How R&D Financial Subsidies, Regional R&D Input, and Intellectual Property Protection Affect the Sustainable Patent Output of SMEs: Evidence from China

Abstract

1. Introduction

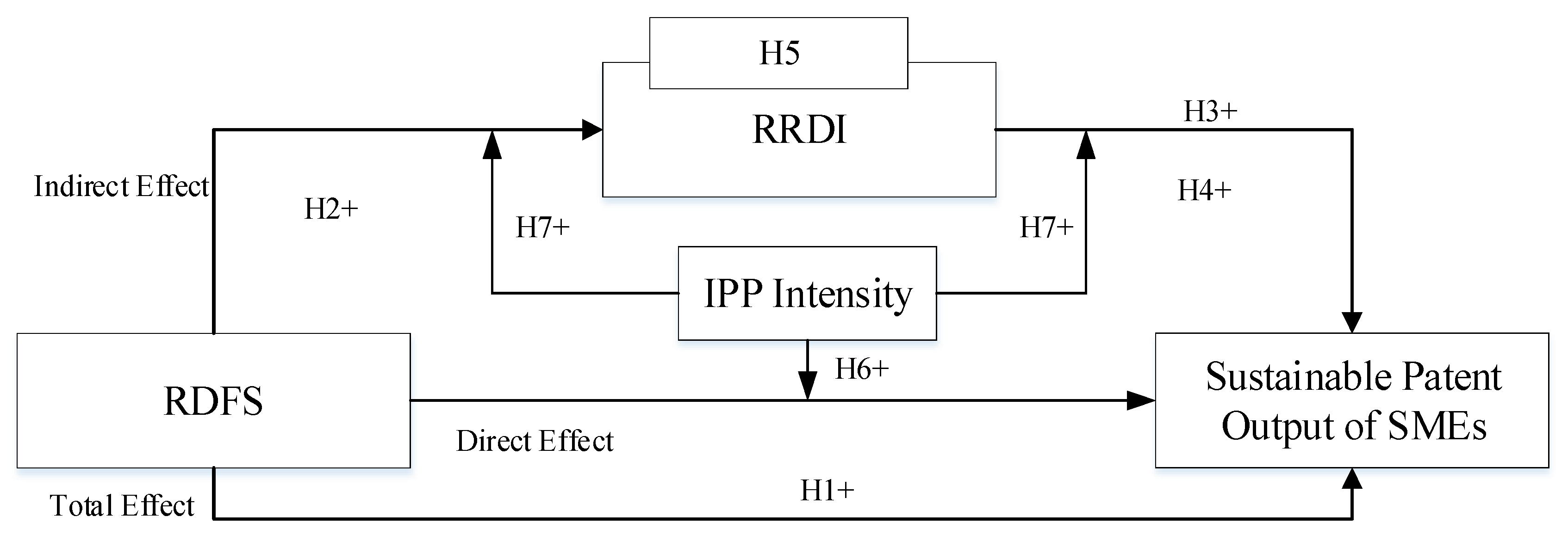

2. Literature Review and Hypotheses Development

2.1. RDFS and the Sustainable Patent Output of SMEs

2.2. RDFS and RRDI

2.3. RRDI and the Sustainable Patent Output of SMEs

2.4. Mediating Role of RRDI

2.5. Moderating Role of the Intensity of IPP

3. Methodology

3.1. Data

3.2. Measurement of Variables

4. Analysis Method

4.1. Mediation Effect

4.2. Moderation Effect

4.3. Robust Test

5. Results

5.1. Mediating Role of Regional R&D Input

5.2. Moderating Role of IPP Intensity

5.3. Robust Test

6. Discussion

6.1. Discussion of the Findings

6.2. Theoretical Implications

6.3. Managerial Implications

6.4. Limitations and Future Research Directions

Author Contributions

Funding

Conflicts of Interest

References

- Zhu, Y.; Wittmann, X.; Peng, M.W. Institution-based barriers to innovation in SMEs in China. Asia Pac. J. Manag. 2012, 29, 1131–1142. [Google Scholar] [CrossRef]

- Romer, P.M. Endogenous technological change. J. Polit. Econ. 1990, 98, 71–102. [Google Scholar] [CrossRef]

