Can the Energy Transition Be Smooth? A General Equilibrium Approach to the EROEI

Abstract

1. Introduction

2. Literature Review

3. Method: A Dynamic General Equilibrium Model of Energy Transition

3.1. The Dynamic System

3.1.1. Non-Renewable Energy Sector

3.1.2. Renewable Energy Sector

3.1.3. The Final Goods Sector

3.1.4. Households

3.1.5. Market Clearing Conditions in Period t

3.1.6. General Equilibrium

- the dynamics of the NRE stock (1);

- equations describing the technical progress that governs the evolutions of technological variables , and .

3.1.7. Savings Rate and EROEI Ratios

3.2. Numerical Simulations

4. Results

4.1. EROEI, Savings and Economic Growth

4.2. Stationary State Results

- The long run EROEI is given by:

- The share of output allocated to the energy sector is the inverse of the EROEI ratio:

- the long-termism of private agents β;

- the productivity factors (1) of investment goods φ in capital formation; (2) of energy and capital ζ in final production; (3) of capital in RE production;

- the renewable energy flow ;

- the elasticity of substitution σ between energy and capital in final production.

- Equation (28) can be easily understood when computing the net energy consumption of the energy sector: it is the energy content of the units of capital invested in RE. Since each unit of final output has an energy content of and is made from of such units, its energy content amounts to . Accordingly, (the ratio between the output of RE sector () and its own energy needs) is equal to , i.e., the inverse of .

- Equation (27), which gives the general equilibrium level of the EROEI, shows that a partial equilibrium reasoning about its determinants may be misleading.First, the EROEI at the global level does not exclusively depend on technological considerations but also on economic factors affecting the savings rate of the economy: in particular, it also depends on the discount factor . Second, changes in technological factors that could improve the EROEI, all other things equal, do not necessarily do so at the global level when they favor economic activity and thereby increase the energy requirements of the economy. Rewriting (28) as shows that only depends on and parameters that influence : at given , a change in a parameter of the model, increases only if it decreases . For instance, a higher (or a higher ) reduces the quantity of final output that must be invested in the RE sector all other things equal, which improves the EROEI of energy production. However, it also induces a rebound effect in the production of energy and finally decreases the EROEI. A larger would save energy at unchanged output level but it has the opposite effect at a general equilibrium level: it ultimately leaves and unchanged.

- The expression of in (27) is larger than 1 because it is the product of two terms (respectively and the expression between square brackets) that are both larger than 1. This result echoes the literature in energy science which argues that a global EROEI sufficiently above 1 is necessary “to maintain what we call civilization” [6], (p. 45).

4.3. Transitory Dynamics Results

4.3.1. A Transition with a Possible Output Contraction

- A contraction of private consumption occurs when the real price of an efficient unit of energy (i.e., ) is above its stationary state value, i.e., when

- If a contraction of output occurs, it starts before the completion of the transition, when the increase in RE production is not fast enough to compensate for the decline in NRE production.

