossRef]

- Hui, E.C.M.; Liang, C. Spatial spillover effect of urban landscape views on property price. Appl. Geogr. 2016, 72, 26–35. [Google Scholar] [CrossRef]

- Chen, Z.; Haynes, K.E. Impact of high speed rail on housing values: An observation from the Beijing–Shanghai line. J. Transp. Geogr. 2015, 43, 91–100. [Google Scholar] [CrossRef]

- Manski, C.F. Identification of endogenous social effects: The reflection problem. Rev. Econ. Stud. 1993, 60, 531–542. [Google Scholar] [CrossRef]

- LeSage, J.P.; Dominguez, M. The importance of modeling spatial spillovers in public choice analysis. Public Choice 2012, 150, 525–545. [Google Scholar] [CrossRef]

- Elhorst, J.P. Applied spatial econometrics: Raising the bar. Spat. Econ. Anal. 2010, 5, 9–28. [Google Scholar] [CrossRef]

- Nase, I.; Berry, J.; Adair, A. Hedonic modelling of high street retail properties: A quality design perspective. J. Prop. Invest. Financ. 2013, 31, 160–178. [Google Scholar] [CrossRef]

- Brasington, D.M. The supply of public school quality. Econ. Edu. Rev. 2003, 22, 367–377. [Google Scholar] [CrossRef]

| Variable | Description | Expected Sign | Remark |

|---|---|---|---|

| LnP | Logarithm of transaction price (in natural logarithm form) (HK$) | NA | Dependent Variable |

| AGE | (year) | ? | Control |

| SIZE | Size or gross floor area (m2) | + | Control |

| SIZE2 | Square term of SIZE | ? | Control |

| FRON | Length of frontage facing the street (m) | + | Control |

| LnMTR | Logarithm of distance to the nearest MTR station exit (m) (in natural logarithm form) | − | Control |

| LnMALL | Logarithm of distance to the nearest shopping mall (m) (in natural logarithm form) | − | Control |

| CORN | Dummy variable, 1 if the property is located in the street corner and 0 otherwise | + | Control |

| ACM | Number of hotels and guesthouses within the 250m radius | + | Control |

| ACM2 | Square term of ACM | − | Control |

| UCU | Dummy variable, 1 if the property’s upper story is commercial use and 0 otherwise | + | Control |

| UOU | Dummy variable, 1 if the property’s upper story is office use and 0 otherwise | + | Control |

| URU | Dummy variable, 1 if the property’s upper story is residential use and 0 otherwise | + | Control |

| LnINDEX | Private Retail Prices Index (1999=100) (in natural logarithm form) | + | Control |

| OTHERS | Number of non-IVS visitors | + | Control |

| IVS | Number of visitors under the IVS | + | Control |

| IVS × LnMTR | Interaction between IVS and LnMTR | − | H1 |

| IVS×ACM | Interaction between IVS and ACM | + | H2A and H2B |

| IVS×AGE | Interaction between IVS and AGE | − | H3 |

| Variable | ACM | AGE | FRON | INDEX | IVS | LnMTR | LnMALL | PRICE | OTHERS | SIZE |

|---|---|---|---|---|---|---|---|---|---|---|

| Mean | 20.65 | 32.49 | 4.23 | 152.87 | 358.93 | 5.44 | 5.66 | 122.24 | 1300.73 | 59.41 |

| Median | 16 | 34.21 | 3.7 | 138.5 | 627.98 | 5.35 | 5.67 | 73.34 | 1353.82 | 45.06 |

| Max. | 54 | 53.5 | 22.76 | 344.6 | 1786.25 | 6.55 | 7 | 787.41 | 2175.31 | 656.08 |

| Min. | 0 | 0.43 | 0 | 79.4 | 0 | 2.64 | 2.4 | 2.41 | 427.25 | 5.02 |

| Std. Dev. | 14.83 | 11.45 | 3.05 | 60.29 | 463.99 | 0.67 | 0.68 | 128.89 | 390.36 | 58.5 |