- Griliches, Z. R & D and the productivity slowdown. Am. Econ. Rev. 1980, 70, 343–348. [Google Scholar]

- Guo, D.; Guo, Y.; Jiang, K. Government-subsidized R&D and firm innovation: Evidence from China. Res. Policy 2016, 45, 1129–1144. [Google Scholar] [CrossRef]

- Alecke, B.; Mitze, T.; Reinkowski, J.; Untiedt, G. Does Firm Size make a Difference? Analysing the Effectiveness of R&D Subsidies in East Germany. Ger. Econ. Rev. 2011, 13, 174–195. [Google Scholar] [CrossRef]

- Cin, B.C.; Kim, Y.J.; Vonortas, N.S. The Impact of Public R&D Subsidy on Small Firm Productivity: Evidence from Korean SMEs. Small Bus. Econ. 2017, 48, 345–360. [Google Scholar] [CrossRef]

- Lach, S. Do R&D Subsidies Stimulate or Displace Private R&D? Evidence from Israel. J. Ind. Econ. 2010, 50, 369–390. [Google Scholar] [CrossRef]

- Görg, H.; Strobl, E. The Effect of R&D Subsidies on Private R&D. Economica 2007, 74, 215–234. [Google Scholar] [CrossRef]

- Boeing, P. The allocation and effectiveness of China’s R&D subsidies—Evidence from listed firms. Res. Policy 2016, 45, 1774–1789. [Google Scholar] [CrossRef]

- Kanwar, S.; Sperlich, S. Innovation, productivity and intellectual property reform in an emerging market economy: Evidence from India. Empir. Econ. 2019. [Google Scholar] [CrossRef]

- Brüggemann, J.; Crosetto, P.; Meub, L.; Bizer, K. Intellectual property rights hinder sequential innovation. Experimental evidence. Res. Policy 2016, 45, 2054–2068. [Google Scholar] [CrossRef]

- Hu, A.G. Ownership, Government R&D, Private R&D, and Productivity in Chinese Industry. J. Comp. Econ. 2001, 29, 136–157. [Google Scholar] [CrossRef]

- Vancauteren, M. The effects of human capital, R&D and firm’s innovation on patents: A panel study on Dutch food firms. J. Technol. Transf. 2018, 43, 901–922. [Google Scholar] [CrossRef]

- Yang, C.H.; Kuo, C.C.; Ramstetter, E.D. Intellectual Property Rights and Patenting in China’s High-technology Industries: Does Ownership Matter? China World Econ. 2011, 19, 102–122. [Google Scholar] [CrossRef]

- Aghion, P.; Howitt, P.; Prantl, S. Patent rights, product market reforms, and innovation. J. Econ. Growth 2015, 20, 223–262. [Google Scholar] [CrossRef]

- Lai, L.C. International intellectual property rights protection and the rate of product innovation. J. Dev. Econ. 1998, 55, 133–153. [Google Scholar] [CrossRef]

- Sweet, C.M.; Eterovic Maggio, D.S. Do Stronger Intellectual Property Rights Increase Innovation? World Dev. 2015, 66, 665–677. [Google Scholar] [CrossRef]

- Neicu, D.; Teirlinck, P.; Kelchtermans, S. Dipping in the policy mix: Do R&D subsidies foster behavioral additionality effects of R&D tax credits? Econ. Innov. New Technol. 2014, 25, 218–239. [Google Scholar] [CrossRef]

- Dirk, C.; Julie, D. R&D policies for young SMEs: Input and output effects. Small Bus. Econ. 2015, 3, 465–485. [Google Scholar] [CrossRef]

- Klemetsen, M.E.; Bye, B.; Raknerud, A. Can Direct Regulations Spur Innovations in Environmental Technologies? A Study on Firm-Level Patenting. Scand. J. Econ. 2018, 120, 338–371. [Google Scholar] [CrossRef]

- Hewitt-Dundas, N.; Roper, S. Output Additionality of Public Support for Innovation: Evidence for Irish Manufacturing Plants. Eur. Plan. Stud. 2010, 18, 107–122. [Google Scholar] [CrossRef]

