A City Capability Assessment Framework Focusing on Planning, Financing, and Implementing Sustainable Energy Projects

Abstract

1. Introduction

2. Background

3. Materials and Methods

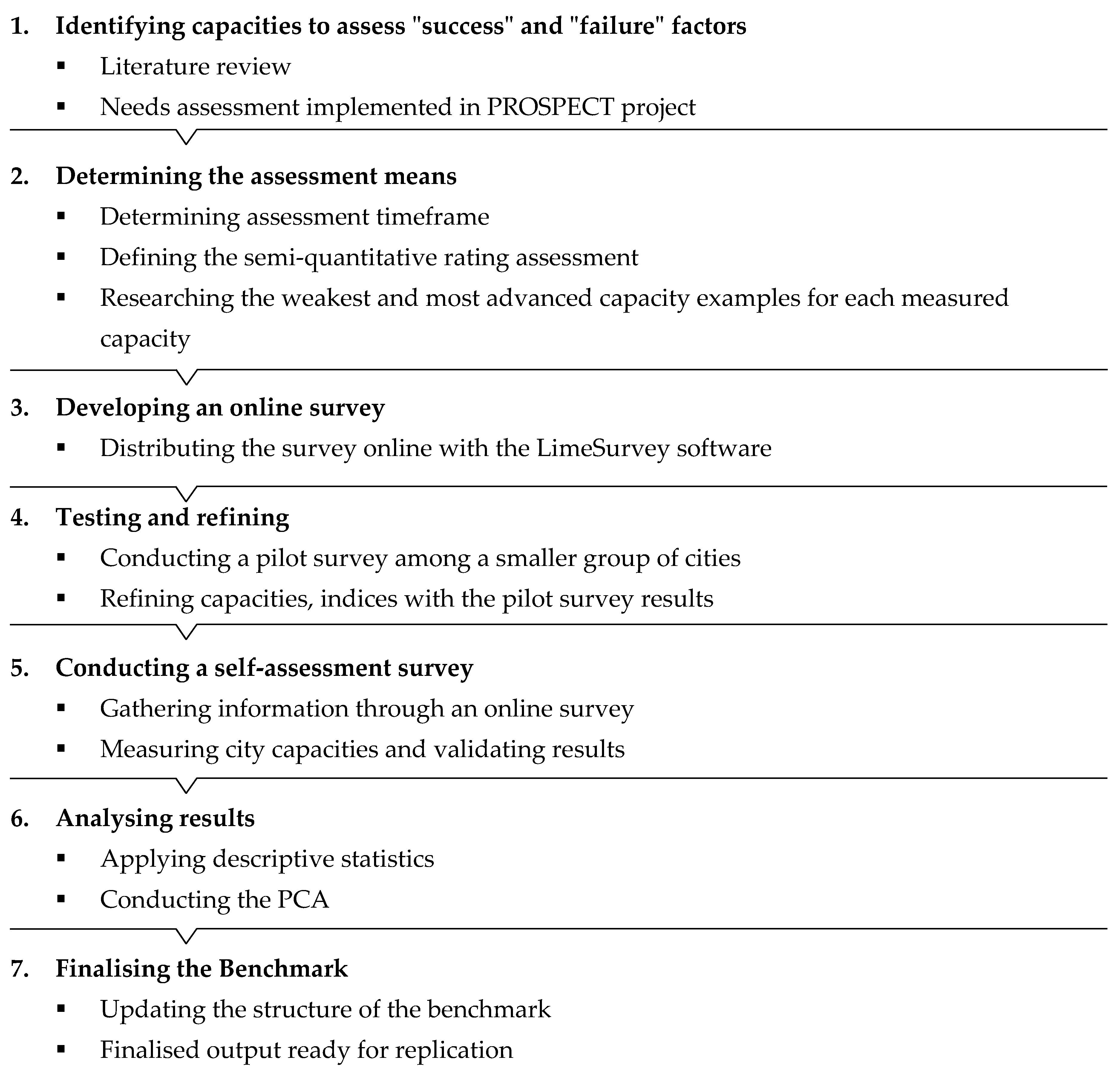

3.1. Process for Developing a City’s Capacity Assessment Framework

3.2. Assessment of Capacities: General Principles and Aim

- Clarity of purpose. The selected measurement means aimed to determine and evaluate the different capacities that best describe the ability of municipalities and regions to secure sustainable financing for energy and climate-related projects.

- Nature of information required and choice of the data collection method. In the PROSPECT assessment framework, well-conceived and targeted survey questions were complemented by indicators to reduce information overload. Examples of evidence were provided for each field of assessment to facilitate the completion of the survey as well as offer participant cities a collection of best-case practices and real-world illustrations on how similar issues are being handled in other city-contexts.

- Overall management of the assessment process. Online survey-tool and indicators were developed to manage the assessment process. These were combined with information and example cases to guide good judgment and self-evaluation.

- Review of relevant works to reach an initial framework structure and identify the most important capacities that affect city capability.

- Utilization of the information provided by the PROSPECT needs assessment survey to refine and improve the created benchmark, making it more applicable to real-world situations.

- Utilization of user feedback gathered from its application within PROSPECT learning cycles to update and enhance benchmark ease of use and improve its applicability.

