Abstract

This study aims to advance the understanding of and address the valley of death that is significantly widening in the clean energy domain due to its financing challenges. We conduct a case study on three new investment vehicles in the US energy sector (First Look Fund by Activate, Prime Impact Fund by Prime Coalition, and Aligned Climate Capital), which set their missions to contribute to bridging the valley of death in clean energy. While three cases focus on different technological development phases, they raise a consistent point that investment opportunities (and risks) are not assigned to the appropriate investors. We argue that current financial intermediaries have failed to effectively channel funding sources to entrepreneurs, as we evidence network fragmentation and information asymmetries among investor groups and companies. Therefore, we propose three intermediary functions that can facilitate intelligent and effective information flow among investors throughout the entire energy technology development cycle. Our findings highlight the emergence of collaborative platforms as critical pillars to address financing issues among new energy ventures.

1. Introduction

Entrepreneurs pursuing energy innovation need to secure consistent and long-term investment capital sources to fuel their endeavors to bring novel energy technology from the lab to the global marketplace. Entrepreneurs who fail to connect with aligned, long-term capital sources confront a severe funding shortage, which is often referred to as a “valley of death” (VoD) [,]. Crossing the VoD is often the most intractable and poorly understood challenge faced by entrepreneurs in the energy sector, because scaling up an energy technology to full-sized deployment tends to require particularly large-scaled and long-term investments long before the technology’s commercial viability has been fully proven [,,]. Yet, without bridging the VoD, the renewable energy industry cannot innovate quickly enough to compete with conventional sources of energy and drive the global energy transformation [].

Investments by private equity (PE) and venture capital (VC) firms are expected to play a key role in supporting cutting-edge technology entrepreneurs as they cross the widening VoD, as they have fueled innovations in technology and science-oriented sectors, such as semiconductor and pharmaceuticals []. However, the same funds are divesting from (or are not fully committed to) the renewable energy sector. In the 2000s, developers and entrepreneurs in this sector were provided significant private equity funding. During this “clean energy investing 1.0” period, VC/PE funds invested in clean energy with return expectations similar to those of other industries. Unfortunately, because clean energy technology demands large-scale, long-term commitment of capital, what followed this period of investment was a significant and painful venture funding retreat. Between 2006 and 2011, in the period known as “clean energy investing 2.0”, VC firms lost over 50% of their $25 billion investment []. New investments from VC/PE funds in the US clean energy market thus dropped from about $5 billion per year during 2006–2011 to below $2 billion per year after 2011, and the share in clean energy investment of total VC investment plummeted from 16.8% in 2011 to 7.6% in 2016 [,].

While the past two decades of clean energy investing may appear as a tell-tale warning for investors to avoid this sector, our view is that it should not be the case. Investors should instead understand that the key lesson here is that investors were not connected to clean energy opportunities through the appropriate financing vehicles, investment products, and asset managers to deliver the requisite long-term alignment of interests. The capital that flows into these clean technology projects mostly came out of traditional VC/PE fund structures, and that capital is often too expensive to support the long duration needed to develop these projects []. Hull, Lo, and Stein (2019) [] argue that the VC/PE industry has historically had a disproportionate influence on technological innovation, particularly in the sectors that require an ability to undertake long shots. As a result, many investors have inaccurately concluded that clean energy investment is not profitable and, in fact, likely loss-making, which has driven fiduciary-bound investors away from this asset class [,,]. On the other hand, investors with long-term investment perspectives, like philanthropic funds, institutional investors, strategic corporate funding, and strategic investors, are better suited to support renewable energy projects, but there are not enough investment vehicles that meet these investors’ needs [].

This lesson from clean energy investing 1.0 and 2.0 suggests that the traditional form of financial intermediation is not adequately addressing clean energy financing needs by not effectively connecting companies with investors. Today’s investment policies that aim to de-risk clean energy investment lack insight into the unique risks involved in each phase of a technology’s or project’s development cycle []. One of the most prominent proposals for a novel investment model that addresses this shortfall is Lo’s megafund model, a large diversified portfolio of biomedical development projects [,], but this concept has not taken off in the cleantech sector (or in biomedicine, its original target industry) due to practical reasons. Future policies around technology investing require a better understanding of “what investor types are more willing to invest in risky technologies, and what policies may direct them to do so in greater quantities” [] (p. 7). Energy companies and projects need a balanced mix of capital, which must show greater patience and invest more in late-stage companies while, at the same time, not losing sight of the many truly innovative and pioneering early-stage companies that require assistance. It is still relatively less well-known what barriers exist that prevent potential investors from emerging, and how we can effectively channel these investors to appropriate entrepreneurs.

In this study, therefore, we take a new approach to understand and address the widening VoD in the energy sector by using organizational perspectives and suggest new roles of financial intermediaries to better support energy innovation. The arguments of the paper are supported by case studies on three emerging investment vehicles in the US energy sector, First Look Fund by Activate, Prime Impact Fund by Prime Coalition, and advisory services provided by Aligned Climate Capital. We review how and why new investment vehicle structures are being forged to support the investor groups that have been widely untapped for energy financing.

Our main findings and conclusions are threefold. First, we found that bringing a new energy technology to the market requires catalytic capital that can mobilize a diverse investor pool. Investors are often uncertain whether late-stage capital will be available to take even promising technologies and companies to market, and we found that this uncertainty limits the amount of capital that is willing to flow into the earlier stages. The important role of catalytic capital, then, is to seed, scale, and sustain the energy projects and startups from their nascent stages. We also found organizational barriers that block capable and well-suited investors from deploying such catalytic capital, and the barriers include a lack of understanding about capital providers’ investment preferences and misaligned investment management services. For instance, the relatively short-term investment model pursued by most VC/PE funds limits their utility in these types of assets. Yet, this is the structure utilized by most long-term institutional investors (LTIs), such as pensions, endowments, sovereign funds, family offices, and foundations. As a result, despite their large-scale and long-term capital, LTIs remain largely untapped [,].

Second, we found that the practice of financial intermediaries today has not adequately addressed the organizational barriers that prevent investors from deploying capital in the space. Investment opportunities (and risks) are not effectively assigned to the appropriate investors due to the fragmented nature of investor networks and the large information asymmetries among different investor categories and companies. The existing clean energy investment opportunities are only accessible to those who have already developed expert investment knowledge and strategies [,]. In theory, financial intermediaries should match investors and entrepreneurs by providing reliable information and reducing transaction costs [,,,,,]. In practice, we found that today’s financial services industry has fostered information asymmetries between early- and late-stage investors, as well as increased transaction costs [,,,].

Lastly, we conclude, as a result of our findings, that we need three new roles filled by a new generation of financial intermediaries in the energy sector: (1) an anchor that offers nominal amounts of priming capital that can, in some cases, take a first-loss position; (2) a later stage mechanism that enables entrepreneurs to raise capital, at scale, from various funding sources and provides equity and debt capital to companies maturing commercially; and (3) a boundary spanner between the early and late stage functions that provide reliable and objective information about clean energy companies or projects in a highly transparent and trustworthy manner. Each role does not only define the role of catalytic capital deployment but also describes how to facilitate intelligent information and capital flow across the entire clean energy development cycle. Our belief is that we need a balanced barbell of early and late-stage capital connected by proactive information sharing. We design this as an “integrated control tower” that could simultaneously coordinate these three proposed roles as a new integrated platform that would collect and disperse information to the marketplace in a tailored fashion, while coordinating among key intermediaries. The platform would hence enable early-stage investors and entrepreneurs to be cognizant of all the players that could in turn, facilitate future exits right from the outset. Furthermore, early-stage investors can also explicitly consider the late-stage company scenarios that might even need to be “tested” with late-stage actors even at that early stage.