- Fallah, M.H.; Choudhury, P. Movement of inventors and the effect of knowledge spillovers on spread of innovation: Evidence from patent analysis in high-tech industries. In Proceedings of the Portland International Center for Management of Engineering and Technology (PICMET 2009), Portland, OR, USA, 2–6 August 2009. [Google Scholar]

- Patel, P.; Keith, P. National innovation systems: Why They Are Important, and How they might be measured and compared. Econ. Innov. New Technol. 1994, 3, 77–95. [Google Scholar] [CrossRef]

- Wallsten, S.J. The Effects of Government-Industry R&D Programs on Private R&D: The Case of the Small Business Innovation Research Program. Rand J. Econ. 2000, 31, 82. [Google Scholar] [CrossRef]

- Cowling, M. You can lead a firm to R&D but can you make it innovate? UK evidence from SMEs. Small Bus. Econ. 2016, 46, 565–577. [Google Scholar] [CrossRef]

- Hottenrott, H.; Lopes-Bento, C. (International) R&D collaboration and SMEs: The effectiveness of targeted public R&D support schemes. Res. Policy 2014, 43, 1055–1066. [Google Scholar] [CrossRef]

- Arrow, K.J. The Economic Implications of Learning by Doing. Rev. Econ. Stud. 1962, 29, 155–173. [Google Scholar] [CrossRef]

- Branstetter, L.; Fisman, R.; Foley, C.F.; Saggi, K. Does intellectual property rights reform spur industrial development? J. Int. Econ. 2011, 83, 27–36. [Google Scholar] [CrossRef]

- Lee, J.M.; Joo, S.H.; Kim, Y. The complementary effect of intellectual property protection mechanisms on product innovation performance. R D Manag. 2018, 48, 320–330. [Google Scholar] [CrossRef]

- Barbu, A.; Militaru, G. The Moderating Effect of Intellectual Property Rights on Relationship between Innovation and Company Performance in Manufacturing Sector. Procedia Manuf. 2019, 32, 1077–1084. [Google Scholar] [CrossRef]

- Ang, J.S.; Cheng, Y.; Wu, C. Does Enforcement of Intellectual Property Rights Matter in China? Evidence from Financing and Investment Choices in the High-Tech Industry. Rev. Econ. Stat. 2014, 96, 332–348. [Google Scholar] [CrossRef]

- Shi, G.; Pray, C.; Zhang, W. Effectiveness of Intellectual Property Protection: Survey Evidence from China. Agric. Resour. Econ. Rev. 2012, 41, 286–297. [Google Scholar] [CrossRef]

- Lee, M.; Alba, J.D.; Park, D. Intellectual property rights, informal economy, and FDI into developing countries. J. Policy Model. 2018, 40, 1067–1081. [Google Scholar] [CrossRef]

- Ginarte, J.C.; Park, W.G. Determinants of patent rights: A cross-national study. Res. Policy 1997, 26, 283–301. [Google Scholar] [CrossRef]

- Griliches, Z. Patent Statistics as Economic Indicators: A Survey. J. Econ. Lit. 1990, 28, 1661–1707. [Google Scholar] [CrossRef]

- Aristei, D.; Sterlacchini, A.; Venturini, F. Effectiveness of R&D subsidies during the crisis: Firm-level evidence across EU countries. Econ. Innov. New Technol. 2017, 26, 554–573. [Google Scholar] [CrossRef]

- Xu, C.; Shan, X. Constructing of the Index System and Verification for the Intensity of Intellectual Property Protection in China. Stud. Sci. Sci. 2008, 26, 715–723. [Google Scholar] [CrossRef]

- Capasso, M.; Treibich, T.; Verspagen, B. The medium-term effect of R&D on firm growth. Small Bus. Econ. 2015, 45, 39–62. [Google Scholar] [CrossRef]

- Yang, C.; Lin, C.; Ma, D. R&D, Human Capital Investment and Productivity: Firm-level Evidence from China’s Electronics Industry. China World Econ. 2010, 18, 72–89. [Google Scholar] [CrossRef]

