The Impact of Purchase Subsidy on Enterprises’ R&D Efforts: Evidence from China’s New Energy Vehicle Industry

Abstract

1. Introduction

2. Literature Review

3. Model Specification and Data

4. Results

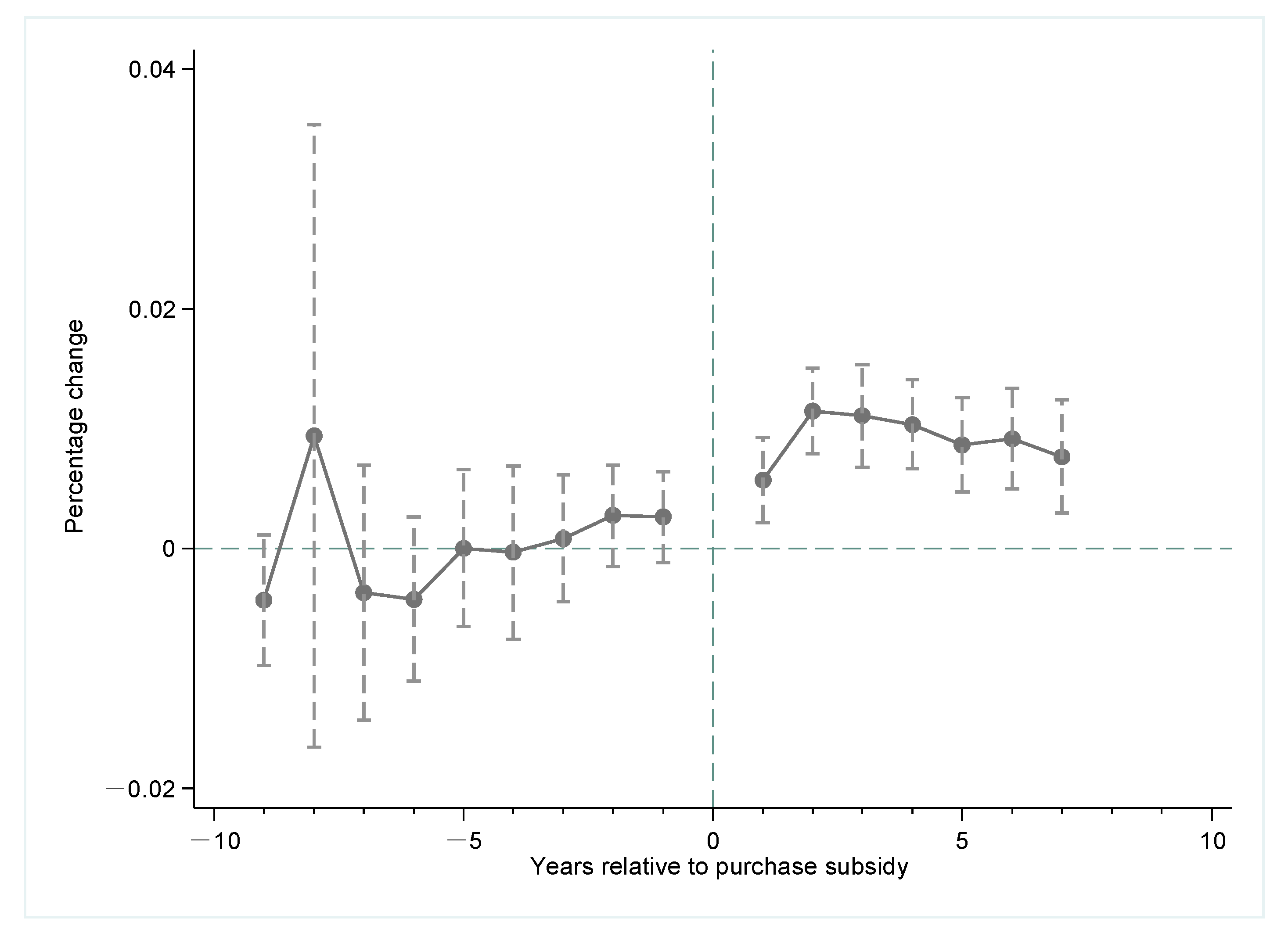

4.1. DID Estimation

4.2. Impacts of Government Procurement and Exemption on Purchase Tax

5. Conclusions and Policy Implications

Author Contributions

Funding

Conflicts of Interest

References

- Pikas, E.; Kurnitski, J.; Thalfeldt, M.; Koskela, L. Cost-benefit analysis of nZEB energy efficiency strategies with on-site photovoltaic generation. Energy 2017, 128, 291–301. [Google Scholar] [CrossRef]

