1. Introduction

In recent years, the express industry grows up rapidly with the development of e-commerce. Grace [

1] predicted that the number of global cross-border online consumers will reaching 1 billion by 2020, which is triple that that in 2014. The global e-commerce market is expected to grow at a compound annual growth rate of

. E-commerce brings great convenience to customers, while it also produces a large amount of express packaging waste [

2,

3]. Packaging materials generally include paper boxes, foam cotton, woven bags, tapes, and so on [

4]. Europe produces 73 million tons of packaging each year, including packaging paper, cardboard, plastics, and others [

5]. Chueamuangphan et al. [

6] provided reports and cases of e-commerce in Thailand, showing that the growth of e-commerce will cause the increase in solid waste and environmental issues such as global warming. In China, the express industry took more than 40 billion express orders in 2017, and only about 10% of express packages are recycled and reused [

7]. These disposable materials lead to serious solid wastes and white pollution.

The environmental problems caused by express packaging garbage have attracted wide attention from scholars. Zhang et al. [

8] discussed the current mainstream approaches for waste treatments, including landfill, incineration, and compost. The environmental impact of landfill for solid wastes was investigated by El-Fadel et al. [

3]. They pointed out that landfill not only brings potential health threats, but also incurs fire and explosion, vegetation damage, and air pollution. For plastic packing which is known as white pollution, Liu et al. [

9] showed large amounts of residual plastic film have detrimental effects on soil structure, water and nutrient transport, and crop growth, which will cause the damage of the agricultural environment and the reduction of crop yield.

How to deal with this issue is a pressing concern. Laws and regulations are necessary because of the externality of environmental behaviors. In 1991, the German government passed a packaging law that required manufacturers to recycle or dispose any packaging materials they sold. As a result, the German industry set up a “dual system” of waste collection, which picked up household packaging in parallel to the existed municipal waste-collection systems. This system greatly facilitates the recycling of packaging materials produced by manufacturers [

10]. Besides, South Korea implemented the “Volume-based Waste Fee (VWF) System” in 1995 [

11,

12]. The “Producer Responsibility Obligations Packaging Waste Regulations” was passed by UK legislation in 1997 [

13,

14]. Many potential policies for the government have been explored by scholars, including subsidies [

15,

16], incentive strategies [

17,

18], punishments [

19], and carbon emission tax (or “green tax”) [

20,

21]. Furthermore, Dong and Hua [

22], Cao and Liu [

23] investigated the willingness of consumers to recycle express packages. Pazoki and Zaccour [

24] discussed the mechanism to promote product recovery and the impact on the environments.

In general, subsidy, penalty, and tax reduction are three main policies that the government may take to control the express packaging garbage. However, most current research focuses on the qualitative analysis. Duan et al. [

7] suggested that the government should consider to establish producer responsibilities to encourage express service providers to recycle packaging waste. Express service providers, especially large companies, should take on more social responsibilities. Consumers should raise awareness of environmental protection, and do a good job of garbage classification to facilitate the recycling of waste packaging. Chueamuangphan et al. [

6] believed that both consumers and sellers are responsible for solving the problem of packaging waste. Companies need to set up a reverse logistics system to promote reuse and recycling, so that consumers can make sustainable consumption. Escursell et al. [

25] reviewed the development status of e-commerce packaging technology and pointed out the current problems of express packaging, such as excessive packaging and the use of non-renewable materials. They suggested to use degradable materials and new technologies such as 3D printing to design new express packaging. In this paper, we quantitatively consider the effects of three policies on express packaging recycling. A two-stage model is established from the perspective of manufacturers to discuss the production and recycling strategies under the three policies. Besides, we suggest an optimal choice between subsidy and tax reduction for the government when the budget is fixed. This paper provides guidelines for the government to improve related policies on promoting the recycling of express packages.

This paper is organized as follows.

Section 2 introduces a two-stage model and the objective function of the manufacturer.

Section 3 studies the optimal strategies of manufacturers under the three policies.

