The Involvement of Real Estate Companies in Sustainable Development—An Analysis from the SDGs Reporting Perspective

Abstract

1. Introduction

2. Sustainable Reporting in the Real Estate Field

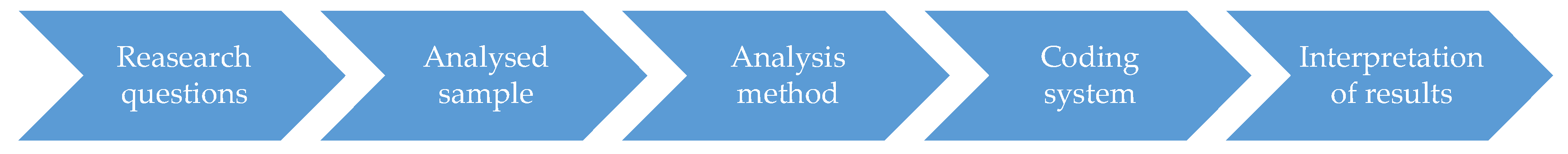

3. Methodological Approach to Content Analysis

3.1. Sample Definition

3.2. Content Analysis Process and Coding System

- The entity declares the importance of the SDGs, but without including certain aspirations.

- The entity declares the importance of the SDGs and includes qualitative aspirations for achieving them.

- The entity identifies quantitative key performance indicators (KPIs) for the relevant SDGs.

- The entity identifies KPIs and quantitative targets for the relevant SDGs.

- The entity correlates KPIs assigned priority SDGs with the impact on the company.

