Abstract

The work investigates the volatility connectedness between oil price and clean energy firms over the period 2011–2020 (including the COVID-19 outbreak). Using the volatility spillover models, and dynamic conditional correlation, we are able to identify the volatility spillover effect between these financial markets and its implications for portfolio diversification. The results indicate a significant change in both static and dynamic volatility connectedness around the COVID-19 outbreak. For instance, total connectedness index changes from 21.36% (pre-COVID-19) to 61.23% (COVID-19). This finding shows the strong effect of the COVID-19 pandemic on these financial markets. Furthermore, we show how the WTI oil from the volatility transmitter (before the outbreak of the pandemic) becomes a risk receiver after the start of the global pandemic COVID-19. Our findings indicate that recent pandemic intensified volatility spillovers, supporting the financial contagion effects. Finally, we determine the optimal hedge ratios and portfolio weights. The estimates provided suggest the need for active portfolio management, taking into account the distinct characteristics of each sector and thus, the firm. For example, the optimal weight analysis shows how the clean sector has become important in optimal diversification strategies. Our results can be used for portfolio decisions and regulatory policymaking, particularly in the current context of high uncertainty.

1. Introduction

The relationship between the oil market and the clean (renewable) energy market has been attracting the attention of politicians and economists in recent times. In fact, many researchers have studied the interconnection between clean energy stocks, technology stocks and oil prices [1,2,3,4,5,6,7,8] along with other variables such as interest rates, VIX (VIX is short for the Chicago Board Options Exchange Volatility Index. It is a measure used to track volatility on the S&P 500 index. It is the most well-known volatility index on the markets), gas price, agricultural commodities, and other asset classes [9,10,11,12,13,14,15,16,17,18,19]. However, the spillover effects of volatility between oil and the clean energy market have become more crucial due to uncertainty in financial markets. For example, events such as the COVID-19 pandemic can act as a catalyst for contagion [20,21]. Investors, seeking to improve risk-adjusted returns on their portfolios, have to modify their asset allocations to take into account the impact of spillovers and reduce contagion risks [2,22]. From a theoretical point of view, the future evolution of the green market depends on less use of the brown market [7]. From an energy investment prospective, “brown” market refers to fossil fuel energy projects, including coal, oil and gas production, and fossil fuel-based power generation, while “green” market concerns to clean energy projects, such as solar, wind, geothermal energy. As underlined by [14,18,23], there is a substitution effect between these financial markets. On the one hand, an increase in oil prices leads to an increase in the use of renewable energy, thus increasing profits. On the other hand, a decrease in oil prices leads to less use of clean energy. Hence, the high volatility of oil prices can strongly influence the profitability of the clean energy sector. To study the price volatility spillover between these financial markets is fundamental to build optimal diversification (trading and hedging) strategies and to formulate regulatory policies [2,6], especially in the current context of sustainable development of energy sources.

While the literature has shown that the relationship between oil price and clean (renewable) energy stock prices at the aggregate level is missing, it is a complete understanding of how oil volatility can affect clean energy companies. This document aims to bridge this gap.

The objective of this research is to investigate the volatility spillovers between oil price volatility and the volatility prices of major energy clean companies (wind, solar and technology) in the period from January 2011 to June 2020. To this purpose, we follow the [24,25] approach. In particular, using the spillover index framework of [26,27], and the dynamic conditional correlation (DCC) model proposed by [28], we are able to (1) identify the transmission of volatility shocks between oil price and clean energy companies; (2) provide investors and portfolio managers with optimal hedging and portfolio diversification strategies.

We contribute to the relevant literature by profoundly examining the nexus between oil price volatility and clean energy market price volatility using firm-wide data. To our knowledge, an analysis of volatility spillovers between clean energy firms and oil price has not yet been implemented. Many studies analysed the relationship between oil prices and clean (renewable) energy markets at an aggregate level using sector indices [1,2,4,5,7,8,13,23,29,30]. Nevertheless, the use of stock indexes is not useful to investigate the different facets of the relationship. Moreover, an aggregate examination is not particularly useful for portfolio diversification or risk management analysis [6,24]. Furthermore, our dataset covers the period from 2011 to 2020. Therefore, our time-series data allows us to study the effect of the COVID-19 outbreak. The study of the impact of COVID-19 pandemic has implications for a wide range of issues related to risk management (asset allocation) and thus, regulatory formulation. For instance, during financial turbulence periods, investors rebalance their portfolios in order to reduce risk. In this case, the substitution effect between the two markets can play an important role. Therefore, we are able to verify the role assumed by COVID-19 in shaping the volatility connection patterns between the two markets, thus its impact on diversification strategies.

Our empirical findings can be summarised as follows. First, there is a significant increase in the degree of connection of volatility due to the COVID-19 outbreak. This result is consistent with the fact that the interconnection between crude oil and the financial markets rises significantly during periods of high uncertainty [7,14,30,31]. We can see how COVID-19 altered the connection network, generating substantial increases in total connection (from 21.36% to 61.23%), and also in directional connections (TO and FROM). Specifically, the from-connection grew from a maximum of 48.38% (for Canadian Solar) in the pre-COVID-19 period to 125% (for Applied Materials) in the current period. Moreover, the findings suggest that the West Texas Intermediate (WTI)’s volatility in recent years has been affected by the volatility of the clean energy companies rather than the opposite, i.e., oil is a net shock receiver. Second, our results point out that the cost of using oil as a hedging instrument for clean energy stocks is variable over time. Indeed, we study the optimal diversification strategies in the pre-pandemic and during the COVID-19 period. We show how the hedging ratios reached their maximum during the epidemic. Therefore, the results suggest the need for active portfolio management, taking into account the distinct characteristics of each sector and thus, the company.

The paper is organized in the following sections. In Section 2, we provide a review of the empirical studies on the nexus between oil prices and clean energy stocks. Section 3 outlines data descriptions and preliminary statistics. Section 4 describes the methodology. Section 5 explains the empirical findings. Finally, in Section 6, we present our concluding remarks.

2. Related Studies

The study of the interdependence between crude oil and clean energy stock prices has been addressed using different econometric techniques. Several papers studied the link between oil price and stock prices returns. One of the first works is the study of [1]. To analyse the nexus, the authors compute a vector autoregressive model (VAR) and linear Granger causality analysis. Their results suggest a linear Granger causality from crude oil to clean energy stock prices, and the strong relationship between the technology sector and renewable energy. The same empirical evidence is found by [3,9], who highlight the close link between clean energy and the technology markets. Moreover, Inchauspe et al. [11] by a state-space model, documents a high level of correlation between the MSCI World Index, technology stock returns, and clean energy. Reboredo [4] employs a copula model and CoVaR measure to study the effect of oil price on renewable energy stock return. The findings suggest that oil price dynamics have a strong impact on clean energy index. Specifically, he finds that the oil price contributes around 30% to the downside and upside risk (CoVaR) of renewable energy stocks. Bondia et al. [23], using threshold cointegration analysis, reveals a significant short-run relationship between oil price and clean energy return. These results are in contrast to [5]. Applying continuous and discrete wavelets, the authors find that the relationship between oil and renewable energy returns is weak in the short run. On the other hand, the connection increases over the long term. In addition, Reboredo et al. [32], by a multivariate wine-copula, document how the energy extreme (upside/downside) price movements is an important factor of the dynamic of renewable energy financial market. More recently, Zhang et al. [8] use the wavelet-based quantile-on-quantile and Granger causality-in-quantiles methods to analyse the impact of oil price shocks (oil supply shock, aggregate demand shock and oil-specific demand shock) on clean energy equities, from January 2006 to December 2018. They find: (i) a significant strong impact in the short and long term of oil supply shock on clean energy; (ii) a positive effect on clean energy of oil demand shocks in the middle term; (iii) an asymmetric impact of oil specific demand shock in higher quantiles of energy stocks in the long run. Few authors have focused on the volatility interrelationships between the oil and clean energy stock market, i.e., the volatility spillovers. Such volatility plays a crucial role in portfolio strategies (risk management). Therefore, we think that understanding the volatility spillover dynamic is particularly useful, especially in the era of high volatility like this one (due to the COVID-19 outbreak). Furthermore, Sadorsky [2] by the multivariate generalised autoregressive conditional heteroskedasticity (MGARCH) model, investigates the volatility spillovers between oil prices and clean energy equity prices. The author finds that clean energy stock prices are highly linked with technology stock prices. Moreover, using dynamic conditional correlation and optimal hedging ratio, he shows that a “1$ long position in clean energy companies can be hedged for 20 cents with a short position in the crude oil futures market”. Moreover, Dutta [13] investigates the nexus between oil price uncertainty and clean energy stock return. To this, the author computes several measures of realised volatility. The results document the significant impact of oil price implied volatility index (OVX) on clean energy market. Specifically, the relationship is positive; a decrease in OVX implies a reduction in clean energy realised volatility, and the contrary. Moreover, Ahmad [29] employs the [26] framework to study the return and volatility spillover effect between oil prices, clean energy and technology stock prices. He finds that technology and clean energy stocks are net emitters of returns, while crude oil is the net receiver. The same results are documented by [14]. The authors analyse the connectedness dynamics among US clean energy stock prices, crude oil prices and other financial variables (high technology and conventional energy stock prices, 10-year US Treasury bond yields, US default spread and volatility in US stock and Treasury markets). The empirical results show a higher degree of interconnectedness during turbulent times (such as the global financial crisis) and how crude oil prices are a net receiver of financial shocks. Ahmad et al. [22] use three variants of MGARCH model to construct an optimal diversification strategy in clean energy equity. Furthermore, Maghyereh et al. [7] extends the analysis of [22] combing wavelets analysis with MGARCH. Their results confirm the strong volatility transmission between clean energy and technology stock index. On the other hand, the authors show a significant risk of spillover from oil to clean energy, especially in the long run (as in [5]). Focusing on clean energy sub-sector index, [6] shows how the link between oil price and clean energy prices is heterogeneous. The author illustrates the importance of active portfolio management at a disaggregate level. Recently, Nasreen et al. [30] by three econometric techniques (MGARCH model, wavelet analysis, and the [26] model) document a high persistence of volatility on future oil markets, and a weak interdependence between clean energy and oil price.