4.3.2. A Baseline Scenario

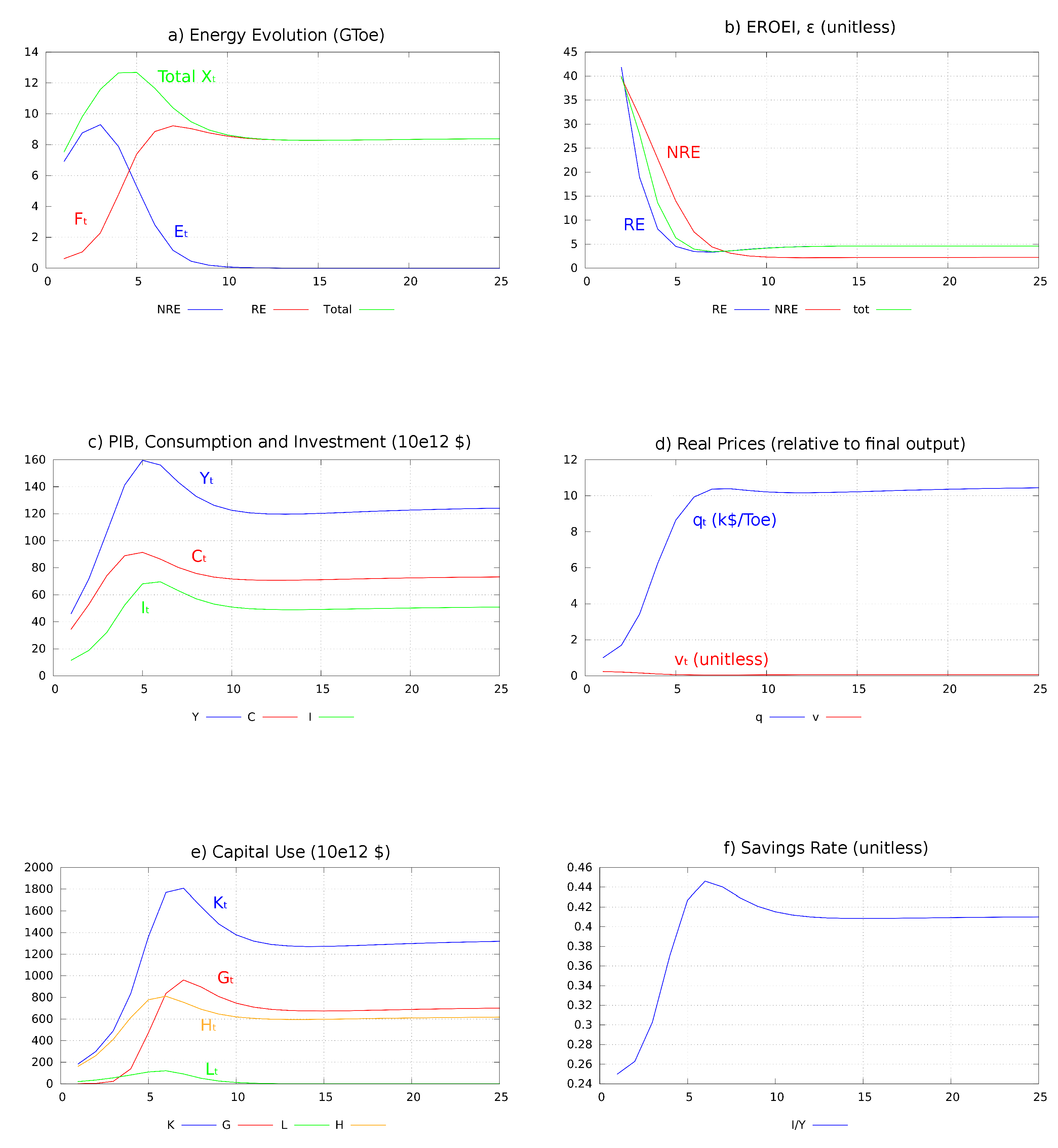

- The energy transition is characterized by a reduction in the EROEI ratio (Figure 1b) and a progressive rise in the real energy price (Figure 1d). Initially, both NRE and RE production offer relatively high EROEIs (Figure 1b). As hydroelectricity represents the main part of the RE mix in the first period, the initial (calibrated) EROEI of RE is higher than that of NRE. But the two types of energy production become more capital intensive when the NRE stock decreases and RE production rises. The EROEI of each energy production process, therefore, decreases even though energy efficiency gains progressively reduce the energy content of each unit of capital.The fall in the EROEI of RE, however, stops when RE production peaks. After this peak, it slightly improves not only because decreases but also because increases (the energy efficiency gains reduce the energy content of capital used in the RE sector).

- A rapid increase in RE production is only observed when NRE production is still relatively abundant (Figure 1a). This will also be the case in the sensitivity analysis.

- Even though the output level is, in the long run, well above its initial value, it evolves non-monotonically: before the completion of the transition, final output, private consumption and investment (Figure 1c) overshoot the level that the economy is able to sustain in the long run. This contraction of output and consumption starts after the peak in NRE production but well before the end of the NRE extraction (Figure 1a–c). The mechanism that explains this contraction is the one described in the comment following Proposition 3. The contraction stops when the energy transition is completed, output being then 25% lower than at its peak level.