4. Results and Discussions Regarding SDGs Reporting

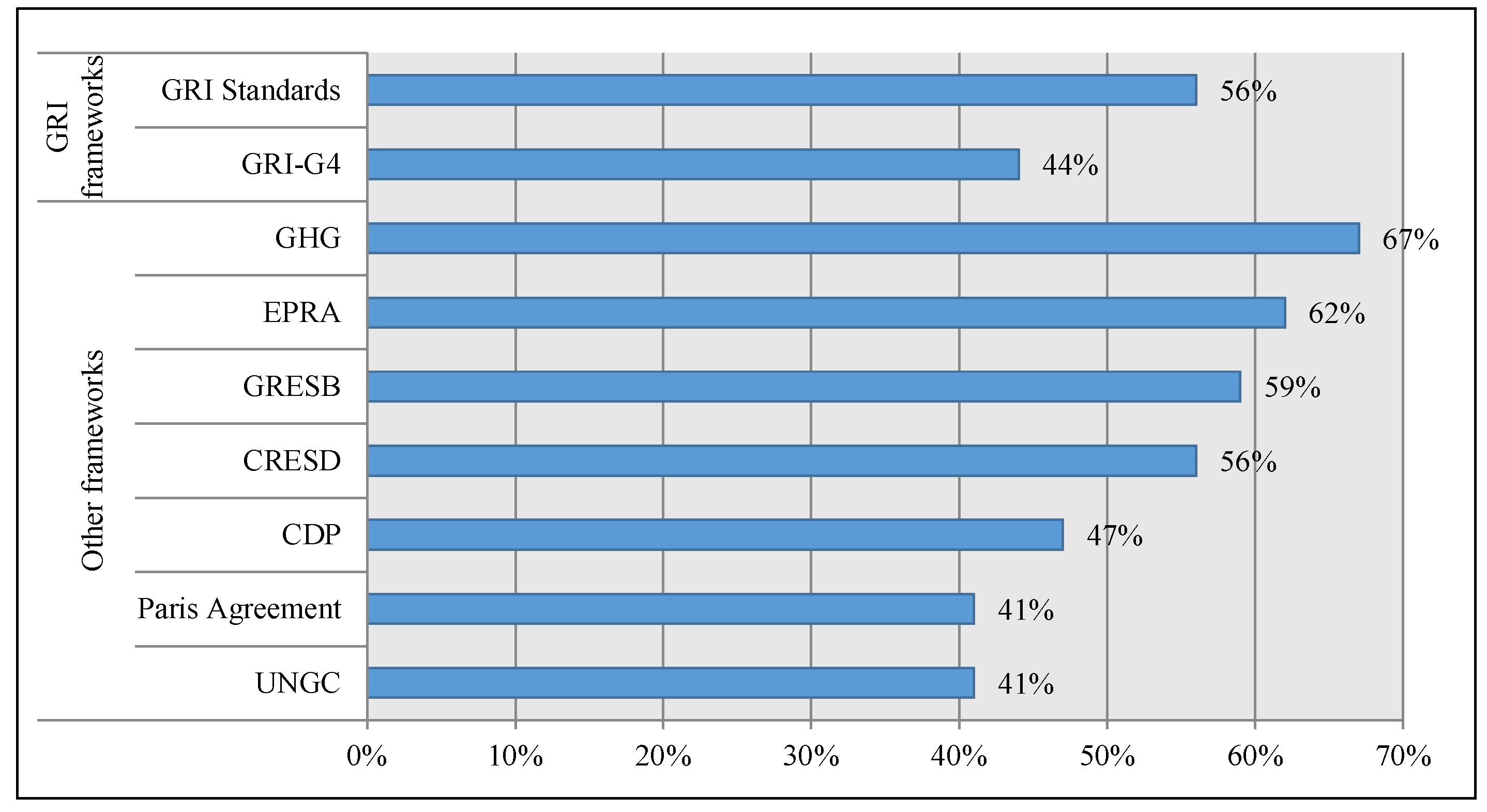

4.1. Results of Stage 1: Generalities about the Studied SRs

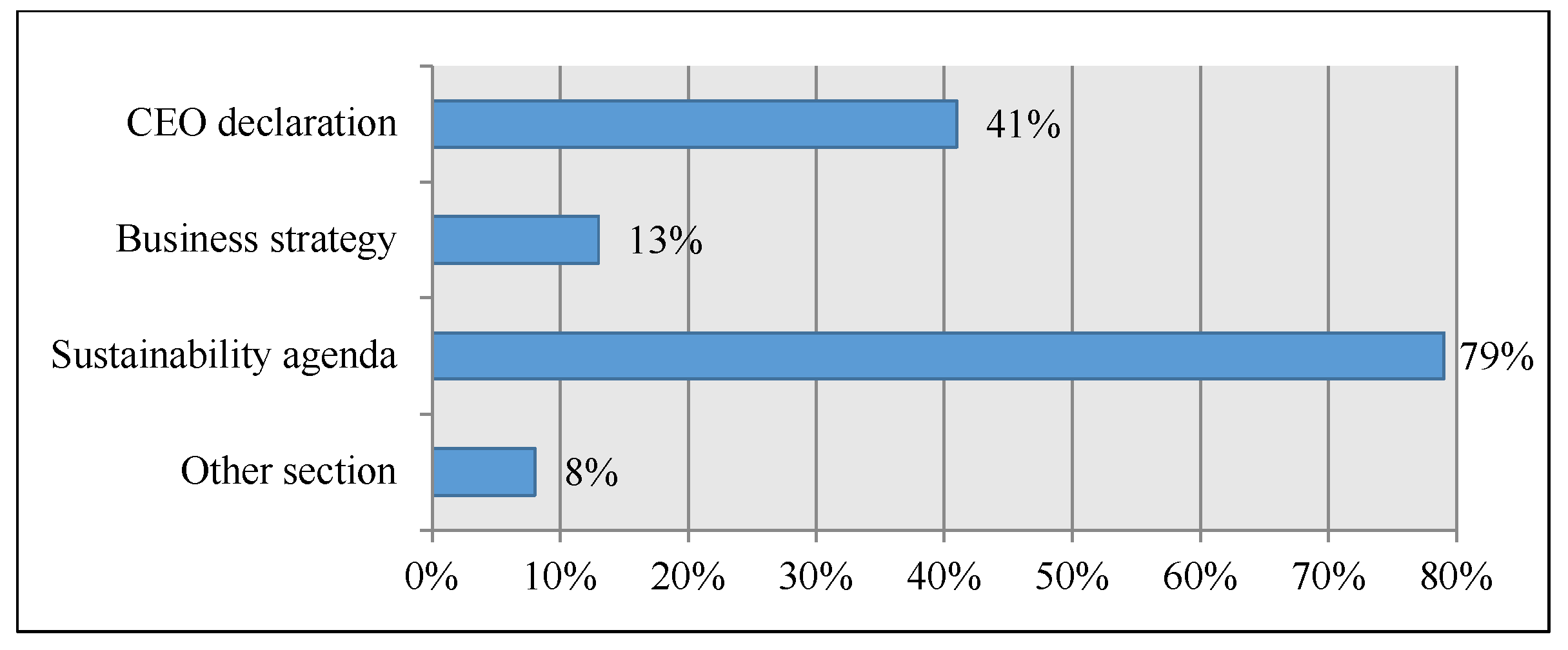

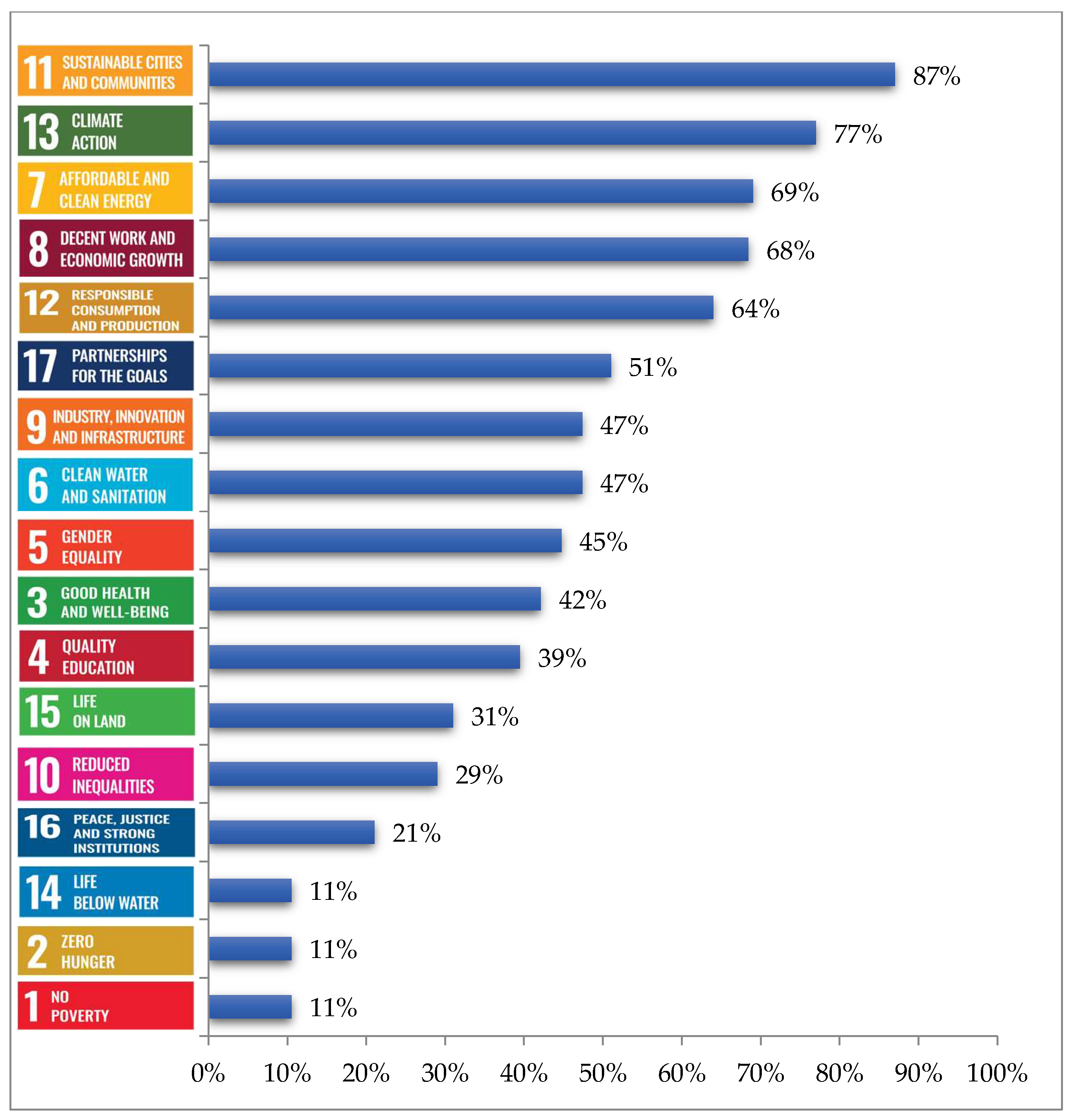

4.2. Results of Stage 2: Reporting over SDGs

5. Summary and Concluding Discussion

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Name | Country | Organization Type | Listed/Non-Listed | Sector | Size | Number of Employees | Real Estate Investments (EUR mil.) | Total Revenues (EUR mil.) | Total Fixed Assets (EUR mil.) | Reporting Years |

|---|---|---|---|---|---|---|---|---|---|---|

| Arcadis | The Netherlands | Private | Listed | Real estate owners and developers | MNE | 27,354 | - | 3255.57 | 1232.70 | 2017, 2018 |

| Bonava | Sweden | Private | Listed | Real estate owners and developers | Large | 2075 | - | 1366.06 | 70.21 | 2016, 2017, 2018 |

| Castellum | Sweden | Private | Listed | Real estate owners and developers | Large | 381 | 8695.66 | 543.87 | 8871.69 | 2016, 2017, 2018 |

| Conwert Immobilien Invest 1 | Austria | Subsidiary | Listed | Real estate owners’ and developers’ spaces | MNE | n/a | n/a | n/a | n/a | 2016 |

| JM AB | Sweden | Private | Listed | Real estate owners and developers | Large | 2562 | - | 1576.02 | 20.87 | 2016, 2017, 2018 |

| Kungsleden | Sweden | Private | Listed | Real estate owners and developers | Large | 109 | 3383.65 | 232.59 | 3385.70 | 2016, 2017, 2018 |

| Sato Oyj | Finland | Private | Unlisted | Real estate owners and developers | SME | 218 | 3875.10 | 290.40 | 3903.40 | 2016, 2017, 2018 |