| Variable | Coefficient | t-Statistic | p-Value |

|---|---|---|---|

| AGE | −0.0002 | −0.041 | 0.968 |

| SIZE | 0.0151 *** | 11.126 | 0.000 |

| SIZE2 | −0.00002 *** | −7.008 | 0.000 |

| FRON | −0.7949 ** | 2.175 | 0.030 |

| LnMTR | −0.1115 *** | −6.379 | 0.000 |

| LnMALL | 0.0511 | −0.893 | 0.372 |

| CORN | −0.0008 ** | 2.282 | 0.023 |

| ACM | 0.0352 *** | 5.102 | 0.000 |

| ACM2 | 0.2395 *** | −4.215 | 0.000 |

| UCU | −0.3118 * | −1.896 | 0.059 |

| UOU | 0.3963 | 1.506 | 0.133 |

| URU | −0.0819 | −0.941 | 0.347 |

| LnINDEX | −0.0461 | −0.257 | 0.797 |

| OTHERS | 0.2116 | 1.173 | 0.241 |

| IVS | −1.1021 | −1.394 | 0.164 |

| IVS×LnMTR | −0.0032 | −0.456 | 0.649 |

| IVS×ACM | 0.2297 * | 1.864 | 0.063 |

| IVS×AGE | 0.0057 | 0.904 | 0.366 |

| Constant | 14.5565 *** | 13.023 | 0.000 |

| R-squared | 0.569 | ||

| Adjusted R-squared | 0.555 | ||

| Number of observations | 580 | ||

| Variable | Coefficient | t-Statistic | Variable | Coefficient | t-Statistic |

|---|---|---|---|---|---|

| AGE | −0.0041 | −1.300 | W-AGE | 0.0302 *** | 8.698 |

| SIZE | 0.0147 *** | 2.703 | W-SIZE | 0.0055 *** | 2.801 |

| SIZE2 | 0.0000 | −0.012 | W-SIZE2 | −0.0001 | −0.032 |

| FRON | 0.0281 *** | 414.103 | W-FRON | 0.0358 *** | 141.582 |

| LnMTR | −0.5319 *** | −13.996 | W-LnMTR | 1.2102 *** | 13.298 |

| LnMALL | 0.1117 *** | 2.708 | W-LnMALL | −0.9153 *** | −9.717 |

| CORN | 0.2259 *** | 13.658 | W-CORN | 0.5342 *** | 12.462 |

| ACM | 0.0212 *** | 4.598 | W-ACM | 0.0370 *** | 3.207 |

| ACM2 | −0.0003 | −0.165 | W-ACM2 | −0.0004 | −0.148 |

| UCU | 0.0413 *** | 3.944 | W-UCU | −0.7653 *** | −8.900 |

| UOU | 0.7428 *** | 3.592 | W-UOU | −1.9626 *** | −3.782 |

| URU | −0.1577 | −1.500 | W-URU | 0.6691 *** | 8.676 |

| LnINDEX | −0.0397 *** | −6.641 | W-LnINDEX | 0.4750 *** | 3.542 |

| OTHERS | 0.1896 *** | 5.697 | W-OTHERS | −0.0695 *** | −4.316 |

| IVS | −1.2468 *** | −10.602 | W-IVS | 14.1643 *** | 26.942 |

| IVS×LnMTR | 0.2043 *** | 90.737 | W-IVS×LnMTR | −1.9169 *** | −181.821 |

| IVS×ACM | 0.0103 *** | 10.276 | W-IVS×ACM | −0.0490 *** | −4.043 |

| IVS×AGE | 0.0035 | 1.202 | W-IVS×AGE | −0.0960 *** | −14.666 |

| Rho | 0.2780 *** | 16.383 | Constant | 3.915 *** | 85.369 |

| R-squared | 0.662 | ||||

| Adjusted R-squared | 0.639 | ||||

| Number of observations | 580 | ||||

| Variable | Direct Effect (t-Statistic) | Indirect Effect (t-Statistic) | Total Effect (t-Statistic) |

|---|---|---|---|

| AGE | −0.0039 (−0.885) | 0.0411 * (1.821) | 0.0372 * (1.668) |

| SIZE | 0.0146 *** (11.863) | 0.0129 (1.143) | 0.0276 ** (2.461) |

| SIZE2 | 0.0000 *** (−7.558) | −0.0001 ** (−2.443) | −0.0001 *** (−2.908) |

| FRON | 0.0279 * (1.833) | 0.0670 (0.741) | 0.0949 (1.063) |

| LnMTR | −0.5238 *** (−3.516) | 1.5536 * (1.836) | 1.0298 (1.262) |

| LnMALL | 0.1113 (0.674) | −1.2839 * (−1.805) | −1.1726 * (−1.823) |

| CORN | 0.2320 ** (2.503) | 0.8208 (1.438) | 1.0528 * (1.789) |

| ACM | 0.0214 (1.475) | 0.0611 (1.240) | 0.0825 * (1.787) |

| ACM2 | −0.0003 (−0.986) | −0.0008 (−0.937) | −0.0010 (−1.430) |

| UCU | 0.0456 (0.250) | −1.0706 ** (−1.968) | −1.0251 * (−1.801) |

| UOU | 0.7442 *** (2.899) | −2.7011 * (−1.657) | −1.9569 (−1.184) |

| URU | −0.1609 (−1.538) | 0.8949 ** (2.084) | 0.7340 * (1.793) |

| LnINDEX | −0.0417 (−0.261) | 0.6126 (0.555) | 0.5710 (0.504) |

| OTHERS | 0.1914 (1.195) | −0.1213 (−0.086) | 0.0701 (0.049) |

| IVS | −1.1895 * (−1.705) | 19.8424 ** (2.498) | 18.6529 ** (2.298) |

| IVS×LnMTR | 0.1960 * (1.775) | −2.6588 ** (−2.237) | −2.4628 ** (−2.011) |

| IVS×ACM | 0.0102 * (1.792) | −0.0649 (−1.203) | −0.0547 (−0.991) |

| IVS×AGE | 0.0032 (0.474) | −0.1362 *** (−3.480) | −0.1330 *** (−3.399) |

| Theoretical Background | Economic Concern | Psychological Implication | |

|---|---|---|---|

| Hypothesis | H1 | H2A and H2B | H3 |

| Hedonic variable | IVS×LnMTR | IVS×ACM | IVS×AGE |

| Expected sign | - | +/insignificant | - |

| Test result | Confirm | Reject H2A and confirm H2B | Confirm |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, Y.; Yang, L.; Chau, K.W. Impacts of Tourism Demand on Retail Property Prices in a Shopping Destination. Sustainability 2020, 12, 1361. https://doi.org/10.3390/su12041361

Liu Y, Yang L, Chau KW. Impacts of Tourism Demand on Retail Property Prices in a Shopping Destination. Sustainability. 2020; 12(4):1361. https://doi.org/10.3390/su12041361

Chicago/Turabian StyleLiu, Yan, Linchuan Yang, and Kwong Wing Chau. 2020. "Impacts of Tourism Demand on Retail Property Prices in a Shopping Destination" Sustainability 12, no. 4: 1361. https://doi.org/10.3390/su12041361

APA StyleLiu, Y., Yang, L., & Chau, K. W. (2020). Impacts of Tourism Demand on Retail Property Prices in a Shopping Destination. Sustainability, 12(4), 1361. https://doi.org/10.3390/su12041361