Green Production as a Factor of Survival for Innovative Startups: Evidence from Italy

Abstract

1. Introduction

2. The Italian Legislative Framework of Innovative Startups: the “Startup Act”

3. Empirical Methodology: Survival Analysis

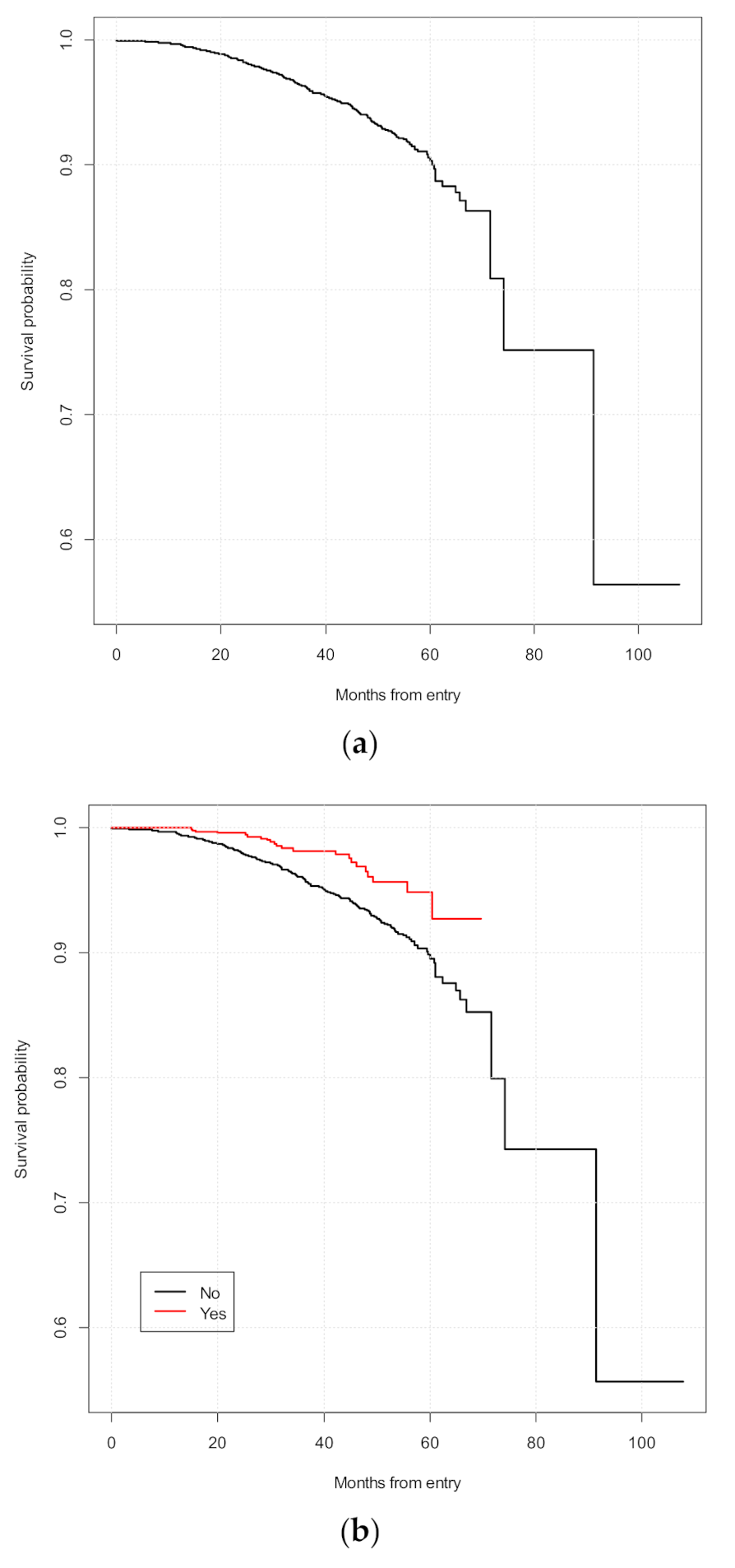

3.1. Descriptive Survival Analysis: The Kaplan-Meier Curves

3.2. Survival Regression Modelling: The Cox Proportional-Hazards Model

4. Results

5. Discussion

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Forbes. The Unfashionable Business of Investing in Startups in the Electronic Data Processing Field. Forbes, 15 August 1976; p. 6. [Google Scholar]

- Kirchhoff, B.A.; Newbert, S.L.; Hasan, I.; Armington, C. The Influence of University R & D Expenditures on New Business Formations and Employment Growth. Entrep. Theory Pract. 2007, 31, 543–559. [Google Scholar] [CrossRef]

