Contingent Decision of Corporate Environmental Responsibility Based on Uncertain Economic Policy

Abstract

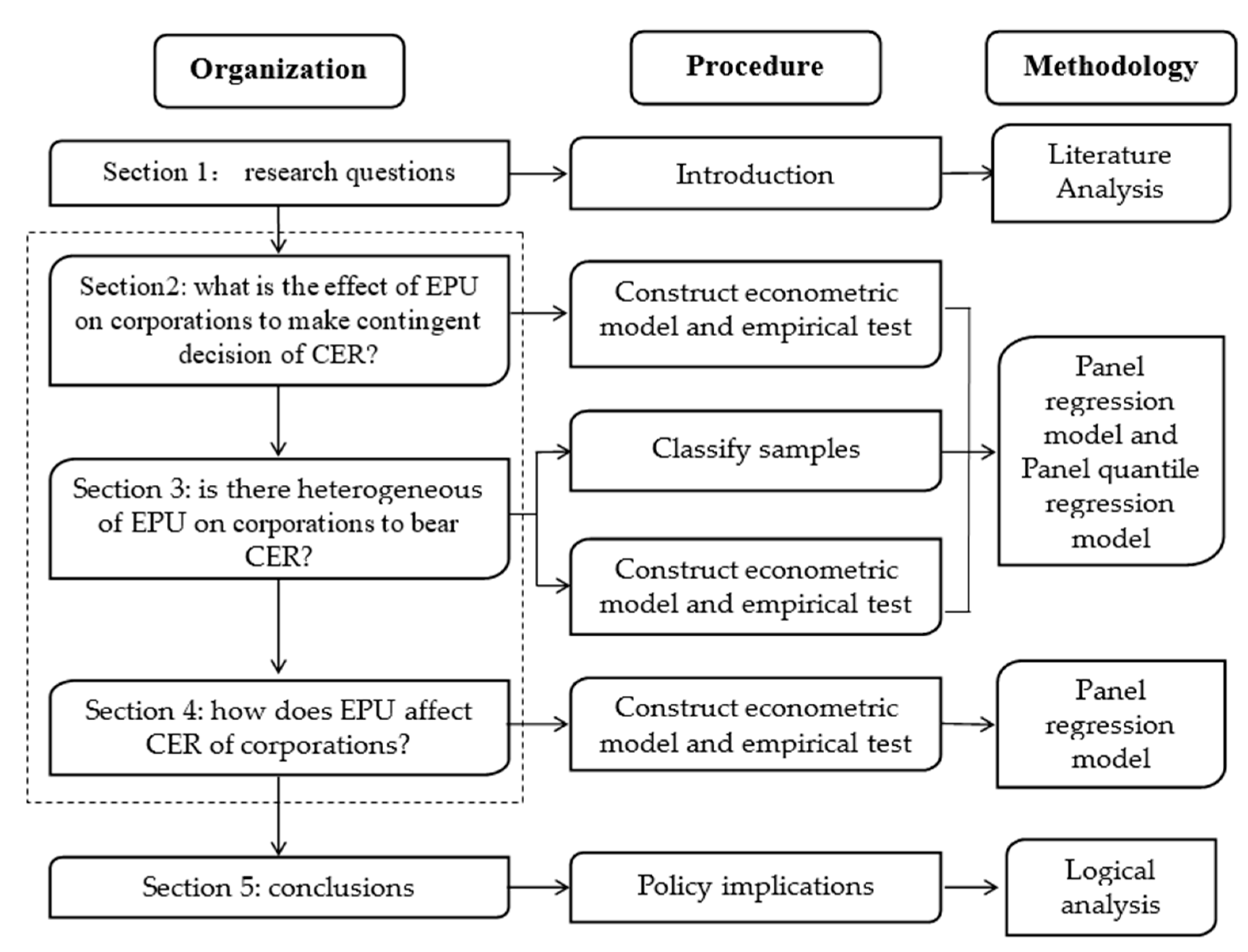

1. Introduction

2. The Effect of EPU on Corporations to Make Contingent Decisions on Undertaking CER

2.1. Methodology

2.1.1. Panel Regression Model

2.1.2. Panel Quantile Regression Model

2.2. Variables and Data

2.2.1. Dependent Variable-The Measurement of CER

2.2.2. Explanatory and Control Variables

2.2.3. Data and Descriptive Statistics

- (1)