- Bettencourt, L.M.A.; Lobo, J.; Strumsky, D. Invention in the city: Increasing returns to patenting as a scaling function of metropolitan size. Res. Policy 2007, 36, 107–120. [Google Scholar] [CrossRef]

- Chevassus-Lozza, E.; Galliano, D. Local Spillovers, Firm Organization and Export Behaviour: Evidence from the French Food Industry. Reg. Stud. 2003, 37, 147–158. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The moderator-mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Pers. Soc. Psychol. 1999, 51, 1173–1182. [Google Scholar] [CrossRef]

- Sobel, M.E. Asymptotic Confidence Intervals for Indirect Effects in Structural Equation Models. Sociol. Methodol. 1982, 13, 290–312. [Google Scholar] [CrossRef]

- Edwards, J.R.; Lisa Schurer, L. Methods for integrating moderation and mediation: A general analytical framework using moderated path analysis. Psychol. Methods 2007, 12, 1–22. [Google Scholar] [CrossRef] [PubMed]

- Mackinnon, D.P.; Lockwood, C.M.; Hoffman, J.M.; West, S.G.; Sheets, V. A comparison of methods to test mediation and other intervening variable effects. Psychol. Methods 2002, 7, 83–104. [Google Scholar] [CrossRef] [PubMed]

- Preacher, K.J.; Rucker, D.D.; Hayes, A.F. Addressing Moderated Mediation Hypotheses: Theory, Methods, and Prescriptions. Multivar. Behav. Res. 2007, 42, 185–227. [Google Scholar] [CrossRef]

- Mackinnon, D.P. Introduction to Statistical Mediation Analysis, 1st ed.; Psychology Press: New York, NY, USA, 2008. [Google Scholar]

- Hayes, A. Introduction to Mediation, Moderation, and Conditional Process Analysis; The Guilford Press: New York, NY, USA, 2013. [Google Scholar]

- Wooldridge, J.M. Econometric Analysis of Cross Section and Panel Data; MIT Press: Cambridge, MA, USA, 2002. [Google Scholar]

- Zhang, Q.; Chen, L.; Feng, T. Mediation or Moderation? The Role of R&D Investment in the Relationship between Corporate Governance and Firm Performance: Empirical Evidence from the Chinese IT Industry. Corp. Gov. Int. Rev. 2014, 22, 501–517. [Google Scholar] [CrossRef]

- Han. The Interaction Effect of R&D Investment and Human Capital Investment on Value Relevance. Korean J. Manag. Account. Res. 2007, 7, 115–136. [Google Scholar]

- Lin, J.Y. Effects on diversity of R&D sources and human capital on industrial performance. Technol. Forecast. Soc. Chang. 2014, 85, 168–184. [Google Scholar] [CrossRef]

| Item | Option or Value | Frequency |

|---|---|---|

| Number of SMEs (10,000) | ≤50 | 66 (20.0%) |

| 50–100 | 88 (26.7%) | |

| ≥100 | 176 (53.3%) | |

| SMEs’ Output/Total Industrial Output | 80 | 44 (13.3%) |

| 80–95 | 88 (26.7%) | |

| 95–100 | 198 (60.0%) | |

| Location | East | 121 (36.7%) |

| Middle | 88 (26.7%) | |

| West | 121 (36.7%) |

| Variable | Abbreviation | Type | Operational Definition | Mean | Standard Deviation |

|---|---|---|---|---|---|

| Sustainable Patent Output of SMEs | Pat | Dependent variable | Number of authorized patents in logarithmic form | 5.416 | 1.544 |

| RDFS | Rdfs | Independent variable | Government funds for SMEs in logarithmic form | 11.854 | 1.199 |

| IPP | Ipp | Moderating variable | Turnover of technology trading market in logarithmic form | 7.291 | 1.768 |

| RRDFI | Rdf | Mediating variable | Internal R&D expenditure of each region in logarithmic form | 8.356 | 1.352 |

| RRDPI | Rdp | Mediating variable | Full-time equivalent of R&D personnel in logarithmic form | 6.742 | 1.177 |

| Level of Economic Development | Ecle | Control variable | Per capita GDP in logarithmic form | 10.504 | 0.554 |

