Sustainable Technology Analysis of Blockchain Using Generalized Additive Modeling

Abstract

1. Introduction

2. Research Background

2.1. Blockchain Technology

2.2. Additive Modeling

3. Generalized Additive Modeling for Sustainable Technology Analysis of Blockchain

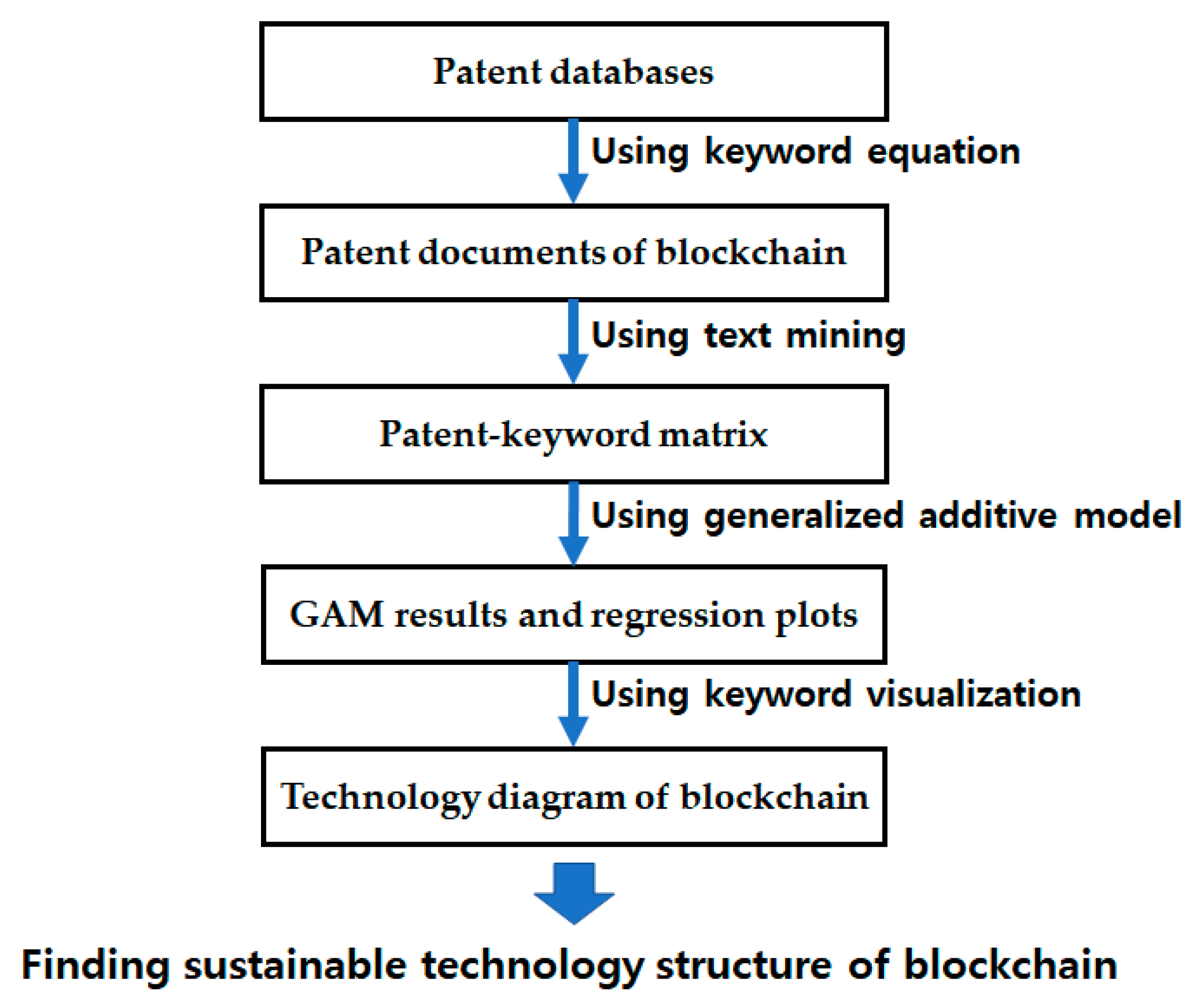

- (RQ.1)

- How can we find the technological structure and relationships for sustainability of blockchain technology?