- agriculture; forestry, animal husbandry, fishery;

- (2)

- mining;

- (3)

- manufacturing;

- (4)

- power, heat, gas and water production and supply;

- (5)

- construction;

- (6)

- wholesale and retail;

- (7)

- transportation, warehousing and postal services;

- (8)

- accommodation and catering;

- (9)

- information transportation, software and information technology services industry;

- (10)

- real estate

- (11)

- leasing and business services industry;

- (12)

- scientific research and technical services industry;

- (13)

- water conservancy, environment and public facility management industry;

- (14)

- resident service, repair and other service industry;

- (15)

- culture, sports and entertainment industry;

- (16)

- public management, social security and organization.

2.3. Empirical Results

3. Heterogeneous Impact of EPU on Decision-Making Behavior of Corporations in Environmental Responsibility

3.1. The Heterogeneity in Different Types of Corporations

3.2. Empirical Results

4. The Mediation Effect between EPU and CER

4.1. Intermediary Effect Model

4.2. Empirical Results

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Li, Z.; Liao, G.; Albitar, K. Does corporate environmental responsibility engagement affect firm value? The mediating role of corporate innovation. Bus. Strat. Environ. 2019, 29, 1045–1055. [Google Scholar] [CrossRef]

- Bahmani-Oskooee, M.; Saha, S. On the effects of policy uncertainty on stock prices: An asymmetric analysis. Quant. Financ. Econ. 2019, 3, 412–424. [Google Scholar] [CrossRef]

- Baker, S.R.; Bloom, N.; Davis, S.J. Measuring Economic Policy Uncertainty. Q. J. Econ. 2016, 131, 1593–1636. [Google Scholar] [CrossRef]

- Liu, Y.; Zheng, Y.; Drakeford, B.M. Reconstruction and dynamic dependence analysis of global economic policy uncertainty. Quant. Financ. Econ. 2019, 3, 550–561. [Google Scholar] [CrossRef]

- Ntarmah, A.H.; Kong, Y.; Gyan, M.K. Banking system stability and economic sustainability: A panel data analysis of the effect of banking system stability on sustainability of some selected developing countries. Quant. Financ. Econ. 2019, 3, 709–738. [Google Scholar] [CrossRef]

- Wang, Y.; Chen, C.R.; Huang, Y.S. Economic policy uncertainty and corporate investment: Evidence from China. Pac. Basin Financ. J. 2014, 26, 227–243. [Google Scholar] [CrossRef]

- Gulen, H.; Ion, M. Policy Uncertainty and Corporate Investment. Rev. Financ. Stud. 2015, 29, 523–564. [Google Scholar] [CrossRef]

- Xu, Z. Economic policy uncertainty, cost of capital, and corporate innovation. J. Bank. Financ. 2020, 111, 105698. [Google Scholar] [CrossRef]

- Ross, J.-M.; Fisch, J.H.; Varga, E. Unlocking the value of real options: How firm-specific learning conditions affect R&D investments under uncertainty. Strat. Entrep. J. 2017, 12, 335–353. [Google Scholar] [CrossRef]

- Van Vo, L.; Le, H.T.T. Strategic growth option, uncertainty, and R&D investment. Int. Rev. Financ. Anal. 2017, 51, 16–24. [Google Scholar] [CrossRef]

- Duong, H.N.; Nguyen, J.H.; Nguyen, M.; Rhee, S.G. Navigating through economic policy uncertainty: The role of corporate cash holdings. J. Corp. Financ. 2020, 62, 101607. [Google Scholar] [CrossRef]

- Demir, E.; Ersan, O. Economic policy uncertainty and cash holdings: Evidence from BRIC countries. Emerg. Mark. Rev. 2017, 33, 189–200. [Google Scholar] [CrossRef]

- Tran, Q.T. Economic policy uncertainty and corporate risk-taking: International evidence. J. Multinatl. Financ. Manag. 2019, 100605. [Google Scholar] [CrossRef]