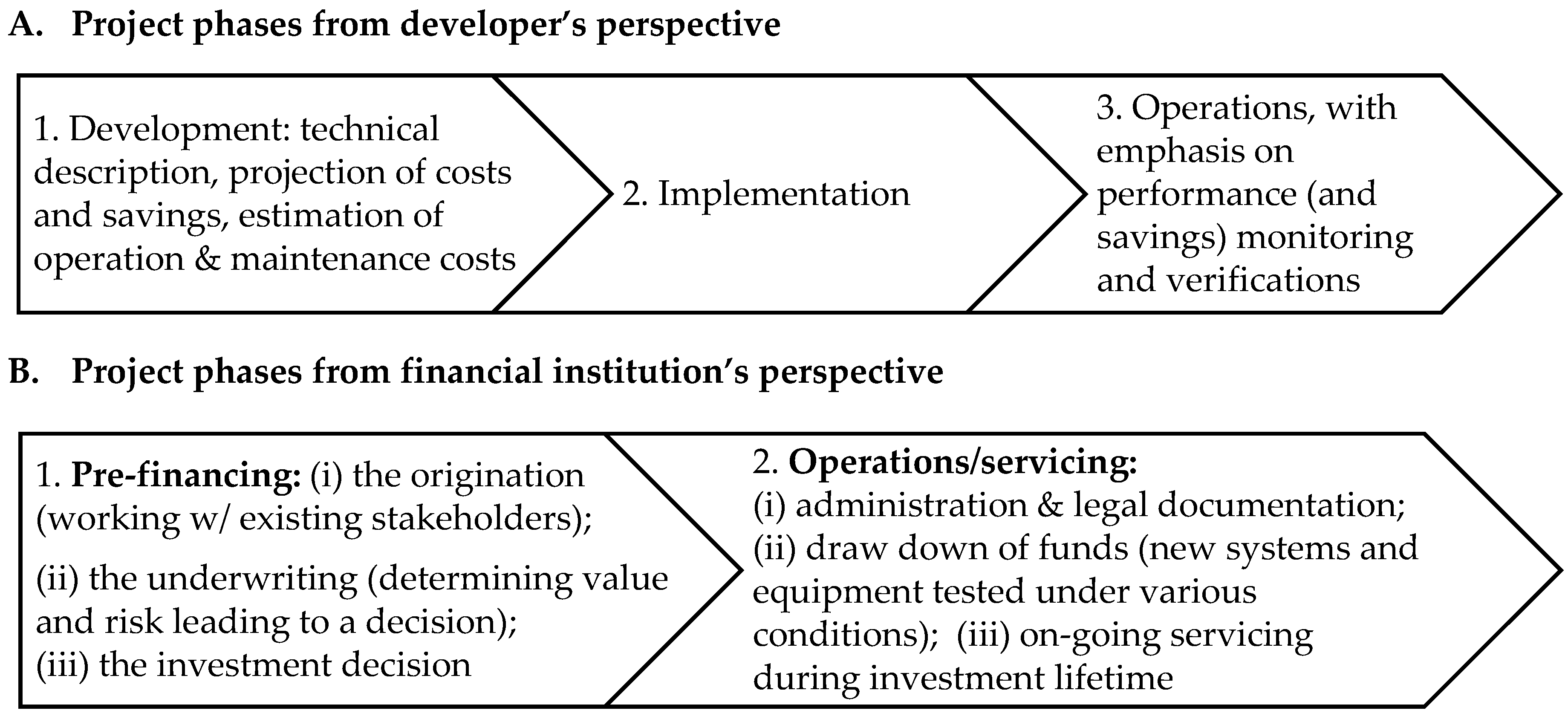

3.3. Overview of the Initial Assessment Framework: Structure and Assessment Axes

- Axis 1.

- Attracting Investments

- Axis 2.

- Identifying and utilizing financing options

- Axis 3.

- Setting up, implementing, and monitoring the financing of SECAP or other SE projects

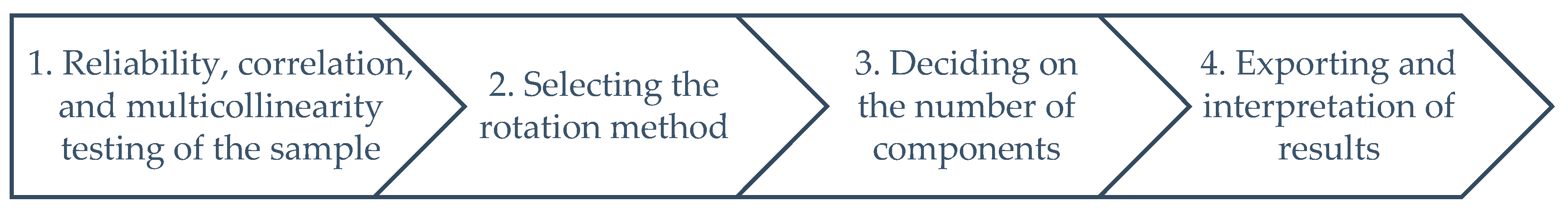

3.4. Applying Descriptive Statistics and the PCA

4. Results

4.1. The City Sample

4.2. PCA Results and the Final Benchmark Framework

5. Discussion and Implications

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Grafakos, S.; Enseñado, E.M.; Flamos, A.; Rotmans, J. Mapping and measuring European local governments’ priorities for a sustainable and low-carbon energy future. Energies 2015, 8, 11641–11666. [Google Scholar] [CrossRef]

- C40 CITIES. Deadline 2020: An Analysis of the Contribution C40 Cities Can Make to Delivering the Paris Agreement Objective of Limiting Global Temperature Rise Up to 1.5 Degrees; C40 CITIES: London, UK, 2017. [Google Scholar]

- Androulaki, S.; Doukas, H.; Spiliotis, E.; Papastamatiou, I.; Psarras, J. A framework to assess the behavior and performance of a city towards energy optimization. Stud. Comput. Intell. 2016, 627, 189–205. [Google Scholar] [CrossRef]

- Moraci, F.; Errigo, M.F.; Fazia, C.; Burgio, G.; Foresta, S. Making less vulnerable cities: Resilience as a new paradigm of smart planning. Sustainability 2018, 10, 755. [Google Scholar] [CrossRef]

- Pirlone, F.; Spadaro, I.; Candia, S. More resilient cities to face higher risks. the case of Genoa. Sustainability 2020, 12, 4825. [Google Scholar] [CrossRef]

- Hernantes, J.; Maraña, P.; Gimenez, R.; Sarriegi, J.M.; Labaka, L. Towards resilient cities: A maturity model for operationalizing resilience. Cities 2019, 84, 96–103. [Google Scholar] [CrossRef]

- Grafakos, S.; Flamos, A. Assessing low-carbon energy technologies against sustainability and resilience criteria: Results of a European experts survey. Int. J. Sustain. Energy 2017, 36, 502–516. [Google Scholar] [CrossRef]

- Mori, K.; Fujii, T.; Yamashita, T.; Mimura, Y.; Uchiyama, Y.; Hayashi, K. Visualization of a City Sustainability Index (CSI): Towards transdisciplinary approaches involving multiple stakeholders. Sustainability 2015, 7, 12402–12424. [Google Scholar] [CrossRef]

- International Energy Agency (IEA). An IEA Analysis: Energy Efficiency can Boost Economies Quickly, with Long-Lasting Benefits. Available online: https://www.iea.org/commentaries/energy-efficiency-can-boost-economies-quickly-with-long-lasting-benefits?utm_content=buffer29105&utm_medium=social&utm_source=linkedin.com&utm_campaign=buffer&fbclid=IwAR0Oqc9FgjNoHqF-ClQNIFydCxq628E3W9TJjie3ZH5wClhCVeQzel (accessed on 14 April 2020).