| Sonae Sierra | Portugal | Private | Listed | Real estate owners and developers | Large | 1057 | 2097.00 | 144.30 | 2097.00 | 2017, 2018 |

| Specialfastigheter Sverige | Sweden | State owned | Unlisted | Real estate owners and developers | SME | 144 | 2661.13 | 208.50 | 2761.96 | 2016, 2017, 2018 |

| Wallenstam | Sweden | Private | Listed | Real estate owners and developers | MNE | 251 | 4467.49 | 186.26 | 4639.42 | 2017, 2018 |

| Alstria Office | Germany | Private | Listed | REITs | Large | 149 | 3938.86 | 193.00 | 4003.51 | 2016, 2017 |

| Befimmo | Belgium | Private | Listed | REITs | Large | 86 | 1447.24 | 144.07 | 2458.21 | 2017, 2018 |

| Cofinimmo | Belgium | Private | Listed | REITs | Large | 134 | 3694.20 | 212.17 | 3881.02 | 2016, 2017, 2018 |

| Covivio | France | Private | Listed | REITs | Large | 922 | 20,139.34 | 955.89 | 22,052.53 | 2016, 2017, 2018 |

| Grivalia | Greece | Subsidiary | Listed | REITs | SME | 28 | 1008.23 | 72.54 | 1083.07 | 2017 |

| IntuProperties | Great Britain | Private | Listed | REITs | Large | 2654 | 7175.78 | 584.13 | 8093.21 | 2016, 2017, 2018 |

Appendix B

| The Categories Represented by the SDGs | Description of Codes |

|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

References

- GRI. Sustainability and Reporting Trends in 2025: Preparing for the Future; GRI: Amsterdam, The Netherlands, 2015; Available online: https://www.globalreporting.org/resourcelibrary/Sustainability-and-Reporting-Trends-in-2025-1.pdf (accessed on 9 September 2019).