| Level of High-Tech Industry Development | Hitech | Control variable | Proportion of the total output of high-tech industry in the total industrial output | 0.092 | 0.077 |

| Market Capacity | Mc | Control variable | Number of industrial enterprises above the scale in logarithmic form | 8.273 | 1.494 |

| Regional Openness | Ro | Control variable | Proportion of total import and export in the regional GDP | 0.303 | 0.364 |

| Statistic | p-Value | Fixed-N Exact Critical Values | |||||

|---|---|---|---|---|---|---|---|

| Rdfs | Pat | Rdfs | Pat | 1% | 5% | 10% | |

| t-bar | −3.1327 | −2.3781 | −1.830 | −1.740 | −1.690 | ||

| t-tilde-bar | −2.5881 | −2.7391 | |||||

| Z-t-tilde-bar | −7.4011 | −7.6752 | 0.00 *** | 0.00 *** | |||

| Statistic | p-Value | Fixed-N Exact Critical Values | |||||

|---|---|---|---|---|---|---|---|

| Rdf | Rdp | Rdf | Rdp | 1% | 5% | 10% | |

| t-bar | −3.2579 | −3.2981 | −1.830 | −1.740 | −1.690 | ||

| t-tilde-bar | −2.6302 | −3.1932 | |||||

| Z-t-tilde-bar | −7.7011 | −8.6752 | 0.0000 | 0.0000 | |||

| Hypothesis | Test | Statistics | p-Value |

|---|---|---|---|

| Ho: Error has No Spatial AutoCorrelation Ha: Error has Spatial AutoCorrelation | LM Error | 0.0073 | 0.9269 |

| Ho: Spatial Lagged Dependent Variable has No Spatial AutoCorrelation Ha: Spatial Lagged Dependent Variable has Spatial AutoCorrelation | LM Lag | 3.7432 | 0.0501 |

| Ho: No General Spatial AutoCorrelation Ha: General Spatial AutoCorrelation | LM SAC | 4.1904 | 0.1295 |

| B | B | b-B | S.E. | |

|---|---|---|---|---|

| Fe | re | |||

| L.Pat | 0.808 | 0.412 | 0.396 | 0.044 |

| wPat | 0.040 | 0.021 | 0.019 | 0.008 |

| Rdfs | 0.116 | 0.212 | −0.096 | 0.052 |

| L.Rdfs | 0.084 | 1.276 | −1.192 | 0.034 |

| wRdfs | −0.065 | −0.015 | −0.05 | 0.015 |

| Ecle | 1.634 | 1.276 | 0.358 | 0.044 |

| Hitech | 0.523 | 2.617 | −2.094 | 0.317 |

| Mc | −0.011 | 0.086 | −0.097 | 0.007 |

| Ro | −0.336 | −0.435 | 0.099 | 0.120 |

| Cons | −8.812 | −9.520 | 0.708 | 0.511 |

| Hausman test statistics | 110.26 | |||

| p | 0.000 *** | |||

| Variables | Model (1) | Model (2) | Model (3) | ||

|---|---|---|---|---|---|

| Pat | Rdf | Rdp | Pat | ||

| Rdfs | 0.138 *** (0.028) | 0.435 *** (0.046) | 0.083 ** (0.035) | 0.065 * (0.039) | 0.048 ** (0.020) |

| Rdf | 0.167 *** (0.063) | ||||

| Rdp | 1.084 *** (0.378) | ||||

| L.Pat | 0.808 *** (0.044) | 0.795 *** (0.043) | 0.808 *** (0.044) | ||

| wPat | 0.040 *** (0.008) | 0.036 *** (0.008) | 0.040 *** (0.008) | ||

| L.Rdfs | 0.045 *** (0.013) | 0.038 ** (0.019) | 0.027 ** (0.012) | 0.006 (0.012) | 0.004 (0.011) |

| wRdfs | 0.065 *** (0.015) | 0.034 * (0.021) | 0.034 *** (0.009) | 0.006 (0.017) | 0.028 ** (0.013) |