Section 4 summarizes the paper and provides some suggestions for the government to make decisions.

2. Models

Traditionally, the government may take three types of policies to guide the market: subsidy, penalty, and tax reduction [

24]. The subsidy policy supports the enterprises who participate in recovering and reprocessing the express packages. The penalty policy means the enterprises who fail to meet the regulations of the recovery level set by the government will be punished. Here, the tax reduction policy is to reduce the consumption of new packaging materials for express packages. Specifically, the tax for reprocessed packaging is less than that for new packaging.

Once the policy made by the government, the enterprises will determine their optimal strategies for production. In the first stage, we assume that the enterprises can only produce recyclable packaging and non-recyclable packaging without consideration of the recycling process. The recovery and reprocessing for old packaging is considered in the second stage. The enterprises may recycle old packaging and reprocess it into recovered products. Manufacturers determine the optimal quantity for each type of productions to maximize their profits.

Table 1 presents the notations for variables and parameters as follows. Here,

(including

and

) denotes non-recyclable packaging, recyclable packaging, and reprocessed packaging, respectively.

2.1. The First Stage

In the first stage, we only consider the production of non-recyclable packaging and recyclable packaging. The inverse demand functions [

26,

27] are defined as follows:

Here,

means the maximum willingness to pay of consumers [

28,

29].

denotes a negative relationship between quantities and prices. The prices of products decrease with the increasing of quantities produced by manufacturers.

characterize the competitive intensity between two types of products. The price of one type decreases when the quantity of the other type increases. The impacts are assumed to be symmetric between two types of products. The white noises in the real market are also considered by

and

with zero means and finite variances [

30,

31].

Considering the production cost

, the object of manufacturers is to maximize their expected profits by determining the quantity of two types of products

[

30]. The optimization problem in the first stage can be written as

where

denotes the profits of manufacturers.

By taking the derivative of Equation (

2), let

Then, the optimal quantities

are obtained as follows:

2.2. The Second Stage

In the second stage, in addition recyclable and non-recyclable packaging, reprocessed packaging is considered in our model. There are competitive relationships among these three types of packaging. Thus, the inverse demand functions can be defined as

The interpretation of parameters are similar to those in Equation (

1). The only difference is that there are three types of packaging competing with each other now. The price of one type will be affected by the quantity of the other two types.

Here, we consider the three common policies for the government to guide the market: subsidy, penalty, and tax reduction. Under the subsidy policy, manufacturers will get subsidies for each reprocessed packaging. It is a direct motivation to encourage manufacturers to recycle the used packaging. The regulation function is defined as , where is the per-unit subsidy. On the contrary, the penalty policy forces manufacturers to reprocess old packaging by imposing penalty. The regulation function is defined as , where is the per-unit penalty for remaining recyclable packaging. Here, Q is the maximal quantity of returnable used packages, which is viewed as a given constant. Tax reduction is another form of subsidy policy. It provides a discount rate of tax for reprocessed packaging compared with new packaging. The regulation function is defined as , where is the per-unit tax for new package and is the discount rate.

In general, considering the production cost

and the cost of acquiring and reprocessing the used packaging

, the objective function of manufacturers under the government’s policies is

Note that the quantity of reprocessed packaging

must be less than the maximal quantity

Q. Thus, the optimization problem can be written as

3. Analysis of Policies

In this section, we discuss the optimal strategies of manufactures under the three policies.

3.1. Subsidy

Under this policy, the government subsidizes

to per-unit reprocessed packaging. The regulation function is

. Then, the optimal strategy of manufacturers is to optimize Equation (

5) as follows:

By taking the derivatives of Equation (

6), let

Then, the optimal quantity

are obtained as follows:

where

Here, are symbols for convenience and are used in the following solutions.

Considering the inequality constraint

,

in Equation (

8) is the optimal reprocessed quantity when

. Otherwise, the optimal quantity should be

Q, which means all the recyclable packagings have been recycled. Intuitively, manufacturers prefer to recycle more reprocessed packaging with higher subsidies.