- O’Donovan, G. Environmental Disclosures in the Annual Report: Extending the Applicability and Predictive Power of Legitimacy Theory. Acc. Audit. Acc. J. 2002, 15, 344–371. [Google Scholar] [CrossRef]

- GRI; UN Global Compact. Business Reporting on the SDGs. An Analysis of the Goals and Targets; GRI: Amsterdam, The Netherlands; UN Global Compact: New York, NY, USA, 2017; Available online: https://www.unglobalcompact.org/library/5361 (accessed on 12 September 2019).

- Romero, S.; Ruiz, S.; Fernandez-Feijoo, B. Sustainability Reporting and Stakeholder Engagement in Spain: Different Instruments, Different Quality. Bus. Strategy Environ. 2018, 28, 221–232. [Google Scholar] [CrossRef]

- Blasco, J.L.; King, A. The Road Ahead. The KPMG Survey of Corporate Responsibility Reporting 2017. Available online: https://assets.kpmg/content/dam/kpmg/xx/pdf/2017/10/kpmg-survey-of-corporate-responsibility-reporting-2017.pdf (accessed on 11 October 2019).

- PwC. From Promise to Reality: Does Business Really Care about the SDGs? And What Needs to Happen to Turn Words into Action; PwC: London, UK, 2018; Available online: https://www.pwc.com/gx/en/sustainability/SDG/sdg-reporting-2018.pdf (accessed on 11 October 2019).

- Goubran, S.; Masson, T.; Caycedo, M. Evolutions in Sustainability and Sustainable Real Estate. In Sustainable Real Estate; Walker, T., Krosinsky, C., Hasan, L., Kibsey, S., Eds.; Palgrave Macmillan: Cham, Switzerland, 2019; pp. 11–31. [Google Scholar] [CrossRef]

- RICS. Fostering the Implementation of the Sustainable Development Goals in Land, Construction, Real Estate and Infrastructure; RICS: London, UK, 2018; Available online: https://www.rics.org/globalassets/rics-website/media/about/rics-sustainability-report-2016-2018.pdf (accessed on 15 October 2019).

- Lo Giudice, A. Sustainable Development Goals: Challenges and Perspectives for Real Estate Companies with the 2030 Agenda. 2017. Available online: http://vigeo-eiris.com/wp-content/uploads/2017/10/Vigeo-Eiris-Opinion-column-SDG-real-estate-2017.pdf (accessed on 15 October 2019).

- Rashidfarokhi, A.; Yrjänä, L.; Wallenius, M.; Toivonen, S.; Ekroos, A.; Viitanen, K. Social Sustainability Tool for Assessing Land Use Planning Processes. Eur. Plan. Stud. 2018, 26, 1269–1296. [Google Scholar] [CrossRef]

- Rashidfarokhi, A.; Toivonen, S.; Viitanen, K. Sustainability Reporting in the Nordic Real Estate Companies: Empirical Evidence from Finland. Int. J. Strategy Manag. 2018, 22, 51–63. [Google Scholar] [CrossRef]

- World Economic Forum. Environmental Sustainability Principles for the Real Estate Industry; World Economic Forum: Cologny/Geneva, Switzerland, 2016; Available online: http://www3.weforum.org/docs/GAC16/CRE_Sustainability.pdf (accessed on 15 October 2019).

- Sayce, S.; Ellison, L.; Parnell, P. Understanding Investment Drivers for UK Sustainable Property. Build. Res. Inf. 2007, 35, 629–643. [Google Scholar] [CrossRef]

- Warren-Myers, G. Sustainability—The Crucial Challenge for the Valuation Profession. Pac. Rim Prop. Res. J. 2011, 17, 491–510. [Google Scholar] [CrossRef]

- Amran, A.; Ooi, S.K. Sustainability Reporting: Meeting Stakeholder Demands. Strategy Dir. 2014, 30, 38–41. [Google Scholar] [CrossRef]

- Bellucci, M.; Simoni, L.; Acuti, D.; Manetti, G. Stakeholder Engagement and Dialogic Accounting Empirical Evidence in Sustainability Reporting. Acc. Audit. Acc. J. 2019, 32, 1467–1499. [Google Scholar] [CrossRef]

- Marimon, F.; Alonso-Almeida, M.D.M.; Rodríguez, M.D.P.; Cortez Alejandro, K.A. The Worldwide Diffusion of the Global Reporting Initiative: What Is the Point? J. Clean. Prod. 2012, 33, 132–144. [Google Scholar] [CrossRef]

- CSR Europe; GRI. Member State Implementation of Directive 2014/95/EU. A Comprehensive Overview of How Member States are Implementing the EU Directive on Non-Financial and Diversity Information; Policy & Reporting; CSR Europe: Bruxelles, Belgium; GRI: Amsterdam, The Netherlands, 2017; Available online: http://www.thecsragency.ro/wp-content/uploads/2018/01/CSR-Europe_GRI-NFR-publication_0-1.pdf (accessed on 2 January 2020).