| L.Rdf | 0.272 *** (0.036) | ||||

| wRdf | 0.047 *** (0.016) | ||||

| L.Rdp | 0.749 *** (0.031) | ||||

| wRdp | 0.002 (0.017) | ||||

| Ecle | −0.107 *** (0.062) | 0.214 *** (0.038) | 0.317 *** (0.044) | −0.273 *** (0.077) | 0.138 *** (0.028) |

| Hitech | 1.467 *** (0.356) | 0.367 *** (0.074) | 0.566 ** (0.309) | 1.054 *** (0.504) | 0.508 *** (0.015) |

| Mc | 0.298 *** (0.024) | 0.418 *** (0.217) | 0.368 *** (0.026) | 0.348 *** (0.042) | −0.054 *** (0.037) |

| Ro | 0.341 *** (0.104) | −0.044 (0.100) | 0.042 (0.136) | 0.535 *** (0.101) | 0.204 *** (0.012) |

| Log-likelihood | 140.45 | 139.68 | 140.32 | 123.11 | 135.35 |

| Adusted R2 | 87.05% | 90.20% | 75.46% | 89.15% | 88.16% |

| Total Effect | 0.138 | ||||

| Direct Effect (Rdf as Mediator) | 0.065 | Direct Effect (Rdp as Mediator) | 0.048 | ||

| Mediation Effect (Rdf as Mediator) | 0.073 | Mediation Effect (Rdp as Mediator) | 0.090 | ||

| Variables | Model (4) | Model (5) | Model (6) | ||

|---|---|---|---|---|---|

| Pat | Rdf | Rdp | Pat | ||

| Rdfs | 0.124 *** (0.037) | 0.433 *** (0.046) | 0.048 * (0.022) | 0.037 ** (0.014) | 0.111 *** (0.040) |

| Rdf | 0.145 ** (0.063) | ||||

| Rdp | 0.871 *** (0.284) | ||||

| L.Pat | 0.800 *** (0.044) | 0.784 *** (0.043) | 0.794 *** (0.045) | ||

| wPat | 0.040 *** (0.008) | 0.036 *** (0.017) | 0.041 *** (0.008) | ||

| L.Rdfs | 0.042 *** (0.015) | 0.033 * (0.020) | 0.022 ** (0.010) | 0.037 *** (0.012) | 0.023 (0.019) |

| wRdfs | 0.065 *** (0.015) | 0.035 * (0.021) | 0.008 ** (0.004) | 0.060 *** (0.017) | 0.058 (0.044) |

| L.Rdf | 0.269 *** (0.036) | ||||

| wRdf | 0.049 *** (0.016) | ||||

| L.Rdp | 0.761 *** (0.033) | ||||

| wRdp | 0.030 *** (0.010) | ||||

| Rdfs*Ipp | 0.018 *** (0.006) | 0.008 *** (0.003) | 0.005 ** (0.002) | 0.012 ** (0.006) | 0.005 * (0.003) |

| Rdf*Ipp | 0.013 * (0.008) | ||||

| Rdp*Ipp | 0.015 ** (0.006) | ||||

| Ecle | −0.131 ** (0.052) | 0. 478 *** (0.047) | 0.147 *** (0.034) | −0.146 *** (0.023) | −0.234 *** (0.035) |

| Hitech | 1.233 *** (0.578) | 0.893 ** (0.462) | 0.875 *** (0.225) | 1.458 *** (0.534) | 1.442 *** (0.322) |

| Mc | 0.793 *** (0.033) | 0.849 *** (0.031) | 0.645 *** (0.031) | 0.596 *** (0.042) | 0.448 *** (0.035) |

| Ro | 0.468 *** (0.137) | −0.156 * (0.078) | −0.065 (0.072) | 0.524 *** (0.112) | 0.433 *** (0.115) |

| Log-likelihood | 142.93 | 147.63 | 145.03 | 134.35 | 193.98 |

| Adusted R2 | 89.83% | 89.88% | 94.28% | 97.44% | 94.33% |

| Total Effect | 0.124 + 0.018*ipp | ||||

| Direct Effect (Rdf as Mediator) | 0.037 + 0.012*ipp | Direct Effect (Rdp as Mediator) | 0.111 + 0.005*ipp | ||