- Cheng, Z.; Li, L.; Liu, J. Identifying the spatial effects and driving factors of urban PM2.5 pollution in China. Ecol. Indic. 2017, 82, 61–75. [Google Scholar] [CrossRef]

- Rennings, K. Redefining innovation–Eco-innovation research and the contribution from ecological economics. Ecol. Econ. 2000, 32, 319–332. [Google Scholar] [CrossRef]

- Ardito, L.; Petruzzelli, A.M.; Ghisetti, C. The impact of public research on the technological development of industry in the green energy field. Technol. Forecast. Soc. Chang. 2019, 144, 25–35. [Google Scholar] [CrossRef]

- Foray, D.; Mowery, D.C.; Nelson, R.R. Public R&D and social challenges: What lessons from mission R&D programs? Res. Policy 2012, 41, 1697–1702. [Google Scholar]

- Ghisetti, C.; Pontoni, F. Investigating policy and R&D effects on environmental innovation: A meta-analysis. Ecol. Econ. 2015, 118, 57–66. [Google Scholar]

- Edler, J.; Yeow, J. Connecting demand and supply: The role of intermediation in public procurement of innovation. Res. Policy 2016, 45, 414–426. [Google Scholar] [CrossRef]

- Corrocher, N.; Zirulia, L. Demand and innovation in services: The case of mobile communications. Res. Policy 2010, 39, 945–955. [Google Scholar] [CrossRef]

- Lin, R.; Tan, K.; Geng, Y. Market demand, green product innovation, and firm performance: Evidence from Vietnam motorcycle industry. J. Clean. Prod. 2013, 40, 101–107. [Google Scholar] [CrossRef]

- Armand, A.; Mendi, P. Demand drops and innovation investments: Evidence from the Great Recession in Spain. Res. Policy 2018, 47, 1321–1333. [Google Scholar] [CrossRef]

- Li, K.; Lin, B. Impact of energy technology patents in China: Evidence from a panel cointegration and error correction model. Energy Policy 2016, 89, 214–223. [Google Scholar] [CrossRef]

- Gao, X.; Rai, V. Local demand-pull policy and energy innovation: Evidence from the solar photovoltaic market in China. Energy Policy 2019, 128, 364–376. [Google Scholar] [CrossRef]

- Wang, X.; Zou, H. Study on the effect of wind power industry policy types on the innovation performance of different ownership enterprises: Evidence from China. Energy Policy 2018, 122, 241–252. [Google Scholar] [CrossRef]

- Wang, I.K.; Seidle, R. The degree of technological innovation: A demand heterogeneity perspective. Technol. Forecast. Soc. Chang. 2017, 125, 166–177. [Google Scholar] [CrossRef]

- Xie, Z.; Li, J. Demand Heterogeneity, Learning Diversity and Innovation in an Emerging Economy. J. Int. Manag. 2015, 21, 277–292. [Google Scholar] [CrossRef]

- Gambardella, A.; Raasch, C.; von Hippel, E. The user innovation paradigm: Impacts on markets and welfare. Manag. Sci. 2017, 63, 1450–1468. [Google Scholar] [CrossRef]

- Diamond, D. The impact of government incentives for hybrid-electric vehicles: Evidence from US states. Energy Policy 2009, 37, 972–983. [Google Scholar] [CrossRef]

- Ma, S.; Fan, Y.; Feng, L. An Evaluation of Government Incentives for New Energy Vehicles in China Focusing on Vehicle Purchasing Restrictions. Energy Policy 2017, 110, 609–618. [Google Scholar] [CrossRef]

- Earl, J.; Michael, J.F. Electric vehicle manufacturers’ perceptions of the market potential for demand-side flexibility using electric vehicles in the United Kingdom. Energy Policy 2019, 129, 646–652. [Google Scholar] [CrossRef]

- Yang, D.; Qiu, L.; Yan, J.; Chen, Z.; Jiang, M. The government regulation and market behavior of the new energy automotive industry. J. Clean. Prod. 2019, 210, 1281–1288. [Google Scholar] [CrossRef]

- Bjerkan, K.Y.; Nørbech, T.E.; Nordtømme, M.E. Incentives for promoting battery electric vehicle (BEV) adoption in Norway. Transp. Res. D Transp. Environ. 2016, 43, 169–180. [Google Scholar] [CrossRef]