- Vural-Yavaş, Ç. Economic policy uncertainty, stakeholder engagement, and environmental, social, and governance practices: The moderating effect of competition. Corp. Soc. Responsib. Environ. Manag. 2020. [Google Scholar] [CrossRef]

- Cai, L.; Cui, J.; Jo, H. Corporate Environmental Responsibility and Firm Risk. J. Bus. Ethics 2015, 139, 563–594. [Google Scholar] [CrossRef]

- Zeng, S.X.; Xu, X.D.; Yin, H.T.; Tam, C.M. Factors that Drive Chinese Listed Companies in Voluntary Disclosure of Environmental Information. J. Bus. Ethic- 2011, 109, 309–321. [Google Scholar] [CrossRef]

- He, F.; Ma, Y.; Zhang, X. How does economic policy uncertainty affect corporate Innovation?–Evidence from China listed companies. Int. Rev. Econ. Financ. 2020, 67, 225–239. [Google Scholar] [CrossRef]

- Liu, X.; Anbumozhi, V. Determinant factors of corporate environmental information disclosure: An empirical study of Chinese listed companies. J. Clean. Prod. 2009, 17, 593–600. [Google Scholar] [CrossRef]

- Ayyagari, M.; Demirgüç-Kunt, A.; Maksimovic, V. Formal versus Informal Finance: Evidence from China. Rev. Financ. Stud. 2010, 23, 3048–3097. [Google Scholar] [CrossRef]

- Li, Z.; Zhong, J. Impact of economic policy uncertainty shocks on China’s financial conditions. Financ. Res. Lett. 2020, 35, 101303. [Google Scholar] [CrossRef]

- Zhang, G.; Han, J.; Pan, Z.; Huang, H. Economic policy uncertainty and capital structure choice: Evidence from China. Econ. Syst. 2015, 39, 439–457. [Google Scholar] [CrossRef]

- Ortas, E.; Gallego-Alvarez, I.; Etxeberria, I. Álvarez Financial Factors Influencing the Quality of Corporate Social Responsibility and Environmental Management Disclosure: A Quantile Regression Approach. Corp. Soc. Responsib. Environ. Manag. 2014, 22, 362–380. [Google Scholar] [CrossRef]

- Cormier, D.; Magnan, M. Corporate Environmental Disclosure Strategies: Determinants, Costs and Benefits. J. Account. Audit. Financ. 1999, 14, 429–451. [Google Scholar] [CrossRef]

- Koenker, R.; Hallock, K.F. Quantile Regression. J. Econ. Perspect. 2001, 15, 143–156. [Google Scholar] [CrossRef]

- Machado, J.A.; Silva, J.S. Quantiles via moments. J. Econ. 2019, 213, 145–173. [Google Scholar] [CrossRef]

- Lioui, A.; Sharma, Z. Environmental corporate social responsibility and financial performance: Disentangling direct and indirect effects. Ecol. Econ. 2012, 78, 100–111. [Google Scholar] [CrossRef]

- Li, D.; Cao, C.; Zhang, L.; Chen, X.; Ren, S.; Zhao, Y. Effects of corporate environmental responsibility on financial performance: The moderating role of government regulation and organizational slack. J. Clean. Prod. 2017, 166, 1323–1334. [Google Scholar] [CrossRef]

- Kim, H.; Park, K.; Ryu, D. Corporate Environmental Responsibility: A Legal Origins Perspective. J. Bus. Ethics 2015, 140, 381–402. [Google Scholar] [CrossRef]

- Reyes-Rodríguez, J.F.; Ulhøi, J.P.; Madsen, H. Corporate Environmental Sustainability in Danish SMEs: A Longitudinal Study of Motivators, Initiatives, and Strategic Effects. Corp. Soc. Responsib. Environ. Manag. 2014, 23, 193–212. [Google Scholar] [CrossRef]

- Li, Z.; Liao, G.; Wang, Z.; Huang, Z. Green loan and subsidy for promoting clean production innovation. J. Clean. Prod. 2018, 187, 421–431. [Google Scholar] [CrossRef]