- European Parliament. Fact Sheets on the European Union. Available online: https://www.europarl.europa.eu/factsheets/en/sheet/69/energy-efficiency (accessed on 20 April 2020).

- European Commission. Regional Policy, EU Solidarity Fund for COVID-19. Available online: https://ec.europa.eu/regional_policy/en/funding/solidarity-fund/covid-19 (accessed on 18 April 2020).

- Pucher, J. Obstacles to Investments at Local and Regional Level; European Committee of the Regions: Brussels, Belgium, 2016. [Google Scholar]

- EUROCITIES. Peer Powered Cities and Regions: Report on Needs Assessment; European Commission: Brussels, Belgium, 2020. [Google Scholar]

- European Federation of Agencies and Regions for Energy and the Enviroment (FEDARENE). Innovative Financing Schemes in Local and Regional Energy Efficiency Policies; FEDARENE: Brussels, Belgium, 2015. [Google Scholar]

- Floater, G.; Dowling, D.; Chan, D.; Ulterino, M.; Braunstein, J.; Mcminn, T.; Ahmad, E. Global Review of Finance for Sustainable Urban Infrastructure; Coalition for Urban Transitions: Washington, DC, USA, 2017. [Google Scholar]

- International Finance Corporation. Financing Climate-Smart Investments in Cities; International Finance Corporation: Washington DC, USA, 2018. [Google Scholar]

- Wolfram, M. Conceptualizing urban transformative capacity: A framework for research and policy. Cities 2016, 51, 121–130. [Google Scholar] [CrossRef]

- Seeliger, L.; Turok, I. Towards sustainable cities: Extending resilience with insights from vulnerability and transition theory. Sustainability 2013, 5, 2108–2128. [Google Scholar] [CrossRef]

- Li, Q. Resilience thinking as a system approach to promote China’s sustainability transitions. Sustainability 2020, 12, 5008. [Google Scholar] [CrossRef]

- CLIMATE-KIC. Peer Powered Cities and Regions: Report on Certification Framework; European Commission: Brussels, Belgium, 2018. [Google Scholar]

- Ketels, D.C. Review of competitiveness frameworks. Irish Natl. Compet. Counc. 2016, 15, 2017. [Google Scholar]

- Van den Berg, L.; Galal, H.; Teunisse, P. Innovative City Strategies for Delivering Sustainable Competitiveness. 2014, pp. 1–80. Available online: https://www.pwc.com/gx/en/psrc/global/assets/pwc-innovative-city-strategies-for-sustainable-competitiveness.pdf (accessed on 14 April 2020).

- Jabareen, Y. An assessment framework for cities coping with climate change: The case of New York City and its plaNYC 2030. Sustainability 2014, 6, 5898–5919. [Google Scholar] [CrossRef]

- The Economist Intelligence Unit. Hot Spots 2025: Benchmarking the Future Competitiveness of Cities; The Economist Intelligence Unit: London, UK, 2013. [Google Scholar]

- A.T. Kearnay. Global Cities 2017: Leaders in a World of Disruptive Innovation; A.T. Kearnay: New York, NY, USA, 2017. [Google Scholar]

- Institute for Urban Strategies—The Mori Memorial Foundation. Global Power City Index 2017; The Mori Memorial Foundation: Tokyo, Japan, 2017. [Google Scholar]

- Berrone, P.; Ricart, J.E.; Carraso, C.; Ricart, R. IESE Cities in Motion Index; IESE Business School—Barcelona Campus Norte: Barcelona, Spain, 2017. [Google Scholar]

- Vegara, A. The critical factors for the competitiveness of cities. Sustain. City XI 2016, 1, 47–56. [Google Scholar] [CrossRef]

- European Commission. Financing a Sustainable European Economy; European Commission: Brussels, Belgium, 2018. [Google Scholar]

- Cities Exchanging on Local Energy Leadership (CASCADE)—IEE Project. Available online: http://www.cascadecities.eu/cascadecities/home#.XqTJU2gzY2w (accessed on 16 April 2020).

- Wuppertal Institute and EUROCITIES. Benchmark of Renewable Energy Sources and Distributed Energy Generation; European Commission: Brussels, Belgium, 2013. [Google Scholar]

- Gibberd, J. Strengthening Sustainability Planning: The City Capability Framework. Procedia Eng. 2017, 198, 200–211. [Google Scholar] [CrossRef]

- Campillo, J.; Dahlquist, E.; Vassileva, I. Technology capacity assessment tool for developing city action plans to increase efficiency in mid-sized cities in Europe. Energy Procedia 2016, 88, 16–22. [Google Scholar] [CrossRef]

- European Investment Bank. EIB Group Survey on Investment and Investment Finance: Municipality Infrastructure Investment Activities; European Investment Bank: Luxembourg, 2017. [Google Scholar]

- United Nations Development Programme (UNDP). Annual Report 2005: A Time for Bold Action; United Nations Development Programme: New York, NY, USA, 2005. [Google Scholar]

- Renn, O.; Klinke, A. A framework of adaptive risk governance for urban planning. Sustainability 2013, 5, 2036–2059. [Google Scholar] [CrossRef]

- United Nations Development Programme (UNDP). Measuring Capacities: A Guide to Benchmarks and Indicators; United Nations Development Programme: New York, NY, USA, 2005. [Google Scholar]

