Abstract

Serious environmental issues have drawn the attention of the agricultural sector. Consumers’ concerns about their personal health and food safety have stimulated the demand for green agri-food, which has also made it important to focus on the green agri-food supply chain to improve the food quality and reduce the associated environmental concerns. This paper discusses coordination issues of the green agri-food supply chain under the background of farmers’ green farming and retailers’ green marketing, and the impact of a revenue-sharing contract on key decisions of supply chain participants. On the basis of the two-echelon green agri-food supply chain composed of a farmer and a retailer, a revenue-sharing contract was established that takes the cost of farmer’s green farming and retailer’s green marketing into account. Through the comparison of the model results, it is concluded that the revenue-sharing contract is beneficial to not only increase the greening level, but also improve both the farmer’s profit and the retailer’s profit. Moreover, the effectiveness of the revenue-sharing contract is positively correlated with consumers’ sensitivity to the greening level. Finally, the conclusion is verified by numerical simulation and some management suggestions are given.

1. Introduction

Nowadays, greenhouse gases (including carbon dioxide, nitrous oxide, and so on) and other harmful gases produced by the metallurgical industry, the burning of fossil fuels, and the reinforced cement industry damage not only the environment (such as acid rain, ozone holes, global warming, and so on) but also the health of organisms [1,2]. However, the largest source of anthropogenic emissions of methane, one of the greenhouse gases, is agriculture, and according to the Food and Agriculture Organization of the United Nations (FAO), these greenhouse gases may increase by 30% by 2050 if emissions reductions are not strengthened [3,4]. Green and sustainable development has become critical for the agriculture industry and the agri-food sector [5]. On the other hand, with the growing attention to food quality and safety, the need for food ranges from full to healthy and green. There has been a significant increase in green agri-food consumption in both developed and developing countries [6]. Compared with traditional agricultural products, the high nutritional value and low risk of diet-related diseases of green agri-food stimulate the demand of health-conscious consumers [7]. In addition, such growth can also be explained as the farming process of green agri-food overcomes the sustainable disadvantages of traditional agriculture, such as soil degradation, nutrient loss, biodiversity loss, and so on, which caters to the needs of environment-conscious consumers who prefer to buy green products [8,9]. In the green agri-food supply chain, farmers and retailers need to invest in a variety of green farming technologies and green marketing strategies, respectively. For example, farmers have to use environmentally-friendly and efficient fertilizers, and biological pesticides, as well as intelligent agricultural equipment using renewable energy, to reduce pollution [10,11], which will add more to their cost. Further, retailers have to make additional green marketing efforts to promote the demand as the price of agri-food is usually higher than that of traditional agri-food. Increasing green agri-food consumption will increase revenue, while green farming and marketing efforts will increase costs. Therefore, it is an important issue for farmers and retailers to determine the reasonable degree of green farming and marketing to balance the costs and profits, and the concept of green supply chain management came into being to promote the coordinated development of the economy and environment.

Studies on the green supply chain have continued for several decades and have become a new research area of operation management [12,13,14,15]. The initial research on green supply chains mainly focused on case studies and questionnaire surveys, and there were fewer quantitative studies. In recent years, scholars have proposed to establish green supply chain game models by integrating internal and external resources to assign tasks, which enables members of supply chains to achieve sustainable development through improving collaborative performance [16,17,18]. At this point, we focus on an important research area which is the green agri-food supply chain coordination and discuss how a revenue-sharing contract affects green agri-food supply chain members’ decision-making.

Most studies on green supply chain coordination issues mainly discuss the production process in the manufacturing industry, for example, how to reduce carbon emissions and improve resource utilization [19,20,21,22]. However, some empirical studies indicate that green marketing plays an important role in promoting green products to achieve supply chain sustainability [23,24]. Retailer marketing, also known as local advertising, refers to advertising or promotional activities conducted by retailers to promote sales locally [25]. Retailers can turn consumers’ green awareness into actual buying behavior through green marketing [24]. Since retailers directly connect with the end consumers, they can invest more in implementing certain promotion activities for consumers to stimulate instant sales [26,27,28]. For example, Philips’ green marketing approach in the "Marathon" project increased sales of this product by 12% [8]. And Yonghui Superstores has set up a special counter for green pollution-free vegetables and fruits. Through vivid and visual display decoration and special effects lighting, the greenness of the fresh agri-food can be shown to consumers to guide the fresh green consumption [29]. Thus, in a green agri-food supply chain, green marketing is critically important for retailers to maximize the promotion of green agri-food when facing consumers [30]. Their goal is to increase the sales volume of green agri-food in the end market, thereby increasing the income of the entire green supply chain. Hence, we consider the retailer’s green marketing efforts besides the farmer’s green farming. Additionally, the retailers’ green marketing leads to an increase in cost, which gives supply chain members an opportunity to re-examine and redistribute their costs and benefits. They will also all work to maximize their own interests, which will further intensify competition and channel conflicts. Thus, it is essential for a green agri-food supply chain to rationally design coordination contracts to alleviate channel conflicts and reasonably allocate green agri-food supply chain resources.