The main contribution of this study is to demonstrate that an organizational approach can address investment barriers by showing how greater coordination among investors can effectively promote sustainable energy innovation.In the clean energy space, it is a mistake to think of this sector in terms of early-stage investors (e.g., VC/PE funds) and late-stage investors (e.g., corporate investors, banks and public market). Because of the time horizon, the fates of all these investors are interwoven (or should be). This study brings an equal focus to the early stage and late stage, which will then give confidence back to investors so they can do the heavy lifting to accelerate sustainable energy innovation. We discuss that financial intermediaries in the current energy sector do not effectively mobilize enough capital to bridge the clean energy VoD. In fact, most intermediaries increase information gaps and transaction costs. Thus, we review recent developments in intermediation theories such as reintermediation [,] and disintermediation [,]. Our argument that new forms of financial intermediation perform value-adding activities is supported by case studies. In this regard, this study illustrates how to advance the organizational understanding of the clean energy investing ecosystem, and how such an approach can help correct the dysfunction of today’s energy market and bolster clean energy innovation.

This paper is structured as follows. Section 2 reviews how previous literature approaches the widening VoD in the energy sector. Section 3 describes our research methodologies, including case selection process, the final set of cases, and the interview design, and summarizes three cases. Section 4 discuss how the three investment vehicles of our study describe barriers, source relevant capital, and design new interventions. It provides in-depth discussions on identified challenges to financing energy innovation and review the theory of intermediation in the context of addressing investment and organizational barriers. Section 5 proposes new roles of financial intermediation in clean energy, which become the core functions of the new coordinating platform. Section 6 concludes with our main findings, recommendations for future studies, and policy implications to further validate the novel concept that we discuss in this study.

2. Widening Valley of Death in Clean Energy: An Analysis of Literature

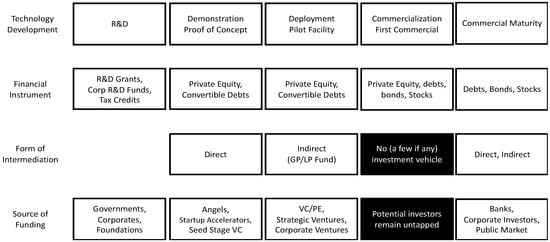

To address the clean energy VoD, it requires a clear understanding of where the VoD exists and why. The “technology development cycle” describes the process that new technology goes through to reach the stage of technological/commercial maturity, and it generally consists of five stages: (1) research and development (R&D); (2) demonstration and proof of concept (PoC); (3) deployment and pilot facility; (4) diffusion and first commercialization; and (5) commercial maturity. The VoD separates the discovery phase from the commercialization phase and is often associated with financing challenges [,]. It is widely accepted that VoD is difficult to survive and delays the global energy transition, but reasons why are not fully clarified, and consensus on solutions is yet to be reached [].

The previous literature conceptualizes and attempts to bridge the widening VoD in clean energy largely from two perspectives. The first line of research focuses on the economic viability of clean energy projects, which may influence decisions of early-stage investors seeking high-risk/high-return and late-stage investors seeking low-risk/low-return (see, for example, [,,,]). A clean energy project requires large-scale capital with a long-term commitment to commercializing its technology, and the investment should come in even before the technology becomes commercially proven. For instance, energy technology requires extensive and costly field testing to prove its commercial viability at a point when investors are still uncertain about technology risks and reluctant to deploy investment capital at scale. This challenge has been termed the “commercialization VoD”. Accordingly, most investors have high barriers for entry as they have few diversification opportunities. Furthermore, the clean energy sector generally faces far more regulatory and commercial scrutiny because of its real-world physical impacts and public good nature. The expected return (exit value) of clean energy investment tends to be low to medium as clean energy technologies tend to have applications in highly regulated and conservative industries such as in power utilities. On the other hand, successfully commercialized clean energy facilities can provide stable cash flows and high operating margins.

Entrepreneurs use a mixture of debt and equity financing throughout the technology development cycle []. In general, VC/PE funds are used to financing early-stage projects, as they seek high-risk technologies for potentially high-return investment profiles. Capital is deployed through multiple investment structures such as debts, public equity, guarantees, and hybrid instruments for more mature technologies and projects, as the investors at these phases seek lower risks and lower returns []. Like other technology-driven industries, VC/PE funds play a critical role in initiating and catalyzing investment [,,,]. However, there is an emerging consensus that the traditional VC/PE investing model is poorly aligned with clean energy companies due to a lack of exit opportunities, lower exit valuations, and a long illiquid period. Gaddy, Sivaram, and O’Sullivan (2016) [] argue that the size and duration of typical VC/PE models do not align with these assets, as they cannot generate the needed return over the time horizon required. Typically, VC/PE firms are biased towards investing in projects whose commercial viability is established within 3 to 5 years and invest $10 to $15 million in equity per startup. But most clean energy startups require hundreds of millions of dollars to build facilities, which ties up precious capital in illiquid assets. Nanda and Ghosh (2014) [] argue that the experimental nature of the VC/PE investment model is particularly unsuited to clean energy investments that are capital intensive. Most VC/PE funds are optimized to manage high levels of technology risk, which in turn translates into a high volume of small risky investments to diversify and hedge their risk portfolio. In other words, VC/PE funds increase their chance of gaining positive returns by investing in a large number of companies and projects, not the few capital-intensive projects that are typical of clean energy investments.

The economic viability of energy projects also relates to a lack of established late-stage investors, which further reduces the early-stage investors’ exit opportunities. This circumstance is often referred to as a structural gap in the energy investing ecosystem, that there is a limited number of investors to whom the early-stage investors could look for follow-on capital before they hit one of the VoDs. It also discourages VC/PE funds’ support to clean energy projects because VC/PE funds often value earlier exit options to reduce the duration of retaining illiquid investments and to re-sell the investment to another investor at a higher valuation. Large banks that can finance expensive projects through debt finance do not deploy any capital until a project’s technology is proven [,]. The history of other capital-intensive industries, such as biotechnology, communications networking, and semiconductors, where traditional VC/PE has been a key funding source for a range of technology innovation, suggests that early-stage investment capital can become increasingly available as the corporates start buying startups. For instance, in the biotechnology sector, large pharmaceutical companies acquire startups in their pre-commercial stages []. Chesbrough (2002) [] discusses that corporates can be patient investors with their superior knowledge of markets and technologies and strong balance sheet. Moreover, they are less volatile to market booms and busts, where VC/PE funds are either oversupplied or very scarce as we observe from clean energy investing 1.0 and 2.0 []. Thus far, however, energy-producing firms and utilities that supply electricity to customers have been far from active in acquiring promising clean energy startups [].