| Mediation Effect (Rdf as Mediator) | (0.433 + 0.008*ipp)*(0.145 + 0.013*ipp) | Mediation Effect (Rdp as Mediator) | (0.048 + 0.005*ipp)*(0.871 + 0.015*ipp) | ||

| Variable | Model (1) | Model (2) | Model (3) | ||||

|---|---|---|---|---|---|---|---|

| Pat | Rdf | Rdp | Pat | ||||

| Coefficient | CI | Coefficient | CI | ||||

| Rdfs | 0.138 *** (0.028) | 0.435 *** (0.046) | 0.083 ** (0.035) | 0.065 * (0.039) | 0.048 ** (0.020) | ||

| Rdf | 0.167 *** (0.063) | ||||||

| Rdp | 1.084 *** (0.378) | ||||||

| Direct Effect | 0.065 | (0.043, 0.129) | 0.048 | (0.022, 0.113) | |||

| Mediation Effect | 0.073 | (0.054, 0.151) | 0.090 | (0.066, 0.186) | |||

| Total Effect | 0.138 | (0.107, 0.235) | 0.138 | (0.107, 0.235) | |||

| Proportion of Mediating Effect | 52.9% | 65.2% | |||||

| Moderating Variable | Level | Effects | Proportion of Mediating Effect | |||||

|---|---|---|---|---|---|---|---|---|

| RDFS → RRDFI → Pat | ||||||||

| Direct Effect | Mediation Effect | |||||||

| Coefficient | Lower Limit | Upper Limit | Coefficient | Lower Limit | Upper Limit | |||

| Intensity of IPP | Low ipp = 11.423 | 0.174 *** (0.018) | 0.139 | 0.209 | 0.156 *** (0.011) | 0.127 | 0.248 | 47.27% |

| High ipp = 14.959 | 0.216 *** (0.017) | 0.183 | 0.249 | 0.177 *** (0.016) | 0.159 | 0.392 | 45.04% | |

| High-Low ipp = 3.536 | 0.042 *** (0.017) | 0.035 | 0.062 | 0.021 * (0.012) | 0.012 | 0.034 | 2.23% | |

| Moderating Variable | Level | Effects | Proportion of Mediating Effect | |||||

|---|---|---|---|---|---|---|---|---|

| RDFS → RRDPI → Pat | ||||||||

| Direct Effect | Mediation Effect | |||||||

| Coefficient | Lower Limit | Upper Limit | Coefficient | Lower Limit | Upper Limit | |||

| Intensity of IPP | Low ipp = 11.423 | 0.168 *** (0.010) | 0.149 | 0.193 | 0.162 *** (0.022) | 0.166 | 0.425 | 49.09% |

| High ipp = 14.959 | 0.186 *** (0.011) | 0.160 | 0.202 | 0.207 *** (0.023) | 0.187 | 0.493 | 52.67% | |

| High-Low ipp = 3.536 | 0.018 ** (0.010) | 0.001 | 0.037 | 0.045 ** (0.022) | 0.009 | 0.083 | 3.58% | |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xu, P.; Zhang, M.; Gui, M. How R&D Financial Subsidies, Regional R&D Input, and Intellectual Property Protection Affect the Sustainable Patent Output of SMEs: Evidence from China. Sustainability 2020, 12, 1207. https://doi.org/10.3390/su12031207

Xu P, Zhang M, Gui M. How R&D Financial Subsidies, Regional R&D Input, and Intellectual Property Protection Affect the Sustainable Patent Output of SMEs: Evidence from China. Sustainability. 2020; 12(3):1207. https://doi.org/10.3390/su12031207

Chicago/Turabian StyleXu, Pengyuan, Meiqing Zhang, and Min Gui. 2020. "How R&D Financial Subsidies, Regional R&D Input, and Intellectual Property Protection Affect the Sustainable Patent Output of SMEs: Evidence from China" Sustainability 12, no. 3: 1207. https://doi.org/10.3390/su12031207

APA StyleXu, P., Zhang, M., & Gui, M. (2020). How R&D Financial Subsidies, Regional R&D Input, and Intellectual Property Protection Affect the Sustainable Patent Output of SMEs: Evidence from China. Sustainability, 12(3), 1207. https://doi.org/10.3390/su12031207