Until now, there are few studies that discuss green agri-food supply chain from the perspective of channel coordination and retailers’ green marketing. To fill this gap, this paper considers a green agri-food supply chain with green farming and marketing and focuses on the impact of a revenue-sharing contract. Then, we develop three theoretical models and obtain some conclusions and management insights through comparative analyses of model results. Specifically, we have to address the following three questions:

- (1)

- How do the green agri-food supply chain members determine their optimal decisions regarding the greening level of agri-food and price?

- (2)

- Whether a revenue-sharing contract could increase the greening level of agri-foods and stimulate market demand?

- (3)

- Under what circumstances are the green agri-food supply chain players willing to participate in revenue-sharing coordination?

The remainder of the paper is organized as follows. A comprehensive review is presented in Section 2. Section 3 first describes the basic assumptions and notations, then solves the optimal values under three models, and finally draws the main conclusions by comparing and analyzing the results of different models. Section 4 summarizes the major conclusions of this study through numerical analysis. Section 5 summarizes the main research contents and results and puts forward several shortcomings of this paper.

2. Literature Review

In this section, we mainly review the literature relevant to this paper and highlight the motivation.

Coordinating supply chains through contracts is generally applied to address supply chain inefficiencies and align objectives of supply chain members [31]. The types of contracts usually discussed are buyback contracts, wholesale price contracts, revenue-sharing contracts, and so on [32]. Pasternack [33] discussed the pricing and after-sale policies for perishable goods in a revenue-sharing contract. Bernstein et al. [34] characterized perfect coordinated supply chain settings through wholesale pricing schemes, which include specific constant unit wholesale prices and volume discount schemes. Tasy [35] modeled the incentives of the two parties through a quantity flexibility contract to identify the causes of inefficiencies and suggest remedial measures in a supply chain with two independent agents. Cachon and Lariviere [36] researched the revenue-sharing contracts in the videocassette rental industry and compared them with other supply chain contracts, demonstrating that revenue-sharing contracts can coordinate the supply chain by distributing the profits of the supply chain arbitrarily. Ghosh and Shah [37] used a game theory approach to study the coordination issues caused by green supply chains and the impact of cost-sharing contracts on participants’ key decisions in implementing green initiatives. Research by Veen and Venugopal [38] showed that revenue-sharing contracts can bring a win-win situation to industry participants by optimizing the supply chain. Notably, compared with the traditional coordination mechanism, revenue-sharing contracts are more effective in coordinating the profit distribution among members and can improve the performance of the supply chain [39]. Therefore, this paper chooses a revenue-sharing contract to coordinate the green agri-food supply chain.

The revenue-sharing contract can be regarded as an agreement where suppliers obtain a portion of retailers’ income while providing retailers with a lower wholesale price, and finally achieves a fair distribution of profits within the supply chain. In the past, revenue-sharing contracts were widely used in the manufacturing industry [40,41,42]. For example, Ghosh and Shah [43] established a game-theoretic model to show how channel structures affect the price, profit, and green level, and then further proposed a revenue-sharing mechanism. Under a decentralized system, Bai et al. [44] discussed a revenue-sharing contract considering two competing retailers to improve profits and reduce carbon emissions and tested the robustness of operational decisions.

As governments and consumers pay more attention to the agri-food industry, revenue-sharing contracts are gradually being applied in agriculture. According to Qian et al. [45], a case study of Hohhot found that the setting of revenue-sharing contracts has increased the total profit of the dairy industry by 12.49%, and a win-win situation could be achieved under certain circumstances. On the basis of the characteristics of perishable foods, Zheng et al. [46] designed a fresh food supply chain (FPSC), taking the cost of freshness preservation into account, and the results showed that fresh-keeping cost-sharing and the revenue-sharing contract has the best coordination effect on FPSC. Taking the field of Internet of Things as a research object, Yan et al. [47] improved the revenue-sharing contract for the fresh agriculture supply chain to discuss the impact of fresh agricultural products on costs of controlling freshness and market demand. Obviously, the above studies have well documented the motivation of agriculture to use revenue-sharing contracts. A large amount of pollution produced by farming makes it extremely important to research green agri-food. However, there is less research on this aspect. One relevant study is Song et al. [48]. They considered greenness-level and freshness-level of the product in a green fresh produce supply chain. However, when designing revenue-sharing contracts, there is less literature to consider the green marketing efforts of retailers. Although, effective green marketing can be used to educate consumers, help them understand the nature of green agri-food, and cultivate consumers’ awareness of green consumption. Therefore, considering the retailer’s green marketing effort is very important to help consumers form a more complete environmental awareness and promote the demand for green agri-food [49], and also makes the research results more relevant to the actual situation.

In summary, researchers have done a large number of quantitative studies on the impact of revenue-sharing contracts on supply chains. Most of the literature, however, focuses on the manufacturing industry and traditional agriculture and considers only manufacturers’ greening investment costs. The existing literature rarely involves the green agri-food supply chain and retailers’ green marketing costs. On the basis of the existing research and different from the literature above, we try to apply a revenue-sharing contract in a green agri-food supply chain considering both the farmer’s green farming and the retailer’s green marketing. The purpose is to explore whether a revenue-sharing contract could improve the market demand and greening level, and increase both the total profit of the supply chain and the interests of all participants to achieve a win-win situation.