- Bester, A. Capacity Development: A Report Prepared for the United Nations Department of Economic and Social Affairs for the 2016 Quadrennial Comprehensive Policy; United Nations: New York, NY, USA, 2015. [Google Scholar]

- Energy Efficiency Financial Institutions Group. Eefig Underwriting Toolkit: Value and Risk Appraisal for Energy Efficiency Financing; European Commission: Brussels, Belgium, 2017. [Google Scholar]

- Enviromental Defense Fund (EDF). Energy Performance Protocol: Project Development Specification; Enviromental Defense Fund: New York, NY, USA, 2016. [Google Scholar]

- DENTONS. A Guide to Project Finance; DENTONS: Washington, DC, USA, 2018. [Google Scholar]

- Mosannenzadeh, F.; Di Nucci, M.R.; Vettorato, D. Identifying and prioritizing barriers to implementation of smart energy city projects in Europe: An empirical approach. Energy Policy 2017, 105, 191–201. [Google Scholar] [CrossRef]

- G20 Energy Efficiency Finance Task Group (EEFTG). G20 Energy Efficiency Investment Toolkit; International Energy Agency: Paris, France, 2017. [Google Scholar]

- International Renewable Energy Agency (IRENA). Financial Mechanisms and Investment Frameworks for Renewables in Developing Countries; IRENA: Abu Dhabi, UAE, 2012. [Google Scholar]

- Guillermo, A.; de Cunto, A.; Kontinakis, N.; Saraceno, P.P. Peer Powered Cities and Regions: Report on Needs Assessment; European Commission: Brussels, Belgium, 2017. [Google Scholar]

- European Commission. Smart Cities Stakeholder Platform: Financing Models for Smart Cities; European Commission: Brussels, Belgium, 2013. [Google Scholar]

- EURELETRIC. A Eureletric Policy Paper: Triggering Energy Efficiency Investments; EURELETRIC: Brussels, Belgium, 2015. [Google Scholar]

- UN-Habitat. Financing Sustainable Urban Development: Challenges and Opportunities; UN-Habitat: Nairobi, Kenya, 2013. [Google Scholar]

- Du, Q.; Wang, Y.; Ren, F.; Zhao, Z.; Liu, H.; Wu, C.; Li, L.; Shen, Y. Measuring and analysis of urban competitiveness of Chinese provincial capitals in 2010 under the constraints of major function-oriented zoning utilizing spatial analysis. Sustainability 2014, 6, 3374–3399. [Google Scholar] [CrossRef]

- CityInvest. A Guide for the Launch of a One Stop Shop on Energy Retrofitting: RenoWatt’s Experience in Liège; European Commission: Brussels, Belgium, 2017. [Google Scholar]

- Limaye, D.R.; Limaye, E.S. Scaling up energy efficiency: The case for a Super ESCO. Energy Effic. 2011, 4, 133–144. [Google Scholar] [CrossRef]

- Rezessy, S.; Bertoldi, P. Financing Energy Efficiency: Forging the link between financing and project implementation. Environ. Plan. A 2010, 41, 1072–1089. [Google Scholar]

- European Commission. Guidance Document on Indicators of Public Administration Capacity Building; European Commission: Brussels, Belgium, 2014. [Google Scholar]

- International Renewable Energy Agency (IRENA). Renewable Power Generation Costs in 2012: An Overview; IRENA: Abu Dhabi, UAE, 2012. [Google Scholar]

- Smart Cities Council. Smart Cities Financing Guide: Expert Analysis of 28 Municipal Finance Tools for City Leaders Investing in the Future; Center for Urban Innovation—Arizona State University: Tempe, AZ, USA, 2013. [Google Scholar]

- Spyridaki, N.A.; Stavrakas, V.; Dendramis, Y.; Flamos, A. Understanding technology ownership to reveal adoption trends for energy efficiency measures in the Greek residential sector. Energy Policy 2020, 140, 111413. [Google Scholar] [CrossRef]

- Kjaer, T.; Andersen, J.; Kjaer, N. Identifying Areas of Improvements of Monitoring and Verification Schemes and Coordination Mechanisms; European Commission: Brussels, Belgium, 2016. [Google Scholar]

- Li, T.; Zhang, H.; Yuan, C.; Liu, Z.; Fan, C. A PCA-based method for construction of composite sustainability indicators. Int. J. Life Cycle Assess. 2012, 17, 593–603. [Google Scholar] [CrossRef]

- Richardson, M. Principal Component Analysis. 2009. Available online: http://www.dsc.ufcg.edu.br/~hmg/disciplinas/posgraduacao/rn-copin-2014.3/material/SignalProcPCA.pdf (accessed on 25 July 2020).

- Bartholomew, D.J. Principal components analysis. Int. Encycl. Educ. 2010, 374–377. [Google Scholar] [CrossRef]

- Field, A. Discovering Statistics Using Spss; Sage Publications Ltd.: London, UK, 2009. [Google Scholar]

- Preacher, K.J.; Zhang, G.; Kim, C.; Mels, G. Choosing the Optimal Number of Factors in Exploratory Factor Analysis: A Model Selection Perspective. Multivar. Behav. Res. 2013, 48, 28–56. [Google Scholar] [CrossRef]

- Schmitt, T.A. Current methodological considerations in exploratory and confirmatory factor analysis. J. Psychoeduc. Assess. 2011, 29, 304–321. [Google Scholar] [CrossRef]

- Karytsas, S.; Choropanitis, I. Barriers against and actions towards renewable energy technologies diffusion: A Principal Component Analysis for residential ground source heat pump (GSHP) systems. Renew. Sustain. Energy Rev. 2017, 78, 252–271. [Google Scholar] [CrossRef]

- Yong, A.G.; Pearce, S. A Beginner’s Guide to Factor Analysis: Focusing on Exploratory Factor Analysis. Tutor. Quant. Methods Psychol. 2013, 9, 79–94. [Google Scholar] [CrossRef]

- Thurstone, L.L. Multiple-Factor Analysis; a Development and Expansion of The Vectors of Mind; University of Chicago Press: Chicago, IL, USA, 1947. [Google Scholar]