In this background, our research aims to study of the volatility spillover between oil price and major clean energy firms, in order to understand the dynamics within the sector and to implement optimal diversification strategies, specifically in the current context of high uncertainty due to the COVID-19 outbreak.

3. Data

Our dataset is composed of 24 companies from the clean energy sector, i.e., firms belong to wind, solar and clean technology sectors, and West Texas Intermediate (WTI) crude oil. Specifically, we use daily firms stock data from these indexes: (1) NASDAQ OMX Wind Index; (2) NASDAQ OMX Solar Index and (3) MSCI Global Energy Efficiency Index (tracks the clean technology firms). We select 24 clean energy firms in our sample following two constraints: (1) the firm must be large companies (main players), and (ii) they should be listed prior to 2011 to have observations to study the impact of the COVID-19 epidemic. Therefore, our dataset is composed of 24 firms (8 wind, 8 solar and 8 tech). All stocks data are obtained by Datastream. The sample period runs from 3 January 2011 to 25 June 2020 (2255 observations) including the tumultuous era of COVID-19 outbreak. Following [24,33,34], we compute the price volatility of asset i as the absolute return: , where is the closing price of firm i at daily t.

Table 1 presents the clean energy firms in the sample, including full name, abbreviation, and total asset (December 2019). Table 2 reports the descriptive statistics. Each series rejects the normally distributed hypothesis, as suggest the kurtosis level and the Jarque–Bera (JB) test. All the volatility series are stationary verified by augmented Dickey–Fuller (ADF) test.

Table 1.

Clean energy companies. Listed clean energy firms with abbreviation (Abbr.) and total asset (T.A.). They are classified by three types: (1) Wind firms, (2) Solar firms and (3) Clean Technology firms. Total assets are in billions of Dollar (USD) as of December 2019.

Table 2.

Descriptive statistics. Descriptive statistics for daily volatility. The augmented Dickey–Fuller (ADF) statistic tests the null hypothesis of unit root. The JB is the Jarque–Bera statistic tests for the null hypothesis of normal distribution. *** denotes the rejection of null hypothesis at the 1% significance level.