3. The Model

3.1. Model Hypotheses

In our model, we establish a two-echelon green agri-food supply chain with a single farmer and a single retailer, in which the farmer invests in achieving green farming and the retailer is engaged in green marketing and sells the high-quality green agri-food to consumers. Consumers in the market prefer green agri-food and will consider both the retail price and the greening level when purchasing agri-food [37]. In the following, several assumptions are made to make the analysis more tractable, and Table 1 summarizes the notations used in this paper.

Table 1.

Notations.

Assumption 1.

With reference to Savaskan’s research [50], we assume that the actual market demand is ‘’, which is a linear function of greening level ‘’ and retail price ‘’. The actual market demand function is defined as

Assumption 2.

Assume that the farming cost is composed of two parts: regular cost and additional expenditure for green farming. The regular cost can be defined as ‘’, where ‘’ is the basic unit farming cost. Compared with traditional farming, green farming needs to reduce the impact on the environment through improved management, the use of eco-fertilizers, and smart agriculture equipment, which all generate additional costs. Therefore, we formulate the green farming cost as follows: , where ‘’ is the green farming investment parameter. The same quadratic cost function can be found in the research by Banker et al. [51].

Assumption 3.

The consumers’ awareness of consumption directly determines the market demand for green agri-food. Green marketing can be seen as the use of ecological brands, environmental advertising, and other methods to make it easier for environment-conscious consumers to perceive the attributes and characteristics of green products and guide their consumption [24]. Therefore, in order to increase the purchasing consciousness of consumers, retailers need to make green marketing efforts, which result in additional costs associated with the greening level. The quadratic cost function is widely used in the literature of marketing [25,52]. We assume that the retailer’s green marketing cost is a quadratic function of the greening level of agri-food. It is given by , where ‘’ is the green marketing parameter.

Assumption 4.

In order to simplify the model, costs related to raw material purchase, inventory, transportation, and third-party logistics are neglected [53].

Considering all the above assumptions, the farmer’s (F), retail’s (R), and supply chain’s (SC) profit functions, thus, are as follows:

3.2. Mathematical Formulation

3.2.1. Centralized Model

In the centralized game model, the farmer and retailer do not make personal decisions based on their own profits, but instead, treat the green agri-food supply chain as a whole to maximize the profit of the whole supply chain.

Therefore, according to Equation (4), we can obtain the profit of the whole supply chain as follows:

The corresponding Hessian Matrix is . When , is a concave function of and . Therefore, the optimal retail price and greening level of green agri-food can be obtained by making the first derivative of equal to the following:

Finally, we put Equations (6) and (7) into Equation (5) and obtain as follows:

3.2.2. Decentralized Game Model

Unlike centralized decision-making, in the decentralized decision-making game model, the farmer and the retailer make their own decision based on maximizing their own profits, but the results of the decisions affect each other. The sequence of this dynamic game model can be described as follows: first, the farmer uses the retailer’s response function to determine the greening level of agri-food and the wholesale price; then, the retailer responds to determine the retail price. We solve this two-echelon Stackelberg problem by inverse induction methods, such as the research by Ma et al. [54].

Thus, we first obtain the retailer’s profit function according to Equation (3):

The first derivative of is and the second-order condition of is . Next, we set and obtain

Then, we consider the decision problem of the farmer and get Equation (10) from Equation (2):

We substitute the result of Equation (9) into Equation (10), and obtain the corresponding Hessian Matrix . When , is a concave function of . Equating and , we can get optimal and .

We put the values of and into Equation (9), and get the optimal retail price.

Finally, we substitute Equations (11)–(13) into Equations (8) and (10) and get the maximum profits: , , .

3.2.3. Retailer-Led Revenue-Sharing Game Model

In this section, a revenue-sharing contract is established between participants in the green agri-food supply chain in order to promote their further cooperation. At this point, the retailer shares part of sales revenue with the farmer to motivate the farmer to produce high-quality green agri-food and then determine the proportion of revenue-sharing, while ensuring that their own interests are maximized. In order to better understand this retailer-led revenue-sharing contract, we assume that the retailer provides the farmer with a revenue-sharing ratio , which indicates that in the retail sales revenue, the proportion is obtained by the retailer, and the residual is shared with the farmer. Next, taking the retailer’s reaction function and into consideration, the farmer determines the optimal wholesale price and greening level of agri-food to maximize its profit; last, the retailer determines the green agri-food’s retail price.

Thus, the profit functions of the retailer and the farmer are as follows:

The first derivative of is and the second derivative condition of is . Then, we set and obtain

Next, we substitute the results of Equation (16) into Equation (15) and obtain the corresponding Hessian Matrix . When , is a strictly concave function of . Equating the first derivative condition of to zero, we can get the wholesale price and greening level of agri-food for .

Therefore, we can obtain the retail price for :

We substitute Equations (17)–(19) into Equation (14), and get the second derivative. When , we set , and then obtain

Substituting the value of into Equations (17)–(19), we can then get , , and .