- Brammer, S.; Jackson, G.; Matten, D. Corporate Social Responsibility and Institutional Theory: New Perspectives on Private Governance. Socio-Econ. Rev. 2012, 10, 3–28. [Google Scholar] [CrossRef]

- Siminica, M.; Cristea, M.; Sichigea, M.; Noja, G.G.; Anghel, I. Well-Governed Sustainability and Financial Performance: A New Integrative Approach. Sustainability 2019, 11, 4562. [Google Scholar] [CrossRef]

- Gorte, J. Investors: A Force for Sustainability. In Sustainable Investing: The Art of Long-Term Performance; Krosinsky, C., Robins, N., Eds.; Earthscan: London, UK, 2008; pp. 31–40. [Google Scholar]

- Glass, J. The State of Sustainability Reporting in the Construction Sector. Smart Sustain. Built Environ. 2012, 1, 87–104. [Google Scholar] [CrossRef]

- De Francesco, A.J.; Levy, D. The Impact of Sustainability on the Investment Environment. J. Eur. Real Estate Res. 2008, 1, 72–87. [Google Scholar] [CrossRef]

- Mironiuc, M. Financial Analysis versus Extra-Financial Analysis in Measuring the Performance of the Sustainable Organization. Theor. Appl. Econ. 2009, 5, 149–164. [Google Scholar]

- IIRC. The International <IR> Framework; IIRC: London, UK, 2013; Available online: https://integratedreporting.org/wp-content/uploads/2015/03/13-12-08-THE-INTERNATIONAL-IR-FRAMEWORK-2-1.pdf (accessed on 15 November 2019).

- Deloitte. Integrated Reporting as a Driver for Integrated Thinking; Deloitte: Amsterdam, The Netherlands, 2015; Available online: https://www2.deloitte.com/content/dam/Deloitte/nl/Documents/risk/deloitte-nl-risk-integrated-reporting-a-driver-for-integrated-thinking.pdf (accessed on 15 November 2019).

- D’Arcy, É. The Evolution of Institutional Arrangements to Support the Internationalisation of Real Estate Involvements. Some Evidence from Europe. J. Eur. Real Estate Res. 2009, 2, 280–293. [Google Scholar] [CrossRef]

- UN Global Compact. A Call to Action for Sustainable Business; UN Global Compact: New York, NY, USA, 2017; Available online: https://www.unglobalcompact.org/docs/publications/UNGC-Value-Proposition.pdf (accessed on 15 November 2019).

- Sachs, J.; Schmidt-Traub, G.; Kroll, C.; Lafortune, G.; Fuller, G. Sustainable Development Report 2019. Available online: https://s3.amazonaws.com/sustainabledevelopment.report/2019/2019_sustainable_development_report.pdf (accessed on 15 November 2019).

- Cho, C.H.; Patten, D.M. The Role of Environmental Disclosures as Tools of Legitimacy: A Research Note. Acc. Organ. Soc. 2007, 32, 639–647. [Google Scholar] [CrossRef]

- European Commission. Driving Energy Efficiency in the European Building Stock: New Recommendations on the Modernisation of Buildings; European Commission: Brussels, Belgium, 2019. Available online: https://ec.europa.eu/info/news/driving-energy-efficiency-european-building-stock-new-recommendations-modernisation-buildings-2019-jun-21_en (accessed on 15 December 2019).

- GRESB. 2018 Results—Sustainable Real Assets; GRESB: Amsterdam, The Netherlands, 2018; Available online: https://gresb.com/2018-real-estate-results/ (accessed on 15 November 2019).

- Holtermans, R. Information Asymmetry and Sustainability in Real Estate Markets. Ph.D. Thesis, Maastricht University, Maastricht, The Netherlands, 23 June 2016. [Google Scholar]

- Alawneh, R.; Mohamed Ghazali, F.E.; Ali, H.; Asif, M. Assessing the Contribution of Water and Energy Efficiency in Green Buildings to Achieve United Nations Sustainable Development Goals in Jordan. Build. Environ. 2018, 146, 119–132. [Google Scholar] [CrossRef]

- Afjei, S.M. A Content Analysis of Sustainability Dimensions in Annual Reports. Ph.D. Thesis, Florida International University, Miami, FL, USA, 20 February 2015. [Google Scholar]

- Laposa, S.P.; Villupuram, S. Corporate Real Estate and Corporate Sustainability Reporting: An Examination and Critique of Current Standards. J. Sustain. Real Estate 2010, 2, 23–49. [Google Scholar]

- Bryman, A.; Bell, E. Business Research Methods, 3rd ed.; Oxford University Press: Oxford, UK, 2011; ISBN 978-0-19-958340-9. [Google Scholar]

- Michelon, G.; Pilonato, S.; Ricceri, F. CSR Reporting Practices and the Quality of Disclosure: An Empirical Analysis. Crit. Perspect. Acc. 2015, 33, 59–78. [Google Scholar] [CrossRef]

- Elo, S.; Kyngäs, H. The Qualitative Content Analysis Process. J. Adv. Nurs. 2008, 62, 107–115. [Google Scholar] [CrossRef]

- White, M.D.; Marsh, E.E. Content Analysis: A Flexible Methodology. Libr. Trends 2006, 55, 22–45. [Google Scholar] [CrossRef]

- Unerman, J. Methodological Issues—Reflections on Quantification in Corporate Social Reporting Content Analysis. Acc. Audit. Acc. J. 2000, 13, 667–681. [Google Scholar] [CrossRef]

- GRI. GRI’s Sustainability Disclosure Database; GRI: Amsterdam, The Netherlands, 2016; Available online: https://database.globalreporting.org/ (accessed on 15 December 2019).