- (RQ.2)

- How can we solve the skewed and sparse problems that occur in the preprocessing of patent big data?

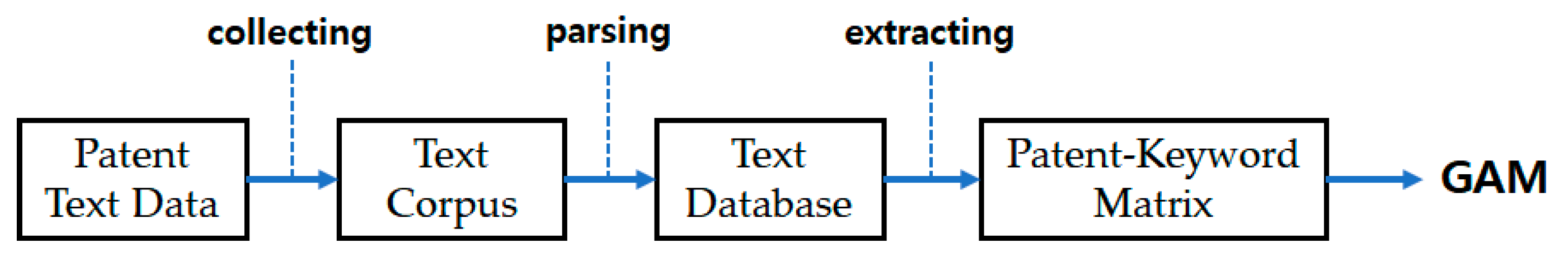

- Step 1.

- Collecting patent documents related to blockchain technology from patent databases.

- Step 2.

- Preprocessing collected patent documents using text mining techniques.

- Step 3.

- Selecting significant keywords that affect technological development of blockchain using GAM.

- Step 4.

- Performing trend analysis of significant keywords for blockchain technology using regression plotting.

- Step 5.

- Building a technology diagram for understanding sustainability of blockchain technology.

4. Case Study Using Patent Data of Blockchain

5. Discussion

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Roper, A.T.; Cunningham, S.W.; Porter, A.L.; Mason, T.W.; Rossini, F.A.; Banks, J. Forecasting and Management of Technology; John Wiley & Sons: Hoboken, NJ, USA, 2011. [Google Scholar]

- Choi, J.; Jun, S.; Park, S. A patent analysis for sustainable technology management. Sustainability 2016, 8, 688. [Google Scholar] [CrossRef]

- Park, S.; Jun, S. Statistical Technology Analysis for Competitive Sustainability of Three Dimensional Printing. Sustainability 2017, 9, 1142. [Google Scholar] [CrossRef]

- Kim, J.; Jun, S.; Jang, D.; Park, S. An Integrated Social Network Mining for Product-based Technology Analysis of Apple. Ind. Manag. Data Syst. 2017, 117, 2417–2430. [Google Scholar] [CrossRef]

- Kim, J.; Sun, B.; Jun, S. Sustainable Technology Analysis Using Data Envelopment Analysis and State Space Models. Sustainability 2019, 11, 3597. [Google Scholar] [CrossRef]

- Jun, S.; Park, S.; Jang, D. Document Clustering Method Using Dimension Reduction and Support Vector Clustering to Overcome Sparseness. Expert Syst. Appl. 2014, 41, 3204–3212. [Google Scholar] [CrossRef]

- Jun, S. Bayesian Count Data Modeling for Finding Technological Sustainability. Sustainability 2018, 10, 3220. [Google Scholar] [CrossRef]