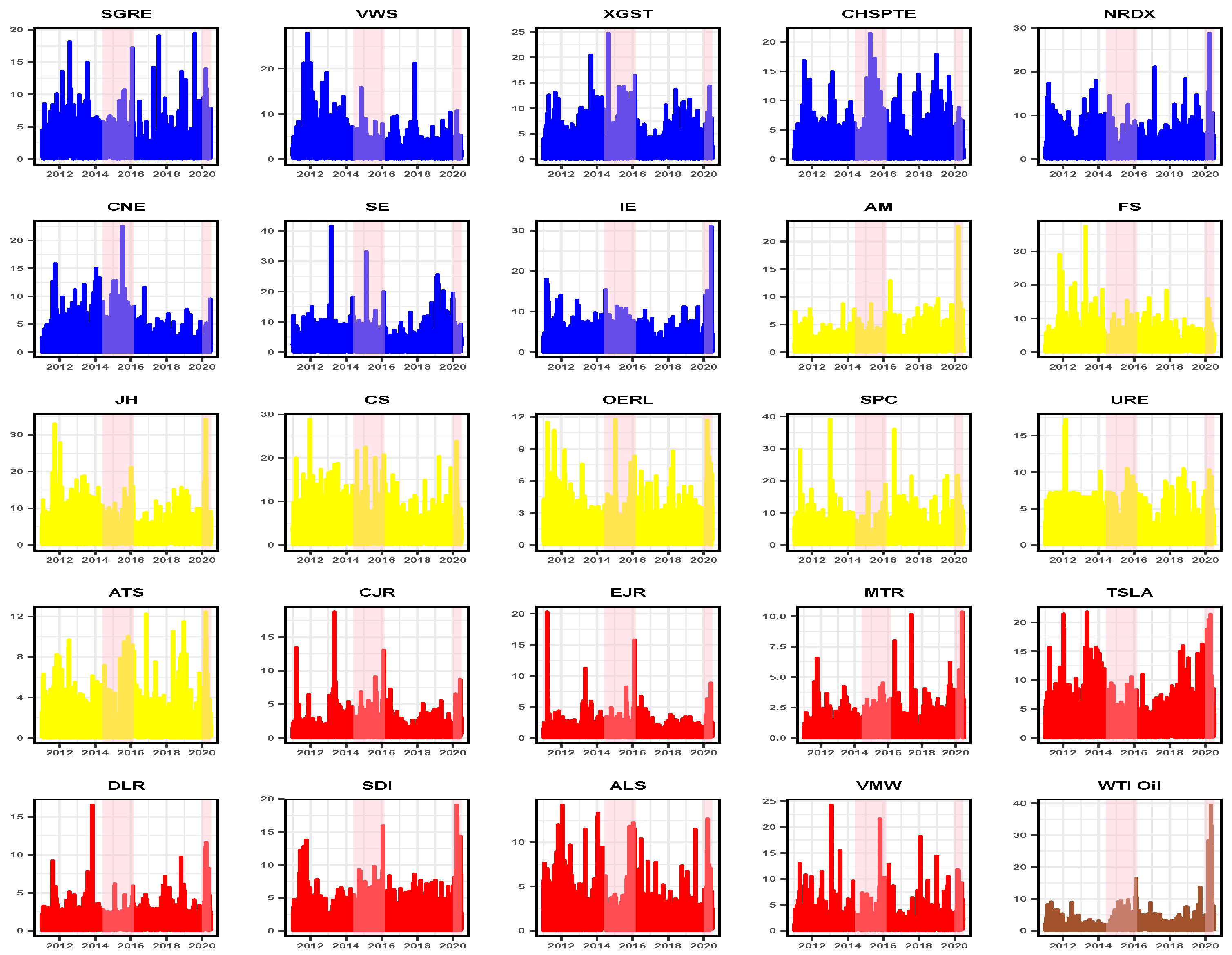

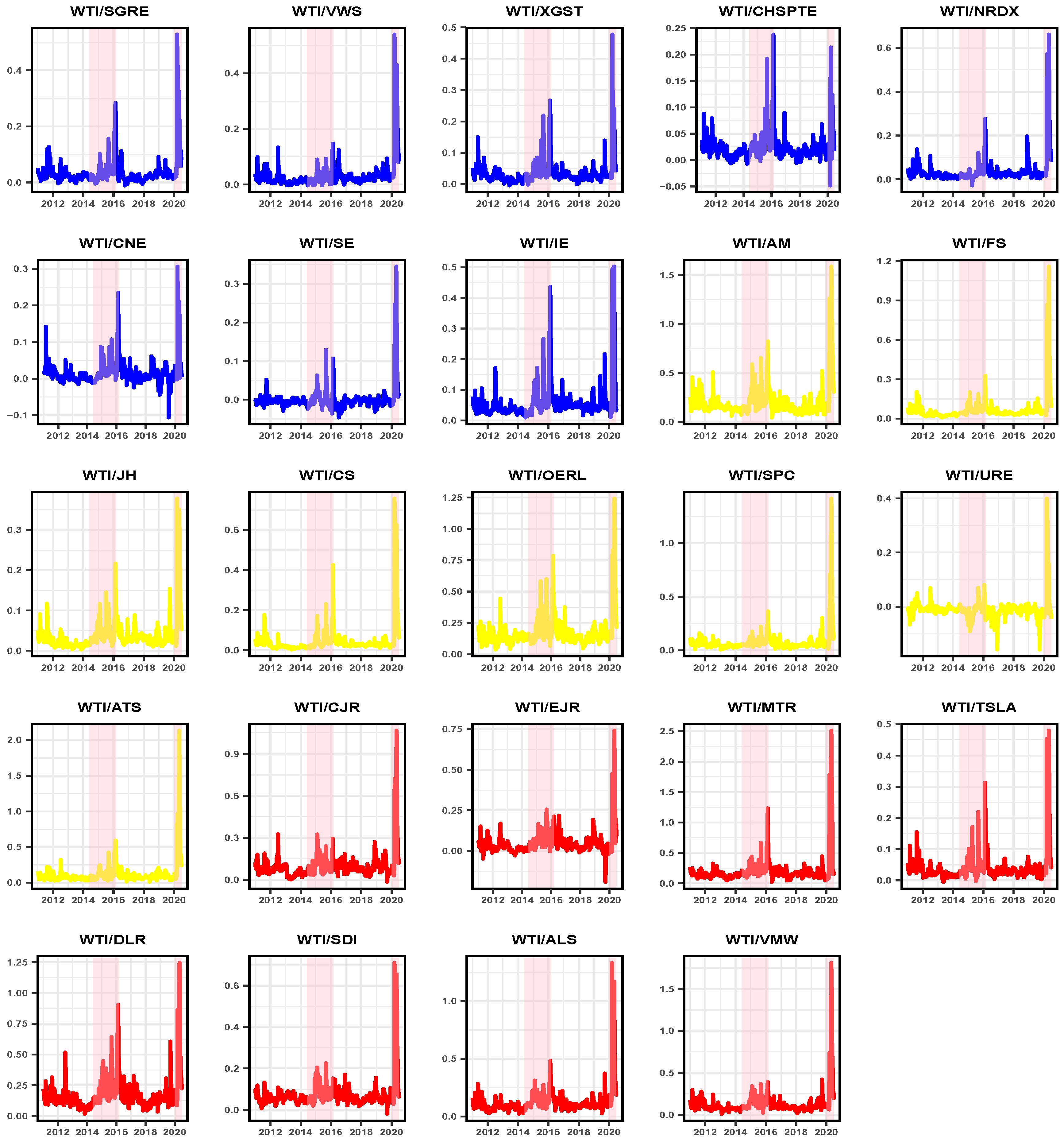

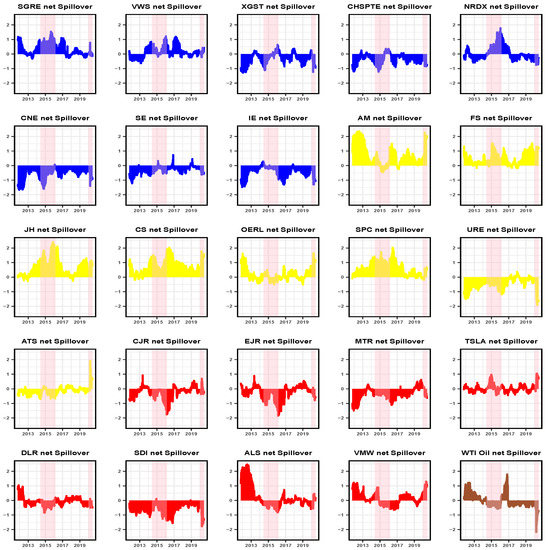

Figure 1 displays the dynamic of the volatility price during the sample period. Each series shows different periods of volatility clustering. There are some common peaks and troughs in their volatility. We can see the most striking peaks during the period of the European sovereign debt crisis, during the collapse of oil and during the era of the COVID-19 pandemic.

Figure 1.

Price Volatility. Time series plot of Absolute returns. Blue: Wind firms; Yellow = Solar firms; Red = Clean Technology firms; Brown = WTI Oil. The shaded area denotes the period of oil price drop (June 2014 to February 2016) and COVID-19 outbreak (January 2020 to now).

4. Empirical Approach

Our empirical approach consists of two steps. First, we analyse the volatility spillover between WTI oil and 24 clean energy firms, in order to show the transmission mechanism of volatility shock. In the second step, we compute the dynamic conditional correlations (DCC) among our series to construct the optimal diversification strategies.

4.1. Volatility Dynamic Connectedness

To analyse the volatility spillover between clean energy firms and WTI oil, we employ the generalized VAR model of [26,27]. In particular, thanks to this method, we are able to capture the spillover index measure across several assets. Following [27], we specify the covariance stationary model as follows:

where is a vector of endogenous variables at time t, is a matrix of coefficients, k is the VAR lag order, while is the residual vector that are assumed to be serially uncorrelated. The moving average representation of Equation (1) is given by:

where stands for a matrix of parameters defined as . is an identity matrix and for .

We use the generalized variance decomposition (GVD) framework of [35,36]. The GVD is invariant to the variable ordering, therefore the H-step-ahead generalized forecast error variance is given by:

where is an vector equal to 1 for element i and 0 otherwise, is the covariance matrix of the error vector , while denotes the standard deviation for the volatility of variable j [26]. Hence, we obtain a generalized variance decomposition matrix . The diagonal elements show the contributions of variable i to its own forecast error variance; on the other hand, the off-diagonal elements captures the contributions of other variables j to the forecast error variance of variable i, i.e., the cross-spillover [6]. Following [26], we normalise each element of H-step-ahead matrix by its row sum, then:

Now, we are able to define the total spillover index as follows:

The index captures the average contribution of cross-volatility shock spillovers to the total forecast error variance. The directional volatility spillover (variable i from all other variables j) is given by:

while the directional volatility spillover (variable i to all other variables j) is defined as follows:

Finally, we compute the net volatility spillovers (from variable i to all other variables j) as the difference between Equations (6) and (7), i.e.,

This measure quantifies the main net transmitters and receivers of volatility spillovers.

4.2. Dynamic Conditional Correlations

In order to analyse the time-varying correlation between clean energy firm’ volatility and oil one, we compute the dynamic conditional correlation of [28]. The model is defined as:

where is a vector of volatilities [24], denotes a vector of conditional mean, is the residual, while is a conditional covariance matrix of and . can be decomposed as:

where is the diagonal square root conditional variance, while stands for the time-varying conditional correlations matrix, defined as:

is a symmetric positive definite matrix, i.e.,

where denotes a correlation matrix of the standardized residuals , while and are non-negative parameters satisfying . Finally, the time-varying correlations is calculated as follows:

Following [7,24], we estimate the DCC model using the quasi-maximum likelihood (QML) estimator under a multivariate Student distribution.

5. Empirical Results

5.1. Volatility Connectedness Analysis

Following [37,38,39], we compute the volatility connectedness among the clean firms and WTI oil using a 200-day rolling window and 10-day-ahead forecast horizon (as a robustness check, we estimate the model based on alternative rolling windows (150, 250, 500 days), and forecast horizons (20, 30, and 60 days). The results are quite similar and are available upon request). The optimal lag length of the VAR model is chosen according to the Schwarz and Akaike information criterion (lag order ). Table 3 reports the static volatility connectedness estimate based on the full sample period, i.e., the values of total connectedness and the pairwise directional connectedness (to-connectedness, from-connectedness, and net-connectedness).

Table 3.

Static volatility connectedness. Volatility connectedness for 24 clean energy firms and WTI crude oil for the entire period from 4 January 2011 to 25 June 2020. Variance decompositions are based on 10-days-ahead forecasts. A VAR lag length of order 1 was selected by the Schwarz Bayesian information criterion and Akaike information criterion. “FROM” shows the total spillovers received by a firm i from all other series. “TO” shows the total spillovers transmitted by a company i to all other firms. The row “ALL” shows the total spillovers transmitted by variable i to all series, including itself. “NET” shows the net spillovers from firm i to all other firms j. TCI is the total spillover index.

The diagonal elements correspond to the “own variance share” ([39]) and are the highest values in the table. The sum of the rows of the pair connection gives an estimate of the total directional spillover “from others”. Therefore, the rightmost column corresponds to the share of volatility shocks received from other oil companies. While the sum of the columns of the pair connection gives a view of the total directional spillover “to others”. Finally, the difference between the sum of the column of each firm and the sum of the rows of the same company gives the net-connectedness of the respective firm to all the other firms. Table 3 shows that the most significant measurement of pair connectivity is 26.29%, with pair connectivity occurring from EJR to CJR. As we can note, EJR and CJR are both Japanese clean technology companies. Therefore, they can be considered similar in terms of portfolio diversification. The companies, AM and CS (both belong to the SOLAR sector), are the main transmitters of net volatility (13.07% and 8.61%, respectively) for all other firms. SDI (TECH), URE (SOLAR) are the main volatility receivers (−6.17% and −5.27%, respectively). This preliminary result indicates that even small companies in terms of total asset contribute to the volatility connection.

In order to explore the COVID-19 effect on the evolution of the connection, we split the sample in the pre- and post-outbreak.