- Chersan, I.C. Corporate Responsibility Reporting According to Global Reporting Initiative: An International Comparison. Audit Financ. 2016, 14, 424–435. [Google Scholar] [CrossRef]

- Schaltegger, S.; Windolph, S.E.; Harms, D.; Hörisch, J. Corporate Sustainability in International Comparison. State of Practice, Opportunities and Challenges; Springer: Cham, Switzerland, 2014. [Google Scholar]

- Hsieh, H.F.; Shannon, S.E. Three Approaches to Qualitative Content Analysis. Qual. Health Res. 2005, 15, 1277–1288. [Google Scholar] [CrossRef] [PubMed]

- Krippendorff, K. Content Analysis: An Introduction to Its Methodology, 2nd ed.; Sage Publications: Thousand Oaks, CA, USA, 2004. [Google Scholar]

- Guthrie, J.; Petty, R.; Yongvanich, K.; Ricceri, F. Using Content Analysis as a Research Method to Inquire into Intellectual Capital Reporting. J. Intellect. Cap. 2004, 5, 282–293. [Google Scholar] [CrossRef]

- Beattie, V.; Thomson, S.J. Lifting the Lid on the Use of Content Analysis to Investigate Intellectual Capital Disclosures. Account. Forum 2007, 31, 129–163. [Google Scholar] [CrossRef]

- GRI; UN Global Compact. Business Reporting on the SDGs. Integrating the SDGs into Corporate Reporting: A Practical Guide; GRI: Amsterdam, The Netherlands; UN Global Compact: New York, NY, USA, 2018; Available online: https://www.globalreporting.org/resourcelibrary/GRI_UNGC_Reporting-on-SDGs_Practical_Guide.pdf (accessed on 15 November 2019).

- Clean Energy for All Europeans Package. Available online: https://ec.europa.eu/energy/en/topics/energy-strategy-and-energy-union/clean-energy-all-europeans (accessed on 5 January 2020).

- Sustainable Development Goal 11: Targets and Indicators. Available online: https://sustainabledevelopment.un.org/sdg11 (accessed on 5 January 2020).

- Guthrie, J.; Abeysekera, I. Content Analysis of Social, Environmental Reporting: What Is New? J. Hum. Resour. Costing Account. 2006, 10, 114–126. [Google Scholar] [CrossRef]

- PwC. SDG Reporting Challenge 2017: Exploring Business Communication on the Global Goals; PwC: London, UK, 2017; Available online: https://www.pwc.com/gx/en/sustainability/SDG/pwc-sdg-reporting-challenge-2017-final.pdf (accessed on 10 December 2019).

- Joseph, C.; Taplin, R. The Measurement of Sustainability Disclosure: Abundance versus Occurrence. Account. Forum 2011, 35, 19–31. [Google Scholar] [CrossRef]

- D’Amato, D.; Korhonen, J.; Toppinen, A. Circular, Green, and Bio Economy: How Do Companies in Land-Use Intensive Sectors Align with Sustainability Concepts? Ecol. Econ. 2019, 158, 116–133. [Google Scholar] [CrossRef]

- Morin, I.; Muruganathan, K. Innovation in Sustainability Reporting: New Design Trends and Digital Solutions for Powerful Storytelling. 2017. Available online: https://www.eco-business.com/opinion/innovation-in-sustainability-reporting-new-design-trends-and-digital-solutions-for-powerful-storytelling/ (accessed on 16 December 2019).

- Rosati, F.; Faria, L.G.D. Addressing the SDGs in Sustainability Reports: The Relationship with Institutional Factors. J. Clean. Prod. 2019, 215, 1312–1326. [Google Scholar] [CrossRef]

- Schaltegger, S.; Wagner, M. Sustainable Entrepreneurship and Sustainability Innovation: Categories and Interactions. Bus. Strategy Environ. 2011, 20, 222–237. [Google Scholar] [CrossRef]

- Wanner, J.; Janiesch, C. Big Data Analytics in Sustainability Reports: An Analysis Based on the Perceived Credibility of Corporate Published Information. Bus. Res. 2019, 12, 143–173. [Google Scholar] [CrossRef]

- Jones, P.; Hillier, D.; Comfort, D. Materiality and External Assurance in Corporate Sustainability Reporting. An Exploratory Study of Europe’s Leading Commercial Property Companies. J. Eur. Real Estate Res. 2016, 9, 147–170. [Google Scholar] [CrossRef]

- Hirsch, J.; Lafuente, J.J.; Recourt, R. Stranding Risk & Carbon: Science-Based Decarbonising of the EU Commercial Real Estate Sector; CRREM Report No. 1; CRREM: Wörgl, Austria, 2019; Available online: https://www.crrem.eu/wp-content/uploads/2019/09/CRREM-Stranding-Risk-Carbon-Science-based-decarbonising-of-the-EU-commercial-real-estate-sector.pdf (accessed on 10 December 2019).