While these studies provide a rationale for the recent dry-up of clean energy startup investment, they have been limited in providing solutions to address them independently. We find studies highlighting the need for policy and regulatory interventions (e.g., subsidies, tax equity credits, and other incentives) that can make clean energy technologies more economically viable. Couture and Gagnon (2010) [], Eyraud, Wane, Zhang, and Clements (2011) [], Criscuolo, Johnstone, Menon, and Shestalova (2014) [], and Criscuolo and Menon (2015) [] find a positive correlation between clean energy investments and public policy measures, and highlight feed-in tariffs as one of the most important instruments for stimulating the expansion of clean energy. Criscuolo, Johnstone, Menon, and Shestalova (2014) [], and Criscuolo and Menon (2015) [] confirm a positive relationship between generous feed-in tariffs and clean energy investments via mergers and acquisitions and venture capital. However, this positive association was not present for all types of clean energy: for example, excessively generous feed-in tariffs have a negative effect on solar energy investments. In this regard, Nemet (2009) [], Doblinger, Dowling, and Helm (2016) [], and Hoppmann, Peters, Schneider, and Hoffmann (2013) [] argue that policymakers’ efforts to make cleantech investments attractive are limited for several reasons. First, because policy-driven growth raises speculations among investors on a project’s actual market competitiveness and resilience, concerning when these favorable policies are eased. Nemet’s (2009) [] findings suggest that the effect is felt more strongly for radical technology development, especially if there is uncertainty around the longevity of public policies. Second, these researchers find that strong demand-pull measures can in fact have a lock-in effect on firm innovativeness, as firms may want to “play safe” and pursue technologies that already meet policy requirements instead of pursuing radical innovation. Hoppmann, Peters, Schneider, and Hoffmann (2013) [] warn that firms that are focusing on less mature yet potentially groundbreaking technology may have a harder time bridging the VoD given strong policy-induced market growth. To counteract these constraining influences, firms can engage by maintaining close industry ties, such as relations with research associations.

The second line of research focuses on the gap between the early- and late-stage investors due to the lack of effective intermediation in the clean energy investing ecosystem and overall network failure (see, for example, [,,]). The technology development cycle is not simply a technological development process, but it is a process where an idea moves from lab to market. Additionally, strategies and required resources at each stage should therefore transform along the cycle. For instance, resources to make the market recognize the idea as an economically viable product are different from ones that reduce technological uncertainty of the idea. Weyant (2011) [] discusses “knowledge gaps” between laboratory and marketplace as they occur, but that Kennedy and Basu (2013) [] highlight the importance of investor brokerage as it enables access to finance networks and investor matchmaking, and Gabriel (2016) [] argues that such work of intermediation should be based on thorough understanding of investors’ needs. Islam (2017) [] developed an “integrated technology-push and market-pull” model that suggests a crucial role for intermediary organizations. Other research has emphasized a dynamic interdependence between all innovation actors []. Studies such as Ferrary and Granovetter (2009) [] and Engle (2011) [] argue that complete and robust organizational networks, alliances, and cooperation can make innovative technologies economically competitive. On the contrary, investors in today’s financial market tend to compete rather than collaborate. Consequently, information has become decentralized as everyone tries to hide information as much as possible []. As mentioned earlier, the first line of research sees it as a structural gap (i.e., retreat of late-stage investors due to the retreat of early-stage investors), and use of public funds to fill the gap between early- and late-stage investors. This line of research, however, tries to address it by understanding and advancing interorganizational networks and ecosystems.

Researchers in this line of research try to identify an untapped investor pool, which works outside of the traditional VC/PE structure, but many entrepreneurs do not have a systematic approach to identifying potential investors and meeting their unique investment goals [,]. For instance, researchers studying institutional investors find that while LTIs are theoretically well-suited to provide catalytic capital at scale in the long-term, they remain, in practice, untapped. LTIs should be willing partners in clean energy investments thanks to their long horizon and capacity and indeed desire to manage illiquidity risks, which is particularly well suited to the lifespan of clean energy projects [,,,,]. Moreover, LTIs increasingly seek investment opportunities in real asset classes because they can provide steady cash flows that are less correlated to the returns from other existing investments and are also adjusted for inflation. They have a growing appetite to invest in clean energy projects and companies, in order to align their portfolios with the trajectory of global economies and because their present portfolios often have relatively high exposure to fossil fuels [,].

Despite all of this, LTIs find it increasingly difficult to access clean energy investment opportunities in cost-effective ways that align with their long-term objectives. There are very few financial products and services that meet LTIs’ unique risk/return profiles while managing the risks specific to clean energy projects. First, this is due to the short-term, opportunistic behavior of current investment managers that may not be well-connected to source deals []. Investing through VC/PE funds incurs a very high cost of investing. In the LP/GP structure, LPs have to pay an extra layer of fees for the potential advantages offered by GPs under the current market structure. In the private equity industry, GPs charge annual management fees on capital and often take a carried interest. The typical fee structure is “2 and 20”—the GP charges management fees of around 2% (or less) annually and receives 20% of the gains when the fund exits [,]. Many LTIs pay high fees to private equity funds while they can also consider taking advantage of economies of scale in-house. Additionally, very few of those third-party managers offer low-carbon-specific investments, thereby exacerbating the lack of knowledge in specialized investing []. Not only do LTIs find the classic 2 and 20 fees that GPs charge untenable, but their lack of specialized institutional knowledge makes them an unattractive option to more targeted investors.

Studies in this line of research claim that the widening VoD in the energy sector should not be interpreted as evidence that energy projects and companies are unattractive to invest in but rather as evidence of the limited capacity of the traditional investment vehicles in clarifying development pathways and unlocking long-term and large-scale capital (see, for example, [,]). Weyant (2011) [] discusses that a targeted applied research program in GHG-reducing technology could substantially increase the number of new ideas that are tried, and that well-thought-out consumer education programs can increase the rate of diffusion of developed products that should be economically viable but have not yet been widely adopted. Rossi et al. (2020) [] argue that the increased number of ideas and projects can catalyze more investment. However, extant research is limited to conceptualizing the impact of a robust and integrated ecosystem, while its validation through empirical evidence lacks. It is widely acknowledged that common statistical methods cannot demonstrate the increase in the overall clean energy startup investment performance other than an in-depth case study on a few innovative practices. This leads us to search for the relevant investment vehicles and conduct a case study.

While previous literature takes a starting point of one or the other, this study highlights the value of mutual interaction between the two perspectives. That is, it is important to transform the institutions that can structure a collaborative and robust clean energy investing ecosystem. In the meantime, such transformation should come with a good understanding of the organizations that play within it. These goals can only be achieved by innovating the governance of the investment organizations themselves, transforming the management and operations of investors via new collaboration, and encouraging cooperation among asset owners and managers. This renders specific questions, such as in which aspect regulatory policies are limited to support clean energy ventures, why the traditional VC/PE model remains unsuccessful in supporting energy technology innovation and transition, whether alternative organizations, like LTIs, can bridge the funding gap more effectively, and if so, why such organizations remain inactive in the clean energy sector. By conducting the case study, we characterize the required capital to bridge the clean energy VoD, understand organizations and their barriers, and identify roles that organizations should perform in building a sound clean energy investing ecosystem.

3. Case Study: Three Emerging Investment Vehicles in the Energy Sector

We study three new investment vehicles that are designed and implemented to intermediate specific investor groups. The three cases illustrate how a financial intermediary adequately tailored to investors’ needs can substantially mobilize more capital in the clean energy sector. This section explains our research design on how we select the three cases and conduct semi-structured interviews.

3.1. Case Selection

We looked for innovative investment vehicles that aim to address investment barriers in the energy sector. We acknowledge a broad range of innovation that has already been implemented at the early stage of the technology development cycle. For example, there are advanced incubator labs that provide extensive mentoring services and even grants that are convertible to the first round of equity. However, the term “innovation” in our criteria is related explicitly to new intermediation functions such as lowering barriers to different investor groups that used to be inactive in clean energy investing. These alternative investor groups may include LTIs, philanthropic investors, and other strategic investment funds, who remain unwilling to invest in the clean energy sector despite the alignment of their needs with this opportunity.

