Relationship between Panic Buying and Per Capita Income during COVID-19

Abstract

1. Introduction

2. Brief Literature Review

2.1. Consumer Behavior in Extreme Events

2.2. Recently Panic Buying Works (During and Before COVID-19 Pandemic)

3. Materials and Methods

4. Results

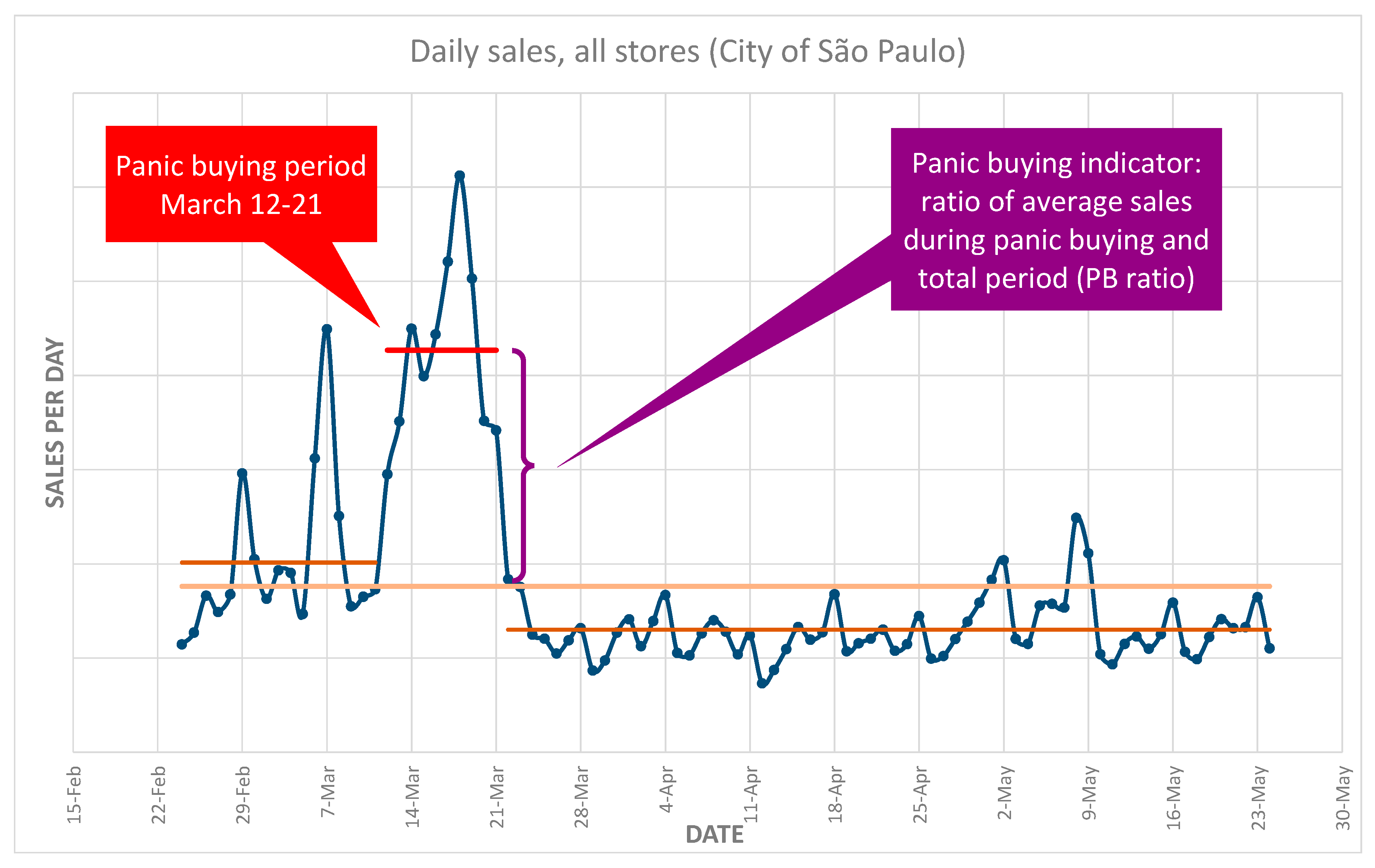

4.1. Did Panic Buying Happen in São Paulo City During COVID-19?

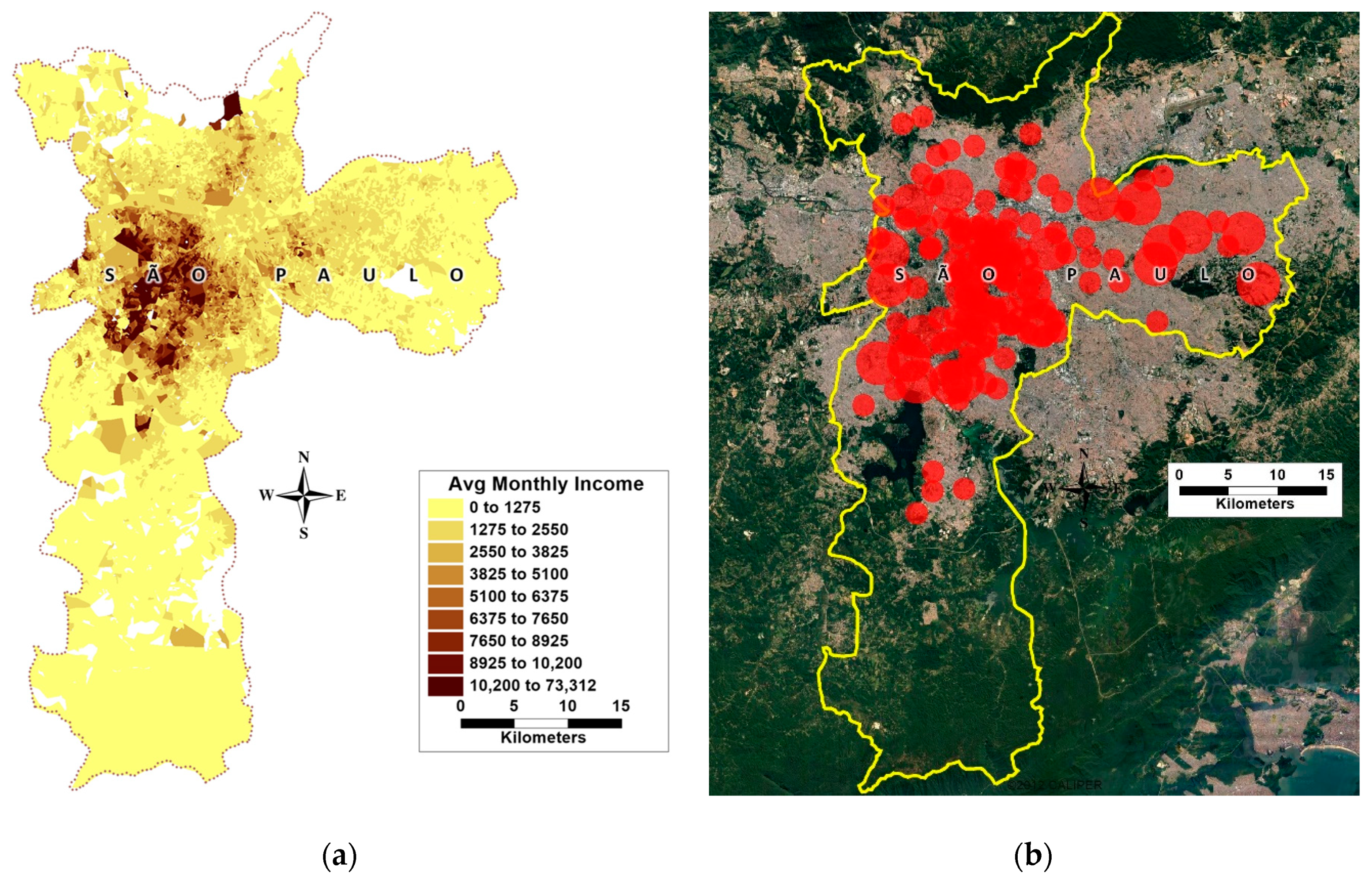

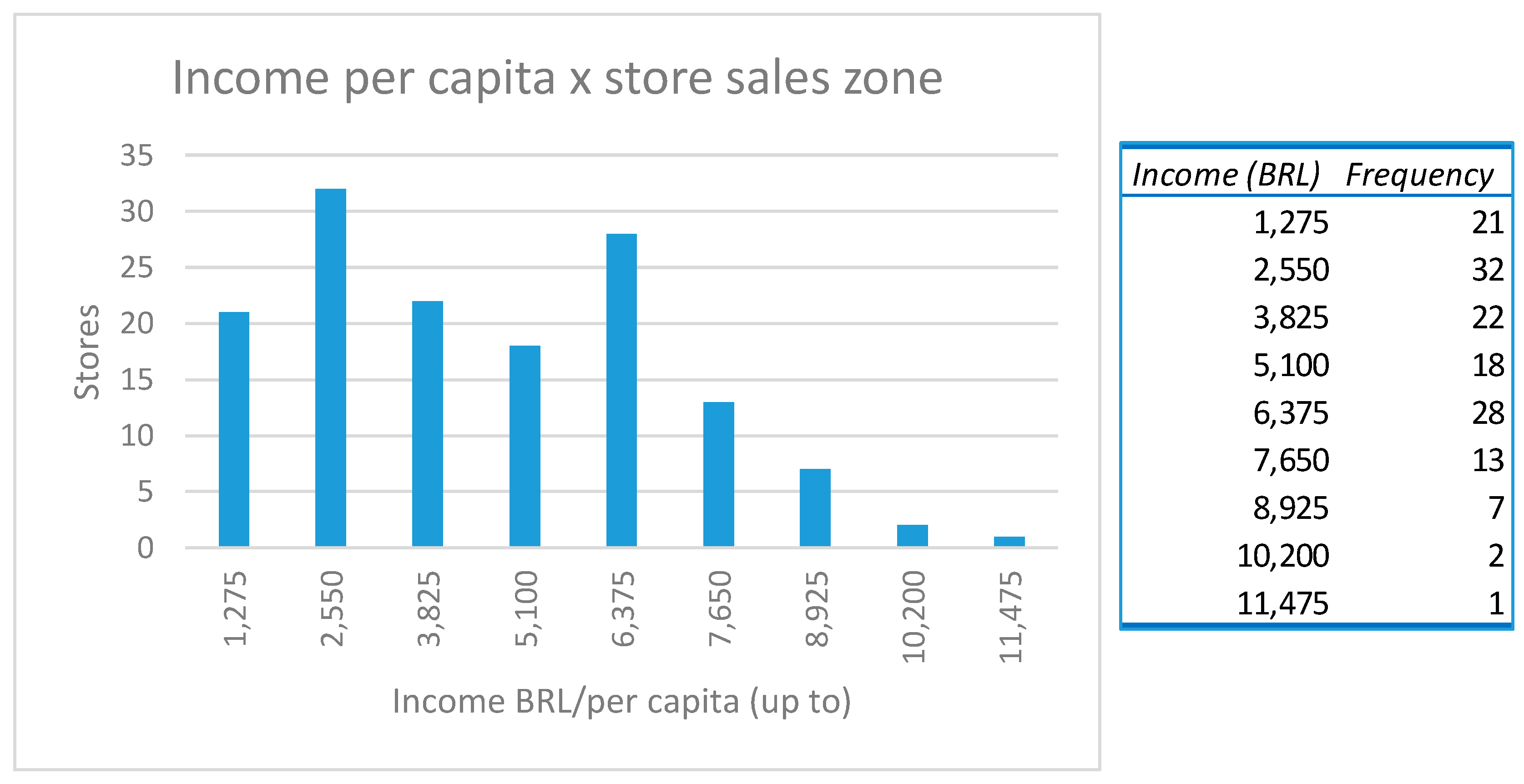

4.2. Does the Sample Adequately Cover the City?