- Uhm, D.; Ryu, J.; Jun, S. Patent Data Analysis of Artificial Intelligence Using Bayesian Interval Estimation. Appl. Sci. 2020, 10, 570. [Google Scholar] [CrossRef]

- Hastie, T.J.; Tibshirani, R.J. Generalized Additive Models; Chapman & Hall: New York, NY, USA, 1990. [Google Scholar]

- Stasinopoulos, D.M.; Rigby, R.A. Generalized Additive Models for Location Scale and Shape (GAMLSS) in R. J. Stat. Softw. 2007, 23, 1–46. [Google Scholar] [CrossRef]

- Murphy, K.P. Machine Learning: A Probabilistic Perspective; MIT Press: Cambridge, MA, USA, 2012. [Google Scholar]

- Efron, B.; Hastie, T. Computer Age Statistical Inference; Cambridge University Press: New York, NY, USA, 2016. [Google Scholar]

- Google Trends. Available online: https://trends.google.com/trends (accessed on 21 September 2020).

- Melanie, S. Blockchain: Blueprint for a New Economy, 1st ed.; O’Reilly: Farnham, UK, 2015. [Google Scholar]

- Chuen, D.L.K. Handbook of Digital Currency: Bitcoin, Innovation, Financial Instruments, and Big Data; Elsevier: Waltham, MA, USA, 2015. [Google Scholar]

- Aderibole, A.; Aljarwan, A.; Rehman, M.H.U.; Zeineldin, H.H.; Mezher, T.; Salah, K.; Damiani, E.; Svetinovic, D. Blockchain Technology for Smart Grids: Decentralized NIST Conceptual Model. IEEE Access 2020, 8, 43177–43190. [Google Scholar] [CrossRef]

- Nadarajah, S.; Chu, J. On the inefficiency of Bitcoin. Econ. Lett. 2017, 150, 6–9. [Google Scholar] [CrossRef]

- Syed, T.A.; Alzahrani, A.; Jan, S.; Siddiqui, M.S.; Nadeem, A.; Alghamdi, T. A Comparative Analysis of Blockchain Architecture and its Applications: Problems and Recommendations. IEEE Access 2019, 7, 176838–176869. [Google Scholar] [CrossRef]

- Lu, H.; Huang, K.; Azimi, M.; Guo, L. Blockchain Technology in the Oil and Gas Industry: A Review of Applications, Opportunities, Challenges, and Risks. IEEE Access 2019, 7, 41426–41444. [Google Scholar] [CrossRef]

- Vranken, H. Sustainability of bitcoin and blockchains. Curr. Opin. Environ. Sustain. 2017, 28, 1–9. [Google Scholar] [CrossRef]

- Giungato, P.; Rana, R.; Tarabella, A.; Tricase, C. Current Trends in Sustainability of Bitcoins and Related Blockchain Technology. Sustainability 2017, 9, 2214. [Google Scholar] [CrossRef]

- Hussien, H.M.; Yasin, S.M.; Udzir, S.N.I.; Zaidan, A.A.; Zaidan, B.B. A Systematic Review for Enabling of Develop a Blockchain Technology in Healthcare Application: Taxonomy, Substantially Analysis, Motivations, Challenges, Recommendations and Future Direction. J. Med. Syst. 2019, 43, 320. [Google Scholar] [CrossRef] [PubMed]

- Kumar, T.; Ramani, V.; Ahmad, I.; Braeken, A.; Harjula, E.; Ylianttila, M. Blockchain Utilization in Healthcare: Key Requirements and Challenges. In Proceedings of the 2018 IEEE 20th International Conference on e-Health Networking, Applications and Services, Ostrava, Czech Republic, 12 November 2018; pp. 1–7. [Google Scholar]

- Alessandretti, L.; ElBahrawy, A.; Aiello, L.M.; Baronchelli, A. Forecasting of Cryptocurrency Prices Using Machine Learning. Advanced Studies of Financial Technologies and Cryptocurrency Markets; Springer: Berlin/Heidelberg, Germany, 2018; p. 8983590. [Google Scholar]