We compose an initial sample set of cases that highlights the ability to mobilize untapped capital from these new types of investors and help them access promising entrepreneurs. We create this initial set using the networks from Global Projects Center and Precourt Institute for Energy at Stanford University. The former has an extensive network with various investor groups, including LTIs, who express their strong interests in investing in clean energy projects. The latter provides seed grants to early-stage university born entrepreneurs in the energy sector and also helps them to connect with energy researchers, practitioners, and investors. Using these networks, we collect relevant cases that involve new intermediation functions.

A deliberate process is followed to select final cases for this study. We reduce our final case set further to three cases by requiring that cases met the following conditions:

- The case aims to financially support energy startups by providing investment management and consulting services.

- The case aims to engage new types of investors that have been relatively inactive despite their potential capacities to fund energy technologies.

- The case does not follow the traditional investment model (for instance, simply lowering fees is not qualified as an innovative intermediation tool).

The Table 1. Case list presents three final cases based on the selection process identified above. Our first case is the First Look Fund by Activate. By partnering with a technology incubator—Cyclotron Road at the Lawrence Berkeley National Lab, Activate connects for-profit investors and philanthropic grants to promising technologies. Activate makes its particular focus on hard technologies, which advance physical products or process (e.g., advanced materials, advanced manufacturing, microelectronics, energy generation, energy storage, etc.) Our second case is Prime Impact Fund by Prime Coalition. Prime Coalition mobilizes capital from catalytic investors—private foundations, donor advised funds, corporate giving programs, high net worth individuals, and family offices—to support for-profit companies in demonstration phases. The third case is the Aligned Climate Capital. Aligned Climate Capital engages with institutional investors that can provide large-scale and long-term capital but who have not been leading sources of capital in clean energy.

Table 1.

Case list.

We consider several issues that may be raised regarding our case selection. First, one point of concern may be selection bias—geographical bias in particular, but we have checked that those two centers’ networks cover all areas in the US. Second, in creating the initial case list, we rely on key persons in both centers. We present the roles and functions of financial intermediaries and ask them to list cases they consider as relevant cases to new types of intermediation. It depends on whether our concept is clearly presented and understood. We have several rounds of meetings and workshops with them to clarify their understanding. Lastly, although it is not necessary, we are unable to get an innovative case that aims to bridge the funding gap between the pilot-scale to first commercialization. We discuss how the absence of an intermediary in this phase is one of the main bottlenecks to clean energy investment in Section 4.

3.2. Interviews

We conducted semi-structured interviews with individuals representing the three selected cases. We interviewed two key personnel from each case, which include co-founder, c-suite executives, board member, and managing director. The preliminary interviews on the three cases were conducted in June–September 2018, and subsequent communication (e.g., additional open-ended interviews and email survey) was followed up. Many unstructured interactions were also conducted before and after the six extensive interviews during the process of understanding each case. The main interviews were conducted and transcribed in November 2019–January 2020. We conducted interviews through phone or video with one of the authors joined as an observer. Two people from the research team, including the authors of this study and two research assistants, cross-validate the transcripts and their coding. Interview responses are aggregated, and we do not provide further identifying information about interviewees. When the response represents a specific case, we denote as a respondent from the corresponding organization.

The goal of the semi-structured interview was to obtain clear and specific information about how the three cases identify critical barriers to clean energy innovation and what their strategies to address the barriers are. We ask interviewees to describe investment barriers from the entity’s own perspective, targeted investors, sectors, and development phases, the design of the intervention that the entity tries to implement and expected impact from the intervention (see Table 2 for the full list of interview questions).

Table 2.

Semi-structured interview questions.

The semi-structured data collection technique is appropriate for this type of research because it enhances consistent data collection while providing an in-depth examination of case differences []. This study uses semi-structured interviews instead of survey methods for three reasons. First, semi-structured interviews allow for a more nuanced and qualitative assessment of conditions that may be lost in survey data. It also allows the researcher to explore the new concepts and ideas that have not been discussed in previous literature and to ask the respondent to elaborate if the response is unclear. Second, creating a personal connection through semi-structured interviews allows the opportunity to create additional rapport and generate additional contacts in the spirit of snowball sampling. The investor network in clean energy is relatively small and interconnected. Most interviewees have worked on more than one clean energy project, and, at the conclusion of the interview, we also asked whether they were willing to refer to other associates who worked on similar projects.

3.3. Case Overview

3.3.1. Activate Global

Activate is a 501c3 non-profit that supports with the U.S. Department of Energy’s Lawrence Berkeley National Laboratory (Berkeley Lab). Its direct partner at the Berkeley Lab is Cyclotron Road, a technology incubator established to advance ground-breaking and promising concepts to first products. Cyclotron Road supports scientific R&D that is too risky for private-sector investment but too applied for academia by providing typical incubator programs’ services such as lab access, mentoring, and legal support. Activate connects Cyclotron Road’s companies to Activate’s investor network to expand the reach and impact of Cyclotron Road. Thus, Activate and Berkeley Lab partner to help the cohorts achieve pre-set milestones and raise capital for their PoC phase by being as the information source for industry and venture financing. Activate is uniquely positioned to help the scientist-entrepreneurs bridge VoDs as it intermediates between the national research facilities and for-profit industry.

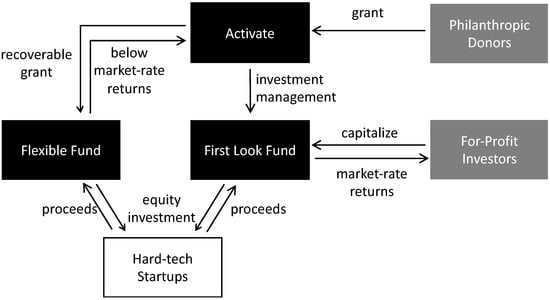

Activate is developing a dual fund structure, which combines its existing fund named Flexible Fund (FF) and its new fund called First Look Fund (FLF) (see Figure 1 for how this dual fund is structuredAs of 24 April 2020, Activate has not raised FLF yet. See Price and Ethier (2019) [] for the initial proposal of FLF). The FF is a philanthropic-only fund focused on providing flexible dollars in the form of recoverable grants, as opposed to most grants that restrict use to R&D only. The philanthropic donors provide grant money to Activate, and Activate capitalizes the FF with those grants. On the other hand, the FLF is designed to raise for-profit capital for energy companies. The FLF would be capitalized by its limited partners (LPs), individuals, corporations, pensions, endowments, trusts interested in FLF potential returns, and it makes priming capital investments at standardized terms in selected companies participating in early-stage technology development programs. Under this structure, Activate would manage two for-profit entities: an investment management company to execute operational aspects of LPs of FLF and a general partner (GP) to make the investment decisions for the FLF.

Figure 1.

Activate’s dual fund structure.

By combining these two funding sources, Activate could maximize its funding capacity, and companies would use these unrestricted funds to accelerate their technology and business de-risking process. Activate identifies that the main difference between the philanthropic donors and for-profit investors as to whether investors’ main objectives are achieving market-rate returns or some other impacts such as supporting energy innovation. Thus, the return from the recoverable grants are returned to FF for the purposes of being used in future companies while those of the FLF’s portion are paid to the FLF’s LPs, less proceeds reserved for management fees, and GP carried interest. Investment managers of FLF will ideally work with government, academia, and prominent capital partners such as traditional VC and strategic corporate VC groups to investigate the feasibility of such a fund to generate attractive financial returns. Investors in the FLF will benefit from rights to information on the companies’ development and an opportunity to get “first look” into the companies’ next financing rounds before their official fundraising begins while still achieving market-rate returns.