- Chen, Z.; Hamilton, T. What is driving corporate social and environmental responsibility in China? An evaluation of legacy effects, organizational characteristics, and transnational pressures. Geoforum 2020, 110, 116–124. [Google Scholar] [CrossRef]

- Berger, A.N.; Udell, G.F. Relationship Lending and Lines of Credit in Small Firm Finance. J. Bus. 1995, 68, 351. [Google Scholar] [CrossRef]

- Verrecchia, R.E. Essays on disclosure. J. Account. Econ. 2001, 32, 97–180. [Google Scholar] [CrossRef]

- Harjoto, M.A.; Jo, H. Legal vs. Normative CSR: Differential Impact on Analyst Dispersion, Stock Return Volatility, Cost of Capital, and Firm Value. J. Bus. Ethic- 2014, 128, 1–20. [Google Scholar] [CrossRef]

- Dhaliwal, D.S.; Li, O.Z.; Tsang, A.; Yang, Y.G. Voluntary Nonfinancial Disclosure and the Cost of Equity Capital: The Initiation of Corporate Social Responsibility Reporting. Account. Rev. 2011, 86, 59–100. [Google Scholar] [CrossRef]

- Cheng, B.; Ioannou, I.; Serafeim, G. Corporate social responsibility and access to finance. Strat. Manag. J. 2013, 35, 1–23. [Google Scholar] [CrossRef]

- El Ghoul, S.; Guedhami, O.; Kwok, C.C.; Mishra, D.R. Does corporate social responsibility affect the cost of capital? J. Bank. Financ. 2011, 35, 2388–2406. [Google Scholar] [CrossRef]

- Baker, S.R.; Bloom, N.; Canes-Wrone, B.; Davis, S.J.; Rodden, J. Why Has US Policy Uncertainty Risen Since 1960? Am. Econ. Rev. 2014, 104, 56–60. [Google Scholar] [CrossRef]

- Su, X.; Zhou, S.; Xue, R.; Tian, J. Does economic policy uncertainty raise corporate precautionary cash holdings? Evidence from China. Account. Financ. 2020, 26. [Google Scholar] [CrossRef]

- Dewenter, K.L.; Malatesta, P.H. State-Owned and Privately Owned Firms: An Empirical Analysis of Profitability, Leverage, and Labor Intensity. Am. Econ. Rev. 2001, 91, 320–334. [Google Scholar] [CrossRef]

- Escrig-Olmedo, E.; Muñoz-Torres, M.J.; Fernández-Izquierdo, M.; Ángeles; Rivera-Lirio, J.M. Measuring Corporate Environmental Performance: A Methodology for Sustainable Development. Bus. Strat. Environ. 2015, 26, 142–162. [Google Scholar] [CrossRef]

- Darnall, N.; Edwards, D. Predicting the cost of environmental management system adoption: The role of capabilities, resources and ownership structure. Strat. Manag. J. 2006, 27, 301–320. [Google Scholar] [CrossRef]

- Cleary, S. The Relationship between Firm Investment and Financial Status. J. Financ. 1999, 54, 673–692. [Google Scholar] [CrossRef]

- Almeida, H.; Campello, M.; Weisbach, M.S. Corporate financial and investment policies when future financing is not frictionless. J. Corp. Financ. 2011, 17, 675–693. [Google Scholar] [CrossRef]

- Bloom, N.; Bond, S.; Van Reenen, J. Uncertainty and Investment Dynamics. Rev. Econ. Stud. 2007, 74, 391–415. [Google Scholar] [CrossRef]

- Bordo, M.D.; Duca, J.V.; Koch, C. Economic policy uncertainty and the credit channel: Aggregate and bank level U.S. evidence over several decades. J. Financ. Stab. 2016, 26, 90–106. [Google Scholar] [CrossRef]