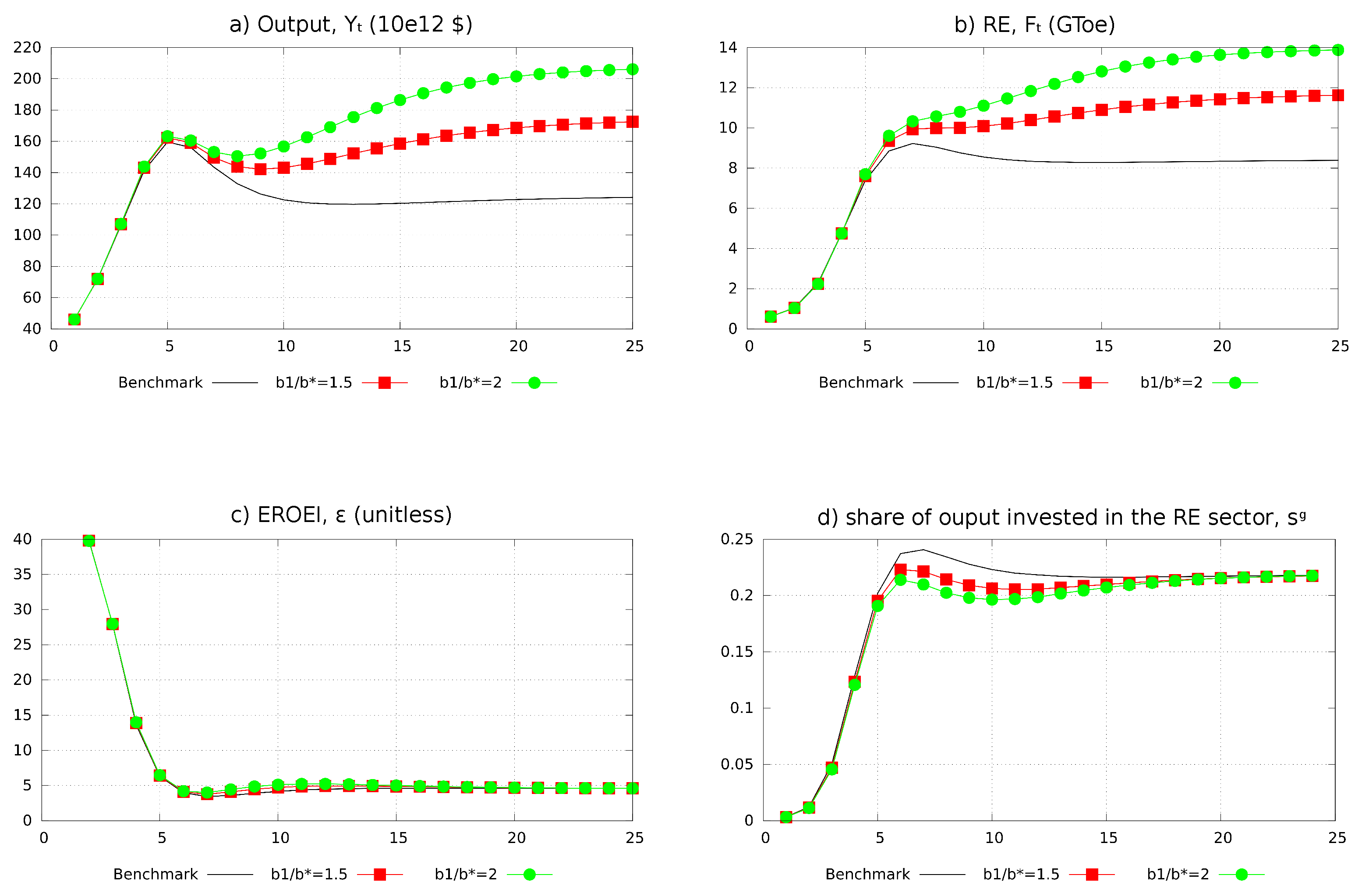

4.4. Sensitivity Analysis

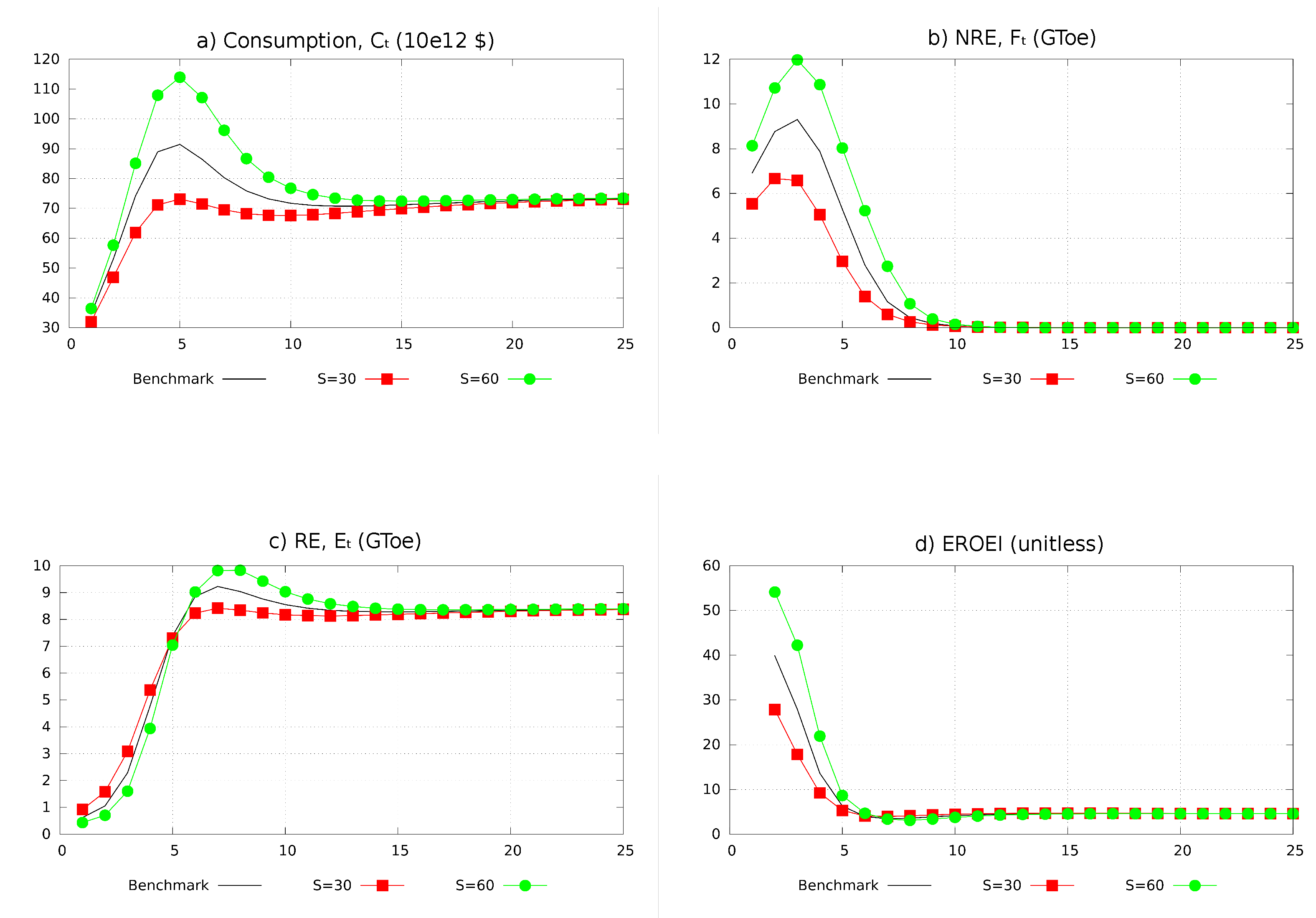

4.4.1. The Impact of the NRE Stock and of Agents’ Short-Termism

- The condition of a downward adjustment of consumption and output during the energy transition is more easily met when the initial NRE stock is high. Using point 2 of Proposition 3, we know that with a zero initial stock , an undercapitalized economy (for which ) would not overshoot its stationary levels of consumption and output during the transitory dynamics. This is in accordance with [34] which shows that the transitory dynamics of output in an economy that only uses a constant renewable resource flow is monotonic. By continuity, this certainly remains true if the NRE stock is positive but small enough. Said differently, an overshooting of output and consumption can only occur in an economy with a sufficiently large initial NRE stock. Though it will not be further discussed here, it is also easier to meet the condition of a downward adjustment of consumption and output during the energy transition when economic agents have a lower discount factor β, which leads them to consume the NRE stock faster.

- If a contraction of consumption and output occurs during the energy transition of an economy with an initial NRE stock , its magnitude is increasing in . With a bigger , the NRE production cost and the energy price are initially lower at a given level of final output. Consequently, the overshooting condition (29) will be verified at a higher output level -and possibly at a later time- in a better-endowed economy. Moreover, as the initial NRE stock does not affect the long-run equilibrium, the output contraction will also be larger in an initially better endowed economy.

- A bigger initial stock of NRE resource delays the development of the RE sector. As a bigger initially implies a lower , it also reduces the profitability of the RE sector and initially slows down its development.