3.3.2. Prime Coalition

Prime Coalition (Prime) is a 501c3 public charity that mobilizes capital from philanthropic and other catalytic capital investors to aggregate funds at a sufficient scale for demonstration and PoCs of still relatively new clean energy technologies (see Section 4.1. for in-depth discussion of catalytic capital). Mobilizing philanthropic capital for early-stage climate technologies is particularly challenging due to high barriers that face philanthropic asset owners—institutional inertia away from energy innovation capital gaps, operational barriers away from unconventional (for-profit) grantmaking mechanics, and perceived regulatory barriers around establishing “charitability” of each investment transaction. From 2015–2018, Prime mobilized $24 million on a deal-by-deal basis to back ten startups, each of which could mitigate one gigatonne per year of carbon equivalent emissions when deployed at scale.

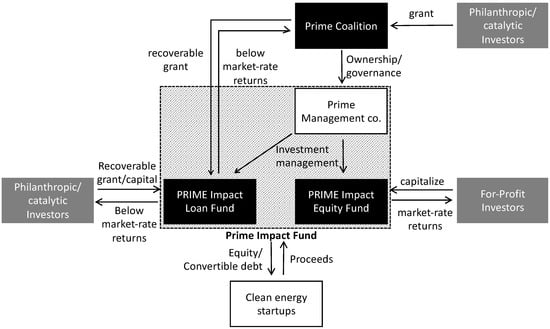

To scale its support for innovators, Prime recently closed its first impact fund called Prime Impact Fund, which is $50 million catalytic (impact-first) fund. Prime works closely with university and national labs and their incubator programs, such as Cyclotron Road, and filters investment pipelines that satisfy both soundness of technology and desired impact. It also provides legal and financial expertise and relevant information so that a new class of investors can support private ventures that are too risky for traditional sources of capital. Prime raises funding from philanthropic (tax exempt) and other catalytic (non-tax exempt, but impact-first) investors (see Figure 2).

Figure 2.

Prime impact fund structure.

3.3.3. Aligned Climate Capital

Aligned Climate Capital, LLC. is an investment advisory group that is specialized in supporting LTIs to deploy their long-term, direct investment capital in clean energy infrastructure projects. Monk, Kearney, Seiger, and Donnelley (2015) [] present the conceptual foundation of Aligned Climate Capital: they identify the absence of the investment vehicle that meets specific needs of LTIs. LTIs are fiduciary bounded, and thus they are limited to investing in only profitable and commercial assets. However, LTIs through today’s investment vehicles are not provided the needed information to properly evaluate the risk associated with a potential clean energy deal. Moreover, facilitating other funds’ direct investments is not something many asset managers are keen to encourage, as it creates competition for deals and limits asset managers fee revenue.

Unlike Activate and Prime, Aligned Climate Capital itself does not provide financing to companies or projects. Instead, it serves as a credible and well-resourced information platform that: (1) entrepreneurs and project sponsors can count on to access the community of LTIs; and (2) LTIs can count on to be incredibly well-networked within the clean energy ecosystem and aligned to their return objectives. With Aligned Climate Capital’s deep network and domain expertise, it has helped LTIs access investment opportunities across the risk spectrum that fits their unique risk tolerance, geographic, and technology preferences. Aligned Climate Capital was incubated as a research effort at Prime Coalition, initially funded with research grant support from the Planet Heritage Foundation, the John D. and Catherine T. MacArthur Foundation, the Hewlett Foundation, and the Packard Foundation, and eventually spun out as a standalone public benefit corporation. Aligned Climate Capital works as an origination team that also deeply understands its LTI members. It can then coordinate among multiple LTIs, some of whom might wish to proceed on investment, and share investment information with non-member, like-minded investors. This bridge between the biggest pools of capital and the entrepreneurs was explicitly designed to help overcome the commercialization VoD. More recently, the Aligned Climate Capital has evolved to focus more on the development of new pooled vehicles that meet the needs of LTIs, but the mission of AI remains the same: helping LTIs access clean energy infrastructure via innovation in finance.

4. Case Analysis and Discussions

4.1. Catalytic Capital for Energy Innovation

Six respondents from three cases identify the following goals that their entities aim to achieve: climate change mitigation, a nurturing entrepreneurship ecosystem, and tech-to-market support for their investments. The respondents also expect to generate a broader impact by deploying “catalytic capital” to cutting-edge energy technologies. From our interviews, we find that the source of capital may affect characteristics of the catalytic capital that their entity aims to provide. The funding sources of the three cases are different: Activate will source mainly from for-profit, market-rate investors such as angel investors and corporate VCs, for the FLF; Prime manages capital from philanthropic and other catalytic capital investors; and Aligned Climate Capital provides investment services to LTIs (Activate’s current fellowship program and recoverable grants for its Flexible Fund [FF] are funded by philanthropic investors and government entities. In this study, we focus on Activate’s FLF, which has not been raised yet, because it aims to raise capital from for-profit investors). We note that the catalytic capital does not necessarily come from the public sector, instead all three cases highly value the impact of blended finance. For instance, Activate manages recoverable grants from philanthropic donors, and Prime designs structured blended finance that pools investment from a wide variety of catalytic asset owners—private foundations, donor advised funds, corporations, individuals, and family offices. All respondents tend to connect the unique characteristics of their funding sources to their entity’s competitive advantages in generating the identified impact. A respondent from Prime, for example, argues that Prime can “optimize for climate impact as the paramount end goal because its philanthropic investors are using capital in most cases that is mandated to do so itself”.

In general, catalytic capital is defined here as patient, risk-tolerant, and flexible capital that can mobilize a range of other capital and enable (where appropriate) blended finance solutions. In this regard, catalytic capital accepts a disproportionate risk and/or concessionary return to generate positive impacts and to enable third-party investment that otherwise would not invest []. For instance, a respondent from Aligned Climate Capital describes “two greatest needs not being met in climate were mobilizing institutional investors and working to accelerate outlier technologies beyond the low hanging fruit”. Catalytic capital is well-suited for investors who want to support enterprises or funds that have high-impact potential but struggle to raise suitable financing because they are: too early-stage or otherwise risky, expected to generate only modest returns, or require a longer investment time horizon. Yet, depending on the contexts of catalytic impacts (e.g., which third-party to catalyze, what specific risks that the catalytic investor can tolerate), who and how to deploy such capital can differ. John and Catherine (2019) [], building upon Clark, Emerson, and Thornley (2013) [], propose a framework, through which catalytic investors can better understand their role and position and articulate their approaches. The framework includes the investment structure, the roles that catalytic capital are expected to play in supporting the investee, and the specific uses of that capital. The findings of our case studies validate this approach: in particular, we find that energy investors define the capital demand in the energy sector is seeding, scaling, and sustaining new energy technologies. In addition, this role can further direct the risk, scale, and time of the capital demand. Therefore, we identify three main catalytic capital categories that are supported by our interviews: (1) early-stage risky capital, (2) late-stage scaling capital, and (3) long-term sustaining capital.