- World Green Building Council. Green Building & the Sustainable Development Goals; World Green Building Council: London, UK; Available online: https://www.worldgbc.org/green-building-sustainable-development-goals (accessed on 2 January 2020).

- Alawneh, R.; Ghazali, F.; Ali, H.; Sadullah, A.F. A Novel Framework for Integrating United Nations Sustainable Development Goals into Sustainable Non-Residential Building Assessment and Management in Jordan. Sustain. Cities Soc. 2019, 49, 101612. [Google Scholar] [CrossRef]

- Vierra, S. Green Building Standards and Certification Systems. 2019. Available online: http://www.wbdg.org/resources/green-building-standards-and-certification-systems (accessed on 2 January 2020).

- Goubran, S.; Cucuzzella, C. Integrating the Sustainable Development Goals in Building Projects. J. Sustain. Res. 2019, 1, e190010. [Google Scholar] [CrossRef]

- Rydin, Y. Sustainability and the Financialisation of Commercial Property: Making Prime and Non-Prime Markets. Environ. Plan. D Soc. Space 2016, 34, 745–762. [Google Scholar] [CrossRef]

- Livingstone, N.; Ferm, J. Occupier Responses to Sustainable Real Estate: What’s next? J. Corp. Real Estate 2017, 19, 5–16. [Google Scholar] [CrossRef]

- Cajias, M.; Geiger, P.; Bienert, S. Green Agenda and Green Performance: Empirical Evidence for Real Estate Companies. J. Eur. Real Estate Res. 2012, 5, 135–155. [Google Scholar] [CrossRef]

- European Commission. Sustainable Development in the European Union. Monitoring Report on Progress towards the SDGs in an EU Context; European Commission: Brussels, Belgium, 2019.

- Van Doorn, L.; Arnold, A.; Rapoport, E. In the Age of Cities: The Impact of Urbanisation on House Prices and Affordability. In Hot Property; Nijskens, R., Lohuis, M., Hilbers, P., Heeringa, W., Eds.; Springer: Cham, Switzerland, 2019; pp. 3–13. [Google Scholar] [CrossRef]

- Fifka, M.S. Corporate Responsibility Reporting and Its Determinants in Comparative Perspective—A Review of the Empirical Literature and a Meta-Analysis. Bus. Strategy Environ. 2013, 22, 1–35. [Google Scholar] [CrossRef]