A numerical simulation is presented to demonstrate this result. The parameters are set by referring to the ideas in [

32]. Here, we focus on the ordinal relation of different parameters, rather than specific values. Among the three kinds of packaging, the non-recyclable packaging is one-off and thus has the lowest cost. The second is the recyclable packaging, which has higher technology. The reprocessed packaging has the highest cost when considering the costs of acquiring and reprocessing. Thus, we set

,

, and

, respectively, to characterize the ordinal relation. The parameter

is the conversion coefficient for quantity and price of the

jth packaging. The packaging with lower cost should have the lower conversion coefficient since most of costs are rigid and inevitable. The quantity has lower effects on the price of product. Thus,

,

, and

are set, respectively, which also characterize their ordinal relation. Note that both non-recyclable and recyclable packaging are new packaging, while the reprocessed packaging is reused. The competitive intensity between new packaging should be higher than they are with reused packaging. Thus, we set

and

in the numerical simulation. Besides, we assume that maximum willingness of consumers to pay

and the maximal quantity of returnable used packages

. These parameters are summarized in

Table 2.

Given the parameters in

Table 2, the optimal quantities

and profit

are solved under different

in

Table 3.

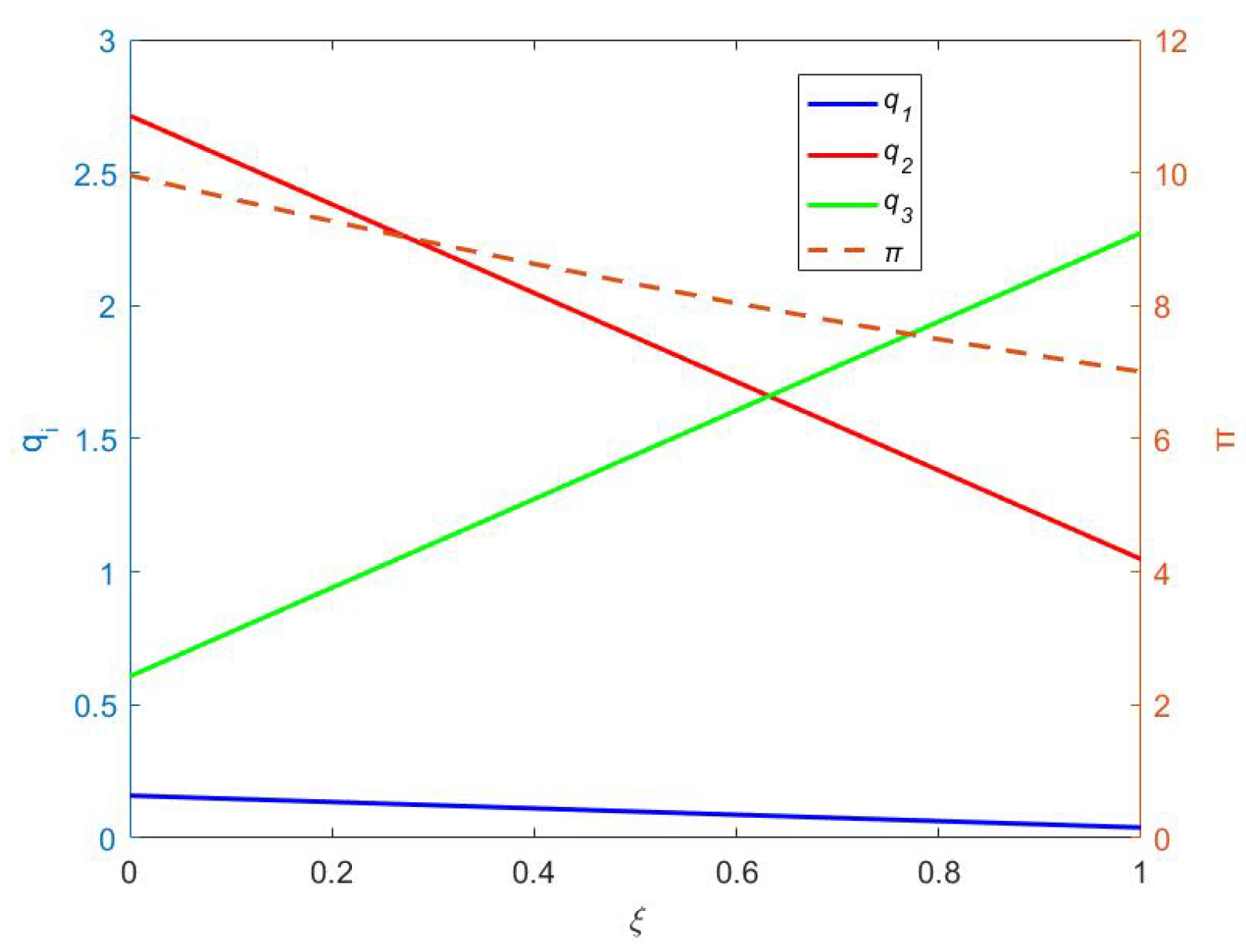

According to

Table 3, there is a significant negative trend in

and

and a positive trend in

with the increasing of

. It demonstrates that manufacturers prefer to recycle more reprocessed packaging rather than produce new packaging with higher subsidies. In addition, manufacturers gain more profits with higher subsidies from the government. The corresponding graph is shown in

Figure 1.

3.2. Penalty

Under this policy, the government imposes penalty for failing to meet the recycling requirements. The regulation function is

. It is a cost for manufacturers to avoid it, and thus they are forced to recycle used packaging. The optimal strategy of manufacturers is to optimize Equation (

5) as follows:

By taking the derivatives of Equation (

10), let

Then, the optimal quantity

are obtained as follows:

where

are defined in Equation (

9).

Considering the inequality constraint

,

in Equation (

12) is the optimal reprocessed quantity when

. Otherwise, the optimal quantity should be