- Chen, L.; Wang, B. Evaluate the Efficiency of Demand-Side Innovation Policies on New Energy Vehicles. Sci. Sci. Manag. S T 2015, 36, 15–23. [Google Scholar]

- Zhao, Q.; Li, Z.; Zhao, Z.; Ma, J. Industrial Policy and Innovation Capability of Strategic Emerging Industries: Empirical Evidence from Chinese New Energy Vehicle Industry. Sustainability 2019, 11, 2785. [Google Scholar] [CrossRef]

- He, W.; Xiao, X. The Impact of New-Energy Automobile Industry Promotion Policy on Patent Activities of Automobile Enterprises: Based on the Study of Corporate Patent Application and Patent Transfer. Contemp. Financ. Econo. 2017, 5, 103–114. [Google Scholar]

- Hoppmann, J.; Peters, M.; Schneider, M.; Hoffmann, V.H. The two faces of market support-How deployment policies affect technological exploration and exploitation in the solar photovoltaic industry. Res. Policy 2013, 42, 989–1003. [Google Scholar] [CrossRef]

- Nemet, G.F. Demand-pull, technology-push, and government-led incentives for non-incremental technical change. Res. Policy 2009, 38, 700–709. [Google Scholar] [CrossRef]

- Xu, L.; Su, J. From government to market and from producer to consumer: Transition of policy mix towards clean mobility in China. Energy Policy 2016, 96, 328–340. [Google Scholar] [CrossRef]

- Nill, J.; Kemp, R. Evolutionary approaches for sustainable innovation policies: From niche to paradigm. Res. Policy 2009, 38, 668–680. [Google Scholar] [CrossRef]

- Chen, K.; Zhao, F.; Hao, H.; Liu, Z. Synergistic Impacts of China’s Subsidy Policy and New Energy Vehicle Credit Regulation on the Technological Development of Battery Electric Vehicles. Energies 2018, 11, 3193. [Google Scholar] [CrossRef]

- Zhu, Z.; Zhu, Z.; Xu, P.; Xue, D. Exploring the impact of government subsidy and R&D investment on financial competitiveness of China’s new energy listed companies: An empirical study. Energy Rep. 2019, 5, 919–925. [Google Scholar]

- Bronzini, R.; Piselli, P. The impact of R&D subsidies on firm innovation. Res. Policy 2016, 45, 442–457. [Google Scholar]

- Graves, S.B.; Langowitz, N.S. Innovative productivity and returns to scale in the pharmaceutical industry. Strateg. Manag. J. 2006, 14, 593–605. [Google Scholar] [CrossRef]

- Xiong, H.; Yang, Y.; Zhou, J. The Effect of Government Subsidies on the R&D Investment of Enterprises Which Are in Different Life-Cycles Stages. Sci. Sci. Manag. S T 2016, 37, 3–15. [Google Scholar]

- Plank, J.; Doblinger, C. The firm-level innovation impact of public R&D funding: Evidence from the German renewable energy sector. Energy Policy 2018, 113, 430–438. [Google Scholar]

- Dai, M.; Li, X.; Lu, Y. How Urbanization Economies Impact TFP of R&D Performers: Evidence from China. Sustainability 2017, 9, 1766. [Google Scholar]

- Beck, T.; Levine, R.; Levkov, A. Big Bad Banks? The Winners and Losers from Bank Deregulation in the United States. J. Financ. 2010, 65, 1637–1667. [Google Scholar] [CrossRef]

- Horbach, J.; Rammer, C.; Rennings, K. Determinants of eco-innovations by type of environmental impact—The role of regulatory push/pull, technology push and market pull. Ecol. Econ. 2012, 78, 112–122. [Google Scholar] [CrossRef]

- Sun, X.; Liu, X.; Wang, Y.; Yuan, F. The effects of public subsidies on emerging industry: An agent-based model of the electric vehicle industry. Technol. Forecast. Soc. Chang. 2019, 140, 281–295. [Google Scholar] [CrossRef]

- Jiang, C.; Zhang, Y.; Bu, M.; Liu, W. The Effectiveness of Government Subsidies on Manufacturing Innovation: Evidence from the New Energy Vehicle Industry in China. Sustainability 2018, 10, 1692. [Google Scholar] [CrossRef]

- Ji, S.; Zhao, D.; Luo, R. Evolutionary game analysis on local governments and manufacturers’ behavioral strategies: Impact of phasing out subsidies for new energy vehicles. Energy 2019, 189, 116064. [Google Scholar] [CrossRef]

- Finon, D.; Menanteau, P. The static and dynamic efficiency of instruments of promotion of renewables. Energy Stud. Rev. 2003, 12, 53–82. [Google Scholar] [CrossRef]