| Conventional Approach | Stage 1. Generalities about the Studied SRs |

| (a) Type, structure and dimension of the SRs | |

| (b) The reporting framework used | |

| (c) Independent external insurance | |

| Coordinated Approach | Stage 2. Reporting Regarding SDGs |

| (a) Reporting modalities | |

| (b) Prioritising objectives | |

| (c) Assessment of the reporting quality | |

| (d) Contributions to SDGs achievement |

| Variable | Observations | Mean | Standard Deviation | Min | Max |

|---|---|---|---|---|---|

| Number of SDGs reported | 39 | 7.77 | 4.57 | 0 | 17 |

| Number of pages dedicated to the SDGs | 39 | 17.26 | 22.34 | 1 | 72 |

| % SR dedicated to the SDGs | 39 | 14.14 | 15.63 | 0.74 | 52.17 |

| Pages/SDG | 38 | 1.85 | 1.80 | 0.07 | 6.27 |

| SDGs | Observations | Mean | Standard Deviation | Min | Max |

|---|---|---|---|---|---|

| SDG 1 | 4 | 1.00 | 0.00 | 1.00 | 1.00 |

| SDG 2 | 4 | 1.00 | 0.00 | 1.00 | 1.00 |

| SDG 3 | 16 | 3.50 | 1.26 | 1.00 | 5.00 |

| SDG 4 | 15 | 3.27 | 1.16 | 1.00 | 5.00 |

| SDG 5 | 17 | 3.59 | 1.00 | 2.00 | 5.00 |

| SDG 6 | 18 | 3.94 | 1.06 | 1.00 | 5.00 |

| SDG 7 | 27 | 3.81 | 1.33 | 1.00 | 5.00 |

| SDG 8 | 26 | 3.54 | 1.27 | 1.00 | 5.00 |

| SDG 9 | 18 | 3.44 | 1.82 | 1.00 | 5.00 |

| SDG 10 | 11 | 3.36 | 1.03 | 2.00 | 5.00 |

| SDG 11 | 34 | 2.94 | 1.59 | 1.00 | 5.00 |

| SDG 12 | 25 | 3.76 | 1.16 | 1.00 | 5.00 |

| SDG 13 | 30 | 3.37 | 1.71 | 1.00 | 5.00 |

| SDG 14 | 4 | 1.00 | 0.00 | 1.00 | 1.00 |

| SDG 15 | 12 | 2.17 | 1.59 | 1.00 | 5.00 |

| SDG 16 | 8 | 3.75 | 0.46 | 3.00 | 4.00 |

| SDG 17 | 20 | 1.90 | 0.85 | 1.00 | 4.00 |

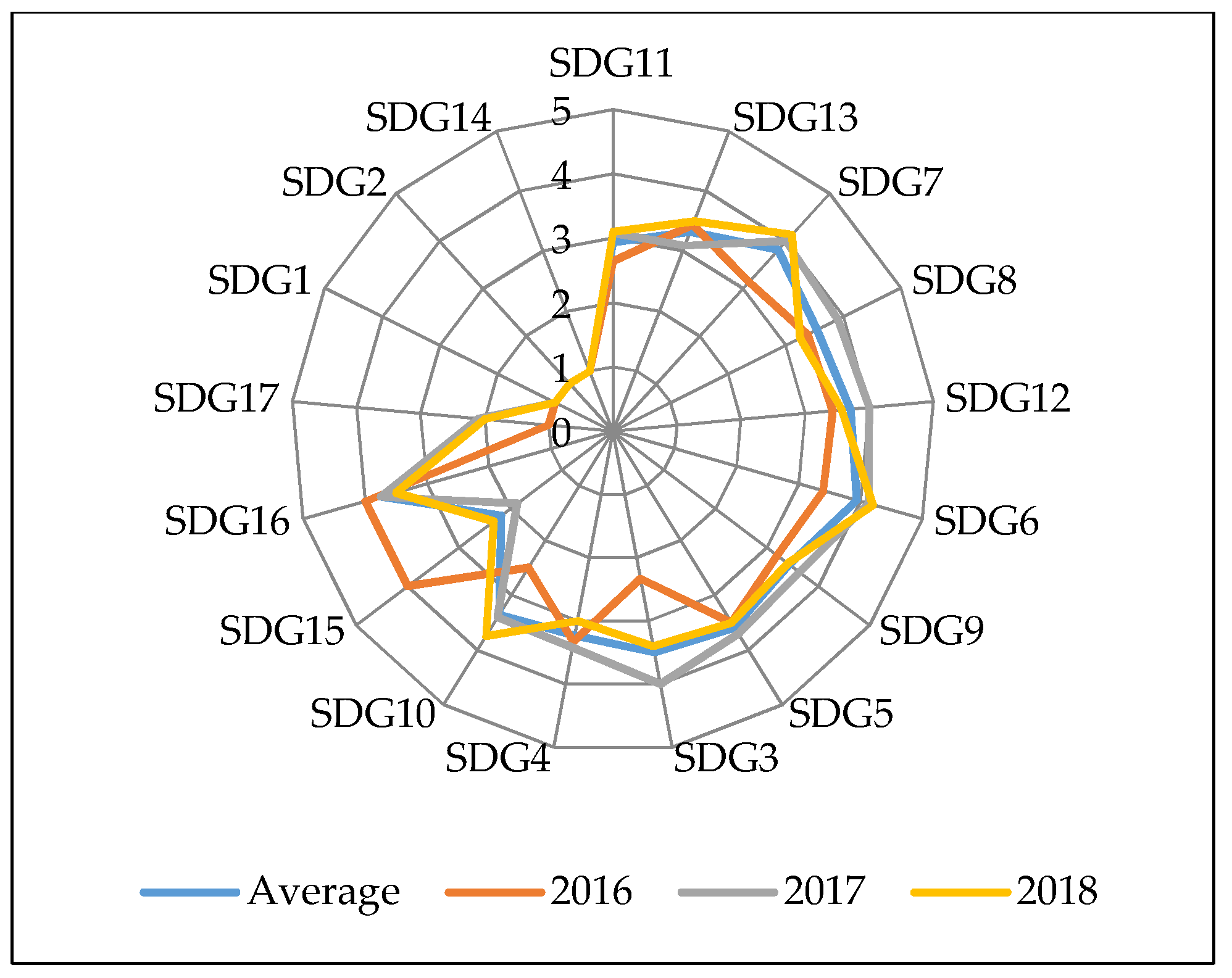

| SDG 2016 | 12 | 2.73 | 1.34 | 1.00 | 4.29 |

| SDG 2017 | 14 | 3.14 | 0.93 | 1.67 | 4.60 |

| SDG 2018 | 11 | 3.08 | 0.81 | 1.67 | 4.67 |

| Average Quality | 37 | 2.99 | 1.03 | 1.00 | 4.67 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ionașcu, E.; Mironiuc, M.; Anghel, I.; Huian, M.C. The Involvement of Real Estate Companies in Sustainable Development—An Analysis from the SDGs Reporting Perspective. Sustainability 2020, 12, 798. https://doi.org/10.3390/su12030798

Ionașcu E, Mironiuc M, Anghel I, Huian MC. The Involvement of Real Estate Companies in Sustainable Development—An Analysis from the SDGs Reporting Perspective. Sustainability. 2020; 12(3):798. https://doi.org/10.3390/su12030798

Chicago/Turabian StyleIonașcu, Elena, Marilena Mironiuc, Ion Anghel, and Maria Carmen Huian. 2020. "The Involvement of Real Estate Companies in Sustainable Development—An Analysis from the SDGs Reporting Perspective" Sustainability 12, no. 3: 798. https://doi.org/10.3390/su12030798

APA StyleIonașcu, E., Mironiuc, M., Anghel, I., & Huian, M. C. (2020). The Involvement of Real Estate Companies in Sustainable Development—An Analysis from the SDGs Reporting Perspective. Sustainability, 12(3), 798. https://doi.org/10.3390/su12030798