Q, which means all the recyclable packagings have been recycled and manufacturers receive no penalty from the government. Using common sense, higher penalty forces manufacturers to produce more reprocessed packaging to satisfy the government’s requirement. A numerical simulation is presented to demonstrate this result. We use the same parameters in

Table 2. The optimal quantities

and profit

are solved under different

in

Table 4.

According to

Table 4, there is a significant negative trend in

and

and a positive trend in

with the increasing of

. It demonstrates that manufacturers are forced to recycle more reprocessed packaging rather than produce new packaging under higher penalty. The profits of manufacturers also decrease with higher penalty. The corresponding graph is shown in

Figure 2.

3.3. Tax Reduction

Tax reduction is another type of subsidy policies. The government may provide a discount of tax for reprocessed packaging. The regulation function is

, where

is the normal tax for new packaging and

is the discount rate. The optimal strategy of manufacturers is to optimize Equation (

5) as follows:

By taking the derivatives of Equation (

13), let

Then, the optimal quantity

are obtained as follows:

where

are defined in Equation (

9).

Considering the inequality constraint

,

in Equation (

12) is the optimal reprocessed quantity when

. Otherwise, the optimal quantity should be

Q. The government imposing less tax for reprocessed packaging may encourage the motivation of manufacturers to recycle the used packaging. Intuitively, the lower is the tax discount, the higher should be the optimal quantity of reprocessed packaging

. A numerical simulation is presented to demonstrate this result. We use the same parameters in

Table 2. The optimal quantities

and profit

are solved under different

with a fixed tax rate

in

Table 5.

According to

Table 5, there is a significant positive trend in

and

and a negative trend in

with the increasing of

. It demonstrates that manufacturers are willing to produce more reprocessed packaging when the discount of tax is lower.

In addition, we also consider the influence of parameter

on

,

,

, and

when

is fixed, which is set as an intermediate value

. Since the discount rate

is fixed, the higher tax rate

brings more tax advantages to reprocessed packaging compared with new packaging. The optimal quantity of reprocessed packaging

is expected to increase with the tax rate

.