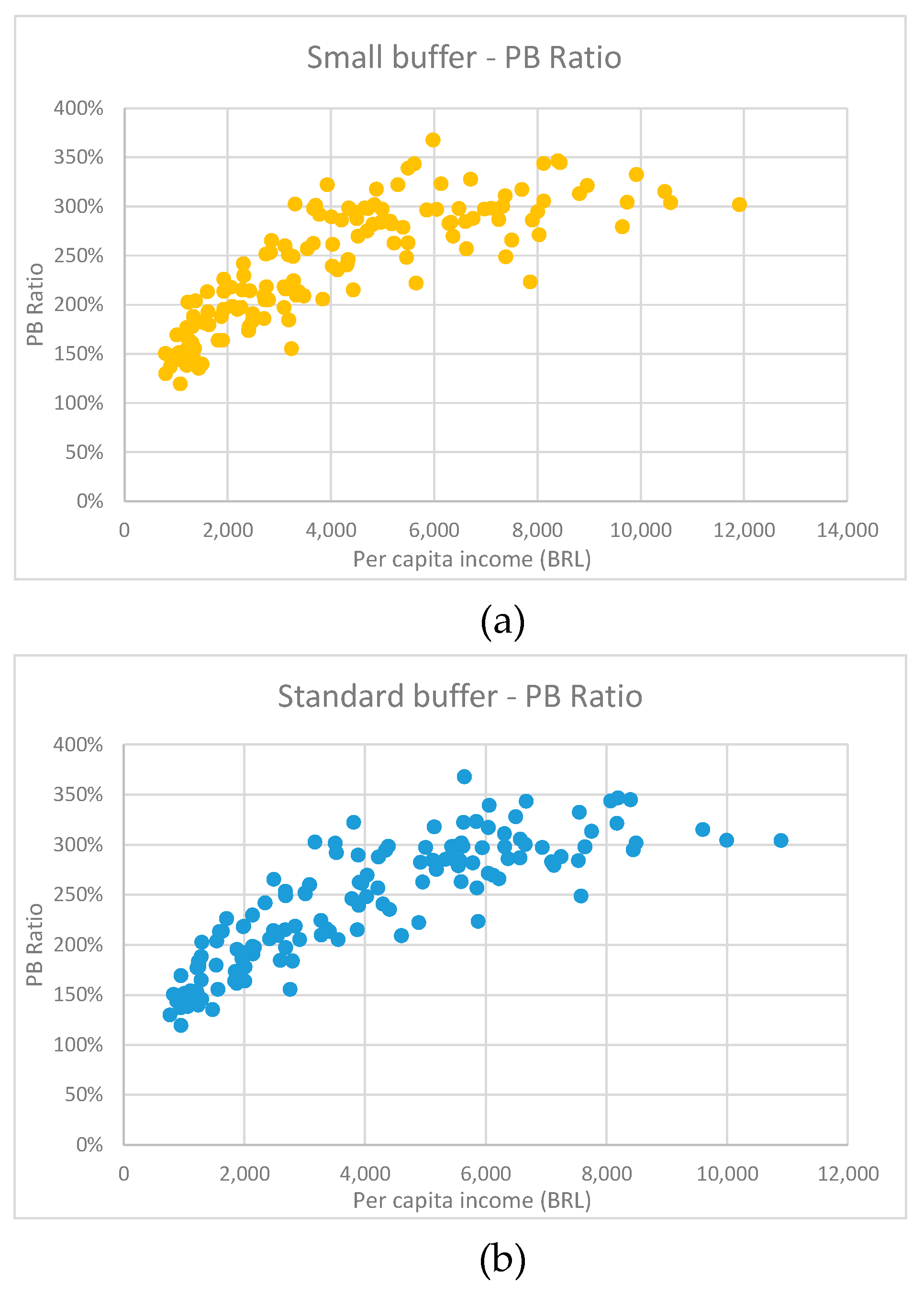

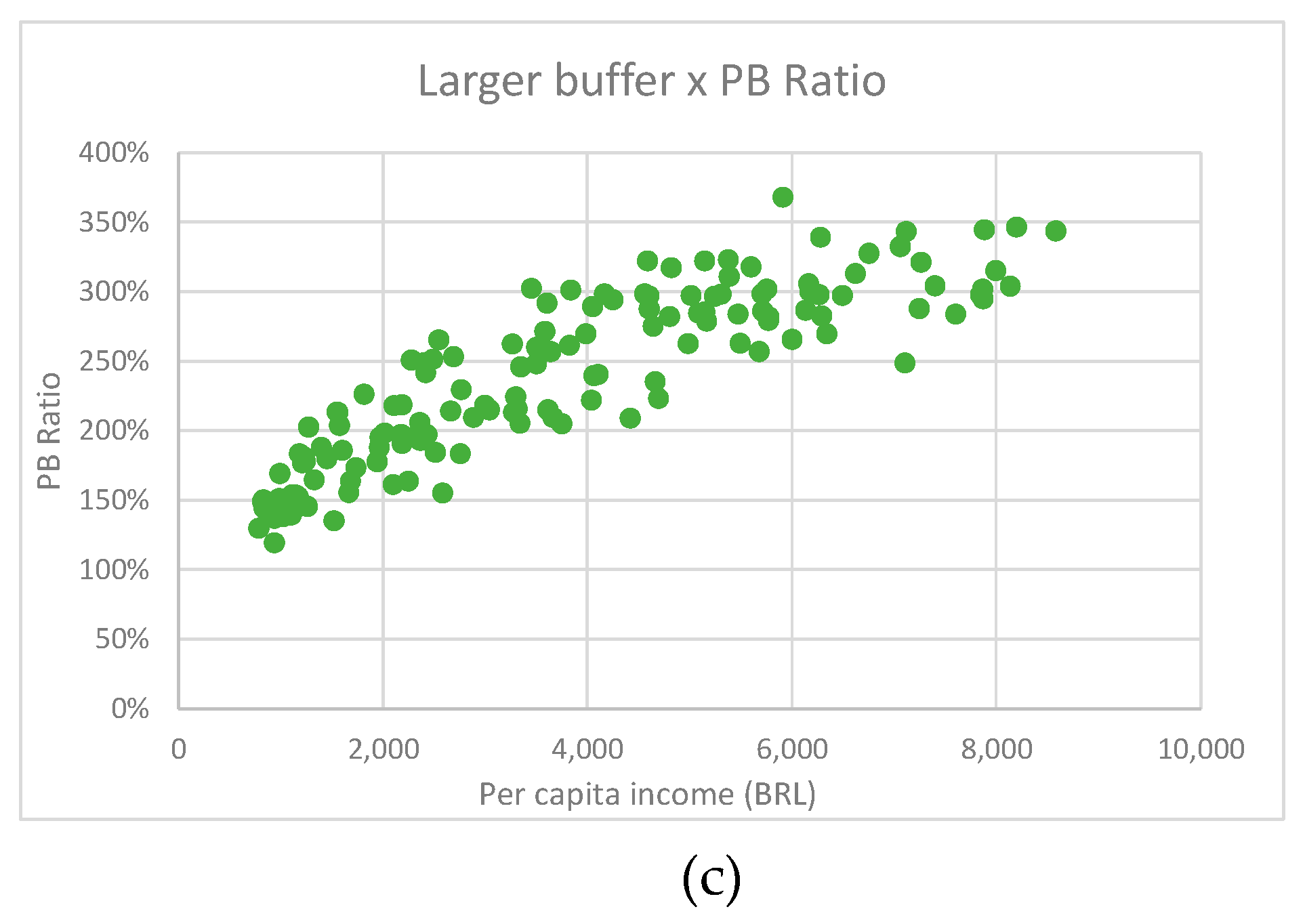

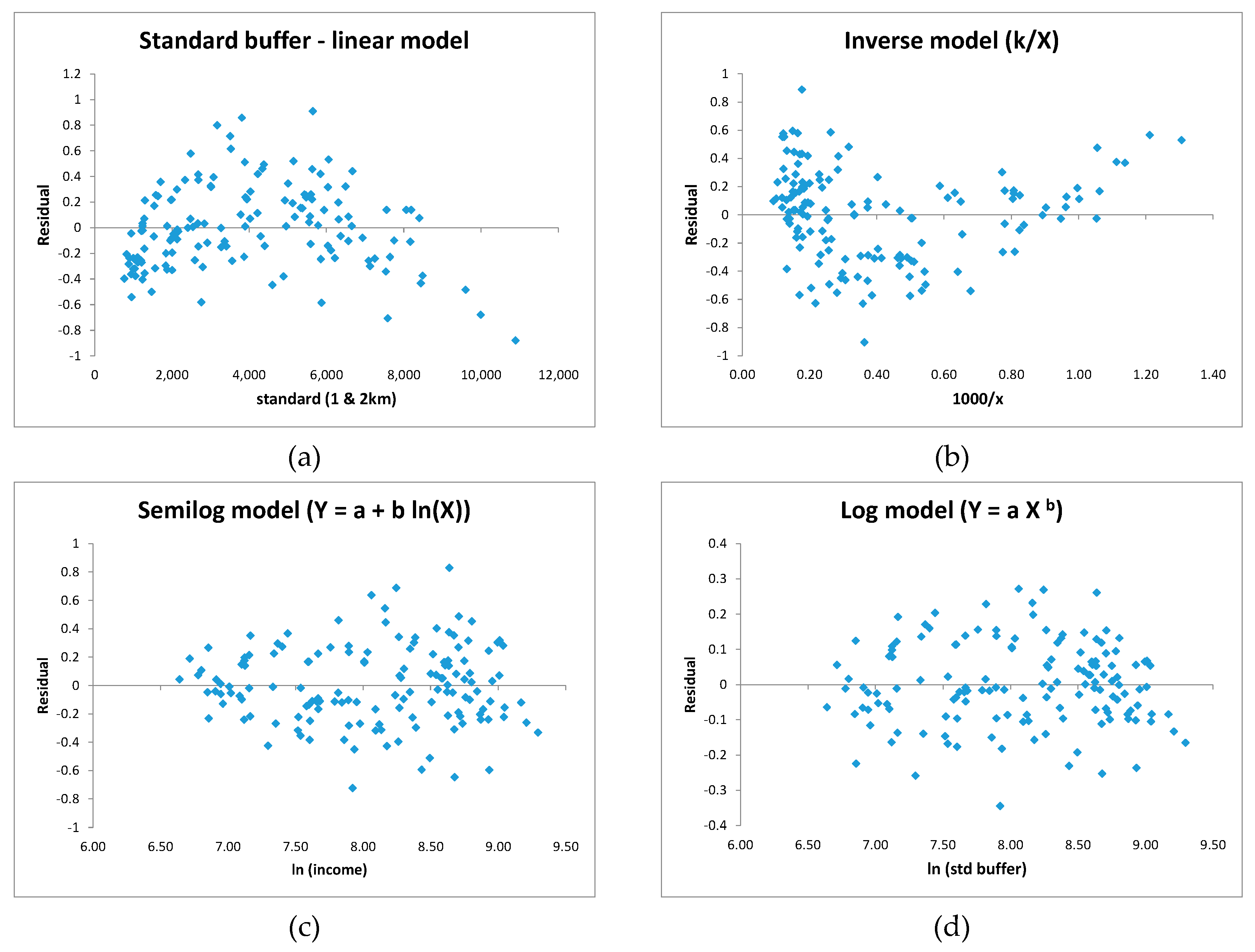

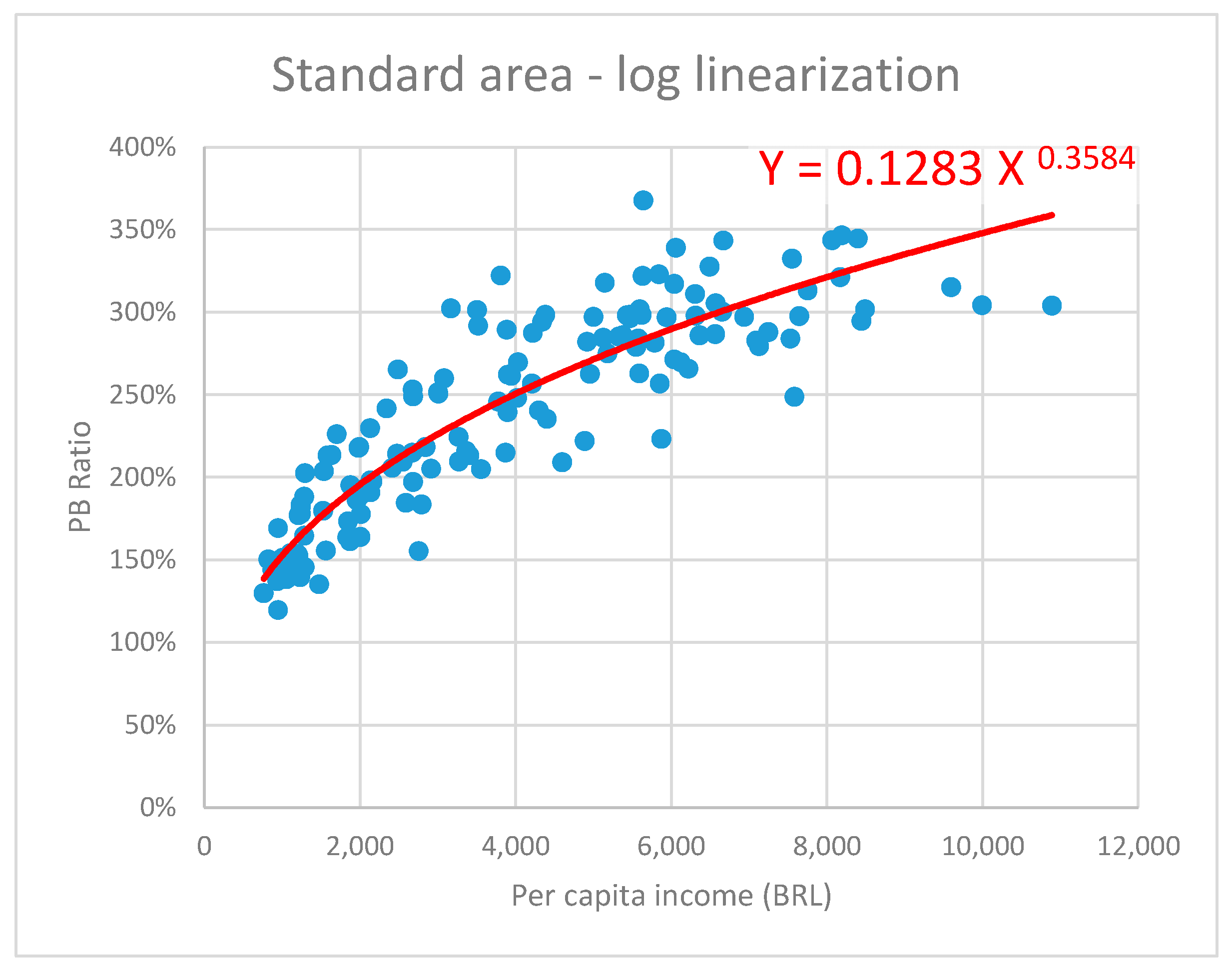

4.3. Is There a Positive Correlation Between Income and Panic Buying?

5. Discussion and Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Grashuis, J.; Skevas, T.; Segovia, M.S. Grocery shopping preferences during the COVID-19 pandemic. Sustainability 2020, 12, 5369. [Google Scholar] [CrossRef]

- Zhang, H.; Shaw, R. Identifying research trends and gaps in the context of covid-19. Int. J. Environ. Res. Public Health 2020, 17, 3370. [Google Scholar] [CrossRef]

- EM-DAT. EM-DAT Classification. Available online: http://www.emdat.be/classification (accessed on 4 February 2012).