- Anna, B.; Costello, J.W.O. Best Practices in Exploratory Factor Analysis: Four Recommendations for Getting the Most From Your Analysis. Pract. Assess. Res. Eval. 2005, 10, 1–9. [Google Scholar]

- Brown, J.D. Choosing the Right Type of Rotation in PCA and EFA. JALT Test. Eval. SIG Newsl. 2009, 13, 20–25. [Google Scholar]

- Matsunaga, M. How to Factor-Analyze Your Data Right: Do’s, Don’ts, and How-To’s. Int. J. Psychol. Res. 2010, 3, 97–110. [Google Scholar] [CrossRef]

- Reckien, D.; Salvia, M.; Heidrich, O.; Church, J.M.; Pietrapertosa, F.; De Gregorio-Hurtado, S.; D’Alonzo, V.; Foley, A.; Simoes, S.G.; Krkoška Lorencová, E.; et al. How are cities planning to respond to climate change? Assessment of local climate plans from 885 cities in the EU-28. J. Clean. Prod. 2018, 191, 207–219. [Google Scholar] [CrossRef]

- Beaumont, R. An introduction to Principal Component Analysis & Factor Analysis Using SPSS 19 and R (psych package). J. Geophys. Res. 2012, 1–24. [Google Scholar]

- Hair, J.F., Jr.; Black, W.C.; Babin, B.J.; Anderson, R.E.; Tatham, R.L. Multivariate Data Analysis, 7th ed.; Pearson Education Limited: Harlow, UK, 2014. [Google Scholar]

- Brown, J.D. Principal components analysis and exploratory factor analysis—Definitions, differences, and choices. JALT Test. Eval. SIG Newsl. 2009, 13, 26–30. [Google Scholar]

- Iturriza, M.; Labaka, L.; Hernantes, J.; Abdeltawad, A. Shifting to climate change aware cities to facilitate the city resilience implementation. Cities 2020, 101, 102688. [Google Scholar] [CrossRef]

- Iturriza, M.; Hernantes, J.; Abdelgawad, A.A.; Labaka, L. Are Cities aware enough? A framework for developing city awareness to climate change. Sustainability 2020, 12, 2168. [Google Scholar] [CrossRef]

- Angelidou, M. Smart cities: A conjuncture of four forces. Cities 2015, 47, 95–106. [Google Scholar] [CrossRef]

- Mi, Z.; Zheng, J.; Meng, J.; Zheng, H.; Li, X.; Coffman, D.M.; Woltjer, J.; Wang, S.; Guan, D. Carbon emissions of cities from a consumption-based perspective. Appl. Energy 2019, 235, 509–518. [Google Scholar] [CrossRef]

- Stavrakas, V.; Flamos, A. A modular high-resolution demand-side management model to quantify benefits of demand-flexibility in the residential sector. Energy Convers. Manag. 2020, 205, 112339. [Google Scholar] [CrossRef]

- United Nations. Sustainable Development Financing; United Nations: New York, NY, USA, 2014. [Google Scholar]

- European Commission. Clean Energy for All Europeans; European Commission: Brussels, Belgium, 2019. [Google Scholar]

- Reckien, D.; Salvia, M.; Pietrapertosa, F.; Simoes, S.G.; Olazabal, M.; De Gregorio Hurtado, S.; Geneletti, D.; Krkoška Lorencová, E.; D’Alonzo, V.; Krook-Riekkola, A.; et al. Dedicated versus mainstreaming approaches in local climate plans in Europe. Renew. Sustain. Energy Rev. 2019, 112, 948–959. [Google Scholar] [CrossRef]

- Croci, E.; Lucchitta, B.; Janssens-Maenhout, G.; Martelli, S.; Molteni, T. Urban CO2 mitigation strategies under the Covenant of Mayors: An assessment of 124 European cities. J. Clean. Prod. 2017, 169, 161–177. [Google Scholar] [CrossRef]

- Bulkeley, H.; Coenen, L.; Frantzeskaki, N.; Hartmann, C.; Kronsell, A.; Mai, L.; Marvin, S.; McCormick, K.; van Steenbergen, F.; Voytenko Palgan, Y. Urban living labs: Governing urban sustainability transitions. Curr. Opin. Environ. Sustain. 2016, 22, 13–17. [Google Scholar] [CrossRef]

| Index | Index Categories |

|---|---|

| Global City Competitiveness Index [24] | Economic strength Physical capital Financial maturity Institutional effectiveness Social and cultural character Human capital Environment and natural hazards Global appeal |

| A. T. Kearney’s Global Cities Index [25] | Business activities Human capital Information exchange to cultural experience Political engagement |

| Mori Memorial Foundation’s Global Power City Index [26] | Economy Research and development Cultural interaction Liveability Environment Accessibility |

| Centre of Globalization and Strategy Index (Berrone et al., 2017) | Human capital Social cohesion Economy Public management Governance Mobility and transportation Environment Urban Planning Technology International outreach |