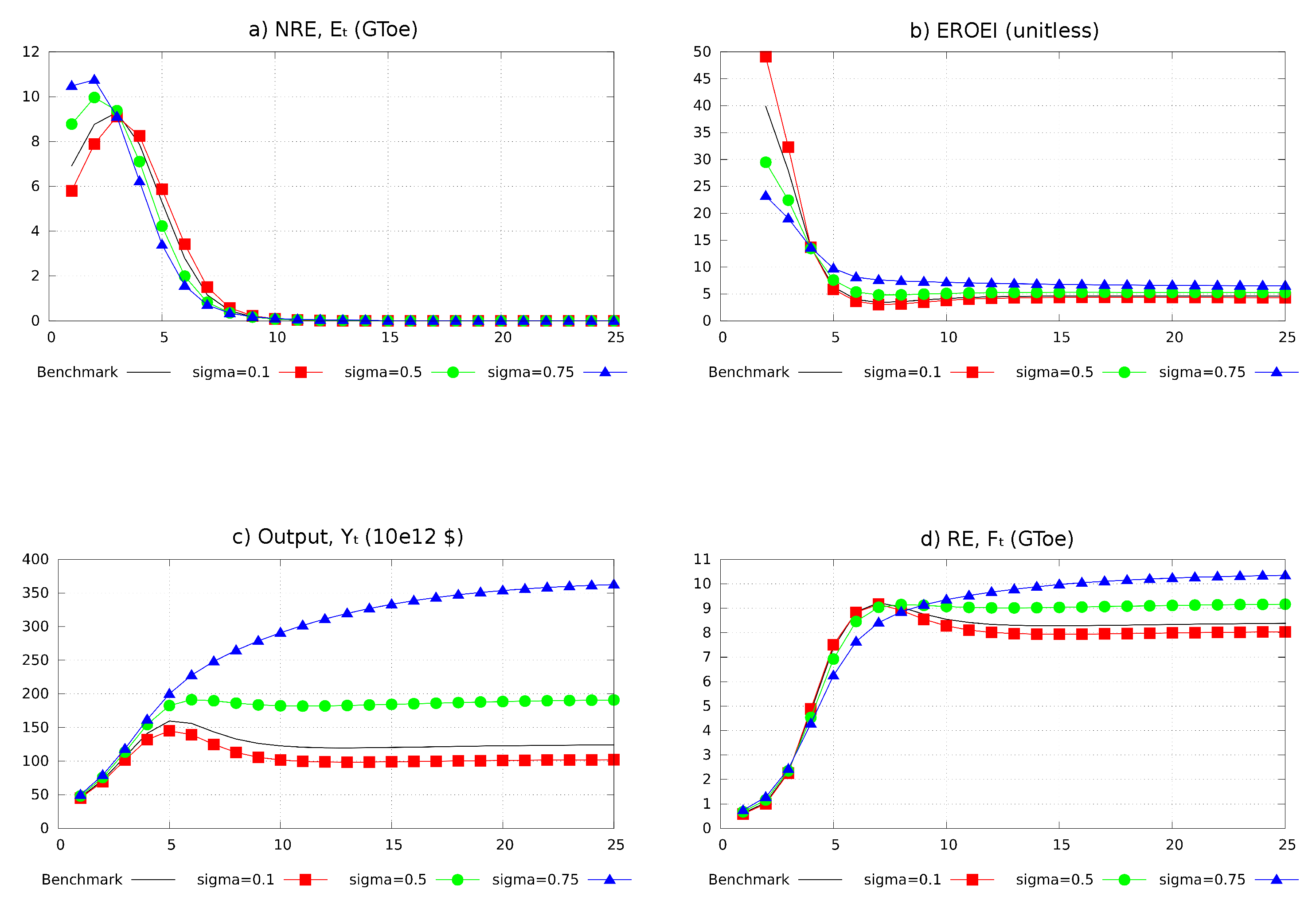

4.4.2. The Role of the Substitutability Between Capital and Energy

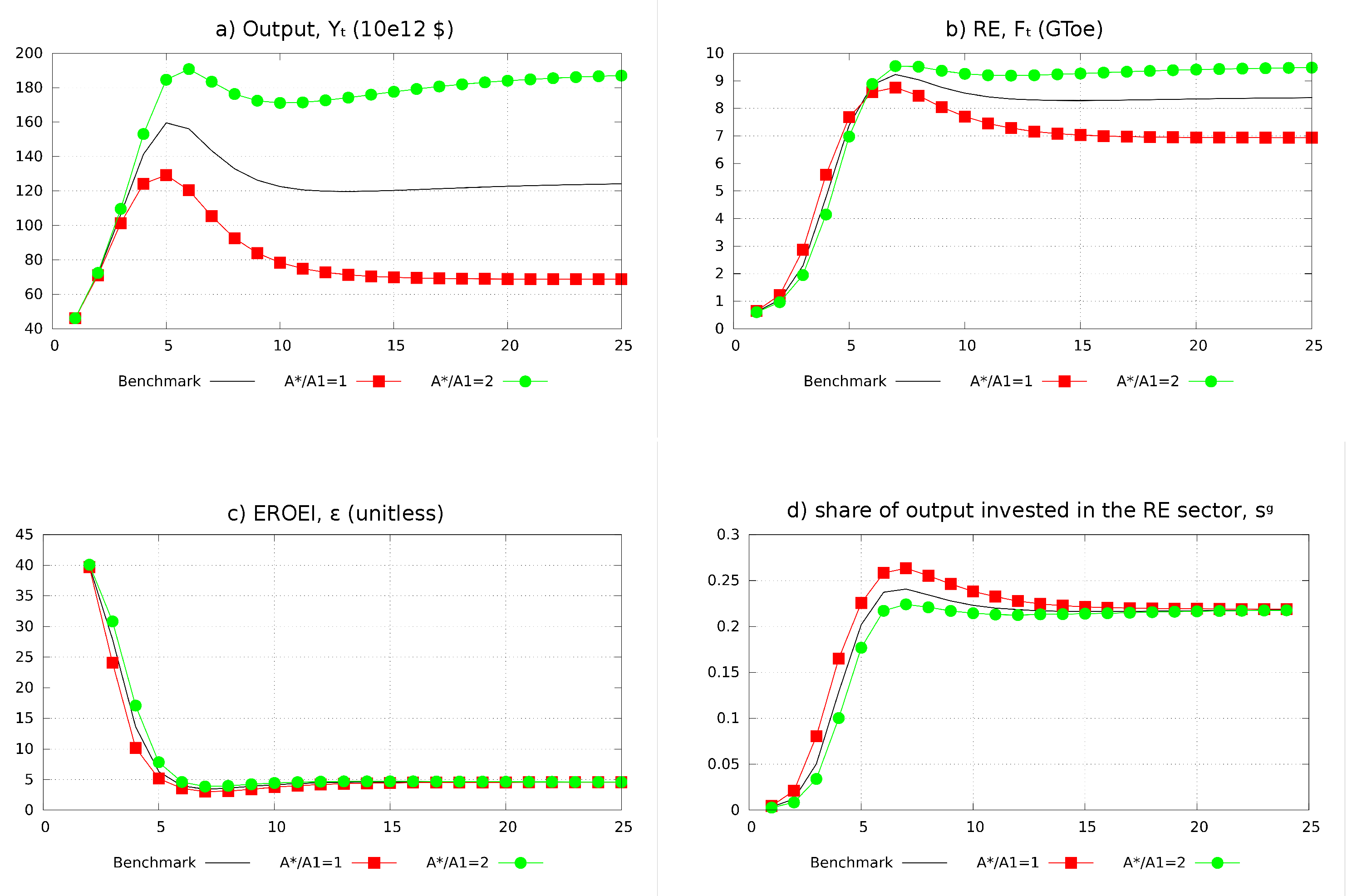

4.4.3. The Role of Technical Progress

5. Discussion and Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Abbreviations

| Energy production and NRE stock | |

| NRE production during period t | |

| RE production during t | |

| total energy production during t | |

| NRE stock at the beginning of period t | |

| last period of NRE extraction | |

| global EROEI of the energy sector in t | |

| Capital stock | |

| Aggregate capital stock at the beginning of period t | |

| Capital stock used in the final goods sector in t | |

| Capital stock used in the RE sector in t | |

| Capital stock used in the NRE sector in t Final production and its allocation | |

| Final output level in period t | |

| Private consumption in period t | |

| savings rate in t | |

| fraction of period t output invested in the final production sector | |

| fraction of period t output invested in the RE sector | |

| fraction of period t output invested in the NRE sector | |

| Technological variables | |

| Factor of energy efficiency in the final goods sector t | |

| Factor of capital intensiveness of the RE production process in t | |

| Factor of capital intensiveness of the NRE extraction process in t | |

| Real prices | |

| real price of energy in t | |

| real interest rate in period t | |

| real rental price of capital in t | |

| firms’ discount factor of period t profits | |

| List of parameters | |

| Inter-temporal elasticity of substitution of consumption | |

| Households’ subjective discount factor | |

| Capital elasticity of RE production at the firm level | |