Finally, we obtain the optimal profit of the farmer, retailer, and the whole supply chain, respectively.

In order to better compare the green agri-food supply chain efficiency under different models, we summarize the optimal values of each variable in Table 2.

Table 2.

Equilibrium solutions under different models.

3.3. Model Comparison

On the basis of the results of the above models, comparative analyses of related variables are made and the following corollaries are proposed:

Corollary 1.

The optimal wholesale price of green agri-foods is in the following order: .

Corollary 1 indicates that the wholesale price of green agri-food under the revenue-sharing contract is lower than that under the decentralized game model.

Proof.

The detailed process of the certification is given in the Appendix A. □

Corollary 2.

The optimal greening level of agri-food is in the following order: .

Corollary 2 illustrates that the greening level of agri-food is the highest in the centralized case, followed by that in the retailer-led revenue-sharing contract, and the lowest in the decentralized case.

Proof.

The detailed process of the certification is given in the Appendix A. □

Corollary 3.

The retail price of green agri-food is in the following order: .

Corollary 3 indicates that the retail price of green agri-food is the highest in the decentralized case, followed by that in the retailer-led revenue-sharing contract, and the lowest in the centralized case. This can be explained by the fact that the revenue-sharing contract is beneficial to lowering the retail price to meet consumers’ expectations of purchasing green agri-food at lower prices.

Proof.

The detailed process of the certification is given in the Appendix A. □

Corollary 4.

The optimal market demand for green agri-food is in the following order: .

Corollary 4 shows that the optimal market demand for green agri-food is the highest in the centralized decision game model, followed by that in the retailer-led revenue-sharing contract, and the lowest in the decentralized case.

Proof.

The detailed process of the certification is given in the Appendix A. □

Corollary 5.

The overall profit of the agri-food supply chain is in the following order: .

Corollary 5 illustrates that the green agri-food supply chain performs best under the centralized case, followed by the that in retailer-led revenue-sharing contract, while the decentralized model has the lowest profit.

Proof.

The detailed process of the certification is given in the Appendix A. □

Conclusion 1.

Under the revenue-sharing contract, the wholesale price is reduced, which may lead to an increase in retailer’s income. This part of the increased income may compensate the retailer for increased costs due to green marketing, which makes the retailer more willing to participate in green marketing investments. Simultaneously, a lower wholesale price enables the retailer to reduce the retail price. As a result, the retailer’s green marketing and a lower price will stimulate consumer purchasing behavior, that is, market demand. The value of profit loss caused by the decrease in retail price is less than the value of profit added by the expansion of the market, which results in the increase of the overall supply chain profit.

Conclusion 2.

Revenue-sharing contracts can stimulate farmers to make efforts to improve the greening level and the market demand for green agri-food from consumers who care about environmental issues. Compared with the traditional decentralized case, revenue-sharing contracts have a higher environmental performance.

Corollary 6.

The profit of the farmer is in the following order: , and the profit of the retailer is in the following order: .

Corollary 6 indicates that, compared with the decentralized case, revenue-sharing contracts result in higher profits of the farmer and retailer. The revenue-sharing contract can benefit both the farmer and the retailer, which is the motivation for both players to be willing to participate in cooperation.

Proof.

The detailed process of the certification is given in the Appendix A. □

Corollary 7.

When and , and .

Corollary 7 illustrates that the farmer’s and retailer’s optimal profit differ under two game models (the value under the revenue-sharing contract minus the value under the decentralized case) and consumer sensitivity to the greening level increase in the same direction.

Proof.

The detailed process of the certification is given in the Appendix A. □

Conclusion 3.

According to the calculation part of Section 3.2.3, the revenue-sharing contract can be established between farmers and retailers under relevant algebraic conditions, and both parties have the optimal decision. At the same time, the revenue-sharing contract can bring a win-win situation. Meanwhile, as consumers become more sensitive to the greening level, the effect of a revenue-sharing contract is more obvious. Therefore, when consumers have higher sensitivity coefficients, members of the green agri-food supply chain are more willing to participate in coordination.