- Orlitzky, M.; Benjamin, J.D. Corporate Social Performance and Firm Risk: A Meta-Analytic Review. Bus. Soc. 2001, 40, 369–396. [Google Scholar] [CrossRef]

| Dimensions | Indicator Name |

|---|---|

| Legal consciousness | 1. Whether it follows the guide of sustainable development reporting from Global Reporting Initiative (GRI) 2. Whether it discloses environmental and sustainable development 3. Whether it is subjected to environmental penalties |

| Social evaluation | 1. Whether it receives environmental awards 2. Whether it has other environmental advantages |

| Eco-friendly production | 1. Whether it adopts a circular economy 2. Whether it has engaged in green production (measurement to decrease three waste) |

| Low-carbon technology | 1. Whether it saves energy 2. Whether it generates environment-friendly products |

| Green management | 1. Whether it has been verified by a third party 2. Whether it has vision in relation to environmental responsibility 3. Whether it has environment recognition 4. Whether it uses environmentally protected offices |

| Variable | Obs | Mean | Std.Dev. | Min | Max | |

|---|---|---|---|---|---|---|

| Full sample | CER | 4968 | 4.843 | 2.596 | 1.000 | 12.000 |

| EPU | 4968 | 1.782 | 0.784 | 0.989 | 3.648 | |

| SIZE | 4968 | 9.912 | 0.624 | 8.609 | 11.622 | |

| LEV | 4968 | 0.514 | 0.195 | 0.079 | 0.928 | |

| FP | 4968 | 0.047 | 0.057 | −0.142 | 0.234 | |

| OC | 4968 | 0.389 | 0.161 | 0.089 | 0.780 | |

| State-owned enterprise | CER | 3444 | 5.027 | 2.605 | 1.000 | 12.000 |

| EPU | 3444 | 1.781 | 0.782 | 0.989 | 3.648 | |

| SIZE | 3444 | 10.021 | 0.632 | 8.766 | 11.738 | |

| LEV | 3444 | 0.528 | 0.192 | 0.086 | 0.927 | |

| FP | 3444 | 0.041 | 0.054 | −0.152 | 0.204 | |

| OC | 3444 | 0.419 | 0.155 | 0.107 | 0.767 | |

| Non-state-owned enterprise | CER | 1524 | 4.426 | 2.528 | 1.000 | 12.000 |

| EPU | 1524 | 1.785 | 0.787 | 0.989 | 3.648 | |

| SIZE | 1524 | 9.668 | 0.540 | 8.368 | 11.049 | |

| LEV | 1524 | 0.482 | 0.197 | 0.066 | 0.942 | |

| FP | 1524 | 0.061 | 0.061 | −0.091 | 0.281 | |

| OC | 1524 | 0.322 | 0.153 | 0.075 | 0.780 | |

| Low financing constraints | CER | 2484 | 5.723 | 2.470 | 1.000 | 12.000 |

| EPU | 2484 | 1.860 | 0.847 | 0.989 | 3.648 | |

| SIZE | 2484 | 10.415 | 0.439 | 9.860 | 11.798 | |

| LEV | 2484 | 0.584 | 0.168 | 0.141 | 0.896 | |

| FP | 2484 | 0.045 | 0.048 | −0.094 | 0.215 | |

| OC | 2484 | 0.423 | 0.167 | 0.093 | 0.825 | |

| High financing constraints | CER | 2484 | 3.963 | 2.415 | 1.000 | 12.000 |

| EPU | 2484 | 1.704 | 0.707 | 0.989 | 3.648 | |

| SIZE | 2484 | 9.410 | 0.313 | 8.387 | 9.841 | |

| LEV | 2484 | 0.445 | 0.197 | 0.066 | 1.016 | |

| FP | 2484 | 0.050 | 0.065 | −0.179 | 0.246 | |

| OC | 2484 | 0.356 | 0.148 | 0.086 | 0.718 | |

| East | CER | 3681 | 4.887 | 2.652 | 1.000 | 12.000 |

| EPU | 3681 | 1.782 | 0.784 | 0.989 | 3.648 | |