As we can see from Table 4 and Table 5, volatility connectedness changes if we consider the periods before and after the start of the COVID-19 outbreak. As was to be expected, there is evidence of substantial growth in connection, i.e., the index varies from 21.36% to 61.23%. This indicates a high interdependence between the volatilities during the COVID-19 period. Focusing on directional connections (TO and FROM), we find that they have increased considerably for all variables. For instance, from-connectedness varies between 29.97% and 76.21% compared to the pre-COVID-19 period (from 3.03% to 40.55%). At the same time, to-connectedness has increased from a maximum of 48.38% (CS) in the pre-COVID-19 period to 125% (AM) in the current period. On the other hand, the double shock that hit the oil market (the COVID-19 pandemic and the dissolution of the OPEC production agreement) has transformed its role (transmitter) within the energy market. In fact, it has gone from volatility emitter (0.79%) to a volatility receiver (−14.36%). This finding suggests that the volatility of the WTI is affected by the volatilities of clean sector companies. These results appear to be in agreement with [6,29,40], who reveals how the crude oil is a net recipient of volatility connectedness.

Table 4.

Volatility connectedness Pre-COVID-19. Volatility connectedness for 24 clean energy firms and WTI crude oil for the pre-COVID-19 outbreak from 4 January 2011 to 31 December 2019. Variance decompositions are based on 10-days-ahead forecasts. A VAR lag length of order 1 was selected by the Schwarz Bayesian information criterion and Akaike information criterion. “FROM” shows the total spillovers received by a firm i from all other series. “TO” shows the total spillovers transmitted by a company i to all other firms. The row “ALL” shows the total spillovers transmitted by variable i to all series, including itself. “NET” shows the net spillovers from firm i to all other firms j. TCI is the total spillover index.

Table 5.

Volatility connectedness during COVID-19. Volatility connectedness for 24 clean energy firms and WTI crude oil for during COVID-19 outbreak from 2 January 2020 to 25 June 2020. Variance decompositions are based on 10-days-ahead forecasts. A VAR lag length of order 1 was selected by the Schwarz Bayesian information criterion and Akaike information criterion. “FROM” shows the total spillovers received by a firm i from all other series. “TO” shows the total spillovers transmitted by a company i to all other firms. The row “ALL” shows the total spillovers transmitted by variable i to all series, including itself. “NET” shows the net spillovers from firm i to all other firms j. TCI is the total spillover index.

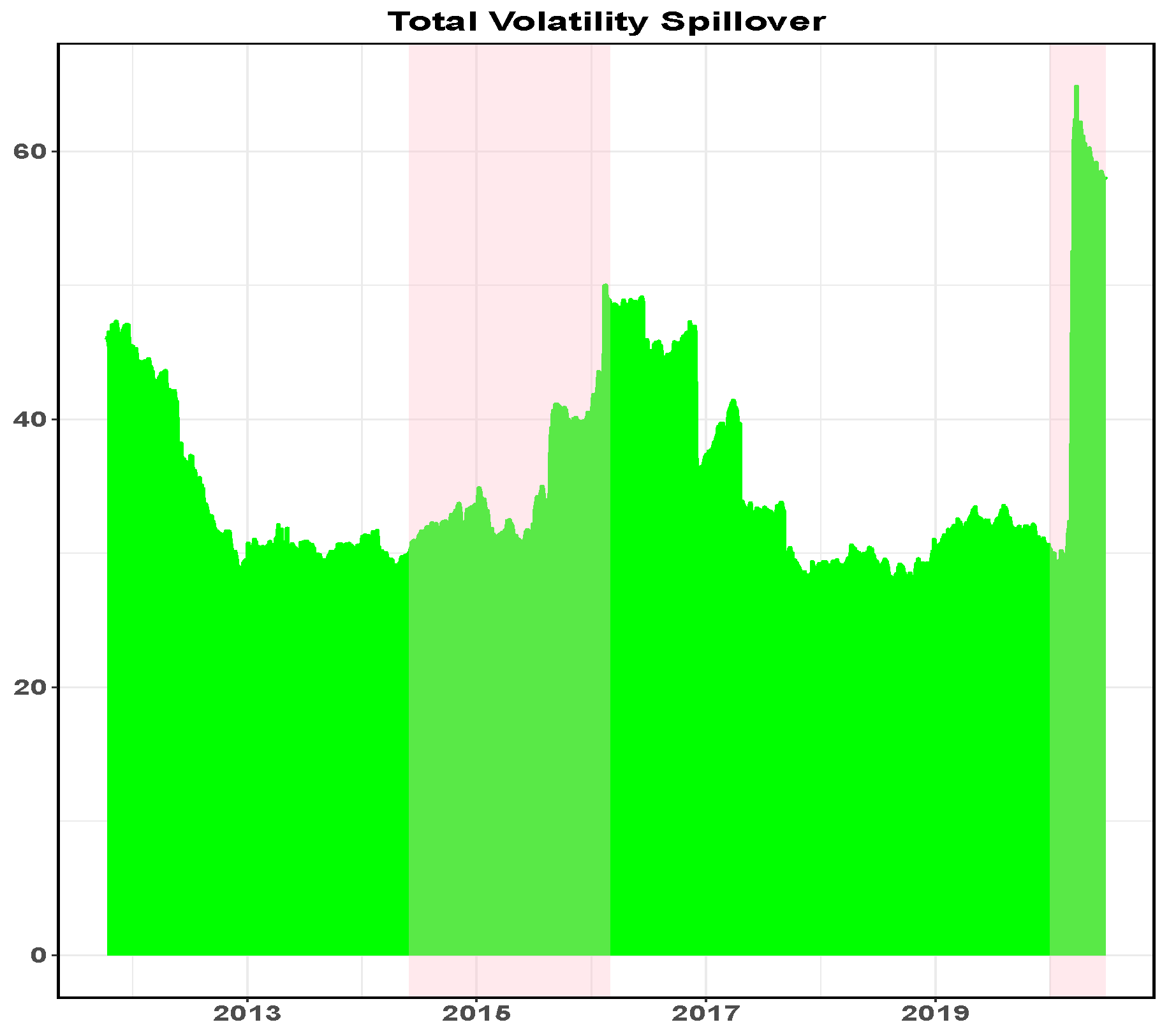

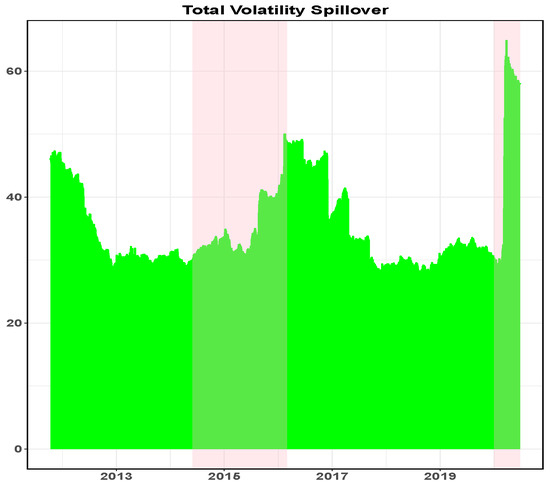

Table 3, Table 4 and Table 5 report the static results of connectedness, i.e., the intensity of interdependence observed between markets is assumption constant over time. However, the various financial and non-financial events that occurred during the sample period may have triggered significant changes in volatility transmission patterns. Therefore, attention should be paid to the time dynamics of the connections. For this purpose, in Figure 2, we plot the total volatility spillover using 200 days rolling windows.

Figure 2.

Total volatility spillover. Time series plot of total volatility spillover. It is calculated with a rolling window of 200 day and predictive horizon for the underlying variance decomposition with 10-step-ahead forecasts. The shaded area denotes the period of oil price drop (June 2014 to February 2016) and COVID-19 outbreak (January 2020 to now).

The index in Figure 2 presents three major volatility transmission cycles. The first coincided with the start of the analysis and ended at the end of 2012. During this period, the connection reached 47.08%. This dynamic reflects several events that occurred during those years, such as, the European sovereign debt crisis, the political upheaval in the Middle East and North Africa and the war in Libya in 2012. During the second cycle (2014–2017), the link fluctuated between 40% and 50%. This period coincided with a drastic reduction in oil prices. During this period, oil prices decreased due to a significant rise in oil production in the United States and a drop in demand in developing countries [37,39]. It is interesting to note that after the drop in oil, volatility spillover increases. A possible explanation could be that a low price of oil stimulated investors to sell “clean” and buy oil. In fact, according to the theory of substitution effect, low oil prices reduce the use of renewable energy due to the high costs associated with the construction and installation of these energy systems [17]. This implies a decrease in the returns of clean energy companies [9,41]. Later, the connection returned to 30%, but increased again at the beginning of 2020, coinciding with the emergence of the new infectious disease (COVID-19). After the outbreak of the epidemic, volatility spillovers reached a higher point than previous peaks (64.85%). In fact, during this period, the spot price of WTI crude oil fell to even negative values, which is the lowest price ever reached [42,43].