- Maksimov, D.B.; Yakimov, I.A.; Kuznetsov, A.S. Statistical model checking for blockchain-based applications. IOP Conf. Ser. Mater. Sci. Eng. 2020, 734, 012152. [Google Scholar] [CrossRef]

- James, G.; Witten, D.; Hastie, T.; Tibshirani, R. An Introduction to Statistical Learning with Applications in R; Springer: New York, NY, USA, 2013. [Google Scholar]

- Sott, M.K.; Furstenau, L.B.; Kipper, L.M.; Giraldo, F.D.; Lopez-Robles, J.R.; Cobo, M.J.; Zahid, A.; Abbasi, Q.H.; Imran, M.A. Precision Techniques and Agriculture 4.0 Technologies to Promote Sustainability in the Coffee Sector: State of the Art, Challenges and Future Trends. IEEE Access 2020, 8, 149854–149867. [Google Scholar] [CrossRef]

- Escobar, N.; Laibach, N. Sustainability check for bio-based technologies: A review of process-based and life cycle approaches. Renew. Sustain. Energy Rev. 2021, 135, 110213. [Google Scholar] [CrossRef]

- Li, W.; Ren, X.; Ding, S.; Dong, L. A multi-criterion decision making for sustainability assessment of hydrogen production technologies based on objective grey relational analysis. Int. J. Hydrog. Energy 2020, 45, 34385–34395. [Google Scholar] [CrossRef]

- Tomatis, M.; Jeswani, H.K.; Stamford, L.; Azapagic, A. Assessing the environmental sustainability of an emerging energy technology: Solar thermal calcination for cement production. Sci. Total Environ. 2020, 742, 140510. [Google Scholar] [CrossRef]

- Bai, C.; Dallasega, P.; Orzes, G.; Sarkis, J. Industry 4.0 technologies assessment: A sustainability perspective. Int. J. Prod. Econ. 2020, 229, 107776. [Google Scholar] [CrossRef]

- Tasleem, M.; Khan, N.; Nisar, A. Impact of technology management on corporate sustainability performance the mediating role of TQM. Int. J. Qual. Reliab. Manag. 2020, 36, 1574–1599. [Google Scholar] [CrossRef]

- Schinckus, C. The good, the bad and the ugly: An overview of the sustainability of blockchain technology. Energy Res. Soc. Sci. 2020, 69, 101614. [Google Scholar] [CrossRef]

- Wood, S.N. Generalized Additive Models: An Introduction with R; Chapman & Hall/CRC: London, UK, 2017. [Google Scholar]

- USPTO. The United States Patent and Trademark Office. Available online: http://www.uspto.gov (accessed on 15 March 2020).

- R Development Core Team. R: A Language and Environment for Statistical Computing; R Foundation for Statistical Computing: Vienna, Austria, 2019; Available online: http://www.R-project.org (accessed on 9 April 2020).

- Feinerer, I.; Hornik, K. Package ‘tm’ Ver. 0.7–5, Text Mining Package, CRAN of R Project. 2018. Available online: https://cran.r-project.org/web/packages/tm/tm.pdf (accessed on 1 January 2020).

- Gelman, A.; Carlin, J.B.; Stern, H.S.; Dunson, D.B.; Vehtari, A.; Rubin, D.B. Bayesian Data Analysis, 3rd ed.; Chapman & Hall/CRC Press: Boca Raton, FL, USA, 2013. [Google Scholar]

- Hilbe, J.M. Negative Binomial Regression, 2nd ed.; Cambridge University Press: Cambridge, UK, 2011. [Google Scholar]

- Zha, L.; Lord, D.; Zou, Y. The Poisson inverse Gaussian (PIG) generalized linear regression model for analyzing motor vehicle crash data. J. Transp. Saf. Secur. 2016, 8, 18–35. [Google Scholar] [CrossRef]