| SIZE | 3681 | 9.927 | 0.655 | 8.539 | 11.725 | |

| LEV | 3681 | 0.512 | 0.196 | 0.081 | 0.922 | |

| FP | 3681 | 0.048 | 0.055 | −0.136 | 0.232 | |

| OC | 3681 | 0.391 | 0.163 | 0.083 | 0.780 | |

| Central and West | CER | 1287 | 4.717 | 2.425 | 1.000 | 12.000 |

| EPU | 1287 | 1.782 | 0.784 | 0.989 | 3.648 | |

| SIZE | 1287 | 9.871 | 0.536 | 8.817 | 11.001 | |

| LEV | 1287 | 0.520 | 0.193 | 0.075 | 0.944 | |

| FP | 1287 | 0.044 | 0.061 | −0.152 | 0.241 | |

| OC | 1287 | 0.386 | 0.156 | 0.103 | 0.825 |

| (1) Pool OLS | (2) FE | 0.1 | 0.25 | (3) 0.5 | 0.75 | 0.9 | |

|---|---|---|---|---|---|---|---|

| variables | CER | CER | CER | CER | CER | CER | CER |

| EPU | 1.122 *** | 1.189 *** | 1.363 *** | 1.293 *** | 1.189 *** | 1.089 *** | 1.008 *** |

| (0.0731) | (0.0961) | (0.148) | (0.11) | (0.0821) | (0.111) | (0.155) | |

| SIZE | 1.734 *** | 1.485 *** | 1.033 *** | 1.214 *** | 1.484 *** | 1.745 *** | 1.954 *** |

| (0.0623) | (0.229) | (0.304) | (0.226) | (0.169) | (0.227) | (0.319) | |

| LEV | −1.105 *** | −1.236 *** | −0.874 | −1.019 ** | −1.236 *** | −1.445 *** | −1.612 *** |

| (0.211) | (0.463) | (0.567) | (0.42) | (0.314) | (0.423) | (0.595) | |

| FP | −0.294 | −0.882 | −2.273 * | −1.715 * | −0.883 | −0.0796 | 0.564 |

| (0.614) | (0.891) | (1.256) | (0.932) | (0.696) | (0.938) | (1.318) | |

| OC | −0.754 *** | −0.77 *** | −0.735 * | −0.749 ** | −0.770 *** | −0.79** | −0.806 * |

| (0.208) | (0.663) | (0.839) | (0.623) | (0.465) | (0.627) | (0.881) | |

| Constant | −15.12 *** | −12.39 *** | |||||

| (0.564) | (2.069) | ||||||

| industry | Yes | No | no | no | no | no | no |

| year | Yes | yes | yes | yes | yes | yes | yes |

| individual | No | yes | yes | yes | yes | yes | yes |

| Observations | 4.968 | 4.968 | 4.968 | 4.968 | 4.968 | 4.968 | 4.968 |

| R-squared | 0.315 | 0.282 | |||||

| Number of d | 552 | 552 | 552 | 552 | 552 | 552 |

| State-Owned Enterprise | Non-State-Owned Enterprise | Low Financing Constraints | High financing Constraints | East | Central and West | |

|---|---|---|---|---|---|---|

| Variables | CER | CER | CER | CER | CER | CER |

| EPU | 1.217 *** | 0.900 *** | 1.359 *** | 0.965 *** | 1.199 *** | 0.972 *** |

| (0.088) | (0.132) | (0.116) | (0.099) | (0.084) | (0.150) | |

| SIZE | 1.706 *** | 1.751 *** | 1.673 *** | 1.817 *** | 1.722 *** | 1.482 *** |

| (0.070) | (0.146) | (0.104) | (0.142) | (0.071) | (0.138) | |

| LEV | −1.018 *** | −1.022 ** | −1.422 *** | −1.050 *** | −0.903 *** | −1.401 *** |

| (0.255) | (0.399) | (0.383) | (0.252) | (0.256) | (0.396) | |

| FP | 0.112 | −1.135 | −1.158 | −0.106 | 0.247 | −1.693 |

| (0.762) | (1.129) | (1.121) | (0.736) | (0.731) | (1.156) | |

| OC | −0.620 ** | −0.880 ** | −1.050 *** | −0.382 | −1.226 *** | 0.683 |

| (0.259) | (0.403) | (0.297) | (0.292) | (0.232) | (0.465) | |

| Constant | −15.21 *** | −14.44 *** | −14.81 *** | −15.61 *** | −15.14 *** | −12.82 *** |