| Productivity factor of the investment goods in the capital formation | |

| Elasticity of substitution between energy and capital in the final goods technology | |

| Capital productivity factor in the final goods technology | |

| a | Weight of energy in the final goods technology |

| RE flow per period | |

| Initial NRE stock | |

Appendix A.

Appendix A.1. NRE Sector

- or for where () is the optimal time length during which the NRE stock is exploited;

- or for .

Appendix A.2. RE Sector

Appendix A.3. Final Goods Sector

Appendix A.4. Consumers’ Behaviour

Appendix A.5. Proof of Lemma 1

Appendix A.6. Proof of Proposition 2

Appendix A.7. Proof of Lemma 2

Appendix A.8. Proof of Proposition 3

- Point (1) implies that if a contraction in consumption starts in a period t, we then have (since there is no contraction in ) and therefore . Since , these inequalities imply thatHence, the contraction in starts at a time where RE production and its capital requirements increase. Moreover, inequality and (7) jointly imply thatSince , a fall in output () will therefore occur only if total energy production decreases: in such a case, one hasThe combination of (A22) and (A23) proves ad absurdio that if a contraction occurs, it starts when NRE is still used. Assume indeed that the decrease in consumption and output starts when NRE resource is not extracted anymore (so that and ): (A22) would then imply that , i.e., , which contradicts (A23).

Appendix A.9. Calibration

References

- British Petroleum. BP Statistical Review of World Energy 2018. Available online: bp.com/statisticalreview (accessed on 10 January 2020).

- International Energy Agency. World Energy Outlook 2019; IEA: Paris, France; Available online: www.iea.org/reports/world-energy-outlook-2019 (accessed on 10 January 2020).