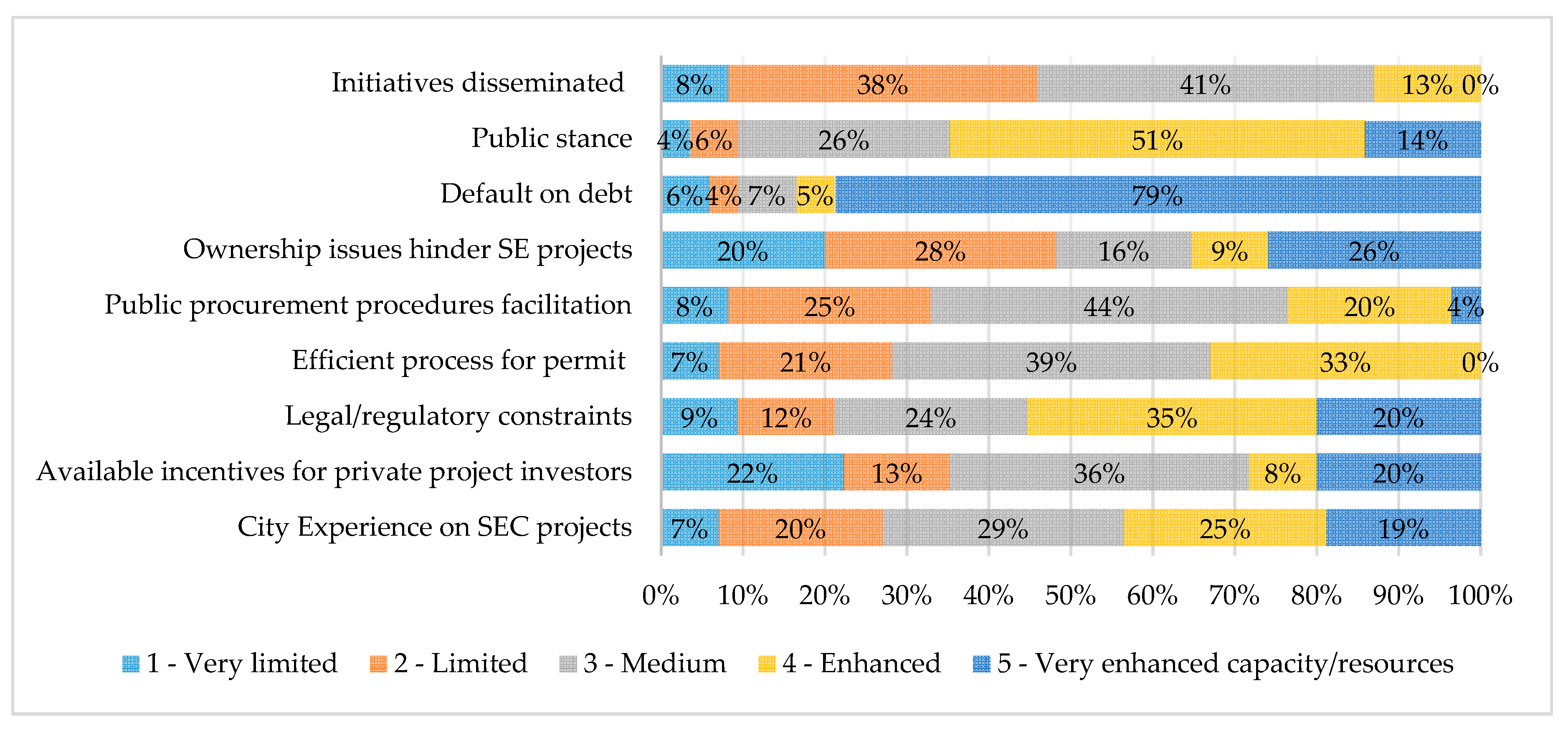

| Categories | Measured Capacities |

|---|---|

| Assessment axis 1: Attracting investments | |

| Local (and broader) strategy and commitments | City Experience on SE projects (Mosannenzadeh et al., 2017) |

| Available incentives for private project investors [42,43] | |

| Legal/regulatory constraints [42,43,44] | |

| Legislative and regulatory situation (local) | Efficient process for permit [42,43,44] |

| Public procurement procedures facilitation [44,45,46] | |

| Ownership issues hinder SE projects [42,44,45,47] | |

| Economic situation (local) | City Gross Domestic Product (GDP) [24,44,48,49] |

| GDP growth rate [24,44,49] | |

| Annual city expenditure [24,48,49] | |

| Annual city revenues [24,48,49] | |

| City debt [24] | |

| Default on debt (no such citation) | |

| Nominal bank lending rate [24,43,44] | |

| Taxation rate for corporations [24,44] | |

| Taxation rate for individuals [24,44] | |

| City population [24,49] | |

| Unemployment rate [24,44] | |

| Public stance (on SE and Climate Action Plans (SECAP) related investments) and dissemination | Public stance [42,46] |