| (0.646) | (1.240) | (1.085) | (1.287) | (0.633) | (1.215) | |

| industry | yes | yes | yes | yes | yes | yes |

| year | yes | yes | yes | yes | yes | yes |

| Observations | 3444 | 1524 | 2484 | 2484 | 3681 | 1287 |

| R-squared | 0.322 | 0.306 | 0.232 | 0.238 | 0.339 | 0.274 |

| Variables | CER | CER | CER | CER | CER | |

|---|---|---|---|---|---|---|

| 0.1 | 0.25 | 0.5 | 0.75 | 0.9 | ||

| state-owned enterprises | EPU | 1.513 *** | 1.413 *** | 1.261 *** | 1.124 *** | 1.017 *** |

| (0.188) | (0.139) | (0.101) | (0.134) | (0.185) | ||

| Observations | 3444 | 3444 | 3444 | 3444 | 3444 | |

| non-state-owned enterprises | EPU | 1.060 *** | 1.049 *** | 1.034 *** | 1.017 *** | 1.004 ** |

| (0.266) | (0.196) | (0.177) | (0.28) | (0.393) | ||

| Observations | 1524 | 1524 | 1524 | 1524 | 1524 | |

| low financing constraints | EPU | 1.890 *** | 1.797 *** | 1.669 *** | 1.543 *** | 1.449 *** |

| (0.359) | (0.263) | (0.172) | (0.198) | (0.277) | ||

| Observations | 2484 | 2484 | 2484 | 2484 | 2484 | |

| high financing constraints | EPU | 0.968 | 0.957 | 0.941 | 0.924*** | 0.912 |

| (2.859) | (2.190) | (1.147) | (0.233) | (0.700) | ||

| Observations | 2484 | 2484 | 2484 | 2484 | 2484 | |

| East | EPU | 1.496 *** | 1.404 *** | 1.266 *** | 1.144 *** | 1.039 *** |

| (0.170) | (0.126) | (0.093) | (0.121) | (0.172) | ||

| Observations | 3681 | 3681 | 3681 | 3681 | 3681 | |

| Central and West | EPU | 1.032 *** | 1.017 *** | 0.992 *** | 0.963 *** | 0.943 *** |

| (0.297) | (0.227) | (0.174) | (0.247) | (0.343) | ||

| Observations | 1287 | 1287 | 1287 | 1287 | 1287 |

| Variables | CER | LEV | CER |

|---|---|---|---|

| EPU | 1.176 *** | −0.0495 *** | 1.122 *** |

| (0.0721) | (0.005) | (0.0731) | |

| LEV | −1.105 *** | ||

| (0.211) | |||

| OC | −0.701 *** | −0.0479 *** | −0.754 *** |

| (0.208) | (0.0136) | (0.208) | |

| SIZE | 1.590 *** | 0.130 *** | 1.734 *** |

| (0.0561) | (0.00416) | (0.0623) | |

| FP | 1.264 ** | −1.409 *** | −0.294 |

| (0.531) | (0.0477) | (0.614) | |

| Constant | −14.47 *** | −0.594 *** | −14.01 *** |

| (0.55) | (0.044) | (0.573) | |

| industry | yes | yes | yes |

| year | yes | yes | yes |

| Observations | 4968 | 4968 | 4968 |

| R-squared | 0.311 | 0.453 | 0.312 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yang, J.; Luo, P.; Tan, Y. Contingent Decision of Corporate Environmental Responsibility Based on Uncertain Economic Policy. Sustainability 2020, 12, 8839. https://doi.org/10.3390/su12218839

Yang J, Luo P, Tan Y. Contingent Decision of Corporate Environmental Responsibility Based on Uncertain Economic Policy. Sustainability. 2020; 12(21):8839. https://doi.org/10.3390/su12218839

Chicago/Turabian StyleYang, Jieqiong, Panzhu Luo, and Yong Tan. 2020. "Contingent Decision of Corporate Environmental Responsibility Based on Uncertain Economic Policy" Sustainability 12, no. 21: 8839. https://doi.org/10.3390/su12218839

APA StyleYang, J., Luo, P., & Tan, Y. (2020). Contingent Decision of Corporate Environmental Responsibility Based on Uncertain Economic Policy. Sustainability, 12(21), 8839. https://doi.org/10.3390/su12218839