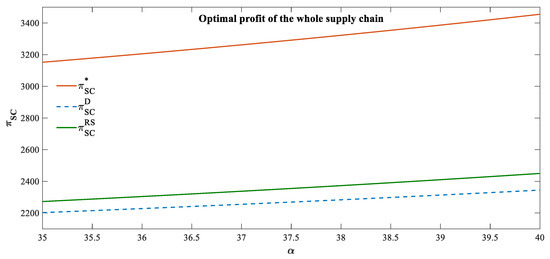

4. Numerical Analysis

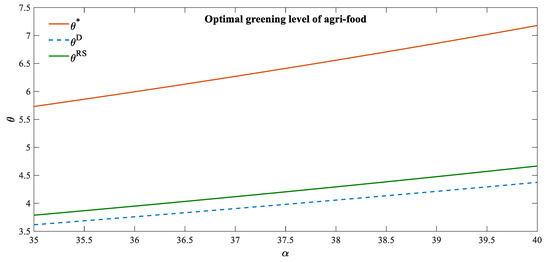

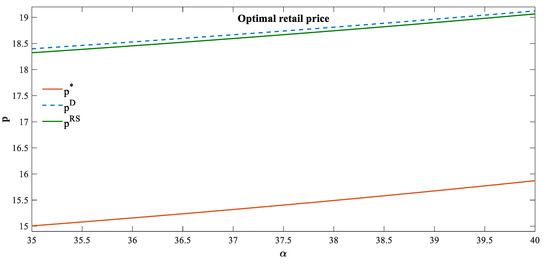

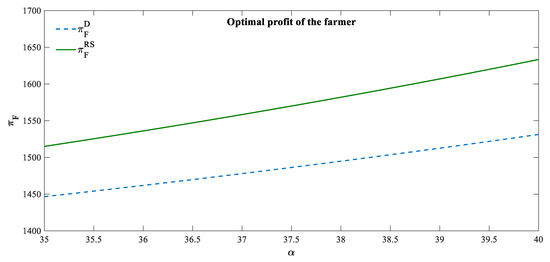

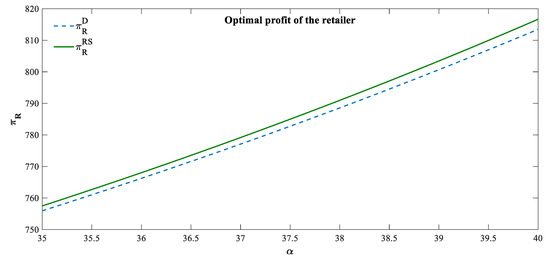

To better illustrate the above corollaries and conclusions, we present some numerical analyses as follows. Let the model parameters be . Similar data assignments can be found in some recent literature of Ghosh and Shah [37] and Song et al. [39]. We take consumer sensitivity to the greening level ‘’ as an independent variable, and the greening level, the retail price, the profit of the farmer and the retailer, and the total profit of green agri-food supply chain as the dependent variables. Using MATLAB to simulate the change of the dependent variables, Figure 1, Figure 2, Figure 3, Figure 4 and Figure 5 can be plotted.

Figure 1.

The optimal greening level of agri-food vs .

Figure 2.

The optimal retail price vs .

Figure 3.

The optimal profit of farmer vs .

Figure 4.

The optimal profit of the retailer vs. .

Figure 5.

The optimal profit of the whole supply chain vs. .

It can be observed from Figure 1 that consumer sensitivity to the greening level of agri-food has a positive impact. Consumers tend to purchase the high greening level agri-food in the market where consumers are highly sensitive. Further, consistent with Corollary 2, the agri-food greening level in the centralized channel is the highest and that in the decentralized channel is the lowest. Thus, retailer-led revenue-sharing contracts we have established can improve the greening level more than the decentralized case.

As can be seen from Figure 2, the retail price is an increasing function of consumer’s sensitivity to the greening level, which indicates that consumers with higher sensitivity to greening levels are willing to buy green agri-food at a higher price. Consistent with Corollary 3, the retail price is the lowest in the centralized channel. Notably, the results also indicate that the retail price in the retailer-led revenue-sharing contract is only slightly lower than the decentralized channel. A high greening level of agri-food increases farming cost, which is the farming pressure of farmers. However, the introduction of a revenue-sharing contract does not increase the retail price, but decreases slightly, which also proves the effectiveness of the revenue-sharing contract. Combined with Figure 1, we illustrate that the retailer-led revenue-sharing contract allows consumers to purchase affordable agri-food with a higher greening level at a lower price.

As shown in Figure 3 and Figure 4, farmers and retailers under revenue-sharing contracts are more profitable than those in the decentralized channel, although the retailer’s added value is smaller than that of the farmer. However, as consumers become more sensitive to greening level, the additional profits brought by the revenue sharing contract will increase significantly. It is also confirmed in Figure 5 that profit of the whole green agri-food supply chain has also increased in revenue-sharing contracts compared with decentralized cases. Notably, according to Figure 3, the slight decrease in the retail price in revenue-sharing contract can be understood as a small effect of price fluctuations on market demand. Therefore, the greening level and consumers’ sensitivity to it are the main factors affecting market demand, which also explains Conclusion 3—the larger the consumers’ sensitivity to greening level, the better the performance of the revenue-sharing contract.

In summary, our analysis thus reveals that the benefits of green marketing to stimulate market demand by retailers can compensate for the increase in costs, and at the same time, increase the greening level and reduce retail prices slightly under the revenue-sharing contract. Importantly, compared with the traditional decentralized conditions, the revenue-sharing contract can generate higher profitability of the green agri-food supply chain and better environmental performance.

5. Conclusions

In this paper, we establish a revenue-sharing contract for a two-echelon green agri-food supply chain with a farmer and a retailer, while taking the retailer’s green marketing efforts into account. To analyze the influences of the contract on the greening level and relevant price and profits of the green agri-food supply chain, we compare the greening level, market demand, prices, and profits under different cases.