First, early-stage risky capital support projects or stages that are not doable for market-rate investors but could be if they are sufficiently de-risked. This capital targets companies or technologies that struggle with uneven cash flows (i.e., no-to-slim operating margins), a long runway to profitability, and time to test and refine their business models and/or to adapt to serving new geographies or previously underserved populations []. This type of catalytic capital is the aim of Activate and Prime, who raise funds from private investors (e.g., angel investors, corporate VCs) and catalytic investors (e.g., philanthropists). Some private investors are willing to take the first-loss risk with the expectation of extremely high returns. In general, their investment model is experiment-based and prefers a high volume of small investment []. In addition to these investors, philanthropic investors who prioritize social impacts over economic returns have also expressed their interests in providing early-stage risky capital. This catalytic capital is an early-stage, risky investment that does not require large financial quantities: a respondent from Prime said “our hypothesis was that the earliest capital gap might be a good place to start trying to mobilize catalytic capital because you could accomplish more with relatively small dollar amounts. Now that we are six years in, I can say with confidence that the opportunity and momentum within the catalytic capital asset owner community is bigger and growing faster than even we anticipated. We are eager to bring Prime’s approach of lowering barriers for catalytic capital to other capital gaps that might require bigger dollars (like first of a kind commercial plants), and we now have the conviction and confidence that sufficient catalytic capital may be out there ready to answer the call—at the amount required”.

Second, late-stage scaling capital is catalytic capital that is structured specifically to help enterprises scale and replicate their business. Catalytic capital at this stage can multiply a startups’ impact through scaling or commercialization, which is the goal of Aligned Climate Capital. Aligned Climate Capital looks to move large sums of capital, usually in the form of equity that is sourced from sovereign development funds, regional pension funds, and foundations. Their investments aim to help companies realize economies of scale and reach new geographies or population segments. By forming deep relationships with their investment partners, Aligned Climate Capital “sees that regions have a different type of profile [with] the deals they wanted to do. We got to know exactly what type of deals they want to do in terms of returns, in terms of risks to industries and geographies” (respondent from Aligned Climate Capital). Unlike its earlier-stage counterpart, late-stage scaling capital tends to favor project development or operational risk over technology risk. For instance, Aligned Climate Capital categorizes their investments into two buckets, neither of which touch early-stage technology risk. “One was infrastructure-like investments, meaning investments that have offtake agreements”, which is characterized by “a higher return in the 20% range”. Alternatively, an investor could “come in as an equity investor once that project is essentially up and running”, which is characterized by a return on investment of 6–9% (respondent from Aligned Climate Capital).

Lastly, it is important to unlock capital that can support a company or project throughout its development cycle. Whether the company is a parent company that owns multiple land development projects through its special purpose vehicles (SPVs) or a technology company that sells commercial products, sustaining capital is particularly important for energy companies because their development duration is typically longer than that in other sectors. This particular capital can bridge the gap between early- and late-stage investors, pass on the history and information of the company, and preserve its goal of reaching vulnerable beneficiaries or to otherwise operate a business model not designed to be fully commercially viable. Sustaining capital should thus have combined abilities of early-stage and late-stage investing and require a high level of expertise and market access.

4.2. Organizational Networks

Three cases are originated by identifying weak or broken ties within organizational networks in the clean energy, which often locate between entrepreneurs and investors, between early- and late-stage investors, and among various types of investors that are to provide catalytic capital. The three investment vehicles are designed and implemented to complement these weak ties, because they cause information flow disconnections and discourage investment. First, as a clean energy startup evolves through its development cycle, the distance between the company and the original source of its funding widens, and the original network connection and its associated information eventually disconnect from the growing company. In early-stage investments, angel investors and startup accelerators work directly and closely with their invested startups during the demonstration period. Over time, throughout the commercialization period, these communication channels become increasingly infrequent as startups focus on securing scaled capital for pilot and commercial facilities through a GP/LP fund structure (The GP/LP fund is the limited partnership model that is formed for the specific purpose of investing money, and it is most widely used in private equity funds. The fund manager structures the partnership and is responsible for the management of the fund being raised. GPs then organize as a limited partnership controlled by the fund manager, and they are responsible for all management decisions of the partnership. LPs have limited liability and usually have priority over GPs upon liquidation of the partnership. However, LPs have no control over the daily management of the fund. GPs have a fiduciary responsibility to act for the benefit of their LPs and are fully liable for their actions. Therefore, GPs charge two types of fee: management fee, an annual service fee to the GPs, and carried interest fee, the GPs’ share of profit generated by fund’s investment). The change in fund sourcing introduces a change in reporting structure, thereby introducing an information disconnect. For instance, in the early stages of a startup, return targets may deviate from market standard metrics such that later-stage investors could have difficulty accepting those metrics. While ingenious reporting may ignite early-stage investing, over time this could lead to an information disconnect with missing information about the status of a company that makes long-term investing more difficult.

Second, while both the earlier and later investors undergo a similar investment diligence process, but not necessarily in a cooperative manner. Investment during pre-commercialization is mostly irreversible, whereas post-commercialization phase investors have the option to either delay or deploy their investment. The extraordinary capital requirements expose early-stage VC investments to a possible high sunk-cost environment and increase uncertainty around exit strategies. Although post-commercialization investors, such as banks and corporates, can meet the size of capital requirement, they only invest when they have a certain level of confidence in commercial viability of the technology. As the investment duration lengthens, early-stage investors need to be compensated for the illiquidity of their committed capital. Thus, they sometimes aim to sell it at a competitive price by withholding any negative or confusing information about a startup or its technology []. Late-stage investors, who may not be able to properly evaluate the expected return (or the value of clean energy venture) with incomplete information, tend to offer a price that corresponds to the average in the market. This adverse selection problem plagues the clean energy VC market, and further decreases expected returns on early-stage investment, as the lack of reliable information means good companies get lumped in with bad companies [,]. Over time, this behavior leads to a breakdown in trust between early- and late-stage investors. As such, the current clean energy market seems to be in a negative feedback loop whereby the opportunity set shrinks due to a lack of capital, lack of trust, and lack of investors interested in entering such an environment.

However, there is no formal requirement for GPs to make all of their data available or to standardize for the general market; as a result, some information remains bespoke. Most GPs in the sector do not disclose their performance numbers or measure their investments based on market returns, which leaves long-term investors coming in after the VCs ignorant to or confused by their approach and success. Of course, GPs provide some data to their current and potential investors (the LPs), but even here it is normally under confidentiality agreements that allow GPs to cherry-pick the provided information []. Even if one obtains comprehensive data, measuring returns to illiquid private equity is a complicated task []. Brown, Gredil, and Kaplan (2017) [] empirically illustrate that GPs with poor performance are likely to inflate their investment performance reports through questionable selection of benchmarks and data. Rather than subscribing to market returns, investment vehicles should find objective and consistent measures to evaluate the impacts that their investors are willing to generate. A respondent from Prime notes that “We think that we want to embrace high risk at an early stage and be meaningful investors on relatively small amounts of capital in companies that will take a lot of time…The guiding light and metric for us is greenhouse gas emissions reduction”.

Third, from the perspective of early-stage capital, the objectives of venture finance can be starkly different from those of family offices. Even if both attempt clean energy investments, it can seem “like the venture capital firms were making decisions based on very different criteria than we were as a philanthropic family. It felt like the most potentially impactful projects that we were funding with grant money at the R&D stage might not be a fit for market rate venture capital in the earliest stages of company formation” (respondent from Prime). Oftentimes this juxtaposition can obscure the identity and business model of the latter to potential investors. A respondent from Prime said: “There are very few firms that have been purpose-built to mobilize philanthropic capital for early-stage climate investment. For those new to Prime, in our early days, we found that it was difficult to clarify our mission and niche. [Potential investors] would ask, “Are you a membership group for family offices?” The answer is no. We have wonderful partner organizations like CREO or Mission Investors Exchange or Confluence Philanthropy that do that hard work with families. Prime was built exclusively to aggregate philanthropic capital and to do investment transactions that accept disproportionate risk to advance climate innovation”.