- Loxton, M.; Truskett, R.; Scarf, B.; Sindone, L.; Baldry, G.; Zhao, Y. Consumer Behaviour during Crises: Preliminary Research on How Coronavirus Has Manifested Consumer Panic Buying, Herd Mentality, Changing Discretionary Spending and the Role of the Media in Influencing Behaviour. J. Risk Financ. Manag. 2020, 13, 166. [Google Scholar] [CrossRef]

- Molyneaux, R.; Gibbs, L.; Bryant, R.A.; Humphreys, C.; Hegarty, K.; Kellett, C.; Gallagher, H.C.; Block, K.; Harms, L.; Richardson, J.F.; et al. Interpersonal violence and mental health outcomes following disaster. BJPsych Open 2020, 6, 1–7. [Google Scholar] [CrossRef] [PubMed]

- Giudice, F.; Caferra, R.; Morone, P. COVID-19, the Food System and the Circular Economy: Challenges and Opportunities. Sustainability 2020, 12, 7939. [Google Scholar] [CrossRef]

- Ben Hassen, T.; El Bilali, H.; Allahyari, M.S. Impact of COVID-19 on Food Behavior and Consumption in Qatar. Sustainability 2020, 12, 6973. [Google Scholar] [CrossRef]

- Nicola, M.; Alsafi, Z.; Sohrabi, C.; Kerwan, A.; Al-Jabir, A.; Iosifidis, C.; Agha, M.; Agha, R. The socio-economic implications of the coronavirus pandemic (COVID-19): A review. Int. J. Surg. 2020, 78, 185–193. [Google Scholar] [CrossRef] [PubMed]

- McKinnon, G.; Smith, M.E.; Keith Hunt, H. Hoarding behavior among consumers: Conceptualization and marketing implications. J. Acad. Mark. Sci. 1985, 13, 340–351. [Google Scholar] [CrossRef]

- Sterman, J.D.; Dogan, G. I’m not hoarding, I’m just stocking up before the hoarders get here. J. Oper. Manag. 2015, 39–40, 6–22. [Google Scholar] [CrossRef]

- Depoux, A.; Martin, S.; Karafillakis, E.; Preet, R.; Wilder-Smith, A.; Larson, H. The pandemic of social media panic travels faster than the COVID-19 outbreak. J. Travel Med. 2020, 27, 1–2. [Google Scholar] [CrossRef]

- Keane, M.; Neal, T. Consumer panic in the COVID-19 pandemic. J. Econom. 2020, 1–20. [Google Scholar] [CrossRef]

- Shanthakumar, S.G.; Seetharam, A.; Ramesh, A. Understanding the Socio-Economic Disruption in the United States during COVID-19′s Early Days. Available online: http://arxiv.org/abs/2004.05451 (accessed on 11 April 2020).

- BBC. Australia Caps Toilet Roll Sales after Panic-Buying. Available online: https://www.bbc.com/news/world-australia-53196525 (accessed on 15 October 2020).

- Moreira, F. Pânico por Coronavírus faz Clientes Trocarem Socos em Disputa por Papel Higiênico em Supermercado. Available online: https://extra.globo.com/noticias/page-not-found/panico-por-coronavirus-faz-clientes-trocarem-socos-em-disputa-por-papel-higienico-em-supermercado-24293826.html (accessed on 13 October 2020).

- Sphere Association. The Sphere Handbook, 4th ed.; Sphere Association: Geneva, Switzerland, 2018; Volume 1, ISBN 9781908176004. [Google Scholar]

- Sampaio, P. Em mercado de Elite de SP, Clientela Estoca Mantimentos Para Encarar Vírus. Available online: https://noticias.uol.com.br/colunas/paulo-sampaio/2020/03/14/em-mercado-de-elite-de-sp-vips-estocam-alimentos-para-enfrentar-virus.htm (accessed on 13 October 2020).

- SEADE. Fundação Sistema Estadual de Análise de Dados São Paulo Diversa: Uma Análise a Partir de Regiões da Cidade. Available online: https://www.seade.gov.br/wp-content/uploads/2020/01/Pesquisa-SEADE_Aniversario-SP_23jan2020.pdf (accessed on 17 October 2020).

- Gordon, B.R.; Goldfarb, A.; Li, Y. Does Price Elasticity Vary with Economic Growth? A Cross-Category Analysis. J. Mark. Res. 2013, 50, 4–23. [Google Scholar] [CrossRef]

- IBGE. Instituto Brasileiro de Geografia e Estatística IBGE Pop e Domicilios Censo. 2010. Available online: http://www.ibge.gov.br/home/estatistica/populacao/censo2010/default_resultados_universo.shtm (accessed on 1 December 2011).

- Garbe, L.; Rau, R.; Toppe, T. Influence of perceived threat of Covid-19 and HEXACO personality traits on toilet paper stockpiling. PLoS ONE 2020, 15, e0234232. [Google Scholar] [CrossRef] [PubMed]

- Boon Yau, E.K.; Tze Ping, N.P.; Shoesmith, W.D.; James, S.; Nor Hadi, N.M.; Jiann Lin, L. The Behaviour Changes in Response to COVID-19 Pandemic within Malaysia. Malaysian J. Med. Sci. 2020, 27, 45–50. [Google Scholar] [CrossRef]

- Kuruppu, G.N.; De Zoysa, A. COVID-19 and Panic Buying: An Examination of the Impact of Behavioural Biases. SSRN Electron. J. 2020. [Google Scholar] [CrossRef]