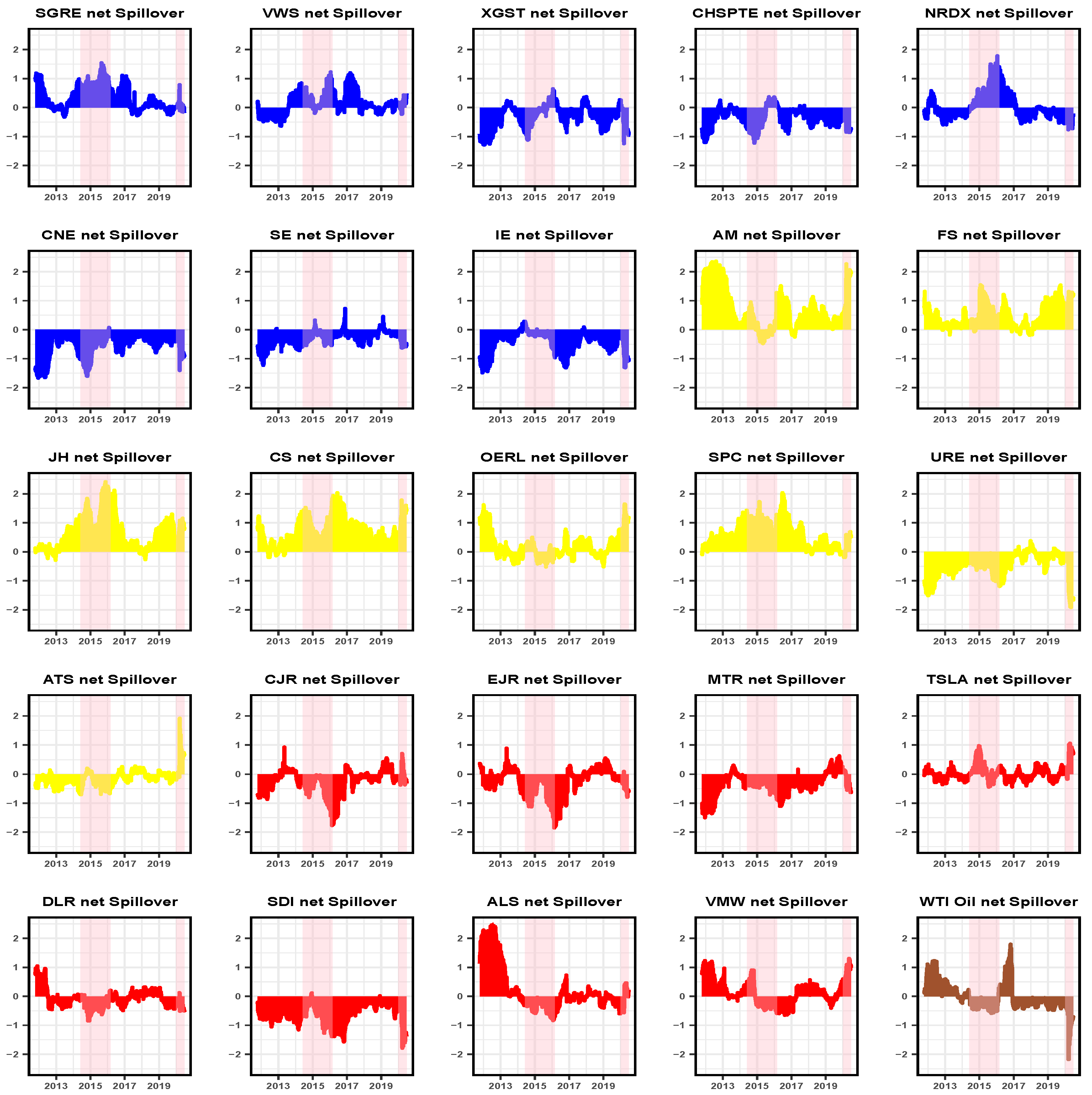

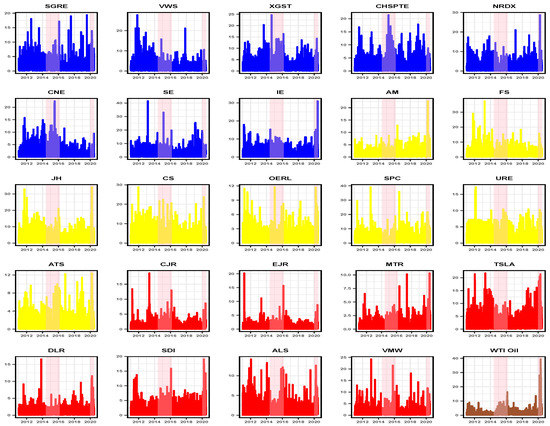

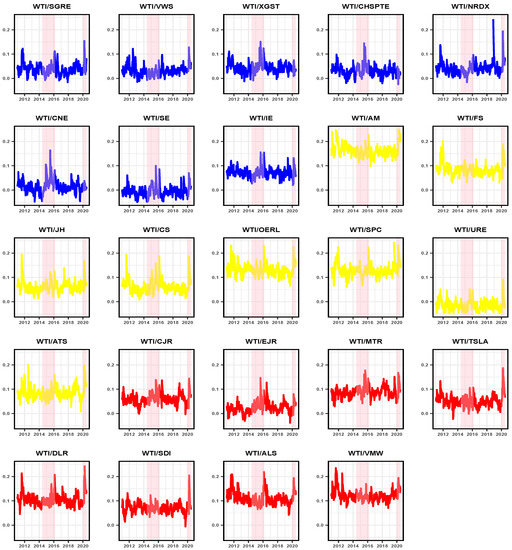

We present in Figure 3 the patterns of net volatility spillover. This measure shows the information about the direction of the volatility, i.e., from one market to all the other ones. Negative (positive) values mean that a market receives (transmits) more volatility than it transmits (receives). The net effects of volatility for each stock market show an asymmetry in the magnitude of negative and positive values over time. Figure 3 displays different dynamics concerning the clean sector, both at the level of individual companies. We can see that firms in the SOLAR sector are the most transmitters of volatility, according to the results of [4,44,45]. At the same time, TECH companies are, on average, the net receivers.

Figure 3.

Net volatility spillover. Time series plot of net volatility spillover. Blue: Wind firms; Yellow = Solar firms; Red = Clean Technology firms; Brown = WTI Oil. The shaded area denotes the period of oil price drop (June 2014 to February 2016) and COVID-19 outbreak (January 2020 to now).

The dynamics of WTI oil are fluctuating. In the last three years, it has been a net risk receiver. These results are perfectly in line with [6,14,24,40], who find the same empirical evidence. In particular, they find that the value of shock transmitted from oil price to clean energy stocks is lower than the amount of shock transmitted oppositely.