Our theoretical analysis shows the following results: (1) The revenue-sharing contract can alleviate the pressure on farmers to farm produce high greening level agri-food, thereby decreasing the wholesale price, which has led the retailer to reduce its retail price to a certain extent. When consumers purchase high-quality green agri-food at a lower price, their purchasing enthusiasm is stimulated, thereby increasing the profit of the green agri-food supply chain. This increase in profits can be understood as the benefits brought by increased demand outweigh the losses of the decreased retail price. (2) Compared with the decentralized game model, the greening level of agri-food and market demand under the revenue-sharing contract are higher, which means that farmers and retailers need to invest more in green farming and marketing, respectively. However, the increase in market demand can compensate for the increased costs, making the profits of both participants higher than the decentralized case and closer to the optimal value in the centralized case, which in turn also stimulates farmers and retailers to work for green farming and marketing. (3) According to the calculation results in Section 3.2.3, under certain conditions, farmers and retailers are both willing to participate in revenue-sharing contracts to achieve a win–win situation. Further, when consumers have a high sensitivity to the greening level of agri-food, the effect of coordination is more obvious. Thus, we draw a conclusion that a revenue-sharing contract can benefit both the retailer and farmer and promote the sustainable development of the green agri-food.

Then, we can derive some implications for managers. According to the points in the previous paragraph, we can draw that the effectiveness of the revenue-sharing contract is directly proportional to consumers’ sensitivity to the greening level. Therefore, farmers and retailers should strengthen the dissemination of information on green agri-food, increase consumer awareness of environmental protection, and transform this protection awareness into actual purchasing behavior. The government should play an active role as a mediator and provide farmers and retailers with a platform to negotiate contracts fairly and promote coordination. At the same time, governments should improve relevant laws and regulations, standardize green farming and green marketing, and avoid low-quality agri-food and information to weaken consumers’ confidence in green consumption. A coordinated development among farmers, retailers, governments, and consumers will be formed to drive the prosperity and development of the green agri-food market.

Despite the fact that we innovatively applied the revenue-sharing contract to the green agri-food supply chain in our research and considered the retailer’s green marketing behavior, the model still has some shortcomings. In this study, we consider the actual market demand as a linear form related to green agri-foods’ greening level and retail price, and the model is also limited to a two-echelon green agri-food supply chain with a single farmer and a single retailer. Therefore, the stochastic demand function and the supply chain composed of multiple farmers and retailers can be new directions for future research.

Author Contributions

Writing: S.G. and L.C.; Providing case and idea: S.G. and H.Z.; Providing revised advice: L.C. and Z.H. All authors have read and agreed to the published version of the manuscript.

Funding

We gratefully acknowledge the support of the National Key R&D Program of China (2017YFC1600605); the Project of Beijing Philosophy and Social Science (Nos. 17GBL013, 18GLC017).

Acknowledgments

The authors are especially grateful to the editors and anonymous referees for their kindly review and helpful comments.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Proof of Corollary 1.

,

,

,

, □

Proof of Corollary 2.

According to Assumption 2. and the value of optimal retail price under different models (as shown in Table 2), we find that .

,

,

In summary, . □

Proof of Corollary 3.

,

,

,

,

In summary, . □

Proof of Corollary 5.

,

,

,

In summary, . □

Proof of Corollary 6.

,

,

,

, □

Proof of Corollary 7.

□

References

- Lin, B.; Xu, M. Regional differences on CO2 emission efficiency in metallurgical industry of China. Energy Policy 2018, 120, 302–311. [Google Scholar] [CrossRef]

- Dulebenets, M.A. Advantages and disadvantages from enforcing emission restrictions within emission control areas. Marit. Bus. Rev. 2016, 1, 107–132. [Google Scholar] [CrossRef]

- Agricultural Greenhouse Gas Emissions are on the Rise. Available online: http://www.fao.org/news/story/zh/item/224418/icode/ (accessed on 11 April 2014).

- Greenhouse Gas Methane: The Biggest Emitter is Agriculture! Available online: http://www.china-nengyuan.com/news/143826.html (accessed on 14 August 2019).

- Mangla, S.K.; Luthra, S.; Rich, N.; Kumar, D.; Rana, N.P.; Dwivedi, Y.K. Enablers to implement sustainable initiatives in agri-food supply chains. Int. J. Prod. Econ. 2018, 203, 379–393. [Google Scholar] [CrossRef]

- Peštek, A.; Agic, E.; Cinjarevic, M. Segmentation of organic food buyers: An emergent market perspective. Br. Food J. 2018, 120, 269–289. [Google Scholar] [CrossRef]

- Cavaliere, A.; Peri, M.; Banterle, A. Vertical coordination in organic food chains: A survey based analysis in France, Italy and Spain. Sustainability 2016, 8, 569. [Google Scholar] [CrossRef]

- Hong, Z.; Guo, X. Green product supply chain contracts considering environmental responsibilities. Omega 2019, 83, 155–166. [Google Scholar] [CrossRef]

- Brzezina, N.; Kopainsky, B.; Mathijs, E. Can organic farming reduce vulnerabilities and enhance the resilience of the European food system? A critical assessment using system dynamics structural thinking tools. Sustainability 2016, 8, 971. [Google Scholar] [CrossRef]

- Notice of the Ministry of Agriculture and Rural Affairs on Issuing the “Technical Guidelines for Green Agricultural Development (2018–2030)”. Available online: http://www.igea-un.org/m/view.php?aid=5839 (accessed on 18 July 2018).