- Baptista, R.; Esària, V.; Madruga, P. Entrepreneurship, regional development and job creation: The case of Portugal. Small Bus. Econ. 2008, 30, 49–58. [Google Scholar] [CrossRef]

- Bygrave, W.; Hay, M.; Ng, E.; Reynolds, P. Executive forum: A study of informal investing in 29 nations composing the Global Entrepreneurship Monitor. Ventur. Cap. 2003, 5, 101–116. [Google Scholar] [CrossRef]

- Colombelli, A.; Krafft, J.; Vivarelli, M. To be born is not enough: The key role of innovative start-ups. Small Bus. Econ. 2016, 47, 277–291. [Google Scholar] [CrossRef]

- Audretsch, D.B. Innovation and Industry Evolution; MIT Press: Cambridge, MA, USA, 1995. [Google Scholar]

- Reynolds, P.D. New and Small Companies in Expanding Markets. Small Bus. Econ. 1997, 9, 79–84. [Google Scholar] [CrossRef]

- Hanchi, S.E.; Kerzazi, L. Startup innovation capability from a dynamic capability-based view: A literature review and conceptual framework. J. Small Bus. Strategy 2020, 30, 72–92. [Google Scholar]

- Roberts, E.B.; Murray, F.E.; Kim, J.D. Entrepreneurship and Innovation at MIT: Continuing Global Growth and Impact—An Updated Report. Found. Trends Entrep. 2019, 15, 1–55. [Google Scholar] [CrossRef]

- Bandera, C.; Thomas, E. The Role of Innovation Ecosystems and Social Capital in Startup Survival. IEEE Trans. Eng. Manag. 2018, 66, 542–551. [Google Scholar] [CrossRef]

- Vivarelli, M.; Audretsch, D. The Link between the Entry Decision and Post-entry Performance: Evidence from Italy. Ind. Corp. Chang. 1998, 7, 485–500. [Google Scholar] [CrossRef]

- Acs, Z.J.; Audretsch, D.B. Innovation, Market Structure, and Company Size. Rev. Econ. Stat. 1987, 69, 567–574. [Google Scholar] [CrossRef]

- Shearman, C.; Burrell, G. New Technology-based Companies and the Emergence of New Industries. New Technol. Work Employ. 1998, 3, 87–99. [Google Scholar] [CrossRef]

- Matricano, D. Economic and social development generated by innovative startups: Does heterogeneity persist across Italian macro-regions? Econ. Innov. New Technol. 2020, 1–18. [Google Scholar] [CrossRef]

- Birch, D.L. The Job Generation Process; MIT Program on Neighborhood and Regional Change: Cambridge, UK, 1979. [Google Scholar]

- Birch, D.L. Job Creation in America: How Our Smallest Companies put the Most People to Work; Free Press: New York, NY, USA, 1987. [Google Scholar]

- Phillips, B.D.; Kirchhoff, B.A. Formation, growth and survival; Small firm dynamics in the U.S. Economy. Small Bus. Econ. 1989, 1, 65–74. [Google Scholar] [CrossRef]

- Rickne, A.; Jacobsson, S. New Technology-Based Firms in Sweden—A Study of Their Direct Impact on Industrial Renewal. Econ. Innov. New Technol. 1999, 8, 197–223. [Google Scholar] [CrossRef]

- Barboza, G.; Capocchi, A. Innovative startups in Italy. Managerial challenges of knowledge spillovers effects on employment generation. J. Knowl. Manag. 2020. [Google Scholar] [CrossRef]

- Stinchcombe, A.L. Social structure and organizations. In Cognition and Strategy; Elsevier BV: Amsterdam, The Netherlands, 2004; pp. 229–259. [Google Scholar]

- Gimenez-Fernandez, E.M.; Sandulli, F.D.; Bogers, M. Unpacking liabilities of newness and smallness in innovative start-ups: Investigating the differences in innovation performance between new and older small firms. Res. Policy 2020, 49, 104049. [Google Scholar] [CrossRef]

- Wiklund, J.; Baker, T.; Shepherd, D. The age-effect of financial indicators as buffers against the liability of newness. J. Bus. Ventur. 2010, 25, 423–437. [Google Scholar] [CrossRef]

- LaZear, E.P. Balanced Skills and Entrepreneurship. Am. Econ. Rev. 2004, 94, 208–211. [Google Scholar] [CrossRef]

- Dahl, M.S.; Reichstein, T. Are You Experienced? Prior Experience and the Survival of New Organizations. Ind. Innov. 2007, 14, 497–511. [Google Scholar] [CrossRef]