| Initiatives disseminated [42,46] | |

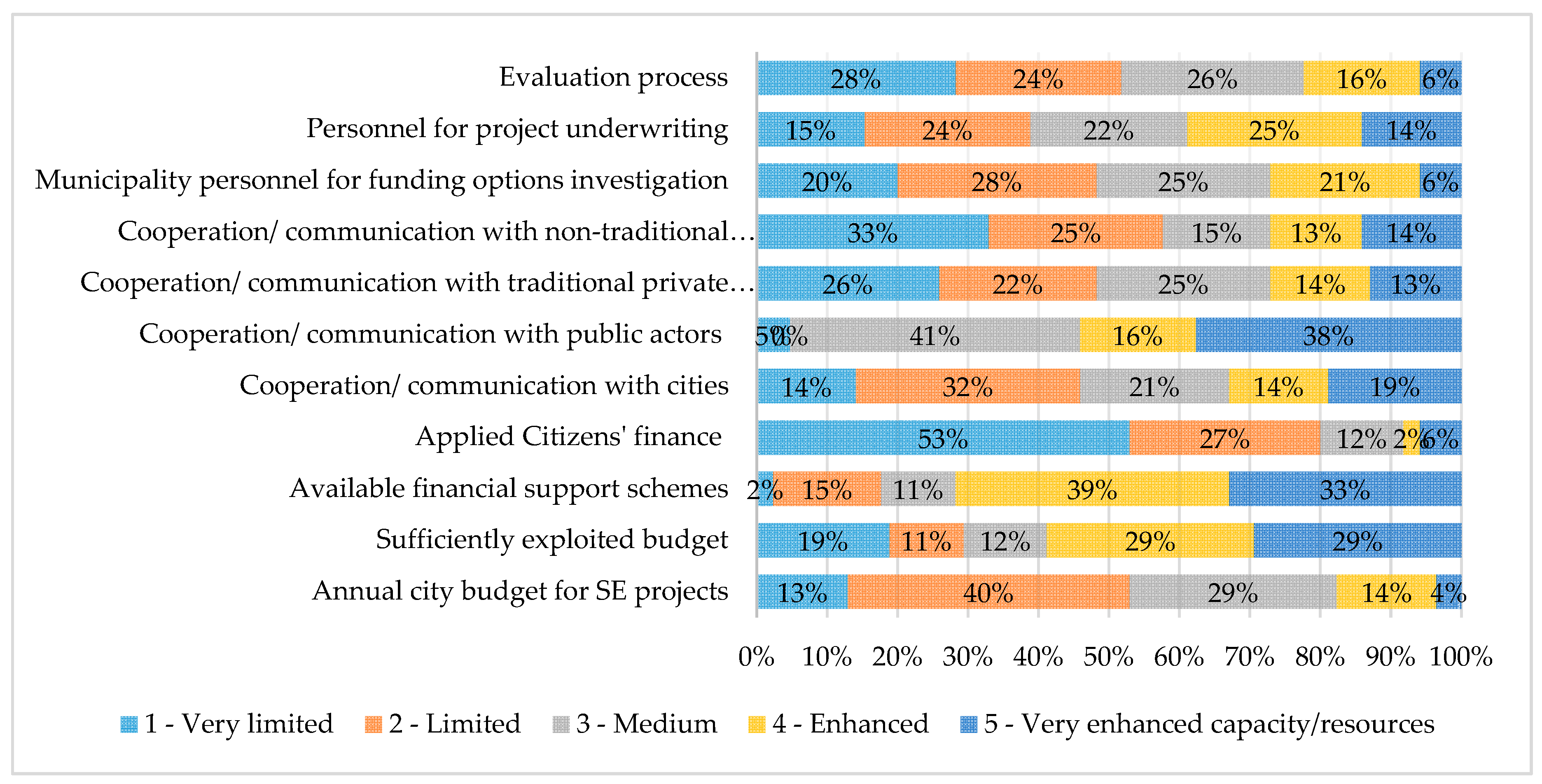

| Assessment axis 2: Identifying and utilizing financing options | |

| Project origination capacity | Annual city budget for SE projects [42,48] |

| Sufficiently exploited budget [31] | |

| Available financial support schemes [47] | |

| Applied Citizens’ finance [14,47] | |

| Cooperation/communication with other cities [14,31,50] | |

| Cooperation/communication with public actors [14,31,43,44] | |

| Cooperation/communication with traditional private actors [43,44,50] | |

| Cooperation/communication with non-traditional private actors [51,52] | |

| Project underwriting and evaluation capacity | Municipality personnel for funding options investigation [31,53] |

| Personnel for project underwriting [45,53] | |

| Project selection and prioritization process [54,55] | |

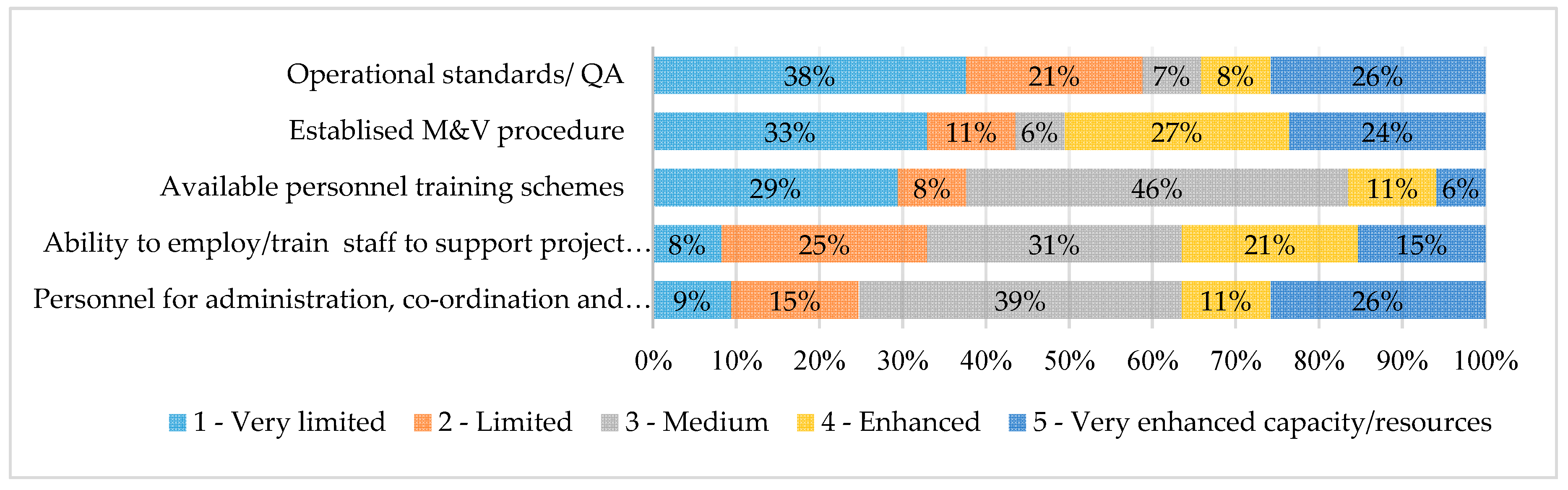

| Assessment axis 3: Setting-up, implementing, and monitoring SE projects financing | |

| Project origination capacity | Personnel for administration, co-ordination, and monitoring [14,53] |

| Ability to employ/train personnel to support project underwriting [14,53] | |

| Available personnel training schemes [14,53] | |

| Project underwriting and evaluation capacity | Established monitoring and evaluation (M&V) procedure [31,53] |