- Hu, H.; Hong, H.; Xiao, L.; Liu, W. Tax preference and R&D investment: Moderation of property right nature and the mediating role of cost stickiness. Sci. Res. Manag. 2017, 38, 135–143. [Google Scholar]

- Hall, B.H.; Van Reenen, J. How effective are fiscal incentives for R&D? A review of the evidence. Res. Policy 2000, 29, 449–469. [Google Scholar]

- Zhang, X.; Rao, R.; Xie, J.; Liang, Y. The Current Dilemma and Future Path of China’s Electric Vehicles. Sustainability 2014, 6, 1567–1593. [Google Scholar] [CrossRef]

- Aschhoff, B.; Sofka, W. Innovation on demand-Can public procurement drive market success of innovations? Res. Policy 2009, 38, 1235–1247. [Google Scholar] [CrossRef]

- Ghisetti, C. Demand-pull and environmental innovations: Estimating the effects of innovative public procurement. Technol. Forecast. Soc. Chang. 2017, 125, 178–187. [Google Scholar] [CrossRef]

- Uyarra, E.; Edler, J.; Garcia-Estevez, J.; Georghiou, L.; Yeow, J. Barriers to innovation through public procurement: A supplier perspective. Technovation 2014, 34, 631–645. [Google Scholar] [CrossRef]

- Du, J.; Mickiewicz, T. Subsidies, rent seeking and performance: Being young, small or private in China. J. Bus. Ventur. 2016, 3, 22–38. [Google Scholar] [CrossRef]

| Type | Year | Policy Name | Department | Key Criterion |

|---|---|---|---|---|

| Purchase Subsidy | 2010 | Notice on Launching Pilot Projects of Subsidy for Private Sales on NEVs | MOF, MST, MIIT, NDRC | Purchase subsidy 50,000 RMB Per BEV Purchase subsidy 6000 RMB Per Plug in Hybrid Electric Vehicle (PHEV) |

| 2013 | Notice on Promotion and Adoption of NEVs | MOF, MST, MIIT, NDRC | Purchase subsidy 60,000 RMB Per BEV Purchase subsidy 35,000 RMB Per BEV Purchase subsidy 200,000 RMB Per BEV | |

| 2014 | Notice on Further Promotion and Adoption of NEVs | MOF | Purchase subsidy in 2014 and 2015 is decreased by 5% and 10% to 2013. | |

| 2015 | Notice on Financial Support on Promotion and Adoption of NEVs from 2016 to 2020 | MOF | Purchase subsidy from 2017 to 2018 is decreased by 20% to 2016. Purchase subsidy from 2019 to 2020 is decreased by 40% to 2016. | |

| 2016 | Notice on Adjustment of Financial Support on Promotion and Adoption of NEVs | MOF, MST, MIIT, NDRC | Purchase subsidy is adjusted in accordance with the energy consumption, mileage, battery, and safety of NEVs. | |

| Government Procurement | 2008 | Circular of Guideline of Government Procurement | MOF | Launch government procurement on NEVs. |

| 2014 | Notice on Purchase Program for NEVs for Government Departments and Public Institutions | NGOA, MOF, MST, MIIT, NDRC | Volumes of government procurement on NEVs 30%. | |

| Tax Exemption | 2014 | Notice on the Exemption of Purchase Tax on NEVs | MOF, DTP, MIIT | Tax exemption for NEVs was carried out from 2014 to 2017. |

| 2017 | Announcement on Exemption of Purchase Tax on NEVs | MOF, DTP, MIIT, MST | Tax exemption for NEVs was carried out from 2018 to 2020. |

| Variables | Definitions |

|---|---|

| R&D | The ratio of total R&D investment to total asset of NEV enterprises (%) |

| du × dt | Equal to 1 if NEV enterprises gain purchase subsidy, and 0 otherwise. |

| Sub | The amount of subsidies that NEV enterprises received from government (10,000 RMB) |