- Mayr, S.; Mitter, C.; Kücher, A.; Duller, C. Entrepreneur characteristics and differences in reasons for business failure: Evidence from bankrupt Austrian SMEs. J. Small Bus. Entrep. 2020, 1–20. [Google Scholar] [CrossRef]

- Eisenhardt, K.M.; Schoonhoven, C.B. Organizational Growth: Linking Founding Team, Strategy, Environment, and Growth Among U.S. Semiconductor Ventures, 1978–1988. Adm. Sci. Q. 1990, 35, 504. [Google Scholar] [CrossRef]

- Vedula, S.; Kim, P.H. Gimme shelter or fade away: The impact of regional entrepreneurial ecosystem quality on venture survival. Ind. Corp. Chang. 2019, 28, 827–854. [Google Scholar] [CrossRef]

- Shapero, A.; Giglierano, J. Exits and entries: A study in yellow pages journalism. In Frontiers of Entrepreneurship Research; Vesper, K.H., Ed.; Babson College: Wellesley, MA, USA, 1982; pp. 113–141. [Google Scholar]

- Cánovas-Saiz, L.; March-Chordà, I.; Yagüe-Perales, R.M. New evidence on accelerator performance based on funding and location. Eur. J. Manag. Bus. Econ. 2020, 29, 217–234. [Google Scholar] [CrossRef]

- Russo, P.F.; Magri, S.; Rampazzi, C. Innovative Start-Ups in Italy: Their Special Features and the Effects of the 2012 Law. SSRN Electron. J. 2016, 2, 297–329. [Google Scholar] [CrossRef]

- Finnegan, S.; Jones, C.; Sharples, S. The embodied CO2e of sustainable energy technologies used in buildings: A review article. Energy Build. 2018, 181, 50–61. [Google Scholar] [CrossRef]

- Garbasso, G. Verso Un’economia Verde: La Nuova Sfida Dell’europa; Fazi Editore: Roma, Italy, 2014. [Google Scholar]

- Crespi, F.; Ghisetti, C.; Quatraro, F. Environmental and innovation policies for the evolution of green technologies: A survey and a test. Eurasian Bus. Rev. 2015, 5, 343–370. [Google Scholar] [CrossRef]

- Iazzolino, G.; De Carolis, M.; Clemeno, P. Energy innovative start-ups and knowledge- based strategies: The italian case. Int. J. Energy Econ. Policy 2019, 9, 88–102. [Google Scholar] [CrossRef]

- Söderblom, A.; Samuelsson, M. Sources of capital for innovative start-up companies. An empirical study of the Swedish situation. Entreprenörskapsforum 2014, 9, 15–39. [Google Scholar]

- Autio, E.; Parhankangas, A. Employment generation potential of new, technology-based companies during a recessionary period: The case of Finland. Small Bus. Econ. 1998, 11, 113–123. [Google Scholar] [CrossRef]

- Ejermo, O.; Xiao, J. Entrepreneurship and survival over the business cycle: How do new technology-based firms differ? Small Bus. Econ. 2014, 43, 411–426. [Google Scholar] [CrossRef]

- Storey, D.J.; Tether, B.S. New technology-based companies in the European Union: An introduction. Res. Policy 1998, 26, 933–946. [Google Scholar] [CrossRef]

- Mazzanti, M.; Zoboli, R. Environmental efficiency and labour productivity: Trade-off or joint dynamics? A theoretical investigation and empirical evidence from Italy using NAMEA. Ecol. Econ. 2009, 68, 1182–1194. [Google Scholar] [CrossRef]

- Costantini, V.; Mazzanti, M.; Montini, A. Environmental performance, innovation and spillovers. Evidence from a regional NAMEA. Ecol. Econ. 2013, 89, 101–114. [Google Scholar] [CrossRef]

- Gilli, M.; Mancinelli, S.; Mazzanti, M. Innovation complementarity and environmental productivity effects: Reality or delusion? Evidence from the EU. Ecol. Econ. 2014, 103, 56–67. [Google Scholar] [CrossRef]

- Arbia, G.; Espa, G.; Giuliani, D.; Micciolo, R. A spatial analysis of health and pharmaceutical company survival. J. Appl. Stat. 2017, 44, 1560–1575. [Google Scholar] [CrossRef]

- Giraudo, E.; Giudici, G.; Grilli, L. Entrepreneurship policy and the financing of young innovative companies: Evidence from the Italian Startup Act. Res. Policy 2019, 48, 103801. [Google Scholar] [CrossRef]

- Schick, H.; Marxen, S.; Freimann, J. Sustainability Issues for Start-up Entrepreneurs. Greener Manag. Int. 2002, 2002, 56–70. [Google Scholar] [CrossRef]

- Ministry of Economic Development. The Italian Startup Act. Italy’s National Strategy to Support Innovative Startups and Innovative SMEs; MISE: Rome, Italy, 2019.