- Sovacool, B.K.; Del Furszyfer Rio, D.; Griffiths, S. Contextualizing the Covid-19 pandemic for a carbon-constrained world: Insights for sustainability transitions, energy justice, and research methodology. Energy Res. Soc. Sci. 2020, 68, 101701. [Google Scholar] [CrossRef]

- Kanda, W.; Kivimaa, P. What opportunities could the COVID-19 outbreak offer for sustainability transitions research on electricity and mobility? Energy Res. Soc. Sci. 2020, 68, 101666. [Google Scholar] [CrossRef]

- Buechler, E.; Powell, S.; Sun, T.; Zanocco, C.; Astier, N.; Bolorinos, J.; Flora, J.; Boudet, H.; Rajagopal, R. Power and the Pandemic: Exploring Global Changes in Electricity Demand During COVID-19. Available online: https://arxiv.org/ftp/arxiv/papers/2008/2008.06988.pdf (accessed on 23 November 2020).

- Cheshmehzangi, A. COVID-19 and household energy implications: What are the main impacts on energy use? Heliyon 2020, 6, e05202. [Google Scholar] [CrossRef]

- Khare, A.; He, Q.; Batta, R. Predicting gasoline shortage during disasters using social media. OR Spectr. 2020, 42, 693–726. [Google Scholar] [CrossRef]

- Upton, E.; Nuttall, W.J. Fuel Panics: Insights From Spatial Agent-Based Simulation. IEEE Trans. Intell. Transp. Syst. 2014, 15, 1499–1509. [Google Scholar] [CrossRef]

- Wang, H.; Liu, X.; He, K. Agent-Based Simulation Approach for Managing Communicative Competence in Public Emergence Event. In Proceedings of the 2013 Sixth International Conference on Business Intelligence and Financial Engineering, Hangzhou, China, 14–16 November 2013; pp. 96–100. [Google Scholar]

- Hori, M.; Iwamoto, K. The Run on Daily Foods and Goods After the 2011 Tohoku Earthquake. Jpn. Polit. Econ. 2014, 40, 69–113. [Google Scholar] [CrossRef]

- Ballantine, P.W.; Zafar, S.; Parsons, A.G. Changes in retail shopping behaviour in the aftermath of an earthquake. Int. Rev. Retail. Distrib. Consum. Res. 2014, 24, 1–13. [Google Scholar] [CrossRef]

- Wei, K.; Wen-wu, D.; Lin, W. Research on Emergency Information Management Based on the Social Network Analysis—A Case Analysis of Panic Buying of Salt. In Proceedings of the Proceedings of 18th International Conference on Management Science & Engineering, Rome, Italy, 13–15 September 2011. [Google Scholar]

- Kawashima, S.; Morita, A.; Higuchi, T. Emergency Stockpiling of Food and Drinking Water in Preparation for Earthquakes: Evidence From a Survey Conducted in Sendai City, Japan. J. Hunger Environ. Nutr. 2012, 7, 113–121. [Google Scholar] [CrossRef]

- Zheng, R.; Shou, B.; Yang, J. Supply disruption management under consumer panic buying and social learning effects. Omega 2020, 102238. [Google Scholar] [CrossRef]

- Sim, K.; Chua, H.C.; Vieta, E.; Fernandez, G. The anatomy of panic buying related to the current COVID-19 pandemic. Psychiatry Res. 2020, 288, 113015. [Google Scholar] [CrossRef] [PubMed]

- Sheu, J.-B.; Kuo, H.-T. Dual speculative hoarding: A wholesaler-retailer channel behavioral phenomenon behind potential natural hazard threats. Int. J. Disaster Risk Reduct. 2020, 44, 101430. [Google Scholar] [CrossRef]

- Yuen, K.F.; Wang, X.; Ma, F.; Li, K.X. The psychological causes of panic buying following a health crisis. Int. J. Environ. Res. Public Health 2020, 17, 3513. [Google Scholar] [CrossRef]

- Dammeyer, J. An explorative study of the individual differences associated with consumer stockpiling during the early stages of the 2020 Coronavirus outbreak in Europe. Pers. Individ. Differ. 2020, 167, 110263. [Google Scholar] [CrossRef]

- Lins, S.; Aquino, S. Development and initial psychometric properties of a panic buying scale during COVID-19 pandemic. Heliyon 2020, 6, e04746. [Google Scholar] [CrossRef]

- Martin-Neuninger, R.; Ruby, M.B. What Does Food Retail Research Tell Us About the Implications of Coronavirus (COVID-19) for Grocery Purchasing Habits? Front. Psychol. 2020, 11. [Google Scholar] [CrossRef]

- Hobbs, J.E. Food supply chains during the COVID-19 pandemic. Can. J. Agric. Econ. Can. D’agroeconomie 2020, 68, 171–176. [Google Scholar] [CrossRef]

- Solomon, M.Z.; Wynia, M.; Gostin, L.O. Scarcity in the Covid-19 Pandemic. Hastings Cent. Rep. 2020, 50, 3. [Google Scholar] [CrossRef]

- Arafat, S.M.Y.; Kar, S.K.; Kabir, R. Possible Controlling Measures of Panic Buying During COVID-19. Int. J. Ment. Health Addict. 2020. [CrossRef]

- Micalizzi, L.; Zambrotta, N.S.; Bernstein, M.H. Stockpiling in the time of COVID-19. Br. J. Health Psychol. 2020. [Google Scholar] [CrossRef] [PubMed]

- Ahmed, R.R.; Streimikiene, D.; Rolle, J.-A.; Duc, P.A. The COVID-19 Pandemic and the Antecedants for the Impulse Buying Behavior of US Citizens. J. Compet. 2020, 12, 5–27. [Google Scholar] [CrossRef]