5.2. Correlation and Portfolio Management

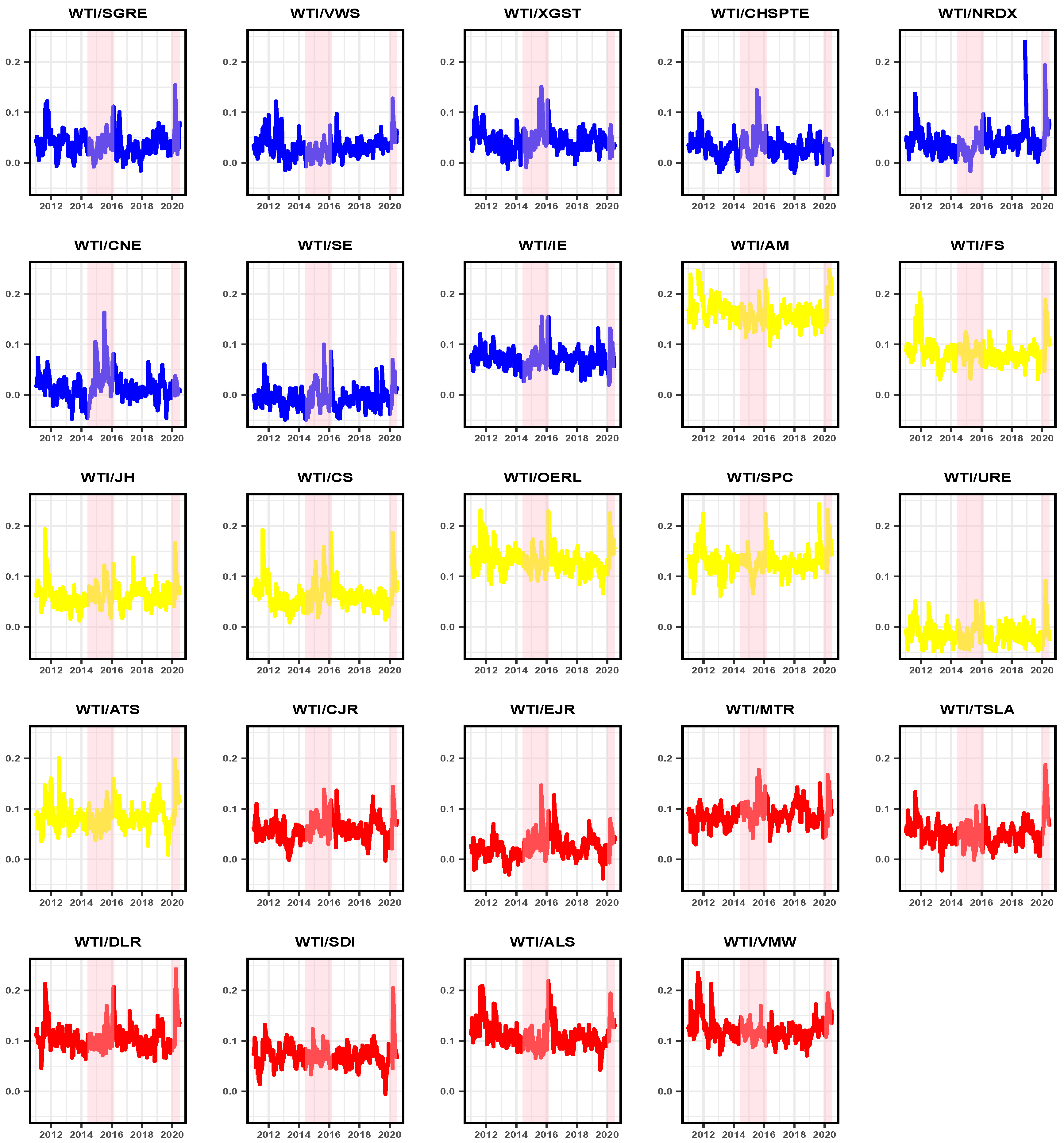

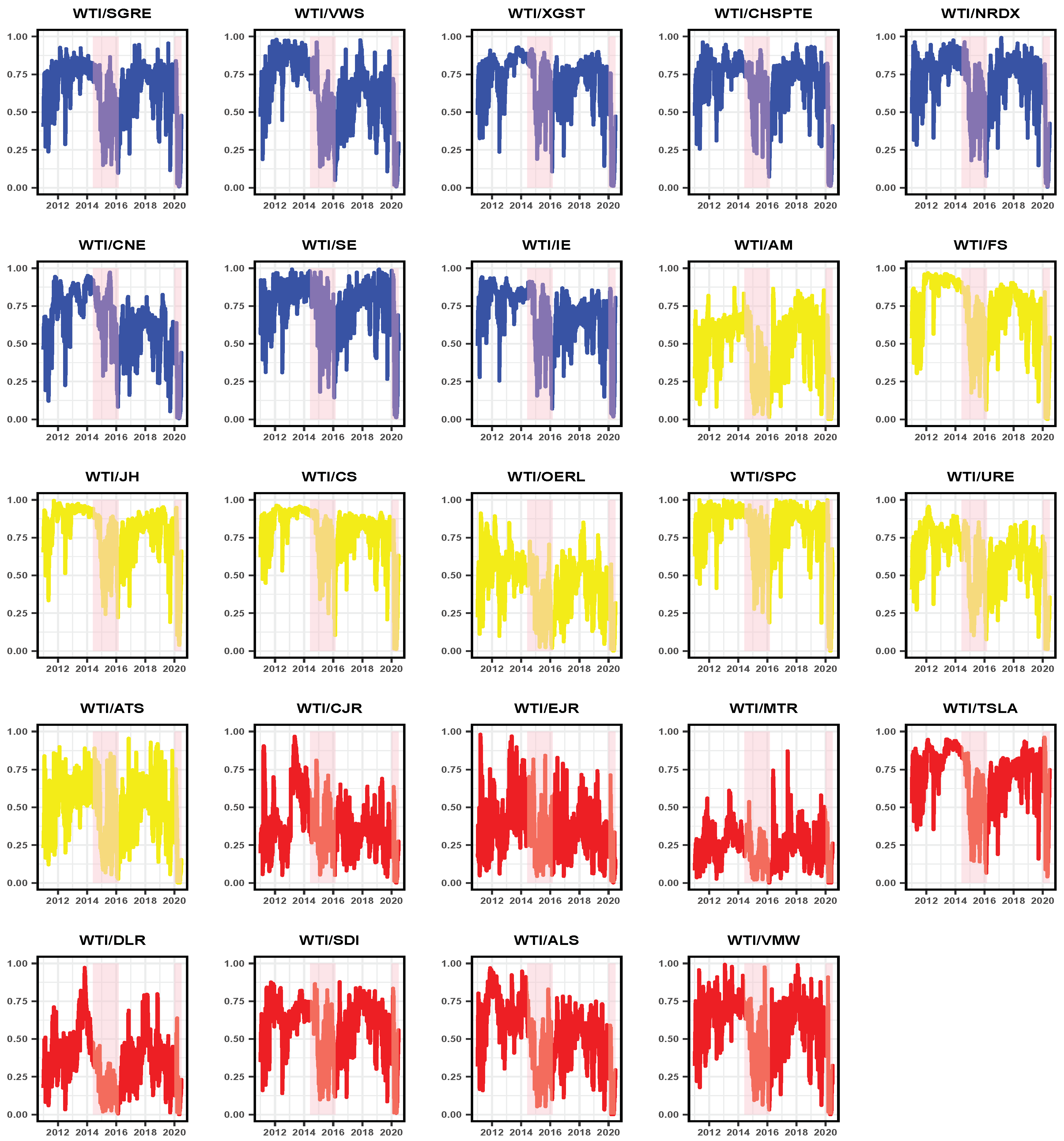

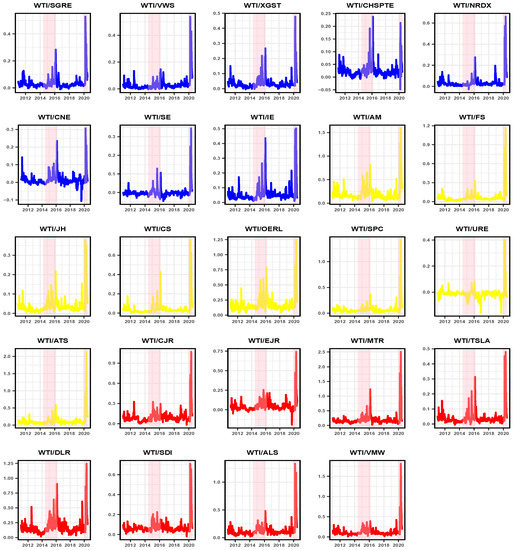

In this section, we analyse the relationship between oil price and clean energy stock prices on portfolio diversification and risk management view. For this purpose, first, we compute the dynamic conditional correlation [28], and second, we use the results of the DCC model to build an optimal portfolio diversification strategy. Figure 4 plots the time-varying conditional correlations from the DCC model.

Figure 4.

Dynamic conditional correlation. Time series plot of dynamic conditional correlation. Blue: Wind firms; Yellow = Solar firms; Red = Clean Technology firms; Brown = WTI Oil. The shaded area denotes the period of oil price drop (June 2014 to February 2016) and COVID-19 outbreak (January 2020 to now).

We can see that the dynamics are not constant and that for each asset, a volatility clustering model is evident. The correlations oscillate from a minimum of −0.07 (WTI/URE) to a maximum of 0.33 (WTI/AM). In addition, the figure displays how, during the fall of the oil price, and during the COVID-19 outbreak, all volatility connections increased dramatically. The dynamics of conditional correlation are quite homogeneous even at a sectoral level, with peaks during periods of high uncertainty.

The correlation between the clean and oil market has changed over time, influenced by extreme events. Therefore, a question we aim to answer is whether there are optimal diversification strategies in the previous period, or during the COVID-19 pandemic. Following [2,6,24], we calculate two alternative diversification strategies: the optimal hedge ratio and the optimal portfolio weight. Both diversification strategies are computed by the DCC model. In the next section, we analyse the implications of these results from a portfolio management perspective.

5.2.1. Hedging

A typical hedging strategy can be implemented by taking a long position on one asset (i) and a short position on the other one (j). In our case, following [24], we assume that investors are taking a long position in the volatility of the WTI oil when the future volatility of either asset is expected to be higher than the current level of volatility. A short position is expected when future volatility is expected to decrease. To calculate the hedge ratios, we use the conditional variance estimated [46,47]. The time-varying optimal hedge ratio between WTI oil volatility (o) and clean firm volatility (f) is defined as follows:

where is the conditional covariance of WTI oil volatility and clean firm volatility, while is the conditional variance of clean firm volatility.