- Unioncamere and Fondazione Symbola. GreenItaly Report 2019. Available online: https://www.symbola.net/ricerca/greenitaly-2019/ (accessed on 8 October 2020).

- Kaplan, E.L.; Meier, P. Nonparamentric estimation from incomplete observations. J. Am. Stat. Assoc. 1958, 53, 457–481. [Google Scholar] [CrossRef]

- Peto, R.; Pike, M.C.; Armitage, P.; Breslow, N.E.; Cox, D.R.; Howard, S.V.; Mantel, N.; McPherson, K.; Peto, J.; Smith, P.G. Design and analysis of randomized clinical trials requiring prolonged observation of each patient. II. Analysis and examples. Br. J. Cancer 1977, 35, 1–39. [Google Scholar] [CrossRef]

- Cox, D.R. Regression Models and Life-Tables. J. R. Stat. Soc. Ser. B 1972, 34, 187–202. [Google Scholar] [CrossRef]

- Grambsch, P.M.; Therneau, T.M. Proportional hazards tests and diagnostics based on weighted residuals. Biometrika 1994, 81, 515–526. [Google Scholar] [CrossRef]

- Cox, D.R. Partial likelihood. Biometrika 1975, 62, 269–276. [Google Scholar] [CrossRef]

- Swaminathan, A.; Baum, J.A.; Singh, J.V. Organizational Ecology: Neither Straightjacket Nor Big Tent. Adm. Sci. Q. 1996, 41, 543. [Google Scholar] [CrossRef]

- Hannan, M.T.; Freeman, J. Structural Inertia and Organizational Change. Am. Sociol. Rev. 1984, 49, 149–164. [Google Scholar] [CrossRef]

- Panno, A. An empirical investigation on the determinants of capital structure: The UK and Italian experience. Appl. Financ. Econ. 2003, 13, 97–112. [Google Scholar] [CrossRef]

- Buchholz, H.; Eberle, T.; Klevesath, M.; Jürgens, A.; Beal, D.; Baic, A.; Radeke, J. Forward Thinking for Sustainable Business Value: A New Method for Impact Valuation. Sustainability 2020, 12, 8420. [Google Scholar] [CrossRef]

- Dressler, M.; Paunović, I. Towards a conceptual framework for sustainable business models in the food and beverage industry. Br. Food J. 2019, 122, 1421–1435. [Google Scholar] [CrossRef]

- Zhang, Y.; Khan, U.; Lee, S.; Salik, M. The Influence of Management Innovation and Technological Innovation on Organization Performance. A Mediating Role of Sustainability. Sustainability 2019, 11, 495. [Google Scholar] [CrossRef]

- Cappa, F.; Del Sette, F.; Hayes, D.; Rosso, F. How to Deliver Open Sustainable Innovation: An Integrated Approach for a Sustainable Marketable Product. Sustainability 2016, 8, 1341. [Google Scholar] [CrossRef]

- Centobelli, P.; Cerchione, R.; Esposito, E. Knowledge Management in Startups: Systematic Literature Review and Future Research Agenda. Sustainability 2017, 9, 361. [Google Scholar] [CrossRef]

- Costa, J.; Matias, J.C.D.O. Open Innovation 4.0 as an Enhancer of Sustainable Innovation Ecosystems. Sustainability 2020, 12, 8112. [Google Scholar] [CrossRef]

- Adebayo, O.P.; Worlu, R.; Moses, C.L.; Ogunnaike, O.O. An Integrated Organisational Culture for Sustainable Environmental Performance in the Nigerian Context. Sustainability 2020, 12, 8323. [Google Scholar] [CrossRef]

- Wei, S.; Ang, T.; Jancenelle, V.E. Willingness to pay more for green products: The interplay of consumer characteristics and customer participation. J. Retail. Consum. Serv. 2018, 45, 230–238. [Google Scholar] [CrossRef]

| Macro-Area | Until to 12.31.2013 | 12.31.2014 | 12.31.2015 | 12.31.2016 | 12.31.2017 | 12.31.2018 | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| n | % | n | % | n | % | n | % | n | % | n | % | |

| North-East | 113 | 20.1 | 388 | 20.9 | 786 | 22.1 | 1250 | 22.9 | 1883 | 23.6 | 2207 | 23.3 |

| North-West | 174 | 31.0 | 558 | 30.0 | 1081 | 30.4 | 1707 | 31.2 | 2495 | 31.3 | 3004 | 31.8 |