- Meadows, D.; Randers, J.; Meadows, D. Limits to Growth. The 30-Year Update; Chelsea Green Publishing Company: White River Junction, VT, USA, 2004. [Google Scholar]

- Turner, G. Is Global Collapse Imminent? An Updated Comparison of The Limits to Growh with Historical Data; Research Paper n0 4; Melbourne Sustainable Society Institute: Parkville, Australia, 2014. [Google Scholar]

- Capellán-Pérez, I.; Mediavilla, M.; de Castro, C.; Carpintero, Ó.; Miguel, L.J. Fossil fuel depletion and socio-economic scenarios: An integrated approach. Energy 2014, 77, 641–666. [Google Scholar] [CrossRef]

- Hall, C.; Balogh, S.; Murphy, D. What is the minimum EROI that a sustainable society must have? Energies 2009, 2, 25–47. [Google Scholar] [CrossRef]

- Cleveland, C. Energy Return on Investment EROI, Encyclopedia of the Earth. 2008. Available online: http://eoarth.org/article/Energy_return_on_invesment (accessed on 30 June 2016).

- Hall, C.; Lambert, J.; Balogh, S. EROI of different fuels and the implications for society. Energy Policy 2014, 64, 141–152. [Google Scholar] [CrossRef]

- Cleveland, C. (Ed.) Encyclopedia of Energy; Elsevier: Dordrecht, The Nertherlands, 2004. [Google Scholar]

- Moriarty, P.; Honnery, D. What is the global potential for renewable energy? Renew. Sustain. Energy Rev. 2012, 16, 244–252. [Google Scholar] [CrossRef]

- Moriarty, P.; Honnery, D. Can renewable energy power the future? Energy Policy 2016, 93, 3–7. [Google Scholar] [CrossRef]

- Dupont, E.; Koppelaar, R.; Jeanmart, H. Global available wind energy with physical and energy return on investment constraints. Appl. Energy 2018, 209, 322–338. [Google Scholar] [CrossRef]

- Dupont, E.; Koppelaar, R.; Jeanmart, H. Global available solar energy under physical and energy return on investment constraints. Appl. Energy 2020, 257, 113968. [Google Scholar] [CrossRef]

- Rye, C.; Jackson, T. A review of EROEI-dynamics energy-transition models. Energy Policy 2018, 122, 260–272. [Google Scholar] [CrossRef]

- King, C.; Hall, C. Relating financial and energy return on investment. Sustainability 2011, 3, 1810–1832. [Google Scholar] [CrossRef]

- Murphy, D.; Hall, C. EROI or energy return on (energy) invested. Ann. N. Y. Acad. Sci. 2010, 1185, 102–118. [Google Scholar] [CrossRef]

- Heun, M.; de Wit, M. Energy return on (energy) invested (EROI), oil prices, and energy transitions. Energy Policy 2012, 40, 147–158. [Google Scholar] [CrossRef]

- Dale, M.; Krumdieck, S.; Bodger, P. Global energy modelling? A biophysical approach (GEMBA) Part 1: An overview of biophysical economics. Ecol. Econ. 2012, 73, 152–157. [Google Scholar] [CrossRef]

- Režný, L.; Bureš, V. Energy transition scenarios and their economic impacts in the extended neoclassical model of economic growth. Sustainability 2019, 11, 3644. [Google Scholar] [CrossRef]

- Ponta, L.; Raberto, M.; Teglio, A.; Cincotti, S. An Agent-based Stock-flow Consistent Model of the Sustainable Transition in the Energy Sector. Ecol. Econ. 2018, 145, 274–300. [Google Scholar] [CrossRef]

- Tahvonen, O.; Salo, S. Economic growth and transitions between renewable and nonrenewable energy resources. Eur. Econ. Rev. 2001, 45, 1379–1398. [Google Scholar] [CrossRef]

- Tsur, Y.; Zemel, A. Scarcity, growth and R&D. J. Environ. Econ. Manag. 2005, 49, 484–499. [Google Scholar]

- Amigues, J.-P.; Moreaux, M.; Schubert, K. Optimal use of a polluting non-renewable resource generating both manageable and catastrophic damages. Ann. Econ. Stat. 2011, 103/104, 107–130. [Google Scholar] [CrossRef][Green Version]

- Bonneuil, N.; Boucekkine, R. Optimal transition to renewable energy with threshold of irreversible pollution. Eur. J. Operat. Res. 2016, 248, 257–262. [Google Scholar] [CrossRef]

- Growiec, J.; Schumacher, I. On technical change in the elasticities of resource inputs. Resour. Policy 2008, 33, 210–221. [Google Scholar] [CrossRef][Green Version]

- Van der Meijden, G.; Smulders, S. Technological change during the energy transition. Macroecon. Dyn. 2018, 22, 805–836. [Google Scholar] [CrossRef]