Yet, individual organizations are limited to address the broken network. Despite the importance that investors place on human resources and experienced managers, investors have limited access to these intellectual and human capital []. Although for-profit and non-profit investors are pooled to support early-stage investments, their objectives are significantly different. For-profit investors seek market-rate returns, whereas non-profit investors focus on deploying catalytic capital. Non-profit investors co-invest with for-profit investors to scale and also to have greater access to the market. Activate points out that human resources, experienced and expertise in entrepreneurship, are walking away from this industry, a phenomenon that a respondent from Activate denotes as the “brain drain problem”. “The industry would only employ them to solve problems that were 1 to 3 years down the road, and risky capital had largely moved away from being able to support them through a startup vehicle. Therefore, they are not working on these hard science problems, and rather largely directing their attentions to large, software companies” (respondent from Activate). Thus, the high burn rate of talented individuals seems to work against maintaining healthy levels of experienced individuals within the investing ecosystem. Adding to complications in maintaining the ecosystem is information withholding amongst investors.

5. Recommendations

5.1. Rethinking Financial Intermediation

Our interview results highlight the importance of understanding and incorporating organizational context into financial intermediation. Respondents identify not understanding different capital providers, having information asymmetry, working with misaligned investment models, and not having financial intermediation as specific hardships to address in order to successfully deploy capital for targeted investment groups. It is less understood that investor groups have their own investment objectives, expected impact, and risk preferences. For instance, other types of early-stage capital-like philanthropic funds, institutional investors, strategic corporate funding, and strategic investors could be better suited to the dynamics of sustainable energy innovation. Yet, there are a limited number of clean energy investment vehicles that connect investors to entrepreneurs throughout the development cycle. Figure 3 demonstrates the gap between early- and late-stage investor groups and the absence of an investment vehicle that overlaps the time horizon.

Figure 3.

Valley of Death in clean energy.

This gap leads us to revisit the intermediation theory and practice. Traditional intermediation theories that are based on the models of resource allocation in perfect and complete markets highlight the importance of intermediation in addressing market frictions, such as transaction costs and asymmetric information (see, for example, [,,,,,]). Financial intermediaries are specialized in pooling capital and supplying lower-cost services (e.g., due to economies of scale). Their comparative advantages come from production of information: they produce and analyze information about companies and projects and set financial contract terms to improve entrepreneurs’ incentives [].

However, in the current marketplace, financial intermediaries are not performing this role effectively: conventional investment models are misaligned with the capital needs of clean energy entrepreneurs. Intermediation is particularly important in early-stage investment as a means of providing scaled capital for a technology whose information (e.g., market readiness, intellectual property) is not publicly available or incomplete. Historically, for clean energy, VC/PE funds have played a central role as the financial intermediary, and the LP/GP model developed by VC/PE funds is the most widely used form of financial intermediation. To provide valuable intermediation, GPs must create a profile of return and risk that is better than what outside investors can otherwise achieve. While this profile creation helps a technology gain early-stage fund access, the services provided by traditional VC/PE funds in clean energy are not optimized to reduce transaction and information costs, which the traditional intermediation theory highlights as the role of financial intermediation.

The high cost of intermediation and the distorted incentives have raised debates as to whether asset owners should simply work to disintermediate and invest directly []. In fact, institutional investors have increasingly looked for direct investment opportunities, bypassing the traditional intermediated fund structure. In the infrastructure market, for example, Australian, Canadian, and Dutch pension funds began investing directly in infrastructure projects, allowing the asset class to mature []. Fang, Ivashina, and Lerner (2015) [] empirically show that direct investments outperform the corresponding private equity fund benchmarks, and this performance gap has been widening in recent years. They evidence the adverse selection problem as a driver of the underperformance of co-investments relative to direct investments because institutional investors can only invest in deals that are available to them. However, Fang, Ivashina, and Lerner (2015) [] and Monk and Sharma (2015) [] highlight that the skills needed to assess and manage these assets are very hard to boil down into a single organization, and disintermediation may not be an optimal option, especially when investment management skills of the organization are not mature enough (Disintermediation occurs when a traditional intermediary gets pushed out by other firms, or when the services it provides become irrelevant in a marketplace that offers other ways to get the same kind of transaction done).

5.2. New Roles of Financial Intermediaries in Clean Energy Investing

The above discussion on organizational barriers to clean energy investing invites a reconceptualization of the roles of financial intermediaries in successfully funding and growing clean energy technologies. We suggest that entrepreneurial and investment efforts would benefit from new functions of intermediation, which should provide high-level communication and cooperation (without necessarily forcing coordination or collaboration) among those actors trying to deliver capital to the space. We share a view of Weyant et al. (2018) [], Engel (2011) [], and Ferrary and Granovetter (2009) [], while this study further specifies the role of financial intermediaries in aligning multiple agents in the energy investing ecosystem. Financial intermediaries in clean energy must align the interests of a diverse group of investors along with those of the entrepreneur. This requires that both early- and late-stage investors understand what the realistic set of possible outcomes are for a given company, recognizing that some companies may align with VC/PE funding, while other companies will be on a humbler glide path that does not include a high-flying initial public offering (IPO).

We identify three intermediary functions that can better facilitate intelligent information flow across the entire clean energy development cycle: (1) an anchor that offers small amounts of early-stage risky capital that can, if needed, take a first-loss position; (2) a mechanism that enables companies to raise capital, at-scale, from various funding sources and provide equity and debt capital to companies maturing commercially (connecting both sides of the “barbell” of financial innovation); and (3) a boundary spanner that provides reliable and objective information about clean energy companies or projects in a highly transparent and trustworthy manner, and helps investors with long-term perspective mobilize their capital into clean energy ventures while also meeting their unique investment criteria.

5.2.1. Anchor

The anchor coordinates early-stage investors to provide small amounts of early-stage risky capital, which can take the first-loss risk. Meanwhile, it pursues a long-term strategy by adding value through risk-sharing and credit enhancement processes and attracting other investors through their reputation and capabilities [,]. Thus, the anchor should gather, assess, and provide critical information about the risks of opportunities to syndicate partners, and align early- and late-stage investors from the outset.

Although previous studies argue that the VC/PE investing model may not be a good fit for commercializing clean energy technologies, VC/PE has played and will need to play an indispensable role in early stage, high-risk/high-return technologies. Moreover, Nanda, Younge, and Fleming (2015) [] empirically demonstrate that VC investing significantly contributes to raising the share of patenting by startups, and that new clean energy technologies financed by VCs are more novel and influential than incumbent-backed technologies. Nonetheless, most VCs do not see their job as cultivating deep relationships with the long-term investor community (e.g., LTIs and philanthropic investors), which was part of the problem in the first clean energy innovation cycle of investment. Some recent studies suggest that public institutions (e.g., development banks and state investment banks) should work as anchor investors and promote a market-based solution by catalyzing investment capital to the real economy [,,]. European Commission (2017) [] highlights that these public institutions have “the potential to attract investment from institutional investors and, possibly, sovereign wealth funds at a significant scale”. They can mitigate specific project or portfolio risks through securitization and guarantees, and provide credit enhancement in order to facilitate the entry of private investors [].