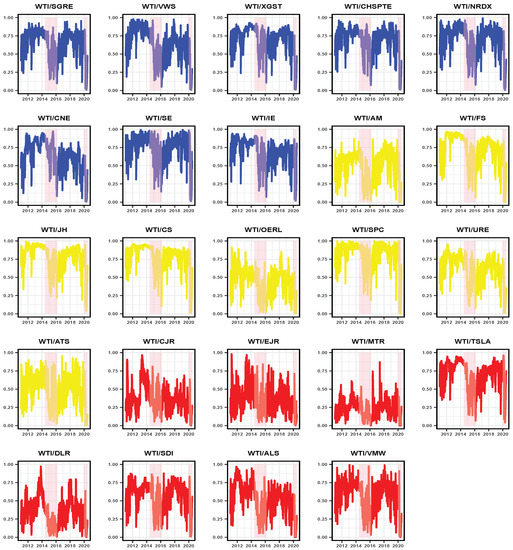

Figure 5 shows the dynamic of hedge ratios. As we can see, all series (for WTI hedged with the 24 clean energy companies) fluctuate significantly over time. Besides, all hedge ratios indicate a rise in hedging costs during periods of high volatility, such as during the oil price collapse and the COVID-19 era. This result confirms the analysis of [6], who documents the same dynamics at an aggregate level.

Figure 5.

Time-varying hedge ratios. Time series plot of time-varying optimal hedge ratios. It is computed from DCC model. Long (WTI) and short (clean energy firm). Blue: Wind firms; Yellow = Solar firms; Red = Clean Technology firms; Brown = WTI Oil. The shaded area denotes the period of oil price drop (June 2014 to February 2016) and COVID-19 outbreak (January 2020 to now).

Table 6 shows the summary statistics of hedges ratios for three estimations: (i) full sample, (ii) pre-COVID-19 and (iii) for the COVID-19 era.

Table 6.

Hedge ratios summary statistics.

The average value of the hedge ratios between a long position in WTI volatility and a short position in the volatility of clean energy companies varies between 19 and 0.1 cents of a dollar. We can see that the most expensive hedge for a long position of 1$ in WTI is obtained with AM, while the cheapest is obtained with SE. Focusing on the different periods, we can see that the average hedging ratios for a long 1$ position in WTI volatility change significantly, pre- and during COVID-19. In the last period, the hedge ratios have increased considerably, from a maximum of 16 cents (MTR company) in the pre-COVID-19 period to a maximum of 1$ (DLR company). This suggests that it has become more expensive to hedge, i.e., a grow in the cost of hedging due to the rise in the number of contracts required for the hedging strategy. Moreover, WTI/SE, WTI/URE (pre-COVID-19), WTI/CHSPTE and WTI/SE (COVID-19 era) have negative average values. This is mainly due to negative conditional correlations. This implies that for these activity pairs, either long positions should be taken on each asset, or short positions on both assets [22]. At the sector level, we find that wind is the cheapest sector; 0.22 cents in the pre-COVID-19 period, 22 cents during the pandemic period. Therefore, the wind sector is the most useful for hedging against the volatility of the WTI. On the other hand, the solar sector is the most expensive (53 cents).

5.2.2. Optimal Portfolio Weight

Now, we compute the optimal portfolio weights for WTI oil and clean energy firms. Following [47], we define:

where is the weight of WTI volatility in a 1$ dollar portfolio of WTI volatility and one clean energy firm stock price volatility at time t. For definition, the weight of the one clean energy firm volatility is equal to . In Figure 6, we plot the time-varying portfolio weights. We can note that during high volatility periods (e.g., drop-oil and COVID-19 era), the optimal weights tend to be zero, i.e., zero dollar investment in WTI volatility. This means that the minimum variance portfolio is obtained by using a single asset, namely one clean energy firm. Table 7 reports the summary statistics for the portfolio weights for the oil-clean portfolio.

Figure 6.

Time-varying portfolio weights. Time series plot of time-varying portfolio weights. It is computed from DCC model. Blue: Wind firms; Yellow = Solar firms; Red = Clean Technology firms; Brown = WTI Oil. The shaded area denotes the period of oil price drop (June 2014 to February 2016) and COVID-19 outbreak (January 2020 to now).

Table 7.

Portfolio weights summary statistics.

The average of optimal weight ranges from a minimum of 0.24 for MTR to a maximum of 0.81 for SPC. This indicates that for a 1$ portfolio, 0.24 (0.81) cents should be invested in MTR (SPC) and 76 (19) cents in WTI oil. Again, we can see the significant impact of the COVID-19 outbreak. All optimal weights are drastically reduced. For example, WTI/SGRE went from 0.67 in the pre-COVID-19 period to 0.30 in the COVID-19 period. This pattern documents that the clean sector has become important in optimal diversification strategies. Finally, we can observe that, as with hedge ratios, there are significant variations in the optimal portfolio weights over time and in all sectors of clean energy. For instance, for the WTI/WIND pair, the optimal weight has been reduced by 43% (from 0.68 to 0.29).

6. Conclusions

In this paper, we investigate the volatility connectedness between WTI crude oil price and 24 stock prices of major clean energy firms (wind, solar and technology) from 2011 to 2020, using the [26,27] model. We analysed the connection of static volatility using full sample estimation, pre-COVID-19, during COVID-19, and the total volatility spillover using rolling-sample estimation. Furthermore, we examined the contribution of each company to the total dynamic connection. Finally, by the DDC model [28], we highlighted the results in terms of asset management.

Our empirical findings can be summarised as follows. First, the connection analysis provides evidence of strong volatility spillover effects on the energy market during high stress episodes after the onset of the global pandemic. Specifically, the total connectedness index changes from 21.36% to 61.23%. Besides, we show how the WTI oil from volatility transmitter (before the outbreak of the pandemic) becomes a risk receiver after the start of the global pandemic COVID-19. These results corroborate the analysis of [2,6,14], who find that dynamic connectedness between oil and clean energy sector reach their highest values in turbulence times. Second, our results indicate that the cost of using oil as a hedging instrument for clean energy stocks is variable over time. We show how the hedge ratios reached their maximum during the COVID-19 outbreak. In fact, both average hedge and portfolio weights ratios vary considerably, pre-, and during COVID-19.

Our results significantly exhibit the importance of a disaggregated approach to investigate the oil-clean nexus. A disaggregated analysis highlights different heterogeneity within the clean energy market, suggesting important implications for investors and policymakers. The results point out the importance of active portfolio management at the disaggregated level. For example, investors should give importance to clean companies that act as net transmitters of volatility because they can influence the risk of other companies. Hence, the research can help policymakers better understand the relationship and risks between clean companies and oil. It can also help them to define reasonable energy policies based on the information transmission characteristics of the different periods. Moreover, according to [6], energy policies to promote clean energy investments should take into account the distinctive characteristics of each clean energy sub-sector. As clean energy markets are increasingly important, necessary policy actions should be taken to ensure price stability in times of economic turbulence such as the current one. Overall, the evolving nature of COVID-19 situation makes it difficult to predict what the pandemic really means for the clean energy sector. However, policymakers should develop more policies, such as subsidies that can stimulate the development of the sector.

The main limitation of our research concerns the selected companies (only eight for each sector, given the limited availability of data). Therefore, a significant extension could be to consider other clean firms in order to have a more comprehensive view of the degree of connection. Moreover, a further extension, from the methodological point of view, it would be to apply the recent methodology of TVP-VAR proposed by [48]. This framework allows us to overcome the disadvantages of the rolling window connection approach, especially in the case of short time-series data.

Author Contributions

The current paper is a combined effort of M.F. and E.A. Conceptualisation, M.F. and E.A.; data curation, M.F.; formal analysis, M.F.; methodology, M.F.; software, M.F.; validation, M.F.; visualisation, M.F.; writing—original draft preparation, M.F.; writing—review and editing, M.F. and E.A.; supervision, E.A. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Henriques, I.; Sadorsky, P. Oil prices and the stock prices of alternative energy companies. Energy Econ. 2008, 30, 998–1010. [Google Scholar] [CrossRef]

- Sadorsky, P. Correlations and volatility spillovers between oil prices and the stock prices of clean energy and technology companies. Energy Econ. 2012, 34, 248–255. [Google Scholar] [CrossRef]

- Managi, S.; Okimoto, T. Does the price of oil interact with clean energy prices in the stock market? Jpn. World Econ. 2013, 27, 1–9. [Google Scholar] [CrossRef]

- Reboredo, J.C. Is there dependence and systemic risk between oil and renewable energy stock prices? Energy Econ. 2015, 48, 32–45. [Google Scholar] [CrossRef]

- Reboredo, J.C.; Rivera-Castro, M.A.; Ugolini, A. Wavelet-based test of co-movement and causality between oil and renewable energy stock prices. Energy Econ. 2017, 61, 241–252. [Google Scholar] [CrossRef]

- Pham, L. Do all clean energy stocks respond homogeneously to oil price? Energy Econ. 2019, 81, 355–379. [Google Scholar] [CrossRef]

- Maghyereh, A.I.; Awartani, B.; Abdoh, H. The co-movement between oil and clean energy stocks: A wavelet-based analysis of horizon associations. Energy 2019, 169, 895–913. [Google Scholar] [CrossRef]

- Zhang, H.; Cai, G.; Yang, D. The impact of oil price shocks on clean energy stocks: Fresh evidence from multi-scale perspective. Energy 2020, 196, 117099. [Google Scholar] [CrossRef]