- Xu, X.; Wei, Z.; Ji, Q.; Wang, C.; Gao, G. Global renewable energy development: Influencing factors, trend predictions and countermeasures. Resour. Policy 2019, 63, 101–470. [Google Scholar] [CrossRef]

- Sroufe, R. Effects of Environmental Management Systems on Environmental Management Practices and Operations. Prod. Oper. Manag. 2009, 12, 416–431. [Google Scholar] [CrossRef]

- Corbett, C.J.; Klassen, R.D. Extending the horizons: Environmental excellence as key to improving operations. Manuf. Serv. Oper. Manag. 2006, 8, 5–22. [Google Scholar] [CrossRef]

- Curkovic, S.; Sroufe, R. Total Quality Environmental Management and Total Cost Assessment: An exploratory study. Int. J. Prod. Econ. 2007, 105, 560–579. [Google Scholar] [CrossRef]

- Kumar, S.; Putnam, V. Cradle to cradle: Reverse logistics strategies and opportunities across three industry sectors. Int. J. Prod. Econ. 2008, 115, 305–315. [Google Scholar] [CrossRef]

- Heydari, J.; Govindan, K.; Aslani, A. Pricing and greening decisions in a three-tier dual channel supply chain. Int. J. Prod. Econ. 2019, 217, 185–196. [Google Scholar] [CrossRef]

- Xu, X.; Hao, J.; Yu, L.; Deng, Y. Fuzzy Optimal Allocation Model for Task-Resource Assignment Problem in a Collaborative Logistics Network. IEEE Trans. Fuzzy Syst. 2019, 27, 1112–1125. [Google Scholar] [CrossRef]

- Liu, J.; Chen, M.; Liu, H. The role of big data analytics in enabling green supply chain management: A literature review. J. Data Inf. Manag. 2019, 1–9. [Google Scholar] [CrossRef]

- Cao, E.; Yu, M. The bright side of carbon emission permits on supply chain financing and performance. Omega 2019, 88, 24–39. [Google Scholar] [CrossRef]

- Jamali, M.B.; Rasti-Barzoki, M. A game theoretic approach to investigate the effects of third-party logistics in a sustainable supply chain by reducing delivery time and carbon emissions. J. Clean. Prod. 2019, 235, 636–652. [Google Scholar] [CrossRef]

- Yu, M.; Cruz, J.M.; Li, D. “Michelle” The sustainable supply chain network competition with environmental tax policies. Int. J. Prod. Econ. 2019, 217, 218–231. [Google Scholar] [CrossRef]

- Hosseini-Motlagh, S.M.; Ebrahimi, S.; Jokar, A. Sustainable supply chain coordination under competition and green effort scheme. J. Oper. Res. Soc. 2019, 1–16. [Google Scholar] [CrossRef]

- Leonidou, L.C.; Leonidou, C.N.; Palihawadana, D.; Hultman, M. Evaluating the green advertising practices of international firms: A trend analysis. Stud. Econ. Financ. 2011, 28, 6–33. [Google Scholar] [CrossRef]

- Rahbar, E.; Wahid, N.A. Investigation of green marketing tools’ effect on consumers’ purchase behavior. Bus. Strateg. Ser. 2011, 12, 73–83. [Google Scholar] [CrossRef]

- Martín-Herrán, G.; Sigué, S.P. Retailer and manufacturer advertising scheduling in a marketing channel. J. Bus. Res. 2017, 78, 93–100. [Google Scholar] [CrossRef]

- Jørgensen, S.; Sigué, S.P.; Zaccour, G. Dynamic cooperative advertising in a channel. J. Retail. 2000, 76, 71–92. [Google Scholar] [CrossRef]

- Jørgensen, S.; Taboubi, S.; Zaccour, G. Retail promotions with negative brand image effects: Is cooperation possible? Eur. J. Oper. Res. 2003, 150, 395–405. [Google Scholar] [CrossRef]

- Ge, D.; Pan, Y.; Shen, Z.-J.; Wu, D.; Yuan, R.; Zhang, C. Retail supply chain management: A review of theories and practices. J. Data Inf. Manag. 2019, 1, 45–64. [Google Scholar] [CrossRef]

- Business Philosophy of Yonghui Superstores. Available online: http://www.yonghui.com.cn/about/yhln/ (accessed on 30 January 2020).