| Center | 141 | 25.1 | 391 | 21.0 | 772 | 21.7 | 1148 | 21.0 | 1636 | 20.5 | 1940 | 20.5 |

| South | 133 | 23.7 | 522 | 28.1 | 915 | 25.7 | 1358 | 24.9 | 1959 | 24.6 | 2302 | 24.4 |

| Total | 561 | 100 | 1859 | 100 | 3554 | 100 | 5463 | 100 | 7973 | 100 | 9453 | 100 |

| Sector | Until to 12.31.2013 | 12.31.2014 | 12.31.2015 | 12.31.2016 | 12.31.2017 | 12.31.2018 | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| n | % | n | % | n | % | n | % | n | % | n | % | |

| Manufacturing | 95 | 16.9 | 326 | 17.5 | 631 | 17.8 | 1008 | 18.5 | 1474 | 18.5 | 1736 | 18.4 |

| Services | 434 | 77.4 | 1437 | 77.3 | 2721 | 76.6 | 4140 | 75.8 | 6053 | 75.9 | 7208 | 76.3 |

| Tourism | 6 | 1.1 | 13 | 0.7 | 31 | 0.9 | 49 | 0.9 | 81 | 1.0 | 92 | 1.0 |

| Trade | 26 | 4.6 | 83 | 4.5 | 171 | 4.8 | 266 | 4.9 | 365 | 4.6 | 4,17 | 4.4 |

| Total | 561 | 100 | 1859 | 100 | 3554 | 100 | 5463 | 100 | 7973 | 100 | 9453 | 100 |

| Parameter | All Companies | Companies Born before 2017 | |

|---|---|---|---|

| Model 1 | Model 2 | Model 3 | |

| EnergyRelated—YES | −0.79 (0.22) *** | −0.72 (0.23) *** | −0.63 (0.24) *** |

| Industry—Services | 0.35 (0.17) ** | 0.32 (0.18) * | 0.30 (0.19) |

| Industry—Tourism | 1.17 (0.41) *** | 1.17 (0.44) *** | 0.88 (0.53) * |

| Industry—Trade | 0.49 (0.28) * | 0.51 (0.29) * | 0.43 (0.30) |

| ROA—quartile 2 | −0.78 (0.15) *** | ||

| ROA—quartile 3 | −1.87 (0.24) *** | ||

| ROA—quartile 4 | −1.71 (0.22) *** | ||

| Debt2Equity—quartile 2 | −0.12 (0.17) | ||

| Debt2Equity—quartile 3 | −0.84 (0.20) *** | ||

| Debt2Equity—quartile 4 | −0.40 (0.18) ** | ||

| YearOfEntry—2014 | 0.11 (0.21) | 0.11 (0.21) | 0.10 (0.21) |

| YearOfEntry—2015 | 0.73 (0.23) *** | 0.73 (0.23) *** | 0.61 (0.23) *** |

| YearOfEntry—2015 | 0.86 (0.26) *** | 0.86 (0.26) *** | 0.67 (0.28) ** |

| YearOfEntry—2015 | 1.49 (0.31) *** | ||

| YearOfEntry—2015 | 1.06 (0.80) | ||

| Num. obs. | 9453 | 5463 | 5010 |

| Missings | 5 | 5 | 458 |

| Num. events | 294 | 260 | 241 |

| AIC | 4695.90 | 4079.72 | 3598.62 |

| Num. events | 294 | 260 | 241 |

| PH test | 0.90 | 0.72 | 0.72 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Serio, R.G.; Dickson, M.M.; Giuliani, D.; Espa, G. Green Production as a Factor of Survival for Innovative Startups: Evidence from Italy. Sustainability 2020, 12, 9464. https://doi.org/10.3390/su12229464

Serio RG, Dickson MM, Giuliani D, Espa G. Green Production as a Factor of Survival for Innovative Startups: Evidence from Italy. Sustainability. 2020; 12(22):9464. https://doi.org/10.3390/su12229464

Chicago/Turabian StyleSerio, Riccardo Gianluigi, Maria Michela Dickson, Diego Giuliani, and Giuseppe Espa. 2020. "Green Production as a Factor of Survival for Innovative Startups: Evidence from Italy" Sustainability 12, no. 22: 9464. https://doi.org/10.3390/su12229464

APA StyleSerio, R. G., Dickson, M. M., Giuliani, D., & Espa, G. (2020). Green Production as a Factor of Survival for Innovative Startups: Evidence from Italy. Sustainability, 12(22), 9464. https://doi.org/10.3390/su12229464