Table 6 demonstrates this result numerically.

According to

Table 6, given a fixed

, there is a significant negative trend in

and

and a positive trend in

with the increasing of

. This demonstrates that manufacturers are more willing to recycle old packaging when the tax advantage is higher.

Figure 3 and

Figure 4 present the impacts of

and

on

,

,

, and

, respectively.

We perform the sensitivity analysis of main policy parameters

,

,

and

. The impact of these policy parameters on the decision variables

,

, and

and target profit

is summarized in

Table 7, where

denotes the positive impact and

denotes the negative impact.

3.4. Comparison of Three Policies

We continue to explore the conditions when these policies will work, i.e., . That means that manufacturers will reprocess the used products.

For the subsidy policy, the condition can be solved by

in Equation (

8) as follows:

It shows that the subsidy from the government should be larger than the threshold value. Otherwise, the subsidy cannot cover the costs of manufacturers and they may not produce the reprocessed packaging.

For the penalty policy, the condition can be solved by

in Equation (

12) as follows:

The threshold value for penalty is equal to that in the subsidy policy. It demonstrates a symmetric effect between penalty and subsidy. The government may provide subsidy to manufacturers in the positive direction or impose penalty in the negative direction. The profits of manufacturers will be influenced by the policy greatly.

For the tax reduction policy, the condition can be solved by

in Equation (

15) as follows:

The policy works when the discount rate of tax is less than the threshold value. Tax reduction is another type of subsidy policies. The lower discount rate is corresponding to higher subsidy from the government.

Among the three policies, the subsidy policy is a direct expense for the government. It encourages manufacturers to recycle the used packaging and produce reprocessed packaging. Manufacturers are happy since they gain more profits. It is a win–win result that the market becomes prosperous and the environment is protected. The disadvantage is this policy causes much financial pressure on the government when the budget is finite. The government may not have enough funds to afford this subsidy policy.

On the contrary, the penalty policy does not need to consider the constraint of budgets. It means this policy is a good choice when the budgets of the government are limited. The consequence is that it will reduce the profits and enthusiasm of manufacturers and thus may lead the market into recession.

The tax reduction policy is a combination of subsidy and penalty. It encourages manufacturers by using different tax rates for different products. It will not add financial burden for the government since it actually imposes the extra tax incomes. The goals of environment protection and prosperous markets can be attained with suitable parameters of the tax rate and the discount rate .

To sum up, every policy will take its price. There is no such thing as a free lunch. Some prices are explicit, such as direct financial expenditure. However, some prices are implicit, which will appear in the following years, such as recession of the industry. The government policy should balance the short- and long-term interests, and consider both market prosperity and budget constraints. In practice, we believe the tax reduction policy is the most promising to attain these targets.

4. Conclusions

In this paper, we consider three types of policies applied to the express packaging industry, including subsidy, penalty, and tax reduction. A two-stage model is established to characterize the decision process of manufacturers. The optimal quantities of manufacturers are solved under different policies.

In general, all three policies could guide manufacturers to produce reprocessed packaging. The subsidy policy brings manufacturers more profits and makes the market more prosperous, but it causes heavy burden for the government’s budgets. In the Chinese market, the express industry takes more than 40 billion packages each year and the number is still increasing rapidly. Even if the subsidy coefficient is small, the government will face excessive fiscal expenditures. Thus, the subsidy policy may be the best for the market and enterprises, but it may not be practical in China. The penalty policy could guide the market without extra financial investment from the government. The negative effect is that the penalty may frustrate the enthusiasm of manufacturers and thus lead the market into recession. It goes against China’s policy of developing new industries such as e-commerce. The tax reduction policy combines the properties of subsidy and penalty. The goals of environment protection and prosperous markets can be attained with suitable parameters of the tax rate and the discount rate . Thus, the tax reduction may be the most suitable policy in China. It can achieve a good balance between the development of new industries and environmental protection.