- Ross, S.M. Introduction to Probability and Statistics for Engineers and Scientists, 4th ed.; Elsevier: Seoul, Korea, 2012. [Google Scholar]

- Montgomery, D.C.; Peck, E.A.; Vining, G.G. Introduction to Linear Regression Analysis; John Wiley & Sons: Hoboken, NJ, USA, 2012. [Google Scholar]

- Chatterjee, S.; Hadi, A.S. Regression Analysis by Example, 5th ed.; Wiley: Hoboken, NJ, USA, 2012. [Google Scholar]

- WIPSON. WIPS Corporation. Available online: http://global.wipscorp.com (accessed on 15 January 2020).

| Authors | Definitions of Blockchain |

|---|---|

| Melanie (2015) | Open transparent and decentralized database |

| Aderibole et al. (2020) | Distributed data structure whereby all data items are permanently recorded after they are verified by majority of the nodes in peer-to-peer network |

| Chuen (2015) | Sequence of blocks which holds a complete list of transaction records like conventional public ledger |

| Evaluation Measure | Poisson | Negative Binomial | Poisson Inverse Gaussian | Normal |

|---|---|---|---|---|

| AIC | 7772 | 5605 | 5647 | 7213 |

| BIC | 8260 | 6097 | 6140 | 7705 |

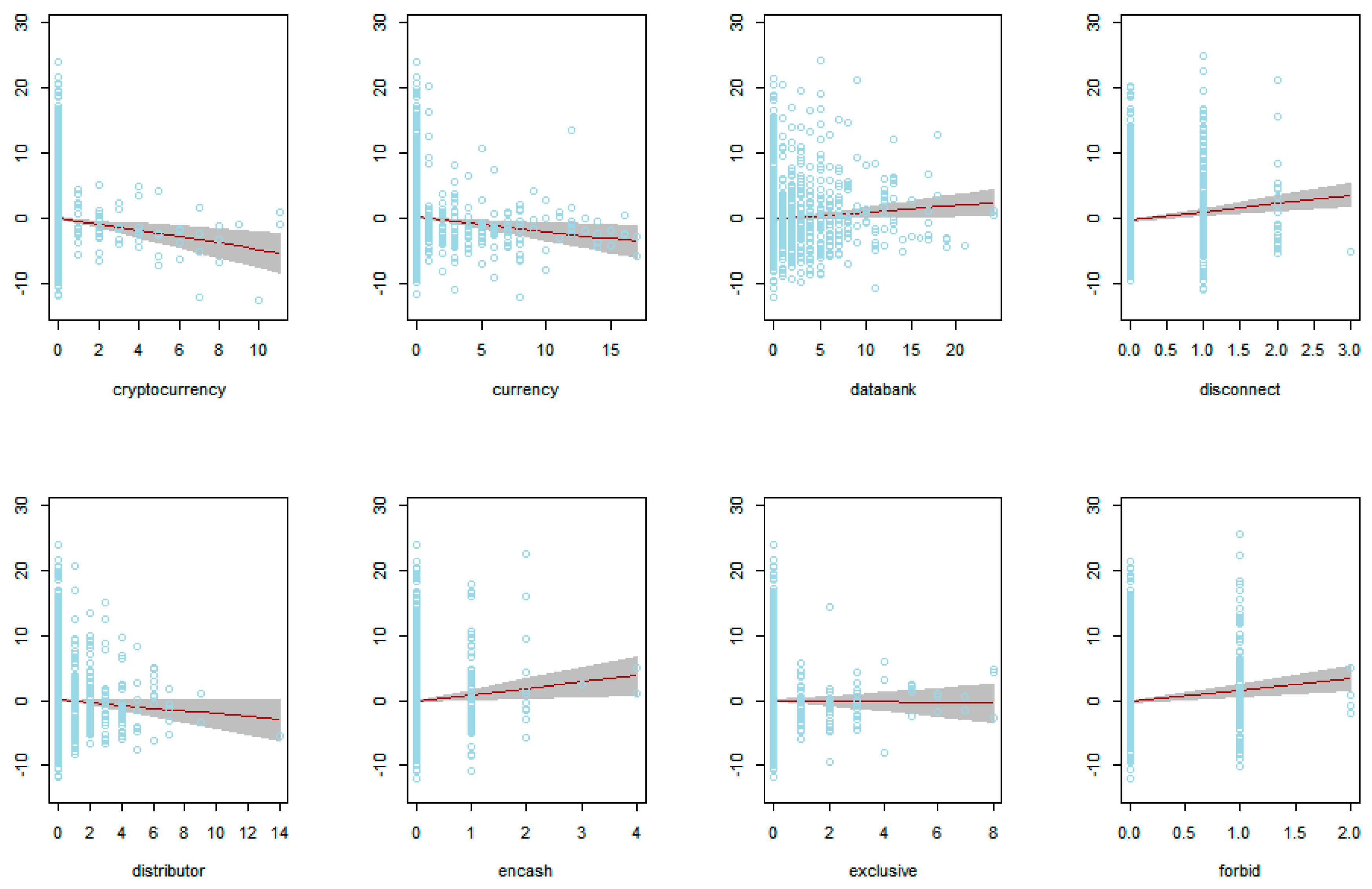

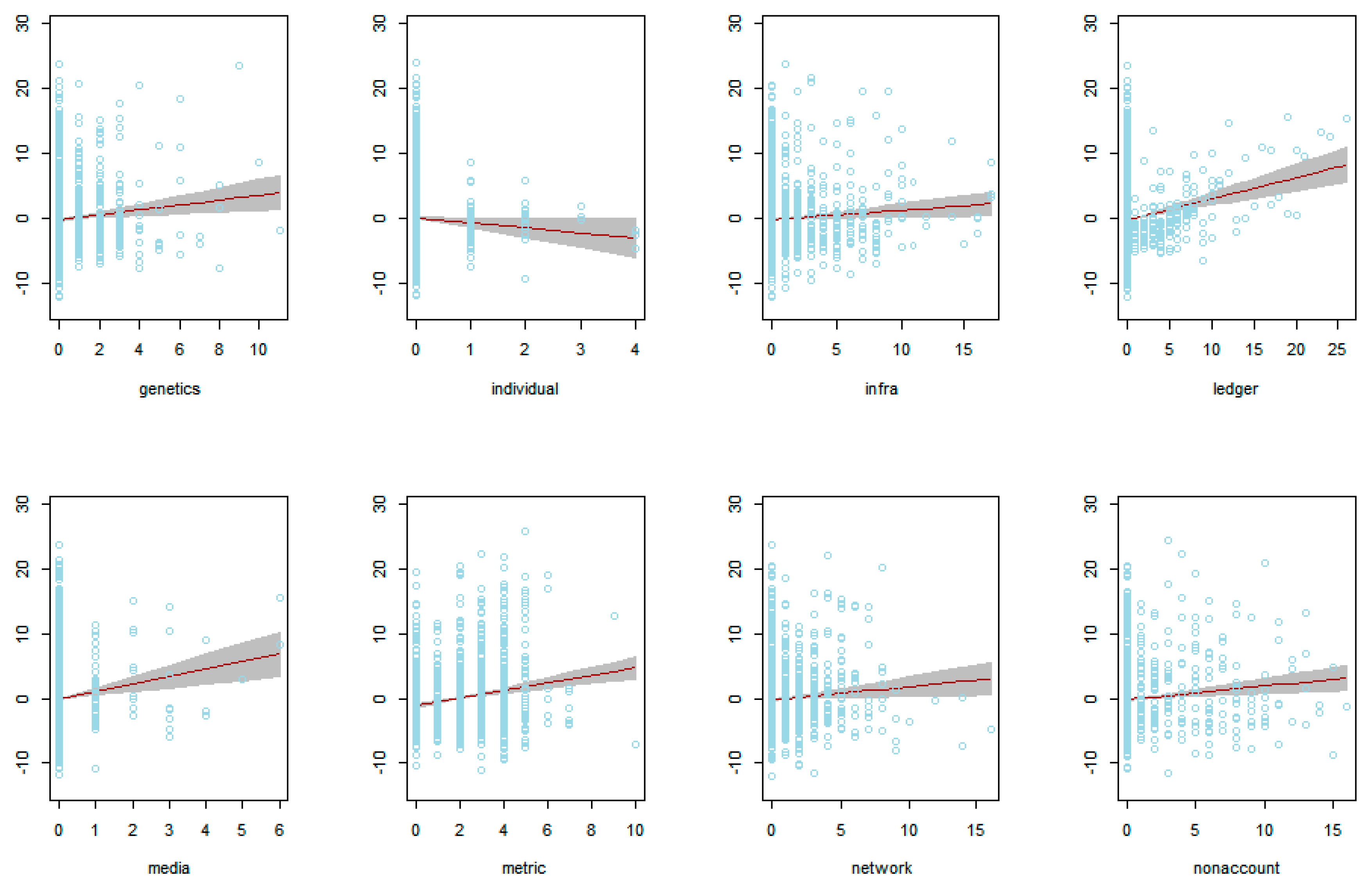

| Keyword | p-Value | Keyword | p-Value | Keyword | p-Value | Keyword | p-Value |