- Jouvet, P.-A.; Schumacher, I. Learning-by-doing and the costs of a backstop for energy transition and sustainability. Ecol. Econ. 2011, 73, 122–132. [Google Scholar] [CrossRef]

- Fagnart, J.-F.; Germain, M. Can the Energy Transition Be Smooth? CEREC Working Paper 2014/11; Université Saint-Louis: Bruxelles, Belgium, 2014. [Google Scholar]

- Court, V.; Jouvet, P.-A.; Lantz, F. Long-Term Endogenous Economic Growth and Energy Transitions. Energy J. 2018, 39, 29–57. [Google Scholar] [CrossRef]

- Meran, G. Thermodynamic constraints and the use of energy-dependent CES-production functions A cautionary comment. Energy Econ. 2019, 81, 63–69. [Google Scholar] [CrossRef]

- Van der Werf, E. Production functions for climate policy modeling: An empirical analysis. Energy Econ. 2008, 30, 2964–2979. [Google Scholar] [CrossRef]

- Krysiak, F. Entropy, limits to growth, and the prospects for weak sustainability. Ecol. Econ. 2006, 58, 182–191. [Google Scholar] [CrossRef]

- Fagnart, J.-F.; Germain, M. Quantitative versus qualitative growth with recyclable resource. Ecol. Econ. 2011, 70, 929–941. [Google Scholar] [CrossRef]

- Germain, M. Equilibres et effondrement dans le cadre d’un cycle naturel. Brussels Econ. Rev. Cahiers Econ. Bruxelles 2012, 55, 427–455. [Google Scholar]

- Anderson, C.L. The production process: Inputs and wastes. J. Environ. Econ. Manag. 1987, 14, 1–12. [Google Scholar] [CrossRef]

- Fagnart, J.-F.; Germain, M. Net energy ratio, EROEI and the macroeconomy. Struct. Chang. Econ. Dynam. 2016, 37, 121–126. [Google Scholar] [CrossRef]

- Brandt, A.R.; Dale, M. A general mathematical framework for calculating systems-scale efficiency of energy extraction and conversion: Energy Return on Investment (EROI) and other energy return ratios. Energies 2011, 4, 1211–1245. [Google Scholar] [CrossRef]

- Brandt, A.R.; Dale, M.; Barnhart, C. Calculating systems-scale energy efficiency and net energy returns: A bottom-up matrix-based approach. Energy 2013, 62, 235–247. [Google Scholar] [CrossRef]

- Michel, P.H.; Thibault, E.; Vidal, J.-P. Intergenerational Altruism and Neoclassical Growth Models. In Handbook of the Economics of Giving, Altruism and Reciprocity: Applications Vol. 2; Kolm, S.-C., Mercier Ythier, J., Eds.; North-Holland: Amsterdam, The Netherlands, 2006; pp. 1055–1106. [Google Scholar]

- Pearce, D.W. Economic Values and the Natural World; Earthscan: London, UK, 1993. [Google Scholar]

- Piketty, T. Le Capital au XXIe Siècle; Seuil: Paris, France, 2013. [Google Scholar]

- Gupta, K.; Ajay, K.; Hall, C. A review of the past and current state of EROI data. Sustainability 2011, 3, 1796–1809. [Google Scholar] [CrossRef]

- Kemfert, C. Estimated substitution elasticities of a nested CES production function approach for Germany. Energy Econ. 1998, 20, 249–264. [Google Scholar] [CrossRef]

- Forito, G.; van den Bergh, J.M. Capital-energy substitution in manufacturing for seven OECD countries: Learning about potential effects of climate policy and peak oil. Energy Effic. 2016, 9, 49–65. [Google Scholar] [CrossRef]

- Valero, A.; Martinez, A. Inventory of the exergy resources on earth including its mineral capital. Energy 2010, 35, 989–995. [Google Scholar] [CrossRef]

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Fagnart, J.-F.; Germain, M.; Peeters, B. Can the Energy Transition Be Smooth? A General Equilibrium Approach to the EROEI. Sustainability 2020, 12, 1176. https://doi.org/10.3390/su12031176

Fagnart J-F, Germain M, Peeters B. Can the Energy Transition Be Smooth? A General Equilibrium Approach to the EROEI. Sustainability. 2020; 12(3):1176. https://doi.org/10.3390/su12031176

Chicago/Turabian StyleFagnart, Jean-François, Marc Germain, and Benjamin Peeters. 2020. "Can the Energy Transition Be Smooth? A General Equilibrium Approach to the EROEI" Sustainability 12, no. 3: 1176. https://doi.org/10.3390/su12031176

APA StyleFagnart, J.-F., Germain, M., & Peeters, B. (2020). Can the Energy Transition Be Smooth? A General Equilibrium Approach to the EROEI. Sustainability, 12(3), 1176. https://doi.org/10.3390/su12031176