- Jeżewska-Zychowicz, M.; Plichta, M.; Królak, M. Consumers’ Fears Regarding Food Availability and Purchasing Behaviors during the COVID-19 Pandemic: The Importance of Trust and Perceived Stress. Nutrients 2020, 12, 2852. [Google Scholar] [CrossRef] [PubMed]

- Prentice, C.; Chen, J.; Stantic, B. Timed intervention in COVID-19 and panic buying. J. Retail. Consum. Serv. 2020, 57, 102203. [Google Scholar] [CrossRef]

- Naeem, M. Do social media platforms develop consumer panic buying during the fear of Covid-19 pandemic. J. Retail. Consum. Serv. 2021, 58, 102226. [Google Scholar] [CrossRef]

- Naeem, M. The role of social media to generate social proof as engaged society for stockpiling behaviour of customers during Covid-19 pandemic. Qual. Mark. Res. Int. J. 2020. [Google Scholar] [CrossRef]

- Du, H.; Yang, J.; King, R.B.; Yang, L.; Chi, P. COVID-19 Increases Online Searches for Emotional and Health-Related Terms. Appl. Psychol. Heal. Well Being 2020. [Google Scholar] [CrossRef]

- Baker, E.J. Household preparedness for the Aftermath of Hurricanes in Florida. Appl. Geogr. 2011, 31, 46–52. [Google Scholar] [CrossRef]

- Power, M.; Doherty, B.; Pybus, K.; Pickett, K. How COVID-19 has exposed inequalities in the UK food system: The case of UK food and poverty. Emerald Open Res. 2020, 2, 11. [Google Scholar] [CrossRef]

- Katie Warren Grocery Stores in the Richest and Poorest Parts of NYC are Struggling, but for Very Different Reasons. It’s yet Another Sign of How Diferently the Wealthy are Weathering the Pandemic. Available online: https://www.businessinsider.com/nyc-grocery-stores-struggling-wealth-flight-jobs-cut-2020-4 (accessed on 29 October 2020).

- Ismail, O.; Sharnoubi, O. El Corona Panic Buyers are Mostly Rich People, Grocers Say. Available online: https://www.madamasr.com/en/2020/03/22/feature/society/corona-panic-buyers-are-mostly-rich-people-grocers-say/ (accessed on 29 October 2020).

- Parente, J.; Kato, H.T. Área de influência: Um estudo no varejo de supermercados. Rev. Adm. Empres. 2001, 41, 46–53. [Google Scholar] [CrossRef]

- Parente, J.; Kato, H.T. Um Estudo dos Supermercados no Brasil: Uma Investigação sobre a Área de Influência. In Proceedings of the XXVII Encontro da ANPAD; Associação Nacional de Pós Graduação e Pesquisa em Administração: Atibaia, Brazil, 2003; pp. 1–17. [Google Scholar]

- Taylor, S. The Psychology of Pandemics: Preparing for the Next Global Outbreak of Infectious Disease; Cambridge Scholars Publishing: Newcastle upon Tyne, UK, 2019; ISBN 9781527539594. [Google Scholar]

- São Paulo SP Contra o Novo Coronavírus. Available online: https://www.saopaulo.sp.gov.br/coronavirus/quarentena/ (accessed on 1 November 2020).

| Store Format | Influence Area Radius (GIS Buffer Size) | ||

|---|---|---|---|

| Small | Standard | Large | |

| Supermarket | 0.5 km | 1.0 km | 1.5 km |

| Supercenter | 1.5 km | 2.0 km | 2.5 km |

| Influence Buffer Radius | Area | Covered Population | Population Coverage |

|---|---|---|---|

| 2.0 km | 654 km2 | 7,609,242 | 67.6% |

| 1.5 km | 511 km2 | 6,027,360 | 53.6% |

| 1.0 km | 314 km2 | 3,874,343 | 34.4% |

| Obs. São Paulo population is 11,252,204 (Census 2010); total area is 1524 km2. | |||

| Influence Area Size | a | p-Value (a) | b | p-Value (b) |

|---|---|---|---|---|

| Small | 1.344 × 10−1 | *** | 3.510 × 10−1 | *** |

| Standard | 1.283 × 10−1 | *** | 3.584 × 10−1 | *** |

| Large | 1.147 × 10−1 | *** | 3.735 × 10−1 | *** |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yoshizaki, H.T.Y.; de Brito Junior, I.; Hino, C.M.; Aguiar, L.L.; Pinheiro, M.C.R. Relationship between Panic Buying and Per Capita Income during COVID-19. Sustainability 2020, 12, 9968. https://doi.org/10.3390/su12239968

Yoshizaki HTY, de Brito Junior I, Hino CM, Aguiar LL, Pinheiro MCR. Relationship between Panic Buying and Per Capita Income during COVID-19. Sustainability. 2020; 12(23):9968. https://doi.org/10.3390/su12239968

Chicago/Turabian StyleYoshizaki, Hugo T. Y., Irineu de Brito Junior, Celso Mitsuo Hino, Larrisa Limongi Aguiar, and Maria Clara Rodrigues Pinheiro. 2020. "Relationship between Panic Buying and Per Capita Income during COVID-19" Sustainability 12, no. 23: 9968. https://doi.org/10.3390/su12239968

APA StyleYoshizaki, H. T. Y., de Brito Junior, I., Hino, C. M., Aguiar, L. L., & Pinheiro, M. C. R. (2020). Relationship between Panic Buying and Per Capita Income during COVID-19. Sustainability, 12(23), 9968. https://doi.org/10.3390/su12239968