|---|---|---|---|---|---|---|---|

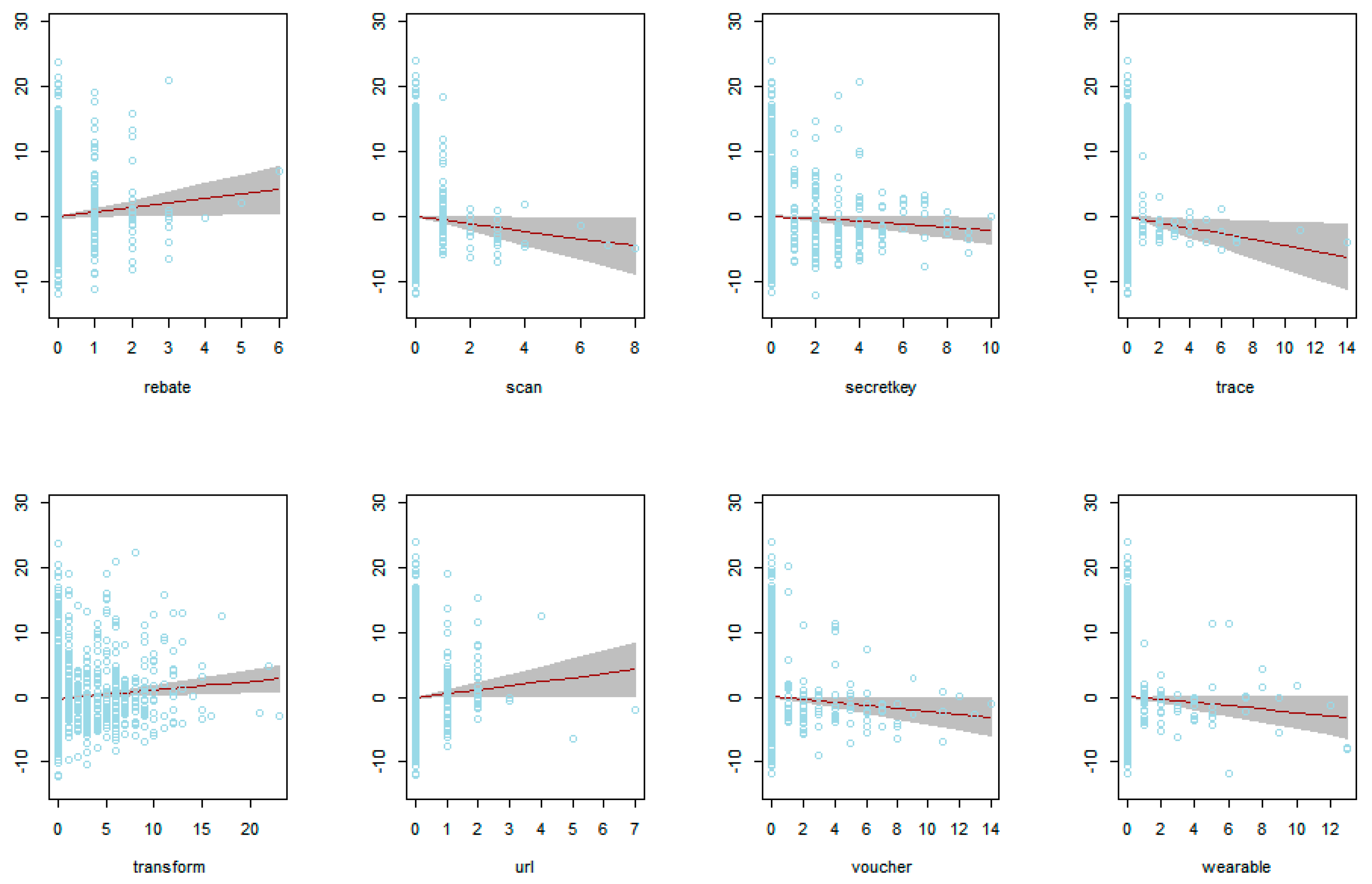

| access | 0.0464 | cryptocurrency | 0.0002 | genetics | 0.0191 | rebate | 0.0475 |

| address | 0.0001 | currency | 0.0002 | individual | 0.0292 | scan | 0.0340 |

| android | 0.0007 | databank | 0.0019 | infra | 0.0147 | secretkey | 0.0083 |

| assort | 0.0299 | disconnect | 0.0599 | ledger | 0.0001 | trace | 0.0003 |

| authentication | 0.0246 | distributor | 0.0907 | media | 0.0074 | transform | 0.0049 |

| bankcard | 0.0003 | encash | 0.0116 | metric | 0.0001 | url | 0.0630 |

| bitcoin | 0.0001 | exclusive | 0.0115 | network | 0.0223 | voucher | 0.0001 |

| configuration | 0.0021 | forbid | 0.0301 | nonaccount | 0.0134 | wearable | 0.0716 |

| Influence | Independent Variables |

|---|---|

| Positive (16) | access, address, configuration, databank, disconnect, encash, forbid, genetics, ledger, media, metric, network, nonaccount, rebate, transform, url |

| Neutral (4) | assort, authentication, exclusive, infra |

| Negative (12) | android, bankcard, bitcoin, cryptocurrency, currency, distributor, individual, scan, secretkey, trace, voucher, wearable |

| Group | Keyword |

|---|---|

| I | android, bitcoin, configuration |

| II | distributor |

| III | individual, media |

| IV | rebate, scan, trace, url |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Park, S.; Jun, S. Sustainable Technology Analysis of Blockchain Using Generalized Additive Modeling. Sustainability 2020, 12, 10501. https://doi.org/10.3390/su122410501

Park S, Jun S. Sustainable Technology Analysis of Blockchain Using Generalized Additive Modeling. Sustainability. 2020; 12(24):10501. https://doi.org/10.3390/su122410501

Chicago/Turabian StylePark, Sangsung, and Sunghae Jun. 2020. "Sustainable Technology Analysis of Blockchain Using Generalized Additive Modeling" Sustainability 12, no. 24: 10501. https://doi.org/10.3390/su122410501

APA StylePark, S., & Jun, S. (2020). Sustainable Technology Analysis of Blockchain Using Generalized Additive Modeling. Sustainability, 12(24), 10501. https://doi.org/10.3390/su122410501