| Operational standards/QA [31,53] | |

| Observations | Mean | SD | Min | Max | |

|---|---|---|---|---|---|

| Interval capacities | |||||

| “City GDP per capita (€)” | 84 | 18.793 | 15.763 | 1.876 | 102.214 |

| “City GDP growth rate (%)” | 56 | 5.48 | 7.69 | −1.57 | 42 |

| “Annual city expenditure (Million €)” | 65 | 187.6 | 451.4 | 0.8 | 3130 |

| “Annual city revenues (Million €)” | 64 | 175.3 | 447.4 | 1.1 | 3160 |

| “Value of city debt (Million €)” | 49 | 112.9 | 481.1 | 0 | 3250 |

| “Nominal bank lending rate (%)” | 84 | 5.9 | 5.9 | 0.3 | 35 |

| “Corporate taxation rate (%)” | 84 | 20 | 7.5 | 1.5 | 33.3 |

| “City population” | 84 | 461,009 | 1,244,969 | 1853 | 8,173,941 |

| “Unemployment rate (%)” | 84 | 9.3 | 6.4 | 0.3 | 27.3 |

| Ordinal capacities (1 = lower limit, 5 = upper limit) | |||||

| “City experience on SE projects” | 84 | 3.27 | 1.2 | 1 | 5 |

| “Available incentives for private investors” | 84 | 2.9 | 1.39 | 1 | 5 |

| “Legal/regulatory constraints” | 84 | 3.44 | 1.22 | 1 | 5 |

| “Efficient process for permit” | 84 | 2.98 | 0.92 | 1 | 4 |

| “Public procurement procedure facilitation” | 84 | 0.96 | 0.96 | 1 | 5 |

| “Ownership issues hinder SE projects” | 84 | 2.94 | 1.5 | 1 | 5 |

| “Default on debt” | 84 | 4.46 | 1.16 | 1 | 5 |

| “Public stance” | 84 | 3.64 | 0.91 | 1 | 5 |

| “Initiatives disseminated” | 84 | 2.58 | 0.82 | 1 | 5 |

| “Annual city budget for SE projects” | 84 | 2.57 | 1 | 1 | 5 |

| “Sufficiently exploited budget” | 84 | 3.38 | 1.48 | 1 | 5 |

| “Available financial support schemes” | 84 | 3.83 | 1.12 | 1 | 5 |

| “Applied citizens’ finance” | 84 | 1.82 | 1.12 | 1 | 5 |

| “Cooperation/communication with cities” | 84 | 2.89 | 1.33 | 1 | 5 |

| “Cooperation/communication with public actors” | 84 | 3.82 | 1.1 | 1 | 5 |

| “Coop./communication with traditional private actors” | 84 | 2.67 | 1.36 | 1 | 5 |

| “Coop./communication with non-traditional private actors” | 84 | 2.51 | 1.44 | 1 | 5 |

| “Personnel for funding options investigation” | 84 | 2.63 | 1.19 | 1 | 5 |

| “Personnel for project underwriting” | 84 | 2.98 | 1.3 | 1 | 5 |

| “Project selection and prioritization process” | 84 | 2.46 | 1.23 | 1 | 5 |

| “Administration, coordination, and monitoring personnel” | 84 | 3.27 | 1.27 | 1 | 5 |

| “Available personnel training schemes” | 84 | 2.55 | 1.2 | 1 | 5 |

| “Established M&V procedure” | 84 | 2.96 | 1.64 | 1 | 5 |

| “Operational standards/QA” | 84 | 2.63 | 1.66 | 1 | 5 |

| “Ability to employ/train personnel to support project underwriting” | 84 | 3.1 | 1.19 | 1 | 5 |

| Component | Eigenvalue | % of Variance |

|---|---|---|

| 1 | 6.04 | 20.12 |

| 2 | 4.92 | 16.41 |

| 3 | 3.3 | 11 |

| 4 | 3.02 | 10.06 |

| 5 | 2.5 | 8.33 |

| Total % of Variance | 65.92 | |

| Component | 1 | 2 | 3 | 4 | 5 | h2 |

|---|---|---|---|---|---|---|

| ||||||

| Available personnel training schemes | 0.891 | 0.897 | ||||

| Personnel for project underwriting | 0.854 | 0.855 | ||||

| Personnel for administration/coordination and monitoring | 0.832 | 0.849 | ||||

| Municipality personnel for funding options investigation | 0.794 | 0.855 | ||||

| Project selection and prioritization process | 0.715 | 0.914 | ||||

| Available financial support schemes | 0.673 | 0.874 | ||||

| Ability to employ/train personnel to support project underwriting | 0.649 | 0.882 | ||||

| ||||||

| Cooperation/communication with cities | 0.894 | 0.908 | ||||

| Cooperation/communication with non-traditional private actors | 0.804 | 0.756 | ||||

| Cooperation/communication with traditional private actors | 0.770 | 0.847 | ||||

| Initiatives Disseminated | 0.712 | 0.726 | ||||

| Cooperation/communication with public actors | 0.706 | 0.776 | ||||

| ||||||

| Nominal bank lending rate | 0.795 | 0.920 | ||||

| Ownership issues hindering SE projects | 0.655 | 0.686 | ||||

| Unemployment rate | 0.736 | 0.823 | ||||

| ||||||

| Public Stance | 0.893 | 0.824 | ||||

| Applied Citizens’ Finance | 0.652 | 0.821 | ||||

| ||||||

| Public procurement procedures facilitation | 0.830 | 0.769 | ||||

| Legal/regulatory constraints | 0.788 | 0.893 | ||||

| Efficient process for permit | 0.689 | 0.881 | ||||

| % of variance explained by each component | 20.12 | 16.41 | 11 | 10.06 | 8.33 | |

| Total % of variance | 65.92 | |||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Spyridaki, N.-A.; Kleanthis, N.; Tzani, D.; Matosović, M.D.; Flamos, A. A City Capability Assessment Framework Focusing on Planning, Financing, and Implementing Sustainable Energy Projects. Sustainability 2020, 12, 8447. https://doi.org/10.3390/su12208447

Spyridaki N-A, Kleanthis N, Tzani D, Matosović MD, Flamos A. A City Capability Assessment Framework Focusing on Planning, Financing, and Implementing Sustainable Energy Projects. Sustainability. 2020; 12(20):8447. https://doi.org/10.3390/su12208447

Chicago/Turabian StyleSpyridaki, Niki-Artemis, Nikos Kleanthis, Dimitra Tzani, Mia Dragović Matosović, and Alexandros Flamos. 2020. "A City Capability Assessment Framework Focusing on Planning, Financing, and Implementing Sustainable Energy Projects" Sustainability 12, no. 20: 8447. https://doi.org/10.3390/su12208447

APA StyleSpyridaki, N.-A., Kleanthis, N., Tzani, D., Matosović, M. D., & Flamos, A. (2020). A City Capability Assessment Framework Focusing on Planning, Financing, and Implementing Sustainable Energy Projects. Sustainability, 12(20), 8447. https://doi.org/10.3390/su12208447