Therefore, the financial intermediary in clean energy should provide the anchor function, which does not only source early-stage investors that look for high-risk/high-return investment such as traditional VCs but also provides private information to potential late-stage investors. This supports the early-stage investors to invest in ways that offer sufficient flexibility to accommodate for different outcomes, which means bringing in more types of capital partners earlier in the process. In particular, the earlier that large, long-term investors can be brought into the capitalization structure, the better.

5.2.2. Balanced Barbell

The balanced barbell—a late-stage financing mechanism to go alongside the early-stage mechanism above—will raise investment capital from various sources while labeling the ground for early- and late-stage investors. Startups between pre- and post-commercialization phases require such a large scale of capital that individual investors would not be able to raise without the intermediary’s support combining them. Early- and late-stage investors therefore ought to closely interconnect each other, but we have seen a severe misalignment between the two groups. As a result, VC/PE funds divest out of pre-commercialization clean energy projects as they fail to meet their return expectations compare to the risks they have to take. Large banks, on the other hand, do not deploy capital in post-commercialization clean energy projects because these projects are still risky for them []. The clean energy market today is like a weightlifter without a “balanced barbell”, something which could better coordinate the nascent stage and late stage.

In finance, a barbell strategy is often used in bond investment, with which an asset manager invests in long- and short-duration bonds but does not invest in the intermediate duration bonds. The manager utilizes two parts of the yield curve (i.e., two weights on the barbell): he/she can diversify investment risks and lock in higher interest rates through long-duration bonds while rate-mitigating through short-duration bonds (e.g., short-duration bonds provide greater flexibility to invest in other assets should rates fall too low to provide sufficient income.) This strategy is more useful when interest rates are rising as the short-term maturities are rolled over, they receive a higher interest rate, raising the value. Thus, this barbell strategy has increased the overall investment in both short- and long-duration bonds while meeting investors’ risk-adjusted return expectations.

A financial intermediary in clean energy should accumulate and disseminate relevant information about the company or project, so that pre- and post-commercialization investors can efficiently share knowledge to each other. The intermediary collects information about the company or project at its nascent stage and delivers that data to investors at the late stage, while also collecting information about investors at all stages for the benefit of the company. With support of the barbell strategy, the early-stage investors and startups need to be cognizant of all the players that could facilitate future exits right at the outset. The late-stage company scenarios should be explicitly considered, and those investors might even need to be approached at earlier stage (perhaps not for capital, but definitely for advice and input). In this respect, the success of the barbell investment strategy in clean energy will give confidence back to link early-stage actors with late-stage actors and do the heavy lifting to help stabilize the marketplace. This could reignite the entire investment ecosystem by reducing uncertainty.

5.2.3. Boundary Spanner

The boundary spanner will mobilize scaled investment capital from long-term investors by making private information accessible to them and addressing their unique capital requirements of clean energy ventures. It should provide capital with longer maturity such as that from LTIs, and increase the probability for the company to reach an exit.

In commercializing new technologies, it is important to source scaled, long-term capital providers such as LTIs. Thus, there should be a partner whose domain of expertise is building a syndicate of early- and late-stage investors, just as it is in the underlying startups invested in by the partner. The financial intermediary should provide a tailored access point to potential investors’ unique investment criteria, including aligned fee structures. But current financial intermediaries in clean energy have failed to effectively deliver such functions as they undermine personal/social interaction. The severe knowledge gap between early- and late-stage investors in clean energy implies the absence of the relational components. In this regard, we suggest that boundary spanners can invigorate organizational interaction across the disconnected investor network in this sector.

In organization literature, boundary spanners exist to process the information coming from the partner organization, represent the interests of their own firm in the relationship, and link organizational structure to environmental elements [,]. The term boundary spanner is also used in corporate banking to define and re-invent the relationship manager (RM)’s role, which is to interface between the bank and client company cultures and management process []. RMs develop a long-term interpersonal relationship with customers and direct banking services tailored to customers’ need through knowledge of the customer. Successful RMs have shared roots and common interests with customers though close bonding. When boundary spanning effectively functions, customers often identify more closely with the boundary spanner than with the service firm itself. Thus, boundary spanners gather information about customers’ experiences, act as external representatives of the firm, and work with customers who become co-producers of the services [].

The financial intermediary in clean energy should understand the unique risk profile of LTIs, and coordinates a syndicate of them and other investors. It sources and triages investment opportunities, conducts research, serves as an information clearing house, and coordinates investor alliances in a highly transparent manner. Moreover, the level of trust of a boundary spanner has a significant influence on its service delivery performance. Thus, the boundary spanner should provide reliable and objective information about clean energy companies or projects in a highly transparent and trustworthy manner.

5.3. New Coordinating Platform Design and Management

Based on the gaps we have identified out of this study, we propose a new platform that fills these gaps; simultaneously coordinating the three intermediary functions in order to better align risks with investors and thereby facilitate high investment returns. The platform should seek to obtain and synthesize information while coordinating among other key intermediaries, and then disperse that information to the marketplace in a tailored fashion to facilitate the intelligent flow of capital. It integrates and enhances the efficiency of scattered investor communities with lower costs, and helps entrepreneurs and investors alike navigate through the phases of a startup so that they know to whom they should pass their baton and avoid investment holdups.

In this regard, this coordinating platform works as an “integrated control tower”, offering a tailored path to all agents participating in this sector, just as an air traffic control tower guides planes on different glide paths depending on their specific characteristics and objectives (destinations). From our qualitative studies on three cases in this study, we argue that the innovation pipeline will not increase its throughput until risk and return are reframed and a new generation of hybrid early- and late-stage investors can be recruited to the sector through high risk-adjusted investment returns. Through this platform, we expect that new capital inflows can and will increase as it better allocates the risks (and thus returns) of clean energy investments to the parties that can shoulder them.

Bose, Gao, Moshkin, Patel, and Laipple (2018) [] highlight the need for innovative finance platforms that nurture a collaborative investing ecosystem, and that these platforms should operate by bridging different stakeholders, aggregating decentralized information and use the information to allocate capital to do the most important need. It is particularly interesting to us when respondents distinguish their investment vehicles in achieving these missions. The services that they provide include aligning goals externally and internally, clarifying development pathways, sharing information, and mobilizing new sources of capital. Yet, our respondents highlight that their entities are in competitive positions because they have built a relational bond with their capital providers: this relational bond describes slightly different terminologies such as trust, credibility, loyalty, etc. We thus set a separate category called an enabling factor for these concepts because we believe this can be a value that the new financial intermediaries should take into account in governing and managing the new funds.

6. Conclusions

Overcoming the VoDs requires an entire re-conceptualization of the “clean energy deal”. The previous studies reveal that the clean energy finance ecosystem remains undeveloped and that making consistent capital flows from the upstream to downstream of the technology development cycle is key to bridge the widening VoD in clean energy. However, we find that most current theories of intermediation have little to say about why coordination should play such an important role in the activities of intermediaries. Investors are often presented with a “deal” rather than a “historical understanding of a company”, while entrepreneurs themselves are often faced with countless types of investors, from pensions and sovereigns to tax-equity providers. The entrepreneurs also quickly realize that there exists large variation among and within investor types, leaving even more confusion about who their right investors could be. This study therefore suggests the need for new intermediaries in clean energy that facilitate a better alignment between entrepreneurs and investors to promote clean energy innovation.