- Zhou, Y.; Bao, M.; Chen, X.; Xu, X. Co-op advertising and emission reduction cost sharing contracts and coordination in low-carbon supply chain based on fairness concerns. J. Clean. Prod. 2016, 133, 402–413. [Google Scholar] [CrossRef]

- Cachon, G.P. Supply Chain Management: Design, Coordination and Operation. Handbooks Oper. Res. Manag. Sci. 2003, 11, 227–339. [Google Scholar]

- Sluis, S.; De Giovanni, P. The selection of contracts in supply chains: An empirical analysis. J. Oper. Manag. 2016, 41, 1–11. [Google Scholar] [CrossRef]

- Pasternack, B.A. Optimal pricing and return policies for perishable commodities. Mark. Sci. 2008, 27, 131–132. [Google Scholar] [CrossRef]

- Bernstein, F.; Chen, F.; Federgruen, A. Coordinating supply chains with simple pricing schemes: The role of vendor-managed inventories. Manag. Sci. 2006, 52, 1483–1492. [Google Scholar] [CrossRef]

- Tsay, A.A. The quantity flexibility contract and supplier-customer incentives. Manag. Sci. 1999, 45, 1339–1358. [Google Scholar] [CrossRef]

- Cachon, G.P.; Lariviere, M.A. Supply chain coordination with revenue-sharing contracts: Strengths and limitations. Manag. Sci. 2005, 51, 30–44. [Google Scholar] [CrossRef]

- Ghosh, D.; Shah, J. Supply chain analysis under green sensitive consumer demand and cost sharing contract. Int. J. Prod. Econ. 2015, 164, 319–329. [Google Scholar] [CrossRef]

- Van Der Veen, J.A.A.; Venugopal, V. Using revenue sharing to create win-win in the video rental supply chain. J. Oper. Res. Soc. 2005, 56, 757–762. [Google Scholar] [CrossRef]

- Song, H.; Gao, X. Green supply chain game model and analysis under revenue-sharing contract. J. Clean. Prod. 2018, 170, 183–192. [Google Scholar] [CrossRef]

- Vafa Arani, H.; Rabbani, M.; Rafiei, H. A revenue-sharing option contract toward coordination of supply chains. Int. J. Prod. Econ. 2016, 178, 42–56. [Google Scholar] [CrossRef]

- Hsueh, C.F. Improving corporate social responsibility in a supply chain through a new revenue sharing contract. Int. J. Prod. Econ. 2014, 151, 214–222. [Google Scholar] [CrossRef]

- Qian, D.; Guo, J. Research on the energy-saving and revenue sharing strategy of ESCOs under the uncertainty of the value of Energy Performance Contracting Projects. Energy Policy 2014, 73, 710–721. [Google Scholar] [CrossRef]

- Ghosh, D.; Shah, J. A comparative analysis of greening policies across supply chain structures. Int. J. Prod. Econ. 2012, 135, 568–583. [Google Scholar] [CrossRef]

- Bai, Q.; Gong, Y.; Jin, M.; Xu, X. Effects of carbon emission reduction on supply chain coordination with vendor-managed deteriorating product inventory. Int. J. Prod. Econ. 2019, 208, 83–99. [Google Scholar] [CrossRef]

- Qian, G.X.; Zhang, Y.P.; Wu, J.G.; Pan, Y.H. Revenue sharing in dairy industry supply chain - a case study of Hohhot, China. J. Integr. Agric. 2013, 12, 2300–2309. [Google Scholar] [CrossRef]

- Zheng, Q.; Ieromonachou, P.; Fan, T.; Zhou, L. Supply chain contracting coordination for fresh products with fresh-keeping effort. Ind. Manag. Data Syst. 2017, 117, 538–559. [Google Scholar] [CrossRef]

- Yan, B.; Wu, X.H.; Ye, B.; Zhang, Y.W. Three-level supply chain coordination of fresh agricultural products in the Internet of Things. Ind. Manag. Data Syst. 2017, 117, 1842–1865. [Google Scholar] [CrossRef]

- Song, Z.; He, S.; An, B. Decision and coordination in a dual-channel three-layered green supply chain. Symmetry 2018, 10, 549. [Google Scholar] [CrossRef]

- Chang, S.; Hu, B.; He, X. Supply chain coordination in the context of green marketing efforts and capacity expansion. Sustainability 2019, 11, 5734. [Google Scholar] [CrossRef]

- Savaskan, R.C.; Bhattacharya, S.; Van Wassenhove, L.N. Closed-Loop Supply Chain Models with Product Remanufacturing. Manag. Sci. 2004, 50, 239–252. [Google Scholar] [CrossRef]

- Banker, R.D.; Khosla, I.; Sinha, K.K. Quality and Competition. Manag. Sci. Publ. 1998, 44, 1179–1192. [Google Scholar] [CrossRef]

- Sacco, A.; De Giovanni, P. Channel coordination with a manufacturer controlling the price and the effect of competition. J. Bus. Res. 2019, 96, 97–114. [Google Scholar] [CrossRef]

- Cao, J.; Zhang, X.; Zhou, G. Supply Chain Coordination with Revenue-Sharing Contracts Considering Carbon Emissions and Governmental Policy Making. Environ. Prog. Sustain. Energy 2015, 35, 479–488. [Google Scholar] [CrossRef]

- Ma, W.; Cheng, Z.; Xu, S. A game theoretic approach for improving environmental and economic performance in a dual-channel green supply chain. Sustainability 2018, 10, 1918. [Google Scholar] [CrossRef]

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).