- Kumar, S.; Managi, S.; Matsuda, A. Stock prices of clean energy firms, oil and carbon markets: A vector autoregressive analysis. Energy Econ. 2012, 34, 215–226. [Google Scholar] [CrossRef]

- Haixia, W.; Shiping, L. Volatility spillovers in China’s crude oil, corn and fuel ethanol markets. Energy Policy 2013, 62, 878–886. [Google Scholar] [CrossRef]

- Inchauspe, J.; Ripple, R.D.; Trück, S. The dynamics of returns on renewable energy companies: A state-space approach. Energy Econ. 2015, 48, 325–335. [Google Scholar] [CrossRef]

- Li, H.; An, H.; Liu, X.; Gao, X.; Fang, W.; An, F. Price fluctuation in the energy stock market based on fluctuation and co-fluctuation matrix transmission networks. Energy 2016, 117, 73–83. [Google Scholar] [CrossRef]

- Dutta, A. Oil price uncertainty and clean energy stock returns: New evidence from crude oil volatility index. J. Clean. Prod. 2017, 164, 1157–1166. [Google Scholar] [CrossRef]

- Ferrer, R.; Shahzad, S.J.H.; López, R.; Jareño, F. Time and frequency dynamics of connectedness between renewable energy stocks and crude oil prices. Energy Econ. 2018, 76, 1–20. [Google Scholar] [CrossRef]

- Dutta, A.; Bouri, E.; Noor, M.H. Return and volatility linkages between CO2 emission and clean energy stock prices. Energy 2018, 164, 803–810. [Google Scholar] [CrossRef]

- Shahzad, S.J.H.; Hernandez, J.A.; Al-Yahyaee, K.H.; Jammazi, R. Asymmetric risk spillovers between oil and agricultural commodities. Energy Policy 2018, 118, 182–198. [Google Scholar] [CrossRef]

- Uddin, G.S.; Rahman, M.L.; Hedström, A.; Ahmed, A. Cross-quantilogram-based correlation and dependence between renewable energy stock and other asset classes. Energy Econ. 2019, 80, 743–759. [Google Scholar] [CrossRef]

- Ji, Q.; Du, Y.J.; Geng, J.B. The dynamic dependence of fossil energy, investor sentiment and renewable energy stock markets. Energy Econ. 2019, 84, 104564. [Google Scholar]

- Yahya, M.; Ghosh, S.; Kanjilal, K.; Dutta, A.; Uddin, G.S. Evaluation of cross-quantile dependence and causality between non-ferrous metals and clean energy indexes. Energy 2020, 202, 117777. [Google Scholar] [CrossRef]

- Rizwan, M.S.; Ahmad, G.; Ashraf, D. Systemic Risk: The Impact of COVID-19. Finace Res. Lett. 2020, 36, 101682. [Google Scholar] [CrossRef]

- Ashraf, B.N. Stock markets’ reaction to COVID-19: Cases or fatalities? Res. Int. Bus. Financ. 2020, 54, 101249. [Google Scholar] [CrossRef]

- Ahmad, W.; Sadorsky, P.; Sharma, A. Optimal hedge ratios for clean energy equities. Econ. Model. 2018, 72, 278–295. [Google Scholar] [CrossRef]

- Bondia, R.; Ghosh, S.; Kanjilal, K. International crude oil prices and the stock prices of clean energy and technology companies: Evidence from non-linear cointegration tests with unknown structural breaks. Energy 2016, 101, 558–565. [Google Scholar] [CrossRef]

- Antonakakis, N.; Cunado, J.; Filis, G.; Gabauer, D.; De Gracia, F.P. Oil volatility, oil and gas firms and portfolio diversification. Energy Econ. 2018, 70, 499–515. [Google Scholar] [CrossRef]

- Mandacı, P.E.; Cagli, E.Ç.; Taşkın, D. Dynamic connectedness and portfolio strategies: Energy and metal markets. Resour. Policy 2020, 68, 101778. [Google Scholar] [CrossRef]

- Diebold, F.X.; Yılmaz, K. Better to give than to receive: Predictive directional measurement of volatility spillovers. Int. J. Forecast. 2012, 28, 57–66. [Google Scholar] [CrossRef]

- Diebold, F.X.; Yılmaz, K. On the network topology of variance decompositions: Measuring the connectedness of financial firms. J. Econom. 2014, 182, 119–134. [Google Scholar] [CrossRef]

- Engle, R. Dynamic conditional correlation: A simple class of multivariate generalized autoregressive conditional heteroskedasticity models. J. Bus. Econ. Stat. 2002, 20, 339–350. [Google Scholar] [CrossRef]

- Ahmad, W. On the dynamic dependence and investment performance of crude oil and clean energy stocks. Res. Int. Bus. Financ. 2017, 42, 376–389. [Google Scholar] [CrossRef]

- Nasreen, S.; Tiwari, A.K.; Eizaguirre, J.C.; Wohar, M.E. Dynamic connectedness between oil prices and stock returns of clean energy and technology companies. J. Clean. Prod. 2020, 260, 121015. [Google Scholar] [CrossRef]

- Nazlioglu, S.; Soytas, U.; Gupta, R. Oil prices and financial stress: A volatility spillover analysis. Energy Policy 2015, 82, 278–288. [Google Scholar] [CrossRef]

- Reboredo, J.C.; Ugolini, A. The impact of energy prices on clean energy stock prices. A multivariate quantile dependence approach. Energy Econ. 2018, 76, 136–152. [Google Scholar] [CrossRef]

- Forsberg, L.; Ghysels, E. Why do absolute returns predict volatility so well? J. Financ. Econom. 2007, 5, 31–67. [Google Scholar] [CrossRef]

- Wang, G.J.; Xie, C.; Jiang, Z.Q.; Stanley, H.E. Who are the net senders and recipients of volatility spillovers in China’s financial markets? Financ. Res. Lett. 2016, 18, 255–262. [Google Scholar] [CrossRef]

- Koop, G.; Pesaran, M.H.; Potter, S.M. Impulse response analysis in nonlinear multivariate models. J. Econom. 1996, 74, 119–147. [Google Scholar] [CrossRef]

- Pesaran, H.H.; Shin, Y. Generalized impulse response analysis in linear multivariate models. Econ. Lett. 1998, 58, 17–29. [Google Scholar] [CrossRef]

- Awartani, B.; Aktham, M.; Cherif, G. The connectedness between crude oil and financial markets: Evidence from implied volatility indices. J. Commod. Mark. 2016, 4, 56–69. [Google Scholar] [CrossRef]

- Maghyereh, A.I.; Awartani, B.; Bouri, E. The directional volatility connectedness between crude oil and equity markets: New evidence from implied volatility indexes. Energy Econ. 2016, 57, 78–93. [Google Scholar] [CrossRef]

- Restrepo, N.; Uribe, J.M.; Manotas, D. Financial risk network architecture of energy firms. Appl. Energy 2018, 215, 630–642. [Google Scholar] [CrossRef]

- Lundgren, A.I.; Milicevic, A.; Uddin, G.S.; Kang, S.H. Connectedness network and dependence structure mechanism in green investments. Energy Econ. 2018, 72, 145–153. [Google Scholar] [CrossRef]

- Baldi, L.; Peri, M.; Vandone, D. Clean energy industries and rare earth materials: Economic and financial issues. Energy Policy 2014, 66, 53–61. [Google Scholar] [CrossRef]

- Dutta, A.; Bouri, E.; Uddin, G.S.; Yahya, M. Impact of COVID-19 on Global Energy Markets. IAEE Energy Forum 2020, 26–29. [Google Scholar]

- Sharif, A.; Aloui, C.; Yarovaya, L. COVID-19 pandemic, oil prices, stock market, geopolitical risk and policy uncertainty nexus in the US economy: Fresh evidence from the wavelet-based approach. Int. Rev. Financ. Anal. 2020, 70, 101496. [Google Scholar] [CrossRef]

- Kazemilari, M.; Mardani, A.; Streimikiene, D.; Zavadskas, E.K. An overview of renewable energy companies in stock exchange: Evidence from minimal spanning tree approach. Renew. Energy 2017, 102, 107–117. [Google Scholar] [CrossRef]

- Kim, B.; Kim, J.; Kim, J. Evaluation model for investment in solar photovoltaic power generation using fuzzy analytic hierarchy process. Sustainability 2019, 11, 2905. [Google Scholar] [CrossRef]

- Kroner, K.F.; Sultan, J. Time-varying distributions and dynamic hedging with foreign currency futures. J. Financ. Quant. Anal. 1993, 28, 535–551. [Google Scholar] [CrossRef]

- Kroner, K.; Ng, V. Modeling asymmetric movement of asset prices. Rev. Financ. Stud. 1998, 11, 844–871. [Google Scholar] [CrossRef]

- Antonakakis, N.; Chatziantoniou, I.; Gabauer, D. Refined measures of dynamic connectedness based on time-varying parameter vector autoregressions. J. Risk Financ. Manag. 2020, 13, 84. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).