| Size | The amount of NEV enterprises’ total assets (10,000 RMB) |

| Lev | The ratio of total debt to total asset of NEV enterprises (%) |

| Age | The years from registration (Year) |

| Profit | The ratio of total profit to total income of NEV enterprises (%) |

| Variable | Mean | Std. Dev | Min | Max |

|---|---|---|---|---|

| R&D | 0.024 | 0.026 | 0.000 | 0.399 |

| Sub | 15.321 | 3.021 | 0.000 | 20.040 |

| Size | 17.119 | 4.354 | 9.592 | 24.779 |

| Lev | 0.554 | 0.176 | 0.072 | 0.970 |

| Age | 2.660 | 0.500 | 0.000 | 4.060 |

| Profit | 0.059 | 0.254 | −2.207 | 3.107 |

| Model 1 | Model 2 | |

|---|---|---|

| Du × dt | 0.007 *** | 0.006 *** |

| (3.18) | (2.82) | |

| Sub | 0.002 ** | |

| (2.13) | ||

| Size | −0.010 ** | |

| (−2.14) | ||

| Lev | 0.031 ** | |

| (2.36) | ||

| Age | −0.021 | |

| (−1.62) | ||

| Profit | 0.011 | |

| (1.34) | ||

| Cons | 0.057 *** | 0.192 *** |

| (7.06) | (2.68) | |

| R2 | 0.6287 | 0.6739 |

| N | 428 | 428 |

| Model 3 | Model 4 | |

|---|---|---|

| Du × dt × Exit | 0.006 *** | 0.005 ** |

| (2.87) | (2.52) | |

| Sub | 0.002 ** | |

| (2.13) | ||

| Size | −0.010 ** | |

| (−2.14) | ||

| Lev | 0.032 ** | |

| (2.40) | ||

| Age | −0.021 | |

| (−1.62) | ||

| Profit | 0.011 | |

| (1.34) | ||

| Cons | 0.057 *** | 0.192 *** |

| (7.04) | (2.68) | |

| R2 | 0.627 | 0.673 |

| N | 428 | 428 |

| Model 5a | Model 6a | Model 7a | Model 5b | Model 6b | Model 7b | |

|---|---|---|---|---|---|---|

| Du × dt | 0.007 *** | 0.006 *** | 0.006 *** | 0.006 *** | 0.005 ** | 0.005 ** |

| (3.11) | (2.79) | (2.74) | (2.73) | (2.37) | (2.29) | |

| Proc | 0.002 | 0.001 | 0.004 * | 0.004 | ||

| (0.54) | (0.47) | (1.69) | (1.63) | |||

| Exemp | 0.006 *** | 0.006 *** | 0.006 *** | 0.006 ** | ||

| (2.70) | (2.66) | (2.59) | (2.56) | |||

| Sub | 0.002 ** | 0.002 ** | 0.002 ** | |||

| (2.21) | (2.18) | (2.25) | ||||

| Size | −0.010 ** | −0.010 ** | −0.010 ** | |||

| (−2.18) | (−2.15) | (−2.19) | ||||

| Lev | 0.031 ** | 0.030 ** | 0.029 ** | |||

| (2.34) | (2.30) | (2.28) | ||||

| Age | −0.021 | −0.021 | −0.021 | |||

| (−1.62) | (−1.63) | (−1.64) | ||||

| Profit | 0.012 | 0.011 | 0.012 | |||

| (1.41) | (1.33) | (1.40) | ||||

| Cons | 0.057 *** | 0.056 *** | 0.056 *** | 0.193 *** | 0.191*** | 0.192 *** |

| (7.03) | (7.13) | (7.10) | (2.69) | (2.69) | (2.70) | |

| R2 | 0.629 | 0.632 | 0.632 | 0.675 | 0.677 | 0.678 |

| N | 428 | 428 | 428 | 428 | 428 | 428 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jiang, C.; Zhang, Y.; Zhao, Q.; Wu, C. The Impact of Purchase Subsidy on Enterprises’ R&D Efforts: Evidence from China’s New Energy Vehicle Industry. Sustainability 2020, 12, 1105. https://doi.org/10.3390/su12031105

Jiang C, Zhang Y, Zhao Q, Wu C. The Impact of Purchase Subsidy on Enterprises’ R&D Efforts: Evidence from China’s New Energy Vehicle Industry. Sustainability. 2020; 12(3):1105. https://doi.org/10.3390/su12031105

Chicago/Turabian StyleJiang, Cailou, Ying Zhang, Qun Zhao, and Chong Wu. 2020. "The Impact of Purchase Subsidy on Enterprises’ R&D Efforts: Evidence from China’s New Energy Vehicle Industry" Sustainability 12, no. 3: 1105. https://doi.org/10.3390/su12031105

APA StyleJiang, C., Zhang, Y., Zhao, Q., & Wu, C. (2020). The Impact of Purchase Subsidy on Enterprises’ R&D Efforts: Evidence from China’s New Energy Vehicle Industry. Sustainability, 12(3), 1105. https://doi.org/10.3390/su12031105